[2025] ATP 16

Catchwords:

Decline to make a declaration – association – placement – board spill

Corporations Act 2001 (Cth), sections 12(2), 203D, 249D, 606, 608(3), 609(2), 657C(3), 671B

Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68

ASIC Regulatory Guide 128: Collective action by investors

ASIC Regulatory Guide 222: Substantial holding disclosure - Securities lending and prime broking

Global Lithium Resources Limited 02R [2025] ATP 4, Webcentral Group Limited 03 [2021] ATP 4, Aguia Resources Limited [2019] ATP 13, The President's Club Limited 02 [2016] ATP 1, Viento Group Ltd [2011] ATP 1, Mt Gibson Iron Limited [2008] ATP 4, Azumah Resources Limited [2006] ATP 34

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| YES | NO | YES | NO | NO | NO |

Introduction

- The Panel, Jonathan Gidney, Ruth Higgins SC and Deborah Page AM (sitting President), declined to make a declaration of unacceptable circumstances in relation to the affairs of Mayfield Childcare Limited. The application concerned an alleged undisclosed association between certain Mayfield shareholders holding at least approximately 43%, and other persons, some of whom participated in a placement of shares completed by Mayfield on 3 January 2025, in the context of an upcoming annual general meeting at which resolutions concerning the composition of the board are to be considered. The Panel considered that the application was out of time under section 657C(3)(a)1 and decided not to exercise its discretion to extend the time under section 657C(3)(b). Accordingly, the Panel decided not to make a declaration of unacceptable circumstances.

- In these reasons, the following definitions apply.

- 2025 Genius Form 604

- has the meaning given in paragraph 34

- Alleged Connected Parties

- has the meaning given in paragraph 38

- Citicorp Nominees

- Citicorp Nominees Pty Ltd

- Finexia

- Finexia Securities Limited

- Finexia Wealth

- Finexia Wealth Pty Ltd

- Genius Education

- Genius Education Group Pty Ltd

- Genius Holdings

- Genius Education Holdings Pty Ltd

- Genius Parties

- Mr Darren Misquitta, Genius Holdings and Genius Education

- Hoppers Lane

- Hoppers Lane Investments Pty Ltd

- Hoppers Lane Genius Acquisition

- has the meaning given in paragraph 15

- Lazarus

- Lazarus Securities Pty Ltd

- Mayfield

- Mayfield Childcare Limited

- OPM

- O P M Structured Holdings Pty Ltd

- Placement

- has the meaning given in paragraph 17

- PLC

- PLC Corporation Pty Ltd

- Rothman

- Rothman Consulting Pty Ltd

- Rush Asset Holdings

- Rush Asset Holdings Pty Ltd

Facts

- Mayfield is an ASX‑listed company (ASX code: MFD) which owns and operates childcare centres.

- The current directors of Mayfield are Ms Roseanne Healy, Mr Gregory Johnson and Ms Lubna Matta.2

- On 6 December 2021, Mayfield sought and received shareholder approval at a general meeting of shareholders for the issue of 21,704,347 Mayfield shares to Genius Holdings for the purposes of item 7 of section 611, as consideration for the acquisition by Mayfield of Genius Education Pty Ltd.3

- On 15 December 2021, Genius Holdings and its parent company Genius Education (a company controlled by Mr Darren Misquitta) gave Mayfield a substantial holder notice4 disclosing a relevant interest and voting power in 21,704,347 Mayfield shares (approximately 34.23% of the issued shares at that time).

- On 19 January 2024, Genius Holdings transferred 6,530,000 Mayfield shares (approximately 10.00% of the issued shares at that time) to Finexia.

- On 2 February 2024, Finexia transferred 3,265,000 Mayfield shares (approximately 5.01% of the issued shares at that time) to Citicorp Nominees, and, on 5 February 2024, transferred a further 3,265,000 Mayfield shares (approximately 4.99% of the issued shares at that time) to Citicorp Nominees.

- On 28 March 2024, Citicorp Nominees transferred 6,530,000 Mayfield shares (approximately 10.18% of the issued shares at that time) to Lazarus. On 3 May 2024, Lazarus transferred this parcel of shares back to Citicorp Nominees.

- On 26 September 2024, Genius Holdings acquired 142,401 Mayfield shares (approximately 0.22% of the issued shares at that time) as part of a dividend reinvestment plan allotment by Mayfield.

- Also on 26 September 2024, Genius Holdings transferred 16,148,211 Mayfield shares (approximately 24.72% of the issued shares at that time) to Finexia.

- On 28 October 2024, Finexia transferred 16,424,555 Mayfield shares (approximately 25.15% of the issued shares at that time) to Citicorp Nominees.

- On 30 October 2024, Genius Holdings executed an agreement with Finexia Wealth for the provision of financial product advice and dealing services by Finexia Wealth in relation to (among other things) securities, and which may include (among other things) arranging for the execution of transactions and acting as authorised person for Genius Holdings, for such purpose.

- On 31 October 2024, Genius Holdings entered into a “Prime Agreement” with Lazarus for the provision of the following services (among other things):

- providing credit for “Transactions”5 and services under the Prime Agreement

- borrowing and lending of securities (if applied for by Genius Holdings and accepted).

- On 28 November 20246, Hoppers Lane (a company controlled by Mr Kevin Wright) as trustee of the Misquitta Family Trust (of which Mr Misquitta is a beneficiary) became the sole shareholder of Genius Education (Hoppers Lane Genius Acquisition).

- On 19 December 2024, Mr Misquitta sent an email to Finexia titled ‘Proposed directors and shareholders’ relating to the proposed shareholders of a new Genius corporate entity including Mr Misquitta, Mr David Robert May and Mr Ruchir Parekh. The proposed directors of the new Genius corporate entity were Ms Matta and two other individuals.

- On 3 January 2025, Mayfield completed a placement (Placement) of 9,837,992 Mayfield shares at an issue price of $0.465 per share to raise $4,574,666 as follows:

- 3,750,000 Mayfield shares (approximately 4.97% of the issued shares at that time) to PLC (a company controlled by Mr Wright) ATF Wright Reading FC Family Trust

- 1,500,000 Mayfield shares (approximately 1.99% of the issued shares at that time) to Rothman ATF Vader Family Trust

- 2,350,000 Mayfield shares (approximately 3.12% of the issued shares at that time) to Mr May ATF Rose Chenny Family Trust and

- 2,237,992 Mayfield shares (approximately 2.97% of the issued shares at that time) to Mr Joseph Carbone ATF Jcace Family Trust.

