[2017] ATP 12

Catchwords:

Review – declaration – orders – association – otherwise unacceptable – shared goal – collaborative conduct – structural links – common knowledge – contemporaneous buying – board spill – common director – relevant agreement – propose to enter into relevant agreement – propose to act in concert – divestment of shares – unfair prejudice

Corporations Act 2001 (Cth), sections 9, 12, 249D, 602, 606, 657A, 657C(3), 657D, 657EA(4), 671B

Australian Securities and Investments Commission Regulations 2001 (Cth), regulations 16(1)(a), 16(2)(a)

Corporations Regulations 2001 (Cth), regulation 6.10.01

Kyriackou v Law Institute of Victoria Limited [2014] VSCA 322, Sullivan v Civil Aviation Safety Authority [2014] FCAFC 93, Tinkerbell Enterprises Pty Limited as Trustee for The Leanne Catelan Trust v Takeovers Panel [2012] FCA 1272, CEMEX Australia Pty Ltd v Takeovers Panel [2009] FCAFC 78, CEMEX Australia Pty Ltd v Takeovers Panel [2008] FCA 1572, Endresz v Whitehouse (1997) 24 ACSR 208, Gjergja v Cooper [1987] VR 167, Elders IXL Ltd v NCSC [1987] VR 1, Adsteam Building Industries Pty Ltd & Anor v The Queensland Cement and Lime Co Ltd & Ors (1984) 14 ACLR 456, Briginshaw v Briginshaw [1938] HCA 34; (1938) 60 CLR 336

Guidance Note 2 – Reviewing Decisions

Molopo Energy Limited 01 & 02 [2017] ATP 10, Sovereign Gold Company Limited [2016] ATP 12, Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, Mungana Goldmines Limited 01R [2015] ATP 7, Gondwana Resources Limited 02R [2014] ATP 18, Touch Holdings Limited [2013] ATP 3, World Oil Resources Limited [2013] ATP 1, CMI Limited 01R [2011] ATP 5, CMI Limited [2011] ATP 4, Viento Group Limited [2011] ATP 1, Goldlink IncomePlus Limited 04R [2009] ATP 3, Mount Gibson Iron Limited [2008] ATP 4, Orion Telecommunications Ltd [2006] ATP 23, Anaconda Nickel Limited 16 & 17 [2003] ATP 15, Winepros Limited [2002] ATP 18, Anzoil NL 01 [2002] ATP 19

R da Silva Rosa, M Kingsbury and D Yermack, "Evaluating Creeping Acquisition" [2015] 37 Sydney Law Review 37

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | YES | YES | YES | YES | NO |

Introduction

- The Panel, Peter Day, Ian Jackman SC (sitting President) and Tony Osmond, set aside the declaration made on 30 May 2017 in relation to the affairs of Molopo Energy Limited1 and made a declaration of unacceptable circumstances in substitution. The Panel considered that two substantial shareholders of Molopo, Keybridge and Aurora, were associated and contravened section 6062 and the substantial holder notice provisions. Further or in the alternative, the Panel also agreed with the initial Panel that the involvement of Mr Nicholas Bolton, or Mr Bolton together with Mr John Patton, in Keybridge and Aurora gave rise to unacceptable circumstances in relation to the affairs of Molopo. The Panel made orders including a divestment order.

- In these reasons, the following definitions apply.

- AFARF

- Aurora Fortitude Absolute Return Fund, an unlisted investment management fund

- AGIT

- Aurora Global Income Trust, an ASX listed registered unit trust (ASX: AIB)

- ASG

- Australian Style Group Pty Ltd

- ASH

- Australian Style Holdings Pty Ltd

- Aurora

- Aurora Funds Management Limited, including as responsible entity of AFARF, AGIT, Buy-Write and HHY

- Aurora Trust

- Aurora Investments Unit Trust

- Bently

- Bentley Capital Limited (ASX: BEL)

- Buy-Write

- Aurora Property Buy-Write Income Trust, an ASX listed investment trust (ASX: AUP)

- HHY

- HHY Fund, an ASX listed investment trust (ASX: HHY)

- Keybridge

- Keybridge Capital Limited (ASX: KBC)

- Molopo

- Molopo Energy Limited (ASX: MPO)

- Mr Bolton

- Mr Nicholas Bolton

- NAC

- NAOS Absolute Opportunities Company Limited (ASX: NAC)

- Scarborough

- Scarborough Equities Pty Ltd

- Seventh Orion

- Seventh Orion Pty Ltd

Facts

- Molopo is an ASX listed entity. It currently has no operating activity and holds cash on hand of approximately $66 million.

- Keybridge is an ASX listed entity. It has a relevant interest in 19.95% of Molopo.

- ASG holds 21.16% of Keybridge. ASG is wholly owned by ASH whose shareholders are Mr Bolton (1%) and Mr Bolton’s sister (99%). Mr John Bolton, Mr Bolton’s father, is the sole director of ASG and ASH. Prior to being disqualified by ASIC from managing a corporation for a period of three years from 17 November 2015,3 Mr Bolton was a co-director of ASG with his father and the sole director of ASH.

- Mr Bolton also holds 2.2% of Keybridge in his personal capacity.

- Mr Bolton was managing director of Keybridge from 22 February 2013 until his disqualification. Another director of Keybridge (nominated by ASG), Mr Antony Sormann, assumed the day-to-day executive leadership of Keybridge after Mr Bolton’s resignation.

- Aurora is an unlisted funds manager. It has a relevant interest in 17.92% of Molopo, as responsible entity for AGIT and AFARF.

- Aurora was wholly owned by Keybridge until 30 June 2016. Effective on 1 July 2016, Keybridge sold Aurora (for up to $1.8m) to Seventh Orion as trustee for the Aurora Trust.

- At the time of the acquisition, Seventh Orion was owned 100% by Mr John Patton and he was the sole director of the company.

- As a result of the transaction, Mr Patton was appointed managing director and Mr Jim Hallam was appointed as a non-executive director of Aurora. The other director on the Aurora board was Ms Betty Poon, Aurora’s chief financial officer.

- Units in the Aurora Trust are held by: Mr Bolton (49.9%), Mr Patton (26.1%)4, Ms Poon (8.5%), Mr Victor Siciliano (8.5%)5 and Mr Stephen Rowley (7%)6.

- At the time of the acquisition, Aurora had a relevant interest in approximately 1.88% of Molopo.

- On 1 July 2016, Keybridge filed a substantial holder notice advising that its relevant interest in Molopo had reduced to 18.48% as a result of the sale of Aurora.7

- On 10 August 2016, Mr Patton was appointed as a non-executive director of Keybridge, nominated by ASG.

- On 20 September 2016, Keybridge filed a substantial holder notice stating that it had acquired 1,682,763 Molopo shares and had voting power of 19.15% in Molopo.

- On 7 October 2016, Mr Siciliano, Aurora’s portfolio manager, commenced buying shares in Molopo.8 By 31 October 2016, Aurora’s total interest had increased to approximately 3.5% of Molopo’s issued capital.

- On 13 October 2016, upon the resignation of Mr Sormann as executive director of Keybridge, Mr Patton was appointed Chairperson of the Keybridge board and engaged in a part time executive role.

- On 14 October 2016, Mr Bolton entered into a consultancy agreement with Keybridge to provide Keybridge with advice and assistance in relation to its investments, including in Molopo.9

- On 17 October 2016, Mr Rowley became a 50% shareholder in Seventh Orion (through SNDR Investments Pty Ltd) and was appointed as a director at the invitation of Mr Patton. Mr Rowley deposed that Mr Patton indicated that he had received legal advice that the introduction of another director may be beneficial, although not essential.

- On 26 October 2016, Keybridge held a strategy meeting at which both Mr Bolton and Mr Patton were in attendance and where Keybridge’s strategy in relation to acquisitions and disposals of Molopo shares and representation on the Molopo board was discussed.

- In early November 2016, at Mr Patton’s request, Mr Siciliano prepared and sent an investment paper to Aurora’s board members proposing that Aurora ”move to a 19.99% as a balance of power stake, seek board representation”.

- On 1 December 2016, Aurora lodged a notice of initial substantial holder disclosing that it had voting power of 9.75% in Molopo.

- Aurora continued to acquire shares in Molopo through to 21 March 2017, resulting in its then relevant interest in 17.92% of Molopo’s issued capital.

- On 12 December 2016, Molopo submitted a report of misconduct to ASIC concerning a potential association between Keybridge and Aurora.

- On 12 March 2017, Keybridge requisitioned a meeting of Molopo shareholders under section 249D to consider resolutions for the removal of all the directors of Molopo and the appointment of three new directors nominated by Keybridge (namely, Messrs Anthony Hartnell, William Johnson and David Sanders).

- On 22 March 2017, Mr Patton on behalf of Aurora wrote to the then Chairperson of Molopo indicating that Aurora would seek to nominate one or more persons for election to the Molopo board. Aurora ultimately nominated one director.

