[2023] ATP 7

Catchwords:

Declaration – orders – association - costs - failure to disclose – power or control – voting power – substantial holding – board spill – lack of independence – extension of time for making application – extension of time for making declaration – conference – underwriting – rights issue – confidentiality

Corporations Act 2001 (Cth), sections 12, 249D, 602, 606, 657B, 657C and 671B

Australian Securities and Investments Commission Act 2001 (Cth), sections 190, 192 and 194

Australian Securities and Investments Committee Regulations 2001 (Cth), regulation 16

ASX Listing Rules, rules 3.1 and 10.1

Takeovers Panel Procedural Rules 2020, rules 6(1), 11(1), 18 and 19

Palmer Leisure Coolum Pty Ltd v Takeovers Panel [2015] FCA 1498, Tinkerbell Enterprises Pty Limited as Trustee for The Leanne Catelan Trust v Takeovers Panel [2012] FCA 1272, Dyinda Pty Ltd and Ors v First Distribution Services Ltd and Ors [2004] FCA 12, Re Takeovers Panel [2002] FCA 1120, Briginshaw v Briginshaw [1938] HCA 34

Guidance Note 4 – Remedies General

ASIC Regulatory Guide 128: Collective Action by Investors (RG 128)

Tribune Resources Limited [2018] ATP 18, Strategic Minerals Corporation NL 02R, 03R, 04R and 05R [2018] ATP 5, Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, Merlin Group Limited [2016] ATP 1, Tigers Real Coal Limited [2014] ATP 2, Avalon Minerals Limited [2013] ATP 11, World Oil Resources Limited [2013] ATP 1, Bentley Capital Limited 01R [2011] ATP 13, CMI Limited 01R [2011] ATP 5, CMI Limited [2011] ATP 4, Viento Group Limited [2011] ATP 1, Mount Gibson Iron Limited [2008] ATP 4, LV Living Limited [2005] ATP 5, Winepros Limited [2002] ATP 18

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | YES | YES | YES | NO |

Introduction

- The Panel, Kelvin Barry, Kerry Morrow and Karen Phin (sitting President), made a declaration of unacceptable circumstances in relation to the affairs of The Market Herald Limited (TMH). The application concerned an alleged association between two of TMH’s substantial shareholders and issues in relation to two entitlement offers. The Panel considered that the two substantial shareholders were associated with each other and one other person and one of those substantial shareholders was associated with other shareholders. The non-disclosure of these associations constituted or gave rise to contraventions of section 671B and were not consistent with an efficient, competitive and informed market. The Panel also considered that the 2022 Entitlement Offer did not disclose the association between the two substantial shareholders and that there were other disclosure deficiencies in the 2022 Entitlement Offer and 2023 Entitlement Offer. The Panel made orders requiring (among other things) disclosure from the associates and TMH in relation to the circumstances found to be unacceptable, the divestment of certain shares, a restriction on certain acquisitions and that TMH appoint at least two independent directors in accordance with the process prescribed under the orders. The Panel also had concerns in relation to the conduct of some of the parties and their legal advisers in these proceedings. The Panel also made costs orders.

- In these reasons, the following definitions apply.

- 2022 Entitlement Offer

- 2 for 5 pro rata renounceable entitlement offer of fully paid ordinary shares in TMH at an offer price of $0.34 per new share to raise approximately $26.6 million in 2022

- 2022 Entitlement Offer

Booklet - Offer booklet dated 5 September 2022 in relation to the 2022 Entitlement Offer

- 2023 Entitlement Offer

- 1 for 6 pro rata renounceable entitlement offer of fully paid ordinary shares in TMH at an offer price of $0.34 per new share to raise approximately $15.52 million in 2023

- 2023 Entitlement Offer

Booklet - Offer booklet dated 2 February 2023 in relation to the 2023 Entitlement Offer

- Adevinta

- Adevinta Oak Holdings B.V.

- ASIC Act

- Australian Securities and Investments Commission Act 2001 (Cth)

- Canaccord

- Canaccord Genuity (Australia) Limited

- CIP

- Capital Investment Partners Pty Ltd

- GAB

- GAB Superannuation Fund Pty Ltd

- GCA

- Gumtree, Carsguide and Autotrader Australia, which were acquired by TMH

- Gumtree

- Gumtree AU Pty Ltd

- HotCopper

- HotCopper Holdings Limited

- Procedural Rules

- Takeovers Panel Procedural Rules 2020

- Re-election Letters

- has the meaning in paragraph 140

- Relevant Party

- has the meaning in paragraph 307

- Relevant Shares

- has the meaning in paragraph 307

- SG Hiscock

- SG Hiscock and Company Limited

- TMH

- The Market Herald Limited

- UIL

- UIL Limited

- Vendor Loan

- Vendor loan of approximately $60.1 million to TMH by Adevinta to partially fund TMH’s acquisition of GCA

- Zero Nominees

- Zero Nominees Pty Ltd

Facts

- TMH is an ASX listed company (ASX code: TMH). It listed on 13 September 2016 as HotCopper.

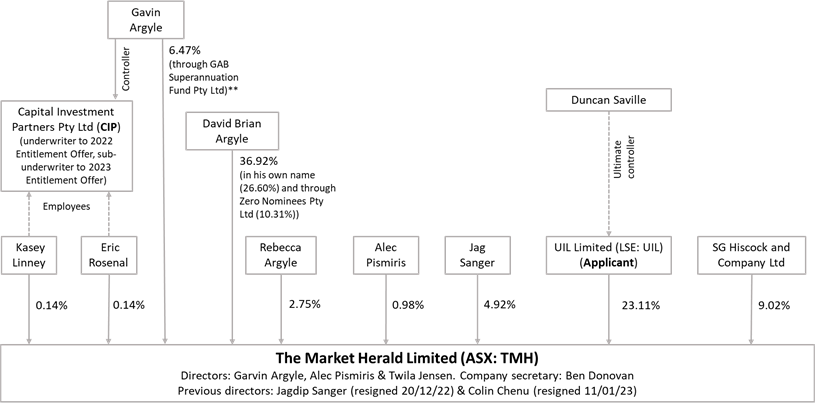

- UIL, the applicant, is a Bermuda company listed on the London Stock Exchange. It holds a relevant interest in approximately 23.11% of TMH voting shares.[1]

- Mr David Brian Argyle holds a relevant interest in approximately 36.92% of TMH voting shares,[2] directly and through Zero Nominees.

- Mr Gavin Argyle, Mr David Argyle’s son, holds a relevant interest in approximately 6.47% of TMH voting shares through GAB.[3] He is, and has been since 2016, a director of TMH, appointed “following a request from substantial shareholder Mr David Brian Argyle…as nominee to the position of Non-Executive Director.”

- Mr Jagdip Sanger holds a relevant interest in approximately 4.92% of TMH voting shares.[4] He was the managing director of TMH from November 2018 until he was formally removed from that position by resolution of the TMH board on 30 November 2022.[5]

- Mr Alec Pismiris is the chairman of TMH and holds a relevant interest in approximately 0.98% of TMH voting shares.[6] He has been a director since listing in 2016 and became chairman in June 2017.

- Relevant shareholdings[7], in diagrammatic form, are as follows:

- On 26 August 2022, TMH announced, among other things, the acquisition of GCA. It stated that the acquisition would be funded by the Vendor Loan of approximately $60.1m and the 2022 Entitlement Offer.

- At this time, the directors of TMH were Mr Pismiris (Non Executive Chairman), Mr Sanger (Managing Director), Mr Gavin Argyle (Non Executive Director) and Mr Colin Chenu (Non Executive Director).

- The 2022 Entitlement Offer was partially underwritten to 80% by CIP, a company controlled by Mr Gavin Argyle. CIP had entered into sub-underwriting agreements with 6 sub-underwriters for 43.41% of the underwritten amount. The 2022 Entitlement Offer Booklet did not disclose that two CIP employees were sub-underwriters.

- On 5 September 2022, TMH issued the 2022 Entitlement Offer Booklet which stated (among other things) that “David Argyle and Gavin Argyle are not considered ‘associates’ as defined under the Corporations Act and as such their shareholdings are not aggregated in accordance with section 606 of the Corporations Act”.

- On 19 September 2022, TMH announced that the 2022 Entitlement Offer had closed having received valid applications for approximately 81% of all new shares offered under the entitlement offer and that shortfall shares had also been taken up under the shortfall offer. The announcement further stated that remaining shortfall shares had been “subscribed for by sub underwriters in accordance with the Company Shortfall dispersion strategy and the Underwriting Agreement”.

