[2019] ATP 27

Catchwords:

Decline to conduct proceedings – announcement of bid – intention statement – association – general meeting – collateral benefits

Corporations Act 2001 (Cth), sections 249F, 606, 631(1), 633, 659B, 670F, 671B

Bentley Capital Limited v Keybridge Capital Limited [2019] FCA 1675, Flinders Diamonds Ltd v Tiger International Resources Ltd & Ors [2004] SASC 119, Elders IXL Ltd v NCSC [1987] VR 1

Guidance Note 23 – Shareholder Intention Statements

Keybridge Capital Limited 02 [2019] ATP 19, Resource Generation Limited [2015] ATP 12, IFS Construction Services Limited [2012] ATP 15, Austock Group Limited [2012] ATP 12, TheChairmen1 Pty Ltd and Guildford Coal Limited [2010] ATP 10, Regis Resources Limited [2009] ATP 7, GoldLink IncomePlus Limited 04 [2009] ATP 2, SSH Medical Limited [2003] ATP 43

Procedural Rules, rule 6.1.1| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Yasmin Allen, Richard Hunt (sitting President) and Kerry Morrow, declined to conduct proceedings on an application by Mr John Patton in relation to the affairs of Keybridge Capital Limited. The application concerned whether an announced intention to bid for Keybridge Capital Limited by WAM Active Limited, that had not proceeded, resulted in a contravention of section 6311, whether Bentley Capital Limited’s acceptance intention statement for the bid indicated an association with parties connected to WAM Active Limited in contravention of section 606, and a consequent contravention of section 671B, and whether in any event the circumstances surrounding the conduct of an extraordinary general meeting of Keybridge Capital Limited and the voting at that meeting gave rise to unacceptable circumstances. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Applicant

- Mr John Patton

- ASG

- Australian Style Group Pty Ltd

- Bentley

- Bentley Capital Limited

- Keybridge

- Keybridge Capital Limited

- WAM Active

- WAM Active Limited

- Wilson parties

- Wilson Asset Management (International) Pty Limited and its associated entities, including WAM Active

Facts

- Keybridge is an ASX listed company (ASX code: KBC).

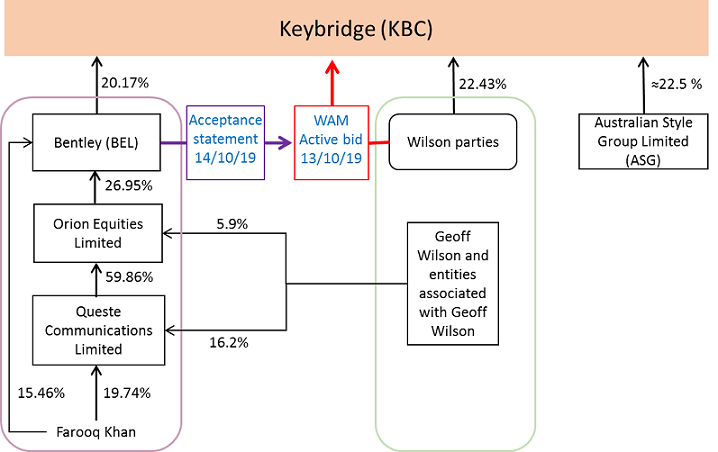

- Bentley is an ASX listed company (ASX code: BEL). Bentley holds approximately 20% of the shares in Keybridge.

- The Wilson parties hold approximately 22% of the shares in Keybridge.

- ASG holds approximately 22.5% of the shares in Keybridge.

- A diagram of the parties’ relationships is as follows.

- On 28 June 2019, WAM Active announced an intention to make a bid for Keybridge. It subsequently announced the withdrawal of its intention due to defeating conditions having been triggered.

- On Saturday, 12 October 2019, Keybridge directors were advised of a board meeting to be held on Sunday, 13 October 2019 at 2:00pm. The Keybridge directors at that time were Messrs Jeremy Kriewaldt and John Patton representing ASG and Messrs William Johnson and Simon Cato representing Bentley. The agenda included for consideration the potential appointment of new directors to the Keybridge board.

