[2024] ATP 14

Catchwords:

Declaration – orders – undertakings – association – relevant interest – voting power – contravention of s606 – acquisition of shares – effect on control – board spill – requisition notice – meeting – director nomination – collective action – substantial holder notice

Corporations Act 2001 (Cth), sections 12, 249D, 602, 606, 611 item 9, 657A(2), 657C(3), 671B

Guidance Note 1: Unacceptable Circumstances, Guidance Note 4: Remedies

ASIC Regulatory Guide 128: Collective action by investors

The Market Herald Limited [2023] ATP 7, Indiana Resources Limited [2017] ATP 8, Merlin Diamonds Limited [2016] ATP 18, Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, Avalon Minerals Limited [2013] ATP 11, World Oil Resources Limited [2013] ATP 1, Bentley Capital Limited 01R [2011] ATP 13, CMI Limited [2011] ATP 4, Viento Group Limited [2011] ATP 1, Mount Gibson Iron Limited [2008] ATP 4, Winepros Limited [2002] ATP 18

Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68, Adsteam Building Industries Pty Ltd & Anor v The Queensland Cement and Lime Co Ltd & Ors (1984) 14 ACLR 456

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | YES | YES | YES | YES | NO |

Introduction

- The Panel, Con Boulougouris, Stephanie Charles and Denise McComish (sitting President) made a declaration of unacceptable circumstances in relation to the affairs of Sequoia Financial Group Limited. The matter concerned an alleged association of parties ahead of a section 249D1 requisitioned meeting to remove directors and appoint others. The Panel found the alleged association established and that there had been acquisitions of shares in contravention of section 606. It ordered voting restrictions and corrective disclosure.

- In these reasons, the following definitions apply.

- A. Jones Group

- has the meaning given in paragraph 6

- ABS

- has the meaning given in paragraph 70(a)

- Associated Parties

- A. Jones Group, Brent Jones and Unrandom and Glennon Capital

- Attenov

- Attenov Pty Ltd as trustee for the Vonetta Superannuation Fund

- Cojones

- Cojones Pty Ltd <Jones Family No 2 A/C>

- GC1

- has the meaning given in paragraph 10

- Glennon Capital

- has the meaning given in paragraph 10

- Interprac

- Interprac Ltd[2]

- Jones/Glennon Circular

- has the meaning given in paragraph 29

- Requisitioning Shareholders

- Cojones, Attenov, Vonetta, Glennon Capital and Anthony Jones

- Requisitionists’ Form 603

- has the meaning given in paragraph 23

- Requisitionists’ Form 604

- has the meaning given in paragraph 30

- Section 249D Meeting

- has the meaning given in paragraph 26

- Section 249D Notice

- has the meaning given in paragraph 19(a)

- Sequoia

- Sequoia Financial Group Limited

- Statement by Requisitioning Shareholders

- has the meaning given in paragraph 19(d)

- Tarakita

- Tarakita Pty Ltd <Jones Property A/C>

- Toclo

- Toclo Investments Pty Ltd <TLC Investment A/C>

- Unrandom

- Unrandom Pty Ltd

- Vonetta

- Vonetta Pty Ltd <TRBC S/F A/C>

Facts

- Sequoia is an ASX listed company (ASX code: SEQ). It provides services to financial planner stockbrokers, self-directed investors, superannuation funds and accountants that allows them to offer wealth management solutions to their customers.

- As at 15 May 2024, the directors of Sequoia were Mr Charles Sweeney (non-executive chairman), Mr John Larsen (non-executive director), Mr Kevin Pattison (non-executive director) and Mr Garry Crole (CEO and managing director).3

- Sequoia has 131,507,791 voting shares on issue.4

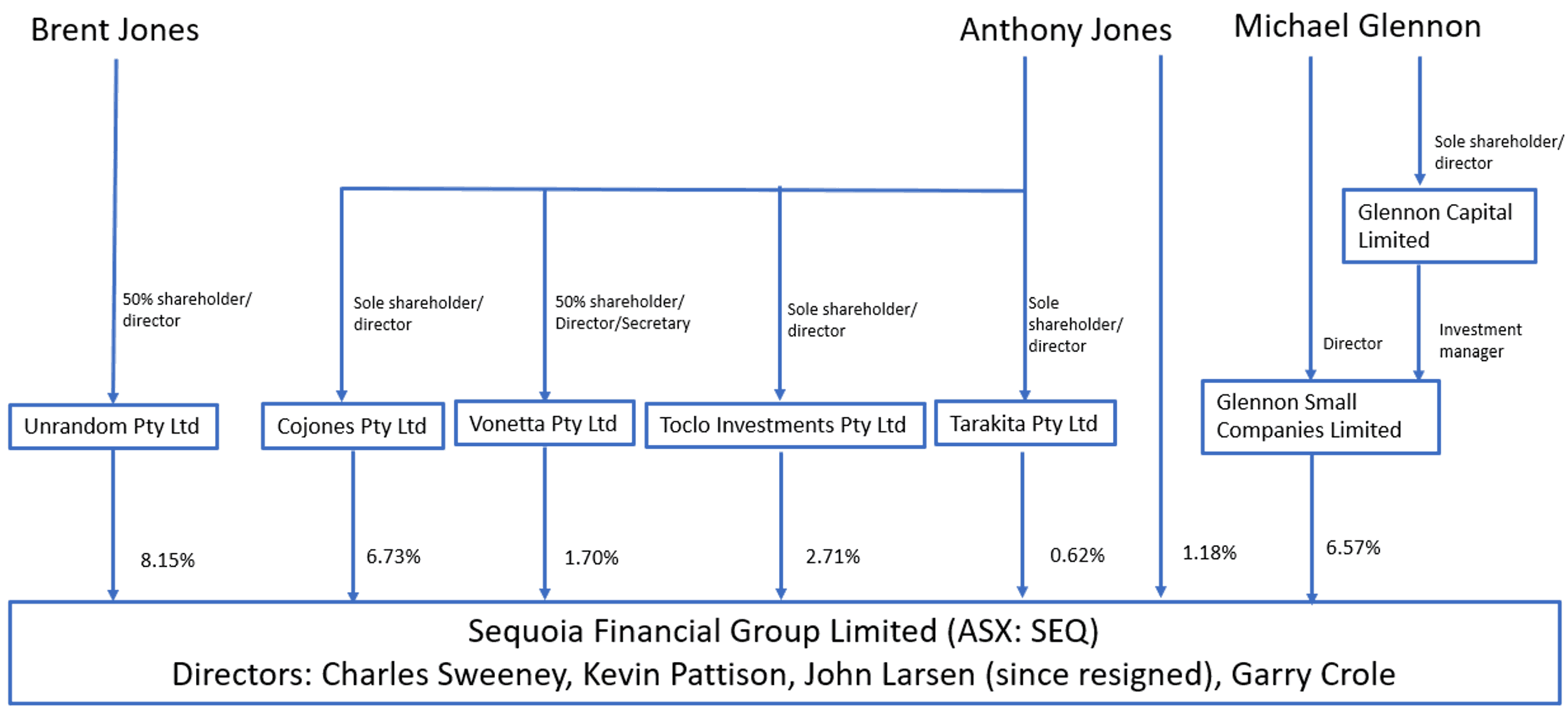

- Mr Anthony Jones and his controlled entities listed below (together, A. Jones Group) have a relevant interest in 17,019,470 Sequoia shares (12.94% of the issued voting shares), held as follows:

- 817,620 Sequoia shares (0.62% of the issued voting shares) held by Tarakita, in which he is the sole shareholder and director

- 8,847,004 Sequoia shares (6.73% of the issued voting shares) held by Cojones, in which he is the sole shareholder and director

- 1,549,952 Sequoia shares (1.18% of the issued voting shares) held in his personal capacity

- 3,564,894 Sequoia shares (2.71% of the issued voting shares) held by Toclo, in which he is the sole shareholder and director and

- 2,240,000 Sequoia shares (1.70% of the issued voting shares) held by Vonetta, in which he is a 50% shareholder and a director.

- Mr Brent Jones is the son of Anthony Jones. He has been a management employee of the Sequoia group since Sequoia acquired Interprac in 2017 and was until 13 June 2024 the head of Sequoia’s professional services division.

- Brent Jones and his controlled entity Unrandom5 have a relevant interest in 10,724,746 Sequoia shares (8.15% of the issued voting shares). Brent Jones is a 50% shareholder and a director of Unrandom.6

- Brent Jones is also a director of Vonetta. In his preliminary submissions he notes “[w]hile the Requisitioning Shareholders includes Vonetta, of which B Jones in his personal capacity is an associate… – B Jones maintains that he is not associated with the Requisitioning Shareholders” (our emphasis).

