[2025] ATP 20

Catchwords:

Decline to conduct – board control – loan facility – bid – association – acting in concert - triggered conditions of bid – participating insiders

Corporations Act 2001 (Cth), sections 249F, 259C, 259E, 606, 636, 713

Takeovers Panel Procedural Rules 2020, Takeovers Panel Procedural Guidelines, 1 April 2021

Guidance Note 12: Frustrating Action, Guidance Note 19: Insider Participation in Control Transactions

Bolton v WAM Active Ltd (No 2) [2025] NSWCA 99, In the matter of Keybridge Capital Limited [2025] NSWSC 240, Tinkerbell Enterprises Pty Limited as Trustee for The Leanne Catelan Trust v Takeovers Panel [2012] FCA 1272, Attorney-General (NSW) v Wentworth (1988) 14 NSWLR 481

Excelsior Capital Limited [2020] ATP 25 at [19], Aguia Resources Limited [2019] ATP 13, Strategic Minerals Corporation NL [2018] ATP 2, Innate Immunotherapeutics Limited [2017] ATP 2, The President’s Club Limited 02 [2016] ATP 1, Celamin Holdings NL 01R [2014] ATP 23, GoldLink IncomePlus Limited 02 [2008] ATP 19, Mount Gibson Iron Limited [2008] ATP 4, Pinnacle VRB Ltd 08 [2001] ATP 17, Taipan Resources NL 07 [2000] ATP 18

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Teresa Dyson (sitting President), Christopher Stavrianou and James Stewart1 declined to conduct proceedings on an application from Mr Nicholas Bolton in his personal capacity in relation to the affairs of Keybridge Capital Limited. Keybridge is the borrower under a loan facility from WAM Active Limited and is subject to a takeover bid by Yowie Group Limited. Mr Bolton submitted, among other things, that a director of Keybridge, Antony Catalano, had “[teamed] up with WAM to form a control block of 43.5% + 10% in Keybridge” and further that the WAM nominee directors of Keybridge were participating insiders in relation to Yowie’s bid. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Bid

- has the meaning given in paragraph 23

- Bridge Funding Facility

- has the meaning given in paragraph 27

- Keybridge

- Keybridge Capital Limited

- Keybridge s249F Proceedings

- has the meaning given in paragraph 17

- No Control Condition

- has the meaning given in paragraph 30

- WAM

- WAM Active Limited

- WAM nominees

- The directors of Keybridge elected pursuant to the s249F meeting on 10 February 2025, namely Geoffrey Wilson AO, Jesse Hamilton, Martyn McCathie, and Sulieman Ravell

- Yowie

- Yowie Group Ltd

- Yowie s249F meeting

- has the meaning given in paragraph 25

Facts

- Keybridge is an ASX listed company (ASX code: KBC).

- Yowie is an ASX listed company (ASX code: YOW).

- WAM is an ASX listed company (ASX code: WAA).

- WAM has a relevant interest in 43.5% of Keybridge.

- Catalano Super Investments Pty Ltd as trustee for Catalano Superannuation has a relevant interest in 10.6% of Keybridge.

- Keybridge holds a relevant interest in 58.07% of Yowie. Keybridge is indebted to Yowie.

- The directors of Keybridge are Messrs Geoffrey Wilson AO, Jesse Hamilton, Martyn McCathie, Sulieman Ravell and Antony Catalano.

