[2016] ATP 1

Catchwords:

Remittal – Federal Court – Full Court – time share – stapled securities – unlisted company – more than 50 members – contravention of s606 – extension of time for making application – extension of time for making declaration – interim orders – new interim orders – principles for making interim orders – conducting proceedings – serious contravention – declaration – unacceptable circumstances – orders – voting restrictions, creep – unfair prejudice

Acts Interpretation Act 1901 (Cth), section 33

Australian Securities and Investments Commission Act 2001 (Cth) section 193

Corporations Act 2001 (Cth), sections 601ED, 606, 611 item 7, 611 item 9, 621, 631, 633, 636, 657A, 657B, 657C, 657D, 657E, 659AA, 659B

Corporations Amendment (Takeovers) Bill 2007

Corporations Law section 733A

ASIC regulation 13(c)

Procedural Rules 3.1.1, 6.1.1

Guidance Note 1 "Unacceptable Circumstances", Guidance Note 2 – "Reviewing Decisions", Guidance Note 4 - "Remedies General"

Palmer Leisure Coolum Pty Ltd v Takeovers Panel [2015] FCA 1498, Queensland North Australia Pty Ltd v Takeovers Panel (No 2) [2015] FCAFC 128, Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68, Quach v Health Care Complaints Commission [2015] NSWCA 187, Queensland North Australia Pty Ltd v Takeovers Panel [2014] FCA 591, Chen v Lym International; Chen v Marcolongo [2009] NSWCA 121, Ford v Child Support Registrar [2009] FCA 328, Attorney-General (Cth) v Alinta Limited [2008] HCA 2, Takeovers Panel v GIencore International AG [2005] FCA 1628, Attorney-General for the State of Victoria v Weston [2004] VSC 314, Brown v AEP Belgium SA [2004] VSC 255, Eastland Technology Australia Pty Ltd v Whisson [2003] WASCA 307, Waikato (Pty) Ltd and Anor v Kaplan and Anor [2002] VSC 310, Australian Securities & Investments Commission v Yandal Gold Pty Ltd [1999] FCA 799, Cellante and Ors v G Kallis Industries Pty Ltd [1991] 2 VR 653, Attorney-General v Wentworth (1988) 14 NSWLR 481, Gjergjia v Cooper [1987] VR 167, Federal Commissioner of Taxation v. Myer Emporium Ltd. (No. 1) [1986] HCA 13, Scarborough's v Lew's Junction Stores Pty Ltd [1963] VR 129

The President's Club Ltd [2012] ATP 10, CMI Limited [2011] ATP 4, Blue Energy Limited [2009] ATP 15, GoldLink IncomePlus Limited 04R [2009] ATP 3, Golden Circle Ltd 02, [2007] ATP 24, Austral Coal Limited 02(RR) [2005] ATP 20,Brisbane Broncos Limited (No 3) [2002] ATP 03, Brisbane Broncos Limited 01 and 02 [2002] ATP 01

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| Yes | No | Yes | Yes | Yes | No |

Introduction

- The Panel, Peter Day (sitting President), Michelle Jablko and Ian Jackman SC, extended time for the application, obtained a court extension of time for a declaration, made a declaration and made orders. The application concerned the remittal of the proceedings in The President's Club Limited [2012] ATP 10 (first proceeding). In the first proceeding, two acquisitions of shares in July 2011 and March 2012 (with associated villa interests) were declared to give rise to unacceptable circumstances and the Panel ordered a voting, acquisition and disposal freeze on the acquired shares. The freeze was to be lifted if an unconditional bid on certain terms was made. No bid has been made. The first Panel's decision was set aside by the Full Court of the Federal Court of Australia, on the basis of a procedural irregularity when the first Panel extended time without giving an opportunity for submissions, and the application was remitted to be heard and determined according to law (remittal proceeding). The remittal Panel considered the matter afresh and considered that each of the acquisitions in July 2011 and March 2012 gave rise to unacceptable circumstances. It ordered a voting freeze on shares in excess of 20% (after deducting from the calculation the shares subject to the freeze) and modified the application of item 9 of s611 (the 'creep' exemption) so as to allow future creep based on the reduced voting level.

- In these reasons, the following definitions apply.

- Acquisition Shares

- 3,328 shares in TPC held:

- as to 3,107 shares, by CDLI or an associate and

- as to 221 shares, by PLC or an associate

- Associated Parties

- CDLI, CDLH, Closeridge, PLC, Mr Clive Frederick Palmer and each of their respective associates

- CDLH

- Coeur de Lion Holdings Pty Ltd

- CDLI

- Coeur de Lion Investments Pty Ltd

- Closeridge

- Closeridge Pty Ltd

- PLC

- Palmer Leisure Coolum Pty Ltd (formerly, Queensland North Australia Pty Ltd)

- TPC

- The President's Club Limited

- Annexed to these reasons are the following Panel documents:

Annexure Document A Interim orders dated 4 September 2015 (short term) B Variation interim orders dated 10 September 2015 C Second variation interim orders dated 18 September 2015 D Third variation interim orders dated 25 September 2015 E Interim orders (voting) dated 17 November 2015 F New Interim orders (disposal) dated 18 November 2015 G New Interim orders (voting) dated 18 January 2016 H New Interim orders (disposal) dated 18 January 2016 I Declaration of unacceptable circumstances J Final orders

Facts

- The detailed facts are set out in The President's Club Limited [2012] ATP 10.

- Drawing on those facts, and from the application, briefly:

- TPC is an unlisted company with more than 50 members1 that operated a time share. Each participant owned a parcel of 13 ordinary shares and a corresponding one-quarter interest, as tenant in common, in one of two community title schemes - "The President's Club Golf Community Titles Scheme" or "The President's Club Tennis Community Titles Scheme" (each a "villa interest"). The villa interests were subject to a letting pool.

- The scheme was granted an exemption from s601ED2 by ASIC on the basis (among others) that members not associated with the developer (CDLI, then owned by Lend Lease) had 90% of the votes. To achieve this, CDLI executed a deed poll in favour of ASIC which (among other things) restricted its voting to no more than 10% of the votes actually cast in TPC, save on a winding up resolution or with ASIC's consent.

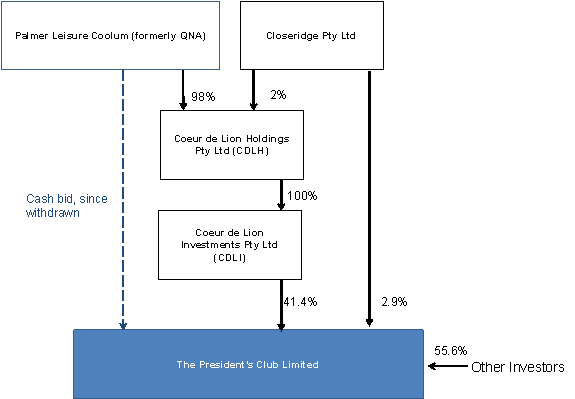

- CDLI owns 41.4% of the shares in TPC. CDLH owns all the shares in CDLI.

- On or about 1 July 2011, PLC acquired 98% of the shares in CDLH and, as a result, increased its relevant interest in TPC from 0% to 41.4% (first acquisition). Closeridge, an associated company of PLC, acquired the other 2% of CDLH.

- Between 13 and 19 March 2012, Closeridge, an associated party as noted, bought an additional 17 lots, being 221 shares or approximately 2.9% of TPC, in a series of acquisitions (second acquisition), taking PLC's relevant interest to approximately 44.4%. The highest price paid for a villa interest and its corresponding 13 shares was $65,013.

- The relationship between the parties at the time of the application (ie, June 2012) was as follows:

- The deed poll was revocable on giving 180 days' notice to ASIC, which was done on or about 15 September 2011, and it was revoked on or about 13 March 2012. Thereafter, TPC was unable to rely on the ASIC exemption from s601ED.

