[2023] ATP 8

Catchwords:

Decline to make a declaration – contravention of section 606 – creep exception – family links - relevant interests – voting power – association – control – disclosure – financial information – insider participation - efficient, competitive and informed market – extension of time – proprietary company with more than 50 members – CSF shareholders – pre-emptive rights – employee shareholders – historical contraventions

Corporations Act 2001 (Cth), sections 247A, 602(a), 606(1), 608(1)(a), 608(2)(b)(iii), 609(8), 610(1), 610(3), 611 item 7, 611 item 9, 611 item 15, 611 item 19A, 657A, 657A(2), 657C(3), 657C(3)(b), 659B, 670A(1)

Corporations Regulations 2001 (Cth), regulation 6.2.01A

Australian Securities and Investments Committee Regulations 2001 (Cth), regulations 13(c) and 16

Takeovers Panel Procedural Guidelines, paragraph 2(b)

Uniform Civil Procedure Rules 2005 (NSW), rule 5.3

Tinkerbell Enterprises Pty Limited as Trustee for The Leanne Catelan Trust v Takeovers Panel [2012] FCA 1272, Brierly Investments Ltd v Australian Securities Commission (1997) 24 ACSR 629, Elders IXL Ltd v NCSC [1987] VR 1, North Sydney Brick & Tile Co Ltd v Darvall (1986) 5 NSWLR 681

Webcentral Group Limited 03 [2021] ATP 4, Excelsior Capital Limited [2020] ATP 25, Tribune Resources Ltd 02R [2018] ATP 22, Tribune Resources Ltd [2018] ATP 18, Auris Minerals Limited [2018] ATP 7, Yancoal Australia Limited 04R & 05R [2017] ATP 16, The President’s Club Limited [2012] ATP 10, Careers Australia Group Limited [2012] ATP 5, Tower Software Engineering Pty Ltd 02 [2006] ATP 26, Tower Software Engineering Pty Ltd 01 [2006] ATP 20, Skywest Limited [2004] ATP 17, Re Village Roadshow Ltd 02 [2004] ATP 12

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| YES | NO | YES | NO | NO | NO |

Introduction

- The Panel, Alberto Colla, Elizabeth Hallett (sitting President) and Bruce McLennan, declined to make a declaration of unacceptable circumstances in relation to the affairs of A S P Aluminium Holdings Pty Ltd. The application concerned alleged contraventions of section 606(1)1 by ASP, its Controllers and others and an alleged plot by ASP and others to reduce the number of ASP shareholders below 51 so that the takeovers provisions in Chapter 6 no longer apply to ASP. The Panel was not satisfied the Applicant had established that the circumstances were unacceptable.

- In these reasons, the following definitions apply.

- ASP

- A S P Aluminium Holdings Pty Ltd

- ASP Staff

- ASP Staff Holdings Pty Ltd

- ASP Staff Acquisitions

- has the meaning given to that term in paragraph 19

- Controllers

- Ms Lolita Younes, Mr Paul Nakhle and Mr Louis Hanna

- Controlling Shareholders

- the Controllers, Lalspec, Lolita Investments, Michael Three, Michael Four and Youla Holdings

- Cooper Transfers

- has the meaning given to that term in paragraph 20

- Court Proceedings

- has the meaning given to that term in paragraph 23

- FY22 Report

- has the meaning given to that term in paragraph 73(a)

- Lalspec

- Lalspec Pty Ltd

- Lalspec Acquisitions

- has the meaning given to that term in paragraph 14

- Lolita Investments

- Lolita Investments Pty Limited

- Michael Four

- Michael Four Pty Ltd

- Michael Three

- Michael Three Pty Ltd

- Millard Entities

- Mr Michael Millard, Ms Lolita Younes, Lolita Investments, Lalspec, Youla Holdings Pty Ltd, Michael Three and Michael Four

- Sale Shares

- has the meaning given in paragraph 30(a)

- Valuation Report Excerpt

- has the meaning given in paragraph 17

- Villefranche

- Villefranche Investments Pty. Limited, as trustee of the Gates Family Trust

- Villefranche Transfers

- has the meaning given to that term in paragraph 21

- Youla Holdings

- Youla Holdings Pty Ltd

Facts

- ASP is a proprietary company limited by shares which had 51 shareholders as at the date of the application. ASP’s business comprises the wholesaling and general merchandising of aluminium and hardware products for commercial, residential, home improvement and industrial applications, trading under the name “Alspec”. The net asset value of the ASP group as at 30 June 2022 was $175.78 million (approximately $640 per ASP share).

- ASP is governed by a constitution which contains restrictions on transfers of securities including:

- pre‑emptive rights which apply where shares are sold or transferred to entities other than family members or entities majority owned by the existing shareholder and family members

- tag along rights and drag along rights which apply where shareholders holding at least 50% of the shares are seeking to sell their shares to a third party. An extract of the provisions in ASP’s constitution relevant to this decision are set out in Annexure A.

- Mr Michael Millard is the principal founder of ASP and is 87 years of age. Mr Millard is married to Ms Lolita Younes. Mr Millard and Ms Younes have been in a relationship since 2010 and married since 2017.

- ███████████████████████████████████████████████████ ███████████████████████████████████████████████████████ ██████████████████████████████████████████████████████ ██████████████████████████████████████████████████████ ███████████████████████████████████████████████████████ █████████████████████.

- Mr Millard was twice previously married. He divorced his first wife Ms Joan Millard in 1983. He divorced his second wife in 1994. Ms Younes separated from her previous husband Mr Paulus (Paul) Nakhle in 2010. Mr Nahkle is the current CEO of Alspec and a director of ASP.

- ASP Staff is a wholly owned subsidiary of ASP and is the trustee of the Alspec Employee Share Trust, a trust established in or around late 2020 to hold securities on behalf of ASP employees and their associates as part of their employee incentive arrangements from time to time.

- ASP and ASP Staff are controlled by Ms Younes and her controlled entities. Ms Younes is a director of ASP2 and a director3 and company secretary4 of ASP Staff.

- The applicant, Villefranche, is the second largest shareholder of ASP holding 46,834 shares representing 17.02% of the ASP shares on issue. Villefranche has been a longstanding ASP shareholder and the genesis of its shareholding is the late Mr Daryl Gates who was one of the initial shareholders in ASP and was involved in the Alspec businesses in an executive capacity for approximately 40 years. Villefranche is controlled by Ms Nadia Gates, the surviving wife of Mr Gates.

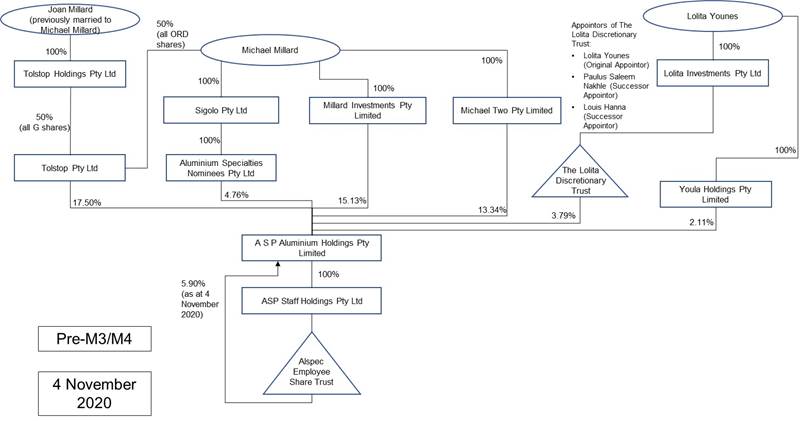

- In late 2020, Mr Millard, through four different entities,5 controlled 50.73% of the ASP shares as set out in the diagram below:

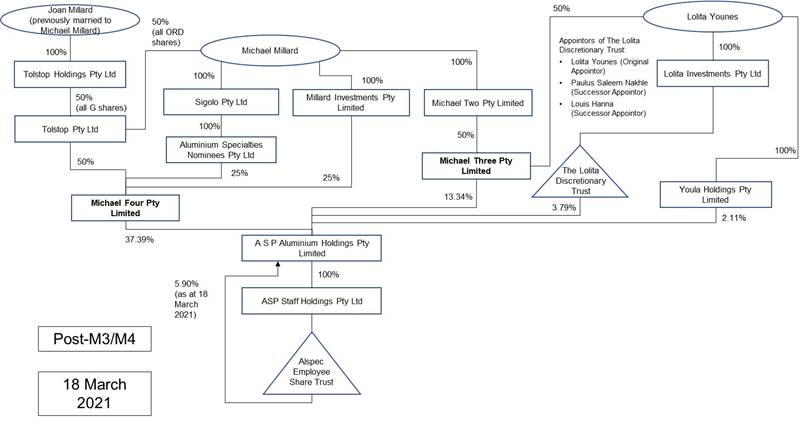

- Through a series of transactions which occurred between November 2020 and March 2021, those ASP shares were transferred to Michael Three (13.34%) and Michael Four (37.39%) as set out in the diagram below:

