[2018] ATP 18

Catchwords:

Tracing notices – failure to disclose – identity of substantial holders – substantial holdings – indirect self-acquisition – efficient, competitive and informed market – declaration – orders – extension of time – standing

Corporations Act 2001 (Cth), sections 12, 249D, 249F, 259C, 259D, 606, 608, 609, 610, 657B, 657C, 671C, 672A, 672B, 672F and 1314

ASIC Regulations 2001, regulation 13

ASX Listing Rules, Appendix 3Y

Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68, ASIC v Terra Industries Inc (1999) 31 ACSR 186

Guidance Note 4: Remedies General

Auris Minerals Limited [2018] ATP 7, Molopo Energy Limited 03R, 04R & 05R [2017] ATP 12, Molopo Energy Limited 01 & 02 [2017] ATP 10, Innate Immunotherapeutics Limited [2017] ATP 2, Merlin Diamonds Limited [2016] ATP 18, Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, Condor Blanco Mines Limited [2016] ATP 8, Brisbane Markets Limited [2016] ATP 3, The President’s Club Limited 02 [2016] ATP 1, Gondwana Resources Limited 02 [2014] ATP 15, Northern Iron Limited [2014] ATP 11, Azumah Resources Limited [2006] ATP 34, Rusina Mining NL [2006] ATP 13, Austral Coal Limited 03 [2005] ATP 14, Village Roadshow Limited 01 [2004] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| Yes | No | Yes | Yes | Yes | No |

Introduction

- The Panel, Chelsey Drake, Teresa Dyson and Christian Johnston (sitting President) made a declaration of unacceptable circumstances in relation to the affairs of Tribune Resources Limited. The application concerned the identity of persons who have a relevant interest in the shareholdings of Tribune shareholders who together hold approximately 60% of Tribune shares. The Panel declared the circumstances unacceptable because (among other things) the market has not been informed to a very significant degree, and over a lengthy period, as to the persons who have substantial interests in, or control of, Tribune and the extent of their holding.

- In these reasons, the following definitions apply.

- Applicant

- R Hedley Pty Ltd

- Lake Grace

- Lake Grace Exploration Pty Ltd

- Nimby WA

- Nimby WA Pty Ltd

- Northwest

- Northwest Capital Pty Ltd

- Rand

- Rand Mining Ltd (ASX: RND)

- Relevant Parties

- Tribune, Mr Anthony Billis, Ms Phanatchakorn Wichaikul, Ms Buasong Wichaikul, SGL, SGPL, Trans Global, Rand, Nimby WA, Lake Grace and Northwest

- Resource Capital

- Resource Capital Ltd (a company incorporated in the Seychelles)

- SGL

- Sierra Gold Ltd (a company incorporated in the Seychelles)

- SGPL

- Sierra Gold Pty Ltd

- Trans Global

- Trans Global Capital Ltd (a company incorporated in the Seychelles)

- Tribune

- Tribune Resources Ltd

Facts

- Tribune is an ASX listed company (ASX code: TBR). Its principal activities involve gold exploration, development and production involving its East Kundana Joint Venture tenements.

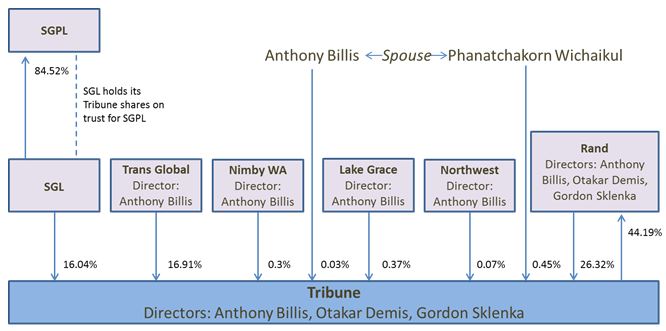

- Tribune’s directors are Messrs Anthony Billis, Otakar Demis and Gordon Sklenka. Tribune has the following major shareholders:

- SGL, with a shareholding of approximately 16.04% in Tribune.

- Trans Global, with a shareholding of approximately 16.91% in Tribune.

- Rand, with a shareholding of approximately 26.32% in Tribune.

- Tribune has a shareholding of approximately 44.19% of Rand and controls Rand.

- The Applicant is a Tribune shareholder. During the period from 25 May 2018 to 10 July 2018, the Applicant requested ASIC exercise its powers under s672A(1)1 to issue:

- tracing notices to SGL, Trans Global and Rand in relation to their shareholdings in Tribune2 and

- subsequently, tracing notices to SGPL and its shareholders,3 SGL and Ms Phanatchakorn Wichaikul, who were named in tracing notice responses from SGL, Trans Global and Rand as having a relevant interest in the Tribune shares held by SGL, Trans Global and Rand.

- ASIC received tracing notice responses from SGL, SGPL, Trans Global and Rand.

- ASIC did not receive responses to tracing notices issued to the shareholders of SGPL (other than Henley Point Pty Ltd4) and Ms Phanatchakorn Wichaikul. ASIC also did not receive a response to its further request to SGL. The same law firm acted in relation to all the responses received.

- Shareholdings and relevant relationships between relevant Tribune shareholders are shown in the following diagram:

Application

Declaration sought

- By application dated 20 August 2018, the Applicant sought a declaration of unacceptable circumstances. The Applicant submitted (among other things) that:

- the existing substantial holding notices lodged by SGL, Trans Global and Rand were defective

- there is a lack of clarity in relation to the identity of the ultimate controllers of the Tribune shares held by SGL and Trans Global

- various other persons have voting power in Tribune of more than 5% and had not lodged substantial holding notices identifying their interest and

- various persons identified as having voting power in Tribune of more than 5% have not taken any steps to remedy their failure to lodge accurate substantial holder notices, despite being advised by legal counsel in relation to their tracing notices responses.

- The Applicant submitted that the effect of the circumstances gave rise to a material failure to comply with the substantial holding and tracing notice provisions in Chapter 6C, resulting in:

- the trading of Tribune shares not taking place in an efficient, competitive and informed market and

- the holders of Tribune shares and the market in general not being aware, and continuing not to be aware, of the ultimate ownership or identities of persons who have acquired a substantial holding in Tribune.

Interim orders sought

- The Applicant sought interim orders restraining SGL, Trans Global and Rand from exercising any voting rights in relation to, or acquiring or disposing of any, Tribune shares, pending determination of its application. We decided to make an interim order that, without the consent of any member of the sitting Panel, each of the Tribune shareholders disclosed in the diagram above (and each of their respective associates) must not dispose of, transfer, charge or otherwise deal with any ordinary shares in Tribune in which they have a relevant interest (Annexure A).

Final orders sought

- The Applicant sought final orders to the effect that SGL, Trans Global and Rand (and any other persons identified as having voting power in Tribune of at least 5%) issue substantial holding notices in a form approved by the Panel and, in the event that any relevant individual fails to make such disclosure, that individual’s shares be vested in ASIC for sale.

Discussion

Introduction

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

- We conducted proceedings. Tribune, SGL and SGPL (combined submission), Trans Global and Mr Billis (combined submission) and Rand admitted that their responses to the ASIC tracing notices were incorrect.

- The submissions from Mr Billis and Trans Global (together with the submissions from SGL and SGPL) admitted that Mr Billis had a relevant interest in the Tribune shares held by him, SGL, Trans Global, Nimby WA, Lake Grace and Northwest, totalling 33.72%. SGL and Trans Global have held their interests in Tribune since 2008 when they acquired those shares from entities that appear to be related. Mr Billis’s relevant interest in these Tribune shares has not been disclosed in a substantial holder notice at any time.

- This admitted relevant interest means that Mr Billis also has a relevant interest in Rand’s 26.32% holding in Tribune, as a result of Tribune’s control of Rand and the operation of s608(3)(a) and (b), giving Mr Billis a relevant interest in at least 60.04% of Tribune shares. This has not been disclosed in a substantial holder notice at any time.

- We also consider that Mr Billis is associated with his wife, Ms Phanatchakorn Wichaikul, who has a relevant interest of 0.45% in Tribune - giving Mr Billis voting power of (at least) 60.49% in Tribune. It follows that Ms Phanatchakorn Wichaikul also has similar voting power in Tribune. This has also not been disclosed in a substantial holder notice. If this voting power can be exercised in practice, it would mean that Mr Billis and Ms Phanatchakorn Wichaikul have effective control over Tribune.