- On 20 June 2017, at the annual general meeting where the resolutions to change the board were considered, none of the resolutions seeking the removal of the existing directors or the appointment of Keybridge and Aurora nominees were passed.10

- Other facts are set out in Molopo Energy Limited 01 & 02 and are not repeated here.

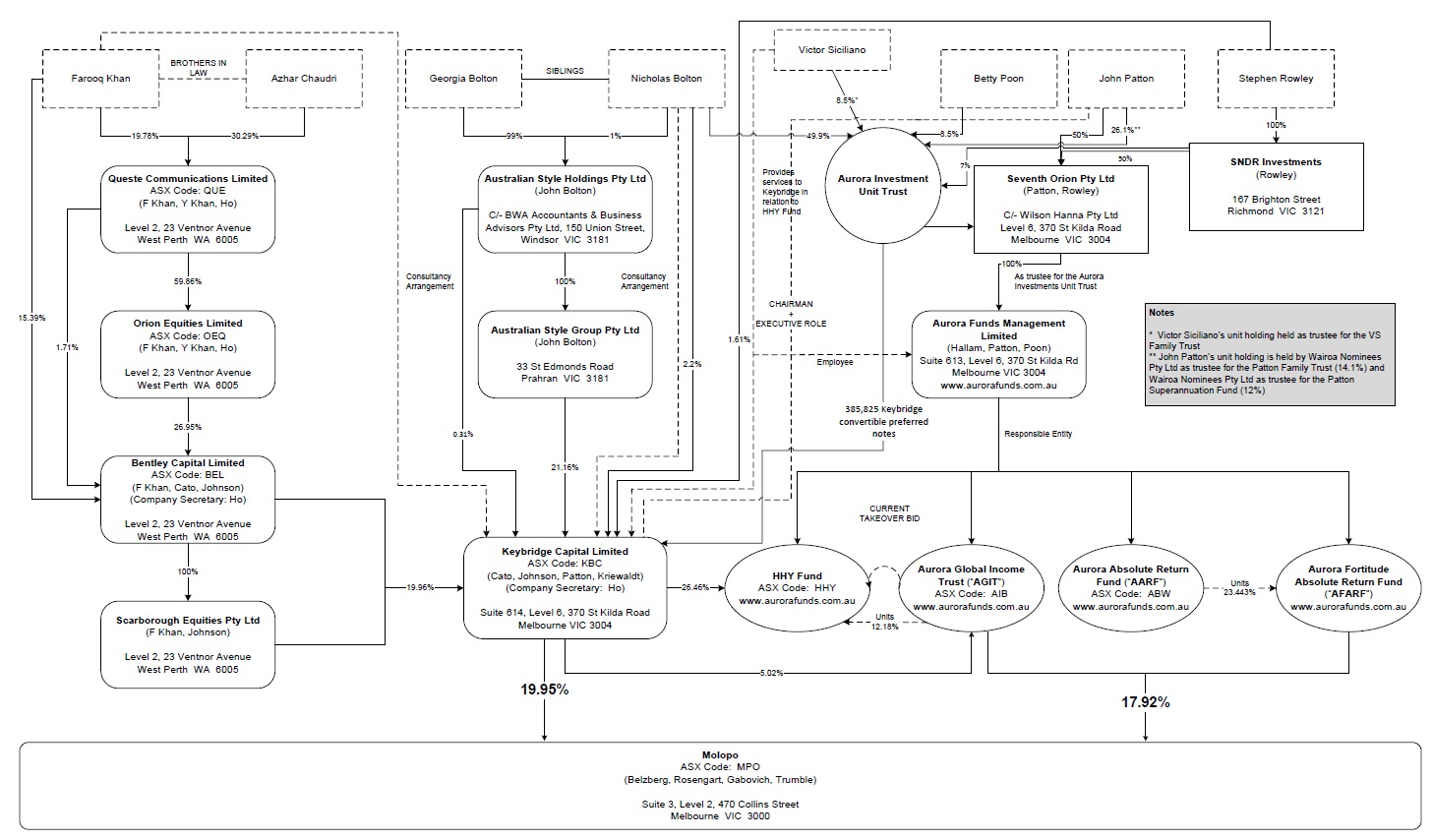

- Relevant relationships between the parties as at the date of the review applications of Keybridge and Molopo are shown in the diagram set out in Annexure A.

Applications

- The Panel received three applications for review following the initial Panel’s decision.

- By applications dated 1 June 2017, Keybridge and Molopo each sought a review of the initial Panel’s decision to make a declaration of unacceptable circumstances in Molopo Energy Limited 01 & 02.

- The initial Panel’s preliminary view was that an association had been established between Keybridge and Aurora in relation to Molopo but, in the end, it was not persuaded that it should confirm that preliminary view.

- The initial Panel did, however, declare the circumstances unacceptable as it considered that the involvement of Mr Bolton, or Mr Bolton together with Mr Patton, in Keybridge and Aurora gave rise to unacceptable circumstances in relation to the affairs of Molopo.

- In its review application, Keybridge submitted (among other things) that the evidence presented to the initial Panel did not support the finding that Mr Bolton has the capacity to influence significantly the investment strategies of Keybridge and that the initial Panel had not identified any acquisition of control over voting shares or of a substantial interest in Molopo in relation to which Mr Bolton, either alone or together with Mr Patton, was involved.

- In its review application, Molopo submitted that the initial Panel erred in failing to find association between Keybridge and Aurora and failed to take account adequately of the evidence presented regarding the involvement of Bentley and Mr Farooq Khan in the factual matrix relevant to the alleged association.

- Molopo requested the consent of the President to make its application for review, if required, because the review application submitted that the declaration should have extended to other circumstances.11 The President granted her consent.

- By application dated 15 June 2017, Aurora sought a review of the initial Panel’s decision on orders. The initial Panel’s orders included a divestment order. Aurora submitted (among other things) that the divestment order was unprecedented in circumstances where the initial Panel had not found a breach of the Corporations Act. It further submitted that the orders did not cure the unacceptable circumstances. It also submitted that the divestment order was unfairly prejudicial to underlying Aurora unit holders (by devaluing their investment) and to Molopo shareholders (because of the overhang caused in the market).

Discussion

Scope of review

- The powers of a review Panel are set out in section 657EA. Subsection (4) provides that a review Panel has the same powers to make a declaration or orders as the initial Panel and may vary or set aside the decision reviewed or substitute a new decision. It may also affirm the decision reviewed after conducting proceedings or decline to conduct proceedings and allow the initial Panel’s decision to stand.12

- Mr Bolton submitted that because the initial Panel did not make a finding of association, in the absence of new evidence, there was no basis for us to now determine that Mr Bolton is associated with ASG, ASH, Mr Patton, Keybridge, Aurora or Seventh Orion.

- Our review is not limited by the findings of the initial Panel or confined to the grounds raised in the review applications. This is because our review is a de novo hearing of the matters before the initial Panel based on the material before us13 and on which we exercise our own discretion. It is open for us to re-consider all aspects of the initial applications.14 This includes a potential association between one or more of Messrs Khan, Simon Cato, Johnson, Bolton, Patton and Hallam and Ms Poon, and their controlled entities, including Bentley, Scarborough, ASG, Keybridge and Aurora (defined in the initial Panel’s reasons as “Relevant Persons”) as submitted in Molopo’s application to the initial Panel.

- We decided to conduct proceedings on each of the review applications and considered afresh the circumstances in Molopo Energy Limited 01 & 02. We directed15 that the applications be considered together.

Materials considered

- In determining this matter, we have been provided with, and have considered, the following materials:

- all the material before the initial Panel

- the initial Panel’s preliminary findings, decision emails, declaration of unacceptable circumstances, final orders and reasons for decision

- the review applications and

- the submissions and rebuttals of the parties in the review.

- We have considered all the material, but address specifically only those we consider necessary to explain our reasoning.

Extension of time

- The initial Panel decided under section 657C(3)(b) to extend time for the making of the applications by ASIC and Molopo.16

- Section 657C(3) says:

An application for a declaration under section 657A can be made only within:

- two months after the circumstances have occurred; or

- a longer period determined by the Panel.

- The review applications were made within the mandated timeframe for reviews.17 It is unclear whether the review applications intended or could seek review of the initial Panel’s decision under section 657C(3)(b). For the avoidance of doubt and to the extent it is necessary, we affirm that decision, essentially for the same reasons as the initial Panel.

Undertakings

- Following the making of final orders in Molopo Energy Limited 01 & 02, the undertakings given by Keybridge and Aurora in those proceedings fell away. We asked whether each of Keybridge and Aurora would provide undertakings on the same terms as those provided in Molopo Energy Limited 01 & 02. Keybridge and Aurora did so. Accordingly, Keybridge and Aurora agreed not to dispose of or acquire any shares in Molopo without the review Panel being given two business days’ prior notice (Annexure C).

Interim orders

- Molopo’s annual general meeting was scheduled to be held on 20 June 2017. The agenda was to consider:

- required items of business (accounts, reports and remuneration report)

- the reappointment of Mr Wayne Trumble, and the election of Mr Ben Norman (Aurora’s nominee), as directors and

- the items the subject of the section 249D requisition (removal and election of directors nominated by Keybridge).

