[2024] ATP 19

Catchwords:

Review – decline to conduct proceedings – association – warehousing – evidence

Corporations Act 2001 (Cth), sections 606, 657EA

Australian Securities and Investments Commission Regulations 2001 (Cth) regs 15, 20

Takeovers Panel Procedural Rules 2020, Rule 10(6)

AIMS Property Securities Fund 04 [2024] ATP 18, AIMS Property Securities Fund 03 [2023] ATP 5, AIMS Property Securities Fund 01 & 02 {2021] ATP 15

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The review Panel, Ruth Higgins SC, Bruce McLennan and Karen Phin (sitting President), declined to conduct proceedings on an application by Benjamin Graham atf the Graham Family Trust and Warwick Sauer in his personal capacity and as a director of Baauer Pty Ltd atf the Baauer Family Trust to review the decision of the initial Panel to decline to conduct proceedings in AIMS Property Securities Fund 04.1 The review application concerned an alleged association between the controlling unitholder of APW and other unitholders. The review Panel considered, among other things, that on balance the applicants did not provide a sufficient body of material to justify the review Panel making further enquiries in relation to whether the persons and entities referred to in the application were associates in relation to APW. The review Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- 9 August 2022 unit transfer

- has the meaning given in paragraph 19(a)

- 14 August 2024 unit transfer

- has the meaning given in paragraph 19(c)

- 14 June 2024 unit transfer

- has the meaning given in paragraph 19(b)

- AIMS 04

- AIMS Property Securities Fund 04 [2024] ATP 18

- Applicants

- Benjamin Graham atf the Graham Family Trust and Warwick Sauer in his personal capacity and as a director of Baauer Pty Ltd atf the Baauer Family Trust

- APW

- AIMS Property Securities Fund

- APW RE

- AIMS Fund Management Limited

- Consolidated AIMS Group

- Great World Financial Group Holdings Pty Ltd and subsidiaries referred to in Part 1 of Annexure A of the substantial holder notice lodged by Great World Financial Group Holdings Pty Ltd and Subsidiaries and Mr George Wang directly owned and controlled entities (and signed by Mr George Wang) dated 14 August 2024

- LH&F

- LH&F Pty Ltd, on its own behalf and as trustee of the LH&F Family Trust

Facts

- APW is an ASX listed2 managed investment scheme (ASX code: APW). It has 44,519,083 units on issue. The units are thinly traded.

