[2011] ATP 8

Catchwords:

Association – association hurdle – acting in concert – family – structural links – substantial shareholders – substantial holding notice – decline to make a declaration – timing of application – history of co-investment – facilitating share purchases – buy-back resolution – proxy

Corporations Act 2001 (Cth), sections 12, 53, 602, 606, 657B, 657C, 671B

Corporations Regulation 1.0.18

CMI Limited 01R [2011] ATP 5, CMI Limited [2011] ATP 4, Viento Group Limited [2011] ATP 1, Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Mount Gibson Iron Limited [2008] ATP 4, Rusina Mining NL [2006] ATP 13, Winepros Limited [2002] ATP 18

Introduction

- The Panel, Hamish Douglass (sitting President), Rod Halstead and Vickki McFadden, declined to make a declaration of unacceptable circumstances in relation to the affairs of Bentley Capital Limited. The application concerned whether parties were associates in relation to Bentley and alleged breaches of s606 and s671B.1 On the material available to it, the Panel was not satisfied that it could draw the necessary inferences and find the alleged associations. Accordingly, the Panel was not satisfied that the circumstances were unacceptable.

- In these reasons, the following definitions apply.

- applicants

- Bellwether Investments Pty Ltd and Mr Jim Craig

- Bentley

- Bentley Capital Limited

- DBS

- Data Base Systems Limited

- Fast Scout

- Fast Scout Limited

- Orion

- Orion Equities Ltd

- Queste

- Queste Communications Ltd

- Software Communication

- Software Communication Group Limited

- Strike

- Strike Resources Ltd (formerly Fast Scout)

Facts

- Bentley is an ASX listed company (ASX code: BEL).

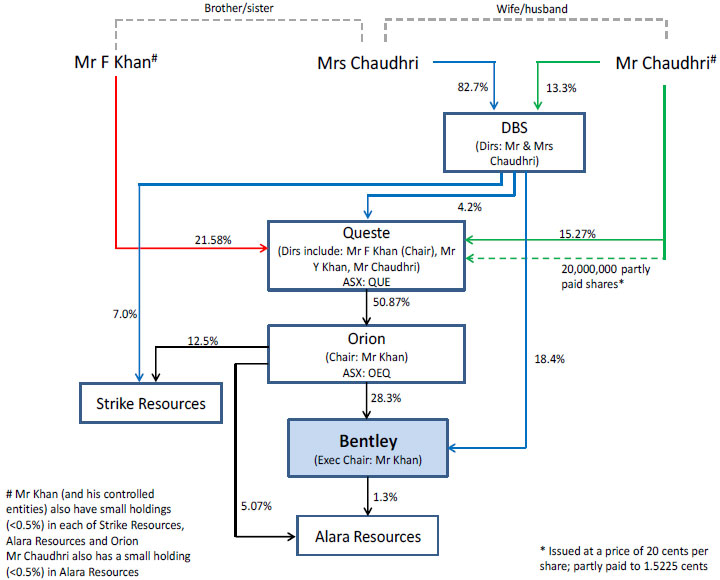

- Shareholdings in the companies and various relationships between the parties are shown in the following diagram:

2003 Memorandum of understanding

- On 30 September 2003, Software Communication, Queste and Fast Scout entered a Memorandum of Understanding (MOU) in relation to Bentley "to record the terms of their desire to exercise their rights as individual shareholders of [Bentley] as one collective 'bloc'". At this time, Fast Scout was controlled by DBS.

- On 1 October 2003, Software Communication, Queste, Fast Scout, Mr Farooq Khan (chairman of Bentley), DBS, Mrs Ambreen Chaudhri (Mr Khan's sister) and Mr Azhar Chaudhri (Mrs Chaudhri's husband) and others lodged a substantial holding notice indicating that they had acquired voting power of 5.315% in Bentley. Those shareholders lodged a further substantial holding notice dated 9 October 2003 indicating they had increased their voting power to 7.434%.

- On 21 September 2004, Queste, Mr Khan and others (not including DBS or Mr and Mrs Chaudhri) lodged a substantial holding notice indicating that they ceased to have a relevant interest in Bentley shares following termination of the MOU.

2009 resolutions and acquisitions

- On 18 June 2009, Mrs Chaudhri and her controlled entity, DBS, began acquiring Bentley shares on market.

- In June 2009, some Bentley shareholders (including Mr Barnett and Mr Craig) were engaged in discussions with Mr Khan and Bentley regarding a possible reduction of capital.

