[2018] ATP 10

Catchwords:

Review – decline to conduct proceedings – board spill – collective action – association – requisition notice – voting intention statement – relevant agreement – control

Corporations Act 2001 (Cth), sections 249D, 657EA

Guidance Note 2: Reviewing decisions, ASIC Regulatory Guide 128: Collective action by investors

Caravel Minerals Limited [2018] ATP 8

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | No | No | No | No | No |

Introduction

- The Panel, Chelsey Drake, Elizabeth Hallett and Tony Osmond (sitting President), declined to conduct proceedings on a review application by Caravel Minerals Limited in relation to the affairs of Caravel Minerals Limited. The application (and review application) concerned allegations of association between shareholders of Caravel who had requisitioned a general meeting pursuant to s249D1 to replace directors of Caravel and between the requisitioning shareholders and other shareholders. The review Panel agreed with the initial Panel's decision not to make a declaration of unacceptable circumstances and considered that there was no reasonable prospect that it would come to a different conclusion if it conducted proceedings.

- In these reasons, the following definitions apply.

- Bridge Street

- Bridge Street Capital Partners Pty Limited

- Caravel

- Caravel Minerals Limited (ASX code: CVV)

- MRG

- Mitchell River Group Pty Ltd

- Other Shareholders

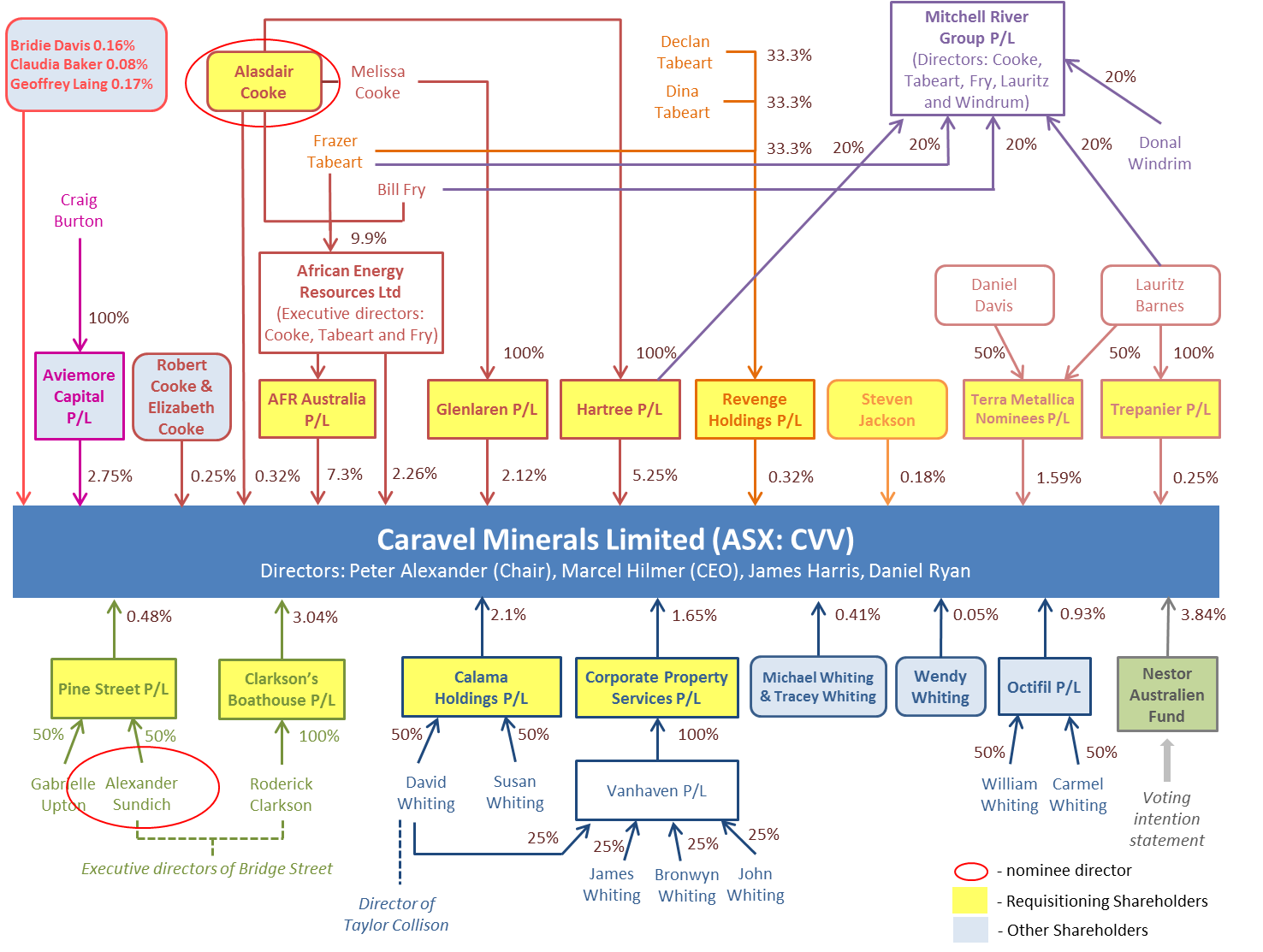

- Ms Bridie Davis, Ms Claudia Baker, Mr Geoffry Laing, Mr Michael Whiting and Mrs Tracey Whiting, Ms Wendy Whiting, Octifil Pty Ltd, Mr Robert Cooke and Mrs Elizabeth Cooke, and Aviemore Capital Pty Ltd (highlighted in blue in the diagram below)

