[2015] ATP 9

Catchwords:

Association – efficient, competitive and informed market – financing arrangements – family links – structural links – relevant agreement – relevant interest – substantial holder notice – declaration of unacceptable circumstances – orders – disclosure – divestiture – withdrawal rights

Corporations Act 2001 (Cth), sections 12, 53, 602, 606, 608, 636, 657A, 657D, 671B, 672B

Australian Securities and Investments Regulations 2001 (Cth), 16

Corporations Regulations 2001 (Cth), 1.0.18

ASIC Regulatory Guide 5: Relevant interests and substantial holding notices

Tinkerbell Enterprises Pty Limited as Trustee for The Leanne Catelan Trust v Takeovers Panel [2012] FCA 1272

Guidance Note 4 Remedies General

World Oil Resources Limited [2013] ATP 1; CMI Limited 01R [2011] ATP 5; CMI Limited [2011] ATP 4; Brockman Resources Limited [2011] ATP 3;Viento Group Limited [2011] ATP 1; Mount Gibson Iron Limited [2008] ATP 4; Taipan Resources NL 03 [2000] ATP 17; Re Email Limited (No. 2) [2000] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| Yes | Yes | Yes | Yes | Yes | No |

Introduction

- The Panel, Geoff Brunsdon (Sitting President), Elizabeth Bryan AM and Karen Evans-Cullen, made a declaration of unacceptable circumstances in relation to the affairs of Affinity Education Group Limited. The application concerned contraventions of s606, the substantial holding provisions and beneficial interest provisions by G8 and parties alleged to be associated with G8. The Panel considered that parties were associated, made a declaration of unacceptable circumstances and ordered divestment of Affinity shares, withdrawal rights and disclosure.

- In these reasons, the following definitions apply.

- Advanced

- Advanced Share Registry Ltd

- Affinity

- Affinity Education Group Limited

- Anchorage

- Anchorage Childcare Pty Ltd

- Armstrong

- Armstrong Registry Services Pty Limited

- G8

- G8 Education Limited

- Hunter Green

- Hunter Green Institutional Broking Pty Ltd

- JB Super

- JB Super Fund Pty Ltd

- Mills Oakley

- Mills Oakley Lawyers

- On-market bid

- G8's on-market takeover bid for Affinity announced on or about 3 August 2015

- Print Mail

- Print Mail Logistics Limited

- Scrip bid

- G8's off-market takeover bid for Affinity announced by G8 on 3 July 2015 (revised on 3 August 2015)

- Shaw

- Shaw and Partners Limited

- Taxonomy

- Taxonomy Pty Ltd

- Taylor Collison

- Taylor Collison Ltd

- West Bridge

- West Bridge Holdings Pty Ltd

- Yuan

- Yuan Essentials Pty Ltd

Facts

- Affinity is an ASX listed company (ASX code: AFJ).

- G8 is an ASX listed company (ASX code: GEM). G8's chairperson was Ms Jennifer Hutson.

- On 2 July 2015, G8 acquired 16.41% of Affinity shares.

- On 3 July 2015, G8 acquired further Affinity shares, increasing its interest to 19.89%, and made an announcement to the market of its intention to make a takeover bid for all of Affinity's shares, offering 1 G8 share for every 4.61 Affinity shares (implied value of $0.703 based on the closing price of G8 shares on 2 July).

- On 6 July 2015, JB Super acquired 97,500 Affinity shares. Dr Jane Hutson is the sole director and shareholder of JB Super. JB Super acts solely as the trustee for the JB Super Fund Investment Account. The beneficiary of the JB Super Fund Investment Account is Dr Hutson.

- On 9 and 10 July 2015, Taxonomy acquired 10,500,000 Affinity shares. Of these, 2,000,000 shares are CHESS Sponsored and 8,500,000 shares are Issuer Sponsored. Alwyn Peffer is the director and company secretary of Taxonomy. The sole shareholder of Taxonomy is Bamson Pty Ltd which is owned by Mr Peffer and his wife, Karen Peffer.

- Between 13 July and 28 July 2015, West Bridge acquired 11,300,000 Affinity shares. It purchased shares on market on most of those days. The sole director and shareholder of West Bridge is Nigel Elias.

- On 30 July 2015, G8 issued the bidder's statement for the scrip bid.

- On 3 August 2015, G8 lodged:

- a supplementary bidder's statement and a replacement bidder's statement in relation to its scrip bid, which:

- increased the consideration offered to 1 G8 share for every 4.25 Affinity shares (implied value of $0.80 based on the closing price of G8 shares on 31 July 2015)

- freed the offer from all conditions and

- announced that the scrip bid was final and would not be increased, unless required by law and

- a bidder's statement in relation to a new on-market cash offer at $0.80. This offer was stated to be final and would not be increased.

- a supplementary bidder's statement and a replacement bidder's statement in relation to its scrip bid, which:

- Also on 3 August 2015, Affinity announced that Affinity shareholders should take no action with regard to their Affinity shares until they received the target's statement and that the Affinity directors were in discussions with an interested third party.

- On 14 August 2015, G8 issued a supplementary bidder's statement for its on-market bid, stating that the offer period for the bid would commence on 26 August 2015.

- On 20 August 2015, G8 issued a further supplementary bidder's statement and replacement bidder's statement in relation to its scrip bid, stating that the offer period for the bid would commence on 21 August 2015.

- On 24 August 2015 at 8:28am, Affinity lodged its target statement, which included a unanimous recommendation by the Affinity Board to reject both the scrip bid and the on-market bid.

- On 24 August 2015 at 8:45am, G8 lodged a substantial holder notice indicating that it had acquired a relevant interest in 10,597,500 Affinity shares (4.58% of Affinity) through acceptances of the scrip bid. This took its interest to 24.48%.

- Also on 24 August 2015 at 2:10pm, Affinity announced that it had entered into a conditional heads of agreement with Anchorage Capital Partners Pty Limited. The heads of agreement proposed that Anchorage would acquire all the assets and business of Affinity for $208.3 million and Affinity would return $0.90 cash per share to its shareholders. Affinity indicated that it would seek to negotiate and enter into binding transaction documents by 21 September 2015, and would advise shareholders, by no later than 21 September 2015, when Anchorage confirmed it had completed its outstanding due diligence and on the entry into binding transaction documents.

- On 28 August 2015, G8 lodged a further substantial holder notice indicating acceptances to 24.55% of Affinity, the details of which included an acceptance for 97,500 shares on 24 August 2015.

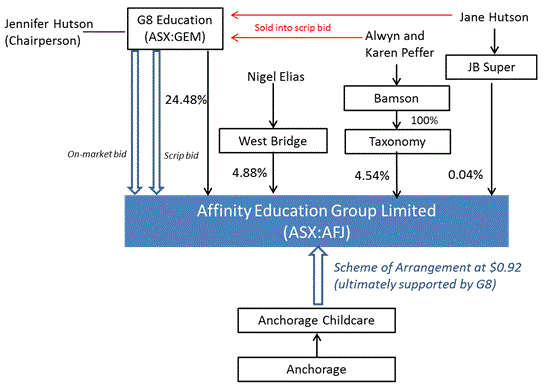

- The structure of holdings and transactions of the various parties are shown in the following diagram:

Application

Declaration sought

- By application dated 26 August 2015, Affinity sought a declaration of unacceptable circumstances. Affinity submitted that:

- Taxonomy, JB Super and West Bridge acquired Affinity shares after the announcement of G8's intention to make a bid

- Taxonomy and JB Super accepted the scrip bid on the first day it was open, when it was "economically and commercially irrational to do so"

- there were structural links between each of Taxonomy, JB Super and West Bridge and G8 and

- Taxonomy and JB Super must have an understanding about acceptance of the scrip bid, and an association, with G8.

- Affinity submitted that there had been contraventions of the following sections:

- s6061 in relation to the acceptances by Taxonomy and JB Super

- s671B, in relation to disclosure of voting power or the terms of the relevant agreements and

- s672B, by Taxonomy as it had failed to provide ASIC with the correct information under ASIC's tracing notice.

- Affinity submitted that the effect of the circumstances was, among other things, that the acquisition of over 20% of Affinity shares did not take place in an efficient, competitive and informed market.