- On 27 September 2022, TMH issued 74,788,852 new shares and on 6 October 2022, TMH issued 3,470,587 new shares, in each case under the 2022 Entitlement Offer.

- On 6 October 2022, TMH announced the completion of its acquisition of GCA.

- On 24 October 2022, TMH released the notice of meeting for its annual general meeting to be held on 28 November 2022. The notice of meeting included a resolution for the re-election of Mr Gavin Argyle as a director.

- On 28 November 2022, TMH held its annual general meeting. TMH subsequently announced (among other things) that Mr Gavin Argyle had been re-elected at the annual general meeting.

- On 29 November 2022, Mr David Argyle served a section 249D notice on TMH requisitioning a general meeting at which a resolution was to be put to shareholders “That Mr Jagdip Singh Sangha be removed as a director of [TMH] with immediate effect”.[8]

- On 1 December 2022, TMH announced that it had received the section 249D notice.

- On 2 December 2022, TMH announced (among other things) that:

- Mr Sanger “will no longer be Managing Director of the Company. Mr Sanger, however, remains a non-executive director of the Company”

- Mr Sanger “has been placed on leave and during that time will not be performing an executive role in [TMH]” and

- “Non-Executive Chairman Mr Alec Pismiris and Non-Executive Director Mr Gavin Argyle will also increase their involvement to support [TMH] during this transition period.”

- On 6 December 2022, TMH announced that Adevinta had agreed to waive certain provisions of the Vendor Loan requiring partial payment of the loan by 31 December 2022 and instead required repayment of the full $60.1 million loan amount by 31 March 2023.

- On 20 December 2022, TMH announced (among other things) that:

- “[Mr Sanger] has resigned from the board of The Market Herald” and

- “as a result of the resignation of Mr Sanger, the requisitioned Section 249D meeting announced on 1 December 2022 will no longer proceed.”

- In January 2023:

- Ms Twila Jensen was appointed as an executive director of TMH

- Mr Chenu resigned as a non executive director of TMH and

- Mr Tommy Logtenberg, CEO and CFO of Gumtree, was appointed as interim CEO of TMH (which appointment was subsequently confirmed).

- On 16 January 2023, TMH announced that Adevinta had agreed to extend the Vendor Loan repayment date from 31 March 2023 to 31 May 2023 “on commercial terms”.

- On 24 January 2023, TMH announced that it would undertake the 2023 Entitlement Offer to raise approximately $15.52 million to pay down debt associated with the purchase of GCA. The offer was fully underwritten by Canaccord. Canaccord had entered into sub‑underwriting agreements with 13 sub‑underwriters for 100% of the underwritten amount, including Mr David Argyle, Mr Gavin Argyle, CIP and two CIP employees[9].

- On 2 February 2023, TMH issued the 2023 Entitlement Offer Booklet which:

- disclosed that Mr David Argyle, CIP and Mr Gavin Argyle were related party sub-underwriters of TMH (but did not disclose that the two CIP employees were sub-underwriters)

- stated (on certain assumptions) that the increase in voting power of Mr David Argyle (37%) and Mr Gavin Argyle (6.4%) would be zero

- unlike the 2022 Entitlement Offer booklet, did not include any statement regarding whether Mr David Argyle and Mr Gavin Argyle are associated and

- disclosed a dispersion strategy whereby ‘restricted persons’, being shareholders with a relevant interest of 20% or more in TMH shares and related parties of TMH, were prohibited from applying for TMH shortfall shares in excess of their entitlements under the 2023 Entitlement Offer.

- On 17 February 2023, TMH announced that the 2023 Entitlement Offer had closed, and that it had received valid applications to subscribe for 36,599,046 new shares, representing approximately 80% of all new shares offered. The announcement stated that TMH had received applications for 1,599,097 new shares from shareholders under the top up facility, which was subject to a bookbuild and allocation process.

- On 21 February 2023, TMH announced that the bookbuild did not clear above the offer price and that:

- 1,599,097 shortfall shares would be issued to TMH shareholders under the top up facility and

- the remaining 7,476,428 shortfall shares would be placed to sub-underwriters other than shareholders who hold a relevant interest in excess of 20% or any related parties.

- On 27 February 2023, TMH issued 45,674,571 new shares.

Application

Declaration sought

- By application dated 6 February 2023, UIL sought a declaration of unacceptable circumstances. It submitted that the 2023 Entitlement Offer Booklet:

- contained misleading statements on the effect of the sub-underwriting, the allocation of the shortfall and voting power of the related party sub-underwriters

- failed to disclose the association between Mr David Argyle and Mr Gavin Argyle and

- failed to disclose the effect of the 2023 Entitlement Offer on control of TMH.

- UIL also submitted that the alleged association had remained undisclosed since TMH listed on ASX in September 2016 resulting in an uninformed market and breaches of the substantial holder disclosure requirements. In addition, UIL submitted that acquisitions by the alleged associates between 2017 and 2018 may have occurred in breach of section 606.

- UIL raised concerns about the shortfall allocation in the 2022 Entitlement Offer. UIL also raised concerns that the shortfall offer and shortfall allocation policy under the 2023 Entitlement Offer was not genuine, based on the manner Canaccord and TMH proposed to manage the shortfall and the apparent disregard of the shortfall allocation policy under the 2022 Entitlement Offer.

Interim orders sought

- UIL sought interim orders to the effect that the 2023 Entitlement Offer be suspended until corrective disclosure was made in relation to the 2023 Entitlement Offer Booklet, and that the alleged associates be restrained from exercising any voting or other rights attached to their TMH shares or acquiring any further TMH shares, including through the 2023 Entitlement Offer, pending determination of the application.

- We considered, on an urgent basis, UIL’s request for an interim order to suspend the 2023 Entitlement Offer and sought submissions from the parties.

- UIL submitted (among other things) that the extension for the repayment of the Vendor Loan announced on 16 January 2023 meant that there was no urgent need for funds and that UIL was “not aware of any commercial reason why the rights issue could not be suspended or otherwise extended until the Panel has had an opportunity to properly consider whether to commence proceedings and make its determination”.

- TMH submitted that the extension for the repayment of the Vendor Loan was in fact conditional on TMH completing the 2023 Entitlement Offer on or before 28 February 2023 and using the net proceeds towards repaying no less than $15 million. TMH submitted that extending the timetable of the 2023 Entitlement Offer would place TMH in potential breach of its obligations under the Vendor Loan and “be significantly prejudicial to the interests of TMH and its financial position”.

- In circumstances where TMH had an apparent and pressing need for funds[10] and considering that the close of the 2023 Entitlement Offer would not prevent us from addressing any unacceptable circumstances, we decided not to make the interim orders sought by UIL to suspend the 2023 Entitlement Offer or restrict the alleged associates’ voting or acquisition rights.

Final orders sought

- UIL sought final orders including to the effect that:

- the alleged associates provide substantial shareholder disclosure and be restrained from exercising any voting or other rights attached to their TMH shares until one month after such disclosure has been made

- any TMH shares acquired by the alleged associates as a result of “the unlawful acquisition of voting shares in TMH” (including in rights issues) be vested in ASIC for sale

- the alleged associates be restrained from acquiring any further TMH shares for a period of six months and

- in an ASX announcement, TMH describe the circumstances around and the existence and nature of the alleged association, its effect on voting power and the effect of any Panel orders.

Discussion

- The Panel is a specialist, peer review tribunal. When making an assessment of all the material in this matter, we have relied on our skills and experience as practitioners (which has been made known to the parties) and as members of the sitting Panel.[11]

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Decision to conduct proceedings

- Referring to the Panel’s decision in Viento Group,[12] UIL submitted that the following factors were relevant to the Panel deciding to make a finding of association:

- Mr David Argyle and Mr Gavin Argyle acting in concert in relation to TMH’s affairs

- Mr David Argyle and Mr Gavin Argyle having common shareholdings in TMH and the directorship of Mr Gavin Argyle in TMH

- Mr David Argyle and Mr Gavin Argyle having a number of former or current common investments or directorships in Australian companies

- Mr David Argyle and Mr Gavin Argyle being directors in TCC Holdings Pty Ltd and Total Corrosion Control Pty Ltd

- Mr David Argyle ‘nominating’ (by request to TMH according to the announcement dated 7 November 2016) Mr Gavin Argyle as a non-executive director of TMH

- Mr David Argyle serving the section 249D notice on TMH for the removal of Mr Sanger as a director and Mr Gavin Argyle’s subsequent increased involvement in TMH following Mr Sanger’s resignation the day after the section 249D notice was served and

- Mr David Argyle being the father of Mr Gavin Argyle.