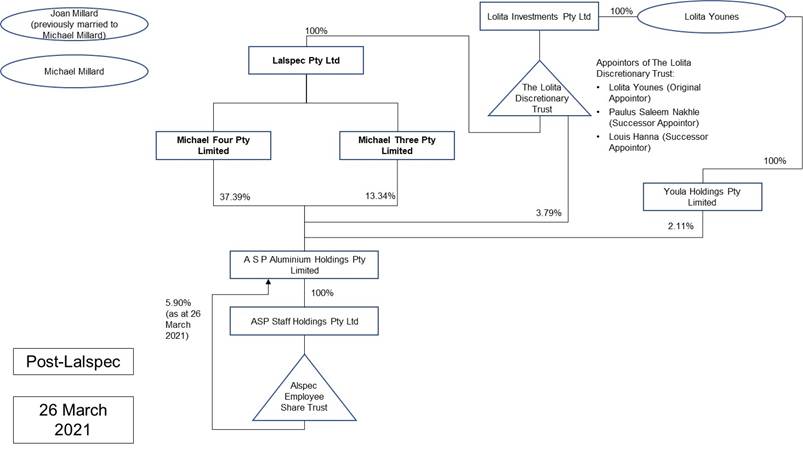

- On 25 March 2021, Lalspec was incorporated. All of the shares in Lalspec are held by Lolita Investments as trustee for The Lolita Discretionary Trust. Ms Younes is the sole director and secretary of Lolita Investments and Lalspec, respectively, and is the appointor and principal beneficiary under The Lolita Discretionary Trust. █████████████████████████████████████████████████████████.6 ███████████████████████████████████████████████████████████████████████████ █████████████████████████████████████████████████████ █████████████████████████████████████████.

- On 26 March 2021, Lalspec acquired all of the shares in Michael Three and Michael Four (Lalspec Acquisitions) as set out in the diagram below:

- ASP and ASP Staff are associates of Lolita Investments, Lalspec, Michael Three, Michael Four and Youla Holdings (and vice versa) under section 12(2)(a)(iii) because they are all controlled by Ms Younes. Accordingly:

- ASP and ASP Staff appear to have:

- voting power in 100% of the shares in those companies (under section 610) and

- the same relevant interests in ASP shares as those companies (under section 608(3)(a))

- Lolita Investments, Lalspec, Michael Three, Michael Four and Youla Holdings similarly appear to have the same relevant interests in ASP shares as ASP Staff.

- ASP and ASP Staff appear to have:

- On or about 18 March 2021, ASP sent a letter to ASP shareholders providing an update in relation to a range of matters and enclosing a “short survey questionnaire” to gauge ASP shareholders’ interest in selling their ASP shares to ASP and, if so, whether they would be willing “to accept a price as determined by a properly qualified independent expert”.

- On or about 6 April 2022, ASP sent a further letter to ASP shareholders attaching an excerpt from a valuation report from Lonergan Edwards & Associates Limited (Valuation Report Excerpt). The Valuation Report Excerpt stated (among other things) the “application of [Lonergan Edwards’] adopted discount range indicates a value of the issued shares in Alspec on a minority interest basis as at 30 June 2021 in the range of $550 to $580 per share”. The letter stated (among other things) the following:

"A share buy back is unlikely by the company in the next three years at the Lonergan Edwards valuation range.”

“We will continue to review the possibility of developing an exit strategy for those who are anxious sellers. Currently the structure established by all shareholders in the past combined with legislative and regulatory issues make progress difficult.”

- In response to these letters, various ASP shareholders had conversations with the Chairman of ASP, Mr Robert Barraket, about selling their ASP shares. Following those discussions, various ASP shareholders offered their ASP shares for sale under the pre‑emptive rights provisions in ASP’s constitution at prices ranging from $300 to $650 per share. Between 2 July 2021 and 18 August 2022, 16 of these shareholders sold their shares to ASP Staff and 4 of these shareholders sold their shares to Villefranche, at prices ranging from $300 to $400 per share.7 No shares were sold at prices above $400.

- As a result of these transactions, the number of shareholders in ASP was reduced from 68 to 51 and ASP Staff increased the percentage of voting shares in ASP it held from 5. 90% to 8.96%. Specifically, as a result of acquisitions made in:

- July and August 2021, ASP Staff increased its percentage of voting shares in ASP by 0.26% and

- July and August 2022, ASP Staff increased its percentage of voting shares in ASP by a further 2.80%,

(together, the ASP Staff Acquisitions).

- On 8 April 2022, Mr Mark Cooper (a shareholder in ASP who holds 600 shares) offered his shares for sale through the pre‑emptive rights process under the ASP constitution for $625 per share. No shareholder accepted his offer. Villefranche subsequently contacted Mr Cooper and offered to acquire 110 shares for $625 per share in the names of various beneficiaries of the Gates Family Trust. These acquisitions were permitted for a period of 3 months after Mr Cooper had offered his shares for sale under the pre‑emptive rights provisions. On 4 July 2022, Mr Cooper transferred shares to these beneficiaries (Cooper Transfers).

- On 20 September 2022, Villefranche agreed to transfer 65 of the shares it held in ASP to various entities in which Gates Family Trust beneficiaries were shareholders (Villefranche Transfers). The Villefranche Transfers were sent to ASP for registration on 23 September 2022.

- On 11 October 2022, ASP advised Villefranche’s advisers that the Board of ASP had refused to register:

- the Cooper Transfers and that the exercise of that power is “consistent with the [ASP] constitution and the arrangements in place between Mr Cooper and [ASP]” and because “it is not in [ASP’s] interest to waive the restrictions attaching to the subject shares nor to permit transfers to minors”8 and

- the Villefranche Transfers because “in the context of Villefranche's ongoing dispute with the Company, it is difficult to see how the [Villefranche Transfers] could be said to have been made for estate planning purposes. This is particularly so taking into account the nominal amounts of shares being transferred and the potential capital gains consequences associated with each of the potential transactions.”

- On 23 December 2022, following extensive correspondence between the solicitors for Villefranche and ASP concerning a range of issues9, Villefranche filed an originating process in respect of an application to inspect and make copies of the books of ASP under section 247A, and for preliminary discovery pursuant to rule 5.3 of the Uniform Civil Procedure Rules 2005 (NSW) against Lolita Younes, Lolita Investments and Lalspec (Court Proceedings).

- Following the provision of documents after the application for preliminary discovery on 31 January 2023, the Court Proceedings against Lolita Younes, Lolita Investments and Lalspec were discontinued on 10 February 2023 (on the basis some further outstanding documents would be provided if in existence). Following the provision of documents on various dates, the first being provided on 10 March 2023 and the final documents being provided on 14 April 2023, the Court Proceedings against ASP were discontinued.

- On various dates during April 2023, ASP notified its shareholders that a further 13 shareholders had offered their shares for sale under the pre‑emptive rights provisions under ASP’s constitution. 11 of those offers are within the price range of $375‑$400, which is the price range ASP Staff paid for the ASP Staff Acquisitions. These offers were open for acceptance from 12 May 2023.

Application

Declaration sought

- By application dated 2 May 2023, Villefranche sought a declaration of unacceptable circumstances. Villefranche submitted (among other things) that:

- the Lalspec Acquisitions and the ASP Staff Acquisitions have resulted in contraventions of section 606(1)

- ASP, Ms Younes and others have attempted to reduce the number of shareholders in ASP to 50 or below so that the takeover provisions no longer apply to ASP, including by refusing to register the Cooper Transfers and the Villefranche Transfers and

- material price sensitive information in relation to ASP was withheld by ASP and ASP Staff from ASP shareholders at a time when ASP Staff acquired shares from ASP shareholders.