- Mr Billis also has a relevant interest in the Rand shares in which Tribune has a relevant interest by operation of s608(3)(a). Accordingly, Mr Billis has 44.19% voting power in Rand.

- It follows, in our view, based on facts that did not appear to be contested, that the market has been uninformed to a very significant degree, and over a lengthy period, as to the persons who have substantial interests in, or control of, Tribune and Rand.

- Our concerns relating to these significant contraventions of the substantial holding and tracing notice provisions are discussed in detail below.

Standing

- Trans Global and Mr Billis submitted that the Applicant did not have standing to make its application under s657C(2) because (in part) it had not identified any commercial interests underpinning its application or pointed to any fact or matter which suggested its interests were affected by the relevant circumstances alleged. Accordingly the Applicant stands in no different position “to other members of the relevant investing public who might be considering acquiring shares in Tribune”. They also submitted that the Applicant had acquired its shares at the time “after any relevant circumstances had arisen”.

- The Applicant submitted that it had a 0.7% shareholding in Tribune and that the circumstances complained of in its application clearly impact on its interests as a shareholder of Tribune. We agree that the Applicant has standing. The Applicant has held its shares for some time5 and is entitled to have assumed that substantial shareholders in Tribune were complying with Chapter 6C at the time it acquired its shares.

SGL and SGPL

- SGL lodged a substantial holder notice on 10 November 2009 in relation to its shareholding in Tribune. It did not disclose any other person who had a relevant interest in those shares.

- On 19 June 2018, SGL replied to an ASIC tracing notice disclosing, among other things, that:

- SGL holds its Tribune shares on trust for SGPL.

- The shareholders of SGPL, including SGL, have a relevant interest in SGL’s Tribune shares “by virtue of their shareholding in Sierra Gold Pty Ltd and as a result of the Shares being held on trust for Sierra Gold Pty Ltd”.

- To the best of SGL’s knowledge and recollection all instructions given to SGL in respect of the acquisition or disposal of its Tribune shares, the exercise of any voting or other rights attached to those shares or any other matter relating to those shares, “at all or any time during the period that SGL has been the registered legal owner of the Shares, has been given to SGL by the shareholders...of Sierra Gold Pty Ltd in accordance with the terms of Sierra Gold Pty Ltd’s constitution”.

- On 11 July 2018, SGPL replied to an ASIC tracing notice disclosing that:

- the 8,020,000 Tribune shares held by SGL are held as trustee on trust for SGPL and SGPL’s shareholders have a relevant interest in those shares

- the sole director of SGPL also has a relevant interest in the 8,020,000 Tribune shares held by SGL by virtue of his directorship.

- SGL and SGPL’s submissions admit that their responses to ASIC’s tracing notices were incorrect, stating the responses were prepared based on a misunderstanding of the relevant law, which “occurred primarily due to the relatively short period of time to respond to the tracing notices under s672B”. They also accepted “that the Form 603 filed on 10 November 2009 was inaccurate in several respects”. They submitted that the correct position was that:

- SGL is the registered owner of the 8,020,000 Tribune shares (SGL’s Tribune shares) but holds those shares as nominee and bare trustee for SGPL. There is no trust deed relating to this trustee arrangement. Under that trust, SGPL has an unconditional and enforceable right to call for the transfer of SGL’s Tribune shares and SGL cannot deal with them without the consent of SGPL. Therefore as a result of s609(2), SGPL has a relevant interest in SGL’s Tribune shares “as a beneficiary under the SGPL Trust” and SGL does not have a relevant interest in SGL’s Tribune shares.

- Ms Phanatchakorn Wichaikul “is the registered holder and beneficial owner of all the share capital of SGL” but does not have a relevant interest in SGL’s Tribune shares because SGL does not have a relevant interest in them.

- Mr Billis is the sole director of SGL.

- SGL holds 80.95% of the shares in SGPL as nominee and bare trustee for Mr Billis, accordingly Mr Billis has a relevant interest in SGL’s Tribune shares.

- Mr Billis submitted6 that he has a relevant interest in SGL’s Tribune shares and he did not rebut any of the submissions made by SGL and Sierra Gold Pty Ltd.

- We consider that the non-disclosure of a 16.04% relevant interest would of itself be material and lead to an uninformed market. In fact, as discussed elsewhere, here there has been non-disclosure of a 60.04% relevant interest.

Trans Global and Mr Billis

- Trans Global lodged a substantial holder notice on 9 April 2009 in relation to its shareholding in Tribune. It did not disclose any other person who had a relevant interest in those shares. Mr Billis’s Appendix 3Y dated 19 May 2016 disclosed he had an interest in 8,454,000 ordinary shares in Tribune in his capacity as a director of Trans Global.

- On 6 July 2018, Trans Global replied to an ASIC tracing notice disclosing, among other things, that Ms Phanatchakorn Wichaikul has a relevant interest in Trans Global’s shareholding in Tribune and Mr Billis was a director of Trans Global. Ms Phanatchakorn Wichaikul is Mr Billis’s wife.

- Trans Global and Mr Billis in their submissions stated that Trans Global’s tracing notice response inaccurately disclosed that Ms Phanatchakorn Wichaikul had a relevant interest in Trans Global’s shareholding in Tribune and submitted that:

- Trans Global held 4,454,000 Tribune shares “as nominee or bare trustee” for Mr Billis and held 4,000,000 Tribune shares “as nominee or bare trustee” for Ms Buasong Wichaikul.

- Mr Billis has a relevant interest in the Tribune shares held by Trans Global because Mr Billis is the sole director of Trans Global and “therefore has the power to exercise, or control the exercise, of the right to vote attached to the shares in Tribune held in the name of” Trans Global “and the power to dispose of, or control the exercise of a power to dispose of, those shares”.

- Ms Buasong Wichaikul has a relevant interest in 4,000,000 of the 8,454,000 shares in Tribune held by Trans Global.

- Trans Global and Mr Billis provided Trans Global’s Register of Members and Share Ledger which stated that:

- Trans Global and Mr Billis submitted that Mr Billis has a relevant interest in the Tribune shares held by Nimby WA, Lake Grace and Northwest because he is the sole director of these companies and therefore “has the power to exercise, or control the exercise, of the right to vote attached to the shares in Tribune held in the name of the Companies and the power to dispose of, or control the exercise of a power to dispose of, those shares”.7

- If the submissions above are accepted, Mr Billis has a relevant interest in Tribune of at least 33.72% through SGL, Trans Global, Nimby WA, Lake Grace, Northwest and his own holding. As noted above, this interest has not been disclosed in a substantial holding notice. Ms Buasong Wichaikul has also failed to disclose her 8% relevant interest in Tribune shares held by Trans Global in a substantial holder notice.

Rand

- Rand’s board is identical to Tribune’s board, comprising Messrs Anthony Billis, Otakar Demis and Gordon Alfred Sklenka.

- On 3 July 2018, Rand replied to an ASIC tracing notice disclosing, among other things, that each of Messrs Anthony Billis, Otakar Demis and Gordon Alfred Sklenka had a relevant interest in Rand’s Tribune shares “by virtue of their position as directors of Rand”. Rand in its submissions stated that its directors “do not in fact have a relevant interest in Rand’s shares in Tribune as disclosed in Rand’s tracing notice response”.

- Mr Billis and Trans Global submitted that Mr Billis does not have a relevant interest in any Tribune shares held by Rand. We consider that these submissions are incorrect, for the reasons discussed below.

- On or about 27 January 2010, Tribune increased its voting power in Rand from 20.51% to 43.85%. As a result s259D(1) applied requiring within 12 months from that time that either Rand cease to hold Tribune shares or Tribune cease to control Rand, unless ASIC provided an extension of time. Subsection 259D(3) also applied, and continues to apply, prohibiting Rand from exercising voting rights to its Tribune shares while Tribune controls Rand.

- On 24 December 2010, Tribune applied to ASIC for an extension of time under s259D(1). ASIC subsequently informed Tribune that it would not give an extension. Rand continues to be controlled by Tribune and holds 26.32% of Tribune shares.