- Mr Michael Glennon is the Chairman of Glennon Small Companies Limited (GC1), an ASX-listed investment company for which Glennon Capital Pty Ltd acts as investment manager (together, Glennon Capital). Glennon Capital has a relevant interest in 8,644,723 Sequoia shares (6.57% of the issued voting shares).

-

Relevant shareholdings in Sequoia,7 in diagrammatic form, are as follows:

- Anthony Jones and Brent Jones were directors and shareholders of Interprac, as was Garry Crole8. On 1 December 2017, upon completion of the sale of shares in Interprac to Sequoia:

- Cojones became a substantial shareholder of Sequoia with voting power in 12,624,566 shares and

- Unrandom became a substantial shareholder of Sequoia with voting power in 10,781,500 shares.

- On 14 June 2023, Brent Jones sent an email to the non-executive directors of Sequoia, copied to Anthony Jones, stating that changes needed to be made in respect of leadership of Sequoia and that he no longer supported Garry Crole acting as CEO.

- On 15 June 2023, Anthony Jones sent a ‘reply all’ email stating (among other things) “I would like to say that I agree entirely with the fundamentals expressed in the email”.

- On 13 March 2024, there was an exchange of text messages between Michael Glennon and Garry Crole following the sale by Sequoia of shares in GC1. Michael Glennon stated “Garry as a heads up. We will be buying 5% of SEQ and calling an EGM as soon as we are there. But I have spoken with a lot of your larger shareholders who are supportive.”

- On 14 March 2024, Michael Glennon emailed Charles Sweeney asking for a telephone call regarding Sequoia. He was concerned that Glennon Capital had been portrayed as a short-term investor in Sequoia, stating “[w]e have been a shareholder for 7-8 years.”

- On 15 March 2024, Michael Glennon told Charles Sweeney in a telephone call that he was “close to owning 5% of Sequoia and that when he does he is going to call a shareholder meeting to vote Garry out.” Michael Glennon also said he “has spoken to a large proportion (around 40%) of our share register and believes he has their support.”

- On 3 April 2024, the Requisitioning Shareholders gave a section 203D notice to Sequoia, stating their intention to move resolutions for the removal of Garry Crole and Kevin Pattison as directors of Sequoia.

- On 4 April 2024, Michael Glennon sent an email to Garry Crole and Charles Sweeney attaching the following documents:

- a section 249D notice (Section 249D Notice) signed by the Requisitioning Shareholders, requesting a general meeting of Sequoia’s members to consider resolutions to appoint Brent Jones and Mr Peter Brook as directors of Sequoia and to remove Garry Crole and Kevin Pattison as directors of Sequoia

- a consent to act as a director of Sequoia signed by Brent Jones and dated 31 March 2024

- a consent to act as a director of Sequoia signed by Peter Brook and dated [blank day] April 2024 and

- an unsigned page commencing “Dear Shareholders” (Statement by Requisitioning Shareholders).

- The Statement by Requisitioning Shareholders includes statements about plans and objectives that “we” have for changes to the business and governance of Sequoia. For example, it states:

- “[t]he new directors will improve corporate governance and ensure the significant cash balance available to Sequoia doesn’t result in a repeat of the acquisitions like Sharecafe”

- “[w]e would additionally suggest limits to the discretions and authority of the Managing Director” and

- “[t]he requisitioning shareholders expect the new board to establish both a strategic plan for the growth of the business together with a plan to improve operational performance.”

- The statement also includes biographical information about “our proposed directors”, namely Peter Brook and Brent Jones.

- On 9 April 2024, Brent Jones sent an email to Mr John Blangiardo (an employee of the Sequoia group), copied to Anthony Jones and Michael Glennon, asking him to “please advise Tony (copied) of his total holding, via the platform/s, in SEQ. In particular Attenov, but any others if he holds them on platform.”

- On 10 April 2024, a notice of initial substantial holder (Requisitionists’ Form 603) was sent to Sequoia naming the Requisitioning Shareholders as having become substantial holders of Sequoia on 2 April 2024 and stating an association between them “because all holders are acting in concert to seek to compel the directors of SEQ (under Section 203D [sic] of the Corporations Act) to convene a meeting of SEQ’s members to consider resolutions to remove Mr Garry Crole and Mr Kevin Pattison as directors of SEQ”.9

- The list included Anthony Jones, Cojones (in two capacities), Vonetta, Attenov and Glennon Capital. The Requisitionists’ Form 603 stated that:

- the Requisitioning Shareholders had voting power in 13,970,308 Sequoia shares (10.65% of the issued voting shares) and

- Glennon Capital acquired 3,240,042 shares in Sequoia (2.47% of the issued voting shares) on behalf of GC1 in the period of 26 February 2024 to 21 March 2024.

- The Requisitionists’ Form 603 did not disclose:

- the A. Jones Group shares in Sequoia held by Toclo and Tarakita. This is admitted to have been an error10 and has since been corrected.

- Brent Jones and Unrandom in the list of associates. Whether they should have been included is disputed.

- On 24 April 2024, in response to the Section 249D Notice, Sequoia’s directors called a general meeting of members to be held on 4 June 2024 (Section 249D Meeting).

- Also on 24 April 2024, a letter from Charles Sweeney as chairman of Sequoia dated 24 April 2024 was released on ASX. It stated “[a]s Chairman, I unreservedly will be voting against the notice and in favour of the retention of both [Kevin Pattison] and [Garry Crole] in their current positions” (emphasis removed).

- Also on 24 April 2024, Sequoia shareholder Mr Matthew Wilson,11 who holds a total of 1,670,000 Sequoia shares (approximately 1.27%)12 received a telephone call from Brent Jones in relation to the Section 249D Meeting. According to Matthew Wilson, Brent Jones wanted to explain why “they” had lodged the Section 249D Notice.

- In or about the week commencing 6 May 2024, Sequoia shareholders received a document signed by Anthony Jones and Michael Glennon and headed “Sequoia Financial Group Ltd Extraordinary General Meeting”, with the sub-heading “VOTE IN FAVOUR of Resolutions 1, 2, 3 and 4” (the Jones/Glennon Circular). It stated (among other things):

- “Glennon Capital has been a shareholder continuously since March 2018”

- “[n]either Mr Brent Jones nor Mr Peter Brook are prepared to act as directors while Mr Crole remains a director of the business and unless there is a majority of new board members”

- “[t]he new directors will seek to quickly make strategic changes to the company to bring about a more focused and profitable business, with the share price reflecting these changes” (emphasis removed)

- “[t]he requisitioning shareholders expect the new board to establish a strategic plan for the growth of the business…”. There followed a list of plans that may be pursued and

- “[w]e would seek to identify a new CEO…”.

- On 14 May 2024, a notice of change of interests of substantial holder (Requisitionists’ Form 604) was received by Sequoia, given on behalf of the Requisitioning Shareholders stating that there was a change in interests on 10 May 2024. The Requisitionists’ Form 604 stated that:

- the Requisitioning Shareholders had voting power in 21,236,424 Sequoia shares (16.15% of the issued voting shares) and

- the following changes in relevant interests had occurred via on market purchases:

- between 4 April 2014 and 10 May 2024, Glennon Capital as investment manager for GC1 had acquired 5,210,041 Sequoia shares for $2,833,639

- on 13 May 2024, Cojones had acquired 1,056,075 Sequoia shares for $565,000 and

- on 13 May 2024, Vonetta had acquired 1,000,000 Sequoia shares for $535,000.

- The Requisitionists’ Form 604 did not disclose the A. Jones Group shares in Sequoia held by Toclo and Tarakita.13

Application

Declaration sought

- By application dated 15 May 2024, Sequoia sought a declaration of unacceptable circumstances.

- Sequoia submitted that, between 31 March 2024 and 10 May 2024:

- “Associated parties seeking to change the composition of Sequoia’s board and to control or influence the conduct of Sequoia’s affairs:

- have failed to fully disclose the identity of those who are associated with them, the nature of their association and the extent of their collective voting power in Sequoia (disclosed as 16.15% but believed by Sequoia to be in excess of 20%); and

- have purchased additional shares in Sequoia after acquiring collective voting power of at least 20%, in contravention of s.606.”

- “Associated parties seeking to change the composition of Sequoia’s board and to control or influence the conduct of Sequoia’s affairs:

- Sequoia submitted that A. Jones Group had failed to disclose in the Requisitionists’ Form 603 all the shares in which it had a relevant interest, namely the holdings of Toclo and Tarakita which resulted in an understatement of 4,382,514 shares (3.34% of the total Sequoia voting shares on issue as at 2 April 2024). It submitted that the omission was repeated in the Requisitionists’ Form 604.