- On 29 June 2009, Bentley shareholders (including Mr Barnett) requisitioned a general meeting of Bentley shareholders to consider the removal of Mr Khan and Mr William Johnson from the Bentley board. The resolutions were supported by Mr Craig. The general meeting was held on 7 August 2009 and the resolutions were defeated.

- On 14 August 2009, Bentley announced that it would convene a general meeting to consider an off-market share buy-back. The Bentley board did not support the buy-back.

- At some stage before the meeting to consider the buy-back, Mr Khan and Mr Craig discussed the possible sale of Mr Craig's shares in Bentley. The applicants submitted that Mr Khan offered to buy the shares, although Mr Khan denies this. The applicants submitted that Mr Craig "decided not to proceed with any negotiations with Mr Khan as he did not consider that such a transaction could be effected without breaching the takeovers provisions". Mr Craig put it this way in his witness statement: "I advised Mr Khan that my legal advice was that he could not acquire my shares without a takeover bid to all shareholders". Mr Khan offered to attempt to find a purchaser or purchasers for the shares. Some of Mr Craig's shares were ultimately sold on market. Based on substantial holder notices lodged by DBS and Mrs Chaudhri, it appears some of those shares were purchased by DBS.

- Mr Khan had previously suggested to Mrs Chaudhri that she buy stock in Bentley. Mrs Chaudhri submitted that Mr Khan approached her to advise that there may be parcels of shares for sale "held by shareholders who did not share the newly approved vision for the Company and that he had offered as Chairman of [Bentley] to assist them in selling their shares to someone who shared the new direction for the company".

- On 24 August 2009, a substantial holding notice was lodged indicating that DBS and Mrs Chaudhri had acquired shares and voting power of 8.356% in Bentley. On 27 August 2009, DBS and Mrs Chaudhri lodged a further substantial holding notice indicating that they had acquired further shares on market and increased their voting power in Bentley to 10.451%.

- A general meeting was held on 9 October 2009 and the buy-back resolution was defeated. The directors recommended that shareholders vote against the buy-back resolution. DBS granted an open proxy in relation to the resolution in favour of Mr Khan. Mr Khan did not vote the proxy. Mrs Chaudhri had advised that, if she decided she wanted to vote on the resolution, she would let Mr Khan know how to vote, otherwise he should abstain. Mr Khan did not hear further from his sister and therefore abstained from voting.

2011 acquisitions

- Discussions took place in March 2011 between Mr Hamish Nairn, a stock broker for the Simpson family (a substantial shareholder in Bentley at the time), and Mr Khan regarding the possible sale or buy-back of the Simpson family's shares. Bentley declined to buy-back the shares. Mr Khan then offered to buy the shares. In a witness statement, Mr Nairn stated that the consideration offered by Mr Khan was "a combination of cash and shares in [an ASX listed company]". Mr Khan submitted that his recollection of discussions with Mr Nairn was "broadly consistent, although not identical with, Mr Nairn's statement". Further, he submitted that consideration as a combination of cash and shares "would have required Bentley shareholder approval." Mr Khan did not ultimately purchase the shares himself.

- Mr Nairn informed Mr Khan that the Simpson family would be willing to sell the shares for $0.25 per share. Mr Khan approached Mrs Chaudhri regarding the possible purchase of the shares by DBS. Mrs Chaudhri informed Mr Khan that DBS would be prepared to acquire up to $1.3 million of Bentley shares at no more than $0.22 per share. On 7 April 2011, Mr Khan and Mr Nairn agreed that a purchaser would buy 6 million of the Bentley shares held by the Simpson family at $0.22 per share. Mr Nairn contacted a broker and the transaction was completed by market sale. It appears the purchaser was DBS.

- On 11 April 2011, DBS and Mrs Chaudhri lodged a further substantial holding notice indicating that they had acquired 5,940,000 Bentley shares on-market on 7 April 2011, increasing their voting power in Bentley to 18.487%. The shares were acquired for $0.22 each.

- In April 2011, Mr Craig and Mr Khan had a discussion about Mr Craig's shares in Bentley. The import of the conversation is disputed. Mr Craig submitted that he informed Mr Khan that his cost base for his shares was 32 cents per share and that he would only sell his shares at or above that price. Mr Khan provided a "contemporaneous handwritten file note that [he] made during his telephone conversation with Mr Craig". The file note stated that Mr Craig "[wanted] 32c/ share to go away on a commercial basis".