Interim orders

- Affinity sought interim orders including to the effect that:

- G8 be restrained from processing any acceptances under the scrip bid, including issuing consideration for the acceptances of Taxonomy and JB Super

- Taxonomy and JB Super be restrained from withdrawing their acceptances or otherwise dealing with their Affinity shares and

- West Bridge be restrained from accepting either of the G8 offers or otherwise disposing of its Affinity shares.

- On 27 August 2015, the President accepted an undertaking (Annexure A) from G8 not to:

- issue consideration to, or further process acceptances from, Taxonomy or JB Super before the earlier of the conclusion of the Panel's deliberations and the time by which it must issue the consideration under s620(2)

- allow the acceptances of JB Super and Taxonomy to be withdrawn until the conclusion of the Panel's deliberations and

- process any acceptance received from West Bridge until the conclusion of the Panel's deliberations.

- The undertaking maintained the status quo pending the determination of the application.

- On 21 September 2015, we made an interim order (Annexure B) preventing G8 issuing consideration to, or taking further steps to process acceptances from, Taxonomy or JB Super Fund because part of the undertaking described in paragraph 24(a) was to be superseded by the requirement in the Corporations Act to issue the consideration.

Additional interim order affecting West Bridge

- On 30 August 2015, West Bridge requested permission to dispose of its shares in Affinity "in the ordinary course of market trading". West Bridge was not required to seek permission and we are appreciative of its openness in this regard.

- On 2 September 2015, Affinity submitted that the Panel should make interim orders restricting West Bridge from disposing of its Affinity shares until the Panel had concluded its proceedings. West Bridge proposed to undertake to realise the investment at market but, in any event, at no less than 80.5 cents per Affinity share. West Bridge submitted that this would ensure that G8 could not be the purchaser of the shares.

- In Re Email Limited (No. 2), the Panel said:

In making an interim order, the Panel needs to consider whether unacceptable circumstances exist or would develop if the order was not made, and weigh the burden of the interim order against the mischief which would occur if the order was not made....2

- We looked at a range of factors in considering whether to make interim orders restricting West Bridge's disposal of its shares. These included the factors set out in Guidance Note 4,3 in particular the strength of the preliminary evidence against West Bridge and the impact on the status quo of allowing the sales on market.

- We considered that interim orders allowing the sale on market at prices that would prevent G8 or any associate acquiring those shares would provide adequate protection and reflect an appropriate balance of rights in the circumstances. Our position is similar to the one the Panel adopted when it varied its interim orders in Brockman.4

- We decided to make interim orders which had the effect of allowing West Bridge to sell its shares in controlled circumstances (Annexure C).

Final orders sought

- Affinity sought final orders to the effect that:

- G8, Taxonomy, JB Super and any other Affinity shareholders that the Panel determines are associates, be required to lodge corrective substantial holder disclosure to the market

- Taxonomy and JB Super be required to vest their Affinity shares in ASIC, which ASIC will sell on-market, other than to G8 under either of the G8 offers, or to any of G8's associates.

Discussion

Association test

- Section 12 sets out the tests for association as they apply to Chapter 6. There are two relevant tests here:

- s12(2)(b) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company's board or conduct of its affairs and

- s12(2)(c) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company's affairs.

- As stated by the Panel in CMI Limited 01R,5 the cases make it clear that there is significant overlap between the concepts of "acting in concert" and "relevant agreement" in s12.

- In Mount Gibson Iron Limited,6 the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

Decision to conduct proceedings

- G8 provided a preliminary submission. It submitted (among other things) that no director or officer of G8 had spoken to or corresponded with the following parties in relation to any matter involving G8 or Affinity:

- Taxonomy, Mr Peffer or Bamson Pty Ltd

- West Bridge or Mr Elias or

- JB Super or Dr Hutson.

- ASIC also provided a preliminary submission. It submitted that "Having regard to the circumstances in which Taxonomy Pty Ltd accepted the G8 scrip bid, ASIC has concerns that there may have been an association, or arrangement giving rise to a relevant interest, between the accepting shareholder and either G8 or its associates."

- Anchorage also provided a preliminary submission. It noted ASIC's submission and submitted that we should conduct proceedings.

- We decided to conduct proceedings. In our view there is, in terms of the test set out in Mount Gibson, "a sufficient body of evidence of association and to convince the Panel as to that association, albeit with proper inferences being drawn."7

Response by various Parties

- Mr Peffer, on behalf of Taxonomy, said in an email in response to the application that "(a)s a private investor, Taxonomy Pty Ltd does not wish to participate in any dispute between Affinity and G8 and it will not be lodging a submission or notice of appearance." Taxonomy was informed that the application sought orders that would affect it. We also nevertheless invited Taxonomy to make a submission and asked various questions of it.8 It did not make a submission. Taxonomy was next provided with the statement of our preliminary findings. It made a submission on this. After consideration of all the submissions and rebuttals, we were minded to make a declaration and provided Taxonomy with the draft declaration and the supplementary brief on orders for comment.9 Taxonomy made submissions on these documents and informed us that it had instructed legal advisers and would be filing a Notice of Appearance seeking to become a party. Taxonomy did become a party and made further submissions on orders.

- We regard it as unusual that a person with a direct interest in proceedings did not participate until virtually the end of the proceeding. We have had regard to the fact that information readily available to Taxonomy that might have assisted it was not provided.

- West Bridge lodged a notice of appearance at the outset and became a party. It made a submission on the brief and a very brief rebuttal submission but no further submissions. We also have had regard to the fact that information readily available to West Bridge that might have assisted it was not provided.

- JB Super lodged a notice of appearance at the outset and became a party. Its legal advisers requested a copy of the application and other materials, which were provided. It made submissions and rebuttals at the various stages of the proceeding.

Preliminary findings

- Having considered the issues raised in the application and submissions and rebuttals, we made preliminary findings in relation to the issue of association and invited comments on them. Our conclusion on the issue of association follows our consideration of the comments made on the preliminary findings as well as the other material supplied to us.

- We considered the cumulative effect of all the material and have drawn inferences that, in our experience, seem appropriate. In doing so we had in mind that we must be satisfied by logical and probative material and the potential seriousness of a finding of association.

- Further, when making an assessment of all the material in this matter we have relied on our skills, knowledge and experience as practitioners (which has been made known to the parties) and as members of the sitting Panel.10 We have procedural requirements to meet and statutory time constraints in which to make a decision.11 In our view, we have met these.

- In these reasons the many connections between various parties have not been stated in as much detail as they were in the preliminary findings, both for ease of reading and to protect personal information.

Circumstances relevant to Taxonomy

- Taxonomy is a company ultimately owned by Mr and Mrs Peffer.

- On 19 June 2015, an amount of $8,355,068.49 was deposited with solicitors, Mills Oakley. It was provided by Yuan. The description of the transaction on the Mills Oakley bank statement was "Deposit payment of Yuan loan." Mr Peffer, on behalf of Taxonomy, submitted that he was not aware that this had occurred on that date. In response to the preliminary findings he submitted that the deposit on 19 June 2015 was "irrelevant and unknown to me… until I was later advised of this date by Mills Oakley." This is despite Taxonomy providing a document to ASIC which recorded in its books a loan amount of $8,000,000 on 19 June 2015.

- On 8 July 2015, Taxonomy entered a loan agreement with Yuan for $8,000,000. Also on that date, a solicitor with Mills Oakley who handled the transaction, Ms Rachel Weeks, recorded in a file note of a conversation with Mr Peffer that there was "money in trust ". Taxonomy made the following purchases of Affinity shares to acquire a total of 4.54% of Affinity:

- 8,500,000 shares on 9 July 2015 at an average price of $0.6948 and

- 2,000,000 shares on 10 July 2015 at an average price of $0.70.

- Charlie Green, director of Hunter Green, who had various levels of involvement (see below), had arranged for the acquisitions through a stockbroker, Taylor Collison.

- On 9 July 2015 Mr Peffer provided written instructions to Ms Weeks to apply the funds held by Mills Oakley for Taxonomy to settle the trades.

- On 13 July 2015, Taylor Collison was paid $7,345,981.90 from the Mills Oakley trust account in settlement of the acquisitions. Ms Weeks submitted12 that "Yuan Essentials Pty Ltd provided the funds which were used to settle the acquisitions".

- On 21 and 24 August 2015, Taxonomy accepted the scrip bid for all its Affinity shares. The first day the offers for the scrip bid were open for acceptance was 21 August 2015.

