[2019] ATP 19

Catchwords:

Decline to conduct proceedings – board spill – requisition notice – acting in concert – substantial holder notices – public interest

Corporations Act 2001 (Cth), sections 12, 249F, 606, 671A

Aguia Resources Limited [2019] ATP 13, Australian Whisky Holdings Limited [2019] ATP 12, Molopo Energy Limited 03R, 04R & 05R [2017] ATP 12, Molopo Energy Limited 01 & 02 [2017] ATP 10

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Amy Alston, Marissa Freund and Bruce McLennan (sitting President), declined to conduct proceedings on an application by Bentley Capital Limited and Messrs William Johnson, Simon Cato and Farooq Khan in relation to the affairs of Keybridge Capital Limited. The application concerned whether associations existed between certain groups of shareholders in Keybridge resulting in contraventions of s6061 and the substantial holding provisions in the context of a board dispute and two general meetings convened to consider competing resolutions for removal of directors. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- applicants

- Bentley and Messrs William Johnson, Simon Cato and Farooq Khan

- ASG

- Australian Style Group Pty Ltd

- ASH

- Australian Style Holdings Pty Ltd

- Bentley

- Bentley Capital Limited

- Keybridge

- Keybridge Capital Limited

- Shareholder Meetings

- the general meeting of Keybridge convened by Bentley to be held on 25 September 2019 and the general meeting of Keybridge convened by ASG to be held on 23 September 2019

Facts

- Keybridge is an ASX listed company (ASX code: KBC). Bentley is also an ASX listed company (ASX code: BEL) which holds approximately 20% of the shares in Keybridge. The directors of Keybridge are Messrs Cato, Patton, Johnson and Kriewaldt.

- On 22 July 2019, Bentley announced that:

- its nominees on the Keybridge board (Messrs Johnson and Cato) had advised that the Keybridge board was effectively deadlocked and no longer able to function effectively and

- Bentley had proposed that each director resign and seek re-election to resolve the impasse.

- The announcement stated that the other directors of Keybridge (Messrs Patton and Kriewaldt) represent the interests of ASG.

- On 5 August 2019, Bentley announced that it had convened a meeting of Keybridge shareholders under s294F on 25 September 2019 to consider resolutions (i) to remove Messrs Patton and Kriewaldt and (ii) re-elect retiring directors, Messrs Johnson and Cato.

- On 26 August 2019, Keybridge announced that ASG had convened a meeting of Keybridge shareholders under s249F on 23 September 2019 to consider resolutions to remove Messrs Johnson and Cato.

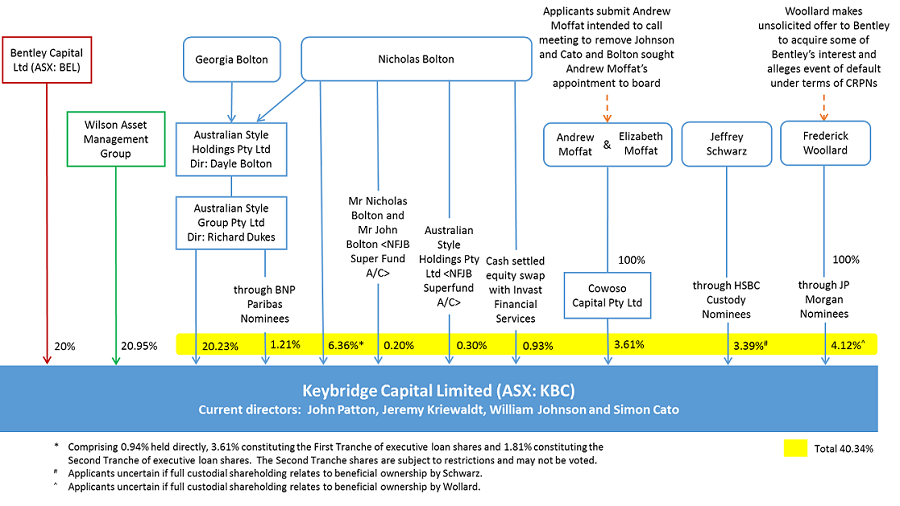

- Shareholdings and interests in Keybridge, and some relationships, as submitted in the application are set out in the diagram below:

Application

Declaration sought

- By application dated 11 September 2019, the applicants sought a declaration of unacceptable circumstances. The applicants submitted that they believed persons holding in aggregate approximately 40.34% of the shares in Keybridge (see the diagram above) are associated (relevant shareholders) in contravention of s606 and the substantial holding provisions. The applicants submitted, among other things, that:

- the Keybridge board is dysfunctional and unable to effectively deal with significant matters, including its compliance with disclosure obligations, leading to a risk that shareholders may vote at the Shareholder Meetings on an uninformed basis

- 9,000,000 Executive Loan Shares issued to Mr Bolton on or around 10 December 2014 (approximately 5.42% of the shares now on issue) are voting shares in which Mr Bolton has a relevant interest for the purposes of the substantial holding requirements

- Mr Bolton had recently claimed that he is entitled to exercise voting rights attached to 6,000,000 Keybridge shares

- Mr Bolton has a relevant interest in the Keybridge shares held by ASG under s608(3)(b), and/or Mr Bolton and ASG are associates, referring to previous findings of the Panel as to the relationship between Mr Bolton and ASG2 and

- the relevant shareholders are associates as a result of acting in concert or having entered into relevant agreements for the purposes of controlling or influencing the composition of the Board or the conduct of its affairs.