Interim orders sought

- Villefranche sought interim orders to the effect that certain persons and their associates including the Millard Entities and ASP Staff must not acquire any shares in ASP and ASP must not register any transfer of shares in ASP if it would lead to ASP having less than 51 shareholders, unless ASP also registers the Cooper Transfers and the Villefranche Transfers.

- Villefranche submitted these interim orders were necessary to maintain the status quo to ensure that ASP remains subject to the jurisdiction of the Panel and the ambit of Chapter 6 while these proceedings are ongoing and that the interim orders needed to be made prior to 12 May 2023 at which point certain offers for sale made under the pre‑emptive rights provisions of ASP’s constitution would become open for acceptance.

- Recognising these complexities and the potential detriment to Villefranche and other minority shareholders if the number of ASP shareholders were to fall below 51, on 11 May 2023, the Panel made interim orders (see Annexure B) to the effect that:

- without the consent of the Panel:

- ASP, ASP Staff, the Millard Entities, Mr Nakhle, Mr Hanna and their associates must not acquire any shares in ASP and

- ASP must not register any transfer of shares in ASP and

- ASP must communicate to all shareholders of ASP the effect of the interim orders.

- without the consent of the Panel:

Final orders sought

- Villefranche sought a range of final orders, including that:

- the Controlling Shareholders and ASP Staff must not dispose of the shares in ASP held by them that, in aggregate when taken together with the shares in ASP held by the other Controlling Shareholders and ASP Staff, exceed 3.79% of the shares in ASP (Sale Shares) (representing approximately 61.81% of the issued share capital)

- the Controlling Shareholders and ASP Staff must not exercise any voting rights in respect of the Sale Shares and, if any voting rights are exercised, they must be disregarded by ASP

- the Sale Shares be vested in the Commonwealth for sale by ASIC

- the Controlling Shareholders, ASP Staff, Mr Millard and their respective associates be prohibited from acquiring any Sale Shares and

- the Cooper Transfers and the Villefranche Transfers be registered by ASP as soon as possible.

Discussion

- We have considered all the submissions and rebuttals from the parties but address specifically only those we consider necessary to explain our reasoning.

Decision to conduct proceedings

- ASP and ASP Staff made a preliminary submission stating that the Panel should decline to conduct proceedings, including because:

- the application is very substantially out of time and concerns circumstances that occurred over two years ago and would require investigating facts from several years earlier10

- none of the alleged conduct subverted the purposes of Chapter 6 identified in section 602, noting that the Lalspec Acquisitions “give effect to a property settlement between Mr Millard and his former wife, Joan; as well as giving effect to decisions made in the administration of a family trust”

- there was no clear breach of section 606(1)

- “the preliminary evidence is conspicuously weak…[and] comprises only a small integrant of the evidentiary and factual substratum which is complex and covers many years of corporate, and familial, relations. Indeed, the dispute has its antecedent in an oppression suit commenced by inter alia Villefranche all the way back in 2018 and is part of a broader dispute between the parties stemming from Villefranche’s dissatisfaction with the management of the company’s day to day affairs, longstanding complaints regarding the dividend policy, interpersonal differences between the director of Villefranche, Ms Gates, and the other parties, as well as Villefranche’s continued attempts to exert commercial pressure on ASP so as to facilitate an exit strategy”

- many of the claiMs set out in the application had already been the subject of extensive correspondence between the parties and the Court Proceedings

- “ASP has historically been a private company and intended to remain as such…the current membership is a consequence of incentivisation of employees (many of whom are now former employees)…” and that “Maintaining a private company as not subject to the regulation, and the consequential management costs, is a legitimate corporate purpose, as is the acquisition of shares from employees and former employees to constitute a new employee share scheme” and

- in the absence of a control transaction, it is unclear how the alleged circumstances relating to the withholding of material price information from ASP shareholders invokes the Panel’s jurisdiction.

- The Millard Entities also made a preliminary submission stating that the Panel should decline to conduct proceedings, including because:

- the application is out of time and there are no exceptional or extenuating circumstances justifying the delay

- there is insufficient material to demonstrate that there was a plan to reduce the number of shareholders in ASP to 50 or below

- alternative remedies are available to the applicant, including under section 1325A and

- two documents annexed to the application relating to the Lolita Discretionary Trust were provided to Villefranche in connection with the Court Proceedings and that:

- Villefranche is bound by the implied undertaking not to use documents or information obtained in a court proceeding for a purpose unrelated to the conduct of that proceeding

- use of those documents in these proceedings may be a contempt of court by Villefranche and

- there is a risk the Panel will participate in that contempt if it considers or relies on the documents.11

- Despite these submissions, we had concerns in relation to several of the issues raised in the application and decided to conduct proceedings to further investigate whether:

- the Lalspec Acquisitions involved any contraventions of section 606(1)

- the ASP Staff Acquisitions involved any contraventions of section 606(1)

- the ASP Staff Acquisitions were made in circumstances contrary to the purposes of Chapter 6 in section 602, including because:

- there was a plot by ASP or others to reduce the number of ASP shareholders below 51 to take ASP outside the ambit of Chapter 6

- they were made when ASP and ASP Staff were in possession of material price information not held by the selling shareholders

- to extend the time for making an application under section 657C(3) and

- the final orders sought by Villefranche were appropriate and, if not, whether any other final orders might be more appropriate to address a finding of unacceptable circumstances.

- We address these matters in our reasons below.

Lalspec Acquisitions

- Villefranche submitted that the Lalspec Acquisitions involved contraventions of section 606(1) and were unacceptable because, as a result of those transactions, the voting power in ASP of:

- Ms Younes increased from 19.24% to 62.54%

- Lolita Investments increased from 19.24% to 62.54%

- Lalspec increased from 19.24% to 62.54%

- Youla Holdings increased from 19.24% to 62.54%

- ASP increased from 56.64% to 62.54%

- ASP Staff increased from 56.64% to 62.54% and

- Mr Nakhle and Mr Hanna increased from 3.79% to 60.43%,

in each case, contrary to the purposes of Chapter 6 set out in section 602.

- The Millard Entities submitted that there was no contravention of section 606(1) as alleged because Ms Younes had a relevant interest in the ASP shares held by Michael Three (13.34%) and Michael Four (37.39%) prior to the Lalspec Acquisitions under section 608(2)(b)(iii) by having agreed to act in concert with Mr Millard for the purposes of effecting his estate planning and otherwise in relation to ASP.

- The Millard Entities summarised these estate planning purposes as follows:

████████████████████████████████████████████████████████ ██████████████████████████████████████████████████ ███████████████████████████████████████████████ ████████████████████████████████████████████████████ █████████████████████████████████████████████████████████ █████████████████████████████████████████████████████████ ██████████████████████████████████████████████ ██████████████████████████████████████████████████ ███████████████████████████████████████████████████████ ████████████████████████████████████████████████████████ ███████████████████████████████████████████████████████████████████████.

███████████████████████████████████████████████████ ████████████████████████████████████████████████████ █████████████████████████████████████████████████████████ ███████████████████████████████████████████████████ █████████████████████████████████████████████████████████ ███████████████████████████████████████████████████████████

- The Millard Entities also submitted that Mr Millard and Ms Younes were associates in relation to ASP prior to the Lalspec Acquisitions because they had a common understanding that they will, and in fact have since that time, worked together to control both the composition of ASP’s board and the conduct of ASP’s affairs, and that this may be inferred from:

- their marriage

- since 2010 they have cast the votes attached to their ASP shares in the same way

- Ms Younes was nominated by Mr Millard to be a director of ASP in 2018

- Ms Younes holds Mr Millard’s enduring power of attorney12 and

- Ms Younes is a co‑director of all Mr Millard’s companies which presently hold shares in ASP, and was a co‑director of the majority of his companies that previously held shares in ASP.

- Villefranche submitted that Ms Younes did not hold a relevant interest in the ASP shares held by Michael Three (13.34%) and Michael Four (37.39%) prior to the Lalspec Acquisitions and that the submissions of the Millard Entities confuse the concepts of relevant interest, association and voting power. Villefranche submitted that:

- at its highest, acting in concert would only make Mr Millard, Ms Younes and Lalspec associates, and give Ms Younes and Lalspec voting power in the ASP shares controlled by Mr Millard

- association would not give Ms Younes and Lalspec a relevant interest in the shares held by Michael Three (13.34%) and Michael Four (37.39%) as Ms Younes and Lalspec had no power or control in respect of the voting or disposal those shares and

- even if Lalspec was an associate of Mr Millard from the time it was incorporated, section 610(3) would apply in relation to the Lalspec Acquisitions, meaning Lalspec breached section 606(1) when it acquired Michael Three and Michael Four.