- Mr Peffer, in a letter dated 10 September 2015 responding to an ASIC request for documents of Taxonomy, stated that he "was informed that the loan funds were deposited into the Trust Account of Mills Oakley on the basis that Taxonomy Pty Ltd could give direction about the disbursement of those funds". He stated that the funds were "clearly applied to the purchase of the Affinity shares". Mr Peffer attached to the letter a "listing of transactions under the loan agreement" between Yuan and Taxonomy. In that listing, the loan amount is stated as $8,000,000 and dated 19 June 2015. It is unclear why this amount is different to the amount deposited in the Mills Oakley account, although it is consistent with the amount in the loan agreement (but not consistent with the date of the loan agreement).

- In response to our preliminary findings, Taxonomy offered a ‘corrected version' of the listing "if it would assist the Panel to have a corrected version". Taxonomy attached a ‘corrected version' of the listing showing the transaction date as 8 July 2015. It does not assist us that this version had a changed date of the loan funds from 19 June 2015 to 8 July 2015, even with the explanation that Taxonomy provided, namely that the listing had shown only those transactions of relevance to Taxonomy's borrowing from Yuan and "the date of the first transaction should be shown at 8 July because that is the date of the loan but I have shown the date the funds came into the Mills Oakley trust account".

- Mr Peffer submitted in response to the preliminary findings that the listing initially recorded the date of the loan as 19 June 2015 as that was the date he was provided by Mills Oakley for the receipt of the deposit.

- We note the following discrepancies with the loan transaction:

- the deposit of the loan funds into the account occurred 19 days before the loan agreement was signed and the acquisition of shares was transacted. No explanation of this has been provided

- the loan funds deposit was for $355,068.49 more than the $8,000,000 specified in the loan agreement and shown in Taxonomy's records. Taxonomy submitted that the difference between the funds borrowed and investment in Affinity shares was for the capitalisation of interest. We were provided with a copy of the secured loan agreement which stipulated that interest was capitalised and only payable at the termination of the loan. However, the explanation for the differences remains unclear and

- there is no correspondence, or file notes of conversations, between Ms Weeks and Taxonomy on or around 19 June 2015 in relation to the deposit of funds. The lack of paperwork in relation to Taxonomy around the receipt of funds is surprising.

- The deposit of the loan funds into the Mills Oakley account occurred two weeks before the announcement of G8's takeover bid.

- The money trail is, in our experience, unusual in a number of respects, some of which we have noted already. Additionally, no explanation of the need to use a solicitor for handling the loan funds, or the share acquisition, has been provided.

- We infer that Mr Peffer on behalf of Taxonomy had little or no involvement in the financing or other aspects of Taxonomy's acquisition, apart from the formalities of them.

Craig Wallace

- The loan funds for Taxonomy's purchase of Affinity shares came from Yuan.

- The sole director and shareholder of Yuan is Craig Wallace. In Mr Peffer's letter of 10 September 2015 to ASIC, he stated that he had known Mr Wallace "through various business transactions over the years". Mr Peffer did not provide any details regarding those transactions.

- Mr Wallace has, or has had, professional connections to Mr Peffer, through some of the partners at the Brisbane law firm McCullough Robertson and directly.

- Mr Wallace has, or has had, professional connections with Ms Hutson, or entities related to Ms Hutson, including common directorships and company secretarial roles. The companies involved included Wellington Capital Limited, of which Ms Hutson is Managing Director. Mr Wallace and Ms Hutson worked together on the acquisition by Wellington Capital of Octaviar Investment Management Limited, the responsible entity for Premium Income Fund, in 2008. There are also press reports of Mr Wallace's involvement in a meeting of unit holders of Premium Income Fund in 2011.

- Mr Wallace also has, or has had, professional connections with Mary-Anne Greaves, company secretary of Wellington Capital Limited. Ms Greaves has connections to Ms Hutson and to Ms Weeks.

- Mr Wallace also has a connection with G8. In March 2010, Early Learning Services Limited merged with Payce Child Care Pty Ltd and was renamed G8. Mr Wallace owned 75% of Payce. Immediately after the merger he effectively controlled G8, holding approximately 50.5%. Payce nominated three people to the board of G8, one of whom was Ms Hutson. Mr Wallace was last listed as one of G8's top twenty holders in G8's 2012 annual report.

Rachel Weeks

- Ms Weeks was instructed by Taxonomy to:

- liaise directly with Mr Charlie Green and Taylor Collison to have a share trading account opened for Taxonomy with Taylor Collison, who would arrange for Affinity shares to be purchased and

- to apply the funds held by Mills Oakley for Taxonomy to settle the share purchases.

- Ms Weeks has a considerable number of professional and personal links to Ms Hutson, including common investments, for example in Queen Bee Enterprises Pty Ltd (also with Mary-Anne Greaves), and having previously worked at McCullough Robertson (where Ms Hutson was a partner and at one stage was in the same corporate area). Ms Weeks' firm, Mills Oakley, has also acted for Wellington Capital Limited.

- Ms Weeks also appears to have professional links to Mr Wallace, for example acting as company secretary to companies he is connected with and being co-directors of Wellington Funds Management Ltd.

- Ms Weeks liaised with Mr Green and Taylor Collison between 8 and 13 July 2015. She sent the contract notes for the share purchases to Mr Peffer by mail.

- In response to our invitation to Ms Weeks seeking "details of any communication you had with Mr Peffer or any other representative of Taxonomy" (and requesting documents), Ms Weeks did not provide any correspondence from on or around 19 June 2015 regarding the loan money going into the trust account. We assume therefore that there is no such documentation in relation to Taxonomy. This is consistent with Taxonomy's submission that Mr Peffer was unaware of the original deposit until later. We concluded that Ms Weeks' instructions must have come from someone other than Mr Peffer.

- On 8 July 2015, by phone Mr Peffer instructed Ms Weeks not to correspond by email. She made a file note of this as follows: "private investment so no emails – ‘old fashioned'" (original emphasis). On 9 July 2015, he gave her written instructions to the same effect by letter. He said "It is important to me that my private investment arrangements remain private, so please do not send emails rather post or have delivered to me all relevant correspondence". We consider this unusual for a number of reasons. It is not clear why letters would remain more private than emails. It is not clear why there was an apparent need for such privacy. And Mr Peffer otherwise used email, for example, for his acceptance of G8's scrip bid.

- On 3 August 2015, Mr Green emailed forms to Ms Weeks to open a client account with Shaw for Taxonomy stating that it was "[g]ood for Taxonomy to have more than one route to market if required." Shaw was involved in West Bridge's and G8's acquisitions of Affinity shares. It was also used by West Bridge to dispose of its shares on market (see below). We have received nothing from Mr Peffer or Mr Green to evidence that Mr Peffer provided Mr Green with instructions in respect of opening an account with Shaw. No explanation for this has been provided.

Charlie Green

- Charlie Green is a director of Hunter Green, based in Brisbane. It provides institutional broking and corporate advice. Mr Green was involved in the purchase of G8's pre-bid holding in Affinity.

- On 2 July 2015, Ms Hutson engaged Hunter Green to find a stockbroker to purchase its pre-bid stake of Affinity shares. Hunter Green was engaged, it was submitted by G8, following a recommendation from one of the sellers of Affinity shares to G8. The firm was known to G8. Mr Green was also acting for Wellington Capital Limited and liaising with Ms Hutson in relation to another, unrelated transaction.

- On 2 July 2015, Mr Green instructed Shaw as the stockbroker for G8's pre-bid acquisition of Affinity shares. Shaw acquired part of the ultimate stake.

- On 3 July 2015, Mr Green connected G8 with Taylor Collison as G8 was interested in purchasing additional Affinity shares. Taylor Collison acquired further pre-bid Affinity shares for G8.

- G8 submitted that none of Shaw, Taylor Collison or Hunter Green "had any involvement with or were privy to the thinking behind the instructions [to execute the trades] or G8's plans and strategies. [Hunter Green] has not been engaged by G8 in this matter. [Hunter Green] is an institutional broker which follows G8" and was suggested by one of the sellers "to act as an intermediary to make arrangements" to effect the acquisitions by G8 of Affinity shares. G8 submitted that there was no mandate between G8 and Hunter Green in relation to Affinity and no fee, commission or brokerage had been paid by G8 to Hunter Green. This seems odd.

