[2019] ATP 18

Catchwords:

Declaration – orders – circumventing Panel orders – lock-up device – independent expert's report – supplementary target's statement

Corporations Act 2001 (Cth), sections 203D, 249F, 602(a)(i), 640, 646, 650F(1), 657A, 657C, 657D(2)(a), 657D(2)(d) 670C(2)

Australian Securities and Investments Commission Regulations 2001 (Cth), regulation 16

Guidance Note 4: Remedies General, Guidance Note 7: Lock-up devices, Guidance Note 22: Recommendation and Undervalue Statements

Eastern Field Developments Limited v Takeovers Panel [2019] FCA 311, Glencore International AG v Takeovers Panel [2006] FCA 274, ACI Operations Pty Ltd v Berri Ltd (2005) 15 VR 312, Re Village Roadshow Limited 02 (2004) 22 ACLC 1332

Aurora Absolute Return Fund [2019] ATP 14, Benjamin Hornigold Limited 02 and Henry Morgan Limited 02 [2019] ATP 1, Finders Resources Limited 03R [2018] ATP 11, Strategic Minerals Corporation NL 02R, 03R, 04R and 05R [2018] ATP 5, Molopo Energy Limited 01 & 02 [2017] ATP 10,The President's Club Limited 02 [2016] ATP1, Austral Coal Limited 03 [2005] ATP 14, Sirtex Medical Limited [2003] ATP 22

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | YES | YES | YES | NO |

Introduction

- The Panel, Christian Johnston, John Sheahan QC (sitting President) and Sharon Warburton, made a declaration of unacceptable circumstances in relation to the affairs of Benjamin Hornigold Limited because the placement of foreign currency banknotes by Benjamin Hornigold with King's Currency Exchange Pty Ltd effectively replaced a loan the subject of a previous order of the Panel and, individually and in conjunction with an extension of the period for the return of all banknotes placed by Benjamin Hornigold with King's Currency, operated as a lock-up device in relation to John Bridgeman's off-market takeover bid for Benjamin Hornigold.

- In these reasons, the following definitions apply.

- 2018 Bid

- has the meaning given in paragraph 5

- 2019 Bid

- has the meaning given in paragraph 13

- Bartholomew Roberts or BRL

- Bartholomew Roberts Pty Ltd

- Benjamin Hornigold or BHD

- Benjamin Hornigold Limited

- Benjamin Hornigold Limited 02

- Benjamin Hornigold Limited 02 and Henry Morgan Limited 02 [2019] ATP 1

- BHD Application

- the application by Benjamin Hornigold dated 8 August 2019

- CIO

- Chief Investment Officer

- Court Proceeding

- has the meaning given in paragraph 14

- Diagram

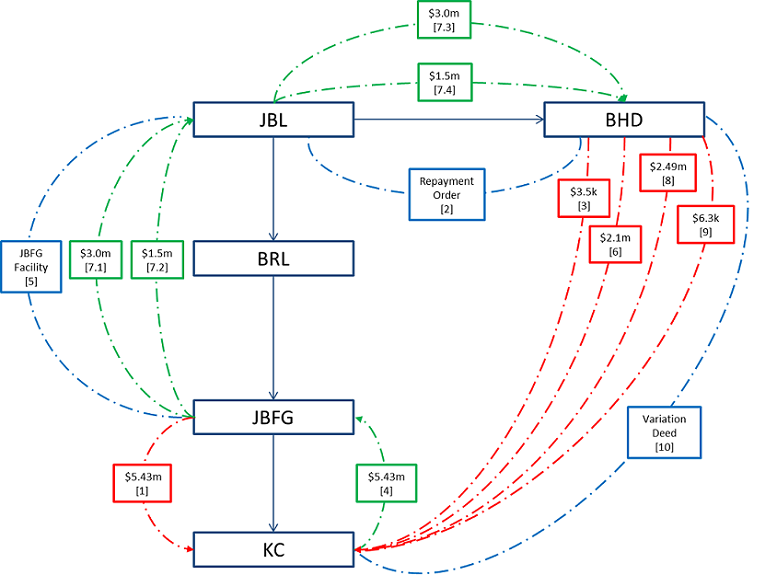

- the diagram in paragraph 64

- Foreign Currency Transactions

- means the placement of foreign currency banknotes by Benjamin Hornigold with King's Currency referred to in paragraphs 67, 69, 71 and 72

- Henry Morgan or HML

- Henry Morgan Limited

- IER

- has the meaning given in paragraph 16

- JB Financial Group or JBFG

- JB Financial Group Pty Ltd

- JBFG Facility

- has the meaning given in paragraph 10

- JBL Application

- the application by John Bridgeman dated 8 August 2019

- JBL Loan

- has the meaning given in paragraph 6

- John Bridgeman or JBL

- John Bridgeman Limited

- King's Currency or KC

- King's Currency Exchange Pty Ltd

- Partners for Growth

- Partners for Growth V, L.P.

- Repayment Order

- has the meaning given in paragraph 7

- Request Letter

- has the meaning given in paragraph 73

- s249F Meeting

- has the meaning given in paragraph 12

- Services Agreement

- has the meaning given in paragraph 8, including as amended by variation deeds dated 31 July 2018, 17 September 2018 and the Variation Deed (as the context requires)

- Supplementary Opinion

- has the meaning given in paragraph 23

- Supplementary Target's Statement

- has the meaning given in paragraph 22

- Variation Deed

- has the meaning given in paragraph 19

- Variation Request

- the request by Benjamin Hornigold dated 24 July 2019

Facts

- Benjamin Hornigold is an ASX listed investment company (ASX code: BHD). Trading in Benjamin Hornigold securities has been suspended since 30 July 2018. Benjamin Hornigold has no employees.

- John Bridgeman is an NSX listed company (NSX code: JBL). Trading in John Bridgeman securities has been suspended since 10 April 2019.

- On 10 September 2018, John Bridgeman announced an intention to make an off-market bid for all of the securities in Benjamin Hornigold. John Bridgeman's bidder's statement was lodged with ASIC on 6 November 2018 and offers under the takeover bid opened on 9 November 2018 (2018 Bid).

- On 28 December 2018, certain Benjamin Hornigold shareholders1 made applications to the Panel seeking declarations of unacceptable circumstances in relation to the affairs of Benjamin Hornigold2 and the Panel made a declaration of unacceptable circumstances in relation to the affairs of Benjamin Hornigold on 25 January 2019.3 The Panel made the declaration on the basis that (in combination with other things) on or about 17 September 2018 a $4.5 million receivable due to Benjamin Hornigold from John Bridgeman was converted into an unsecured loan with a term of 18 months (JBL Loan). This diminished the value of important assets of Benjamin Hornigold making Benjamin Hornigold less attractive to an acquirer and less likely to attract competing proposals (and as a result, diminished the value of Benjamin Hornigold if shareholders did not accept the 2018 Bid), in effect operating as a lock-up device.4

- On 8 February 2019, the Panel made orders in relation to the affairs of Benjamin Hornigold,5 including order 6 (the Repayment Order) which required John Bridgeman to repay the JBL Loan (with any interest) by 6 March 2019.

- Through a series of transactions made after the date of the Repayment Order, John Bridgeman (as exclusive investment manager for Benjamin Hornigold) directed Benjamin Hornigold to place approximately $5.46 million in foreign currency banknotes with King's Currency6 (increasing the total balance of foreign currency banknotes placed to approximately $7.12 million as at 31 May 2019) for management and on-trading pursuant to a services agreement dated 21 February 20187 between Benjamin Hornigold and King's Currency (Services Agreement) (discussed in paragraph 64 to paragraph 75).

- On 5 March 2019, John Bridgeman announced that it had determined not to proceed with the 2018 Bid and all previous acceptances of the 2018 Bid were cancelled and the 2018 Bid would lapse.

- On 6 March 2019, JB Financial Group provided an unsecured loan facility to John Bridgeman for up to $7.0 million (JBFG Facility). On 7 March 2019, John Bridgeman drew down $3.0 million of the JBFG Facility for the purpose of repaying Benjamin Hornigold in accordance with the Repayment Order and repaid $3.0 million of the amount due under the Repayment Order to Benjamin Hornigold.

- On 8 March 2019, John Bridgeman drew down a further $1.5 million of the JBFG Facility for the purposes of repaying Benjamin Hornigold and repaid the remaining $1.5 million in principal due under the Repayment Order to Benjamin Hornigold (albeit late).

