[2020] ATP 1

Catchwords:

Association – board spill - decline to conduct proceedings – substantial holder notices – voting power

Corporations Act 2001 (Cth), sections 606, 657A(2)(c), 671B

ASIC Regulatory Guide 128: Collective action by investors

Havilah Resources Limited [2019] ATP 17, Aguia Resources Limited [2019] ATP 13, Australian Whisky Holdings Limited [2019] ATP 12, Auris Minerals Limited [2018] ATP 7, Sovereign Gold Company Limited [2016] ATP 12, Resources Generation Limited [2015] ATP 12, Gondwana Resources Limited 02 [2014] ATP 15, Dragon Mining Limited [2014] ATP 5, Bentley Capital Limited [2011] ATP 8, CMI Limited [2011] ATP 4, Mount Gibson Iron Limited [2008] ATP 4, Orion Telecommunications Ltd [2006] ATP 23| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Richard Hunt (sitting President), Rory Moriarty and Sharon Warburton, declined to conduct proceedings on an application by Cromwell Corporation Limited and Cromwell Property Securities Limited as responsible entity for the Cromwell Diversified Property Trust in relation to the affairs of Cromwell. The application concerned whether a number of persons were associated in relation to Cromwell and held a combined, but undisclosed, relevant interest and voting power of up to 35.85% in Cromwell, consequently leading to breaches of the substantial holder notice provisions and the takeovers threshold in section 606.1 The Panel considered that it was not provided with a sufficient body of material to justify the Panel making further enquiries as to the alleged associations.

- In these reasons, the following definitions apply.

- Alleged Associated Parties

- the Tang Group, the ARA Group and Ms Jialei Tang

- ARA

- ARA Real Estate Investors XXI Pte Ltd

- ARA Group

- ARA and related ARA entities

- ASIC Relief

- has the meaning given in paragraph 9

- Cromwell

- Cromwell Corporation Limited and Cromwell Property Securities Limited as responsible entity for the Cromwell Diversified Property Trust

- Haiyi

- Haiyi Holdings Pte Ltd

- Ms Jialei Tang

- the daughter of Mr Gordon Tang and Mrs Celine Tang

- Placement

- has the meaning given in paragraph 8

- Placement Resolution

- has the meaning given in paragraph 10

- SingHaiyi

- SingHaiyi Group Limited

- Senz Holdings

- Senz Holdings Limited

- Tang Group

- Mr Gordon Tang, Mrs Celine Tang, Haiyi, SingHaiyi, Senz Holdings and others

- Tang Parties

- the Tang Group and Ms Jialei Tang

Facts

- Cromwell is an ASX listed real estate investor and manager (ASX code: CMW). Shares in Cromwell Corporation Limited are ‘stapled’ to units in Cromwell Diversified Property Trust.

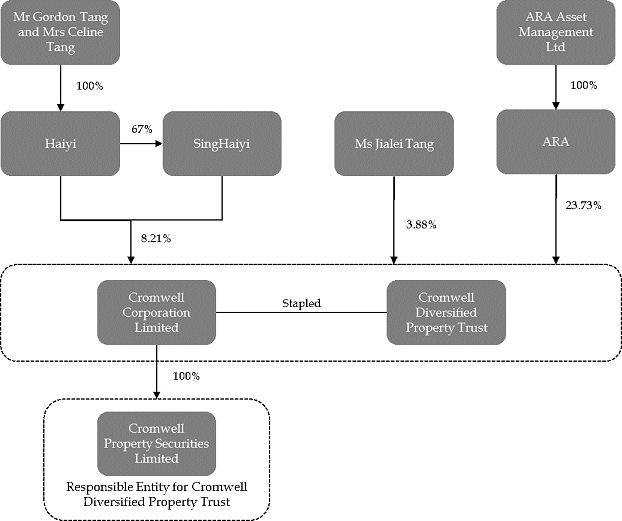

- A diagram setting out the simplified corporate structure of the ARA Group and the Tang Group (including Ms Jialei Tang), as submitted by Cromwell, is below:

- On 15 December 2017, the Tang Group acquired an initial 8.83% interest in Cromwell.

- On 8 March 2018, ARA acquired an initial 19.5% interest in Cromwell. ARA subsequently acquired further Cromwell securities.