- Mr Green submitted that he had no further instructions in relation to G8 beyond helping put G8 in touch with Shaw and Taylor Collison to execute the 2 July and 3 July acquisitions respectively.

- However, we have found that Mr Green went much further.

- Hunter Green actively followed G8 and was a vocal advocate of G8's bid for Affinity.

- On 3 July 2015, "[c]onnected with the trade", Mr Green asked Taylor Collison to provide certain VWAP information on an urgent basis for the "client" (G8 submitted that it was the client referred to). Mr Green submitted that it was not unusual to provide VWAP information for no fee. It is more unusual to refer to someone as a ‘client' if they are not.

- We find it unusual that, given the time invested by Mr Green in carrying out G8's requests, Mr Green (or Hunter Green) was neither formally engaged by G8 nor received a fee for such services. We infer that there was a closer relationship between Mr Green and G8 than disclosed and that his role went beyond simply connecting G8 with Shaw and Taylor Collison to execute the pre-bid share transactions.

- Mr Green also acted for Taxonomy in its purchase of Affinity shares, arranging them through Taylor Collison. Mr Green apparently had considerable authority in relation to Taxonomy's transaction. For example, on 16 July 2015, Mr Green emailed Ms Weeks that an investment bank acting for Affinity had contacted Taylor Collison to offer Taxonomy a meeting. Mr Green stated in his email "We took the liberty of responding … on Taxonomy's behalf and (politely) declined that opportunity at this stage."

- Mr Green submitted that he made the decision based on his experience of the likely outcome of such a meeting. While he may have intended to protect Taxonomy, we think it is unusual not to seek instructions. Mr Green responded to an ASIC notice that Hunter Green had no records of correspondence between himself (or any employees, officers or agents of Hunter Green) and Mr Peffer apart from two letters from Mr Peffer. These were one dated 9 July 2015 authorising the purchase of up to 8,500,000 shares in Affinity and one dated 10 July 2015 authorising the purchase of up to 2,000,000 shares in Affinity. Such instructions clearly do not extend to responding to the investment bank's enquiry.

- This supports our inference that Mr Peffer had limited or no involvement in the transaction.

- Taxonomy submitted that Mr Peffer was notified about this approach by Ms Weeks who provided him with a copy of the email dated 16 July 2015 from Mr Green. This was following the event and not before a response had been given. There is no suggestion that Mr Peffer was asked to confirm the decision.

- Mr Green was also involved with West Bridge's acquisition of Affinity shares (see below).

- It seems an unlikely coincidence that Mr Peffer contacted Mr Green to act as an intermediary, the very person who was involved in G8's pre-bid acquisition and who became involved in West Bridge's acquisition. We infer that Mr Green approached Mr Peffer or that Mr Peffer was directed to Mr Green. This is supported, in our view, by the fact that Mr Green's role in the acquisitions was apparently not a functional one, as it appears from the emails and contract notes that Taylor Collison undertook the relevant trades for the acquisition by Taxonomy of Affinity shares.

- In addition to these links, Mr Peffer is connected, directly or indirectly, to G8 or Ms Hutson through a number of other avenues, including through Taxonomy having been a shareholder in Early Learning Services Limited, G8's predecessor.

Actions which are uncommercial

- Affinity submitted that Taxonomy's acceptance on the first day of the scrip bid was "economically and commercially irrational" and that it was reasonable to conclude that, in light of both the G8 offers being declared final, "any other shareholders who are not interested in the possibility of a superior offer for their Affinity shares, may be seeking to advance G8's interest, over their individual interests." We agree.

- At no time until we put our preliminary findings to the parties did Taxonomy provide an explanation for accepting the scrip bid on the first day the offers were open. Taxonomy then submitted that Mr Peffer was motivated by the loan terms and duration to see G8's takeover offer gain momentum as quickly as possible.

- Affinity further submitted that:

- it had foreshadowed to the market on 3 August 2015 that it was in discussions in relation to an alternative proposal and on 10 August 2015, Affinity announced that it would be releasing its target statement on 24 August 2015. Therefore it would be expected that shareholders would wait

- under the settlement terms of the scrip bid, Taxonomy would not be issued G8 shares until one month after its acceptance. In contrast, if Taxonomy sold its Affinity shares, and acquired G8 shares on-market, these acquisitions would be settled on a T+3 basis

- if Taxonomy was motivated to acquire G8 shares, or to realise a profit, then on each day since 3 August it could have acquired more G8 shares had it sold its Affinity shares (and bought G8 shares) on market instead of by accepting the scrip bid and

- if CGT rollover relief was a factor in accepting the scrip bid, a rational investor would have waited until they could judge if relief would be likely (as CGT rollover relief would require acceptances taking G8 to 80%).

- G8 speculated on factors that may have had a material influence on the decision of Taxonomy to accept the scrip bid, including the likelihood of a competing proposal, the effect on price that sale of its shares on-market may have had, the value of G8 shares, and the certainty that came with acceptance of the scrip bid. We did not get a lot of assistance from this.

- ASIC submitted that, even if investors considered G8's shares to be undervalued, it would make more commercial sense for investors to acquire the best possible price for their Affinity shares on market and use the proceeds to acquire G8 shares on market at an undervalue. We agree. Taxonomy could have received more value by selling its Affinity shares on-market on any day during the period from 3 to 21 August 2015.

- On 21 August 2015, the value of the consideration under the scrip bid was $0.78118 and Affinity's share price closed at $0.810. By accepting the scrip bid, Taxonomy forwent, on our calculation, gross profit of $302,647. This would have given it the ability to purchase an additional 91,158 G8 shares. Alternatively, if Taxonomy had accepted the on-market bid instead of the scrip bid, it would have made an additional $197,647.

- While we accept that an attempt to sell 10,500,000 Affinity shares on market would put downward pressure on the price, at least to the floor price created by the on-market bid, Taxonomy was under no compulsion to sell all its Affinity shares on one day. On each day since 3 August 2015 the price of Affinity shares was higher than the implied value of the scrip bid on that day.

- In our view this indicates that Taxonomy had no desire to dispose of its Affinity shares as soon as it could, or to get the best price, but was waiting until it could accept the scrip bid.

- Taxonomy's acceptance of the scrip bid was also inconsistent with its stated intentions. According to file notes of a conversation between Mr Peffer and Ms Weeks, the acquisition of Affinity shares by Taxonomy "had nothing to do w/ G8's takeover bid" rather it was a "good opportunity : profit". And according to an email from Taylor Collison to ASIC: "Charlie [Green] said the buyer was not related to Wellington Capital…I asked Charlie why Mr Peffer was buying AFJ, and Charlie said as it gave him "optionality" over the outcome; either he would recoup his cash, or he might receive GEM scrip which I was told he would be happy with…We concluded here that Mr Peffer may have had wider business dealings with AFJ/GEM that he wanted to protect".

- An opportunity for profit, or optionality, does not align with Taxonomy's actions. At the least, its bid acceptance was sub-optimal. Moreover, no explanation has been given as to why it was felt necessary for Ms Weeks and Taylor Collison to ask or be told that Taxonomy's acquisition had nothing to do with the G8 bid or that Taxonomy was not related to Wellington Capital Limited.

- Lastly, there was an unusual level of involvement in the Taxonomy acceptance by G8.

- On 21 August 2015, Mr Peffer called Advanced, the share registry for G8, asking how he should send the acceptance forms. Advanced told him to email the signed forms to it and it would attend to the acceptance, which it did. As an experienced investor he could easily have followed the instructions on the forms.

- Affinity submitted that Taxonomy's immediate acceptance of the scrip bid in a manner inconsistent with the offer terms indicated that G8 had collaborated with Taxonomy in relation to processing the acceptances. Mr Peffer has denied any collaboration. However, the urgency and reason for processing the acceptances in that way are unexplained.

- We have been informed that "[p]rocedural matters relating to the takeovers were delegated by the board to management". Yet G8 has provided copies of communications between Ms Hutson (who is not management) and Advanced and others regarding technical issues about acceptances under the scrip bid by Taxonomy and others. While we accept that a chairperson of a bidder would be interested in knowing the number of acceptances received under a bid, we would not expect matters related to acceptance mechanics to be referred to a company chairperson. G8 submitted that the company secretary was overseas at this time with the Managing Director. All the same, we find Ms Hutson's involvement in the acceptance process unusual, even if her office was providing support on administrative matters relating to the bids.

