[2025] ATP 32

Catchwords:

Decline to make a declaration – association – conference – substantial holding – board spill – interim order – legal privilege

Corporations Act 2001 (Cth), sections 9, 12, 12(2)(b), 12(2)(c), 16(1), 53, 203D, 249D, 249P, 602, 606, 657B, 671B, 708A

Corporations Regulation 2001 (Cth), regulation 1.0.18

Australia Securities and Investments Commission Act 2001 (Cth), section 192

Australian Securities and Investments Commission Regulations 2001, regulation 18(1)

Takeovers Panel Procedural Rules 2020, rule 11(2)

Guidance Note 4 – Remedies General

Aurora Funds Management Limited v Australian Government Takeovers Panel [2020] FCA 496, Asahi Holdings (Australia) Pty Ltd v Pacific Equity Partners Pty Limited (No 4) [2014] FCA 796, Adsteam Building Industries Pty Ltd & Anor v The Queensland Cement and Lime Co Ltd & Ors (1984) 14 ACLR 456

Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, Viento Group Limited [2011] ATP 1, CMI Limited [2011] ATP 4, World Oil Resources Limited [2013] ATP 1, CMI Limited 01R [2011] ATP 5, Mount Gibson Iron Limited [2008] ATP 4, Winepros Limited [2002] ATP 18

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| YES | NO | YES | NO | NO | NO |

Introduction

- The Panel, Tonianne Dwyer, Diana Nicholson (sitting President) and Karen Phin, declined to make a declaration of unacceptable circumstances in relation to the affairs of Bryah Resources Limited. The application concerned an alleged association between certain shareholders following a placement and a subsequent section 249D notice to change the board of Bryah. The Panel was not satisfied that there was sufficient material to enable the drawing of inferences of association such that the circumstances were unacceptable.

- In these reasons, the following definitions apply.

- 888

- 888 (Aust) Pty Ltd, a company controlled by Mr Flynn Huang, an executive director of GBA

- AFSL

- Australian Financial Services Licence

- Alleged Associates

- Mr Yonglu Yu, 888, Mr Joshua Duff, Mr Cedric Koh, Swanside, Ms Lin Zhu, Ms Chunyan Niu, Vera Fides, Safinia, Mr Timothy Morrison, Scintilla, Mr Tangnian Yuan, Mr Patrick Kok and Mr Antanas Guoga1

- Application

- Bryah’s application to the Panel dated 9 July 2025

- Bryah

- Bryah Resources Limited

- Bryah GM

- The section 249D meeting of Bryah’s shareholders held on 29 July 2025

- GBA

- GBA Capital Pty Ltd

- Placement

- The placement of shares by Bryah in two tranches, on 11 February 2025 and 7 April 2025

- Placees

- means the individuals or entities who were allocated Bryah shares under the Placement

- Safinia

- Safinia Pty Ltd, a company controlled by Mr Nick Katounas

- Scintilla

- Scintilla Strategic Investments Limited, whose directors include Mr Kim Muller, Mr Craig Chapman and Mr Andre Marschke

- Swanside

- Swanside Investments Pty Ltd, a company controlled by Mr Martin Nguyen

- Tranche One

- has the meaning in paragraph 8(a)

- Tranche Two

- has the meaning in paragraph 8(b)

- Trigg Minerals

- Trigg Minerals Limited

- Vera Fides

- Vera Fides Holdings Pty Ltd, a company controlled by Mr Ming Shing Loo

Facts

- Bryah is a WA based mining and exploration company listed on ASX (ASX: BYH).

- The directors of Bryah are Mr Ian Stuart, Mr Ashley Jones, formerly the CEO,2 and Mr Leslie Ingraham.

- GBA is an Australian investment and advisory firm. It is a Corporate Authorised Representative under an AFSL held by GBA Capital Holdings Pty Limited.

- On 29 January 2025, Bryah entered a “lead manager engagement” with GBA for the purpose of raising up to $1 million of capital in two tranches. The fully paid ordinary placement shares were to be issued to sophisticated and professional investors at $0.003 per share, with a free attaching option.

- Clause 4.1 of the lead manager engagement stated that GBA would allocate the securities in consultation with Bryah. Clause 4.2 stated that GBA may take into account (in effect) bidders and demand levels “to facilitate a successful transaction that promotes a supportive and liquid after‑market”. Clause 4.3 stated that GBA, its directors, officers and employees may participate in the placement “subject to this clause 4”.

- GBA completed the placement as follows:

- On 20 May 2025, Bryah shares were suspended pending the announcement of a major acquisition. There followed an announcement of the acquisition of a Canadian mineral claim.

- On 21 May 2025, the shares were reinstated to trading.

- On 25 May 2025, one of GBA’s Placees, Mr Yonglu Yu, emailed the directors of Bryah to ask whether the company needed to raise cash for short term obligations.

- On 26 May 2025, Mr Stuart replied “The company does not need to raise cash for short term obligations. We are still in the Due Diligence phase with the Canadian proposed acquisition.” The “not in the short term” wording in response to Mr Yu’s email was suggested by Mr Flynn Huang (an executive director at GBA) in a phone call between Mr Huang, Mr Stuart and Mr Jones.

- On 27 May 2025, Mr Huang sent a WhatsApp message to Mr Jones asking for a call with the Bryah directors.

- Also on 27 May 2025, Mr Yu lodged a section 203D5 notice with Bryah of his intention to move resolutions at the next general meeting of Bryah to remove all three directors of Bryah.