- However, Villefranche’s arguments do not explain why a relationship of association between Ms Younes and Mr Millard could not have resulted in each of them having voting power above 20% in entities through which the other held ASP shares, giving each of them the same relevant interests as those entities under section 608(3)(a). If that were the case, section 610(3) would not apply.

- The Millard Entities submitted that Mr Millard and Ms Younes have had a practice of acting in concert in respect of any decision made with respect to ASP since Lolita Investments first acquired ASP shares (by way of gift from Mr Millard) in 2010. They submitted also that ASP only gained more than 50 members “sometime in 2010”.13 If Ms Younes and Mr Millard became associates (or otherwise acquired relevant interests in ASP shares held or controlled by the other) before ASP gained more than 50 members, the acquisition would not have contravened section 606(1) as ASP would not have been a company to which section 606 applies.

- Another issue that is unclear on the material we were given, but still potentially significant, is the effect of section 609(8) which was enacted to reverse the holding in Darvall14 that “pre‑emptive rights in a company’s articles gave each shareholder a relevant interest in all the company’s shares”.15 The decision in Darvall implies that the takeovers threshold prohibition (now section 606) would not restrict existing members acquiring shares, but a non‑member could not acquire even one share without reliance on an exception to the prohibition (such as making a takeover bid).16

- If Darvall applied to the pre‑emptive rights in ASP’s constitution, none of the acquisitions by existing members would contravene section 606 (but acquisitions by non‑members, once ASP had more than 50 members, would contravene section 606). Section 609(8) provides that members do not have a relevant interest “merely because” the company’s constitution gives pre‑emptive rights on transfer of securities, but only “if all members have pre‑emptive rights on the same terms”. We sought submissions from parties on this. ASIC did not provide a submission on this issue. Other parties had differing views as to what rights were “pre‑emptive rights” for the purposes of section 609(8), but all agreed that section 609(8) would apply to prevent a relevant interest arising from some clauses at least.

- Had it been necessary to decide, we would be inclined to give section 609(8) a broad reading to give effect to Parliament’s apparent desire to avoid the rather arbitrary effects of the approach in Darvall. However, the question of what approach the Panel should take in determining when pre‑emptive rights give rise to unacceptable circumstances may be more difficult. The pre‑emptive right given by clause 9.3(4) of ASP’s constitution applied, in form, to all members on the same terms. However, in substance, it was subject to exceptions and qualifications likely to benefit some more than others. The exceptions for transfers to family members and entities they control would clearly be of no use to members with no family. The fact that all transfers and pre‑emptive rights were subject to the Directors’ unfettered discretion to refuse to register a transfer (see clauses 9.2(c), 9.3(a)) might make those rights more advantageous for large or controlling shareholders who can determine the composition of the board than for small shareholders. This may not take the pre‑emptive rights outside the operation of section 609(8), but misuse of such exceptions and qualifications may still be contrary to section 602(c).

- The significance of these issues to the alleged contraventions regarding the Lalspec Acquisitions was not apparent when we decided to conduct proceedings. We consider that, in the light of those issues, the alleged contraventions regarding the Lalspec Acquisitions would be more appropriate for a court to resolve, given:

- The issues appear to raise questions of law17 and contested factual matters, some of which occurred as long as 13 years ago. We note the Panel has previously declined to determine whether old historical contraventions of section 606 have occurred.18

- Courts are better equipped to resolve contested factual matters, especially matters occurring so long ago, and only courts can conclusively determine questions of law.19 The Panel was created to deal with disputes in a relatively informal and expeditious manner,20 and is required to act in as timely a manner as proper consideration of the matter permits.21

- There is no restriction on parties commencing proceedings in the courts regarding these matters.22

- We have also considered whether the Lalspec Acquisitions, aside from contraventions, gave rise to unacceptable circumstances. In our view, that raises a policy question the Panel has rarely had to consider,23 as to how the Panel should exercise its powers and apply the purposes in section 602 to a proprietary company with more than 50 members. This question does not appear to have been the subject of detailed consideration in previous Panel proceedings. We consider that there may be circumstances or factors which justify the Panel approaching proprietary companies differently for the purposes of Chapter 6, including but not limited to:

- Proprietary companies need to have no more than 50 shareholders (excluding employee shareholders and crowd‑sourced funding (CSF) related shareholders).24 Accordingly, Chapter 6 and the Panel’s jurisdiction generally only extends to proprietary companies that have employee shareholders or make a “CSF offer” (as defined in the Act).

- The constitutions of proprietary companies often contain a pre‑emptive rights regime and “tag along” or “drag along” rights similar to those in ASP’s constitution.

- The exemption for proprietary companies (but not public companies) that have “CSF shareholders” (as defined in the Act) from the prohibition in section 606(1)25 is an example of Parliament treating certain proprietary companies differently for the purposes of Chapter 6.

- The lack of guidance as to what is unacceptable in the case of a proprietary company that falls under Chapter 6 and the operation of pre‑emptive rights regimes makes us reluctant to conclude that matters raised by the application give rise to unacceptable circumstances. Some of those matters (for reasons explained below) may well have given us concerns had they related to a widely‑held public company or a listed entity. However, we do not think it appropriate, or in the public interest, to impose on proprietary companies that fall (often unwittingly) within Chapter 6 the same expectations, when they have not had the benefit of guidance as to what is required of them.

ASP Staff Acquisitions

- Villefranche submitted that the ASP Staff Acquisitions were unacceptable including because:

- with respect to the acquisitions that occurred in July and August 202126, those acquisitions were made in contravention of section 606(1) as ASP Staff had no ability to rely on the creep exception in section 611 item 9 due to the earlier increase in voting power of ASP Staff as a result of the Lalspec Acquisitions three months earlier and

- with respect to the acquisitions that occurred in July and August 202227 which were made without contravening section 606(1) in reliance on the creep exception in section 611 item 9, those acquisitions were still unacceptable as the only reason the creep exception was available was because of the earlier contraventions of section 606(1) as a result of the Lalspec Acquisitions.

- Additionally, Villefranche submitted that we should take into account the conduct of ASP and ASP Staff in relation to the ASP Staff Acquisitions, and the effect of those acquisitions, all of which contribute to the ASP Staff Acquisitions constituting unacceptable circumstances, including that:

- shareholder funds have been inappropriately used to entrench the control of the majority shareholders at the expense of minority shareholders who suffered the effective dilution of their collective relevant interest and voting power in ASP as a result of the ASP Staff Acquisitions

- there was no legitimate need for ASP Staff to acquire further ASP shares on behalf of the Alspec Employee Share Trust as it is not clear whether any employees had any entitlement to shares, or there was any reasonable prospect of any employees or directors being entitled to or receiving an allocation of shares in the near future under the trust. Accordingly, the Panel may infer that the shares acquired by ASP Staff are being warehoused in the trust for the purposes of entrenching the control position of the Controlling Shareholders.

- The shares acquired under the ASP Staff Acquisitions represent 3.06% of the voting power in ASP. Accordingly, for the reasons set out in paragraph 15, these acquisitions increased the voting power of Ms Younes and her controlled entities in ASP from 62.54% to 65.60%.

- ASP and ASP Staff submitted that incremental increases in control above 50% (but below 75%) do not have a practical effect on control. Villefranche disagreed.

- Villefranche submitted that it is no answer to say that by the time of the ASP Staff Acquisitions, the Controlling Shareholders were already in control of over 50% of the shares in ASP, both because there had been a change in who the Controlling Shareholders were which had not been disclosed to shareholders and because control for the purposes of Chapter 6 is an incremental, and not an absolute, concept.

- Villefranche cited the decisions of the Panel in Re Village Roadshow Ltd 02 [2004] ATP 12 and The President’s Club Limited [2012] ATP 10.

- In Re Village Roadshow Ltd 02, the Panel stated at [34] that:

“The takeovers code is consistently concerned with fine gradations of control, and does not treat control as an absolute concept. Chapter 6 regulates acquisitions of shares conferring voting power across the whole of the range from 20% to 90% voting power. Chapter 6C requires disclosure of voting power across the whole of the range from 5% to 100% voting power, in increments of 1%. Panels have consistently explained the relationship between unacceptable circumstances and control in terms of increments of control, as have the Courts.”