- On 14 March 2012, TPC held a meeting of shareholders at which resolutions were put to amend its constitution to limit the voting of CDLI to 10%. The resolution was not carried.

- On 12 April 2012, PLC lodged a bidder's statement with ASIC for an unconditional bid for all the shares in TPC and corresponding villa interests. The consideration was to be $55,013 for each villa interest and its corresponding 13 shares. On 24 April 2012, the bidder's statement was 'withdrawn'. ASIC responded that the bid had been made public and PLC was required to make offers as s631 applied. On 11 May 2012, ASIC granted an extension of time for dispatching offers. On or about 21 May 2012, PLC lodged a replacement bidder's statement. On 24 May 2012, PLC wrote to owners advising (among other things) that an offer "will be distributed to members in the normal course of events within the next two weeks". No offers were made under the bidder's statement or replacement bidder's statement.

- TPC applied to the Panel, by application dated 26 June 2012, for a declaration of unacceptable circumstances and orders. The first Panel, Ewen Crouch (sitting President), Ron Malek and Julie McPherson, made a declaration of unacceptable circumstances in relation to the affairs of TPC and ordered a voting, acquisition and disposal freeze on the Acquisition Shares, which would be lifted if an unconditional bid was made on certain terms that resulted in PLC obtaining more than half the outstanding shares.

- On 28 November 2013, TPC held its annual general meeting at which shareholders carried a resolution to amend the constitution to limit the voting of CDLI to 10% in the following terms:

(a) On a poll at a meeting of Members, neither the Developer or any of its associates or any other developer, operator, manager, promoter (or any of their respective associates) in connection with the Resort, being present in person, or by proxy or attorney or by representative, may vote more than the number of votes equal to 10% of the total number of votes that may be cast (after deducting any votes not cast by any one or more Members) on a resolution of the Company, other than in relation to a resolution to wind up the Company.

(b) …

(c) ….

- No offer, complying with the first Panel's orders or otherwise, has been made.

- PLC (and associated parties) sought judicial review of the first Panel's decision, declaration and orders in the Federal Court of Australia. On 5 June 2014, the judicial review was dismissed.3 PLC (and associated parties) appealed to the Full Court. On 22 May 2015, the appeal was upheld.4 Subsequently, on 4 September 2015, the Full Court set aside the first Panel's declaration and orders and remitted the application to the Panel to be heard and determined according to law.5

- The application that has been remitted is the application dated 26 June 2012 made in the proceedings in The President's Club Limited [2012] ATP 10.

The court proceedings

- The application by TPC has been the subject of three court challenges. The first two relate to the decision of the first Panel as noted in paragraph 8.

- The circumstances found by the first Panel to constitute unacceptable circumstances related to the first acquisition and the second acquisition. The first Panel declared that the first acquisition occurred in contravention of section 606 and that the second acquisition occurred in purported reliance on item 9 of section 611, but complied only by reason of the first acquisition, which was in contravention of section 606. It made a declaration of unacceptable circumstances in respect of each of the first and second acquisitions.

- Under subsection 657C(3), an application to the Panel must be made "within 2 months after the [relevant] circumstances have occurred" or within a longer period determined by the Panel. The application was considered by the first Panel to have been made within time on the basis that the application related to alleged contraventions of the Corporations Act that were ongoing circumstances. The first Panel, in the alternative, said it had extended the time for making the application.

- Very briefly, the Courts decided:

- at first instance that:

- the circumstances were ongoing and therefore the application had been made within time and no extension of time was necessary

- if an extension was necessary, the first Panel had denied procedural fairness to PLC when it extended time without having first sought submissions on that question

- the first Panel should not have conducted proceedings as it did unless an extension of time was unnecessary and

- on appeal to the Full Court that:

- the circumstances found by the first Panel were not ongoing and

- an extension of time was necessary and, no challenge having been made to the finding on the procedural fairness point, the first Panel should not have conducted proceedings as it did.

- at first instance that:

- The Full Court allowed the appeal and remitted the application dated 26 June 2012 to the Panel to be heard and determined according to law.

- Two members of the first Panel are no longer Panel members. On 4 September 2015, we - Peter Day (sitting President), Michelle Jablko and Ian Jackman SC – were appointed as the remittal Panel.

- On 6 November 2015, we decided under s657C(3)(b) to extend time for the making of the application and to seek an extension of time from the Court under s657B for the making of a declaration of unacceptable circumstances. See paragraph 106 and following.

- The third court challenge by PLC (and associated parties) was to our decision to extend time (and interim orders on voting – see below). On 24 December 2015, the Court dismissed the application for judicial review.6 The Court also granted us an extension of time to make a declaration under s657B to a date 6 weeks from the date of the decision. For avoidance of doubt we have treated that date as 3 February 2016.

- On 2 February 2016, we made a declaration of unacceptable circumstances followed by orders. These are our reasons.

Application

- By application dated 26 June 2012, TPC sought a declaration of unacceptable circumstances.

- In brief, TPC submitted that:

- the first acquisition breached s606 and PLC appeared to continue to be in breach (ie, the breach was not remedied)

- the offer in the bidder's statement did not comply with the minimum bid price principle

- disclosure in the bidder's statement was materially deficient and

- a complying bid had not been lodged within time.

- It submitted that PLC (together with its associates) had contravened s606,7 s621(3),8 s631(1)9and s636.10

- TPC also submitted that the effect of the circumstances was to:

- inhibit or likely inhibit an efficient, competitive and informed market and

- prevent or likely prevent TPC members getting necessary information to assess the merits of the offer.

Interim orders sought

- TPC sought interim orders on the application to the following effect:

- that the despatch of a second Replacement Bidder's Statement be restrained until the Panel determines this application; and

- that [PLC] (and its associates) be restrained from exercising voting rights in the President's Club in excess of 20% until the Panel determines this application.

- The first Panel did not make interim orders.

- On 4 September 2015, immediately following remittal of the application, ASIC made an application for interim orders to the following effect:

- The Associated Parties11 must not exercise any voting rights that attach to the Acquisition Shares.

- The Associated Parties must not make any further acquisitions of a relevant interest in shares in TPC, except with the consent of the Panel.

- The Associated Parties must not dispose of, transfer or charge any of the Acquisition Shares, except with the consent of the Panel.

- "Acquisition Shares" had the same meaning as given in the first Panel's final orders. "Associated Parties" had the same meaning as given in the first Panel's final orders, namely CDLI, PLC, CDLH, Closeridge and their respective associates.

- ASIC submitted that its application for interim orders under s657E did not need to be made within the time set by s657C(3), but was governed by s657E. Thus, if a sufficient case for interim orders in relation to circumstances was made out, it was not necessary for there to be a declaration, or even an application, and if there was an application relating to those circumstances it was not necessary for the Panel to determine whether to extend time in relation it. ASIC submitted that this was "consistent with the underlying purpose of the Panel's power to make interim orders – which recognises the need at times for the Panel to act quickly after receiving an application in order to preserve the status quo and ensure its function is not undermined by intervening actions or events. This underlying policy is demonstrated by the fact the power can be exercised by the Panel President where necessary prior to the convening of a sitting Panel."

- ASIC further submitted that its requested interim orders were similar in nature to the final orders made by the first Panel. Those orders could ultimately be replicated by the remittal Panel, it submitted, and if they were then "The effectiveness of final orders of this kind, by their very nature, will be undermined if there are changes in the Associated Parties' holdings, or the exercise of voting rights occur, prior to the Panel determining the proceedings."

- ASIC noted that PLC had recently taken steps aimed at requisitioning an extraordinary general meeting of TPC for the purposes of winding up TPC.

- The final orders made by the first Panel were, relevantly:

- The Associated Parties must not exercise any voting rights that attach to the Acquisition Shares (41.4%).