- Sequoia also submitted that there had been a failure to disclose an association between Brent Jones and the Requisitioning Shareholders, and so Unrandom’s shares had not been included in the Requisitionists’ Form 603, which resulted in an understatement of an additional 8.15% in collective voting power.

- It submitted that there had been contraventions of sections 606 and 671B. It submitted that “the Panel should infer that Glennon Capital acquired some or all of the 3,240,042 Sequoia shares … disclosed in the Requisitionists’ Form 603 after becoming an associate of the A. Jones Group and Brent Jones in relation to Sequoia, with the common objective of ‘calling a meeting to remove [Garry Crole]’”.

- It further submitted that the Panel should conclude that by no later than 31 March 2024, when Brent Jones signed his consent to act as a director of Sequoia - or 4 April 2024, when it was delivered with the Section 249D Notice - the association between Brent Jones and the Requisitioning Shareholders had arisen.

Interim orders sought

- Sequoia did not seek interim orders in its application.

- However, we asked in our brief about voting at the pending Section 249D Meeting and in response Sequoia submitted that it sought interim orders, in summary:

- restraining the exercise of voting rights attached to the relevant shares

- requiring Sequoia to disregard an exercise of voting rights on those shares at the meeting

- requiring Sequoia to keep a record of all votes cast and to provide a poll report on each resolution and

- requiring Sequoia to convene a further meeting if the resolutions are not all passed at the meeting.

- Undertakings to similar effect were offered (discussed at paragraph 163 and following) and we did not need to make any interim orders.

Final orders sought

- Sequoia sought final orders to the effect that:

- the associated parties provide corrected substantial shareholder disclosure

- in respect of any Sequoia shares acquired on or after 31 March 2024 –

- by Glennon Capital, it and GC1 and any person acting on their behalf (as a voting proxy or otherwise) not exercise, or allow the exercise of, voting rights in those shares

- by Cojones and Vonetta, they and any person acting on their behalf (as a voting proxy or otherwise) not exercise, or allow the exercise of, voting rights in those shares

- Sequoia disregard voting rights in respect of the shares referred to above and

- the shares referred to above be vested in the Commonwealth for sale by ASIC, with the condition that the Glennon parties, A. Jones parties, Brent Jones and their respective associates may not purchase any of those shares.

Discussion

Preliminary submissions

- A. Jones Group made a preliminary submission in which it accepted that Toclo and Tarakita should have been included in the substantial holder notices lodged by the Requisitioning Shareholders and that it was willing to provide corrective disclosure of this.14

-

A. Jones Group submitted, in summary, that the Panel should decline to conduct proceedings on the basis that Sequoia had not provided a sufficient body of evidence of association between either:

- the Requisitioning Shareholders and Brent Jones (and their controlled entities); or

- Anthony Jones and Brent Jones (and their controlled entities),

to enable the Panel to conclude that the above parties have a relevant agreement for the purposes of controlling or influencing the composition of Sequoia’s board or the conduct of its affairs pursuant to section 12(2)(b) or are acting, or are proposing to act, in concert in relation to Sequoia’s affairs pursuant to section 12(2)(c).

- Brent Jones made a preliminary submission in which he submitted that the Panel should decline to conduct proceedings due to the insufficiency of the preliminary evidence, and:

- denied any association with the Requisitioning Shareholders and

- submitted that the application failed “to provide sufficient logical and probative material to justify the Panel conducting proceedings in relation to the Application insofar as it relates to his association with the Requisitioning Shareholders.”

- Glennon Capital15 also made a preliminary submission. It submitted that (footnote omitted) “there are no circumstances warranting the Panel proceeding to a hearing of the matter at this time. Glennon Capital has at no stage been aware of, nor does the Application substantiate an association between director nominee Brent Jones and any Requisitioning Shareholder. Instead, and regrettably, the Application represents only one of the latest steps in Sequoia’s directors’ accelerating electioneering using company resources to entrench their incumbency.”

- Glennon Capital acknowledged that an “administrative error appears to have transpired in relation to the substantial holding disclosure made on 10 April 2024 for the A. Jones Group.”

- Each of the parties made the point that nominating a director, and agreeing to stand, does not necessarily establish an association.

Decision to conduct proceedings

- Section 12 sets out the tests for association as applied to Chapter 6. There are two relevant tests here:

- section 12(2)(b) – which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company’s board or conduct of its affairs and

- section 12(2)(c) – which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company’s affairs.

- A relevant agreement is an agreement, arrangement or understanding:

- whether formal or informal or partly formal and partly informal and

- whether written or oral or partly written and partly oral and

- whether or not having legal or equitable force and whether or not based on legal or equitable rights.16

- As stated by the Panel in CMI Limited 01R,17 the cases make it clear that there is significant overlap between the concepts of “acting in concert” and “relevant agreement” in section 12.

- An understanding means an understanding – “plainly a word of wide import”18 – as to some common purpose or object in relation to the company in question.

- Often establishing an association requires the Panel “to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association.”19

- The Panel is a specialist, peer review tribunal. When assessing the material in this matter, we have relied on our skills and experience as practitioners (which has been made known to the parties) and as members of the sitting Panel.

- In Mount Gibson Iron Limited20, the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- We agree with the preliminary submission of Brent Jones that the onus is on Sequoia, as the one who is alleging the relationship of association, to demonstrate that such a relationship exists. We considered that the application raised elements of the above factors sufficiently to suggest that an association exists here and these factors are discussed below.

- For this reason, we decided to conduct proceedings and issue a brief.

Overall conclusions

- Having considered the application, preliminary submissions, submissions and rebuttals on the brief, the results of the Section 249D Meeting and a further question asked following that meeting, we made preliminary findings and invited comments on them. Our conclusions follow consideration of responses.

- We considered the cumulative effect of all the material and have drawn appropriate inferences. In doing so, we had in mind that we must be satisfied by logical and probative material and the potential seriousness of a finding of association.

- For the reasons set out below, we infer that by no later than 31 March 2024 (being the date Brent Jones signed the consent to act as a director of Sequoia attached to the Section 249D Notice issued by the Requisitioning Shareholders) in relation to Sequoia:

- Brent Jones became associated with Anthony Jones

- Brent Jones became associated with the Requisitioning Shareholders (that is, also with Michael Glennon) and

- the association between A. Jones Group and Glennon Capital extended to voting.

Brent Jones and Anthony Jones

Family and other structural links

- Anthony Jones submitted that “the Panel should have regard to the fact that Mr Anthony Jones is in his mid-70s and is not familiar with the logistics or practicalities of share trading. As outlined in these submissions, the A. Jones Group acknowledges that Mr Anthony Jones and Mr Brent Jones have discussed trading in Sequoia shares before, and that, from time to time, Mr Brent Jones plays a role in assisting Mr Anthony Jones in the administration of his holdings. However, it is reiterated that all investment decisions (including decisions to exercise voting rights attached to shares) are made by Mr Anthony Jones without input or influence from Mr Brent Jones, and those investments are made by Mr Anthony Jones for family wealth and estate planning purposes as well as funding his retirement.”

- Anthony Jones is the father of Brent Jones. While a familial relationship does not automatically make persons associates, it may be relevant in assessing whether the broader factual matrix establishes association.21 In our view it is relevant here. They have a history of working together. They have held, and now hold, a common investment (previously being in Interprac and now in Sequoia). Brent Jones assists Anthony Jones in the administration of his (Anthony’s) holdings. Anthony Jones submitted “the advice and carrying out of instructions is done in Mr Brent Jones’ capacity as Mr Anthony Jones’ son.” For the reasons set out in this document, Brent Jones’ role goes further. They are both finance professionals who worked together, although Anthony Jones has retired.

- Anthony Jones and Brent Jones are also co-directors of Vonetta together with Anthony Jones’ two other sons and his daughter-in-law. Vonetta is the trustee of the Jones Family Super Fund. Each of the directors is a beneficiary of the trust. We asked whether Brent Jones is an associate of Vonetta in relation to Sequoia because he is a beneficiary of the Jones Family Super Fund, or for other reasons relating to the Jones Family Super Fund arrangements.22 We did not get a clear answer and decided not to pursue this enquiry further as we did not consider it necessary to do so in order to reach our overall conclusions.

- Nevertheless, the common directorship of Vonetta is clearly a structural link between Anthony Jones and Brent Jones. In light of our findings, we consider that Vonetta’s holding in Sequoia should be included in the voting power aggregation of A. Jones Group and Brent Jones.