- On 28 February 2019, Ms Jialei Tang acquired an initial 0.15% interest in Cromwell. Ms Jialei Tang subsequently acquired further Cromwell securities.

- On 26 June 2019, Cromwell undertook a $375m institutional placement (Placement). The Cromwell board determined that ARA would be precluded from participating in the Placement as ARA was a related party of Cromwell (in the Cromwell board’s determination). As a result of the Placement, ARA was diluted from 20.9% to 18.05%.

- On 18 October 2019, ARA obtained ASIC relief to be able to make acquisitions of Cromwell securities under the “creep exception” in item 9 of s611 (ASIC Relief) despite ARA’s dilution to below 19% as a result of the Placement. Following the granting of that relief, ARA increased its voting power in Cromwell to 23.73%.

- On 7 November 2019, ARA sent a letter and a pre-completed proxy form to Cromwell securityholders recommending that Cromwell securityholders vote against 6 out of the 8 resolutions to be considered at Cromwell’s 2019 Annual General Meeting. ARA’s recommendations included that Cromwell securityholders vote against a resolution to ratify the Placement for the purposes of ASX Listing Rule 7.4 and for all other purposes (Placement Resolution) and to vote against the appointment of two independent directors.

- Between 11 and 13 November 2019, Senz Holdings acquired an initial interest in Cromwell of 0.077%. Between 15 and 22 November 2019, Senz Holdings acquired further Cromwell securities and increased its interest in Cromwell to 0.31%.

- Cromwell submitted that on 21 November 2019, in response to a question from a representative of Cromwell, a representative of the Tang Group stated that Mr Gordon Tang had “concerns about the Board and the Placement issues”.

- On 28 November 2019, Cromwell’s 2019 Annual General Meeting took place. The Placement Resolution was not approved by shareholders.

- On 2 December 2019, ARA’s legal advisers requested to inspect and to obtain copies of the registers of beneficial ownership and members maintained by Cromwell “to consider contacting members in relation to the management and strategy of Cromwell”.

- On 4 December 2019, ARA sent a letter to the chairman of Cromwell stating among other things “In the event that you do not step down as Chair and resign from the Board, we will consider our options, which may include reviving our previous intention to requisition a meeting of security holders to consider your further tenure on the board of Cromwell”.

Application

Declaration sought

- By application dated 11 December 2019, Cromwell sought a declaration of unacceptable circumstances. Cromwell submitted that:

- “Ms Jialei Tang (the daughter of Mr Gordon Tang and Mrs Celine Tang) and Senz Holdings (a company controlled by the Tang family) are associated with [Haiyi] and [SingHaiyi]”

- “the ARA Group has a relevant agreement and is associated, with Ms Jialei Tang in relation to, inter alia, the conduct of Cromwell’s affairs” and

- “the ARA Group has a relevant agreement and is associated with the Tang Group in relation to, inter alia, the conduct of Cromwell’s affairs”.

- Cromwell submitted that the circumstances were unacceptable for a number of reasons, including because they were preventing an efficient, competitive and informed market in Cromwell securities and because they constituted a breach of s606 and s671B.

Final orders sought

- Cromwell sought final orders including that the shares held by the Alleged Associated Parties above 20% be vested in ASIC for sale (on a pro rata basis), the ASIC Relief be revoked and the Alleged Associated Parties pay Cromwell’s costs. Cromwell did not seek any interim orders.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Preliminary matters

- The application alleges various associations in the context of a potential board dispute. This does not necessarily take the matter outside the purview of the Panel. As the Panel said in Aguia Resources Limited, “If, in the context of issues regarding the composition of a company’s board, there is an accumulation or exercise of voting power possibly in contravention of s606, without proper disclosure under Chapter 6C or in otherwise unacceptable circumstances, those issues may be treated as control issues for the purposes of s657A”.2

Alleged association between the ARA Group and the Tang Group

- Cromwell submitted that the ARA Group and the Tang Group were associated on the basis of material including “common investments, dealings and other structural links between the ARA Group and the Tang Group” and “current and prior collaborative conduct between the ARA Group and the Tang Group”.