- The Panel also stated at [37], referring to Brierly Investments Ltd v Australian Securities Commission28 that:

“Emmett J quoted with approval Elders IXL Ltd v NCSC [1987] VR 1 at 17–18, to the effect that the meaning of “substantial interest” in a particular case “must attach to a step in the direction of takeover or a change in corporate control” and para 8 of NCSC Policy Statement 105 to the effect that “a substantial interest normally involves an interest which affects control by being a parcel which may influence either a change of or maintenance of existing control”. Although the context in each case is the substantial interest limb of what is now subs 657A(2), there is clear agreement that in Ch 6, control is a graduated concept. This accords with common sense and experience, not least that bidders are prepared to pay more to obtain greater levels of control, eg for sufficient shares to force through special resolutions or initiate compulsory acquisition.”

- In The President’s Club Limited [2012] ATP 10, the Panel considered that an acquisition of only 2.9% consolidated the control of the majority shareholder and was relevant to it finding unacceptable circumstances. In reaching its decision, the Panel considered this acquisition was unacceptable despite being permitted under the 3% creep exception in section 611 item 9 because it was made following and in reliance on an earlier contravention of section 606(1).

- We accept that control is an incremental, not an absolute, concept and there may be circumstances where small and/or incremental acquisitions of shares directed at maintaining and obtaining greater levels of control may be unacceptable even where a controlling shareholder already holds more than 50% of the shares, for example, in the circumstances arising in The President’s Club Limited proceedings. However, unlike in that matter:

- we have not made any finding in relation to whether the Lalspec Acquisitions contravened section 606(1) (see paragraphs 36 to 46)

- there appear to be legitimate reasons for ASP Staff making the acquisitions outside of any control purpose, including to facilitate an exit for ASP shareholders wishing to sell their shares in circumstances where they would otherwise be unable to do so with a view to holding those shares in a trust for the purposes of operating an employee incentive scheme and

- the Controlling Shareholders have only increased their voting power in ASP by 3.06% from 62.54% to 65.60%.

- Whether certain of the ASP Staff Acquisitions contravened section 606 is linked to whether the Lalspec Acquisitions contravened section 606. For example, if the Lalspec Acquisitions did not contravene section 606, then each of the ASP Staff Acquisitions would have been permitted under the creep exception in item 9 of section 611.

- As we have not made any finding in relation to whether the Lalspec Acquisitions contravened section 606, we make no finding in relation to whether the ASP Staff Acquisitions contravened section 606.

- In these circumstances, including the matters discussed above at paragraphs 47 to 49, we are not satisfied that the ASP Staff Acquisitions have had, are having, or are likely to have an unacceptable effect on:

- the control, or potential control, of ASP

- the acquisition, or proposed acquisition, of a substantial interest in ASP,

or are otherwise unacceptable having regard to the purposes of Chapter 6 set out in section 602.

Plan to remove ASP from the ambit of Chapter 6

- ASP is subject to the takeovers provisions in Chapter 6 as a result of having more than 50 shareholders.

- As noted in paragraphs 19 and 25, the number of shareholders in ASP has recently reduced from 68 to 51 and a further 13 sale offers have been made under the pre‑emptive rights provisions in ASP’s constitution. The interim orders made by the Panel prohibit ASP, ASP Staff, the Millard Entities, Mr Nakhle, Mr Hanna and their associates accepting these offers and prohibit ASP registering any transfers of these shares. Without these interim orders, if any of these offers were accepted, ASP would no longer be subject to Chapter 6 as it would no longer have more than 50 shareholders.

- Villefranche submitted that the recent reduction in the number of shareholders is part of a plan by ASP to remove it from the ambit of Chapter 6, including because:

- removing ASP from the ambit of Chapter 6 would benefit the Controlling Shareholders because Lalspec (which controls over 65% of ASP shares) could be sold to a third party without triggering the pre‑emptive rights or tag along rights in ASP’s constitution and without having to satisfy any permitted exceptions to the takeovers prohibition (e.g. obtaining the approval of independent shareholders under section 611 item 7)

- many of the sale offers made by ASP shareholders under the pre‑emptive rights provisions in ASP’s constitution were made on or around the same day for or for around the same price29 from which it may be inferred that ASP has been encouraging or even coercing shareholders to offer their shares at a price that is below fair value and

- ASP has refused to register the Cooper Transfers and the Villefranche Transfers without adequate justification from which Villefranche submitted30 it may be inferred that ASP is not doing so because registering the transfers would increase the number of ASP shareholders.

- ASP and ASP Staff submitted that its “corporate object is not and has never been directed at achieving any particular number of ASP shareholders, whether that be above or under the number of 50. Rather, it has in the past and continues to be a legitimate corporate objective of ASP to offer employee share schemes and, in what is otherwise an illiquid market for the members, acquire shares from employees and former employees.”

- Villefranche submitted that “the desire of ASP to achieve other objectives in addition to the desired objective of removing ASP from the ambit of Chapter 6 does not make what is unacceptable acceptable.”

- In Careers Australia Group Limited [2012] ATP 5, the Panel considered whether an offer by the majority shareholder to buy the shares of 40 shareholders under separate option arrangements was unacceptable in circumstances where, if those offers were accepted, and options exercised, the number of shareholders would fall from 88 to below 50, thus removing the company from Chapter 6. The Panel declined to make a declaration of unacceptable circumstances after an undertaken was given. However, in its reasons, the Panel acknowledged:

“We accept there will be circumstances in which removal of a company from the ambit of Chapter 6 will clearly not be unacceptable, for instance, if a company ends up with 50 or fewer shareholders by coincidence; that is, as an ancillary result of some other act. Where there is a plan or proposal designed to cause a company to be taken outside the ambit of Chapter 6, unacceptable circumstances may, in our view, arise.”

- We agree that unacceptable circumstances may arise where there is a deliberate strategy to reduce the number of shareholders in a company with a view to taking the company outside the ambit of Chapter 6 and depriving shareholders of the benefits and protections afforded under that Chapter. However, to the extent that ASP or the Controlling Shareholders wanted the company to cease to be subject to Chapter 6, we are not satisfied that was unacceptable in the circumstances of this matter as a whole, including the fact that ASP:

- is a proprietary company which only falls under Chapter 6 due to employee shareholders31 and

- has pre‑emptive rights in its constitution that are not unusual for proprietary companies.

- We consider it relevant that the ASP Staff Acquisitions:

- appeared to be for some legitimate corporate purposes, being:

- to facilitate an exit for its employee shareholders in accordance with the pre‑emptive rights regime under the ASP constitution in circumstances where an exit may not otherwise be available given ASP is a proprietary company

- to hold shares on trust for eligible employees that have or may in the future be granted incentives under the Alspec Employee Share Trust and

- were made in response to shareholders offering to sell their shares in accordance with the pre‑emptive rights provisions under ASP’s constitution. While ASP may have indicated to its shareholders that it would be willing to acquire shares offered for sale at a certain price that were not acquired by other shareholders under the pre‑emptive rights process, ultimately, this process is driven by the sellers, not ASP. Once shares were offered for sale under the pre‑emptive rights process, each other ASP shareholder had the opportunity to acquire those shares at the nominated price before ASP Staff. In fact, Villefranche acquired shares from at least three shareholders under this process which contributed to the reduction in the number of shareholders which it seeks to rely on to support its contention that ASP is plotting to reduce the number of ASP shareholders. We were not provided with sufficient probative material to suggest that the offers that led to the ASP Staff Acquisitions were encouraged, solicited, or coerced by ASP as suggested by Villefranche.

- appeared to be for some legitimate corporate purposes, being:

- We also considered it relevant that there appeared to be some legitimate reasons for ASP to refuse to register the Cooper Transfers and the Villefranche Transfers32 although we have not considered whether those reasons constitute proper grounds under the ASP constitution and the Act as we think a court is a more appropriate forum for such matters.

Information asymmetry and trading allegations

- Villefranche submitted in its application that the ASP Staff Acquisitions were undertaken at times when ASP clearly had “material price sensitive information” in relation to ASP shares that it had not disclosed to all shareholders. Villefranche further submitted that some of the shareholders who sold their shares to ASP Staff were likely to have done so in circumstances which might have constituted insider trading by ASP Staff in acquiring the shares, or by ASP in procuring ASP Staff to acquire the shares.