- On 22 March 2019, Benjamin Hornigold announced that it had received from certain Benjamin Hornigold shareholders a notice under ss249F8 and 203D of an intention to call a general meeting of Benjamin Hornigold shareholders to consider resolutions to remove and appoint directors (s249F Meeting). The s249F Meeting was later called to be held on 13 June 2019.

- At a John Bridgeman board meeting held on 1 April 2019, the board considered that it may be the appropriate time for it to proceed with a new takeover bid for Benjamin Hornigold and resolved to commence preparation of a new bidder's statement. On 26 April 2019, John Bridgeman announced its intention to make a new off-market takeover bid for all of the securities in Benjamin Hornigold. The proposed consideration was 1 JBL share for each BHD share and 0.5 JBL option for each BHD option. At a John Bridgeman board meeting held on 30 April 2019, the board resolved to finalise the preparation and lodgement of the new bidder's statement which was ultimately lodged with ASIC on 3 May 2019 (at which stage its voting power in Benjamin Hornigold was 0.47%). Offers under the new takeover bid opened on 17 May 2019 (2019 Bid).

- On 26 May 2019, Benjamin Hornigold commenced proceedings in the Supreme Court of Queensland seeking to restrain the s249F Meeting from proceeding (Court Proceeding).

- On 28 May 2019, John Bridgeman announced that it had resolved to increase the consideration offered under the 2019 Bid from 1 JBL share per BHD share to 1.5 JBL shares per BHD share. The consideration for BHD options remained unchanged.

- On 30 May 2019, Benjamin Hornigold lodged its target's statement in relation to the 2019 Bid with ASIC. The target's statement included a recommendation by the 'Voting Directors' of Benjamin Hornigold (Messrs Peter Aardoom and Bryan Cook) that Benjamin Hornigold securityholders should accept the 2019 Bid, in the absence of a superior proposal. The target's statement was accompanied by an independent expert's report dated 30 May 2019 that opined that John Bridgeman's offer to acquire BHD shares was 'fair and reasonable'9 to BHD shareholders and the offer to acquire BHD options was 'not fair but reasonable' to BHD optionholders (IER).

- On 3 June 2019, evidence was served in the Court Proceeding that indicated a strong likelihood that the resolutions to remove the directors of Benjamin Hornigold would be carried by a majority at the s249F Meeting. A copy of the evidence was sent by Benjamin Hornigold's legal adviser to the directors (including Mr Stuart McAuliffe) and company secretary of Benjamin Hornigold late on 3 June 2019. The Court Proceeding was dismissed with costs on 4 June 2019.

- On 12 June 2019, John Bridgeman gave notice under s650F(1) that the 2019 Bid had been freed from all defeating conditions and that its voting power in Benjamin Hornigold was 17.02%.

- Also on 12 June 2019, Benjamin Hornigold and King's Currency amended the Services Agreement under a variation deed dated 12 June 2019 (Variation Deed) to (among other things) increase the minimum return to Benjamin Hornigold and provide that all banknotes placed by Benjamin Hornigold are not returnable until 12 November 2019 (see paragraph 74).10

- Following the resignation of all of the directors of Benjamin Hornigold and the company secretary at 7:45pm on 12 June 2019 (see paragraph 75), Benjamin Hornigold announced on 13 June 2019 that the newly appointed directors were considering the 2019 Bid and advised Benjamin Hornigold shareholders to 'take no action' in relation to the 2019 Bid (withdrawing the 'accept' recommendation of the former 'Voting Directors' made on 30 May 2019).

- On 17 June 2019, Benjamin Hornigold's independent expert sent a letter to Benjamin Hornigold advising that it was considering (among other things) certain matters that had arisen since the date of the IER to assess any implications on the conclusions reached in the IER.

- On 23 July 2019, Benjamin Hornigold lodged its first supplementary target's statement with ASIC (Supplementary Target's Statement). The Supplementary Target's Statement contained a recommendation from the board of Benjamin Hornigold that BHD securityholders should 'reject' the 2019 Bid.

- The Supplementary Target's Statement was accompanied by a supplementary opinion from the independent expert dated 19 July 2019 (Supplementary Opinion) that withdrew its opinion in the IER on the basis that it was unable to form an opinion on the fairness or reasonableness of John Bridgeman's offer to acquire BHD shares given:

- the degree of uncertainty regarding the value of a BHD share and very significant degree of uncertainty regarding the value of a JBL share and

- the limited information currently available to the independent expert meant that the range of potential values it considered reasonable for each BHD security was too wide to provide useful analysis.

Benjamin Hornigold's Request

Variation Request

- By request dated 24 July 2019 (Variation Request), Benjamin Hornigold submitted that John Bridgeman had effectively circumvented the effect of the Repayment Order by directing Benjamin Hornigold to place foreign currency banknotes with King's Currency pursuant to the Services Agreement.

- Benjamin Hornigold submitted that the effect of the alleged circumvention of the Repayment Order was to deprive Benjamin Hornigold of more than $4.5 million cash at bank which, together with the Variation Deed, operated to lock-up the cash with John Bridgeman controlled entities until 12 November 2019.

Variation sought

- Benjamin Hornigold sought a variation to the Repayment Order, in effect, to require King's Currency to provide the "Banknotes"11 or other foreign currency with equal value, to Benjamin Hornigold within 20 days after the date of the variation to the Repayment Order.

Preliminary submissions

- John Bridgeman made a preliminary submission in relation to the Variation Request. It submitted (among other things) that a variation of the Repayment Order was not appropriate because:

- the 2018 Bid, to which the orders made in relation to Benjamin Hornigold in Benjamin Hornigold Limited 02 (including the Repayment Order) related, was no longer on foot

- the individual commercial transactions to which the Variation Request related were transactions between Benjamin Hornigold and entities other than John Bridgeman and

- the variation to the Repayment Order in the form sought by Benjamin Hornigold:

- requested that the Panel "instate a new substantive order (which is not contemplated by the existing orders) rather than varying the existing orders" and

- was unfairly prejudicial to John Bridgeman in circumstances where it has already been required to comply (and has complied) with the terms of the Repayment Order.

- John Bridgeman submitted that, in the circumstances, should Benjamin Hornigold wish to raise the matters set out in the Variation Request with the Panel, it would be more appropriate that this occur by way of a separate application.

- King's Currency also made a preliminary submission, submitting (among other things):

- matters to the effect of those submitted by John Bridgeman in paragraphs 27(a) and 27(b)

- that variations to the Services Agreement (including the Variation Deed) were negotiated, agreed and authorised by the King's Currency directors and, to the knowledge of King's Currency, negotiated, agreed and appropriately authorised by Benjamin Hornigold, and then subsequently documented and

- as a consequence of the Variation Deed, the foreign currency banknotes the subject of the Services Agreement were not returnable until 12 November 2019.

- Before deciding how to proceed with the Variation Request, we invited Benjamin Hornigold to indicate whether it intended to make a new application for a declaration and orders under s657C12 (to be potentially considered at the same time as the Variation Request under Regulation 16 of the Australian Securities and Investments Commission Regulations 2001 (Cth)). It responded in the affirmative. John Bridgeman confirmed that it intended to lodge its own application in relation to the affairs of Benjamin Hornigold.

Benjamin Hornigold's Application

Declaration sought

- By application dated 8 August 2019, Benjamin Hornigold sought a declaration of unacceptable circumstances in relation to the affairs of Benjamin Hornigold (BHD Application). Benjamin Hornigold submitted (among other things) that:

- John Bridgeman and Benjamin Hornigold have circumvented the effect of the Repayment Order, which interferes with the efficiency and competitiveness of the market

- the Variation Deed in effect diminished the value of material assets of Benjamin Hornigold by locking-up approximately $7.12 million in cash (being the total amount of foreign currency banknotes placed by Benjamin Hornigold with King's Currency pursuant to the Services Agreement). Together, the placement of foreign currency banknotes and the Variation Deed made Benjamin Hornigold a less attractive acquisition target (and in turn made it less likely to attract competing proposals), which interferes with the efficiency and competitiveness of the market and

- the withdrawal of the opinion in the IER was a material development and that Benjamin Hornigold shareholders have not been given enough information to enable them to assess the merits of the proposal such that shareholders that have already accepted the 2019 Bid should be entitled to withdraw their acceptance.

