[2017] ATP 18

Catchwords:

Decline to conduct proceedings – prescribed occurrences – frustrating action – target's statement – disclosure – interim orders

Corporations Act 2001 (Cth), sections 253E, 652C

Panel Guidance Note 12 – Frustrating Action

Mungana Goldmines Limited 01R [2015] ATP 7

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| YES | NO | NO | NO | NO | NO |

Introduction

- The Panel, Yasmin Allen, Richard Hunt (sitting President) and Rebecca Maslen-Stannage, declined to conduct proceedings on an application by Aurora Funds Management Limited as responsible entity of the Aurora Property Buy-Write Income Trust in relation to the affairs of RNY Property Trust. RNY was the subject of an off-market takeover bid by Aurora. The Panel considered that it was unlikely to find that the implementation by RNY of its cash distribution strategy would be a frustrating action giving rise to unacceptable circumstances. While the Panel had a concern with the disclosure in the target's statement, it considered that (in the exceptional circumstances of this matter) there was no reasonable prospect that it would make a declaration of unacceptable circumstances.

- In these reasons, the following definitions apply.

- Aurora

- Aurora Funds Management Limited as responsible entity of the Aurora Property Buy-Write Income Trust

- RAML

- RNY Australia Management Limited as responsible entity of RNY

- RAML Cash

Distribution Strategy - as defined in RNY's Notice of Meeting and Explanatory

Memorandum dated 7 August 2017 - Resolution 1

- the resolution to approve the RAML Cash Distribution Strategy

- RNY

- RNY Property Trust

- RXR

- RXR Realty LLC and/or its associates

- U.S. LLC

- Reckson Australia Operating Company LLC

Facts

- RNY is a listed managed investment scheme that invests in office properties in the USA (ASX code: RNY).

- RXR is a New York-based real estate operating and development company. It controls RAML, the responsible entity of RNY.

- On 18 July 2017, Aurora requisitioned an extraordinary general meeting of RNY unitholders to consider resolutions to replace RAML as responsible entity of RNY with Aurora.

- On 7 August 2017, RAML released the notice of meeting and explanatory memorandum which, in addition to the resolutions proposed by Aurora, included Resolution 1 (to approve the RAML Cash Distribution Strategy). The RAML Cash Distribution Strategy included approval for the disposal of RNY's interest in its remaining properties (whether by transfer of such properties to RNY's lender in lieu of foreclosure or sale of such properties), the payment of a distribution to RNY unitholders to the extent possible after payment of debts, liabilities, costs and expenses and the delisting and winding up of RNY.

- On 28 August 2017, Aurora announced an off-market takeover bid for all of the units in RNY not owned by Aurora, for a cash price of 1.5 cents per unit. The only defeating condition was the "prescribed occurrences" set out in s652C.1

- The extraordinary general meeting was held on 12 September 2017. At the meeting, Resolution 1 was passed and the resolutions proposed by Aurora failed to pass.

- On 15 September 2017, Aurora announced (a) it would increase its offer to 1.7 cents per unit if it reached a relevant interest in RNY of greater than 50% and, when that happened, there had been no prescribed occurrences and (b) if the improved offer was triggered, it would also declare the offer free of its conditions.

- On 26 September 2017, RAML released RNY's target's statement and recommended that RNY unitholders not accept Aurora's offer.

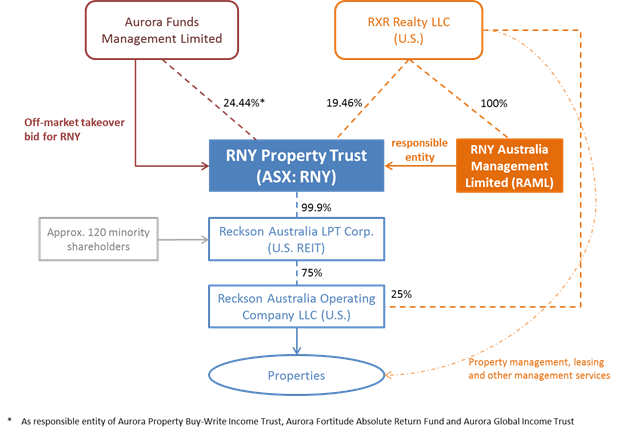

- A diagram of shareholdings and relationships in RNY follows.