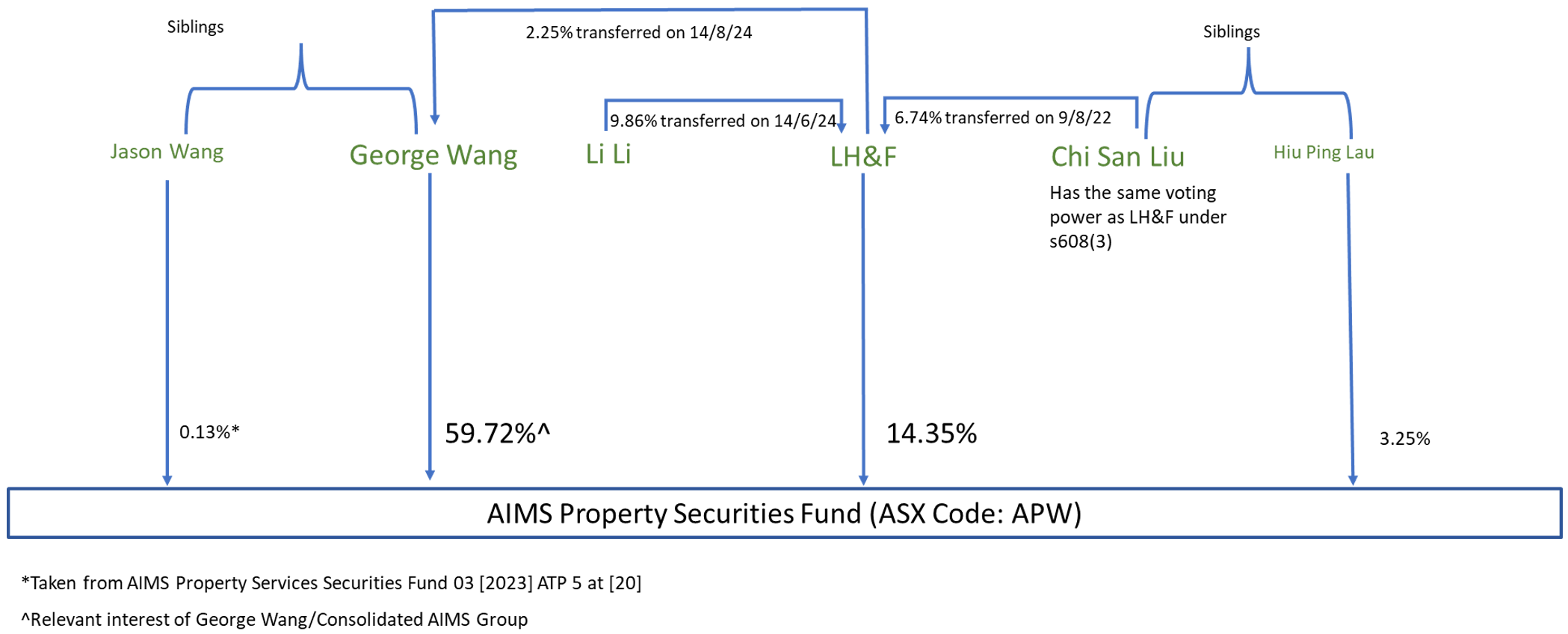

- Mr George Wang has voting power of 59.72% in APW through the Consolidated AIMS Group.

- On 24 December 2020, AIMS Investment Group Holdings Pty Ltd (a member of the Consolidated AIMS Group), Ms Li Li, Mr Chi San Liu and Ms Hiu Ping Lau acquired approximately 22.84% (in aggregate) of the APW units on issue from two former unitholders of APW for $1.785 per unit.3 The market price for APW units on 24 December 2020 was $1.34 per unit. Following the acquisition:

- Mr George Wang had voting power of 42.78% in APW.

- Ms Li Li had voting power of 9.86% in APW.

- Mr Chi San Liu had voting power of 6.74% in APW.

- Ms Hiu Ping Lau had voting power of 3.25% in APW.

- Mr Chi San Liu and Ms Hiu Ping Lau are siblings.4 Mr Chi San Liu submitted in the AIMS Property Securities Fund 01 & 02 proceedings that Ms Li Li was a family friend.5

- On 9 August 2022, Mr Chi San Liu transferred his 6.74% interest in APW to LH&F for $1.785 per unit (the price at which he had acquired the units). The market price for APW units on 9 August 2022 was between $1.255 and $1.30 per unit. Mr Chi San Liu, in a substantial holder notice, disclosed that he continued to have a relevant interest in 6.74% of APW under section 608(3)6 as he had voting power of more than 20% in LH&F.

- On 14 June 2024, Ms Li Li transferred her 9.86% interest in APW to LH&F, also for $1.785 per unit. The market price for APW units on 14 June 2024 was $1.53 per unit.

- On 14 August 2024, AIMS Investment Group Holdings Pty Ltd (a member of the Consolidated AIMS Group) acquired 1,000,000 APW units (2.25%) from LH&F for $1.577 per unit. The market price for APW units on 14 August 2024 was $1.57 per unit.

-

Unitholdings in APW and various relationships between the parties are set out in the diagram below:

- On 20 August 2024, and as amended on 22 August 2024, the Applicants sought a declaration of unacceptable circumstances. The Applicants submitted (among other things) that:

- The 14 August 2024 sale of 1,000,000 APW units from LH&F to the Consolidated AIMS Group at $1.577 per unit caused LH&F to incur a loss of $208,000 vis-à-vis LH&F’s purchase of APW units from Ms Li Li at $1.785 per unit 2 months earlier.

- LH&F acquired the APW units from Mr Chi San Liu on 9 August 2022 and from Ms Li Li on 14 June 2024 for the purpose of warehousing those units for Mr George Wang and the Consolidated AIMS Group.

- The conduct would, if not remedied, result in the Consolidated AIMS Group and its associates, LH&F and Mr Chi San Liu, retaining 9.86% of APW acquired in contravention of the prohibition in section 606.7

- On 9 January 2024, the initial Panel in AIMS 04 declined to conduct proceedings on the basis that (among other things) the Applicants did not provide a sufficient body of material to justify the initial Panel making further enquiries in relation to whether the persons and entities referred to in the application were associates in relation to APW.

Application

Review application

- On 29 August 2024, the Applicants sought a review of the initial Panel’s decision to decline to conduct proceedings in AIMS 04 pursuant to section 657EA8. The Acting President provided consent to the application for review.