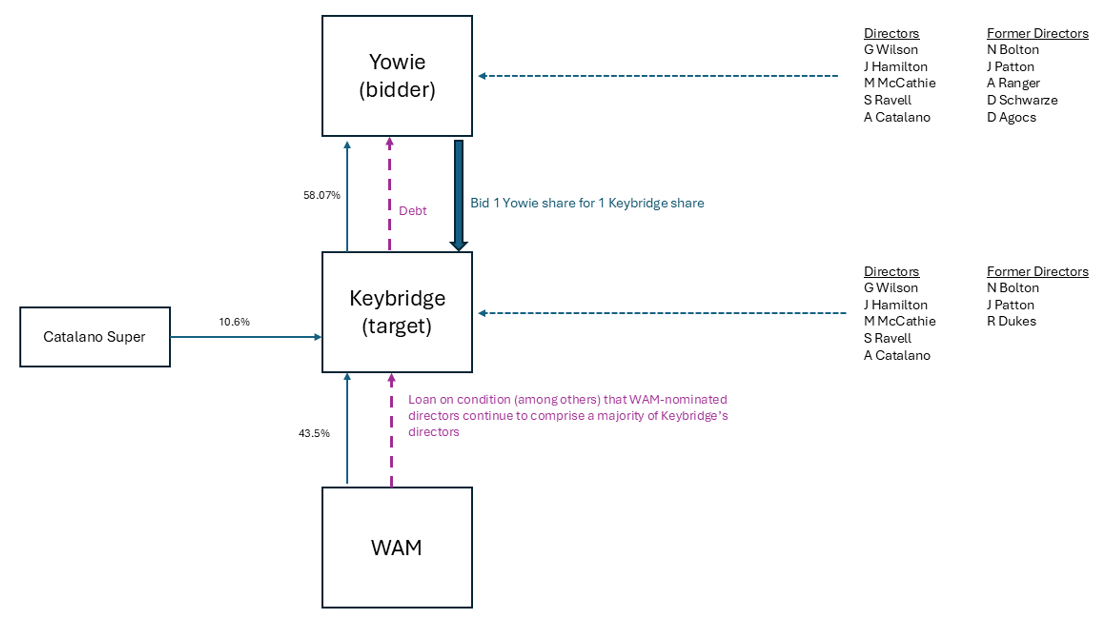

- The relationship between the parties prior to the Yowie s249F meeting can be shown diagrammatically as follows.

Text description

This diagram shows the relationships between different companies and individuals. The relationships are as follows. Keybridge is the majority shareholder of Yowie. WAM owns about 43% of Keybridge. Catalano Super owns about 10% of Keybridge. Yowie has made a bid for Keybridge. Keybridge owes Yowie money. WAM has given a loan to Keybridge on the condition (among others) that WAM-nominated directors continue to comprise a majority of Keybridge’s directors.

The directors of Yowie were previously N Bolton, J Patton, A Ranger, D Schwarze, and D Agocs. The directors of Yowie are now G Wilson, J Hamilton, M McCathie, S Ravell, and A Catalano.

The directors of Keybridge were previously N Bolton, J Patton, R Dukes, and A Catalano. The directors of Keybridge are now G Wilson, J Hamilton, M McCathie, S Ravell, and A Catalano.

- The applicant, Mr Nicholas Bolton, is a member of Keybridge and Yowie.

- On 27 November 2024, WAM nominated Messrs Wilson, Hamilton, McCathie and Ravell to the Keybridge board.

- Mr Catalano, a Keybridge board member, had been supportive of the previous Keybridge board2. His relationship with Mr Bolton soured in the following circumstances:

- by separate dealings, the previous board of Keybridge considered that a company connected to Mr Catalano, Australian Community Media, owed Keybridge approximately $23 million in cash and shares.

- on 8 December 2024, Mr Catalano, emailed Mr Bolton saying “I am seriously running out of patience with the lack of action in relation to the sale of my shares and a resolution over the ACM issue” and “Unless there is an immediate resolution to these issue (sic) you will no longer have my support at board level.”

- on 9 December 2024, Mr Bolton advised Mr Catalano that Keybridge would not release the obligation.

- On 9 December 2024, Mills Oakley, on behalf of WAM, gave Keybridge notice of WAM’s intention to call a s249F meeting.

- On 19 December 2024, WAM by notice under section 249F sought a meeting of Keybridge shareholders to replace the previous directors of Keybridge.3 The meeting was scheduled for 10 February 2025.

- On 10 February 2025, the following events occurred:

- At 9.16am, Keybridge published on ASX an announcement dated Sunday 9 February 2025, that Yowie had formally demanded repayment of $4.6 million by 7 February 2025.

- Also at 9.16am, Keybridge published an announcement dated Monday 10 February 2025 on ASX that it had appointed a voluntary administrator.

- Keybridge (in Administration) held a s249F meeting of shareholders. Mr Patton sought to adjourn the meeting. Mr Hamilton took the chair and completed the meeting. The WAM nominees were elected to the Keybridge board to replace the previous Keybridge board (other than Mr Catalano).

- On 11 February 2025, WAM and Messrs Hamilton, Wilson and McCathie commenced proceedings in the Supreme Court of New South Wales in relation to Keybridge’s administration and the Keybridge s249F meeting (Keybridge s249F Proceedings).

- On 12 February 2025, WAM offered financing to Keybridge by way of a “Comfort Letter.”

- On 6 March 2025, WAM offered a “Bridge Funding Facility” term sheet to Keybridge for bridging financing pending finalisation of a capital raising.

- On 21 March 2025, Nixon J of the Supreme Court of New South Wales made orders in the Keybridge s249F Proceedings, including that:

- “on 10 February 2025 at 4:30pm, Keybridge validly held a meeting of its members convened in accordance with s 249F”

- “at the Section 249F Meeting, the members of Keybridge resolved that Mr Bolton, Mr Patton and Mr Dukes be removed as directors of Keybridge and that Mr Wilson, Mr Hamilton, Mr McCathie and Mr Ravell be appointed as directors of Keybridge” and

- following the s249F meeting, the directors of Keybridge were Messrs Catalano, Wilson, Hamilton, McCathie and Ravell.4

- On 1 April 2025, Mr Bolton presented a Deed of Company Arrangement to the Administrator of Keybridge.