- This included that “as between the ARA Group and the Tang Group, the correspondence and behaviour supports an inference that the strategies of the ARA Group and the Tang Group were, and continue to be known to each other and they have become increasingly aligned and coordinated in respect of controlling or influencing the composition of Cromwell’s board and the conduct of affairs of Cromwell”.

- In support, Cromwell submitted that:

- Mr Gordon Tang and Mrs Celine Tang were aware as early as mid-October 2017 of ARA’s intention to acquire 19.5% of Cromwell from a third party, which ultimately occurred on 8 March 2018

- prior to Cromwell’s 2018 Annual General Meeting, a representative of the Tang Group informed Cromwell that “we too will be abstaining from the Remuneration resolution”, which was significant as the statement was made before ARA notified Cromwell that it would be abstaining from the relevant resolution and

- the Tang Group and Ms Jialei Tang voted by proxy in accordance with the recommendations of ARA, including voting against the Placement Resolution and the appointment of two independent directors.

- In preliminary submissions, the Tang Parties did not deny the existence of links between the Tang Group and the ARA Group and submitted that:

Of course, Mr Gordon Tang and senior management of the ARA Group know each other. They are senior business leaders of the Singapore community. Naturally, they and their representatives have discussed matters relating to the governance of Cromwell. This would be the same with senior business leaders and institutional investors in Australia. There is nothing unusual or inappropriate about any of this.

…

While it is true that certain of [the Tang Parties] have invested in assets owned or managed by the ARA Group, such investments have been made in furtherance of a broader investment strategy focussed on businesses with a strong asset base that offer stable returns.

- ARA submitted that ARA has “many investors larger than Mr Tang and his entities” and that the broader ARA Group is a global real estate fund manager with more than S$80 billion in gross assets under management.

- Without more, the fact that there are long-standing business relationships between parties is not sufficient to establish an association.3 Whilst Mr and Mrs Tang’s prior knowledge of ARA’s initial investment in Cromwell and the proximate initial investment in Cromwell by ARA could suggest an association, those events occurred a not insignificant time before the application was made.

- In relation to the voting at Cromwell’s 2019 Annual General Meeting, Cromwell submitted that “unless it is important to the Tang Group that ARA is not diluted, there is no other apparent commercial reason as to why the Tang Group would be concerned about ARA’s inability to participate in the [Placement]”.

- We are not persuaded by Cromwell’s submission. The Tang Parties submitted that they carefully considered the matters raised in ARA’s letter dated 7 November 2019 and voted in a manner supportive of that agenda purely for commercial reasons, noting that:

… the order placed by [the Tang Parties] in the Placement conducted by Cromwell in June 2019 was scaled-back with the result that [the Tang Parties’] security holdings were diluted. In these circumstances, it is logical that [the Tang Parties] would vote against the resolution to refresh Cromwell’s placement capacity as they held legitimate concerns that Cromwell may again use a placement to dilute their holdings.

- The Tang Parties also submitted that “In circumstances where security holders are unhappy with the performance of the board (as was the case with our clients and the Cromwell board), it is a natural and common course of action to vote against resolutions proposed by the board”.

- ARA submitted that “many other securityholders and commentators were also troubled” by Cromwell’s refusal to allow ARA to participate in the Placement and noted that at least 484 Cromwell securityholders submitted proxy forms for Cromwell’s 2019 Annual General Meeting in accordance with the public voting recommendations of ARA (using the pre-completed proxy form provided to securityholders by ARA).

- In Dragon Mining Limited,4 the Panel stated that, in considering whether to conduct proceedings:

…there must be a sufficient body of material demonstrated by the applicant, which together with inferences (for example from partial evidence, patterns of behaviour and a lack of a commercially viable explanation) support the Panel conducting proceedings.

- The Panel went on to state:5

Dromana Estate Limited 01R acknowledges the difficulties that an applicant faces in gathering evidence in association matters. In deciding whether to conduct proceedings on an association case, this must be kept in mind. However, the Panel has limited investigatory powers which means, before we decide to conduct proceedings, an applicant must do more than make allegations of association and rely on us to substantiate them. An applicant must persuade us by the evidence it adduces that we should conduct proceedings.