Application

- By application dated 3 May 2011, the applicants sought a declaration of unacceptable circumstances in relation to the affairs of Bentley. It submitted that Mr Khan, his sister Mrs Chaudhri, her husband Mr Chaudhri and their controlled entities (including Queste, Orion and DBS):

- were associated and had acquired shares otherwise than in accordance with Chapter 6 and

- had failed to lodge substantial holder notices disclosing their association and aggregated voting power.

- The applicants submitted that the conduct of the parties had given rise to unacceptable circumstances because:

- the market and Bentley shareholders had not been informed in relation to transactions which have had, will have and are continuing to have, an effect on the control of Bentley and

- Bentley shareholders had not had a reasonable and equal opportunity to participate in the benefits of such transactions.

Orders Sought

- The applicants sought interim orders preventing Mr Khan, Mrs Chaudhri, Mr Chaudhri and their controlled entities from acquiring any further shares or increasing their voting power in Bentley, disposing of or transferring any Bentley shares or exercising any voting rights attaching to shares in Bentley, until the application was determined.

- The applicants sought final orders to the effect that:

- Mr Khan, Mr and Mrs Chaudhri and their controlled entities lodge substantial holder notices disclosing their association and aggregate voting power and

- the shares acquired in breach of the Corporations Act be vested in ASIC and sold.

Discussion

Conduct proceedings

- Before the Panel will conduct proceedings on the issue of association, there must be a sufficient body of material demonstrated by the applicant, together with inferences that might be drawn (for example from partial evidence, patterns of behaviour and a lack of a commercially viable explanation), to support the Panel conducting proceedings.2

- As the Panel said in Winepros Limited:

Allegations of association will, by their very nature, usually be very difficult to prove and it is very difficult to provide direct evidence of the existence of association or agreements. On that basis, the Panel will frequently be required to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association. However, until there is a body of such material, the onus will normally remain on the person alleging the association....3

- The Panel said in Viento Group Ltd,4 relying on Mount Gibson Iron Limited: 5

Circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- DBS did not become a party to the proceedings. Nevertheless, it made preliminary submissions (which the Panel agreed to receive) including to the effect that Mrs Chaudhri's decisions to purchase Bentley shares through DBS were independent of Mr Khan. Further, she submitted that she bought the shares because of the company's performance and her respect for Mr Khan's business acumen, which she said was demonstrated by the increase in Strike's market capitalisation after Mr Khan became involved with the company (and the subsequent profit DBS made on the sale of its Strike shares).

- Further, Mrs Chaudhri submitted that the funds for the 2009 purchase came from the sale of those Strike shares and that "Though DBS could have easily bought the whole amount of the Simpson stake [in 2011], it did not do so because the price and total dollar commitment was not [what] DBS was prepared to pay." We understand from this that DBS had sufficient cash available for the purchases and Mrs Chaudhri was making the investment decisions for DBS in relation to the purchases.

- Mr Khan made preliminary submissions that the Panel should not conduct proceedings as the application did not provide evidence of association, but merely contained assertions based on family relationships, directorships of companies, shareholdings in companies and telephone conversations between Mr Khan and others. Further, he submitted that the pricing of the share purchase in 2011 demonstrated a "clear commercially viable explanation for the transaction complained of".

- Mr Khan also submitted that we should decline to conduct proceedings because the application related to matters that occurred "as far back as two years ago".

- The Panel can make a declaration within 3 months after the circumstances occur or 1 month after the application is made, and an application must be made within 2 months after the circumstances have occurred or a longer period determined by the Panel.6

- We asked the applicants why they were bringing the application now when the initial acquisitions complained of occurred in 2009. They submitted that "Bellwether took a commercial decision at that stage, given the level of aggregate control that Mr Khan and his associates had established, not to pursue the matter further".

- The applicants also submitted that, at the time Mr Craig sold shares on market in 2009, they "were not aware that Mr Khan continued to position himself or his associates in the market to acquire more shares until this became clear on the lodgement by Mrs Chaudhri/DBS of their initial substantial holder notice". Even if the applicants were not aware of Mr Khan's involvement at the time the shares were sold, they became aware that DBS was the purchaser when the substantial holder notices were lodged in August 2009. They have taken no action in relation to the 2009 acquisition until now.

- We decided to conduct proceedings in relation to the acquisition of Bentley shares by DBS in 2011.