- On 21 January 2025, Genius Holdings provided a notice under section 203D signed by Mr Misquitta to Mayfield concerning the proposed removal of each of the then Mayfield directors, being Ms Healy, Mr Johnson, Mr David Niall and Ms Heidi Beck.

- On 24 January 2025, following negotiations between Mayfield and Mr Misquitta in respect of the composition of the board, which resulted in the resignations of Mr Niall and Ms Beck and the appointment of Ms Matta, Mr Misquitta withdrew the section 203D notice.

- On 31 March 2025, Rothman nominated Mr Scott Beeton, a director and responsible manager of Finexia and a director and company secretary of Finexia Wealth, to be a director of Mayfield.

- On 6 April 2025, Mayfield issued section 672A tracing notices to PLC, Rothman, Mr May, and Mr Carbone.7

- Also on 6 April 2025, PLC transferred 3,750,000 Mayfield shares (approximately 4.97% of the issued shares at that time) to Finexia Wealth.

- On 22 April 2025, Mayfield released a Notice of Annual General Meeting in relation to its annual general meeting (AGM) to be held on 20 May 2025 to consider the following resolutions (among others):

- Resolution 1 – Adoption of Remuneration Report

- Resolution 2 – Spill Resolution8

- Resolution 3 – Election of Director – Gregory Johnson

- Resolution 4 – Election of Director – Lubna Matta

- On 23 April 2025, Finexia Wealth stated in response to a tracing notice under section 672A issued to it by Mayfield that Finexia Wealth:

- held a total of 3,750,000 Mayfield shares of which PLC is the beneficial owner and

- does not exercise discretion over the acquisition, disposal, or voting of these shares unless explicitly instructed by the beneficial owner.

- On 1 May 2025, Rothman transferred 1,500,000 Mayfield shares to Finexia Wealth and Mr May transferred 2,350,000 Mayfield shares to Finexia Wealth (in total, approximately 5.83% of the issued shares at that time).

- Also on 1 May 2025, Finexia Wealth stated in response to a tracing notice under section 672A issued to it by Mayfield that Finexia Wealth:

- held a total of 7,600,000 Mayfield shares, 5,000,000 of which OPM is the beneficial owner and 2,600,000 of which PLC is the beneficial owner and

- does not exercise discretion over the acquisition, disposal, or voting of these shares unless explicitly instructed by the beneficial owners.

- On 6 May 2025, Finexia Wealth transferred 2,500,000 Mayfield shares (approximately 3.32% of the issued shares at that time) of which PLC was the beneficial owner to Rush Asset Holdings (a company of which Mr Parekh is a director).

- Also on 6 May 2025, Finexia Wealth stated in response to a tracing notice under section 672A issued to it by Mayfield that Finexia Wealth:

- held a total of 5,100,000 Mayfield shares, 5,000,000 of which OPM is the beneficial owner and 100,000 of which PLC is the beneficial owner and

- does not exercise discretion over the acquisition, disposal, or voting of these shares unless explicitly instructed by the beneficial owners.

- On 12 May 2025, Mayfield announced the receipt of notices under section 203D and 249D (respectively) concerning the proposed removal of Ms Healy, signed by Mr Misquitta on behalf of Genius Holdings. Mayfield stated that the section 249D notice was invalid9 and that the Mayfield directors would accordingly not convene a general meeting to consider the resolution in the notice.

- On 16 May 2025, Lazarus wrote to Mayfield stating that, as at 16 May 2025, Genius Holdings held 22,954,552 Shares with Lazarus under a prime broking agreement.10

- On 16 May 2025, proxy reports indicated that Citicorp Nominees (Genius Holdings), Finexia Wealth (OPM, PLC), Rush Asset Holdings and Mr Carbone had each voted “for” resolutions 2, “against” resolution 3 and “for” resolution 4 at the upcoming AGM.

- On 18 May 2025 at 2.00pm (the proxy deadline), proxy reports indicated that Finexia Wealth, Rush Asset Holdings and Mr Carbone had each changed their votes to “against” resolution 2.

- On 19 May 2025, Mayfield announced that the AGM scheduled to be held on 20 May 2025 had been postponed to allow Mayfield to prepare and lodge an application with the Takeovers Panel.

- On 21 May 2025, Genius Education and Genius Holdings gave Mayfield a substantial holding notice (2025 Genius Form 604) disclosing a relevant interest and voting power in 23,096,956 Mayfield shares (approximately 30.62% of the issued shares at that time) as follows:

- as “[h]older of relevant interest under section 608(1) of the Corporations Act as the beneficial holder of the securities and (in the case of [Genius Education]) holder of relevant interest under section 608(3) of the Corporations Act as controller of [Genius Holdings]”

- in relation to 22,954,555 Mayfield shares (approximately 30.43% of the issued shares at that time), the person entitled to be registered as holder is “[Citicorp Nominees] as holder for [Genius Holdings] under a Prime Brokerage Agreement with Lazarus Capital Partners” and

- in relation to 142,401 Mayfield shares (approximately 0.19% of the issued shares at that time), the person entitled to be registered as holder is “[Genius Holdings] as holder for [Genius Holdings] under a Prime Brokerage Agreement with Lazarus Capital Partners”.

- The 2025 Genius Form 604 disclosed the following changes in relevant interests:

- two entries stating that on 5 February 2024, Genius Holdings ceased to be registered holder of 3,265,000 Mayfield shares “as a result of transfer of holdings to [Citicorp Nominees] as holder for [Genius Holdings] under a Prime Brokerage Agreement with Lazarus Capital Partners”

- on 28 October 2024, Genius Holdings ceased to be registered holder of 16,424,555 Mayfield shares “as a result of transfer of holdings to [Citicorp Nominees] as holder for [Genius Holdings] under a Prime Brokerage Agreement with Lazarus Capital Partners”

- on 4 April 2022, 23 September 2022 and 26 September 2024, Genius Education and Genius Holdings acquired a relevant interest in a total of 1,112,265 Mayfield shares pursuant to participation in the dividend re‑investment plan and

- on 3 January 2025, Genius Education and Genius Holdings were diluted as a result of the Placement.