- Rand submitted that it “accepts that the cross holding between Rand and Tribune is inconsistent with the provisions of sections 259C and 259D”. Tribune submitted that it agreed that it acquired and continues to hold a controlling interest in Rand in a manner inconsistent with s259D. Both parties acknowledge that s259D(3) operates8 so that Rand cannot vote its Tribune shares.

- Tribune submitted that it acknowledged that it had failed to formally disclose its relevant interest in Tribune in a substantial holder notice and advanced “no excuse for that failure”. However it submitted that the market was aware of Tribune’s acquisition of a controlling interest in Rand, and Rand’s interest in Tribune, noting that it had submitted substantial holder notices disclosing its interest in Rand.

- We consider that Tribune has a relevant interest in Rand’s 26.32% interest in Tribune shares by operation of s608(3)(a) and (b) and its failure to disclose this interest is more than a technical contravention. Disclosure of such an interest would assist the market in determining the control Tribune has over its own shares.

- As noted above, if the submissions of the parties are accepted, Mr Billis has a relevant interest of at least 33.72% in Tribune through his personal holding, SGL Trans Global, Nimby WA, Lake Grace and Northwest and, by operation of s608(3)(a) and (b), also has a relevant interest in Rand’s Tribune shares, resulting in Mr Billis having a total relevant interest of 60.04% in Tribune. When combined with Ms Phanatchakorn Wichaikul’s interest (see below), Mr Billis has voting power of 60.49% in Tribune. This significant interest has not been disclosed in a substantial holder notice and cannot be gleaned from other disclosures.

- Mr Billis also has a relevant interest in the Rand shares in which Tribune has a relevant interest by operation of s608(3)(a). Accordingly, Mr Billis has at least 44.19% voting power in Rand.

- ASIC submitted that the cross-shareholding between Tribune and Rand may constitute unacceptable circumstances due to the effect it has in relation to the control or potential control of Tribune in light of (i) the defensive effect of the cross-shareholding and its impact on persons who may seek to acquire control of or a substantial interest in Tribune, (ii) if the Tribune shares are being voted despite s259D(3), the impact this has on the ability of the Tribune board to influence voting in general meetings, and (iii) if the Tribune shares are not being voted, the impact this has on exacerbating the voting power of other Relevant Parties.

- We agree that the cross-shareholding has an effect on the control or potential control of Tribune and exacerbates the already unacceptable circumstances created by the undisclosed substantial interests. In addition, the market has been uninformed about whether Rand’s Tribune shares (26.32%) could be voted.

Resource Capital

- On 23 December 2010, Rand entered into an Option and Access Agreement with Resource Capital and Iron Resources Limited. Pursuant to the Option and Access Agreement, Resource Capital granted Rand the option to acquire all the issued shares in Iron Resources Limited. If Rand exercised the option, a share purchase agreement (attached to the Option and Access Agreement) would have full force and effect, which involved (among other things) Rand paying Resource Capital a deposit of 8,000,000 Tribune shares (approximately 16% of the Tribune shares on issue).

- Rand submitted that Resource Capital had a relevant interest in 8,000,000 Tribune shares (16%) by virtue of Resource Capital being a party to the Option and Access Agreement. Resource Capital has not lodged a substantial holder notice disclosing its interest in Tribune. Rand submitted that its only failure to disclose information in response to ASIC’s tracing notice was Resource Capital’s interest but considered that “this error was an honest mistake”. Rand submitted that following “a review of the acquisition opportunity the subject of the Option Agreement, Rand has determined that it wishes to terminate the Option Agreement as it will not be proceeding with the acquisition”. On 24 September 2018, Rand announced that the Option Agreement had fallen away and was no longer in effect.

Association and s606

- Mr Billis’s Appendix 3Y (director’s interest notice) dated 19 May 2016 disclosed that he had an interest in the shares held by Ms Phanatchakorn Wichaikul.

- The Applicant submitted that there were a number of factors which support an inference that Mr Billis and Ms Phanatchakorn Wichaikul are associates in relation to the affairs of Tribune.9 We consider that the following support such an inference:

- Their relationship as husband and wife. The Panel has previously considered spousal relationships as an indicator of association.10

- Mr Billis being the sole director of SGL, Trans Global and Lake Grace and Ms Phanatchakorn Wichaikul being the sole shareholder of those companies.

- The Option and Access Agreement between Rand, Resource Capital and Iron Resources Limited was signed by Mr Billis as a director of Resource Capital and Iron Resources Limited and by Ms Phanatchakorn Wichaikul as “Secretary/Director” of Resource Capital and Iron Resources Limited. Resource Capital’s response dated 26 June 2018 to an ASIC tracing notice disclosed that Mr Billis is a director of Resource Capital.

- In Tribune’s application to ASIC dated 24 December 2010 (referred to in paragraph 40), Tribune stated that Rand had informed it that Mr Billis was one of the two directors of Iron Resources Limited and the directors of Resource Capital were Mr Billis and Ms Phanatchakorn Wichaikul.

- The uncommercial nature of the sale of Mr Billis’s interest in Trans Global on 20 May 2010 for US$100, referred to in paragraph 33(b).

- We consider that Mr Billis and Ms Phanatchakorn Wichaikul currently and since at least 20 May 2010:

- have a relevant agreement for the purpose of controlling or influencing the composition of the board of Tribune or the conduct of Tribune’s affairs and are associated with each other under s12(2)(b) or

- acted in concert in relation to the affairs of Tribune and are associated with each other under s12(2)(c).

- The Application submitted that:

Based on publicly available information and the Tracing Notice Responses, the Applicant considers there are a number of circumstances which suggest that breaches of section 606 of the Act have occurred and which are likely to lead to a separate application to the Takeovers Panel. However, until such time as the tracing notice and substantial holding requirements of the Act have been complied with, it is not possible to confirm several key facts pertaining to those breaches.11

- We asked the Tribune shareholders referred to in the diagram in paragraph 9 for details of all acquisitions (including subscribing for shares), disposals and transfers in Tribune shares.12

- Rand provided a table of dealings of shares by Rand and Tribune. Tribune submitted that in the time available it was not possible to provide “a fulsome review of the movement in shareholdings as between Tribune and Rand”.

- SGL and SGPL submitted that SGPL received 11,500,000 shares in and around 1987 as consideration for assets contributed by SGPL as part of Tribune’s initial public offering. Between 1992 and 1998, SGPL sold approximately 3,480,000 ordinary shares in Tribune. SGL and SGPL did not have records for each transaction given that “these transactions were effected on market and some period of time has elapsed since then”. On 10 February 2008, the remaining 8,020,000 Tribune shares were transferred off-market to SGL to be held as nominee and bare trustee for SGPL.

- Trans Global and Mr Billis submitted that shares were acquired by ‘the TG Trust’ between 1995 and 2008 and were transferred to Trans Global on 10 September 2008 “by a series of off market transactions”. Trans Global and Mr Billis submitted that they had not “had a sufficient opportunity to compile material to enable the provision of a more complete answer” and the time and costs outlay required in providing this material was oppressive “given the period over which the acquisitions occurred”.

- The Applicant submitted the interested parties, specifically SGL, Trans Global and Mr Billis:

… have selectively responded to the Panel’s questions and provided no information on the details of acquisitions, disposals and transfers of Tribune shares. Without this information it is difficult for anyone to analyse breaches of section 606 of the Act. The Applicant should not be penalised for this historical vacuum of information and the continued defiance of these parties to provide the Applicant and the Panel with the requisite information.

- The Applicant submitted that we should draw adverse inferences from the failure of these parties to provide this information “that acquisitions of relevant interests and increases in voting power in Tribune shares have occurred in breach of” s606 and that there were nonetheless identifiable breaches of s606 by Mr Billis and others.