- We did not conduct proceedings in relation to the 2009 transaction referred to in the application although we considered it as part of the factual matrix. While this transaction may place the application in context, it occurred too long ago.7

Association

- Section 12 sets out the tests of association. Two are relevant here:

- Section 12(2)(b) - which provides that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company's board or conduct of its affairs. This provision treats those who, by arrangement, can control a board or the affairs of the company through the actual owners of shares as the owners; that is "[t]hose who manipulate the strings are to be regarded as the personification of the puppet." The association cannot be unilateral.

- Section 12(2)(c) - which provides that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company's affairs. Again, this provision means having an understanding as to some common purpose or object - not simply two persons separately and coincidentally acting in the same manner. 8

2009 and 2011 share acquisitions

- The applicants submitted that in 2009 Mr Khan facilitated the purchase of shares by DBS from shareholders (including Mr Craig and Mr Barnett) who would have voted in favour of the share buy-back (which Mr Khan was opposed to). They submitted that, even if Mr Khan "did not directly negotiate the sale" to his contacts via the market, he was aware that certain shareholders would sell their shares on market "at the right price". The applicants also submitted that in 2011 Mr Khan arranged Mrs Chaudhri's purchase of shares from the Simpson family. The applicants submitted that by virtue of Mr Khan's role in Mrs Chaudhri's purchases "Mr Khan and Mrs Chaudhri have demonstrably acted in concert".

- Mr Khan denied that he "sought to negotiate the purchase of shares" from Mr Craig in 2009, although he acknowledged that he had recommended Bentley to Mrs Chaudhri. Mrs Chaudhri submitted that Mr Khan had informed her that "he had offered as Chairman of [Bentley] to assist them in selling their shares to someone who shared the new direction for the company". Independently minded people can share a view about the direction of a company.

- We asked for (among other things) copies of documents in relation to the discussions between DBS and Mr Khan in 2009 and 2011. Other than a contract note for the purchase in 2011, Mr Khan and Mrs Chaudhri submitted that there were no written documents in relation to the discussions. The applicants submitted that we should draw inferences from the "refusal" to provide documentary evidence. We are not satisfied that there has been a refusal. It is not surprising that a brother and sister have not documented their discussions. We therefore have difficulty drawing an adverse inference from this.

- The applicants also submitted that Mr Khan and Mrs Chaudhri "clearly had a discussion prior to her investment in Bentley where Mr Khan became satisfied that his sister would cooperate with him in relation to Bentley". They submitted that the absence of details as to how Mr Khan satisfied himself that Mrs Chaudhri would cooperate with him provides a basis for inferring that they had an agreement regarding Bentley. The applicants submitted that it was "quite telling" that Mr Khan made a file note of his 11 April 2011 conversation with Mr Craig, but did not have other written records. In our view, it is not surprising that Mr Khan made notes of a conversation in which he felt pressured, but not of conversations between brother and sister.

- We think the applicants' submission goes too far. We do not think it is uncommon for the Chairman of a company to facilitate purchasers for shares in a company where a major shareholder is looking to exit. Such "facilitation" may be more frequent where the stock is illiquid (as in Bentley's case). Such facilitation is not, of itself, conclusive of an association. Of course, in doing so the Chairman must be very careful not to cross a line dividing a willing investor from an associated party, particularly where the Chairman has a relevant interest in a substantial number of shares in the company (as is the case here). On the material available to us, we do not think the facilitation was unacceptable here because we do not think it leads to a conclusion of association.

Purpose of the acquisitions

- The applicants submitted that it was "not clear whether Mrs Chaudhri made her own decision to invest in Bentley", and, in effect, that the purpose of the acquisitions was to consolidate holdings of Bentley shares in "friendly" hands.

- Mr Khan submitted that there was a commercial explanation for the 2009 purchase because the acquisition was for a price below the net tangible asset backing of Bentley. Further, Mr Khan submitted that, if the 2009 buy-back resolution had been approved and the buy-back had proceeded, the percentage holding of Orion would have increased from 28.7% to 44% and that his opposition to the buy-back undermined the applicants' submission that Mr Khan and Mrs Chaudhri were working together to acquire control of Bentley. This submission has some merit.

- Mrs Chaudhri submitted that she did not acquire the shares in 2009 "to assist [Mr Khan] in control", but rather decided to invest because of Mr Khan's commercial acumen and Bentley's new investment mandate.

- Mrs Chaudhri gave similar reasons for the 2011 purchase. The applicants submitted that, even if this was the reason for the purchase, it did not exclude the position that Mr Khan and Mrs Chaudhri were acting in concert. That is true, but it does not lead to the conclusion either.