- On 3 June 2025, Mayfield announced that ASIC had granted an extension of time for Mayfield to hold its AGM to 30 June 2025 and that Mayfield would advise the date and time of the AGM in due course.

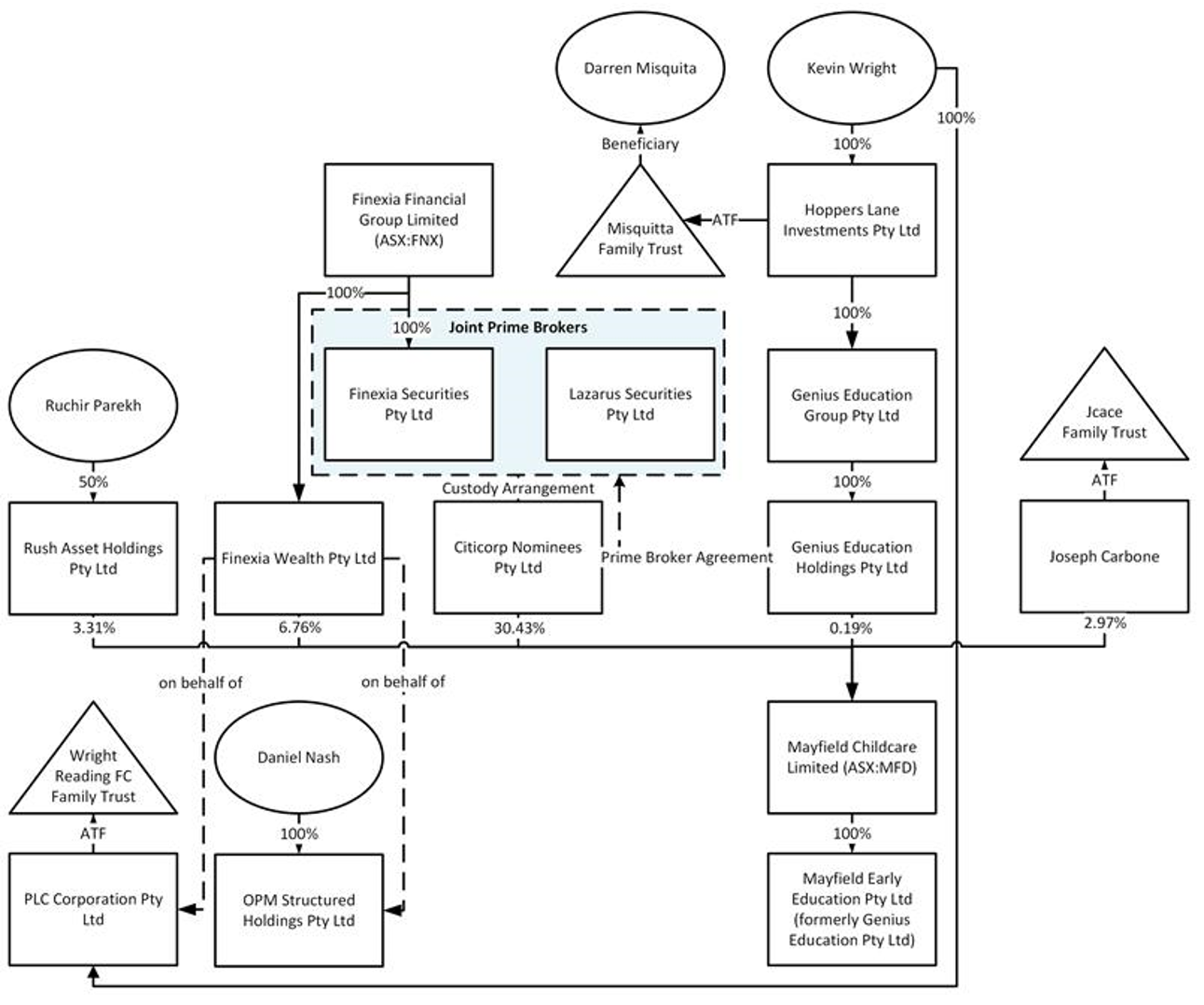

- Relevant current shareholdings in Mayfield are as follows:

Text description

Structural diagram showing:

- The following persons as shareholders of Mayfield: Citicorp Nominees Pty Ltd (30.43%); Finexia Wealth Pty Ltd (6.76%); Rush Asset Holdings Pty Ltd (3.31%); Joseph Carbone as trustee for the Jcace Family Trust (2.97%); Genius Education Holdings Pty Ltd (0.19%).

- A Prime Broker Agreement in relation to Citicorp Nominees Pty Ltd’s shares in Mayfield, under which Finexia Securities Pty Ltd and Lazarus Securities Pty Ltd are Joint Prime Brokers.

- Finexia Financial Group Limited (ASX: FNX) holds 100% of Finexia Wealth Pty Ltd and Finexia Securities Pty Ltd.

- Finexia Wealth Pty Ltd’s shares in Mayfield are held on behalf of OPM Structured Holdings Pty Ltd and PLC Corporation Pty Ltd as trustee for Wright Reading FC Family Trust.

- Daniel Nash holds 100% of OPM Structured Holdings Pty Ltd.

- Ruchir Parekh holds 50% of Rush Asset Holdings Pty Ltd.

- Genius Education Group Pty Ltd holds 100% of Genius Education Holdings Pty Ltd.

- Hoppers Lane Investments Pty Ltd as trustee for Misquitta Family Trust holds 100% of Genius Education Group Pty Ltd.

- Darren Misquitta is a beneficiary of the Misquitta Family Trust.

- Kevin Wright holds 100% of Hoppers Lane Investments Pty Ltd and PLC Corporation Pty Ltd.

- Mayfield holds 100% of Mayfield Early Education Pty Ltd, which was formerly known as Genius Education Pty Ltd.