- The Associated Parties must not make any further acquisitions of a relevant interest in shares in TPC, except:

- with the consent of the Panel or

- pursuant to acceptances under a takeover offer referred to in Order 4 or

- the acquisition by Mr Clive Palmer of the shares corresponding to Lot 64 on BUP 8874 recently acquired by Mr Palmer from CDLI.

- The Associated Parties must not dispose of, transfer or charge any of the Acquisition Shares, except:

- with the consent of the Panel or

- for a disposal or transfer pursuant to the acquisition by Mr Clive Palmer of the shares corresponding to Lot 64 on BUP 8874 recently acquired by Mr Palmer from CDLI.

- Orders 1, 2 and 3 cease if all of the following requirements are met:

- QNA or an associate of it makes offers for all the shares in TPC under a takeover bid that complies with chapter 6 and which meets the following conditions:

- the terms are no less favourable than those set out in the original Bidder's Statement lodged with ASIC on 12 April 2012

- the offer price is no less than $65,013 for each parcel of shares and the corresponding villa interest

- the offer period is no less than 2 months and

- ASIC has confirmed in writing to the proposed bidder that it is otherwise satisfied with the terms of the offer and the disclosure in the bidder's statement. This confirmation is not to be construed as ASIC's approval of the bidder's statement and

- no less than 50% of the offers made for shares not already held by the Associated Parties are accepted and

- all the accepting shareholders have been paid.

- QNA or an associate of it makes offers for all the shares in TPC under a takeover bid that complies with chapter 6 and which meets the following conditions:

- We notified the parties that we were considering making a short-term interim order (say, for 48 hours) to allow time for fuller submissions. We indicated that in the meantime we would receive any short submissions and that making such short submissions would not preclude the making of further submissions on interim orders in due course.

- PLC submitted that the Panel did not have jurisdiction as there was no bid on foot. It also submitted that it had had insufficient time to consider the request, and that the matters raised by the first proceeding were now some 4 years old which, given the passing of time, removed the Panel's jurisdiction. PLC also took issue with all matters set out in ASIC's application for interim orders. Accordingly, PLC submitted, the Panel should not make the orders sought.

- We considered the submissions carefully. We were also mindful of the Full Court's statement, although made in the context of a requested stay of its orders, that "One would normally expect that in any application for a stay, an applicant would seek to demonstrate some prospects of success in the substantive proceeding. In the present case that would involve demonstration of a basis upon which a further extension of time might be granted."12

- We did not agree that we lacked jurisdiction to make an interim order. We agreed with ASIC's submission.

- Section 657E does not require there to be an application for a declaration of unacceptable circumstances before the Panel can make an interim order.13 The Corporations Law before 13 March 2000 required an application.14 In any event, there is an application in this matter, namely the application dated 26 June 2012 that has been remitted from the Full Court. In the application TPC sought interim orders.

- If, as PLC submitted, the Panel lacked jurisdiction to consider TPC's application, then that would be a strong, perhaps compelling, factor against making an interim order. The broader jurisdictional question is to be determined by reference to an extension of time to receive TPC's application (s657C) and an extension of time to make a declaration (s657B). If we declined to extend time to make the application under s657C, then that would be an end to the application. If we extended time, but the Court declined to extend time to make a declaration under s657B, then that would be an end to the application.

- If it was clear that one or other of the extensions would not be granted, the request for interim orders would be refused. However, this is not clear. This is discussed below. So the question was, we think, whether the purpose of, and requirements for, interim orders had been met making an assumption that the extensions will be granted.

- The question of whether to make interim orders bears similarities to the question a court addresses in considering an application for a stay. The principles applicable to the granting of a stay of a court order may be summarised as: 15

- The successful party is ordinarily entitled to enforce the decision16 and it is for the applicant for a stay to establish why discretion should be exercised.

- Special circumstances are needed, centrally whether the stay is necessary to preserve the subject matter or integrity of the action (ie, whether the appeal would otherwise be rendered nugatory or there is a real risk that it will not be possible for a successful appellant to be restored to the former position17).

- A stay will generally still be refused unless it can be established that –

- Relevant principles for granting an interim order are set out in Panel Guidance Note 4, as follows:20

- Whether the risk that unacceptable circumstances will occur, continue or worsen in the absence of an order outweighs the adverse effects of the order on the person to whom it is directed and the market. This is similar to the factors in paragraphs 38(b) and 38(c)(ii).

- The strength of the evidence. This is similar to the factor in paragraph 38(c)(i).

- Whether the circumstances can be adequately remedied by final relief alone. In part this turns on a similar objective to an interim or interlocutory injunction, which is "to preserve the position which is in dispute in statu quo until the hearing and determination of the dispute or further order."21 ASIC noted in its application for interim orders dated 4 September 2015 that there had been one attempt to change the situation. It referred to PLC taking steps in about May 2015 aimed at requisitioning an Extraordinary General Meeting of TPC for the purposes of winding up TPC in connection with an offer to buy the property interests of TPC members.

- The availability of alternative measures, such as undertakings. None were offered.

- Applying these principles, in our view ASIC provided a basis for interim orders and there appeared to be a case to be decided. In our preliminary view as things stand, and before we heard further submissions and rebuttals, there had been a serious contravention of s606 the effects of which appeared to give rise to unacceptable circumstances and warrant a remedy. Therefore, the situation should be held pending that determination. Given the situation that has existed since the first Panel's orders in July 2012, maintaining the status quo was appropriate.

- We also considered whether making interim orders would cause hardship or undue prejudice. No submissions that they would do so had been received. Of course, there is some prejudice whenever orders affecting the ability of a party to deal with its property are made. But in our view (making no conclusion about the ultimate dispute) the prejudice here was not unfair or undue in the sense expressed in, for example, Gjergjia v Cooper.22

'Disposal' interim orders

- We decided to make a short-term interim order (Annexure A) to the effect that the Associated Parties23 not dispose of, transfer, charge or otherwise deal with any of the Acquisition Shares. It had effect until 7pm (Melbourne time) on 10 September 2015 to allow for further submissions on whether the interim 'disposal' order should be continued or allowed to lapse.

- We twice extended the short-term interim 'disposal' order, on 9 September and again on 16 September 2015 (Annexures B and C). We did so because of requests for extensions of time by PLC to make submissions on preliminary questions that we had asked. When granting the extensions we gave notice that the requests would be a factor in the time taken by us to decide the matter, should it be relevant to seeking an extension of time from the Court under s657B (ie, for making a declaration). On the second occasion we also gave notice that, while cognisant of the need to provide procedural fairness, we were required to balance this with the Panel's statutory obligation to act promptly.24 As had been noted by the Full Court:

The legislative scheme contemplates applications to the Panel being made, as well as the making of declarations by the Panel, within relatively short periods of time following the occurring of the particular "circumstances". 25

- Given the need to apply to the Court for an extension of time under s657B, should we decide to extend time under s657C(3)(b), the time limits imposed by the legislation did not apply in the same way as in the usual case, so we could grant the extensions. Had this been an application being considered in the usual case, and therefore subject to the usual statutory deadlines, we would likely have needed to refuse the requests.

- No substantive submissions were received on the question we had asked about whether the short-term interim 'disposal' order should be continued or allowed to lapse.

- In any event, when we made the short-term interim 'disposal' order we indicated that, if, prior to the further consideration of the interim order question, it was proposed to dispose of or transfer the shares, or create a security interest in them, we would be prepared to consider an application for a variation of the interim 'disposal' order. No such application was made.

- When we decided to conduct proceedings (see paragraph 78) we extended the short-term 'disposal' interim order until the earliest of further order, completion of the proceedings or 2 months (Annexure D). After we made this order we remained prepared to consider any application for variation on its merits.

