[2025] ATP 33

Catchwords:

Decline to conduct proceedings – merger – scheme – placement – shareholder approval - voting power – association – effect on control – jurisdiction – substantial holder notice - disclosure

Corporations Act 2001 (Cth), sections 12, 602, 606, 657A, 657C(3), 671B

ASX Listing Rules 10.1, 10.5.10, 14.11.2

Guidance Note 1: Unacceptable circumstances

Pact Group Holdings Ltd 02 & 03 [2025] ATP 13, Re Argosy Minerals Ltd [2014] ATP 7, Gloucester Coal Limited 01R(a) and (b) [2009] ATP 9, Mount Gibson Iron Limited [2008] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Constantine Boulougouris, Michael Lishman (sitting President) and Erin Tinker declined to conduct proceedings on an application by Mr Grant David Jopling1, Mr Edward Fraser Hesket Youds, Explorer Corporations Pty Ltd and Mr Chun Kei Leung in relation to the affairs of Duxton Farms Ltd. The application concerned alleged contraventions of sections 6062 and 671B by Messrs Richard Magides and Edouard (Ed) Peter, arising from their alleged undisclosed association, in the context of a merger proposal and conditional placement announced by Duxton Farms. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Applicants

- Mr Grant David Jopling, Mr Edward Fraser Hesket Youds, Explorer Corporations Pty Ltd and Mr Chun Kei Leung

- Duxton Bees

- Duxton Bees Pty Ltd

- Duxton Dried Fruits

- Duxton Dried Fruits Pty Ltd

- Duxton Capital (Aust)

- Duxton Capital (Australia) Pty Ltd

- Duxton Capital Investments

- Duxton Capital Investments Pty Ltd

- Duxton Farms

- Duxton Farms Ltd

- Duxton Orchards

- Duxton Orchards Pty Ltd

- Duxton Walnuts

- Duxton Dairies (Cobram) Pty Ltd

- EGM

- has the meaning given in paragraph 11

- EP Placement Entity

- EP Group Holdings Pty Ltd as custodian for the Peter Family Trust

- Merger

- has the meaning given in paragraph 6

- Merger Company

- has the meaning given in paragraph 6

- Notice of EGM and EM

- has the meaning given in paragraph 11

- Placement

- has the meaning given in paragraph 15

- Preference Shareholders

- has the meaning given in paragraph 8

- RSM

- RSM Corporate Australia Pty Ltd

- Transaction

- means the Merger and the Placement

Facts

- Duxton Farms is an ASX-listed investment company that owns and operates a diverse portfolio of agricultural assets across Australia (ASX: DBF).

- Mr Peter is one of the directors of Duxton Farms and has voting power of 23.69% in Duxton Farms (as of 3 October 2025)3.

- Mr Magides is a substantial holder and has voting power of 35.92% in Duxton Farms (as of 3 October 2025).

- On 26 June 2025, Duxton Farms announced a merger proposal (Merger) and entered into four separate scheme implementation agreements to acquire all of the issued preference shares (not already held by Duxton Farms) in four unlisted Australian proprietary companies which Messrs Magides and Peter have an interest in – Duxton Bees4, Duxton Dried Fruits5, Duxton Walnuts6 and Duxton Orchards7 (each, a Merger Company).

- The Merger will occur via a combination of schemes of arrangement (in relation to preference shares) and a private treaty acquisition (in relation to ordinary shares).8

- Under the proposed transaction structure, preference shareholders in each Merger Company (collectively, the Preference Shareholders) will receive Duxton Farms shares valued at $1.25 per share9, with the option to elect to receive up to 20% of their consideration in cash.

- Duxton Capital Investments will receive, subject to the passing of resolution 5 at the EGM, Duxton Farms shares also valued at $1.25 per share as consideration for the sale of all of the ordinary shares in each Merger Company to Duxton Farms.10

- The Merger will proceed if the schemes are approved by the Preference Shareholders in respect of all four Merger Companies or in respect of all Merger Companies except Duxton Orchards.