- In light of the material provided, we considered that there was a sufficient body of material demonstrated by UIL to support a potential finding of association.[13]

- TMH, in its preliminary submission, submitted (among other things) that it rejected UIL’s assertions that the 2023 Entitlement Offer had been structured in such a way as to allow any shareholders to increase any control over TMH and submitted that instead the 2023 Entitlement Offer included a comprehensive dispersion mechanism with a view to minimising any potential control effects. TMH also submitted that the 2023 Entitlement Offer Booklet fully disclosed the underwriting and the sub-underwriting arrangements under the 2023 Entitlement Offer and “reflects the factual position as informed to TMH that David Argyle and Gavin Argyle are independent of, and not associated with, each other in relation to TMH”.

- We considered that several matters raised in the application warranted investigation, including:

- the alleged undisclosed association between Mr David Argyle and Mr Gavin Argyle

- the circumstances around Mr Sanger’s resignation in December 2022 and Mr Chenu’s resignation in January 2023

- the apparent lack of disclosure from TMH around the circumstances of the 2023 Entitlement Offer and the refinancing of the Vendor Loan and

- the potential breaches of section 606 and section 671B alleged by UIL and the fact that the acquisition of control over voting shares in TMH may not have been taking place in an efficient, competitive and informed market.

- Accordingly, we decided to conduct proceedings.

- SG Hiscock, a substantial shareholder of TMH who was listed as an interested party in the application, submitted a Notice to Become Party at the start of the proceedings. To assist us in deciding whether to accept its Notice to Become a Party, we asked SG Hiscock to advise why it considered that it may be able to assist the Panel. In light of SG Hiscock’s response, which was limited to its participation as a sub-underwriter in the 2022 Entitlement Offer, and the fact that SG Hiscock is a substantial shareholder of TMH, we decided not to accept it as a party. However we did invite SG Hiscock to make a non-party submission on the brief, which it did.

- Other interested parties, Mr Eric Rosenal, Ms Kasey Linney and Ms Rebecca Argyle declined invitations to become parties. Given our potential findings in relation to these interested parties, we invited them to make non-party submissions and provided them with access to confidential information, including the parties’ submissions. Before providing them with access to confidential information, and after seeking submissions from each of them and the parties, we made a direction pursuant to section 190 of the ASIC Act to Mr Rosenal, Ms Linney and Ms Rebecca Argyle preventing or restricting the publication of submissions or evidence made or given to, or matters contained in documents lodged with, the Panel. Mr Chenu was also invited to make non-party submissions and agreed to provide an undertaking to comply with rules 18 (confidentiality) and 19 (publicity) of the Procedural Rules.

Scope of findings

- By raising the non-disclosure of an alleged association that (it was alleged) started in 2016, we had to make inquiries into the history of Mr David Argyle and Mr Gavin Argyle’s involvement in TMH, the circumstances surrounding the 2022 Entitlement Offer, the circumstances surrounding the 2023 Entitlement Offer, and the circumstances surrounding the removal of Mr Sanger as managing director of TMH. This has necessarily led to a substantial and wide-ranging inquiry, reflected in the length of these reasons.

- Parties provided a significant number of submissions in the course of these proceedings. Some of these submissions included allegations of misconduct against Mr Sanger. Determining the truth or otherwise of these allegations is not within our jurisdiction. We did not, and did not have to, test the veracity of these allegations and we make no findings in relation to such matters.

- Also, we have not sought to test the veracity of all the assertions made, or to chase down every assertion.

- We remained mindful throughout the proceedings about the prospect that our processes might be used tactically in the context of a wider employment dispute.

Conference

- In response to the Panel’s brief, Mr Chenu stated “[h]aving regard to my obligations of confidentiality set out in my Letter of Appointment as a Non-Executive Director of HotCopper Holdings Limited dated 25 October 2016, I decline to respond to the question.” Similarly, Mr Sanger submitted that he was “unable at this time to address Question 19 … nor the general questions asked of all parties and non-parties, due to contractual restraints imposed on him by the Company.”

- After noting that we considered that each of Mr Chenu and Mr Sanger would be able to assist us in our enquiries, we asked TMH to “waive the restrictions applying to each of them in so far as necessary to allow them to assist the Panel and undertake not to take any detrimental steps against either of them by reason of, or as a consequence of, their assisting the Panel”. We also noted that if TMH had a particular concern that could be addressed as part of such a release and undertaking.

- TMH responded that it agreed to the request in relation to Mr Chenu but not Mr Sanger. In relation to Mr Sanger, TMH submitted that it had taken advice from its independent employment lawyers (who advised TMH on the resignation of Mr Sanger) for the purposes of the Panel's request and the advice received by TMH was not to waive the confidentiality obligations between TMH and Mr Sanger, “given the purpose of the contractual arrangements between those parties”.

- As TMH refused to waive Mr Sanger’s confidentiality obligations to TMH for the purpose of responding to our enquiries in these proceedings, Mr Sanger considered that he was unable to do so without being compelled by law. Accordingly, to obtain his evidence, we issued a summons to Mr Sanger and convened a conference to receive his evidence.

- We held the conference by videoconference on 1 March 2023 and on 3 March 2023. On 1 March 2023, Mr Sanger answered the questions we had put to him in the form of a written submission. On 3 March 2023, the sitting President re-convened the conference and (after considering questions for Mr Sanger from the other parties) we asked follow-up questions of Mr Sanger, which he answered orally. The conference was then adjourned and subsequently closed on 8 June 2023.

- Parties were provided with a transcript of the conference and an opportunity to make rebuttal submissions on Mr Sanger’s evidence. We also accepted an out-of-process submission from Mr Sanger where he noted that, in his view, there were material errors in the rebuttal submissions of TMH, Mr Gavin Argyle and Mr David Argyle which, he submitted, could be disproved with reference to materials in possession of TMH.

- We considered there were significant differences in the account of events provided by the parties and decided to issue a further supplementary brief which included a request for certain documents to be provided by TMH.

Association

- Section 12 sets out the tests for association as applied to Chapter 6. There are two relevant tests here:

- section 12(2)(b) – which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company’s board or conduct of its affairs and

- section 12(2)(c) – which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company’s affairs.

- A relevant agreement is an agreement, arrangement or understanding:

- whether formal or informal or partly formal and partly informal and

- whether written or oral or partly written and partly oral and

- whether or not having legal or equitable force and whether or not based on legal or equitable rights.[14]

- As stated by the Panel in CMI Limited 01R,[15] the cases make it clear that there is significant overlap between the concepts of “acting in concert” and “relevant agreement” in section 12.

- An understanding means an understanding – “plainly a word of wide import”[16] – as to some common purpose or object in relation to the company in question.

- Often establishing an association requires the Panel “to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association.”17

- In Mount Gibson Iron Limited[18], the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- We note that submissions were made denying individual ‘association’ factors. However, we have considered the totality of the factors.

- Having reviewed all of the material, we considered possible associations between:

- Mr David Argyle and Mr Gavin Argyle

- Mr Pismiris and each of Mr Gavin Argyle and Mr David Argyle

- Mr Gavin Argyle and each of Ms Linney and Mr Rosenal and

- Mr David Argyle and Ms Rebecca Argyle.

Association - Mr David Argyle and Mr Gavin Argyle

Family relationship

- Mr David Argyle is the father of Mr Gavin Argyle. While a familial relationship does not automatically make persons associates, it may be relevant in assessing whether the broader factual matrix establishes association.[19] We consider that it is relevant here.

- Mr David Argyle and Mr Gavin Argyle have a close personal and professional relationship. Their relationship “has been disclosed to the market on numerous occasions and Mr David Argyle has always been treated as a related party of [TMH] as reflected in the 2023 Entitlement Offer Booklet.” There has been no evident change in their relationship.

- Mr David Argyle has been a long-term client of Mr Gavin Argyle, including at CIP. Before starting CIP, Mr Gavin Argyle worked as a stockbroker and investment banker with Hartleys Limited and Patersons Securities Limited and acted for Mr David Argyle.

- While Mr David Argyle ordinarily resides in London and has not returned to Australia since February 2022, there were periods during the pandemic when he spent time in Australia. Mr Sanger submitted that Mr David Argyle “had a desk that he often used at CIP”. He also submitted that the TMH office “was contiguous with the CIP office, at one point there was a barrier, relationally there wasn’t a barrier” and that Mr David Argyle would occasionally be physically in the TMH office.

- In March 2021, Mr David Argyle lent Mr Gavin Argyle funds to purchase a private residence in Perth. The loan was unsecured and bears interest at 2.5%. Mr Gavin Argyle repaid the loan in part to meet the subscriptions of Mr David Argyle and his sister, Ms Rebecca Argyle, under the 2023 Entitlement Offer. UIL submitted that the manner in which the loan was repaid was “indicative of the Argyle’s treatment of TMH shares as a familial unit of account and trade”.

