[2019] ATP 14

Catchwords:

Decline to make a declaration – interim orders – replacement of responsible entity – collective action – association – voting power – relevant interest – relevant agreement – voting agreement – investment adviser – public interest – substantial holder notice – tracing notices – request for register

Corporations Act 2001 (Cth), sections 12, 252B, 252D, 606, 611 (item 9), 657A, 657C, 671B, 672A, 672B

Australian Securities and Investments Commission Act 2001 (Cth), s192

In the matter of Aurora Funds Management Limited [2019] NSWSC 630, Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68

Guidance Note 4 – Remedies General, ASIC Regulatory Guide 128 – Collective action by investors, UK Takeover Panel Practice Statement No 26, Shareholder activism

Aguia Resources Limited [2019] ATP 13, Indiana Resources Limited [2017] ATP 8, Resource Generation Limited [2015] ATP 12, Mesa Minerals Limited [2010] ATP 4, Orion Telecommunications Limited [2006]ATP 23

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| YES | NO | YES | NO | NO | NO |

Introduction

- The Panel, Stephanie Charles, John O'Sullivan (sitting President) and Nicola Wakefield Evans, declined to make a declaration of unacceptable circumstances in relation to the affairs of Aurora Absolute Return Fund (ABW). The application concerned (among other things) whether certain persons were associated in relation to ABW and alleged contraventions of s606 and s671B.1 The Panel was not satisfied that there was sufficient material to establish the alleged associations. Moreover, the Panel concluded that, even if the alleged associations had existed, the public interest test required under s657A(2) to justify a declaration of unacceptable circumstances was not met.

- In these reasons, the following definitions apply.

- ABW

- Aurora Absolute Return Fund

- AFARF

- Aurora Fortitude Absolute Return Fund

- Alleged Associates

- the Wonfair Parties, Solano, Primary, Messrs Tan, Fraser, Greiner and Rigoni

- Application

- the application by Aurora in relation to the affairs of ABW dated 18 June 2019

- Aurora

- Aurora Funds Management Limited (the responsible entity of ABW)

- CMDP

- Corporacion Monte de Piedra SA (a company controlled by Mr Greiner)

- Court Decision or Court Proceedings

- the decision or proceedings of the Supreme Court of New South Wales (Rees J) in the matter of Aurora Funds Management Limited [2019] NSWSC 630, as applicable

- January Meeting

- the ABW unitholder meeting held on 15 January 2019, declared to be invalid in the Court Decision

- Primary

- Primary Securities Ltd

- RG 128

- ASIC Regulatory Guide 128 - Collective action by investors

- Solano

- Solano Investment LLC (a company controlled by Dr Johns)

- Staermose Spreadsheet

- has the meaning given in paragraph 19(d)

- Wonfair

- Wonfair Investments Pty Ltd (a company controlled by Mr Staermose)

- Wonfair Parties

- Mr Staermose and Wonfair

Facts

- ABW is an ASX listed managed investment scheme (ASX code: ABW). Most of the facts below are taken from the judgement of Rees J inthe Court Decision.

- Aurora is the responsible entity for both ABW and AFARF (an unlisted fund). Aurora submitted that "To provide access to AFARF's portfolio for investors who prefer or require that their investments be listed, ABW was established as a listed feeder fund that would be almost entirely invested at all times in AFARF."2 As at 30 June 2018, ABW held 47.36% of the units in AFARF, being its sole investment.

- The following persons commenced acquiring units in ABW on or about the dates set out below:

- 15 June 2017 – Mr Tim Staermose

- 25 July 2017 – Solano

- 9 August 2017 – Mr "Peter" Chor Leng Tan

- 22 August 2017 – Mr Zachary Fraser

- 28 August 2017 – CMDP (in the name of JP Morgan as nominee)

- 8 September 2017 – Wonfair

- On 6 October 2017, Mr Staermose requested a copy of the ABW register. He stated, among things, that his "purpose for getting" the ABW register "is to understand who became a member and who ceased to be a member, and when."

- On 10 October 2017, Mr John Patton (Managing Director of Aurora) called Mr Staermose in relation to Mr Staermose's request and recorded in a file note of the conversation that he had concerns about whether there was a relationship between Messrs Staermose and Tan, and Solano.

- On 11 October 2017, Mr Staermose requested to inspect the books of ABW. Also on 11 October 2017, Aurora issued tracing notices to Messrs Staermose and Tan, Wonfair, Solano and JP Morgan.

- On 13 October 2017, Mr Staermose and Wonfair separately refused to respond to the tracing notices on the ground that the notices were vexatious (Mr Tan, Solano and JP Morgan did not respond to the tracing notices). Also on 13 October 2017, Aurora declined to provide a copy of the register to Mr Staermose. Among other things, Aurora expressed concerns that its investigations had indicated that Mr Staermose appeared to have co-invested in ABW with Wonfair, Solano and Mr Tan with a combined interest of 7.81% without disclosure under the substantial holder notice provisions.

- On 24 October 2017, Mr Staermose emailed Mr Michael Rigoni (an ABW unitholder). Mr Rigoni subsequently provided Mr Staermose materials he had gathered in the course of an unsuccessful attempt in 2016 to replace Aurora as responsible entity of ABW by requisition, including a register of ABW unitholders.

- On 31 October 2017, Mr Staermose lodged a notice of substantial holder recording that he and Wonfair together held in aggregate 5.53% of the voting power in ABW.3

- On 5 March 2018, Aurora issued tracing notices to Wonfair, Solano and Mr Tan. On 7 March 2018, Wonfair responded stating that Mr Staermose, by virtue of having more than 20% voting power in Wonfair, had a relevant interest in all of Wonfair's ABW units.4 Aurora did not receive a response to these tracing notices from Solano or Mr Tan.

- On 11 May 2018, Mr Staermose lodged a notice of change of interest of substantial holder, disclosing that he and Wonfair held in aggregate 19.99% of the voting power in ABW. On 3 July 2018, Mr Tan filed a substantial holder notice disclosing that he held 5.23% of the voting power in ABW.

- In August and September 2018, Mr Staermose corresponded with Aurora regarding access to ABW's register. On 12 October 2018, Mr Staermose inspected ABW's register but, under the instruction of Mr Patton, was not allowed to make a copy.

- On 15 October 2018, Mr Staermose wrote to Aurora requisitioning a meeting of members of ABW under s252B to consider the removal of Aurora as responsible entity and the appointment of Millinium Capital Managers Limited or, alternatively, that ABW be wound up. Mr Staermose subsequently withdrew the requisition.

- On 16 October 2018, Mr Andrew Purcell called Mr Robert Garton Smith of Primary during which they discussed ABW. Mr Purcell subsequently emailed Mr Garton Smith, advising that:

A significant number of unit holders in ABW are dissatisfied with Aurora's performance and lack of communication and therefore want to call a meeting to seek the removal of Aurora as RE. I have been asked by one of these unit holders to help him find a replacement RE.

- On 17 October 2018, Mr Garton Smith queried which of the top 20 unitholders in ABW wanted to replace Aurora, and Mr Purcell replied:

In confidence, the first two names on the top 20 list [Mr Staermose and Wonfair] want to see the RE replaced and it is believe > 40% of the register would be interested in this motion being brought.

- On 29 October 2018, Primary requested from ABW's unit registry a copy of ABW's register. Aurora did not provide a copy of the register to Primary until 28 December 2018 (see paragraph 21).

- On 20 December 2018:

- Mr Staermose and Wonfair executed authorities for Primary to convene a meeting of members under s252D.

- Mr Purcell and Mr Garton Smith had a telephone conversation during which they discussed the location for the meeting. Mr Purcell stated that there were some members in Canberra holding significant votes.

- Primary prepared a notice of meeting and an accompanying explanatory memorandum proposing resolutions (in effect and among others) to replace Aurora as responsible entity with Primary or if the replacement resolutions failed, the winding up of ABW.

- Mr Purcell provided to Primary (among other things) a spreadsheet prepared by Mr Staermose with "Tim's analysis on where votes lie based on who he has talked to" with unitholders colour coded (the Staermose Spreadsheet).