- On 28 May 2025, Mr Cedric Koh, a trader at GBA, sent Bryah a Form 603 on behalf of Mr Yu showing that Mr Yu had voting power in 102,965,235 shares representing 11.84%. No associates were included in the form. The PDF of the Form 603 included comments which indicated that Mr Sebastian Jurd, founder and managing director of GBA, had some involvement in the creation of the document.

- On 29 May 2025, Mr Yu lodged a section 249D notice with Bryah seeking the removal of two directors, Messrs Ingraham and Stuart, and the appointment of two new directors, Mr Nicholas Katris and Mr Bishoy Habib. Bryah released the notice on ASX on 2 June 2025.

- On 30 May 2025, Mr Yu gave Bryah a statement for distribution to members under section 249P. Included were the following reasons (in effect) for issuing the section 249D notice:

- Since listing in 2017, Bryah’s share price had fallen 98%

- Lack of updates to shareholders on the company’s drilling results and

- The proposed directors had mining experience and had demonstrated success at Trigg Minerals.

- On 19 June 2025, Bryah released on ASX the notice of meeting for the section 249D meeting which was scheduled to be held on 29 July 2025. The notice did not include resolutions for the appointment of Messrs Katris and Habib. It included only resolutions to remove Messrs Stuart and Ingraham, which the directors of Bryah recommended shareholders vote against.

- On 20 June 2025, Mr Yu emailed the directors of Bryah enclosing a letter regarding non‑compliance with section 249D and consents to act as directors from Messrs Katris and Habib.

- On 24 June 2025, Mr Yu sent another letter to the directors of Bryah stating that section 249D had not been complied with.

- On 3 July 2025, Bryah announced on the ASX that a subsidiary of Bryah had agreed to acquire a mineral royalty over various mining tenements held by Bryah (unrelated to the Canadian mineral claim acquisition referred to in paragraph 9), in consideration for the issue of 100,000,000 Bryah shares.

- On 9 July 2025, Bryah lodged the Panel application.

- On 29 July 2025, following the section 249D meeting, Bryah announced on ASX that the resolutions to remove Messrs Stuart and Ingraham were not carried6.

- Following lodgement of the section 249D notice with Bryah, some dealers at GBA, as well as some of GBA’s clients, bought and sold shares in Bryah.7

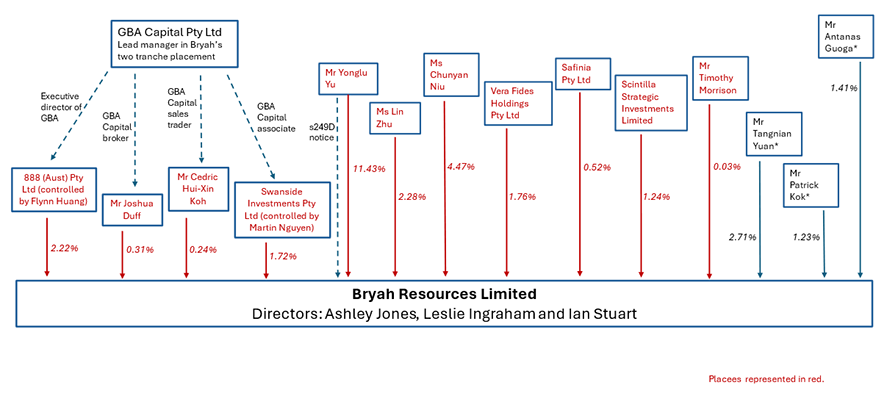

- The parties can be shown diagrammatically as follows, with their shareholdings in Bryah as at 11 July 2025:

Text description

The diagram illustrates the ownership structure of Bryah Resources Limited. It includes the key shareholders and their respective ownership percentages (as at 11 July 2025), such as Mr Yonglu Yu (11.43%), Ms Chunyan Niu (4.47%) and 888 (Aust) Pty Ltd (controlled by Mr Flynn Huang) (2.22%). It also lists the placees who participated in the two-tranche placement, which was led by GBA Capital Pty Ltd. The directors of Bryah are also listed: Ashley Jones, Leslie Ingraham and Ian Stuart.

Application

Declaration sought

- By application dated 9 July 2025, Bryah sought a declaration of unacceptable circumstances. It submitted:

“The conduct of GBA Capital and the Shareholders infringes the fundamental principles expressed in section 602 of the Corporations Act in that:

- They have formed an unlawful association to acquire voting power in more than 20% of Bryah.

- They have taken steps to take control of the Board of Bryah.

- No other shareholder of Bryah has had a reasonable and equal opportunity to participate in the attempted change of control.”

- It further submitted that:

- Mr Yu had breached the substantial holder provisions in relation to the timing and content of his initial substantial holder notice and

- the Alleged Associates had breached the substantial holder provisions by failing to disclose the effect of the association.

- Bryah submitted that sections 606 and 671B had been contravened.

Interim order sought

- Bryahsought an interim order restraining each of the Alleged Associates from acquiring any further securities in Bryah until further order.

Final orders sought

- Bryah sought final orders to the effect that:

- Bryah shares acquired in breach of section 606 be vested in ASIC for disposal, or alternatively shares acquired by the Alleged Associates since the date of the section 249D notice be vested in ASIC for disposal

- the Alleged Associates be restrained from exercising any voting rights in Bryah shares until their voting power collectively is no greater than 20%

- Mr Yu lodge a corrected notice of initial substantial holding and

- each of the Alleged Associates “give notice of their substantial holding in Bryah and their association giving rise to that substantial shareholding.”