- On 9 May 2025, Keybridge announced that the following had occurred:

- On 9 May 2025, Yowie announced its intention to make a scrip bid for Keybridge (Bid), on conditions including:

- that Keybridge not seek to change the composition of the Yowie Board

- that Keybridge not encumber its assets (see details in paragraph 68) and

- that “ASIC provides the Company an exemption under section 259C(2) of the Corporations Act from the operation of section 259C(1) for the purposes of Yowie acquiring KBC Shares pursuant to the Offer”.

- On 16 May 2025, Keybridge made an announcement on ASX that shareholders should “take no action” in relation to the Bid. The announcement stated that Keybridge did not consider the Bid to be genuine, including because of “the sheer number and breadth of the 35 defeating conditions to the ‘Bid’, many of which will be breached by Keybridge securing operational control of its subsidiary, Yowie.”

- On or about 26 May 2025, Keybridge called a s249F meeting to seek to replace the Yowie board (Yowie s249F meeting). The calling of the Yowie s249F meeting for 27 June 2025 at 10:00 am was announced on ASX on 5 June 2025. The notice of meeting was executed by Messrs Hamilton and Ravell.

- On or about 29 May 2025, Australian Style Group Pty Ltd, a company connected to Mr Bolton and a substantial shareholder of Keybridge, called a s249F meeting of Keybridge seeking to remove the WAM nominees from the Keybridge board. The calling of the meeting for 27 June 2025 at 9:00 am was announced on ASX on 13 June 2025.

- On 6 June 2025, by notice dated 5 June 2025, Keybridge announced that it had entered a bridge funding facility with WAM (the Bridge Funding Facility).7 The announcement stated:

“The Bridge Funding Facility was negotiated with WAM Active on an arm’s length basis by those of Keybridge’s directors who are independent of the Wilson Asset Management Group.”

- The announcement set forth the material terms of the Bridge Funding Facility including the following:

“A change of directors of the Borrower such that a majority of the directors nominated by the Financiers cease to comprise a majority of the directors of the Borrower, or a change in Guarantor directors without the prior written consent of the Financier is an event of default.”

- On 13 June 2025, Yowie lodged its bidder's statement with ASIC. The Bid had a condition that:

“Prior to the end of the Offer Period Yowie shareholders do not pass a resolution in general meeting (including any resolution set out in the general meeting of Yowie Shareholders purportedly called by Keybridge under section 249F of the Corporations Act in its notice of meeting dated 26 May 2025) the effect of which is to change the composition of the board of directors of Yowie.”

- The Bid did not include the condition relating to ASIC relief under s259C(2) (as stated in paragraph 23(c)) but included the following conditions instead:

- a 35% ‘Minimum Acceptance Condition’ (excluding any relevant interest by reason of Keybridge controlling Yowie) and

- a ‘No Control Condition’ in these terms: “By no later than the end of the Offer Period, Keybridge does not control (within the meaning of section 259E of the Corporations Act) Yowie” (No Control Condition).

- The Bid stated that:

“Neither the Minimum Acceptance Condition nor the No Control Condition may be waived by Yowie. Despite the previous sentence, Yowie may fulfil the No Control Condition by issuing Yowie Shares to those Keybridge Shareholders who have accepted the Offer if the effect of the issue is that Keybridge does not control (within the meaning of section 259E of the Corporations Act) Yowie immediately after the issue.”

[…]

“The satisfaction or waiver of the Minimum Acceptance Condition and the No Control Condition are each a condition precedent to the formation of any contract arising from acceptance of an Offer. Yowie will not process acceptances while either Condition has not been fulfilled or waived. As a result, if you accept the Offer, you will be able to revoke your acceptance at any time while either Condition has not been fulfilled or waived. Neither such Condition can be waived at any time while Keybridge continues to control Yowie. However, the No Control Condition can be fulfilled by Yowie issuing Yowie Shares to those Keybridge Shareholders who have accepted the Offer if the effect of the issue would be that Keybridge no longer controls Yowie.”

Application

Declaration Sought

- By application dated 26 June 2025, Mr Bolton sought a declaration of unacceptable circumstances.