Application

- By application dated 2 June 2025, Mayfield sought a declaration of unacceptable circumstances. Mayfield submitted (among other things) that Mr Misquitta, Genius Holdings, Genius Education, Finexia, Finexia Wealth, Lazarus, PLC, Hoppers Lane, Mr Wright, Rothman, Mr May, Mr Carbone, OPM and Rush Asset Holdings (the Alleged Connected Parties) are associates11 and made various submissions with reference to the indicia of association set out in Mt Gibson Iron Limited [2008] ATP 4 and Viento Group Ltd [2011] ATP 1 including as follows:

- the Alleged Connected Parties have demonstrated a shared goal to influence the conduct of Mayfield’s affairs and, ultimately, the control of the company, including through Mr Misquitta’s actions in seeking to change the composition of the board in January 2025 and May 2025

- Finexia and Lazarus have “significant commercial links” with the Genius entities, Mr Misquitta and various other entities controlled by Mr Misquitta, including that Mr Misquitta owes in excess of $48 million to Finexia, and Finexia and Lazarus have security over assets owned by Mr Misquitta

- there are structural links or examples of prior collaborative conduct between the Alleged Connected Parties, including:

- PLC and Hoppers Lane (the sole shareholder of Genius Education) are related bodies corporate and Mr Wright is the sole director and secretary of Hoppers Lane and the sole director and sole shareholder of PLC

- the sole shareholder, secretary and director of Rothman has a structural link to the registered ASIC agent for Genius Education

- Mr May was involved in Federal Court proceedings relating to a statutory demand for payment against a company controlled by Mr Misquitta, including swearing an affidavit dated 22 January 2025

- Mr May and Mr Parekh are both named as proposed shareholders of a new Genius corporate entity in Mr Misquitta’s email of 19 December 2024

- Mr Carbone was previously employed as a Project Manager by a company controlled by Mr Misquitta which is now in administration and

- the sole director, shareholder and secretary of OPM has previously acted as a solicitor to Mr Misquitta and is recorded on the PPSR as the named addressee for service in relation to security interests over, inter alia, Genius Holdings’ shareholding in Mayfield, in favour of both Finexia and Lazarus12

- three of the four Placement participants transferred 100% of their Placement shares by way of off‑market transfers to Finexia Wealth which was a “deliberate responsive action to disguise these holdings, following receipt of the S672A Tracing Notices”, and which required a relationship between the parties

- given Finexia has responded to various section 672A tracing notices indicating that it did not beneficially hold any Mayfield shares “this increases the potential that these shares were transferred to Finexia in connection with these shares being ‘warehoused’ on behalf of Mr Misquitta” and

- the complete alignment on resolutions 2, 3 and 4 on 16 May 2025, followed by an identical change on resolution 2 within a 14‑hour period “goes beyond a mere coincidence”, and demonstrates that Finexia Wealth, Rush Asset Holdings and Mr Carbone are acting in concert.

- Mayfield further submitted that the Alleged Connected Parties:

- have acquired control over voting shares in Mayfield other than in an efficient, competitive and informed market contrary to section 602(a)

- contravened section 606(1), as they have acquired a relevant interest in the voting shares of Mayfield by way of transactions which have increased their voting power in Mayfield from a starting point above 20% to less than 90% and

- contravened section 671B, as they acquired a substantial holding in Mayfield and failed to provide the required disclosures of such an acquisition at the relevant times, and public disclosures of their substantial holdings have been deficient.

- Mayfield sought interim orders that the Alleged Connected Parties and their associates be prevented from:

- acquiring further shares, increasing their voting power in Mayfield or increasing their relevant interest in Mayfield

- disposing of or transferring any shares held directly or indirectly and

- exercising any voting rights attached to their combined shares held at shareholders’ meetings of Mayfield, should any such meetings occur while the Panel proceedings are ongoing.

- Mayfield sought final orders including (in summary) that:

- the Alleged Connected Parties be required to disclose their combined voting power in compliance with section 671B

- the Alleged Connected Parties be prevented from exercising any voting rights attached to their aggregated shareholding in Mayfield

- any aggregated shares held by the Alleged Connected Parties “in excess of 30.62%” vest in ASIC and be sold by private tender to non‑associated parties, with the net proceeds paid to the Alleged Connected Parties and

- the Alleged Connected Parties be prohibited from making any further acquisition of shares unless permitted by section 611.

Discussion

- We have considered all the material but address specifically only that part of the material we consider necessary to explain our reasoning.

Interim Orders

- The President of the Panel considered the request for interim orders on an urgent basis and invited submissions from the Alleged Connected Parties.

- The Genius Parties submitted (among other things) that the interim orders would appear to be disproportionate and unwarranted and that “the Genius Parties’ interest (30.62%) itself is not in question”.

- The President considered the relevant factors for making an interim order.13 Having regard to (among other things), the transfers of Mayfield shares by certain of the Placement participants following the Placement14, the President considered there was a risk that further transfers may occur which could present difficulties for the sitting Panel and may not be amenable to remedy by final relief alone.

- Accordingly, the President made interim orders restricting the Alleged Connected Parties from disposing of, transferring, charging or otherwise dealing with their shares or interests in shares in Mayfield (see Annexure A).

Preliminary submissions and decision to conduct proceedings

- The Genius Parties provided preliminary submissions asserting that we should decline to conduct proceedings. Among other things, they submitted that:

- all relevant circumstances referred to in the application occurred well before 2 months before the application and the application is well out of time

- “[i]t is accepted that there appears to have been a technical (and in the Genius Parties’ view, inadvertent) relevant interest in the 30.62% relevant interest vested in 2021, extended to [Hoppers Lane] by s608(3)”

- while ultimately a matter for Hoppers Lane and Mr Wright, the Genius Parties would be happy to provide such information as may be required to assist in the preparation of a Form 603 for this purpose

- Finexia Wealth and Lazarus are joint prime brokers and margin lenders to the Genius Parties’ interest and their roles, as the Genius Parties understand, are limited to the provision of financial services and financial advice to clients

- the transfers of shares by any other party to Finexia Wealth are not in any way associated with the Genius Parties’ relationships with Finexia Wealth

- Rothman, Mr May, Mr Carbone, OPM and Rush Asset Holdings have a “pre‑existing commercial relationship with the Genius Parties (in particular Mr Misquitta)” and “[s]ome were introduced into the Placement opportunity… via Mr Misquitta, in response to a request for assistance from [one of the directors of Finexia] (who is known to Mr Misquitta by reason of his commercial relationships with the Finexia entities)” and

- other than in relation to Hoppers Lane, in respect of the balance of the Alleged Connected Parties, there is no “relevant agreement” or conduct amounting to “acting in concert”, and the mere existence of commercial relationships, similar voting patterns, or participation in a placement does not establish association.