- On 18 November 2015, we made a new interim 'disposal' order (Annexure F) and on 18 January 2016 made a further new interim 'disposal' order (Annexure H). The latter was made by quorum of two, one of the members of the remittal Panel being unavailable on leave. The reasons are set out in paragraph 68.

- This proceeding is unusual. An interim order can have effect for up to 2 months.26 Panel proceedings are usually completed within that time. However, in our view there is no statutory limit on the ability of the Panel to make a new interim order, even on the same terms, if it considers that it is warranted. There is nothing in s657E to suggest such a limitation. Moreover, the time limit in s657B for making a declaration of unacceptable circumstances can be 3 months.27 It would be a curious result if an interim order could not be remade, leaving the circumstances free to change towards the end of a Panel proceeding that took 3 months. In our view, the limit of 2 months is to ensure that interim orders are reconsidered in a timely way, not to prevent another order being made.28

'Voting' interim orders

- ASIC's application for interim orders dated 4 September 2015 included a request for an interim order restraining voting in the following terms:

The Associated Parties must not exercise any voting rights that attach to the Acquisition Shares.

- When we made the interim 'disposal' order, it was not necessary, in the absence of any forthcoming vote, to make an interim 'voting' order. We advised the parties accordingly.

- However, the position changed with the annual general meeting of TPC scheduled for 23 November 2015. According to TPC:

On 2 November 2015, TPC received from CDLI a notice proposing numerous resolutions at that meeting designed to enable CDLI and its related parties to assume control of TPC and pay to themselves the sum of $2 million prior to the winding up of TPC. CDLI proposes the spill of the TPC board and other resolutions despite having refused to pay levies since at least 2013. CDLI also refuse to recognise a 10% cap on its voting rights passed by the members at TPC's 2013 annual general meeting.

- On 6 November 2015, TPC applied for an interim order restraining CDLI and its associates from exercising any voting rights in respect of their TPC shares pending a final determination by the Panel of the remitted application.

- TPC submitted that the requested interim order "will serve to maintain the status quo and prevent CDLI and its related parties assuming control of TPC and rendering these proceedings futile to the detriment of members who will be exposed to the consequences of the unacceptable circumstances currently being considered by the Panel."

- ASIC made a submission supporting the making of an interim 'voting' order.

- PLC submitted that CDLI had challenged the amendment to TPC's constitution and that TPC was attempting to use the Panel in that dispute. It submitted that the proposed interim 'voting' order was "in effect, a prohibitory injunction in relation to a separate dispute between TPC and CDLI" over the constitution amendment. It submitted that the Panel was not the appropriate forum for that dispute so an interim order would be an inappropriate exercise of power.

- We make no comment on the issue regarding the amendment to TPC's constitution on 28 November 2013 as to the voting rights that may be exercised by CDLI and its associates. That is a matter for another forum. It is not for us to resolve such a dispute between the parties. However, it does not follow that we should therefore not consider whether to make the requested interim order. PLC was maintaining that it had voting rights. If they were exercised the status quo would be changed. If CDLI and its associates had the ability to exercise their full voting power and the member resolutions proposed by CDLI were passed, potentially the effect of those resolutions could not be reversed by final orders. An order therefore was justified to maintain the status quo while proceedings were continuing.

- PLC also submitted, in essence, that the interim 'voting' order was unnecessary because TPC maintained the efficacy of the constitutional restriction on CDLI voting. We could not resolve that dispute. For the reasons given in the paragraph above we did not think PLC's argument removed the need for an interim 'voting' order.

- PLC also submitted that the effect of an interim 'voting' order would not be to preserve the status quo, but to further restrict the rights of CDLI and its associates to vote by extending the restriction on those rights to any resolution to wind up TPC. We noted that the constitutional amendment excluded from the limitation on voting "a resolution to wind up the Company". We did not agree with PLC's submission. In our view an interim 'voting' order that includes a prohibition on voting to wind up the company will preserve the status quo. Nothing is more final, or removes the ability of the Panel to make orders in relation to shares more completely, than the winding up of the company. If CDLI could vote its entire 44.4% holding that would significantly contribute towards, perhaps bring about, the passing of a winding up resolution.

- TPC made its request for an interim order regarding voting rights in a timely fashion after CDLI and its associates sent a notice proposing resolutions to be voted on at the forthcoming TPC annual general meeting.

- A longer than usual time was allowed for PLC and its associates to make submissions.

- Therefore we made an interim 'voting' order (Annexure E) on 17 November 2015. The effect of the order is to restrict the Associated Parties from voting any more than 20% of the total votes that may be cast and to require TPC to disregard any votes cast in contravention of that order.

- PLC and its associates were not, in our view, unfairly prejudiced by the interim 'voting' order which, given the passage of time, went no further than was necessary and allowed voting of up to 20% of the shares that could be voted. The voting restriction we applied acknowledged that PLC could have acquired up to 20% of the shares in TPC without contravening s606.

- The Panel has previously taken the view that acquisitions that occur in a single transaction should be dealt with as a single acquisition. Thus in CMI Limited, in response to a submission that at least part of the acquisition would have been permitted under item 9 of s611, the Panel said "In our view, the entire parcel was acquired as a single transaction and should be divested."29 The first Panel took a similar approach with PLC.30 However, a long time has now passed since the first proceeding – making this an unusual case - and the existence of the 'share block' is known to the directors and shareholders of TPC. While this does not itself necessarily ameliorate any possible unacceptable circumstances, we have been influenced by a consideration of what remedies might be appropriate should we find unacceptable circumstances.

- Limiting the restriction to 20% also resolved another submission made by PLC, namely that the order requested by TPC extended beyond the 10% voting rights permitted by the constitution. We do not need to address this submission.

- We informed the parties that this interim order did not have the effect of revoking the interim order in relation to disposal of shares.31

- On 18 January 2016 we made a new interim 'voting' order (Annexure G) by quorum of two, one of the members of the remittal Panel being unavailable on leave.32 The reasons are in the next paragraph.

- In the view of the quorum of two members on the interim orders issues:

- The new orders in relation to voting and disposal preserve the status quo, including –

- in relation to the interim 'disposal' order by ensuring that the shares held by CDLI and its associates remained held by those parties and so could be the subject of final orders, if appropriate. In other words, to protect the subject matter of the application and

- in relation to the interim 'voting' order by continuing the restriction on voting that we had ordered on 17 November 2015 in the light of the intentions expressed in a letter from CDLI to TPC dated 24 December 2015. In that letter, CDLI informed TPC that "As a result of the Directors (sic) failure to call the EGM as required under s249D of the Act we hereby call and will arrange an EGM of the company pursuant to s249E of the Act." Our interim voting order was, in a sense, anticipatory. In our view it was appropriate to make the interim 'voting' order, rather than wait until the intentions of CDLI in that letter were effected, because there was no reason to assume CDLI would not carry out its intentions (which we think must extend to voting its shares),33 TPC submitted that the letter constituted a "present threat" and leaving the issue open would give rise to uncertainty. In respect of this last point we agreed with ASIC's submission that "it would be beneficial for the question of PLC and its associates' voting rights to have been resolved in advance, rather than being the subject of a separate application to the Panel in the event that a meeting is convened."

- If CDLI and its associates have the ability to exercise their full voting power, potentially the effect of any resolutions could not be reversed by final orders. TPC submitted that "At that meeting, CDLI and its associated entities propose to assume control of the TPC board, pay themselves $2M from TPC funds and wind up TPC as set out in their previous correspondence which is before the Panel."

- As noted previously, the Panel's preliminary view as things stand, and before hearing further submissions and rebuttals, was that there had been a serious contravention of s606 the effects of which appeared to give rise to unacceptable circumstances and warrant a remedy. Given the deadline set by the Court's extension of time under s657B, the matter was to be finalised promptly.

