[1997]

Corporations and Securities Panel.

Decision handed down 17 February 1997

Before: R Miller (President), J Cripps QC (Deputy President) and M Sharpe (Member). R Miller (President), J Cripps QC (Deputy President), M Sharpe (Member):

Introduction

1. The need for an efficient, competitive and informed market is a central aim of the regulation of takeovers in Australia. The Corporations and Securities Panel has a role to play in achieving that aim. The Panel is charged with responsibility for determining whether conduct in relation to takeovers has been unacceptable according to principles embodied in legislation, the origins of which can be traced back to the Report of the Eggleston Committee in 1969.

2. This case involves allegations, dealt with in detail below, that conduct of Pivot Nutrition Pty Limited (Pivot Nutrition) and its parent company, Pivot Limited (Pivot), in relation to a takeover offer for Gibson's Limited (Gibson's), was unacceptable within the meaning of section 732(1)(d) of the Corporations Law. The Australian Securities Commission (ASC) has, as a consequence, asked the Panel to make a Declaration and Orders.

3. The ASC lodged an Application with the Panel on 20 January 1997. The Corporations Law allows the Panel a period of only 30 days to conduct an inquiry up to the point of determining whether or not a declaration should be made, although the Panel may apply to the Federal Court for an extension of time if that were required. The time limit imposed on the Panel reflects, no doubt, a desire to ensure that inquiries by the Panel involve as little delay as possible. The Panel was able, with the co-operation of all parties, to complete its work with the 30 day limit.

Relevant parties

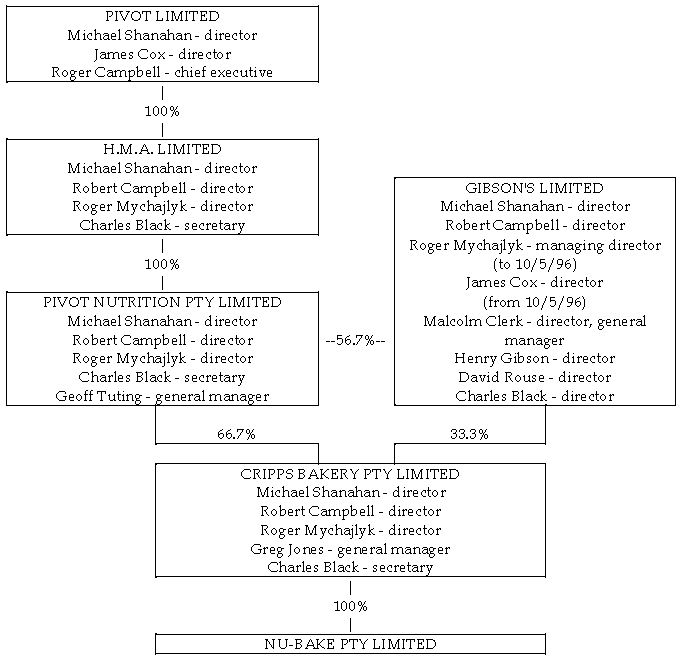

4. The relevant parties are Pivot Nutrition, Pivot and Gibson's. Pivot and Gibson's are both listed public companies. Their shares are traded on the Australian Stock Exchange. Pivot Nutrition is a wholly owned subsidiary of H.M.A. Limited (HMA), an unlisted public company, all of the shares in which are held by Pivot.

5. Pivot Nutrition has for some time held a substantial number of shares in Gibson's. Prior to launching its takeover, Pivot Nutrition held over 56% of the issued shares in Gibson's, having increased its position progressively as permitted by section 618 of the Corporations Law.

6. Cripps Bakery Pty Limited (Cripps Bakery) is a major Hobart based production- line plant bakery which had, for many years, purchased its flour from Gibson's. At all relevant times 66.7% of the issued shares in Cripps Bakery were owned by Pivot Nutrition and 33.3% by Gibson's.

7. Cripps Bakery has a wholly owned subsidiary, Nu-Bake Pty Limited (Nu-Bake), which operates a production bakery in Launceston. That bakery has traditionally been supplied with flour by Pivot Nutrition.

8. The relevant shareholdings of the parties and details of the directors and relevant officers of the corporations are set out in the following diagram. As the diagram shows:

- Messrs Shanahan, Campbell, Cox, Mychajlyk and Black, all of whom are directors or executives of Pivot or Pivot Nutrition and held board or management positions with Gibson's and/or Cripps.

- There are directors of Gibson's - Messrs Clerk, Gibson and Rouse - who are independent of Pivot and Pivot Nutrition.