- The application, which was 39 pages, was very detailed and raised complex matters including the prime brokerage and other financial arrangements relating to the Genius Parties’ shareholding in Mayfield. Notwithstanding the length of the application, we considered that the evidence going to the indicia of association was somewhat limited. We were also mindful that the Genius Parties had significant voting power of approximately 30% in Mayfield on their own and had held voting power at or above this level since the transaction approved on 6 December 202115 (which did not appear to be in dispute). However, we had some concerns in relation to (among other things) the relevant interest of Hoppers Lane (and PLC and Mr Wright) in Mayfield, noting the acknowledgment in the Genius Parties’ preliminary submissions, potential substantial holder notice deficiencies, and the movement of Mayfield shares following the Placement and the issuance of tracing notices.

- A period of approximately 5 months had elapsed between the Placement and the lodgement of the application. An application for a declaration under section 657A can be made only within 2 months after the circumstances have occurred or a longer period determined by the Panel.16 We had some doubts in relation to our ability to investigate the complaints, given the factually dense nature of the circumstances and the timing of Mayfield’s upcoming AGM which, at the time of the application, was required to be held by 30 June 2025.17

- As observed by the Full Court of the Federal Court,18 the Panel may first resolve the factual questions in an application before deciding whether to extend time under section 657C(3)(b). On balance, we considered it appropriate to make further enquiries. We decided to conduct proceedings.

Alleged Association

- We asked the Genius Parties to provide further details about the “pre‑existing commercial relationship” they had with Rothman, Mr May, Mr Carbone, OPM and Rush Asset Holdings, and what role, if any, Mr Misquitta had in relation to the Placement.

- We also asked each of the Placement participants a series of questions, including why they decided to participate in the Placement and why they voted the way they did concerning resolutions 2, 3 and 4 of the upcoming AGM. We asked PLC, Mr May and Rothman why they decided to transfer their shares to Finexia Wealth and what commercial arrangement was behind the transfer.

- The Genius Parties submitted:

- Mr May has consulted for one of Mr Misquitta’s businesses under a professional engagement and was introduced to the Placement opportunity by Mr Misquitta

- Rothman was introduced to Mr Misquitta by Mr Misquitta’s accountant in the context of the Placement

- Mr Joseph Carbone is known to Mr Misquitta in a historical, professional context and has consulted for one of Mr Misquitta’s businesses under a professional engagement, but was not introduced to the Placement opportunity by Mr Misquitta

- the son of one of the directors of OPM and a son of Mr Misquitta are friends, but OPM was not introduced to the Placement opportunity by Mr Misquitta

- Rush Asset Holdings, an experienced child care sector investor known in the child care market, is known to, but was not introduced to the Placement opportunity by, Mr Misquitta

- they have no information regarding the transfer of Mayfield shares to Finexia Wealth or Rush Asset Holdings

- in relation to voting at the AGM:

- the Genius Parties had no issue with the re‑election of Ms Matta to the board of the company

- the Genius Parties had expressed their concerns regarding the re‑election of Mr Johnson in May 2025 to the company in light of events that, in the Genius Parties’ view, were undesirable conduct by a listed company director and therefore voted against his re‑election to the board and

- there have been differences in voting decisions among the alleged associates on resolution 2 and if there had been any association as asserted by Mayfield, it could reasonably be expected that the voting preferences would have converged and

- this is not the first time, over a 12‑month period, that the Mayfield board has had to face a spill, referencing an extraordinary general meeting (EGM) called by another substantial shareholder in March 2024 to remove all of the board members at the time and appoint new directors.

- Mr Carbone submitted (among other things):

- he had had a number of positive interactions with Mayfield’s former CEO and was approached by him in December 2024 regarding the Placement and suggested it might align with his investment approach and background

- Mayfield had come through a challenging period including an EGM in 2024 but it appeared the worst was behind the company and the Placement was an “opportunity to acquire a large parcel given the low liquidity in the market for this stock”

- his decision to participate in the Placement was made independently

- he had no involvement in the post‑Placement transfers referred to in the application and

- in relation to voting at the AGM:

- he initially voted in line with all of the company’s recommendations

- he changed his vote to support the spill and vote against the election of Mr Johnson as a result of becoming aware of inappropriate conduct involving a Mayfield director posting anonymously on a public investor forum (Hot Copper)19 and

- he subsequently withdrew his support for the board spill after becoming aware, through discussions with the former CEO of Mayfield, that the two major shareholders of Mayfield had been feuding and that Mayfield’s corporate adviser considered that board spill motions would be value destructive.

- Mr Parekh made submissions on behalf of Rush Asset Holdings, including as follows:

- “I do not hold shares on behalf of PLC – I bought the shares from PLC in a commercial transaction and I own them” (emphasis in original)

- he invested in Mayfield because he “thought it was cheap compared to the market and with a good prospect”.

- he is not associated with any other party and is happy to provide an undertaking to this effect

- he initially voted for the board spill as he was “aware of several issues with the business and thought it was time for a fresh start” and the change came from “speaking to a few people in the market that it may disrupt the performance to have a complete spill of the board”

- he voted against Mr Johnson as he “had heard regarding the [sic] governance issues and hence did some inquiry” and was “aware of the director engaging in inappropriate conduct on public forums” and

- he voted for Ms Matta as he knew of her experience in childcare through his business network.

- We did not receive submissions from the other Alleged Connected Parties.

- In rebuttals, Mayfield submitted (among other things):

- it considers the submissions of the Genius Parties to be “intentionally lacking detail to the point of being evasive” and an attempt to diminish and downplay the true nature of the relationships between the Genius Parties and the other alleged associates

- it is particularly telling that PLC, Mr May and Rothman, which Mr Misquitta acknowledges he introduced to the director of Finexia to facilitate their participation in the Placement, did not provide submissions and

- there is clearly enough evidence for the Panel to conclude, drawing reasonable inferences, that the relationships and conduct of the alleged associates gives rise to association.