- On or soon after 20 December 2018, Primary dispatched the notice of meeting to those ABW unitholders for whom Primary had addresses, based in part on the register provided to Mr Staermose by Mr Rigoni (see paragraph 10).

- On or about 28 December 2018, ABW's unit registry (on Aurora's instruction) provided Primary with a copy of ABW's register (with email addresses removed). Primary subsequently sent the notice of meeting to those unitholders who had not previously received it.

- The January Meeting was held on 15 January 2019. Mr Staermose's solicitor (Mr Richard Liebmann of Norton Smith) was appointed chair. Mr Garton Smith and another director of Primary attended the January Meeting as proxies. The only ABW unitholders who attended in person were Mr Staermose and another ABW unitholder (who arrived half an hour late and voted against the resolutions). Aurora did not attend the January Meeting, having previously made an ASX announcement advising that ABW unitholders should not attend the meeting and that Aurora did not recognise the validity of the meeting or any resolution passed at it. After tallying the votes of those present and the proxies, the resolutions were passed.

- On 15 January 2019, Primary advised Aurora of the outcome of the January Meeting and Aurora issued tracing notices to Messrs Tan and Fraser, Primary, Solano and Wonfair. Aurora received replies from:

- Mr Fraser (on 21 January 2019) stating (among other things) that "given the recent vote by members, I do not acknowledge [Aurora] as the RE for ABW any longer and therefore, I have no intention, nor obligations to be dealing with Aurora accordingly" and

- Mr Staermose (on 22 January 2019) on behalf of Wonfair, stating (among other things) that "Wonfair holds a total of 1,000,000 units directly, registered in its own name" and that he held "780,010 units in ABW directly."

- On 16 January 2019, Aurora made an ASX announcement advising that it did not consider the January Meeting or resolutions to be valid. The ASX issued a pause trading notice in respect of ABW units.

- On 18 January 2019, Primary lodged a notification of change of responsible entity with ASIC. Aurora invited Primary to commence legal proceedings to clarify the position in respect of the validity of the change of responsibility entity. Primary declined the invitation. On 21 January 2019, the ASX suspended trading in ABW units, "pending clarification of the validity or otherwise of the appointment of Primary."

- On 31 January 2019, Aurora commenced proceedings in the Supreme Court of New South Wales, seeking orders that the January Meeting, and the resolutions passed at it, were invalid, and that the register maintained by ASIC be rectified accordingly. On 30 May 2019, the Court made orders in Aurora's favour, including orders that the January Meeting and the resolutions passed at that meeting were invalid and that Primary was not, or ever was, the responsible entity for ABW.5

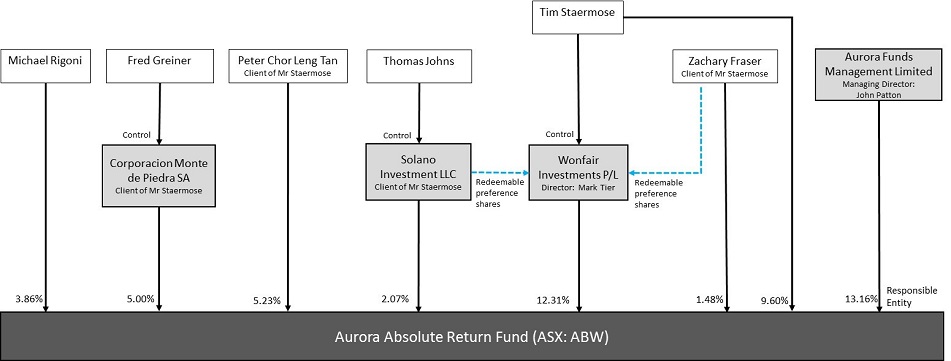

- Unitholdings and various relationships6 in relation to ABW are set out in the diagram below:

Application

Declaration sought

- By application dated 18 June 2019, Aurora sought a declaration of unacceptable circumstances. Aurora submitted (among other things) that:

- Messrs Staermose, Tan and Fraser, Wonfair and Solano (and possibly Mr Greiner) have had relevant agreements between each other in relation to the acquisition of ABW units.

- Primary became a party, "principally through the agency of Mr Andrew Purcell", to a voting agreement between it and the other Alleged Associates.7

- As a result of the above, there have been contraventions of s671B and s606.

- Some of the Alleged Associates, including Messrs Staermose and Tan, Wonfair, Solano and Primary, have either not responded to tracing notices issued by Aurora under s672A or, where they have responded, they have not provided the prescribed information, in contravention of s672B.

- Aurora submitted that the factual findings set out in the Court Decision substantiated each of the above submissions.8

- Aurora submitted that the effect of the circumstances were unacceptable because the true position of the interest and control in ABW of the Alleged Associates has not been disclosed to the market and the Alleged Associates have attempted to control ABW and change the responsible entity in a way which was contrary to Chapter 6.

Interim orders sought

- Aurora sought interim orders, pending determination of the Application, including in effect restraining the Alleged Associates from:

- selling, transferring, requesting the redemption of or otherwise disposing of their ABW units or entering any agreement to do so and

- exercising, or granting any authority to exercise, any right attaching to their ABW units, including in relation to voting.

- On 19 June 2019, the substantive President (Alex Cartel) decided not to make interim orders. The substantive President:

- noted that the alleged contraventions of s606 and s671B (and s672B) appeared to have existed for some time

- noted that trading in ABW units on ASX was currently suspended and considered that any off-market transfers or disposals of ABW units by the Alleged Associates could adequately be remedied by final relief if unacceptable circumstances were found by the sitting Panel and

- considered the interim orders could be considered again by the sitting Panel (once appointed).

- On 26 June 2019, after inviting and receiving comments on proposed interim orders, we decided to make interim orders in order to maintain the status quo pending determination of the Application (Annexure A). The interim orders provided that CMDP, Primary, Wonfair, Solano, Messrs Fraser, Purcell, Rigoni, Staermose, Tan and each of their respective associates could not dispose of, transfer, charge or otherwise deal with (including exercise any rights in) any units in ABW in which they have a relevant interest, without consent from one of us.

- In making the interim orders we had regard to the matters in Guidance Note 4 – Remedies General. In particular, we considered the strength of the Application and the material referred to in the Court Decision and the need to maintain the status quo pending our determination of the Application. We were satisfied that the consent mechanism in the interim orders balanced our need to maintain the status quo and the desirability to not impinge on the rights of the persons whose interests were affected by the orders.

Final orders sought

-

Aurora sought final orders including vesting certain ABW units registered in the name of Mr Staermose and/or Wonfair for sale by ASIC. Aurora submitted that the "final orders should be directed to those who were the prime movers in relation to the contraventions, Mr Staermose and the entity that he controls, Wonfair – the other participants seem to have been guileless tools of Mr Staermose, Mr Purcell, his representative, and Primary, his chosen facilitator, so that to impose the same consequences on them seems harsh."

Discussion

- We have considered all of the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Decision to conduct proceedings

- We received preliminary submissions from Messrs Staermose and Tan, Wonfair and Primary each denying the alleged associations and expressing the view that we should not conduct proceedings.

- Mr Staermose submitted that none of the Alleged Associates (other than Primary) were parties to the Court Proceedings and therefore, Her Honour's comments on Chapter 6 matters were "based solely on evidence from one side of the argument." He submitted that the Court made no actual findings in respect of any Chapter 6 matters.

- Primary submitted that it intends to appeal the Court Decision. It submitted that we should "not waste [our] time" considering the Application because, if successful on appeal, all actions taken by Aurora as responsible entity of ABW in the interim, including this Application, would be annulled. Further, Primary submitted that it gave no evidence in the Court Proceedings on the Chapter 6 matters because it took the view that these matters were not relevant to the validity of the January Meeting. However, to the extent these matters are canvassed on appeal, it submitted that it was possible that two bodies could be considering the same issues at the same time.

