[2025] ATP 15

Catchwords:

Decline to make a declaration – board spill – announced bid – triggered conditions – frustrating action

Corporations Act 2001 (Cth), sections 203D, 249D, 249F, 249G, 259C, 259E, 629

Australian Securities and Investments Commission Regulations 2001 (Cth), regulation 20

ASX Listing Rules, Listing Rules 10.1, 11.1, 11.2

Guidance Note 12: Frustrating Action, Guidance Note 19: Insider Participation in Control Transactions

In the matter of Yowie Group Ltd [2025] NSWSC 648, Bolton v WAM Active Ltd (No 2) [2025] NSWCA 99, Keybridge Capital Limited [2025] NSWSC 240, Advance Bank Australia Ltd v FAI Insurances Ltd (1987) 9 NSWLR 464

Strategic Minerals Corporation NL [2018] ATP 2, Molopo Energy Limited 09 [2017] ATP 22, Austock Group Limited [2012] ATP 12, Resource Pacific Holdings Limited [2007] ATP 26, Pinnacle VRB Ltd 05 [2001] ATP 14

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | YES | NO | NO | NO |

Introduction

- The Panel, Teresa Dyson (sitting President), Christopher Stavrianou and James Stewart, declined to make a declaration of unacceptable circumstances in relation to the affairs of Keybridge Capital Limited. Yowie announced a bid for Keybridge that included a condition (among other things) that Keybridge, its officers or associates not issue a notice pursuant to sections 249D, 249F or 249G1 for the purpose of convening a meeting of Yowie shareholders that would influence the control or composition of the board of Yowie. Yowie submitted that calling the meeting would trigger a defeating condition of its announced bid and be a frustrating action. The Panel considered that Yowie was aware of the likelihood that Keybridge may seek to change the composition of the Yowie board when Yowie announced its proposed bid, and accordingly that the condition was likely to be triggered by Keybridge.

- In these reasons, the following definitions apply.

- Condition 9

- has the meaning given in paragraph 24

- Incumbent Directors

- has the meaning given in paragraph 8

- Keybridge

- Keybridge Capital Limited

- Proposed Bid

- has the meaning given in paragraph 24

- Proposed Directors

- has the meaning given in paragraph 27(c)

- Section 249F Meeting

- has the meaning given in paragraph 26

- WAM

- WAM Active Limited

- Yowie

- Yowie Group Ltd

Facts2

- Keybridge is an ASX listed company (ASX code: KBC).

- Yowie is an ASX listed company (ASX code: YOW).

- WAM is an ASX listed company (ASX code: WAA).

- WAM holds a relevant interest in 43.5% of Keybridge.

- Keybridge holds a relevant interest in 58.07% of Yowie.

- The incumbent directors of Yowie (the Incumbent Directors) are Messrs Nicholas Bolton, John Patton, Andrew Ranger, Diesel Schwarze (who is Mr Bolton’s brother‑in‑law) and Daniel Agocs. Mr Bolton was also CEO of Keybridge.

- The current directors of Keybridge are Messrs Geoffrey Wilson AO, Jesse Hamilton, Martyn McCathie, Sulieman Ravell and Antony Catalano.