- On 4 September 2025, Duxton Farms sent its shareholders a Notice of Extraordinary General Meeting and Explanatory Memorandum (Notice of EGM and EM) stating that it will hold an Extraordinary General Meeting at 2.00pm (Adelaide time) on Friday, 10 October 2025 (EGM) for shareholders to consider and, if thought fit, pass several resolutions in connection with the Merger.

- The Merger is subject to several conditions precedent, including the approval of resolutions 3 and 4 (both seeking approval for the purpose of Listing Rule 10.1), as set out further in the Notice of EGM and EM.11

- These resolutions seek approval from Duxton Farms shareholders for Duxton Farms to acquire shares in the Merger Companies from Mr Magides (resolution 4) and entities associated with Mr Peter (resolution 3). The approvals are required under Listing Rule 10.1, given that Mr Magides is a substantial (10%+) holder in Duxton Farms12 and the entities associated with Mr Peter are related parties or associates of related parties of Duxton Farms13.

- The independent expert’s report14, prepared by RSM and accompanying the Notice of EGM and EM, concluded that the Merger is “not fair but reasonable” to shareholders not excluded from voting on resolutions 3 and 4 because (in summary) while the consideration to be paid to the related party exceeds the assessed fair value of the Merger Companies, the independent expert considered the Merger was reasonable due to its strategic benefits and the absence of superior proposals.

- As part of the Merger, Duxton Farms is also proposing to undertake a fully underwritten15 conditional placement to support the implementation of the Merger (Placement).

- The Placement involves the issue of new Duxton Farms shares at $1.25 per share to selected institutional investors, including entities associated with Mr Magides and Mr Peter.

- Under the Placement, Duxton Farms will issue 400,000 shares to the EP Placement Entity and 2,000,000 shares to Mr Magides.16

- The Placement will be undertaken, in part, to ensure that necessary funds will be available to meet the cash component of the merger consideration.

- The Placement is conditional on, and will only settle upon, the implementation of the Merger.

- Based on Messrs Magides and Peter’s shareholdings as at 3 October 2025, the Transaction was expected to result in:

- Mr Magides’ voting power in Duxton Farms being reduced from 35.92% to between 22.36% - 23.71% and

- Mr Peter’s voting power in Duxton Farms being reduced from 23.69% to between 13.54% - 14.61%17.