Application

Declaration sought

- By application dated 27 September 2017, Aurora sought a declaration of unacceptable circumstances.

- Aurora submitted that the passing of Resolution 1, if implemented, would trigger the defeating condition of its bid and constitute a 'frustrating action' giving rise to unacceptable circumstances.

- It submitted that unacceptable circumstances existed in relation to the passing of Resolution 1 including that:

- RXR had an interest in Resolution 1 other than as a member because it was entitled to a fee on the disposal of the properties2 and was therefore ineligible under s253E to vote on Resolution 1

- prior to the meeting, RAML made no public statement that any fee would be waived in a way that removed any interest to which s253E might apply3

- Resolution 1 would not have passed but for RXR's vote and

- given the levels of unit holding of RXR and Aurora, other RNY unitholders may have deemed it unnecessary to vote on Resolution 1 believing that it was likely to fail because it was reasonable for RNY unitholders to conclude that RXR would not be voting without any disclosure to the contrary.

- In addition, Aurora submitted that the target's statement provided inadequate disclosure including regarding:

- the s253E concerns raised by Aurora

- the details and terms of the waiver of the disposal fee, e.g. whether it was revocable

- the reasons for rejecting the bid including because RAML:

- inaccurately described the effect of the defeating conditions and what would happen to the defeating conditions if Aurora had more than 50% of the units of RNY and

- failed to give guidance on the return expected from implementing Resolution 1, depriving RNY unitholders of the ability to make an assessment of the alternatives available to them.

- Aurora submitted that, if Resolution 1 was implemented and Aurora relied on a defeating condition, this would prevent the acquisition of control taking place in an efficient, competitive and informed market and deprive RNY unitholders from having a reasonable and equal opportunity to participate in the bid. In addition, the misstatements and omissions in the target's statement made it difficult for RNY unitholders to assess the merits of the bid.

Interim orders sought

- Aurora sought interim orders that RAML be prevented from taking any steps to implement Resolution 1 without Aurora's consent or a court determining that the resolution was properly passed.

- RAML submitted that the interim orders sought by Aurora could result in short listed bidders for RNY's properties walking away or the lender which holds security over the properties taking action to foreclose or exercise other powers affecting the properties. RAML noted that RNY is currently dependent on the lender's forbearance.

- Aurora submitted that, based on information it had received from RAML, the sale process on the properties was advanced and it considered therefore that interim orders were needed on an urgent basis.

- On 28 September 2017, after considering parties' submissions, the substantive President of the Panel made interim orders requiring RAML to obtain consent, or provide 24 hours' notice, before causing or permitting the disposal, or the entering into of any agreement or binding commitment to dispose, of any interest in RNY's properties (see Annexure A).

- The President was concerned that the sale of the properties could worsen any possible unacceptable circumstances and in a way that could not be easily reversed before the Panel had an opportunity to consider the matter. The President made the interim orders to maintain the status quo, noting that they do not imply any view on the merits of the application and the Panel, once appointed, may consider it appropriate to review the orders. In order to reduce any adverse impact of the orders, the President limited the interim orders to the disposal of the properties (as opposed to the taking of any steps to implement Resolution 1), enabled RAML to provide short notice to the Panel and indicated that the Panel would be open to considering a request for consent or variation of the interim orders on an urgent basis.

Final orders sought

- Aurora sought final orders including that RAML be prevented from taking any steps to implement Resolution 1 without Aurora's consent or a court determining that the resolution was properly passed or the resolution being passed at a general meeting of RNY unitholders on which RAML and its associates (which included RXR) cast no votes.

Discussion

- We consider the implementation of the RAML Cash Distribution Strategy would result in a 'frustrating action' because one or more steps involved in the strategy would allow the bid to be withdrawn by Aurora under its "prescribed occurrences" condition.4

- Guidance Note 12 – Frustrating Action indicates that a frustrating action is unlikely to give rise to unacceptable circumstances where "the frustrating action is announced before the bid or potential bid".5

- In its preliminary submissions, RAML submitted that the strategy was first announced in February 2017 and Aurora launched its bid knowing that RNY proposed to sell its remaining properties and, absent such sale, faced serious lender foreclosure and general solvency issues. It submitted that while Aurora was entitled to include defeating conditions that would be triggered by these actions, this should not limit RNY's scope of action.