Discussion

Preliminary submission

- Only Scintilla made preliminary submissions. It submitted that it was not part of any association and had been a long‑term shareholder. It submitted that when the shares were suspended, one of its directors contacted Mr Jones to express interest in participating in the placement. It submitted that it received only a portion of its application and had since been a seller of Bryah shares.

- Bryah submitted in response to our brief (below) that the evidence provided by Scintilla supported “an inference that Scintilla is not an associate of the other Alleged Associates.”

- Accordingly, we did not consider whether Scintilla was associated with any of the other shareholders referred to in the application.

Interim Orders

- On 28 July 2025, we met and considered the request for interim orders on an urgent basis.

- We decided to make an interim order after considering (among other things) the relevant factors8, the fact that the Bryah GM was to be held the next day and the unresolved allegations of association.

- Accordingly, we made interim orders requiring Bryah to keep a record of any votes cast on the resolutions to be considered at the Bryah GM in respect of the ordinary shares in Bryah held by each of the Alleged Associates and

- ensure copies of such voting records (being any voting card, proxy form or other document evidencing votes cast on the poll) are kept for 14 days following the date of the meeting and

- provide to us by 12.00pm (Melbourne time) on the day after the meeting the poll report for each resolution (see Annexure A).9

Decision to conduct proceedings

- Section 12 sets out the tests for association as applied to Chapter 6. There are two relevant tests here:

- section 12(2)(b) – which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company’s board or conduct of its affairs and

- section 12(2)(c) – which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company’s affairs.

- The “affairs” of a body corporate for the purposes of these tests include the matters listed in section 53.10

- A relevant agreement is an agreement, arrangement or understanding:

- whether formal or informal or partly formal and partly informal and

- whether written or oral or partly written and partly oral and

- whether or not having legal or equitable force and whether or not based on legal or equitable rights.11

- Section 16(1) provides that a person is not an associate of another by virtue of s12 “merely because of one or more” specified matters, including:

- one gives advice to the other, or acts on the other’s behalf, in the proper performance of the functions attaching to a professional capacity or a business relationship12;

…

- one gives advice to the other, or acts on the other’s behalf, in the proper performance of the functions attaching to a professional capacity or a business relationship12;

- As stated by the Panel in CMI Limited 01R,13 the cases make it clear that there is significant overlap between the concepts of “acting in concert” and “relevant agreement” in s12.

- An understanding means an understanding – “plainly a word of wide import”14 – as to some common purpose or object in relation to the company in question.

- Often establishing an association requires the Panel “to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association.”15

- The Panel is a specialist, peer review tribunal. When making an assessment of all the material in this matter, we have relied on our skills and experience as practitioners and as members of the sitting Panel.

- In Mount Gibson Iron Limited16, the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- We considered that the application raised elements of the above factors sufficiently to warrant further enquiries to establish whether an association exists here.

- For this reason, we decided to conduct proceedings and issue a brief.

Association

- Bryah submitted that, as at 3 July 2025, it had identified 15 shareholders – either employees of GBA, clients of GBA or shareholders who had common investments in other ASX‑listed entities – who together held 31.19% of Bryah.17

- It further submitted that, on 27 May 2025, Mr Huang told the Bryah board that he controlled 35% of Bryah and wanted to change control of the board. Mr Huang denied that he said he controlled 35% of Bryah.

- Bryah submitted that the following shareholders are employees of GBA or companies controlled by employees:

- 888, controlled by Mr Huang who is an Executive Director of GBA

- Joshua Duff, a GBA broker

- Cedric Koh, a GBA sales trader and

- Swanside, controlled by Mr Nguyen who is a GBA sales associate.

- Other than Mr Tangnian Yuan, Mr Patrick Kok and Mr Antanas Guoga, the other Alleged Associates were Placees.

- Bryah submitted that:

- the Alleged Associates had a shared goal or purpose in taking control of the Bryah board

- there was evidence of prior collaborative conduct in Trigg Minerals, Perpetual Resources Limited and Summit Minerals Limited

- there were structural links between GBA, Mr Yu and the other Alleged Associates

- there were common investments in other ASX‑listed entities held by many of the Alleged Associates

- the Alleged Associates had common knowledge of the section 249D notice and

- there was uncommercial trading, both in terms of trading volume and trading price, in the period between 2 June 2025 and 2 July 2025.

Brief

- A brief was issued on 22 July 2025 to the parties, namely Bryah and Mr Yu (and also to ASIC)18. Questions for non‑parties, namely GBA and the other Alleged Associates, were sent to them separately.

- Responses were received from Bryah, Mr Yu and Mr Timothy Morrison to the brief and from Mr Flynn Huang to the questions for non‑parties.

- Bryah noted, in addition to its response, that 9 of the Alleged Associates had lodged proxies for the Bryah GM directing the proxyholder to vote in favour of each resolution (that is, to remove the two directors).19

- Mr Yu submitted that he was not an associate of any of the other Alleged Associates in relation to Bryah. He submitted that he had no relationship or dealings with any of the other Alleged Associates, except Mr Huang, who was his broker. He submitted that he had no agreement, arrangement or understanding with Mr Huang regarding voting or controlling or influencing the board of Bryah and was not acting in concert with Mr Huang.

- Mr Yu submitted that he:

- “acquired Bryah shares following his participation in the February placement because, prior to delivery of the 249D notice, he wanted to increase his shareholding in Bryah from what was initially acquired under the placement” and

- “acquired Bryah shares via on market purchases to minimise the extent of the dilution of his voting rights…” since delivery of the 249D notice.