Inquiry and brief

9. In accordance with regulation 20 of the Australian Securities Commission Regulations the Panel decided, on 24 January 1997 that it would hold an inquiry into the matters raised in the Application and notified all relevant persons of that decision. The Panel prepared a brief setting out a general description of the matters to be examined, a summary of the grounds presented in the Application and issues which the Panel requested parties to address in their submissions.

Submissions

10. In support of its Application, a detailed submission was filed by the ASC. Detailed submissions were also filed by Pivot Nutrition, Pivot, the independent directors of Gibson's, Cripps Bakery and Mr Greg Jones.

11. Submissions were also made by Mr Charles Black who, at all relevant times, was the secretary of Pivot Nutrition, Gibson's and Cripps Bakery.

12. A number of shareholders, or former shareholders in Gibson's, wrote to the Panel, some in response to an advertisement placed by the Panel in daily newspapers. Their letters to the Panel were circulated to the parties and taken into account by the Panel.

13. Mr Mychajlyk, Mr Black and Mr Jones responded to requests from the Panel to give oral evidence which was of assistance to the Panel. Each was assisted at the Inquiry by a legal practitioner.

14. Rebuttal submissions were filed by the ASC, Pivot Nutrition and the independent directors of Gibson's. Pivot Nutrition, with some justification, criticised the ASC rebuttal submission as lengthy and containing extracts from interviews not presented to the Panel in full, not made available to Pivot Nutrition and which may have been taken out of context. The Panel re-convened the conference to hear submissions on what weight, if any, it should give to those parts of the ASC rebuttal submission the subject of criticism. The matter was debated fully in conference and the Panel decided to place no weight on assertions made in the ASC rebuttal submission not otherwise supported by material before it.

15. Each of the submissions made have been carefully considered by the Panel as has the documentation submitted with them.

Conference

16. The Panel decided to hold a conference to permit the parties an opportunity to address the Panel on salient points in their written submissions to ensure that the Panel has a complete appreciation of their submissions. Everyone who had lodged a submission with the Panel was invited to attend the conference. The conference was attended by representatives of the ASC, Pivot Nutrition and the independent directors of Gibson's. Each attendee was assisted by a legal practitioner. The independent directors of Gibson's were also assisted by a financial adviser.

17. The conference provided the Panel with an opportunity to hear submissions and comments first hand from Mr Campbell and Mr Cox for Pivot Nutrition and Mr Clerk from Gibson's. The Panel found the conference of assistance in focusing on important areas of factual dispute.

Inquiry process

18. As noted earlier, the time limitation imposed in deliberations by the Panel by the Australian Securities Commission Act is very tight. The Panel is required to complete its Inquiry, to the point of deciding whether or not to make a Declaration, with 30 days of the lodgement of an application.

19. Notwithstanding the tight time limit, the Panel is satisfied that it has had sufficient time to reach its conclusions in this matter. It has been assisted by the timely filing of detailed submissions and general co-operation of all parties.

Preliminary orders

20. At the time it filed the Application, the ASC sought interim orders freezing the takeover as the offer was then due to close on 2 February 1997.

21. The Panel found it unnecessary to make the order sought as Pivot Nutrition announced that it would extend the offer until 16 February 1997. The Panel expressed the view that it would be reluctant to intervene in the market while a take-over offer was open, unless that were the only course open to preserve the status quo pending finalisation of its Inquiry.

22. The ASC renewed its application for interim orders on 3 February 1997. In response Pivot Nutrition decided to extend the offer to 2 March 1997 to allow sufficient time for the Panel to complete its Inquiry and the market to be informed of the outcome. In these circumstances the Panel saw no reason to make the interim orders sought.

Application

23. The ASC's originating Application alleged, in essence, that unacceptable circumstances had occurred in relation to the proposed acquisition by Pivot Nutrition of shares in Gibson's under the takeover scheme for which a Part A Statement was deemed registered with the Commission on 7 November 1996. The unacceptable circumstances were said to arise from the conduct of Pivot Nutrition and/or Pivot, leading up to the takeover offer for Gibson's, including Pivot Nutrition depriving Gibson's of a valuable asset: namely its contract to supply flour to Cripps Bakery, prior to and in connection with the takeover.

24. The allegations were denied by Pivot and Pivot Nutrition.

25. It became clear early in the Inquiry and was formally conceded by the ASC at the conference that there was, in fact, no contract between Gibson's and Cripps Bakery. Rather, there had been a very long course of dealings between them under which Gibson's had supplied Cripps Bakery with all of its flour requirements.

26. The Panel, having formed the view that the circumstances set out in the Application disclosed serious matters which should be investigated, decided to proceed with the Inquiry. This approach seemed to the Panel to be consistent with its role.