- Villefranche submitted (in summary) that there were at least 3 categories of material price sensitive information that may have been available to ASP and ASP Staff and not other shareholders:

- Financial information: Villefranche submitted that each of the ASP Staff Acquisitions occurred after or close to the end of the relevant financial year, but before the financial statements for that year had been released to shareholders, and that ASP and ASP Staff had material information about ASP’s performance that was not available to other shareholders. Villefranche noted that the ASP Financial Report in respect of FY22 (FY22 Report), which was sent to shareholders in late October 2022, showed a significant increase in revenue, earnings and profit for ASP in the financial year ended 30 June 2022 over the prior year.33

- Full copy of valuation report: Villefranche submitted that while ASP provided the 2 page Valuation Report Excerpt to all ASP shareholders on 6 April 2022 (see paragraph 17), the full report, which would likely have assisted shareholders to form a view as to the value of their shares, was not provided to all shareholders.

- Entry into Alspec Business Park agreement: Villefranche also noted that the FY22 Report disclosed that a wholly owned subsidiary of ASP had entered into an agreement to build ‘Alspec Business Park’ in the financial year ending 30 June 2022, which project is expected to be completed in 2026. Villefranche submitted that details of this agreement, the nature and size of ASP’s commitments, and the implications of the project for ASP’s future financial performance and risk profile, which were not disclosed in the FY22 Report, were all matters which were likely to influence the decision of investors whether to acquire or dispose of shares in ASP, and therefore constituted material price sensitive information.

- Villefranche also noted that the FY22 Report states that “[l]ikely developments in the operation of the consolidated group and the expected results of those operations in future financial years have not been included in the FY22 Report as the inclusion of such information is likely to result in unreasonable prejudice to the consolidated group.” Villefranche submitted that this was an acknowledgement by ASP that there was material information relevant to shareholders and their ability to understand the value of their shares which ASP had deliberately chosen to withhold from shareholders, and that trading without disclosing material price sensitive information is not excused by the fact that the information is commercially sensitive.

- Villefranche submitted that the withholding of material price sensitive information from ASP shareholders at the time of the ASP Staff Acquisitions constituted unacceptable circumstances given:

- the acquisitions occurred while ASP and ASP Staff were in possession of material price sensitive information which was not available to all shareholders, depriving those who sold their shares to ASP Staff of information required to form a proper view of the value of their shares and

- other shareholders who could have accepted the offers were deprived of the information they required to assess the price at which the shares were being offered against their fair value and make a fully informed decision as to whether to acquire those shares,

meaning there was “not an efficient, competitive and informed market for the acquisition of these shares, shareholders did not have enough information to assess the merits of buying or selling (as the case may be) these ASP shares and did not have a reasonable and equal opportunity to participate in the benefits accruing to the Controllers and the Controlling Shareholders” as a result of the ASP Staff Acquisitions.

- Villefranche also submitted as follows:

“While it is not the Panel’s remit to consider whether there has been a breach of the insider trading provisions of the Corporations Act, the fact that a subsidiary of ASP is buying shares from shareholders where those shareholders are not in possession of material information in relation to ASP’s performance and future prospects, contributes to the unacceptable circumstances created.”

- In Skywest Limited34, the Panel stated as follows as part of [47]:

“Of course, conduct which may contravene provisions of the Act other than the takeovers code, or of other statutes or of the general law, may also be conduct which we may regard as unacceptable because of its effect on either control, or potential control, of a company (including its effect on transactions relating to control the company) or the acquisition, or potential acquisition, of a substantial interest in the company. For example, the Panel is not concerned with the enforcement of the insider trading provisions themselves. However, it is likely that facts relevant to establishing that the insider trading provisions have been contravened may also indicate the existence of unacceptable circumstances: the insider trading provisions are designed to ensure that dealing in securities occurs in an informed market and this is one of the policies to which the Panel is obliged to have regard.”

- Accordingly, while we considered that any contraventions of the insider trading provisions are a matter for ASIC, we were concerned that the allegations concerning information asymmetry may have had the potential to undermine the principles in section 602. We invited the parties to make submissions on this aspect. We also requested that ASP and ASP Staff provide (among other things) all financial information given to ASP shareholders from 4 November 2020.

- ASP and ASP Staff made submissions rejecting the insider trading allegations. They also submitted that:

- “[o]nce the information required by the Act and the company’s constitution is provided, it is generally a matter for ASP’s Board, the directors acting conformably with their duties, what further information is provided to shareholders” and

- “[i]n deciding what information should be disseminated to the membership, the ASP Board considers many factors, including that some former employees and shareholders maintain relationships with competitors in a highly competitive market.”

- ASP and ASP Staff also submitted that since 4 November 2020, ASP has provided ASP shareholders with financial information contained in letters dated 18 March 2021, 6 April 2022 and 11 May 2022, the FY22 Report and its notice of annual general meeting and associated materials, each of which were included in the materials provided with the application.

- The Millard Entities submitted as follows:

- No ASP shareholder has made a complaint about the price they received for their shares.

- Whilst it is correct that the FY22 Report had not been provided to shareholders at the time of the ASP Staff Acquisitions, and that there was an increase in profit from the previous year, the likelihood of that increased profit had been foreshadowed in a letter from ASP to shareholders dated 11 May 2022 in which the Board identified that “[t]rading and revenue growth have been strong despite the interruption to the supply chain resulting from the impact of COVID, builders collapsing, fluctuating metal prices, predicted interest rate rises and the conflict in eastern Europe” and that “revenue from 01 July 2021 to 31 March 2022 has been strong and, absent any major catastrophic events between now and 30 June 2022, profit will show an increase on last year”.

- In relation to the Valuation Report Excerpt, Villefranche concedes that the shareholders were provided with a two‑page summary which “would likely have assisted shareholders to form a view as to the value of their shares” and that it is to be observed that this summary was provided to the shareholders on 6 April 2021, being more than a year prior to the update as to increased profitability on 11 May 2022.

- In relation to ASP’s entry into Alspec Business Park agreement, that ASP proposed to embark on a project of capital works at new premises was disclosed to shareholders in the letter of 18 March 2021 (see paragraph 16).

- As part of its rebuttals in relation to ASP and ASP Staff’s submissions, Villefranche submitted:

- “When the acquisition of the substantial interest is by the Company itself, the obligations to provide such information are heightened. The principle in section 602(a) also provides support for the requirement. It is no answer to this requirement that the information might be confidential or commercially sensitive.”

- “Disclosure of the information to shareholders before trading with them would be a solution to this problem. If ASP does not wish to disclose the information, for reasons of confidentiality or otherwise, then it should not trade.”

- As part of its rebuttals in relation to the Millard Entities’ submissions, Villefranche submitted:

- In relation to the financial information, “[t]elling shareholders that there is likely to be an increase in profit does not mean that the Company no longer had material price sensitive information that shareholders did not have. There was no quantification of the potential increase in profit and certainly no indication that FY22 profit would be 133% of FY21 profit”.

- in relation to the Valuation Report Excerpt, “[t]he body of the Lonergan Edwards Report provides significant information that would likely have influenced the decision of a shareholder to sell their ASP shares” and “[t]he Millard Submission that the 2‑page summary was provided on 6 April 2021 is incorrect, as it was provided on 6 April 2022”.

As set out above, the ASP Staff Acquisitions involved 16 ASP shareholders selling a total of approximately 3.06% of ASP shares to ASP Staff under the pre‑emptive rights provisions in clause 9.3 of ASP’s constitution in a series of transactions spanning 2 July 2021 to 18 August 2022. The size of the parcels of shares sold ranged from approximately 0.04%to 0.91%.

- It was difficult for us to determine exactly what information each selling shareholder was in possession of vis‑à‑vis ASP Staff or ASP at the time of the ASP Staff Acquisitions, and this was complicated by the ASP Staff Acquisitions having occurred via a series of transactions, some of which occurred almost 2 years ago.

- Having regard to all the circumstances, including that:

- ASP is a proprietary company with 51 shareholders35 and

- the ASP Staff Acquisitions appeared to be for some legitimate corporate purposes36 and concerned a relatively small quantum of shares,

we did not take this further as we were not satisfied that further investigation was likely to lead to a finding of unacceptable circumstances. We also note that we did not consider it part of our role to evaluate or opine on the price paid for the ASP shares in connection with the ASP Staff Acquisitions.