- Following submissions and rebuttals, we had formed the following preliminary views:

- we did not consider, on the materials before us, that there was enough to make a finding of association or other unacceptable relationships. In particular:

- we did not consider that either Mr Carbone or Rush Asset Holdings was part of the alleged group of associates having regard to their submissions and the other material

- we considered that the alleged concerted actions between the Alleged Connected Parties could potentially be explained as permissible collective action20 or other conduct unlikely to constitute acting as associates or entering into a relevant agreement giving rise to a relevant interest, noting the Genius Parties’ pre‑existing 30.62% interest in Mayfield and the Genius Parties’ submissions concerning Mr Misquitta’s pre‑existing commercial relationships with a number of the Alleged Connected Parties21

- while we had some concerns about the transfer by PLC of the Mayfield shares it acquired under the Placement to Finexia Wealth on the same day it was sent a tracing notice from Mayfield, we considered that the subsequent transfer of 2,500,000 shares of which PLC was beneficial owner to Rush Asset Holdings (being more than half of the shares PLC acquired under the Placement) weighed against a finding of association

- we considered that the change of proxy voting by Finexia Wealth (OPM, PLC) and others from “for” to “against” the board spill resolution at the upcoming AGM weighed against a finding of association and

- while we had concerns in relation to the lack of submissions received from certain of the Alleged Connected Parties, we were not prepared to draw the inferences requested by Mayfield, including because of our comments at paragraph 58(a)(ii) above and

- we had some concerns regarding whether it was in the public interest to continue to investigate the alleged association, noting (among other things) the following:

- each of the Genius Parties, Mr Carbone and Rush Asset Holdings had made submissions indicating a level of shareholder discontent with the Mayfield board22

- in light of the orders requested, the application was causing a delay to Mayfield’s AGM, where in addition to the resolutions concerning board composition, other matters were to be considered and

- continuing the Panel proceedings was likely to involve a considerable time and resource allocation including legal costs for those involved, noting the complexity of the matter.

- we did not consider, on the materials before us, that there was enough to make a finding of association or other unacceptable relationships. In particular:

- Having regard to our decision not to extend time to hear the application (see below), we did not consider we needed to reach a concluded view on these matters.

Alleged contraventions of section 606 and section 671B and ASIC referral

- In the application, Mayfield submitted that, according to ASIC records, on 28 November 2024, Hoppers Lane (of which Mr Wright is the sole director, secretary and shareholder) became the sole shareholder of Genius Education and that given Genius Holdings’ disclosed 34.23% voting power in Mayfield at that time, the acquisition by Hoppers Lane of Genius Education may have contravened section 606(1) on the basis that Mr Wright, as sole shareholder of Genius Education, holds a relevant interest in the shares held by Genius Holdings in Mayfield and/or as a result of the transaction the parties became associates.

- We asked the parties whether there had been a contravention of section 606 as a result of the Hoppers Lane Genius Acquisition and if so, whether this gives rise to unacceptable circumstances.

- The Genius Parties’ submissions included as follows:

- Hoppers Lane was appointed trustee of the Misquitta Family Trust on 30 September 2020 because the existing trustee was placed into administration

- “Hoppers Lane has no power to control disposal or voting over the 30.62%23 of shares in Mayfield, despite the possibility that the powers of Hoppers Lane as trustee are not that of a bare trustee within the meaning of section 609(2)”24

- “there appears to have been a technical contravention of section 606 as a result of deemed holdings on the part of Hoppers Lane. In 2021, Ashurst was not the legal advisor of the Genius Parties at that time and we understand the Genius Parties and Hoppers Lane acted without the benefit of expert legal advice concerning the application of Ch 6 of the Corporations Act. However the Genius Parties confirm that the power to vote and dispose of the ordinary shares in the Company has always been ultimately vested in Darren Misquitta as beneficiary of the Misquitta Family Trust, subject to the terms of the prime broker agreements” and

- the Genius Parties have no intention of increasing their voting power in the near future.

- No submissions were received from Mr Wright, Hoppers Lane or PLC.

- Mayfield submitted that it is no defence to a contravention that “the Genius Parties and Hoppers Lane acted without the benefit of expert legal advice concerning the application of Ch 6 of the Corporations Act.”

- The materials indicated that the potential contravention of section 606 by Hoppers Lane occurred in 2020–2021 and in the context of a change in trustee arrangements relating to the Genius Parties’ shareholding where the Genius Parties retained the power to vote and dispose of the shares notwithstanding there being a “possibility” that Hoppers Lane is not a bare trustee.25 In these circumstances, on the materials presently before us we did not consider this potential contravention of itself to be unacceptable. That said, we are mindful that a relevant interest extended to Hoppers Lane could have implications for PLC’s acquisition of shares in the Placement.26 In the circumstances, we considered it appropriate to refer this aspect to ASIC for further investigation. We did this on 4 July 2025.

- In the application, Mayfield had submitted that the substantial holder notices for the Genius Entities dated 15 December 2021 and 21 May 2025, and accordingly the Alleged Connected Parties’, are deficient, and that the public disclosure of substantial holding information has been deficient as a result of:

- Finexia becoming the registered holder of Mayfield shares exceeding the 5% substantial holding threshold or there being a movement of at least 1% in its holding on each of 2 February 2024, 5 February 2024, 28 March 2024, 3 May 2024, 28 October 2024, 1 May 2025 and 6 May 2025

- Mr Wright commencing having effective control of Genius Education and Genius Holdings under the Hoppers Lane Genius Acquisition from 28 November 2024, resulting in Mr Wright holding a relevant interest in Mayfield shares exceeding the 5% substantial holding threshold

- the association between the Alleged Connected Parties which “commenced at a minimum” on completion of the Placement on 3 January 2025 and

- OPM holding a relevant interest in Mayfield shares exceeding the 5% substantial holding threshold (6.63%) on 1 May 2025.

- We asked the Alleged Connected Parties whether they had complied with their obligations under Chapter 6C (as modified by ASIC) with respect to any interests in Mayfield and the matters and transactions referred to in the application, including in connection with any securities lending or prime brokerage,27 and whether any contraventions of Chapter 6C give rise to unacceptable circumstances.

- We also asked the Genius Parties why the 2025 Genius Form 604 was given late (noting it was given on 21 May 2025 but refers to a change in interests on 3 January 2025) and why it refers to one or more prime brokerage agreements but does not attach the agreement(s) or provide the information required by section 671B(4A)‑(4C) (as inserted by ASIC Corporations (Securities Lending Arrangements) Instrument 2021/821).

