[2012] ATP 20

Catchwords:

Lock-up device - efficient, competitive and informed market - effect on control - equal opportunity - funding arrangements - need for funds - review application - decline to conduct

Corporations Act 2001 (Cth), sections 602, 657A

Guidance Note 7: Lock-up devices

Multiplex Prime Property Fund 03 [2009] ATP 22, Babcock & Brown Communities Group 02 [2008] ATP 26

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | No | No | No | No | No |

Introduction

- The Panel, Hamish Douglass (sitting President), Rod Halstead and Nora Scheinkestel, declined to conduct proceedings on an application by McDermott Industries Limited for a review of the initial Panel's decision in Mission NewEnergy Limited [2012] ATP 19. The review Panel considered that the exclusivity provision was no longer linked to a control transaction, and in any event was not unacceptable given the commercial reality that Mission faced. Accordingly, the review Panel considered there was no reasonable prospect of it coming to a different conclusion to the initial Panel.

- In these reasons, the following definitions apply.

- KNM

- KNM Group Berhad

- McDermott

- McDermott Industries Limited

- Mission

- Mission NewEnergy Limited

- SLW

- SLW International, LLC

- Term Sheet

- the definitive term sheet between Mission and SLW setting out the general terms on which SLW would provide Mission with a US$5 million line of credit facility over 24 months to be secured through a first priority security over the assets of Mission

Facts

- Mission is an ASX listed company (ASX code: MBT).

- The initial Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable. The facts are set out in the reasons of the initial Panel.1

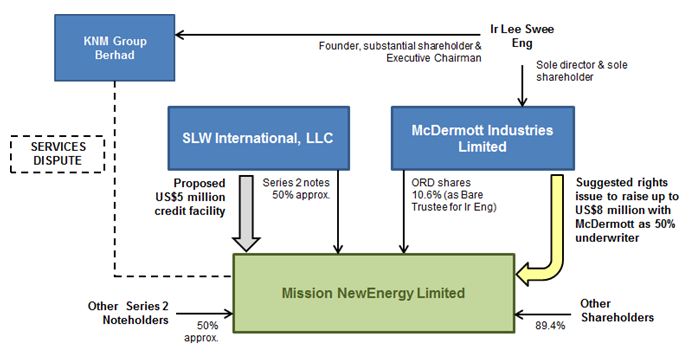

- Various relationships between the parties are described below2

- On 8 October 2012, Mission announced an amendment to the Term Sheet so that the facility was no longer conditional on the restructure of Mission's existing convertible note debt. Accordingly, the facility was no longer effectively subject to shareholder approval but was still subject to conditions, including definitive documentation. Therefore, each would proceed independently of the other.

- Also on 8 October 2012, Mission announced a placement (under the 15% capacity in listing rule 7.1) at A$0.0705 per share (a slight premium to the 10 day VWAP). The announcement said that the placement was to a third party who was not related to Mission, its directors or any substantial shareholder. The placement was to raise approximately A$100,000 and was expected to be completed within a week.

Application

Declaration sought

- By application dated 2 October 2012, McDermott sought a review of the initial Panel's decision. The President consented to the review.

- McDermott's original application sought final orders that the Term Sheet be cancelled, or cancelled to the extent that it required Mission to deal exclusively with SLW for funding, and restricted Mission from dealing with its assets.

- McDermott, in a submission in support of its review application, sought an interim order preventing the placement proceeding.

Discussion

- In our view the revised facility is not a control transaction, but a funding proposal. It has been decoupled from the restructure of the existing convertible notes.

- Nevertheless, as the circumstances that the initial Panel considered involved a control transaction, we have considered the position if there was a control transaction.

McDermott alternative proposal

- McDermott submitted in its review application that the initial Panel failed or neglected to have regard to the rights issue proposal made by McDermott. We note that the proposal was made after the initial Panel had accepted Mission's undertaking. We disagree with McDermott's submission. It is clear that the initial Panel took the proposal into account3, as have we.

