TP25/089

The Panel has declined to conduct proceedings on an application dated 18 September 2025 from Grant David Jopling1, Edward Fraser Hesket Youds, Explorer Corporations Pty Ltd and Chun Kei Leung in relation to the affairs of Duxton Farms Ltd (ASX: DBF) (Duxton Farms).

The application concerned alleged contraventions of sections 6062 and 671B by Messrs Richard Magides and Edouard (Ed) Peter, arising from their alleged undisclosed association, in the context of a merger proposal and conditional placement announced by Duxton Farms on 26 June 2025 (the Transactions).

The Panel considered that the disclosures relating to the Transactions were complex and has decided to set out a summary of the Transactions below.

Proposed merger

The proposal involves the merger of Duxton Farms with four unlisted entities (Merger) which Richard Magides and Ed Peter have an interest in – Duxton Bees Pty Ltd, Duxton Dried Fruits Pty Ltd, Duxton Dairies (Cobram) Pty Ltd and Duxton Orchards Pty Ltd (each, a Merger Company). The Merger will occur via separate schemes of arrangement for preference shares and share purchase agreements for ordinary shares3. The Merger will proceed if schemes are approved in respect of all four Merger Companies or in respect of all Merger Companies except Duxton Orchards.

Under the proposed transaction structure, scheme shareholders will receive Duxton Farms shares valued at $1.25 per share, with the option to elect up to 20% of their consideration in cash.

The Merger is subject to several conditions precedent, including the approval of resolutions 3 and 4 (both seeking approval for purposes of Listing Rule 10.1), as set out in the Explanatory Memorandum.4 These resolutions seek approval from Duxton Farms shareholders for Duxton Farms to acquire shares in the Merger Companies from Richard Magides and entities associated with Ed Peter. Richard Magides is a substantial shareholder and the entities associated with Ed Peter are related parties or associates of related parties of Duxton Farms for the purposes of the Listing Rules approvals.

The Independent Expert Report concluded that the Merger is “not fair but reasonable” to shareholders not excluded from voting on resolutions 3 and 4 because (in summary) while the consideration to be paid by Duxton Farms exceeds the assessed fair value of the shares in the Merger Companies held by Richard Magides and the entities associated with Ed Peter, the Independent Expert considered the Merger reasonable due to its strategic benefits and the absence of superior alternatives.

Placement

As part of the Merger, Duxton Farms proposes to undertake a capital placement to support the implementation of the Merger (Placement). The Placement involves the issue of new Duxton Farms shares at $1.25 per share to selected institutional investors, including entities associated with Ed Peter (who will be issued 400,000 shares) and Richard Magides (who will be issued 2,000,000 shares).

Resolutions 1 and 2 relate to the issue of shares to entities associated with Ed Peter and Richard Magides under the Placement. The Placement is conditional on, and will only occur upon, the implementation of the Merger.

As a result of the Transaction:

- Richard Magides’s voting power will be reduced from 35.92% to between 22.36% – 23.71%; and

- Ed Peter’s voting power will be reduced from 23.69% to between 13.54% – 14.61%5.

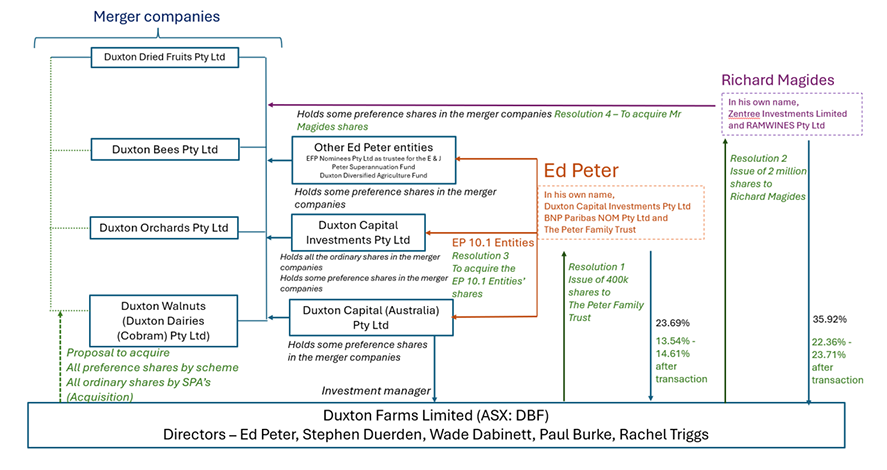

The structure diagram below provides a visual summary of the Transactions.

Text description

The diagram outlines the existing corporate structure of Duxton Farms Ltd and proposed merger involving Duxton Farms Ltd and several unlisted entities – Duxton Dried Fruits Pty Ltd, Duxton Bees Pty Ltd, Duxton Orchards Pty Ltd, and Duxton Walnuts (Duxton Dairies (Cobram) Pty Ltd) (each, a Merger Company).

The diagram shows a proposal to acquire all of the preference shares in the Merger Companies via a scheme and all of the ordinary shares in the Merger Companies via share purchase agreements.

The diagram also outlines the ownership percentages of two of Duxton Farm’s largest shareholders (Ed Peter and Richard Magides) both before and after the transaction.

- Ed Peter: 23.69% before and between 13.54% to 14.51% after.

- Richard Magides: 35.92% before and between 22.36% to 23.71% after.

The diagram also lists the directors of Duxton Farms: Ed Peter, Stephen Duerden, Wade Dabinett, Paul Burke, and Rachel Triggs.

Panel declines to conduct proceedings

The Panel considered that had there been an effect on control, further enquiries may have been warranted to assess potential association in accordance with the Mt Gibson6 test. However, the Panel is not satisfied that the Transactions have any actual or potential effect on control in relation to Duxton Farms Ltd, noting that:

- Based on the materials provided, the Transactions resulted in a reduction of voting power for the major shareholders (Ed Peter and Richard Magides) with no increase in control either individually or in aggregate.

- The determination of voting exclusions on resolutions 3 and 4 is primarily a matter for the ASX given that the resolutions concern related party transactions and not on matters that affect control.

The Panel also considered that the alleged contraventions of sections 606 and 671B by Richard Magides and Ed Peter were outside the time limits in section 657C(3) and considered it unlikely that it would extend time under section 657C(3)(b) in the circumstances.

The Panel concluded there was no reasonable prospect that it would make a declaration of unacceptable circumstances. Accordingly, the Panel declined to conduct proceedings.

The sitting Panel was Constantine Boulougouris, Michael Lishman (sitting President) and Erin Tinker.

The Panel will publish its reasons for the decision in due course on its website.

Allan Bulman

Chief Executive, Takeovers Panel

Level 16, 530 Collins Street

Melbourne VIC 3000

Ph: +61 3 9655 3500

takeovers@takeovers.gov.au

1 Mr Jopling is described in the application as the “lead applicant”.

2 All statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapters 6 to 6C have the meaning given in the relevant Chapter (as modified by ASIC)

3 All the ordinary shares in each of the Merger Companies are held by Duxton Capital Investments Pty Ltd, a company controlled by Ed Peter.

4 Refer to Notice of Extraordinary General Meeting dated 4 September 2025

5 Depends on cash/scrip elections. Calculated based on most recent substantial shareholder notices and Appendix 3Ys.

6 Mount Gibson Iron Limited [2008] ATP 4