- Advanced processed the acceptance for Taxonomy's 8,500,000 issuer sponsored Affinity shares on 21 August 2015 and sent a takeover acceptance message via CHESS to the sponsoring broker for Taxonomy's 2,000,000 CHESS sponsored Affinity shares. On the evening of 21 August 2015, Advanced informed Ms Hutson that, in respect of the CHESS sponsored shares, Advanced was "waiting for their broker to accept the CHESS Message". The CHESS message was only received by Advanced on 24 August 2015 after G8's substantial holder notice issued at 8:45am Sydney time on 24 August 2015 included all of Taxonomy's shareholding of 10,500,000 shares.

- We infer that Taxonomy was keen to accept the scrip bid for all its shares on the opening day of the offers and G8 through Ms Hutson was keen to have them processed accordingly.

Conclusion on Taxonomy

- In our opinion, based on our experience, Taxonomy's actions were inconsistent with its commercial interests. We infer that Taxonomy subordinated its interest in connection with an agreement, arrangement or understanding it had with G8 in relation to the scrip bid. In other words, there was a shared goal or purpose. Mr Peffer has denied this. We do not accept his denial. Given, as well, the financing, the structural links and common investments and dealings, the roles intermediaries played, and G8's involvement in the Taxonomy acceptance, we infer that G8 and Taxonomy had a relevant agreement (alternatively, were acting in concert) in connection with Taxonomy's acquisition of Affinity shares and Taxonomy's acceptance of the scrip bid.

- Taxonomy did not provide any substantial response to us until the orders stage of the proceeding. Even then it did not clarify many of these issues. Assuming that Mr Peffer had the typical level of involvement in transactions of this type, Taxonomy could easily have explained much of the above. We infer that the explanations would not have assisted Taxonomy. We are therefore more comfortable with drawing the inference above.

Circumstances relevant to West Bridge

- West Bridge was incorporated on 13 July 2015. The director of West Bridge, Mr Nigel Elias, submitted:

I, Nigel Benjamin Elias, the sole director and shareholder of West Bridge Holdings Pty Ltd made the decision to incorporate West Bridge Holdings Pty Ltd as a special purpose vehicle with the intention of investing in ASX listed securities.

- West Bridge acquired 11,300,000 Affinity shares (4.88%) between 13 July (the day of its incorporation) and 28 July "out of the total 15,435,315 shares offered during this time, equating to 73% of the volume of shares traded".

- West Bridge has since disposed of its Affinity shares following discussions with the Panel.

Structural links

- Mr Elias is a director of Print Mail and a former director of Armstrong (Print Mail's share registry).

- Ms Hutson is a former shareholder of Print Mail, as was Mr Elias. She has been a director of Armstrong since its incorporation on 24 August 2009. Wellington Capital is a nominated adviser of Print Mail and a former shareholder.

- Ms Greaves is the company secretary of Print Mail and a director and company secretary of Armstrong. She is a director and company secretary of Wellington Capital. She is a shareholder with Ms Hutson and Ms Weeks in Queen Bee Enterprises Pty Ltd.

- It is clear that Mr Elias has, or had, business connections with Ms Huston, which connections continue with Wellington Capital's advisory role to Print Mail.

- Mr Elias resides in Sandy Bay, Tasmania. However, Mr Elias used a Brisbane firm, McCullough Robertson, to incorporate his company, attending in person at their Sydney office. West Bridge submitted that it:

…was incorporated by McCullough Robertson upon my [Nigel Elias'] instructions delivered in person to a lawyer domiciled in the Sydney office of McCullough Robertson located at 55 Hunter Street, New South Wales on 13 July 2015.

- McCullough Robertson acted for G8 in its bids for Affinity.

- It is unclear why Mr Elias incorporated West Bridge using McCullough Robertson, even accepting that they had undertaken legal work for Mr Elias in the past. It seems likely to have been much less convenient than any number of firms of lawyers or accountants in Tasmania which could have incorporated an investment company for Mr Elias. The coincidence of Mr Elias's use of a firm acting for G8 and with former connections with Ms Hutson and Ms Weeks is unexplained.

Common investments and dealings

- Mr Green, who acted in relation to G8's pre-bid acquisition of Affinity shares and Taxonomy's acquisition of Affinity shares, also acted in relation to West Bridge's acquisition of Affinity shares. Mr Green submitted that he:

…received written instructions from Nigel Elias, dated 13 July 2015, to purchase 11.3m AFJ shares. I forwarded these instructions to Shaw & Partners, which executed the trades, evidenced by way of contract notes sent by Shaw & Partners to West Bridge. I have no further instructions in relation to West Bridge beyond these.

- In giving effect to those instructions, from 13 July 2015 to 3 August 2015 there was regular communication between Mr Green and Shaw including:

- Shaw providing updates as to the number of shares purchased and the number of shares remaining to be purchased to fill West Bridge's order

- a request from Mr Green on 13 July 2015 to resend trading information "so I can send to lawyers". It is unclear why lawyers needed to be involved in a simple acquisition transaction and

- a request by Shaw's General Counsel and Head of Compliance to Mr Green on 21 July 2015 to confirm that there was no connection to G8. Once again this appears to have been an area of alert for the stockbroker involved.

- Settlement of purchases of Affinity shares by West Bridge were made through a trust account at Mills Oakley. Mills Oakley submitted that "Mills Oakley does not act, and has not acted, for West Bridge on any transaction. The transfer of funds to Shaws (sic) referred to in paragraph 123 [of the preliminary findings] was not made at the direction of West Bridge." We are not told at whose direction it was made.

- We received little information from West Bridge in relation to our enquiries. In response to a request for documents relating to its decision to acquire Affinity shares West Bridge submitted – "Nil". This is surprising, as it even excludes the existence of contract notes. Moreover, Mr Green submitted that he received written instructions from Mr Elias (see paragraph 121).

- ASIC served a notice on Shaw seeking, among other things, communications between West Bridge and Shaw relating to West Bridge's acquisition of Affinity shares. ASIC submitted that no correspondence evidencing written instructions between West Bridge and Shaw was received in response to the notice. This suggests that there was no correspondence between West Bridge and Shaw.

- In response to a question about how West Bridge funded its acquisition of Affinity shares, West Bridge submitted "Equity". This is not a proper response, and it appears that it may not be accurate. We asked West Bridge what this meant but got no further response. However, there is evidence that at least one payment to settle the purchase of Affinity shares by West Bridge was made through Mills Oakley. ASIC was provided with a payment detail report dated 16 July 2015 from Westpac showing a payment of $1,915,518.62 from a Brisbane trust account of Mills Oakley to Shaw. This amount corresponds to the instructions given by Shaw to Mr Green also on 16 July 2015 seeking payment for West Bridge's share purchase.

- Moreover, ASIC submitted documents at the orders brief stage of the proceeding which casts doubt on West Bridge's response to the funding question of "Equity" (see paragraph 190).

- On 9 September 2015 at 5:05pm, Mr Elias sent an email to the Panel stating:

The Panel would be aware that West Bridge Holdings Pty Ltd has responded to all questions asked of it by the Panel and the Panel is advised that as I, Nigel Elias, sole director and shareholder of West Bridge Holdings Pty Ltd will shortly be departing for annual leave. Whilst on annual leave I will not have access to or be in a position to respond to emails.

- We do not accept that West Bridge responded to all the questions put to it, or that such responses as were received constituted satisfactory answers, or that Mr Elias was not in a position to respond to emails - he responded to an inquiry by Mr Green at about the same time as our supplementary brief called for a response.

- We infer that Mr Elias attempted to limit the information made available to the Panel because it would not have assisted West Bridge.

Actions which are uncommercial

- Mr Elias (in West Bridge's submission) stated that he had "a great deal of experience in securities and funds management including advising, underwriting and investing in securities since the late 1980s". We find it unusual that someone with that amount of experience would have no documentation at all, not even contract notes, in relation to an acquisition of 4.88% of Affinity's share capital.

- West Bridge also submitted that its investment in Affinity represented "less than 1/3" of Mr Elias's investment interests. This is still a substantial investment (indeed $8 million) and it is unusual in our experience for any company – even a private investment company like West Bridge – to have no documentation in relation to such an acquisition.