- While we are concerned that there may be contraventions of s606, further historical material would be required to allow us to determine whether any such contraventions of that provision13 have taken place. We accept that some of the parties may have had difficulties providing us with this information in a timely manner. In our view, it is clear, regardless of any breaches of s606, that unacceptable circumstances exist and the market is seriously uninformed as to substantial interests in, and control of, Tribune. It is not clear to us that identifying historical breaches would make a significant difference to the orders we think appropriate to address the most pressing unacceptable circumstances. Furthermore, attempting to investigate any such breaches is likely to delay orders to correct a seriously uninformed market. We are required to proceed in as timely a manner as the legislation and a proper consideration of the matters before us permits.14 Accordingly, we decided not to make any further enquiries, noting that the Applicant had reserved the right to make a further application in relation to any breach of s606.

Conclusion

- Tracing notice responses by SGL, SGPL, Trans Global and Rand contain material that, in the submissions made by those parties to the Panel, were and are false.

- In addition, if the material provided to us in the submissions by Tribune, SGL, SGPL, Trans Global and Rand is accurate, there have been numerous contraventions of the substantial holder provisions in relation to Tribune shares, including by:

- Mr Billis, at least in relation to Tribune shares held by himself (0.03%), Ms Phanatchakorn Wichaikul (0.45%), SGL (16.04%), Trans Global (16.91%), Rand (26.32%), Nimby WA (0.3%), Lake Grace (0.37%) and Northwest (0.07%) – meaning that he has voting power of 60.49% in Tribune

- Tribune, in relation to having an interest in its own shares by operation of s608(3)(a) and (b) as a result of Tribune controlling Rand and Tribune holding voting power in over 20% in Rand and

- Ms Phanatchakorn Wichaikul as a result of her association with Mr Billis.

- Tribune, SGL and SGPL, Trans Global and Mr Billis and Rand all offered to provide undertakings to make further disclosure and submitted that we should not make a declaration.15

- Tribune submitted, with reference to its failure to lodge a substantial holder notice in relation to its own shares referred to in paragraph 62(b), that we should not make a declaration of unacceptable circumstances because (among other things):

- the circumstances are historic and well disclosed through other means (noting Mr Billis’s Appendix 3Y disclosure and annual report disclosure) and without immediate consequence

- “there is no takeover bid or other control transaction on foot or proposed in relation to Tribune and Rand: this is not a dispute that Parliament intended the Panel to be the principal forum”

- where matters “are historic, involve a long course of dealings, and not related to a present control transaction, the pursuit of those alternative Court based remedies (which is in the hands of others) is the most appropriate course”.

- We consider that market participants should not be expected to glean from other publicly available information persons who may have a substantial holding in a listed company. Such an approach undercuts the underlying purpose of the substantial holding provisions - that holders, directors and the market have access on a timely basis to sufficient information to know:

- who the controllers of substantial blocks of voting shares are

- who the associates of substantial holders are

- details of any consideration or special benefits a person received for disposing of their relevant interest and

- details of any agreements or special conditions or restrictions that may affect the disposal of shares or the way in which they are voted.16

- In addition, we do not consider that the circumstances, in particular the matters referred to in paragraph 62, have been adequately disclosed through other means. Tribune, Trans Global and Mr Billis submitted that there had been disclosure in Mr Billis’s Appendix 3Y. We consider that Mr Billis’s Appendix 3Y disclosure was insufficient. For example his latest Appendix 3Y did not disclose his 16.04% interest through SGL and was inaccurate in the way it described his other interests, including his interest in Rand’s Tribune shares.

- A contravention of Chapter 6C clearly can give rise to unacceptable circumstances.17 We accept that in deciding whether to make a declaration we need to have regard to, among other things, the purposes of s602, the provisions of Chapter 6 and, more broadly, the role Parliament intended the Panel to perform.18

- We have done so. While there is no control transaction on foot, the lack of disclosure here is more than historic. The market has not been informed for some time, and continues to be uninformed to a significant degree, of persons who have substantial interests in, or control of, Tribune and the extent of their holding.

- SGL and SGPL submitted their deficient substantial holder disclosure and tracing notice responses were either through inadvertence or mistake and therefore the defences in ss671C(2)(a) and 672F(2)(a) apply. Mr Billis and Trans Global made a similar submission.

- It is not for us to decide whether any of the parties could rely on a defence for civil liability to the contraventions of Chapter 6C and, even in the event that such defences could be established, this does not preclude us from making a declaration.19 Given the extent of noncompliance with the substantial holding notice and tracing provisions, we are not satisfied this was the result of inadvertence or mistake.20

- We also do not consider it appropriate to accept undertakings in lieu of a declaration because (among other things): (i) we were not offered undertakings that would address our concerns (ii) of the period in which there has been non-compliance with the substantial holding provisions in relation to a significant percentage of Tribune’s shares and (iii) of the inaccurate disclosure in the responses to the tracing notices.21

- It appears to us that:

- the acquisition of control over voting shares in Tribune and Rand has not taken, and continues not to take, place in an efficient, competitive and informed market

- the holders of Tribune and Rand shares and the market in general have not known, and continue not to know, the identity of persons who acquired a substantial interest in Tribune and Rand and

- the above effects in relation to Tribune are magnified by Rand being prohibited from voting its 26.32% interest in Tribune by virtue of s259D(3).

Decision

Declaration

- It appears to us that the circumstances are unacceptable:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have:

- on the control, or potential control, of Tribune

- on the acquisition, or proposed acquisition, by a person of a substantial interest in Tribune or

- as a consequence of (i) and (ii), on the control or potential control of Rand

- in the alternative, having regard to the purposes of Chapter 6 set out in s602

- in the further alternative, because they constituted, constitute, will constitute or are likely to constitute a contravention of a provision of Chapter 6C or gave or give rise to, or will or are likely to give rise to, a contravention of a provision of Chapter 6C.

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have:

- Accordingly, we made the declaration set out in Annexure B and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

Extension of time

- Section 657C(3) says:

An application for a declaration under section 657A can be made only within:

(a) two months after the circumstances have occurred; or

(b) a longer period determined by the Panel.

- As stated in Queensland North Australia Pty Ltd (QNA) v Takeovers Panel:

… Before the discretion to extend time may be exercised under s 657C(3) those circumstances require to be proved. There may be a factual contest. There is no difficulty, in that situation, for the Panel first resolving the factual questions and thereafter determining whether or not to extend time under s 657C(3). The legislative scheme here does not suggest a different approach.22

- The Applicant submitted that its application related to the “non-disclosure of associations and substantial holdings of the parties which are continuing”. Tribune submitted that the Applicant had not sought an extension of time in its application on the basis that the circumstances submitted in the application were ongoing, which is contrary to the Full Federal Court’s reading of s657C in QNA, which stated that:23

In that context it cannot be thought that the Parliament intended the expressions “after the circumstances occur” and “after the circumstances have occurred” to be capable of being reset on a daily basis with each new day being the starting point for the calculation of the time limits imposed. Such a construction would strain against the policy objectives and, far from being timely, very long periods of time could elapse between the first “occurring” of the circumstances and their continuing occurrence, without offending the time limits. During such extended periods the market would be operating on a basis which might later be the subject of regulatory intervention by the Panel.

Such an approach does not meet the commercial imperatives, including timeliness, found in the legislative scheme.

- We consider it is sufficient that the Applicant sought an extension of time in its submissions. The first task in considering this request is to determine what ‘circumstances’ are relevant in this matter for the purposes of s657C(3)(a). As discussed above, we consider that a number of Tribune shareholders have not complied with the substantial holding and tracing notice provisions in relation to substantial interests in Tribune and the market has not been informed, and continues not to be informed, of who may have voting power in relation to the shares held by the three largest shareholders in Tribune.

- We consider the following factors are relevant in considering whether to extend time under s657C(3):

- the discretion to extend time should not be exercised lightly24

- whether the application made credible allegations of clear and serious unacceptable circumstances, the effects of which are ongoing25

- whether it would be undesirable for a matter to go unheard, because it was lodged outside the 2 month time limit, if essential matters supporting it first came to light during the 2 months preceding the application26

- whether there is an adequate explanation for any delay, and whether parties to the application or third parties will be prejudiced by the delay.27

- For the reasons discussed below, we are satisfied when considering the factors described above to extend the time for making the application in this case.