- The Applicants submitted (among other things) that:

- the relevant control effect is not that flowing from LH&F’s 14 August 2024 off-market sale of 1,000,000 APW units (i.e. 2.25%of APW) to the Consolidated AIMS Group, but is that which flows from the alleged warehousing (i.e. 9.86% of APW)

- the initial Panel’s reasons make no mention of other matters that the Applicants submitted are highly probative to their concerns about warehousing

- the Consolidated AIMS Group and its associates have never bought APW units on-market, despite ample opportunity to do so for less than they have paid off-market

- the evidence examined in AIMS Property Securities Fund 039 is highly suggestive of Mr George Wang having a propensity to engage in the very type of conduct being complained of in the current application (i.e. warehousing), and

- the Panel in AIMS Property Securities Fund 03 was so concerned about Mr George Wang’s conduct, which is the very type of conduct being complained of by the Applicants (i.e. warehousing), that it referred the matter to ASIC.

Interim order sought

- The Applicants sought an interim order that LH&F and Mr Chi San Liu not deal with the 6,390,053 APW units they had voting power in, and the Consolidated AIMS Group not deal with 1,000,000 of its APW units, pending determination of its application.

Final orders sought

- The Applicants sought the same final orders it sought in the initial application, namely that:

- LH&F’s 6,390,053 APW units and the 1,000,000 units acquired by the Consolidated AIMS Group on 14 August 2024 be vested in ASIC for sale.10

- The Consolidated AIMS Group, Mr George Wang (his siblings – Mr Jason Wang and Ms Jenny Wang), LH&F, Mr Chi San Liu, Ms Li Li, Ms Hiu Ping Lau, and their associates, be prohibited from acquiring any of the vested units from ASIC.

Discussion

- The role of a review Panel is to conduct a de novo review.11 It is open to the review Panel in doing so to reach the same decision as the initial Panel and affirm its decision to decline to make a declaration.12

- We have considered all the material, including the material before the initial Panel in AIMS 04 and the initial Panel’s reasons for decision, but address specifically only that part of the material we consider necessary to explain our reasoning.

Commercial rationality of the relevant transactions

- On the face of the materials available, we considered that there were certain questions as to the commerciality of the following transactions:

- the transfer of 3,002,033 APW units by Mr Chi San Liu to LH&F on 9 August 2022 for a price of $1.785 per unit (9 August 2022 unit transfer)

- the transfer of 4,388,020 APW units by Ms Li Li to LH&F on 14 June 2024 for a price of $1.785 per unit (14 June 2024 unit transfer) and

- the transfer of 1,000,000 APW units by LH&F to the Consolidated AIMS Group on 14 August 2024 for a price of $1.577 per unit (14 August 2024 unit transfer).

-

In respect of the 14 August 2024 unit transfer, the initial Panel said in AIMS 04 at [19] (emphasis added):

“The transfer of 1,000,000 APW units at $1.577 per unit from LH&F to the Consolidated AIMS Group of 14 August 2024 was potentially more probative, as the sale was at a loss to LH&F and in the light of Ms Li Li’s disposal to LH&F two months earlier. However, while the commerciality of this acquisition could be questioned, it was at or around the market price for APW units at the time, did not have a material control effect, did not involve all of LH&F’s holding and occurred more than 3½ years after the original purchases by Ms Li Li and Mr Chi San Liu. On balance by itself, this was not sufficient for us to consider conducting proceedings.”

- We sought submissions from the relevant parties to explain the circumstances that led to those transactions, including the commercial rationale for participating in those transfers and the price of those transfers.

14 June 2024 unit transfer

- In response to our questions, Ms Li Li submitted that she initially invested in APW due to her knowledge of Mr Chi San Liu’s intention to invest and her belief that APW would serve as a good diversification strategy for investments in Australia.

- Ms Li Li submitted that the reason for the sale of her APW units on 14 June 2024 was due to a change in her migration plans and the need for liquidity for her family business amid the economic slowdown in China.

- Mr Chi San Liu submitted that, given Ms Li Li’s circumstances, he agreed to purchase Ms Li Li’s APW units at her original acquisition price.13

- Mr Chi San Liu submitted that he considered this acquisition price was advantageous and provided substantial value, as it represented a significant discount to APW’s current net asset value, and that this acquisition aligns with his long-term investment strategy.