- We find it an unlikely coincidence that West Bridge used the same intermediary as Taxonomy and G8 for its purchases of Affinity shares, and the same law firm to manage the payment for the shares as Taxonomy. It is surprising that West Bridge did not mention the involvement of Mr Green. It is also surprising that G8 did so first in its response to our supplementary brief.

- Mr Elias submitted that he had "no understanding, agreement or association with any other party in relation to [Affinity] shares." He did not elaborate.

- We infer that there are connections between G8 and West Bridge in relation to West Bridge's purchase of Affinity shares.

Conclusion on West Bridge

- In our opinion, based on our experience, West Bridge's acquisition of Affinity shares is not properly explained. We infer that West Bridge acquired its Affinity shares in connection with an agreement, arrangement or understanding it had with G8 in relation to the scrip bid. In other words, there was a shared goal or purpose. Given, as well, the structural links and common investments and dealings, the roles intermediaries played, and the funding of at least some of the purchases, we infer that G8 and West Bridge had a relevant agreement (alternatively, were acting in concert) in connection with West Bridge's acquisition of Affinity shares.

- There is likely to have been an agreement, arrangement or understanding in relation to West Bridge accepting the scrip bid, but West Bridge had not done so by the time of the Panel application and, for reasons explained earlier, was permitted to sell its shares on-market. Nevertheless, particularly given the common features of West Bridge's acquisition to Taxonomy's acquisition, we think it is more likely than not that its acquisition was part of a proposal for it to acquire shares and accept the scrip bid. No alternative explanation for the acquisition has been provided. We infer that G8 and West Bridge had a relevant agreement (alternatively, were acting in concert) in connection with West Bridge's acceptance of the scrip bid.

- West Bridge did not provide any substantial response to us and, as noted, the responses that we did receive may have been inaccurate in at least one crucial respect. West Bridge could easily have explained much of the above. We infer that the explanations would not have assisted it. We are therefore more comfortable with drawing the inferences above.

Circumstances relevant to JB Super

- On 6 July 2015, JB Super acquired 97,500 Affinity shares at $0.71 per share.

- Ms Hutson and Dr Hutson are sisters. They are reasonably close because Ms Hutson is a director and shareholder of FUB Investments Pty Ltd, which jointly owns a beach house with Dr Hutson in NSW.

- They also have, or had, other common investments, such as Crossborder Investments Pty Ltd in which Dr Hutson was a shareholder and director and Ms Hutson is currently a shareholder and director. Mr Peffer was also a former director of Crossborder from 2 June 1993 until 9 November 1993, prior to Ms Hutson's appointment as a director.

- They also have some common dealings, such as John Bridgeman Limited in which Dr Hutson invested and Ms Hutson (through Wellington Capital) advised. Ms Greaves was also a director of John Bridgeman and is currently its company secretary. Taxonomy is an option holder in John Bridgeman.

- Affinity submitted that there were other connections between McCullough Robertson and JB Super but we do not consider that much turns on this.

- At approximately 4pm on 21 August 2015 (the day offers under the scrip bid opened) Dr Hutson instructed Ord Minnett Limited to accept. At 3:02pm on 24 August, JB Super's acceptance was processed on CHESS.

- JB Super submitted that it did not hold any discussions with G8 in relation to JB Super "acquiring an interest in Affinity nor the acceptance [of] the Scrip bid or the on-market bid".

- G8 submitted that there "have been no interactions with JB Super or Jane Ann Hutson by any director, adviser, agent or substantial holder of G8, or any person on behalf of G8, in relation to G8's acquisition of shares in Affinity, the scrip bid or the on-market bid".

- Affinity questioned the accuracy of such submissions given JB Super's acquisition of Affinity shares the business day after G8 announced its scrip bid and its instructions to Ord Minnett to accept the scrip bid on the day that offers opened. We do not accept that nothing was said between the sisters. The timing of Dr Hutson's acquisition of Affinity shares, acceptance of the scrip bid and how G8 represented that acceptance in a substantial holding notice each raise questions in our view.

- On Monday, 24 August 2015 at 8:45am, G8 lodged a substantial holder notice disclosing that it had received acceptances under the scrip bid for 10,597,500 shares. This number includes 10,500,000 shares from Taxonomy and an additional 97,500 shares.

- In response to an ASIC notice seeking documents in relation to G8's 24 August substantial holder notice, G8 provided to ASIC documentation in relation to Taxonomy's acceptances for 10,500,000 Affinity shares and a copy of a "Transfer and Acceptance Form" from HSBC Custody Nominees (Australia) Ltd.

- The HSBC form is signed by two individuals "under the Power of Attorney dated 31 March 2009 by its Attorneys". The number of shares, pre-populated in the form, is "2733707". This number has been crossed out and "97,500" inserted and initialled. The signatures and initials are not decipherable. G8 submitted it returned the form to HSBC as incomplete. It is unclear why G8 and not G8's share registry, Advanced, did this. It is also unclear why a copy of the form was provided to ASIC if it was incomplete. HSBC has informed us that it is not aware of the form. Moreover, it advised us that acceptance forms for the scrip bid were not provided by HSBC to the beneficial holders for whom it acts. HSBC submits all acceptances electronically via CHESS on receipt of authenticated instructions from its clients.

- G8 submitted that its 24 August substantial holder notice included the shares in the HSBC acceptance form. On 28 August 2015, G8 lodged a substantial holder notice disclosing that it had received an acceptance under its scrip bid for 97,500 shares on 24 August 2015. JB Super submitted that the shares included in the notice of 28 August represented its acceptance of the scrip bid rather than those in the notice of 24 August.

- Affinity submitted that the HSBC acceptance form was "curiously and inexplicably, the exact number of shares held by JB Super". Whose shares the form represents remains unexplained. We note that G8 included Taxonomy's CHESS holding of 2,000,000 shares in its 24 August notice when those shares could not have been accepted before 9:30am on 24 August 2015. Therefore G8 knew of that acceptance. We think that the likelihood is that the HSBC acceptance form was created to represent JB Super's acceptance.

- We infer that JB Super's instructions to accept the scrip bid were communicated to G8 and this was prematurely reflected in G8's substantial holding notice dated 24 August 2015. We infer that the communication involved an understanding about acceptances into G8's scrip bid.

Actions which are uncommercial

- Affinity submitted that JB Super's acceptance of the scrip bid on 24 August 2015 was uncommercial, essentially for the reasons given earlier in respect of Taxonomy's early acceptance.13

- JB Super submitted that it accepted the scrip bid "as it considered that in the long term the shares in G8 would increase in value."

- JB Super also submitted that "JB Super had been independently advised by Ord Minnett Limited and run solely by Dr Hutson for 14 years" and its decision was "formulated over a 3 week period and was informed by the announcements".

- We consider that JB Super's submissions do not adequately explain why it accepted so early in the offer period. Based on our experience, we think that, if JB Super had sought advice from Ord Minnett, it would likely have been advised to wait and not accept the scrip bid so soon. JB Super has not provided evidence of any advice Ord Minnett actually gave it in relation to the bid.

- Affinity submitted that, if JB Super's purpose in acquiring Affinity shares was to acquire G8 shares, then on each day since 3 August it would have been able to acquire more G8 shares by selling its Affinity shares on market and using the proceeds to buy G8 shares on market, instead of accepting the scrip bid. JB Super submitted that Affinity's calculations did not take into account 1% brokerage costs for both trades. This is true but there would still have been a gain. We consider it unlikely that the company would be managed generally in an uncommercial way unless there was another motivation. Indeed, JB Super's superannuation investment objective is to "outperform the all ordinaries over the medium to long term".

- JB Super has significant total assets of which its investment in Affinity represented about 5.5%. Its portfolio comprises blue-chip investments, apart from two companies each of which is connected with Ms Hutson. It invested in both of these companies in 2015.

Conclusion on JB Super

- We infer that JB Super bought Affinity shares and accepted the scrip bid early, and in doing so forwent profits, to support G8's bid.