- In 2023, Anthony Jones became concerned about the superannuation investments that he believed Garry Crole had been managing as the advisor in relation to investments held on behalf of Attenov since 2014.23 When Anthony Jones received a report from Sequoia it apparently caused him to review the investment and he emailed Brent Jones “[f]rom what I can see, I deposited $740K and lost $356K. Is that what you see?” To which Brent Jones responded “[w]ow, you should take that to your solicitor”. This is an employee of Sequoia acting apparently against its interests, although perhaps understandably acting in his father’s interests. Whatever view is taken of this, we consider that it exceeds merely acting in an administrative role in relation to Anthony Jones’ investments.

- A. Jones Group submitted that offering the suggestion of legal advice was reasonable. Glennon Capital submitted that recommending independent advice was appropriate and was not acting against the interests of Sequoia. However, it is a possibility that the result of taking advice may be a lawsuit against Brent Jones’ employer. It is hard to see how that could be in its interests, but it may well be in the interests of Brent Jones’ father.

- We consider that Brent Jones’ role in assisting Anthony Jones in the administration of his shareholdings, administratively and otherwise, including in relation to Sequoia, is a familial and structural link between them, even accepting that Anthony Jones is a client of Sequoia.

- Having regard to the family and structural links (and to other factors discussed below) we find that Anthony Jones and Brent Jones have a close family relationship. More importantly, Anthony Jones and Brent Jones communicate frequently and there is a level of coordination between them, as we discuss further below.

Prior collaborative conduct

- Anthony Jones and Brent Jones have previously worked together and so collaborated in a professional capacity. Anthony Jones and Brent Jones were both directors and shareholders of Interprac.

- Brent Jones submitted that this relationship ceased in 2017 when Sequoia acquired all the issued shares in Interprac in exchange for shares in Sequoia and that, since the Interprac sale, Anthony Jones and Brent Jones have ceased to have a professional relationship. Nevertheless, they both remain substantial holders in Sequoia and they “share and exchange their views about the composition of the Sequoia board and the conduct of its affairs.” We are not inclined to accept that they have ceased having a professional relationship, as Brent Jones acts both in an administrative and (it seems) an advisory capacity in relation to Anthony Jones’ investments.

- Sequoia submitted a statutory declaration of Garry Crole dated 28 May 2024. Mr Crole stated, in effect:

- on 13 December 2023, Sequoia agreed to acquire Australian Business Structures Pty Limited (ABS). ABS provided legal services to Interprac (now owned by Sequoia)

- the vendor of ABS was an entity controlled by Anthony Jones and his other son, Riley Jones

- the Sequoia division of which Brent Jones was at the time the executive head (Professional Services) was responsible for the negotiation of the sale of ABS to Sequoia and

- “it appeared to me that Mr Brent Jones collaborated with his father concerning the affairs of ABS and the sale of ABS to Interprac.”

- We note that Sequoia did not take issue with the relationships at the time of the sale.

- Email exchanges involving Brent Jones, Anthony Jones and Riley Jones were supplied with the statutory declaration. They include one in which Brent Jones suggested taking control of the partnership that owned ABS’ business assets and one in which Riley Jones discussed with Brent Jones the structure of the proposed sale.

- It seems clear that Brent Jones was on both sides of the ABS sale. We consider these emails are an example of prior collaborative conduct with Anthony Jones. We also consider that they evidence a history of Anthony Jones and Brent Jones working together, even though Brent Jones was responsible for the transaction from the Sequoia side as the relevant executive.

- We accept (as A. Jones Group submitted in rebuttals) that the ABS interactions are historic. However, A. Jones Group also submitted that they were not “demonstrative of a persisting association.” We do not agree, at least in so far as they evidence a history that supports our inference. Another example of historical dealing dating back further is in paragraph 80.

- The statutory declaration of Garry Crole dated 28 May 2024 also states, in effect, that between 21 December 2023 and 27 March 2024 he recalled having approximately four meetings or calls with Brent Jones at which the affairs of Sequoia were discussed. He declared that Brent Jones used language to the effect “we hold 20% in his company” and “we are not happy”, which Mr Crole understood to be references to “collective shareholdings in Sequoia controlled by himself and his father….”

- In rebuttals, Brent Jones referred to “the problematic nature of these declarations given the clear conflict of interest of Mr. Crole and Mr. Pattinson.” He asked us to view these statutory declarations with “this conflict of interest and risk of biased recollections in mind.” In particular, he denied using words to the effect of those above, although submitted that he did make Anthony Jones’ views clear. He also made the point that it was irrelevant to refer to the number of meetings because “it is not unusual for an executive of a company to meet with its Chief Executive Officer to discuss business performance.”

- While the perspective of Mr Crole has undoubtedly influenced his view of various matters, we do not agree that we should therefore disregard them. The matters raised are evidence of Brent Jones’ involvement in, at least, Anthony Jones’ affairs and we draw from Mr Crole’s interpretation of what was said that it is likely Brent Jones intended it to come across as a joint concern.

- Sequoia also submitted a statutory declaration of Ms Floriane Allard (Head of Human Resources for Sequoia) which (among other things) included handwritten notes from a meeting between Garry Crole and Brent Jones on 21 December 2023 which Ms Allard attended. The notes record Brent Jones saying “I don’t believe in the strategy…. My father and I have a lot of money invested in the business and we don’t believe in ‘ssi’24”.

- They clearly shared concerns about Sequoia.

- Sequoia also provided a statutory declaration of Kevin Pattison dated 27 May 2024 in which (among other things) he stated, in effect, that:

- he and Brent Jones had worked together at Interprac

- Brent Jones recommended Mr Pattison as a director of Sequoia to his father and on 17 December 2018, A. Jones Group filed a section 249D notice with Sequoia to remove a director and appoint Mr Pattison and

- Mr Pattison recalled meeting with both Anthony Jones and Brent Jones together “on or about 22 November 2022 to discuss aspects of Sequoia, particularly around Group strategy and Sequoia’s performance compared to its peer group of companies within the Sector”.

- These examples illustrate a close working relationship between Anthony Jones and Brent Jones and prior collaborative conduct.

- Mr Pattison’s statutory declaration also attached a copy of an email exchange between Brent Jones, Kevin Pattison and Anthony Jones:

- On 17 November 2020, Brent Jones emailed Kevin Pattison (copied Anthony Jones) regarding convening a meeting between them. Mr Pattison agreed it would be good to catch up.

- On 21 November 2020, Anthony Jones replied to Brent Jones (copied Kevin Pattison) that “It would be great to catch up and work out how we approach [name of person].”

- The email chain clearly shows that, as far back as 2020, Anthony Jones and Brent Jones were in the habit of working together. We therefore, for this reason as well, do not agree with the submission of Anthony Jones that past communications were merely historic and not “demonstrative of a persisting association”. The material suggests an ongoing association.

- In relation to the exchange referred to in paragraph 82(b), Mr Pattison stated “Brent Jones and myself were intending on meeting with [name of person] from NTAA25 to garner greater support for Sequoia’s Professional Service Division from the NTAA. Brent Jones had told me that he believed Tony Jones could help Sequoia with this matter because of Tony’s knowledge and influence with [name of person].26” We consider Mr Pattison’s understanding to be that the three of them – Anthony Jones, Brent Jones and Kevin Pattison – would work together to influence that person and that Brent Jones had brought Anthony Jones in.

- Our finding on this appears to be confirmed by Sequoia in its rebuttal on our preliminary findings. It submitted that the meeting “was not a meeting that Mr Anthony Jones attended at the invitation of a director of Sequoia. The meeting was convened by Mr Brent Jones at the request of Mr Anthony Jones.”

- A. Jones Group submitted in response to our preliminary findings that “[i]f Sequoia was concerned about an undisclosed association between Mr Brent Jones and Mr Anthony Jones dating back many years, it should have raised this issue then rather than continuing to impose on the goodwill of Mr Anthony Jones to support the development of its business for the benefit of all shareholders.” It submitted that Sequoia was now using this as evidence of association.

- Sequoia submitted in its rebuttal submission on our preliminary findings that it was not suggesting that Anthony Jones was acting otherwise than with goodwill and seeking to benefit all shareholders of Sequoia, merely that he was acting in collaboration with Brent Jones.

- We consider that the exchange referred to at paragraph 82 supports our view. Brent Jones submitted in rebuttals that this exchange “occurred solely in a professional capacity and in his capacity as an employee of Sequioa [sic].” In other words, not in his or Anthony Jones’ capacity as shareholders. But Anthony Jones has no other capacity in relation to Sequoia, so has no other obvious reason to be involved, even accepting that he was acting to benefit all shareholders of Sequoia.

- Brent Jones submitted in rebuttal submissions that the statutory declarations of Mr Crole and Mr Pattison should be viewed with scepticism since they were the two directors who were subject to the Section 249D Notice. We do not agree. We consider that they have not been biased or selective in their statements in order to create a misleading impression because of their personal interest in the Section 249D Meeting. We have not been persuaded to that view by the fact of them making statutory declarations, but on the content of their statements.

