[2019] ATP 13

Catchwords:

Board spill – collective action – association – requisition notice – acting in concert – voting power – relevant interest – control – substantial holder notices – public interest – declaration – orders – undertaking

Corporations Act 2001 (Cth), sections 12(2), 203D, 249D, 606, 611, 657A, 671B, 672A

Guidance Note 4 – Remedies General, Guidance Note 5 – Specific Remedies – information deficiencies,ASIC Regulatory Guide 128 – Collective action by investors, UK Takeover Panel Practice Statement No 26, Shareholder activism

Corporate Law Economic Reform Program Bill 1998 (Cth), Explanatory Memorandum, Australian Government Department of Treasury, Takeovers, Corporate Control: a better environment for productive investment, Corporate Law Economic Reform Program Proposals for Reform: Paper No. 4 (1997)

Australian Whisky Holdings Limited [2019] ATP 12, Caravel Minerals Limited 02R [2018] ATP 10, Caravel Minerals Limited [2018] ATP 8, Auris Minerals Limited [2018] ATP 7, Indiana Resources Limited [2017] ATP 8, Resource Generation Limited [2015] ATP 12, IFS Construction Services Limited [2012] ATP 15,Regis Resources Ltd [2009] ATP 7, Mount Gibson Iron Limited [2008] ATP 4, Orion Telecommunications Limited [2006] ATP 23

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | YES | YES | YES | YES |

Introduction

- The Panel, Amy Alston, Kelvin Barry and Bruce Cowley (sitting President), made a declaration of unacceptable circumstances in relation to the affairs of Aguia Resources Limited (Aguia). The application concerned (among other things) the failure to disclose an alleged association between certain Aguia shareholders and or their controllers in relation to requisitioned general meetings to change the composition of the Aguia board. The Panel considered that persons (holding in aggregate up to 12.50% of Aguia's shares) were associated for the purpose of controlling or influencing the composition of the board of Aguia and or were acting in concert in relation to the affairs of Aguia for the purpose of controlling or influencing the board of Aguia. The Panel (among other things) ordered disclosure in the form of a substantial holding notice.

- In these reasons, the following definitions apply.

- Aguia

- Aguia Resources Limited

- Appointment Resolutions

- has meaning given in paragraph 4

- Associated Parties

- the persons listed in paragraph 74

- Coopster

- Coopster Pty Ltd

- First Requisition Notice

- has the meaning given in paragraph 4

- First Requisitioned Meeting

- has the meaning given in paragraph 8

- Henderson

- Henderson International Pty Ltd

- Kemosabe

- Kemosabe Capital Pty Ltd

- Kemosabe Clients

- has the meaning given in paragraph 15

- Removal Resolutions

- has the meaning given in paragraph 4

- Requisition Notices

- The First Requisition Notice, the Second Requisition Notice and the amended Second Requisition Notice

- Requisitioned Meetings

- The First Requisitioned Meeting and Second Requisitioned Meeting

- Requisitioning Shareholders

- Kemosabe, Henderson and the Shearwood Trust

- Respondents

- Kemosabe, the Requisitioning Shareholders, Messrs David and Harry Shearwood (in their personal capacities) and Coopster

- RG 128

- ASIC Regulatory Guide 128 - Collective action by investors

- Second Requisition Notice

- has the meaning given in paragraph 9

- Second Requisitioned Meeting

- has the meaning given in paragraph 11

- Shearwood Trust

- Messrs David and Harry Shearwood (in their capacity as the trustees of the David K. Shearwood DIY Superannuation Fund)

Facts

- Aguia is an Australian company and its ordinary shares are quoted on the ASX (ASX code: AGR) and the TSX Venture Exchange. Aguia is in the business of exploration and development of mineral resource projects in Brazil and acquired the Andrade Copper Project in February 2019.

- On 11 April 2019, Kemosabe gave a notice to Aguia on behalf of the Requisitioning Shareholders under s249D 1 (First Requisition Notice) requesting that the directors of Aguia call a general meeting of Aguia to consider resolutions to remove five of the existing directors of Aguia (Removal Resolutions) and appoint four new directors nominated by the Requisitioning Shareholders (Appointment Resolutions). Two of the new directors nominated by the Requisitioning Shareholders were Ms Christine McGrath and Mr David Shearwood.

- On 15 April 2019, Aguia issued to each of the Requisitioning Shareholders a tracing notice under s672A. Between 16 April 2019 and 18 April 2019, each of the Requisitioning Shareholders responded to the tracing notices. None of the responses to the tracing notices referenced the Requisitioning Shareholders holding a relevant interest in each other's Aguia shares.

- On 18 April 2019, Aguia sent a letter to Kemosabe alleging that:

- the Removal Resolutions were invalid because of a failure to comply with the timing requirements of s203D(2) and

- the giving of the First Requisition Notice constituted circumstances that meant that the Requisitioning Shareholders were associates.

- On 23 April 2019, Kemosabe disagreed that the Removal Resolutions were invalid and again requested the directors call a general meeting of Aguia to consider the Removal Resolutions and Appointment Resolutions.

- On 1 May 2019, Aguia called an extraordinary general meeting to be held on 11 June 2019 to consider the Appointment Resolutions only (First Requisitioned Meeting). The directors of Aguia unanimously recommended that Aguia shareholders vote against the Appointment Resolutions.

- On 3 May 2019, Kemosabe sent a letter to Aguia maintaining its disagreement that the Removal Resolutions were invalid, but nevertheless it enclosed a notice under s203D(2) of its intention to move the Removal Resolutions. On 6 May 2019, Kemosabe gave further notice to Aguia on behalf of the Requisitioning Shareholders under s249D (Second Requisition Notice) requesting that the directors call a general meeting of Aguia to consider the Removal Resolutions.

- On 8 May 2019, Kemosabe re-issued an amended Second Requisition Notice which withdrew one of the Removal Resolutions such that it now sought the removal of four of the existing directors of Aguia.

- On 16 May 2019, Aguia called an extraordinary general meeting to be held on 17 June 2019 to consider (among other things) the amended Removal Resolutions (Second Requisitioned Meeting). The directors of Aguia unanimously recommended that Aguia shareholders vote against the amended Removal Resolutions.

- The Requisition Notices each disclosed that the Requisitioning Shareholders "collectively hold in excess of 5% of the votes which may be cast at a general meeting of Aguia". The notices of meeting prepared by Aguia for the Requisitioned Meetings both disclosed that the Requisitioning Shareholders "held in aggregate approximately 5.39%" of the shares in Aguia.

- At no stage did any of the Requisitioning Shareholders, individually or collectively, disclose details of their voting power or relevant interest in shares of Aguia in a substantial holder notice.

Application

Declaration sought

- By application dated 1 May 2019, Aguia sought a declaration of unacceptable circumstances. Aguia submitted (among other things) that the Requisitioning Shareholders, Messrs David and Harry Shearwood (in their personal capacities) and Coopster (holding in aggregate 7.28% of Aguia's shares) were associated by reason of entering into a scheme for the purposes of controlling or influencing the composition of the Aguia board and the conduct of Aguia's affairs by giving the First Requisition Notice. As a result, these shareholders had failed to provide substantial holder disclosures in contravention of s671B.