Public interest considerations

- Subsection 657A(2) (last sentence) states the following in relation to the Panel’s power to make a declaration of unacceptable circumstances:

“The Panel may only make a declaration under this subsection, or only decline to make a declaration under this subsection, if it considers that doing so is not against the public interest after taking into account any policy considerations that the Panel considers relevant.”

- Considering this, and given the spectrum of unique legal, factual and policy issues raised by the application, we sought submissions from the parties as to whether we should take into account the status of ASP as a proprietary company, the appropriateness of the final orders sought, the Lalspec Acquisitions potentially being for estate planning purposes and the history of the dispute between the parties, in determining whether it is in the public interest to make a declaration of unacceptable circumstances.

Status of ASP as a proprietary company

- Villefranche submitted that the status of ASP as a proprietary company should not impact the consideration of whether it is in the public interest to make a declaration in relation to the Lalspec Acquisitions as Parliament has chosen a bright line test which should be followed – if a company has more than 50 shareholders, it is within the jurisdiction of Chapter 6, if it does not, then it is not within the jurisdiction of Chapter 6.

- ASP and the Millard Entities made submissions to the effect that the current membership of ASP is a consequence of the issue of shares to employees in accordance with employee incentive arrangements and that it was never intended that ASP would be run as a public company.

- In our view, the fact that the Panel is given jurisdiction in relation to proprietary companies does not mean the Panel must exercise its jurisdiction in the same way as it would for public companies or listed entities. As noted above, Parliament itself has treated certain proprietary companies differently for the purposes of Chapter 6.37 Furthermore, in deciding whether making or declining to make a declaration would not be against the public interest, we are required to take into account policy considerations that we consider relevant. In this case, we do consider the fact that ASP is a proprietary company to be relevant, for the reasons explained above.38

Appropriateness of final orders sought

- Villefranche sought final orders which included the divestment of shares in ASP held by the Controlling Shareholders and ASP Staff that in aggregate exceed 3.79% of the issued share capital (representing approximately 61.81% of the issued share capital).

- Villefranche submitted (among other things) that:

- the Panel should separate the effect of any orders it might make from the decision as to whether to make a declaration of unacceptable circumstances which is an antecedent inquiry to the making of final orders

- divestiture orders are the usual orders that the Panel makes when there has been a breach of section 606(1) and would be appropriate to remedy the alleged unacceptable circumstances, subject to including some aspects to assist with their implementation in the context of an unlisted company (e.g. allowing a longer time frame for the divestment to take place and affording the minority shareholders tag along rights)

- it would be an insufficient remedy to simply unwind the Lalspec Acquisitions and ASP Staff Acquisitions given the serious and significant breaches of section 606(1) which had not been disclosed and the resulting change in control has facilitated significant changes in the financial and operating policies of ASP which benefit Ms Younes████████████████████████████ and

- any prejudice to the Controlling Shareholders of the orders is not unfair when weighed against the prejudice to the rights and interests of the minority shareholders if the effects of the unacceptable circumstances were to go unremedied.

- The Millard Entities submitted (among other things) that:

- a divestiture order would be “utterly inappropriate, unjust and unnecessary” as it would mean “the effective sale of ASP which had been developed as a private business by Mr Millard over more than 40 years, to an unknown third party who could change the direction of the business in a multitude of ways…”

- there are practical issues with divesting such a significant number of shares in a proprietary company which may require providing due diligence access to, and negotiating transaction documents with, a third‑party purchaser and other interested parties before a sale may be effected and

- the only final orders that would be appropriate to reinstate the status quo would be to unwind the Lalspec Acquisitions. However, those orders are unnecessary and unfairly prejudicial to the Millard Entities because the transaction would trigger significant capital gains tax liabilities and have no practical impact on the control of ASP, which would remain jointly controlled by Mr Millard and Ms Younes.

- As we have not made a declaration of unacceptable circumstances, we do not need to make a finding as to the appropriateness of the final orders sought by the applicant. However, we have serious concerns as to whether a divestiture order would have been an appropriate remedy in the circumstances given the potential change of control implications of a third party acquiring the divested shares, the potential difficulties in effecting the divestment given the nature of ASP as a proprietary company, Mr Millard having founded and developed the company over more than 40 years and the Lalspec Acquisitions potentially having being effected as part of an “estate planning strategy” in circumstances where Ms Younes may already have had practical control over ASP (jointly with Mr Millard). Moreover, even if unacceptable circumstances were found to have occurred, it was not clear whether any order would be suitable to remedy the unacceptable circumstances.

Relevance of estate planning strategy

- The Millard Entities submitted that the Lalspec Acquisitions were made for estate planning purposes so as to avoid, to the extent possible, any disputes arising with respect to entitlements under Mr Millard’s Will (see paragraph 38).

- The Millard Entities further submitted (among other things) that it would not be in the public interest for the Panel to make a declaration of unacceptable circumstances in respect of the estate planning arrangements of shareholders of a proprietary company who are and have been associates.

- ASP and ASP Staff submitted (among other things) that that it was not in a position to make submissions as to whether the Lalspec Acquisitions occurred as part of an estate management strategy, but if they did, this would militate against a finding of unacceptable circumstances and a finding that a declaration is in the public interest because the impugned conduct is essentially of a private and personal kind.

- Villefranche submitted (among other things) that “Chapter 6 already provides exceptions which allow for changes of control to occur in the context of the death or incapacity of a controlling shareholder. Those exceptions were not utilised by the Millard Entities. Moreover, based on the responses that were provided to Villefranche when it queried the change of control and whether it had breached Chapter 6, there appears to have been either indifference or disregard to the need to comply with Chapter 6. Ignorance of the law in this regard is no excuse and should not be taken into account when deciding whether to make a declaration of unacceptable circumstances (and section 606(5) is not otherwise available because the proceedings do not concern a prosecution for a criminal offence).”

- ASIC submitted that it is open for any person to apply for exemptions from, or modifications to, the provisions of Chapter 6, including the takeovers prohibition in section 606(1), which ASIC will consider on a case‑by‑case basis having regard to the circumstances as a whole, previous ASIC decisions, the control effects of the particular transaction, and the views of the impacted parties where that is required. ASIC confirmed that it was not aware of having ever granted section 606 relief in relation to family reorganisations or estate planning purposes.

- These submissions raise an interesting policy question as to whether a transfer of securities between spouses for the purposes of estate planning in contravention of section 606(1) to accelerate the timing of a transfer of securities that is proposed to occur following the death or incapacity of the securityholder as permitted under the exception in section 611 item 15 would give rise to unacceptable circumstances. There may be situations where this would not. However, given our conclusions above, we did not need to consider this issue any further in the context of this matter.

Existing disputes between the parties

- As noted above,39 Villefranche, the Millard Entities and ASP had been in various forMs of dispute since 2018, including proceedings in the Supreme Court of New South Wales that concluded in April 2023.

- Villefranche submitted (among other things) that the existence of other disputes should not disentitle one party to relief from the Panel where unacceptable circumstances exist and that all of the prior judicial proceedings had been resolved meaning there should be no concern about the Panel exercising its jurisdiction where applicable.

- The Millard Entities submitted (among other things) that the final orders sought by Villefranche would not confer any benefit on ASP or its minority members, and therefore the sole objective of the application appears to be achieving a reduction in the level of control by the Millard Entities which they have held for many years.

- ASP and ASP Staff submitted (among other things) that:

- “the present dispute is part of a broader dispute between the parties stemming from the Applicant’s dissatisfaction with the management of the company’s day to day affairs, longstanding complaints regarding the dividend policy, interpersonal differences between the director of the Applicant, Ms Gates (Ms Gates), and the other parties, as well as the Applicant’s continued attempts to exert commercial pressure on ASP so as to facilitate an exit strategy for the Applicant” and

- the multitude of ongoing disputes “tends only to fortify the contention that the appropriate forum is curial proceedings, and that the Application is vexatious”

- For the reasons explained above, we consider the issues raised in the application would better be addressed by a court. In our view, the nature and extent of the ongoing disputes between the parties weighs in favour of this conclusion. In light of this, we did not form any view in relation to the submissions of the Millard Entities and ASP that the application was being used by Villefranche to further its strategic objectives to reduce the control of the Millard Entities and to facilitate an exit on fair and reasonable terms.