- We agree. Noting that repayment eliminated the risk of exchange rate losses for Mr David Argyle, we nevertheless think that the terms of the loan and repayment is evidence of close familial ties.

- While we accept that family relationships are not conclusive proof of an association as submitted by both Mr David Argyle and Mr Gavin Argyle, and that Mr David Argyle and Mr Gavin Argyle are both long-experienced investors who reside in different countries,[20] their family history provides context that we consider is indicative of an association between them.[21] The way in which Mr Gavin Argyle spoke about Mr David Argyle and the influence of the family’s shareholding on the values and direction of the TMH business is also instructive and is indicative of an association between them.

- For example, in a meeting of GCA staff held on 23 November 2022,[22] Mr Gavin Argyle stated (based on our transcription of a recording of that meeting):

- “Family shareholding position, my dad is the largest shareholder and it puts extra responsibility on me in order to you know maintain corporate values and his values in the various business activities. The severity of the staff cutbacks was not in the core values of our family”

- “The family position and the board we certainly weren’t aware of the severity of it we thought that the number was 30 we thought that was discussed and that was discussed with Adevinta and that was agreed and they were going to look after those people and that was part of the sales negotiation. From that perspective its obviously not appropriate for me to start talking about ‘core values’ it would seem shallow or contrived. Maybe at another time”

- “Core values that are…integral to our family’s successful investment and strategy, style there’s no business plan that you learn… there’s honesty, trust there’s loyalty, these are our core values”

- “My dad worked at the World Bank for 35 years in Washington DC, so I’ve had an economic tutor essentially for my whole life in terms of the importance in terms of allocating capital efficiently and not to do things that are experimental”

- “The philosophy that my dad taught me” and

- “Mea culpas I take responsibility for it because my dad owns all the shares and who else but me is going to come in when situations arise where its somewhat dark and not in terms of what our… why we’re here”.

- In our view “the family links make one part of the factual matrix”[23] supporting an inference of association.[24]

Common knowledge of the relevant facts

- Mr Gavin Argyle submitted that there were several conversations he had had with his father prior to Mr David Argyle lodging the section 249D notice:

- in February or March 2022, following release of TMH’s half-yearly report for the period ended 31 December 2021. Mr Gavin Argyle submitted “David Argyle expressed concern about the large decline in TMH’s profits for the period.”

- in September 2022, following release of TMH’s annual report for the year ended 30 June 2022. Mr Gavin Argyle submitted “During this discussion David Argyle expressed concern about the overall direction and management of TMH. During this discussion David Argyle asked Gavin Argyle several questions about the financial affairs of TMH which Gavin Argyle was not able to answer at the time as he did not have sufficient knowledge.”

- in November 2022, concerning the debt incurred by TMH to fund the acquisition of GCA that it had announced in August 2022. Mr Gavin Argyle submitted “During this discussion David Argyle expressed concern with the level of debt incurred by the Company and the management of the Company. Gavin Argyle also expressed concern about the progress of TMH in raising capital to repay the debt.” Mr Gavin Argyle also submitted that “During this discussion, Gavin Argyle discussed with David Argyle his options as a shareholder regarding the management and direction of TMH. This discussion would have involved discussing the fact that a shareholder may requisition a meeting for the removal of a director.”

- Mr David Argyle submitted that his infrequent and high-level discussions with Mr Gavin Argyle “did not involve entering into a relevant agreement, a commitment to act in a certain manner or otherwise fettered the discretion of Mr David Brian Argyle or Mr Gavin Argyle to act as each saw fit” and was unlikely to constitute acting as associates or entering into a relevant agreement as set out in ASIC Regulatory Guide 128[25].

- Given the context in which these conversations were made and the structural links between Mr Gavin Argyle and Mr David Argyle, we do not consider these conversations to be equivalent to a briefing to an institutional investor and to fall within the examples of conduct where collective action is unlikely to constitute acting as associates or entering into a relevant agreement under ASIC Regulatory Guide 128.

- TMH submitted that “it is not customary for the TMH Board to brief any shareholders on significant transactions or corporate actions.” Mr David Argyle submitted that he “was not briefed on the details of significant transactions of TMH” and expressed “…his dismay at his failure to be informed about the GCA acquisition….”. However, in a text message on 9 August 2022, before the GCA acquisition was announced on 26 August 2022, Mr Gavin Argyle said to Mr Sanger “Dad is pleased and happy with the deal, so that’s good. Thxs bud.” Mr Sanger replied “So not leaked yet but in the afr tonight” forwarding a link to a news article regarding the sale process for GCA published at 9:35pm on 9 August 2022.

- Mr David Argyle submitted that “he did not engage in any discussions about the details of the GCA acquisition with Mr Gavin Argyle (or Mr Jagdip Sanger) and was unaware of the transaction with GCA prior to it being announced to the public”. However, the announcement on 26 August 2022 states that “David Argyle has committed to subscribe for his full pro rata entitlement of approximately 37% of the voting shares of the Company under the rights issue, which equates to a total of $9.82m.” Mr David Argyle submitted that his commitment to subscribe for his entitlement under the 2022 Entitlement Offer did not suggest that “he knew about the details of the GCA Acquisition” or that “his alleged knowledge of the transaction led him to decide to participate in the 2022 Entitlement Offer.” In our view, it is uncommon for any shareholder to commit to investing almost $10 million in a company without knowing the intended use of the funds.

- We infer from the above that there was a briefing about the GCA acquisition and consider that the briefing and the discussions between Mr David Argyle and Mr Gavin Argyle on concerns regarding the management and direction of TMH reflect a common knowledge of relevant facts.

- We considered the position that Mr Gavin Argyle is Mr David Argyle’s nominee on the board. Nominee directors stand in a complicated position.[26] While they are subject to fiduciary duties that are the same as for other directors, they are generally also subject to an understanding that they ‘represent’ the person nominating them (usually a major shareholder). While neither Mr David Argyle nor Mr Gavin Argyle have put that argument forward during these proceedings, in our opinion the steps taken went beyond fulfilment of those roles.

Common shareholdings and directorships

- Mr David Argyle and Mr Gavin Argyle share many structural links.

- Based on the information available from ASIC’s register, and our analysis of ASIC’s submission setting out a table of common directorships and a table of common shareholdings, Mr David Argyle and Mr Gavin Argyle have, or had, shareholdings in the same 13 public companies, including TMH. They have, or had, shareholdings in the same 12 private companies. They are, or were, directors together of 2 companies[27].

- Mr David Argyle submitted that as a long-term client of CIP, he had invested in similar companies as other clients of CIP in line with the investment strategy and recommendations of the firm and, “[a]s such, the investment portfolios of CIP’s clients are inevitably similar”.

- There is also the example of an historical structural link between Mr David Argyle and Mr Gavin Argyle in the Federal Court case of Dyinda.[28] UIL submitted that the case was evidence of prior collaborative conduct of Mr David Argyle and Mr Gavin Argyle. Mr David Argyle submitted that the case “does not demonstrate ‘a long history of prior collaborative conduct’ … nor a ‘shared goal or purpose’ relevant to TMH or the present matter.” While we accept Mr David Argyle’s submission, we consider it an example of a structural link.

- While many of these shareholdings and directorships are historical, which is not surprising given their long careers and we accept that clients of the same investment firm may have similar investments, we considered that the significant structural links between Mr David Argyle and Mr Gavin Argyle further evidence a personal and professional relationship which is close and longstanding.

Common dealings

- The structural links identified above evidence common dealings between Mr David Argyle and Mr Gavin Argyle.

- Focusing on TMH, Mr David Argyle (directly and through Zero Nominees) and Mr Gavin Argyle (through GAB) each have shares in TMH and have increased their shareholdings over time.

- Report Card Pty Ltd was the owner of the stock market internet discussion forum, HotCopper. TMH acquired Report Card Pty Ltd upon listing on the ASX. Mr David Argyle initially held a 45.44% interest in Report Card Pty Ltd, which was acquired for a 31.69% interest in TMH (plus cash consideration) as part of TMH’s IPO in 2016. Mr David Argyle and Mr Gavin Argyle had discussed the IPO and Mr Gavin Argyle took shares in TMH in the IPO.

- Both Mr David Argyle and Mr Gavin Argyle have continued to increase their relevant interests in TMH shares and neither have sold any shares since the IPO. Mr David Argyle’s relevant interest in TMH shares has increased from the initial 31.69% to the current 36.92%.