- Brent Jones denied or explained in his rebuttals the statements made in the statutory declaration of Mr Crole. However, despite the perspective that Mr Crole brings to his recollections, we accept that he took that perspective from the conversations. Brent Jones does not deny that the conversations took place or the overall import of the statutory declarations, only the interpretation of them. He submitted in rebuttals that “in circumstances where [he] has outlined [Anthony Jones’] views, he has made this clear to the relevant recipients of that information.” We do not consider this statement is supported by the material.

- A. Jones Group and Glennon Capital submitted that the Panel should not place undue weight on the statutory declaration evidence. Glennon Capital submitted that the statutory declarations were made by directors who were the subject of the resolutions to remove them or by persons who reported to, or had a commercial relationship with, Garry Crole. Glennon Capital also submitted that “there are considerable risks in the Panel placing undue weight on Sequoia’s materials, including where the materials include opinions rather than facts.”

- While we accept the point made by Glennon Capital that some of the statements amount to opinions rather than facts, nevertheless we consider that the statutory declarations are supportive of prior collaborative conduct between Anthony Jones and Brent Jones. We note the rebuttal of Glennon Capital, in effect, that we should not simply “prefer materials delivered via statutory declaration.” We have not. As stated earlier, we have relied on the evidence that has been presented.

- We infer that Anthony Jones and Brent Jones have in the past had a longstanding professional relationship and significant prior collaborative conduct.

- We cite one further example. Anthony Jones submitted that approximately two years ago, or a little before, he was dissatisfied with Sequoia’s share price and dividend. He submitted that he was “solely motivated to seek the removal of Mr Crole and Mr Pattison for the reasons set out in Annexure 1.” Annexure 1 set out:

- his dissatisfaction with Sequoia’s share price and dividends and

- that “I communicated this to Brent Jones and then he and I discussed the matter with Garry Crole and Kevin Pattison (I did not diarise the date).”

- The involvement of Brent Jones is unexplained. Perhaps it was because he also held Sequoia shares or perhaps it was because he and Anthony Jones were in the habit of combining to add to the pressure they could bring to bear on Sequoia. Glennon Capital submitted that, in its experience, Garry Crole did not return calls and speculated that perhaps it was a way to overcome a “break-down in communication” between Garry Crole and Anthony Jones. No matter which, in our view it evidences collaborative conduct well beyond mere administrative assistance for Anthony Jones’ holding in Sequoia. We consider that Anthony Jones was capable of taking the matter to the Sequoia board himself and didn’t need to involve Brent Jones, but he chose to do so.

Shared goal or purpose

- Sequoia submitted that there were numerous acts by Brent Jones in co-operation with the Requisitioning Shareholders “in pursuit of their shared objective to change Sequoia’s board and take control of its affairs.”

- As noted at paragraph 13 above, Sequoia supplied (with its application) an email dated 14 June 2023 from Brent Jones to the non-executive directors of Sequoia, copied to Anthony Jones, stating that changes needed to be made in respect of leadership of Sequoia and that he no longer supported Garry Crole acting as CEO. On 15 June 2023, Anthony Jones sent a ‘reply all’ email stating (among other things) “I would like to say that I agree entirely with the fundamentals expressed in the email”.

- If written in Brent Jones’ capacity as an executive in the employ of Sequoia, it is curious that he would copy Anthony Jones in, but reflects a significant level of shared goal in our view. If written in his capacity as a shareholder, which is not made clear in the email or in Brent Jones’ preliminary submissions, the email (and the reply) similarly reflects a significant level of Anthony Jones and Brent Jones having a shared goal. In either case, it is not written in respect of Mr Crole’s board seat but his position as CEO.

- We asked about this exchange and A. Jones Group submitted:

- “In respect of the role of Mr Garry Crole as CEO, both Mr Anthony Jones and Mr Brent Jones have from time to time been dissatisfied with his performance as CEO, although for different reasons. At times, their views have been aligned, as suggested by the email chain in June 2023… However, at other times, and certainly more recently as Mr Anthony Jones was considering being party to the Section 249D Request, they have had different views as to the appropriate course of action for resolving their dissatisfaction.

- For example, we are instructed that in March and April of 2024, while Mr Anthony Jones was of the view that Mr Garry Crole should be removed from the business entirely, and should not continue leading the financial planning division of Sequoia, Mr Brent Jones was of the view that a negotiated outcome with Mr Garry Crole should be sought that would see him maintaining a role within the business if appropriate. Mr Anthony Jones did not agree with this and instead proceeded with the Section 249D Request in conjunction with Mr Michael Glennon and Glennon Capital…”

- We accept that their views on the best way to resolve the issue may have differed from time to time. But even if Anthony Jones and Brent Jones did not initially share the goal of removing Mr Crole as a director (ie. they only initially shared the goal of removing him as CEO), we find that this changed.

- On 28 March 2024, Brent Jones sent a text message requesting that Anthony Jones call Michael Glennon, stating “Garry is trying to kick out John Larsen [at the time a director of Sequoia] and get himself recontracted for 2 years as executive chairman”. We infer that Brent Jones’ concern that Garry Crole was attempting to entrench himself was a factor in Brent Jones coming to share Anthony Jones’ goal of removing him as a director.

- A. Jones Group submitted that Anthony Jones had been dissatisfied with the Sequoia board for an extended time and that his dissatisfaction stemmed from matters personal to him (including, it seems, his belief of Mr Crole’s role as his superannuation adviser).

- We were provided with copies of text messages exchanged between Anthony Jones and Brent Jones between 28 March 2024 (see paragraph 101 above) and 21 May 2024, in the lead up to the Section 249D Meeting. In particular, on 3 April 2024, Anthony Jones relayed to Brent Jones a message that he had received from Kevin Pattison the previous day. Mr Pattison had requested to meet with Anthony Jones to discuss Sequoia’s “leadership issues”. Anthony Jones declined the invitation but passed the information to Brent Jones. He also passed it to Michael Glennon.

- On 9 April 2024, text messages were exchanged regarding Anthony Jones’ holding in Sequoia. In the correspondence Brent Jones stated: “…Did you get the shareholder list off Michael? If you can count up your holdings and get to 13m we’re good.” Between 9 April and 3 May 2024, there was a text message exchange between Anthony Jones and Brent Jones in which Anthony Jones referred to having read “Garry’s blurb” and asked Brent Jones whether a response was needed. Brent Jones’ response to this message included that “[t]he letter to Shareholders which comes from you and Micheal should talk to actual performance and the plan forward”, to which Anthony Jones responded “[g]reat. OK BJ. Makes sense. Thanks”.

- Also on 3 May 2024, Brent Jones queried the manner in which Anthony Jones wanted each of his controlled entities to vote on the resolutions the subject of the Section 249D Notice.

- On 9 May 2024, Anthony Jones messaged Brent Jones in relation to acquiring further Sequoia shares stating “…I can do $1.1 million” and “I’ll let Michael know I’m in for $1.1m.”

-

On 21 May 2024, Brent Jones and Anthony Jones discussed the potential of removing Charles Sweeney from the board of Sequoia. The text message exchange included:

Anthony Jones: “Hey mate, Larsens resigned 16 May”

Brent Jones: “Yes I know”

Anthony Jones: “Shame. Looks like you, Peter and Charles. Can we get rid of him?”

Brent Jones: “Yes, I think… Plus we can appoint another quickly, start strenghthening from the top down”

Anthony Jones: “Great. Peter should know someone good. I’d offer but it’d look bad I think”.

- Brent Jones submitted that, in dealing with shareholdings owned or controlled by Anthony Jones, Brent Jones had acted in a purely administrative capacity and at no point had been involved in the decision-making processes in relation to Anthony Jones or the Requisitioning Shareholders. We do not accept that. The exchanges above suggest that not to be the case. They reflect an involvement beyond administration. Many text messages and email messages are indicative of Brent Jones’ involvement in decision-making in relation to the affairs of Sequoia.

- Brent Jones also submitted that the views “allegedly shared” by him and Anthony Jones “are views shared by a significant proportion of Sequioa’s [sic] shareholders who would like to see Sequioa’s [sic] capital management improve.” That may well be so, but it does not mean that Brent Jones and Anthony Jones did not share the goal or purpose. In our view, they did.

- Having said that, we are mindful of the A. Jones Group rebuttal that correspondence provided by A. Jones Group and Brent Jones in response to the Brief is “often short-hand and without context” and “were clearly informal discussions in and amongst a number of other personal and unrelated discussions” and therefore should not be given undue weight. We do not consider that we have done so.

