[2019] ATP 23

Catchwords:

Decline to conduct proceedings – board spill – association – association hurdle - inferences

Corporations Act 2001 (Cth), sections 12(2)(b), 12(2)(c), 203D, 249D, 250R, Division 9 of Part 2G.2, 606, 671B

Aguia Resources Limited [2019] ATP 13, Donaco International Limited [2019] ATP 11, Viento Group Ltd [2011] ATP 1, Mount Gibson Iron Limited [2008] ATP 4, Dromana Estate Limited 01R [2006] ATP 8

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Karen Evans-Cullen, Kerry Morrow and Tony Osmond (sitting President), declined to conduct proceedings on an application by Donaco International Limited in relation to its affairs. The application concerned whether certain Donaco shareholders who had attempted to requisition a general meeting to spill the Donaco board were associated with other shareholders. The Panel considered that Donaco did not provide a sufficient body of material to justify it making further enquiries as to whether there were any associations. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Alleged Somboon Associate

- an individual described in the application as a close associate of Mr Somboon

- Alliance

- has the meaning given in paragraph 39(a)(i)

- Donaco

- Donaco International Limited

- Highest Point

- has the meaning given in paragraph 8

- July EGM

- the extraordinary general meeting of Donaco held on 18 July 2019 to consider the removal of Mr Joey Lim and Mr Ben Lim as directors

- Management Agreement

- has the meaning given in paragraph 5

- Max Union

- has the meaning given in paragraph 8

- Mr Gerald Tan

- Mr Gerald Nicholas Tan Eng Hoe

- Mr Joey Lim

- Mr Lim Keong Yew

- Mr Patrick Tan

- Mr Tan Teck Lee Patrick

- Mr Somboon

- Mr Somboon Sukcharoenkraisri (also known as Mr Lee Bug Leng)

- On Nut Road

- On Nut Road Limited

- Requisitionists

- Mr Gerald Tan and Mr Patrick Tan

- Share Sale Agreement

- has the meaning given in paragraph 4

- Singapore Arbitration

- has the meaning given in paragraph 11

- Somboon Family Associates

- Mr Somboon, Mr Lee Bug Tong, Mr Lee Bug Huy and Highest Point

- Star Vegas Casino

- Star Vegas Resort & Club in Poipet, Cambodia

Facts

- Donaco is an ASX listed company (ASX code: DNA).

- On 1 July 2015, Donaco acquired the Star Vegas Casino from Mr Somboon and his son, Mr Lee Bug Tong, under the terms of a share sale agreement dated 23 January 2015 (as amended and restated on 18 June 2015, the Share Sale Agreement).

- At closing, Donaco entered into a management agreement with Mr Somboon and another of Mr Somboon's sons, Mr Lee Bug Huy for them to manage and operate the Star Vegas Casino (Management Agreement).

- Part of the purchase price was satisfied by the issue of 147,199,529 Donaco shares, in almost equal proportions, to Mr Lee Bug Tong and Mr Lee Bug Huy.

- On 10 July 2015, Mr Lee Bug Tong and Mr Lee Bug Huy separately lodged an initial substantial holder notice indicating that they each held 8.86% of Donaco.

- On 23 June 2016, Mr Joey Lim (at the time a director of Donaco) and his former wife entered into a loan agreement with Highest Point Investments Limited, a company wholly owned by Mr Somboon and his two sons (Highest Point) for US$7 million which was secured by a pledge over the shares of Max Union Corporate Development Limited, a company wholly owned by Mr Joey Lim's former wife (Max Union). Max Union held 26,000,000 Donaco shares (or 3.15% of Donaco).

- In mid-October 2016, Mr Lee Bug Huy purchased 1,000,000 Donaco shares indirectly through Highest Point.1

- In August 2017, Mr Joey Lim appointed Mr Gerald Tan as Interim General Manager at the Star Vegas Casino.

- On 18 January 2018, Donaco and certain of its subsidiaries commenced arbitrations in Singapore against Mr Somboon and his two sons for breach of the Share Sale Agreement and Management Agreement (collectively, the Singapore Arbitration).

- In February 2018, Mr Gerald Tan was appointed as Chief Operating Officer of Donaco.

- On 3 April 2018, Donaco disclosed that the Supreme Court of New South Wales had granted an order in favour of Donaco restraining Mr Lee Bug Tong and Mr Lee Bug Huy from disposing their Donaco shares until final resolution of the Singapore Arbitration.

- On 29 November 2018, at Donaco's annual general meeting, a representative of the Somboon Family Associates attended the meeting and requested a poll, and voted the Somboon Family Associates' shares against the resolution to approve the remuneration report, contributing to a "first strike" under the "two strikes" rule.2

- On 6 December 2018, Donaco announced that Mr Joey Lim had taken a leave of absence from his position as CEO and Managing Director of Donaco and was replaced on an interim basis by his brother, Mr Ben Lim.