- Mr Bolton submitted that WAM and Yowie were competing for control of Keybridge. He submitted that WAM was doing so using Keybridge’s need for funding and Yowie was doing so through “a s602 compliant bid”. Mr Bolton submitted that:

“Whether Yowie was on notice of WAM director intentions to control Yowie is not the point. The circumstances had changed the moment Keybridge was released from Administration and Yowie made its bid. The participating insiders from that point immediately ought have become recused, and so their opinion prior to the bid ceases to have any real relevance as a competing potential bidder.”

- Among other things, Mr Bolton also submitted, in effect, that:

- “Each of the WAM Nominees are participating insiders.”8

- WAM and Mr Catalano are associated by reason of the section 249F notice in relation to Keybridge

- WAM and Keybridge (and others) are associated by reason of the condition in the Bridge Funding Facility set forth in paragraph 28 and

- the Bridge Funding Facility was coercive, in order to prevent removal of the WAM nominees from Keybridge’s board pursuant to Australian Style’s section 249F notice and (if removal succeeds) to put Keybridge into an “insolvency position.”

Interim orders sought

- Mr Bolton sought interim orders that:

- Keybridge be prevented from voting any Yowie shares at the Yowie s249F meeting.

- Alternatively, any vote cast at the Yowie s249F meeting influenced by the WAM nominees is void and the WAM nominees be prohibited from any involvement in Keybridge’s decision as to how to vote.

- Alternatively, the Yowie s249F meeting be postponed until after the Panel proceedings.

- The President considered the interim orders request on an urgent basis given the application was made the day before the Yowie s249F meeting. The President decided not to make any orders, because (among other things):

- The interim orders were sought by the applicant at a very late stage, making it difficult to assess the strength of the evidence and likelihood of unacceptable circumstances.

- Given that the material facts relevant to this matter have existed since 6 June 2025 (i.e. the announcement of the Bridge Funding Facility), it appears that it was open for the applicant to have made this application earlier.

- Keybridge would be prejudiced as the major shareholder in Yowie if any of the interim orders were made.

- A sitting Panel can make subsequent orders, if necessary, to address or remedy any outstanding issues.

- Following consideration of interim orders by the President, on 30 June 2025 Yowie announced on ASX that the Yowie section 249F meeting called by Keybridge had resulted in the remaining directors of Yowie (Messrs Schwarze and Agocs; Messrs Patton and Bolton having resigned) being removed and that the WAM nominees and Mr Catalano were appointed.

Final orders sought

- Mr Bolton sought final orders to the effect that:

- Keybridge not vote its shares in Yowie at the Yowie s249F meeting it called to replace the Yowie board.

- WAM's shares in Keybridge not be counted at the section 249F meeting called by Australian Style in Keybridge on resolutions to remove the WAM nominees.

- Any Keybridge decision affecting the Bid, that involved the WAM nominees, between the announcement of the Bid and the date of the order be declared void.

- The WAM nominees be prohibited from participating in any deliberations or decision making regarding the Bid or any current or future arrangements between Keybridge and WAM.

- Keybridge must appoint two independent directors to its board, and provide monthly reports, and for 12 months WAM must not vote to remove them.

- Keybridge must “establish an independent board committee and set of protocols consistent with Guidance Note 19 to regulate the conduct of the Keybridge board during the Yowie takeover bid.”

Out of process submissions

- Mr Bolton made 2 out of process submissions, and Keybridge made one response, that we agreed to receive:

- an email from Mr Bolton dated 4 July 2025

- a response from Keybridge dated 4 July 2025 and

- an email from Mr Bolton dated 7 July 2025.

- On 4 July 2025, Mr Bolton provided the Panel with an update to his application. He submitted (among other things) matters that Keybridge and Yowie shareholders would not have been aware of, namely that:

- “On 27 June 2025 the WAM Nominees were removed from Keybridge at a s249F EGM (the WAM Nominees appear to contest this outcome and it is the subject of [Federal Court] proceedings).”9

- “The WAM Nominees contend that they were appointed to the Yowie Board (by Keybridge) on 27 June 2025, however this looks to be invalid and otherwise subject to court proceedings as to whether Keybridge was eligible to vote on those resolutions (and a matter before the present Panel).”

- Mr Bolton submitted that “WAM have a direct relevant interest in 58% of Yowie shares under a security arrangement at Keybridge which gives them a direct material economic interest in Yowie shares different to their interest in Yowie as a Keybridge shareholder (i.e. the difference between s608(1) and s608(3)). As a consequence, they hold a material economic interest in Yowie as bidder of Keybridge of the type that prohibits their participation at the target under GN19 in addition to other reasons in the Application. This step to create the security interest and flowing circumstances (after the announcement of the Yowie Offer) is of itself unacceptable circumstances due to its frustrating action under the Yowie Bid.”