Final orders sought

- Benjamin Hornigold sought final orders including:

- reversing the foreign currency transactions between Benjamin Hornigold and King's Currency described in paragraphs 69 and 71 and that $4.59 million be paid to Benjamin Hornigold

- declaring the Variation Deed to be void and

- offering withdrawal rights to Benjamin Hornigold shareholders that have accepted the 2019 Bid.

Preliminary submissions

- John Bridgeman made a preliminary submission in relation to the BHD Application, submitting (among other things) that:

- John Bridgeman was not a party to the relevant commercial transactions between Benjamin Hornigold and King's Currency

- Benjamin Hornigold has not been deprived of a 'crown jewel' given that the foreign currency banknotes constitute an investment which is consistent with the investment mandate of Benjamin Hornigold as a listed investment company

- the Variation Deed does not operate in a manner which affects the value of Benjamin Hornigold and the extension of the maturity date of the foreign currency banknotes does not alter the substance of the assets held by Benjamin Hornigold and

- it is the obligation of Benjamin Hornigold (as the target in relation to the 2019 Bid) and not John Bridgeman to procure the independent expert's report for the target's statement.

John Bridgeman's Application

Declaration sought

- By application also dated 8 August 2019, John Bridgeman sought a declaration of unacceptable circumstances in relation to the affairs of Benjamin Hornigold (JBL Application). John Bridgeman submitted that:

- the withdrawal of the opinion in the IER caused Benjamin Hornigold's target's statement (as supplemented by the Supplementary Target's Statement) to contravene s640 and

- the Supplementary Target's Statement does not include all of the information that Benjamin Hornigold shareholders and their professional advisers would require to make an informed assessment as to whether or not to accept the 2019 Bid.

- John Bridgeman submitted that the effect of the circumstances was that:

- Benjamin Hornigold shareholders did not have sufficient information to enable them to assess the merits of the 2019 Bid in light of the change of the Benjamin Hornigold directors' recommendation on 23 July 2019 (see paragraph 22) and

- Benjamin Hornigold has omitted material from the Supplementary Target's Statement,

Interim order sought

- John Bridgeman sought an interim order to the effect that the directors of Benjamin Hornigold release to the market a recommendation that BHD shareholders 'take no action' in respect of the 2019 Bid,13 and make no further recommendation pending determination of the JBL Application.

- On 16 August 2019, we decided not to make the interim orders sought by John Bridgeman because (among other things) we were satisfied that any unacceptable circumstances could be adequately remedied by final relief.14

Final orders sought

- John Bridgeman sought final orders to the effect that Benjamin Hornigold:

- commission a supplementary independent expert's report which addresses whether, in the opinion of the expert, the 2019 Bid is 'fair and reasonable' and

- provide a supplementary target's statement which contains the recommendation of the directors of Benjamin Hornigold in relation to the 2019 Bid, having regard to the opinion of the expert and the supplementary independent expert's report referred to in paragraph 38(a).

Preliminary submissions

- Benjamin Hornigold made a preliminary submission in relation to the JBL Application, submitting (among other things) that:

- the alleged deficiencies in the Supplementary Target's Statement were not likely to mislead Benjamin Hornigold shareholders and that the level of information provided in the Supplementary Target's Statement was sufficient in the context in which the statements were made and

- Benjamin Hornigold was not in contravention of s640 by virtue of the independent expert withdrawing the opinion in the IER, as following the changes to the composition of the Benjamin Hornigold board on 12 June 2019, there ceased to be a common director on the boards of both John Bridgeman (as bidder) and Benjamin Hornigold (as target).

Discussion

- We have considered all the material, but address only specifically that part of the material we consider necessary to explain our reasoning.

Decision to make inquiries and conduct proceedings

- On reading the Variation Request, the BHD Application, the JBL Application, the preliminary submissions and accompanying material, we were concerned about:

- the circumstances in relation to the Foreign Currency Transactions and the execution of the Variation Deed (including John Bridgeman's involvement in those matters in its capacity as Benjamin Hornigold's investment manager)

- in relation to the withdrawal of the opinion in the IER, whether:

- this was a material development

- Benjamin Hornigold had provided sufficient guidance as to the value of Benjamin Hornigold15 and

- Benjamin Hornigold had contravened s640 and

- whether Benjamin Hornigold securityholders had all of the information in Benjamin Hornigold's target's statement (as supplemented by the Supplementary Target's Statement) that Benjamin Hornigold securityholders and their professional advisers would require to make an informed assessment as to whether or not to accept the 2019 Bid.

- We decided to make inquiries in relation to the Variation Request and conduct proceedings in relation to the BHD Application and JBL Application, and hear each of the matters together pursuant to Regulation 16 of the Australian Securities and Investments Commission Regulations 2001 (Cth).16

Lock-up device

John Bridgeman is responsible for making investment decisions for Benjamin Hornigold

- As part of our consideration of Benjamin Hornigold's investments in foreign currency banknotes, we considered John Bridgeman's role as investment manager and the particular circumstances leading to the decision to make the various investments.

- John Bridgeman is the exclusive investment manager for Benjamin Hornigold pursuant to the terms of a management services agreement dated 29 March 2017 and a services agreement dated 1 October 2016. John Bridgeman is also the investment manager for Henry Morgan and Bartholomew Roberts under agreements with those respective entities.

- Mr Stuart McAuliffe is the Managing Director and Chief Investment Officer of John Bridgeman. As CIO, Mr McAuliffe has the primary responsibility for the investment decisions of John Bridgeman, including investment decisions made in John Bridgeman's capacity as investment manager for Benjamin Hornigold.17

- The scope of the investment decisions John Bridgeman can make for Benjamin Hornigold in its capacity as investment manager is broad. For example, John Bridgeman submitted (among other things) that:

- "BHD's stated investment objective in its 2017 prospectus is to:

- seek to increase the value of the Portfolio by allocating capital to a limited number of investments in which the investment manager has the highest conviction;

- provide exposure to global markets as well as domestic listed and unlisted investment opportunities to which investors may not otherwise have access; and

- provide investors with moderate to high portfolio appreciation over the medium to long term."

- "BHD's investment strategy [as set out in its Investment Policy] was deliberately crafted to allow BHD to invest in a portfolio of investments which were not restricted by 'particular sectors, geographical regions, financial products or benchmarks. Instead, investment decisions will be based on the level of conviction [of the Investment Manager]'."

- "BHD's stated investment objective in its 2017 prospectus is to:

- In relation to the particular circumstances leading to John Bridgeman directing Benjamin Hornigold to make the Foreign Currency Transactions, John Bridgeman submitted that:

"As markets flattened during February, JBL determined to lower BHD's exposure and exit its positions in equity and currency markets. The positions were closed out, and profits were booked. Once the positions were closed, funds were returned to BHD's bank account with Saxo, which earned interest of between 0 – 1%. Excess cash in the Saxo account which was not required as margins for futures trading, was subsequently directed to BHD's bank account. It was then placed with King's Currency under the BHD Services Agreement to earn a more attractive return then [sic] would be earned if it were held as cash at bank. Stuart McAuliffe was not involved in decisions regarding the placement of the funds after closing out BHD's trading positions on-market."

- It is unclear from the above quote whether Mr McAuliffe was involved in the decision to make the Foreign Currency Transactions before "closing out BHD's trading positions on-market". In any event, as CIO of John Bridgeman, he remained responsible for the investment decisions made by John Bridgeman in relation to Benjamin Hornigold at a time during which he was a director of both John Bridgeman and Benjamin Hornigold, and was CEO of JB Financial Group (see paragraph 53).

- We are satisfied that the matters above and material provided during the course of proceedings supports an inference that John Bridgeman was responsible for and made Benjamin Hornigold's investment decisions, including the decisions to make the Foreign Currency Transactions.

John Bridgeman has influence over JB Financial Group and King's Currency

- Having reviewed the material, we became aware of the existence of shareholdings and common officers and employees (including Mr McAuliffe) across various interrelated entities (including John Bridgeman and Benjamin Hornigold). We were concerned that these relationships may give John Bridgeman control18 or influence over some of the interrelated entities, including in particular in relation to the JBFG Facility and Foreign Currency Transactions.

