[2023] ATP 13

Catchwords:

Declaration – orders – divestment of shares – deemed relevant interests – contravention of s606 – disclosure – substantial holder notice – acquisition of shares – creep exception – extension of time – inadvertence – effect on control

Corporations Act 2001 (Cth), sections 606, 608, 611 item 9, 657A and 671B

Australian Securities and Investments Commission Act 2001 (Cth), section 201A

Broadcasting Services Act 1992 (Cth)

Takeovers Panel Procedural Rules 2020, rule 18

Takeovers Panel Procedural Guidelines 2020, paragraph 10

Attorney-General (Cth) v Alinta Limited (2008) 242 ALR 1, Metals Exploration Ltd v Samic Ltd (1994) 123 ALR 289, Samic Ltd v Metals Exploration Ltd (1993) 11 ACSR 84

Guidance Note 1: Unacceptable Circumstances

ASIC Regulatory Guide 9: Takeover bids (RG 9)

Webcentral Group Limited 03 [2021] ATP 4, Yowie Group Ltd 01 & 02 [2019] ATP 10, Bentley Capital Limited 01R [2011] ATP 13, CMI Limited [2011] ATP 4, Viento Group Limited [2011] ATP 1, Midwest Corporation Limited 02 [2008] ATP 15, Orion Telecommunications Limited [2006] ATP 22, LV Living Limited [2005] ATP 5, ISIS Communications Ltd [2002] ATP 10, Taipan Resources NL 09 [2001] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | YES | YES | YES | YES | YES |

Introduction

- The Panel, Michael Borsky KC (sitting President), Sylvia Falzon and Marina Kelman, made a declaration of unacceptable circumstances in relation to the affairs of Southern Cross Media Group Limited. The application concerned contraventions of section 6061 by ARN Media Limited (ARN) and Allan Gray Australia Pty Limited (Allan Gray) and a contravention of the substantial holder provisions in section 671B by Allan Gray. The Panel declared the circumstances unacceptable having regard to (among other things) the effect the contraventions were likely to have on the control or potential control of Southern Cross. The Panel made orders, which included vesting Southern Cross shares held by ARN in ASIC for sale. The Panel also accepted undertakings from Allan Gray to make corrective disclosure and sell the number of Southern Cross shares it acquired in contravention of section 606.

- In these reasons, the following definitions apply.

- 20 April Report

- has the meaning given in paragraph 28(b)(i)

- ACM Proposal

- has the meaning given in paragraph 33

- Allan Gray

- Allan Gray Australia Pty Limited

- Allan Gray Acquisitions

- has the meaning given in paragraph 25(f)

- Allan Gray Sale

- has the meaning given in paragraph 73

- Anchorage

- Anchorage Capital Partners Pty Limited

- ARN

- ARN Media Limited

- ARN/Anchorage Offer

- has the meaning given in paragraph 13

- ARN Acquisition

- has the meaning given in paragraph 10

- ARN Contravention Shares

- has the meaning given in paragraph 15(c)

- ARN IO Undertaking

- has the meaning given in paragraph 22

- ARN FO Undertaking

- has the meaning given in paragraph 90

- Keybridge

- Keybridge Capital Limited

- Sale Shares

- has the meaning given in paragraph 15(c)

- Southern Cross

- Southern Cross Media Group Limited

Facts

- Southern Cross (ASX: SXL) and ARN (ASX: A1N) are ASX listed companies in the Australian media and entertainment industry.

- Allan Gray is an unlisted fund manager and a shareholder of Southern Cross and ARN.

- Keybridge (ASX: KBC) is an ASX listed financial services company and a shareholder of Southern Cross.

- On 21 June 2022, Allan Gray lodged a notice of change of interests of substantial holder disclosing that it had a relevant interest and voting power in 62,165,031 or 19.98% of ARN shares, based on 311,089,791 ARN shares on issue.

- On 25 August 2022, ARN announced an intention to buy back ARN securities on market.

- On 22 December 2022, Allan Gray lodged a notice of change of interests of substantial holder disclosing that it had a relevant interest and voting power in 52,089,072 or 21.95% of Southern Cross shares, based on 237,348,0272 Southern Cross shares on issue.

- On 21 February 2023, ARN released its 2022 Annual Report which disclosed that Allan Gray held 62,165,031 ARN shares (as at 23 January 2023)3 and that there were 309,080,602 shares on issue (as at 16 February 2023)4, representing an interest of 20.11%5.

- On 19 June 2023, ARN acquired a total of 35,505,074 Southern Cross shares for a consideration of $38,345,479.90 (ARN Acquisition), a portion of which was acquired from Allan Gray.

- On 21 June 2023, ARN lodged a notice of initial substantial holder disclosing that it had a relevant interest and voting power in 35,505,074 or 14.8% of Southern Cross shares.

- On 22 June 2023, Allan Gray lodged a notice of change of interests of substantial holder disclosing that it had a relevant interest and voting power in 39,431,083 or 16.44% of Southern Cross shares.

- On 18 October 2023, ARN announced that a consortium comprising ARN and Anchorage had submitted a non-binding indicative offer to acquire 100% of Southern Cross via a scheme of arrangement (ARN/Anchorage Offer).6

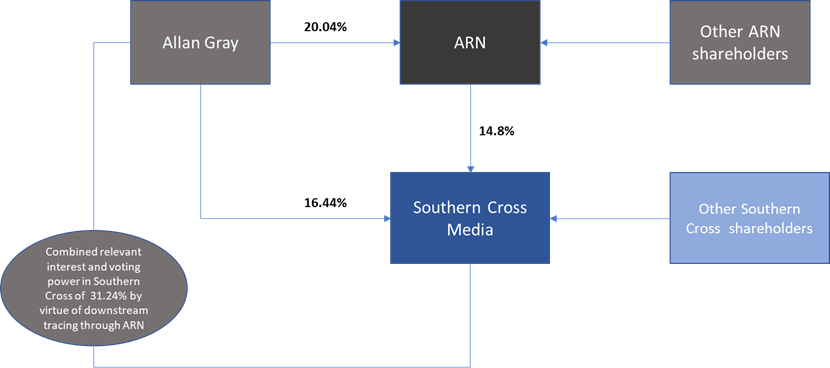

- Relevant interests in Southern Cross and ARN immediately after the ARN Acquisition are shown in the following diagram:

Application

Declaration sought

- By application dated 24 October 2023, Keybridge sought a declaration of unacceptable circumstances. Keybridge submitted (among other things) that:

- as at 19 June 2023, prima facie, Allan Gray had voting power exceeding 20% in ARN7 and accordingly held a deemed relevant interest in the holdings of ARN pursuant to section 608(3)(a)

- as at 19 June 2023, Allan Gray was permitted to hold 24.41% of Southern Cross shares pursuant to the ‘creep exception’ in item 9 of section 611

- as a result of the ARN Acquisition on 19 June 2023, ARN and Allan Gray “collectively held 31.24%”8 in Southern Cross, causing Allan Gray to have a relevant interest exceeding the limits permitted by section 606 (after allowing for section 611 exemptions) by 16,376,774 shares or 6.83%9 and accordingly, ARN had acquired 16,376,774 or 6.83% of Southern Cross shares in contravention of section 60610 (ARN Contravention Shares or Sale Shares) and

- Allan Gray had not lodged a substantial holder notice disclosing its deemed relevant interest in Southern Cross shares in contravention of section 671B.

- Keybridge submitted that the effect of the circumstances was to provide an impermissible springboard for ARN to launch a control transaction for Southern Cross, thereby impeding a competitive market for shares in Southern Cross.

Interim orders

- Keybridge sought interim orders to prevent ARN from (in effect) voting or disposing of any of the ARN Contravention Shares.