- In our view, the Court Decision did not make any findings on Chapter 6 matters. Her Honour stated:

…the relevance of the relationship between Mr Staermose and other members in these proceedings is not whether they were, in fact, "associates" or had a "relevant agreement" or contravened Chapter 6… Rather, the present relevance of the relationship is: whether an adviser and his clients, and perhaps other members, were acting together in a concerted attempt to remove the responsible entity; whether this was a relevant matter for other members to know; and, whether it was misleading not to disclose it.9

- Her Honour concluded that "an adviser, his clients and at least one other member were acting together in a concerted attempt to remove the responsible entity. This was the case by December 2018, when the meeting was called. With that in mind, each of Aurora's contentions as to the invalidity of the meeting need to be considered."10

- We are required to conduct proceedings in a timely manner and did not consider it appropriate to delay our proceedings where appeal proceedings had not commenced and in circumstances where the decision to be appealed did not consider the Chapter 6 matters to be relevant. If an appeal commenced during our proceedings, we would have reconsidered any overlap between the proceedings.

- While we were not provided with, and did not consider, the materials relied on in the Court Proceedings in deciding whether to conduct, we considered the materials described in the Court Decision and Her Honour's conclusions based on those materials warranted us conducting proceedings on the issue of association.11

- Noting that it is an "independent professional responsible entity", Primary submitted that this was not a 'takeover' to put into place a responsible entity controlled by the members seeking to appoint it. Similarly, Mr Tan submitted that he did not wish to gain control of ABW, he was "merely seeking a change as to whom (i.e. the Responsible Entity) manages my money." Wonfair and Mr Staermose both questioned Aurora's purpose for bringing the Application, submitting that it was a self-serving attempt by Aurora to remain the responsible entity.

- 'Self-preservation' arguments are a corollary of most replacement of board or responsible entity matters but do not dissuade us from conducting proceedings where sufficient material has been presented to support us doing so. The submissions however as to the potential change of control purpose for replacing the responsible entity are important to our consideration of the association.

- Mr Staermose and Wonfair further submitted that the Application was out of time given that it was made nearly two years after the events involving the Alleged Original Associates first occurred and more than six months after the events involving Primary and Mr Purcell.

- We accept that the Application has been brought more than two months after circumstances referred to in the Application have occurred. However, we have the discretion to extend the time for making an application.12 Before exercising that discretion, the Panel must first determine the relevant circumstances and thereafter determine whether or not to extend time.13 Having satisfied ourselves that there were sufficient concerns about association and given the seriousness of the potential contraventions raised by the Application, we did not consider it appropriate not to conduct proceedings on the basis that the Application was out of time (leaving open, at the time of deciding whether to conduct proceedings, the question of whether we should exercise our discretion to extend that time – see discussion at paragraphs 140 to 143).

Alleged associations

- The Panel in previous matters has outlined s12 (see s12(3) in relation to managed investment schemes) and the relevant decisions on association.14

- Aurora described the pattern of arrangements and understandings between Mr Staermose and each of the Alleged Associates using a "hub" and "spokes" analogy, submitting that Mr Staermose was the "hub" and that each of the other Alleged Associates were the "spokes" running off that hub. Aurora submitted that under this arrangement "each spoke is able to envisage or assume the existence of the other spokes."

- For the purposes of discussing the alleged associations in these reasons, we have essentially adopted the "hub and spokes" approach described by Aurora.

- We can quickly dismiss one alleged "spoke". There was little material to support any association between Mr Rigoni and the Wonfair parties. It appeared that Mr Rigoni's involvement in the matters alleged in these proceedings was limited to providing Mr Staermose the materials discussed in paragraph 10. Aurora submitted that it accepted "Mr Staermose's statements concerning his contacts with Mr Rigoni and submits that there is substantially less basis for an inference that Mr Rigoni is one of the Alleged Associates."

Wonfair Parties

Share trading and common investments

- Mr Staermose submitted that his career in the financial services industry spans over 20 years across at least four different countries. He owns 100% of the voting shares in Wonfair, which is used as his investment company. Two of the Alleged Associates, Mr Fraser and Solano have a passive investment in Wonfair by reason of being holders of redeemable preference shares. The sole director and company secretary of Wonfair is Mr Mark Tier, with whom Mr Staermose worked with in 1998 and published a book with in 2004.

- Wonfair submitted its business is to "make and monitor investments". Mr Staermose submitted that :

Wonfair has never had more than 20 Australian resident clients of any kind. It has never raised more than $2mn in any 12 month period. It does not, so far as my understanding of the Corporations Act, carry on a financial services business in Australia. It does not induce anyone to engage with it or accept its advice in any way.

- Mr Staermose submitted "My business may be unusual, and not located in Australia. But it is in essence no different to a financial advisor giving clients advice in the ordinary course of his business." He described his"clients" as someone "who compensates me in some way for my advisory services whether by subscription fee to a newsletter, a retainer for financial advice, or a performance or success fee on certain investments I recommend."

- The Staermose Spreadsheet describes "CLT" (which we infer to be a reference to Mr Tan), CMDP, Solano and Mr Fraser each as "My Client – I have an advisory relationship". We asked Mr Staermose a number of questions in relation to his "advisory relationship" with each of these persons and requested a copy of the letter of engagement or similar document evidencing the nature of the relationship.

- Mr Staermose submitted that:

[The persons identified in the Staermose Spreadsheet as 'My Client'] have all either been long-term readers of my newsletters, or are people I have met socially, and I know to be sophisticated investors, with whom I discuss investment ideas from time to time.

There are no formal letters of engagement. Some pay my HK-based company, Wonfair Holdings Limited, a fixed annual retainer to be an advisor. Others pay a percentage of the profits they make on the investments that I suggest to them.

I generally have a policy not to do business with someone I cannot do business with on a handshake. There are no formal contracts between me and any of these parties.

They are generally people I have got to know over a period of many years, met in person on numerous occasions, and whom have grown to trust my advice.

…

I have also sought counsel from experienced people in my network from time to time about "what to do about ABW." We thus discussed it. But there are no advisory arrangements with any of these other investment professionals with whom I discuss ideas.

- Aurora submitted (among other things) that "[i]t seems that Mr Staermose acts well beyond the limits of a usual adviser or agent (i.e. someone who acts on behalf of another). The Staermose Spreadsheet shows this because he has a high degree of certainty of the voting behaviour of the Alleged Associates even before the Notice of Meeting was distributed." For the reasons below, we are not satisfied that this is the case, or that Mr Staermose obtained relevant interests in the ABW units held by his clients in the course of his professional engagement, as submitted by Aurora.

- The existence of some common investments between Mr Staermose and certain of the other Alleged Associates was noted in the Court Decision,15 where Her Honour stated "…it seems to me that Mr Staermose' clients had entered and exited investments in accordance with Mr Staermose' own participation in those investments and, unsurprisingly, it would appear that his clients followed his directions."16

- This pattern of trading was substantiated by records provided by Aurora of trading in ABW units between 1 January 2017 and 31 January 2019 which demonstrated that the Wonfair Parties and certain of the other Alleged Associates had made series of acquisitions of ABW units at or about the same time (and in some instances, on the same day). Aurora submitted that the inference from the trading records was "inescapable – Mr Staermose was coordinating the acquisition strategy of [certain of the Alleged Associates] in relation to ABW" which it said "constituted acting in concert in relation to the affairs of ABW."

- In our brief, we asked questions of Mr Staermose in relation to his common investments and dealings with each of the Alleged Associates and requested details of each instance since 1 January 2014 where any of the Alleged Associates had entered or exited investments in accordance with his own participation in those investments and/or his directions.

- In relation to his common investments and dealings with the Alleged Associates, Mr Staermose submitted:

A very small fraction of the investments I have made around the world over the past several years are listed in the evidence that was presented in the recent court proceedings, to which I note I was not a party, and had no opportunity to defend.

The investments cited appear to be "cherry-picked" to include only those where I, Wonfair and one or more of the Alleged Associates have had at some point, held the same investment at the same time.

If you were to look at a complete picture, I'm confident that you'd see there were likely dozens of such investments, all made in the ordinary course of our respective investing activities.

I make investments myself, and my profession is to advise others to make investments. It is only natural that sometimes the Alleged Associates some of whom are advisory clients of mine and read my newsletter publications will buy some of the investments I draw their attention to.