- Mr Yu also submitted that his only contact with any of the Alleged Associates was with Mr Huang, as his broker, in respect of:

- lodging his proxy

- the “Royalty Transaction”20 and

- “highly dilutive share issues” since the section 249D notice.

- Mr Yu also submitted that the preparation of the section 249D notice was undertaken by his lawyers, but he had consulted Mr Huang as his broker about it. He submitted that communications with his lawyers were “confidential and subject to legal professional privilege.”

- We say more about privilege below.

- We asked how he came to nominate Mr Katris and Mr Habib for election as directors of Bryah. Mr Yu submitted that he knew of them as a shareholder in Trigg Minerals and he had asked Mr Huang to contact them.

- We also asked about an Australian address he had provided in his substantial holding notice. He submitted that it was the home address of a friend, and as an overseas resident, he submitted, he used it as “a simple matter of convenience” for his Australian investments. The documents show that he has used various addresses.21 It is unclear why.

- We also asked why communications with Bryah went through GBA, rather than directly. Mr Yu submitted “In terms of Mr Huang’s communications with Bryah and its directors referred to in the Application, Mr Yu is an overseas resident and English [is] his second language, so he requested and authorised Mr Huang to discuss the s203D and s249D notices with the Bryah directors on his behalf in his capacity as Mr Yu’s broker with a view to negotiating changes to the Bryah board without the need to proceed to a requisitioned shareholder meeting. Mr Yu did not give any specific instructions or directions to Mr Huang in terms of the content of the discussions or negotiations with Bryah and its directors.”

- He added (among other things) “In terms of the statement which paragraph 6 of the Application alleges Mr Huang made regarding him controlling 35% of Bryah shares, Mr Yu was not privy to that conversation so cannot confirm or deny whether that statement was made, other than to confirm that Mr Huang does not control any Bryah shares held by Mr Yu.”

- Despite many opportunities to produce records, no documents evidencing the instructions given by Mr Yu to Mr Huang have been provided to us, either from Mr Yu or Mr Huang.

- And subsequently we learned that Mr Yu held Bryah shares in two accounts, one with CommSec and one with Morrisons, and his responses to us had addressed only one. Bryah submitted in rebuttals that “Mr Yu has again in this question failed to refer at all to any acquisitions of shares in relation to [his other holding].”

- In an out of process submission by email on 28 July 2025, which we agreed to receive, Steinepreis Paganin, legal advisers to Mr Yu, acknowledged that Mr Yu “inadvertently omitted any references” in his submission to certain trades that Bryah had identified in its rebuttals.

- Bryah also, in rebuttal submissions, queried how Mr Yu could acknowledge only a relationship with Mr Huang when he had dealings with Mr Kok22, who emailed Mr Yu’s Form 603 to Bryah, and with Mr Morrison as a shareholder in Trigg Minerals.

- Mr Huang submitted that:

- he did not remember the exact dates when he had a telephone conversation with the Bryah directors regarding Bryah, but had had phone conversations with them and

- he did not say he controlled 35% of Bryah shares, submitting “No, I did not say that. I definitely do not control 35% of the Bryah shares and can only speak for my shares.”

- Mr Timothy Morrison submitted that he had a direct relevant interest in approximately 0.034% of the total fully paid ordinary shares in Bryah. He submitted that he had not acquired any shares since 7 April 2025, and the placement to him came about after being contacted by Mr Brandon Loo of GBA. Other than that, he submitted, he “has not had discussions with anyone in relation to investing in Bryah and in particular has not had any discussions with Mr Yonglu Yu.”

- Mr Morrison set out his relationship to each of the Alleged Associates and submitted that “Bryah has failed to provide evidence of association between Mr Morrison and each of the Alleged Associates…”. He went further in rebuttal submissions, stating: “Bryah has sought to select such number of Bryah shareholders that, in the aggregate, approximately equates to 35% of the total Shares on issue. This approach appears to be selective rather than seeking to establish an association between the Alleged Associates having regard to the matters generally considered by the Panel as being relevant factors which establish association and the meaning of “associate” under the Act.”

- We note that Mr Morrison is the Executive Chairman of Trigg Minerals and a shareholder in it, and that the two directors nominated for election to the board of Bryah by Mr Yu sit on the board of Trigg Minerals. We agree with Mr Morrison, however, that these things are not sufficient to draw an inference of association with the Alleged Associates.

Further questions of non‑parties

- Following the Bryah GM, we asked further questions of Bryah, GBA and the Alleged Associates. In particular, we asked the non‑parties who had not responded to the separate questions, why they had not responded.

- GBA then responded to say it “has decided not to join as party to this proceeding, and respectfully does not intend to respond to the questions in your email.”

- We found this surprising from the authorised representative of an AFSL holder (which appears to be its holding company). We were not satisfied that our inquiries had been adequately responded to and as a result we decided to convene a conference, discussed below.

- Ms Lin Zhu responded “I did not have any discussions with any party, including GBA or Mr Yonglu Yu, prior to my initial investment in Bryah. All decisions were made independently. I am just a passive investor and prefer to be left out of this, I have no involvement in this.”

- Mr Tangnian Yuan responded similarly, submitting “I have acted entirely independently and voted in my personal capacity as a shareholder.”

- Mr Morrison responded that between 3 July 2025 and 4 July 2025, he sold a total of 3,000,000 Bryah shares and that he voted against the resolutions at the Bryah GM. He submitted that these facts were inconsistent with him being an Alleged Associate. We were inclined to agree and therefore did not pursue the allegation of association against him further.