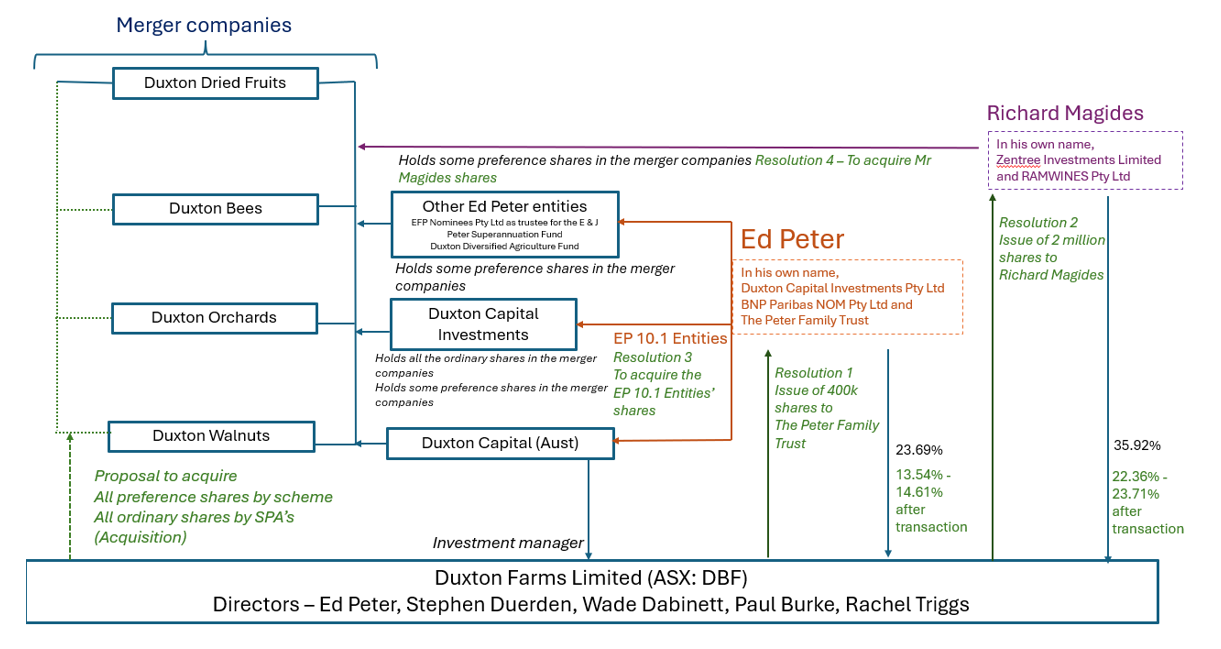

- The structural diagram below provides a visual summary of the Transaction.

Text description

The diagram outlines the existing corporate structure of Duxton Farms Ltd and proposed merger involving Duxton Farms Ltd and several unlisted entities – Duxton Dried Fruits Pty Ltd, Duxton Bees Pty Ltd, Duxton Orchards Pty Ltd, and Duxton Walnuts (Duxton Dairies (Cobram) Pty Ltd) (each, a Merger Company).

The diagram shows a proposal to acquire all of the preference shares in the Merger Companies via a scheme and all of the ordinary shares in the Merger Companies via share purchase agreements.

The diagram also outlines the ownership percentages of two of Duxton Farm’s largest shareholders (Ed Peter and Richard Magides) both before and after the transaction.

- Ed Peter: 23.69% before and between 13.54% to 14.51% after.

- Richard Magides: 35.92% before and between 22.36% to 23.71% after.

The diagram also lists the directors of Duxton Farms: Ed Peter, Stephen Duerden, Wade Dabinett, Paul Burke, and Rachel Triggs.

Application

Declaration sought

- By application dated 18 September 2025, the Applicants sought a declaration of unacceptable circumstances and submitted that:

- there is an undisclosed association between Messrs Magides and Peter to influence the company’s affairs, specifically the Transaction

- Messrs Magides and Peter breached the 3% creep rule18 on multiple occasions, with “their combined voting power increasing by more than 3% in six-month periods since November 2023, amounting to a total increase of approximately 24%”

- there is “preferential and coordinated participation in a discounted share placement”

- the Merger with four unlisted entities, “controlled by EP [Ed Peters] (via Duxton Capital) with RM [Richard Magides] as a significant investor at a significant overvaluation”, leads to a “direct transfer of value from minority shareholders to the alleged associates”

- there is a “continuous lack of disclosure regarding [the] association [between Messrs Magides and Peter] in substantial holder notices as required by section 671B” and

- the unacceptable circumstances “first arose in 2015 [with] RM’s [Richard Magides] inferred backing of EP’s [Ed Peter] Duxton Capital from holdings in unlisted investments but became manifest and actionable in the last three months with the announcement of the merger and placement”.

- The Applicants also submitted that the undisclosed association between Messrs Magides and Peter enabled them to acquire a controlling stake of approximately 58.58%19 without a formal takeover bid, contravening section 606. The Applicants alleged that this control is being leveraged to approve the Transaction in a manner which is demonstrably and financially detrimental to minority shareholders and is against the principles of section 602.

Interim order sought

- The Applicant sought an interim order to adjourn the EGM until we made a final determination on the application and restrain Messrs Magides and Peter (and any of their associates) from voting any of their shares on resolutions 3 and 4 at the EGM.

Final order sought

- The Applicant sought final orders (among other things):

- for corrective disclosure of the association, contraventions of section 606 and ‘the privilege terms’ of the Placement

- to restrain Messrs Magides and Peter (and any of their associates) from voting any of their shares on resolutions 3 and 4 at the EGM

- for the shares acquired in breach of section 606 to be vested in ASIC for sale and

- to restrain Messrs Magides and Peter (and any of their associates) from making further acquisitions or disposals of Duxton Farms shares.

