TP04/088

The Panel has accepted an undertaking from Village Roadshow Limited (VRL) which the Panel considers satisfactorily resolves the issues before it in an application from Boswell Filmgesellschaft mbH (Boswell) dated 17 September 2004 alleging unacceptable circumstances in relation to the affairs of VRL.

Boswell’s application related to a resolution to approve a proposed on-market buy-back of up to 20% of ordinary shares in VRL(Buy-Back), which is to be put to VRL shareholders at a general meeting on 8 October 2004 (Buy-back Resolution). Meeting documents regarding the Buy-back Resolution were sent to VRL shareholders on 8 September 2004.

Boswell alleged that unacceptable circumstances existed due to:

- a failure to provide adequate information to VRL shareholders regarding the Buy-back Resolution; and

- the ability of Village Roadshow Corporation Limited (VRC), the majority shareholder in VRL, to vote in favour of the Buy-back Resolution.

Undertaking

VRL has undertaken not to buy-back any shares under the Buy-Back if the Buy-Back Resolution would not have been passed but for votes cast by VRC, or its associates, in favour of the Buy-Back Resolution.

VRL has also undertaken to announce the undertaking this afternoon on ASX and to publish advertisements in major Australian financial newspapers next week explaining the effect of the undertaking to VRL shareholders (in a form acceptable to the Panel). The Panel has not required VRL to send any additional letter to VRL shareholders.

Decision

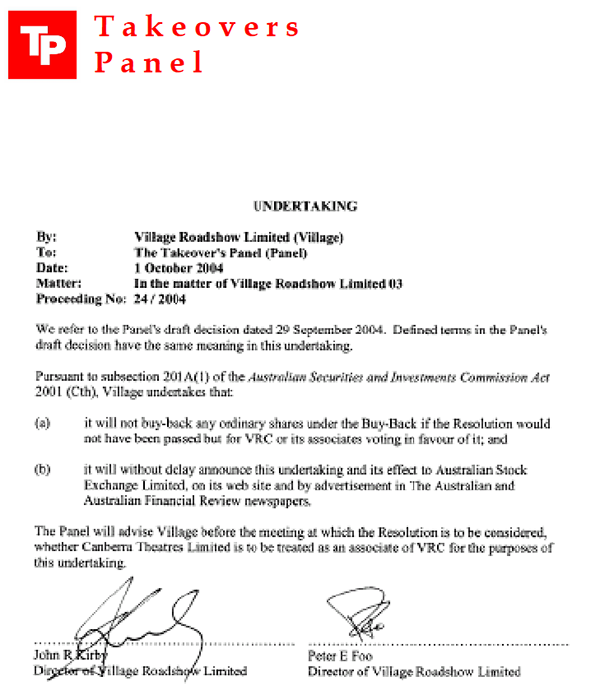

The Panel considers that unacceptable circumstances did exist in relation to the affairs of VRL arising out of the proposed Buy-Back prior to the undertaking provided by VRL. However, the Panel considers that the undertaking remedies the unacceptable circumstances such that it is not in the public interest to make any declaration of unacceptable circumstances. A copy of VRL's undertaking to the Panel is attached at Annexure A.

This is the first case in which the Panel has been asked to consider the principle in relation to a share buy-back, and that is one of the reasons that it considered that making a declaration of unacceptable circumstances would not be in the public interest. In addition, the issue before the Panel had not previously been a part of Australian market practice. However, the Panel considers that the principle underlying its decision (as reflected in the effect of the undertaking) is not new and has stood in the Australian takeovers legislation at least since the introduction of the Companies (Acquisition of Shares) Act, and that it has applied to buy-backs from the time that buy-backs were first permitted under Australian company law. The Panel considers that it is unlikely that it will need to consider this issue frequently in the future given the clear indication of this decision for similar cases in future.

The Panel will consult with market participants to determine whether guidance on the issue is desirable.

The Panel has not agreed with Boswell's request that it require VRL to provide additional information to VRL shareholders on the value of VRL or any of its divisions.