- Mr Bolton also submitted that the election of the new Yowie board was “likely void or invalid” and this created uncertainty during the bid period as to who was acting for the bidder. In our view, the validity of the board election is a matter for the Court, as Keybridge submitted (below).

- Lastly, he submitted that the ASX waiver to facilitate WAM taking security over Keybridge’s assets, when Keybridge was in default, triggered a defeating condition in Yowie’s bid, and this happened “almost a month after being placed on notice of the Yowie Bid and its conditions.” This appears to be related to the frustrating action argument made in paragraph 41.

- Keybridge submitted in the response dated 4 July 2025 that “Mr Bolton’s out of process email raises nothing relevant to the Panel’s deliberations on an application almost identical to the points raised previously in applications by Yowie Group Limited, on which the Panel declined to conduct proceedings”, that (in effect) the WAM Nominees were not removed from the Keybridge board on 27 June 2025 and further, that disputes about the meetings are matters for the Court.

- To this response, Mr Bolton made the further out of process submission on 7 July 2025. He submitted (among other things) that the financing announcement on 6 June 2025 stated that the financiers were “WAM Active \and other entities within the Wilson Asset Management Group” (his emphasis) and the other entities “have gone from a 0% voting power to a 58% voting power in Yowie without an exemption under s611 and have, accordingly, contravened s606 by this transaction.”

- Mr Bolton also identified a potential breach of confidentiality undertakings. This will be referred to the Panel President for further consideration.

Discussion

- We have considered all the material and address specifically only that part of the material we consider necessary to explain our reasoning.

- In our consideration of this matter, we have kept in mind the imprimatur of the review Panel in Pinnacle 08:

“The commercial community is seeking in the Panel, not for a second‑rate court, but for a first‑rate commercial Panel. It should not therefore fall between two stools and attempt to replicate court processes, thereby unduly delaying fast‑moving transactions and the bid itself.

And to what end would we conduct this inquiry? Our decision can only be based on the existence, prevention, removal and remediation of unacceptable circumstances which impact on Reliable’s bid. Legal consequences of people's behaviour can obviously be circumstances. But even assuming such consequences can be established fairly and reliably, they are only relevant insofar as they impact on the bid by creating unacceptable circumstances, or bear upon the public interest.”10

- Accordingly, we have focussed on the commercial realities of the material before us in considering whether there is any prospect that we would make a declaration of unacceptable circumstances, drawing on our skills, knowledge and experience as practitioners.11

Insider participation

- Guidance Note 19 sets out the policy underpinning insider participation:

“The policy bases for this note are that insider participation in a control transaction should not inhibit:

a. the acquisition of control over voting shares taking place in an efficient, competitive and informed market (section 602(a)) and

b. shareholders and directors being given enough information to enable them to assess the merits of a proposal (section 602(b)(iii).”12

- As was made clear in Strategic Minerals, “… transactions involving insiders require an increased sensitivity and vigilance (including by advisers) to ensure that conflicts are avoided, full disclosure of all material information is made and consideration by the target board and management of their response, is undertaken free from any actual influence (or appearance of influence), from participating insiders.”13

- Mr Bolton submitted that Messrs Hamilton and Ravell “as participating insiders determined to call a s249F meeting of Keybridge that will, if Keybridge are allowed to vote to pass its own resolutions on 27 June 2025, cause the failure of the Yowie Bid.”

- Mr Bolton submitted that each of the WAM nominees were participating insiders by, at least, the operation of the Bridge Funding Facility and the preceding offers to make that finance available as a basis to end the administration of Keybridge. He submitted that “the result of removing conflicted participating insiders is that the Keybridge board would not be quorate in dealing with its defence or proposed frustrating actions in response to the Yowie Bid.”

- Mr Bolton also submitted that WAM is a bidder or potential bidder for Keybridge, whose interests are adverse to the Bid, so the WAM nominees were participating insiders who could not participate in Keybridge’s board decisions on the Bid or the Bridge Funding Facility.

- In our view, commercially, WAM is not competing with Yowie for control of Keybridge as it already has practical control. Its shareholding alone may be sufficient to give it control for all practical purposes, but it is particularly so when its 43.5% is added to Catalano Super’s 10.6%. These parties are, at least for the time being, of the same mind regarding Keybridge. The Bridge Funding Facility supports WAM’s control position but is not a control transaction. Accordingly, we consider that the concerns raised by Mr Bolton in relation to approval of the Bridge Funding Facility do not engage the policy bases underlying the Panel’s policy on insider participation (see paragraph 50 above). WAM’s contractual arrangements with Keybridge involve potential questions of directors’ duties that are not for us.

- In relation to the insider participation concerns relating to the WAM nominees making decisions in relation to the Bid, in our view, there is no reasonable prospect that this would lead to unacceptable circumstances in the circumstances of this matter and on the materials provided.