Final orders sought

- Keybridge sought final orders including vesting the ARN Contravention Shares in ASIC for sale and prohibiting ARN and its associates from acquiring any of the vested shares or any other Southern Cross shares for a period of 6 months after the sale of the vested shares.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Interim orders request

- Southern Cross’s annual general meeting was scheduled for 11am on 27 October 2023. Accordingly, the substantive President considered the interim orders requested on an urgent basis and invited submissions on the request.

- Southern Cross submitted (among other things) that ARN had already lodged a proxy in respect of its shareholding. Southern Cross also provided a copy of a proxy report as at approximately 7am on 26 October 2023 which showed that each resolution11 had at least 90% of votes cast in favour of it based on the approximately 60% of Southern Cross shares voted at that time. Southern Cross submitted that based on the report, it was very unlikely that the voting of ARN would change the outcome at the annual general meeting.

- In its submission, ARN offered the following undertaking in lieu of interim orders (ARN IO Undertaking):

“ARN will not sell, transfer, exercise any rights attaching to, or otherwise dispose of its 16,368,919 shares in SXL (the Affected Shares) or any relevant interest in the Affected Shares or enter any relevant agreement to do so until the earlier of:

- the Panel informing the parties to the Application in writing that is has decided not to conduct proceedings;

- the final order of any proceeding the Panel conducts in respect of the Application; and

- the date which is 2 business days after ARN serves a notice terminating the undertaking on the Panel and the applicant(s) to the Application.”

- The substantive President acknowledged that the voting of ARN appeared to be very unlikely to change the outcome of any of the resolutions at the annual general meeting. The President decided not to make any interim orders but communicated to the parties that the sitting Panel, once appointed, may consider it appropriate to consider the question of interim orders and that in the meantime, the President expected ARN to comply with the ARN IO Undertaking.

- In view of the ARN IO Undertaking, we also decided not to make any interim orders and communicated to the parties that we expected ARN to continue to comply with the ARN IO Undertaking.

Preliminary submissions and decision to conduct proceedings

- Allan Gray made preliminary submissions by which it submitted (among other things) that:

- on 19 June 2023, it held 61,501,630 or 20.04% of ARN shares on issue

- its shareholding went above 20% in ARN on 16 May 2023 as a consequence of the gradual reduction in the number of ARN shares on issue as a result of on market buy-backs12

- its substantial holding notice in relation to Southern Cross dated 22 June 2023 should have included the deemed relevant interest in the 14.8% of Southern Cross that ARN acquired under the ARN Acquisition, the reason it did not was that “the Allan Gray personnel filing the SXL notice did not appreciate that Allan Gray’s shareholding… had crept above 20%” and that its failure to do so had not caused any confusion in the market

- its shareholding in ARN would be reduced from its current levels and likely to below 20% of ARN shares on issue to assist in funding a client redemption request for effect on 31 October 2023

- it was willing to lodge a corrective substantial holding notice which includes the deemed relevant interest in ARN’s 14.8% shareholding in Southern Cross, but if its shareholding in ARN were to fall below 20% there may not be any need for such corrective notice and

- “because it was not aware of the deemed relevant interest in ARN's 14.8% shareholding in SXL until the time of the Application”, Allan Gray made two acquisitions of Southern Cross shares after 20 June 2023 totaling 0.08% of Southern Cross (Allan Gray Acquisitions), being 130,422 shares on 7 July 2023 and 62,317 shares on 24 October 2023, at a time when its relevant interest and voting power in Southern Cross was already above 20%.

- ARN also made preliminary submissions requesting that we decline to conduct proceedings and submitting (among other things) that:

- “there was an inadvertent and technical breach of s 606 on 19 June 2023” because Allan Gray held voting power of 20.04% in ARN and was deemed to have acquired voting power in the 14.8% of voting shares in Southern Cross that ARN acquired such that, combined with its existing voting power, Allan Gray’s voting power in Southern Cross increased from 21.95% to 31.24%

- at the time of the ARN Acquisition, ARN and its adviser “were acting upon share register information dated 20 April 2023 showing Allan Gray held 18.67% of ARN’s voting shares” and “did not appreciate that the shareholding had crept above 20%”

- “[t]he Panel has indicated that ‘an honest and accidental contravention of s606 may not be unacceptable if it has not had any relevant adverse effect’13 and that a contravention of Chapter 6 of the Act does not automatically mean that there are unacceptable circumstances14”

- no ‘relevant adverse effect’ had arisen from the breach of section 606 because:

- ARN and Allan Gray received no benefit from the breach

- Allan Gray is not an associate of ARN and does not have power to control the right to vote or dispose of ARN’s 14.8% shareholding in Southern Cross and

- the breach has not had any impact on the control of Southern Cross.

- Accordingly, at the time of our initial meeting to consider this matter it was not in dispute that section 606 had been contravened as a result of the ARN Acquisition and that Allan Gray had contravened section 671B. We were not persuaded that the inadvertence of the contraventions (if established) necessarily meant they were not unacceptable. We decided to conduct proceedings.

ARN Acquisition and Allan Gray Acquisitions

- We asked ARN a number of questions in relation to circumstances surrounding the ARN Acquisition, including why it was acting on share register information which was nearly 2 months out of date and whether it took any steps to verify Allan Gray’s voting power. In response, ARN submitted (among other things) that:

- Allan Gray is not the registered holder of ARN shares and accordingly it is not possible for ARN to check Allan Gray’s holding by looking at its share register, and instead ARN must check beneficial holdings which it does by requesting a third party ‘sharetrak report’

- at the time of the ARN Acquisition, ARN was in possession of:

- the “20[sic] May Report was erroneously not relied on for the ARN Acquisition” and ARN and its adviser were instead acting on the 20 April Report

- no additional steps were taken to verify Allan Gray’s voting power “beyond the ordinary step of obtaining share registry reports… as no further steps were considered necessary in light of the belief that Allan Gray held 20% or less of ARN’s voting shares”

- all documentation prepared for the ARN Board in relation to the ARN Acquisition showed that Allan Gray held a position of 18.67%17 and ARN “reasonably believed” Allan Gray held 18.67%

- in contemplating the ARN Acquisition, ARN was conscious that its shareholding in Southern Cross could not increase above 15%18 and considered that acquiring a lower stake would not give rise to any breach of section 606

- the breach of section 606 was the result of the application of the deeming provisions of section 608(3)(a), which “was not readily obvious to ARN or its advisers in the context of the timing of the ARN Acquisition, which occurred over a four-day period” and

- its lawyers were not asked to provide an opinion on compliance with section 606.

- We sought and were provided with copies of ARN’s board minutes dated 15 and 19 June 2023 in relation to the ARN Acquisition. The board minutes dated 15 June 2023 noted (among other things) that external legal advisers would be engaged in relation to “ACCC and ACMA analysis”,19 and that “[t]he sequencing for any potential stake acquisition was discussed, including whether to initially make a raid for up to 15%... or whether to launch a full bid from the commencement”. The board minutes dated 19 June 2023 noted (among other things) that “[t]he risks of the transaction were also discussed, including the risk that it will not be possible to proceed to a full takeover given the various regulatory hurdles.”

- We asked ARN and Allan Gray whether they had any communications with each other in relation to the ARN Acquisition. ARN submitted there was no prior communication or coordination between ARN and Allan Gray in relation to the ARN Acquisition before the evening of 19 June 2023, when ARN’s adviser had contacted Allan Gray and other Southern Cross shareholders seeking to acquire up to an aggregate of 15% of Southern Cross shares for ARN.20 Allan Gray also submitted that it was not aware of, and had no discussions with ARN in relation to, the ARN Acquisition prior to market close on 19 June 2023.21

- We sought submissions from each of the parties on whether the Panel should make a declaration of unacceptable circumstances and if so on which of the bases set out in section 657A(2) and whether there were any relevant policy considerations.

