[2016] ATP 16

Catchwords:

Decline to conduct proceedings – association – board spill – "two-strikes" rule – collective action – voting agreement

Corporations Act 2001 (Cth), sections 12(b), 249N, 250R, Division 9 of Part 2G.2, 606, 671B

ASIC Regulatory Guide 128: Collective action by investors

Resource Generation Limited [2015] ATP 12, Dragon Mining Limited [2014] ATP 5, Mount Gibson Iron Limited [2008] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | No | No | No | No | No |

Introduction

- The Panel, Peter Day, Sarah Dulhunty (sitting President) and Bruce McLennan, declined to conduct proceedings on an application by Jervois Mining Limited in relation to its affairs. The application concerned an alleged association between shareholders of Jervois for the purpose of changing the composition of the board. The Panel considered that it was not provided with a sufficient body of material to justify the Panel making further enquiries as to the alleged association and accordingly, there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Jervois

- Jervois Mining Limited

- Masterman

- Robert Henry Masterman and 327th P & C Nominees Pty

Ltd ATF Robert Henry Masterman Superannuation Fund - SDI

- Scandium Development International Pty Ltd

Facts

- Jervois is an ASX listed company (ASX code: JRV). Its principal activity is mineral exploration and evaluation.

- SDI is a private company that has a relevant interest in 0.03% of Jervois' issued capital. SDI is a wholly owned subsidiary of Strategic Specialty Metals Ltd, a venture capital firm focused on developing specialty metal projects in Australia.

- Since mid-2014, SDI has put proposals to Jervois including offers to acquire Jervois' scandium assets, arrange financing and subscribe for shares. All of these proposals were rejected by Jervois.

- From August 2015 onwards, SDI contacted other Jervois shareholders to solicit interest or support for its proposals, including removing the current directors of Jervois.1

- At Jervois' 2015 annual general meeting held on 27 November 2015 votes representing approximately 18% of Jervois' issued capital were cast against adoption of the remuneration report and approximately 17% of Jervois' issued capital were cast against re-election of a director. The votes cast against the remuneration report (being 48.8% of the votes cast on the resolution) constituted a "first strike" under the "two strikes" rule.2

- In a letter dated 29 March 2016 from SDI and addressed to "fellow Jervois Mining Limited (JRV) shareholder", Mr Richard Karn, a director of SDI, wrote (emphasis included): "In the 2 weeks before the AGM in November 2015, we rallied 18 m shares of support; today, more than 100 shareholders controlling 23.4 m shares - fully 26% of JRV - support ousting the Board".

- In May 2016, two SDI letters regarding Jervois' management and Jervois' dealings with SDI were posted on the stock discussion website HotCopper, purportedly with the permission of SDI and/or Mr Karn.

- From 4 June to 4 August 2016, five posts expressed to be "produced by a group of JRV shareholders" were made on HotCopper with each post describing a reason to remove the board of Jervois.

- In a further HotCopper post on 5 August 2016, the writer of the post stated in relation to SDI's campaign to oust the Jervois board that "[l]ast I heard, SDI had the support of nearly 27 m shares of JRV".

- On 29 September 2016, Jervois applied to the Panel. On the same day, Masterman (which holds at least 5% of Jervois) gave notice pursuant to s249N to Jervois of proposed resolutions to be considered at the 2016 annual general meeting including resolutions to replace the current board.3

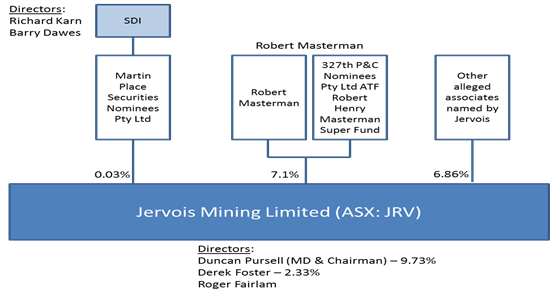

- The holdings of the parties (based on information provided in the application) are shown in the following diagram:

Application

Declaration sought

- By application made on 29 September 2016, Jervois sought a declaration of unacceptable circumstances. Jervois submitted that:

- SDI had formed an association with other Jervois shareholders either as a consequence of a relevant agreement for the purpose of controlling or influencing the composition of Jervois' board or the conduct of Jervois' affairs (s12(2)(b)) or because SDI had been acting in concert with other shareholders in relation to Jervois' affairs (s12(2)(c))