- In terms of various shareholdings across the interrelated entities, we note that as at 8 February 2019:

- Mr McAuliffe held a deemed 22.97% relevant interest in John Bridgeman,19 a 6.77% interest in BRL and a 8.92% interest in JB Financial Group

- John Bridgeman held a 11.07% interest in Henry Morgan,20 a 51.71% direct interest in Bartholomew Roberts and a 7.63% direct interest in JB Financial Group

- Henry Morgan held a 30.12% interest in Bartholomew Roberts and a 19.87% interest in JB Financial Group

- Bartholomew Roberts held a 32.86% interest in JB Financial Group and

- King's Currency was a wholly owned subsidiary of JB Financial Group.21

- In relation to JB Financial Group, ASIC submitted that it understood that "if the total number of directly held shares in JBFG by Mr McAuliffe, BRL, HML and JBL were voted together, it would represent 69% of the voting power in JBFG."

- The table below sets out common officers and employees (including Mr McAuliffe) across various interrelated entities during the period 8 February 2019 to 12 June 2019 (inclusive).22

JBL BHD HML BRL JBFG KC Stuart McAuliffe Managing Director CIO Executive Chairman23 Managing Director Director CEO N/A John McAuliffe Chairman N/A Director Director24 N/A N/A Ross Patane Director Director25 Director Director26 N/A N/A Peter Aardoom N/A Director27 N/A N/A Director Director Peter Ziegler N/A Director28 Director N/A N/A N/A James Stewart-Koster N/A N/A N/A N/A Compliance Officer (Group) CEO (Retail FX) CEO Rachel Weeks Chief Operating Officer N/A N/A N/A Chief Operating Officer N/A Jody Wright29 Company Secretary Company Secretary Company Secretary Company Secretary Company Secretary Director - We had some concerns in relation to whether these various relationships between the interrelated entities had some bearing on the JBFG Facility being provided to John Bridgeman on an unsecured basis (as noted in paragraphs 10 and 11, the JBFG Facility was used for repayment under the Repayment Order). We asked John Bridgeman and JB Financial Group to explain why the JBFG Facility was unsecured and asked all parties whether we should infer that John Bridgeman exercised some degree of control over JB Financial Group given the JBFG Facility was unsecured.

- In relation to why the JBFG Facility was unsecured, John Bridgeman submitted that:

"Initial negotiations between JBL and JBFG regarding the terms of the JBFG Facility included a discussion on whether or not JBL would be required to provide security for the loan facility.

Both parties obtained separate external advice on the terms of the proposed transaction, and made enquiries as to the commercial terms.

Following negotiations, it was determined that the interest rate on the JBFG Facility would be increased above the rate originally proposed, on the basis that the facility would be unsecured. If JBL were later to provide security for the facility, the rate would be revisited by both parties and potentially decreased depending on the circumstances at the time."

- John Bridgeman submitted that we should not draw anything or make any inferences in relation to control from the fact the JBFG Facility was unsecured on the basis that "JBFG required an increase to the interest rate initially proposed on the basis that the JBFG Facility was unsecured. If JBL had been able to exercise control over JBFG, the interest rate would not have increased."

- JB Financial Group submitted that the JBFG Facility was initially proposed to be provided on a secured basis, but following arm's length negotiations, John Bridgeman and JB Financial Group agreed an unsecured loan on the basis that "(a) JB Financial Group formed the view that the risk of default was low and (b) The facility would be subject to a higher interest rate."

- JB Financial Group also submitted that we should not draw any inferences in relation to control, submitting that:

"[The JBFG Facility] was the subject of robust negotiation between the parties and that the interest rate under the loan agreement between John Bridgeman and JB Financial Group was increased as the loan was unsecured. The fact that the loan is unsecured does not imply that John Bridgeman has exercised some degree of control over JBFG but merely indicates that the parties, through their negotiation, reached a commercial agreement as to those terms."

- John Bridgeman and JB Financial Group did not provide supporting material of the expert advice obtained on the terms of the JBFG Facility or material demonstrating that the JBFG Facility was subject to "robust negotiation".

- Benjamin Hornigold submitted that "the fact that the JBFG Facility was unsecured is indicative of JBL having a controlling influence over JBFG" and accordingly we should draw an inference that John Bridgeman exercised some degree of control over JB Financial Group having regard to the financial situation of John Bridgeman and JB Financial Group at the time, noting (among other things) that:

- "JBFG loaned funds to JBL at a time and in circumstances where both JBL and JBFG's ongoing financial viability appeared questionable. Indeed, the Panel noted the uncertainty regarding the financial position of both JBL and JBFG in its decision in Benjamin Hornigold Limited 02 and Henry Morgan Limited 02 [2019] ATP 1 and is something that was taken into account in the Panel's deliberations in those proceedings."

- John Bridgeman's financial report for the half year ended 31 December 2018 highlighted uncertainty as to the ability of John Bridgeman and JB Financial Group to operate as a going concern for the second consecutive reporting period, a matter that was noted in the IER (we note that the accounts of JB Financial Group and King's Currency30 are consolidated into John Bridgeman's group accounts).

- ASIC submitted that it is open to us to infer that John Bridgeman exercised some degree of control over JB Financial Group on the basis that the JBFG Facility was unsecured, also submitting (among other things) that the unsecured loan should be examined in its context, including in particular having regard to:

- "…funds that had been earmarked to expand the business of King's Currency appear to have been lent to JBL on an unsecured basis" and

- "…at the time of the discussions referred to by JBL and JBFG [see paragraphs 55 and 58], JBL's auditor had recently identified material uncertainty about [JBL's] ability to continue as a going concern and the agreement struck needs to be examined in this context."

- We consider that:

- the various relationships existing between the interrelated entities31 (including that the aggregate direct holdings of Mr McAuliffe, John Bridgeman, Bartholomew Roberts and Henry Morgan represent 69% of JB Financial Group) and

- the fact the JBFG Facility was provided on an unsecured basis at a time during which there was uncertainty as to the ability of John Bridgeman and JB Financial Group to operate as a going concern,

- We did not consider it necessary to determine whether John Bridgeman controlled JB Financial Group or King's Currency in finding that the circumstances in relation to Benjamin Hornigold are unacceptable.

Circumstances in relation to the Foreign Currency Transactions and execution of the Variation Deed

- Based on the material provided during the proceedings, we were concerned about the following circumstances in relation to the Foreign Currency Transactions and the execution of the Variation Deed which are depicted in the diagram below (Diagram).

- On 3 December 2018, JB Financial Group placed approximately $5.43 million32 in foreign currency banknotes with King's Currency (see item [1] in the Diagram).33

- As noted in paragraph 7, the Panel made the Repayment Order on 8 February 2019 (see item [2] in the Diagram).

- On 28 February 2019, John Bridgeman directed Benjamin Hornigold to place $350,000 of foreign currency banknotes with King's Currency34 for management and on- trading pursuant to the Services Agreement (see item [3] in the Diagram). Under the terms of the Services Agreement in effect at the time, Benjamin Hornigold was to receive a return of 5.0% per annum on the capital value of the banknotes. The placement by Benjamin Hornigold on 28 February 2019 increased the total amount of physical foreign currency banknotes placed with King's Currency to approximately $1.95 million.

- Through a series of transactions completed by early March 2019, JB Financial Group fully recalled all of the $5.43 million of foreign currency banknotes it had placed with King's Currency in December 2018 (see item [4] in the Diagram).35

- On 6 March 2019 (the day that JB Financial Group provided the JBFG Facility, see item [5] in the diagram above), John Bridgeman directed Benjamin Hornigold to place $2.1 million of foreign currency banknotes with King's Currency (see item [6] in the Diagram), increasing the total amount placed by Benjamin Hornigold with King's Currency to approximately $4.0 million.

- As noted in paragraphs 10 and 11, John Bridgeman drew down $4.5 million of the JBFG Facility in two tranches on 7 March 2019 and 8 March 2019 (see items [7.1] and [7.2] in the Diagram) and made the repayment of principal due under the Repayment Order in two tranches on 7 March 2019 and 8 March 2019 (see items [7.3] and [7.4] in the Diagram).

- Through a series of transactions between 7 March 2019 and 27 March 2019, John Bridgeman directed Benjamin Hornigold to place an additional $2.49 million of foreign currency banknotes with King's Currency (see item [8] in the Diagram), increasing the total amount placed by Benjamin Hornigold in foreign currency banknotes with King's Currency to approximately $6.49 million by 27 March 2019. The amounts placed between 6 March 2019 (see paragraph 69) and 27 March 2019 totalled $4.59 million.