- Bryah responded with a document titled “Notes on calls with Flynn Huang, GBA Capital” which included:

- “Flynn [Mr Huang] stated that the issue couldn’t wait till the next week (when Les [Mr Ingraham] returned from holiday) and that as they held 35% of the register, they wanted two directors gone ASAP and two new directors appointed.”

- “we told Flynn that we had a new project and new CEO. Flynn said that they won’t let that happen.”

- “Flynn offered $50K to each director to walk”

- “FH [Mr Huang] demanded Ian and me [Mr Ingraham] resign”

- “Flynn wanted to know the price/offer that we were making to buy out Yu Yonglu’s BYH shares.”

- “Flynn was adamant that we must include a buy out for his BYH stake as well if we do anything for Yu Yonglu,”

- Bryah submitted that the document “sets out details of the various discussions between Bryah directors and Mr Huang (other than the conversation of 30 May 2025 of which a summary has already been provided), as well as a summary of a conversation between Bryah’s CEO, Mr Greg Hill and Mr Huang on Monday, 28 July 2025.”

- The notes appeared to be reconstructed conversations. We were not given any original (for example, handwritten) contemporaneous notes of the various conversations, or any detailed explanation of how the notes came to be constructed in that form and on what bases the information was derived. Accordingly, it is difficult to give much weight to the document.

- We note that in its rebuttal submissions, Bryah said, referring to Mr Huang’s denial in paragraph 69(b) above (again referenced in paragraph 79(a) above), “Mr Jones and Mr Stuart who were parties to that conversation are prepared to sign statutory declarations consistent with the file note Bryah has produced in relation to that phone call if required by the Panel.”

- Bryah also provided the proxies for the Bryah GM submitting that “proxies for 888 (Aust) Pty Ltd, Mr Koh and Ms Niu were all scanned on the same scanner.” Had we continued the matter, we may have drilled down to understand the accuracy and significance of this.

- Other than Ms Zhu, Mr Yuan and Mr Morrison, the other Alleged Associates did not respond to our further questions.

Conference

- Despite our efforts, in our view the responses from Mr Huang and GBA were either non‑responsive, incomplete or unhelpful. It appeared that GBA (either through Mr Huang or others) was central to issues being raised. As an authorised representative, we felt that GBA’s obligation to the market warranted better conduct. Mr Huang, as an executive director of GBA, likewise.

- Accordingly, we decided to convene a conference23 with the primary purpose of obtaining documents from Mr Sebastian Jurd on behalf of GBA as he is its Founder and Managing Director, and from Mr Huang as he is GBA’s executive director and the controller of 888, which is a shareholder in Bryah and one of the Placees.

- On 18 August 2025, we issued a notice of conference to the parties, GBA and 888. On the same day we issued summonses24 dated 15 August 2025 for Mr Huang as Executive Director of GBA and Director of 888, and for Mr Jurd as Managing Director of GBA.

- The summonses were returnable on 20 August 2025 and required (among other things) the production of documents in connection with the sections 203D and s249D notices, communications with the Bryah board, instructions from Mr Yu and communications with the Alleged Associates. We convened the conference, held by videoconference facility, and extended the date, on request, to 25 August 2025.

- On 25 August 2025, parties, Messrs Jurd and Huang attended. We formally received documents that had been uploaded into the data room and adjourned to consider them.

- Mr Huang appeared to us to approach the conference somewhat informally and gave us pause as to whether he was taking the proceedings seriously.

- Messrs Jurd and Huang were asked “to confirm that you’ve produced all the documents requested in the summons dated 15 August 2025?” They responded, each on affirmation:

- Mr Jurd: “That’s correct.”

- Mr Huang: “That’s correct. That’s correct.”

- The records produced left us underwhelmed.

- Many of the documents produced we already had. In the case of communications with any of the Alleged Associates, Mr Jurd did not provide any documents (“including documents held by GBA Capital”), other than letters confirming the placement to the Alleged Associates. Similarly, Mr Huang produced mostly documents relating to the placement and none regarding communications with any of the Alleged Associates.

- It is Mr Huang’s habit to use WhatsApp to communicate with clients or companies (in this case, Bryah) and he prefers verbal to written communications. So much so, that his WhatsApp messages automatically delete after 7 days and this feature was “likely enabled when I first installed the application.” He told us that this feature applied itself to all chat threads. Even if it did so, it is a feature that could be turned off in the settings. We find it extraordinary that a broker/advisor with a market participant should do business entirely orally and not want (or be obligated) to create or retain any records. We can only wonder why.

- Some of the documents listed in their schedules of documents were identified as possibly subject to legal privilege. This is addressed below.

- In any event, given the paucity of the responses, and acknowledging that perhaps there were no other documents (odd as that may be), we decided to issue a further round of questions for Mr Jurd and Mr Huang before deciding whether to reconvene the conference.

Further questions post‑conference

- On 1 September 2025, we asked further questions of Bryah, Mr Jurd and Mr Huang.

- Mr Huang submitted that to the best of his recollection, he had not had any communications with the five Alleged Associates we identified in our questions regarding Bryah’s board positions or their voting intentions at the Bryah GM between 24 May 2025 and 29 July 2025, except for Mr Yu. He submitted that the communication with Mr Yu was “limited to Mr Yu requesting I obtain consent from Nick Katris and Bishoy Habib to be proposed directors of Bryah and to have their names set out in the s249D.”

- Mr Jurd submitted that “GBA does not record verbal conversations with clients. Where conversations involve client instructions (ie trade orders), then those instructions are 'recorded' by the fact of the trade being placed, and a contract note being produced and provided for the client's records.”