- the association was on-going and related to voting shares constituting approximately 26% of Jervois' issued capital. Jervois provided a list of what it claimed were known associates of SDI who, together with SDI, held approximately 14% of Jervois' issued capital

- by virtue of the voting arrangement or by acting in concert with respect to voting, SDI and its associates had each acquired relevant interests in voting shares in Jervois in breach of the 20% threshold in s606 and which had not been disclosed under s671B and

- even if there was no contravention of the Corporations Act, the collective action by shareholders constituted unacceptable circumstances in accordance with ASIC Regulatory Guide 128 Collective action by investors.

- Jervois submitted that the effect of the circumstances was that the acquisition of control over voting shares in Jervois was not taking place in an efficient, competitive and informed market.

Final orders sought

- Jervois sought final orders that:

- SDI and its associates must not proceed in accordance with a voting agreement, arrangement or understanding in connection with the affairs of Jervois without making a bid or while the breach of ss606 and 671B otherwise continued and

- SDI and its associates must not vote at:

- Jervois' 2016 annual general meeting or any adjournment thereof or

- any other general meeting of Jervois in the period of six months from the date of the order, including a general meeting to approve related party benefits for directors of Jervois to bring defamation proceedings against SDI and others.4

Discussion

Preliminary submission

- SDI made a preliminary submission denying any association or voting agreement. It submitted, among other things, that:

- the Panel should not conduct proceedings because the material did not support findings of association between SDI and other Jervois shareholders or the acquisition of a relevant interest in Jervois shares in breach of s606

- the material rose no higher than demonstrating the type of conduct identified by ASIC in Table 1 of ASIC Regulatory Guide 128 as being unlikely to constitute acting as associates (for example the material was consistent with the investors not being bound to act in a certain way) and

- Jervois was seeking to prevent certain shareholders from voting at the next annual general meeting and future shareholder meetings so as to entrench the Jervois board's position and prevent voting on resolutions that benefit the directors.

Association

- We have considered all the material, but address specifically only those things that we consider necessary to explain our reasoning.

- In Dragon Mining Limited,5 the Panel stated that, in considering whether to conduct proceedings:

...there must be a sufficient body of material demonstrated by the applicant, which together with inferences (for example from partial evidence, patterns of behaviour and a lack of a commercially viable explanation) support the Panel conducting proceedings.

- The Panel went on to state:6

Dromana Estate Limited 01R acknowledges the difficulties that an applicant faces in gathering evidence in association matters. In deciding whether to conduct proceedings on an association case, this must be kept in mind. However, the Panel has limited investigatory powers which means, before we decide to conduct proceedings, an applicant must do more than make allegations of association and rely on us to substantiate them. An applicant must persuade us by the evidence it adduces that we should conduct proceedings.

- Jervois submitted that communications from SDI to other Jervois shareholders supported inferences that SDI and other shareholders were acting in concert or had an arrangement about voting. The communications included references to:

- "we", a "group", a "band" and a "cohort" when referring to the shareholders or their plans or actions, upon which Jervois submitted that inferences could be drawn of a shared plan or goal

- phrases like "co-ordinating efforts" and "actively involved" which Jervois submitted implied an arrangement or acting in concert and

- statements such as "pledge your support" and "we have increased shareholders support to oust the Board from 18.05 m shares to 22.44 m" which Jervois submitted was consistent with a commitment as to a common purpose.

- The language used by SDI in its correspondence with other Jervois shareholders could suggest that a group of shareholders had an understanding or were acting together for a common purpose. Equally, the language may have been used by SDI to provide a sense of momentum. Importantly, however, very little material was provided to us to suggest that these statements were supported by other shareholders, let alone shareholders with aggregate voting power of 5% or more.

- Jervois submitted that an inference could be drawn from the actions of SDI which were uncommercial for a shareholder owning only 0.03% and were only explicable on the basis that SDI was acting for a purpose beyond merely ensuring good governance at Jervois. While this could be a relevant circumstance in finding association, based on all the material, it is not enough to convince us that further enquiry is warranted.

- Jervois also submitted that the s249N notice from Masterman proposing resolutions to replace the current board7 was evidence that Masterman was an associate of SDI and of the plans and intentions of the associated group of shareholders.