- ARN submitted that the section 606 breach arising from the ARN Acquisition was “of little impact” and had no relevant effect on the principles and objectives of section 602, including because the breach was honest, inadvertent and unintended. It further submitted that neither ARN nor Allan Gray had received any tactical advantage. In rebuttals, Keybridge submitted “[h]ad ARN not contravened the Act, it would only have a stake of 7.97%, being below the 10% necessary to block a compulsory acquisition.”

- ARN further submitted that since the ARN Acquisition, there has been no control transaction for Southern Cross (other than the ARN/Anchorage Offer and a non-binding indicative conditional proposal from Australian Community Media announced on 10 November 2023 (ACM Proposal)22), and that as no control transaction has arisen and as no party is prevented from making a control proposal for Southern Cross by the circumstances (as evidenced by the ACM Proposal having been made), there has not been any effect on the control or potential control of Southern Cross to date.

- Allan Gray submitted that “the fact that Allan Gray has no power whatsoever to control the right to vote attaching to, or the disposal of, ARN's 14.8% stake, means that the failure to lodge a technically compliant substantial holder notice has had no impact whatsoever on the market for control of Southern Cross.”

- Keybridge submitted that the ARN Acquisition was unacceptable, including because:

- It has likely had the effect of limiting complying competitors’ access to a substantial stake in Southern Cross and has otherwise caused the concentration of control into the hands of a party with their own control ambitions. In rebuttals, ARN submitted that this was not so because there are a number of other substantial or large shareholders in Southern Cross, including Allan Gray, from whom a substantial stake in Southern Cross could be acquired by a competitor to ARN.

- Although the sectionv 606 breach flowed from Allan Gray’s holding in ARN of 20.04% at the relevant time, being a small number over 20%, the actual breach is a significant 6.83% acquisition in excess of what is permissible under section 606, in the immediate months leading up to a proposed control transaction.

- Keybridge also submitted that the Panel should make a declaration in the public interest and that market participants should be encouraged to be cautious when dealing with positions in downstream targets.

- Southern Cross submitted that, based on the limited information available to it, it is not in a position to make any submissions as to whether or not unacceptable circumstances have arisen.23

- We asked Southern Cross questions about the ARN Acquisition and other third party interest in a control transaction or other material transaction involving Southern Cross or its assets in the past 12 months. In response, Southern Cross submitted (among other things) that:

- it became aware of the ARN Acquisition on 20 June 2023 as a result of ARN’s ASX announcement of that date, and given the size of the shareholding, considered that this may lead to a proposal for a control transaction from ARN

- it first became aware of the ARN/Anchorage Offer on 17 October 2023 when the Chair of ARN contacted the Chair of Southern Cross and

- it had received other confidential, non-binding, indicative proposals on 12 and 26 October 2023 in relation to acquiring some or all of Southern Cross’s regional TV business.

- We also sought submissions from the parties on whether the Allan Gray Acquisitions were unacceptable and if so how the Panel should deal with them.

- We asked Allan Gray to explain in its response why its internal controls and monitoring procedures appeared to have failed to detect that its relevant interest and voting power in Southern Cross was above 20% prior to the Allan Gray Acquisitions, the second of which occurred over 4 months after the ARN Acquisition. In response, Allan Gray submitted:

“…Like many other compliance systems in the market, the Compliance Checker monitors Allan Gray's shareholdings in listed entities, but cannot readily identify shares in a listed entity that are not held by Allan Gray but by another unrelated listed entity in which Allan Gray has a shareholding, as this data is not automatically ingested and therefore requires some level of manual intervention.

Regrettably, this meant that Allan Gray’s deemed relevant interest in the Southern Cross shares held by ARN was not appropriately captured in the Compliance Checker (and therefore the Compliance Checker could not prevent the additional purchases of Southern Cross that were made in the following months). Allan Gray has activated its internal error reporting process in respect of this issue and is currently looking at additional manual checks that can be conducted by the compliance team to ensure such an error is not repeated in future, notwithstanding that the likelihood of its future occurrence is, we feel, relatively low. Allan Gray is not aware of a similar error having occurred in the past in respect of its holdings.”

- In relation to the Allan Gray Acquisitions, Allan Gray also submitted that:

- the acquisitions were of two very small parcels and have had no effect on the market for control of Southern Cross

- its “’real’ shareholding in Southern Cross only increased marginally above 16.44% as a result of the acquisitions” and

- it has also since sold shares in Southern Cross so that its shareholding is approximately 16.40% “[s]o those acquisitions have effectively been reversed in any event.”

- Keybridge submitted that the Allan Gray Acquisitions were contraventions of section 606 and were unacceptable.

- ARN submitted that the Allan Gray Acquisitions were not unacceptable given that together they represent 0.08% of Southern Cross shares and there has been no impact on the market for control of Southern Cross.

- At the outset, we note that aspects of this matter were similar to Yowie Group Limited 01 & 02 [2019] ATP 10. In that matter, two applications (heard together) concerned contraventions of section 606 and the substantial holder provisions by Wilson Asset Management (International) Pty Limited (WAMI) and contraventions of section 606 by Keybridge. WAMI’s acquisitions occurred shortly after Keybridge had announced its intention to make an off-market takeover bid for all of the shares in Yowie Group Limited (Yowie) and resulted in WAMI’s voting power in Yowie increasing from 19.73% to 32.17% in contravention of sectio 606. WAMI had voting power above 20% in both Keybridge and HHY Fund at the time and hence the section 608(3) deeming provision was engaged. Keybridge’s acquisitions occurred during the course of proceedings on Keybridge’s application and resulted in WAMI’s voting power increasing from 32.17% to 32.65% in contravention of section 606. The Panel declared the circumstances unacceptable as they constituted or gave rise to contraventions of section 606 and, in the case of WAMI, section 671B.24

- In Yowie Group Limited 01 & 02, the Panel observed that it did “not consider that s657A(2)(c) operates as to provide automatically that any contravention or a likely contravention of Chapter 6, 6A, 6B or 6C is per se unacceptable.”25 We agree.

- The Panel also observed however, and we agree, that a contravention of section 606 may be more likely to be found unacceptable, as that section is recognised as one of the cornerstone provisions of Chapter 6.26

- In Attorney-General (Cth) v Alinta Limited, it was said in the High Court:

“…In every case it remains for the Panel to conclude whether or not the circumstances are ‘unacceptable’. For that conclusion to be reached, more is required than proof of a contravention of the Act, although in particular cases such proof may, in practice, be sufficient to result, without much more, in a conclusion of unacceptability.”27

- However, as submitted by ARN, it is also recognised in the Panel’s guidance that “an honest and accidental contravention of s606 may not be unacceptable if it has not had any relevant adverse effect.”28

- ARN referred to ISIS Communications Ltd [2002] ATP 10 in support of its submission that the Panel has previously considered as a relevant factor to a determination of unacceptable circumstances whether the breach was “inadvertent and unintended”. It did not refer us to specific paragraphs from that decision or elaborate further.