- We asked if GBA had disclosed to Bryah, prior to the allocation of the placement shares, that some of the proposed Placees were GBA employees or entities related to GBA employees. He submitted “Mr Jurd did not have any specific communications with Bryah regarding the Placement or allocations and therefore does not know what was disclosed regarding the participation of GBA employees. Any relevant communications between GBA and the Bryah board regarding the allocations have been disclosed.” In our view this is a very limited answer, perhaps non‑responsive, as it does not address whether any other officer or employee of GBA had, or state that Mr Jurd had, made any inquiries to find out. It’s all the more surprising given what appears to be a requirement in clause 4 of the lead manager engagement, which required GBA to (among other things) allocate the placement shares in consultation with Bryah.

- One of the Alleged Associates, Ms Chunyan Niu, took shares in the placement and then acquired further shares taking her holding in Bryah to 4.99%. We asked GBA who initiated the trade and for any documents in relation to it. Mr Jurd submitted that Ms Niu “has an account login that allows her to place trades directly through the Iress system without requiring assistance from a GBA employee” and that no records had been located on GBA's system regarding instructions for that trade.

Placement and scale back

- Mr Yu submitted that GBA asked him if he would be interested in participating in the placement and “he received a firm allocation of $300,000 worth of Bryah shares across the two tranches of the placement, which represented a scale back.”

- In the summons to Mr Jurd, we asked him to provide documents identifying who was scaled back under the Placement and explain how the decisions regarding the scaling back were made. In response to this request, Mr Jurd provided a word document titled “Bid allocation sheet explanation”, which stated that “only GBA staff got scaled back, balance got 100%”.

- Furthermore, Mr Jurd also provided a spreadsheet identifying the Alleged Associates who were scaled back:

- 888

- Vera Fides

- Swanside and

- ‘Saba Nominees Pty Ltd’.

- The information provided by Mr Jurd is inconsistent and raises concerns. The spreadsheet lists Vera Fides and Saba Nominees as having been scaled back, despite neither being GBA employees. Scintilla also submitted that its allocation was scaled back which is not reflected in the spreadsheet. This contradicts the stated rationale and adds to a pattern of inconsistencies and lack of transparency in the materials provided.

- Based on the placement records, the only GBA employees who were Placees are 888, Swanside, Mr Cedric Koh and Mr Joshua Duff (see paragraph 50). It is therefore unclear why Vera Fides and Saba Nominees were scaled back, and the basis for these allocation decisions remains unexplained.25

Substantial holding

- In the brief we asked Mr Yu to explain why he did not lodge an initial substantial holder notice after the issue of Tranche One shares, and then an updated notice after the issue of the Tranche Two shares.

- He submitted that he “was not aware that he was required to lodge an initial substantial holder notice in respect his Bryah shareholding until he was advised by Steinepreis Paganin of the requirement in the course of its engagement to assist in preparing the 203D and 249D notices.” He later submitted in response to a different question: “GBA Capital assisted Mr Yu in the preparation of his substantial holder notice in their capacity as Mr Yu’s broker.”

- We do not accept that Mr Yu was unaware of the requirement. Mr Yu is an experienced shareholder. Indeed, to participate in the placement he had to be a sophisticated or professional investor. As Bryah submitted in rebuttals, “Mr Yu’s resume also states he has invested in Australian mining companies over many years.” Moreover, Mr Yu holds shares in, for example, Trigg Minerals. He has lodged substantial holder notices in relation to that company in the past.26

- The placement to Mr Yu in Tranche One, on 11 February 2025, gave him a relevant interest in more than 5% of Bryah. There followed several share issues by Bryah and the Tranche Two placement, because of which, at various times, Mr Yu’s relevant interest in Bryah changed by 1% or more. There was only a notice of initial substantial holding dated 28 May 2025 disclosing voting power of 11.84% of Bryah.

- We consider that Mr Yu’s failure to lodge an initial substantial holder notice following the issue of the Tranche One shares, and to update that notice after the issue of the Tranche Two shares, constituted a breach of his obligations under section 671B. This failure deprived Bryah shareholders of timely and accurate information regarding the identity and intentions of a person with a substantial holding in the company, information which is critical to informed decision‑making in the context of control transactions. In light of the seriousness of this omission and its potential impact on the market for control of Bryah, we intend to refer this matter to ASIC.

Other issue – market trading

- Bryah submitted that on 2 June 2025, before the announcement of the Section 249D notice, the volume of Bryah shares traded increased dramatically.

- It submitted that 5,035,000 shares were traded, which it submitted was “well above the daily average of 1.45 million shares for the period 1 January to 15th May 2025”. It submitted also that the trading price increased by 40% from $0.005 to $0.007, then to $0.01 following the announcement and the volume also continued to increase.

- Bryah also identified other trading over succeeding days which was apparently out of the ordinary.

- This issue was not considered by us as it relates to market issues such as potential insider trading or market manipulation, which are the province of ASIC. In its application Bryah noted that “anomalous share trading is the subject of a complaint made by Bryah to ASX and ASIC.”

Other issue – Legal professional privilege

- At the conference, we asked about possible claims of privilege that GBA had identified. Its legal representative said that GBA itself was not claiming privilege but “wanted to flag that we had those documents in case someone else wanted to claim privilege.”

- We asked the legal representative of Mr Yu, who said “I think the correspondence that [GBA’s representative] is thinking of there, and I haven’t seen it, is correspondence that was between us, Steinepreis Paganin, and our client, Mr Yu, that had representatives from GBA copied on it. So yes, the correspondence between us and Mr Yu is the subject of a claim of privilege from Mr Yu.”