- While there may be an argument that the circumstances here are not continuing, at least it is clear that the application made credible allegations of clear and serious unacceptable circumstances, involving the contravention of provisions that are continuing offences under s1314.28

- Tribune submitted that the essential matters which gave rise to the application “have been apparent from publicly available information for many years and were or should have been apparent to the Applicant as a prudent and informed investor when the Applicant became a shareholder in Tribune in May 2013” and that the Applicant had waited over 5 years after it became a member before requesting ASIC to issue tracing notices. Tribune referred to information contained in annual reports of each of Tribune and Rand, together with Appendix 3Y forms lodged with ASX and submitted that:

While there may not have been completely accurate disclosure by way of substantial shareholders notices, the market was generally informed through those Annual Reports and director disclosures both of Tribune's relevant interest in itself through the Rand cross shareholding, and of the interests of its directors and their associates in Tribune. Indeed, it is likely that there was more disclosure than technically required.

- The Applicant submitted that:

In respect of the time it has taken the Applicant to bring these proceedings before the Panel, that is simply a product of the deliberate actions of the relevant parties to provide the market with false and misleading information to conceal their acquired 60.52% voting power in Tribune shares and the true identity of Tribune’s substantial holders and ultimate controllers. Any asserted delay in the bringing of these proceedings by the Applicant has been caused by the actions and breaches of the Act by the relevant parties.

- We have carefully considered whether to extend time in this case. For the reasons expressed above (at paragraph 66) we do not consider that the market was or is generally informed of the substantial holders in Tribune.

- It may be that the available information justified concerns as to whether there had been compliance with the substantial holder provisions. However as discussed above, material information was only uncovered by ASIC’s tracing notices29 during the 2 months preceding the application. We are not satisfied that the Applicant was tardy in its request to ASIC to issue tracing notices given the lack of disclosure.

Orders

- Following the declaration, we made the final orders set out in Annexure C. The Panel is empowered to make ‘any order’30 if 4 tests are met:

- it has made a declaration under s657A. This was done on 14 September 2018.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. For the reasons below, we are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 19 September, 5 October and 22 October 2018.

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons. The orders do this by (among other things) requiring corrective disclosure and vesting Tribune shares held by Rand in ASIC.

- The Applicant submitted that “it would send a completely unacceptable message to market” if we decided that the unacceptable circumstances could be remedied through disclosure alone and could “harm the public interest by disincentivising compliance with the Act and the principles underlying it, as market participants may see that the risks attached to breaking the law are merely being made to later comply via disclosure”.

- ASIC submitted that that the circumstances in these proceedings were unusual and unique in that the market has not been properly informed of persons who have had a relevant interest in shares held in Tribune for more than a decade and “even when prompted by the receipt of tracing notices, SGL, SGPL, Trans Global and Rand failed to correct the disclosures regarding their holdings”. ASIC submitted that a divestment order should be made at least in relation to the Tribune shares held by Rand subject to the “s259C and/or s259D contravention” because the contraventions were ongoing and had not been remedied and the effect of the holding exacerbates the unacceptable circumstances created by the undisclosed substantial interests.

- The Applicant agreed with ASIC’s submission stating (among other things) that a divestment order in relation to Rand’s Tribune shares was necessary “in order to cure the depressive effect on the Tribune share price caused by the illegal cross shareholding and other unacceptable circumstances caused by the concentration of Mr Billis' voting power”.

- Other parties submitted that vesting orders should not be made. Trans Global and Mr Billis submitted that a divestment order would depress Tribune’s share price. They provided a report from an expert who concluded, among other things, that the value of Tribune’s shares would be depressed by up to 50% if a divestment order was made. Tribune submitted in effect that a vesting order would be punitive rather than remedial in the absence of a contravention of s606 and in the absence of any non-compliance with disclosure orders.

- Tribune submitted that a vesting order in relation to Rand’s Tribune shares did not remedy the unacceptable circumstances, would have an adverse effect on Tribune’s share price, was beyond the Panel’s jurisdiction and would “deal with matters which should properly be dealt with by alternative means or another forum”. Tribune submitted that the cross shareholding could not have amplified the unacceptable circumstances because the cross shareholding was well known and disclosed to the market and if there have been any deficiencies in the disclosure of substantial holdings relating to Rand “they can only relate to holdings by persons now determined to be its associates”. Rand submitted (among other things) that:

- the Panel should be mindful of the impact on Rand and the market of a divestment order noting that its shares were worth approximately $80 million and that the annual volume of traded shares over the past 12 months was in aggregate $912,260 and

- Rand is in a different position compared to most instances before the Panel which involve divestment orders, in that it is a listed company with its own spread of shareholders.

- The Panel and the Courts have made divestment orders to remedy a failure to comply with the substantial holding or tracing notice provisions. In Village Roadshow Limited, the Panel made a divestment order in relation to a failure by a person to comply with the tracing notice provisions, where an order to provide the disclosure required by the tracing notice provisions may have resulted in a breach of a foreign law.31

- In ASIC v Terra Industries, the Court made a divestment order to remedy a contravention of the substantial holder provisions.32 While ASIC had accepted that a late substantial holder notice complied with the substantial holder provisions,33 Merkel J was not satisfied that the “full truth” had emerged.34 His Honour noted in deciding to make a vesting order that the contravention was “wilful, contumelious and…led to a seriously uninformed and misinformed market for Coms 21 shares”, including that “participants in the market were likely to believe that there was a takeover being planned by a bona fide offeror who had acquired a substantial shareholding of 12.9% as a platform for the takeover, when in fact that was not the case”.35

- In Gondwana Resources Limited 02, a director of Gondwana had lodged a substantial holder notice late and failed to disclose 3.79% of Gondwana shares held by an entity he controlled (in total 11.81%).36 The Panel found that a bidder (Ochre Industries) had announced its bid not being aware that the director was a substantial holder and made an order requiring the director to accept the bid in certain circumstances.37

- Here there have been numerous contraventions of the substantial holding notice provisions relating to over 60% voting power in Tribune and contraventions of the tracing notice provisions. We consider that the market has been materially misinformed in relation to these interests and Mr Billis (and others) have disregarded over a long period their obligations under Chapter 6C. While the parties have offered to make additional disclosure, none have provided a draft that has satisfied us. We agree with the Applicant that ordering disclosure alone is not sufficient.

- We considered an order vesting all of the shares (or all other than 5%) relating to the non-disclosure of substantial holdings. In considering this we were faced with a dilemma. One of the reasons why we considered that the non-disclosure here was so egregious was the size of the holding that was not disclosed. However vesting such a large shareholding was likely to have a significant market impact and may be unfairly prejudicial to the Relevant Parties.

- Taking these factors into account we consider it is appropriate to make an order vesting most of Rand’s Tribune shares.38 We do not agree with Tribune’s submissions regarding the cross shareholding and the extent of non-disclosure summarised in paragraph 91. On the basis of the parties’ submissions, Mr Billis has a relevant interest in Rand’s Tribune shares and voting power in 60.49% of Tribune. This and other holdings have not been disclosed in accordance with the substantial holding provisions and we consider this information to be highly material to shareholders and the market. The overall lack of disclosure of substantial shareholdings has been magnified by Tribune shareholders being unaware that s259D(3) prohibited Rand from voting its shares. This effect amplifies the influence of Mr Billis’s other holdings. Also without disclosure, shareholders were unable to take action if Rand voted its shares in contravention of that provision.

- Tribune and Rand recognised that the cross shareholding needed to be resolved to comply with s259D. Tribune proposed as an alternative to a vesting order an in specie distribution to its shareholders of a sufficient number of Rand shares to ensure that Tribune has a relevant interest in Rand of less than 20%, by way of capital reduction.

- Rand proposed a distribution of its Tribune shares in specie to its shareholders, which would require shareholder approval. Rand recognised that many of the Relevant Parties were also shareholders of Rand and proposed that the shares that would notionally be distributed to those shareholders under the in specie distribution be instead vested in ASIC.

- ASIC submitted that in relation to Rand’s proposal:

- “there is no certainty that Rand’s shareholders will give the requisite approval”

- “the proposal will delay the resolution of this matter”

- “to properly administer the proposal will increase the costs and resource burden on ASIC” and

- “the benefits of the proposal suggested are arguably marginal given the apparent holdings of Relevant Parties and their associates in Rand mean that a similarly sized stake would be vested and sold in any event”.39

- ASIC submitted that Tribune’s proposal raised similar issues. We agree with ASIC’s submissions in relation to both proposals.