- We would not impose on Keybridge a requirement for an independent board committee because, in our view, given the unusual circumstances of this matter, it would be an unreasonable burden. It would be unreasonable because we are not persuaded that the Bid has any realistic prospect of proceeding14, for the following reasons, among others:

- In our view prima facie there are disclosure deficiencies in the bidder’s statement such that it appears not to comply with the requirements in s63615. For example, Keybridge shareholders need to be properly informed about the value of the scrip consideration and Yowie cannot provide that without Yowie’s and Keybridge’s 31 December 2024 financial statements (and their current cash positions).

- The No Control Condition (which was added as a condition after the Bid was announced), in our view, is likely to contravene the prohibition on a bidder including conditions in its offer that were not included in its announcement of the offer. Under section 631, the terms and conditions of a bid must be the same as, or not substantially less favourable than, those in the public proposal. Accordingly, this condition should be excluded and without it there is no certainty that the necessary legal requirement that Keybridge cease to control Yowie will occur.

- Even if the No Control Condition was allowed, it suffers from timing problems that perhaps only a court could resolve, if they can be resolved at all. It relies on completion occurring before the offer period closes, which would require that the offer becomes unconditional before the closing date, but it is difficult to see how this could be achieved given that the No Control Condition cannot be waived16 and would only be satisfied (if Yowie’s application of it is correct) by Yowie issuing the consideration shares. Sequencing of the transfers to avoid contraventions of s259C is, at best, uncertain given that, with its current shareholding, Keybridge controls Yowie.

- Keybridge could simply vote against the condition of Yowie shareholder approval (needed for WAM to be able to accept the offer). Moreover, it is a condition within the control of Yowie, or at least its parent company.

- The “no change to board composition” condition, and perhaps others (notably the “No material litigation” condition), has already been breached.

- It follows that we do not accept Mr Bolton’s submission that minority Keybridge shareholders will be deprived of an opportunity to exit into a “Chapter 6 compliant bid”.

- We are not saying that insider participation is not important. It is the responsibility of directors to be mindful of actual and perceived conflicts of interest when undertaking their duties. Guidance Note 19 “Insider Participation in Control Transactions” suggests in some circumstances for the appointment of an independent board committee consisting of those directors who are not participating insiders.

- Mr Bolton also submitted that, by executing the Bridge Funding Facility, Keybridge and WAM:

- “took steps that constitute coercive conduct” to prevent the Australian Style section 249F meeting in Keybridge succeeding and

- entered “a form of impermissible poison pill” to thwart the Yowie Bid.

- We do not accept this. The default event in the Bridge Funding Facility that the WAM nominees retain a majority of the Keybridge board members is a facet of WAM’s practical control and commercially reasonable in the circumstances. It is Keybridge’s shareholding structure, not the existence of the loan, that was likely to prevent the success of Australian Style’s section 249F meeting in Keybridge. We do not consider it likely that we would find any coercion in this regard to lead to unacceptable circumstances.

Association

- Mr Bolton also submitted that the dispute that Keybridge (under the previous board) had with Mr Catalano was the catalyst for him “seeking to team up with WAM to form a control block of 43.5% + 10% in Keybridge that has led to the control situation today at Keybridge.”

- To the extent that Mr Bolton is making an association claim here, we consider that it is not supported by evidence. Mr Bolton submitted that “In circumstances where WAM necessarily needed Mr Catalano’s vote to pass a resolution, it seems apparent that the close timing of the two above events [ie, not releasing ACM from its obligation and Mills Oakley sending notice of a s249F meeting] are in concert.” We are not persuaded by the timing. It is equally open to consider that Mr Catalano and WAM were simply of a like mind. The fact that Mr Catalano had come around to the same view as WAM is not, without more, evidence of association. This interpretation is supported by Mr Catalano saying in an email to Mr Bolton “… This is personal and I’m going to expose you.” He does not suggest in any correspondence that we have been provided with that he is going to act together with any other party. Moreover, the Bridge Funding Facility was conditional on Keybridge retaining a majority of the WAM nominees on the board; it did not include Mr Catalano, which one might have expected if they were associates.

- We are not satisfied that the application meets the Mount Gibson hurdle for conducting proceedings on the application in relation to association, namely that:

“The Panel's starting point was that it was for Mount Gibson – the applicant – to demonstrate a sufficient body of evidence of association and to convince the Panel as to that association, albeit with proper inferences being drawn.”17

- Mr Bolton also submitted that by entering into the Bridge Funding Facility (with “such a board composition condition”) – “WAM and Keybridge became associates of each other”, “Ravell and WAM became associates with each other in the affairs of Keybridge” and “Keybridge became associates of each of the WAM Nominees”. Mr Bolton submitted this resulted in a contravention of s606, as explained in his out of process submission dated 7 July 2025:

“Entities in the WAM group have obtained a direct relevant interest in Yowie under s608(1) by operation of the security instrument (noting none of the s609 exemptions apply). The financing announcement on 6 June 2025 (albeit it [is] dated 5 June 2025) states that the financiers are “WAM Active and other entities within the Wilson Asset Management Group” (emphasis added).