- Aguia also submitted that the Requisitioning Shareholders, Messrs David and Harry Shearwood (in their personal capacities), Coopster and approximately 112 Aguia shareholders who are clients of Kemosabe (holding in aggregate 22% of Aguia's shares- Kemosabe Clients) were associated by reason of entering into a scheme for the purposes of controlling or influencing the composition of the Aguia board and the conduct of Aguia's affairs by having agreed to, or proposed to, exercise their votes in favour of the resolutions proposed in the First Requisition Notice. As a result, these shareholders had failed to provide substantial holder disclosures in contravention of s671B and acquired a relevant interest in Aguia above 20% in contravention of s606(1).

- Aguia attached to its application:

- A statutory declaration from its investor relations adviser stating (among other things) that Mr David Shearwood had told him that he spoke for approximately 60% of Aguia shareholders.

- A statutory declaration from Mr Justin Reid (managing director of Aguia) stating that Mr David Shearwood sent a text message to an Aguia shareholder (who forwarded the message to Mr Justin Reid). Aguia submitted that the text message implied that Kemosabe controlled 40-41% of Aguia.

- A statutory declaration from Mr Fernando Tallarico, a director of a Brazilian subsidiary of Aguia, stating that Mr Peter Curtis (whom Aguia described as "a person known to be associated with Kemosabe") told him that Kemosabe controlled over 60% of Aguia.

Interim orders sought

- Aguiasought interim orders including restraining the Requisitioning Shareholders, Messrs David and Harry Shearwood and Coopster from acquiring, transferring or disposing Aguia shares or exercising the votes attached to Aguia shares, pending determination of its application.

- On 2 May 2019, the substantive President (Alex Cartel) decided not to make interim orders. The substantive President:

- noted that the First Requisitioned Meeting was not intended to be held until 11 June 2019

- considered that any acquisitions, transfers or disposals by the alleged associates could adequately be remedied by final relief if unacceptable circumstances were found by the sitting Panel and

- considered there was time for interim orders to be considered by the sitting Panel.

- We agreed with the substantive President's reasoning in paragraphs 18(a) and 18(b) and decided not to make interim orders.

Final orders sought

- Aguia sought final orders including vesting shares held by those Aguia shareholders which the Panel declared to be associates for sale by ASIC (on a pro rata basis to the extent necessary to reduce the total holding of those associates below 20%).

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Decision to conduct proceedings

- The Respondents, in a preliminary submission, submitted that we should dismiss the application because (among other things) the application "has more to do with a change in the composition of the board rather than a control transaction for the purposes of section 606".2 The Respondents stated that the application "has been made to frustrate a lawful instituted statutory process to determine the composition of the board of [Aguia] rather than because of genuinely held concerns by [Aguia] that the Requisitioning Shareholders are conspiring to effect a control transaction which is not in accordance with Chapter 6 of the Corporations Act" and that we should decline to conduct proceedings "so as to allow [Aguia] shareholders determine the composition of its board in accordance with the Corporations Act".

- The Panel on a number of occasions has considered whether it is the appropriate forum to resolve disputes in the context of a board spill.3 The ability of shareholders to hold a company to account for its performance is important in keeping directors accountable and can enhance long-term performance.4 It has been recognised that the benefits of takeovers include "improved corporate efficiency and enhanced management discipline, leading ultimately to greater wealth creation".5 Collective action by shareholders has similar benefits.

- The Panel was rejuvenated in 2000 to deal with tactical litigation in takeover bids,6 which informs its approach to whether it should restrain the dispatch of takeover documents.7 Similarly, the Panel will consider whether it is in the public interest (see s657A) to intervene in the context of a board spill.8 We consider the following factors are important to the approach the Panel takes to a board spill:

- The "fact that an application involves a proposal to reconstitute a board of directors does not take it outside the purview of the Panel. If, in the context of issues regarding the composition of a company's board, there is an accumulation or exercise of voting power possibly in contravention of s606, without proper disclosure under Chapter 6C or in otherwise unacceptable circumstances, those issues may be treated as control issues for the purposes of s657A."9

- In considering whether to conduct proceedings on the question of whether shareholders are associated in the context of a board spill, the Panel will apply its well-established principle that the applicant must demonstrate a sufficient body of evidence of association to convince the Panel as to that association, albeit with proper inferences being drawn.10 As a practical matter, it may be more difficult for an applicant to demonstrate a sufficient body of probative material where it is alleged that a large number of parties have recently commenced acting in concert.11

- There may be more reason to be concerned if any alleged associates have acquired shares around the time of a s249D requisition.12

- Even if the aggregate voting power of alleged associates is more than 20%, there is no contravention of s606 unless a person has acquired a relevant interest in shares through a transaction in relation to securities entered into by or on behalf of that person. In the context of a board spill, in the absence of any acquisitions of shares by alleged associates, the Panel will need to find that the alleged associates have acquired a relevant interest in each other's shares by entering into a relevant agreement to each vote their shares in favour of the resolutions at the requisitioned meeting.13

- There may be less reason to be concerned if a requisition seeks to appoint directors who are independent from, or not aligned with, the alleged associates and there is no material to suggest that any alleged association is likely to continue after the board spill.14

- There may be more reason to be concerned if there is material to suggest that any of the alleged associates had joint plans for the management of the company after the requisition meeting.15

- A contravention of the substantial holding provisions alone can give rise to unacceptable circumstances. However, it may be less likely to be in the public interest to intervene in a board dispute and make a declaration of unacceptable circumstances on a contravention of the substantial holding provisions alone if it is not material or where the market is not misinformed.16

- A delay in making an application in the context of a requisitioned meeting may increase the Panel's reluctance to interfere with the legitimate right of shareholders to exercise voting rights.17

- Here we were concerned about whether the arrangements between Kemosabe and the Kemosabe Clients resulted in Kemosabe having a relevant interest in the Aguia shares held by the Kemosabe Clients, because (among other things) all of the Kemosabe Clients had email addresses ending in "@kemosabe-capital.com" or postal addresses "C/- Kemosabe".

- The Respondents' preliminary submission disclosed that the total combined relevant interest of the Requisitioning Shareholders as at 3 May 2019 amounted to 8.46% of Aguia's shares. We were concerned that any association between the Requisitioning Shareholders and other shareholders may also involve a material contravention of the substantial holding provisions.

- We decided to ask some preliminary questions of the Respondents, including in relation to Kemosabe's relationship with its clients, communications between the Respondents and communications between the Respondents and the Kemosabe Clients. The Respondents denied they represented that they "'controlled' more than 60% of" Aguia. They submitted that any comments from the Requisitioning Shareholders regarding percentages were in relation to the estimated spilt between Aguia's shareholders, "being 60% in Australia and 40% in Canada."

- We also asked the Respondents to provide statutory declarations responding to Aguia's statutory declarations.

- On examination of the material provided and the answers to further questions of the Respondents and other parties, we formed the preliminary view that the Requisitioning Shareholders and others were acting in concert in relation to the affairs of Aguia.