- CDLI and its associates would not be unfairly prejudiced by either of the interim orders, which extended in time but not in scope the previous interim orders. The Panel was to consider whether a declaration should be made shortly after receiving submissions and rebuttals (due respectively on 21 and 25 January 2016) on its supplementary brief. In this respect ASIC submitted that "in the circumstances where a final order has not yet been made and the Panel has received an extension of time under s657B, it is appropriate for new interim orders to be made to continue the effect of the existing interim orders".

- An appropriate time had been allowed for submissions, and there was no request for an extension. Moreover, CDLI and its associates made no submissions opposing the renewing of the interim orders.

- The new orders in relation to voting and disposal preserve the status quo, including –

Court proceedings on interim 'voting' order of 17 November 2015

- PLC challenged the interim 'voting' order made on 17 November 2015 in the Federal Court. The challenge was dismissed.34

Other interim orders

- It also was not necessary to restrict further acquisitions of shares, which of course must be made only in accordance with the law. However, in communicating this aspect of our decision on interim orders we indicated that, should we ultimately determine that a declaration of unacceptable circumstances was appropriate, we may have had to consider whether orders affecting any further acquired shares should be made.

- At the date of making a declaration (2 February 2016) we are not aware that any further shares have been acquired.

Discussion

Parties

- With the remittal of the application we took it that the Notice of Appearance by TPC that accompanied the application was extant. Its legal advisers remained the same.

- ASIC lodged a Notice of Appearance to become a party.

- Unlike in the first proceeding, PLC lodged a Notice of Appearance and became a party.

Remittal

- Following remittal, we invited submissions on what documents or other information we should or should not consider, identifying:

- the documents provided to the first Panel

- the first Panel's reasons for decision and

- the Court's reasons at first instance and on appeal.

- PLC submitted that we lacked jurisdiction. It did not otherwise engage with the issue. TPC submitted we should consider all the documents we had identified. ASIC submitted that there should be no limitation on the documents or information we should consider, including all documents submitted during the first hearing, the first Panel's reasons, both court judgments and all the documents it had provided in its application for interim orders dated 4 September 2015.

- In considering this remittal we have considered the documents we identified and the documents provided to us by the parties (ie, applications - including ASIC's application for interim orders - attachments, submissions and rebuttals).

Conduct proceedings

- The decision of the first Panel was set aside by the Full Court and the application was remitted to the Panel to be heard and determined according to law.35

- In a Panel's de novo review36 the Panel must consider the matter afresh, including whether it will conduct proceedings.37 The remittal in our view is similar to a review. This was the view adopted in Austral Coal 02(RR).38 On a review, the Panel considers whether it will conduct proceedings. Thus we, as the remittal Panel, have considered whether we should conduct proceedings on the remitted application.

- If we decided not to conduct proceedings then, as in Austral Coal 03,39 we would not extend the time for the making of TPC's application.

- The inquiries the Panel makes when deciding whether to conduct proceedings are set out in the notes to the Panel's Procedural Rules.40 We turn to them.

Jurisdiction

- The first inquiry is whether the Panel has jurisdiction. PLC submitted that the Panel does not have jurisdiction as the application was made out of time. This is circular as any matter out of time would automatically not be able to be considered. This is not the intention of the legislation as set out in s657C(3) allowing the Panel to extend the time for making an application. Moreover it does not accord with what the Full Court said:

… The asserted facts in this case are that certain circumstances were said to exist and were such that the Panel should declare them to be unacceptable circumstances. Before the discretion to extend time may be exercised under s 657C(3) those circumstances require to be proved. There may be a factual contest. There is no difficulty, in that situation, for the Panel first resolving the factual questions and thereafter determining whether or not to extend time under s 657C(3). The legislative scheme here does not suggest a different approach. 41

- PLC submitted that:

The Federal Court found that the shares in TPC were stapled. ASIC release dated 29 June 2004 states that when shares are stapled it is uncertain that Chapter 6 of the Corporations Act 2001 applies. Section 92(3) of the Corporations Act 2001 defines a security for the purposes of Chapter 6. The managed investment scheme for TPC is not and has never been registered so it is not a security under jurisdiction of the Panel or Chapter 6 of the Corporations Act 2001 and consequently the Panel orders have no application to it.

- In our view the 'stapling' does not remove the character of the shares as a security.

- PLC also submitted that time cannot be extended retrospectively 3 years after the bid has expired. We think there are a number of answers to this. First, the Panel's jurisdiction is not limited to the existence of a bid, and the application includes the complaint that a bid was never made, contravening s631. Second, the Full Court made it clear that the extension of time might be decided once it was clear what the circumstances were. Third, the Full Court remitted the matter and, subject to the extension of time, jurisdiction has been established by the court proceedings remitting the application.

Unacceptable circumstances

- The second inquiry is whether the claims would give rise to unacceptable circumstances if established. The first Panel considered that unacceptable circumstances existed based on a contravention of s606 in respect of the July 2011 acquisition and based also on further acquisitions in March 2012 purporting to rely on s611 item 9. Its findings on a contravention of s606 were upheld at first instance in the Federal Court and by the Full Court. The matter was remitted because of a procedural irregularity relating to the granting by the first Panel of the extension of time for making the application.

- Clearly, in our view, the claims if established could give rise to unacceptable circumstances.

Strength of evidence

- The third inquiry is as to the strength of the preliminary evidence. The application includes alleged contraventions of the Act, and we have already noted that the Full Court did not overturn the first Panel's findings that s606 had been contravened.

- Other evidence is also reasonably strong, in that it is clear that a bidder's statement was lodged but no offers made.

- In our view, there was sufficient strength in the preliminary evidence to warrant us conducting proceedings.

Remedies

- The fourth inquiry is as to what remedies might be available. The first Panel's remedy stood from 2012 until it was set aside by the Full Court. Thus, the shares the subject of complaint remain in place and a remedy could be fashioned dealing with the shares.

- A significant time has passed since the orders were made by the first Panel, but in our view there remains the possibility that remedies are still available to address any unacceptable circumstances that might be found. For example, voting restrictions or divestment of shares could be ordered.

Time

- The fifth inquiry is as to whether the application is out of time and, if it is not, whether it is timely. The application is out of time, and we must consider whether to extend the time for making it. We address this below.

Trivial etc

- The final inquiry noted in the Panel's Procedural Rules is as to whether the application is trivial, frivolous or vexatious.

- In our view, the application could not be considered trivial or frivolous, which we take to be words of similar import. Something is trivial or frivolous if it is of little weight or is unfounded. Here there has been a significant acquisition of over 40% of the voting shares in a company subject to chapter 6.

- The test for whether a proceeding is vexatious was stated in Attorney-General v Wentworth:

- Proceedings are vexatious if they are instituted with the intention of annoying or embarrassing the person against whom they are brought.

- They are vexatious if they are brought for collateral purposes, and not for the purpose of having the court adjudicate on the issues to which they give rise.

- They are also properly to be regarded as vexatious if, irrespective of the motive of the litigant, they are so obviously untenable or manifestly groundless as to be utterly hopeless.42

- Similarly, the tests in the various state Acts for declaring vexatious litigants connote proceedings that are an abuse of process, harassment, or are brought for a wrongful purpose.43

- Whether a proceeding is vexatious is to be determined objectively as a question of fact.44 Nothing on the face of the original application suggests that it is vexatious, and the first Panel did not make a determination that it was. Nor do we.

- PLC submitted that "it is an abuse of process for the Panel to use the remittal to it by the Full Court of the Federal Court to correct an error made by the Panel which serves to benefit the Panel." We do not accept PLC's submission. Remittal for the correction of an error is not an abuse of process or for the benefit of the Panel.

Other grounds

- PLC also submitted that conducting proceedings now would be unconscionable, would undermine confidence in the market and would be against the purpose of the legislation. It submitted that "any decision of the remittal Panel which seeks to re-open a matter based on the relevant circumstances which occurred 4 and 3 ½ years ago respectively is contrary to the legislative scheme and purposes of Chapter 6. Such a decision would also set a terrible precedent which may serve to destabilise market confidence in the scheme and the effectiveness of the Panel if the market can see that the relevant circumstances surrounding a takeover can be subjected to proceedings of the Panel outside of the time limits prescribed in the Act and long after those circumstances have occurred."