- In relation to our request for details of each instance where any of the Alleged Associates had entered or exited investments in accordance with his own participation and/or directions, Mr Staermose submitted:

… I can tell you what I have invested in. I cannot tell you exhaustively what THEY may have invested in. I guess you could say I provide an investment menu for lots of people, including some of the Alleged Associates.

They select from it. Sometimes they end up investing alongside me, and / or Wonfair. Sometimes they buy and sell the same things as me at the same time. Sometimes they do not. There is no formal arrangement or pattern.

- Mr Staermose's submissions proceeded to address some of what he described as the "specific investments cherry picked by Aurora for the court case." In relation to HHY, Mr Staermose submitted that the reason Wonfair, Mr Tan and Solano all exited their investment on the same day (ie 10 January 2018) was because Aurora was conducting an on-market buy-back and he "helped arrange for various of the Alleged Associates to sell out in a crossing, as part of HHY's buy-back." In relation to Decimal Software Ltd, Mr Staermose submitted that although he could not "recall precisely", he believed that "Mr. Tan and Wonfair sold into the takeover, or on market the day it became unconditional." Indeed, Mr Staermose submitted that:

Takeover arbitrage, along with deep value, is one of my core strategies. There will likely have been dozens of occasions one or more of the Alleged Associates and I appear to have exited at the same time, by virtue of accepting a takeover bid, or a Scheme of Arrangement becoming effective.

- While the trading records described in paragraph 59 showed instances of acquisitions of ABW units made by the Alleged Associates at or about the same time, we also identified several instances where certain of the Alleged Associates had made acquisitions between 14 May 2018 and 13 December 2018, a time during which the Wonfair Parties made no acquisitions.17 We assume the absence of trading by the Wonfair Parties during this period was to satisfy the six month requirement for the "creep" exception in item 9 of s611 (given that, as at 14 May 2018, the Wonfair Parties had in aggregate voting power of 19.99% in ABW units). In addition, the trading records showed that each of the Alleged Associates had stopped acquiring ABW units at latest in early November 2018, whereas Mr Staermose recommenced making acquisitions from 13 December 2018 until mid-January 2019 (noting that the trading records ended at 31 January 2019). Without something more, it was not obvious to us from the trading records that the purchases by the Alleged Associates between 14 May 2018 and 13 December 2018 were linked to the Wonfair Parties ceasing to make further acquisitions to satisfy the six month requirement in item 9 of s611.

- The Panel has previously considered whether an association exists in the circumstances where clients are alleged to act in accordance with the instructions and recommendations of a financial adviser. 18 While we recognise the existence of the common investments and the coincidence of the acquisitions of ABW units between the Wonfair Parties and certain of the other Alleged Associates, we are not satisfied that, in and of itself, the existence of this is strong enough for an inference of association in this case.19 Without something more we consider, out of the possible inferences available, that the commonalities and coincidences are most likely explained by reason of:

- Mr Staermose's profession as an investment adviser and his engagement in that capacity by the relevant Alleged Associates

- Mr Staermose's clients being subscribers to his investment publications and

- the fact that Mr Staermose is an active trader in his own right (including in some of the various investments he recommends to his clients, including ABW).

- Messrs Tan, Fraser and Greiner each made submissions in relation to the trading commonalities and coincidences that were in effect consistent with this explanation and submissions that they made their own independent decisions in relation to their investment in ABW.

- Given the above, we are not satisfied and do not draw an inference that Mr Staermose and his clients are associated by reason of engaging him as their investment adviser or being subscribers to his investment publications, or by reason of having entered a relevant agreement or acting in concert in relation to the acquisition of ABW units.

The alleged voting association

- In relation to the proposal to replace Aurora as responsible entity, Aurora submitted that Mr Staermose had a "plan for obtaining control of ABW without making a takeover bid." Mr Staermose submitted that "[a]t no point did I actively discuss with any of the Alleged Associates anything about colluding with them to oust Aurora" and that he had no specific plan, "[s]o, by definition, I couldn't have discussed it with anyone in any detail." He submitted that the decision to call the January Meeting "was the culmination of a long, process over a period of almost 18 months", explaining:

All along, I thought ASIC, the regulator charged with policing the Corporations Act, and the conduct of AFSL holders, might do something about Aurora's conduct. To a limited extent, they did, imposing license conditions on Aurora after the incident when $1mn went missing out of AUP. However, I did not particularly want to have to spend a significant amount of my own money calling a members' meeting to try and remove Aurora as RE. But it was nonetheless one of the options at my disposal. The only person I discussed it with in any great detail was my legal counsel, and Mark Tier, the Director of Wonfair.

At no point until shortly before Primary called the Canberra EGM had I even made up my mind as to what the best plan of action to try and "rescue" the ABW investment might be.

- The following events and communications involving (among others) Messrs Staermose, Purcell, and Garton Smith shed some light as to Mr Staermose's evolving intentions in relation to ABW:

- On 2 October 2018, Mr Staermose sent an email to his uncle in which he stated that he (in his personal capacity) and Wonfair were "involved in a nasty activist battle" and that he was agitating either for Aurora to be removed by ASIC or by him calling a meeting.

- As noted in paragraph 15, on 15 October 2018, Mr Staermose sought to requisition a meeting of ABW unitholders to consider replacing Aurora as responsible entity with Millinium Capital Managers Limited or, alternatively, that ABW be wound up. The requisition was subsequently withdrawn.

- On 18 October 2018, Mr Staermose sent an email to his solicitors, Norton Smith, in which he stated:

I have Andrew Purcell negotiating a potential RE in Sydney if it goes super hostile again, and we need to call a meeting.

So, basically I am revving the engines, while in a holding patter, with any and all options open.

- Hostile.

- Wait and do nothing.

- Stop fighting them and see if there is a way I can get in there and help restore value somehow.

- Sell to some other party who wants to do something with it.

- On 24 October 2018, Mr Staermose sent an email to Mr Purcell in which he discussed the possibility of commencing Court proceedings to compel access to the ABW register and, as an alternative, having "someone else to request the registry and call the meeting and for me to step into the shadows. But that may not work either."

- On 22 November 2018, Mr Purcell sent an email to Mr Garton Smith and the solicitors for Primary, stating "Gents, the unit holders we represent are inclined to just call a meeting and let Aurora run it. I know you don't agree with this course of action but we need to show an alternative soon." We infer the statement "unit holders we represent" to be a reference to the Wonfair Parties.

- Further emails sent between Mr Purcell, Mr Garton Smith and Primary's solicitors on 23 November 2018 demonstrated that Mr Staermose "took a lot of cajoling", but ultimately requested a cost agreement in relation to engaging solicitors to threaten proceedings against ABW's registry to compel production of the register. From the material, it seems that this course of action may have been pursued until 13 December 2018.

- On 29 November 2018, Mr Purcell sent an email to Mr Garton Smith asking how long they should wait for a response from ASIC or Primary's registry and stated "I'm keen to keep whatever momentum we have as its difficult keeping everyone committed to this path given how little progress we have made to date (and I'm referring to our efforts long before your firm got involved)." We infer the term "everyone" to be a reference to the Wonfair Parties and the "path" to be that discussed in paragraph 69(f) above.

- Aurora provided a chain of "without prejudice" emails between Mr Staermose and Mr Nicholas Bolton (a major shareholder in Aurora) during 26 and 28 January 2019, in which Mr Staermose stated (among other things):

My other proposal to JP and Aurora has always been, let me control ABW, and I'll leave the rest of Aurora's funds alone. It is no secret that I have been trying to get hold of a listed vehicle for a long time. USR was the first serious crack, but ended up being wrecked by a dead-locked board. Seems CVC will end up with that shell. Though, the saga is still continuing.

…

But people might invest in something that I use ABW for.

I have plenty of loyal clients who might back me. And I haven't lost 75% of my investors' money over the past 30 months the way Aurora has in ABW.

So the way I see it, ABW is certainly worth more to me than to JP and Aurora at this stage.