- We conducted proceedings and later made preliminary findings and invited comments on them from the parties and certain persons identified in the materials, namely Mr David Buckland, Mr Peter Curtis and Ms Christine McGrath.18

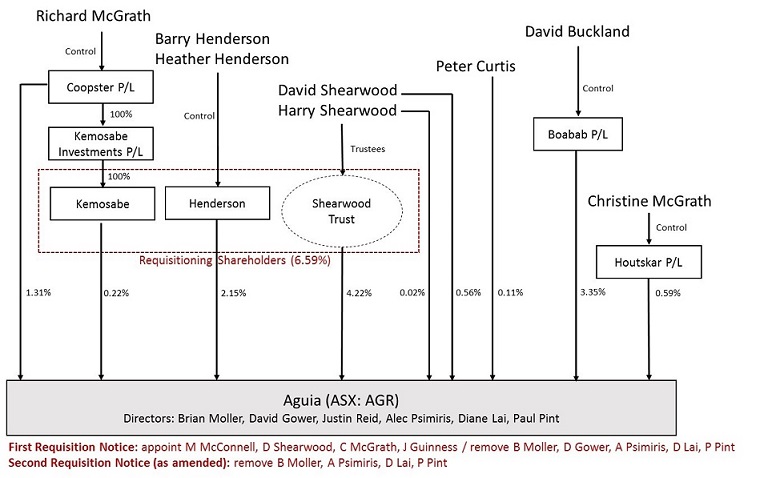

- Shareholdings in Aguia and various relationships between the Requisitioning Shareholders and other potential associates as at the date of the First Requisition Notice are set out in the diagram below.

Overall preliminary conclusion

- The Panel in previous matters has outlined s12 and the relevant decisions on association.19

- Having reviewed all of the material we considered possible associations between:

- Messrs Richard McGrath, David Shearwood and Peter Curtis

- the Requisitioning Shareholders

- the Requisitioning Shareholders and Messrs Richard McGrath, David Shearwood and Peter Curtis

- Mr David Buckland and Messrs Richard McGrath, David Shearwood and Peter Curtis and

- Ms Christine McGrath and Messrs Richard McGrath, David Shearwood and Peter Curtis.

Messrs Richard McGrath, David Shearwood and Peter Curtis

- There are some structural links between Messrs Richard McGrath, David Shearwood and Peter Curtis. Mr Richard McGrath controls Coopster who in turn ultimately controls Kemosabe. Mr David Shearwood is a former consultant of Kemosabe and is the Managing Director of Lowvix Pty Ltd. Mr Peter Curtis is the CFO of Lowvix Pty Ltd.

- On 27 March 2019, Mr David Buckland sent an email to Messrs Richard McGrath, David Shearwood and Peter Curtis, attaching "some preliminary work on the S249D proposal". The email also stated (among other things) "Richard, could you please drop in Christine's brief biography for completeness?" and "Relax, I will not do anything without your approval". From the email, it would appear that there had been previous discussions or correspondence in relation to a s249D requisition. From the material discussed below, we infer the reference to "Christine" is to Ms Christine McGrath as a proposed director of Aguia.

- Mr David Buckland sent emails on 28 and 30 March 2019 to Messrs Richard McGrath, David Shearwood and Peter Curtis providing draft work and other documentation in relation to a s249D requisition. Mr Richard McGrath replied to Mr David Buckland's 30 March 2019 email (copied to Messrs David Shearwood and Peter Curtis), stating "Thanks for your work on this. Kemosabe would be keen to contribute to any expense incurred by you for all of our mutual benefit. We need to be co-ordinated so when we do pull this trigger we get it done". We infer that Mr Richard McGrath was keen for the recipients of the email to work together on the s249D requisition. We also infer from subsequent correspondence teamwork between Messrs Richard McGrath, David Shearwood and Peter Curtis in relation to a s249D requisition.

- There was further email correspondence between Messrs Richard McGrath, David Shearwood, Peter Curtis and David Buckland on 31 March and 1 April 2019. On 31 March 2019, in reply to an email from Mr David Buckland (copied to Messrs David Shearwood and Richard McGrath), Mr Peter Curtis stated: "I know the boys appreciate your help. It's now all about the beat [sic] for agr holders and how to solve this with minimal angst timing has to be perfect with a lot of things including the raise which will be needed down the track. I know this needs to be perfectly timed and executed which we will cover in the next week or so once we find out what they are thinking next week".

- On 6 April 2019, Mr David Shearwood sent an email to Messrs David Buckland, Richard McGrath, Peter Curtis and Ms Christine McGrath. The email was titled "Project Squirrel documents attached". The email and attachments set out a detailed plan in relation to changing the board of Aguia and the actions that a new Aguia board may take and included an agenda for a meeting to be held on 7 April 2019. Mr David Shearwood stated in the email: "As a new Board which might possible [sic] start within a week – we need to at least have the skeleton of a plan, being mindful there is generally a low level of detailed knowledge at this early stage. I made a v fast stab at some strategic planning and milestone - and they need to be put in the right order." We infer that the meeting was held on 7 April 2019 and during that meeting the plans were discussed.

- On 9 April 2019, Mr David Buckland sent an email to Messrs David Shearwood, Richard McGrath, Peter Curtis and Ms Christine McGrath stating "I am pleased to furnish you with my latest work on AGR. Good luck" and providing other advice in relation to the s249D. Mr Peter Curtis responded to Mr David Buckland (copying in the others) stating:

"David, we understand everything you have said and all will be pointed out and believe me they are all duly noted and will be passed on.

We appreciate all the work done and the speed and enthusiasm with which you have pulled this together, not to mention coming up with options for directors.

We also know this work will continue as a shareholder. A feather in your cap.

I am sure when all comes out in the wash we will have a much stronger company. Will keep you looped in all things."

- Given Mr Curtis purported to speak for the others, and used the term "we", we infer acknowledgement of the group.

- There was further email correspondence between Mr David Buckland and Messrs David Shearwood, Richard McGrath and Peter Curtis on 10 April 2019 and 25 April 2019.

- On 25 and 26 April 2019, Messrs David Shearwood, Richard McGrath, Peter Curtis and Ms Christine McGrath corresponded on a number of occasions by email in relation to a s249D Requisitioning Shareholders' letter. One of these emails from Mr David Shearwood started with "Hello Peter (and Team)". There was further email correspondence from the above on 26, 29 and 30 April 2019 on the requisition generally.

- On 7 May 2019, Mr Peter Curtis sent an email to Messrs David Shearwood and Richard McGrath attaching a document titled "Copy of AGR Register YES NO MAYBE.xlsx" stating (names of other shareholders replaced with #):

"I have updated a couple of people and added in # who has indicated he and # are more than likely to vote for the board already in place.

Once we have an outcome from the Takeovers panel and a date for the meeting we will look to get a copy of all registers including nominee companies on the list.

Once again any updates please advise by email so I can update the matter."

- RG 128 deals with collective action by investors wishing to cooperate in relation to their investments and aims to promote investor engagement on corporate governance issues. It recognises a difference between, on the one hand, investors expressing views and promoting appropriate discipline in decision-making and, on the other hand, investors taking control of decision-making.20

- Table 1 of RG 128 identifies "conduct unlikely to constitute acting as associates or entering a relevant agreement", including "discussing and exchanging views on a resolution to be voted on at a meeting." However, it adds:

"If the conduct extends to the formulation of joint proposals to be pursued together or there is an understanding that the investors will act or vote in a particular way, then concerns may arise."