- On 1 March 2019, receivers were appointed over shares equal to 27.25% of Donaco owned by Mr Joey Lim and his controlled companies.3

- On 11 June 2019, Donaco announced that Mr Ben Lim's role as Interim CEO and Managing Director had concluded (with the appointment of a new CEO) and that Donaco's Chief Operating Officer, Mr Gerald Tan, had left the business.4

- On 20 June 2019, On Nut Road and its associates became a substantial holder with voting power of 19.25% in Donaco having acquired a relevant interest in a portion of the shares placed with the receivers.

- On 18 July 2019, at the July EGM, Mr Joey Lim and Mr Ben Lim, were removed as directors of Donaco.

- Between 24 July 2019 and 8 August 2019, Mr Patrick Tan acquired 4.642% of the shares in Donaco.

- On 15 August 2019, Donaco received from the Requisitionists a notice of intention to move a resolution to remove directors pursuant to section 203D.

- On 21 August 2019, the Requisitionists requested by notice under section 249D that Donaco hold a general meeting to consider the removal of all existing directors and the election of themselves and three other nominees. Donaco advised that the notice was invalid.

- On 21 September 2019, the Requisitionists again requested by notice under section 249D that Donaco hold a general meeting to consider the removal of all existing directors and the election of themselves and three other nominees (including one substituted nominee). Donaco advised that this notice was also invalid.

- On 27 September 2019, the Requisitionists provided an initial substantial holder notice disclosing a combined voting power of 5.546% in Donaco solely by virtue of section 12(2)(b), being associated with each other having issued the notice of intention pursuant to section 203D.

- On 10 October 2019, Donaco received a notice requisitioning a general meeting under section 249D from On Nut Road to consider the resolutions proposed by the Requisitionists on 21 August 2019. On 11 October 2019, On Nut Road provided a revised notice that was aligned with the resolutions in the Requisitionists' 21 September 2019 notice. In both notices, On Nut Road stated:

We note that we do not support the resolutions proposed by the Requisitioners … it is our view that in order to settle the matters addressed in the Invalid Notice … it is in the interests of the Company to put these resolutions to members.

- On 16 October 2019, the Donaco board determined, in order to minimise Donaco's expenses, that it would add the resolutions proposed by On Nut Road to the agenda for Donaco's annual general meeting to be held on 29 November 2019.

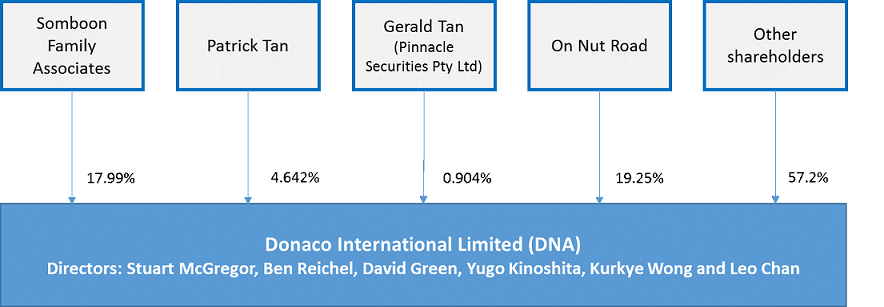

- Below is a diagram of the relevant shareholdings as provided by Donaco.

Application

Declaration sought

- By application dated 4 November 2019, Donaco sought a declaration of unacceptable circumstances. Donaco submitted that the Requisitionists and the Somboon Family Associates were associated by reason of entering into a scheme for the purpose of controlling or influencing the composition of the Donaco board and the conduct of Donaco's affairs.

- Donaco further submitted (among other things) that:

- Mr Lee Bug Tong and Mr Lee Bug Huy had breached section 671B by failing to update their substantial holder notices to reflect Highest Point's interest in 1,000,000 shares and its interest in the 26,000,000 Donaco shares held by Max Union and that since 2015 the market had not been aware of the extent of the Somboon Family Associates and other associates' interest in Donaco

- the Requisitionists had failed to lodge a substantial holder notice that reflected the interests in Donaco of their associates, including the Somboon Family Associates, in contravention of section 671B and

- the combined voting power of the Requisitionists and the Somboon Family Associates was not less than 23.54%, exceeding the 20% threshold in breach of section 606.

- Donaco submitted that these circumstances were unacceptable because Donaco shareholders did not know the identity of shareholders who were acting in concert to take control of Donaco and would not be given a reasonable and equal opportunity to participate in any benefit accruing to the holders through the attempt to take control of Donaco.

Interim orders sought

- Donaco sought interim orders including to the effect that the alleged associates be restrained from acquiring, transferring or voting any Donaco shares pending final determination of the application.