- On Sunday, 13 October 2019 at 12:28pm, Keybridge received a letter from WAM Active regarding its intention to make a bid for all the issued shares in Keybridge at 6.9 cents per share (subject to conditions). The letter was lodged with the ASX announcements platform that day but only released on ASX on Monday, 14 October 2019 at 8:51am.2

- On 14 October 2019, at 10:11am, Bentley announced that it intended to accept WAM Active’s proposed bid at 6.9 cents per share at least 21 days after offers opened, subject to there being no superior proposal.

- Also on 14 October 2019, Keybridge held two extraordinary general meetings3 under section 249F:

- at 10:00am as convened by ASG, to consider the removal of Messrs Johnson and Cato as directors. The resolutions were not carried. However, at the meeting certain proxies were disallowed because the chairman of the meeting had been informed that powers of attorney under which those proxies were purportedly signed had not been received by Keybridge and

- at 12 noon as convened by Bentley, to consider the removal of Messrs Patton and Kriewaldt as directors and the re-election of Messrs Johnson and Cato. It was further adjourned by Mr Patton.

- Also on 14 October 2019, at 6:25pm, Keybridge announced on ASX that it had appointed Nicholas Bolton, Keybridge’s CEO, to the board as Managing Director, and Richard Dukes as a director. Keybridge also announced that Mr Patton had been appointed interim company secretary to replace Victor Ho as company secretary. These appointments were made at the board meeting held the day before. The announcement also advised shareholders to take no action at that stage in relation to WAM Active’s proposed bid.

- On 28 October 2019, Bentley announced that it had withdrawn the adjourned section 249F meeting it had called and convened. Keybridge subsequently cancelled the meeting.

- On 29 November 2019, Keybridge adjourned its annual general meeting to 21 January 2020. Among the business to be transacted is the re-election of Messrs Patton, Kriewaldt and Dukes as directors.

- As at 5 December 2019, no bidder’s statement from WAM Active had been received by Keybridge.

- On 13 December 2019, after the date of the application, WAM Active announced the withdrawal of its proposed bid at 6.9 cents per share because defeating conditions had been triggered. It further announced an intention to make a new bid for all the shares in Keybridge at 6.5 cents per share, subject to conditions.

- Also on 13 December 2019, WAM Active lodged with ASIC a bidder’s statement for the bid at 6.5 cents per share and released the bidder’s statement on ASX. The bid is subject to conditions, including a 50.1% acceptance condition.

- On 16 December 2019, Bentley confirmed that it still desired to sell its Keybridge shares at 6.9 cents per share and would review the new bid at 6.5 cents per share before confirming its intentions in relation to the new lower offer.

Application

Declaration sought

- By application dated 5 December 2019, the Applicant sought a declaration of unacceptable circumstances. He submitted (among other things) that:

- absent a defence under section 670F, or modification by ASIC, WAM Active had contravened section 631(1) because offers not substantially less favourable than those announced (at 6.9 cents per share) could not be made within two months of the announcement WAM Active had made

- Bentley’s announcement of its intention to accept WAM Active’s proposed bid (at 6.9 cents per share), although in apparently acceptable form, was unacceptable “when properly analysed” because it:

- conferred a relevant interest in Bentley’s shares on the bidder

- created associations in contravention of chapter 6 or

- otherwise gave rise to unacceptable circumstances

- Bentley’s announcement, because of the above, also gave rise to a contravention of section 671B and

- by a “tricky” arrangement, the voting of shares at Keybridge’s general meeting was “influenced to achieve collateral advantages for [Wilson parties] and [Bentley] and at the expense of the genuine pursuit of the relevant shareholders views (sic) of the correct outcome for [Keybridge] of the matters before those general meetings”, giving rise to unacceptable circumstances.