- Aurora submitted in effect that the email chain supported an inference that Mr Staermose and the other Alleged Associates had a plan "for a long time" to take control of ABW and AFARF. On considering the email chain in combination with the other relevant material (including the matters referred to in paragraph 69) and drawing from our experience, we do not draw that inference. We have no material that establishes any of the Alleged Associates (other than Wonfair) had formed an agreement or understanding with Mr Staermose in relation to a plan to "control ABW" and indeed, we consider that the statement that his clients "might" back him supports the contrary inference.

- Rather, we consider Mr Staermose's language in the email chain to be broadly consistent with how some value investors may typically communicate, in particular when exchanging views in relation to investments with other value investors, including how they could maximise the return on an investment. In addition, we view Mr Staermose's email as an expression of his views, and we are not satisfied that he was speaking on behalf of his clients (or was authorised to do so) or that the material established that his clients would, or could be pressured to, act in accordance with his plans or implement his proposals.

- Drawing on our experience we consider that, contrary to Aurora's submission that Mr Staermose had a plan "for a long time", the material in paragraph 69 shows that he had been frustrated by Aurora's performance and conduct for a long time, but did not commit to call a meeting to replace Aurora as responsible entity until 20 December 2018 (when he and Wonfair executed authorities for Primary to convene the January Meeting). We consider that the material shows that Aurora's performance led Mr Staermose to evaluate and engage in a number of possible courses of action (which dynamically changed over time) to extract value from his investment in ABW, none of which would be uncommon amongst value investors. The email chain in paragraph 70 also shows that Mr Staermose continued to explore "other proposal[s]" following the January Meeting. In our view this inference is relevant in considering whether the Wonfair Parties entered into a voting agreement with any of the other Alleged Associates (as discussed below).

Wonfair Parties and Mr Tan

- There are some structural links between the Wonfair Parties and Mr Tan. During 2001-2002, Messrs Staermose and Tan worked together at Lehman Brothers in Hong Kong. They lost contact after they stopped working together but reconnected in or around 2009 when Mr Tan came across one of Mr Staermose's publications. Mr Tan submitted that he had declined a number of invitations from Mr Staermose to invest in Wonfair because he wanted control over his own investments.

- In light of our conclusion set out in paragraph 67, we are not satisfied that coincidences in trading and an advisory relationship in and of itself is sufficient to establish that Mr Tan entered into a relevant agreement (or was otherwise associated) with the Wonfair Parties in relation to the acquisition of ABW units by Mr Staermose and Mr Tan. In addition, Mr Tan made his last acquisition of ABW units in July 2018 (ie before he was introduced to Mr Purcell by Mr Staermose), sometime before the last acquisition by the Wonfair Parties in late January 2019.

- There is more material potentially to support an inference of a voting agreement between Mr Tan and the Wonfair Parties compared to the other Alleged Associates. On 25 October 2018, Primary issued an invoice to Lawndale Group (to the attention of Andrew Purcell) in the amount of $1,000 (including GST) for "Requesting the register of unit holders of the Aurora Absolute Return Fund including out of pockets (but not including any legal costs in the event of no response)." In its submission, Primary confirmed that its bank statements showed that the invoice was ultimately paid for by Mr Tan. The date of the invoice is one day after Mr Staermose made the suggestion to Mr Purcell that "someone else…request the registry and call the meeting and for me to step into the shadows" (see discussion at paragraph 69(d)).

- On 8 November 2018, Mr Purcell sent an email to Mr Rob Garton Smith of Primary stating that Mr Tan would be the "appointer (member)" and provided his details. On 9 November 2018, Mr Garton Smith emailed a blank 'Authority to inspect and make copies of the register of members of Aurora Absolute Return Fund' to Mr Purcell which included Mr Tan's details as provided by Mr Purcell the previous day.

- On 13 December 2018, Mr Staermose emailed a complaint to ASIC that set out (among other things) details of his attempts to obtain a copy of the ABW register from Aurora. In his complaint, Mr Staermose stated:

Given these frustrations, I relayed my concerns about Aurora to a fellow unit holder, Chor Leng Tan. Since he holds more than 5% of ABW, he engaged a firm called Primary Securities to request a copy of the register on his behalf. Mr. Tan has just informed me that he has learned via Primary Securities that Aurora has told ASIC that it has never received a request for the register of ABW.

That is a lie…

- On 19 December 2018, Mr Garton Smith sent an email to Mr Purcell that stated:

As to costs, I propose to write to each unitholder and ask that they contribute their proportion of the $27,500, but I am proceeding on the basis that Tim and Leng Tan will provide their portion, after deducting the $1,000 already paid.

- On 24 December 2018, Primary sent a letter to Aurora in relation to a request to inspect the register it had sent on 14 December 2018, in which it stated "We do not represent or act for Chor Leng Tan." In response to our brief, Primary submitted that Mr Garton Smith was not aware at the time of sending the 24 December 2018 letter that it was Mr Tan who had paid the $1,000 invoice issued to Lawndale Group on 25 October 2018.

- We asked questions of Primary in relation to the basis on which it proposed to ask ABW unitholders to contribute to the $27,500 in its email dated 19 December 2018, the identify of the persons who were to be asked to contribute and to provide the names of all ABW unitholders who did contribute.

- Primary submitted that:

Primary is in the business of acting as responsible entity for fees and in these circumstances, its practice is to request all members of a fund to contribute to preliminary expenses.

No draft was prepared and no correspondence was sent.

Chor Leng Tan contributed $1,000 and Tim Staermose contributed $10,000.

- We also asked Mr Staermose whether he contributed to Primary's costs. Mr Staermose submitted:

I didn't "contribute" to Primary's costs. As is the requirement under the Corporations Act, Wonfair and I, being the members who called the EGM, paid all the costs of that meeting.

…

To my knowledge, other than Wonfair and I, no one else contributed to any costs of that meeting.

- In our brief we asked questions of Mr Tan in relation to his relationship with Primary. Mr Tan submitted that:

I engaged Primary Securities on or around late October 2018 so as to obtained the unitholder Register of ABW. Primary was introduced to me by Mr Purcell. He acted as for me as I had not met nor knew Mr Garton Smith of Primary Securities prior to meeting Mr Purcell. I requested the register as I was appalled by Mr Purcell and Mr Staermose continued frustrations with Mr Patton of Aurora. I wished to call for a meeting in ABW given their frustrations with Mr Patton and Aurora's poor financial performance. My request for the register was rejected by Aurora (Mr Patton) for no good reason.

I engaged Primary Securities (with a payment of $1,000) to seek the register as I was appalled by the oppressive nature Mr Purcell and Mr Staermose received by Aurora (Mr Patton) when they had wished for unit/shareholders to express their wishes at meetings. Kindly note, I was actively involved in a legal dispute in the High Court of Malaysia ([#]) whereby the minority had oppressed the wishes of the majority of shareholders. I do not take kindly when the majority of unitholders interests are usurped for no good reason, as in this case I believe Aurora has/is doing so. Consistent with my experience in Malaysia I do not tolerate or like behaviour whereby my rights as a unitholder (together with what I believe are the wishes of the majority of unitholders) are oppressed.

The $1,000 was paid by me as it was a meeting I wished to call.

The $27,500, if that was/is the cost of a meeting, was I believe, paid for by Mr Staermose. The meeting called (after my failed attempt of obtaining a register from Aurora/Mr Patton) was called by Mr Staermose. I did NOT contribute to the costs at all. It was not my meeting.

- Mr Tan also submitted that the first time he had communicated directly with Primary was in or about June 2019 (to offer to contribute to funding the appeal of the Court Decision) and that all his communications, including in relation to the request for the register, was made through Mr Purcell. In addition, there was no evidence of direct correspondence between Mr Tan and Primary in relation to the register request (or indeed, in relation to the January Meeting). As such, we have no reason to view Primary's submission that Mr Garton Smith was not aware at 24 December 2018 that Mr Tan had paid the Lawndale invoice with scepticism or the statement that Primary did not represent or act for Mr Tan as being deliberately misleading.