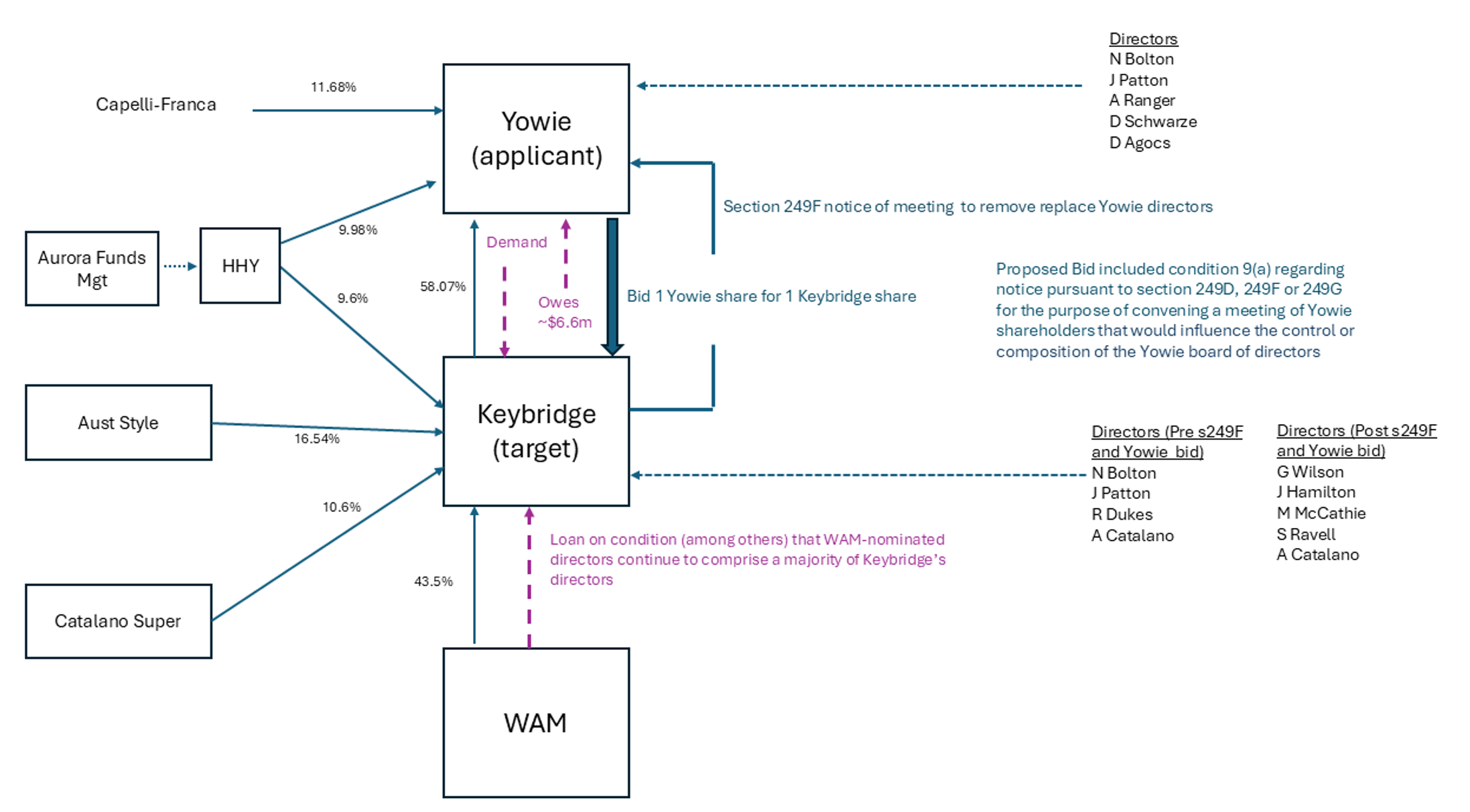

- The relationship between the parties prior to the section 249F Meeting can be shown diagrammatically as follows.

Text description

This diagram shows the relationships between different companies and individuals. The relationships are as follows.

Capelli‑Franca is a shareholder in Yowie (the applicant). Aurora Funds Management is the responsible entity of the HHY Fund, and is a shareholder in both Yowie and Keybridge (the target). Keybridge is the majority shareholder of Yowie.

WAM owns about 43% of Keybridge. Catalano Super owns about 10% of Keybridge. Australian Style Group owns about 16% of Keybridge.

Yowie has made a bid for Keybridge. The bid includes a condition regarding notice under sections 249D, 249F, or 249G. Keybridge owes Yowie $6.6 million. Yowie has made a demand for repayment of that money from Keybridge.

WAM has given a loan to Keybridge on the condition (among others) that WAM‑nominated directors continue to comprise a majority of Keybridge’s directors. Keybridge has called a meeting of Yowie under section 249F to replace its directors.

The directors of Yowie are N Bolton, J Patton, A Ranger, D Schwarze, and D Agocs. The directors of Keybridge were previously N Bolton, J Patton, R Dukes, and A Catalano. The directors of Keybridge are now G Wilson, J Hamilton, M McCathie, S Ravell, and A Catalano.

- Between April 2024 and February 2025, Yowie extended loans to Keybridge.

- By notice under section 249F dated 19 December 2024, WAM had sought a meeting of Keybridge shareholders to replace the directors of Keybridge with 4 of its nominees.3 On 10 February 2025, the section 249F meeting that had been called by WAM was held. The meeting was purportedly adjourned by Mr Patton as the chair but was continued by Mr Hamilton assuming the chair. The meeting proceeded to approve all resolutions, except for the resolution to remove Mr Catalano. Court proceedings ensued.

- On 10 February 2025, Keybridge announced on ASX that Yowie had formally demanded repayment of $4.6 million by 7 February 2025.

- Also on 10 February 2025, Keybridge announced on ASX that it had appointed a voluntary administrator. At the time the directors of Keybridge were Messrs Bolton, Patton, Catalano and Richard Dukes.

- On 6 March 2025, WAM issued a “Bridge Funding Facility” term sheet to Keybridge to provide Keybridge with bridging financing pending finalisation of a capital raising. Included as “Conditions Precedent” were:

- “Messrs Patton and Bolton ceasing to be directors of the Borrower and/or any entity that is a subsidiary (as defined under the Corporations Act 2001 (Cth)) of the Borrower including, for the avoidance of doubt, including (sic) Yowie Group Limited.

- Messrs Wilson, Hamilton, McCathie and Ravell comprising a majority of the directors of the Borrower (New Directors).”

- On 21 March 2025, the Supreme Court of New South Wales declared that the meeting on 10 February 2025 had been invalidly adjourned by Mr Patton and that the directors of Keybridge had been replaced in accordance with the resolutions which were validly passed.4 The Court also decided that outstanding issues regarding the voluntary administration of Keybridge be stood over.

- On 25 March 2025, Mr Bolton filed notice of intention to appeal to the New South Wales Court of Appeal.