- Through a series of additional foreign currency transactions occurring after 27 March 2019, the balance of the total amount Benjamin Hornigold was directed by John Bridgeman to place in foreign currency banknotes with King's Currency increased to approximately $7.12 million as at 31 May 2019 (see item [9] in the Diagram). The total amount placed by Benjamin Hornigold with King's Currency after the date of the Repayment Order was approximately $5.46 million (paragraphs 67, 69, 71 and this paragraph 72).

- On 6 June 2019, King's Currency sent a letter to Benjamin Hornigold requesting that amendments be made to the Services Agreement (Request Letter). The Request Letter stated that "King's is in the process of establishing an external financial facility with a bank or non-bank institution to supply funds for physical banknote trading" and requested the following amendments "to provide King's Currency with sufficient time to finalise the establishment of the facility":

- Increase the minimum return to Benjamin Hornigold of the capital value of the banknotes to 9.65% per annum (from 5.0% per annum).

- Extend the period of notice for the return of the banknotes from 30 days to 8 months.

- Extend the term of the agreement to 21 February 2021.

- The Request Letter was considered at Benjamin Hornigold board meetings held on 6 June 2019, 7 June 2019 and at 7:00am (Brisbane time) on 12 June 2019. Amendments to the Services Agreement were approved at the board meeting on 12 June 2019 and the Variation Deed was executed by Benjamin Hornigold and King's Currency later on 12 June 2019 (see item [10] in the Diagram) to:

- increase the minimum return to Benjamin Hornigold to 9.65% per annum and

- provide that, notwithstanding any other provision of the Services Agreement (including the termination provisions and the 30 day notice period for the return of the banknotes), all banknotes placed by Benjamin Hornigold were not returnable until 12 November 2019.

- At a second board meeting of Benjamin Hornigold convened at 7:30pm (Brisbane time) on 12 June 2019, all of the directors of Benjamin Hornigold and the company secretary resigned (effective 7:45pm), and three new directors were appointed. As noted in paragraph 18, John Bridgeman freed the 2019 Bid from all defeating conditions on 12 June 2019.

The Foreign Currency Transactions and Variation Deed effectively replaced the JBL Loan subject of the Repayment Order

- In the BHD Application, Benjamin Hornigold submitted (among other things) that:

"Whilst the JBL Loan was repaid to BHD, BHD concurrently purchased from King's Currency foreign currency banknotes of almost the exact same value as the JBL Loan.

The net effect of this transaction and the timing of the purchases meant that BHD was again deprived of the 'cash at bank' represented by the Orders [made in Benjamin Hornigold Limited 02] and placed BHD shareholders in effectively the same position as when that money had been tied up in the JBL Loan.

…

[I]t appears that the decision to purchase the bank notes between 6 and 27 March 2019 was an attempt by the directors of BHD at that time, which had strong connections to various JBL and various JBL controlled entities, to circumvent the Orders [made in Benjamin Hornigold Limited 02] as part of an arrangement to (a) continue to deprive BHD of the benefit of the $4.5 million 'cash at bank'; and (b) keep those funds deployed within an entity control [sic] by JBL and for the benefit of JBL..."

- As noted in paragraph 71, the total amount of foreign currency banknotes placed between 6 March 2019 and 27 March 2019 totalled $4.59 million (ie items [6] and [8] in the Diagram). In its Variation Request, Benjamin Hornigold submitted that the total amount owing to Benjamin Hornigold under the Repayment Order was $4.50 million in principal (ie items [7.3] and [7.4] in the Diagram) plus approximately $94,000.00 interest (ie approximately $4.594 million in total). We were concerned about the similarity between these amounts and asked the parties if there was anything that we should draw or infer from this.

- John Bridgeman submitted that it did not believe there is anything untoward in the Foreign Currency Transactions, submitting that each transaction was a completely separate arrangement between Benjamin Hornigold and King's Currency which was commercially rational and on terms which were fair in the circumstances. John Bridgeman also submitted that the dates of 6 March 2019 and 27 March 2019 appeared to have been intentionally selected by Benjamin Hornigold to make the amounts appear similar, when in fact there were a number of transactions that occurred on either side of these dates (see for example paragraphs 67 and 72).36

- JB Financial Group and King's Currency made a joint submission that we should not draw or infer anything, submitting that Benjamin Hornigold's investment in the foreign currency banknotes was on commercial terms and consistent with its mandate as a listed investment company and that any amounts owing and repaid as between Benjamin Hornigold and John Bridgeman do not concern King's Currency or JB Financial Group.

- Given the similarities between the amounts described in paragraph 77, we asked the parties whether certain of the transactions in paragraphs 65 to 74 effectively replaced the JBL Loan that was subject of the Repayment Order as submitted by Benjamin Hornigold.

- John Bridgeman submitted (among other things) that "JBL fails to understand how these transactions could be interpreted as replacing another entirely separate transaction being a repayment arrangement between JBL and BHD for $4.5 million. The parties to each of these transactions, and the commercial rationale for each of these transactions, are separate and distinct." JB Financial Group and King's Currency made similar submissions, stating that they "view the transactions to which they are a party as independent and separate commercial transactions, completely disconnected from any Takeovers Panel orders."

- We acknowledge that King's Currency was not a party to the JBL Loan and that John Bridgeman was not a party to the Foreign Currency Transactions37 or the Variation Deed. However, these matters do not have any bearing on the effect of those transactions (individually and in conjunction).

- As noted above we infer (at paragraph 49) that John Bridgeman was responsible for and made Benjamin Hornigold's investment decisions, including the decisions to direct Benjamin Hornigold to make the Foreign Currency Transactions (at paragraph 62) and that John Bridgeman had (and continues to have) influence over JB Financial Group and King's Currency. In light of this and the similar amounts involved, we also infer that in effect the approximately $5.46 million in foreign currency banknotes placed by Benjamin Hornigold with King's Currency after the date of the Repayment Order (see paragraph 72) in effect replaced the JBL Loan the subject of the Repayment Order.

- In addition to our concerns with the similarities between the amounts described in paragraph 77, we also note that the $5.46 million of foreign currency banknotes placed by Benjamin Hornigold with King's Currency after the Repayment Order (see paragraph 72 and items [3], [6], [8] and [9] in the Diagram) closely resembles the $5.43 million of foreign currency banknotes placed by JB Financial Group with King's Currency which were placed in December 2018 and fully recalled by March 2019 (see paragraphs 65 and 68 and items [1] and [4] in the Diagram).

- Having reviewed the terms of the Services Agreement, we were also concerned about the nature of the agreement and the effect of the Variation Deed.

- Clause 2.1(e)(ii) of the Services Agreement provides that:

- banknotes provided by Benjamin Hornigold to King's Currency remain the property of Benjamin Hornigold38

- Benjamin Hornigold will bear any exchange gain or loss on the currency mix in the parcel of banknotes provided and

- if King's Currency through trading activities is exposed to exchange rate variations in different currencies that variation is for the account of King's Currency.

- Item 4 of the Schedule to the Services Agreement (as executed on 21 February 2018) provided in effect that:

- King's Currency will manage and on-trade the banknotes in such a way to generate a return to Benjamin Hornigold of 9.0% of the capital value of the banknotes

- in consideration for its services, King's Currency will be entitled to be paid an amount equal in value to the return on capital generated on the banknotes in excess of 9.0% and

- if King's Currency does not generate a return of at least 9.0% on the capital value of the banknotes, it is not entitled to be paid any fees for services and instead, it must pay Benjamin Hornigold an amount to ensure that Benjamin Hornigold receives a minimum of 9.0%.

- The Services Agreement was amended by variation deeds on:

- 31 July 2018 to reduce the rate of return from 9.0% to 5.0%

- 17 September 2018 to extend the term by a further 24 months and

- 12 June 2019 (ie the Variation Deed) to (among other things) increase the rate of return to 9.65% and in effect extend the term for the return of foreign currency banknotes from 30 days' to 12 November 2019 (see paragraph 74).

- In our view, the terms of the Services Agreement summarised in paragraphs 86 and 87 (as amended by the variation deeds in paragraph 88) operated such that:

- Benjamin Hornigold was entitled to a specified rate of return at the same time it was exposed to any exchange gain or loss on the parcel of banknotes it provided to King's Currency

- King's Currency was entitled to "on-trade" the banknotes in its business, by which means Benjamin Hornigold's property in the banknotes might be lost, in which event its rights against King's Currency would be contractual and not proprietary and

- King's Currency was entitled to any amount generated in excess of the specified return (if any).