- Irrespective of the exclusivity provision, it is clear that the Mission board does not want to engage with McDermott regarding its proposal given the current situation between the parties. We do not think it gives rise to unacceptable circumstances for the board to take that decision.4

- McDermott submitted that Mission's reason for not dealing with it, namely arbitration proceedings between KNM (connected to Ir Lee) and Mission, was unsatisfactory. It submitted that KNM was a separate company and that decision-making and information could be 'quarantined'. We think this is a matter for the Mission board.

Exclusivity

- McDermott submitted in its initial application that the exclusivity provision was an unacceptable lock-up device that prevented Mission from dealing with the McDermott proposal.

- Looking at the circumstances before they changed, we do not agree. We agree with the initial Panel that the exclusivity provision does not give rise to unacceptable circumstances, although for slightly different reasons.

- The initial Panel took the view that the proposed shareholder vote, the undertaking by Mission that its shareholders would be made aware of and have the opportunity to consider any credible competing proposal, the provision in the exclusivity clause for Mission to seek SLW's consent to be relieved of the lock-up, and the state of Mission's finances all resulted in it declining to conduct proceedings. It said:

While uncomfortable with the exclusivity provision, we have come to our decision based on the very unusual circumstances of this case, where the company is in a financially precarious position and in urgent need of funds to remain solvent and there is to be a shareholder vote and an undertaking has been provided.5

- In our view, an exclusivity provision that restricts control transactions will likely be unacceptable if it does not have a “fiduciary out”. The point of a “fiduciary out” is to free directors to deal with a competing proposal which they view as superior or in the interests of shareholders. A shareholder vote and undertaking as was proposed is materially different to a fiduciary out. Such a model does not grant the directors the ability to deal effectively with a competing proposal and giving shareholders the option to vote down a concrete proposal in favour of an incomplete proposal (that may not eventuate or may turn out to be inferior) may be ineffective.

- In this matter the commercial reality is that Mission is in extremely difficult financial circumstances. SLW holds approximately 50% of the convertible notes. In the absence of dealing with the convertible notes, Mission is unlikely to be able to service the notes let alone repay them when they become repayable. Therefore Mission has to deal with SLW regarding any financing proposal. So the existence of the exclusivity provision is irrelevant in a commercial sense for this reason and the reason expressed in paragraph 14 above. We note that the rights issue proposal from McDermott did not deal with the convertible notes.

- We also note that Mission has arranged a placement for just under 15% of its issued capital for $100,000. While this detracts slightly from an earlier Mission submission (ie, that it was unlikely that any investor would invest more money in Mission), in the circumstances of this company, when considering its financing needs, the placement is not material.

Efforts to canvass alternative proposals

- McDermott submitted that the failure to approach a major shareholder (ie, McDermott) to solicit an alternative financing proposal evidenced a “selective attempt” by Mission to canvass alternative funding. As noted above, Mission was not required to deal with McDermott.

- We note that Mission did seek to canvass alternative proposals.

Decision

- For the reasons above, we consider that there is no reasonable prospect that we would come to a different conclusion to that of the initial Panel. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

- As the placement has not changed our view of the appropriate disposition of this review application, we do not need to deal with the request for an interim order to prevent it proceeding.

Hamish Douglass

President of the sitting Panel

Decision dated 17 October 2012

Reasons published 18 October 2012

Advisers

| Party | Advisers |

|---|---|

| McDermott Industries Ltd | Bennett + Co |

| Mission NewEnergy Limited | Clifford Chance |

1[2012] ATP 19 at [3]-[13]

2 The diagram does not take into account any changes to percentage shareholdings arising from the placement announced on 8 October 2012 (see paragraph 7)

3 [2012] ATP 19 at [38]-[39]

4 Babcock & Brown Communities Group 02 [2008] ATP 26 at [10]-[11]. See also similar reasoning in Multiplex Prime Property Fund 03 [2009] ATP 22 at [41]

5[2012] ATP 19 at [44]