27. If the allegations of misconduct with respect to the loss by Gibson's of the opportunity to supply flour to Cripps Bakery were made out, the circumstance that Gibson's did not have an enforceable supply contract with Cripps Bakery for the supply of flour would not affect that behaviour being regarded as below the acceptable standard. Whether or not this amounted to unacceptable circumstances within the meaning of the Corporations Law is dealt with later in these Reasons for Decision.

Facts

28. Reviewing all of the submissions, evidence and documentation presented to the Panel, with the benefit of interviews with Messrs Mychajlyk, Black and Jones and having had the opportunity to hear from the parties at the conference, the Panel concludes that the relevant facts are as follows.

Planning for change

29. Pivot management decided, at some time in late 1995 when Pivot acquired HMA, that there needed to be a rationalisation of the business in Tasmania. Mr Mychajlyk, the managing director of Pivot Nutrition, was entrusted with the task of rationalisation. At this time Mr Mychajlyk was managing director of Gibson's and was also on the board of Cripps Bakery.

30. At this stage, although Gibson's was a listed public company, it was managed as if it were a division of Pivot Nutrition, as was Cripps Bakery.

31. Pivot engaged consultants who worked with Pivot Nutrition to investigate methods of rationalisation, of the Pivot investments in Tasmania, including the possibility of Gibson's refocussing its business by selling part of it to Pivot Nutrition and concentrating on other parts of its business. The consultants reported on various options and a plan - devised by Mr Mychajlyk and called the Gibson Plan - was adopted by the Gibson's board in March 1996 and pursued by Pivot Nutrition.

32. Mr Mychajlyk explained the Gibson Plan to the Panel as follows:

"The Gibson plan, after years of not having a strategy, as MD I was asked to put my thoughts down to get some strategic directions down and the Gibson plan approved by the Gibson's board was in three parts. Part A, 80 per cent of their business was in aqua culture and they should concentrate their efforts where their business had developed. This was the major strategic thrust of the Gibson plan. The second part of the Gibson plan [was that] all this internal cross-linkage should be simplified by Pivot. We are the major shareholder and we should simplify all the complicated internal mechanisms which are a major inhibitor to stop us doing bench-marking exercises and taking appropriate survival techniques and that point 2. Pivot to rationalise the internal relationships ..."

33. The plan encountered difficulties and Pivot Nutrition was forced to reconsider the plan when the independent directors of Gibson's refused an offer, on 26 March 1996, to sell Gibson's stockfeed business to Pivot Nutrition at a price acceptable to Pivot Nutrition. Mr Mychajlyk reported, in his monthly board report in April 1996, that:

"The stockfeed simplification step has been used as a litmus test for the whole business. The complications involved in this relatively straight forward simplification step have proven too complicated and expensive and so the whole Gibson's situation needs to be revisited."

34. At the same time another initiative, the Flour Mill Location Analysis, was undertaken to report on the options open to Pivot and Gibson's for rationalisation of flour production. That report, which considered various options, recommended that the Hobart mill, operated by Gibson's, be closed and that all production should be re-located to the Pivot Nutrition mill in Launceston. A draft of the report accompanied Mr Mychajlyk's Pivot Nutrition monthly board report for April 1996.

35. Mr Mychajlyk informed the Panel that the Mill Location Analysis was an exercise unrelated to the strategic rationalisation work but in the final analysis nothing seems to turn on the distinction. This is because we have concluded that, whatever the motivation in commissioning the report, it added to the body of information which was leading Pivot Nutrition inexorably towards a takeover of Gibson's.

36. Mr Mychajlyk impressed the Panel as an intelligent and capable manager readily able to appreciate and incorporate in his strategic planning the views expressed in the Mill Location Analysis.

37. It is significant that, at about the same time as the Mill Location Analysis was being completed, the consultants to Pivot Nutrition set out a strategy which demonstrated that detailed high level planning had occurred in relation to a possible take-over of Gibson's by Pivot Nutrition. This was documented by the advisers on 21 May 1996.

38. Mr Campbell, the chief executive of Pivot and a director of Pivot Nutrition and HMA, attended the conference convened by the Panel as did Mr Cox, a director of Pivot and Gibson's. Mr Campbell urged the Panel to conclude that, while there may have been strategic planning going on in Tasmania, this was part of normal management practice and did not signify that any decisions had been taken to proceed with a take-over of Gibson's. No such decision could be taken until the matter was considered by the main Pivot board, which did not occur until September 1996.

39. Mr Campbell told the Panel:

"We encourage managers to look at options for their businesses, we hold them responsible for those businesses and there Roger Mychajlyk as the head of our Tasmanian operations, with his people, would be encouraged to look at the various options."