Discussion

- We have considered all the material presented to us in coming to our decision, but only specifically address those things that we consider necessary to explain our reasoning.

Preliminary submissions

- We received preliminary submissions from Duxton Farms, Mr Magides and Mr Peter.

- Duxton Farms submitted that (among other things):

- the Applicants “have failed to demonstrate a sufficient body of material, with proper inferences being drawn, to support the Panel conducting proceedings and inquiring into the alleged association between EP [Ed Peter] and RM [Richard Magides]”

- the Application is “significantly out of time and there would be significant prejudice to Duxton Farms if the interim orders and final orders are made” and

- the Notice of EGM and EM “provide comprehensive and balanced disclosure in respect of a proposed commercial transaction involving numerous commercial parties which should be voted on by shareholders”.

- Mr Peter submitted that (among other things):

- the Panel should decline to conduct proceedings and that “Mr Peter and Mr Magides are not associates with one another with respect to the Company [Duxton Farms]… and there are no agreements, arrangements or understandings between Mr Peter and Mr Magides where either can control the voting or disposal of the other’s shares, nor do Mr Peter or Mr Magides act in concert in relation to the affairs of DBF”

- the Application “confuses and conflates two separate matters in relation to the Company”- the alleged long-standing relationship between Messrs Magides and Peter and the concerns regarding the “apparent unfairness of the Merger”

- in relation to claims of an association – “the allegations of a continuing long standing associate relationship between Mr Peter and Mr Magides which, taking the Application at face value, began as early as 2015, are allegations in relation to circumstances which arose years ago” and are subsequently out of time20 and

- in relation to the fairness of the Merger – “the Applicants mischaracterise the fairness issue associated with the Merger as a control issue, when the reality of the Merger is that it reduces control by Mr Peter and Mr Magides” and that “the Panel is not the appropriate forum for the Applicants’ complaints about the fairness of the Merger”.

- Mr Magides made a non-party submission21, which we decided to receive. He submitted that (among other things):

- he “strongly refutes that [he] or any member of the Zentree Group is associated with Mr Peter in relation to Duxton Farms”

- his “decision, and the decisions of the relevant members of the Zentree Group, in relation to the Merger are whether it is in [their] commercial interests and benefits [them], without regard to any other matters” and

- “neither [him] nor any member of the Zentree Group has sought or exercised influence over the composition of the Duxton Farm board or the conduct of its affairs”.

- As discussed further below (at paragraphs 58 to 63), we found the disclosure in the Notice of EGM and EM complex. Accordingly, prior to deciding whether to conduct proceedings, we decided to ask Duxton Farms some preliminary questions to get a better understanding of the Transaction and invited the Applicants to respond to the preliminary submissions.

Association

- The Applicants submitted that there was an undisclosed association between Messrs Magides and Peter, which was said to arise from overlapping business interests, historical relationships and purported coordinated conduct in relation to Duxton Farms, demonstrated by them:

- jointly acquiring a commercial building in Adelaide in 2012

- jointly owning a property leased to Duxton Farms and

- coordinating acquisitions of Duxton Farms shares, including recently under a dividend reinvestment plan and participation in the Placement.

- [Redacted] .

- Duxton Farms, in their preliminary submission, rejected these allegations and submitted that the application relied “on circumstantial evidence which is largely factually inaccurate”. Duxton Farms also submitted (among other things) that the Placement was conducted through independent brokers and “marketed to a range of investors in a customary manner”, with no preference given to Messrs Magides or Peter.

- Mr Peter submitted (responding to each of the matters raised by the Applicants summarised in paragraphs 32 and 33) that:

- the acquisition of a commercial building in Adelaide is unrelated to Duxton Farms

- the lease by Duxton Farms of the other property owned by Messrs Magides and Peter was negotiated by the independent directors of Duxton Farms

- the Applicants have not provided any material to indicate that the acquisition of Duxton Farms shares by Messrs Magides and Peter were “due to a common understanding between the two, and Mr Peter says there is none” and “the dividend reinvestment plan is open to all [Australian] and New Zealand based shareholders” and

- [Redacted] .