- In ISIS Communications Ltd, the Panel declined to make a declaration of unacceptable circumstances in response to an application by directors of Radley Corporation Pty Ltd (Receivers and Managers Appointed) (Radley) concerning the affairs of Isis Communications Ltd (Isis), resulting from a contract for the sale by Radley (acting through its receivers) of 19.9% of Isis to MGB Equity Growth Pty Ltd and Investec Australia Ltd (together MGB-Investec). The Panel considered that despite its concerns that the effect of certain clauses in the agreement had been to give MGB-Investec voting power in the remaining 23% of Isis shares held by Radley which were not expressly part of the agreement, resulting in a possible contravention of section 606, the evidence did not support a conclusion that the agreement had caused unacceptable circumstances. The Panel took into account MGB-Investec’s assertions that any offensive parts of the agreement were inadvertent and unintended, the fact of MGB-Investec quickly and voluntarily deleting the relevant clauses when the issues were formally brought to its attention, and the evidence presented that MGB-Investec had been operating on the basis that the receivers had been free to deal with the remaining 23%.29

- We do not consider that the circumstances in ISIS Communications Ltd bear much similarity to the present case. Moreover, we note that the Panel in ISIS Communications Ltd stated as follows in its reasons:

“73. The Panel considers that this matter is an example of the Panel's policy position (which it has regularly expressed in its Guidance Notes) that evidence of a contravention of the Act will not automatically mean that unacceptable circumstances have occurred and the Panel should make such a declaration.

74. The Panel's position has consistently been that the existence of unacceptable circumstances is an issue to be determined in light of, in addition to the particular facts of the case before it, policy, public interest, and market and shareholder interests, rather than by black letter law interpretation…”30

- In our view, the actions of ARN and Allan Gray fell short of what we would expect from sophisticated market participants.

- As observed in Yowie Group Limited 01 & 02, the operation of the section 608(3) deeming provision is well-established and generally well-understood by the market.31

- We do not agree that it was “reasonable” for ARN to believe that Allan Gray held 18.67%. The correct information was readily available and indeed in the possession of ARN. In our opinion, ARN should have exercised greater care in ascertaining Allan Gray’s voting power, particularly in circumstances where that voting power was close to 20%32 and where ARN had been conducting buy-backs of its securities which reduced the number of ARN shares on issue and had the potential effect of increasing the voting power of ARN shareholders.

- Likewise, we consider it unacceptable that Allan Gray had not identified that its shareholding in ARN had crept above 20% (and hence that a deemed relevant interest had been activated) until the time of the application. Allan Gray’s business is managing share investments for its clients and it is a holder of an Australian Financial Services Licence (AFSL). As observed by ASIC in Yowie Group Limited 01 & 02, holding an AFSL imports an obligation to comply with (and take steps to ensure its representatives comply with) the takeover and substantial holder provisions in section 606 and section 671B.33 Allan Gray should have robust systems and procedures in place to ensure such compliance. That Allan Gray’s increase above 20% in ARN occurred as a result of a buy-back does not alter our view that it should have detected that increase.

- While we took into account ARN’s and Allan Gray’s submissions that the breaches were inadvertent, we were not persuaded that the submitted inadvertence should lead to a finding that the circumstances were not unacceptable. We consider that the circumstances surrounding the ARN Acquisition were unacceptable as they constituted or gave rise to contraventions of section 606 and section 671B. We also consider that the Allan Gray Acquisitions contributed to the unacceptability.

- Further, we consider that the acquisition of the ARN Contravention Shares had an effect, or was likely to have an effect, on the control or potential control of Southern Cross or on the proposed acquisition of a substantial interest in Southern Cross, and was unacceptable on that basis.

- As observed by the Panel in Midwest Corporation Limited 02, it is important that there is a level playing field for participants in the securities market.34 There is also judicial support35 for the proposition that a tactical advantage improperly obtained by a bidder may inhibit the efficient, competitive and informed market principle.36

- The Panel in Midwest Corporation Limited 02 made a declaration of unacceptable circumstances on the basis that a bidder failed to comply with the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA) in acquiring Midwest Corporation Limited shares over the limit requiring compulsory notification to the Treasurer, which put a competing bidder at an “unfair competitive disadvantage” in the contest for control of Midwest.37 Although in Midwest Corporation Limited 02 the circumstances involved a breach of the FATA, we consider that an analogy can be drawn to the present case in terms of the effect of the circumstances, noting that in this instance the ARN Acquisition caused a breach of section 606 and therefore falls within our jurisdiction.

- We disagree with ARN’s submissions that the ARN Acquisition has had no effect on the control or potential control of Southern Cross. ARN acquired an additional 6.83% of Southern Cross shares beyond what it was entitled lawfully to acquire on 19 June 2023. This quantum of shares took ARN’s holding over 10% which is sufficient to block compulsory acquisition. In our view this had, is having, will have or is likely to have an effect on the control or potential control of Southern Cross, particularly in light of the subsequently announced ARN/Anchorage Offer.

- In addition, the quantum of the ARN Contravention Shares is substantial and represents a block of shares that was taken out of the market at a time when, in our view, Southern Cross was ‘in play’. It may not be possible to know definitively the effect of this. For example, it is unknown whether, if ARN had not acquired the ARN Contravention Shares, other parties may have emerged to make a proposal for Southern Cross or acquire their own substantial interest in Southern Cross for the purposes of making a proposal, holding a blocking stake or for some other purpose. However, we are satisfied that ARN’s acquisition of the ARN Contravention Shares likely gave or was likely to give ARN a competitive advantage.

Extension of time for application

- The application was made on 24 October 2023, which was more than 2 months after the ARN Acquisition occurred.

- Section 657C(3) provides that an application for a declaration under section 657A can be made only within:

- two months after the circumstances have occurred or

- a longer period determined by the Panel.

- In Webcentral Group Limited 03 [2021] ATP 4, the Panel articulated the following factors as relevant in considering whether to extend time under section 657C(3)(b):

“(a) the discretion to extend time should not be exercised lightly

(b) whether the application made credible allegations of clear and serious unacceptable circumstances, the effects of which are ongoing

(c) whether it would be undesirable for a matter to go unheard, because it was lodged outside the two month time limit, if essential matters supporting it first came to light during the two months preceding the application and

(d) whether there is an adequate explanation for any delay, and whether parties to the application or third parties will be prejudiced by the delay.”38

- Keybridge included in its application a request that we exercise our discretion under section 657C(3) to hear the application. It submitted that “the unacceptable circumstances have been concealed from the market as a result of faulty/non disclosure under s671B of the Act and that ARN’s true intention to control of SXL has only recently come to light” and that the accrual of time should not begin until the market has been properly informed by way of a corrective disclosure being made under section 671B.

- We requested submissions from the parties on this aspect.

- ARN submitted that we should not extend time because (among other things) Keybridge had strategically waited until one week after the ARN/Anchorage Offer was announced and that the Panel should be sceptical in relation to the timing of the application.

- Southern Cross submitted that it would be reasonable in the circumstances for us to extend time, including because there had been adequate explanation of the delay by Keybridge in bringing the application, being the fact that it was “difficult to identify the breaches without the required disclosure which Allan Gray failed to make in breach of section 671B at the time and that interested third parties might understandably only now have cause to investigate the circumstances in light of the change of control proposal put by ARN.” Southern Cross also submitted that no-one would be prejudiced by an extension.

- Keybridge submitted that alternatively time should commence from when the ARN/Anchorage Offer was announced, as it was “this process that enabled Keybridge to identify the potential breach of s. 606”, and that it lodged its application “within days of it discovering the possible breach”. In rebuttals, ARN submitted that the breach occurred on 19 June 2023 and Keybridge could have brought its application on the same facts at that time and did not learn anything new from the announcement of the ARN/Anchorage Proposal on 18 October 2023 that it did not already know.

- In view of the insufficient disclosure by Allan Gray, we consider that there was an adequate explanation for Keybridge’s delay in bringing the application. We were not inclined to accept ARN’s arguments that Keybridge should have brought its application earlier, noting that ARN itself was (on its own submission) unaware of its breach of section 606 until the application was made.

- We also considered that the application raised serious allegations which, if substantiated, would involve a significant quantum of Southern Cross shares having been acquired in contravention of section 606, the effects of which may be ongoing.