- The documents concerned were identified simply as various email chains concluding with an email from Mr Yu, Mr Huang or Steinepreis Paganin. Each individual document within the chain was not identified. The claim of privilege was sought to be maintained ‘en bloc’ as it were.

- Putting that to one side, we sought a written submission detailing, among other things, “why privilege can be maintained when it appears that the documents have been shared between parties other than Steinepreis Paganin and Mr Yu?”

- Mr Yu’s legal representatives submitted that:

- “the dominant purpose of the communications was to give or receive legal advice at the time those communications were made;

- there were only 4 recipients of the communications which are privileged, two of whom are solicitors who were acting for Mr Yu at the time of the communications, one is Mr Yu himself and the other is a broker to Mr Yu;

- confidentiality was maintained by all recipients of the communications; and

- the communications were not disseminated or disclosed to any other person other than the recipients.”

- The legal representatives referred to Asahi Holdings27 in support of the claim for privilege. That case concerned a claim of misrepresentation over the sale of a beverage business. In response to a subpoena, privilege was claimed over various documents. The privilege claim was disputed on two bases – (a) some did not appear to be sent or received by the applicants’ legal advisers, and (b) the titles or number of recipients of some suggested that they may not have been made for the dominant purpose of obtaining or giving legal advice.

- It was argued that the third‑party advisers were engaged under express and implied obligations to keep the communications confidential and were not permitted to disclose or use that information for any purpose contrary to Asahi’s requirements. Evidence was provided that their engagement letters contained confidentiality obligations. In addition, a solicitor deposed that he had considered each of the documents, formed the view that the redacted portions were properly subject to a claim of legal professional privilege, and set out the basis for his belief with respect to each of the documents.

- After examining the documents in detail, Beach J held that the whole of some were privileged and need not be produced while a redacted form of some others should be produced.

- His Honour set out the principles applicable to the legal advice limb of legal professional privilege, in summary:

- Common law principles, rather than the Evidence Act, apply because the relevant issue is whether the communications were created or made for the dominant purpose of obtaining or being provided with legal advice

- An applicant bears the onus of establishing the claims. “In that respect, focused and specific evidence is required in respect of each communication, rather than mere generalised assertion let alone opaque and repetitious verbal formulae.” The communication must also be confidential.

- The relevant time for ascertaining purpose is when the communication was made. If written, the relevant time is when it came into existence. “If the communication was constituted by the forwarding of a copy document, the purpose for the creation of the copy document at the time that the copy was created is what is relevant.”

- The relevant purpose may be that of the author, or the initiator of the communication, or the person at whose request or under whose authority the communication was created or made.

- The purpose is to be objectively ascertained. Evidence of the subjective intention of the author or person requesting the creation of the communication (document) is significant but not conclusive.

- The purpose must predominate. It must be the paramount or most influential purpose.

- A document may be privileged to the extent to which it records a privileged communication, even if the document itself would not satisfy the dominant purpose test.

- His Honour had the power to examine the documents and should not be reticent in exercising it.

- The point made at paragraph 124(h) is not applicable to us. Our powers are different and the process available to a Court to consider claims separately to the trial is not available to a sitting Panel.

- Beach J then addressed the case law. Relevantly he noted that non‑legal advice, even when mixed with legal advice so that the client gains a holistic view of the particular transaction, generally has a distinct function not attracting privilege and that non‑legal advice does not attract privilege by routing through the lawyer.

- In this case, we were not provided with detailed identification of the documents, despite having asked28, or of the basis of the claim in each case, or evidence to establish the confidentiality of each communication, or evidence that in fact they remained confidential. We are not satisfied that a claim of legal privilege has been properly made out. Were the matter to proceed, we would have followed this issue up.

Decision

No Declaration

- The participants in organising, or taking shares in, the placement were sophisticated and professional investors, and a broking firm. The behaviours exhibited, and the conduct complained of, does not appear to be naïve. Some of the behaviour before the Panel may be characterised as obstructionist, resulting in the need for us to take additional measures which put the applicant to additional, unnecessary expense and the Panel to inordinate delay.

- We were left with concerns about the apparent lack of proper engagement and respect for the role of the Panel by GBA and Mr Huang. We were also left with concerns that, even after the production of documents in response to the summonses, we did not receive full and frank responses, which did not assist us in the proceedings.

- While there are several indications of association, on the materials available, we are not satisfied that there is sufficient material available to draw inferences of an association to support a declaration of unacceptable circumstances. The materials needed to support an inference of association, such that the associates’ combined voting power would exceed 20%, were even more limited. In part, we acknowledge that this is a consequence of our limited powers of investigation.

- But we do not doubt that aspects of the matter warrant further investigation, and we are referring various issues (including concerning substantial holder notice compliance)29 to ASIC under regulation 18 of the ASIC regulations30 and otherwise.

- For all the reasons above, we decline to make a declaration of unacceptable circumstances. We consider that it is not against the public interest to decline to make a declaration and we had regard to the matters in s657A(3).

- We communicated our decision to the parties, including that we had closed our conference.

- For completeness, we note that if we had decided to make a declaration, it would have required us to obtain an extension of time under section 657B.31 We were prepared to do so.

No Orders

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Diana Nicholson

President of the sitting Panel

Decision dated 12 September 2025

Reasons given to parties 16 October 2025

Reasons published 23 October 2025

Advisers

| Party | Advisers |

|---|---|

| Bryah Resources Limited | Bennett Litigation and Commercial Law |

| Yonglu Yu | Steinepreis Paganin |

| Timothy Morrison | MPH Lawyers |

Annexure A

Corporations Act

Section 657E

Interim Orders

Bryah Resources Limited

Bryah made an application to the Panel dated 9 July 2025 in relation to its own affairs.