- The Applicant submitted that the effect of the circumstances was that:

… the true position of the interest and control of [Wilson parties] and [Bentley] in [Keybridge] is not disclosed to the market, it appears that the [Wilson parties] and [Bentley] have been acting in concert in a way that confers on each of them a relevant interest in the other’s [Keybridge] shares in relation to the composition of the [Keybridge] board and the [WAM Active] Proposed Bid in breach of s.606, providing an impermissible springboard for [WAM Active] should it wish to proceed with the [WAM Active] Proposed Bid.

Interim orders sought

- The Applicant sought interim orders pending determination of his application preventing the disposal and voting of Keybridge shares held by the Wilson parties and by parties connected to Bentley.

- In view of our decision, we did not need to make interim orders.

Final orders sought

- The Applicant sought final orders that:

- a certain number of Keybridge shares be vested in ASIC for sale so that the combined holding of the Wilson parties and Bentley would not exceed 19.99% and

- the Wilson parties and Bentley (and their respective associates) not acquire further Keybridge shares until the later of 6 months after the vesting of, or disposal of, the vested shares.

Discussion

Section 631

- Section 631(1) provides:

A person contravenes this subsection if:

- either alone or with other persons, the person publicly proposes to make a takeover bid for securities in a company; and

- the person does not make offers for the securities under a takeover bid within 2 months after the proposal.

The terms and conditions of the bid must be the same as or not substantially less favourable than those in the public proposal.

- The Applicant submitted that, to comply with section 633 step 6, a bidder’s statement must be lodged with ASIC and sent to the target at least 14 days before the end of the two month period. In respect of the bid at 6.9 cents per share this requirement, he submitted, could not be met. Therefore “section 631(1) will clearly be contravened” because “there is no apparent basis for [WAM Active] to establish a defence under section 670F”. The Applicant submitted in effect that an inference can be drawn about the lack of a defence from the lack of any announcement regarding the proposed bid.

- Section 670F provides:

A person does not commit an offence under subsection 631(1) … if the person proves that they could not reasonably have been expected to comply … because:

- at the time of the proposal or announcement, circumstances existed that the person did not know of and could not reasonably have been expected to know of; or

- after the proposal or announcement, a change in circumstances occurred that was not caused, directly or indirectly, by the person.

- The Applicant further submitted that:

- Keybridge wrote to WAM Active on 20 November 2019 seeking clarification of WAM Active’s intention as defeating conditions had been triggered, but received an equivocal response and

- “the history of the Wilson Parties announcing proposed takeover bids and then not following through with them is suggestive”.

- WAM Active, in preliminary submissions, submitted that its proposed bid at 6.9 cents per share was made subject to multiple conditions, a number of which Keybridge had since breached,4 and WAM Active was entitled to withdraw its proposed bid. It further submitted that in any event it had applied to ASIC to extend the two month time limit under section 631(1).

- Therefore, WAM Active submitted, “The Application provides no basis for the Panel to declare unacceptable circumstances. The Application contains little more than unsubstantiated assertions, including the Applicant’s assumptions and interpretation of events that the Applicant believes to be ‘suggestive’”.

- Bentley did not make any preliminary submission in respect of the ‘alleged contravention’ of section 631 except to say that if the Panel conducted proceedings on it, the Panel should nevertheless not conduct on the alleged association (because the Applicant failed to demonstrate sufficient probative material) and therefore should exclude Bentley from any such proceedings.

- Keybridge did not make any submission on the allegation in respect of section 631.

- A contravention of section 631 is a serious matter.5 Here, the allegation in respect of section 631 is that it will be breached. This is premature, but in any event the application has since been superseded by events. WAM Active announced the withdrawal of the proposed bid at 6.9 cents per share due to the triggering of defeating conditions. It also announced a new bid at 6.5 cents per share. Whether or not a defence is available under section 670F for the proposed bid at 6.9 cents per share is a matter for ASIC. We make no comment on whether WAM Active can rely on the defence under section 670F in relation to that bid.

- We decline to conduct proceedings on this issue.