- Accordingly, we decided to extend time to hear the application under section 657C(3)(b).

Other matters

- On 16 November 2023, we issued to the parties a Supplementary Brief on Declaration and Orders which included a proposed declaration and proposed set of orders in substantially similar form as the final declaration and orders. In its response to a question in that supplementary brief, Allan Gray submitted that on 17 November 2023, it had sold 10,510,587 Southern Cross shares, representing 4.55% of Southern Cross shares (Allan Gray Sale). In rebuttals, Keybridge submitted that “the sale of over $10 million worth of SXL shares by Allan Gray after the issuance of the Proposed Declaration and Orders and whilst the market is uninformed about the true control of SXL constitutes unacceptable circumstances”, and that Allan Gray likely held insider information as defined by section 1042A and in prima facie contravention of section 1043A.

- Rule 18(1) and (2) of the Panel’s Procedural Rules provide:

“1. A person (whether or not a party) must not use or disclose any confidential information provided to it in proceedings, except:

- in the proceedings itself as permitted under these Rules or

- as required by law or the rules of a securities exchange.

2. Any communication from, and any document provided by, the Panel (or before the Panel is appointed, the President) is confidential information (including a communication or document provided for comment or which is marked as a draft) unless or until the Panel publishes such information.“

- In addition to providing further guidance on rule 18 (at 10.2), the Panel’s Procedural Guidelines also state (at 10.4, notes excluded):

”a. Parties should note that they may receive non-public, material information during proceedings that may create disclosure obligations or give rise to insider trading restrictions.

b. Parties must comply with the law and listing rules, but should do so in a manner consistent with Rules 18 and 19.”

- The Panel takes compliance with its Procedural Rules and Procedural Guidelines seriously. The Panel requires parties to Panel proceedings to give an undertaking to the Panel (and each other party) under section 201A of the Australian Securities and Investments Commission Act 2001 (Cth) to comply with rule 18 and rule 19 (publicity) of the Procedural Rules.

- We asked Allan Gray to provide further information in relation to the Allan Gray Sale, including when it made the decision to sell the shares, the reason(s) it decided to sell and the identity of the purchaser(s). We also invited the parties to make submissions on whether the Allan Gray Sale constituted a breach of the Panel’s Procedural Rules or Procedural Guidelines and whether the Panel should refer any potential breaches or the matter of the Allan Gray Sale more broadly to ASIC.

- Allan Gray submitted that:

- it made a “decision to seek to sell all of its shares in Southern Cross and ARN” in June 2023, as was reported in the financial press39

- on 14 November 2023, “instructions were input” to sell the equivalent of approximately 0.1% of Allan Gray’s portfolio value in Southern Cross shares (roughly equivalent to $10 million), with only a small portion of this order being filled on this date (109,350 shares)

- on 17 November 2023, “instructions were again input” to sell the equivalent of approximately 0.1% of Allan Gray’s portfolio value in Southern Cross shares, with this order being completed in its entirety

- the Allan Gray Sale “formed part of Allan Gray’s regular portfolio management activities whereby stocks performing reasonably strongly are sold to fund purchases of stocks that are considered to be attractive investment opportunities due to their comparatively depressed prices”, and were designed at least partly to fund buys in various other companies which had been depressed and into which the portfolio was and is rotating

- it does not know the identity of the person(s) to whom it sold the shares noting the transaction was executed via algorithmic trading platforms where counterparty visibility is difficult and

- “[it] is not aware of the AG 17 November SXL Sale constituting a breach of any of the Procedural Rules or Procedural Guidelines” and that “there is no Rule or Guideline restricting trading in securities during Panel proceedings, nor was there any interim order restricting trading.”

- We consider that rule 18 of the Procedural Rules can, and often will, operate to restrict parties to Panel proceedings from trading in securities during those proceedings, including for example in circumstances where such parties are in possession of a Panel’s draft proposed declaration or orders in connection with a supplementary brief (noting that in this instance the proposed orders included a divestment order). Further, we do not consider that the Panel should be required to impose interim orders on parties restricting such trading in securities purely to ensure compliance with rule 18.

- Noting that the materials provided to us did not enable us to form any conclusion as to whether Allan Gray had “used” confidential information in breach of rule 18, we say no more about this issue raised by Keybridge. Moreover, we consider that any potentially arguable contraventions of the insider trading provisions are a matter for ASIC (in the first instance).

- ARN also referred in its rebuttal submissions of 21 November 2023 to a press article40 in relation to the purchase of a 4.2% stake in Southern Cross on 17 November 2023, which stated that “[w]hile it is unclear who the buyer was, fingers are pointing to Antony Catalano” (who is a director of Keybridge) and noting that Mr Catalano had denied he was the purchaser. ARN submitted that the Panel should require Keybridge and Mr Catalano to confirm whether either of them or their associates were the purchaser of the 4.2% stake and referred to rule 18.1 of the Procedural Rules and section 10.4 of the Procedural Guidelines.

- In an out of process email later that day, Keybridge stated “Keybridge expressly confirms that it was not the purchaser and after making inquiries of Mr Catalano, confirm that he was not the purchaser consistent with his comments made to the media”.

- Keybridge’s application had noted that Mr Catalano “has formerly [sic] recused himself from this Panel Application)”. We asked Keybridge to explain what measures have been put in place to recuse Mr Catalano and to ensure that he did not receive any confidential information provided to Keybridge in this proceeding (including the Supplementary Brief on Declaration and Orders dated 16 November 2023). We also asked Mr Catalano to confirm that he had not received or otherwise become aware of any confidential information in relation to this proceeding. We were satisfied with the responses received and decided not to take this aspect any further.

Decision

Declaration

- It appears to us that the circumstances are unacceptable:

- because they constituted or gave rise to contraventions of section 606 and section 671B and/or

- in relation to the contravention of section 606 arising from the ARN Acquisition only, having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- the control, or potential control, of Southern Cross or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Southern Cross.

- Accordingly, we made the declaration set out in Annexure A and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

Orders and undertakings

- Following the declaration, we made the final orders set out in Annexure B. We were not asked to, and did not, make any costs orders. The Panel is empowered to make ‘any order’41 if 4 tests are met:

- it has made a declaration under s657A. This was done on 22 November 2023.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. For the reasons below, we are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 16 November 2023 and 27 November 2023. Anchorage and Mr Catalano (who were not parties to the proceedings) were also given an opportunity to make submissions on 27 November 2023.

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons. The orders do this by vesting the ARN Contravention Shares with ASIC.

- ARN had earlier submitted that its section 606 breach had been “rectified” through Allan Gray’s sale of ARN shares bringing Allan Gray’s voting power to less than 20% of ARN with effect from 31 October 2023. Although the ARN Acquisition would not have contravened section 606 if Allan Gray had held less 20% in ARN at that time, we are not satisfied that the unacceptable circumstances are addressed by Allan Gray reducing its holding retrospectively. In Yowie Group Limited 01 & 02, the Panel took a similar view in rejecting an undertaking offered by WAMI to reduce its holding in Keybridge and Yowie to below 20% purportedly to reverse the section 606 contravention. The Panel in that decision proceeded to make orders vesting the shares acquired by WAMI and Keybridge in contravention of section 606 in ASIC for sale.42

- We sought submissions in relation to a proposed order vesting the ARN Contravention Shares with ASIC for sale.

- ARN submitted that compelling the disposal of the ARN Contravention Shares within 3 months would be punitive and unfairly prejudicial to ARN because the ARN Contravention Shares may be sold at an undervalue. We did not find this argument persuasive. It was not clear to us what precisely was meant by “undervalue” in this context and, in any event, fluctuation in the value of shares acquired in contravention of the law is in our view not something from which a contravener should necessarily have a right to be immunised.

- ARN offered an undertaking in lieu of final orders (ARN FO Undertaking) to (in summary) for a period of 12 months:

- not use the ARN Contravention Shares to vote on a scheme of arrangement proposed by a third party and

- accept any takeover bid in respect of the ARN Contravention Shares proposed by a third party provided the “Takeover Bid Conditions” are met (which conditions included that the third party would proceed to compulsory acquisition if ARN accepted the bid in respect of the ARN Contravention Shares).

- ARN submitted that the ARN FO Undertaking would adequately address any unacceptable circumstances and that the Panel need not make any orders.

- In rebuttals, Southern Cross submitted that if the Panel were to consider accepting the form of the ARN FO Undertaking as proposed, it would encourage the Panel to consider several aspects, including (among other things) whether ARN should be required to procure that any transferee of those shares with whom ARN is associated also compies with the undertaking, whether 12 months is an appropriate term for the undertaking, and whether the undertaking should more closely align with the ‘match or accept’ conditions which would be applied by ASIC in connection with the aggregation of a holding under its joint bid policy.43

- ARN subsequently provided a revised version of the ARN FO Undertaking which incorporated amendments in response to certain submissions made by Southern Cross. For example, the undertaking was amended to provide that ARN will procure that its associates will comply with the undertaking. The second limb of the undertaking was also amended such that it applied to any takeover bid in respect of the ARN Contravention Shares proposed by a third party “or an Associate of ARN” (provided the Takeover Bid Conditions are met).44 The revised undertaking did not adjust the term; ARN submitted that the undertaking should apply for a period during which ARN and its associates are considering making a binding proposal in respect of the ARN/Anchorage Proposal. The revised undertaking also did not more closely align with ASIC’s ‘match or accept’ conditions; ARN submitted that this was “entirely irrelevant in the circumstances” but did not explain why.

- We considered that the ARN FO Undertaking (as amended) went some way to addressing the unacceptable circumstances. It would (in effect) prohibit ARN from using the ARN Contravention Shares to vote against a rival scheme or block compulsory acquisition by a rival bidder. However, we had some residual concerns. For example, the ARN FO Undertaking effectively removes 6.83% of Southern Cross shares from participation in voting at a scheme meeting for a rival scheme. This could potentially have a material effect on whether such a rival scheme is approved by Southern Cross shareholders. We were also concerned that the undertaking to accept an offer made for the ARN Contravention Shares under a takeover bid by an associate of ARN would have afforded associates of ARN with a competitive advantage arising from the contravention. In addition, it is unclear whether any rival scheme or takeover bid for Southern Cross will in fact emerge in the future, and hence it is possible that the ARN FO Undertaking may not have any utility in practice, allowing ARN to retain the benefit of the 6.83% of Southern Cross shares acquired in contravention of section 606. Accordingly, we were not convinced that the ARN FO Undertaking sufficiently remedies the unacceptable circumstances and we decided not to accept it.

- In our view, the divestment order returns the ARN Contravention Shares back to the market removing the effect that the unacceptable circumstances had, are having or will likely have on the control or potential control of Southern Cross or the acquisition or proposed acquisition of a substantial interest in Southern Cross and protecting the rights or interests of any person so affected or likely to be so affected by the circumstances.

- We sought submissions on whether ARN and its associates should be allowed to participate in the sale process under the divestment order as a purchaser, noting that as a result of Allan Gray reducing its voting power in ARN to less than 20% on 31 October 2023, it appeared that ARN could acquire the Sale Shares without contravening section 606.

- Keybridge submitted that if the party whose shares are being divested can be involved in the purchase of those same shares, it would negate the very purpose of the divestment order, and that by way of example “ARN could outbid any other party, paying any amount for the Sale Shares”.

- Southern Cross submitted that it does not object to ARN and its associates participating in the sale by the appointed seller provided (among other things) “the sale is conducted in a way which avoids distortion as a result of the recipient of the sale proceeds participating in the sale (eg. if they participate on-market)”.

- ARN submitted that if an order was made prohibiting ARN and its associates from acquiring Sale Shares, there would be a “serious risk of practically restraining each of ARN and [Anchorage] (as an associate) from acquiring any shares in SXL (and not just the Sale Shares)” because “if the Appointed Seller is selling the Sale Shares on market which is the most common and equitable method in a forced sale context, ARN and ACP will be unable to discern, in buying any shares on market, whether the shares being sold are Sale Shares.”

- In decisions where the Panel has made divestment orders, it is often the case that the party whose shares are to be divested itself holds more than 20% voting power in the relevant entity. Accordingly, the Panel typically considers whether that party can participate in the divestment to the extent it is able to acquire up to 3% of the “sale shares” in reliance on the ‘creep exception’ in item 9 of section 611. The Panel has taken various approaches to whether the ‘creep exception’ may be relied on where divestment orders are made.45 In the present case, in considering whether ARN and its associates should be able to participate in acquiring Sale Shares (as they appear now to be entitled to do without contravening section 606), we have sought to balance competing considerations. On the one hand, we are conscious that such participation by ARN or its associates has potential to impact the sale process.46 That said, we accept ARN’s submission in relation to practical difficulties in discerning Sale Shares if it seeks to make future purchases of Southern Cross shares on market. Accordingly, we have reached the conclusion that ARN and its associates should be prohibited from acquiring Sale Shares except where the acquisition is on market.47

- Southern Cross submitted (among other things) that any purchaser of the Sale Shares should be prohibited from acquiring more than 1% of the issued shares in Southern Cross and that absent such a cap, the forced sale of those shares may allow another person to acquire a material shareholding in Southern Cross who would not otherwise have the opportunity to do so. ASIC made rebuttal submissions in relation to the proposed acquisition cap including as follows:

We agree with ASIC’s submission and decided not to impose an acquisition cap.“It is not apparent to ASIC that the principles in s602 require Proposed Order 3 to contain a share acquisition cap, nor why the acquisition of a material stake by another person would be inconsistent with the principles in s602. Chapter 6 is an expression of the principles in s602, and already provides a relevant acquisition threshold of 20% in s606, which is also not ‘capped’ where an exception in s611 applies.

Southern Cross Media’s proposed amendments to Proposed Order 3 [to include a 1% cap] may obviate, and potentially prejudice, the rights of third parties to acquire the Sale Shares within the thresholds already provided by Chapter 6. ASIC notes the imposition of a 1% cap may also materially reduce the return to the beneficial owners of the Sale Shares on the sale, which would not be consistent with the principle of efficiency in s602 by failing to reflect the true value of the Sale Shares.”

- We asked ASIC whether the usual 3 month timeframe for divestment could be expedited in this case. In response, ASIC submitted that having regard to average monthly trading volumes48 3 months may be a reasonable length of time for disposal of the Sale Shares without significant impact on the market for Southern Cross, and that while a shorter timeframe may be possible, it may result in more impact on the market. In light of this submission and drawing on our own experience, we decided that 3 months was appropriate in the circumstances.

- We are satisfied that in the circumstances the orders that vest all of the ARN Contravention Shares in ASIC for sale and prohibit ARN and its associates from participating in the sale process other than on market are an appropriate remedy to the unacceptable circumstances. We are not satisfied that the orders would unfairly prejudice any person.

- We note for completeness that we did not consider it appropriate to order that ARN or its associates be prohibited from acquiring ‘any’ Southern Cross shares for a six-month period after the divestment of the Sale Shares, as requested in the application.49

- We accepted an undertaking by Allan Gray as set out in Annexure C to (in summary) provide a corrective substantial holder notice which includes details of Allan Gray’s historical deemed relevant interest in 14.8% of Southern Cross’s shares by operation of section 608(3)(a) and an explanatory covering letter to that corrective notice. Although Allan Gray subsequently reduced its holding in ARN to below 20% as of 31 October 2023, we consider that corrective disclosure of the historical position was appropriate to address the circumstances.

- We also accepted an undertaking by Allan Gray as set out in Annexure C to sell within 3 months a total of 192,739 ordinary shares in Southern Cross, being equal to the number of Southern Cross shares acquired by Allan Gray in contravention of section 606 under the Allan Gray Acquisitions. In the circumstances and noting the quantum of shares, we were satisfied that this undertaking adequately addressed the circumstances in so far as they related to the Allan Gray Acquisitions.

Michael Borsky KC

President of the sitting Panel

Decision dated 22 November 2023 (declaration) and 4 December 2023 (orders)

Reasons given to parties 14 December 2023

Reasons published 21 December 2023

Advisers

| Party | Advisers |

|---|---|

| Keybridge | – |

| Southern Cross | Corrs Chambers Westgarth |

| ARN | Gilbert + Tobin |

| Allan Gray | Allens |

Annexure A

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Southern Cross Media Group Limited

Circumstances

- Southern Cross Media Group Limited (Southern Cross) and ARN Media Limited (ARN) are ASX listed companies.

- Allan Gray Australia Pty Limited (Allan Gray) is a fund manager.

- As at market close on 19 June 2023, Allan Gray had a relevant interest and voting power in 21.71%50 of Southern Cross. At this time, Allan Gray also had a relevant interest and voting power in 20.04% of ARN.

- After market close on 19 June 2023, ARN acquired a total of 35,505,074 Southern Cross shares (ARN Acquisition) from various Southern Cross shareholders including Allan Gray, consequently obtaining a relevant interest and voting power in 14.8% of Southern Cross.

- As a result of the ARN Acquisition, Allan Gray’s relevant interest and voting power in Southern Cross increased from 21.71% to 31.24%, comprising:

- 16.44% by operation of section 608(1)51 through Allan Gray’s direct holding of Southern Cross shares and

- 14.8% by operation of section 608(3)(a) through Allan Gray’s relevant interest in ARN,

- Allan Gray did not give details of its deemed relevant interest in 14.8% of Southern Cross shares as required by section 671B.

- On 7 July 2023 and 24 October 2023, Allan Gray acquired 130,422 Southern Cross shares and 62,317 Southern Cross shares respectively other than as permitted by one of the exceptions in section 611, resulting in further contraventions of section 606.

- On 18 October 2023, ARN announced that a consortium comprising ARN and Anchorage Capital Partners Pty Limited had submitted a non-binding indicative offer to acquire 100% of Southern Cross via a scheme of arrangement.

Conclusion

- It appears to the Panel that the circumstances are unacceptable circumstances:

- because they constituted or gave rise to contraventions of section 606 and section 671B and/or

- in relation to the contravention of section 606 arising from the ARN Acquisition only, having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- the control, or potential control, of Southern Cross or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Southern Cross.

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Southern Cross.

Tania Mattei

General Counsel

with authority of Michael Borsky KC

President of the sitting Panel

Dated 22 November 2023

Annexure B

Corporations Act

Section 657D

Orders

Southern Cross Media Group Limited

The Panel made a declaration of unacceptable circumstances on 22 November 2023.

The Panel Orders

- The Sale Shares are vested in the Commonwealth on trust for ARN.

- ASIC must:

- sell the Sale Shares in accordance with these orders and

- account to ARN for the proceeds of sale, net of the costs, fees and expenses of the sale and any costs, fees and expenses incurred by ASIC and the Commonwealth (if any).

- ASIC must:

- retain an Appointed Seller to conduct the sale and

- instruct the Appointed Seller:

- to use the most appropriate sale method to secure the best available sale price for the Sale Shares that is reasonably available at that time in the context of complying with these orders, including the stipulated timeframe for the sale and the requirement that none of ARN or its associates may acquire, directly or indirectly, any of the Sale Shares other than on market

- to provide to ASIC a statutory declaration that, having made proper inquiries, the Appointed Seller is not aware of any interest, past, present, or prospective which could conflict with the proper performance of the Appointed Seller’s functions in relation to the disposal of the Sale Shares

- unless the Appointed Seller sells Sale Shares on market, that it obtains from any prospective purchaser of Sale Shares a statutory declaration that the prospective purchaser is not associated with ARN or its associates and

- to dispose of all of the Sale Shares within 3 months from the date of its engagement.

- The Company and ARN must do all things necessary to give effect to these orders, including:

- doing whatever is necessary to ensure that the Commonwealth is registered with title to the Sale Shares in the form approved by ASIC and

- until the Commonwealth is registered, complying with any request by ASIC in relation to the Sale Shares.

- None of ARN or its associates may, directly or indirectly, acquire any of the Sale Shares other than on market.

- Neither Allan Gray nor any of its associates may take into account any relevant interest or voting power that any of them or their respective associates had, or have had, in any of the Sale Shares or any of the shares referred to in paragraph 7 of the Declaration when calculating the voting power referred to in Item 9(b) of section 61153 of a person six months before an acquisition exempted under Item 9 of section 611.

- Nothing in these orders obliges ASIC to invest, or ensure interest accrues on, any money held in trust under these orders.

- Orders 2, 3, 4, and 5 come into effect three business days after the date of these orders. All other orders come into effect immediately.

Interpretation

- In these orders the following terms apply.

- Appointed Seller

- an investment bank or stock broker

- ARN

- ARN Media Limited

- ASIC

- Australian Securities and Investments Commission, as agent of the Commonwealth

- Declaration

- the Panel’s declaration of unacceptable circumstances in these proceedings dated 22 November 2023

- on market

- in the ordinary course of trading on Australian Securities Exchange and not by crossing or special crossing

- Sale Shares

- 16,376,774 ordinary shares in the issued capital of Company held by ARN

- the Company

- Southern Cross Media Group Limited

Tania Mattei

General Counsel

with authority of Michael Borsky KC

President of the sitting Panel

Dated 4 December 2023

Annexure C

Australian Securities and

Investments Commission Act 2001 (CTH) Section 201A

Undertaking

Southern Cross Media Group Limited

Pursuant to section 201A of the Australian Securities and Investments Commission Act 2001 (Cth), Allan Gray Australia Pty Ltd (ACN 112 316 168) (Allan Gray) undertakes to the Panel that:

- within two business days after and subject to approval by the Panel under (b), Allan Gray will disclose to the Australian Securities Exchange, in the form approved by the Panel:

- a corrective notice in relation to its substantial holding in Southern Cross Media Group Limited (ACN 116 024 536) (Southern Cross), which includes details of Allan Gray's historical deemed relevant interest in 14.8% of Southern Cross' ordinary shares by operation of section 608(3)(a) of the Corporations Act 2001 (Cth) due to Allan Gray's relevant interest in the ordinary shares of ARN Media Limited (ACN 008 637 643); and

- an explanatory covering letter to that corrective notice;

- within two business days from the date of this undertaking, Allan Gray will provide a draft of the disclosure to the Panel for review and approval.

Allan Gray agrees to confirm in writing to the Panel when it has satisfied its obligations under this undertaking.

Executed for and on behalf of Allan Gray Australia Pty Ltd

Elizabeth Lee, Head of Legal and Company Secretary

1 December 2023

Australian Securities and

Investments Commission Act 2001 (CTH) Section 201A

Undertaking

Southern Cross Media Group Limited

Pursuant to section 201A of the Australian Securities and Investments Commission Act 2001 (Cth), Allan Gray Australia Pty Ltd (ACN 112 316 168) (Allan Gray) undertakes to the Panel that:

- within three months from the date of this undertaking, it will sell a total of 192,739 ordinary shares in Southern Cross Media Group Limited (ACN 116 024 536) (the Sale Shares); and

- none of Allan Gray or its associates may, directly or indirectly, acquire any of the Sale Shares.

Allan Gray agrees to confirm in writing to the Panel when it has satisfied its obligations under this undertaking.

Executed for and on behalf of Allan Gray Australia Pty Ltd

Elizabeth Lee, Head of Legal and Company Secretary

1 December 2023

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapters 6 to 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 As at 20 December 2022, the number of Southern Cross shares on issue was 243,255,989 and hence Allan Gray’s voting power was 21.41% (instead of 21.95%) at that time. In its substantial holding notice of 6 December 2023, Allan Gray disclosed this error in its previous notice with a note stating “Voting power updated to take into account the corrected total shares on issue figure as at 20 December 2022. The previous notice disclosed an incorrect voting power, due to a third party misreporting the shares on issue figure”

3 On page 127

4 On page 128

5 62,165,031/309,080,602*100

6 As at 14 December 2023, Southern Cross has stated that it and its advisers are continuing to progress their evaluation of the ARN/Anchorage Proposal

7 Keybridge noted in the application that it was relying on current disclosure on ARN’s website (a screenshot of which was provided to us and displayed a ‘top 10 shareholders’ table showing Allan Gray held 62,165,031 or 20.35% of ARN shares and recording 23 January 2023 as the most recent change date) together with Allan Gray’s previous substantial holder notice disclosure and that it would not press the application or seek any orders if, in fact, from 19 June 2023 through to the date of the application, Allan Gray did not at any time have a voting interest in ARN above 20%

8 Refer to paragraph 14 for the relevant interests of Allan Gray and ARN in Southern Cross immediately after the ARN Acquisition. It is noted that ARN’s relevant interest in Southern Cross did not exceed 14.8% as a result of the ARN Acquisition

9 The application had referred to 6.82% or 16,368,919 shares. However, Allan Gray subsequently submitted the figures were 16,376,774 or 6.83% of Southern Cross shares, which was not disputed by the other parties

10 Section 606(1)(c) provides, relevantly, that a person will be in breach of the provision if “that person’s or someone else’s voting power in the company” increases beyond the 20% threshold (emphasis added)

11 The resolutions included the re-election of certain directors, adoption of the remuneration report and the grant of performance rights to the Managing Director

12 Allan Gray included with its preliminary submission a schedule recording the history of its shareholding in ARN since 17 June 2022, which showed that between 15 and 16 May 2023 the total ARN shares on issue was reduced from 309,080,602 to 306,944,649 (as a result of cancellation pursuant to on market buy-backs) and that Allan Gray’s percentage held increased from 19.90% to 20.04%

13 Citing footnote 28 to Guidance Note 1: Unacceptable Circumstances and ISIS Communications Ltd [2002] ATP 10

14 Citing Yowie Group Limited 01 & 02 [2019] ATP 10 at [46]

15 Depending on whether the relevant part of the report expressed figures to one or two decimal places

16 Depending on whether the relevant part of the report expressed figures to one or two decimal places

17 ARN provided a copy of a board paper prepared by its adviser dated 19 June 2023 which showed that Allan Gray held 18.7% in ARN

18 To maintain compliance with the control restrictions imposed under the Broadcasting Services Act 1992 (Cth)

19 That is, analysis of the rules of the Australian Competition and Consumer Commission and Australian Communications and Media Authority

20 ARN provided a copy of a ‘script for accelerated aftermarket raid’ which it submitted its adviser used to contact Allan Gray and other Southern Cross shareholders

21 Allan Gray provided copies of communications between its representatives and ARN’s adviser dated 19 and 20 June 2023 in support of this submission

22 The ACM Proposal contemplated Southern Cross acquiring assets from Australian Community Media in return for the issue of new shares in Southern Cross. On 15 November 2023, Southern Cross announced that it had determined that it would not be in the best interests of Southern Cross and its shareholders to further progress the ACM Proposal

23 However, Southern Cross also submitted that it was concerned to ensure that the acquisition of control over voting shares in Southern Cross occurs in accordance with the principles set out in section 602 and that the Panel should take whichever steps it considers necessary to ensure that outcome, provided that, any orders made do not impede competition for control of Southern Cross or have the effect of depriving shareholders of Southern Cross of an opportunity they might otherwise have to participate in a control transaction

24 [2019] ATP 10 at [50] and [72]

25 [2019] ATP 10 at [46]

26 [2019] ATP 10 at [47], citing Taipan Resources NL 09 [2001] ATP 4 at [38]

27 Attorney-General (Cth) v Alinta Limited (2008) 242 ALR 1, per Kirby J at [43]. See also Crennan and Kiefel JJ at [162]

28 Guidance Note 1: Unacceptable Circumstances at footnote 28 referring to ISIS Communications Ltd [2002] ATP 10

29 [2002] ATP 10 at [66]-[67]

30 [2002] ATP 10 at [73]-[74]

31 [2019] ATP 10 at [49]

32 As set out in the Facts section above, Allan Gray’s most recent substantial holder notice disclosed voting power of 19.98% in ARN and the 2022 Annual Report indicated Allan Gray held 20.11%

33 [2019] ATP 10 at [44], citing sections 912A(1)(c) and (ca)

34 [2008] ATP 15 at [71]

35 See Samic Ltd v Metals Exploration Ltd (1993) 11 ACSR 84, 100; see also Metals Exploration Ltd v Samic Ltd (1994) 123 ALR 289, 301

36 See section 602(a)

37 Midwest Corporation Limited 02 [2008] ATP 15 at [73]. Given in that matter the breach concerned the FATA, an issue arose as to whether the Panel could properly exercise jurisdiction. The Panel considered that it did have jurisdiction in the proceeding, including because there was a takeover on foot and the applicant submitted that circumstances had arisen which had an effect of the type in section 657A(2): see [28]-[35]

38 [2021] ATP 4 at [86] (footnotes omitted)

39 Citing the following article: Simon Mawhinney’s Al...~https://www.afr.com/street-talk/allan-gray-shops-its-southern-cross-arn-stakes-to-media-types-20230622-p5disg

40 News Corp Australia ...~https://www.afr.com/companies/media-and-marketing/news-corp-australia-boss-michael-miller-quashes-rumours-his-time-is-up-20231117-p5eks5 (see ‘In other news’, ‘Sly sale’)

41 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

42 [2019] ATP 10 at [78]-[96]

43 See ASIC RG 9, pages 137-140

44 The first limb of the undertaking was also amended such that it applied to any scheme of arrangement proposed by a third party “or by ARN and/or its Associates”

45 See e.g. LV Living Limited [2005] ATP 5, Orion Telecommunications Limited [2006] ATP 22, Viento Group Limited [2011] ATP 1, CMI Limited [2011] ATP 4, Bentley Capital Limited 01R [2011] ATP 13

46 See Yowie Group Limited 01 & 02 [2019] ATP 10 at [86]

47 See Order 5

48 ASIC submitted that during the July to October 2023 period, the average monthly trading volume of Southern Cross shares on ASX was 8,733,815 shares

49 We also note that Keybridge ultimately submitted that “in light of Allan Gray reducing its ARN holding below 20%, and if the Panel finds that ARN and Allan Gray are not associates, it may be that there is no need for [such an order]”

50 Unless otherwise indicated, all percentages have been rounded to two decimal places

51 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapters 6 to 6C have the meaning given in the relevant Chapter (as modified by ASIC)

52 Allan Gray was permitted to acquire voting power of up to 24.41% in Southern Cross under item 9 of section 611 at that time

53 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth) and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)