- Mr Gavin Argyle’s relevant interest in TMH shares has increased from the initial 2.27% to approximately 6.47%. Notably, Mr Gavin Argyle’s relevant interest in TMH shares increased from approximately 4.72% just prior to the 2022 Entitlement Offer to approximately 6.35% shortly following the 2022 Entitlement Offer. This was largely as a result of acquiring 5,060,000 rights in the renounceable market TMH established for the 2022 Entitlement Offer and exercising those rights (in addition to the 3,240,000 rights he was entitled to and exercised as part of the pro-rata offering). He adopted the same strategy in the 2023 Entitlement Offer, although acquiring a much smaller number of rights.

- Following the 2022 Entitlement Offer, we infer that Mr David Argyle and Mr Gavin Argyle engaged in coordinated buying of shares in TMH from two employees of CIP (see paragraphs 194 to 216 below).[29]

- Mr Gavin Argyle submitted that “[a]part from the fact the TMH share purchases occurred in the same month, which is coincidental, there is no evidence of coordination of the purchases as between Mr David Argyle and Gavin Argyle”. UIL submitted that “the Panel is correct to attribute those events to coordination rather than coincidence where it is the logical inference to be made.” We discuss this further at paragraphs 194 to 216 below.

- We consider that Mr David Argyle and Mr Gavin Argyle have a long history of common dealings and accepted UIL’s submissions that there has been “a multi-decade business relationship between the Argyles that continues to this day.”

Shared goal or purpose

- Mr David Argyle was (and is) the largest shareholder of TMH. He submitted that each time he acquired shares in TMH “his primary motivation was to maintain his shareholding, having been a longstanding shareholder and original major shareholder of the entity prior to listing on the ASX”.

- In 2016, Mr David Argyle requested that Mr Gavin Argyle be appointed to the board of TMH. Mr Gavin Argyle submitted that it was “a desire of David Argyle to ensure that a company in which he held a major investment is properly directed and managed.”

- It appears that Mr Sanger enjoyed a harmonious relationship with Mr David Argyle and Mr Gavin Argyle, being “warm and close and that of a friend.”

- However, the relationship soured. Mr Sanger submitted that a sense had developed that:

- he had become a “threat” in that he did not support the 2023 Entitlement Offer

- he was opportunistic in asking for an incentive following the GCA acquisition and

- he was putting the agenda of Mr David Argyle and Mr Gavin Argyle at risk by pursuing his funding strategy for the GCA acquisition, which they thought was a “betrayal.”

- We consider that the funding strategy for the company was a major concern for Mr David Argyle and Mr Gavin Argyle, as it could be a threat to Mr David Argyle’s stated objective of maintaining his percentage holding in TMH. We also note that Mr David Argyle submitted that he had concerns about the terms of the Vendor Loan and its impact on TMH’s financial situation.

- Critical events between August 2022 and November 2022 culminated in the removal of Mr Sanger as TMH’s managing director. We consider these events in detail below and conclude that they showed a shared goal or purpose between Mr David Argyle and Mr Gavin Argyle in relation to TMH.

The GCA acquisition and funding

- Mr David Argyle submitted that Mr Sanger had proposed, and went ahead with, an $86 million debt without consulting him, effectively leading “to severe differences of opinion”. However, in other sections of his submissions, Mr David Argyle stated that Mr Sanger did not consult with him “regarding the details of the transaction”, “he did not know of the details of the GCA Acquisition, the Vendor Loan, further financing or possible concerns until this information was announced to the ASX” and he was “extremely dissatisfied on reading the details of the GCA Acquisition…” (emphasis added).

- Mr David Argyle also submitted that, at this time, “frankly the affairs of TMH were not at the forefront of his mind.” However, based on his submissions, Mr David Argyle maintained his percentage holding in TMH under the 2022 Entitlement Offer, and he placed a standing buy order with his broker to buy TMH shares on-market between 28 September 2022 and 10 November 2022. He also determined to lodge, and signed, each of signed the Re-election Letters (see paragraphs 138 to 143) and the section 249D notice.

- Given the background discussed in paragraphs 80 to 82, we infer that Mr David Argyle was aware of the transaction (albeit, perhaps not the “details” of the transaction) several weeks prior to its announcement.

- We also infer from the wording of Mr Gavin Argyle’s text message to Mr Sanger on 9 August 2022 (see paragraph 80) that it was important to Mr Gavin Argyle that his father was happy with the transaction.

- Mr Gavin Argyle submitted that “it is unlikely that the GCA Acquisition would have been agreed but for the commitment of TMH’s major shareholder to the rights issue to part-fund the acquisition.” Mr Gavin Argyle appears to suggest that Mr David Argyle was in fact supportive of the proposed GCA acquisition prior to its announcement, although Mr David Argyle maintained that “he was not aware of the details of the GCA Acquisition”. We found this apparent contradiction in what ought to be factual matters troubling. Unfortunately, it was not an isolated occurrence in these proceedings.

- Mr Gavin Argyle provided a list of TMH shareholders (specifically, Mr David Argyle, GAB and Ms Rebecca Argyle) “whom CIP assumed would take up their entitlements to the 2022 Entitlement Offer for the purposes of CIP agreeing to underwrite 80% of the 2022 Entitlement Offer”. We infer that the approval sought from Mr David Argyle by Mr Gavin Argyle included his father’s commitment to take up his entitlement (noting the significant cash outlay involved). This is also consistent with the timing of CIP coming on board as the underwriter of the 2022 Entitlement Offer. In July 2022, TMH were in discussions to appoint a different broker to manage and underwrite the 2022 Entitlement Offer, but by 10 August 2022 the draft documents named CIP as the underwriter.

- While acknowledging that boards make decisions, we infer that Mr David Argyle was troubled by Mr Sanger’s recommendation “that the Company take on an $86 million debt of which almost $30 million would reflect Mr David Brian Argyle’s shareholding percentage”. He submitted that he had had to “invest an additional $15 million in two rights issues in order to maintain his percentage shareholding in a business that he has held a substantial ownership stake in for 20 years” and that had he not contributed, “then he would likely no longer be the major shareholder (enabling UIL and associates to become the majority shareholders)”. He submitted that “the existing strategy of institutional placements proposed to be executed by Mr Jagdip Sanger…would have been dilutive to shareholders, other than UIL and SG Hiscock”.

- Mr Sanger confirmed that part of the funding strategy (sent to the vendor’s bankers) on 24 August 2022 included a further equity round in 2023 but at a higher valuation and that the optimum way to do this would be a placement to institutions or a strategic investor.

- We have no evidence of any proposal that UIL or other entities related to Mr Duncan Saville[30] would provide debt or additional equity funding. Mr Sanger had proposed to Mr Saville that he provide debt funding to TMH at the time of the 2022 Entitlement Offer, but received a “flat no”. Nevertheless, there appears to be a level of preoccupation about the involvement of UIL and Mr Saville in TMH that was shared by Mr David Argyle and Mr Gavin Argyle. Concerns about UIL and Mr Saville are evidenced by:

- Mr Sanger’s employment contract, which required him to report to the TMH board if he had any contact with (among others) Mr Saville

- Mr Sanger’s evidence in conference (given on affirmation) that an “essential part of my time in the four years that I was in the business, was a real fear from the Argyles which has at times shared (sic) by the board, from the potential machinations of Duncan Saville and UIL”

- Mr David Argyle’s submissions that UIL’s application is a “blatant attempt to destabilise the business at a critical juncture and rid Mr David Brian Argyle of his long-term investment…for which he has given many years of support” and

- Mr Gavin Argyle texting Mr Chenu on or around 2 December 2022, stating that Mr Chenu was connected to Mr Saville and “This might be a good time to clarify if any leveraged (sic) applied…I’ve been preparing a plan for this (scenario) for 5 years”. Mr Chenu responded that he had never met Mr Saville and denied any conflict of interest. He got no explanation for Mr Gavin Argyle’s accusation, despite asking for one repeatedly. In the text message, Mr Gavin Argyle concluded “I said I wasn’t going to argue. I’ve got other options”.

- Mr Gavin Argyle submitted that “the Panel has made no proper enquiry into, and has asked no questions about” UIL’s motive in bringing the application, including “the fact that [UIL] is a provider of debt finance to companies which have subsequently become financially distressed, and which has resulted in [UIL] (or its associates) acquiring substantial control of those companies following a conversion of debt to equity” and submitted that he rejected any finding based on the Panel’s view that he was paranoid about UIL or that his concerns in relation to UIL communicated to Mr Chenu in these circumstances were tenuous or disingenuous. Each party has been given the opportunity to put forward information it considers relevant, examine the information put forward by others and make extensive submissions and rebuttals on issues. We do not accept Mr Gavin Argyle’s submission that potentially relevant information was not provided because questions were not asked by the Panel.