- Accordingly, following the meeting on 10 February 2025, the directors of Keybridge, as had been declared by Nixon J at first instance, were Messrs Wilson, Hamilton, McCathie, Ravell and Catalano.5

- On 1 April 2025, a section 203D notice was given to Yowie expressed to be on behalf of Keybridge and signed by Messrs Wilson and Hamilton.6 The notice proposed an intention to move resolutions for the removal of Messrs Patton, Bolton and Ranger from the Yowie board at the next general meeting of Yowie.

- Also on 1 April 2025, Messrs Schwarze and Agocs were appointed to the Yowie board. Yowie announced their appointment on ASX in a market update on 7 April 2025. The market update also stated that Mr Bolton had proposed a deed of company arrangement with Keybridge while WAM had proposed a loan facility for Keybridge, each of which were being assessed by Yowie as a major creditor of Keybridge (which was in administration).

- On 9 April 2025, a second section 203D notice was given to Yowie expressed to be on behalf of Keybridge, also signed by Messrs Wilson and Hamilton, specifying an intention to move resolutions for the removal of Messrs Schwarze and Agocs from the Yowie board at the next general meeting of Yowie.

- On 14 April 2025, Nixon J ordered that the administration of Keybridge was ended, but His Honour stayed the order until 16 April 2025. It was further stayed by the New South Wales Court of Appeal to 8 May 2025 because of the appeal.

- On 8 May 2025, the New South Wales Court of Appeal dismissed the appeal of Justice Nixon’s 21 March 2025 decision and ended the stay of the order terminating the administration.7

-

On 9 May 2025, Yowie announced an intention to make an off‑market scrip takeover bid for all the issued fully paid ordinary shares in Keybridge, offering 1 Yowie share for each Keybridge share on issue (Proposed Bid). The Proposed Bid included the following Condition 9:

No change to Yowie board composition

[Keybridge], its directors, officers or associates do not:

- Issue a notice pursuant to section 249D, 249F or 249G for the purpose of convening a meeting of Yowie shareholders; or

- Propose a resolution at a meeting of Yowie shareholders; or

- take any actions,

that would influence the control or composition of the Yowie board of directors.8 (Condition 9)

- On 16 May 2025, Keybridge made an ASX announcement advising its shareholders to ‘take no action’ in relation to the Proposed Bid, and that it intended to call a section 249F meeting.

- On or about 26 May 2025, Keybridge issued to Yowie a Notice of General Meeting and Explanatory Memorandum dated 26 May 2025 as the convening shareholder under section 249F. The meeting of Yowie shareholders (Section 249F Meeting) was scheduled for 27 June 2025. Keybridge dispatched the notice to Yowie shareholders on 28 May 2025, but the announcement that it had done so was not released on ASX until 5 June 2025.

- Pursuant to the Notice of Meeting, Keybridge proposed resolutions, including:

- a special resolution to amend clause 13.3 of the constitution of Yowie (which required a 75% majority)

- resolutions to remove the Incumbent Directors of Yowie and

- resolutions to appoint Messrs Wilson, McCathie, Hamilton, Ravell and Catalano (the Proposed Directors) to the Yowie board.

- The Notice of Meeting stated that Keybridge “has significant concerns in relation to the actions of the [Incumbent Directors] as regards total failures of corporate governance for the Company and their directors’ duties.”

- On 2 June 2025, Yowie made an ASX announcement advising that Keybridge had purported to send a section 249F notice to Yowie shareholders and that, to the extent it was valid, the meeting was postponed by Yowie’s board to 14 July 2025 for several reasons, including that the constitutional amendment raised issues affecting a number of the proposed resolutions. Court proceedings ensued about this as well.9

Application

Declaration sought

- By application dated 23 May 2025, Yowie sought a declaration of unacceptable circumstances. The application predated the issue of the section 249F notice.

- Yowie submitted that the calling of a section 249F meeting in relation to Yowie by Keybridge would trigger a defeating condition of its bid, if it sought to disturb the composition of the Yowie Board. However, it also noted that “Yowie would not consider the mere issuing of a s203D notice or a proper notice under its constitution to nominate directors at a general meeting would of themselves constitute frustrating action of Condition 9 of the Offer. It is the act of calling a meeting under s249D, s249F or s249G or putting resolutions at a meeting under s249N that would be the frustrating action.”

- Yowie submitted that at no time prior to the announcement of the Proposed Bid had Keybridge (in administration at the time) indicated that it intended to convene a section 249F meeting.

- Yowie further submitted in its application that “There is no urgency or probative reason why Keybridge would need to convene a s.249F meeting of its Bidder until after the conclusion of the [Proposed Bid], other than to frustrate [the Proposed Bid]”.

- It further submitted that WAM was seeking to entrench control of Keybridge by providing finance, conditional upon it holding majority board control.

- It submitted that the acquisition of control over Keybridge shares was not taking place in an efficient, competitive and informed market, contrary to section 602 of the Act. It submitted that it was for target shareholders to determine actions which may interfere with this, and so “Keybridge ought to obtain its own shareholder approval if it wishes to wilfully take steps to…trigger a defeating condition of the [Proposed Bid]. Failure to do so constitutes unacceptable circumstances.”