- In relation to the 2011 purchase, Mr Khan submitted that the acquisition was at a price "materially below" the price originally sought for the shares by Mr Nairn. Further, he submitted that he had advised his sister that the shares would be a good investment "as they could be purchased not only for a significant discount to Bentley's net tangible asset but also possibly below the current market price". This was not rebutted and it appears that the shares were purchased at a price below that at which Bentley shares closed in the trading days before the DBS acquisition. In fact the price rebounded immediately after, but this is not a matter for us. Mrs Chaudhri submitted that the price of $0.25 per share sought by Mr Nairn was not acceptable. She sought a discount to market price and "formed a view that 22c per share was an appropriate price limited always to a total amount of $1.3 million."

- Mrs Chaudhri also submitted that she had previously made a profit on the sale of shares in another company in which Mr Khan was involved and it is not unreasonable to expect that she would reinvest in his business endeavours.

- We do not consider that there is sufficient logical and probative material from the events in 2011 to refute Mrs Chaudhri's submission that she made an independent decision to acquire these shares and instead to infer that she was acting pursuant to a relevant agreement or in concert in relation to the affairs of Bentley. She had confidence in her brother's leadership and had previously profited from an investment in a company in which he was involved. This then takes us to the 2009 proxy.

2009 proxy and previous dealings

- The applicants submitted that Mr Khan and Mrs Chaudhri had previously "acknowledged" that they were associates in relation to Bentley, pointing to substantial shareholder notices lodged in 2003 and 2004.

- Mr Khan submitted that the substantial holder notices disclosed no association, but rather disclosed relevant interests based on s608 of the Corporations Act.

- Regardless of whether there was an association in 2003 and 2004, we do not consider that the substantial holding notices from 2003 and 2004 are sufficient to establish that any such association is continuing, particularly when, at a time when it was not obviously self-serving, a notice of ceasing to be a substantial holder was lodged because of termination of the agreement giving rise to the first notice. In any event, the shareholdings have now changed (including that DBS no longer controls Strike).

- The applicants also submitted that, having acquired a stake in 2009 shortly before the meeting to consider a buy-back resolution, Mrs Chaudhri abstained from voting "effectively warehousing those shares". They submitted that it was reasonable to infer that Mrs Chaudhri would have been aware that her abstention (and Mr Khan's opposition to the buy-back) was sufficient to defeat the resolution and that "one would expect a normal commercially driven investor…to vote and be heard on a proposal that is material to the company".

- Mrs Chaudhri submitted that in relation to the buy-back resolution "DBS was in a good position either way…if the buy back proceeded DBS could sell part of its stock at a…profit with the balance of its holding in a company with a higher [net tangible assets]…If the buy back did not proceed, this was of no consequence as DBS had bought the stock as a long term holder". She submitted that she therefore determined that DBS would abstain from voting.

- Mr Khan submitted that Mrs Chaudhri advised that she would arrange for DBS to appoint him as its proxy and "that if she decided she wanted to vote on the resolution she would let Mr Khan know how to vote, otherwise he should abstain". Mr Khan submitted that because he did not hear further from Mrs Chaudhri, he abstained from voting those shares. Mr Khan also submitted that he did not have any documentation in relation to the discussions with Mrs Chaudhri regarding how to vote.

- The applicants submitted that Mr Khan's explanation was contrary to the publicly announced results of general meeting released in October 2009. It listed only 496 votes as "abstentions", when the DBS proxy would have related to approximately 7 million shares. The applicants submitted that "Effectively, DBS gave an open proxy to Mr Khan…and may have done so in relation to other meetings". Having been given an open proxy, the applicants submitted that Mr Khan "exercised his discretion to direct those votes as required once it was clear to him how many of those shares would need to be warehoused to defeat the resolution".

- The open proxy raises a concern about whether the parties may have been associated in 2009 in relation to the 9 October 2009 meeting. There may be a number of explanations for the proxy arrangements. The applicants submitted that DBS "may have [given an open proxy to Mr Khan] in relation to other meetings". We do not think there is logical and probative material before us that indicates this. Even if the granting of the proxy created an association between these parties in 2009, there is insufficient logical and probative material to suggest that an association is continuing. As discussed above, we did not conduct proceedings in relation to the 2009 acquisition because the application was not timely.