The Panel ORDERS:

- In relation to the section 249D general meeting of Bryah to be held on Tuesday, 29 July 2025 at 2:00pm (WST), that Bryah keeps a record of any votes cast on the resolutions to be considered at that meeting in respect of the ordinary shares in Bryah held by each of the Relevant Shareholders, and:

- ensures copies of such voting records (being any voting card, proxy form or other document evidencing votes cast on the poll) are kept for 14 days following the date of the meeting, which must be provided to the Panel upon its request and

- provides to the Panel by 12:00pm (Melbourne time) on the day after the meeting the poll report for each resolution.

- In these interim orders the following terms have their corresponding meaning:

- Relevant Shareholders

- 888 (Aust) Pty Ltd, Mr Joshua Duff, Mr Cedric Koh, Swanside Investments Pty Ltd, Mr Yonglu Yu, Ms Lin Zhu, Ms Chunyan Niu, Vera Fides Holdings Pty Ltd, Safinia Pty Ltd, Scintilla Strategic Investments Limited, Mr Timothy Morrison, Mr Tangnian Yuan, Mr Patrick Kok, Mr Antanas Guoga

- Bryah

- Bryah Resources Limited

- These interim orders have effect until the earliest of:

- further order of the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Tania Mattei

General Counsel

with authority of Diana Nicholson

President of the sitting Panel

Dated 28 July 2025

1 In its application, Bryah originally included STO Capital Pty Ltd as an Alleged Associate. On 11 July 2025, Bryah acknowledged STO was no longer a shareholder and confirmed that its application was not applicable to STO

2 On 31 March 2025, Bryah announced on ASX, among other things, that with effect from 1 April 2025 Mr Jones would step down as CEO and take up the role of non‑executive director

3 On the same day, Bryah issued a section 708A notice on ASX in respect of tranche 1

4 On 8 April 2025, Bryah issued a section 708A notice on ASX in respect of tranche 2

5 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth) and all terms used in Chapter 6, 6A or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

6 The following Alleged Associates lodged proxies appointing and directing the proxyholder to vote in favour of each resolution: 888, Mr Yu, Mr Koh, Swanside, Mr Yuan, Ms Zhu, Mr Kok, Ms Niu, Vera Fides, Safinia

7 Bryah complained to ASX and ASIC separately in relation to the share trading activities

8 See Guidance Note 4: Remedies at [12]

9 Bryah complied with the interim orders by sending us a poll declaration received from Automic on 30 July 2025 which showed that the resolutions weren’t passed at the Bryah GM and the board spill failed

10 See Regulation 1.0.18 of the Corporations Regulations 2001 (Cth)

11 Section 9

12 The Alleged Associates did not rely on the s16(1) exemption to deny association

13 [2011] ATP 5 at [33]‑[34]

14 Adsteam Building Industries Pty Ltd & Anor v The Queensland Cement and Lime Co Ltd & Ors (1984) 14 ACLR 456 at 459. See also: Aurora Funds Management Limited v Australian Government Takeovers Panel [2020] FCA 496 at [20]‑[39]

15 Winepros Limited [2002] ATP 18 at [27]

16 [2008] ATP 4. These factors have been applied in several Panel decisions including Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, Viento Group Limited [2011] ATP 1, CMI Limited [2011] ATP 4 and World Oil Resources Limited [2013] ATP 1

17 Prior to Bryah issuing 100 million shares on 2 July 2025 as part of a commercial transaction (see paragraph 21), the percentage was submitted to be 34.69%

18 Timothy Morrison became a party subsequently

19 As the notice of meeting did not include resolutions for the appointment of replacement directors it was unclear what would happen next if the resolutions were carried

20 Refer to Bryah’s ASX announcement dated 3 July 2025 titled “Mineral Royalty Purchased by Subsidiary of Bryah Resources”

21 For example, in the Trigg Minerals substantial holder notice dated 25 June 2024, he gave a Mount Waverley Victoria address

22 This may be a typographical error. It was Mr Cedric Koh who emailed the Form 603

23 See Part 3, Division 5 of the of the Australian Securities and Investments Commission Regulations 2001 (Cth)

24 Under section 192 of the Australian Securities and Investments Commission Act 2001 (Cth)

25 One of the documents produced in response to the summons to GBA was a letter to Vera Fides confirming the placement to it, which was addressed to be sent by email to an employee of GBA. This also was not explained. Subsequent to our decision, Mr Jurd clarified that “both Vera Fides and Saba Nominees Pty Ltd are companies that are associated with GBA staff”.

26 For example, Mr Yu lodged a change of substantial holder notice in Trigg Minerals dated 21 August 2024

27 Asahi Holdings (Australia) Pty Ltd v Pacific Equity Partners Pty Limited (No 4) [2014] FCA 796

28 Per the Takeovers Panel Procedural Rules 2020 at Rule 11(2)

29 See paragraph 110

30 Regulation 18(1) of the Australian Securities and Investments Commission Regulations 2001 provides “The Takeovers Panel may refer a matter to the Commission for the Commission to consider with a view to making an application.”

31 Section 657B of the Corporations Act 2001 provides” “The Takeovers Panel can only make a declaration under section 657A within:

- 3 months after the circumstances occur; or

- 1 month after the application under section 657C for the declaration was made;

whichever ends last. The Court may extend the period on application by the Takeovers Panel.”