- ASIC submitted that the Full Court considered that the passage of time of itself did not prevent the Panel from rehearing the matter. We agree that this was the position of the Full Court.

- TPC submitted that the Panel should deal with the matter and supported ASIC's submissions.

- In our view the application alleges a serious contravention of s606 and other contraventions. Even if the other alleged contraventions may now be too late for the Panel to deal with (in that they relate to a bid in 2012 that did not proceed), given the judicial findings on contravention of s606 it seems compelling that it is not unconscionable, and would not undermine confidence, should we conduct proceedings. In fact, in our view, it might undermine confidence in the market if we were not to conduct proceedings.

- No evidence of a change in the factual basis that was before the first Panel has been provided.

- Accordingly, for the reasons above, we decided to conduct proceedings.

Extending time for application

- On 6 November 2015, we granted an extension of time for making the application. We advised the parties and provided them with a summary of our reasons for extending time. PLC sought judicial review of our decision to extend time, which was dismissed.45 What follows in this section are our expanded reasons.

- Section 657C(3) says:

An application for a declaration under section 657A can be made only within:

- two months after the circumstances have occurred; or

- a longer period determined by the Panel.

- The Panel may therefore extend time under s657C to receive an application.

- The Court at first instance decided that the Panel had denied procedural fairness to PLC when it made its decision (in the alternative) to extend time under s657C.46 This was because it did not first seek submissions as to whether it should extend time. On judicial review at first instance this did not matter because the judicial review was dismissed given the primary finding of the first Panel which the Court upheld, namely that the circumstances were ongoing. Accordingly, the extension of time was not necessary. The Full Court overturned that primary finding, holding that the circumstances found by the Panel could not be ongoing. Accordingly, an extension of time was necessary, but had miscarried.

- The Full Court accepted the finding of the Collier J, judge at first instance, on how the Panel had extended time:

The primary judge held that the Panel's decision to extend time was contrary to the rules of natural justice, with the result that the application before it was out of time, and the Panel ought not to have conducted the proceedings, unless it was unnecessary to extend time because, as the Panel found, the relevant circumstances were "ongoing": Reasons at [48]-[51]. The respondents do not challenge her Honour's finding on the extension point…. 47

- The Full Court concluded:

Accordingly, for these reasons, we have concluded that the primary judge erred in failing to find that the application to the Panel and its declaration of unacceptable circumstances were each made out of time. Contrary to her Honour's finding at [48], it was necessary for time to be extended in each case. As her Honour found, the Panel's decision to extend time was contrary to the rules of natural justice.48

- In determining that the circumstances were confined to particular events and were distinguished from the effect of them, which effect could be ongoing, the Full Court also said:

In order for the time limitations under ss 657B and 657C to operate effectively the relevant circumstances must be capable of being identified as having arisen at a particular time.49

- It then said, in response to submissions about how to operate under those time limits:

… Before the discretion to extend time may be exercised under s 657C(3) those circumstances require to be proved. There may be a factual contest. There is no difficulty, in that situation, for the Panel first resolving the factual questions and thereafter determining whether or not to extend time under s 657C(3). The legislative scheme here does not suggest a different approach.50

- On the extension of time issue, at first instance Collier J cited with approval the Panel's reasoning in Austral Coal 03:51

… In particular I note the comments of the Panel at [18] of Austral Coal where the Panel (correctly, in my view) observed:

[18] The Panel is given a discretion to extend the 2 month time limit set out in section 657C(3)(a) to make an application. The Panel considered that it should not lightly exercise that discretion. The time limit was set by the legislature to provide certainty to market participants in the context of takeovers that actions could not be challenged indefinitely.52

- The Panel in Austral Coal 03 went on:

[19] Notwithstanding this, the Panel considered that it would be undesirable for Glencore's application be allowed (sic) to go unheard because it was lodged outside the 2 month time limit, if:

- essential matters supporting Glencore's case first came to light during the 2 month period preceding the application; and

- Glencore's application made credible allegations of clear, serious and ongoing unacceptable circumstances.

[20] Unacceptable circumstances in relation to Austral Coal should not go unremedied merely because their existence has been able to be hidden for more than 2 months.

[21] The Panel, therefore, considered it desirable to review the merits of the Application on its face in order to assist in its decision whether or not to grant an extension of time.

- This led the Austral Coal 03 Panel to consider the application. It decided that there was no reasonable prospect of finding the association as alleged. It did not extend time.

- On the merits of the application before us, the circumstances are different. There is a clear breach of s606 alleged. While it was for us to make a fresh determination about the circumstances alleged in the application, it appeared from all the material that prima facie there had been a contravention of s606. We noted that a contravention of s606 was found by the first Panel and confirmed by the Court at first instance and the Full Court.53 The Full Court said:

In our view the matter should be remitted to the Panel to be considered and determined according to law. In view of our conclusions on the operation of s606, the Panel should now consider whether an extension of time to bring the application should be granted.54

- The existence of a breach is not the only consideration for a sitting Panel when determining whether unacceptable circumstances exist.55 The first Panel considered that unacceptable circumstances existed based on a contravention of s606 and further acquisitions purporting to rely on s611 item 9. The declaration of unacceptable circumstances made by the first Panel distinguished the downstream acquisition of TPC shares (through CDLI) and the subsequent acquisitions. The downstream acquisition constituted the contravention and gave rise to unacceptable circumstances for that and other reasons. The subsequent acquisitions gave rise to unacceptable circumstances only for other reasons; that is, they did not constitute a contravention.

- Our preliminary view was, as things stood, and before hearing further submissions and rebuttals, that there had been a serious contravention of s606 the effects of which appeared to give rise to unacceptable circumstances and warrant a remedy. Therefore in our view there were merits to the application.

- If our preliminary view was maintained, we would need to consider the subsequent acquisitions. There may also be merits to this aspect of the application.

- Lastly, other breaches are alleged, relating to the lodging of the bidder's statements. We were less confident, given the passing time, that these were matters we should address, but did not make a decision about that at this stage of our consideration.

- On the question of market certainty, the legislation set a time limit so that there would be speedy resolution of matters before the Panel. This continued to be relevant in this remittal. However, it is not determinative. The Full Court observed:

There has been a lengthy passage of time since the events forming the subject of the Panel hearing occurred. This may suggest that the matter should not be remitted to the Panel. However, we do not know what has transpired in the market since then. It is by no means clear that remitting the matter to the Panel would be futile.56

- There are two aspects to this – the pre-remittal period and the post-remittal period.

- The relevant timeline for the pre-remittal period is as follows:

In or about July 2011 PLC (then called QNA) acquired an approximately 41.4% interest in TPC indirectly through its acquisition of 98% of CDLH. Closeridge acquiring the other 2% of CDLH. Sep 2011 Notice of intention to revoke the ASIC Deed was given. The Deed limited CDLI, the wholly-owned subsidiary of CDLH that held the 41.4% parcel, to 10% of votes. 13 March 2012 or thereabout Revocation of the ASIC Deed became effective 180 days from the date notice was given. The effect was that CDLI was no longer limited by the Deed to 10% of the votes in TPC. 19 - 23 March 2012 PLC, through Closeridge, acquired further TPC shares representing a further approximately 2.9% interest in TPC. April-May 2012 PLC lodged bidder's statements with ASIC, which were subsequently 'withdrawn'. No offers were made to TPC shareholders. 26 June 2012 TPC made its application to the Panel. 24 July 2012 The first Panel made a declaration of unacceptable circumstances. 27 July 2012 The first Panel made orders. 21 September 2012 PLC sought judicial review of the first Panel's decision. 5 June 2014 The Federal Court at first instance (Collier J) dismissed the judicial review, (relevantly) holding:

- the circumstances found by the first Panel were ongoing circumstances

- the application was not out of time

- had the circumstances not been ongoing, the Panel had extended time for making the application in breach of the requirements of procedural fairness.