History of co-investment

- The applicants submitted there was "a significant portfolio of co-investment within the Khan-Chaudhri family, with elements of uncommercial dealings not restricted to the affairs of Bentley alone". This included that Mrs Chaudhri, DBS and Orion have common investments in Bentley, Strike and Alara Resources Ltd (each of which Mr Khan is a director of) and that Mr Chaudhri's interest in Queste was acquired from Mr Khan for an "extremely low price".

- Mrs Chaudhri submitted that Mr Khan had "made considerable money for [DBS]" by converting Fast Scout to a mining company (which was renamed Strike).

- We asked the parties to provide details of any other arrangements relating to holdings in Australian listed companies between Mr Khan and Mrs Chaudhri and Mr Chaudhri and Mr Khan.

- Mr Khan submitted there were no other current or historical arrangements or relations "other than as disclosed on the public record for Fast Scout" (in relation to Mrs Chaudhri) and "other than as disclosed on the public record for Queste" (in relation to Mr Chaudhri).

- Co-investment does not, of itself, make a person an associate of another; something more is required. Together with other factors, a history of co-investment might indicate an association. Even considering the previous investments in the context of the family relationships (discussed below), previous dealings and the facilitation of the purchases in this case, the material available to us is not sufficient to infer that there is an existing association between Mr Khan and Mrs Chaudhri or between Mr Khan and Mr Chaudhri.

Family relationships

- Mrs Chaudhri is Mr Khan's sister. Mr Chaudhri is Mrs Chaudhri's husband.

- The applicants submitted that "while a sister-brother relationship is not itself determinative of whether two parties are associated…it is a factor that should be taken into consideration". We agree.

- The applicants pointed to the position of the UK Takeover Panel, where family members are normally "presumed to be acting in concert unless the contrary is demonstrated". They submitted that, while the UK rules do not apply in Australia, it is open to the Panel to investigate this relationship and infer that Mr Khan and Mrs Chaudhri do not operate independently. The Australian law does not go as far as the UK Panel rules.

- Mrs Chaudhri submitted that while she has family ties with Mr Khan "by no means do we agree on all things and my investment is simply that, an investment on which I expect a healthy return given the discretionary nature of the investment mandate by which the company operates". There is no pattern of investment or other behaviour to refute this.

- The Panel has considered family relationships relevant in previous decisions.9 However, family relationships are not determinative. There are similarities between the facts here and the facts in CMI Limited10 (for example, common investments and family relationships). However, there are also significant differences, including the level of Mrs Chaudhri's involvement in the decision-making process for DBS and the source of funds for the purchases. There was no material before us to suggest that the purchases were funded other than by DBS out of its own resources.

- In this case, there is insufficient logical and probative material to establish, or allow us to infer, that Mrs Chaudhri was not acting independently.

Conclusion

- While the proxy raised questions, we consider that, even if there was an association between these parties in 2009 in relation to voting at a particular meeting, there was insufficient logical and probative material to suggest that an association is continuing.

Decision

Conclusion

- In the face of a denial of an association (as here), there needs to be sufficient material that points to the contrary. We are not satisfied that there is sufficient material in this case.

- Accordingly, on balance, we are not satisfied on the material available to us that we could draw the necessary inferences and find the alleged associations. Therefore we are not satisfied that the circumstances in this case are unacceptable.

- For the reasons above, we decline to make a declaration of unacceptable circumstances. We consider that it is not against the public interest to decline to make a declaration and we had regard to the matters in s657A(3).

Orders

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Hamish Douglass

President of the sitting Panel

Decision dated 20 May 2011

Reasons published 1 June 2011

| Party | Advisers |

|---|---|

| Bellwether and Mr Jim Craig | Gilbert + Tobin |

| Mr Farooq Khan | Bennett + Co |

1 References are to the Corporations Act 2001 (Cth) unless otherwise indicated

2 Mount Gibson Iron Limited [2008] ATP 4 at [15]. See also Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Rusina Mining NL [2006] ATP 13

3 [2002] ATP 18 at [27]

4 [2011] ATP 1 at [120]

5 [2008] ATP 4

6 Sections 657B and 657C(3). The Court may extend the period for making a declaration on application by the Panel

7 See CMI Limited [2011] ATP 4 at [39]

8 Mount Gibson Iron Limited [2008] ATP 4 at [12], footnotes omitted

9 For example, Viento Group Limited [2011] ATP 1, CMI Limited [2011] ATP 4; CMI Limited 01R [2011] ATP 5

10 [2011] ATP 4