- We consider it is likely that Mr Sanger’s pursuit of the funding strategy for the refinancing of the Vendor Loan and the corresponding perceived risk that this may have led to a reduction in the shareholding percentage of Mr David Argyle, or the Argyle family shareholding, was a factor in Mr David Argyle and Mr Gavin Argyle withdrawing their support for Mr Sanger.

- Mr David Argyle denied any knowledge of conversations between Mr Gavin Argyle and Mr Pismiris regarding the removal of Mr Sanger or any proposals for Mr Gavin Argyle to take on an executive role at Gumtree.

- In our view this lack of knowledge does not undermine the existence of an agreement or understanding between Mr David Argyle and Mr Gavin Argyle of maintaining the level of control of Mr David Argyle, or the Argyle family, in TMH. Mr Gavin Argyle was aware at the latest in September 2022 that Mr David Argyle had concerns about the overall direction and management of TMH. Mr Gavin Argyle felt a responsibility, given his family’s shareholding position and his father as the largest shareholder, to “maintain corporate values and his values in the various business activities”. When Mr Sanger’s strategy threatened that control (both directly through a potential dilution) and strategically (by expanding the business beyond its core business[31] or by implementing deep staff cuts), Mr Gavin Argyle acted to neutralise the threat.

The conduct allegations

- Mr Sanger submitted that he was “told by Mr Gavin Argyle from 15 October 2022 that I would be ‘removed’ from the business by the Argyle family.” Mr Gavin Argyle submitted that he does not recall saying this or saying “words to that effect.” Mr Chenu submitted that he was of the view that Mr Gavin Argyle had lost confidence in Mr Sanger by 15 October 2022, citing comments made by Mr Gavin Argyle to Mr Chenu at a function that Mr Gavin Argyle hosted on 15 October 2022. Given the submission of Mr Chenu, which is consistent with the submission of Mr Sanger, and the fact that Mr Gavin Argyle does not recall, we accept that such a conversation took place. At around this time, it appeared that Mr Gavin Argyle and Mr Sanger stopped communicating with each other.

- Mr Chenu, a director of TMH at all material times,[32] submitted that “From about mid-October and [until] the end of November 2022, concerns were raised regarding the conduct of Jag as managing director of TMH…”. The concerns were raised by Mr Gavin Argyle and were pursued by him.

- On 6 November 2022, Mr Gavin Argyle sent a text message to Mr Pismiris and Mr Chenu stating (among other things) that he was “…in the process of putting in a high level plan in replacing Jag aa (sic) MD of the group until a suitable candidate is found”.

- On 8 November 2022, Mr Gavin Argyle, Mr Pismiris and Mr Chenu held a meeting in the presence of Ms Rhyanna Van Leeuwarden to discuss the future role or involvement of Mr Sanger in TMH, and a proposal by Mr Gavin Argyle that he take an executive role at Gumtree. Ms Van Leeuwarden has been employed by CIP as the “Chief of Staff” since November 2022. At the time of this meeting, Ms Van Leeuwarden was not an employee of CIP, but was consulting to CIP as a contractor. Following that meeting, Ms Van Leeuwarden emailed Mr Pismiris and Mr Chenu requesting that they copy her into future communications with Mr Gavin Argyle relating to his “interim role at Gumtree” and “I will wait to hear how your conversation goes with Jag tomorrow. From there I will begin to map out with Gavin how, when and where he will carry out the requirements of the role.”

- On 10 November 2022, Mr Chenu, Mr Pismiris and Mr Gavin Argyle met and, based on a note sent by Mr Pismiris to the attendees and Mr Sanger, agreed that while the financing process was underway, the “status quo [was] to be maintained with respect to [Gumtree]…including current positions/roles”. The three directors also agreed that Mr Gavin Argyle be appointed as an “additional director of GT” and attend the GCA offices in Sydney, and discussed the terms of a remuneration package for Mr Sanger.

- On 14 or 15 November 2022, an informal meeting of directors was held, which mainly concerned refinancing. There was no board pack or minutes in relation to that informal meeting. However, Mr Chenu submitted that following that meeting, proposals were circulated regarding Mr Sanger’s future role in TMH which severely restricted his executive functions (contrary to what was agreed on 10 November 2022).

- On 16 November 2022, TMH held a meeting of directors which was also attended by Ms Van Leeuwarden. Mr Sanger submitted that he was then “instructed by Mr Alec Pismiris to cease all communications with funders and advisors and direct all communications to Ms Rhyanna Van Leeuwarden” which he found highly concerning as, in his view, she had “no experience in media, classifieds or leveraged finance”. He submitted that he was “effectively removed from all executive duties at TMH by 16 November 2022.”

- It appeared that Mr Chenu did not agree with how the concerns regarding Mr Sanger were being handled, and that Mr Chenu wanted to afford Mr Sanger procedural fairness. He submitted ”that the allegations regarding Jag’s conduct should be substantiated before the Board took the step of completely removing him from his executive role; the allegations should be put to him so that he had the opportunity to respond, and TMH had the benefit of his response, and in the meantime, he should continue to be available to at least assist the process of refinancing the GTA acquisition to completion, and otherwise assist in the management of the group.”

- From around 23 November 2022 to 25 November 2022, Mr Gavin Argyle together with CIP personnel, Ms Van Leeuwarden and Mr Rosenal, attended the GCA offices in Sydney to undertake what Mr Gavin Argyle submitted was an “independent investigation into the current position of GCA and the management team leading the transition.” They met with GCA employees. TMH submitted that the decision for Mr Gavin Argyle to attend the GCA office was made by the TMH board (excluding Mr Sanger). TMH was unable to provide any document evidencing this decision or (per our question to TMH) that the interviews with GCA employees were made with the knowledge and approval of the TMH board (see paragraph 128).

- On 23 November 2022, Mr Gavin Argyle also held a briefing with GCA staff at which he said that his father was the largest shareholder and that put extra responsibility on him. He spoke of the family’s core values (see at paragraph 75).

- The investigation appeared to focus on the conduct of Mr Sanger. Several senior employees of GCA subsequently shared their concerns, directly or indirectly, with Mr Pismiris about the investigation, including that “some level of investigation exercise on Jag” did not follow an adequate process to investigate misconduct allegations and noting that “[i]t is evident they have been here with an agenda which is clearly not in the best interest of our business or our people.”

- In contrast, Ms Van Leeuwarden noted in a report to Mr Pismiris and Mr Chenu that “[t]he support for Gavin and the effort he made to fly to Sydney and connect with them and listen was undeniable.” Her report concluded with a suggestion for “a reverse takeover” with the management team of GCA becoming the management team for the TMH group. Ms Van Leeuwarden also noted that “CIP cannot raise any additional funds and Gavin cannot assist the debt financing process any further if the recommendation is not actioned immediately by the board”.

- Letters were given to GCA staff who had been interviewed (at least some of whom had articulated allegations against Mr Sanger) confirming that “information provided by the employee at the meeting would remain confidential and would not be used against them in any manner.” The letters were signed by Mr Pismiris for and on behalf of the TMH board.

- On 25 November 2022, the Head of People at GCA at that time emailed Mr Pismiris saying “Gavin has made several accusations [about Mr Jagdip Sanger], if that is indeed the case then there is a proper process that such an allegation needs to follow and investigated (sic) by a neutral party.”

- Similarly, it appears that the Head of Legal at GCA at that time also had concerns in relation to the investigation. Referring to a text message received from Ms Van Leeuwarden about “the investigation carried out during [their] time in Sydney”, the Head of Legal at GCA sent an email to the Head of People at GCA stating that the investigation “was not an independent process (given Gavin’s role as a director)”. She also queried the formality of the “investigation” given, as Head of Legal, she had not been formally made aware of it. The Head of Legal at GCA also noted that the letters to Gumtree employees (see above at 128) were not necessary given general whistle-blower protections but she was told Mr Gavin Argyle wanted to ensure that employees “openly feel comfortable”.

- On 26 November 2022, Mr Gavin Argyle sent a long text message to Mr Chenu very critical of Mr Chenu’s position. Mr Gavin Argyle stated (among other things) “So you and Alec had the opportunity to conduct the Independent Director Review investigation but didn’t. I did. So with the board authority you need to go as soon as possible if you do not accept the findings.” Following the text message, Mr Chenu submitted that he came to the view that it was unlikely he and Mr Gavin Argyle could continue to work together on the TMH board and he “began to seriously consider resigning”.

- On 27 November 2022, following an earlier discussion with Mr Gavin Argyle and with the assistance of Ms Van Leeuwarden, Mr David Argyle, signed and sent the Re-election Letters (see paragraphs 138 to 143).