Final orders sought

- Donaco sought final orders including to the effect that the Donaco shares held by the Requisitionists, the Somboon Family Associates5 and their associates be vested in ASIC for sale, the alleged associations be disclosed and the alleged associates be restrained from acquiring any further Donaco shares.

Discussion

- We have considered all of the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Disclosure of the Somboon Family Associates

- On 7 November 2019, after the date of the application, the Somboon Family Associates lodged a substantial holder notice disclosing total voting power of 17.99% in Donaco as associates by virtue of section 12(2)(b). While this notice may have been overdue, we consider that the market has been generally aware that Mr Somboon and his sons have an interest in Donaco of about 17.9% based on public announcements made by Donaco.

- In relation to the Donaco shares held by Max Union, those shares have since been transferred by the receivers. If Highest Point had an interest in those shares, any related breach is historical and we do not consider it necessary to pursue this issue.

Association

- Section 12 sets out the tests for association as applied to Chapter 6. There are two relevant tests here:

- s12(2)(b) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company's board or conduct of its affairs and

- s12(2)(c) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company's affairs.

- The Panel recently stated in Aguia Resources Limited,6 "[i]n considering whether to conduct proceedings on the question of whether shareholders are associated in the context of a board spill, the Panel will apply its well-established principle that the applicant must demonstrate a sufficient body of evidence of association to convince the Panel as to that association, albeit with proper inferences being drawn.7"

- The Panel in Dromana Estate Ltd 01R stated that:

... Issues of association frequently need to be decided on the basis of inferences from partial evidence, patterns of behaviour and a lack of a commercially viable explanation for the impugned circumstances.8

- Donaco's application asked us to infer that the Requisitionists were associated with the Somboon Family Associates by reason of:

- Mr Patrick Tan being a business associate of Mr Somboon and his sons by reason of:

- a company of which he was a director, Alliance Global Energy (Labuan) Limited (Alliance),9 acting as process agent for Mr Somboon and Mr Lee Bug Tong in Singapore in relation to any legal action in connection with the Share Sale Agreement and

- his association with the Alleged Somboon Associate, with whom he was a co-director and co-shareholder of Alliance Global Energy Pte Ltd10 and their common dealings together

- evidence that the Alleged Somboon Associate is associated with Mr Somboon and his two sons by reason of certain alleged structural links and common dealings between them described in a statutory declaration provided by Mr Ben Reichel, an executive director of Donaco

- the timing of when Mr Patrick Tan commenced acquiring shares in Donaco coinciding with certain events around the Singapore Arbitration and partly overlapping the period during which the Alleged Somboon Associate sold all of the Alleged Somboon Associate's Donaco shares (equal to 1.12%)

- Mr Patrick Tan acquiring such number of Donaco shares, when added to Mr Gerald Tan's 0.904% that was just above the 5% required for them to be able to requisition a shareholders meeting

- if the Requisitionists' second notice was accepted as valid then Donaco would have had to call a general meeting no later than 21 November 2019, a few days before 25 November 2019, the date that Mr Somboon and his two sons were due to be cross-examined at a five day hearing in relation to the Singapore Arbitration and

- the Requisitionists lodged complaints with regulators and threatened Donaco directors personally with legal action if they did not action the second requisition notice to hold the shareholders meeting on or before 21 November 2019.

- Mr Patrick Tan being a business associate of Mr Somboon and his sons by reason of:

- The Requisitionists deny that the purpose and timing of their spill requests were connected to the Singapore Arbitration submitting that Mr Patrick Tan was only aware of the Singapore Arbitration to the extent details had been disclosed publicly and "had no knowledge as to the status of the parties, proposed agenda for [the 25 November 2019] hearing or the relevance of that hearing to the outcome of the arbitration". Further, Mr Gerald Tan voluntarily gave evidence on 9 August 2019 at the Singapore Arbitration in support of Donaco and against the Somboon Family Associates. This latter fact, in particular, throws doubt on the inference we are being asked to draw.

- Donaco further submitted that the Requisitionists had not provided any information about why they wanted the current directors replaced by their nominees and the Panel could reasonably infer from this that the Requisitionists became disinterested in the issue either because:

- their objective to have a shareholders meeting held before 25 November 2019 and affect the outcome of the Singapore Arbitration was not able to be achieved or

- they were, and are still, confident of replacing the current directors and have therefore considered it unnecessary to provide other shareholders with that information.

- In preliminary submissions, the Requisitionists submitted that their not having provided information to date should not be taken to infer an association with the Somboon Family Associates. Rather, they submitted that they are deeply dissatisfied with the management of Donaco and consider that Mr Stuart McGregor (Donaco's non-executive Chairman) and Mr Reichel (who were directors at the same time as Mr Joey Lim and Mr Ben Lim) should be held equally accountable for Donaco's performance as Mr Joey Lim and Mr Ben Lim.