- The Panel has found in other cases associations between persons requisitioning a board spill and others who assist in the requisition.20 We consider that there are two competing inferences that could be drawn from the material in relation to Mr Tan's involvement with Primary's request for the ABW register. Either Mr Tan was acting in concert with Mr Staermose or that he was of like mind with Mr Staermose and instructed Primary to obtain the ABW register independently (possibly after discussing or exchanging views on the matter with Mr Staermose). Drawing on our experience, we prefer the latter inference (which is consistent with our conclusion in relation to Mr Tan's approach to his investment decisions in ABW).

- RG 128 deals with collective action by investors wishing to cooperate in relation to their investments and aims to promote investor engagement on corporate governance issues. It recognises a difference between, on the one hand, investors expressing views and promoting appropriate discipline in entity decision-making and, on the other hand, investors taking control of entity decision-making.21

- To the extent Mr Tan and Mr Staermose engaged with one another (directly, or through the agency of Mr Purcell), we are not satisfied that this is sufficient for us to infer that Mr Tan and Mr Staermose had gone beyond "discussing or exchanging views on a resolution to be voted on at a meeting" to forming a joint proposal or understanding to remove Aurora as responsible entity of ABW (including reaching any agreement or understanding in relation to voting) or that they acted in concert to implement such a proposal.

- We recognise that in some instances there may be a fine line between conduct that may comprise merely an expression of views and conduct that may constitute the agreement to pursue a joint proposal (see for example Table 1 and Table 2 of RG 128), however we are not satisfied the evidence in this case established that the conduct of Mr Staermose and Mr Tan in the circumstances extended to the kind described in Table 2 of RG 128.

- Given our findings above, we are not satisfied that Mr Tan's offer to contribute to funding the appeal of the Court Decision is evidence of a continuing association.

Wonfair Parties and Mr Greiner

- Mr Greiner's full-time occupation is managing cattle ranches and a retail business selling dry-aged steaks in Costa Rica.

- In light of our conclusion set out in paragraph 67, we are not satisfied that coincidences in trading and an advisory relationship in and of itself is sufficient to establish that Mr Greiner entered into a relevant agreement (or was otherwise associated) with the Wonfair Parties in relation to the acquisition of ABW units by Mr Staermose and Mr Greiner.

- Mr Staermose submitted that Mr Greiner first began reading his newsletters in 1998, and Wonfair submitted that Mr Greiner was also associated with the same publishing company that previously employed Mr Staermose and Mr Tier.

- We asked questions of Mr Greiner in relation to his relationship with Mr Staermose. Mr Greiner submitted:

I know Mr. Staermose because he has been (and still is) a prolific editor/ writer of various investment newsletters, and our paths have crossed on multiple occasions over the past 2 decades. Notably, Mr. Staermose has been a public speaker at many investment seminars…

My contact with Mr. Staermose as been related to either his newsletters or investment seminars, and the occasional informal dinner/cocktail sessions that follow. In my opinion, being a subscriber to an investment newsletter does not constitute a client/advisor relationship… I would not consider Mr. Staermose to be my personal advisor.

- On 11 January 2019, Mr Greiner sent a mailbox message to UBS, stating:

[CMDP] is part of the group that is trying to replace the Fund's current management. We accumulated shares in this stock so that we would have enough votes to get this done. If the nominee (which is JP Morgan, I think) does not submit the proxy form in time, then this would be very disappointing, both for me and for the other group members who are counting on my vote.

- We asked Mr Greiner several questions in relation to this mailbox message. Mr Greiner submitted that he used the term "we" to note that he was speaking on behalf of his company (CMDP) and also to refer "to a group of disgruntled unit holders who are unhappy with Aurora's management", the identity of which he submitted he was unaware. Mr Greiner submitted:

... I categorically deny that I was involved in a secret conspiracy with any of the Alleged Associates, or anyone else for that matter.

I was not party to any voting agreement. The only alleged associate that I had contact with prior to the vote was Mr. Staermose, and we never discussed how we would vote. There was never a need to. We were both very dissatisfied with Aurora's management. He forwarded me the proxy form, I then read it, determined how I would vote, and sent my instructions to my bank rep … and then my voting wishes were subsequently ignored by the custodian in Australia.

I did not have any plans or intentions for ABW. I simply wanted a competent manager who could make my investment grow. Anybody would have been an improvement over the current managers. To be frank, my full-time preoccupation is managing 4 cattle ranches and a retail business selling our own dry-aged steaks. I spend as much time as I can managing my investments, and searching for new opportunities. But to think that I might have some designs to be actively involved in the management an investment fund in Australia is a bit of stretch.

…

The allegation by Aurora is that I was acting in a secret conspiracy with the other Alleged Associates. The reality is that I meant we (CMP) were part of a group of unit holders that were unhappy with the management and wanted to remove them. Other than Mr. Staermose, I did not know who those other unit holders were, but I was certain that there was a large group of them. I had not had any communication whatsoever with any other unit holders besides Mr. Staermose.

- In the Court Decision, Her Honour added emphasis to the following words in Mr Greiner's mailbox message dated 11 January 2019:

- "part of the group" and

- "We accumulated shares in this stock so that we would have enough votes to get this done."

- While the mailbox message and these words in particular gave us pause, we were not satisfied that the evidence established that a group of ABW unitholders had acted in concert in relation to the acquisition of ABW units or had formed a joint proposal or understanding to remove Aurora as responsible entity of ABW (including reaching any agreement or understanding in relation to voting). Firstly, as stated in paragraph 92, we are not satisfied that Mr Greiner and the Wonfair Parties were associates by reason of coincidences in trading and an advisory relationship.

- Secondly, the trading records showed that most of the acquisitions made by the Alleged Associates had occurred before Mr Staermose had formed his intention to replace Aurora as responsible entity (see paragraph 69). In particular, Mr Greiner made his last acquisition of ABW units on or about 19 October 2018. As such, we consider there is insufficient material to infer that there was a plan that a "group" of ABW unitholders could implement at the time of making these acquisitions.

- Thirdly, drawing on our experience, we are satisfied that Mr Greiner was one of a number of like-minded ABW unitholders who were "disgruntled" and "unhappy with Aurora's management" due to its performance as responsible entity. Given there was no evidence of a joint proposal or understanding or that Mr Greiner was acting in concert with other ABW unitholders, we infer that the statement "part of the group" is a reference to these independent but like-minded dissatisfied ABW unitholders. Accordingly, we infer Mr Greiner's mailbox message as no more than an expression of how he intended to vote at the January Meeting, albeit in rather 'loose' language.

- In February and March 2019, Mr Purcell corresponded with Mr Greiner, seeking Mr Greiner's assistance in relation to the Court Proceedings. From the email correspondence provided by Mr Greiner, it appears that Mr Purcell understood that Mr Greiner's nominee refused to act on Mr Greiner's recommendation "because of the statement made by Aurora on the ASX platform on 8 January stating that they did not recognise the meeting's validity and advising members to ignore it." It is conceivable that Mr Purcell became aware of Mr Greiner's dilemma through Mr Staermose, but we do not consider it supports an inference of association (or indeed, a continuing association).

- Given our conclusions above, we are not satisfied that Mr Greiner and the Wonfair Parties are associated in relation to a proposal to replace Aurora as responsible entity of ABW.

Wonfair Parties and Mr Fraser

- In light of our conclusion set out in paragraph 67, we are not satisfied that coincidences in trading and an advisory relationship in and of itself is sufficient to establish that Mr Fraser entered into a relevant agreement (or was otherwise associated) with the Wonfair Parties in relation to acquisition of ABW units by Mr Staermose and Mr Fraser.

- Mr Fraser is a holder of redeemable preference shares in Wonfair. In response to our request for details as to how the investment in Wonfair came about, Mr Fraser submitted:

I purchased the redeemable preference shares in Wonfair. Mr. Staermose had a proven investment strategy, which was aligned with my own investment ambitions plus, and more importantly I invested in Wonfair to support Mr. Staermose, who is above all, my friend. Wonfair was Mr. Staermose's first investment company launch, and along with a number of other friends / family, we all invested to get things up and running.

- Mr Fraser submitted in response to our request for details of communications with Mr Staermose:

…the only specific communication I had with Mr. Staermose was with respect to who I should appoint as a proxy for the meeting on 15th January, as I was unable to attend in person. During this call, I advised Mr. Staermose which way I intended to vote with respects to the tabled resolutions.