- Without further material suggesting otherwise, the conduct of ARA in making recommendations to shareholders and discussing with members of the Tang Group matters relating to the governance of Cromwell appears to be the type of collective action identified in Table 1 of ASIC Regulatory Guide 128 as unlikely to constitute an association or otherwise give rise to unacceptable circumstances. Such conduct includes discussing and exchanging views on a resolution to be voted on at a meeting, disclosing individual voting intentions on a resolution and recommending that another investor votes a particular way. As the Panel noted in Australian Whisky Holdings Limited, “Discussing concerns about the governance of a company… is not necessarily a common goal of seeking control of the company and does not necessarily amount to the establishment of a relevant agreement”.6

- We understand it can be challenging for an applicant to gather probative material of association. We have taken this into consideration. Nevertheless, given the above we consider that Cromwell has not provided a sufficient body of material to justify us making further enquiries as to the alleged association between the ARA Group and the Tang Group.

Alleged association between the ARA Group and Ms Jialei Tang

- Cromwell submitted that the following material supported an inference that the ARA Group and Ms Jialei Tang were associated:

- “as between the ARA Group and Ms Jialei Tang there was a series of parallel acquisitions that do not appear to be commercially rational or explicable, other than by reason of association” and

- “there is current and prior collaborative conduct between the ARA Group and Ms Jialei Tang, including Ms Jialei Tang voting in accordance with ARA’s instruction, such action seemingly being contrary to Ms Jialei Tang’s [interests]”.

- For the reasons stated above in relation to the Tang Group, without more we are not persuaded that Ms Jialei Tang’s decision to vote in accordance with ARA’s public voting recommendations evidences an association.

- In relation to the alleged parallel acquisitions, Cromwell submitted that:

- many of the acquisitions occurred on days in which the trading volume in Cromwell securities was low, which was significant as “it is common for fund managers not to allow trades to represent more than 20% – 25% of the total trades on a given day to ensure limited movement in a listed company’s stock’s price” and

- the trading of ARA and Ms Jialei Tang “accounted for between 40% and 60% of the corresponding daily trading volume on [the days of the alleged parallel acquisitions]. Having regard to the impact which can be seen on the Cromwell performance relative to the 200 REIT index, the acquisition behaviour is suggestive of an uncommercial rationale for such acquisitions.”

- ARA submitted that:

The Application attempts to show a correlation of trading between ARA and Ms Jialei Tang using what appears to be data from weekly beneficial interest register updates. What it in fact appears to show is that over an approximately 50 week period there were 8 weeks where both ARA and Ms Jialei Tang were acquiring securities. It is likely that there would be the same or more correlation with many of Cromwell’s large investors. There is no other evidence or relevant material in the Application that would indicate an association with Ms Jialei Tang.

- The Tang Parties submitted that:

The Application selectively references certain trades made by Ms Jialei Tang and the ARA Group in a misleading attempt to convey a level of co-ordination between the parties that simply did not exist and is not supported by any reliable evidence. It is pure fiction.

…

Over the past 12 months since Ms Jialei Tang made her initial investment in Cromwell, she and the ARA Group traded in Cromwell securities on 98 days in aggregate (based on the ARA Group’s substantial holder notices). Ms Jialei Tang traded on 68 days while the ARA Group traded on 44 days. There were only 14 days where both parties traded. Ms Tang traded on an additional 54 days on which the ARA Group did not trade, and the ARA Group traded on an additional 30 days on which Ms Jialei Tang did not trade.

- Where two parties are buying shares consistently over a long period, there will be occasional days where they both trade. While sequential or concurrent buying of shares is not of itself evidence of an association, where there is other probative material indicating an association, behaviour that appears to be concerted buying activity may be taken to support an inference of an association.7 In this case, however, Cromwell has not provided sufficient additional probative material. It seems equally probable to us that the alleged parallel acquisitions evidence independence rather than association: if the ARA Group and Ms Jialei Tang were associated it is conceivable they would have sought to not trade on the same day given the potential price impact of such trading as submitted by Cromwell.