- We are not prepared to draw the inference submitted by Donaco. While the Requisitionists may not have publicly expressed their dissatisfaction with the management of Donaco, their attempts to requisition a meeting to replace the current board and Mr Gerald Tan's recent departure from Donaco's management, among other things, support the view that they are dissatisfied with the management and direction of Donaco.

- In relation to Mr Gerald Tan, Donaco submitted that he is a friend and business associate of Mr Joey Lim, including as evidenced by their joint application in Donaco International Limited11and Mr Gerald Tan voting against the resolutions to remove Mr Joey Lim and Mr Ben Lim from the Donaco board at the July EGM.

- Donaco further submitted that:

- Mr Joey Lim owes a substantial amount of money to the Somboon Family Associates, who have been pursuing Mr Joey Lim via an arbitration claim in Singapore and on this basis, Mr Somboon has leverage over Mr Joey Lim and

- Mr Joey Lim did not make himself available to give evidence to support Donaco at the Singapore Arbitration and Donaco is concerned that "there is some agreement between Joey's associate, Gerald Tan, and Somboon's associate, Patrick Tan, to assist Somboon to seize control of DNA".

- Given the history between Mr Joey Lim and Donaco it is unsurprising that he would not make himself available to give evidence at the Singapore Arbitration and we infer nothing from this. Similarly, the relationship between Mr Joey Lim and Mr Somboon appears complicated and we have not been provided with information to draw any inferences with sufficient certainty in this regard.

- The Requisitionists do not deny that there are some structural links and common dealings between themselves, Mr Joey Lim, Mr Somboon and the Alleged Somboon Associate. In preliminary submissions, the Requisitionists admitted that Mr Gerald Tan is a friend and business associate of Mr Joey Lim, and that Mr Patrick Tan has had business dealings with Mr Somboon in the past and has a business relationship with the Alleged Somboon Associate. However, they submitted that any previous affiliation or business relationships between the Requisitionists and these parties do not give rise to the parties becoming associates of one another for the purposes of Chapters 6 to 6C.

- Based on the information we have been provided, we consider that the structural links and any collaborative conduct and common dealings here are weak. The process agent arrangement between Alliance and Mr Somboon and Mr Lee Bug Tong ended in March 2017 when Alliance was wound up. While Mr Patrick Tan signed the letter of appointment of process agent as a director of Alliance, no other information in relation to the directors or shareholders of this company was provided. Further, while Mr Patrick Tan admits that he has a business relationship with the Alleged Somboon Associate, there is no material to support that they have a relevant agreement or are acting in concert in relation to Donaco.

- In our view, establishing the circumstances relevant to an association here is made more difficult for Donaco because the alleged association between the Requisitionists and the Somboon Family Associates is primarily based on inferring an association from separate associations with a third party being either one or both of the following:

- Mr Joey Lim, being an associate of Mr Gerald Tan and in turn an associate of Mr Somboon and

- the Alleged Somboon Associate, being an associate of Mr Patrick Tan and in turn an associate of Mr Somboon.

- We do not consider that sufficient information has been provided by Donaco to warrant us making further enquiries to establish these associations.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Tony Osmond

President of the sitting Panel

Decision dated 12 November 2019

Reasons given to parties 25 November 2019

Reasons published 26 November 2019

Advisers

| Party | Advisers |

|---|---|

| Donaco | Addisons |

| Requisitionists | Steinepreis Paganin |

| Somboon Family Associates | Ashurst |

1 As disclosed in an Appendix 3Y – Change of Director's Interest Notice of Mr Lee Bug Huy

2 Section 250R and Division 9 of Part 2G.2. Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

3 For background details see Donaco International Limited [2019] ATP 11

4 A chronology provided by Donaco with the application stated that in June 2019 "[t]he Donaco Board appoints Paul Arbuckle as Chief Executive Officer, and terminates the executive roles of Ben Lim and Gerald Tan"

5 Subject to a variation of the NSW Supreme Court order referred to in paragraph 13

6 Aguia Resources Limited [2019] ATP 13 at [24(b)]

7 See Mount Gibson Iron Limited [2008] ATP 4 at [15]. See also the circumstances relevant to establishing an association in Viento Group Ltd [2011] ATP 1 at [120] relying on Mount Gibson Iron Limited

8 Dromana Estate Limited 01R [2006] ATP 8 at [25]

9 This company was wound up in 2017 and (as submitted by the Requisitionists) the process agent arrangement ended at that time

10 Based on a credit search report provided by Donaco, this company was registered in November 2000, changed its name to Tri-Alliance Holdings Pte. Ltd in February 2003 and was struck off the register in 2009

11 [2019] ATP 11