- Keybridge sought an interim order that the resolutions considering the appointment or removal of directors should be adjourned until our proceedings were concluded. It submitted that this would preserve the status quo.

- We decided not to make the interim orders. It is a serious matter to withhold from shareholders the right to consider matters on the agenda of a general meeting. We took account of the fact that the initial Panel’s orders continued to limit the voting power of the alleged associates to exclude the Molopo shares vested in ASIC. Nevertheless, we were not satisfied that the balance of convenience favoured making the interim order sought by Keybridge.

Association test

- Section 12 sets out the tests for association as applied to Chapter 6. There are two relevant tests here:

- section 12(2)(b) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company’s board or conduct of its affairs and

- section 12(2)(c) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company’s affairs.

- A relevant agreement is an agreement, arrangement or understanding:

- whether formal or informal or partly formal and partly informal and

- whether written or oral or partly written and partly oral and

- whether or not having legal or equitable force and whether or not based on legal or equitable rights.18

- As stated by the Panel in CMI Limited 01R,19 the cases make it clear that there is significant overlap between the concepts of “acting in concert” and “relevant agreement” in section 12.

- An understanding means an understanding – “plainly a word of wide import”20 - as to some common purpose or object in relation to the company in question.

- Often establishing an association requires the Panel “to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association.”21

- In Viento Group Limited,22 relying on Mount Gibson Iron Limited,23 the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- The above ‘indicia’ are a useful guide in identifying and describing relevant circumstances, and we return to them below. While each of these may support a finding of association, none alone establish association. Similarly, the absence of one or more of the ‘indicia’ does not preclude such a finding where there is other probative material indicating an association.

- The initial Panel provided parties with proposed preliminary findings it was considering making and on which the parties were invited to comment. The preliminary findings included a proposed finding of association between Keybridge and Aurora in relation to Molopo. After considering the submissions and rebuttals on the preliminary findings, the initial Panel said “we have, on balance, hesitated to come to that conclusion in the face of the direct evidence from individuals in Keybridge and Aurora regarding the absence of a consensus as to their dealings concerning Molopo.”24 The direct evidence referred to consisted of affidavits provided by Mr Patton, Mr Hallam, Ms Poon, Mr Rowley and Mr Siciliano and a statutory declaration provided by Mr Kriewaldt, each in response to the preliminary findings. The initial Panel noted that its decision on this was “finely balanced”.25

- We considered on a de novo basis whether there was an association between Keybridge and Aurora in relation to Molopo, as well as other potential associations. For the reasons below, we consider that Keybridge and Aurora are associates on the basis that, through the influence of Mr Bolton, they embarked on parallel conduct, which each was aware or understood the other was engaging in, to achieve their mutual objectives in relation to Molopo. In our view, we can infer a consensus between the parties.

- Our conclusion on the issue of association follows our consideration of the comments made by the parties on the preliminary findings of the initial Panel and the initial Panel’s reasons, as well as all the other material before us.

- We considered the cumulative effect of all the material and have drawn inferences that, in our experience, seem appropriate. In doing so we had in mind that we must be satisfied by logically probative material. We also had regard to the potential seriousness of a finding of association in deciding whether there was sufficient material to support such a finding.26

- Further, when making an assessment of all the material in this matter we have relied on our skills, knowledge and experience as practitioners.27 We have procedural requirements to meet and statutory time constraints in which to make a decision.28 In our view, we have met these.

- Attached to these reasons is also a chronology of events (Annexure B) to assist the reader with what is otherwise a complex set of facts. The parties were given an opportunity to comment on the chronology but were asked to refrain from adding additional events. We have addressed parties’ comments in the version attached and understand the facts outlined in the chronology to be uncontested. Keybridge submitted, in response to the restraint on adding additional events, that the chronology was incomplete and omitted material events relevant to the Panel’s findings. We accept that the chronology is incomplete, as it focuses on the most salient events, but believe that it is still a useful reference.

- We begin our description of the circumstances with a chronological account of three pertinent matters (and the role of Mr Bolton in each of them): Keybridge’s sale of Aurora, Keybridge’s investment in Molopo and Aurora’s investment in Molopo. We then consider the cumulative effect of these matters under the headings of the relevant ‘indicia’ of association, before detailing our conclusions on association and unacceptability.

Background

Aurora and its sale

- On 27 March 2015, Keybridge announced that it had completed its acquisition of Aurora from Aurora Funds Limited for $3.82 million (plus deferred consideration).29 At the time, Aurora had a relevant interest in 3,463,033 Molopo shares (or approximately 1.4% of Molopo).

- Mr Bolton was the managing director of Keybridge at the time that it acquired Aurora and worked on the acquisition.

- During 2015, Keybridge acquired a 21.08% interest in HHY and in June 2015 Aurora was appointed as investment manager and responsible entity of HHY.

- After the acquisition, Aurora’s retail funds under management significantly declined requiring Keybridge to restate the carrying value of the intangible asset recorded on its balance sheet as part of the transaction down to an overall value of $1.576 million. On 29 February 2016, Aurora suspended applications, redemptions and trading on the ASX in relation to three funds as a result of liquidity concerns. In March 2016, Keybridge reported that it had begun to consider its strategic options in relation to its investment in Aurora.30

- Keybridge commenced negotiations for a potential sale of Aurora with two third party purchasers in February 2016 but by the end of May 2016 both parties had terminated discussions. Other potential purchasers were also contacted.

- On 22 February 2016, Mr Sormann contacted Mr Bolton notifying him that Keybridge had received an offer for Aurora and asking whether he wished to put forward an offer. In response to a query from Mr Bolton about whether the offer that had been received was capable of acceptance, Mr Sormann indicated that the offer was above “expected book value”. Two days later, Mr Bolton sent Mr Sormann a term sheet (signed by Mr John Bolton) for ASG to acquire Aurora. In the term sheet, Mr John Bolton wrote that ASG strongly opposed any sale of Aurora at a discount to its acquisition cost and it was only in circumstances where Keybridge was determined to sell Aurora that ASG felt compelled to present the offer.31

- The potential sale to ASG was progressed after the other potential purchasers had walked away. On 26 May 2016, Keybridge’s board asked Mr Sormann to investigate whether shareholder approval would be required for a sale to a major shareholder and to “contact ASG re providing them with an opportunity to make an offer”. Later that day, after Mr Sormann emailed a draft share sale agreement to Mr John Bolton, copying Mr Bolton, Mr Sormann advised Mr Bolton that Keybridge had received advice that shareholder approval was not required.

- On the same day, Mr Bolton sent Mr Patton the draft agreement. Mr Patton deposed that Mr Bolton had first brought the Aurora investment opportunity to his attention towards the end of May 2016 because it was not possible for Mr Bolton to manage Aurora were he to acquire it (given his ban), suggesting that Mr Patton could manage Aurora. Mr Patton deposed that he told Mr Bolton he was not interested in managing the business as an employee. They subsequently discussed Mr Patton having an equity stake, as well as other Aurora employees.

- In its submissions to the initial Panel’s brief, Seventh Orion submitted that “Mr Patton was joined by other investors in acquiring Aurora, including the former managing director and portfolio manager of Keybridge (Nicholas Bolton and Victor Siciliano respectively) and the chief financial officer of Aurora (Betty Poon). Mr Patton believed that securing the expertise, experience and corporate knowledge of these investors would assist Seventh Orion to enhance and develop Aurora’s business…”.

- On 31 May 2016, Mr Patton signed a confidentiality deed in relation to the proposed sale of Aurora and was given access to due diligence materials. He deposed that he had some reservations about the opportunity given the substantive issues facing the business. He met with Mr Sormann who was responsible for the sale process on behalf of Keybridge on 8 June 2016. He deposed that Mr Sormann told him that if Aurora was not sold by 30 June 2016, the Aurora directors had decided that the best course of action would be to wind up the business (and the Keybridge directors would not oppose this). Mr Patton deposed that upon hearing this, he decided the investment may be worth considering on the basis that Keybridge should be happy to receive a price slightly higher than the wind up value. He deposed that extensive due diligence was conducted throughout June and the sale of Aurora to Seventh Orion (as trustee for the Aurora Trust) was negotiated and documented, primarily by himself on the Aurora side.

- Mr Bolton submitted that he was actively involved in assisting Mr Patton with the Aurora purchase and did so in his personal capacity. His involvement, he submitted, was known to Keybridge and, given his personal financial interest in the acquisition, was not remarkable. Mr Patton deposed that he had enlisted Mr Bolton's assistance with the acquisition for a number of reasons including that Mr Bolton had detailed knowledge of the business, its history and issues which was critical to enabling Seventh Orion to meet Keybridge’s 30 June 2016 deadline and that “as the largest investor in the Aurora Investments Unit Trust, it was in his interests for Seventh Orion to acquire Aurora”. Mr Patton also deposed that, given the compressed timetable, “Mr Bolton provided a useful sounding board for completing the acquisition efficiently”.