Interim order sought

- Yowie’s application sought an interim order that Keybridge be restrained from issuing a section 249F, 249D or 249G notice to Yowie until the final determination of the Panel proceedings.

- The interim order request dated 23 May 2025 was overtaken by events, being the issue of the disputed section 249F notice dated 28 May 2025.

Final orders sought

- Yowie’s application sought a final order that “Keybridge be restrained from issuing a s249F, s249D or s249G notice to Yowie that moves resolutions to change the Yowie board until the earlier of:

- the waiver of Condition 9 of the [Proposed Bid]; or

- the end of the [Proposed Bid]; or

- Keybridge shareholders passing a resolution approving the action, on a fully informed basis, at a properly held shareholder meeting.”

- However, the issue of the disputed section 249F Notice by Keybridge also made the final orders sought redundant. Yowie amended them as follows:

“That the EGM be postponed until the date that is the earliest of:

- the date determined by the Company that is no later than 45 days after Yowie waives Modified Condition 9;

- the date determined by the Company that is no later than 45 days after the close of the Offer; and

- the date determined by the Company that is no later than 45 days after Keybridge shareholders in general meeting have passed an ordinary resolution approving the issue of the s249F Notice on a fully informed basis, including as to the effect of issuing the s249F Notice on the Offer and Yowie holding the EGM.”

- Yowie submitted that the 45‑day period was required to allow sufficient time for Yowie to call and hold a meeting of Keybridge shareholders under section 249F to remove and replace the directors of Keybridge prior to the record date for the EGM.

Out of process submission

- We decided to accept an out of process submission from Keybridge enclosing a copy of the section 249F notice dated 28 May 2025. In preliminary questions we asked of Yowie (see below), a copy was also provided to us by Yowie.

Discussion

- We have considered all the material presented to us in coming to our decision, but only specifically address those things that we consider necessary to explain our reasoning. At the outset we comment that the broader ongoing corporate dispute being waged in the Courts and the Panel involving Keybridge, Yowie, WAM and others is complex and multi‑faceted, and this application represents just one aspect of the dispute.

Conduct proceedings?

- The Panel’s first consideration (apart from interim orders) is whether it should conduct proceedings.10

- In view of the notification that Yowie received under section 249F, we asked Yowie two preliminary questions:

- Does Yowie intend to waive announced Condition 9(a) (dealing with the issuance of notices under sections 249D, 249F, or 249G by Keybridge)? If not –

- should the Panel consider that the proposed bid will not go ahead?

- in the absence of, for example, an undertaking not to rely on the condition (either permanently or for a limited period), why does Yowie seek to proceed with the application?

- What final orders are now being sought, noting that Keybridge gave a notice under section 249F on 26 May 2025?

- Does Yowie intend to waive announced Condition 9(a) (dealing with the issuance of notices under sections 249D, 249F, or 249G by Keybridge)? If not –

- Yowie submitted that it intended to replace that condition with a modified condition to the effect that no meeting of Yowie shareholders was held at which a resolution was put to Yowie shareholders for the removal or replacement of any of the existing Yowie directors or for the appointment of any new Yowie directors. Accordingly, it submitted, there was no need for it to waive or otherwise provide any undertaking in relation to Condition 9. It submitted that the modification was consistent with section 631(1) of the Act.

- Yowie also submitted that the heart of its application was that Keybridge should not be permitted to take steps to remove or replace the Incumbent Directors thus triggering a defeating condition of its announced bid and denying Keybridge shareholders a reasonable and equal opportunity to participate in the benefits of the announced bid.

- The application raises a significant policy consideration, namely the interaction of the Panel’s frustrating action policy with board entrenchment and, potentially, using a takeover bid as a defence to a board spill. On the other hand, we also considered what impact conducting proceedings would have in the dispute between the parties.

- On balance, we decided that the issues that the application raised warranted further consideration, and we decided to conduct proceedings.

Frustrating action

- Guidance Note 12 defines frustrating action in the following way:

“A frustrating action is an action by a target, whether taken or proposed, by reason of which:

- a bid may be withdrawn or lapse

- a potential bid is not proceeded with.”11

- The policy basis is stated in paragraph 4 of the Guidance Note, namely that:

“… it is shareholders who should decide on actions that may:

- interfere with the reasonable and equal opportunity of the shareholders to participate in a proposal or

- inhibit the acquisition of control over their voting shares taking place in an efficient, competitive and informed market.”

- Yowie submitted that “Voluntarily triggering Condition 9 of the Yowie Offer is a ‘frustrating action’”.

- The Panel has never sought to restrict a bidder’s freedom to impose any defeating conditions that it is otherwise free to make, although this would not include the freedom to state a condition that is otherwise void or unlawful (as, for example, a condition contrary to section 629 would be). The definition of frustrating action in Guidance Note 12 might theoretically apply to the triggering of any such condition, although in substance a triggering action might only be ‘frustrating’ if it was commercially critical to the bid.