- At the TMH board meeting on 28 November 2022, Mr Pismiris, Mr Sanger, Mr Chenu and Mr Gavin Argyle were present as was the company secretary, Mr Ben Donovan. Solicitors from Clayton Utz dialled into the board meeting for part of the meeting. During the meeting, concerns raised by Mr Gavin Argyle in relation to Mr Sanger around an intra‑group transfer of money were discussed. After discussion, and some explanations by Mr Sanger, Mr Chenu asked Mr Gavin Argyle if “the concerns were now addressed”. Mr Gavin Argyle said he still had concerns. The minutes state that Clayton Utz was instructed to provide the Board with legal advice on the concerns of Mr Gavin Argyle and that “[Mr Chenu] noted that [Mr Gavin Argyle] and [Mr Sanger] could work together on resolving the matter, and that [Mr Gavin Argyle] would take the lead on financing with [Mr Sanger] involved.”

- TMH submitted that “[n]otwithstanding the wording of the TMH Board minutes, TMH confirms that Clayton Utz were not provided with any instructions following the meeting and did not provide any advice on this matter and were not followed up by TMH to provide advice”.

- Mr Sanger submitted that following the 28 November 2022 board meeting he was never contacted regarding the money transfer issue.

- Submissions and rebuttals from TMH, Mr Gavin Argyle and Mr David Argyle include other reasons that they alleged for seeking to remove Mr Sanger. However, these reasons do not appear to have been given at the time. They are not reflected in the board minutes of 28 or 30 November 2022 or the section 249D notice. Mr Sanger submitted that he had no knowledge of the resolution to revoke his appointment as Managing Director that was considered by the board on 30 November 2022 and that he learnt of the matters discussed at that meeting for the first time during these proceedings.

- We infer that Mr Gavin Argyle had determined to use allegations of misconduct to remove Mr Sanger and was not interested in an explanation. In the face of potential resistance at the board level, a request from his father and TMH’s largest shareholder would be the catalyst for change.

The section 249D requisition

- Mr David Argyle submitted that in late 2021 he had a one-hour face to face conversation with Mr Sanger about a potential acquisition of a financial news website. Mr David Argyle submitted that “based on this discussion, it should have been very clear to Mr Jagdip Sanger that expanding the business of the Company outside of its main or core business … would have been a concern to Mr David Brian Argyle, as the Company’s largest shareholder”.

- According to Mr David Argyle, he “determined, after careful consideration over a number of months, to lodge a s249D notice with TMH…”. He submitted that in discussions with Mr Gavin Argyle he “expressed his view that Mr Jagdip Sanger should be removed as a director due to the poor financial performance of TMH Australia and the loan repayment terms (as disclosed to ASX on 26 August 2022) negotiated by Mr Jagdip Sanger when he was Managing Director.” We know that in a conversation occurring in November 2022 “Gavin Argyle discussed with David Argyle his options as a shareholder regarding the management and direction of TMH. This discussion would have involved discussing the fact that a shareholder may requisition a meeting for the removal of a director.”

- On Sunday 27 November 2022, the day before TMH’s annual general meeting, Mr David Argyle signed two letters (Re-election Letters), asking for an extraordinary general meeting at which resolutions be put:

- “That Mr Jagdip Singh Sangha, be re-elected as Director” or “that Mr Jag Sanger, be re-elected as Director” and

- “That Mr Alec Christopher Pismiris, be re-elected as a Director.”

- Mr David Argyle submitted that he believed the process to remove a director would be to vote on the re-election of all the directors. He submitted that he thought all directors would be re-elected except for Mr Sanger “who would not get his vote for re-election”. Mr David Argyle’s explanation is difficult to reconcile with the fact that he only issued letters for the “re-election” of Mr Sanger and Mr Pismiris and not Mr Chenu or Mr Gavin Argyle[33].

- Mr David Argyle “asked, via phonecall, for administrative help for a template letter to be drafted.” Ms Van Leeuwarden, on the instruction of Mr Gavin Argyle, drafted the two Re-election Letters (which appeared to be in the form of final drafts rather than templates) and emailed them to Mr David Argyle on Sunday evening from home (using a personal email address of her partner). Her email said “As per discussion with Gavin, can you please sign the attached and return to this email address as soon as possible”. It is not clear why Ms Van Leeuwarden provided two draft letters to Mr David Argyle, and only for the “re-election” of Mr Sanger and Mr Pismiris, when Mr David Argyle had only asked for administrative help for “a template letter” to be drafted.

- Mr David Argyle submitted that he signed the drafts that night and returned them as instructed so Ms Van Leeuwarden “could print them out for Mr Gavin Argyle to give to Alec Pismiris, on his behalf, on 27 November 2022 as he knew they were meeting the day after”. CIP submitted that “Subsequently, most likely on 28 November 2022, either Gavin Argyle or Ms Van Leeuwarden handed copies of the signed letters to Alec Pismiris in a meeting.”

- However, after Mr Pismiris received the Re-election Letters, it was submitted that a conversation took place between him and Mr David Argyle. Mr David Argyle submitted that during that conversation he “realised the best path forward to achieve his objective was to issue the section 249D notice for the removal of Jagdip Sanger as a director. Mr Alec Pismiris provided Mr David Brian Argyle with details of the requirements of the section 249D notice.“

- It is clear that Mr David Argyle only “realised” the need for a section 249D notice because Mr Pismiris told him. While TMH initially submitted that Mr Pismiris spoke to Mr David Argyle after the section 249D notice was issued, Mr David Argyle’s submission indicates that the call took place before the issue of the section 249D notice. TMH’s subsequent submission states that Mr Pismiris “contacted David Argyle and discussed his letter [referring to the Re-election Letter in respect of Mr Sanger] and clarified that his intention was to submit a section 249D notice” which must have been before the section 249D notice.

- In fact, Mr Pismiris drafted the section 249D notice and on 29 November 2022 emailed it to Ms Van Leeuwarden (copied to Mr Gavin Argyle) requesting “Brian to sign” and requesting for it to be returned that evening. On the same day, Ms Van Leeuwarden emailed Mr David Argyle, copying Mr Gavin Argyle (but not Mr Pismiris who had made the request), stating “Hi Brian, Gavin has requested that you please sign the attached document ASAP” and, early on 30 November 2022, she emailed a signed version back to Mr Pismiris (copied to Mr Gavin Argyle). On receiving the signed section 249D notice, TMH submitted that Mr Pismiris “recognised his own typographical error in the draft notice provided to David Argyle and corrected the reference from "We" to "I"… which due to the international time zone difference Alec Pismiris later confirmed with David Argyle.” As submitted by Mr David Argyle, after correcting the typographical error in the section 249D notice, Mr Pismiris then applied Mr David Argyle’s electronic signature with his approval.

- Mr Pismiris did not wait to receive the signed section 249D notice from Mr David Argyle before anticipating next steps. He emailed the company secretary on the evening of 29 November 2022 stating “we have received correspondence from Mr David Brian Argyle seeking to call a meeting pursuant to s249D of the Corps Act to remove Jag as a director” and asked him to prepare a trading halt request pending an announcement regarding the board composition of the company. He signed off on the request the next morning at 6:23am, attaching the signed notice.

- Mr Gavin Argyle submitted that, at the time of these emails, “Ms Rhyanna Van Leeuwarden was engaged in assisting the non-executive Directors of TMH in their communications with other Board members, employees, shareholders, legal advisers and external parties.” Mr Gavin Argyle sought in his submissions to retain a degree of independence from the section 249D notice process by submitting that:

- “there was no actual discussion between Gavin Argyle and David Argyle concerning the actual section 249D requisition notice before it was received by TMH” (emphasis added)

- “The decision of David Argyle to serve the section 249D requisition notice was a decision that he made alone” and

- “[Ms Rhyanna Van Leeuwarden’s] statement [in her 30 November 2022 email] that the request for Mr David Argyle to sign the notice was from Gavin Argyle is incorrect”.

- These statements were worded in a way that did not necessarily mean that Mr Gavin Argyle was not involved in the section 249D process. Nevertheless, we consider they are difficult to reconcile with the facts.

- Mr Gavin Argyle submitted that he spoke to Mr David Argyle about his options as a shareholder regarding the management and direction of TMH shortly before formal steps were taken by Mr David Argyle to remove Mr Sanger. He also instructed Ms Van Leeuwarden to provide Mr David Argyle with administrative assistance in relation to the Re-election Letters, and he was copied in on most correspondence concerning the requisition notice. Even after the requisition notice had been lodged, Mr Gavin Argyle sought to promote the views of his father at the relevant extraordinary general meeting, noting in an email "We will need some words from my dad regarding the NOM/249d for the EGM."