- Aurora submitted that the frustrating action only commenced when RXR's vote in favour of Resolution 1 was accepted at the meeting, and was neither commenced in RAML's ordinary course of business nor advanced at the time the bid was made.

- The sale of RNY's properties was long contemplated and announced by RAML prior to the announcement of Aurora's bid. Given that, we do not consider that taking steps in implementing the RAML Cash Distribution Strategy after announcement of the bid would give rise to unacceptable circumstances. Aurora was clearly on notice, before announcing the bid, that the RAML Cash Distribution Strategy was proposed.

- We note the submissions and public statements by RAML regarding waiver of the fees said by Aurora to give rise to an interest for the purposes of s253E and do not consider that Aurora's submissions on this issue would justify making a declaration of unacceptable circumstances.

- While Aurora submitted that RNY's target's statement contained a number of misleading statements, we only had one substantial concern. Although the target's statement refers to the 'upside' forecast for the RAML Cash Distribution Strategy, it does not refer to the 'downside' forecast. We are concerned that the risk that RNY unitholders may not receive any cash distribution, following implementation of the RAML Cash Distribution Strategy, is not given sufficient prominence in the target's statement. In other circumstances we would have conducted proceedings on this issue but we consider this an exceptional case. Weighing on our decision is the financial predicament of RNY and the effect of any delay and costs that may arise from our proceedings.6 We expect RNY to address the above issue in a supplementary target's statement.7 If RNY fails to do so, Aurora could highlight this deficiency in a supplementary bidder's statement.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we have decided not to conduct proceedings, the interim orders are lifted.

Richard Hunt

President of the sitting Panel

Decision dated 3 October 2017

Reasons given to parties 9 October 2017

Reasons published 11 October 2017

Post Script

On 4 October 2017, Aurora declared its bid free from the defeating condition. On 6 October 2017, RAML recommended that RNY unitholders accept Aurora's offer.

Advisers

| Party | Advisers |

|---|---|

| Aurora | Atanaskovic Hartnell |

| RAML | Greenwich Legal |

| RXR | - |

Annexure A

Corporations Act

Section 657E

Interim Orders

RNY Property Trust

Aurora Funds Management Limited as responsible entity of the Aurora Property Buy-Write Income Trust made an application dated 27 September 2017 in relation to the affairs of RNY Property Trust (RNY).

The President ORDERS:

- RNY Australia Management Limited (in its own capacity and as responsible entity of RNY) must not cause or permit the disposal, or the entering into of any agreement or binding commitment to dispose, of any interest in any of the five remaining properties of RNY (as referred to in RNY's target's statement), without providing the Panel with at least 24 hours' prior notice of the intention to do so or obtaining the consent of the President or the Panel. For purposes of this interim order, notice to the Panel should be sent by email to takeovers@takeovers.gov.au.

- These interim orders have effect until the earliest of:

- further order of the President or the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Bruce Dyer

Counsel

with authority of Vickki McFadden

President

Dated 28 September 2017

1 - Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth) and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 - Referring to RNY's Product Disclosure Statement dated 15 August 2005 which provides that Reckson Management Group, Inc (now RXR) is entitled to receive from U.S. LLC a disposition fee of 1.0% of the sale price of any and all assets directly or indirectly disposed of by U.S. LLC, less any fees paid to third parties for the same service

3 - On 18 September 2017, in response to an announcement by Aurora questioning the validity of voting at the meeting, RAML announced that: "RXR (such term includes its affiliates) will charge no selling commission (however described) and will be paid no selling commission. There are a number of reasons for this but the principal one is that RXR waived any such entitlement prior to the despatch of the notice of meeting."

4 - See Guidance Note 12 – Frustrating Action at paragraph 3

5 - At paragraph 21(a)

6 - Further at the time of making our decision, other matters had been raised and referred to ASIC that made it inevitable that further disclosure would be required. See the post-script

7 - See Mungana Goldmines Limited 01R [2015] ATP 7 at [27]: "Where there has been materially deficient disclosure by a party, it is not a satisfactory answer to say that it is open to another party to correct that deficiency by making its own disclosures"