- It does not follow that the triggering of any condition results in an unacceptable frustrating action. As early as 2001, in Pinnacle VRB Ltd 0512, the Panel articulated (at [31]) that “The policy needs to be refined to make its application clear in instances where, for instance, the facts involve breaches of conditions which may be unreasonable for a bidder to rely on, transactions which have been entered into or announced before a bid is made, or compelling reasons why shareholder approval should be dispensed with in a particular case. Companies should not be paralysed simply due to the existence of a takeover bid….”.

Unacceptable circumstances

- Yowie submitted in its application that it had received no prior notice of the intention to call a meeting pursuant to the issue of a section 249F notice. It submitted that it could not be on notice of any intention from Keybridge prior to determining to make the Proposed Bid because:

- As Keybridge was in voluntary administration, it needed either the administrator’s approval or court approval for the directors to act in that capacity (i.e. to issue the section 203D notices or call a meeting of Yowie shareholders). Keybridge did not, Yowie submitted, for various reasons, have the requisite approval.13 In short, Yowie took a technical interpretation of ‘notice’ as demonstrated when it submitted in response to the brief: “Importantly, as Keybridge was in administration at the time the notices were purportedly given (at all relevant times before the [announced bid]) and having regard to the prohibitions in s. 198G of the Act and that it is a criminal offence for an officer of a company in external administration to purport to contravene those prohibitions, there can be no ‘reading between the lines’ on what a notice means.”

- Previous notices had not resulted in shareholder meetings. It said “Yowie notes a previous pattern of conduct of the relevant directors in giving a notice under s. 203D and not later calling a shareholder meeting to put the resolutions (as was their right).“ Accordingly, it submitted that it “did not believe that Keybridge as an entity held an intention to issue a s. 249F meeting request and was entitled to have that belief in the circumstances.”

- In any event, the notices given (which concerned section 203D) did not go to the calling of a section 249F meeting.

- Yowie further submitted that Condition 9 was necessary “to protect the operation of a viable bid” and it was not commercially imperative for Keybridge to call a shareholders’ meeting in Yowie without first seeking its own shareholder approval.

- It also submitted that “the act of a target adverse to the bid proceeding, attempting to change control of a bidder during an offer period otherwise constitutes unacceptable circumstances.”

- In response to the brief, Yowie submitted that Keybridge, by issuing the section 249F notice, took a deliberate step to frustrate Yowie’s announced bid and this was, further, a decision made “by parties who ought to have been prohibited insiders pursuant to GN19.”14 We address the latter point later.

- There were, during our consideration, further court proceedings regarding the validity of the section 249F notice given by Keybridge to Yowie. Yowie submitted that we should not infer validity of the notice until these proceedings were determined. We did not.15

- Keybridge submitted that “Yowie has been on notice since at least 1 April 2025 that Keybridge intended to call a meeting to appoint and remove directors of its subsidiary, Yowie.” We agree, without using the term ‘notice’ in a technical sense.

- In our view Yowie’s submissions conflated the concepts of awareness and validity. From all that has passed between the parties it is not credible that the incumbent directors of Yowie were not aware that Keybridge was attempting to replace them on Yowie’s board. We do not accept, for our purposes, that Yowie is entitled to take a strictly legalistic view of the various communications it received (even if its view is correct). Regardless of the validity or otherwise of various notices, in our view Yowie was aware of the likelihood that the newly appointed directors of Keybridge, and therefore Keybridge itself, were seeking to change the composition of the Yowie board when Yowie (a subsidiary of Keybridge whose board included some of the directors who had just been removed from the board of Keybridge) announced the Proposed Bid, and accordingly that Condition 9 was likely to be triggered by Keybridge.

- Not only had section 203D notices been provided (regardless of their legal status) but numerous court proceedings had been engaged in, including proceedings to identify the directors of Keybridge following the section 249F meeting. In the Court of Appeal, the affidavit of Mr Simmons dated 17 April 2025, a solicitor for WAM, was read. The affidavit had been served on Mr Bolton, and Mr Bolton had attended the hearing in person. The affidavit made clear Keybridge’s intentions to take steps to replace the directors of Yowie.

- As well, the solicitors for Keybridge had written to Yowie on 24 April 2025 requesting a copy of Yowie’s register of members and enclosing a letter of the same date stating Keybridge’s intention to nominate directors for election to the Yowie board together with consents to act as directors. There were also court proceedings regarding the register.

- The considerations for whether a frustrating action gives rise to unacceptable circumstances include “how advanced the frustrating action was when the bid was made or communicated.”16 Here the actions of Keybridge were well advanced, and its intentions clear, when the Proposed Bid was announced on 9 May 2025.

- In Molopo Energy Limited 0917, the Panel declined to make a declaration that a proposed payment by Molopo would constitute a frustrating action giving rise to unacceptable circumstances. The application concerned a capital expenditure that exceeded the limit set out in a condition of the bid by Aurora. The Panel said (at [26]):

“We consider that Aurora was sufficiently put on notice regarding the likelihood of one or more payments like the proposed payment being made by Molopo in connection with the Orient project, before it announced its bid ….”18

- Yowie submitted that Condition 9 was critical to the Proposed Bid. It submitted “Given that Keybridge owns a material stake in Yowie, Condition 9 is important to prevent the current Keybridge board taking steps to remove/replace the existing Yowie board with its own nominees which would allow it to effectively kill the Yowie bid.”