- We consider that the Services Agreement and the placement of foreign currency banknotes under that agreement may have in effect operated as an unsecured loan39 by Benjamin Hornigold to King's Currency:

- prior to the execution of the Variation Deed, given the unlikelihood that the banknotes would be called on 30 days' notice due to John Bridgeman's role as investment manager for Benjamin Hornigold and its influence over JB Financial Group and King's Currency (see also paragraphs 116 to 118) and

- upon the execution of the Variation Deed, pursuant to the extension of the term for the return of the foreign currency banknotes (noting that King's Currency's Request Letter requested the extension while it established an external financing facility).

- The fact that Benjamin Hornigold was exposed to the currency risk without any security over the banknotes is of concern given King's Currency's obligation described in paragraph 87(c) to pay a minimum return to Benjamin Hornigold (which happens to be equal to the maximum return).

- For the reasons above, we are satisfied that, in relation to the affairs of Benjamin Hornigold and in the context of the 2019 Bid, the Foreign Currency Transactions and the Variation Deed in effect replaced the JBL Loan that was subject of the Repayment Order.

The Foreign Currency Transactions and Variation Deed diminished the value of a material and important asset of BHD and made it less attractive to a potential acquirer and less likely to attract competing proposals to the 2019 Bid

- Benjamin Hornigold submitted in effect that the placement of foreign currency banknotes and the Variation Deed had the effect of depriving Benjamin Hornigold of approximately $7.12 million (see paragraph 72) in cash at bank which was (and is) a material and valuable asset of Benjamin Hornigold (representing approximately 57% of its total net assets) which is not available to Benjamin Hornigold.

- Further, Benjamin Hornigold submitted that the execution of the Variation Deed increased the total of Benjamin Hornigold's net assets that were invested in illiquid investments to 94% (of which approximately $7.12 million related to the foreign currency banknotes placed with King's Currency), at a time when Benjamin Hornigold had less than $100,000 in working capital and less than $250,000 in other liquid assets. Benjamin Hornigold submitted that this is contrary to its 2017 prospectus which described Benjamin Hornigold's investment objectives in terms of being "able to realise at least 90% of its portfolio assets under normal market conditions at the value ascribed to those assets within five trading days."

- We are satisfied that the foreign currency banknotes placed by Benjamin Hornigold with King's Currency, consisting of 57% of Benjamin Hornigold's total net assets, is a material asset to Benjamin Hornigold.

- Benjamin Hornigold's 2017 prospectus provides that the portfolio construction of Benjamin Hornigold provides (among other things) for the following allocation ranges:

- foreign exchange contracts: 20% to 80% and

- global exchange traded futures contracts including equity market indicies, currency and interest rate futures: 10% to 85%.

- It is not clear to us that the services provided by King's Currency under the Services Agreement constitute foreign exchange contracts. Even if they did, an investment of 57% of Benjamin Hornigold's total net assets in foreign currency banknotes managed and on-traded pursuant to the Services Agreement would likely give rise to significant concentration risk which, in addition to the unsecured nature and illiquidity of this investment, would need to be reflected in the expected return.

- Benjamin Hornigold submitted that in the context of the 2019 Bid the effect of the transactions was "to diminish the value of a material and important asset of BHD, rendering BHD a less attractive acquisition target and making it less likely to attract competing proposals from potential acquirers (and as a result diminish the value of BHD if shareholders do not accept the bid), in effect operating as a lock up device that materially diminished the value of BHD."

- John Bridgeman disputed that the transactions had the effect of diminishing the value of Benjamin Hornigold (and correspondingly of producing the necessary coercive or anti-competitive effect for the arrangements to constitute a lock-up device), submitting that:

"Any argument to the contrary appears to be predicated upon an assumption that cash at bank is of greater value to BHD than the return being generated by BHD on the current transaction. JBL notes that a $5.43 million cash deposit with Westpac fixed for 12 months, with interest paid annually, would attract an interest rate of 1.55% and interest earned over that 12 month period would be $84,165. JBL notes that this observably would be of significantly less benefit to BHD than the certainty of a 9.65% per annum return over the balance of the repayment term of the foreign banknotes, which would return $523,995. This is more than six times larger return than cash at bank."

- Indeed, John Bridgeman submitted that "[r]ather than 'locking up' BHD, JBL is of the view that the arrangement should make BHD attractive to a potential competing bid."

- We accept that an investment of 57% of total net assets in cash at bank and a deposit of foreign currency banknotes on the terms of the Services Agreement as varied are very different investments. The returns under the latter may be greater. However the risks are also very materially greater, and the liquidity effects are starkly different. Taking those matters into account our experience would suggest that the rate of return under the Services Agreement (as amended) is likely below market.40 Certainly, neither King's Currency nor John Bridgeman attempted, whether by evidence or argument, to support a finding that when allowance was made for risk and liquidity the return was adequate. And they were best placed to do so, given that King's Currency was in the business of trading with foreign currency banknotes and the original investment was at the insistence of John Bridgeman as Benjamin Hornigold's investment manager.

- In the circumstances of the matters before us, we are satisfied that in the context of the 2019 Bid the differences to which we have referred have a negative impact on the value of Benjamin Hornigold, in particular to a potential competing bidder.

- ASIC questioned the relevance of John Bridgeman's submission comparing the rates of return under the Services Agreement (as amended by the Variation Deed) and a fixed cash deposit with Westpac, submitting that "it is unlikely investors would consider an investment in a low-interest bank term deposit as an appropriate investment alternative to be pursued by a listed investment company given that investors could invest in a term deposit themselves (and without having to pay management fees)."

- We agree with ASIC. We also consider that the risk profile of the two investments is significantly different (noting that despite the Services Agreement specifying a rate of return, Benjamin Hornigold remains the bearer of the foreign currency risk, see paragraph 86).

- For the reasons above, we consider that the value of Benjamin Hornigold was diminished by the Foreign Currency Transactions and the amendments under the Variation Deed (individually and in conjunction) because:

- the investment in foreign currency banknotes deprived Benjamin Hornigold of a material asset (see paragraph 95), placing the asset with an entity that John Bridgeman had influence over (see paragraph 62)

- the amendments made under the Variation Deed resulted in approximately 94% of Benjamin Hornigold's net assets being in illiquid investments, including 57% of Benjamin Hornigold's net assets being concentrated in foreign currency banknotes placed with King's Currency (see paragraphs 94 and 97) and

- the rate of return under the Services Agreement (as amended) was, in the circumstances, likely to be inadequate when allowance is made for risk and liquidity effects (see paragraph 101).

- We disagree with John Bridgeman's submission that the transactions made Benjamin Hornigold a more attractive target to potential bidders. Drawing on our experience, we consider that the matters in paragraph 105 had the effect of rendering Benjamin Hornigold a less attractive acquisition target and making it less likely to attract competing proposals to the 2019 Bid from potential acquirers.

- In light of our inference (at paragraph 62) that John Bridgeman had (and continues to have) influence over JB Financial Group and King's Currency, we also have concerns in relation to whether the Foreign Currency Transactions occurred, and the Variation Deed was negotiated, on an arm's length basis. We would have determined the circumstances in relation to Benjamin Hornigold are unacceptable whatever our view on this question. However, we are satisfied that the Foreign Currency Transactions and the negotiations were not relevantly at arm's length.

- In ACI Operations Pty Ltd v Berri Ltd (2005) 15 VR 312 at [233] Dodds-Streeton J summarised the effect of the authorities as follows:

[A]n arm's length relationship is that of strangers, or parties who are unaffected by existing mutual duties, liabilities, obligations, cross-ownership of assets, or identity of interests which might: (a) enable either party to influence or control the other; or (b) induce either party to serve that common interest in such a way as to modify the terms on which strangers would deal.

Having regard to the network of shareholdings, office holding and contractual relationships discussed above, in our view the relevant Foreign Currency Transactions and negotiations could not be described as "arm's length".

- In addition, we are not aware of any safeguards as to conflicts that were put in place (other than a due diligence committee established by the Benjamin Hornigold board in relation to the 2019 Bid) and no material was provided in relation to expert advice that was obtained in relation to the transactions (see paragraph 59). However, we were provided material that demonstrated Benjamin Hornigold had received legal advice on 10 June 2019 that "BHD could inadvertently be creating unacceptable circumstances" in relation to a transaction discussed in paragraph 133.