- We consider it is difficult to determine what effect a sale of Rand shares would have on the market. The illiquidity of Tribune shares may be caused in part by the existence of a voting block of over 60% and it is possible that the sell down of Rand’s Tribune shares may increase liquidity and demand. For example market participants may perceive that any potential reduction of Mr Billis’s control could increase the likelihood of a takeover bid. It is also difficult to determine whether the price of Tribune shares is either artificially high or low as a result of the cross shareholding.

- To mitigate the risk that the disposal of the shares vested in ASIC will have an adverse effect on the Tribune share price, we have modified the usual Panel vesting orders as follows:

- we accept Tribune’s and Rand’s submissions that the period for the investment bank or stock broker appointed by ASIC (Appointed Seller) to sell the shares should be extended from 3 to 6 months

- the orders allow the Panel to extend the 6 month period

- the orders require the Appointed Seller to notify ASIC as soon as reasonably practicable if (without being obliged to do so) it forms the view that disposing of any or all of the vested shares within 6 months from the date of its engagement would likely result in a material decrease in the Tribune share price. We would expect ASIC to seek an extension of time or variation of the orders if it received such a report.

- We are satisfied that the vesting order, which as noted above has been modified to take into account the concerns raised by the parties, does not unfairly prejudice them.

- We decided that in the light of the non-compliance with the substantial holding provisions by the Relevant Parties it was not appropriate for them to acquire the shares the subject of the sell down. Similarly we considered it was not appropriate for these shares to be sold to Tribune under a buy-back, which would increase the percentage holdings of all the Relevant Parties.40

- We also consider it appropriate to vest the shares of the other Relevant Parties if they do not provide updated substantial holder notices in a form approved by ASIC within 2 months of the date of the orders, which is consistent with the reasoning of the Panel in Village Roadshow Limited.

- In our view it is appropriate to limit acquisitions by the Relevant Parties in two ways:

- by limiting any acquisitions by the Relevant Parties for 6 months after corrective disclosure is made to allow the market to digest this information and

- by removing the shares vested in ASIC from the calculation of voting power in accordance with the ‘creep’ exception in item 9 of s611.41

- We consider that as the market was misinformed as to who were the substantial holders of Tribune holding over 60% of Tribune’s shares, it is also appropriate that there be a voting freeze on the shares held by the Relevant Parties for the market to digest the updated substantial holder notices. We initially considered a voting freeze of three months but accepted Rand’s and SGL and SGPL’s submissions that a voting freeze relating to over 60% of Tribune’s register for that period may be disruptive42 and reduced this period to one month. We are satisfied that the voting freeze order does not unfairly prejudice any of the Relevant Parties. We also accept ASIC’s submission that there should be an additional voting freeze of a proportion of the Relevant Parties’ shares to take into account the effect of ASIC not voting the shares vested in it.

- We initially considered making a cost order in favour of the Applicant. After considering the submissions of the parties and the Panel’s policy on making costs orders,43 we decided not to make such an order.

Christian Johnston

President of the sitting Panel

Declaration dated 14 September 2018

Orders dated 26 October 2018

Reasons given to parties 22 October 2018 (Declaration), 7 November 2018 (Orders)

Reasons published 9 November 2018

Advisers

| Party | Advisers |

| Applicant | DLA Piper Australia |

| Mr Billis and Trans Global | SBA Law |

| Rand | Baker McKenzie |

| SGL and SGPL | MinterEllison |

| Tribune | Quinn Emanuel Urquhart & Sullivan |

Annexure A

Corporations Act

Section 657E

Interim Orders

Tribune Resources Limited

R Hedley Pty Ltd made an application to the Panel dated 20 August 2018 in relation to the affairs of Tribune Resources Limited.

The Panel ORDERS:

- Without the consent of any member of the sitting Panel, each of the persons named in the schedule, and each of their respective associates, must not dispose of, transfer, charge or otherwise deal with any ordinary shares in Tribune Resources Limited in which they have a relevant interest.

- These interim orders have effect until the earliest of:

- further order of the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Schedule

Sierra Gold Ltd

Nimby WA Pty Ltd

Trans Global Capital Ltd

Mr Anthony Billis

Lake Grace Exploration Pty Ltd

Northwest Capital Pty Ltd

Ms Phanatchakorn Wichaikul

Rand Mining Ltd

Bruce Dyer

Counsel

with authority of Christian Johnston

President of the sitting Panel

Dated 28 August 2018

Annexure B

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Tribune Resources Limited

Circumstances

- Tribune Resources Limited (Tribune) is a company listed on the Australian Securities Exchange (ASX Code: TBR). Tribune’s directors are Messrs Anthony Billis, Otakar Demis and Gordon Alfred Sklenka.

- Tribune has the following major shareholders:

- Sierra Gold Ltd (SGL – a company incorporated in the Seychelles), with a relevant interest of 16.04% in Tribune.

- Trans Global Capital Ltd (Trans Global – a company incorporated in the Seychelles), with a relevant interest of approximately 16.91% in Tribune.

- Rand Mining Limited (Rand – an ASX listed company, ASX Code: RND) with a relevant interest of approximately 26.32% in Tribune.

SGL

- SGL lodged a substantial holder notice on 10 November 2009 in relation to its shareholding in Tribune. It did not disclose any other person who had a relevant interest in those shares.

- On 19 June 2018, SGL replied to a beneficial ownership notice issued by ASIC under s672A(1) of the Corporations Act 2001 (Cth) (Act) disclosing, among other things, that:

- SGL holds its Tribune shares on trust for Sierra Gold Pty Ltd (ACN 009 138 783).

- (The shareholders of Sierra Gold Pty Ltd, including SGL, have a relevant interest in SGL’s Tribune shares “by virtue of their shareholding in Sierra Gold Pty Ltd and as a result of the Shares being held on trust for Sierra Gold Pty Ltd”.

- To the best of SGL’s knowledge and recollection all instructions given to SGL in respect of the acquisition or disposal of its Tribune shares, the exercise of any voting or other rights attached to those shares or any other matter relating to those shares, “at all or any time during the period that SGL has been the registered legal owner of the Shares, has been given to SGL by the shareholders...of Sierra Gold Pty Ltd in accordance with the terms of Sierra Gold Pty Ltd’s constitution”.44

- SGL and Sierra Gold Pty Ltd submitted to the Panel that SGL holds its 80.95% shareholding in Sierra Gold Pty Ltd as nominee and bare trustee for Mr Billis, accordingly Mr Billis has a relevant interest in SGL’s 16.04% interest in Tribune and, to the extent that SGL and Sierra Gold Pty Ltd are aware, none of the other shareholders in Sierra Gold Pty Ltd nor the sole director of Sierra Gold Pty Ltd have a relevant interest in those shares. SGL and Sierra Gold Pty Ltd submitted that Mr Billis is the sole director of SGL.

- SGL and Sierra Gold Pty Ltd submitted that Ms Phanatchakorn Wichaikul “is the registered holder and beneficial owner of all the share capital of SGL”. SGL and Sierra Gold Pty Ltd submitted in effect that SGL’s substantial holder notice referred to in paragraph 3 and SGL’s tracing notice response referred to in paragraph 445 contained inaccurate or deficient disclosure. Ms Phanatchakorn Wichaikul is Mr Billis’s wife.

- Mr Billis is a party to these proceedings and did not rebut any of the submissions made by SGL and Sierra Gold Pty Ltd.

Trans Global

- Trans Global lodged a substantial holder notice on 9 April 2009 in relation to its shareholding in Tribune. It did not disclose any other person who had a relevant interest in those shares.

- On 6 July 2018, Trans Global replied to a beneficial ownership notice issued by ASIC under s672A(1) of the Act disclosing, among other things, that Ms Phanatchakorn Wichaikul has a relevant interest in Trans Global’s shareholding in Tribune and Mr Billis is a director of Trans Global.