- Yowie also submitted that “Condition 9 also critically ensures that s. 259C is not enlivened by the operation of s. 259E.” However, it stated that it intended “to replace the ASIC approval condition [that is, section 259C] with a condition to the effect that Keybridge does not control (within the meaning of section 259E of the Corporations Act) Yowie by the end of the [Proposed Bid].”

- On the other hand, Keybridge submitted that “The announcement of the ‘intention to bid’ on 9 May 2025 was made when other options for resistance were running out.” It also submitted “Yowie has offered no explanation (sensible or otherwise) at all as to why a financial services investment company and a chocolate manufacturer would ever want to combine, or why such a transaction would make sense to the shareholders of either entity, let alone why a board change is commercially critical.”

- Keybridge also submitted that Condition 9 “represents a clear breach of the prohibition against electioneering as set out in Advance Bank Australia Ltd v FAI Insurances Ltd (1987) 9 NSWLR 464…” We do not consider that we need to decide this question.19

- It is a factor in determining whether a frustrating action gives rise to unacceptable circumstances whether the triggered condition is commercially critical to the bid.20 We cannot say with certainty that Keybridge would withdraw or otherwise not proceed with the Proposed Bid (assuming it could do so) if the Proposed Directors were to take charge of Yowie. That would require an assessment by the new directors of Yowie of the merits of the Proposed Bid from Yowie’s perspective, and that seems at this stage uncertain. We also cannot say whether the change to the section 259C condition, assuming it is effective, means that Condition 9 is no longer critical to the bid.

- In short, while we have some doubt as to the criticality of Condition 9, we do not need to form a concluded view.

Other conditions?

- We also considered the additional concerns Yowie raised in prospect of potential applications in respect of its constitution, actions that may defeat a Listing Rule 10.1 resolution, financing provided by WAM, and the changes Yowie proposed to the conditions of the Proposed Bid. We have considered them and address them below.

- Yowie was aware that other conditions of the Proposed Bid were, or were likely to be, triggered. Yowie submitted that the following conditions had been triggered (in brief):

- Keybridge’s proposal to amend the constitution of Yowie, which Yowie said triggered condition 8 of the Proposed Bid.21 The announced Condition 8 referred to changing Yowie’s constitution22 or granting encumbrances over Yowie’s assets.

- Keybridge proposing to vote against a Listing Rule 10.1 approval23 to allow WAM to accept into Yowie’s offer, which Yowie said was a frustrating action. Keybridge holds 58.07% of Yowie and has stated that it would oppose Listing Rule 10.1 approval.24 Yowie however submitted that “this condition will only be relied upon to the extent WAM intends to accept into the bid, which appears unlikely.…”

- Keybridge pursuing the finance arrangement with WAM “frustrates Conditions 5(h) and 8(b) of the [Proposed Bid] and otherwise plainly constitutes unacceptable circumstances….”25 In addition, Yowie submitted that WAM and Keybridge agreeing that the finance was subject to a condition precedent that Messrs Ravell, Hamilton, McCathie and Wilson were a majority of Keybridge’s directors was a frustrating action and unacceptable circumstances.26

- Yowie was, or ought to have been, already sufficiently cognisant of each of these potential actions by Keybridge when announcing the Proposed Bid. For example:

- Condition 2, concerning Listing Rule 10.1 approval, was obviously going to create an issue in respect of the Keybridge shareholders granting that approval. In any event, Yowie has acknowledged that it may not need to rely on the condition if WAM did not accept. And ASX may, pursuant to condition 2(c) of the Proposed Bid, determine that no approval is required.

- Condition 8(b), concerning Keybridge granting encumbrances, was also obviously going to create an issue given Keybridge’s administration and the Comfort Letter offered by WAM.

- We also consider in relation to Condition 8, that the amendment to Yowie’s constitution was not commercially critical to the Proposed Bid.

- In such circumstances we do not find that actions triggering these other conditions give rise to unacceptable circumstances.

- We note further the rebuttal submission of Keybridge identifying other listing rules that may also need to be addressed in order for the Proposed Bid to complete.27 We do not need to concern ourselves with these.

- We also had concerns (but again do not need to decide) about other conditions potentially making the bid not genuinely available to Keybridge shareholders:

- WAM holds about 43.5% of Keybridge and Catalano Super holds about 10.6% of Keybridge, potentially affecting the likelihood of meeting the 50.1% minimum acceptance condition. Yowie submitted that this could be waived, and it intended reducing the minimum to 35%,28 although it did not explain the significance of that number.

- The possibility of Yowie itself triggering a condition as a subsidiary of Keybridge, to which Yowie submitted that it will not rely upon the condition to any extent triggered by Yowie itself and had said as much in its announcement of the Proposed Bid. For this reason, Yowie submitted that the condition was not void under section 629. Again, we leave aside whether this is effective.