- After Mr Bolton introduced Mr Patton to Keybridge as a potential purchaser, there appeared to be a desire from Keybridge’s perspective to distance Mr Bolton from the acquisition. Mr Patton deposed that Mr Sormann had told him on 15 June 2016 that he (Mr Sormann) had authority to proceed the sale with Mr Patton “if the purchasing entity was controlled by me (or my entity, Wilson Hanna) and not Australian Style Group Pty Ltd (ASG), an entity associated with Mr Bolton”.32 It has not been explained why the Keybridge board was willing to contemplate a sale to ASG on 26 May 2016 and were a short time later concerned to ensure that ASG did not control the purchaser.

- We consider that Mr Bolton was actively involved in the purchase of Aurora by Seventh Orion. His involvement was largely in the background with communications occurring primarily between Mr Sormann and Mr Patton. We consider that Keybridge was aware of Mr Bolton’s involvement given that it received from Mr Patton on 10 June 2016 a confidentiality deed signed by Mr Bolton and Mr Bolton had a couple of calls with Mr Sormann regarding the progress of the sale during the relevant period. Mr Sormann’s statement to Mr Patton about the purchasing entity not being controlled by ASG suggests awareness that ASG was involved in some manner behind the scenes. Mr Sormann was “not particularly surprised” when he later learned of Mr Bolton’s interest in the Aurora Trust.

- On the same day as Mr Patton’s conversation with Mr Sormann regarding control of the acquisition vehicle occurred, Mr Patton emailed Mr Bolton asking him if he was comfortable holding no more than 49.9% in the Aurora Trust. Mr Bolton responded that he was happy to do so but asked for confirmation that he “will be offered that 49.9%”. While this is not a majority interest in the Aurora Trust, Mr Bolton is the largest unit holder.

- Aurora submitted that Mr Bolton had no involvement in selecting or establishing Seventh Orion. Mr Bolton submitted that he had no involvement in the composition or appointment of the Aurora board. ASIC submitted that it was improbable that Mr Bolton, at the very least, did not sign off on the structure through which he holds his investment in Aurora. We agree with ASIC.

- While Mr Bolton had no formal role in the Aurora structure as a director, officer, employee or consultant following the acquisition, his expertise and knowledge of the business continued to be utilised by Aurora. Documents produced under notice to ASIC showed that Mr Bolton (among other things):

- was consulted by Mr Patton on various documents and matters relating to different Aurora funds

- was involved in negotiating the potential sale of Buy-Write

- examined proxy forms relating to resolutions for the removal of Aurora as responsible entity of several Aurora funds33 identifying technical deficiencies and

- advised on the validity of online voting for the meetings called to consider these resolutions.

- Mr Bolton also produced a draft letter addressed to Mr Johnson (a director of Keybridge) from Mr Patton on Aurora's letterhead dated 20 December 2016 with a proposed settlement of outstanding items from Seventh Orion’s acquisition of Aurora. The draft letter contained detailed information about Aurora’s affairs post-acquisition. We infer from this that Mr Bolton had a deep knowledge of Aurora’s affairs.

- Aurora did not deny that Mr Bolton and Mr Patton consulted. Mr Patton deposed that, in the six months to 31 December 2016, he received about 45 emails from Mr Bolton or an average of one email every four days down from an average of two emails a day during June 2016. Aurora submitted that Mr Patton consulted Mr Bolton to take advantage of his knowledge of the Aurora funds as former managing director of Keybridge. However, there is evidence that Mr Bolton’s involvement was not so limited; he was active in respect of current and future matters for Aurora, e.g., the potential sale of Buy-Write.

- Aurora further submitted (relying on the affidavits of Ms Poon and Mr Siciliano) that it requested Mr Bolton’s assistance with discrete, largely administrative tasks (referring to the assistance Mr Bolton provided in relation to the meetings called to remove Aurora as responsible entity of several Aurora funds) and occasionally used Mr Bolton’s network to be introduced to potential counter-parties for transactions. However, Mr Patton deposed that “[t]hings like canvassing a person’s views, asking for a person’s help or making the most of a relationship do not result (and have never resulted) in [Mr Patton] or Aurora being beholden to Mr Bolton or doing his bidding”.

- In our view, as explained further below, Mr Bolton’s involvement in Aurora did not arise only when he was asked and was not limited to administrative tasks or introductions.

Keybridge and its investment in Molopo

- Following Mr Bolton’s resignation from Keybridge’s board due to his ban, Keybridge’s management faced pressure from its major shareholders.

- On 12 May 2016, Keybridge announced that it had received a proposal from one of its shareholders, Wilson Asset Management, for a restructure of the company, subject to shareholders’ approval.

- Six days later, Bentley and its subsidiary Scarborough acquired 16.97% of Keybridge and immediately requested two Keybridge board positions. Mr Khan is a substantial shareholder in, and the Chairperson of, Bentley. On 30 May 2016, Scarborough advised Keybridge of its intention to call a section 249F meeting of Keybridge to remove Mr Andrew Moffat as a director and appoint two Scarborough nominees (Messrs Cato and Johnson, who are also directors of Bentley).

- Shortly after Mr Bolton’s resignation from Keybridge’s board, ASG (through Mr John Bolton) began to express concerns with the on-going management of Keybridge. Following Scarborough’s request for board seats (which ASG did not oppose) ASG considered it should also have at least two Keybridge board seats. Mr Bolton approached Mr Patton34 about becoming a director of Keybridge and Mr Patton sent his resume to Mr John Bolton on 25 May 2016.

- On 1 June 2016, Mr Khan emailed Mr Bolton to discuss various meetings he wanted to have with Mr Bolton to discuss “the way forward” and with each of Mr Sormann, Mr Bill Brown and Mr Bolton’s ”rep”, Mr Patton.

- On 2 June 2016, Mr Ian Pamensky (Keybridge’s then chief financial officer and company secretary) sent a letter on behalf of Keybridge’s then chairman, Andrew Moffat, to Mr John Bolton noting that he had received a board nomination of Mr Patton from Mr Bolton which Mr Bolton advised was with Mr John Bolton/ASG’s knowledge and support.

- On 3 June 2016, a meeting was held between Messrs Khan, Bolton, Patton and Johnson. At the meeting, Mr Patton was advised that Messrs Khan, Bolton and Johnson did not want Keybridge to sell Aurora.

- On 7 June 2016, Keybridge convened an extraordinary general meeting to consider the resolutions proposed by Scarborough. Three days later, Keybridge announced that Wilson Asset Management had withdrawn its restructure proposal “[g]iven the recent change in, and discussions with, substantial shareholders and the Keybridge board”.

- In late June or early July 2016, Mr Bolton called Mr Jeremy Kriewaldt to discuss whether Mr Kriewaldt would be prepared to be proposed as a director of Keybridge by ASG.

- On 25 July 2016, Mr Bolton noted in email correspondence with Mr Moffat, regarding Mr Bolton's vote to remove Mr Moffat at the Keybridge extraordinary general meeting, that he ”strongly disagreed with the sale of Aurora. It's worth considerably more than what it was sold for, and again, just a few months after announcing the strategy built around that business, it was sold.”

- At the extraordinary general meeting on 29 July 2016, the resolutions proposed by Scarborough were approved to remove Mr Moffat and appoint Bentley’s nominees Messrs Cato and Johnson. Following the meeting, Keybridge’s board was composed of Messrs Cato, Johnson, Sormann and Mr Bill Brown (who assumed the position of Chairperson).

- On 10 August 2016, following correspondence between Mr John Bolton and Mr Brown earlier in August, Mr Brown resigned from the board and Keybridge appointed Mr Patton as a non-executive director. Keybridge’s announcement stated that Mr Patton “represents the interests of [ASG]”.

- Mr Sormann had also agreed in August to resign as a director of Keybridge following the finalisation of the annual report and some other legacy matters. Keybridge submitted that it needed to have a part-time executive to provide day to day oversight following Mr Sormann’s departure and that Mr Patton was the obvious candidate (with none of the other directors being available for such a role). Mr Patton was first proposed for the role at a Keybridge workshop in Perth held on 16 and 17 August 2016 which was attended by Messrs Bolton, Khan, Ho and Johnson.

- Mr Sormann resigned from the board of Keybridge on 13 October 2016. On the same day, Mr Patton was appointed as Chairperson of the board of Keybridge and was engaged in an executive role (minimum two days per week) and Mr Kriewaldt was appointed a non-executive director of Keybridge. Keybridge’s announcement stated that Mr Kriewaldt “represents the interests of [ASG]”.

- Also, effective 13 October 2016, Mr Khan and Mr Bolton became consultants to Keybridge pursuant to separate consultancy agreements with substantially the same terms and at the same fees. Mr Patton signed both consultancy agreements on behalf of Keybridge. The agreements provided that the consultants report to Mr Patton. Mr Patton deposed, however, that they reported to Mr Johnson in relation to Molopo. It is not clear when the later arrangement became effective and we were not given any written evidence of it.