- Trans Global and Mr Billis submitted to the Panel that:

- Trans Global holds 4,454,000 Tribune shares “as nominee or bare trustee” for Mr Billis and holds 4,000,000 Tribune shares “as nominee or bare trustee” for Ms Buasong Wichaikul

- Mr Billis has a relevant interest in the Tribune shares held by Trans Global because Mr Billis is the sole director of Trans Global and “therefore has the power to exercise, or control the exercise, of the right to vote attached to the shares in Tribune held in the name of” Trans Global “and the power to dispose of, or control the exercise of a power to dispose of, those shares”

- Ms Buasong Wichaikul has a relevant interest in 4,000,000 of the 8,454,000 shares in Tribune held by Trans Global and

- Trans Global’s tracing notice response inaccurately disclosed that Ms Phanatchakorn Wichaikul had a relevant interest in Trans Global’s shareholding in Tribune.

- Trans Global’s Register of Members and Share Ledger states that:

- Ms Phanatchakorn Wichaikul is Trans Global’s sole shareholder and

- Mr Billis was the sole shareholder in Trans Global between 18 September 2009 and 20 May 2010. On 20 May 2010 he sold his shareholding to Ms Phanatchakorn Wichaikul for US$100.

Rand

- Rand’s board is identical to Tribune’s board, comprising Messrs Anthony Billis, Otakar Demis and Gordon Alfred Sklenka.

- On or about 27 January 2010, Tribune increased its voting power in Rand Mining Limited from 20.51% to 43.85%. As a result s259D(1) of the Act applied requiring within 12 months from that time that either Rand cease to hold Tribune shares or Tribune cease to control Rand, unless ASIC provided an extension of time. Subsection 259D(3) of the Act also applied, and continues to apply, prohibiting Rand from exercising voting rights to its Tribune shares while Tribune controls Rand.

- On 24 December 2010, Tribune applied to ASIC for an extension of time under s259D(1). ASIC subsequently informed Tribune that it would not give an extension. Rand continues to be controlled by Tribune and holds Tribune shares.

- On 3 July 2018, Rand replied to a beneficial ownership notice issued by ASIC under s672A(1) of the Act disclosing, among other things, that each of Messrs Anthony Billis, Otakar Demis and Gordon Alfred Sklenka has a relevant interest in Rand’s Tribune shares “by virtue of their position as directors of Rand”. In a submission to the Panel, Rand submitted that its directors “do not in fact have a relevant interest in Rand’s shares in Tribune as disclosed in Rand’s tracing notice response”.

Resource Capital Limited

- On 23 December 2010, Rand entered into an Option and Access Agreement with Resource Capital Limited and Iron Resources Limited. Pursuant to the Option and Access Agreement, Resource Capital Limited granted Rand the option to acquire all the issued shares in Iron Resources Limited. If Rand exercised the option, a share purchase agreement (attached to the Option and Access Agreement) would have full force and effect, which involved (among other things) Rand paying Resource Capital Limited a deposit of 8,000,000 Tribune shares (approximately 16% of the Tribune shares on issue).

- In a submission to the Panel, Rand submitted that Resource Capital Limited had a relevant interest in 8,000,000 Tribune shares by virtue of Resource Capital Limited being a party to the Option and Access Agreement. Resource Capital Limited has not lodged a substantial holder notice disclosing its interest in Tribune. Rand has informed the Panel that it wishes to terminate the Option and Access Agreement.

- The Option and Access Agreement was signed by Mr Billis as a director of Resource Capital Limited and Iron Resources Limited and by Ms Phanatchakorn Wichaikul as “Secretary/Director” of Resource Capital Limited and Iron Resources Limited. Resource Capital Limited’s response dated 26 June 2018 to a beneficial ownership notice issued by ASIC under s672A(1) of the Act discloses that Mr Billis is a director of Resource Capital Limited.

- In Tribune’s application to ASIC dated 24 December 2010 (referred to in paragraph 14), Tribune stated that Rand had informed it that:

- Mr Billis was one of the two directors of Iron Resources Limited and

- The directors of Resource Capital Limited were Mr Billis and Ms Phanatchakorn Wichaikul.

Association between Mr Billis and Ms Phanatchakorn Wichaikul

- The Panel considers that Mr Billis and Ms Phanatchakorn Wichaikul both now and since at least 20 May 2010:

- have a relevant agreement for the purpose of controlling or influencing the composition of the board of Tribune or the conduct of Tribune’s affairs and are associated with each other under section 12(2)(b) or

- acted in concert in relation to the affairs of Tribune and are associated with each other under section 12(2)(c).

- The factors that support the inference that Mr Billis and Ms Phanatchakorn Wichaikul are associates include:

- their relationship as husband and wife

- Mr Billis being the sole director of SGL, Trans Global and Lake Grace Exploration Pty Ltd and Ms Phanatchakorn Wichaikul being the sole shareholder of those companies

- the involvement of Mr Billis and Ms Phanatchakorn Wichaikul in Resource Capital Limited and Iron Resources Limited (see paragraph 18) and

- The uncommercial nature of the sale of Mr Billis’s interest in Trans Global on 20 May 2010 for US$100.

Conclusion

- The market has not been informed, and continues not to be informed, of persons who have a relevant interest in shares held by the three largest shareholders of Tribune.

- Tracing notice responses by SGL, Sierra Gold Pty Ltd, Trans Global and Rand contain material that, in the submissions made by those parties to the Panel, were and are false.

- If the material provided to the Panel in the submissions by Tribune, SGL, Sierra Gold Pty Ltd, Trans Global and Rand is accurate, there have been numerous contraventions of the substantial holder provisions in relation to Tribune shares, including by:

- Mr Billis, at least in relation to Tribune shares held by himself (0.03%), Ms Phanatchakorn Wichaikul (0.45%), SGL (16.04%), Trans Global (16.91%), Rand (26.32%)46, Nimby WA Pty Ltd (0.3%), Lake Grace Exploration Pty Ltd (0.37%) and Northwest Capital Pty Ltd (0.07%) – meaning that he has voting power of 60.49% in Tribune

- Tribune, in relation to having an interest in its own shares by operation of s608(3)(a) and (b) of the Act as a result of Tribune controlling Rand and Tribune holding voting power in over 20% in Rand and

- Ms Phanatchakorn Wichaikul as a result of her association with Mr Billis.

Effect

- It appears to the Panel that:

- the acquisition of control over voting shares in Tribune and Rand has not taken, and continues not to take, place in an efficient, competitive and informed market

- the holders of Tribune and Rand shares and the market in general has not known, and continues not to know, the identity of persons who acquired a substantial interest in Tribune and Rand and

- the above effects in relation to Tribune are magnified by Rand being prohibited from voting its 26.32% interest in Tribune by virtue of s259D(3) of the Act.

Conclusion

- It appears to the Panel that the circumstances are unacceptable circumstances:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have:

- on the control, or potential control, of Tribune

- on the acquisition, or proposed acquisition, by a person of a substantial interest in Tribune or

- as a consequence of (i) and (ii), on the control or potential control of Rand

- in the alternative, having regard to the purposes of Chapter 6 set out in section 602 of the Act

- in the further alternative, because they constituted, constitute, will constitute or are likely to constitute a contravention of a provision of Chapter 6C of the Act or gave or give rise to, or will or are likely to give rise to, a contravention of a provision of Chapter 6C of the Act.

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Tribune.

Bruce Dyer

Counsel

with authority of Christian Johnston

President of the sitting Panel

Dated 14 September 2018

Annexure C

Corporations Act

Section 657D

Orders

Tribune Resources Limited

The Panel made a declaration of unacceptable circumstances on 14 September 2018.

The Panel Orders

Divestment Orders

- The Sale Shares are vested in the Commonwealth on trust for Rand.