- Keybridge submitted that “The challenge faced with the [Proposed Bid] is that it was never intended to continue.” Keybridge based this on, it submitted, the lack of rationale for the bid, the sheer number of conditions imposed, and those specific to preventing shareholder meetings.

- We do not think we have the evidence to accept Keybridge’s submission in this respect, although we are of the view that many of the conditions of the Proposed Bid have been, or are likely to be, breached, and it follows that the Proposed Bid is unlikely to continue successfully. It has, we think, only a remote chance of completion.

- In those circumstances, we do not consider that the conduct of Keybridge’s that has been the subject of complaint should be restricted by the Panel’s policy on frustrating action.

Shareholder approval of a frustrating action?

- Yowie, in its application, stated that it “[did] not oppose Keybridge obtaining its own shareholder approval, on a fully informed basis, to permit it committing an act that would frustrate the [announced bid].” We asked Yowie to explain what would be required for Keybridge’s shareholder approval to be “fully informed”. Yowie submitted, we think, that this required:

- a copy of Yowie’s Bidder’s Statement

- a copy of Keybridge’s Target’s Statement

- an independent expert report opining on the bid

- a clear statement that approving the issuing of a notice or convening of a meeting would trigger a defeating condition

- the intentions of Keybridge (and its nominee directors) concerning the continuation of Yowie’s announced bid and

- any information barriers that are in place with regard to the WAM nominee directors.

- The Panel has previously stated that “In general an action which frustrates a bid will not give rise to unacceptable circumstances if shareholders are given a fair choice between the bid and the alternative proposal.”29

- Keybridge submitted in rebuttals that, given that the position on the outcome of the meeting was already known (since the existing position of two shareholders who together hold over 50% of Keybridge’s issued shares was clear) these requirements laid bare Yowie’s collateral purpose. There is some force in this argument, but we do not need to form a conclusion other than to say that, even where the outcome of a meeting may appear to be a forgone conclusion, there can be a useful purpose served in holding it. Nor do we understand Keybridge to be saying no meeting should be held (if it were required) because the outcome was a forgone conclusion.

- If our conclusion on the application was different and we were considering requiring a meeting of Keybridge’s shareholders, we would not consider it sufficient to say that the outcome was pre‑determined and therefore no meeting was needed. Positions can change, whether on reflection or by the persuasion of other shareholders in attendance.

- In short, given our conclusion below, we do not need to explore further whether shareholders in Keybridge need to be offered the opportunity to decide on the frustrating actions.

Conclusion on frustrating action

- While we do not go as far as Keybridge, which submitted that “The bid has been designed to engage the Panel’s policy on frustrating action, with the current application from Yowie representing an abuse of process”, we have concluded that, even if some or all of Keybridge’s actions were frustrating actions, they did not give rise to unacceptable circumstances.

- As made clear above, we have also considered the additional concerns Yowie raised.

Insider participation

- Keybridge called a section 249F meeting in Yowie triggering a condition of Yowie’s Proposed Bid. This potentially has the effect that the right of other shareholders to consider the Proposed Bid is removed from them. As noted earlier, Yowie submitted that the section 249F decision was made “by parties who ought to have been prohibited insiders pursuant to GN19.”

- We note in passing that the definition of a ‘participating insider’ is directed at an insider (here, presumably a target director) gaining something from the bidder or being in a relationship with the bidder.30 The policy concerns (among other things) ensuring that the target board is free from influence or the appearance of influence from persons with a relationship with the bidder.

- In Strategic Minerals, the Panel said:

“We consider that transactions involving insiders require an increased sensitivity and vigilance (including by advisers) to ensure that conflicts are avoided, full disclosure of all material information is made and consideration by the target board and management of their response, is undertaken free from any actual influence (or appearance of influence), from participating insiders.”31

- Yowie submitted that the nominee directors of WAM on the board of Keybridge were participating insiders in relation to Yowie’s Proposed Bid, by virtue of WAM’s investment in Yowie of a relevant interest of 81.17%. It submitted that “If Yowie is successful in its bid, the WAM directors will be displaced and inevitably their loan (which was entered into after the bid intention was announced) will likely go into default. This presents WAM with an inevitable conflict.”

- This appears to have been put forward to establish that there would be no available directors of Keybridge (perhaps other than Mr Catalano) to respond to the Proposed Bid, and for that reason as well the frustrating action should be put to Keybridge’s shareholders for vote. But we have decided that there is no frustrating action giving rise to unacceptable circumstances, and hence no need for a vote.

- Yowie also submitted that WAM was “the competing bidder to Yowie for Keybridge”, given WAM’s finance. Accordingly, it submitted that “WAM nominee directors are hopelessly conflicted and it cannot be appropriate for WAM nominee directors to be opining on a competing bid.”

- Keybridge in rebuttals submitted that the loan documents were negotiated by Mr Catalano and Mr Ravell for Keybridge, who are independent of the Wilson Asset Management Group, although the submission acknowledged a previous possible “technical association” of Mr Ravell that has since been ended.