- The initial Panel questioned why Keybridge, with an experienced board, needed two consultants. Keybridge submitted that this was to address its limited executive functions and fill the information gap concerning its history. We infer from this that Messrs Bolton and Khan had an active and significant role in the affairs of Keybridge. Keybridge submitted that their roles do not make them the controlling mind and will of Keybridge. We do not need to decide whether that is the case. As explained below, we consider it sufficient that the Keybridge board agreed to or acquiesced in the strategies and actions influenced or orchestrated by Mr Bolton in relation to Molopo.

- Although Mr Sormann resigned from Keybridge, he remained as a director of Molopo while Keybridge sought to replace him with another representative. Mr Sormann was instructed by Keybridge to seek Mr David Sanders’ appointment in his place, but he was unable to get Mr Sanders appointed. On 2 December 2016, he resigned from Molopo’s board.

- In his email dated 2 December 2016 to the Molopo board attaching his resignation letter, Mr Sormann stated:

I have thought long and hard over the last few days and had some wise counsel from a couple of Mentors in relation to the current situation I face having departed Keybridge and noting what they are now doing in combination with Aurora to take control of Molopo.

- Mr Sormann said (in a conference held by the initial Panel) that he was referring to Keybridge’s request to the Molopo board for Mr Sanders to replace him as a director and Aurora becoming a substantial holder in Molopo, adding that he “had a perception that Aurora was making its investment in support of Keybridge’s ambitions to appoint the directors.” Mr Sormann accepted when questioned in the conference that the email made a significant claim.

- Mr Sormann stated that he made the “in combination” statement out of anger and frustration “just to put something out there without necessarily having thought about the specifics around the allegation”. Aurora submitted that given this ‘admission’ from Mr Sormann, the 2 December email should not be treated as having any evidentiary value with respect to a finding of association between Keybridge and Aurora. Mr Sormann’s lawyer submitted that the Panel should not question the veracity of Mr Sormann’s statements given such matters were not put to him during the conference. Molopo submitted that Mr Sormann’s statement was evidence of “some form of collaboration”.

- We accept Mr Sormann’s description of the circumstances in which he made the statement, however we do not consider that this discredits his statement. Mr Sormann said that he based his ‘perception’ on Mr Patton being a director of both Aurora and Keybridge and Mr Bolton having ownership interests in both companies. Given Mr Sormann’s knowledge of the circumstances and individuals involved based on his firsthand experience, we consider that his perception does have some probative value and was not unreasonable in the circumstances.

- Mr Sormann also expressed concerns in the context of his position at Keybridge. On 23 September 2016, Mr Sormann emailed Ms Samantha Tough (Molopo’s then Chairperson) stating:

As you also know, I am finding my position at Keybridge increasingly untenable, and do not see myself staying at the Company much longer…

- By email dated 14 December 2016 to Mr Victor Ho (company secretary of Keybridge) and copied to Mr Patton, Mr Sormann similarly said:

… I felt that my position had been made untenable by the Substantial Shareholder notice lodged by Aurora.

- In the conference held by the initial Panel, Mr Sormann explained that the references to “untenable” referred to him being excluded from discussions regarding the future direction of Keybridge. He said he had raised this with Ms Tough because he did not want Molopo to think that he was taking information back to Keybridge.

- Shortly prior to Mr Sormann’s email to Ms Tough, on 20 September 2016, Keybridge had acquired a further 1,682,763 Molopo shares (taking its holding to 19.15%). The acquisition was prompted by an email from Mr Johnson to Keybridge’s other directors at the time, Messrs Sormann, Patton and Cato, stating that Keybridge’s relevant interest in Molopo needed to move above 19% “ASAP” so that Keybridge could increase its interest using the ‘creep’ provisions of the Corporations Act. Mr Patton was involved in managing the acquisition.

- Keybridge submitted that it considered Molopo (its largest investment) as a strategic stake and to realise maximum value from any sale of that investment, it would be desirable to sell the entire stake to one investor. It submitted that it decided to increase its Molopo stake on the basis that the larger the stake the more attractive it would be. It used as a model the sale on or about 26 August 2015 by Bentley of its shareholding in Molopo (at that time the largest shareholder in Molopo holding a little under 20%) for 26.5 cents per share (compared with a market price of approximately 15 cents per share).

- From October 2016, Keybridge (through primarily Mr Khan) was in negotiations to sell its Molopo stake which broke off in mid-February 2017 due to a failure to finalise commercial terms. Also in October 2016, Keybridge (through Mr Bolton) had discussions with another potential purchaser. That purchaser had previously negotiated with the prior Keybridge board to acquire Keybridge’s Molopo stake but, Keybridge submitted, that transaction failed to conclude at the last moment due to the apparent failure of the Molopo board to grant the purchaser a board seat. The negotiations with Mr Bolton did not proceed to an advanced stage as the price being offered was below both Keybridge’s expectations and that being proposed by the other potential purchaser.

- At the same time as pursuing a sale of the Molopo stake, Keybridge sought to replace Mr Sormann as its representative on the Molopo board. The request to appoint Mr Sanders was rejected by Molopo on 2 December 2016 citing the potential association between Keybridge and Aurora following the announcement of Aurora’s substantial shareholding in Molopo. On 17 January 2017, Keybridge requested that Molopo appoint Mr Johnson as Keybridge’s nominee to the board of Molopo (as an alternative to Mr Sanders). This was also rejected.

- On 26 October 2016, Messrs Johnson, Cato, Patton, Kriewaldt, Khan and Bolton attended a Keybridge strategy meeting which had been called to “map out a clear director (sic) for KBC – from both a strategic and operational perspective”. In relation to Molopo, the draft agenda for the meeting prepared by Mr Ho listed two items – a sale at $████ per share and “launch bid with KBC CRPN” (ie. Keybridge’s listed convertible notes).

- The draft agenda also included the item “Investments co-invested by [Keybridge] and [Aurora] – Manage association”. Keybridge submitted that this item was included in the draft agenda by Mr Ho to raise for discussion any investments in which Keybridge and Aurora independently had an interest. Mr Kriewaldt stated in his statutory declaration that the item was introduced at the strategy meeting by Mr Ho who said “it was important for Keybridge to understand whether any acquisitions or disposals of shares by Aurora could affect the voting power of Keybridge, on the basis that … Mr Patton was the controlling mind and will of Aurora … and might therefore have a relevant interest in the shares held by Aurora.” Mr Kriewaldt stated further that “Mr Patton said that, as far as he believed, he did not have any relevant interest in shares held by Aurora in funds managed by it, but that he would check that this was the case.”

- According to Mr Kriewaldt, at the strategy meeting Keybridge’s strategy remained to sell its entire investment in Molopo for a price of at least $████ per share and in keeping with that strategy, to replace its current representative on the Molopo board, in order to give an indication to any potential purchaser that they would also be likely to be able to secure a board seat. At the meeting, Mr Kriewaldt submitted that Mr Khan had suggested that if Molopo failed to appoint Keybridge’s replacement nominee, Keybridge could consider either a member resolution to alter the composition of the Molopo board or launching a takeover bid. Mr Kriewaldt indicated that Mr Khan’s suggestions were not supported in light of the strategy to sell.

- In addition to the two actions described by Mr Kriewaldt of selling Keybridge’s Molopo stake and seeking to replace its Molopo board representative, Mr Johnson emailed Mr Pamensky (copying Messrs Patton and Ho) on 27 October 2016 noting that at the strategy meeting it was agreed to “top back up in Molopo as much as we can … to just under 20%”. This was supported by Mr Ho’s notes of the meeting. Following its acquisition of Molopo shares on 20 September 2016, Keybridge continued to accumulate shares in Molopo until the commencement of the initial Panel’s proceedings on 11 April 2017 increasing its shareholding to 19.95%.

- Keybridge further submitted that its strategy in relation to its investment in Molopo changed in late February 2017 when the proposed sale of its Molopo stake fell through and Molopo declined Keybridge’s request for a board seat to replace Mr Sormann and instead appointed two new directors who were not representatives of any shareholder. Keybridge submitted that its directors (excluding Mr Patton) “then adopted the proposal of Mr Khan at that time (reviving the possibility that he had discussed at the 26 October 2016 strategy meeting) that the board composition of Molopo should be thrown open for shareholders to consider”. Accordingly, on 12 March 2017, Keybridge lodged its section 249D requisition with Molopo.

- Keybridge submitted that from 10 November 2016 onwards, Mr Patton was excluded from matters relating to Keybridge’s investment in Molopo. At that time, Mr Patton conveyed that he was conflicted in relation to Molopo and an information barrier was established. We discuss this in detail below.

Aurora’s investment in Molopo

- Following the restoration of liquidity at the three frozen Aurora funds on 31 August 2016, Aurora began to focus on ways to attract new investment monies. Mr Patton deposed that Aurora decided to adopt a strategy of trying to attract investors who held large shareholdings in ASX-listed companies and encourage them to swap their shareholdings for units in Aurora’s funds in order to build up their funds under management.