- Mr Magides submitted (among other things) that the fact that he may have invested in several enterprises in which Mr Peter is also invested does not mean that he is associated in relation to Duxton Farms.

- In Mount Gibson Iron Limited [2008] ATP 4 at [15], the Panel stated that it was for the applicant “to demonstrate a sufficient body of evidence of association and to convince the Panel as to that association, albeit with proper inferences being drawn” (commonly referred to as the Mount Gibson hurdle).

- The joint ownership of property suggests a longstanding commercial relationship between Messrs Magides and Peter. It does not automatically follow that they are associates in relation to Duxton Farms. Similarly, the other material provided by the Applicants could have been consistent with either an arm’s length commercial relationship or an association. Had we found that the Transaction gave rise to an effect on control or the acquisition of a substantial interest, we may have considered it appropriate to seek further information or clarification from the parties in order to assess whether the Mount Gibson hurdle was satisfied in this case.

- However, as discussed below, we do not consider that the Transaction had an effect on control.

The Transaction’s effect on control

- In determining whether to make a declaration of unacceptable circumstances, we considered whether the Transaction would have an effect on the control of Duxton Farms.

- Based on the materials provided, including responses to our preliminary questions, the Transaction would result in an overall reduction of the voting power held by Messrs Magides and Peter (see paragraph 20). This is because the issue of Duxton Farms shares under the Merger to all Merger Company shareholders is proportionately greater than the increase in shares to be received by Mr Magides and by Mr Peter and the EP Placement Entity under the Merger consideration and associated Placement.

- As a result, Messrs Magides and Peter’s voting power in Duxton Farms will be diluted, individually and in aggregate, notwithstanding their significant interests in the Merger Companies.

- No person or group (including Messrs Magides or Peter) will increase or consolidate control, either individually or in aggregate, in Duxton Farms as a result of the Transaction. The Transaction will result in a wider dispersion of ownership in Duxton Farms, rather than any consolidation of interests.

- We have previously found that dilution of this nature does not constitute an “effect on control” nor does it give rise to unacceptable circumstances. As the Panel observed in Gloucester Coal Limited 01R(a) and (b)*, dilution of a major shareholder’s interest does not, of itself, constitute an effect on control as to give rise to unacceptable circumstances.22 This principle was also tested in Argosy Minerals Limited, where the Panel considered that dilution of a controlling shareholder’s interest is unlikely to be unacceptable where the effect of the dilution is purely that control is dispersed and no new control block arises.23

- Accordingly, we are not satisfied that the Transaction had any actual or potential effect on control in relation to Duxton Farms.

Jurisdiction

- Section 657A empowers the Panel to make a declaration of unacceptable circumstances. The first ground for a declaration under section 657A(2)(a) requires the Panel to consider the effect of the circumstances and whether the effect appears to the Panel to be unacceptable24:

- having regard to the control or potential control of a company or

- having regard to the acquisition or proposed acquisition of a substantial interest in a company.

- The Applicants submitted that the Transaction would result in an “unacceptable transfer of value”, stating that the Merger is “not a strategic acquisition but a financial rescue of loss-making companies”. We note that these submissions raise concerns about the perceived fairness and financial implications of the Merger, rather than matters that engage our jurisdiction in relation to control (or the acquisition of a substantial interest). We do not have a general oversight role over listed entities25 and do not intervene in the merits of commercial transactions absent an effect on control or other circumstances within our remit. Mere allegations or dissatisfaction with the commercial outcomes are insufficient to enliven our jurisdiction.

- We also note that the Merger was subject to scrutiny by ASIC, ASX and the Federal Court, and was recommended to Duxton Farms shareholders by an independent sub-committee of the Duxton Farms board, from which Mr Peter was excluded.

- Having regard to the process undertaken for the Merger and the nature of the concerns raised, we were not satisfied that the matters before us were within our jurisdiction.