25 June 2014 PLC appealed the decision to the Full Court of the Federal Court. 22 May 2015 The Full Court held (relevantly) that:

- the circumstances were not ongoing

- the first Panel had conflated the circumstances with the effects, which can be ongoing

- as the decision to extend time for making the application had not been validly made, there being no appeal on this, the Panel could not proceed as it had and

- therefore, the decision should be quashed.

The Full Court sought submissions on the final disposition of the matter.

4 September 2015 The Full Court ordered remittal of the matter to the Panel. - The relevant timeline for the post-remittal period (to the point of extending the time for making the application) is as follows:

4 September 2015 ASIC applied to the Panel for interim orders after the Full Court pronounced its orders.

The President of the Panel established the remittal Panel and parties were advised that we wanted to receive submissions in due course, but may consider a short-term interim order to allow time for fuller submissions. Therefore, parties were invited to make any brief submissions on that course. Submissions were received. We met later on that day and decided to make a short-term interim order. The order was varied twice to extend it. This was to accommodate PLC's requests for extensions of time in which to make submissions.

7 September 2015 We invited preliminary submissions from all the parties on: - what documents or other information (from the first hearing or otherwise) we should consider

- what factors were relevant to us deciding whether to conduct proceedings and

- whether we should grant an extension of time. In this respect we asked -

- whether we should first determine the factual questions before considering whether to extend time and

- what factors (both factual and policy) were relevant to our consideration of whether to extend time. We invited parties to address in particular the passage of time since the date of the application (ie 26 June 2012) and any change in circumstances since that time.

9 September 2015 PLC requested an extension of time in which to make submissions. We granted the request but indicated that we would include it as a factor in the time taken to decide the matter, should it be relevant to seek an extension of time from the Court under s657B for making a declaration. 16 September 2015 PLC requested a further extension of time, which we also granted. We noted that procedural fairness had to be balanced against our statutory obligation to act promptly. We also noted that this was a remitted application, so the usual time periods were not applicable because, if a declaration of unacceptable circumstances was warranted, it would be necessary to seek an extension of time from the Court under s657B. 23–24 September 2015 Submissions and rebuttals were received. 25 September 2015 We decided to conduct proceedings and informed the parties. 1 October 2015 A brief was issued seeking submissions on 6 October 2015 and any rebuttals on 8 October 2015 2 October 2015 PLC sought a further extension of time, indicating that it would not take issue with the time that had passed between when the circumstances the subject of TPC's application arose and the date of the Panel's application to extend time (should it make one), where that passing of time was due to a request of PLC. 7 October 2015 Submissions were received from ASIC and TPC 8 October 2015 Noting PLC's indication, we granted an extension to PLC to make submissions on the brief and a right in the other parties to make additional submissions (if any), with rebuttals to follow. 20 October 2015 PLC lodged its submissions. 29 October 2015 ASIC made rebuttal submissions. - The timeline before us was extended by reason of requests for more time in which to make submissions. We granted the requests in part because the unusual nature of these proceedings largely took the normal urgency out of the proceeding.

- PLC's submissions on the question of whether we should extend time were, in essence, that the Panel's power to extend time must be limited to a "reasonable and relevant" period. It submitted:

The power granted to the Panel under s657C(3)(b) for it to extend the time for the making of an application to it regarding circumstances which occur during a takeover must be interpreted in the manner consistent with the purposes of the Panel under the legislation and in accordance with the exclusivity of jurisdiction that the legislature conferred on it such that the Panel's power of extension is interpreted to be similarly limited to a maximum time equal to the bid period of a takeover offer on foot at the time of an application.

- In other words, the power must be interpreted in accordance with the purpose of the Panel and the exclusivity of its jurisdiction. However, in our view it does not follow that the Panel has jurisdiction only during the period in which it has exclusive jurisdiction. It does not follow that, because the Panel is the main forum for dealing with disputes during a bid period, it was intended by Parliament that it cannot be a forum outside this period.57 Had Parliament meant that to be the case, the legislation would have made it very clear, particularly as the legislation specifically addresses exclusivity.58

- Moreover, the Panel deals with circumstances involving control transactions, not all of which involve a bid, let alone happen during a bid period. Prior to the introduction of the privative clause,59 the Panel's jurisdiction in s733 of the Corporations Law made no reference to the bid period, only to time limits.

- Also, there is nothing in s657C to indicate that the Panel's jurisdiction is limited to a bid period. Rather the section sets time limits (that can be extended) on the Panel's jurisdiction, not event limits. Similarly, s657B does not refer to a bid period.

- In our view, outside of the period in which the Panel has exclusive jurisdiction there is a jurisdiction on relevant subject matter that can be exercised by the Panel and one that can be exercised by the Courts.

- We agreed with ASIC's rebuttal submission that the Panel's power to extend time under s657C(3)(b) is not limited to being exercised only within the bid period for a takeover bid. We found no logical connection between the maximum time equal to the bid period of a takeover on foot (as PLC submitted - see paragraph 127) and the actual bid period that would justify that theoretical time as the time within which the Panel has jurisdiction.

Austral Coal 03

- We agreed with the submission of PLC that "it was never intended by the legislature for the power to extend under 657C(3)(b) to be unlimited such that actions could be considered indefinitely". In this respect we considered the factors in Austral Coal 03 as well as other factors we considered relevant to whether time should be extended.

- We did not agree with the submission of PLC that "There are no ongoing circumstances regarding the application of TPC of 26 June 2012, consequently there can be no extension of time." In saying this, we appreciated the distinction in the legislation drawn by the Full Court.60 The Full Court made it clear that "In order for the time limitations under ss 657B and 657C to operate effectively the relevant circumstances must be capable of being identified as having arisen at a particular time."61 The Full Court distinguished the circumstances found by the first Panel from their effect. If PLC's submission was correct, there could never be an extension of time in a case where circumstances occur at a particular time, since the Panel application will inevitably come after that time. If PLC meant that there was no ongoing effect, then that has not been established. Indeed, the seeking of a meeting to, among other things, wind up TPC (see paragraph 52) suggested that there was an ongoing control effect.

- Both ASIC and TPC submitted that there was a basis for extending time.

- ASIC submitted that there had been established a clear breach of s606 and "the lengthy passage of time since the events forming the subject of the Panel hearing have not lessened the effect of PLC's contravention as compared to the circumstances persisting at the time the original Panel made its declaration". It submitted that the first Panel's reasons for the declaration of unacceptable circumstances and orders continued to be relevant. It further submitted that control of TPC passing and the detriment to other shareholders continued. ASIC further submitted:

PLC's purchase of CDLI in 2012 [intended we think to read '2011'] occurred in breach of s606 and in circumstances where TPC's members were not given the opportunity (as would be the case in the event approval under item 7 of section 611 had been sought and obtained) to make a fully informed decision on an acquisition having a significant effect on the control and future direction of their company. Shareholders, and the directors of TPC, were not afforded, the usual opportunity associated with organising an item 7 approval, to seek to negotiate the terms of, or obtain any assurances in connection with, PLC's acquisition of control of TPC. Ultimately this has potentially impacted on TPC's members continued ability to reasonably enjoy their investments.

- TPC submitted that the application was made within time in respect of the alleged contraventions of ss631 and 633(1) item 6. It further submitted that it was "only after it became evident that members would not have the opportunity to receive and consider the announced bid that the Application was made."