- Table 2 of RG 128 identifies "conduct more likely to constitute acting as associates or entering a relevant agreement", including "[i]nvestors formulating joint proposals relating to board appointments or a strategic issue."

- In our opinion, Messrs David Shearwood, Richard McGrath and Peter Curtis went beyond "discussing or exchanging views on a resolution to be voted on at a meeting" and extended to formulating a joint proposal in relation to the requisitions21, and became associates for the purpose of controlling or influencing the composition of the board of Aguia.22 The following (among other things) supports our view:

- The structural links.

- The extent, and content, of the correspondence between Messrs David Shearwood, Richard McGrath and Peter Curtis about the First Requisition Notice.

- References in the correspondence to working together: including the comment in an email by Mr Richard McGrath regarding the "need to be co-ordinated", the comment by Mr Peter Curtis referring to "the boys", the greeting in an email from Mr David Shearwood to "Hello Peter (and Team)" and the numerous references to "we" in the correspondence.

- Mr David Shearwood sending by email detailed plans regarding the requisitions and management of the company in the event the requisitions were successful to Messrs Richard McGrath and Peter Curtis (and others). While we acknowledge that it may be appropriate for a possible incumbent director to prepare for their potential election by undertaking some due diligence on the company and possibly turning their mind to some plans based on the results of the due diligence, we consider the plans attached to the 6 April 2019 email (and discussed at the 7 April 2019 meeting) go beyond legitimate preparation.

- The email from Mr Peter Curtis to Messrs Richard McGrath and David Shearwood, analysing the voting intentions of Aguia shareholders.

- Some of the correspondence also involved Mr David Buckland and Ms Christine McGrath. We consider whether they are individually associated with Messrs David Shearwood, Richard McGrath and Peter Curtis below.

The Requisitioning Shareholders and Messrs Richard McGrath, David Shearwood and Peter Curtis

- Table 2 of RG 128 (with the heading "Conduct more likely to constitute acting as associates or entering into a relevant agreement giving rise to a relevant interest") states:

"We expect that it would be rare for a person to elect to publicly sign a notice requisitioning a resolution without having formed any understanding with their co-signatories as to voting. In these cases, signing a s249D, s249N, s252B or s252L notice will likely give rise to an association, but may not result in an acquisition of a relevant interest."

- The review Panel in Caravel Minerals Limited 02R23 stated that (footnote omitted):

"To the extent that matters relevant to our jurisdiction are concerned, we agree with ASIC that jointly signing a s249D notice is "likely to be considered entering into a relevant agreement" giving rise to association, although we were of the view this will not necessarily be the case in all situations."

- Here there is additional material (together with co-signing the Requisition Notices) to support an inference that the Requisitioning Shareholders are associated with each other. Moreover, we infer the Requisitioning Shareholders are associated with Messrs Richard McGrath, David Shearwood and Peter Curtis. Our reasons include:

- Mr Richard McGrath controls Coopster and he in turn ultimately controls Kemosabe.

- Mr David Shearwood is a trustee of the Shearwood Trust and was a co-signatory to the Requisition Notices. He is the CEO of Lowvix Pty Ltd.

- Mr Peter Curtis is the CFO of Lowvix Pty Ltd.

- Henderson is controlled by Mr Barry Henderson and Mrs Heather Henderson, who were both co-signatories to the Requisition Notices. 24

- We agree with ASIC's submission that that the circumstances in this case can be distinguished from Caravel Minerals Limited 01 and 01R,25 because here "individually none of the [Requisitioning Shareholders] have sufficient voting power alone to requisition a general meeting of Aguia".

- The matters discussed and agreed to at meetings involving Messrs David Shearwood, Peter Curtis and Barry Henderson, discussed directly below.

- On 28 March 2019, Messrs David Shearwood and Peter Curtis met with Mr Barry Henderson (representing Henderson International Pty Ltd). At the meeting, Mr David Shearwood discussed his "potential vision" for Aguia and referred to Mr Richard McGrath and himself meeting with the Chair of Aguia, which he described as a "strategy meeting".

- On 8 April 2019, Messrs David Shearwood and Peter Curtis met again with Mr Barry Henderson. A file note of the conversation stated that:

"I [Mr David Shearwood] discussed with Barry that we got no joy with a meeting with the chair and they left Sydney early after the presentations. Myself and Richard McGrath need greater than 5% to call a 249D to change out some directors and would like you (Barry) to join us as a requisitioner of the meeting. Pointing out the company and all shareholders will benefit from a more independent board and one with a wider skill and experience set.

I then discussed the proposed interim board with Barry, and the desirability to strengthen the board further towards the end of 2019 around the time construction starts on the phosphate project.

Barry agreed to be a requisitioner."

- We consider that the 8 April 2019 meeting shows that Messrs Richard McGrath and David Shearwood are behind the actions of Kemosabe and the Shearwood Trust respectively and that Mr Barry Henderson in signing the requisition notices agreed to the overall strategy of Messrs Richard McGrath, David Shearwood and Peter Curtis. We infer that the Requisitioning Shareholders and Messrs Richard McGrath, David Shearwood and Peter Curtis are associates for the purpose of controlling or influencing the composition of the board of Aguia.26

Mr David Buckland and Messrs Richard McGrath, David Shearwood and Peter Curtis

- As discussed above, Mr David Buckland was involved in the email correspondence with Messrs Richard McGrath, David Shearwood and Peter Curtis.

- Mr David Buckland submitted that:

"As a Director of Baobab Holdings Pty Limited (ACN 130245073), I am not acting in concert with the Requisitioners. I am not a client of Kemosabe, not a client of the requisitioners and am not a client of Peter Curtis.

A little recent history is appropriate.

A meeting had been organized by Peter Curtis for myself (and two of my friends, a Mining Engineering and a Geologist, with six decades combined experience) with AGR Executive Chairman Paul Pint and Technical Director Fernando Tallarico on the morning of Wednesday 3 April 2019 in the offices of Kemosabe Capital. After doing a "deep dive" into the Company, I emailed Executive Chairman Paul Pint on the afternoon of Tuesday 2 April 2019 introducing myself, together with 19 questions largely related to my concerns associated with the Company's poor corporate governance record. I asked Paul Pint to respond to me a week hence on Tuesday 9 April 2019….

… Unsurprisingly, I received a message from Peter Curtis at around 8.30pm on Tuesday 2 April 2019, saying Executive Chairman Paul Pint had cancelled the meeting for myself and my two friends for the ensuing morning. This is despite the fact that I asked Paul Pint to respond to me one week later on Tuesday 9 April 2019, and my two friends, a Mining Engineer and a Geologist, with six decades of combined experience - as was indicated to Paul Pint in my introduction - were hoping to primarily meet with Fernando Tallarico, the Company's Technical Director.

I was disappointed that my friends and I were treated this way, irrelevant of whether I was a shareholder or not, and voiced my concern to Peter Curtis accordingly. I could only conclude Mr Pint had something to hide. In an attempt to clean up what I considered to be AGR's poor corporate governance, I briefly sought some legal advice on this matter, and was effectively told "the only way to "rein in" this sort of culture was via a s249D". I subsequently prepared some information and passed it on to Peter Curtis for his consideration. Soon thereafter, I was told by Peter Curtis the process was in hand by others and thus I disbanded my action."