Association or relevant interest

- The Applicant submitted that WAM Active and Bentley were associated such that there was a contravention of section 606.6 He submitted that Bentley’s statement of its intention to accept WAM Active’s proposed bid created a relevant interest for WAM Active in the shares Bentley held in Keybridge. He submitted that we should be prepared to draw an inference of an agreement, arrangement or understanding of voting support in Keybridge by parties connected to WAM Active in exchange for bid support by Bentley. This inference, he submitted, was justified from the following features (in summary):

- conversations about Bentley exiting its investment in Keybridge

- the timing of WAM Active’s proposed 6.9 cents per share bid, being the Sunday before Keybridge held the section 249F meetings on the Monday

- the circumstances surrounding the replacement of Mr Ho as company secretary

- the timing of Bentley’s acceptance intention statement, despite the usual steps involved in considering an appropriate response to a bid and that a response was not required so quickly and

- the lack of a public explanation of Bentley’s reasons for offering the acceptance intention statement.

- The Applicant submitted that these features suggested “a significant degree of coordination”.

- In addition, the Applicant submitted that, at the EGM convened by ASG, the chairman upheld an objection from Bentley to accept certain custodian proxies as valid7 in circumstances where Bentley’s representatives8 were presumed to have known and did not inform the chairman that Keybridge’s register held valid powers of attorney. The Applicant submitted that the excluded proxies were directed in favour of removing Messrs Cato and Johnson and the resolutions were lost by a margin less than the number of votes excluded. He submitted that the Wilson parties’ representative at the meeting was aware of the position that the Bentley representatives were putting to the chairman.

- Keybridge made a preliminary submission. We might have expected that Keybridge itself would have made the application given the issues raised, rather than the Applicant who is the chairman of Keybridge and whose lawyer is also a director of Keybridge. However, we are also mindful of the long-running division between board members in Keybridge and note that Keybridge is separately represented here.

- Keybridge submitted that the Panel should conduct proceedings having regard to the strength of the preliminary evidence contained in the application.

- It submitted that the timing of Bentley’s intention to accept (within 80 minutes of WAM Active’s announcement) created an inference of a pre-existing agreement, arrangement or understanding between WAM Active and Bentley, which could be explored in proceedings.

- It also submitted that Mr Johnson had emailed the Keybridge board at 11:36am on Monday, 14 October 2019 indicating that he was aware of the Wilson parties’ voting intentions at the EGM of Keybridge that had been convened by Bentley. Moreover, Keybridge submitted that the votes of the Wilson parties and Bentley aligned at that meeting. This created an inference of a pre-existing agreement, arrangement or understanding between the Wilson parties and Bentley.

- Lastly, it submitted that Mr Johnson sought to influence Keybridge’s vote to align with the voting of the Wilson parties in another (unrelated) matter concerning removal of the responsible entity in HHY Fund, despite this not being in Keybridge's best interests. This “demonstrated” an association between the Wilson parties and Bentley.

- Bentley submitted that, while the Panel may find an association by inferring a state of affairs from all the circumstances, “… such a finding must be truly available and not the product of mere suspicion or prejudice”.9 Bentley denied that it is part of any association with the Wilson parties and submitted that the Applicant had failed to provide sufficient probative material to justify the Panel conducting proceedings. It submitted that the Applicant had, instead, relied on “mere speculation”.

- Panel Guidance on intention statements is found in Guidance Note 23:10

[9] In examining a shareholder intention statement, the Panel is concerned with whether the statement has an effect that precludes, or might preclude, the opportunity for a competing proposal. For example, a shareholder intention statement could potentially create a relevant interest in the shares the subject of the statement or support an inference of association which might contravene the Act and undermine the policy of Chapter 6. If it did, it would likely give rise to unacceptable circumstances.

[10] In considering whether the terms of a shareholder intention statement gives rise to unacceptable circumstances, the Panel is guided by the following:

Time before acceptance

- If the statement is qualified by reference to a time before which it will not be acted on, it is likely to give rise to unacceptable circumstances if the shareholder acts before that time has passed.

Aggregation with bidder’s shareholding

- If a statement is given without the qualification that it is subject to no superior offer emerging (or words to that effect), it is likely to give rise to unacceptable circumstances if given before the offer period is open and the shares the subject of the statement would, if aggregated with the bidder’s shareholding and any other shares the subject of similar statements, increase the bidder’s shareholding beyond the 20% threshold.