- The Genius Parties submitted (among other things):

- they did not appreciate the obligation under section 671B(2) to update ASX in respect of the decrease (as a result of the Placement) of the ownership interest of Genius Holdings and Genius Education, noting that they did not participate in the Placement

- the prime brokerage agreements the Genius Parties have with Lazarus and Finexia Wealth do not result in a change of the Genius Parties’ power to vote and dispose of the ordinary shares of the company and the Genius Parties “did not believe such agreements to be material for purposes of the 2025 Genius Form 604”

- ASIC Regulatory Guide RG 222: Substantial holding disclosure – Securities lending and prime broking as well as ASIC Corporations (Securities Lending Arrangements) Instrument 2021/821 were considered in preparing the 2025 Genius Form 604 and the Genius Parties’ approach accords with market practice

- while the delay in lodging the 2025 Genius Form 604 is acknowledged, the Genius Parties note that, as disclosed in the Mayfield Annual Report 2024 (at page 55), Mayfield was already aware of the current voting power (30.26%, and not 34.23% as noted in the earlier substantial holder notice) and

- subject to the foregoing (in relation to the delay) the Genius Parties consider that it is compliant with its obligations under Chapter 6C.

- Mayfield submitted (among other things) that consistent with the decision in Azumah Resources Limited [2006] ATP 34, the right or interest, that must be protected, is the right of Mayfield shareholders and other market participants to know the information that the alleged associates were required to provide under Chapter 6C and, in particular, to know of their identity and status as substantial shareholders.

- We had some concerns in relation to the potential substantial holder notice contraventions, noting that Mayfield had alleged several contraventions and that the Genius Parties appeared to acknowledge there had been certain deficiencies in their disclosure, albeit asserting that these were historical and had now been corrected. We also note that the proceeding raised relatively technical issues concerning substantial holder notice disclosure relating to the Genius Parties’ prime broking arrangements with Finexia Wealth and Lazarus. The Genius Parties made submissions which referred to specific parts of ASIC RG 222, including querying the interaction between RG 222.7228 and RG 222.7429. In the circumstances, we considered that ASIC was better placed to investigate the potential substantial holder notice contraventions and, accordingly, we included this as part of our ASIC referral.

Decision not to extend time

- Mayfield acknowledged in the application that elements of the unacceptable circumstances as a whole may have occurred more than two months before the application was made. However, it submitted that the nature of the unacceptable circumstances in this case as at the date of the application were continuing; that is, there is a continuing state of affairs where persons are acting in concert or proposing to act in concert in relation to the affairs of Mayfield.

- A similar argument concerning ongoing circumstances was considered recently in Global Lithium Resources Limited 02R30. We agree with the observations made by the review Panel at [53] to [56] in that matter, in particular that circumstances are not rendered ongoing by treating ongoing effects as part of the circumstances.

- We consider, for the purpose of section 657C(3)(a), that the relevant circumstances in Mayfield’s application occurred no later than 3 January 2025 when Mayfield completed the Placement. Therefore, we consider that the application was out of time under section 657C(3)(a).

- The Panel is given a discretion to extend the 2‑month limit to make an application31 and in considering whether to do so has regard to the following factors:

- the discretion to extend time should not be exercised lightly

- whether the application made credible allegations of clear and serious unacceptable circumstances, the effects of which are ongoing

- whether it would be undesirable for a matter to go unheard, because it was lodged outside the two month time limit, if essential matters supporting it first came to light during the two months preceding the application and

- whether there is an adequate explanation for any delay, and whether parties to the application or third parties will be prejudiced by the delay.32

- The Panel also takes into account the public interest in deciding whether to extend time.33

- Mayfield submitted that, to the extent the Panel considers that section 657C(3)(a) is applicable, it should exercise its discretion to extend the time on various bases, including as follows.

- Mayfield first became aware of “some of the circumstances” giving rise to this application on 5 March 2025, being more than two months after completion of the Placement

- Mayfield initially notified ASX and ASIC of the matters of which it was aware of at the time

- the matters the subject of the application are complex and involved many parties, and required considerable time to investigate properly

- Mayfield’s view was that there was insufficient information to meet the hurdle test for a Panel application until additional information came to the attention of the company in May 2025. Since this time, Mayfield has sought advice and has not unnecessarily delayed in making the application

- the application provides at a minimum “credible allegations of clear and serious unacceptable circumstances, the effects of which are ongoing” and

- no parties to the application or third parties will be prejudiced by the delay, especially given the AGM has been postponed.

- The Genius Parties submitted (among other things) that:

- Mayfield delayed in making the application until after the “May Section 203D Notice” and “May 249D Notice”, when the Genius Parties’ views on the Board were made clear and public and after the AGM proxy deadline had closed

- the application raises matters from 2021 to January 2025, or (at best) matters that Mayfield “became aware of … on 5 March 2025 “ and all relevant circumstances occurred well before 2 months before the application (being 2 April 2025)

- “[w]e assume the Board took the opportunity to consider the outcome of proxy votes for the AGM”

- a delay in making an application in the context of an AGM should increase the Panel’s reluctance to interfere with the legitimate right of shareholders to exercise voting rights, as it may do in the case of a requisitioned meeting34 and

- “[t]he above strongly suggests that the Application is a defensive move by the Board to preserve their positions, rather than a bona fide attempt to address concerns regarding control.”

- Mayfield strongly rejected the submissions set out at paragraph 78(c) and 78(e) above, asserting (among other things) that they were without any factual basis and that the decision to bring the application and postpone the AGM was made at the “earliest point in time that such a decision could reasonably have been made” and this decision was in no way influenced by the receipt of proxy votes or the passing of the proxy deadline. It further submitted that the directors have acted in good faith, in the best interests of Mayfield, and for a proper purpose.

- We acknowledge the difficulty that applicants face in association matters in seeking to gather enough material to meet the ‘hurdle test’35 without unnecessarily delaying bringing the application. We had some sympathy for Mayfield’s submissions in this regard. However, Mayfield accepts that it was aware of concerns regarding the conduct of the Placement from 5 March 2025. As a result, we consider there was some delay in bringing the application. The discretion to extend time should not be exercised lightly. In view of our observations above in relation to the alleged association and potential contraventions of section 606 and section 671B,36 we were not persuaded that an extension of time was warranted here, including because we were not satisfied on the materials before us that there were credible allegations of clear and serious unacceptable circumstances. Accordingly, we decided not to exercise our discretion to extend time under section 657C(3)(b).