Extension of time for the application

- The application was made on 2 May 2023, which was more than 2 months after the Lalspec Acquisitions and the ASP Staff Acquisitions occurred. It was also potentially more than 2 months after the alleged plan to remove ASP from the ambit of Chapter 6 and ASP allegedly encouraging or coercing shareholders to offer their shares for sale while in possession of material information not available to those shareholders, although these aspects, to the extent they could be made out, may have been ongoing.

- Section 657C(3) provides that an application for a declaration under section 657A can be made only within:

- two months after the circumstances have occurred; or

- a longer period determined by the Panel.

- In Webcentral Group Limited 03 [2021] ATP 4, the Panel articulated the following factors as relevant in considering whether to extend time under section 657C(3)(b):

“(a) the discretion to extend time should not be exercised lightly”

(b) whether the application made credible allegations of clear and serious unacceptable circumstances, the effects of which are ongoing

(c) whether it would be undesirable for a matter to go unheard, because it was lodged outside the two month time limit, if essential matters supporting it first came to light during the two months preceding the application and

(d) whether there is an adequate explanation for any delay, and whether parties to the application or third parties will be prejudiced by the delay.” 40

- The applicant included in its application a request that we exercise our discretion under section 657C(3) to hear the application. It made the following submissions (among others) in support of this request:

- Allegations in the application would, if established, involve serious unacceptable circumstances, and the Lalspec Acquisitions “involved a serious and extensive breach of section 606(1)”.

- Significant information in relation to the actual implications of the Lalspec Acquisitions only came to light on 29 March 2023 when legal advisers acting for Ms Younes provided a copy of a deed of amendment to the trust deed for The Lolita Discretionary Trust41 and confirmed that there were no other relevant documents in relation to that trust.

- The Lalspec Acquisitions and the ASP Staff Acquisitions “cannot be considered in isolation from the other unacceptable circumstances which are ongoing and which have occurred in the last 2 months.”42

- The delay in bringing the application has “largely been due to the actions by ASP and the Controlling Shareholders” and there was an adequate explanation for the delay in lodging the application, with various accompanying submissions as to the chronology of events leading up to the lodgement of the application including (in summary):

- The Lalspec Acquisitions occurred without any disclosure to ASP shareholders and were discovered by chance when the applicant requested a copy of the ASP share register on 13 May 2022, which was not provided until 24 May 2022.

- It was not until some time later that Villefranche’s advisers analysed the register and realised that the Lalspec Acquisitions had taken place, which required numerous ASIC searches and document requests.

- On 15 July 2022, the applicant’s advisers wrote to ASP’s advisers enquiring about the Lalspec Acquisitions and whether there had been a breach of section 606(1), requesting a response by 26 July 2022. ASP’s advisers twice sought an extension to the response deadline and responded on 16 August 2022 noting that there was no material change in control of the major shareholders and that transfers between Mr Millard and Ms Younes were a private matter relating to personal estate planning affairs.

- On 23 August 2022, the applicant’s advisers again wrote to ASP’s advisers questioning whether there had been a breach of section 606(1), to which ASP’s advisers responded on 9 September 2022 that there had been no breach of section 606(1).

- The applicant’s advisers wrote to Ms Younes on 6 October 2022 noting that the applicant may be entitled to make a claim for relief in relation to a breach of section 606(1) and requesting further information by 14 October 2022, to which Ms Younes’ adviser responded on 10 November 2022 refusing to provide the information requested and denying that there was any breach of section 606(1) in relation to the Lalspec Acquisitions.

- Based on the denials contained in the correspondence from advisers for ASP and Ms Younes, the applicant determined that it needed to seek further information before commencing any proceedings, noting that it did not know the basis on which Lolita Investments held the shares in Lalspec (apart from the fact that the shares were held non‑beneficially). Without knowing the terms of the trust on which the shares were held, it was not possible to determine whether the Lalspec Acquisitions had actually resulted in a breach of section 606(1) and if it had, where that breach constituted unacceptable circumstances.

- On 23 December 2022, the applicant commenced the Court Proceedings in the Supreme Court of New South Wales against ASP, Ms Younes, Lolita Investments and Lalspec pursuant to which it sought to inspect and make copies of the books of ASP pursuant to section 247A and for orders for preliminary discovery against Ms Younes, Lolita Investments and Lalspec (see paragraphs 23 and 24).

- While the Court Proceedings were on foot, it was not appropriate to make an application to the Takeovers Panel as there was a risk that the Panel would decline to commence proceedings on the basis that the Panel will generally not commence proceedings on an issue on which the Court has jurisdiction and has already commenced proceedings.

- The applicant supplied with the application copies of the letters and other documentation referred to in its submissions in relation to its request for an extension of time.

- We considered that based on its submissions in the application and the supporting materials provided, the applicant had a good case for an extension. However, we requested submissions from the parties on whether we should extend time.

- As part of their submissions43 that we should not extend time, ASP and ASP Staff submitted:

- “[T]his Application concerns circumstances from at least some two years ago and requiring investigation of facts from several years earlier still. The Panel must first be satisfied that it ought to extend time pursuant to s 657C(3)(b)... The Application has been accompanied by egregious delay…”

- “The proposition that critical further information has recently been obtained (a deed of amendment to the Lolita Discretionary Trust) does not withstand analysis: the “Successor Appointor[s]” have no present function or power, their respective functions and powers are contingent on the death of Ms Younes… and, the power of an “Appointor” is limited to changing the trustee and is not a relevant interest as defined.”

- In relation to the ASP Staff Acquisitions, “[t]aking into account s 611 item 9, the only contravention of s 606 actually alleged are acquisitions within six months of 26 March 2021, the last of which occurred on 17 August 2021: Application at paragraphs 8 and 9. There is no good explanation for the delay. The transfers occurred more than 18 months ago, and Villefranche has known of them since 24 May 2022.”

- As part of their submissions that we should not extend time, the Millard Entities submitted:

- that the applicant did not write to Ms Younes about the Lalspec Acquisitions until almost six months after the applicant first became aware of those transactions

- the application could have been brought at any time since April 2022, when the applicant first became aware of the Lalspec Acquisitions and

- any individual shareholder who wishes to dispose of their shares is unduly prejudiced by the applicant’s delay.

- In its rebuttals submissions, the applicant reiterated that it first received a copy of the members register that included some (but not complete) evidence of the Lalspec Acquisitions on 24 May 2022, and that did not have a complete picture of the change of control that had occurred as a result of the Lalspec Acquisitions until it received the Deed of Appointment on 29 March 2023.

- We consider that the applicant faced challenges in identifying the relevant circumstances due to ASP being an unlisted proprietary company and ASP and other parties resisting the applicant’s requests for information. We also consider that the applicant could potentially have brought the application earlier than 2 May 2023 and sought to rely on the Panel process to obtain outstanding information such as confirmation of the terms of The Lolita Discretionary Trust.44 That said, we had some sympathy for the approach the applicant took in pursuit of confirming that information prior to bringing the application. On balance, we consider there was an adequate explanation for the delay in lodging the application.

- We also consider that the application raised serious allegations which, if substantiated, would involve multiple contraventions of section 606(1) (noting in particular the significant quantum of ASP shares the subject of the Lalspec Acquisitions) and other conduct inconsistent with the principles in section 602, the effects of which may be ongoing.

- Accordingly, we decided to extend time to hear the application under section 657C(3)(b).

Decision

- For the reasons above, we declined to make a declaration of unacceptable circumstances. We consider that it is not against the public interest to decline to make a declaration and we had regard to the matters in section 657A(3).

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Elizabeth Hallett

President of the sitting Panel

Decision dated 26 May 2023

Reasons given to parties 9 June 2023

Reasons published 16 June 2023

Advisers

| Party | Advisers |

|---|---|

| ASP and ASP Staff | Thomson Geer |

| Millard Entities | Russells GRT Lawyers |

| Villefranche | Gilbert + Tobin |

ANNEXURE A

EXTRACT OF ASP’S CONSTITUTION

9.2 Registration of transfers

- A transferor of shares remains the holder of the shares transferred until the transfer is registered and the transferee’s name is entered in the Register as the holder of the shares.

- The Directors are not required to register a transfer of shares in the Company unless:

- the instrument of transfer has been stamped;

- the instrument of transfer and any share certificates or statements have been lodged at the Office;

- any fee payable on registration of the transfer (not exceeding $1.00) has been paid; and