40. Mr Cox told the Panel:

"... it has to be well understood that before any major strategic decision is implemented by a subsidiary, or a member of the Pivot Group, it had to meet final approval from the board of Pivot Limited and if any director of Pivot Limited had been asked up until the date of our strategic planning meeting in conjunction with the executive in September of 1996, if any director of Pivot had been asked are you guys looking at taking over Gibson's, it is not on the agenda because at that stage it was not on the board's agenda."

41. Although we accept that it is normal management practice to undertake strategic planning, we find ourselves unable to accept that what was occurring in May 1996 was merely consideration of options. This is because:

- The nature and extent of the planning as a May 1996, as disclosed in the materials submitted to the Panel, was not consistent with the proposition that the matter had not proceeded beyond consideration of options. The matter had, in our view, gone well beyond strategising. Mr Black had prepared an evaluation of Gibson's share value, adjusted for what he understood to be an unsustainable flour price. The advisers to Pivot Nutrition had set out a detailed takeover strategy.

- Pivot Nutrition's managing director had developed and was pursuing a plan which involved, as one of its elements, the eventual takeover of Gibson's.

- The strategic advisers had not been locally engaged. They had been engaged by Pivot, at head office, to work on strategies to deal with the Tasmanian investment. A number of the adviser's reports were to the chief executive or senior management of Pivot.

- Mr Mychajlyk resigned from the Gibson's board on 10 May 1996.

- Pivot Nutrition had, since 6 March 1996, been buying Gibson's shares on the market and that buying continued regularly until September 1996. The price was less than the current bid.

42. In forming this impression we do not mean to imply that we thought Mr Campbell other than truthful. He is, however, a director of Pivot Nutrition and HMA. Even if he left affairs in Tasmania to Mr Mychajlyk it was his responsibility to ensure proper corporate governance of management in Tasmania. Pivot Nutrition is responsible for what was done on its behalf by its managing director, including the planning of a takeover of Gibson's and any steps taken in that regard.

43. We have not overlooked the statement by Mr Cox that formal approval by the Pivot board for the takeover was not given until September 1996, but in our view that is a technicality. If, as we have concluded, those in authority at Pivot Nutrition had planned and were executing a takeover strategy, the fact that final or formal board approval did not come until later in the process does not change the character of what was done.

44. Likewise, we do not mean to imply that Mr Mychajlyk was proceeding in a manner other than one which he regarded, with some justification, as being in the best interests of his employer.

45. We are, however, of the view that Mr Campbell and Mr Mychajlyk took a narrower view of their obligations to Gibson's than was appropriate. Neither paid proper regard to the fact that Gibson's is not a wholly owned subsidiary of Pivot.

46. We conclude that, from the end of 1995 or early in 1996, Pivot Nutrition, under Mr Mychajlyk's direction, was actively exploring what its directors and management believed to be a necessary rationalisation of the Pivot interests in Tasmania, including Gibson's. The possibility of a take-over of Gibson's was one of the possibilities and became more inevitable in April 1996 when other rationalisation options proved difficult.

Changes at Gibson's

47. The differences between the directors representing Pivot on the Gibson's board and the independent Gibson's directors, which had emerged at the 26 March 1996 board meeting, caused Mr Mychajlyk to re-consider his position as managing director of Gibson's and on 10 May 1996 he relinquished that position. He was replaced by Mr Cox, a Pivot director.

48. Mr Mychajlyk informed us that he resigned as managing director following the Gibson's board meeting on 26 March 1996 because he was in a potentially difficult position being managing director of two companies which theoretically should be in competition but were not.

49. The reference to Pivot competing with Gibson's was a reference to a concern which we accept was raised by the Pivot chief executive, Mr Campbell, at the Gibson's board meeting in March 1996. Mr Campbell expressed concerns about possible restrictive arrangements between Pivot Nutrition and Gibson's which might have given rise to difficulties under the Trade Practices Act. While there were differences between the Pivot Nutrition and the independent Directors of Gibson's about what Mr Campbell had said and meant, in the end little turns on that difference.

50. We are satisfied that the reference to competition, no matter what exactly Mr Campbell meant to convey by it, was a factor motivating Mr Mychajlyk to resign from Gibson's. This represented the point at which Mr Mychajlyk decided that Gibson's was, so to speak, on its own. Whether Pivot Nutrition had, by this time, decided definitely to launch a take- over for Gibson's is not clear but a take-over was definitely one of the possibilities under consideration.

51. Interestingly, notwithstanding the clear reference by Mr Campbell to possible breaches of the Trade Practices Act, nothing seems to have been done about the matter by Mr Campbell, Mr Black, the Gibson's company secretary, or by anyone else.

Supplying Cripps Bakery

52. It is common ground that Cripps Bakery was Gibson's major customer for premium baker flour. It was suggested that Gibson's had been supplying Cripps Bakery for about 100 years.