- In our opinion, based on our experience, JB Super acquired its Affinity shares in connection with an agreement, arrangement or understanding it had with Ms Hutson in relation to the G8 bid. In other words, there was a shared goal or purpose. Given, as well, the family and structural links and common investments, and G8's involvement in processing of JB Super's acceptance, we infer that G8 and JB Super had a relevant agreement (alternatively, were acting in concert) in connection with JB Super's acquisition of Affinity shares and acceptance of the scrip bid.

Contraventions

- We are satisfied that G8 had an agreement, arrangement or understanding with each of Taxonomy, West Bridge and JB Super in relation to the acquisition of Affinity shares and the acceptance of the scrip bid.

- Section 9 defines a relevant agreement as:

"an agreement, arrangement or understanding:

- whether formal or informal or partly formal and partly informal; and

- whether written or oral or partly written and partly oral; and

- whether or not having legal or equitable force and whether or not based on legal or equitable rights."

- By reason of s12(2)(b), G8 and each of Taxonomy, West Bridge and JB Super respectively are associates because they have a relevant agreement for the purpose of the conduct of Affinity's affairs, namely the ownership of its shares.14 (Alternatively, they are associates by reason of s12(2)(c) because they are respectively acting or proposing to act in concert in relation to Affinity's affairs.)

- The relevant agreements gave G8 a relevant interest in the shares because it gave it a power to control the exercise of a power to dispose of the shares.15 This would be so even if the power was unenforceable.16

- By reason of s606, a person must not acquire a relevant interest in Affinity's shares if, among other things, because of a transaction that person's or someone else's voting power in Affinity increased above 20%.

- As a result of Taxonomy's acquisition:

- Taxonomy contravened s606 as G8 increased its voting power to more than 20% of Affinity and

- G8 contravened section 606 by acquiring a relevant interest in Taxonomy's shares.

- As a result of West Bridge's acquisition:

- West Bridge contravened section 606 as G8 increased its voting power to more than 20% of Affinity and

- G8 contravened section 606 by acquiring a relevant interest in West Bridge's shares.

- As a result of JB Super's acquisition, which occurred first in time, the increase in voting power or relevant interest respectively did not take either party above 20%.

- Affinity submitted that, if the Panel found that G8 was associated with Taxonomy, JB Super or West Bridge, "then this results in a number of other breaches of the Corporations Act including disclosure breaches under sections 671B and 636(1)(k)…".

- We agree. Under s671B, notices must include details of the relevant interest of the disclosing party as well as the relevant interest of its associates, and documents or statements evidencing what gave rise to the need for the disclosure.

- We consider that there have been contraventions by the following parties as they failed to lodge substantial holder notices:

- Taxonomy, as it began to have a substantial holding due to the acquisition of Affinity shares and its association with G8

- West Bridge, as it began to have a substantial holding due to the acquisition of Affinity shares and its association with G8 and

- G8, as it increased its substantial holding in Affinity by more than 1% due to the acquisitions of Taxonomy and West Bridge.

- G8 contravened section 636 as its bidder's statement, supplementary bidder's statement and replacement bidder's statement did not include information regarding the amount paid by its associates for securities in the 4 months before the date of the scrip bid or the bidder's voting power.17

- In relation to section 672B and Taxonomy's alleged failure to comply with a tracing notice, we consider that ASIC is best placed to pursue this.

Decision

- The activities engaged in by the parties, and the fact that they were not disclosed, meant that in the context of the scrip bid the acquisition of control over Affinity shares did not take place in an efficient, competitive and informed market and Affinity shareholders were not given enough information to enable them to assess the merits of the scrip bid proposal.

- It appears to us that the circumstances are unacceptable:

- having regard to the effect that we are satisfied the circumstances have had on:

- the control, or potential control, of Affinity or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Affinity and

- having regard to the purposes of Chapter 6 set out in section 602 and

- because they constituted, constitute, or gave or give rise to, contraventions of a provision of Chapter 6 or Chapter 6C.

- having regard to the effect that we are satisfied the circumstances have had on:

- Accordingly, we made the declaration set out in Annexure D and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

Orders

- Following the declaration, we made the final orders set out in Annexure E. Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make ‘any order'18 if 4 tests are met:

- it has made a declaration under s657A. This was done on 5 October 2015

- It must not make an order if it is satisfied that the order would unfairly prejudice any person. For the reasons below, we are satisfied that our orders do not unfairly prejudice any person

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. We issued a supplementary brief on orders on 1 October 2015 to all parties. We provided the supplementary brief on orders to Taxonomy (as it was not a party) and a notice of appearance on behalf of Taxonomy was lodged before it provided submissions and rebuttal submissions on the supplementary brief on orders and

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons. The orders do this by:

- requiring G8 to sell on-market shares in Affinity in which it acquired a relevant interest in contravention of s606

- providing withdrawal rights to shareholders (other than Taxonomy and JB Super) who had accepted the scrip bid and

- requiring corrective disclosure.

Divestment order

- On 15 September 2015, Affinity announced an improved proposal with Anchorage. Affinity also entered an arrangement with G8 for it to support the Anchorage proposal. When deciding on appropriate orders we took into account that Affinity shareholders would vote on the Anchorage proposal.

- Therefore, we proposed requiring G8 to sell on-market the shares it had acquired above 20% in contravention of s606. We proposed that the order be scrutinised by ASIC, rather than an order that the shares vest in ASIC for sale, because of the timing of an ASIC sale and the timing of the Anchorage vote.

- The parties did not dispute this proposed order, with only minor comments provided, including by G8. However, Taxonomy requested that the Panel "make an alternative remedial order cancelling or voiding [Taxonomy's] acceptance, or otherwise permanently prohibiting G8 from processing it." We consider there is no policy basis for Taxonomy to receive its Affinity shares back.

Order relating to other accepting shareholders

- We consider that an order which allows accepting shareholders of the scrip bid (other than Taxonomy and JB Super) to be returned to the same position they would have been in had the unacceptable circumstances not occurred is appropriate. Because the scrip bid has closed, our order provides withdrawal rights for shareholders who accepted the scrip bid (other than Taxonomy and JB Super) by way of electing to avoid any contract or withdrawal of acceptance, depending on whether acceptances have been processed. In our view this protects the rights and interests of those former Affinity shareholders.

- Affinity and ASIC requested that we consider those shareholders who sold to West Bridge and Taxonomy in circumstances where the market was not informed about the true identity of the purchaser (that is, G8). We considered that this would be very difficult to undertake and distinguished between those on-market sellers and others in the market in an unjustifiable way.

- We received submissions that G8 should not profit from the sale of the shares. However, the Panel is concerned with remedying the unacceptable circumstances. It is our view that the divestment of the shares, withdrawal rights and disclosure meet this purpose.19

Disclosure order

- G8 did not agree with our proposal for corrective disclosure orders, as they would require G8 to make disclosure contrary to what it had submitted to the Panel and, in relation to the proposed order requiring a substantial holder notice, West Bridge has already divested its Affinity shares. In relation to the order relating to s636 requirements, G8 submitted that this was no longer appropriate as the bid had closed. G8 also submitted that the declaration and reasons would be sufficient to inform the market.

- We do not fully agree with G8's submissions. While the bid has closed, it is important that the record be corrected, particularly in case someone is looking in future at the disclosures. The market remained uninformed about information which should have been provided to the market, either through a substantial holder notice or a bidder's statement. However, the bid has closed and, for simplicity, we have decided that a single corrective disclosure announcement should be made.

Costs orders

- We sought submissions on costs from the parties. Affinity, Anchorage and ASIC submitted that it was appropriate for costs to be ordered against G8, West Bridge and Taxonomy. ASIC further submitted that costs should be provided to it for its investigative efforts, which were required to obtain information (and which in our view proved very useful).

- G8 submitted that costs were appropriate only against Taxonomy and West Bridge because their "limited involvement, delayed these proceedings unnecessarily".

- We have decided not to award costs. We consider that it is not within our policy and consider that the matter generally only took as long as a typical association matter.

Other matters

Additional information from ASIC

- As noted, in response to our supplementary brief on orders, ASIC submitted additional information it had received from Mills Oakley under notice in relation to West Bridge. The information included a transaction list showing a deposit of $15,000,000 into its trust account and a secured loan agreement and guarantee between G8 and Ingenius Communications Pty Ltd. The agreement was dated 10 July 2015 and was signed by Ms Hutson on behalf of G8. It was for an amount of up to $15m. Ingenious is wholly owned by David Burke, who has connections to Ms Hutson, Ms Greaves and Ms Weeks.