- Requisitioning Shareholders

- Mr Alasdair Cooke, AFR Australia Pty Ltd, Calama Holdings Pty Ltd, Clarkson's Boathouse Pty Ltd, Corporate Property Services Pty Ltd, Glenlaren Pty Ltd, Hartree Pty Ltd, Pine Street Pty Ltd, Revenge Holdings Pty Ltd, Mr Steven Jackson, Terra Metallica Nominees Pty Ltd and Trepanier Pty Ltd (highlighted in yellow in the diagram below)

- RG 128

- ASIC Regulatory Guide 128: Collective action by investors

- s249D Notice

- the request for general meeting of shareholders of Caravel pursuant to s249D signed by the Requisitioning Shareholders and received by Caravel on 8 March 2018

- Voting Intention Statement

- a notice of voting intention to vote in favour of the resolutions proposed by the Requisitioning Shareholders signed by the Voting Intention Statement Shareholder

- Voting Intention

Statement Shareholder - Nestor Australien Fund (highlighted in green in the diagram below)

Facts

- The facts are as set out in Caravel Minerals Limited 01.2

- Shareholdings in Caravel and various relationships between the parties and other relevant persons are set out in the diagram below.

- In Caravel Minerals Limited 01 Caravel submitted that:

- the Requisitioning Shareholders (and possibly the Voting Intention Statement Shareholder and the Other Shareholders) were associated and that this was supported by (among other things) the lodging of the jointly signed s249D Notice which was said to equate to the entering into of a relevant agreement for the purposes of influencing the composition of Caravel's board or the conduct of Caravel's affairs3

- by virtue of signing the Voting Intention Statement in support of the resolutions proposed by the Requisitioning Shareholders, the Voting Intention Statement Shareholder should be deemed an associate of the Requisitioning Shareholders and

- the Other Shareholders should also be deemed associates of the Requisitioning Shareholders by virtue of their personal or professional connections with one or more of the Requisitioning Shareholders.

- The initial Panel conducted proceedings on these matters however declined to make a declaration of unacceptable circumstances. The initial Panel was not satisfied that there was sufficient material to establish such associations or, if there was an association among some of the Requisitioning Shareholders, that the circumstances were unacceptable.

Application

- By application dated 23 April 2018, Caravel applied for review of the initial Panel's decision. The President consented to the review.4

- Caravel submitted (amongst other things) that:

- the Panel should have concluded that the Requisitioning Shareholders acted in association to exercise control and that this association was confirmed by the joint signing of the s249D notice

- there was sufficient material to conclude that an association exists between the Requisitioning Shareholders and between the Requisitioning Shareholders and the Voting Intention Statement Shareholder, and that there was strong evidence that some or all of the Other Shareholders were also acting in association with some or all of the Requisitioning Shareholders and, in support of this, adduced a new email that was sent by Mr Roderick Clarkson to a number of recipients (including, the applicant submitted, by mistake to the Chief Financial Officer of Caravel) after the initial Panel's decision and

- if the Panel is minded to suggest there is a possibility of association between Requisitioning Shareholders who have connections to MRG, despite the aggregated voting power being below 20% (which Caravel submitted it did not accept), these parties should be obliged to issue substantial holder notices for the purposes of establishing an efficient, competitive and informed market.

Discussion

- We received preliminary submissions on the review application from Mr Cooke, Hartree Pty Ltd and Glenlaren Pty Ltd, Calama Holdings Pty Ltd and ASIC.

- Mr Cooke, Hartree Pty Ltd and Glenlaren Pty Ltd, and Calama Holdings Pty Ltd, submitted that the application did not raise anything not already considered by the initial Panel.

- ASIC submitted that we should conduct proceedings to address the application of the concept of association to the joint signing of the s249D Notice by the Requisitioning Shareholders. ASIC expressed concern that the initial Panel's view might diverge from ASIC's view as set out in RG128, but noted also that it had not then received the initial Panel's reasons.5

- To the extent that matters relevant to our jurisdiction are concerned, we agree with ASIC that jointly signing a s249D notice is "likely to be considered entering into a relevant agreement" giving rise to association,6 although we were of the view this will not necessarily be the case in all situations. We did not find it necessary to decide whether the requisition in this case, of itself, was enough to establish association. We were satisfied in this case that, had we found such an association, the initial Panel's other reasons7 for declining to make a declaration of unacceptable circumstances would lead us to the same conclusion as the initial Panel. We consider that there is no reasonable prospect that we would come to a different conclusion if we conducted proceedings.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Tony Osmond

President of the sitting Panel

Decision dated 2 May 2018

Reasons given to parties 14 May 2018

Reasons published 15 May 2018

Advisers

| Party | Advisers |

|---|---|

| Caravel | Steinepreis Paganin |

|

African Energy Resources Limited and AFR Australia Pty Ltd |

DLA Piper Australia |

|

Mr Alasdair Cooke, Hartree Pty Ltd and Glenlaren Pty Ltd |

Tottle Partners |

1 - Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 - Caravel Minerals Limited 01 [2018] ATP 8

3 - Referring to Table 2 of RG 128 which provides that, if two or more shareholders join together for the purposes of a requisitioned meeting, they will likely become "associates" for the purposes of Chapter 6

4 - Section 657EA(2)

5 - The reasons of the initial Panel were not finalised and given to parties until after preliminary submissions were made in the review proceedings

6 - RG 128, Table 2

7 - Caravel Minerals Limited 01 [2018] ATP 8 at [45]-[56]