53. There had never been a formal supply contract between Gibson's and Cripps Bakery. It was asserted on behalf of Pivot Nutrition that there was an unwritten understanding that the Hobart mill (Gibson's) would supply southern Tasmania and the Launceston mill (Pivot Nutrition) would supply northern Tasmania. Whether or not that was the case, Nu-Bake was supplied, without formal contract, by Pivot Nutrition and Cripps Bakery by Gibson's. Furthermore, the price at which Pivot Nutrition supplied Nu-Bake was about $640 per tonne, the same as the Gibson's price to Cripps Bakery until the events of June 1996 which radically changed the position.

54. On either 13 or 14 June 1996 Pivot Nutrition entered a contract to supply flour to Cripps Bakery. Gibson's lost a long standing customer, with a consequent adverse impact on its revenue and therefore the value of its shares.

55. It was the loss of Gibson's supply arrangements with Cripps Bakery that the ASC and the independent directors of Gibson's point to as an important element in what are claimed to be unacceptable circumstances in the Pivot Nutrition take-over offer for Gibson's.

56. The evidence establishes that, on 6 June 1996, Mr Mychajlyk instructed the general manager of the Launceston mill, Mr Tuting, to prepare a contract for Pivot Nutrition to supply premium bakers flour to Cripps Bakery. Mr Tuting called Mr Black, the company secretary of Pivot Nutrition, to arrange for a contract to be prepared. The contract was prepared, negotiated and signed, with a long weekend intervening, by 13 or 14 June 1996.

57. The ASC and the independent directors of Gibson's invited the Panel to concluded that the supply contract was entered as part of a plan on the part of Pivot or Pivot Nutrition to remove a valuable asset of Gibson's in preparation for a take-over by Pivot Nutrition.

58. Pivot Nutrition presented a different story. According to Pivot Nutrition, supported by Mr Jones, the Cripps Bakery general manager, there had been long term problems with the quality of Gibson's flour, there was strong competition in the baker industry and Cripps Bakery was losing customers due to poor quality flour, Gibson's was charging high rates and the Pivot Nutrition offer was a competitive offer which Cripps Bakery found attractive. Cripps Bakery informed the Panel that in May 1996, for the first time, the company had recorded a loss. The Cripps Bakery submission to the Panel stated:

"4.1 During the early months of 1996 Mr Jones had become increasingly concerned about the quality of flour which Cripps was receiving from Gibson's. The main concern was water absorption during the dough mixing.

5.2 In order to turn around a drop in profits, Mr Jones set in train a process to objectively assess the quality of the flour obtainable from Pivot Nutrition."

59. Before entering the contract with Pivot Nutrition, Cripps Bakery had samples of the Pivot Nutrition flour tested. It was said to be superior to that supplied by Gibson's. However, even this aspect of the matter is complicated because it was Pivot Nutrition who arranged the flour supply for both mills. There was a suggestion that Pivot Nutrition has sourced better quality wheat which it did not share with Gibson's. Whether or not this was so, this is not a matter which the Panel needs to resolve.

60. If the Panel could be satisfied that the supply contract between Pivot Nutrition and Cripps Bakery was entered in the ordinary course of business then the Panel would not accept that it was motivated by considerations of the type submitted by the ASC. In forming a view on whether the contract was entered in the ordinary course of business, there were a number of aspects of the negotiation of the contract which are relevant. They are as follows:

- The contract was initiated by Pivot Nutrition rather than Cripps Bakery. It was Mr Mychajlyk who gave instructions for the contract to be drawn up and presented to mr Jones at Cripps Bakery.

- Cripps Bakery was said to be incurring losses due to quality problems with Gibson's yet it seems to have done very little to deal with the matter. Gibson's were not informed in writing of the depth of Cripps Bakery's apparent concerns nor was there any special protest lodged with the Gibson's general manager. Furthermore, nothing of this was drawn to the attention of the Gibson's board even though directors of Cripps Bakery were also on the Gibson's board.

- Even though Cripps Bakery's main concern was with quality, there is little in the contract with Pivot Nutrition on this apparently important matter and, in fact, basic flour specifications in a draft of the contract were excluded from the final version. We were provided with a folder of Mr Jones' day book entries and other documentation concerning flour supply to Cripps Bakery by Gibson's. This material disclosed nothing more, in our view, than what might be regarded as normal production difficulties from time-to-time between the parties. Mr Jones was specifically invited to file statements from his production personnel and any other documentation he wished to support the assertions he made concerning quality problems with Gibson's flour but did not do so. He did, however, provide to the Panel copies of his reports to HMA managers meetings which expressed satisfaction with the Pivot Nutrition flour but also disclosed that the Pivot Nutrition flour did not achieve the desired level of water absorption.