- Mr Gavin Argyle also submitted that “[h]ad Gavin Argyle wanted to requisition a meeting of shareholders to remove Mr Sanger as a director he could have simply and easily arranged for GAB Superannuation (as the holder of more than 5% of the TMH shares) to requisition a meeting of shareholders in accordance with section 249D of the Corporations Act, but he did not do so.” While Mr Gavin Argyle could have arranged for GAB to requisition a meeting in accordance with section 249D, he didn’t and instead his father, who is TMH’s major shareholder, did and it had the desired effect of leading to Mr Sanger’s immediate removal.

- In the afternoon of 30 November 2022, a TMH board meeting was “called to deal with several issues around the performance of the Managing Director and a request by shareholders to call a Section 249D meeting”. Mr Sanger was not present. Indeed, he submitted that he was not informed of the meeting.

- At the meeting, Mr Chenu “advised that he wished to abstain from all further resolutions being considered at the meeting today.” Mr Gavin Argyle and Mr Pismiris, being the other two directors present, “confirmed their intention to vote on all remaining resolutions.”

- Legal advice from Clayton Utz regarding the validity of the section 249D notice was tabled and the board resolved that “Mr Jag Sanger’s appointment as managing director be revoked immediately (effective as at the date of this resolution).” The minutes record no discussion about the performance of Mr Sanger or reasons for his removal, other than a reference to the board noting “[t]here are concerns in relation to Mr Sanger’s conduct both raised in the Notice and by Board members”. However, the section 249D notice did not raise any concerns in relation to Mr Sanger’s conduct or otherwise.

- The board noted that it needed to appoint persons to assist or otherwise be vested with the authority to conduct the business of TMH following Mr Sanger’s removal. The board resolved to give acting roles to Mr Gavin Argyle, Mr Pismiris and Mr Logtenberg. Mr Gavin Argyle was given authority to manage:

- investor and shareholder communications

- financing arrangements and

- communications with Adevinta.

- On 1 December 2022, Mr Sanger was placed on gardening leave.

- The circumstances surrounding Mr Sanger’s investigation and subsequent effective removal from the TMH business by Mr Gavin Argyle and Mr David Argyle (with the support of Mr Pismiris) caused significant friction between Mr Gavin Argyle and Mr Chenu, which is evident from the text message exchanges between the pair described in paragraphs 111(d) and 131 above. Mr Chenu submitted that the exchange described in paragraph 111(d) indicated “a continuation of [Mr Gavin Argyle’s] hostility toward me for not fully supporting him in his efforts to have Mr Sanger removed from TMH, and he therefore also wanted me off the Board”.

- We consider that, with Mr Sanger and Mr Chenu’s resignations, Mr Gavin Argyle with the support of Mr Pismiris (see paragraphs 174 to 193 below), had effective control of the TMH board.

Conclusion of shared goal or purpose

- We consider that Mr David Argyle and Mr Gavin Argyle have a shared goal or purpose in maintaining the level of ownership control of Mr David Argyle, or the Argyle family, in TMH and in turn controlling or influencing TMH’s board composition or the conduct of its affairs.

- While it is possible that this goal has existed since the listing of TMH in 2016, based on the material before us, we find that the goal or purpose existed by no later than 9 August 2022 in relation to the GCA acquisition.

- In our view, it was at this point that Mr David Argyle and Mr Gavin Argyle went beyond “the exchange of views or information” or “raising general issues [that] may range from corporate governance issues to long-term strategic or commercial risks facing the company”. Mr David Argyle was briefed by Mr Gavin Argyle on a major strategic transaction. The transaction proceeded after Mr David Argyle expressed that he was happy with the deal. Mr Gavin Argyle, through CIP as the underwriter, was able to influence the dispersion of new shares under the 2022 Entitlement Offer. Following the transaction, Mr David Argyle maintained his level of shareholding in TMH while Mr Gavin Argyle increased his. These actions demonstrate Mr David Argyle and Mr Gavin Argyle coming together to pursue or influence a strategy for TMH.

- The removal of Mr Sanger also served the interests of both Mr David Argyle and Mr Gavin Argyle. Mr Sanger’s funding strategy posed a risk that the Argyle shareholding may be diluted and Mr Sanger’s post merger integration strategy contradicted the values of the Argyle family. We infer that his removal further evidences the shared goal or purpose of Mr Gavin Argyle and Mr David Argyle of maintaining control of TMH and controlling or influencing TMH’s board composition or the conduct of its affairs. In our opinion, it does not matter which of Mr David Argyle and Mr Gavin Argyle initiated the process to remove Mr Sanger – we infer that there was a meeting of minds that steps would be taken (by one or both of them, as necessary) to remove Mr Sanger.

- First, Mr Gavin Argyle told Mr Sanger that he was to be removed. Mr Sanger’s responsibilities, in particular in relation to the re-financing, were subsequently revoked. There was resistance from another board member about Mr Sanger’s removal at such a critical time for the business. Following an investigation by Mr Gavin Argyle, together with CIP personnel, Mr Gavin Argyle alleged certain misconduct by Mr Sanger. Again, other board members (and some senior members of GCA staff) questioned the procedures for the handling of the misconduct allegations, as well as their veracity. Around this time, with the assistance variously of Mr Gavin Argyle, Mr Pismiris and Ms Van Leeuwarden, Mr David Argyle first served the Re-election Letters and then served a formal section 249D notice for the removal of Mr Sanger as a director.

- Mr David Argyle submitted that “Mr David Brian Argyle and Mr Gavin Argyle’s actions were pursuant to separate but parallel goals and purposes…. Mr David Brian Argyle’s actions are purely motivated from his position as a major shareholder which independently resulted in separate albeit similar actions to that of Mr Gavin Argyle.”

- UIL submitted that “the timing and sequence of events surrounding the removal of Mr Sanger as managing director of [TMH] where there was coordination of, or otherwise a highly coincidental sequence of, events including the issue of a section 249D notice to remove Mr Sanger as managing director followed by the Board removing Mr Sanger as managing director without any impartiality or shareholder participation” supports a finding of association between Mr David Argyle and Mr Gavin Argyle. We agree.

Conclusion on association between Mr David Argyle and Mr Gavin Argyle

- The application alleged that Mr David Argyle and Mr Gavin Argyle have been associates since TMH listed in September 2016.

- ASIC RG 128 deals with collective action by investors wishing to cooperate in relation to their investments. It contrasts investors expressing views and promoting appropriate discipline in decision-making, and investors controlling decision-making.[34]

- Considering the whole of the material, and drawing appropriate inferences, we consider that Mr David Argyle and Mr Gavin Argyle have an agreement, arrangement or understanding for the purpose of controlling or influencing the composition of TMH’s board or for the purpose of controlling or influencing the conduct of TMH’s affairs, including financing, and that this commenced no later than 9 August 2022.

- Alternatively, we consider that Mr Gavin Argyle was acting, or was proposing to act, in concert with Mr David Argyle in relation to TMH’s affairs, from no later than 9 August 2022.

- Mr Gavin Argyle submitted that “there is insufficient evidence for the Panel to make a finding that an association between Gavin Argyle and Mr David Argyle existed before the date of the 2022 Entitlement Offer Booklet (5 September 2022). Instead, if the Panel is to find an association, then that association can only have arisen sometime after 5 September 2022.” We disagree. We consider the text message from Mr Gavin Argyle to Mr Sanger on 9 August 2022, which we infer relates to the GCA acquisition before it was made public, to be evidence of Mr Gavin Argyle’s and Mr David Argyle’s common knowledge of relevant facts and shared goal with regards to the GCA acquisition. Therefore, we consider that Mr Gavin Argyle and Mr David Argyle became associated by no later than 9 August 2022.

- Having said that, we do not rule out that Mr David Argyle and Mr Gavin Argyle may have been associated in relation to TMH from much earlier. There are indications of this, for example:

- in conversations around the IPO of TMH and the appointment of Mr Gavin Argyle as Mr David Argyle’s nominee on the board of TMH

- in conversations from February or March 2022, when Mr David Argyle raised with Mr Gavin Argyle his concerns about the decline in TMH’s profits for the preceding period and

- in Mr Gavin Argyle’s several references to his father, during a GCA staff meeting (see paragraph 75), showing the influence of Mr David Argyle on Mr Gavin Argyle’s professional and personal life.

- Noting that our enquiries were primarily focused around the events that took place from August 2022 onwards, we do not have evidence providing us with a sufficient level of satisfaction[35] to make a finding as to their association at an earlier time.