Approval for related party transaction under ASX Listing Rule 10.1

- Given our observations above in relation to the lack of effect on control, we considered that any issue of association in this matter is only relevant for the purpose of determining which parties are excluded from voting on resolutions 3 and 4 (both for approval of a related party transaction) at the EGM. The identification of associates for voting exclusion purposes is governed by the ASX Listing Rules and is typically a matter for the ASX to administer.

- Our jurisdiction is not engaged because of a dispute about the application of voting exclusions under the ASX Listing Rules. Even if the Applicants’ concerns regarding association was substantiated, the appropriate forum for resolving disputes about voting on resolutions 3 and 4 would be the ASX and not the Panel. Our consideration of association in this matter is limited to its relevance for the purposes of Chapter 6 of the Corporations Act.

- Accordingly, we are not satisfied that there is a sufficient basis to make further enquiries or to conduct proceedings in relation to association in this matter.

Acquisitions and timeliness of the application

- The Applicants submitted that since November 2023, Messrs Magides and Peter acquired Duxton Farms shares which, “if aggregated due to their association, breach the creep provisions under s611 item 7”. The Applicants were in effect submitting that these acquisitions were in contravention of section 606, unless another exception (for example item 11 in relation to a dividend reinvestment plan) applied.

- As noted in paragraphs 28 and 29 above, Duxton Farms and Mr Peter respectively submitted that the application was out of time.

- Section 657C provides that an application for a declaration of unacceptable circumstances may only be made within two months after the circumstances have occurred or a longer period determined by the Panel. The Applicants requested that the Panel exercise its discretion to extend time.

- If the Transaction resulted in a control effect, we may have considered whether to give the Applicants an extension of time to make their application. However, as noted above the Transaction resulted in a reduction of Messrs Magides and Peter’s voting power (both individually and collectively).

- We consider that the Applicants did not provide sufficient material to establish any contraventions of section 606 inside the time limits in section 657C(3) and it is unlikely that we would extend time under section 657C(3)(b) in the circumstances.

Disclosure

- We were concerned that the disclosure provided by Duxton Farms in relation to the Merger was unnecessarily lengthy, complex and difficult to navigate. While the Notice of EGM and EM ran across 305 pages and included multiple annexures, the presentation of key information, in our view, lacked clarity and accessibility for shareholders.

- In particular, the structure of the Transaction, comprising the Merger (via scheme for preference shares and agreement for ordinary shares) and the Placement, was not clearly explained in a way that allowed shareholders to easily understand how the components interacted and what impact they would have on Duxton Farms.

- Furthermore, we also observed that the presentation of the pre- and post- Transaction shareholdings, particularly the “Pro Forma Capital Structure” table on pages 32 and 33 of the Notice of EGM and EM, was unclear. The numbering of the footnotes and superscripts was difficult to follow and, in several instances, did not correspond accurately to the relevant entries in the table. As a result, we had to seek additional information from Duxton Farms to clarify our understanding of the materials. We considered that shareholders would likely have encountered similar confusion which may have impeded their ability to comprehend the impact of the Transaction on their holdings.

- Duxton Farms submitted that their shareholders were provided with “comprehensive, clear, and effective disclosure in a Notice of EGM and EM” and that there were “more than 2,752 pages across seven separate documents, enabling shareholders to make fully informed decisions regarding the Merger”.

- However, we did not equate volume with clarity. While the documents may have contained the necessary information, the way in which it was presented did not assist shareholders in making an informed assessment of the proposed Transaction.

- In addition, in order to assist our understanding of the Transaction, we prepared a diagram of the Transaction (that was provided to the Parties for comment and is set out in paragraph 21 above) and having done so included the diagram and a summary in our media release, which may be of assistance to others in understanding the Transaction.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Postscript

- On 9 October 2025, ASX notified Duxton Farms of its determination to exercise its discretion under ASX Listing Rule 14.11.2 with the effect that:

- Mr Magides is a person excluded from voting in favour of resolution 3 and

- each of the EP 10.1 Entities26 is a person excluded from voting in favour of resolution 4.

- The effect of this was that Mr Magides and each of the EP 10.1 Entities, and their respective associates, were excluded from voting in favour of both resolutions 3 and 4.