Superior proposal

- If a statement is qualified by reference to a superior proposal, it is likely to give rise to unacceptable circumstances if the shareholder accepts before allowing a reasonable time to pass for a superior proposal to emerge. The Panel considers that this is implied by the statement. The amount of time required will depend on the circumstances, but generally the Panel will consider a reasonable time to be 21 days after the offer has opened.

- Bentley’s intention statement met these guidelines and there is no evidence that it was not intending to comply with the qualifications. (We note in passing that, to date, Bentley has not made a statement of intention to accept the 6.5 cents per share bid.)

- The Applicant sought to address the difficulty that Bentley’s intention statement met the guidelines by submitting “It appears to Mr Patton that the [Bentley] Acceptance Announcement seeks to follow the form of an announcement of the kind which GN 23 suggests is innocuous, but which in fact when properly analysed demonstrates the substance of contravening or unacceptable circumstances.”

- We do not agree. We do not consider that sufficient probative material has been provided that would lead us to infer the existence of an arrangement between the Wilson parties and Bentley in the circumstances. We do not consider it likely that we would find the issuance of the shareholder intention statement unacceptable. The statement does not in itself give rise to an association and was in line with the Panel’s guidance.

- We accept that there appears to be a degree of coordination in the timing of the intention statement, but this does not necessarily support an inference of association. Potential bidders may well sound out major shareholders ahead of making a bid. Indeed, Bentley submitted that the previous disputes regarding Keybridge led it to want to avail itself of the opportunity to sell its Keybridge shares.

- The Panel previously noted in Keybridge Capital Limited 02: 11

It appears that the largest shareholders of Keybridge have significant differences and the board of Keybridge has not been able to operate effectively for up to two months. This has been recognised by major shareholders who have convened general meetings to consider conflicting board spill resolutions. It appears that there may be an impasse that can only be resolved by the Shareholder Meetings and/or court proceedings. The matters that fall within the Panel's jurisdiction appear to be relatively peripheral to the main dispute.

- Bentley submitted that the application was “tactical and designed to frustrate the proper operation of [Keybridge’s] AGM by preventing [Bentley] and the Wilson Parties from voting in circumstances where the Applicant’s position on the Keybridge board following the [Keybridge] AGM is far from certain.”

- We make no comment on the Applicant’s purpose, but agree with the sitting Panel in Keybridge Capital Limited 02 that at least some of the matters alleged in the application appear to be peripheral to the main dispute.

- Even if there was any arrangement between the Wilson parties and Bentley, there is no material to suggest that the arrangement continues to exist (noting that the circumstances relied on by the Applicant occurred in mid-October and the acceptance statement has been superseded by events).

- In short, we agree with Bentley’s submission that “the evidence submitted is not of sufficient probative value to warrant conducting proceedings”. We decline to conduct proceedings on the issue of association, and it follows that we decline to conduct proceedings on the alleged contravention of section 671B.12

Unacceptable circumstances generally

- The Applicant submitted that, regardless of any contravention of sections 606, 631 and 671B, “the circumstances are fundamentally unacceptable”. He submitted that by a “tricky” arrangement the voting of shares at the general meeting of Keybridge was influenced to achieve collateral advantages for the Wilson parties and Bentley.

- The Applicant submitted that the meeting “is not of itself part of [the unacceptable] circumstances but rather the occasion on which the unacceptability is demonstrated to have occurred” and therefore, in effect, was not outside the Panel’s jurisdiction.13 He submitted that “[a] series of apparently ordinary and conventional steps, holding meetings, requiring proxies to be supported by powers of attorney where relevant, announcing of takeover bids and of attitudes to takeover bids have occurred in a way which is not supported by commercial logic then their influence on a particular general meeting is considered. It is, however, unacceptable that ‘secret deals’ of this kind are made and not made public to the shareholders generally and that takeovers are announced as “cover” for what would otherwise be clearly unacceptable arrangements.”