- Moreover, we consider that:

- Brent Jones’ agreement to act as a director to the Requisitioning Shareholders (and the associated correspondence he had with the Requisitioning Shareholders) and

- the subsequent telephone conversations Brent Jones had with Sequoia shareholders in relation to his nomination as a director to the Requisitioning Shareholders,

which we discuss further below at paragraphs 130 to 149, also support an inference that he and Anthony Jones (being one of the Requisitioning Shareholders) had a shared goal or purpose.

- Having regard to the above material and the submissions in totality, we consider that there is enough evidence to support an inference that Anthony Jones and Brent Jones had a shared goal in seeking to change the composition of the Sequoia board and in relation to the affairs of Sequoia. We make that inference.

Common knowledge of relevant facts

- Further or alternatively, we consider that the text message, email and other correspondence referred to under ‘Shared goal or purpose’ above supports an inference that Anthony Jones and Brent Jones had common knowledge of relevant facts during the period leading up to the Section 249D Meeting. We make that inference as well.

Common investments and dealings

- Both Anthony Jones and Brent Jones acquired shares in Sequoia as consideration for Sequoia’s acquisition of Interprac in 2017. They were each shareholders (and directors) in Interprac.

- Brent Jones holds his Sequoia shares via his related entity Unrandom. According to the share trading data he provided, the last movement in his Sequoia shareholding was as a result of a sale of 162,000 Sequoia shares by Unrandom on 10 June 2022.

- Anthony Jones holds his Sequoia shares directly and via his related entities Tarakita, Cojones, Toclo and Vonetta. According to the share trading data provided by A. Jones Group:

- the last movement in Cojones’ Sequoia shareholding was as a result of acquiring 1,056,075 Sequoia shares on 13 May 2024 and the last movement prior to that was as a result of an “Adjustment” of 8,059 Sequoia shares on 15 March 2022

- the last movement in Vonetta’s Sequoia shareholding was as a result of acquiring 1,000,000 Sequoia shares on 13 May 2024 and the last movement prior to that was as a result of a sale of 45,559 Sequoia shares on 1 May 2023 and

- the last movement in Tarakita’s Sequoia shareholding was as a result of an “Adjustment” of 5,969 Sequoia shares on 15 March 2022.

- A. Jones Group submitted that “the other shares held on behalf of the A. Jones Group are not held on a broker platform and are instead held as issuer sponsored shareholdings and therefore the A. Jones Group has limited visibility over historical share movements for those holdings.”

- On the material provided, while there does not appear to be any recent coordinated buying of Sequoia shares by Brent Jones and Anthony Jones, their initial and current holdings are common investments, as was the investment in Interprac that led to the initial investment in Sequoia. We therefore consider that Anthony Jones’ and Brent Jones’ longstanding common shareholding in Sequoia is a factor supportive of an association between them in relation to Sequoia.

- We infer, on the basis of their family relationship, structural links, shared goal and common dealings, that Anthony Jones (and therefore A. Jones Group) and Brent Jones have an agreement, arrangement or understanding for the purpose of controlling or influencing the conduct of Sequoia’s affairs, at least in so far as securing board changes and the conduct of Sequoia’s affairs following the Section 249D Meeting are concerned. In addition, they are acting in concert in relation to Sequoia’s affairs.

Brent Jones and Requisitioning Shareholders

- Sequoia submitted in rebuttals that “[n]one of the individual acts and communications by Brent Jones should be viewed in isolation from the others.” We agree and have considered the material in totality.

- On 15 March 2024, Michael Glennon texted Brent Jones to say that Anthony Jones had called him. Brent Jones responded “[y]es, he asked for your number. You two see eye to eye?” They discussed a suggestion from Michael Glennon about who might come onto the board. Subsequently, on 31 March 2024, Michael Glennon texted Brent Jones asking how Anthony Jones’ holdings are held. In the same series, Brent Jones texted to Michael Glennon “[h]ad a good chat with [John Larsen] yesterday, he reckons aim at [Garry Crole] and [Kevin Pattison], leave Charles [Sweeney] out of it he’ll probably walk anyway. Sensible for handover.”

- We also note the following chain of correspondence:

- by email dated 22 April 2024, Brent Jones introduced Peter Brook (the other nominee director), to a significant shareholder of Sequoia

- that significant shareholder provided a counterproposal regarding Sequoia’s management, namely to keep Garry Crole as a director (and appoint Peter Brook but not Brent Jones)

- on 3 May 2024, Peter Brook confirmed to Michael Glennon, Anthony Jones and Brent Jones that, if that significant shareholder’s proposal was pursued, he would withdraw his consent to act as a director and

- on 4 May 2024, Michael Glennon responded to Peter Brook copying Anthony Jones and Brent Jones stating (among other things) “I think everyone is still firmly with continuing as is”.

- Brent Jones submitted that “he did not have any further input on this chain of correspondence.” Glennon Capital submitted that the reference to “I think” was to create an opportunity for anyone to challenge that proposition. But it is unclear why Michael Glennon would purport to speak for him if it was the case that Brent Jones had had no further input unless Michael Glennon already understood that Brent Jones was aligned.

-

On 8 May 2024, Brent Jones and Michael Glennon exchanged text messages in relation to acquiring further shares in Sequoia. The exchange included:

Michael Glennon: “Do you have the ability to take more seq stock. If I can get a line that will secure us the win”

Brent Jones: “No I don’t, plus share purchase policies don’t make it easy”

Michael Glennon: “I need a buyer asap”

Michael Glennon: “But I should be able to secure us victory in the next 12-48 hours”

Michael Glennon: “I’m taking 8m”

Michael Glennon: “Just need to check your father and I don’t go over 20%”

Brent Jones: “Righto, so 9m left?”

Michael Glennon: “1m”

Michael Glennon: "But the price is an issue. But it’s not so bad with a 7cent dividend”

Brent Jones: “Sure, with more to come out after the vote”

Michael Glennon: “I think [name of person] will buy what comes out”

Brent Jones: “Okay, once we have control”

Michael Glennon: “Yes”

Micheal Glennon: “I’m taking out [name of person]”

Michael Glennon: ”That puts Garry 13% behind us. The 6.5 we get and the 6.5 he loses”

Brent Jones: “Nice”

- Glennon Capital submitted that the reference to “us” in the exchange referred to the Requisitioning Shareholders.

- The above text message exchange of 8 May 2024 was followed by the correspondence referred to in paragraphs 106 and 157 and culminated in acquisitions of Sequoia shares by Glennon Capital on 10 May 2024 and by Cojones and Vonetta on 13 May 2024.27

- We consider that the above exchanges support an inference that, as part of the Requisitioning Shareholders, Michael Glennon was engaging with Brent Jones in such a way that indicated an agreement, arrangement or understanding for the purpose of controlling or influencing the composition of Sequoia’s board or they were acting in concert in relation to Sequoia’s affairs.

- Again, we were mindful of potentially attributing undue weight to this correspondence noting the A. Jones Group submission referred to at paragraph 110. We do not consider that we have done so. We think that the text message exchange between Brent Jones and Michael Glennon of 8 May 2024 speaks for itself.

- We note the rebuttal of A. Jones Group that “[t]he statements made in the Jones/Glennon Circular are the matters on which Mr Michael Glennon and Mr Anthony Jones have an agreement, arrangement or understanding as associates.” They submitted that the expression of those views, along with the nomination of directors, did not mean that the Requisitioning Shareholders had an agreement, arrangement or understanding with the nominees. Similarly, Glennon Capital submitted that “while Michael Glennon outlined the strategy for Glennon Capital to Brent Jones, no request was made from Brent Jones as to his opinion or any involvement in that strategy.” However, we do not agree that the involvement of the Requisitioning Shareholders with Brent Jones is so limited. There are a number of examples of exchanges identified above in which the parties go much further, talking about plans for the affairs of Sequoia and share purchases, and voting details at the Section 249D Meeting.28

-

In Indiana Resources Limited29 the Panel noted at [19] (footnotes omitted):

“We accepted that a person who agrees to stand for election as a director is not necessarily an associate of a shareholder who nominates that person. However, that does not mean that association can never arise in such circumstances, or that parties can ignore circumstances giving rise to association between one another, simply because one party has been nominated as a director by the other.”

- A. Jones Group submitted that the Requisitioning Shareholders considered it was appropriate to nominate Brent Jones as a director “not because of his existing shareholding in Sequoia or any other arrangements or understandings between them, but because of his existing role in Sequoia’s business, and his familiarity with the business and the industry more broadly”. It submitted that the Requisitioning Shareholders were simply exercising their rights as substantial shareholders.