These “other” entities, whoever they may be, can only have had (prior to the security arrangements) a voting power in Yowie by way of association under s12 (if at all). They now have a 58% direct relevant interest in Yowie under s608(1). That is, given the operation of s610(3), they have gone from a 0% voting power to a 58% voting power in Yowie without an exemption under s611 and have, accordingly, contravened s606 by this transaction on 5 June 2025.”

- We consider that we do not need to decide whether there has been such a contravention of s606. But even if we addressed the issue and found a contravention, the Panel has previously held that technical submissions pointing to contraventions of Chapter 6 do not necessarily result in unacceptable circumstances.18

Frustrating action

- Mr Bolton submitted that the WAM nominees seeking (through Keybridge) appointment to the Yowie board engaged in a frustrating action “triggering the failure of the Yowie takeover bid.”

- Relevantly, the detailed conditions that Yowie announced on 9 May 2025 were:

(8) Conduct of KBC’s business

Between the Announcement Date and the end of the offer period, none of KBC and any body corporate which is or becomes a subsidiary of KBC, without the written consent of Yowie:

…

(b) Gives or agrees to give any encumbrance (including a Security Interest or mortgage) over any of its assets otherwise in the ordinary course of business; or

(c) Appoints any additional directors to its board of directors whether to fill a casual vacancy or otherwise.

(9) No change to Yowie board composition

KBC, its directors, officers or associates do not:

(a) Issue a notice pursuant to section 249D, 249F or 249G for the purpose of convening a meeting of Yowie shareholders; or

(b) Propose a resolution at a meeting of Yowie shareholders; or

(c) take any actions,

that would influence the control or composition of the Yowie board of directors.

- By the issue of the bidder’s statement the conditions had changed. Condition (8), now 10.14(h), excluded Yowie or its subsidiaries from the list of Keybridge subsidiaries that were subject to the restrictions. Condition (9), now 10.14(i), provided that Yowie shareholders not pass a resolution the effect of which was to change the composition of the board of directors of Yowie.

- Whether the Bid fails remains to be seen.19 As discussed above, we are not persuaded that the Bid has any realistic prospect of proceeding.

- We addressed the issue of frustrating action in Keybridge 17. The issue was also raised on review of our decision by the review Panel in Keybridge 18R.20 The change in condition (assuming it does not run foul of section 631) does not change the position in our view.

- Mr Bolton’s submissions concerning creating the security interest over Keybridge’s assets, said to trigger a defeating condition in the Bid, is not a new circumstance in our view. It is not a frustrating action giving rise to unacceptable circumstances.

- Indeed, a number of the submissions in the application sought to revisit, or substantially overlapped with, matters that had already been considered and determined in earlier court and Panel proceedings. Yet others were highly technical.

- As long ago as Taipan 07, the Panel said:

“… Although Taipan raises some new arguments in this application, we were concerned that many of the arguments raised by Taipan in this application were duplicated arguments that were raised by Taipan and not accepted by the Panel in the Taipan 6 Application. While we decided to conduct proceedings in this case, it may be appropriate for a sitting Panel (other than a review Panel) in the future to decline to conduct proceedings in relation to an application if enough of the issues raised have been previously considered and determined by a sitting Panel.”21

Other considerations

- Several of the final orders requested by Mr Bolton have been overtaken by events. For example, the two section 249F meetings have been held and key aspects of the final orders that he sought related to those meetings. While some final orders relate to the Bid, it is unclear whether a reconstituted Yowie board will pursue the Bid.22

- We consider it unlikely that, even if we found unacceptable circumstances, we would make any of the remaining orders. The question of what remedies are available is one of the considerations a Panel takes into account when deciding whether to conduct proceedings23 and can be a basis for not conducting proceedings.24 In our view this is another reason not to conduct proceedings in this matter.

- We also considered whether it was an appropriate application on which to conduct proceedings, given the history of Keybridge applications, Yowie applications and other related applications involving Mr Bolton in a corporate, rather than personal, role. In other words, even if the application is not vexatious or an abuse of process, or made otherwise for a collateral purpose, 25 (none of which we form a concluded view on), as a matter of public policy many of the issues have had (indeed, continue to have) long, sometimes tortured, ventilation – before the Panel and the Courts – and we are not minded to require the parties to engage yet again.