Interim orders sought

- The applicants sought interim orders to the effect that:

- each of Bentley and ASG be prevented from convening the Shareholder Meeting called by them (in the absence of undertakings from each of them to adjourn their respective meetings) and

- the relevant shareholders be prevented from acquiring, disposing, and exercising any voting rights in, Keybridge shares pending determination of the application.

Final orders sought

- The applicants sought final orders including to the effect that:

- the Keybridge shares held by or on behalf of the relevant shareholders in excess of 20% be vested in ASIC for sale and

- the relevant shareholders give corrective substantial holding disclosure.

Discussion

- The application suggested that the genesis of the Keybridge board's problems was a dispute over a continuous disclosure issue, █████████████████████████████████ ██████████████████████.

- Although the Panel's jurisdiction is broad, there needs to be a sufficient link to the purposes of s602 or the provisions of Chapters 6 to 6C to allow the Panel to make a declaration under one of the paragraphs of s657A(2). It is not the role of the Panel to police Chapter 6CA, the ASX listing rules or the conduct of general meetings3, even though the orders it makes sometimes address unacceptable circumstances that may contravene those requirements. For reasons below, we were not satisfied that the disclosure issues raised in the application had a sufficient connection with matters within our jurisdiction to justify further enquiry. We note also, that the concerns of the applicants regarding disclosure have been provided, through the application, to the holders of more than 80% of Keybridge shares and ASIC (which is the regulator of obligations under the Corporations Act, including continuous disclosure).

- We would have conducted proceedings had we considered there was a reasonable prospect that further enquiries could establish contraventions of the takeovers threshold warranting a declaration of unacceptable circumstances. The shareholdings of Mr Bolton and ASG, if aggregated, would be over 20% of the ordinary shares in Keybridge. However, the application did not suggest there had been recent purchases of Keybridge shares by either of them in contravention of s606. As far as earlier acquisitions were concerned, such as the issue of 9,000,000 Executive Loan Shares to Mr Bolton in 2014, the application provided little to suggest that Mr Bolton and ASG were necessarily associated at that time. The fact that the applicants submitted that the application was not out of time suggests they were not alleging contraventions of s606 in 2014. The application sought an extension under s657(3)(b) in the alternative, but did not provide persuasive reasons for us to extend time and examine circumstances in 2014.

- The application raised several matters within the Panel's jurisdiction that, if established, would be of concern, including:

- whether findings of the Panel in previous matters4 as to the relationship between Mr Bolton and ASG reflect their current relationship with respect to Keybridge, such as to warrant further inquiry and

- whether the interests disclosed by Mr Bolton in his proposed Key Management Personnel Disclosure for the year ended 30 June 2019, taken alone, indicate that Mr Bolton has a substantial holding in Keybridge that has not been notified in accordance with s671B.

- In other circumstances, we would have conducted proceedings to consider the above matters, at least. However, in the unusual circumstances of this matter, we were not satisfied that it would be in the public interest to make a declaration, even if the matters alleged in the application were established, for reasons including:

- It appears that the largest shareholders of Keybridge have significant differences and the board of Keybridge has not been able to operate effectively for up to two months. This has been recognised by major shareholders who have convened general meetings to consider conflicting board spill resolutions. It appears that there may be an impasse that can only be resolved by the Shareholder Meetings and/or court proceedings. The matters that fall within the Panel's jurisdiction appear to be relatively peripheral to the main dispute.

- The potential matters of concern regarding substantial holder disclosure mentioned above are unlikely, in our view, to have a material effect on the outcome of the Shareholder Meetings. Holders of the great majority of Keybridge shares should be aware of those issues as a result of the application, if they were not before. That does not excuse any lack of disclosure, but we consider it relevant in determining whether to conduct proceedings on aspects of a dispute raising issues that would need to be considered in another forum.

- In our view, the applicants did not provide a sufficient body of material to justify us making further enquiries as to other associations alleged in the application.

- The facts underlying most other matters raised by the application have clearly been known to the applicants for some time.

- The applicants have delayed in bringing the application until less than two weeks before the first Shareholder Meeting without, in our view, an adequate explanation for that delay.5

- Even if we had been minded to conduct proceedings, we would have had reservations about granting an extension of time under section 657C(3)(b) in respect of those circumstances occurring more than 2 months before the application.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Bruce McLennan

President of the sitting Panel

Decision dated 19 September 2019

Reasons given to parties 30 September 2019

Reasons published 2 October 2019

Advisers

| Party | Advisers |

|---|---|

| Bentley | Squire Patton Boggs |

| WAM Active Limited | OB Law |

| Mr Victor Ho | |

| Mr Woollard | Corrs Chambers Westgarth |

| Mr Moffat |

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth) and all terms defined in Chapter 6 or 6C have the meaning given in the relevant chapter (as modified by ASIC)

2 See: Molopo Energy Limited 01 & 02 [2017] ATP 10 and Molopo Energy Limited 03R, 04R & 05R [2017] ATP 12

3 In relation to the Panel's role in relation to board spills, see Aguia Resources Limited [2019] ATP 13 at [23] and [24]

4 See Molopo Energy Limited 01 & 02 [2017] ATP 10 and Molopo Energy Limited 03R, 04R & 05R [2017] ATP 12 (this decision is currently subject to judicial review)

5 Noting that a "delay in making an application in the context of a requisitioned meeting may increase the Panel's reluctance to inferfere with the legitimate right of shareholders to exercise voting rights", Aguia Resources Limited [2019] ATP 13 at [24(h)]. See also Australian Whisky Holdings Limited [2019] ATP 12 at [24]-[26]