- ASIC submitted that in supplying the information in response to the notice "Mills Oakley is indicating that the $15m in funds deposited into its trust account on 14 July 2015 were used to settle the purchase of Affinity shares by West Bridge".

- G8 submitted that the transactions related to a "a non-public project of G8's that does not in any way relate to Affinity, shares in Affinity or to West Bridge."

- We consider it likely that, as Mills Oakley provided information to ASIC under notice, it did so carefully (and indeed, it has not suggested that there was an error made) and so the transactions are related to West Bridge.

Media canvassing

- Following the release of our declaration of unacceptable circumstances Ms Hutson, as a representative of G8, made a number of comments to the press in relation to the merits of the Panel's decision. We sought submissions from G8 as it appeared that such statements were in contravention of the Panel's media canvassing and confidentiality undertakings G8 had given in its Notice of Appearance.

- In response, it was submitted that "Ms Hutson sought to confine the substance of her responses to material that had already been published by the Panel" and "To the extent Ms Hutson's statements in the Panel's view go beyond what is permitted under the undertaking given as to media canvassing, she has asked us to convey her apologies to the Panel." In the circumstances, we decided not to take any further action.

Geoff Brunsdon

President of the sitting Panel

Decision dated 5 October 2015

Reasons published 6 November 2015

Advisers

| Party | Advisers |

|---|---|

| Affinity | Corrs Chambers Westgarth |

| Anchorage | Minter Ellison |

| G8 | Allens |

| JB Super | HWL Ebsworth |

| Taxonomy | Talbot Sayer |

| West Bridge | NA |

Annexure A

Australian Securities and Investments Commission Act (Cth) 2001

Section 201A

Undertaking

Affinity Education Group Limited

Pursuant to section 201A of the Australian Securities and Investments Commission Act 2001 (Cth), G8 Education Limited (G8 Education) undertakes to the Panel that it will not:

- issue consideration to, or take any further step to process acceptances from, Taxonomy Pty Ltd ACN 119 667 328 (Taxonomy) or JB Super Fund Pty Ltd ACN 088 983 233 (JB Super) before the earlier of:

1.1. the conclusion of the Panel's deliberations on the application of Affinity Education Group Limited (Affinity Education); and

1.2. the time by which it must issue the consideration under section 620(2) Corporations Act 2001 (Cth), being 21 September 2015 (one month after Taxonomy accepted the offer under G8 Education's off-market bid for Affinity Education);

- allow the acceptances of Taxonomy or JB Super to be withdrawn (if permitted at law), until the conclusion of the Panel's deliberations on the application;

- process any acceptance received from West Bridge Holdings Pty Ltd ACN 607 036 028 until the conclusion of the Panel's deliberations on the application of Affinity Education.

AND further undertakes that it will:

- confirm in writing to the Panel when it has satisfied its obligations under this undertaking.

Signed by Jenny Hutson of G8 Education Limited, 159 Varsity Parade, Varsity Lakes, Queensland 4227 with the authority, and on behalf, of G8 Education Limited

Dated 27 August 2015

Annexure B

Corporations Act

Section 657E

Interim Order

Affinity Education Group Limited (Affinity)

Affinity made an application to the Panel dated 26 August 2015 in relation to its affairs.

The Panel ORDERS:

- G8 Education Group Limited (G8) not issue consideration to, or take any further step to process acceptances from, Taxonomy Pty Ltd ACN 119 667 328 or JB Super Fund Pty Ltd ACN 088 983 233 under G8's off market scrip takeover bid, which opened on or about 21 August 2015.

- These interim orders have effect until the earliest of::

- further order of the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Alan Shaw

Counsel

with authority of Geoff Brunsdon

President of the sitting Panel

Dated 21 September 2015

Annexure C

Corporations Act

Section 657E

Interim Order

Affinity Education Group Limited (Affinity)

Affinity made an application to the Panel dated 26 August 2015 in relation to its affairs.

The Panel ORDERS:

- West Bridge Holdings Pty Ltd (West Bridge) will not dispose of, transfer or grant a security interest over any shares or interests in shares in Affinity except for a disposal by way of an on-market transaction (as defined in the Corporations Act 2001) where the following conditions are satisfied:

- any sale of Affinity shares by West Bridge is for not less than 80.5 cents per Affinity share

- West Bridge has not provided any assistance, financial or otherwise, to the purchaser and

- West Bridge notifies the Panel by 9.30am (Melbourne time) on the first business day after any trade of the number of shares disposed of on the previous business day.

- These interim orders have effect until the earliest of:

- further order of the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Allan Bulman

Director

with authority of Geoff Brunsdon

President of the sitting Panel

Dated 2 September 2015

Annexure D

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Affinity Education Group Limited

Circumstances

- Affinity Education Group Limited (Affinity) is an ASX listed company (ASX code: AFJ).

- On 2 July 2015, G8 Education Limited (G8), an ASX listed company (ASX Code: GEM), acquired 16.41% of Affinity shares. G8's chairperson is Ms Jennifer Hutson.

- On 3 July 2015, G8 acquired further Affinity shares, increasing its interest to 19.89% of Affinity shares.

- On the same day G8 announced to the market its intention to make an off-market takeover bid for all of Affinity's shares. The consideration offered was to be one G8 share for every 4.61 Affinity shares (implied value of $0.703) (scrip bid).

- On 6 July 2015, JB Super Fund Pty Ltd (JB Super) acquired 97,500 Affinity shares (0.04%). The sole director and shareholder of JB Super is Dr Jane Hutson, Ms Jennifer Hutson's sister.

- On 9 and 10 July 2015, Taxonomy Pty Ltd (Taxonomy) acquired in total 10,500,000 Affinity shares (4.54%). The sole shareholder of Taxonomy is Bamson Pty Ltd, which is owned by Mr Alwyn Peffer and his wife, Ms Karen Peffer. The sole director of Taxonomy is Mr Peffer.

- Between 13 July and 28 July 2015, West Bridge Holdings Pty Ltd (West Bridge) acquired 11,300,000 Affinity shares (4.88%). The sole director and shareholder of West Bridge is Mr Nigel Elias.

- On 30 July 2015, G8 lodged a bidder's statement in relation to the scrip bid.

- On 3 August 2015, G8 increased the consideration under the scrip bid to one G8 share for every 4.25 Affinity shares (implied value of $0.80). It also freed the bid from all conditions. It lodged a supplementary bidder's statement and a replacement bidder's statement. It also announced an on-market offer at $0.80.

- On the same day Affinity announced that its directors were in discussions with an interested third party.

- On 21 August 2015, offers under the scrip bid opened.

- On 24 August 2015, G8 lodged a substantial holder notice indicating that it had acquired a relevant interest in 4.58% of Affinity shares through acceptances of the scrip bid, taking its interest to 24.48%.

- On 28 August 2015, G8 lodged a further substantial holder notice indicating that it had acceptances taking its interest to 24.55% of Affinity shares, the details of which included an acceptance for 97,500 shares.

Taxonomy

- There are, or have been, structural links and common investments and dealings between Ms Jennifer Hutson and Mr Peffer. Funding for Taxonomy's acquisition of Affinity shares was provided by a company whose principal has structural links to Ms Jennifer Hutson. Further, Taxonomy's acquisition was facilitated through intermediaries who have structural links with Ms Jennifer Hutson. These same intermediaries acted for both West Bridge and Taxonomy, with one of the intermediaries acting for G8, West Bridge and Taxonomy on the acquisition of shares.

- The acceptance of the scrip bid by Taxonomy occurred in uncommercial circumstances, on the first day the scrip bid was open, before more information about Affinity's potential alternative proposal was available, and where substantial additional profits were forgone.

West Bridge

- There are structural links and common investments and dealings between Ms Jennifer Hutson and Mr Elias. The funds for West Bridge's acquisition of Affinity shares were paid through an intermediary that has links to Ms Hutson. Further, West Bridge's acquisition was facilitated through intermediaries who have structural links with Ms Jennifer Hutson. As mentioned above, these same intermediaries acted for both West Bridge and Taxonomy, with one of the intermediaries acting for G8, West Bridge and Taxonomy on the acquisition of shares.

JB Super

- There are structural and family links and common investments and dealings between Ms Jennifer Hutson and Dr Hutson.