- Mr David Buckland did more than prepare "some information" to pass "on to Peter Curtis for his consideration". Mr David Buckland provided draft s249 materials and information in emails to Messrs Richard McGrath, David Shearwood and Peter Curtis on 27 March, 28 March, 30 March and 31 March 2019. This all occurred prior to Mr Buckland being informed that the 9 April 2019 meeting (referred to above) was cancelled. In addition, Mr David Buckland continued to communicate with Messrs Richard McGrath, David Shearwood, Peter Curtis and others after he forwarded material relating to a s249D meeting.

- Mr David Buckland on 9 April 2019 sent an email to Messrs Richard McGrath, David Shearwood, Peter Curtis and Ms Christine McGrath providing some further material on Aguia stating "Good luck". In his email, he provided some advice in relation to the proposed s249D requisition and concluded with "You can worry about this stuff once you get control of the Board. Over to you. Best wishes, David". Mr Peter Curtis, in thanking Mr David Buckland for his assistance in a reply email (copied to Messrs Richard McGrath and David Shearwood) concluded stating, "Will keep you looped in all things".

- On 10 April 2019, Mr David Buckland emailed Messrs Richard McGrath, David Shearwood, Peter Curtis and Ms Christine McGrath forwarding consents to be a director from Mr Jonathan Guinness. On 24 April 2019, almost two weeks after the First Requisition Notice was given to Aguia, Mr David Buckland emailed Messrs Richard McGrath, David Shearwood and Peter Curtis, stating:

"Gents,

I think the attached link requires the likes of AGRL to have two Independent Canadian directors. Maybe if we drop the requirement for David Gower to be sacked, then the current Directors will find it harder to fight the s249D.

If successful then 4/2 and our problems are partially solved."

- On 29 April 2019, Mr Richard McGrath, in an email to Messrs David Shearwood, Peter Curtis and Ms Christine McGrath, relayed advice from Mr David Buckland.

- While some of the emails referred to Mr David Buckland providing advice, and although he was not copied on all the correspondence, we infer from the material that Mr David Buckland was working closely with Messrs Richard McGrath, David Shearwood and Peter Curtis in relation to seeking changes to the Aguia board and he was associated with them for the purpose of controlling or influencing the composition of the board of Aguia.27 We consider that Mr Peter Curtis's statement that they would keep Mr David Buckland "looped in all things" supports our inference.

- We infer that in providing strategic advice in his email of 24 April 2019 and using terms such as 'we' and 'our', Mr David Buckland still regards himself as part of the group pursuing the requisition.

- Other than Mr David Buckland's submissions that he "disbanded my action" in relation to the requisition, we have no material before us to suggest that Mr David Buckland is no longer associated with Messrs Richard McGrath, David Shearwood and Peter Curtis. Accordingly, we have no basis to accept that Mr David Buckland "disbanded [his] action", particularly in light of his ongoing involvement subsequent to the giving of the First Requisition Notice on 11 April 2019.

Ms Christine McGrath and Messrs Richard McGrath, David Shearwood and Peter Curtis

- Ms Christine McGrath is one of the proposed directors under the First Requisition Notice and is related to Mr Richard McGrath. Ms Christine McGrath was copied in on the following emails (involving Messrs Richard McGrath, David Shearwood, Peter Curtis and David Buckland):

- Mr David Shearwood's email dated 6 April 2019, which set out a detailed plan in relation to changing the board of Aguia and the actions that a new Aguia board may take.

- Mr David Buckland's email dated 9 April 2019.

- Mr David Buckland's email dated 10 April 2019.

- On 25 and 26 April 2019, Ms Christine McGrath and Messrs Richard McGrath, David Shearwood and Peter Curtis emailed one another in relation to a s249D Requisitioning Shareholders' letter.

- On 25 April 2019, Ms Christine McGrath emailed Messrs Richard McGrath, David Shearwood and Peter Curtis, stating:

"The 3 directors deemed to be independent are Lai, Gower & Pismiris according to the AGUIA website.

Are they all from Forbes Manhattan? If so they are truly independent?"

- On 26 April 2019, Ms Christine McGrath emailed Messrs Richard McGrath, David Shearwood and Peter Curtis, stating:

"Ok so that doesn't go anywhere

David I am happy to write this up when you get the information together if that helps"

- We infer from the above email that Ms Christine McGrath was offering to assist in writing up the s249D Requisitioning Shareholders' letter.

- Later on 26 April 2019, Ms Christine McGrath emailed Messrs Richard McGrath, David Shearwood and Peter Curtis, stating:

"Yes

I called my friend at […] but she is on leave. The person I spoke to said to call […] re s249E meeting. I called twice and they're not picking up. The receptionist doesn't take messages. I'm going out so I'll text the number to Peter.

I think we agreed it would be a general enquiry & we would not mention Aguia."

- On 30 April 2019, Ms Christine McGrath emailed Messrs Richard McGrath, David Shearwood and Peter Curtis, stating:

"I think it's great work – very persuasive. I'll take another look after afternoon.

A thought – without being jingoistic should we play up the failed move to Toronto – costs – plus the poor showing of shareholder on the TSV- failure to raise money there – more a bid for control – when you think about it could the Forbes/Manhattan connection be a real turn off there???? Just off the top of my head."

- We infer that the above email demonstrates that Ms Christine McGrath is assisting Messrs Richard McGrath, David Shearwood and Peter Curtis in relation to the First Requisition Notice.

- In Indiana Resources Limited,28 that Panel stated (footnotes omitted):

"We accepted that a person who agrees to stand for election as a director is not necessarily an associate of a shareholder who nominates that person. However, that does not mean that association can never arise in such circumstances, or that parties can ignore circumstances giving rise to association between one another, simply because one party has been nominated as a director by the other.

- We are prepared to consider that Ms Christine McGrath's assistance in the preparation of the s249D Requisitioning Shareholders statement went beyond "what might ordinarily be expected where a person merely agrees to be nominated for election as an independent director"29 and therefore infer that Ms Christine McGrath is associated with Messrs Richard McGrath, David Shearwood and Peter Curtis for the purpose of controlling or influencing the composition of the board of Aguia.30

Conclusions in relation to association

- Considering the whole of the material, and drawing appropriate inferences, we infer that the following persons (Associated Parties) are associated for the purpose of controlling or influencing the composition of the board of Aguia and are acting in concert in relation to the affairs of Aguia for the purpose of controlling or influencing the board of Aguia:

- Messrs Richard McGrath, David Shearwood and Peter Curtis

- the Requisitioning Shareholders

- the Requisitioning Shareholders and Messrs Richard McGrath, David Shearwood and Peter Curtis

- Mr David Buckland and Messrs Richard McGrath, David Shearwood and Peter Curtis and

- Ms Christine McGrath and Messrs Richard McGrath, David Shearwood and Peter Curtis.

Contravention of s671B

- As a result of the various associations between the Associated Parties, as at the date of the First Requisition Notice the following persons' voting power in Aguia shares is as set out below.