- On 9 January 2019, Mr Staermose forwarded an email to Mr Fraser (and Mr Purcell) setting out "some analysis of how I thought the vote might go at the EGM." On the same day, Mr Fraser appointed Messrs Andrew and Oska Purcell (in equal proportions) as proxies for his ABW units.

- Mr Staermose submitted in response to our request for details of communications with Mr Fraser:

Being a banking professional of 25+ years' standing Mr. Fraser had an intellectual and professional interest in the "bizarre" goings on at Aurora, as he called them, on more than one occasion when we spoke. As best I recall, Mr. Fraser's position was always that, "Obviously Aurora has to go. They are incompetent at best and unethical at worst. Anyone has to be better than them. I just want them to stop losing my money!"

It was so obvious to us how any sane person would vote that we never even specifically discussed it.

- In its rebuttals, Aurora attached an email dated 20 June 2019 from Mr Fraser to Aurora in which he stated (among other things):

The facts clearly show that I was a party to a vote back in January 2019 to replace Aurora as the RE, a vote I made freely on my own without outside influence, basis the incredibly poor performance of the fund vs the benchmark. Aurora needs to be held accountable for this, as unit holders, we have suffered great loss and yet Aurora continues to take in disproportionate fees for said inadequate performance.

I am a sophisticated investor and I alone make my own decisions. The assertions in your claims to the Courts and now the Takeover Panel about my alleged involvement in an "association" are erroneous and slanderous.

Setting all the above aside, in the last 48 hours I have released Mr. Staermose from his role as my investment adviser, as I have said above, I didn't sign up for any of this nonsense. Whilst this investment was recommended by Mr Staermose, I saw deep value in ABW at the time and agreed to the trade; regrettably, that value has all but been eroded.

- Aurora submitted that "This shows that the relationship involved precisely the kind of acting in concert that independent parties can form, without realising that this constitutes an association under the Corporations Act. The reality that Mr Fraser has acknowledged in this email also encompasses the other [Alleged Associates]."

- We disagree with Aurora's interpretation of Mr Fraser's 20 June 2019 email. We are not satisfied that the evidence establishes, or opens the inference, that Mr Fraser and Mr Staermose had gone beyond "discussing or exchanging views on a resolution to be voted on at a meeting" and had extended to forming a joint proposal (or involved any acting in concert) to remove Aurora as responsible entity of ABW, or that they had reached an agreement or understanding as to vote in favour of removing Aurora. Accordingly we are not satisfied that Mr Fraser and the Wonfair Parties are associated in relation to a proposal to replace Aurora as responsible entity of ABW.

Wonfair Parties and Solano

- Solano has a registered address in Florida, USA and is controlled by Dr Thomas Johns. Solano is a holder of redeemable preference shares in Wonfair. Solano did not become a party to proceedings and made no submissions in response to our brief.22

- Mr Staermose submitted that Dr Johns subscribed to his current newsletter in 2012 and explained that this is how he has an "advisory relationship" with Solano. He also submitted that he has periodic telephone calls with Dr and Mrs Johns in his capacity as their "financial adviser".

- On 9 January 2019, Solano appointed Mr Garton Smith and another director of Primary as proxies in equal proportions.

- In light of our conclusion set out in paragraph 67, we are not satisfied that coincidences in trading and an advisory relationship in and of itself is sufficient to establish that Solano entered into a relevant agreement (or was otherwise associated) with the Wonfair Parties in relation to acquisition of ABW units by Mr Staermose and Solano. We consider that the appointment of Mr Garton Smith as Solano's proxy does not take us very far.

- We have no material that establishes that Solano was in any way involved in a proposal to replace Aurora as responsible entity of ABW. Accordingly, we are not satisfied that Solano and the Wonfair Parties are associated in relation to a proposal to replace Aurora as responsible entity of ABW.

Wonfair Parties and Primary

- Primary prefaced its response to our brief noting that it had filed an intention to appeal against the whole of the Court Decision and that "[u]ntil that appeal is commenced and determined, Primary does not accept the findings of fact or conclusions of law made by the Court."

- There are no structural links between the Wonfair Parties and Primary. It would appear from the material that Mr Purcell introduced Mr Staermose to Mr Garton Smith and Primary. Mr Purcell was temporarily appointed as a company secretary of Primary between 25 January 2019 and 30 January 2019 for the purpose of lodging an original hardcopy ASIC Form 5107 Notice of change of responsible entity following the January Meeting.

- We asked Primary to provide an overview of its day-to-day business. Primary submitted:

Primary Securities Ltd is a professional responsible entity operating almost 30 retail and wholesale schemes (financial assets, property, mortgages and forestry) as well as conducting broking operations. Primary provides administration and registry services and employs a number of in-house lawyers and accountants. Primary's managers include experts in financial assets, property, banking, forestry and other activities.

As part of its business, Primary has consented to becoming responsible entity of many schemes in circumstances where the scheme members have legitimate and serious complaints about the incumbent responsible entity.

Primary sees this as carrying out a public duty by providing support for aggrieved unit holders collectively seeking rescue or redress, particularly when ASIC has not had the resources to take action. This is never a matter of "control" for a particular group of scheme members but always a case of rescuing and protecting not just the group taking action by collectively convening a meeting, but also the silent minority, from an insolvent, negligent, conflicted or rapacious responsible entity in a situation in which, had things continued, they might continue to suffer losses or even lose their entire investment.

ABW is the first listed scheme for which Primary has consented to be replacement responsible entity.

- Aurora submitted that by agreeing to act in the role as responsible entity, Primary became a party to an alleged voting agreement to co-operate to replace Aurora as responsible entity of ABW and "thereby obtained a power to control the casting of a vote by any of the [Alleged Associates]… in any way inconsistent with the [alleged voting agreement]." We are not satisfied that merely consenting to a request to being appointed as a responsible entity is sufficient to establish an association between the requester and the potential appointee.

- Mr Garton Smith prepared and provided a report to the board of Primary dated 18 October 2018 entitled "Takeover Report". Among other things, the report stated that:

Information in this report comes from documents filed with ASX and ASIC and document supplied by Andrew Purcell who is assisting some of the investors in [ABW]. He believes that 40% or more of investors in [ABW] would vote to change responsible entity. Andrew Purcell has examined the Aurora structure and … believes there is a pathway for takeover of all of the Aurora schemes.

…

[ABW] appears to be operated by the incumbent RE and there is no manager. Investors have previously expressed displeasure that [ABW] is both the fund manager and the RE. If [AFARF] is taken over, then a manager will need to be found to operate [ABW]. According to Andrew Purcell, one of the investors in Hong Kong who wants to see the responsible entity changes is a fund manager and would like this role.

- Under a heading titled "Strategy", the Takeover Report stated:

Some investors holding 5% or more have authorised Primary to convene a meeting to amend the Constitution and to seek the replacement of the responsible entity of [ABW]. The meeting documents will be sent out just before Christmas.

Primary will follow up with a request for funding from the top 20 investors, asking each to pay their proportion of our fees $27,500. These include [Aurora] itself, so we may refrain from asking them.

…Primary would then proceed to seek the replacement of the responsible entity of [AFARF].

It is proposed to first investigate the poor and illiquid investments of [ABW] and [AFARF] and whether or not there is any evidence of lack of care and diligence on the part of [Aurora] or any officer or other party.

- Following our review of the Takeover Report in its entirety, we consider that the Takeover Report was a standard proposal to the Primary board to accept an appointment as responsible entity in the event that Aurora was removed at the January Meeting, in return for fees. We are not satisfied, or prepared to infer, that the Takeover Report (including the "Strategy" section) provides evidence of any agreement or understanding between Primary and any of the other Alleged Associates as to a strategy or proposal in the event that Primary was appointed as responsible entity.

- Primary submitted that:

AFARF is an unlisted fund.