- While there is some evidence of discussions between Gibson's and Cripps Bakery over the years about flour quality, the importance of this matter seemed to the Panel to be overstated by Mr Jones.

- No attempt was made by Cripps Bakery to investigate other supply possibilities or to discuss the possibility of a contract with Gibson's. Indeed, when Gibson's heard of the Pivot Nutrition negotiations with Cripps Bakery, a price lower than the Pivot Nutrition price was offered but was rejected. Although we accept that Mr Jones negotiated alterations, the contract was negotiated hastily and Cripps Bakery did not seek independent legal advice on it. There was no opportunity given to Gibson's to better the price offered by Pivot Nutrition nor was any tender apparently contemplated.

61. Mr Mychajlyk's role in the conclusion of the contract was closely examined by the Panel. Mr Mychajlyk gave evidence that he had left the matter entirely to Mr Jones and Mr Tuting, including the setting of the price which was a substantial reduction on the price Gibson's and Pivot Nutrition were charging Cripps Bakery and Nu-Bake respectively. At the same time as the contract was entered with Cripps Bakery, Pivot Nutrition signed a contract with Nu-Bake at the same lower price.

62. Mr Jones gave evidence that he reported to Mr Mychajlyk as his managing director and took his instructions from Mr Mychajlyk. Mr Jones was rather vague when asked whether he had discussed the contract with Mr Mychajlyk. However, we do not need to decide whether or not Mr Jones received detailed instructions from Mr Mychajlyk in relation to the contract because we have formed the clear view, in part from our impressions of Mr Mychajlyk and Mr Jones during their evidence to the Panel, that Mr Mychajlyk was less removed from the matter than he would have the Panel believe. Our clear impression of Mr Mychajlyk was that he is an astute, hands on managing director to whom his general managers would have referred any major matter with which they had to deal. For Cripps Bakery the supply of flour was a major matter.

63. It must be remembered that, in addition to his position with Pivot Nutrition, Mr Mychajlyk was one of the directors of Cripps Bakery; the others being the chairman and the chief executive of Pivot. Mr Jones gave evidence that he was not aware that Cripps Bakery had a board until the ASC started investigating the matter. He reported to, and regarded himself as directly accountable to, Mr Mychajlyk as the managing director of Pivot Nutrition.

64. We have no doubt that Mr Mychajlyk directed that the contract be drawn up and that he knew that Mr Tuting and Mr Jones, both general managers reporting to him, would enter a contract as Mr Mychajlyk wished. We are also satisfied that Mr Mychajlyk is astute enough to know exactly what effect this would have on Gibson's.

65. It follows that, although supply problems with Gibson's may have been a factor in the decision to change suppliers and although there may have been some justification for the view that the Launceston mill was capable of supplying flour of a more consistent quality, we are unable to conclude that these factors were the major reason for the change. The change occurred because Mr Mychajlyk had decided that it should occur. What flows from this conclusion is dealt with later in these Reasons for Decision.

Mr Mychajlyk's motivation

66. My Mychajlyk focussed on improving the Pivot business in Tasmania. He was, with some justification, of the view that rationalisation was an imperative. He concentrated on ensuring that this occurred. He appreciated that the rationalisation on which he was working would be aided by Gibson's loss of the Cripps Bakery supply arrangements.

67. Mr Mychajlyk was given an opportunity to explain to the Panel the motivations for the contract with Cripps Bakery. He told the Panel that the decision was independently arrived at by Mr Tuting and Mr Jones and that the decisions were theirs. As we have already said, we do not find this explanation plausible. Accordingly, we conclude that a major motivation, as far as Pivot Nutrition was concerned, was to further its rationalisation plan.

68. We have already concluded that, at some time in May 1996, a take-over offer for Gibson's was squarely on the Pivot Nutrition agenda. We therefore conclude that the takeover was a major motivating factor in Mr Mychajlyk decision to have Gibson's replaced as supplier to Cripps Bakery.

Proceeding with the takeover

69. Purchases of shares in Gibson's by Pivot Nutrition, on the Stock Exchange, continued after June 1996, although on a more minor scale, up until September 1996.

70. In July/August 1996 the takeover became one of the projects included in the Pivot Nutrition budget and the budget was approved in August 1996. Formal approval to proceed with the takeover appears to have been received from the Pivot board in September 1996.

71. External funding for the takeover was required and according to Mr Mychajlyk this was arranged in September 1996.

72. The advisers who had been working with Pivot Nutrition on the strategy which evolved, in the circumstances earlier referred to, into a takeover strategy, continued to work on the takeover.