Person Voting Power Mr David Buckland, through his controlled entity Baobab Holdings Pty Ltd 9.76% Mr Peter Curtis (in his personal capacity) 12.50% Henderson 8.46% Ms Christine McGrath, through her controlled entity Houtskar Pty Ltd 7.00% Mr Richard McGrath, through his controlled entities Coopster Pty Limited and Kemosabe 12.50% Mr David Shearwood (in his personal capacity) and the Shearwood Trust 12.50% - No substantial holder notice has been lodged disclosing the various associations between the Associated Parties or the various voting powers listed in paragraph 75. We consider that the failure of each of the Associated Parties to disclose their association and voting powers in a substantial holder notice constitutes or gives rise to a material contravention of s671B.

- As a result of the failure to disclose their association, Aguia shareholders are not aware ahead of the Requisitioned Meetings:

- that the Associated Persons are associates for the purpose of controlling or influencing the composition of the Aguia board or

- of the accumulation of voting power through the various associations listed in paragraph 75.

- Given the various associations listed in paragraph 75 did not concern an accumulation of voting power of more than 20% and there was no material before us that established that the Associated Parties had not retained their right to vote their Aguia shares in any way they wished on the resolutions proposed in the Requisition Notices, we do not need to decide whether a voting agreement exists.

Other alleged associations

- From the large volume of material received in response to our preliminary inquiries and the briefs, and for the reasons set out below, we are not satisfied there is sufficient material to establish, even with proper inferences being drawn, an association between any of the Associated Parties and:

- the Kemosabe Clients or

- Mr Harry Shearwood (in his personal capacity).

Kemosabe Clients

- Aguia submitted that the Kemosabe Clients were associated with the Requisitioning Shareholders, Messrs David and Harry Shearwood and Coopster by reason of structural links with Kemosabe, submitting that each of the Kemosabe Clients are recorded on the Aguia share register as having their registered addresses directed to 'care of' Kemosabe.

- Aguia submitted that this structural link was most likely explained by Kemosabe acting as the investment manager, or financial adviser for each of the Kemosabe Clients. Aguia submitted that the Kemosabe Clients:

"(a) are likely to be accustomed to act in accordance with Kemosabe's instructions and recommendations, and by corollary, the other Kemosabe Client in respect of [Aguia shares]; and

(b) further, and in the alternative, may have given Kemosabe an authority to act on behalf of that person in relation to their [Aguia shares] (including for the purposes of voting)."

- We made inquiries of Kemosabe in relation to the Kemosabe Clients, including:

- the basis on which the Kemosabe Clients who are Aguia shareholders have their registered address directed to "care of" Kemosabe, and the rationale for this

- any rights it has in relation to buying, selling, transferring or disposing of shares held by the Kemosabe Clients (including Aguia shares)

- any rights it has in relation to voting securities held by the Kemosabe Clients (including Aguia shares) and how it deals with voting of Aguia shares held by the Kemosabe Clients in practice (including in relation to submitting proxies)

- requesting details of any correspondence with the Kemosabe Clients during the past six months in relation to the composition of the board of Aguia and the requisition (or potential requisition of) a meeting of the shareholders of Aguia and

- how it deals with voting of Aguia shares held by the Kemosabe Clients in practice (including in relation to submitting proxies).

- Kemosabe submitted that, as a service to its clients, all clients of Kemosabe are able to register their email addresses for corporate communications and direct all issuer documentation to Kemosabe's postal address. Kemosabe submitted that this service is offered to assist its clients' administration and to assist Kemosabe and its clients to manage their ongoing record keeping and annual reporting obligations.

- Kemosabe submitted that while the ultimate decision of how to vote always rests with its clients, Kemosabe does make recommendations and take instructions from its clients in relation to casting of the votes attached to its clients' shares in Aguia. Kemosabe submitted that, if necessary and as a service to its clients, it assists its clients to electronically cast their votes by logging on to Aguia's share registrar's voting platform and by casting the relevant votes in accordance with the client's instructions.

- We are not satisfied that the material provided by Aguia in the application or by Kemosabe in response to our inquiries established, and we were not prepared to infer, that Kemosabe:

- has any authority or discretion to initiate buy or sell transactions in any Aguia shares held by the Kemosabe Clients

- generally has power to exercise, or to control the exercise of, a right to vote attached to any Aguia shares held by the Kemosabe Clients or

- was associated with any of the Kemosabe Clients (other than Mr David Shearwood) in relation to the Requisitioned Meetings.

- While we were of the view that there was insufficient material to establish an association with any of the Kemosabe Clients (other than Mr David Shearwood) or that Kemosabe has voting power in any of the Kemosabe Clients' shares, we were concerned that Kemosabe may have a conflict of interest in providing a recommendation to its clients in relation to a meeting it has requisitioned.31 We asked the parties and Mr David Buckland, Mr Peter Curtis and Ms Christine McGrath whether we should make a declaration to address this issue.

- Aguia submitted that we should make a declaration to cover the potential conflict of interest, stating:

"…whether or not Kemosabe makes a recommendation as to voting, there is already an understanding an expectation that its clients are, as a matter of commercial reality, likely to vote in favour of the resolutions proposed by their investment manager (and therefore be 'voting in concert' with Kemosabe).

If Kemosabe were permitted to, and did, make a recommendation as to voting, [Aguia] submits that the understanding and expectation of Kemosabe's clients voting in accordance with that recommendation is even more evident, particularly given the existing practice of Kemosabe's clients accepting Kemosabe's recommendations."

- Aguia submitted that in addition to making a declaration we should make orders "restricting the making of recommendations and holding of undirected voting capacity" to assist curing the potential conflict.

- Kemosabe submitted that it has not furnished any of its clients with a recommendation in relation to the manner in which their votes should be cast at the Requisitioned Meetings. In addition, Kemosabe submitted that it "is required to comply with the obligations attached to its Australian financial services licence, various financial services and corporations law statutes and is also under a fiduciary obligation in relation to the provision of financial advice (including in relation to the provision of voting recommendations)". Kemosabe submitted that it did not believe that any additional regulation or orders will be of benefit to its clients, or that they are necessary to ensure that it acts in a disinterested manner.

- Nevertheless Kemosabe also submitted that it was willing to give an undertaking to the Panel to the effect that it would write a letter to its clients "to reiterate the fact that despite any recommendations that it might make in relation to any of the resolutions to be considered at either of the [Requisitioned Meetings], all decisions that the client may make in relation to casting of the votes attached to their shares in [Aguia] are and must be entirely their own". It submitted that this would "obviate any residual concern that the Takeovers Panel might have in relation to any perceived conflict of interest between the interests of Kemosabe Capital and those of its clients".

- We ultimately accepted the undertaking offered by Kemosabe (Annexure A) on the basis that it sufficiently addressed our concerns in relation to the potential conflict of interest and the public interest was served by us doing so. As such, we did not need to consider the matter further.

Harry Shearwood

- The Requisition Notices were co-signed by Messrs David and Harry Shearwood in their capacities as the trustees of the David K. Shearwood DIY Superannuation Fund.

- Aguia submitted that Mr Harry Shearwood (in his personal capacity) was associated with the Requisitioning Shareholders, Mr David Shearwood (in his personal capacity) and Coopster. As shown in the diagram in paragraph 31, Mr Harry Shearwood has voting power in his personal capacity of 0.02% of Aguia shares.