Effect of the Undertaking

The Panel considers that effectively, the decision on whether or not the Buy-Back is approved is now in the hands of the shareholders of VRL who are not associated with VRC. If those shareholders approve the Buy-Back Resolution then:

- VRL may buy-back the proposed ordinary shares; and, significantly

- if VRC does not dispose of VRL shares, either into the Buy-Back or otherwise, its voting power will increase as a consequence of VRL buying back and cancelling up to 20% of the ordinary shares in VRL.

This is consistent with the underlying policy of Chapter 6 of the Corporations Act that a vote which will decide whether or not the a transaction proceeds should be passed only on the support of shareholders who will not gain any special benefit from any changes in control which the transaction might bring about.

VRC and its associates are free to vote against the Buy-Back Resolution if they choose.

Control over VRL - VRC Voting

The Panel considers that the following circumstances constituted unacceptable circumstances in relation to the affairs of VRL:

- the shareholders of VRL did not have sufficient information concerning whether VRC could, or would, vote on the Buy-Back Resolution;

- the uncertainty in the market for VRL securities caused by lack of information concerning VRC's ability to vote for the Buy-Back Resolution, VRC's advice to VRL shareholders that it had not decided whether or not to participate in the Buy-Back, and VRC's ability to decide not to participate in the Buy-Back. The Panel was concerned that if VRC decided not to participate in the Buy-Back and VRL bought back all of the shares subject to the Buy-Back Resolution, it appeared likely that VRC's voting power in VRL would increase from 56% to 70%; and

- the potential consolidation of VRC’s control of VRL which would be occasioned by VRC voting to approve the Buy-Back Resolution and then deciding not to participate in the Buy-Back.

The Panel notes, that it sent a letter to parties on 29 September 2004, setting out its concerns, including this concern. Following that letter, VRC advised the Panel that it intended to vote for the Buy-Back Resolution. VRC had previously explained to the Panel that it had not disclosed its intentions as to voting because various corporate governance organisations had published policy that suggested that majority shareholders should not announce their voting intention prior to a meeting or resolution because that might stifle debate on the issue.

However, as set out above, the Panel decided that following the giving of the undertaking by VRL, unacceptable circumstances no longer existed and it was not in the public interest for the Panel to make any declaration of unacceptable circumstances.

Information to VRL Shareholders

The Panel has considered the concerns raised by Boswell in its application, and submissions by parties in these proceedings, concerning the adequacy of information provided to VRL shareholders in the notice of meeting to approve the Buy-Back Resolution (Notice of Meeting).

The Panel does not consider that evidence has been produced before it to cause it to believe that additional information is required to be given to VRL shareholders in relation to the value of VRL's production division to enable VRL shareholders to assess the value of VRL.

In coming to this conclusion, the Panel considered a number of facts, including:

- VRL's auditor signed off the VRL 2004 accounts on 3 September 2004; and

- the directors of VRL have asserted (directly or indirectly) in submissions before the Panel and in the Notice of Meeting, that VRL shareholders have all the information known to VRL that is material to the decision by VRL shareholders on how to vote on the Buy-Back Resolution.

The Panel and ASIC also received some confidential documents from VRL in the proceedings which related to the value of VRL’s film production division. Those documents related to ongoing litigation in which VRL is involved and also to a possible reengineering process of its film production division which VRL has previously announced. ASIC raised concerns with the Panel concerning aspects of those documents. However, the Panel considered that ASIC’s initial concerns were not supported by the relevant documents.

Normally, the Panel is highly reluctant to consider documents or information which it is not in a position to provide to all parties. However, in the current matter, it considered that there were enough external circumstances to make a limited exception. Part of the basis for this decision was that, in the interests of progressing the proceedings, Boswell waived its right to see documents provided to the Panel that the Panel considered were significantly, commercially confidential. The Panel appreciates Boswell’s decision to do so, which has allowed the proceedings to be resolved more expeditiously.