73. A Part A Statement proposing an offer for all of the shares in Gibson's not owned by Pivot Nutrition was deemed registered by the ASC on 7 November 1996.

Corporations Law

74. The Panel's role is to inquire into certain conduct with a view to making declarations about that conduct if appropriate. Section 733(3) of the Corporations Law provides:

"Where, on an application under subsection (1), the Panel is satisfied:

- that unacceptable circumstances have occurred:

- in relation to an acquisition of shares in the company; or

- as a result of conduct engaged in by a person in relation to shares in, or the affairs of, the company; and

- having regard to the matters referred to in section 731 and any other matters the Panel considers relevant, that it is in the public interest to do so;

the Panel may be writing declare the acquisition to have been an unacceptable acquisition, or the conduct to have been unacceptable conduct, as the case may be."

75. The term unacceptable circumstances is defined in section 732(1). It is common ground between the parties that the only relevant provision for the purposes of this case is as follows:

"For the purposes of this Part, unacceptable circumstances shall be taken to have occurred if, and only if:

- the shareholders of a company did not all have reasonable and equal opportunities to participate in any benefits, or to become entitled to participate in any benefits, accruing, whether directly or indirectly and whether immediately or in the future, to any shareholder or to an associate of a shareholder, in connection with the acquisition, or proposed acquisition, by any person of a substantial interest in the company …"

76. Finally, the reference to section 731 is a reference to an obligation placed on the ASC (and, in the circumstances of an application, the Panel) to take account of the desirability of ensuring that the acquisition of shares in companies takes place in an efficient, competitive and informed market.

Submissions on legal issues

77. Pivot Nutrition and the ASC made detailed submissions on legal issues arising in relation to this Inquiry.

78. The ASC case was based on an assertion that a valuable asset of Gibson's was taken away by Pivot Nutrition. As noted earlier, unacceptable circumstances were said by the ASC to arise from the conduct of Pivot Nutrition and/or Pivot, leading up to the takeover offer for Gibson's, including Pivot Nutrition depriving Gibson's of a valuable asset; namely its contract to supply flour to Cripps Bakery, prior to and in connection with the takeover.

79. The first submission by Pivot Nutrition was that the ASC Application did not disclose a proper factual basis for a finding that Pivot Nutrition had deprived Gibson's of a contract to supply flour to Cripps Bakery. It was conceded at the Panel conference that there was no contract between Gibson's and Cripps Bakery. Nevertheless, for reasons earlier given, the Panel, on 24 January 1997 decided the facts and circumstances set out in the Application should be investigated and decided to commence an Inquiry.

80. While it is clear that there was no relevant contract between Gibson's and Cripps Bakery, that does not put an end to the matter. It is equally clear that there was a long-standing trading arrangement of value to Gibson's which was terminated and replaced by a contract between Cripps Bakery and Pivot Nutrition which was of benefit to Pivot Nutrition and detriment Gibson's.

81. Pivot Nutrition made a series of further submissions to the following effect:

- The Pivot Nutrition conduct was incapable of constituting unacceptable conduct with the meaning of section 732(1) of the Corporations Law.

- The alleged unacceptable circumstances did not occur as a result of the impugned conduct.

- If unacceptable circumstances did occur it would be against the public interest to make a declaration.

82. It was submitted by Pivot Nutrition that the word shareholders in section 732 refers to shareholders other than the offeror and its associates and that, accordingly, the section has no application where any benefit accrues only to those shareholders. The Panel rejects this submission. There is no good reasons for reading the provision down in the manner submitted. We see nothing in the decision of Marks J in Intercapital Holdings Ltd v NCSC (1988) 6 ACLC 243 dictating a contrary conclusion.

83. On the facts we have found, Pivot Nutrition procured Cripps Bakery to cease dealing with Gibson's and source its supply of flour from Pivot Nutrition. This is, as the ASC has argued, a benefit accruing to Pivot Nutrition.

84. The next question is whether the benefit accrued directly or indirectly to a shareholder. We find that it did. That shareholder was Pivot Nutrition.

85. Furthermore, we find that the benefit accrued in connection with the proposed acquisition by Pivot Nutrition of a substantial interest in Gibson's. On the facts as we have found them, the takeover was a major motivating factor in the procurement of the contract between Pivot Nutrition and Cripps Bakery.

86. The benefit that Pivot Nutrition has secured for itself is a benefit which is not available to the other Gibson's shareholders. Pivot Nutrition has submitted that it is possible for such of those shareholders who wish to do so to acquire shares for the purpose of obtaining the same benefit as Pivot Nutrition. This may be a theoretical possibility but for practical purposes should be disregarded.