- Glennon Capital submitted that Brent Jones did not participate in the requisition. It submitted that it never asked him or Anthony Jones how they would vote.

- Of course, shareholders may nominate persons to be directors. The significance in our view is who was nominated and whether there was, or an inference can be drawn from the material that there was, an agreement, arrangement or understanding between the nominee and nominator that went beyond merely consent to stand, or which evidenced that they were acting in concert in relation to the affairs of Sequoia. We consider that there was.

- ASIC Regulatory Guide 12830 tabulates conduct unlikely to constitute acting as associates or entering into a relevant agreement giving rise to a relevant interest. Table 131 includes “[i]nvestors holding discussions or meetings about voting at a specific or proposed meeting of an entity”. The table says that if the conduct is confined to the exchange of views or information between the investors, then this is unlikely to give rise to an association. It goes on to say, however, that if the conduct extends to the formulation of joint proposals to be pursued together or there is an understanding that the investors will act or vote in a particular way, then concerns may arise.

- In our view the conduct here strayed beyond mere exchange of views.

- Brent Jones submitted that when he was approached by the Requisitioning Shareholders he did not enter into any arrangement or understanding regarding his appointment as a nominee director; rather he “merely agreed” to be nominated by the Requisitioning Shareholders as he was “comfortable being appointed to the board of directors to fill any absence or satisfy any legal requirements until a suitable replacement for Mr. Crole was found”. We note that neither the Statement by Requisitioning Shareholders nor the Jones/Glennon Circular identified Brent Jones’ appointment (if it occurred) as interim.32

- Brent Jones further submitted that:

- his nomination had a strong commercial rationale because he has a deep working knowledge of the business model and governance qualifications, and he would be an executive director following Mr Crole’s removal and

- his interests were aligned with the broader shareholder base of Sequoia by having ‘skin in the game’.

- In support, Brent Jones further submitted that, on 31 March 2024, Michael Glennon emailed Brent Jones a template consent to act as a director and Brent Jones replied with a signed consent to act on the same date. Brent Jones submitted that there was no further “email correspondences in relation to Brent Jones’ proposed appointment.”

- However, he submitted that Michael Glennon made initial contact with him “in his capacity as an executive” of Sequoia on 13 March 2024 outlining Mr Glennon’s intentions to remove Mr Crole as CEO and change the board structure. It is unclear to us why Michael Glennon would contact an employee of Sequoia to discuss the removal of the CEO and seek his participation in that removal.

- Glennon Capital submitted that Michael Glennon contacted Brent Jones because “he understood that Brent Jones had been an employee of InterPrac for a long time and was also a substantial shareholder in Sequoia” and because “he understood that Garry Crole had previously reported to Brent Jones.” This submission appears to be inconsistent with Brent Jones’ submission referred to at paragraph 139. Regardless, the material suggests that Michael Glennon was seeking to collaborate with Brent Jones.

- Brent Jones further submitted that, being an employee, he did not support or actively engage with Mr. Glennon on 13 March 2024, but suggested that Mr. Glennon discuss his strategy with Anthony Jones “on the basis that it was apparent that Mr. Glennon and Tony Jones shared common views regarding the direction of [Sequoia].” It is unclear why Brent Jones would do this if he was contacted in his capacity as an employee of Sequoia. Regardless, while Brent Jones may have initially adopted a position of neutrality, it changed at the latest when he consented to stand as a director, if not before.

- Sequoia also submitted that the Statement by Requisitioning Shareholders includes statements as to plans and a general approach to the strategic priorities of Sequoia, which the Panel should infer are statements of a common purpose and intention shared by Brent Jones. Glennon Capital submitted that the statement made it clear that observations about general corporate governance and commercial considerations would be the responsibility of the new board.

- Sequoia provided (with the application) a statutory declaration of Matthew Wilson dated 14 May 2024. Mr Wilson declared that:

- he is a former consultant to Sequoia and a shareholder

- as noted in paragraph 28 above, he received a telephone call from Brent Jones on 24 April 2024 to explain why “they” had lodged a section 249D notice and

- he took contemporaneous notes of the conversation. Those notes disclose (among other things):

- “Brent called me to explain why ‘they’ were lodging a s249D notice…”

- “He said they had finally lost patience with Garry. ‘The old man and I are sick of Garry promising to make changes yet nothing ever happens.’”

- “The Jones camp had tried to work with Garry to give him a graceful exit…”

- The notes also include “I asked Brent what the Jones camp would do if they got control? He replied [followed by reference to two potential strategic changes to Sequoia’s business]”.

- The notes also indicate that Brent Jones made clear to Mr Wilson what the concerns were of each of Anthony Jones and Michael Glennon and why they wanted to remove Garry Crole. That reflects a significant level of knowledge on Brent Jones’ part.

- Brent Jones submitted that he spoke to Mr Wilson because, on 23 April 2024, Michael Glennon had asked him to. Glennon Capital submitted that it did so because “Michael Glennon believed it would be beneficial for proposed directors to engage with shareholders.” This is in our view unusual. We would have thought it more likely that the Requisitioning Shareholders would speak to other Sequoia shareholders, even accepting that Brent Jones controlled a substantial shareholder (Unrandom).

- Brent Jones submitted further in relation to the notes that:

- “it is unclear when those notes were taken, when the typed document annexed to the statutory declaration was prepared and whether the typed version is identical to any notes which may have been taken”

- references to the “Jones camp” were ambiguous and he denied “making any reference or statement to the “Jones Camp” saying it was a term used by Mr Wilson and

- a number of assertions were inaccurate, incorrect or did not reflect the content of the discussion as recalled by Brent Jones.

- Mr Wilson declared the notes to be a contemporaneous record of his conversation. While he could perhaps have provided more detail about having typed the notes up, we have no reason to doubt him. We accept that Brent Jones may not have made references to the “Jones camp” and that it may be Mr Wilson’s expression. But we consider that Mr Wilson used the term as shorthand because he clearly understood the discussion to include Brent Jones.

- Brent Jones also submitted that he had telephone conversations with a number of former investors of Interprac. These discussions were held “in his capacity as a potential director of Sequioa [sic] and were related to B Jones’ nomination as a director and providing a background of his professional history and credentials associated with his nomination.” They reflect that he was more than merely a passive nominee for the board. We consider he was promoting the Requisitioning Shareholders’ position.33

- We infer, on the basis of their dealings that the Requisitioning Shareholders (and therefore including Glennon Capital and A. Jones Group) and Brent Jones had an agreement, arrangement or understanding for the purpose of controlling or influencing the conduct of Sequoia’s affairs, at least in so far as securing board changes and seeking to implement changes to the business and governance of Sequoia following the Section 249D Meeting. In addition, they are acting in concert in relation to Sequoia’s affairs.

Voting association A. Jones Group and Glennon Capital

- The Requisitioning Shareholders are clearly associated, and they have disclosed as much. The Requisitioning Shareholders have disclosed an association in the Requisitionists’ Form 603 in the following terms: “Each holder is an associate of the other because all holders are acting in concert to seek to compel the directors of SEQ (under Section 203D of the Corporations Act) to convene a meeting of SEQ’s members to consider resolutions to remove Mr Garry Crole and Mr Kevin Pattison as directors of SEQ.”

- The question is whether their association extended to voting as well as to the calling of the Section 249D Meeting. Glennon Capital appears to deny that it does. In response to further questions from us following the outcome of the Section 249D Meeting, Glennon Capital submitted “[a]s co-requisitioners of the Sequoia meeting, the Requisitioning Shareholders disclosed to the market their association in taking such an action together. However, Glennon Capital has at no point in time been bound to Brent Jones (or indeed the A. Jones Group) to exercise its voting power in any manner.”

- We consider that the association went beyond convening of the Section 249D Meeting. It extended to the voting.

- ASIC Regulatory Guide 128 at Table 234 states that jointly signing a section 249D notice to requisition a general meeting of a company for the purposes of putting forward a resolution relating to the composition of the board or the company’s affairs is “likely to be considered entering into a relevant agreement and for these investors to be considered associates. If this is accompanied by an understanding about the exercise of voting rights, it will also result in the acquisition of a relevant interest. We expect that this would be the case in most instances.”

- A. Jones Group submitted in rebuttals that Michael Glennon and Anthony Jones “did not need to form an association and work together with respect to the Section 249D Request, given they had both acquired stakes in Sequoia exceeding 5%; that is, they each could have requisitioned a meeting without the other’s participation. They chose to work together given they had compatible views on the leadership and performance of Sequoia.”

- We agree that they did not need to work together, but they chose to do so.