However, it should be noted, the number of documents which Boswell asserted VRL should provide to the Panel and ASIC was very large and ASIC has had limited time to review a very large number of documents. ASIC, in turn has provided the Panel with only a few documents that had initially raised concerns with ASIC. However, the Panel believes that the other items of information on which it based its view are sufficient to base its decision not to require VRL to defer the meeting, despite ASIC having limited time to review a very large number of documents.

Overall Information

The Panel considered that, overall, VRL shareholders are likely to have received sufficient information on the proposed Buy-Back to be able to make a properly informed decision on the Buy-Back Resolution. However, this decision is taken on balance. It takes into account the Independent Expert Report by provided by Grant Samuel for the VRL preference share buy-back scheme in late 2003 (albeit over 9 months old and written for a different purpose), the Notice of Meeting, the disclosures required by the Village 02 Panel, discussions in the media and the on-market nature of the Buy-Back. The Panel is concerned that the explanation and discussion of the capital management project is just adequate. For example, the Panel considers that a VRL shareholder would have difficulty achieving an informed understanding of the relative benefits and disadvantages of VRL buying-back ordinary shares as opposed to preference shares, and this appears to be a central issue to the resolution before them.

Independent Expert Report

Boswell sought the Panel to require VRL to commission an independent report by an expert to advise VRL shareholders whether the Buy-Back is in the best interests of VRL shareholders. An expert could give VRL shareholders advice on such issues as:

- the benefits and disadvantages of potential effects of the Buy-Back on control of VRL (especially any increase in VRC's voting power);

- the benefits and disadvantages of potential effects of the Buy-Back on liquidity of VRL shares;

- whether the ordinary share buy-back would be likely to deliver the capital management goals asserted by VRL management;

- whether those capital management goals are in the best interests of VRL shareholders.

Such a report would have had the merits of presenting the information required by VRL shareholders in a systematic manner and in one place, rather than VRL shareholders having to piece the information together from a number of different sources. However, ultimately, the Panel decided it would not require such a report.

The proposed terms of the buy-back

ASIC submitted that the terms (including price) at which VRL proposed to buy shares under the Buy-Back should be specified in the Buy-Back Resolution.

The Panel considered that, as a matter of general law, the requirements of section 257C and consistent with the principles set out in section 602 of the Act, if shareholders of a company are not given a sufficiently firm proposal on which to vote, then the approval will not be valid. The Panel considers that that VRL has given VRL shareholders adequate detail of the terms of the proposed Buy-Back (including an indicative price) in the Notice of Meeting. On that basis, the Panel did not accept that the current Buy-Back Resolution and Notice of Meeting would not comply with section 257C of the Act.

However, if the terms under which VRL buys back its shares, for example the VRL market price, move materially away from the indicative terms disclosed in the Notice of Meeting, at some point, VRL would no longer be entitled to rely on the Buy-Back Resolution as authorising continued buying of VRL shares on-market. Therefore, with that proviso, the Buy-Back Resolution appears to be competent in having disclosed the terms of the Buy-Back sufficiently to allow VRL shareholders to give valid approval of the Buy-Back under section 257C.

Voting by VRC on the Buy-Back Resolution

The Panel considered two interrelated issues when addressing the issue raised by Boswell as to VRC voting on the Buy-Back Resolution. They were:

- a. whether voting by VRC on the resolution would constitute unacceptable circumstances; and

- b. whether VRC's voting power being increased in consequence of the Buy-Back would constitute unacceptable circumstances.

Voting by VRC

The Panel considered that VRC, and its associates, should not both vote in favour of the resolution and have VRC’s voting power increased by the Buy-Back. This is consistent with:

- Item 7 of s611, which allows only disinterested shareholders to approve an acquisition of shares which would otherwise be prohibited by section 606;

- the concept that the VRL shareholders are voting whether or not to allow the potential control effects of the Buy-Back. The Panel considers that it is unacceptable for a controlling shareholder to vote for a resolution under which shareholders are asked to consider the effects of control of a transaction that could increase that shareholder's control. To allow it to do so would make a nonsense of shareholders considering the potential implications for control over the company in the case of substantial buy-backs; and

- the equality of opportunity principle in s602 (including the logical obverse which is that if the non-associated/non-participating shareholders logically can’t participate (such as in this case) then they should have the right to approve or veto the proposal).