- On 10 October 2025, the EGM was held and all of the resolutions in relation to the Transaction (ie. resolutions 1 to 6) were carried.

Michael Lishman

President of the sitting Panel

Decision dated 3 October 2025

Reasons given to parties 6 November 2025

Reasons published 20 November 2025

Advisers

| Party | Advisers |

|---|---|

| Mr Grant David Jopling , Mr Edward Fraser Hesket Youds, Explorer Corporations Pty Ltd and Mr Chun Kei Leung | - |

| Duxton Farms | Clayton Utz |

| Duxton Capital (Aust) | Cowell Clarke |

| Edouard Peter | Piper Alderman |

1 Mr Jopling is described in the application as the “lead applicant”

2 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

3 Mr Peter directly holds 334,680 ordinary shares and indirectly holds 10,045,710 ordinary shares in Duxton Farms. The indirect holdings are held through The Peter Family Trust A/C (8,056,069 ordinary shares) and BNP Paribas NOMS Pty Ltd (1,989,641 ordinary shares). Mr Peter is also a director of Duxton Capital Investments Pty Ltd which holds 400,088 ordinary shares in Duxton Farms.

4 Duxton Bees is a company engaged in beekeeping, honey production and the sale of related products and services.

5 Duxton Dried Fruits is a company that is engaged in the cultivation, harvesting and sale of dried grapes.

6 Duxton Walnuts is a company transitioning from dairy cattle farming to cultivation, harvesting and sale of walnuts.

7 Duxton Orchards is a company that is engaged in the cultivation, harvesting and sale of apples.

8 Duxton Farms entered into a share purchase agreement with Duxton Capital Investments, who holds all of the ordinary shares in each of the Merger Companies.

9 The agreed consideration for the acquisition of the preference shares in each Merger Company is: 0.839 shares in Duxton Farms for each Duxton Bees preference share, 0.729 shares in Duxton Farms for each Duxton Dried Fruits preference share, 1.471 shares in Duxton Farms for each Duxton Walnuts preference share and 0.043 shares in Duxton Farms for each Duxton Orchards preference share.

10 The agreed consideration for the acquisition of the ordinary shares in each Merger Company is: nil consideration for ordinary shares in Duxton Dried Fruits and Duxton Orchards, 201,897 Duxton Farms shares for all of the ordinary shares in Duxton Bees (implied price of $0.31 per Duxton Bees ordinary share) and 1,048,471 Duxton Farms shares for all of the ordinary shares in Duxton Walnuts (implied price of $0.93 per Duxton Walnut ordinary share).

11 Refer to Notice of Extraordinary General Meeting dated 4 September 2025

12 Listing Rule 10.1.3

13 Listing Rule 10.1.1 and 10.1.4

14 Listing Rule 10.5.10 requires a NoM containing a resolution under Listing Rule 10.1 to include a report on the transaction from an independent expert

15 The Placement is fully underwritten by Morgans Corporate Limited and Bell Potter Securities Limited

16 The issue of placement shares to the EP Placement Entity and Mr Magides is conditional on the passing of resolutions 1 and 2, respectively, at the EGM

17 Depending on cash / scrip elections (see paragraph 8)

18 Item 9, s 611

19 As of the date of the application

20 Section 657C(3) states that an application for a declaration under section 657A can be made only within (a) 2 months after the circumstances have occurred or (b) a longer period determined by the Panel.

21 Made in accordance with rule 20 of the Panel’s Procedural Rules

22 [2009] ATP 9 at [25]

23 [2014] ATP 7 at [25]

24 See Guidance Note 1: Unacceptable Circumstances

25 Pact Group Holdings Ltd 02 & 03 [2025] ATP 13 at [37]

26 EP 10.1 entities include (1) EFP Nominees, Duxton Capital Investments, Duxton Capital (Aust) and Duxton Agricultural Holdings, companies controlled by Mr Peter and (2) DDAF, where DDAF’s trustee and custodian are companies controlled by Mr Peter (being Duxton Agri Services Pty Ltd and Duxton Capital (Aust))