The Foreign Currency Transactions and Variation Deed operated as a lock-up device

- Guidance Note 7: Lock-up devices (last updated in February 2010)provides at [1] to [2] (footnotes omitted):

This guidance note has been prepared to assist market participants understand the Panel's approach to lock-up devices. It applies in control transactions, including takeovers. For convenience, the terms 'bid', 'bidder' and 'target' are used. The types of lock-up devices addressed might also be referred to as 'deal protection' measures.

The principles discussed in the note are of general application and can be applied to any arrangement which has the effect of fettering the actions of a target, a bidder or a substantial shareholder.

- We consider that in the peculiar circumstances of the matter (in particular, the relationships between the interrelated entities and the influence of John Bridgeman in relation to those transactions), Guidance Note 7 is relevant to our consideration of whether the arrangements constitute a 'lock-up device'41. While lock-up devices are not unacceptable as such, they may deter rival bidders.42

- To guide the Panel in considering whether an 'asset lock-up'43 agreement gives rise to unacceptable circumstances, Guidance Note 7 sets out at [32] a number of factors for the Panel to have regard to. These factors include:

- the commercial reason for it

- the size or strategic value of the asset involved

- whether the agreement was negotiated on an arms-length basis

- the safeguards in place

- whether the agreement is at a fair price. This includes whether any expert advice or sufficient evidence was obtained by the target on the appropriateness of any fixed price, or price formula, in the agreement

- its effect on the amount of, or distribution of benefits to, shareholders in the target in connection with the takeover and

- the timing of entry into the agreement and the length of the lock-up.

- We discuss each of the above factors in relation to the Foreign Currency Transactions and the amendments made in the Variation Deed below, having considered the factors in an objective manner with a focus on the effect of the alleged lock-up device.

- In terms of John Bridgeman's commercial reasons for the transactions, we note that John Bridgeman explained, in relation to its role and involvement in the transactions, that:

"BHD received unexpected expedited repayment of $4.5 million plus interest from JBL in early March 2019 [ie the amount repaid under the Repayment Order]. Under the terms of the [management services agreement], JBL as investment manager has an obligation to invest BHD's funds in such a way as to provide an appropriate return to BHD. Given anticipated market volatility at the time, JBL directed BHD's excess cash into physical banknotes with King's Currency to reduce its market exposure and generate a more certain and higher return for BHD than could be achieved onmarket in the short-term or if held as cash at bank.

JBL's role, as BHD's investment manager, extended to the original decision to invest in foreign currency banknotes from time to time in accordance with the terms of the Services Agreement between King's Currency and BHD. It was otherwise not part of any decision-making process regarding the amendments to the Services Agreement in June 2019."

- In terms of the size or strategic value of the asset involved, we are satisfied that the foreign currency banknotes are a material asset (consisting of approximately 57% of Benjamin Hornigold's total net assets).44 In addition, we consider the fact that, as a result of the investment and Variation Deed, approximately 94% of Benjamin Hornigold's net assets were in illiquid investments,45 is strategically significant in the context of the 2019 Bid.

- King's Currency made submissions in effect that over the past 19 months it had placed reliance on the terms of the Services Agreement and that if foreign currency banknotes were called to be returned in a single tranche by one client, there was a risk that this "would decrease the company's capital, thereby slowing down its business plans and impacting its business performance." Given that banknotes provided by Benjamin Hornigold under the Services Agreement were to remain the property of Benjamin Hornigold and were to be on-traded by King's Currency to generate a return to Benjamin Hornigold (see paragraphs 86 and 87), we have concerns as to how King's Currency may have been using (or planned to use) these banknotes if their recall could (in any material way) slow down King's Currency's business plans and impact its business performance.

- In addition, King's Currency submitted in effect that it sought the variations described in the Request Letter (see paragraph 73) in order to:

"(a) document what had historically been occurring and ensure that the banknotes placed with it would not be called in one tranche on 30 days' notice; and

(b) document a longer earliest date for return of the Banknotes (or foreign currency with an equal value of such Banknotes) to allow King's Currency/JB Financial Group time to negotiate and establish additional external finance arrangements to ensure that it had certainty around a funding line, rather than a more volatile trading arrangement as with BHD."

- We consider that King's Currency's submissions in relation to the unlikelihood that the banknotes would not be called in one tranche on 30 days' notice to be further evidence that the Services Agreement was in effect an illiquid investment that operated in effect as an unsecured loan prior to the execution of the Variation Deed (see also paragraph 90). This would likely reflect the circumstance that up to the date of execution of the Variation Deed, Benjamin Hornigold's board was not independent of John Bridgman. Thereafter, the Variation Deed cemented the de facto illiquidity of the investment by a contractual obligation that would survive the resignation of the board of Benjamin Hornigold that took place later the same day.

- In relation to the effect of the Foreign Currency Transactions and Variation Deed, we consider that they (individually and in conjunction):

- for the reasons in paragraphs 76 to 92, effectively replaced the JBL Loan to be repaid under the Repayment Order and

- for the reasons in paragraphs 93 to 106, rendered Benjamin Hornigold a less attractive acquisition target and made it less likely to attract competing proposals to the 2019 Bid from potential acquirers.

- In terms of timing in relation to the transactions, we note that:

- at least approximately $6.49 million of foreign currency banknotes had been placed by Benjamin Hornigold with King's Currency before John Bridgeman announced the 2019 Bid

- approximately $5.46 million was placed after the date of the Repayment Order and

- the Variation Deed executed by Benjamin Hornigold on 12 June 2019 significantly extended the illiquidity of the foreign currency investment from being returnable on 30 days' notice to not being returnable before five months (ie until 12 November 2019).

- John Bridgeman submitted (among other things) that the transactions do "not in any way restrict, fetter or inhibit any other bidder from making a competitive bid for shares in BHD" and that "[i]t is open for any other bidder to make a competing bid…" Even if the transactions do not restrict or fetter a competing bid per se, based on our experience we are satisfied that the effect of the transactions as described in paragraph 106 rendered Benjamin Hornigold a less attractive acquisition target and made it less likely to attract competing proposals to the 2019 Bid from potential acquirers. We consider that this is likely to have inhibited potential competing proposals to the 2019 Bid, preventing the acquisition of control of Benjamin Hornigold taking place in an efficient, competitive and informed market.

- John Bridgeman also submitted that the transactions have had no effect on the 2019 Bid, noting that it is the second bid that John Bridgeman has made for Benjamin Hornigold, and that no third party has made or announced a competing offer or indicated an interest to increase its holding in Benjamin Hornigold (including during the period between the lapse of the 2018 Bid and the announcement of the 2019 Bid). While this may be the case as a matter of fact, we do not consider this to be evidence that the transactions do not have the effect as described in paragraph 106 and it is of course possible that this effect is indeed precisely the reason that no competing proposal has been forthcoming. Further, ASIC disputed the notion that there has been no third party interest in Benjamin Hornigold, citing in its submissions an unsuccessful attempt to spill the board of Benjamin Hornigold under s249D by Ramcap Limited in early June 2019.

- For the reasons above, we are satisfied that (individually and in conjunction) the Foreign Currency Transactions and the Variation Deed diminished the value of a material and important asset of Benjamin Hornigold, making it less attractive to a potential acquirer and less likely to attract competing proposals to the 2019 Bid (and as a result, diminished the value of Benjamin Hornigold if securityholders do not accept the 2019 Bid), operating in effect as a lock-up device in relation to the affairs of Benjamin Hornigold.

Intentions and motivations

- Our conclusions that the Foreign Currency Transactions and the Variation Deed (individually and in conjunction) effectively replaced the JBL Loan that was the subject of the Repayment Order and operated as a lock-up device was drawn on the basis of what we determined to be the effect (or likely effect) of those transactions, and not what we determined or inferred to be the intentions or motivations of the relevant entities for those transactions.

- However, we did make a number of inquiries of the parties and certain non-parties in relation to the decision-making processes regarding the Foreign Currency Transactions and the execution of the Variation Deed, including the timing of those transactions which caused us concern (including in relation to the conduct of various officers of John Bridgeman and former officers of Benjamin Hornigold).

- In relation to the various placements of foreign currency banknotes with King's Currency, we note:

- the amounts placed in December 2018 and fully recalled by JB Financial Group by early March 2019 are remarkably similar to the amounts placed by Benjamin Hornigold after the Repayment Order (see paragraph 84)

- the amounts placed by Benjamin Hornigold between 6 March 2019 and 27 March 2019 and the amount ordered to be repaid under the Repayment Order are remarkably similar (see paragraph 77) and

- on the basis of the proximity of the Foreign Currency Transactions up to 27 March 2019 in relation to the authorisation of the preparation of a new bidder's statement on 1 April 2019, we infer that John Bridgeman was likely to have been contemplating making a new takeover bid at the same time as directing Benjamin Hornigold to place foreign currency banknotes with King's Currency (see paragraph 13).