- Mr Siciliano was the portfolio manager at Keybridge of HHY from February 2015 to July 2016. He invested in the Aurora Trust at the time of the Aurora acquisition by Seventh Orion and joined Aurora as a portfolio manager on 26 July 2016. In early October, after the departure of the former investment manager, Mr Siciliano assumed investment responsibility for AGIT and AFARF and began trading and rebalancing across the portfolios.

- As part of the Aurora sale, Keybridge retained the investment management rights for HHY, while Aurora remained as responsible entity. Following Mr Siciliano’s appointment by Aurora, Keybridge hired Mr Siciliano pursuant to a consulting agreement to action trades on instructions from Mr Johnson and to perform administrative services for HHY.

- Mr Siciliano deposed that, sometime in September 2016, he raised the “Molopo investment idea” with Mr Patton. Mr Patton deposed that it looked like an interesting investment idea (based on the then current trading price) but he was concerned about the risk of investing in a company where about 50% of shares were held by three parties (one being Keybridge). Mr Patton subsequently mentioned Molopo, as well as Aurora’s strategy for increasing its funds under management, to Mr Bolton. Mr Patton deposed that Mr Bolton said he knew investors located overseas who in aggregate held about 18% of Molopo and offered to sound them out about whether they would be interested in selling in exchange for units in an Aurora fund. Mr Siciliano also deposed that, at or around mid-October 2016, he and Mr Bolton discussed potential sellers of Molopo shares. Mr Bolton stated that “Mr Siciliano did not communicate to me his buying of Molopo in October 2016” but did not specifically deny having communications with Mr Siciliano regarding potential sellers of Molopo shares.

- Mr Bolton emailed one Molopo shareholder on 28 September 2016 and another on 17 October 2016 in both cases forwarding the email exchanges to Mr Patton.

- On 7 October 2016, Mr Siciliano commenced buying shares in Molopo. By 31 October 2016, Aurora’s total interest had increased to approximately 3.5% of Molopo’s issued capital.35

- Mr Siciliano deposed that he acquired the shares on the basis that Molopo was trading at a 48% discount to its cash backing. It was one of a number of stocks he purchased in similar weightings using this investment thesis and the acquisitions were made within the investment mandate delegated to him by Aurora (only investments representing more than 5% of net asset value of any given fund required Aurora board approval). Aurora submitted that Mr Siciliano “was not required to seek the approval of the directors of Aurora, or otherwise notify them, before making these acquisitions (and did not do so)”. While Mr Patton received daily reports setting out the number of shares held by the Aurora funds at each trading day, he deposed that he did not become aware of the buying until “later in October 2016”.

- After he became aware of the buying, Mr Patton deposed that he asked Mr Siciliano to “take it easy” until Mr Patton had “reached a landing about Molopo's suitability as an Aurora investment”. Mr Siciliano kept buying Molopo shares but reduced Aurora’s average daily spend.

- Mr Patton deposed that, on or around 8 November 2016, he instructed Mr Siciliano to see whether he could build a stake up to 5% while Aurora concurrently progressed efforts to acquire the holdings of the three overseas investors contacted by Mr Bolton, with the view to building a stake in Molopo of approximately 14%. Mr Patton deposed that he thought this would be sufficient to secure a board seat.

- In early November, Mr Siciliano prepared an investment paper at Mr Patton’s request to summarise the analysis and to support the investment proposal. Referring to Molopo’s shareholder base as appearing to be “dysfunctional”, the paper proposed that Aurora ”move to a 19.99% as a balance of power stake, seek board representation”.

- The paper was sent to Aurora’s other directors on or around 18 November 2016. In the cover email from Mr Patton to Mr Hallam, Mr Patton wrote that he “wouldn’t normally run investment strategies past you but because of the potential for a substantial shareholder notice to be issued, just wanted to let you know in advance”. Mr Hallam provided some comments on the investment paper (in mark-up) to Messrs Patton and Siciliano on 5 December 2016. His comments included: “Does [Aurora] funds and/or executives/shareholders have related party issues” and “[Keybridge] holds 19% - how do we manage conflicts and being viewed as a collective holding”. The next day he requested legal advice from Norton Gledhill on the issues raised by the Molopo investment paper.

- In the meantime, however, Mr Siciliano had begun increasing the spend on Aurora’s acquisitions of Molopo shares on market and on 29 November 2016, as Mr Patton deposed, “the trade was consummated” and Aurora became a substantial holder in Molopo.

- Aurora submitted that it engaged in discussions with one of the overseas Molopo shareholders (Seller A), to acquire a block of approximately 10 million shares by a special crossing in November 2016, but the transaction did not proceed. It subsequently acquired over 10 million Molopo shares on 29 November 2016, through 29 standard on market trades.

- Mr Siciliano was aware of the approaches to overseas Molopo shareholders and deposed that Mr Bolton had advised him of the position of each of these shareholders, including Seller A. Mr Bolton corresponded with representatives of Seller A between 19 and 23 November 2016 regarding settlement of the sale of Molopo shares to Aurora and forwarded or copied the correspondence to Mr Siciliano.

- Aurora also sought legal advice from Mr Kriewaldt, in his capacity as a partner of the law firm Atanaskovic Hartnell, about whether there would be any legal impediments to its proposed Molopo investment. The advice, dated 18 November 2016, did not highlight any potential issues including any association issues with Keybridge.

- Aurora continued to purchase Molopo shares on market through 15 December 2016 and then began buying again from 6 February 2017 through 21 March 2017. These acquisitions included Aurora entering into binding agreements on 17 March 2017 with another of the overseas Molopo shareholders introduced by Mr Bolton (Seller B) to acquire 9,629,118 Molopo shares (or 3.87% of Molopo’s issued capital) in consideration for units in AFARF.

- We were provided with confidential material by Aurora regarding its commercial objectives concerning Molopo during the period after January 2017. Aurora submitted that it was acquiring a strategic stake in Molopo in furtherance of these objectives which were incompatible with Keybridge’s objective of replacing the Molopo board. We considered Aurora’s confidential material but were not satisfied that it was relevant or significant in relation to the matters before us, and were not persuaded that it provided credible support for Aurora’s submissions.36

- At a board meeting of Aurora on 16 February 2017, the board discussed seeking representation on the Molopo board in light of its then approximately 10% shareholding in Molopo. Aurora submitted that “it was focussed on building an investment stake that would provide it with some influence on the use of Molopo’s cash and to protect its substantial investment in Molopo (through a board representative)”.

- On 2 March 2017, Mr Patton wrote to Ms Tough to open communications between Aurora and Molopo. In a subsequent phone call that day between Mr Patton and Ms Tough, Ms Tough advised that Molopo had requested ASIC to investigate Keybridge and Aurora and Molopo would not consider granting Aurora a board seat at that time.

- After Keybridge requisitioned a general meeting of Molopo, Mr Patton wrote to Ms Tough to confirm the due date for nominations for directors for election at the meeting. On 31 March 2017, Aurora put forward one nomination for director.

Association

Common investments and dealings and other structural links

- We agree with the initial Panel that, in addition to their respective investments in Molopo, there are a considerable number of common investments and dealings and other structural links between Keybridge and Aurora, as highlighted in the diagram in Annexure A and described below.

- Mr Bolton was the former managing director of Keybridge. He holds 1% of ASH, the holding company of ASG which holds 21.16% of Keybridge. He also holds 2.2% of Keybridge directly. He is currently a consultant to Keybridge. He also owns 49.9% of the Aurora Trust.

- Mr Patton is currently Chairperson and an executive director of Keybridge, nominated by ASG. He and his wife through their self-managed superannuation fund have a small investment of approximately 0.09% of Keybridge. He is the managing director of Aurora. Mr Patton owns 26.1% of the Aurora Trust and 50% of its trustee, Seventh Orion. Mr Bolton was previously a client of Mr Patton’s when Mr Patton worked at Ernst & Young. Mr Bolton introduced Mr Patton to the Aurora transaction and proposed his appointment to the Keybridge board.

- Keybridge has a relevant interest in 27.98% of HHY and Aurora has a relevant interest in 12.18% of HHY being acceptances under a current takeover bid by AGIT for HHY. Aurora is the responsible entity for HHY and Keybridge is its investment manager. Keybridge hired Mr Siciliano, Aurora’s portfolio manager and a unit holder in the Aurora Trust, to assist in the management of the fund. Mr Siciliano was a former employee of Keybridge. He has known Mr Bolton since 2012 and approached Mr Bolton about working at Keybridge in 2015.

- Keybridge also holds a relevant interest in 5.02% of AGIT.

- Aurora holds 385,825 Keybridge convertible preferred notes (ASX: KBCPA).

- Mr Rowley is a friend and business partner of Mr Bolton. He has a relevant interest in 1.61% of Keybridge, a 7% interest in the Aurora Trust and a 50% interest in Seventh Orion. He is also a director of Seventh Orion. He was introduced to Mr Patton by Mr Bolton as a person interested in investing in Aurora. Aurora submitted that Mr Rowley invested in the Aurora Trust as a ‘top up’ investor for funding the Aurora acquisition.