- Nonetheless, in its submission, Keybridge said “… the [Proposed Bid] is not a genuine bid. In the event the [Proposed Bid] (or any other bid) were genuinely to be made, for such time as WAM was providing funding to Keybridge including conditions on board composition it would be appropriate for Keybridge to establish an independent board committee to respond to any genuine takeover bid.”

Decision

- In short, even if some or all Keybridge’s actions were frustrating actions, we consider that they do not give rise to unacceptable circumstances.

- For the reasons above, we declined to make a declaration of unacceptable circumstances. We consider that it is not against the public interest to decline to make a declaration and we had regard to the matters in s657A(3).

- Given that we make no declaration, we make no final orders, including as to costs.

Post‑script

- On 30 June 2025, Yowie announced that following the Section 249F Meeting on 27 June 2025, the Yowie board comprises Messrs Wilson, Hamilton, McCathie, Catalano and Ravell.

- On 10 July 2025, Yowie announced that it will not proceed with despatch of offers and the Bidder’s Statement in relation to the Proposed Bid, stating that following the outcome of the Section 249F Meeting, the “no change to Yowie Board composition” condition to the bid had been triggered and that it is not in Yowie’s interest to proceed with the bid.

Teresa Dyson

President of the sitting Panel

Decision dated 13 June 2025

Reasons given to parties 31 July 2025

Reasons published 7 August 2025

Advisers

| Party | Advisers |

|---|---|

| Keybridge | Mills Oakley |

| Yowie | Minter Ellison and KCL Law |

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth) and all terms used in Chapter 6, 6A or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 As at 23 May 2025, being the date of the application

3 The resolutions called for the removal of Messrs Bolton, Patton, Catalano and Dukes and the appointment of Messrs Wilson, McCathie, Hamilton and Ravell

4 In the matter of Keybridge Capital Limited [2025] NSWSC 240

5 Mr Catalano had been appointed by a separate process

6 Under section 203D, a person gives 2 months’ notice to a company of the intention to remove a director at the next general meeting

7 Bolton v WAM Active Ltd (No 2) [2025] NSWCA 99

8 The numbering of the conditions is as per Yowie’s announcement on ASX on 9 May 2025

9 Keybridge disputed Yowie’s purported postponement of the section 249F meeting until 14 July 2025 and applied to the NSW Supreme Court seeking orders in relation to the purported postponement. Since making our decision, but before publishing these reasons, the Court declared the postponement to be invalid: In the matter of Yowie Group Ltd [2025] NSWSC 648

10 ASIC Regulations, Regulation 20

11 Guidance Note 12 – Frustrating Action at [3] (footnotes omitted)

12 [2001] ATP 14

13 It also submitted that the notices were issued by “certain directors” rather than Keybridge itself. We do not need to explore this further

14 Guidance Note 19 – Insider Participation in Control Transactions deals with insider participation in a bid. Yowie submitted that the terms of WAM’s financing arrangement with Keybridge made the directors insiders

15 After we had informed the parties of our decision on 17 June 2025, the NSW Supreme Court on 20 June 2025 declared that Keybridge’s section 249F notice was valid, that the purported postponement of the meeting to 14 July 2025 by the Incumbent Directors was invalid, and ordered that an independent person chair the meeting to be held on 27 June 2025: In the matter of Yowie Group Ltd [2025] NSWSC 648

16 GN 12 – Frustrating Action at [12]

17 [2017] ATP 22

18 Molopo Energy Limited 09 [2017] ATP 22 at [26]

19 If we had been minded to make a declaration of unacceptable circumstances, this submission may have become relevant in considering whether it was not against the public interest to make such a declaration.

20 Guidance Note 12 – Frustrating Action at [12]

21 Yowie submitted that it “reserves its right to make a separate application in relation to this frustrating action unless the Panel wishes to hear it as part of these proceedings.” We are doing so

22 This issue has since been overtaken by the decision of Black J in the NSW Supreme Court on 20 June 2025: In the matter of Yowie Group Ltd [2025] NSWSC 648

23 Listing Rule 10.1 concerns the acquisition, or disposal, of a substantial asset to, or from, a related entity etc

24 See Keybridge Capital Limited, ‘Take no action – takeover bid from Yowie Group’ (ASX Announcement, 16 May 2025)

25 Yowie submitted that, for this too, it “reserves its right to make a separate application in relation to this frustrating action unless the Panel wishes to hear it as part of these proceedings.” We are doing so

26 Yowie submitted that, for this too, it “reserves its right to make a separate application in relation to this frustrating action and unacceptable circumstances unless the Panel wishes to hear it as part of these proceedings.” We are doing so

27 Listing Rule 11.1 (proposed change to nature or scale of activities and Listing Rule 11.2 (change involving main undertaking)

28 In fact, condition 2.9(a) of the bidder’s statement is a 35% minimum acceptance condition: see announcement by Yowie dated 13 June 2025 released on ASX

29 Austock Group Limited [2012] ATP 12 at [30]. See also Resource Pacific Holdings Limited [2007] ATP 26 at [23]

30 Guidance Note 19 – Insider Participation in Control Transactions at [8]

31 Strategic Minerals Corporation NL [2018] ATP 2 at [68]