- While Masterman was copied on an email sent by Mr Roger Fairlam of Jervois to Mr Karn in early March 2016 and a reply, without more, this is not sufficient to persuade us to make further enquiries. Nothing came to our attention, for example, that suggested that Masterman's nominee directors were not independent.

- Jervois further submitted that the "first strike" on the remuneration report resolution that occurred at the 2015 annual general meeting demonstrated the existence and effectiveness of the voting bloc of SDI and its associates. The "first strike" could reflect an agreement or understanding among a group of Jervois shareholders to vote a certain way. Equally, it may simply be like-minded shareholders voting the same way for corporate governance purposes. There is nothing to suggest that this was not a genuine example of shareholder disapproval of Jervois' executive remuneration.

- Without more, the conduct of SDI in canvassing support from other Jervois shareholders appears to be the type of collective action identified in Table 1 of ASIC Regulatory Guide 128 that may be unlikely to constitute association or otherwise give rise to unacceptable circumstances. Such conduct includes discussing and exchanging views on a resolution to be voted on at a meeting, disclosing individual voting intentions on a resolution and recommending that another investor votes a particular way.

- Table 1 of ASIC Regulatory Guide 128 cautions that concerns may arise "[i]f the conduct extends to the formulation of joint proposals to be pursued together or there is an understanding that the investors will act or vote in a particular way". This was found to be the case in Resource Generation Limited where the Panel considered that two shareholders of Resource Generation, Noble and Altius, were associated and stated:8

...parties can hold as many discussions as they want. They can be like-minded without necessarily creating an association. But Noble and Altius went beyond discussion. They went beyond even a discussion with an expectation that the other would act in a certain way. Their actions fitted the example extracted from Table 2 of RG 128 ... They formulated a proposal that involved "at least an understanding between the parties as to a common purpose or object", namely a joint proposal for controlling or influencing the composition of the board of RES.

- We understand it can be challenging for an applicant to gather probative material of association. We have taken this into consideration. Nevertheless, we consider that Jervois has not provided a sufficient body of material to justify us making further enquiries as to the alleged association. For example, there is insufficient material presented of a connection between SDI and any other Jervois shareholder. There is a clear sense of agitation among some Jervois shareholders and the company appears to be under pressure, but it does not necessarily follow that shareholders are acting, or have agreed to act, together in a certain way or have agreed to vote their shares in a particular way.

- There was also email correspondence from two of the named potential associates, which was not consistent with association.

- In addition to our view on the material available to support the alleged association, the application only named potential associates with a combined voting power of approximately 14%. Therefore, we do not consider it likely that there would be a breach of s606.

- If additional material becomes available, it is open to Jervois to bring a new application.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Sarah Dulhunty

President of the sitting Panel

Decision dated 5 October 2016

Reasons published 13 October 2016

Advisers

| Party | Advisers |

|---|---|

| Jervois Mining Limited |

Mr Peter Willis, SC |

| Scandium Development International Pty Ltd | Clifford Chance |

1 Material was produced that SDI had called, emailed and written to other Jervois shareholders

2 Section 250R and Division 9 of Part 2G.2 of the Corporations Act 2001 (Cth). If 25% of the votes cast at two consecutive annual general meetings oppose the adoption of the remuneration report, then at the second annual general the company must, if 50% or more of votes cast are in favour of a 'spill', convene a further general meeting at which all the directors (except the managing director and any directors appointed since the remuneration report was approved by the board) stand for re-election. All section references are to the Corporations Act 2001 (Cth) unless otherwise indicated

3 Jervois informed its shareholders about the s249N notice on 6 October 2016

4 The Jervois board proposed to bring a defamation case against SDI for comments made in letters sent directly to shareholders and in postings on the HotCopper website about Jervois and its board. Legally, the action had to be taken in the names of the individual directors. Jervois had informed shareholders that it proposed to put the question of payment of the directors' legal fees to shareholders at the 2016 annual general meeting

5 [2014] ATP 5 at [27] (footnote omitted), quoting Mount Gibson Iron Limited [2008] ATP 4 at [15]

6 [2014] ATP 5 at [60]

7 Jervois made this submission in a supplement to its application dated 3 October 2016

8 [2015] ATP 12 at [97]. While the Panel found an association, it did not consider there to be sufficient evidence that Noble or Altius had a voting agreement in relation to their Resource Generation shares (see [105] to [107])