On that basis, the Panel accepted the undertaking from VRL that it would not proceed with the Buy-Back if approval of the Buy-Back Resolution relied upon the votes of VRC, or its associates. The Panel accepts that the undertaking imposes no restriction on VRL counting any votes cast by VRC, or its associates, voting against the Buy-Back Resolution.

Related Party Transaction

If the Buy-Back proceeds, VRC will benefit from the buy-back in economic terms in the same way as all the other shareholders who remain as shareholders in VRL. Alternatively, if it sells VRL shares into the Buy-Back it will similarly benefit in economic terms in the same way as all the other shareholders who sell into the Buy-Back. In addition, since the Buy-Back is likely to be conducted on arm’s length terms, being an on-market buy-back, it would not need approval of the type contemplated in Chapter 2E, and there appears to be no direct transaction between VRL and VRC. In those respects, the Buy-Back appears not to be a related party transaction and the related party transaction provisions of the Corporations Act should not apply.

Control

However, having said that VRC is similar to other VRL shareholders in economic interests, it is also true that VRC is different to all other shareholders when considering the issue of control of VRL and the effects of the Buy-Back. VRC is the only shareholder whose control of VRL may be consolidated by the Buy-Back. Therefore, it is not appropriate for VRC (or any votes it cast in favour of the Buy-Back Resolution) to be treated identically to all other shareholders in voting because it will receive different benefits, in control terms, than other shareholders.

If the Buy-Back Resolution is approved by shareholders in VRL not associated with VRC, the Panel sees no reason why any change in VRC's voting power as a consequence of the Buy-Back would be objectionable. The fact of this potential increase in VRC’s voting power has been disclosed to VRL shareholders in the Notice of Meeting.

VRC's Legitimate Economic Interests

The Panel acknowledges that VRC has a very significant investment in VRL so it should not have a buy-back that it considers inimical to its financial interests thrust upon it as a result of the Panel depriving it of its voting rights. Therefore, the Panel considers that VRC should be allowed, if it chooses, to vote against the Buy-back, and have VRL count and rely upon those votes.

Voting Intentions and Other VRL Shareholders

The Panel considers that VRL shareholders should be told well in advance as to VRC’s, and its associates’, ability to vote. The Panel considers that this is very material information for VRL shareholders. In the absence of such information, the Panel foresees some distinct possibility of minority VRL shareholders considering the Buy-Back Resolution to be a foregone conclusion and not voting.

The Panel considers that this announcement, VRL's announcement on ASX and VRL's own website, combined with the proposed newspaper advertisements will adequately inform shareholders of VRL who are not associated with VRC that the decision on the Buy-Back is theirs and that it is the votes of those non-associated shareholders which, effectively, will determine the outcome of the Buy-Back Resolution.

Alternative remedies

The Panel considered a range of other remedies, including seeking an undertaking from VRC concerning selling down, and not voting, any shares in VRL by which its voting power had been increased by the Buy-Back. However, VRC had argued strongly in its submissions that such an undertaking, or order if the Panel had decided so, would be, in practical terms, impossible. The Panel does not agree with VRC's analysis of that alternative.

The Panel considered ordering VRC not to vote, or VRL not to count any votes cast by VRC or its associates, on the Buy-Back Resolution. It did consider that such an order would more quickly and clearly remedy as many of the causes of unacceptable circumstances as possible. Ordering VRC not to vote would have:

- immediately informed the market;

- removed any concerns about VRL shareholders being dissuaded from participating in the decision;

- removed the need for further Panel proceedings in the event of VRC both voting on the Buy-Back Resolution and having its voting power increased by the Buy-Back;

- removed VRC's apprehensions about any future forced sale by it of VRL shares; and

- avoided the need for postponing the meeting with the resulting increased cost and expense that that would incur for VRL.