This is a strange structure that serves no function other than to protect an unlisted fund from takeover. Those wanting to change the responsible entity of AFARF and seek redress for poor management have first to take control of ABW. This means obtaining a register of members of ABW, which Aurora never gives except under pressure from ASIC, and being subject to all the other attacks which Aurora mounts because of the takeovers legislation.

- We asked whether we should infer from this statement that Primary and one or more of the Alleged Associates had a plan to take control of ABW and AFARF. Primary submitted (among other things) that:

The above supplementary submission was poorly worded as the appointment of Primary as responsible entity of ABW did not give "control" of ABW to any particular unit holders or group of unit holders but to Primary for the benefit of unit holders as a whole…

The unit holders themselves were not able to take "control" of ABW such as by the appointment of nominee directors on the board of a company or by having control of a responsible entity or the responsible entity being controlled or managed by them under some management agreement.

They were seeking to appoint an independent non-conflicted professional responsible entity that is not controlled or managed by them and had no links to any of them, in order that Primary should represent unit holders as a whole.

Even after appointment, as a matter of trust law, unit holders are not able to meet to resolve that a responsible entity manage in a particular way. The unit holders wanting Primary appointed would never directly or indirectly have the capacity to determine the outcome of decisions about financial and operating policies of ABW.

- On 29 January 2019, Primary sought a copy of the register of members of AFARF. Primary submitted that the reason it did so was because it "was carrying out its obligations as a newly appointed responsible entity to investigate and get in the assets of ABW."

- We consider that Primary's submission as to its reasons for requesting a copy of the register may be accurate. But it is not likely to be the whole story. We consider that the Takeovers Report and Primary's submission in paragraph 123 suggests that if Primary was successfully appointed as responsible entity of ABW it intended to "proceed to seek the replacement of the responsible entity of [AFARF]" and a fund manager to operate ABW. However, we were unable to find out the identity of the Hong Kong investor who was interested in the role as fund manager because Primary submitted it did not know who Mr Purcell was referring to, and Mr Purcell did not respond to our brief (see paragraph 131).

- Notwithstanding the above, we are not satisfied that the material establishes that any of the Alleged Associates had entered an agreement or reached an understanding to give effect to Primary's plans in relation to ABW or AFARF. On the contrary the following extract from an email sent by Mr Staermose to Mr Purcell on 17 April 2019 (albeit, at a much later date) sets out what he considered the differing objectives of the Wonfair Parties, Mr Purcell and Primary:

[Mr Purcell's] main objective is still to get at HHY and its MEL holding, right? [Mr Garton Smith's] objective is to turn past and future time billed into cash. And mine is to try and recover as much as possible, while spending as little as possible. So we may be rowing the boat in very different directions.

- On 18 April 2019, Mr Staermose became a "Committee Member" under a Committee Member Agreement entered into with Primary in relation to ABW. The recitals of the agreement provided that:

The purpose of the Committee is to serve as a forum in which Committee Members, as representatives for the general body of Investors can review strategies, proposals and issues relating to the Scheme and exchange feedback, views and opinions on these strategies, proposals and issues.

- In addition, clause 7.2 of the agreement provided:

Except as otherwise specifically directed by Primary from time to time, the Committee Member will have no authority to incur any obligation on behalf of Primary or bind Primary to any agreement or otherwise hold himself out or deal as agent of Primary.

- We are not satisfied that if Primary was ultimately validly appointed as responsible entity for ABW it would not remain "an independent non-conflicted professional responsible entity that is not controlled or managed by them and had no links to any of [the Alleged Associates]", including in its proposed pursuit to replace Aurora as responsible entity of AFARF.

Mr Purcell

- Mr Purcell did not become a party to proceedings and made no submissions in response to our brief. Aurora submitted:

The lack of information from Mr Purcell leaves a lacuna which will need to be dealt with by inference from the other material before the Panel. The Panel should infer that Mr Purcell's decision not to participate in the Proceedings suggests that truthful answers from him would not assist him or the other Alleged Associates.

- We considered exercising our power to summon Mr Purcell to give evidence and produce specific documents.23 We considered the material before us and were not satisfied that summoning Mr Purcell was likely to produce additional material from which we could draw any inference of association24 or would otherwise justify prolonging proceedings. We were also satisfied that Mr Purcell had differing objectives to both Mr Staermose and Primary (see paragraph 127).

Conclusion in relation to alleged associations

- Given our findings above, we are not satisfied that the Alleged Associates have contravened s671B or s606, or that the Wonfair Parties and any of the Alleged Associates attempted to control ABW and change the responsible entity in a way which was contrary to Chapter 6. As such, we are not satisfied that the circumstances were unacceptable.

Public interest

- In Aguia Resources Limited, the sitting Panel recognised that (footnotes omitted):

The ability of shareholders to hold a company to account for its performance is important in keeping directors accountable and can enhance long-term performance. It has been recognised that the benefits of takeovers include 'improved corporate efficiency and enhanced management discipline, leading ultimately to greater wealth creation'. Collective action by shareholders has similar benefits.25

- We consider that it is equally important for unitholders in a managed investment scheme to be able to hold a responsible entity accountable through collective action, in particular in circumstances where unitholders are dissatisfied with the performance or conduct of the responsible entity. Indeed, in an appropriate case, such dissatisfaction may form a sound basis for unitholders to exercise their rights and powers to seek the replacement of a responsible entity.

- In Aguia Resources Limited the sitting Panel acknowledged that the Panel will consider whether it is in the public interest (see s657A) to intervene in the context of a board spill and set out a number of factors that are important to the approach the Panel takes to a board spill.26 While the Application in this proceeding relates to different circumstances, we consider that some of the factors addressed in Aguira Resources Limited are relevant.

- If, despite our conclusions above, we were to assume that all or any combination of the Alleged Associates were in fact associates, we would nevertheless still not be minded to make a declaration in any event as we consider that doing so would not be in the public interest because of the following combination of factors:

- we consider that any of the alleged associations are likely to have ceased since the January Meeting27

- we were not satisfied that the material established that Primary was not independent from, or aligned with, the Alleged Associates or that the alleged association would likely continue after it was appointed as responsible entity28 and indeed, we are satisfied the material demonstrated that the Wonfair Parties were "seeking to appoint an independent non-conflicted professional responsible entity that is not controlled or managed by them and had no links to any of them, in order that Primary should represent unit holders as a whole"29 and

- we were not satisfied that the material established that any of the Alleged Associates had joint plans for the management of ABW after the January Meeting.30

Failure to comply with tracing notices and other matters

- While securityholders are required to comply with tracing notices issued to them, in the circumstances of this case we do not consider that noncompliance with these provisions resulted in unacceptable circumstances. It is a matter for ASIC to pursue historical contraventions of the tracing notice provisions if it wishes.

- Throughout the course of proceedings a number of allegations were raised by parties and non-parties in relation to (among other things) the conduct of Aurora. These matters did not form part of the Application and are matters to be pursued by ASIC, if it wishes.

Extension of time

- Aurora sought an extension of time for the making of the Application under s657C(3)(b) to August 2017. We asked the parties what factors (both factual and policy) should we consider when deciding whether to extend the time to receive the Application.

- Aurora submitted (among other things) that although the alleged "underlying 'relevant agreements' and some of the relevant 'conduct' occurred months (if not years) before the filing of the Application, despite its suspicions, Aurora had very little solid information in relation to the matters that are subject of the Application until 18 March 2019 when that information was obtained in the course of litigation." In addition, Aurora submitted that the stay of the orders in the Court Proceedings expired on 6 June 2019, after which "Aurora waited a reasonable period to see if the Alleged Associates had decided to give up their coordinated action and, having determined that that would not occur acted promptly so as to file the Application on 18 June 2019."

- While we disagree that the information obtained in the course of litigation and provided to us during the course of our proceedings established any association between the Alleged Associates or that the Alleged Associates continued to be associated after the Court Decision, we decided to extend the time for making the Application because we were satisfied that:

- the Application made credible allegations of clear and serious unacceptable circumstances (notwithstanding those allegations were not ultimately made out) and

- Aurora had made the Application a reasonable time after the Court Decision.

Given the above, we considered that it would be undesirable for the matter to go unheard merely because it was lodged outside the two month time limit.