- As set out in the preliminary findings above, we received large volumes of correspondence between certain of the Associated Parties in relation to the Requisitioned Meetings and material in relation to their future plans for Aguia. Other than the fact that Mr Harry Shearwood co-signed the Requisition Notices in his capacity as a trustee of the Shearwood Trust, none of the materials showed that Mr Harry Shearwood in his personal capacity was in anyway involved with the Requisitioned Meetings. For example, Mr Harry Shearwood was not present at any meetings with the other Requisitioning Shareholders and was not copied on any of the email correspondence sent in relation to the Requisitioned Meetings.32

- The signing of the Requisition Notices by Mr Harry Shearwood in his capacity as a trustee of the Shearwood Trust alone was not in our view sufficient to establish that Mr Harry Shearwood was associated with any of the Associated Parties in his personal capacity. We considered the circumstances to fall within one of the rare situations referred to in RG 128 and Caravel Minerals Limited 02R (see discussion in paragraphs 49 and 50 above).

Decision

Declaration

- It appears to us that the circumstances are unacceptable:

- having regard to the purposes of Chapter 6 set out in s602

- in the alternative, because they gave rise to a contravention of s671B.

- Accordingly, we made the declaration set out in Annexure B. We considered that the contraventions of the substantial holding provisions were material and accordingly, in the light of the factors discussed in these reasons, considered that it is not against the public interest to make the declaration. We had regard to the matters in s657A(3).

Orders

- Following the declaration, we made the final orders set out in Annexure C. Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make 'any order'33 if 4 tests are met:

- it has made a declaration under s657A. This was done on 31 May 2019.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. We are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 27, 29 and 31 May 2019. Each party made submissions and rebuttals. We did not receive submissions or rebuttals in relation to the proposed declaration and orders from Mr David Buckland, Mr Peter Curtis or Ms Christine McGrath.

- it considers the orders appropriate to protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons. The orders do this by requiring each of the Associated Parties to disclose their association and respective voting power in Aguia shares in substantial holder notices (in a form acceptable to the Panel). The Respondents agreed in effect that the disclosure orders "are a sensible remedy" to the conclusion drawn by us.

Costs

- In its submissions on orders, Aguia noted that it had not sought an order as to costs, however it submitted that "given the Respondents' grave and continued concerns for [Aguia's] financial health, and the fact that it was both appropriate and necessary for [Aguia] to commence [the] proceedings, [Aguia] invites the Panel to consider whether it is appropriate in the circumstances to make orders against the Respondents relating to costs".

- Costs orders are the exception not the rule "so may not follow to a 'successful' party" and a party is entitled to resist an application once without exposure to a costs order, provided it presents a case of reasonable merit in a businesslike way.34 We do not consider a costs order was warranted in this instance.

Postscript

- On 4 June 2019, the Associated Parties lodged a substantial holder notice in accordance with our orders which disclosed the following persons' voting power in Aguia shares as at 4 June 2019.

Person Voting Power Mr David Buckland, through his controlled entity Baobab Holdings Pty Ltd 10.07% Mr Peter Curtis (in his personal capacity) 13.12% Henderson 8.74%35 Ms Christine McGrath, through her controlled entity Houtskar Pty Ltd 7.06% Mr Richard McGrath, through his controlled entities Coopster Pty Limited and Kemosabe 13.12% Mr David Shearwood (in his personal capacity) and the Shearwood Trust 13.12% - On 11 June 2019, the First Requisitioned Meeting was held and the Appointment Resolutions were passed.

- On 14 June 2019, Messrs Alex Pismiris, Brian Moller and Paul Pint and Ms Diane Lai resigned as directors of Aguia. The Requisitioning Shareholders subsequently withdrew the amended Removal Resolutions from the business of the Second Requisitioned Meeting.

Bruce Cowley

President of the sitting Panel

Decision dated 31 May 2019

Reasons given to parties 28 June 2019

Reasons published 2 July 2019

Advisers

| Party | Advisers |

|---|---|

| Aguia | HopgoodGanim Lawyers |

| Respondents | K&L Gates |

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 Citing Regis Resources Ltd [2009] ATP 7

3 See for example Caravel Minerals Limited [2018] ATP 8 at [38] (and the authorities cited therein) and Auris Minerals Limited [2018] ATP 7at [23]

4 See RG 128 at [128.1]

5 Australian Government Department of Treasury, Takeovers, Corporate Control: a better environment for productive investment, Corporate Law Economic Reform Program Proposals for Reform: Paper No. 4 (1997)

6 Corporate Law Economic Reform Program Bill 1998 (Cth), Explanatory Memorandum, at [7.14] –[7.16]

7 Guidance Note 5 – Specific Remedies – information deficiencies, at [10(a)]

8 See Caravel Minerals Limited [2018] ATP 8 at [52] and [55]

9 Resource Generation Limited [2015] ATP 12 at [48]

10 See Mount Gibson Iron Limited [2008] ATP 4 at [15]

11 Auris Minerals Limited [2018] ATP 7 at [20]

12 See for example Indiana Resources Limited [2017] ATP 8 at [20] and Orion Telecommunications Limited [2006] ATP 23 at [103]-[108]. See also UK Takeover Panel Practice Statement No 26, Shareholder activism, at [1.7]

13 Resource Generation Limited [2015] ATP 12 at [99] – [108]

14 Resource Generation Limited [2015] ATP 12 at [93], RG 128 at Table 2 and Table 3, and UK Takeover Panel Practice Statement No 26, Shareholder activism, at [1.3]

15 Resource Generation Limited [2015] ATP 12 at [93]

16 See Caravel Minerals Limited [2018] ATP 8 at [50] and Auris Minerals Limited [2018] ATP 7 at [23] – [24]. There are rare cases where the Panel may intervene in a board spill where there is no material suggesting a contravention of s606 and substantial holding provisions but there is a bid or proposed bid on foot (see IFS Construction Services Limited [2012] ATP 15)

17 Australian Whisky Holdings Limited [2019] ATP 12 at [24]-[26]

18 The Panel noted that the Requisitioning Shareholders' legal adviser also acted for Messrs David and Harry Shearwood (in their personal capacities) and Coopster in relation to the proceedings. On this basis the Panel advised the parties that it assumed that Mr Richard McGrath, being the controller of Kemosabe and Coopster, was already aware of, and involved in, the proceedings. However, the Panel also invited Mr Richard McGrath to provide any additional relevant material that he may have (ie to the extent the Panel did not already have it)

19 See for example Resource Generation Limited [2015] ATP 12 at [56]-[61]

20 RG 128 at [128.3]

21 In a way which is similar in nature to the requisitioning shareholders and some proposed directors in Indiana Resources Limited [2017] ATP 8 at [20(c)] and [21]

22 Having a relevant agreement and/or were acting in concert in relation to the affairs of Aguia for the purpose of controlling or influencing the board of Aguia

23 [2018] ATP 10 at [12]

24 We note that neither Mr or Ms Henderson hold Aguia shares in their personal capacities

25 [2018] ATP 8 and 10 respectively

26 Having a relevant agreement and/or were acting in concert in relation to the affairs of Aguia for the purpose of controlling or influencing the board of Aguia

27 Having a relevant agreement and/or were acting in concert in relation to the affairs of Aguia for the purpose of controlling or influencing the board of Aguia

28 [2017] ATP 8 at [19]

29 Indiana Resources Limited [2017] ATP 8 at [20]. See also RG 128, Table 3 that states: "Particularly in circumstances where the proposed directors have a connection with the investors who may be engaged in collective action, board control activity can be used as a pathway to control over the entity and more traditional control transactions".