- While the commerciality of this acquisition could be questioned, on balance and by itself, this was not sufficient for us to consider conducting proceedings because (among other things) the 14 June 2024 unit transfer did not have a material control effect and occurred more than 3½ years after the original purchase by Ms Li Li. We considered that there was some force in:

- Ms Li Li’s submissions that she initially invested in APW due to her knowledge of Mr Chi San Liu’s intention to invest and then, as a result of a change in her circumstances, she decided to exit this investment, and

- Mr Chi San Liu’s submissions that he agreed to purchase Ms Li Li’s APW units following her decision to exit her APW investment, having regard to his knowledge of Ms Li Li’s circumstances and that Ms Li Li is a family friend of Mr Chi San Liu who initially invested in APW due to her knowledge of Mr Chi San Liu’s intention to invest.

9 August 2022 unit transfer

- Mr Chi San Liu submitted that the 9 August 2022 unit transfer was a transfer of Mr Chi San Liu’s APW units held in his own name to his own family trust, LH&F the trustee for the LH&F Family Trust.14

- Mr Chi San Liu submitted that the primary reason for the 9 August 2022 unit transfer was tax-related because, as Mr Chi San Liu remains a non-tax resident of Australia, the transfer of the APW units to LH&F allows Mr Chi San Liu to manage the tax implications while retaining his investment in APW.

- Mr Chi San Liu submitted that the APW units were transferred at a price of $1.785 per unit, which was Mr Chi San Liu’s acquisition cost, and that this transaction facilitated a cost-effective transfer within his family structure.

- We considered that Mr Chi San Liu’s explanation of this transaction evidenced sufficient commercial rationale to support the transaction.

14 August 2024 unit transfer

- Mr Chi San Liu submitted that the 14 August 2024 unit transfer enabled LH&F to “rebalance its portfolio and maintain liquidity for other investment opportunities.” Mr Chi San Liu also submitted that this transfer was prompted by:

- recent investment losses that Mr Chi San Liu experienced in Hong Kong and China due to downturns in the Chinese property markets and

- China’s stringent restrictions on remitting funds overseas,

which “left Mr. Liu with no choice but to liquidate part of his APW holdings to fund other global investments and development projects.”

- Mr Chi San Liu submitted that he sought to transfer LH&F’s APW units to Mr George Wang and the Consolidated AIMS Group because they are the largest unitholders of APW.

- Mr Chi San Liu also submitted that the transaction price of $1.577 per unit was based on the average market price of APW units over the two weeks prior to the transaction date.

- The Consolidated AIMS Group submitted that the commercial rationale for the transaction was as follows:

- “[The Consolidated AIMS Group] has always believed APW is a good investment from a long-term perspective and continues to have that view. This is because, as noted above, APW’s net asset value has more than tripled and its market capitalisation has more than doubled since 2009 when AIMS first invested in APW.

- [The Consolidated AIMS Group] remains of the view that there will be continuing upside in relation to APW in the long-term.

- [The Consolidated AIMS Group] was willing to acquire the 1 million APW units being offered by LH&F at a price that reflected the current market value of APW, and this is in compliance with its creep obligations under the Corporations Act.”

- The Consolidated AIMS Group submitted that it purchased the APW units directly from LH&F, rather than on-market, because the opportunity presented itself and because APW is thinly traded. The Consolidated AIMS Group further submitted that it is not improper or inappropriate for a seller to approach a potential buyer to enter into a block trade in such circumstances, particularly where there is a substantial shareholder such as the Consolidated AIMS Group.

- The Consolidated AIMS Group further submitted that, in these circumstances, it considered that buying APW units off-market was equivalent to buying APW units on-market as the 14 August 2024 unit transfer was conducted at a price equal to APW’s 2-week volume-weighted average price and the 14 August 2024 unit transfer and its terms was disclosed on the ASX.

- We do not consider that the 14 August 2024 unit transfer in isolation is probative in respect of the allegation of warehousing in relation to Mr George Wang, including because the transfer:

- was at or around the market price for APW units at the time

- did not have a material control effect and

- occurred more than 3½ years after the original purchases by Ms Li Li and Mr Chi San Liu.

- On balance, we agree with the initial Panel that, while ASIC may wish to make further enquiries in relation to whether the parties have historically complied with their substantial holder notice obligations, we do not consider the 9 August 2022 unit transfer, the 14 June 2024 unit transfer, or the 14 August 2024 unit transfer, individually or collectively, sufficient to support further inquiry into the allegation of warehousing in relation to Mr George Wang or the Consolidated AIMS Group.