Failure to respond to brief

- Our brief included a number of inquiries directed at all or some of the Alleged Connected Parties. However, certain Alleged Connected Parties did not engage and hence we did not receive submissions in response to some of our questions. The Panel expects parties to provide responses to questions asked of them and we remind parties of the Panel’s powers to summon witnesses37 and conduct conferences38 during Panel proceedings. In addition, in appropriate cases the Panel may draw adverse inferences from a lack of response to a question or failure to fully answer a question. While we did not take those steps in this instance, if the circumstances had been different we may have done so.

Decision

- For the reasons above, we declined to make a declaration of unacceptable circumstances. We consider that it is not against the public interest to decline to make a declaration and we had regard to the matters in s657A(3).

Orders

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Deborah Page AM

President of the sitting Panel

Decision dated 25 June 2025

Reasons given to parties 30 July 2025

Reasons published 5 August 2025

Advisers

| Party | Advisers |

|---|---|

| Mayfield Childcare Limited | Steinepreis Paganin |

| Mr Darren Misquitta Genius Education Holdings Pty Ltd Genius Education Group Pty Ltd |

Ashurst |

Annexure A

Corporations Act

Section 657E

Interim Orders

Mayfield Childcare Limited

Mayfield made an application to the Panel dated 2 June 2025 in relation to its own affairs.

The President ORDERS:

- Without the prior consent of the President or the Panel (once appointed), Connected Parties and their associates must not dispose of, transfer, charge or otherwise deal with their shares or interests in shares in Mayfield.

- In these interim orders the following terms have their corresponding meaning:

- Connected Parties

- Mr Darren Misquitta, Genius Education Holdings Pty Ltd (ACN 653 363 636), Genius Education Group Pty Ltd (ACN 654 583 221), Finexia Securities Ltd (ACN 608 667 778), Finexia Wealth Pty Ltd (ACN 637 420 672), Lazarus Securities Pty Ltd (ACN 610 367 416), PLC Corporation Pty Ltd (ACN 679 210 112), Hoppers Lane Investments Pty Ltd (ACN 644 683 009), Mr Kevin Wright, Rothman Consulting Pty Ltd (ACN 672 263 839), Mr David Robert May, Mr Joseph Carbone, O P M Structured Holdings Pty Ltd (ACN 626 347 788) and Rush Asset Holdings Pty Ltd (ACN 650 033 560)

- Mayfield

- Mayfield Childcare Limited

- These interim orders have effect until the earliest of:

- further order of the President or the Panel (once appointed)

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Allan Bulman

Acting General Counsel

with authority of Alex Cartel

President

Dated 5 June 2025

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth) and all terms used in Chapter 6, 6A or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 Appointed on 8 November 2023, 13 August 2024 and 23 January 2025, respectively

3 Renamed Mayfield Early Education Pty Ltd

4 Unless otherwise indicated, references to “substantial holder notice” mean a Form 603 notice of initial substantial holder under section 671B(1)(a), a Form 604 notice of change of interests of substantial holder under s671B(1)(b) or a Form 605 notice of ceasing to be a substantial holder under s671B(1)(a) (as applicable)

5 Defined as “the purchase or sale by [Genius Holdings] of any security, derivative, currency or other financial instrument (whether on or off market), including without limitation, any foreign exchange transaction, securities loan or exchange traded derivative transaction”

6 According to ASIC records

7 Mr Carbone’s response to his tracing notice stated “[n]o other person has a relevant interest in any shares that I hold” and “I have not received any instructions from anyone regarding these shares”. Rothman’s response to its tracing notice (provided by its sole shareholder, secretary and director) stated “I am solely in control of the company and personally make all decisions related to any activity by the company”. PLC and Mr May did not provide responses to their tracing notices

8 Conditional on Mayfield receiving a “second strike” on its remuneration report

9 Given that Genius Holdings was not a member (being a registered holder) of at least 5%

10 This followed letters sent by Mayfield to Finexia Financial Group for the purpose of clarifying certain matters in relation to the relevant interests of Finexia, Finexia Wealth and Lazarus in Mayfield and a meeting between Ms Healy and a representative of Finexia, where the relationship between Mr Misquitta, Finexia, Finexia Wealth and Lazarus was discussed

11 With particular emphasis on section 12(2)(c)

12 Mayfield supplied ASIC extracts and other documentation in support of these submissions

13 See Guidance Note 4: Remedies at [12]

14 See paragraphs 22, 25 and 27

15 See paragraph 5

16 See section 657C(3)

17 On 30 June 2025 (after we handed down our decision), Mayfield announced that ASIC had granted a further extension of time for it to hold its AGM to 31 August 2025

18 Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68 at [75]

19 Mr Carbone supplied an extract of a page showing the relevant Hot Copper post history

20 See Table 1 of ASIC Regulatory Guide 128: Collective action by investors

21 See paragraph 53

22 See paragraphs 53 to 55

23 As set out in the 2025 Genius Form 604, Genius Education and Genius Holdings were diluted from approximately 34.23% to 30.62% as a result of the Placement

24 We note however that clause 5.4 of the Misquitta Family Trust Deed states that “The Trustee may vote on and agree to the variation of any rights attached to any Securities held by it.”

25 See section 609(2)

26 Noting the subsequent transfers of PLC’s Placement shares to Finexia Wealth and Rush Asset Holdings

27 With reference to ASIC Regulatory Guide RG 222: Substantial holding disclosure – Securities lending and prime broking and ASIC Corporations (Securities Lending Arrangements) Instrument 2021/821

28 Which states that “lengthy, standard documentation may not assist the market “

29 Which states that “a prime broking agreement is… a lengthy, complex document and [in the context of the ASIC relief referred to in RG 222], the clause conferring the borrowing right is the only relevant clause “

30 [2025] ATP 4

31 See section 657C(3)(b)

32 Webcentral Group Limited 03 [2021] ATP 4 at [86]

33 See The President’s Club Limited 02 [2016] ATP 1 at [145]‑[158]

34 Citing Aguia Resources Limited [2019] ATP 13 at [24(h)]

35 Mount Gibson Iron Limited [2008] ATP 4 at [15]

36 See paragraphs 58, 65 and 71

37 See Australian Securities and Investments Commission Act 2001 (Cth), section 192; Australian Securities and Investments Commission Regulations 2001 (Cth), regulations 42–43

38 See Australian Securities and Investments Commission Regulations 2001 (Cth), regulation 35–41