- On 19 December 2016, Keybridge moved its registered office to Melbourne so that it was in the same place as its chief executive, Mr Patton (although its administration moved to Perth). This was in the same office, or at least on the same floor, as Aurora, Seventh Orion and Mr Patton’s entity, Wilson Hanna Pty Ltd.

- Keybridge and Aurora also have or have had co-investments in PTB Group Limited (ASX: PTB), Metgasco Limited (ASX: MEL), Copper Strike Limited (ASX: CSE) and NAC (NAOS Absolute Opportunities Company Limited). Mr Patton is a non-executive director of Metgasco Limited, as a representative of Keybridge.

- In relation to their common investment in Molopo, we have described in detail events surrounding the acquisition of Molopo shares by each of Keybridge37 and Aurora38 between September 2016 and April 2017. Keybridge submitted that the decisions by Aurora to acquire Molopo shares were co-incidences of which it had no knowledge. We do not accept this. While the contemporaneous buying of shares by two entities is not of itself evidence of an association, when considered together with other probative material before us,39 we consider that it does support an inference in this case that the strategies of Keybridge and Aurora were compatible and becoming increasingly aligned and coordinated. As discussed below, Mr Bolton was aware of both Keybridge and Aurora’s investment strategies for Molopo and used his influence to guide the strategies and actions of Keybridge and Aurora toward the ultimate objective shared by both companies to control Molopo and access its cash reserves.

Prior collaborative conduct

Voting at the 2016 NAC annual general meeting

- ASIC had obtained under notice a series of email exchanges between Keybridge and Aurora in relation to NAC which ASIC submitted revealed Keybridge and Aurora collaborating on voting shortly before NAC’s 2016 annual general meeting. At the time, Keybridge and Aurora held collectively approximately 11.4% of NAC.

- Three resolutions were proposed at the annual general meeting relating to approval of the remuneration report and auditor remuneration and the re-election of one director.

- In an email dated 14 November 2016 to Messrs Patton, Bolton, Johnson, Khan and Siciliano, Mr Ho listed “[o]ur voting shares” in NAC as two parcels of NAC shares held by Keybridge – one for itself and the other for ARARF (pending transfer to Aurora as responsible entity) – and a third parcel held by HHY. He then asked:

I am not sure about voting on the HHY holding as the corro (sic) goes to [Aurora]

Can I please have the Investment Committee’s position on voting directions by COB Tuesday so that voting can be lodged Tuesday night (Perth time) and Wednesday morning…by [Aurora].

- Keybridge’s investment committee comprised Messrs Patton and Johnson. Mr Patton responded saying: “[Mr Johnson], I’m supportive of all the resolutions. Do you concur?”

- In response, Mr Bolton suggested “Vote against REM report (as we can probably defeat it) and abstain on others (as we can’t defeat). Nuisance value. Best to give them a reason to get us out, or bring them to the table." We infer that Mr Bolton was presuming that Keybridge and Aurora would vote in the same way in order to exert ‘nuisance value’.

- Mr Khan opposed all resolutions, saying “My inclination is to vote against all resolutions. We owe them nothing and our intention should be made clear … They voted against us at the hhy meeting so why do them any favours now irrespective of wether (sic) our vote counts. It also sends a clear signal we are to be dealt with our (sic) we will be hostile”. We infer that Mr Khan was also presuming that Keybridge and Aurora would act together to send a ‘signal’ to NAC. Mr Khan’s response also shows how Keybridge and Aurora’s shared interest in HHY40 may influence their corporate strategy on another entity in which they are co-invested.

- Mr Johnson agreed with Mr Khan. However, in response, Mr Patton queried “[s]houldn’t we only vote against where we think it is likely to have an impact?”

- Mr Bolton agreed with Mr Patton, however he noted that “it's not necessary for Keybridge/HHY to vote the same way as Aurora”. ASIC submitted that Mr Bolton’s response suggested it was usual for them to do so. Mr Bolton submitted that he made the comment to demonstrate that Keybridge (as manager of HHY) could ask Aurora (as responsible entity) to vote in a particular way but it was Aurora’s decision as to how to vote. We share the initial Panel’s doubt that this comment conveyed the message that Mr Bolton submitted was its purpose.41 In any case, we consider that Mr Bolton’s statement indicated his view of the NAC shares of Keybridge and HHY being a ‘bloc’.

- While the email exchange purportedly related to how Keybridge’s investment committee would vote Keybridge’s shares at the NAC meeting, the involvement of Mr Patton and Mr Bolton and the recognition that it was Aurora as responsible entity which would vote HHY’s shares, showed a blurring of the activities of each of Keybridge and Aurora in relation to NAC.

- This continued after the meeting when Mr Ho emailed Messrs Patton, Bolton, Johnson, Khan and Siciliano, as well as Ms Poon and Mr Pamensky, reporting that NAC just missed out on a first strike on the remuneration report and that a number of options held by HHY that could not be exercised in time for the meeting, would have tipped them over 25%.

Defending Aurora as responsible entity of HHY, AGIT and Buy-Write

- Keybridge shareholder, Wilson Asset Management, also a major unit holder in Aurora funds, had requisitioned meetings to remove and replace Aurora as the responsible entity of HHY, AGIT and Buy-Write. ASIC submitted that Keybridge and Aurora collaborated to protect Aurora's position as responsible entity. Aurora submitted that there were commercial reasons for Keybridge to wish for Aurora to remain the responsible entity of the funds because Keybridge was entitled to earn-out consideration on the sale of Aurora contingent on Aurora remaining the responsible entity of AFARF. Aurora submitted that this had nothing to do with Aurora’s investment in Molopo.

- In the lead up to the requisitioned meeting of HHY, Mr Johnson emailed Messrs Sormann, Patton and Cato on 12 September 2016 saying “[Keybridge] should increase its holding in HHY if we wish to defend the position of Aurora as Responsible Entity.” Keybridge subsequently increased its holding in HHY from 21.08% to 24.03%.42

- In respect of AGIT and Buy-Write, Aurora’s board papers circulated on 17 October 2016 show that Aurora’s directors decided to issue significant numbers of units to defend Aurora’s position as responsible entity. In both cases, the resolutions for replacement were defeated. ASIC submitted that in the case of AGIT, the issue of units was critical to the defeat.

- Keybridge subscribed for units in each of AGIT and Buy-Write up to 4.9% using funds from a redemption of AFARF units. On 1 December 2016, Mr Ho noted in an email that Keybridge needed to “have the units allotted by Friday as the EGMs for [AGIT] and [Buy-Write] are on next Tuesday". He also noted that Keybridge would hold the AGIT units until matters were resolved with Wilson Asset Management whereas the Buy-Write units could be redeemed after the meeting (which they were on 9 December 2016, three days after the meeting).

- In AGIT, Aurora issued units equal to around 44% of its pre-issued capital. In addition to Keybridge, AGIT issued units to Aurora (directly and through AFARF) of 19.9% and, as submitted by ASIC, to Bentley/Scarborough of 4.9%. Buy-Write issued units to AFARF up to 4.9%.

- ASIC submitted that Aurora and Keybridge personnel collaborated to ensure that the investments by Keybridge and Bentley/Scarborough stayed below the substantial holder threshold of 5%. Mr Patton by email dated 3 December 2016 instructed Ms Poon to alter the allocations and have more units allocated to AFARF. Ms Poon in a later email stated that she had obtained final numbers “per phone call from Nick”. Although her email was in response to Mr Patton’s instruction to increase Aurora’s investment, Ms Poon deposed that her reference to Mr Bolton related to Keybridge’s investment allocations in the Aurora funds and believed Mr Bolton was acting in his role as a consultant of Keybridge. That may be so, but this nevertheless provides an example of close cooperation in which it is difficult to delineate the roles of Messrs Bolton and Patton in relation to Keybridge and Aurora.

- In our view, the examples above relating to voting at the NAC annual meeting and the defence of Aurora’s position as responsible entity show that Keybridge and Aurora have acted together in relation to a number of listed entities, at times with a significant level of involvement by Mr Bolton (e.g., his email proposal “abstain on [other resolutions] (as we can’t defeat them)”).

- In our view neither Keybridge nor Aurora have adequately addressed the evidence relating to collaboration and it is reasonable to infer from this, taken together with the other material before us, that Keybridge and Aurora also acted together in relation to Molopo.