Panel’s ability to obtain information from persons outside Australia

-

The initial Panel in its reasons made the following statement at [22]:

“In addition, noting the difficulty of obtaining information by compulsion from persons resident outside Australia,15 we consider that if we did make enquiries that it is unlikely that we would obtain sufficient material to make inferences that the limited transactions described above were for the purposes of warehousing.”16

- The Applicants submitted that such a statement could encourage potential wrongdoers:

- to structure transactions deliberately to involve non-resident or potentially uncooperative witnesses or

- not to meet their legal obligation to cooperate with the Panel.

- Given our consideration of the 14 August 2024 unit transfer and the fact that Ms Li Li and Mr Chi San Liu and LH&F were represented by Australian counsel and made submissions in relation to our preliminary questions, we did not consider it was necessary to consider our ability to obtain further information from these parties.

Other matters

- We were informed that two submissions during the initial Panel’s proceedings in AIMS 04 from APW RE and Mr George Wang, both dated 23 August 2024, were not provided to the Applicants and ASIC.17 These submissions attached notices to become a party, objected to the Panel members who sat on previous matters relating to APW18 being appointed to consider this matter and made other preliminary submissions.19

- We decided to receive those submissions and to consider whether any procedural issues arose from them.

- To ensure that the Applicants were provided with an opportunity to respond to those submissions, we requested that the Applicants provide their submissions in relation to any matters raised therein.

- We do not consider that the Applicants’ further submissions included any material information that could cause us to change our decision that there is no reasonable prospect that we would make a declaration of unacceptable circumstances.

Out of process submissions

- Given that we declined to conduct proceedings, we decided not to receive additional out of process emails received from Mr Claud Chaaya on behalf of APW RE and from Mr George Wang.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Karen Phin

President of the sitting Panel

Decision dated 18 September 2024

Reasons given to parties 7 November 2024

Reasons published 11 November 2024

Advisers

| Party | Advisers |

|---|---|

| Applicants | Deffenti & Queiroz Lawyers |

| APW RE | - |

| Consolidated AIMS Group | - |

| Mr Chi San Liu LH&F Pty Ltd Ms Li Li Ms Hiu Ping Lau |

Clayton Utz |

1 [2024] ATP 18

2 On 14 December 2023, APW was delisted from the main board of the Singapore Exchange Securities Trading Limited at the request of APW RE

3 As part of the same transaction, Ms Li Li also acquired units in AIMS Total Return Fund. For more background see AIMS Property Securities Fund 01 & 02 [2021] ATP 15 at [4] and [112] to [164]

4 AIMS Property Securities Fund 01 & 02 [2021] ATP 15 at [115]

5 Ibid at [117]

6 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

7 The Applicants also sought as an order a declaration that each of LH&F, Mr Chi San Liu, Ms Li Li, Ms Hiu Ping Lau, Ms Jenny Wang, and Mr Jason Wang are associates of the Consolidated AIMS Group in relation to APW

8 Section 657EA(2)

9 [2023] ATP 5

10 The Applicants sought a further order that “insofar as the net proceeds of sale of the ASIC vested units exceeds the net acquisition cost of those units, that excess, after payment of ASIC’s reasonable costs of effecting those units’ sale, be distributed among those unitholders who suffered loss by reason of the respondents' wrongdoing set out in this application”

11 Benjamin Hornigold Limited 08R, 10R & 11R [2019] ATP 22 at [11] and Eastern Field Developments Limited v Takeovers Panel [2019] FCA 311 at [181]

12 Section 657EA(4) and Australian Securities and Investments Commission Regulations 2001 (Cth) regs 15 and 20

13 Ms Li Li and Mr Chi San Liu each submitted that the price of $1.785 per unit was based on Mi Li’s acquisition cost

14 Mr Chi San Liu submitted that he is a director of, and shareholder in, LH&F, and is also a beneficiary of the LH&F Family Trust

15 Both Ms Li Li and Mr Chi San Liu reside outside Australia

16 AIMS 04 at [22]

17 Contrary to Rule 10(6) of the Takeovers Panel Procedural Rules 2020

18 AIMS Property Securities Fund 01 [2021] ATP 15, AIMS Property Securities Fund 02 [2021] ATP 15 and AIMS Property Securities Fund 03 [2023] ATP 5

19 Mr George Wang submitted that the application was frivolous and vexatious