87. It follows that the offeree shareholders, could not have reasonable and equal opportunities to participate in that benefit. It was not available to any of them. We do not think that, in order to be a benefit to which the section relates, there is any need for the benefit to be one in which the offeree shareholders are capable of participating. To interpret section 732(1)(d) to the contrary would place an unnecessary fetter on the plain words of the section.

88. In our opinion, even if the view we have expressed were not correct, there is another view available on the facts which lead to the conclusion that there were unacceptable circumstances in this case. On this approach, the relevant benefit is the benefit which will in the future accrue to Pivot Nutrition in acquiring shares in Gibson's under the takeover scheme, at less than the price which would have been required had Gibson's supply arrangements with Cripps Bakery not been terminated.

89. Although each case must be considered on its particular facts, when a major trading arrangement with a partly owned subsidiary (Cripps Bakery) is changed in favour of a holding company (Pivot Nutrition) at the expense of another partly owned subsidiary (Gibson's) then such a change must be handled with due regard to the conflicts of interest that will inevitably arise. This is particularly so when the holding company (Pivot Nutrition) has under consideration a takeover offer for one of the partly owned subsidiaries involved (Gibson's).

Economic issues

90. From an economic viewpoint, the circumstances of this case do not seem to the Panel to warrant the take-over be withdrawn. This would not appear to serve the interest of the minority shareholders. Rather, the takeover should proceed, but at a price which properly reflects the benefit which accrued to Pivot Nutrition.

91. The Panel would see an increment added to the present offer price as an appropriate method of dealing with the matter.

93. The material presently before the Panel is not sufficient for the Panel to determine what the increment should be. Further financial information would be required from the financial advisers to the parties.

94. However, any such increment should represent the value lost to Gibson's, based on a competitive price for the supply of flour and taking account of the fact that the supply arrangements, although of long term, were not legally enforceable. On this basis the increment may not be large.

Should a declaration be made - public interest

95. Section 733(3) of the Corporations Law provides that the Panel is only entitled to make a declaration if it determines it to be in the public interest that a declaration be made. Section 731 makes it clear that it is in the public interest for acquisitions of shares to take place in an efficient, competitive and informed market.

96. Pivot Nutrition submitted that it is not in the public interest that a declaration be made, even if the Panel were to find unacceptable circumstances, because there has been full disclosure in the Part A and also because the conduct resulted in the unwinding of an anti- competitive arrangement.

97. In our view, while there was a degree of disclosure of this matter in the Part A Statement, that is not sufficient to persuade us that no declaration should be made. Although the history of the matter is set out in the Part A Statement, no statement could provide shareholders with appropriate recompense for the benefit which we have found accrued to Pivot Nutrition from the circumstances we have found unacceptable. Recompense could only be achieved through an offer priced with reflects the benefit.

98. Nor are we convinced that the suggestion that there were anti-competitive arrangements is a basis for declining to make a declaration. We have made no finding on whether the arrangements were anti-competitive, but if they were, that did not justify the way in which the matter was dealt with by Pivot Nutrition. If the price and supply arrangements had been dealt with in an open manner, with the opportunity for all suppliers or potential suppliers to compete, then the outcome of this case may have been different.

Should there be orders?

99. There remains the question of whether orders should be made under section 734(2) of the Corporations Law. That subsection gives the Panel a very wide power to make orders necessary or desirable to protect rights and interests.

100. Although we have found Pivot Nutrition's conduct in this particular case to be unacceptable, we do not suggest that Pivot Nutrition or Pivot are other than responsible companies. They should have an opportunity to consider what might be done to redress the position in the light of these Reasons for Decision.

101. As far as shareholders who sold their shares on the Stock Exchange are concerned, as we have not found the information in the Part A Statement to be inadequate. The recommendation of the independent directors of Gibson's was against accepting the original bid. No recommendation has, as yet, been made with respect to the increased offer price.

102. Those shareholders who sold their shares appeared from their letters well informed of the matters raised with the Panel. Each could have chosen to await the outcome of the takeover bid. Intervention in sales through the Stock Exchange, except where sales are crossed, should only occur in exceptional circumstances. This case does not appear to warrant such intervention.

The Panel finds that:

1. unacceptable circumstances, within the meaning of section 732 of the Corporations Law, have occurred in the conduct of Pivot Nutrition Pty Limited in relation to the takeover scheme concerning Gibson's Limited under the Part A Statement deemed registered on 7 November 1996 as amended;

2. it is in the public interest to so declare

AND the Panel declares accordingly.

Other Orders

The Panel directs that the parties lodge submissions with the Panel within 2 business days of this Decision addressing the orders which should be made and providing any financial analysis they may think appropriate in support of their submissions, having regard to the economic issues referred to in the Reasons for Decision.