- ASIC must:

- ASIC must:

- retain an Appointed Seller to conduct the sale and

- instruct the Appointed Seller:

- to use the most appropriate sale method to secure the best available sale price for the Sale Shares that is reasonably available at that time in the context of complying with these orders, including the stipulated timeframe for the sale and the requirement that none of the Relevant Parties or their respective associates may acquire, directly or indirectly, any of the Sale Shares

- to provide to ASIC a statutory declaration that, having made proper inquiries, the Appointed Seller is not aware of any interest, past, present, or prospective which could conflict with the proper performance of the Appointed Seller’s functions in relation to the disposal of the Sale Shares

- unless the Appointed Seller sells Sale Shares on market, that it obtain from any prospective purchaser of Sale Shares a statutory declaration including:

- a statement that the prospective purchaser is not associated with any of the Relevant Parties

- details of all historical relationships or connections (if any) between the prospective purchaser and any Relevant Party and

- details of all communications, agreements, arrangements or understandings (if any) between the prospective purchaser and any Relevant Party in the 12 months prior to the date of the statutory declaration

- to provide ASIC with a copy of each statutory declaration obtained under paragraph 3(b)(iii) within 2 business days of receipt and not sell any Sale Shares to a prospective purchaser until 2 business days after providing ASIC with a copy of the statutory declaration from the prospective purchaser

- unless the Appointed Seller sells Sale Shares on market, not to sell any Sale Shares to a prospective purchaser:

- who is a Relevant Party

- who does not provide a statutory declaration containing the statement and information required by paragraph 3(b)(iii) or

- in circumstances where ASIC has informed the Appointed Seller that it has reason to believe or suspect, drawing inferences where necessary, that the prospective purchaser may be an associate of a Relevant Party, unless ASIC has subsequently advised the Appointed Seller that it has formed the view that, on the basis of the information available, it is not likely that the prospective purchaser is an associate of a Relevant Party

- to dispose of all of the Sale Shares within 6 months from the date of its engagement or a longer period approved by the Panel and

- to notify ASIC as soon as reasonable practicable if (without being obliged to do so) it forms the view that disposing of any or all of the Sale Shares within 6 months from the date of its engagement would likely result in a material decrease in the Tribune share price.

- The Company and the Relevant Parties must do all things necessary to give effect to these orders, including:

- doing whatever is necessary to ensure that the Commonwealth is registered with title to the Sale Shares in the form approved by ASIC and

- until the Commonwealth is registered, complying with any request by ASIC in relation to the Sale Shares.

- None of the Relevant Parties or their respective associates may, directly or indirectly, acquire any of the Sale Shares (including, in the case of the Company, under a buy-back).

- The Relevant Parties must not otherwise dispose of, transfer, charge or vote any Sale Shares.

- Nothing in these orders obliges ASIC or the Commonwealth to:

- invest, or ensure interest accrues on, any money held in trust under these orders or

- exercise any rights (including voting rights) attaching to, or arising as a result of holding, the Sale Shares.

Corrective Disclosure Orders

- Each Relevant Party must as soon as reasonably practicable and in any event within 2 months of the date of these orders:

- give the Company a substantial holder notice (Notice) detailing all acquisitions made, or disposals of, relevant interests in Company shares (to the extent known by the Relevant Party after making reasonable enquiries or to the extent that ASIC has otherwise indicated it is satisfied that disclosure will not be necessary having regard to the historical nature of the acquisitions and/or disposals) in a form acceptable to ASIC and containing any additional information reasonably required by ASIC within 14 days of receiving the draft required by Order 9 or

- satisfy ASIC that the market is adequately informed of the information that would otherwise be included in the Notice.

- Each Relevant Party must as soon as practicable, and in any event within 14 days of the date of these orders, provide ASIC with a draft Notice. One Notice may be provided for multiple Relevant Parties if acceptable to ASIC.

- The Company must publish a Notice on its ASX Announcements Platform within 2 business days of receiving the Notice.

- If a Relevant Party does not comply with Order 8 within 2 months of the date of these orders, the Company shares held by that Relevant Party are vested in the Commonwealth on trust for the Relevant Party. Orders 2 to 7 and 14 will then apply to those shares as if they are ‘Sale Shares’ and Order 2(b) will then apply as if the reference to ‘Rand’ is replaced with the name of the Relevant Party.

Voting Restrictions

- A Relevant Party must not exercise, and the Company must disregard, any voting rights in respect of the Company shares held by that Relevant Party and must not dispose of, transfer, charge or otherwise deal with any Company shares held by that Relevant Party until the date that is 1 month after the Relevant Party has complied with Order 8 (Initial Restriction Period).

- After the Initial Restriction Period, a Relevant Party (not including Rand) may only exercise, and the Company may only take into account, voting rights in respect of such number of Company shares calculated in accordance with the following formula:

Where:

A is the number of Company shares in respect of which voting rights may be exercised and taken into account under this Order 13 by the Relevant Party

B is the number of Company shares held by the Relevant Party

C is the total number of Company shares on issue

D is the total number of Company shares that are vested in ASIC under Orders 1 and 11 and have not been sold by the Appointed Seller

Creep

- No Relevant Party may take into account any relevant interest or voting power that they or their associates had, or have had, in:

- the Sale Shares and

- until six months after the Relevant Party has complied with Order 8, any other Company shares,

when calculating the voting power referred to in Item 9(b) of s611 of the Corporations Act 2001 (Cth), of a person six months before an acquisition exempted under Item 9 of s611.

Timing

- Orders 1 to 4 come into effect three business days after the date of these orders.

- All other orders come into effect immediately.

- For the avoidance of doubt, Order 13 ceases to apply when the Appointed Seller has sold all of the Sale Shares.

Interpretation

- In these orders the following terms apply.

- Appointed Seller

- an investment bank or stock broker

- ASIC

- Australian Securities and Investments Commission, as agent of the Commonwealth

- Company or Tribune

- Tribune Resources Limited

- Company shares

- Ordinary shares in the issued capital of the Company

- date of the orders

- 26 October 2018 or in relation to a specific order, the business day after any stay of that order is lifted

- Notice

- the notice described in Order 8(a)

- on market

- in the ordinary course of trading on Australian Securities Exchange and not by crossing or special crossing

- Rand

- Rand Mining Limited

- Relevant Parties

- Company, Mr Anthony Billis, Ms Phanatchakorn Wichaikul, Ms Buasong Wichaikul, Sierra Gold Ltd, Sierra Gold Pty Ltd, Trans Global Capital Ltd, Rand, Nimby WA Pty Ltd, Lake Grace Exploration Pty Ltd and Northwest Capital Pty Ltd

- Sale Shares

- 12,025,519 Company shares held by Rand (comprising Rand’s holding in Tribune less 1,135,000 Tribune shares acquired by Rand on or about 2 and 10 January 2014) and any Company shares vested in accordance with Order 11

Bruce Dyer

Counsel

with authority of Christian Johnston

President of the sitting Panel

Dated 26 October 2018

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 The Applicant also applied to ASIC, requesting ASIC issue a tracing notice to Resource Capital Limited in relation to its shareholding in Rand. Resource Capital Limited responded on 26 June 2018

3 Except in relation to two shareholdings in the names of persons who are deceased

4 On 5 July 2018, Henley Point Pty Ltd replied to an ASIC tracing notice disclosing, among other things, that the shareholders in SGPL provide the directors of SGL with instructions relating to SGL’s Tribune shares

5 For an example of a shareholder acquiring shares immediately prior to making a Panel application, see Innate Immunotherapeutics Limited [2017] ATP 2 at [22] to [27]

6 in his combined submission with Trans Global

7 Mr Billis’s Appendix 3Y dated 19 May 2016 disclosed that he had an interest in the Tribune shares held by Nimby WA (156,000 shares), Lake Grace (186,400 shares) and Northwest (55,000 shares). A draft amended substantial holder notice provided by Tribune disclosed these interests except it disclosed that Northwest holds 23,385 Tribune shares

8 Other than a passing reference in the application, prior to making our declaration no party made any submission as to whether or how s259C operated

9 The Applicant also submitted that there was an association between (i) Ms Buasong Wichaikul and both Mr Billis and Ms Phanatchakorn Wichaikul (ii) Tribune and its directors (iii) Tribune’s directors and (iv) Tribune and Rand. We did not consider it necessary to decide that

10 See Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9 at [53] to [57] and Innate Immunotherapeutics Limited [2017] ATP 2 at [15]

11 The Application submitted that, on the basis of ASIC records, the TG Trust contravened the takeovers prohibition when it acquired 80.95% of SGPL sometime between 1995 and 2001

12 made by either the shareholder or a company controlled by the shareholder, including the name of each shareholder, the date of each transaction, consideration paid, the number of shares and whether the transaction was on market, off market or a subscription

13 Or its predecessor provisions prior to 13 March 2000

14 ASIC Regulations 2001, regulation 13