- We consider it is not against the public interest to decline to conduct proceedings.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- Given that we make no declaration, we make no final orders, including as to costs.

Teresa Dyson

President of the sitting Panel

Decision dated 10 July 2025

Reasons given to parties 31 July 2025

Reasons published 7August 2025

Advisers

| Party | Advisers |

|---|---|

| Mr Nicholas Bolton | ‑ |

| Keybridge | Gadens |

| Yowie | Gilbert + Tobin |

1 There was no objection to the same sitting Panel as in Yowie Group Ltd 04 & 05, Keybridge Capital Limited 17 and Yowie Group Ltd 06 and Keybridge Capital Limited 19

2 Namely Messrs Bolton, Patton, Dukes and Catalano

3 Announced by Keybridge on 24 December 2024. It released further announcements on 10 January 2025 and 14 January 2025, referring to WAM’s section 249F notice that was sent to shareholders as “defective”. It appears that Keybridge did not release WAM’s actual section 249F notice.

4 In the matter of Keybridge Capital Limited [2025] NSWSC 240

5 Bolton v WAM Active Ltd (No 2) [2025] NSWCA 99

6 Nixon J had ordered the end of the administration but stayed the orders, and the Court of Appeal had granted a further stay until the appeal had been heard and determined

7 The facility is referred to in the application as the “Control Loan”

8 Although it was not clear from his application in relation to whom, since they had board control of the target (Keybridge) and sought, by a section 249F meeting, board control of the bidder (Yowie)

9 Mr Bolton subsequently provided a copy of a Federal Court Originating Process filed by Australian Style Group Pty Ltd on 2 July 2025

10 Pinnacle VRB Ltd 08 [2001] ATP 17 at [55]‑[56]. See also Excelsior Capital Limited [2020] ATP 25 at [19]

11 Tinkerbell Enterprises Pty Limited as Trustee for The Leanne Catelan Trust v Takeovers Panel [2012] FCA 1272 at [114]

12 Guidance Note 19: Insider Participation in Control Transactions, Issue 3, para [4] (footnotes omitted)

13 Strategic Minerals Corporation NL [2018] ATP 2 at [68]

14 On 10 July 2025 (the same day as our decision), Yowie announced that it will not proceed with despatch of offers and the Bidder’s Statement in relation to the Proposed Bid, stating that following the outcome of the Section 249F Meeting, the “no change to Yowie Board composition” condition to the bid had been triggered and that it is not in Yowie’s interest to proceed with the bid.

15 For example, noting that if all Keybridge shareholders accepted the Bid, the number of Yowie shares on issue would increase from 263,773,086 to 479,192,738. There is a question as to whether the bidder’s statement properly disclosed the effect of the offer for Yowie shares under the bid on Yowie given this potentially large increase in Yowie’s share capital, see s636(1)(g) and s713.

16 The bidder’s statement provides in paragraph 10.15:

“Each of the Minimum Acceptance Condition and the No Control Condition is a condition precedent to the acquisition of any right or interest in Shares by Yowie under the Offer and will prevent a contract to sell Shares from arising until it is fulfilled or waived” and

“Neither the Minimum Acceptance Condition nor the No Control Condition may be waived by Yowie. Despite the previous sentence, Yowie may fulfil the No Control Condition by issuing Yowie Shares to those Keybridge Shareholders who have accepted the Offer if the effect of the issue is that Keybridge does not control (within the meaning of section 259E of the Corporations Act) Yowie immediately after the issue.”

17 Mount Gibson Iron Limited [2008] ATP 4 at [15]

18 GoldLink IncomePlus Limited 02 [2008] ATP 19 at [11] to [12]

19 Postscript: on 10 July 2025 Yowie announced that it would not proceed with the bid for Keybridge

21 Taipan Resources NL 07 [2000] ATP 18 at [52]

22 See fn 19

23 Takeovers Panel Procedural Guidelines, 1 April 2021, paragraph 4.6(b)

24 See Celamin Holdings NL 01R [2014] ATP 23 at [25]

25 See s658A. In Innate Immunotherapeutics Limited [2017] ATP 2 at [26], the Panel acknowledged that ‘it may be appropriate’ to decline to conduct proceedings ‘if the application is vexatious or frivolous or has been made for a collateral purpose.’ In The President’s Club Limited 02 [2016] ATP 1 at [96], the Panel approved of the statement of Roden J in Attorney‑General (NSW) v Wentworth (1988) 14 NSWLR 481 that proceedings are ‘vexatious if they are brought for collateral purposes, and not for the purpose of having the court adjudicate on the issues to which they give rise.’