30 Having a relevant agreement and/or were acting in concert in relation to the affairs of Aguia for the purpose of controlling or influencing the board of Aguia

31 Noting that the Respondents' submissions had submitted that "on occasions when Kemosabe Capital considered it inappropriate or imprudent to make a voting recommendation in relation to any shareholder resolution proposed by the Company, it has declined to make the relevant voting recommendation."

32 In addition, there were no materials showing that Mr Harry Shearwood had discussed or received any drafts of any of the documents prepared in relation to the Requisitioned Meetings

33 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

34 Guidance Note 4 – Remedies General at paragraph 28

35 The substantial holder notice did not expressly disclose Henderson's voting power in Aguia shares as at 4 June 2019, however it could be calculated to be 8.74%

Annexure A

Australian Securities and Investments Commission Act 2001 (Cth) Section 201A

Undertaking

Aguia Resources Limited

Kemosabe Capital Pty Ltd (Kemosabe) undertakes to the Panel that within two business days from the day of this undertaking it will provide the Panel with a draft letter for approval by the Panel to all its clients that hold Aguia Resources Limited (Aguia) shares attaching a copy of (or link to) the notices of meeting for the general meetings currently scheduled for 11 and 17 June 2019 (Requisition Meetings) stating:

- The background to Kemosabe's requisitions under s249D of the Corporations Act 2001 (Cth) for the Requisition Meetings including Kemosabe's reasons behind these requisitions.

- That despite any recommendations that it might make in relation to any of the resolutions to be considered at the Requisition Meetings, all decisions that the client may make in relation to casting of the votes attached to their shares in Aguia are and must be entirely their own.

- That the Takeovers Panel has required Kemosabe and other Aguia shareholders to disclose that they are associates, attaching a copy of the substantial holder notice disclosing these associations.

Kemosabe further undertakes to dispatch the letter within two business days after the Panel has approved it.

Kemosabe agrees to confirm in writing to the Panel when it has satisfied its obligations under this undertaking.

Signed by Richard McGrath

with the authority, and on behalf, of

Kemosabe Capital Pty Ltd

Dated 31 May 2019

Annexure B

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Aguia Resources Limited

Circumstances

- Aguia Resources Limited is an ASX listed company (ASX code: AGR) (Aguia).

- Shareholders of Aguia and their relevant interests as at 11 April 2019 include:

- Mr David Buckland, through his controlled entity Baobab Holdings Pty Ltd (D. Buckland) – 3.35%

- Mr Peter Curtis, in his personal capacity (P. Curtis) – 0.11%

- Henderson International Pty Limited (Henderson) – 2.15%

- Ms Christine McGrath, through her controlled entity Houtskar Pty Ltd (C. McGrath) – 0.64%

- Mr Richard McGrath, through his controlled entities Coopster Pty Limited and Kemosabe Capital Limited (Kemosabe) (together, R. McGrath) – 1.53% and

- Mr David Shearwood, in his personal capacity and David Shearwood and Harry Shearwood as trustees for the David K. Shearwood DIY Superannuation Fund (Shearwood Trust) (together, Shearwood Parties) – 4.80%.

- On or about 11 April 2019, Kemosabe, Henderson and the Shearwood Trust (the Requisitioning Shareholders) gave a notice under s249D1 to requisition a meeting of Aguia shareholders to consider resolutions to remove five of the current directors of Aguia and appoint four new directors nominated by the Requisitioning Shareholders (First requisition meeting). Two of the new directors nominated by the Requisitioning Shareholders were Ms Christine McGrath and Mr David Shearwood.

- On 8 May 2019, the Requisitioning Shareholders gave a second notice under s249D to remove four of the current directors of Aguia (Second requisition meeting). The First requisition meeting (which now only deals with the resolutions to appoint directors) is scheduled for 11 June 2019 and the Second requisition meeting is scheduled for 17 June 2019.

- The Panel considers that structural links and correspondence establishes that the following persons are associated for the purpose of controlling or influencing the composition of the board of Aguia (s12(2)(b)) and/or are acting in concert in relation to the affairs of Aguia for the purpose of controlling or influencing the board of Aguia (s12(2)(c)):

- Messrs Richard McGrath, David Shearwood and Peter Curtis.

- The Requisitioning Shareholders.

- The Requisitioning Shareholders and Messrs Richard McGrath, David Shearwood and Peter Curtis.

- Mr David Buckland and Messrs Richard McGrath, David Shearwood and Peter Curtis.

- Ms Christine McGrath and Messrs Richard McGrath, David Shearwood and Peter Curtis.

- As a result of the various associations between the persons listed in paragraph 5, the following persons' voting power in Aguia shares has increased as set out below.

Person Voting Power D. Buckland 9.76% P. Curtis 12.50% Henderson 8.46% C. McGrath 7.00% R. McGrath 12.50% Shearwood Parties 12.50% - In contravention of s671B, no substantial holder notice has been given disclosing the above voting powers in Aguia and the various associations in relation to Aguia.

Effect

- As a result of the failure to disclose their association, Aguia shareholders are not aware that the persons listed in paragraph 5 are associates for the purpose of controlling or influencing the composition of the Aguia board ahead of the requisitioned meetings.

Conclusion

- It appears to the Panel that the circumstances are unacceptable:

- having regard to the purposes of Chapter 6 set out in s602

- in the alternative, because they gave rise to a contravention of s671B.

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Aguia Resources Limited.

Tania Mattei

Counsel

with authority of Bruce Cowley

President of the sitting Panel

Dated 31 May 2019

1 References are to the Corporations Act 2001 (Cth) unless otherwise indicated.

Annexure C

Corporations Act

Section 657D

Order

Aguia Resources Limited

The Panel made a declaration of unacceptable circumstances on 31 May 2019.

The Panel Orders

- By no later than two business days from the date of these orders, each of the Associated Parties must provide to Aguia Resources Limited and the ASX a substantial holder notice in a form acceptable to the Panel (such draft substantial holder notice to be provided to the Panel for its review no later than one business day from the date of these orders), disclosing:

- all the information required by a Form 603 in respect of each of the Associated Parties and their respective associates and

- the existence and nature of the association between the Associated Parties.

Interpretation

- In these orders the following terms apply.

- Associated Parties

-

- Messrs Richard McGrath, David Shearwood and Peter Curtis

- The Requisitioners

- The Requisitioners and Messrs Richard McGrath, David Shearwood and Peter Curtis

- Mr David Buckland and Messrs Richard McGrath, David Shearwood and Peter Curtis

- Ms Christine McGrath and Messrs Richard McGrath, David Shearwood and Peter Curtis

- Requisitioners

- Kemosabe Capital Pty Ltd, Henderson International Pty Ltd and Messrs David and Harry Shearwood (in their capacity as the trustees of the David K. Shearwood DIY Superannuation Fund)

Tania Mattei

Counsel

with authority of Bruce Cowley

President of the sitting Panel

Dated 31 May 2019