Common knowledge of relevant facts

Mr Bolton’s knowledge of Keybridge’s strategy in relation to Molopo

- Notwithstanding that Mr Bolton was not a director of Keybridge and did not attend board meetings43, on the materials, we consider that Mr Bolton was aware of Keybridge’s strategy in relation to Molopo at all relevant times. For example:

- on 13 October 2016, Mr Bolton emailed Messrs Johnson, Cato, Patton, Kriewaldt, Khan and Ho regarding his consulting agreement and noted that he had an interested purchaser in Keybridge’s Molopo stake detailing their terms for sale

- on 19 October 2016, Mr Khan emailed Messrs Johnson, Bolton, Patton and Ho with an update on his negotiations with the other potential purchaser of Keybridge’s Molopo stake. Mr Khan said that he felt that the purchaser did not have the cash to raise his price and so in Mr Khan’s view “we should get the cash position of Keybridge up and then creep to the maximum possible amount and then launch a scrip bid for Molopo using Keybridge con notes”

- on 26 October 2016, Mr Bolton attended the Keybridge strategy meeting which discussed Keybridge’s strategies in relation to Molopo

- subsequently, he was copied on multiple emails with updates regarding Mr Khan’s negotiations with the potential purchaser of Keybridge’s Molopo shares

- from 9 November 2016 through 20 February 2017, Mr Bolton received multiple emails attaching correspondence between Keybridge and Molopo regarding Keybridge’s replacement board nominee

- in a text from Mr Khan to Mr Bolton on 3 January 2017, Mr Khan asked Mr Bolton whether he recalled when Keybridge “can creep on mpo”

- on 11 January 2017, Mr Johnson suggested in an email holding “a board conference in the next few days (with Nick and Farooq attending)” to decide whether to go ahead with the sale of Keybridge’s Molopo stake. Mr Bolton responded that he would not attend a Keybridge board discussion on Molopo on the advice of Mr Patton. Mr Bolton indicated in his statutory declaration that Mr Patton told him not to participate given his knowledge of Aurora’s interest to buy more Molopo shares

- on 9 February 2017, Mr Bolton responded to an email from Mr Khan asking which Molopo directors were subject to rotation and reelection at Molopo’s next annual general meeting

- on 17 February 2017, Mr Bolton and Mr Khan met in Sydney. Subsequently, Mr Khan emailed Messrs Johnson and Ho referring to his meeting and stated:

Mr Johnson responded to Messrs Khan and Ho stating “Sounds like a plan!”We agreed that we should send a share register request to MPO on Monday and then wait till the end of the week to see if they hold a board meeting and appoint either William or David.

If they don’t by cob Friday we should serve before cob Friday a request for them to convene a meeting to add William and David as board members.

Thereafter we can see if they appoint both anyway (say a week later) and if not then serve another requisition this time calling our own meeting to remove the two Ion representatives.

On that basis, Vic could you please prepare and serve the request for the register…

- on 24 February 2017, Mr Bolton indicated that he would provide comments on a draft letter to the Molopo board regarding board representation that had been sent to him and in the interim provided information on the investment thesis Keybridge had previously presented to Molopo

- in a text from Mr Khan to Mr Bolton on 1 March 2017, Mr Khan again asked Mr Bolton when Keybridge can creep on Molopo. Mr Bolton responded to the question although he noted that he would prefer not to be involved in any Keybridge trading if it chooses to do so

- on 8 March 2017, Mr Bolton and Mr Khan exchanged text messages regarding the composition of the Molopo board, including whether the newly appointed managing director of Molopo would be up for reelection at the annual general meeting and the notice period for appointment of a director

- on 10 March 2017, Mr Khan emailed Mr Bolton and others attaching a draft ASX announcement regarding Keybridge’s requisition notice to Molopo and

- also on 10 March 2017, Mr Khan sent an email to Mr Ho (copying Messrs Kriewaldt and Johnson) which advised that he had just spoken to Mr Bolton and both he and Mr Bolton supported the proposal to stand behind the director fees of Mr Hartnell (one of Keybridge’s proposed nominees). A follow up email also noted that Mr Bolton commented on the fees payable to Ms Tough as Chairperson of Molopo.

- Mr Bolton declared in his statutory declaration that he distanced himself from discussions at Keybridge regarding Molopo from November 2016 onwards when it became clear to him that Aurora was to progress its own strategy in relation to Molopo. He indicated that he informed Messrs Johnson, Ho and Khan to the effect that he could no longer provide any advice or information to Keybridge in relation to Molopo. None of Messrs Johnson, Ho or Khan could recall being so informed by Mr Bolton in November 2016, although they acknowledged (through Keybridge’s submissions) that may have occurred. Even assuming that occurred, the material outlined above suggests that Mr Bolton generally was not excluded from correspondence or discussions44 regarding Molopo from November 2016 onwards.

- Mr Bolton further declared that prior to November 2016, his involvement as a consultant to Keybridge was “reasonably limited” given that Keybridge had limited occasion to meet following his appointment effective on 13 October 2016. We note, however, that the 26 October 2016 strategy meeting occurred in this period. Mr Bolton declared in his statutory declaration that the advice he did provide in this period was in relation to Keybridge’s historic attempts and continued effort to sell its Molopo stake. We know that discussions in relation to Molopo during this period in which Mr Bolton participated, whether he was providing ‘advice’ as a consultant or otherwise, were not limited to selling Keybridge’s stake.

- Mr Bolton further declared in his statutory declaration that he was engaged as a consultant to provide detail on the past investment ideas he had presented to Molopo as the then managing director of Keybridge and to provide a history of the previous prospective purchaser of Keybridge’s Molopo stake. Mr Bolton’s description of the scope of his consultancy as it relates to Molopo generally suggests a focus on past events. However, his consulting agreement provided for services including the “generation of investment ideas, corporate and board planning and strategies and executive management and corporate and commercial affairs”. It is also difficult to reconcile a purely historical focus with the reason provided by Keybridge for hiring Mr Bolton as a consultant.45 More importantly, in practice, Keybridge’s communications and meetings relating to Molopo in which Mr Bolton was involved related to Keybridge’s current and future events and strategies, not simply past events.

- Mr Bolton also submitted, more generally, that a person cannot help being the recipient of an email and receiving an email is not evidence of the exercise of influence, in particular, when the recipient of the email does not reply. We agree with the first part of his submission but not the second. We consider that Mr Bolton being copied on multiple emails demonstrates a desire by relevant Keybridge representatives to confer with Mr Bolton and supports a finding that he was copied because he was heavily involved in Keybridge matters. For the reasons below, we consider that Mr Bolton does exercise influence over Keybridge.

Mr Bolton’s role and influence in the affairs of Keybridge

- As the former managing director of Keybridge, Mr Bolton was fully across Keybridge’s investments and strategies. Following his resignation due to his disqualification from managing a corporation, Mr Bolton was unhappy with the direction taken by Keybridge’s then management, including its decision to sell Aurora, as communicated to Mr Moffat.46 We know on 1 June 2016, the day after Scarborough advised of its intention to call a section 249F meeting of Keybridge, Mr Khan contacted Mr Bolton (presumably as a representative of ASG) to discuss “the way forward”.

- When Mr Bolton approached Mr Kriewaldt about Mr Kriewaldt’s interest in becoming a director of Keybridge in late June or early July 2016, Mr Kriewaldt stated:

I asked who the other directors of Keybridge were. Mr Bolton indicated that he expected that at an extraordinary general meeting of Keybridge the current chairman was likely to be removed and Mr Cato and Mr Johnson appointed. In that situation, the other Keybridge directors, Mr Brown and Mr Sormann, might well resign and there might then be a need for one or two further directors to be proposed by ASG. Mr Bolton explained to me that ASG and Bentley Capital Ltd (Bentley), both of which held approximately 20% of Keybridge's issued share capital, respectively, thought that the board should have two members proposed by each of them and should operate, in effect on the basis that three directors would need to vote in favour of any proposal (with the chairman not having a casting vote).

I pointed out that this was an unusual arrangement to which Mr Bolton replied that Bentley and ASG had been concerned with how the then existing board of Keybridge had made decisions without approaching apparently considering (sic) the interests of current shareholders and this arrangement was designed to ensure that the board in future it (sic) would not behave in that way. Mr Bolton also stated that Bentley and ASG did not have any significant history of working with each other and so this was (sic) arrangement was also designed to ensure that the proposals or goals of either of them could not be pushed through on the casting vote of a chairman.

- As indicated, the then Chairperson, Mr Moffat, was removed and Messrs Brown and Sormann did resign. Thereafter, Messrs Patton and Kriewaldt were appointed ‘representing the interests of ASG’ with the balance of the board consisting of Bentley’s nominees, Messrs Cato and Johnson. We agree with Mr Kriewaldt that this arrangement is “unusual”.

- Aurora submitted that Messrs Patton and Kriewaldt were nominated to represent the interests of all shareholders of Keybridge, not just ASG. It is true that their duties require them to act in the best interests of the company, but does not prevent them taking account of the interests of the shareholder who nominated them nor prevent expectations on the part of that shareholder that its interests will be promoted. Mr Patton deposed that he does not consult with, report back to or receive any instructions, directions or other communications from ASG or any representative of ASG, including Mr Bolton, in relation to the affairs of Keybridge. We accept that Mr Patton is not simply a nominee director of Keybridge and does not take whatever action ASG may instruct. However, we do not consider Mr Patton’s statement is inconsistent with Mr Bolton having the potential to exercise influence in relation to the strategy and actions of Keybridge, particularly in light of their close consultative relationship.