Discretion

- The first factor62 in Austral Coal 03 is that the discretion to extend time should not be exercised lightly.63 We have, for the reasons we set out, exercised our discretion to extend time under s657C for the making of the application dated 26 June 2012. We did not do so lightly, but weighed the factors and were persuaded that there had been a serious contravention of chapter 6 and the control implications and impact on other shareholders of that remained. The Full Court found that s606 had been contravened and nothing in the submissions to date led us to consider that a different conclusion might be open.

- The next factor in Austral Coal 03 is that it would be undesirable for a matter to go unheard, because it was lodged outside the 2 month time limit, if essential matters supporting it first came to light during the 2 months preceding the application. This factor applies a policy that an applicant should not be disadvantaged because it does not know (and it cannot be said that it ought to know) a relevant fact. TPC submitted that:

The breaches of sections 631, 633, the minimum bid price issue and the disclosure deficiencies all occurred and came to light within the two months preceding the Application. The facts set out in the Schedule to the Brief clearly establish that during this two month period PLC indicated that it would be lodging a replacement bidder's statement and seeking further relief from ASIC. TPC believed that such action would address the effect of the breaches with respect to first acquisition, the second acquisition, the minimum bid price issue and the disclosure deficiencies.

- In other words, TPC was hopeful that the matter would be resolved and TPC made its application when it became apparent that the matter was not going to be resolved. It could not have known that no offers would be made and the bid 'withdrawn'. However, while the Panel encourages parties to seek to resolve matters by negotiation it says in the notes to its Procedural Rules that applicants should not delay in making an application.64

- TPC also submitted that it had not taken specific advice as to whether or not breaches of the Corporations Act had arisen at that time (that is, it was not specifically aware of the breaches of the Corporations Act). It submitted that it was not until after PLC announced its intention to make a takeover bid for TPC in April 2012 that it sought and received advice in relation to the matter. Given that PLC had argued that it was not in breach when it acquired the shares in July 2011 because of the ASIC Deed, and was not in breach when it revoked the ASIC Deed because there was then no transaction to which s606 applied, we had some sympathy for this submission by TPC. In our view, while well short of a compelling reason, it weighed in favour of an extension.

Credible allegations

- The next factor in Austral Coal 03 is that it would be undesirable for a matter to go unheard, because it was lodged outside the 2 month time limit, if the application made credible allegations of clear, serious and ongoing unacceptable circumstances. In our view, the contravention of s606 was a compelling consideration for an extension of time, and prima facie there appeared to be "ongoing unacceptable circumstances".

- We did not mean by this that a contravention of s606 was ongoing. We meant that a serious contravention of s606, found by the original Panel and confirmed by the Federal Court at first instance and the Full Court on appeal, had not been remedied; and that the effects of that contravention appeared to be ongoing; and that this gave rise, prima facie, to "ongoing unacceptable circumstances" (to adopt the language of Austral Coal 03).

- To put it another way, we took the expression "ongoing unacceptable circumstances" used in Austral Coal 03 to incorporate the effects of identified circumstances. We think this is consistent with what the Full Court said:

TPC submits that the expression "unacceptable circumstances" can embrace more than the facts of a contravention and may include the circumstances created by or arising from a contravention. This analysis is unhelpful. It tends to conflate what constitutes the "circumstances" and what the Panel may have regard to in deciding that those circumstances constitute "unacceptable circumstances".

There is a clear delineation between the circumstances and the effect that they have had, are having, will have or are likely to have on the control or potential control of the company or the acquisition, or proposed acquisition, of a substantial interest in the company: s657A(2)(a)(i) and (ii). Relevantly, in this case it is the effect of the circumstances which rendered them unacceptable circumstances…65 (Emphasis added)

Public interest

- We also thought that we should take into account the public interest in deciding whether we should extend time. PLC submitted that one issue the remittal by the Full Court contemplated was "whether it is in the public interest for the Panel to consider the merits of TPC's application so long after the relevant circumstances occurred, so far outside of a bid period and where there is no takeover on foot."

- We considered whether to extend time from two perspectives. First, whether we would have extended time had we been the first Panel.66 We would have. Second, whether the passage of time meant that we should not extend time. We thought that we should still extend time.

- On the latter aspect, PLC submitted that:

PLC has been substantially prejudiced by the (now ultra vires) orders of the Panel of August 2012 which prevent PLC from using and enjoying its rights and property again weigh heavily against the granting of the Court's leave such that there can be no guarantee that the Court's leave will be forthcoming should the Panel make such an application.

- On the question of prejudice, a serious contravention of s606 occurred and the consequence, namely the control effect of ownership of those shares, has been held effectively in abeyance. We weighed this against the prejudice likely to other shareholders if the control effect of ownership was permitted without a consideration of whether it gave rise to unacceptable circumstances. On the question of whether the Court was likely to extend time for the making of a declaration, we agreed that there can be no guarantee but could not conclude that it was not likely.

- It is true that around 4 years has now passed. But that is not because of any action or inaction on the part of the applicant.

- We noted TPC's submission to the effect that changes in circumstances since the first Panel made its decision were not relevant for otherwise PLC would benefit from its own actions. We did not go as far as to say they are irrelevant.

- PLC also submitted that:

The Panel cannot act against the principles of natural justice and the law and a delay of 3 years from the expiry of the bid for the Panel to retrospectively extend time 3 years after the application would be made contrary to the principles of natural justice as set down by the High Court. Likewise, an act of the Panel to have effect 3 years retrospectively breaches the principles of natural justice. Further, it is an abuse of process for the Panel to use the remittal to it by the Full Court of the Federal Court to correct an error made by the Panel which serves to benefit the Panel.

- We did not accept this submission for a number of reasons:

- while true that we cannot act against the principles of natural justice, PLC had not explained what exactly the natural justice issue was that affected it

- if the submission was making the point that PLC was prejudiced by the lapse of time, we did not think that extending time and conducting proceedings necessarily prejudiced it more than not doing so might prejudice the applicant and therefore the other shareholders in TPC. Moreover, we had not proposed making a declaration of unacceptable circumstances or orders. That was a further opportunity for the question of prejudice to be considered, particularly in respect of orders67

- the Full Court remitted the matter. If there was no conceivable basis on which the Panel could extend time, the Court would not have done so and

- PLC submitted to the Full Court that it was content with ASIC's proposed order for the Full Court to remit the matter to the Panel.

- PLC also submitted that "The bid for the shares in the [TPC] is over, therefore any action by the Panel would not serve the purposes of Chapter 6 to facilitate an efficient, competitive and informed takeover." We noted that there never was a bid in the sense that no offers were made. Bidder's statements were lodged, but never dispatched with offers and were 'withdrawn'. Moreover chapter 6, as evidenced by s602, s611 and s657A, is concerned not only with bids but with control transactions in companies.

- On 5 November 2015, PLC made a further submission, out of time, that we agreed to receive. PLC directed us to paragraph [109] of the Full Court's reasons68 and submitted that:

Since the Panel knows what the Full Court of the Federal Court did not know at the time of it handing down of its judgment, in that nothing has transpired in the market since the events forming the subject of the Panel hearing occurred, then the facts that nothing has transpired and that there are no ongoing or any new relevant circumstances to give rise to any new 'events' in addition to the lengthy passage of time since the original events occurred, the act of Full Court in remitting the matter to the Panel is futile. Consequently, in light of the foregoing facts and of the Court's findings that the original Panel ought not to have conducted proceedings in 2012, the Panel now ought not conduct proceedings on the remittal to undertake any consideration of the application of The President's Club Limited of June 2012.

- We did not agree with PLC's submission. There had been a serious contravention of s606 that had not been remedied by PLC in the intervening period – and the passing of time does not do so. Moreover, if the submission was to the effect that, had the Full Court known that nothing has transpired it would have considered remittal futile, then we did not agree with this either. It does not follow from what the Full Court said, and we did not think that this is what it meant. Indeed, in the very next paragraph the Full Court said: