[2021] ATP 7

Catchwords:

Undertakings – decline to make a declaration – effect on control – need for funds – rights issue – shortfall shares – disclosure – disclosure of intentions – supplementary disclosure – undertaking

Corporations Act 2001 (Cth), sections 602(b)(iii), 606, 657A(3), 710

Australian Securities and Investments Commission Act 2001 (Cth) – section 201A

ASIC Regulatory Guide 228: Effective Disclosure for retail investors

Guidance Note 17 Rights Issues

Energy Resources of Australia Limited 02R [2020] ATP 3; Energy Resources of Australia Limited [2019] ATP 25; McAleese Limited [2016] ATP 13; CuDeco Limited [2015] ATP 11; Argosy Minerals Limited [2014] ATP 7; Yancoal Australia Limited [2014] ATP 24; Gladstone Pacific Nickel Limited 02 [2011] ATP 16; Multiplex Prime Property Fund 03 [2009] ATP 22; Anaconda Nickel 02, 03, 04 & 05 [2003] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | YES | NO | NO | YES |

Introduction

- The Panel, Bruce Cowley, Marissa Freund and Diana Nicholson (sitting President), declined to make a declaration of unacceptable circumstances in relation to the affairs of Sementis Limited after accepting undertakings. The application concerned (among other things) an entitlement offer being undertaken by Sementis in circumstances where Fortitude Nominees (an entity controlled by a Sementis director) could potentially increase its voting power in Sementis from approximately 47.55% to a maximum of 59.3%. The Panel accepted undertakings by Sementis and Fortitude Nominees to (among other things) provide further disclosure in relation to the entitlement offer (including of Fortitude Nominees’ intentions and its financial position), limit Sementis’ discretion in relation to the shortfall facility and, in the case of Fortitude Nominees, to not apply for or acquire shortfall shares.

- In these reasons, the following definitions apply.

- Applicant

- Dr Glen Harold Burgess

- Entitlement Offer

- Sementis' pro rata entitlement offer to eligible shareholders of 0.6083 new shares for every 1 existing share held at an issue price of $0.01 per new share to raise up to $10 million.

- Fortitude Nominees

- Fortitude Nominees Pty Ltd

- Grant

- The Medical Research Future Fund Grant awarded to the University of South Australia pursuant to which Sementis' Chief Scientific Officer, Professor John Hayball, is named as Chief Investigator

- Replacement Prospectus

- has the meaning given in paragraph 6

- Sementis

- Sementis Limited

Facts

- Sementis is an unlisted Australian public company with over 50 shareholders that is involved in the research and development of new vaccines. It does not yet have a product in the market.

- The Applicant is a former director of Sementis with a voting power of approximately 5% of Sementis.

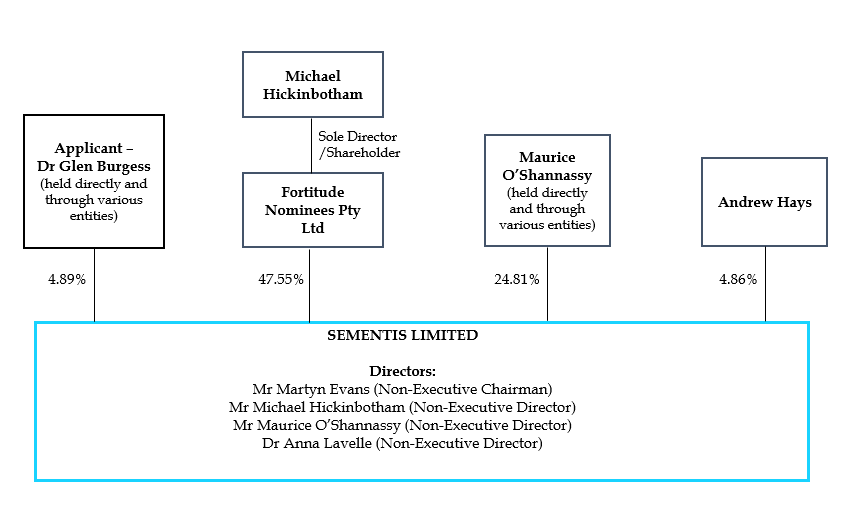

- As at 6 May 2021, Sementis had 1,643,839,733 shares on issue. Relevant shareholdings in Sementis as at this date are set out in the diagram below:

- On 6 May 2021, Sementis issued a replacement prospectus to its shareholders in respect of the Entitlement Offer1 (Replacement Prospectus). The relevant terms of the Entitlement Offer were as follows:

- The Entitlement Offer was made to “Eligible Shareholders”, being all shareholders of Sementis on the register as at 6 May 2021, on the basis of 0.6083 new shares for every 1 share held at an issue price of $0.01 per share.

- The maximum amount proposed to be raised under the Entitlement Offer was $10 million.

- There was a maximum of 1 billion new shares to be issued under the Entitlement Offer, which represented approximately 61% of the current share capital of Sementis.

- In addition to their entitlements, eligible shareholders could apply for additional new shares under a shortfall facility, subject to compliance with applicable laws.

- The closing date for applications under the Entitlement Offer was 28 May 2021. The new Sementis shares to be issued under the Entitlement Offer were scheduled to be issued on 4 June 2021.

- The Replacement Prospectus disclosed, in relation to the issues set out below, that:

- Purpose: The purpose of the Entitlement Offer “is for Sementis to raise funds to cover the funding requirements of the business for the next 18 months to 30 June 2022”. The use of funds would vary depending upon the participation rate in the Entitlement Offer, but included (i) manufacturing process development; (ii) development of a COVID-19 vaccine; (iii) Sementis Copenhagen Vector (SCV) platform characterisation and optimisation; (iv) peanut hypo allergy vaccination; (v) employee costs; (vi) office and corporate expenses; and (vii) increase in scientists consulting.

- Grant: Sementis had, in partnership with a research institute, “…applied for a significant grant to assist with vaccine development. The outcome of this application has not been publicly announced. In the event that Sementis is successful with the grant application, the funds from this grant will be used to accelerate the development of the SCV platform system and vaccine portfolio…”

- Control effect: In respect of the effect of the Entitlement Offer on the control of Sementis:

“If Fortitude Nominees subscribes for its Entitlement in full and:

- 50% of Entitlements in total are taken up, then Fortitude Nominees’ Voting Power in the Company will increase to approximately 58.64%;

- 65% of Entitlements in total are taken up, then Fortitude Nominees’ Voting Power in the Company will increase to approximately 54.80%.

Any increase in Fortitude Nominees’ voting power above 50% would enable it to carry ordinary resolutions of the Company in general meetings.

If Maurice O’Shannassy, through his associated entities, subscribes for his Entitlement in full and no other Shareholders subscribe, the Voting Power of Maurice O’Shannassy and his associated entities would increase to 34.67%.”

- Shortfall facility: In respect of the shortfall facility, the Sementis board retained a discretion to “… alter or supplement the allocation policy, if it considers the alteration or supplement to be in the best interests of the Company or necessary to mitigate or alleviate circumstances that may have arisen and the effect of those circumstances on the control of the Company.”

Application

Declaration sought

- By application dated 25 May 2021, the Applicant sought a declaration of unacceptable circumstances. In summary, the Applicant submitted that the Entitlement Offer is unacceptable because (among other things):

- the control effect of the Entitlement Offer exceeded what is reasonably necessary for the fundraising purposes of Sementis

- the size, pricing and structure of the Entitlement Offer appeared to be designed to exacerbate that control effect. In particular, “[t]o the extent that the Entitlement Offer is not fully subscribed, the offer is likely to result in a significant shareholder (being Fortitude Nominees – an entity controlled by Mr Michael Hickinbotham, a Sementis director) acquiring [a] majority shareholding, and therefore control of Sementis” and

- the Replacement Prospectus does not provide adequate disclosure in relation to a significant grant that has been awarded to Professor John Hayball, Sementis’ Chief Scientific Officer, which the Applicant submitted was “known to the directors prior to the [Replacement Prospectus] being lodged with ASIC” (the Replacement Prospectus disclosing that the Grant had been “applied for” and the outcome “not publicly announced”2).

- The Applicant submitted that the circumstances were unacceptable having regard to the effect that such circumstances will have or are likely to have on the control, or potential control of Sementis and because they are preventing an efficient, competitive and informed market in Sementis shares.

Interim orders sought

- The Applicant sought interim orders to restrain the Entitlement Offer from proceeding pending determination of its application.

- Sementis resolved to extend the closing date of its Entitlement Offer on three occasions during the course of the Panel proceedings, and ultimately until 5pm (ACST) on 2 July 2021, making an interim order unnecessary. This date was then further extended under the undertaking provided by Sementis described below.

Final orders sought

- The Applicant sought final orders that Sementis be permanently restrained from proceeding with the Entitlement Offer on its current terms.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Decision to conduct proceedings

- Sementis made a preliminary submission in response to the application, submitting that we should decline to conduct proceedings on the basis that (among other things):

- the application was premature and that “[u]ntil the facts surrounding the applications under the entitlement offer are known, the expressed concerns of the applicant are purely speculative and no rational basis exists at this time for the final order sought…”

- a pro rata entitlement offer “is the most inherently fair” form of fundraising that Sementis could have undertaken to secure its balance sheet and the Sementis board “has taken appropriate steps to mitigate any control effect, including a shortfall facility in accordance with Panel Guidance Note 17…”

- the application did not raise any serious question that Sementis needs to raise capital

- “Sementis has undertaken its previous two fundraisings at the same price as the current entitlement offer... The board of Sementis considered whether the pricing of the offer was appropriate, and by majority formed the view that the offer price was appropriate” and

- Sementis was unable to disclose the fact of the award of the Grant until an embargo on the announcement of the Grant was lifted, “but the financial information in the prospectus was prepared on the basis that the grant had been awarded.”

- Mr Maurice O’Shannassy, a Sementis director and Sementis’ second largest shareholder, made a preliminary submission, submitting (among other things) that the Entitlement Offer “has been structured with the effect of providing Mr Hickinbotham with absolute control of the Company…” and that he had voted against the capital raising “for reasons including that no price discovery had been undertaken and I knew, in my capacity as a shareholder, that investors were willing to pay at least 2c per share in July 2020.”

- Mr O’Shannassy also noted that he had signed the Replacement Prospectus as a director, “[having] been told that my signature is required for it to proceed. This is why I am signing it now not because I am in favour of the capital raise” and had subsequently raised additional concerns as to disclosure after the Replacement Prospectus was issued.

- We also received a preliminary submission from Mr Andrew Hays, a Sementis shareholder, submitting that “Sementis (under its Chair, Mr Martyn Evans) has undertaken a consistent and purposeful course of action to attempt to secure control of Sementis for its major shareholder, Mr Michael Hickinbotham, in circumvention of the protections provided to shareholders by Chapter 6 of the Corporations Act” and that the Entitlement Offer “is just the latest instance in a long-standing campaign” to deliver control to Mr Hickinbotham.

- Applications relating to rights issues have been considered premature where the Panel was not “in a position to assess whether the entitlement offer… may give rise to unacceptable circumstances”.3 The Panel has declined to conduct proceedings on applications for being premature where the application was made prior to the release of a prospectus,4 or where there is no evidence that a party will acquire control in connection with the rights issue.5

- However, this is not such a case. This application was made after the release of the Replacement Prospectus, which also discloses the potential control effect of the Entitlement Offer. We do not consider the application to have been made prematurely.

- In our view, the application raised concerns that warranted consideration, in particular, the size and structure of the Entitlement Offer and the sufficiency of the disclosure in the Replacement Prospectus. Accordingly, we decided to conduct proceedings.

Need for funds

- Sementis submitted that it needed to raise funds urgently to continue operations, to implement the strategic plans adopted by the board of Sementis and to remain solvent. In particular, Sementis submitted that if it continued “its expenditure program in the ‘business as usual’ manner approved by the board” it would become insolvent or have to cease operations in July 2021 or, if necessary expenditure was deferred, no later than October 2021.

- In assessing Sementis’ need for funds we looked at its financial position, solvency, requisite funding for Sementis to pursue its business objectives and the relative amount sought to be raised. We have been provided with some evidence in respect of Sementis’ funding requirements, including in respect of the timing of future commitments.

- Applying our commercial judgment, we accept that it is reasonable for Sementis, as an unlisted entity operating in a capital intensive industry, to seek to raise sufficient funds to provide a reasonable “cash runway” to meet its disclosed business objectives. In our view, while the urgency for funds may have initially been overstated by Sementis, the need for those funds has not been contrived and the Applicant has not provided sufficient material to warrant a deeper enquiry into the decision of Sementis’ directors concerning Sementis’ need for funds.

Structure, pricing and ratio

- The Applicant made submissions concerning the structure of the Entitlement Offer, including that the offer was being undertaken at a “de minimus price” without the benefit of Sementis having undertaken any form of price discovery and that the size of the offer “far exceeds the demonstrated funding needs of the company”. Similar submissions were received from both Mr O’Shannassy and Mr Hays.

- In considering whether the structure of the Entitlement Offer gives rise to unacceptable circumstances, we have considered the structure of the Entitlement Offer as a whole and the current market conditions.6

- In the circumstances of the matter, we consider the following relevant:

- Sementis is an unlisted public company that operates an early stage vaccine business such that it is difficult to determine a market value for its securities in the absence of a liquid market

- Sementis had received advice in the past that the company was not ready for external investment and a majority of directors had accepted this advice

- Sementis took and followed advice from a financial advisor (notwithstanding our concerns regarding the advice set out in paragraph 27 below)

- Sementis is seeking to raise sufficient funds in order to provide a “cash runway” to meet its disclosed business objectives over a reasonable period (in so doing minimising costs associated with needing to repeatedly raise funds from shareholders) in circumstances where it does not currently generate returns so as to be able to fund on-going development and

- contrary to other examples where the Panel has had concerns regarding the structure of a rights issue,7 the Entitlement Offer is not highly dilutive and, to maintain their relative equity and voting power in Sementis, minority shareholders need to subscribe for 0.6083 new shares under the Entitlement Offer for every 1 share held, at a price which is equivalent to the price at which Sementis has previously raised funds.

- While we obtained a degree of comfort from the advice obtained by Sementis in relation to fundraising, we were concerned that:

- current advice was not received until after the board of Sementis had resolved to undertake the Entitlement Offer

- the instructions given to the financial advisor were restrictive and the advisor was not asked to advise on the size or structure of the fundraising

- limited materials were provided to the financial advisor in connection with the engagement (including no financial information) with the advice based on the advisor having maintained its connection with Sementis following initial advice obtained in May 2020, which itself was qualified on limited access to financial information and

- no valuation work was undertaken by the financial advisor, notwithstanding that we recognise that there were difficulties in obtaining a valuation of Sementis as set out in paragraph 26(a) above.

- We were also concerned that we were not provided with any evidence that Sementis had meaningfully considered any capital raising alternatives outside of proposing to structure the Entitlement Offer without a shortfall facility.

- However, given the matters set out in paragraph 26 above and the undertakings received from Sementis and Fortitude Nominees (Annexures A and B respectively), we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances in relation to the structure of the Entitlement Offer.

Effect of the Entitlement Offer on control of Sementis

- The Replacement Prospectus disclosed the potential control effect of the Entitlement Offer as set out in paragraph 7(c) above.

- Sementis and Fortitude Nominees each submitted that it is probable that Fortitude Nominees already has “practical and effective control” of Sementis as a result of its voting power of 47.55%. Sementis submitted that “Fortitude Nominees might well have control of a general meeting as a practical matter, given that it could only be outvoted if virtually every other shareholder (a) votes and (b) votes against.”

- The Applicant submitted that Fortitude Nominees does not currently control Sementis at a general meeting as it currently “needs the support of other shareholders to pass relevant resolutions at general meetings” and an increase in Fortitude Nominees’ voting power of up to 59.3% would entrench Fortitude Nominees’ control of Sementis. Similar submissions were received from both Mr O’Shannassy and Mr Hays.

- In the circumstances, we consider that the Entitlement Offer could have the effect of consolidating Fortitude Nominees’ control of Sementis. This is because:

- the voting power of Fortitude Nominees could increase to a maximum of 59.3% as a result of the Entitlement Offer

- while Fortitude Nominees could have a degree of comfort that it can control the outcome of ordinary resolutions with control over 47.55% of the votes capable of being cast at a general meeting, if its voting power increases above 50% it would have the certainty of being able to pass ordinary resolutions on its own and

- the practical control of a 47.55% shareholder in an unlisted public company with 86 shareholders may be less than that of an equivalent shareholder in a listed company with a substantially larger, more diverse, shareholder base.

- With such potential implications for control, we would expect the Entitlement Offer to contain appropriate mechanisms to mitigate the potential control effect. While Sementis offered a shortfall facility which allowed shareholders to apply to take extra shares, we had concerns with the nature of the proposed shortfall facility in the Replacement Prospectus. In particular, we were concerned about:

- the discretion of the board to alter or supplement the allocation policy8 and

- the duration of the shortfall facility, which was not expressly limited.

- In response, Sementis and Fortitude Nominees agreed to give the attached undertakings (Annexures A and B respectively) which we are satisfied sufficiently addresses our concerns regarding the shortfall facility. These included, among other things, undertakings:

- by Fortitude Nominees not to apply for, nor acquire any securities under the shortfall facility9 and

- by Sementis to, in effect, only exercise its discretion to alter or supplement its allocation policy under the shortfall facility to cases where an issue of shares under the shortfall facility would cause a breach of section 606.10

Disclosure

- The Panel has indicated a clear preference for more disclosure regarding the potential control effect of a rights issue rather than less. We consider that disclosure is of increased importance when shareholders are considering the desirability of making a further investment in a company, what the control implications of a rights issue might be and whether to take steps to protect against the dilution of their existing holding. The principle in section 602(b)(iii) applies to all transactions where there is a potential change of control.11

- ASIC had a number of disclosure concerns with the Replacement Prospectus. ASIC submitted that the exposure period for the Entitlement Offer had been extended by it on the basis that (among other reasons) the disclosure of Sementis’ financial position did not comply with section 710 and ASIC Regulatory Guide 228: Effective Disclosure for retail investors and because of concerns regarding the disclosure of Sementis’ proposed use of funds. ASIC further submitted that it had become “concerned that the Replacement Prospectus does not appear to contain all the information required by s710 of the Act in relation to the prospects of Sementis…”

- We consider that the disclosure in the Replacement Prospectus fell short of what was required. In particular, the Replacement Prospectus failed to adequately inform shareholders about:

- the financial circumstances of Sementis, including its funding requirements to operate its business in accordance with its disclosed plans (as well as the pace of implementation of those plans) and to remain solvent12

- the intentions of Fortitude Nominees with respect to its participation in the Entitlement Offer and the business of Sementis if Fortitude Nominees obtains a relevant interest in at least 50.1% of the voting shares of Sementis and

- the nature of the Grant and how this impacts Sementis’ business and funding requirements and the disclosed use of funds in the Replacement Prospectus.

- Disclosure of “the intentions for the company of persons who may obtain control” in connection with a rights issue enables shareholders to better make an informed decision on whether to participate.13 Whether such intentions should be disclosed depends upon the circumstances.14

- While such disclosure may not always be necessary in respect of major shareholders whose voting power may increase simply by taking up their entitlement in a non-underwritten offer,15 in the circumstances, we consider the disclosure of the intentions of Fortitude Nominees to be important information for shareholders. This is because:

- Fortitude Nominees is controlled by Mr Hickinbotham, a director of Sementis

- in his capacity as a director of Sementis, Mr Hickinbotham approved the Entitlement Offer and authorised the lodgment of the Replacement Prospectus

- by reason of Mr Hickinbotham’s position as a director of Sementis, Fortitude Nominees has access to more information regarding Sementis and its prospects than ordinary shareholders

- the voting power of Fortitude Nominees could increase from 47.55% to a maximum of 59.3% in connection with the Entitlement Offer and will increase above 50.1% if 87% or less of entitlements are taken up by Sementis shareholders

- the outcome of the Entitlement Offer and whether Sementis will raise sufficient funds to remain solvent and to pursue its business objectives will materially depend upon whether or not Fortitude Nominees participates in the Entitlement Offer and, if so, the extent of such participation and

- the intentions of Fortitude Nominees in these circumstances are materially relevant to a minority shareholder’s decision whether to participate in the Entitlement Offer.

- In response Sementis and Fortitude Nominees agreed to give the attached undertakings (Annexures A and B respectively), which we are satisfied sufficiently addresses our concerns regarding disclosure.

Other matters

- The Applicant and others expressed concerns in relation to Sementis’ management of conflicts of interest in relation to the Entitlement Offer, particularly in respect to Mr Hickinbotham’s involvement in the decision making of the Sementis Board in circumstances where Fortitude Nominees (being a company in which Mr Hickinbotham is the sole shareholder and director) is likely to materially increase its control of Sementis.

- While, on their face, those concerns appeared to be of some substance, we did not find it necessary to reach a concluded view on the matter given the undertakings offered by Sementis and Fortitude Nominees.

Decision

No declaration - undertakings

- Given the undertakings offered by Sementis and Fortitude Nominees (Annexures A and B respectively) and accepted by us, we decline to make a declaration and are satisfied that it is not against the public interest to do so. We have had regard to the matters in section 657A(3).

Orders

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Diana Nicholson

President of the sitting Panel

Decision dated 23 June 2021

Reasons given to parties 27 July 2021

Reasons published 30 July 2021

Advisers

| Party | Advisers |

|---|---|

| Dr Glen Burgess | Corrs Chambers Westgarth |

| Sementis Limited | Johnson Winter & Slattery |

| Mr Andrew Hays | Gilbert + Tobin |

| Mr Maurice O'Shannassy | - |

| Fortitude Nominees Pty Ltd | DMAW Lawyers |

Annexure A

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSIONS ACT 2001 (CTH)

SECTION 201A UNDERTAKING

Sementis Limited

Sementis Limited ABN 36 138 550 811 (Sementis) undertakes to the Takeovers Panel (Panel) under section 201A of the Australian Securities and Investments Commission Act 2001 (Cth) as follows:

- Sementis will not proceed with the Entitlement Offer unless or until:

- the Panel and ASIC have provided written confirmation that they do not object to the Supplementary Disclosure;

- the Supplementary Disclosure is lodged with ASIC under section 719 of the Corporations Act,

- the closing date of the Entitlement Offer has been extended to a date not less than 10 Business Days after the Supplementary Disclosure is lodged with ASIC under section 719 of the Corporations Act and provided to shareholders of Sementis.

- Sementis will obtain and disclose in the Supplementary Disclosure details of Fortitude Nominees’ intentions with respect to:

- participation in the Entitlement Offer; and

- the business of Sementis if it obtains a relevant interest in at least 50.1% of the voting shares of Sementis, including whether it intends to make any changes to the use of funds program set out in the Replacement Prospectus or change the composition of the board of directors of Sementis, and, in each case, if so, how.

- The directors of Sementis may only exercise their discretion to alter or supplement the allocation policy in respect of the shortfall facility under the Replacement Prospectus where an issue of Additional New Shares would cause a breach of section 606 of the Corporations Act.

- In the event that any applications for Additional New Shares are made, Sementis will fill the applications without regard to the concerns of shareholder association unless, in relation to those concerns of shareholder association, the Panel or a Court has made a finding of association or has made an interim order or injunction.

In this undertaking, the following terms have the following meanings:

- Additional New Shares

- shares issued under the shortfall facility under the Replacement Prospectus.

- ASIC

- Australian Securities and Investments Commission.

- Business Day

- a day that is not a Saturday, Sunday or public holiday in Adelaide, South Australia.

- Corporations Act

- Corporations Act 2001 (Cth).

- Entitlement Offer

- Sementis' pro-rata entitlement offer of 0.6083 new shares for every one share held by those shareholders registered at 6 May 2021 at an issue price of $0.01 per share to raise up to $10,000,000.

- Fortitude Nominees

- Fortitude Nominees Pty Ltd ACN 069 302 889.

- Grant

- the Medical Research Future Fund Grant awarded to the University of South Australia with Sementis' Chief Scientific Officer, Professor John Hayball, as Chief Investigator referred to in an email from Mr Martyn Evans to Sementis shareholders dated 3 April 2021.

- Replacement Prospectus

- the replacement prospectus of Sementis in relation to the Entitlement Offer dated 6 May 2021 and where applicable any subsequent supplementary or replacement prospectus in relation to the Entitlement Offer.

- Supplementary Disclosure

- a supplementary or replacement prospectus lodged under section 719 of the Corporations Act in relation to the Replacement Prospectus which, at least, includes information in relation to:

- the financial circumstances of Sementis, including its funding requirements to remain solvent, and to continue to operate its business in accordance with its disclosed plans, including its actual or proposed contractual commitments;

- the intentions of Fortitude Nominees obtained pursuant to paragraph 2 of this undertaking;

- the shortfall facility as amended by paragraphs 3 and 4 of this undertaking; and

- the nature of the Grant and how this impacts Sementis’ business and funding requirements and the disclosed use of funds in the Replacement Prospectus.

Signed by Martyn John Evans, Chair

with the authority, and on behalf, of

Sementis Limited ABN 36 138 550 811

Dated 21 June 2021

Annexure B

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION ACT 2001 (CTH)

SECTION 201A UNDERTAKING

Sementis Limited

Fortitude Nominees Pty Ltd ACN 069 302 889 (Fortitude) undertakes to the Takeovers Panel that Fortitude will:

- not apply for, nor acquire, any securities under the shortfall facility described in the Replacement Prospectus;

- provide full details to Sementis of its intentions with respect to the Entitlement Offer (including the extent that it will subscribe for shares under the Entitlement Offer) and the business of Sementis, if it obtains a relevant interest in at least 50.1% of the voting shares of Sementis, including whether it intends to make any changes to the use of funds program set out in the Replacement Prospectus or change the composition of the board of directors of Sementis, and, in each case, if so, how. To the extent such intentions are qualified as statements of current intention, such a qualification will relate only to new information that is material or material changes in circumstances;

- consent to the disclosure of this undertaking and the information required to be provided to Sementis under this undertaking in all supplementary and replacement prospectuses in relation to the Entitlement Offer lodged with ASIC after the date of this undertaking.

In this undertaking, the following terms have the following meanings:

- Entitlement Offer

- Sementis' pro-rata entitlement offer of 0.6083 new shares for every one share held by those shareholders registered at 6 May 2021 at an issue price of $0.01 per share to raise up to $10,000,000.

- Replacement Prospectus

- the replacement prospectus of Sementis in relation to the Entitlement Offer dated 6 May 2021 and where applicable any subsequent supplementary or replacement prospectus in relation to the Entitlement Offer.

Signed by Michael Robb Hickinbotham, Director

with the authority, and on behalf, of

Fortitude Nominees Pty Ltd ACN 069 302 889

Dated 22 June 2021

1 which replaced Sementis' prospectus lodged with ASIC on 12 April 2021

2 See paragraph 7(b)

3 McAleese Limited [2016] ATP 13, [30].

4 McAleese Limited [2016] ATP 13; CuDeco Limited [2015] ATP 11.

5 Argosy Minerals Limited [2014] ATP 7.

6 Guidance Note 17: Rights Issues at [13].

7 See, for example, Yancoal Australia Limited [2014] ATP 24 (similar in effect to a 23 for 1 rights issue); Gladstone Pacific Nickel Limited 02 [2011] ATP 16 (11 for 1 non-renounceable rights issue); Multiplex Prime Property Fund 03 [2009] ATP 22 (178:1 non-renounceable rights issue); Anaconda Nickel 02, 03, 04 & 05 [2003] ATP 4 (14:1 renounceable rights issue).

8 Guidance Note 17: Rights Issues at [7(b)(iii)].

9 Given Sementis is not listed and, accordingly, is not subject to the restrictions in Exception 3 of Listing Rule 7.2, it would otherwise be open for Fortitude Nominees to apply for shortfall shares and (assuming Sementis agreed) have shares issued to it over a period relying on item 9 of section 611.

10 Sementis also undertook, in effect, not to take into account any concerns it may have regarding association “unless, in relation to those concerns of shareholder association, the Panel or a Court has made a finding of association or has made an interim order or injunction”.

11 Energy Resources of Australia Limited [2019] ATP 25, [202]; Anaconda Nickel Limited 02, 03, 04 & 05 [2003] ATP 4, [70].

12 After we considered Sementis’ submissions in relation to its need for funds as set out in paragraph 21 above.

13 Guidance Note 17: Rights Issues at [31].

14 Energy Resources of Australia Limited 02R [2020] ATP 3, [38].

15 See Guidance Note 17: Rights Issues at fn 38.