Alleged association between Ms Jialei Tang, Senz Holdings, Haiyi and SingHaiyi

- Family relationships are a possible indicator of association, depending on the context.8 However, the Panel has previously commented that “family relationships are not determinative” of the question of association9 and that a “relationship between a parent and an adult child is less of an indicator of association compared to the spousal relationship”.10

- Cromwell submitted that the timing and context of the acquisitions of Ms Jialei Tang, Senz Holdings and other Tang Group companies are inconsistent with the actions of persons acting independently of one another and that “while a daughter-parent relationship is not itself determinative of whether two parties are associated, it is an important factor to be considered, particularly in light of the other strong connections, and other patterns of behaviour”.

- Cromwell also made submissions in relation to:

- the significant capital outlay required by Ms Jialei Tang to acquire her stake in Cromwell (in the order of $120m), particularly given her age and

- connections between Senz Holdings and other members of the Tang Group, including that:

- Mrs Celine Tang is a director of Senz Holdings and

- Mr Tang Jialin and Madam Yang Chanzhen, Mr Gordon Tang’s mother, are entitled to exercise, or control the exercise of, not less than 20% of the votes attached to the shares held by them in Senz Holdings.

- ARA made no submissions as to whether Ms Jialei Tang and Senz Holdings were associated with Haiyi and SingHaiyi.

- The Tang Parties submitted that Ms Jialei Tang, Senz Holdings and the other members of the Tang Group make investment decisions on an independent basis having regard to their own interests. As an example, the Tang Parties submitted that in November 2019 Ms Jialei Tang purchased ~8.9 million Cromwell securities while SingHaiyi sold ~10.1 million Cromwell securities during the same month.

- However, the Tang Parties acknowledged that “in an Australian context, familial links may create a perception of an association” and offered to jointly lodge an updated substantial holding notice including Ms Jialei Tang and Senz Holdings.

- On 23 December 2019, a substantial holder notice was lodged by Haiyi, SingHaiyi, Mr Gordon Tang, Mrs Celine Tang, Ms Jialei Tang, Senz Holdings, Madam Yang Chanzhen, Mr Tang Jialin and others which disclosed an aggregate voting power of 13.67% by the Tang family, including Ms Jialei Tang and Senz Holdings, without acknowledging any association existing with Ms Jialei Tang and Senz Holdings.

- We make no conclusion on whether any associations exist between Ms Jialei Tang, Senz Holdings, Haiyi and SingHaiyi. While a contravention of Chapter 6C clearly can give rise to unacceptable circumstances,11 in deciding whether that is likely to be the case we need to have regard to, among other things, the purposes in section 602, the provisions of Chapter 6 and, more broadly, the role Parliament intended the Panel to perform.12 We are not satisfied that the application justifies us making further enquiries given:

- the combined interest is now disclosed and the disclosed aggregate voting power is less than 20% and

- there is no evidence to suggest that the amount of the disclosed aggregate voting power is incorrect (notwithstanding that the substantial holder notice does not acknowledge any association existing with Ms Jialei Tang and Senz Holdings).

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- If circumstances change such as to potentially give rise to unacceptable circumstances, a new application can always be made.

Orders

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Richard Hunt

President of the sitting Panel

Decision dated 2 January 2020

Reasons given to parties 4 February 2020

Reasons published 6 February 2020

Advisers

| Party | Advisers |

|---|---|

| Cromwell | Corrs Chambers Westgarth |

| ARA | Arnold Bloch Leibler |

| Tang Parties | Gilbert + Tobin |

1 - Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 - Aguia Resources Limited [2019] ATP 13 at [24(a)], quoting Resources Generation Limited [2015] ATP 12 at [48]

3 - See, for example, Gondwana Resources Limited 02 [2014] ATP 15 at [48]

4 - [2014] ATP 5 at [27], quoting Mount Gibson Iron Limited [2008] ATP 4 at [15]

5 - [2014] ATP 5 at [60]

6 - [2019] ATP 12 at [17]

7 - See Orion Telecommunications Ltd [2006] ATP 23 at [107]

8 - See, for example, CMI Limited [2011] ATP 4

9 - Bentley Capital Limited [2011] ATP 8 at [66]

10 - Havilah Resources Limited [2019] ATP 17 at [20]

11 - Section 657A(2)(c) (referring to contraventions of Chapter 6C)

12 - Auris Minerals Limited [2018] ATP 7 at [23]