- Further, the Applicant submitted that the structural links between the Wilson parties, Bentley and their associates (see paragraph 7 above), as well as conversations between Messrs Bolton and Khan regarding certain assets of Keybridge, suggested that:

- there “may well be an arrangement for the provision of an impermissible” collateral benefit under the proposed bid

- the making of the intention statement “may have itself required shareholder approval under ASX Listing Rule 10.1” and

- the proposed bid announcement and the intention statement do not disclose all relevant information.

- Each of the issues above has been superseded by events. And in any event, absent an association other evidence is required to establish collateral benefit or relationships under ASX Listing Rule 10.1 (an ASX issue in any event) or non-disclosure, and none was provided.

Orders sought by the Applicant

- One of the factors the Panel takes into account when deciding whether to conduct proceedings is the remedies available.14

- The Applicant sought an order vesting shares so that the combined holdings of the Wilson parties and Bentley did not exceed 20%.

- In this case, even if we were to find unacceptable circumstances, we do not consider it likely that we would make a vesting order or an acquisition restriction order as requested by the Applicant. One reason is that, even if a relevant agreement was entered into, there was no acquisition of shares. In our view, the requested orders were, in the words of the Panel in Regis Resources Limited, “disproportionate and would not help remedy the unacceptable circumstances”.15

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- If circumstances change such as to potentially give rise to unacceptable circumstances, a new application can always be made. Alternatively the Applicant can take appropriate action in court, subject to section 659B.16

Orders

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders, including as to costs.

Richard Hunt

President of the sitting Panel

Decision dated 17 December 2019

Reasons given to parties 21 January 2020

Reasons published 23 January 2020

Advisers

| Party | Advisers |

|---|---|

| Applicant | Jeremy Kriewaldt Lawyers |

| Bentley | Squire Patton Boggs |

| Keybridge | Baker McKenzie |

| WAM Active | Mont Lawyers |

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 A further short announcement of its intention was released by WAM Active on 15 October 2019

3 Each of the EGMs had been postponed by consent, due to a disagreement over who chaired Keybridge. See Bentley Capital Limited v Keybridge Capital Limited [2019] FCA 1675

4 For example, the reported unaudited after-tax net asset backing (NTA) of Keybridge not declining by 5% or more from its reported NTA at 31 August 2019

5 SSH Medical Limited [2003] ATP 43 at [40]-[42]; Austock Group Limited [2012] ATP 12 at [59]

6 Essentially a person must not acquire a relevant interest in issued voting shares in a company if, because of the transaction, that person’s or someone else’s voting power increases above 20%

7 See paragraph 12(a)

8 Mr Cato is the chairman of Advanced Share Registry, Keybridge’s share registrar, and Mr Ho, a Bentley representative, was Keybridge’s company secretary at the time

9 Elders IXL Ltd v NCSC [1987] VR 1 per Marks J

10 Guidance Note 23 - Shareholder Intention Statements, First issue, 11 December 2015 at [9]-[10], footnotes omitted

11 Keybridge Capital Limited 02 [2019] ATP 19 at [16(a)]

12 TheChairmen1 Pty Ltd and Guildford Coal Limited [2010] ATP 10 at [33]

13 We note that the Panel has previously found that meetings taking place in the context of proposed bids can raise issues that the Panel may address. See IFS Construction Services Limited [2012] ATP 15 at [25]-[26]

14 Procedural Rules, rule 6.1.1 note 2

15 Regis Resources Limited [2009] ATP 7 at [25]. See also Flinders Diamonds Ltd v Tiger International Resources Ltd & Ors [2004] SASC 119 at [66] where the Full Court regarded vesting and voting restrictions ordered at first instance as warranting its intervention because “The order went beyond what was reasonably necessary to remedy the contravention of the Act given the range of alternative remedies which might be available to the Court either generally or by way of available remedial orders contemplated by s 1325A of the Corporations Act.”

16 Noting as in GoldLink IncomePlus Limited 04 [2009] ATP 2 at [53] that even with alternative remedies available, the Panel must “still consider whether or not unacceptable circumstances exist”