However, given that:

- VRL offered an undertaking which very largely achieved the Panel's policy objective;

- such orders would have required the Panel to make a declaration of unacceptable circumstances; and

- the decision is the first time that the Panel has had to give its views on the type of transaction set before it in these proceedings;

the Panel decided that it was not in the public interest to make the declaration and the subsequent orders.

Extension of the Panel's order to other VRL shareholders

It was put to the Panel that any decision to prevent VRC from voting on the Buy-Back Resolution because its voting power would increase as a result of the Buy-Back if VRC did not participate in the Buy-Back or otherwise sell shares in VRL, would eliminate many other VRL shareholders from voting and have the Buy-Back Resolution decided by a very small and unrepresentative minority. The Panel rejected this argument. Such a remedy would only ever apply to shareholders whose voting power would increase above 20% i.e. in contravention of section 606, and there is no other shareholder in VRL whose voting power might be increased to consolidate effective control. VRC is unique in the VRL circumstances. Therefore, the argument that immaterial minorities would decide such resolutions is incorrect.

Consistency with Previous Panel Decisions

In its submissions, VRL asserted that the Panel could not decide that there are (or would be) unacceptable circumstances affecting (or resulting from) the Buy-Back, because that would be inconsistent with the reasons for decision in Village 02.

The Village 02 Panel confirmed that it gave full weight to the exception in item 19 of section 611. VRL argued that, consistently with that decision, the Panel cannot decide that unacceptable circumstances would, or could, result from a buy-back which has the benefit of item 19, because it complies with section 257A.

In effect, that means that regardless of findings on the facts, the item 19 exception would be an absolute protection against a finding of unacceptable circumstances, as well as of breach of section 606. The Panel does not accept such a proposition. Whenever relevant1, the Panel has insisted that unacceptable circumstances can result from inappropriate reliance on the exceptions in section 611. Historically and as a matter of legislative policy, the original power to declare conduct or acquisitions unacceptable was intended to prevent avoidance of the main requirements of Chapter 6 (and its predecessors) by astute use of the exceptions. That function has not been lost in the move to a wider function of declaring circumstances unacceptable.

If it had been the intention of the legislature that unacceptable circumstances could not apply to a buy-back, the relevant provision in Chapter 6 would say that Chapter 6 did not apply to the buy-back provisions. Rather, it is clear that Chapter 6 does apply but that the exception in item 19 means that a complying buy-back does not cause a person to contravene section 606.

However, the Village 02 Panel went on to say, after it said it gave full weight to the buy-back exception, that all the exceptions operate on the proviso that the acquisitions carried out in reliance on them do not constitute unacceptable circumstances.

The Village 02 Panel also said that giving full weight to the buy-back exception meant that the Panel would not find that an increase in VRC's voting power as a result of the buy-back considered in the Village 02 proceedings would be considered unacceptable in and of itself.

While a complying buy-back cannot be unacceptable for no other reason than that it results in an increase in voting power, it can be unacceptable if the increase is coupled with circumstances which are contrary to the policy of Chapter 6.

The Panel notes that VRC currently has voting power in VRL of 56%. About 5% of that voting power is due to a pre-emptive right that VRC has over a parcel of ordinary VRL shares held by Canberra Theatres Limited (CTL). The Panel will seek advice from VRC and CTL early next week to ascertain whether or not CTL should properly be considered to be an associate of VRC, in which case the VRL undertaking would apply to votes cast in favour of the Buy-Back Resolution by CTL. The Panel will announce the result of those enquiries next week.

In due course, the Panel will publish the reasons for its decision in the Village 03 proceedings on its website at: Media Releases.

Nigel Morris

Director, Takeovers Panel

Level 47, 80 Collins Street

Melbourne, VIC 3000

Ph: +61 3 9655 3501

nigel.morris@takeovers.gov.au

1 For example, in paragraph 36 of the decision in Investorinfo, the Panel said:

"Ensuring that these exceptions [items 10 and 13] are not being used in a way that infringes the policies, or avoids the protections, of Chapter 6 is an important element of the policy."