- In relation to the execution of the Variation Deed on 12 June 2019, we note the proximity of:

- the evidence filed in the Court Proceeding and provided to the directors of Benjamin Hornigold on 3 June 2019

- the receipt of the Request Letter on 6 June 2019

- the Benjamin Hornigold board meetings held on 6 June 2019, 7 June 2019 and at 7:00am on 12 June 2019 at which (among other things) the Receipt Letter amendments to the Services Agreement were considered. Indeed, we note that while Mr McAuliffe abstained from voting, he remained present during the Benjamin Hornigold board meeting held on 12 June 2019 at which amendments to the Services Agreement were approved

- the resignation of Benjamin Hornigold directors and company secretary at 7:45pm on 12 June 2019

- the freeing of the 2019 Bid from all defeating conditions on 12 June 2019 and

- the scheduled date for the s249F Meeting (being 13 June 2019).

- The Panel has previously noted that it expects directors to comply with directors' statutory and fiduciary duties, but that the Panel's primary focus is to determine whether unacceptable circumstances have arisen, rather than whether those duties have been breached.46 In Strategic Minerals Corporation NL 02R, 03R, 04R and 05R, the Panel noted that "It is clear that breach of those duties can give rise to unacceptable circumstances, and there may be cases where the Panel needs to make a finding as to whether there has been a breach, even though that finding would not be conclusive." 47 While we made a number of inquiries in relation to these matters, we did not consider it necessary in this case to make such a finding as we were satisfied unacceptable circumstances had arisen regardless and any such finding (if made) would not make a difference to the orders we think appropriate.

- That said, having regard to the considerations in paragraphs 101 to 106 above, the timing of the transactions, their size, and the fact that relevant decisions and negotiations were not at arm's length, and the poverty of the justifications offered for them, we are satisfied that the Foreign Currency Transactions and the variation to the Services Agreement are not explained merely by ordinary commercial considerations for Benjamin Hornigold.

Policy implications

- In accordance with s657A(4), we provided an opportunity for submissions to be made in relation to a draft of the declaration in Annexure A.

- John Bridgeman submitted that the making of the declaration, on the basis that the foreign currency banknotes constitute a lock-up device, misconceives the nature of the role of an investment manager. John Bridgeman stated that:

"The foreign bank notes are an investment of BHD's funds – once returned, the funds will comprise part of BHD's investment portfolio which would be invested again by JBL in accordance with the management services agreement.

The making of the Declaration has the potential to give rise to the presumably unintended consequence that any decision made by any investment manager during the course of a takeover bid could constitute a lock-up device, which is inconsistent with the responsibilities of an investment manager and may stifle the legitimate commercial activities of both an investment manager and the portfolios which it manages."

- We disagree. The making of a declaration relates to the unacceptability of the particular circumstances of the matter before us (as set out in these reasons). We would expect John Bridgeman to have regard to the effect of any future investment of Benjamin Hornigold's funds made in accordance with the management services agreement. Indeed, we would also expect John Bridgeman to have regard to the influence that its involvement as investment manager of Benjamin Hornigold may have in relation to any future bid for Benjamin Hornigold securities and to manage any potential conflicts of interest and duty to ensure that investment decisions made in relation to Benjamin Hornigold do not operate as a lock-up.

Additional transactions

- Throughout the course of proceedings, material was made available in relation to additional transactions which Benjamin Hornigold submitted also form part of the lock-up device the subject of the declaration.

- As these matters were not raised by Benjamin Hornigold in the Variation Request or BHD Application, we make no findings in relation to these transactions.

Withdrawal of the opinion in the IER

- The BHD Application and JBL Application both sought declarations in relation to the withdrawal of the opinion of the IER (see paragraphs 31(c) and 34(a)). We discuss both of these matters together, firstly by considering whether a supplementary independent expert's report is required under s640 and secondly, by considering whether the withdrawal of the IER is a material development in the context of the 2019 Bid.

- Section 640 provides:

- If:

(a) the bidder's voting power in the target is 30% or more; or

(b) for a bidder who is, or includes, an individual--the bidder is a director of the target; or

(c) for a bidder who is, or includes, a body corporate--a director of the bidder is a director of the target;

a target's statement given in accordance with section 638 must include, or be accompanied by, a report by an expert that states whether, in the expert's opinion, the takeover offers are fair and reasonable and gives the reasons for forming that opinion.

- In determining whether the bidder's voting power in the target is 30% or more, calculate the bidder's voting power at the time the bidder's statement is sent to the target.

- An offence based on subsection (1) is an offence of strict liability.

- If:

- In the JBL Application, John Bridgeman submitted that:

"[A]s the Supplementary Target's Statement is to be read together with the original target's statement dated 30 May 2019 that it supplements, the withdrawal of the Expert's opinion by virtue of the Supplementary Target's Statement has the effect of causing the target's statement to contravene section 640. This is unacceptable as it constitutes a contravention of a provision of Chapter 6.

JBL acknowledges that as at the date of the Supplementary Target's Statement, no director of JBL was a director of BHD; however, JBL submits it is consistent with subsection 640(2) (regarding calculation of a bidder's voting power as at the date that a bidder's statement is sent to the target) to consider that if an independent expert report would be required as at the date that a bidder's statement is sent to the target, that requirement, with respect to a target's statement, is not displaced by a subsequent alteration to the board of the bidder or target."

- We asked the parties whether Benjamin Hornigold was required to provide a supplementary independent expert's report under s640.

- Citing the Panel in Sirtex Medical Limited [2003] ATP 22 at [65], Benjamin Hornigold submitted that "[t]he purpose of Section 640 of the Act is to address the risk or perceived risk that target directors will not provide a properly independent and critical target's statement, in certain cases where there are facts which are a danger to their independence, and to require an alternative assessment." We agree.

- In relation to the circumstances of the 2019 Bid, Benjamin Hornigold explained that:

"An independent expert's report was originally required in relation to the JBL offer owing to the existence at the time of the common directorship of Mr. Stuart McAuliffe on the boards of both JBL (as bidder) and BHD (as target). However, following the changes to the BHD board's composition on 12 June 2019, an independent expert's report was no longer required pursuant to s 640, as there ceased to be a common director on the boards of both JBL (as bidder) and BHD (as target). It is also contended that from 12 June 2019, the independence of the BHD board ceased to be an issue vis-à-vis the JBL offer."

- Further, Benjamin Hornigold disagreed with John Bridgeman's "suggestion that s640(2) supports an interpretation of s 640(1) such that a subsequent alteration of a target board would not displace the requirement for an independent expert's report where a common director existed at the date of the bidder's statement", submitting that:

"Section 640(2) deals with very different circumstances. Section 640(2) clearly and exclusively deals with the timing of the calculation of the bidder's voting power for the purpose of determining when an independent expert's report is required. It bears no relation to the common director trigger."

- We agree that an independent expert's report was no longer required under s640 once there ceased to be a common director on the boards of Benjamin Hornigold and John Bridgeman upon the resignation of the directors on 12 June 2019.

- In addition, we do not agree with John Bridgeman's submission that s640(2) or s646 (which provides that a supplementary target's statement is taken to be the original target's statement together with the supplementary statement) required an independent expert's report in relation to the 2019 Bid notwithstanding the resignation of Benjamin Hornigold directors on 12 June 2019. ASIC submitted that:

- "[s670C(2)] imposes an obligation on the expert to notify the target in writing if the expert becomes aware that during the bid period (a) a material statement made in the report is misleading or deceptive or (b) there has been a significant change affecting information included in the report" and

- "…once an expert report is prepared under s640 and is included in or accompanies a target statement given under s638, s670C(2) is the relevant provision governing any need for the expert to update its opinion or report."

- We agree with ASIC that s670C(2) provides the procedure to be followed in the circumstances, which we are satisfied was followed by the independent expert on 17 June 2019 (see paragraph 21) and 19 July 2019 (see paragraph 23).

- For the reasons above, we are not satisfied Benjamin Hornigold has contravened s640 or that the withdrawal of the IER was otherwise unacceptable.