- It seems clear that the association extended to voting of the shares each holds in Sequoia. A text message from Michael Glennon to Anthony Jones on 9 May 2024, is an example. It said that there was a line of stock available that would result in a change in voting proportions. It queried whether Anthony Jones would like to acquire some of the stock. The message stated: “Garry would lose 6% and we gain 6%...” While on one view that might be seen as merely indicating the totality of the votes without any agreement, arrangement or understanding, we infer that it goes further based on all the exchanges.35

- Moreover, we consider that the statement (in the Statement by Requisitioning Shareholders) “[w]e are proposing to appoint two new well credentialed directors and the removal of two of the current directors” is one of voting intention, not nomination, even accepting, as Glennon Capital submitted, that “Glennon Capital was at all times in a position to withdraw its support of the Section 249D Request if Mr Crole elected to resign as a director and accept an executive role as CEO” and as A. Jones Group submitted “[a]t no time did Mr Anthony Jones regard himself as not being free to exercise his votes in any way he considered appropriate”.

- Glennon Capital in rebuttal submissions submitted that “Glennon Capital has at all times retained the ability to vote at its absolute discretion including to change its vote, and Glennon Capital understood that to be the case with each of the A. Jones Group and Brent Jones.” The question however is, in part, whether they had an understanding (or more) even if it might be breached.

- We do not agree with the A. Jones Group that “the evidence is ‘weak and inferential at best’.” We consider that Brent Jones actively participated in the intentions of the Requisitioning Shareholders, such as to establish an association between him and the Requisitioning Shareholders. Several factors distinguished his actions from what might ordinarily be expected of a person merely agreeing to be nominated for election as an independent director.

- Glennon Capital also submitted that even if an association existed, it “would have ceased at the conclusion of the requisitioned meeting on 5 June 2024.” A. Jones Group made a similar submission when it said “[f]ollowing the completion of the Meeting on 5 June 2024, the A. Jones Group ceased to be associated with Glennon Capital, as reflected in the updated substantial holder notices made by the A. Jones Group and Glennon Capital on 7 June 2024.”

- We consider that this is relevant to the question of what orders are appropriate.36 We do not accept that it follows that a declaration should not be made.

Outcome of the Section 249D Meeting

- The Section 249D Meeting was to be held (as rescheduled) on 5 June 2024. To address the possibility of the relevant shares affecting the outcome of voting at that meeting, given that the application by Sequoia was still under consideration by us, the parties offered undertakings (Annexure A).

- Glennon Capital and A. Jones Group each offered undertakings in essence not to vote any Sequoia shares acquired by them on or after 31 March 2024. This amounted to, in aggregate, 7,448,378 shares or approximately 5.69% of Sequoia’s issued share capital.

- Sequoia undertook to disregard any votes on those shares and to keep a record of all votes cast at the Section 249D Meeting and to provide a poll report on each resolution. It also undertook to hold a further meeting if the resolutions were not all passed but would have been if the votes attached to the above shares had been cast in favour.

- The Section 249D Meeting took place on 5 June and Sequoia announced on ASX that none of the resolutions passed and none would have passed even if the relevant shares had been voted in favour of the resolutions.

Conclusions in relation to association

- Anthony Jones submitted that “Mr Brent Jones is the son of Mr Anthony Jones, and therefore the two naturally have regular discussions of which no records are kept. Accordingly, it is not possible to provide accurate recounts of all verbal conversations that have taken place.” We accept that.

- However, considering the whole of the material, and drawing appropriate inferences, we are of the view that there is enough documentary evidence, and other probative material from the submissions and rebuttals, to form a conclusion on association as set out in paragraph 59.

- We come to this view based on the overall weight of material, noting that the allegations of association have been denied and taking the denials into account.

- We accept that reaching a level of understanding (potentially the lowest bar for finding an association) requires “a consensus as to what is to be done, rather than a mere hope that something will be done”. We consider that the relevant level has been reached.

- In A. Jones Group’s submissions on our preliminary findings, they submitted “[w]hile it is accepted that the Panel can consider prior circumstances to help establish an association, the A Jones Group submits that the relevant circumstances are those that occurred in connection with the Section 249D Request and Meeting, and the Panel has not confined its considerations to such circumstances.”

- We agree in part. We have confined our findings to circumstances that occurred in connection with the Section 249D Notice and the Section 249D Meeting, but in forming our views we have looked at the broader context.

Conclusions in relation to contravention of s606

- As at 31 March 2024, Unrandom, A. Jones Group and Glennon Capital held combined voting power in 29,122,82337 Sequoia shares (representing approximately 22.20%38 of the issued voting shares).

-

After 31 March 2024, the following acquisitions of Sequoia shares (collectively, the Relevant Shares) were made:

Date Acquirer Number of shares acquired Percentage of shares acquired39 Combined voting power percentage40 4 April 2024 Glennon Capital 599,777 0.46% 22.66% 5 April 2024 Glennon Capital 583,629 0.44% 23.11% 10 May 2024 Glennon Capital 4,026,635 3.06% 26.11% 13 May 2024 Cojones 1,056,075 0.80% 26.91% 13 May 2024 Vonetta 1,000,000 0.76% 27.67% 14 May 2024 Glennon Capital 218,762 0.17% 27.84% 15 May 2024 Glennon Capital 3,500 0.003% 27.84% Total 7,488,378 5.69%41 - Accordingly, based on our view in relation to association, we find that as a result of the acquisition of the Relevant Shares, the combined voting power of Unrandom, A. Jones Group and Glennon Capital in Sequoia increased from 29,122,823 Sequoia shares (representing approximately 22.20% of the issued voting shares) to 36,611,20142 Sequoia shares (representing approximately 27.84%43 of the issued voting shares). None of the exceptions in section 611 applied and accordingly section 606 was contravened by each of Glennon Capital, Cojones and Vonetta.

Conclusions in relation to contravention of section 671B

- Based on our view in relation to association, we find that Unrandom, A. Jones Group and Glennon Capital have failed to give substantial holder notices fully disclosing their association including their combined voting power in Sequoia. Further, in contravention of section 671B, the Requisitioning Shareholders failed to fully disclose the extent of their association in Sequoia.

Extension of time to make the application

- Section 657C(3) states: “[a]n application for a declaration under section 657A can be made only within:

(a) two months after the circumstances have occurred; or

(b) a longer period determined by the Panel.” - Sequoia formed the view that the association between Brent Jones and the Requisitioning Shareholders had arisen no later than 31 March 2024. It made its application on 15 May 2024. We asked why it waited.

- Sequoia submitted that while it thought it had evidence to support a finding by the Panel that Brent Jones was associated with the Requisitioning Shareholders, it was “mindful, based on previous Panel decisions, that more evidence may be needed to ‘demonstrate a sufficient body of evidence of association’”. It submitted that this subsequently emerged and it took Sequoia “some time to conduct the investigations to establish whether there was sufficient evidence to make an application and then to prepare the application”.

- Sequoia further submitted that “[u]ntil the large share trades that occurred on Friday, 10 May 2024, Sequoia was of the view that it was most likely that the only contravention that would be established was a contravention of s.671B” and “up until 10 May 2024, there was doubt about whether the alleged contraventions were sufficiently material to support a finding of unacceptable circumstances by the Panel”.

- A. Jones Group submitted in rebuttals that Sequoia “has had concerns about the alleged conduct of the Requisitioning Shareholders and Mr Brent Jones for some time and yet has only raised those matters a few weeks before the Section 249D meeting.” A. Jones Group submitted that Sequoia’s “decision to delay the making of the application may be indicative of a collateral purpose.” We do not agree that there was an obvious collateral purpose that would prevent us from considering the matter.

-

In Queensland North Australia Pty Ltd v Takeovers Panel the Court said:

… Before the discretion to extend time may be exercised under s 657C(3) those circumstances require to be proved. There may be a factual contest. There is no difficulty, in that situation, for the Panel first resolving the factual questions and thereafter determining whether or not to extend time under s 657C(3). The legislative scheme here does not suggest a different approach.44

- Based on our findings of when the associations occurred, 31 March 2024 was within two months of the date of the application and we do not therefore consider we need to extend time under section 657C(3) for making the application in this instance. Accordingly, we did not consider this aspect of the matter any further.

Other matters

- Section 657A(2) states: “The Takeovers Panel may only make a declaration under this subsection, or only decline to make a declaration under this subsection, if it considers that doing so is not against the public interest after taking into account any policy considerations that the Takeovers Panel considers relevant.”

- Glennon Capital made a submission to the effect that Sequoia had invested extensive resources in the application, which concerned the personal positions of incumbent directors. While the use of company funds to make a Panel application may be relevant to the question of whether making a declaration of unacceptable circumstances is in the public interest, in this case45 we considered that it is not against the public interest to make a declaration.