[2025] ATP 3

Catchwords:

Decline to conduct proceedings — association — board spill — requisition notice — collective action — public interest — concurrent proceedings

Corporations Act 2001 (Cth), sections 177, 249F, 606, 608, 611 (item 14), 671B

Corporate Law Economic Reform Program Bill 1999, Explanatory Memorandum

Australian Securities and Investments Commission Regulations 2001 (Cth), regulation 16

Takeovers Panel Procedural Rules 2020, Rule 20

Takeovers Panel Procedural Guidelines 2020, 4.6

ASIC Regulatory Guide 128: Collective action by investors

Keybridge Capital Limited 02 [2019] ATP 19, Aguia Resources Limited [2019] ATP 13, Caravel Minerals Limited [2018] ATP 8, Auris Minerals Limited [2018] ATP 7, Lantern Hotel Group [2014] ATP 6, Dragon Mining Limited [2014] ATP 5, Mount Gibson Iron Limited [2008] ATP 4, LV Living Limited [2005] ATP 5, Richfield Group Limited [2003] ATP 41, Taipan Resources NL 07 [2000] ATP 18

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Michael Lishman, Rebecca Maslen-Stannage (sitting President) and Emma-Jane Newton declined to conduct proceedings on two applications from Keybridge Capital Limited – one in relation to its own affairs and the other in relation to the affairs of Benjamin Hornigold Ltd. The two applications (heard together) concerned alleged associations and contraventions of section 606 in the context of a requisitioned general meeting of Keybridge Capital Limited shareholders. At the meeting resolutions concerning the replacement of the Keybridge Capital Limited board were to be considered. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Alleged Associates

- has the meaning given in paragraph 20(a)

- Benjamin Hornigold

- Benjamin Hornigold Ltd

- Capital Raising Meeting

- has the meaning given in paragraph 16

- Glennon Small

- Glennon Small Companies Limited

- Injunctive Relief Proceedings

- has the meaning given in paragraph 14

- Keybridge

- Keybridge Capital Limited1

- Ravell Group

- Mr Sulieman Ravell, S4 Family Services Pty Ltd, S4 Super Pty Ltd and Wealth Focus Pty Ltd

- Resolution 7

- has the meaning given in paragraph 16

- S249F Meeting

- has the meaning given in paragraph 15

- WAM

- WAM Active, WAM Capital Limited, Wilson Asset Management (International) Pty Limited, MAM Pty Limited, WAM Research Limited, Botanical Nominees Pty Limited as trustee of the Wilson Asset Management Equity Fund, WAM Leaders Limited, WAM Microcap Limited, WAM Global Limited, WAM Strategic Value Limited, WAM Alternative Assets Limited and Wilson Asset Management Leaders Fund

- WAM Active

- WAM Active Limited

- WAM Proceedings

- has the meaning given in paragraph 24(c)

Facts

- Keybridge and Benjamin Hornigold are ASX listed companies (ASX codes: KBC and BHD respectively).

- Keybridge holds voting power of 19.59% in Benjamin Hornigold, and since 9 January 2024, has been “active calling shareholder meetings and seeking proportional board representation” (as submitted by Keybridge).

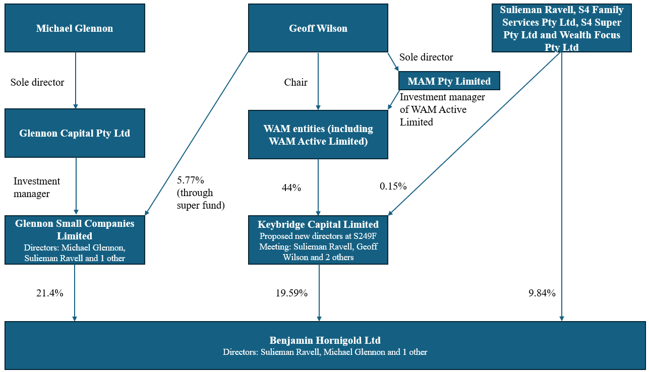

- WAM holds a relevant interest in approximately 44% of Keybridge2 and therefore is deemed to have a relevant interest in Keybridge’s shares in Benjamin Hornigold pursuant to section 608(3).3

- Mr Geoff Wilson is a director of each of the WAM entities and is the sole director of WAM Active’s investment manager, MAM Pty Limited.

- Glennon Small holds a relevant interest in 21.4% in Benjamin Hornigold. Mr Michael Glennon is a director of Benjamin Hornigold and Glennon Small and is the sole director of Glennon Small’s investment manager, Glennon Capital Pty Ltd. Neither Mr Glennon nor Glennon Small hold any shares in Keybridge.

- Ravell Group holds relevant interests of 9.84% in Benjamin Hornigold and 0.15% in Keybridge. Mr Sulieman Ravell is a director of Benjamin Hornigold and Glennon Small.

- Shareholdings in Benjamin Hornigold and Keybridge, and various relationships between the parties and other relevant persons, are set out in the diagram below.

- On 27 November 2024, WAM Active issued to Keybridge a ‘Notice of intention to nominate for election’ under Keybridge’s constitution. The notice sought to add four new directors to the board, including Mr Wilson and Mr Ravell.

- On 2 December 2024, Ravell Group gave a Form 603 – Notice of initial substantial holder to Keybridge disclosing a potential combined voting power of Ravell Group and WAM of 45.78% in Keybridge.4 Ravell Group’s notice stated:

“On 27 November 2024 (after close of business hours) Mr Ravell consented to be nominated by WAM Active as a proposed director of Keybridge Capital Limited. This consent might be taken to give rise to a technical association with WAM Active Limited. For an abundance of caution, it was considered appropriate to lodge this form.”

- On the same day, Ravell Group5 also gave a Form 604 – Notice of change of interests of substantial holder to Benjamin Hornigold disclosing a potential combined voting power of Ravell Group and WAM of 29.43% in Benjamin Hornigold. Ravell Group’s notice stated:

“Mr Ravell’s consent to act as a future Director [of Keybridge] if elected might be taken to give rise to a technical association with WAM Active Limited (WAM), and thereby might result in Mr Ravell being deemed to have an indirect relevant interest in the BHD shares in which WAM or its associates have a deemed relevant interest, by virtue of owning a minority (less than 50%) shareholding but more than 20% holding of the issued share capital of Keybridge.

WAM Active Limited declared its and its associates’ deemed indirect relevant interest in 4,733,066 fully paid ordinary shares in BHD held by Keybridge (the Deemed WAM Relevant Interest in BHD Shares), pursuant to an ASIC Form 604 lodged by WAM on 19 January 2024, a copy of which is attached at Annexure B of this notice.

For an abundance of caution, it was considered appropriate to lodge this form. Mr Ravell does not beneficially own, and exerts no control or influence over, BHD shares which WAM may be deemed to have a relevant interest in through their shareholding in Keybridge” (emphasis in original).

- On 9 December 2024, WAM Active issued Keybridge a notice under section 203D to propose resolutions for the removal of Keybridge’s four directors.

- On 12 December 2024, after having been informed by Keybridge of a potential capital raising, WAM Active made an ex parte application to the Supreme Court of New South Wales seeking to restrain Keybridge from raising equity capital (Injunctive Relief Proceedings).

- On 19 December 2024, Keybridge received a notice from WAM Active under section 249F to requisition a general meeting of Keybridge shareholders (S249F Meeting) to move resolutions to replace the Keybridge board with the four directors notified to Keybridge on 27 November 2024 (including Mr Wilson and Mr Ravell). The EGM was scheduled to be held on 10 February 2025.

- On 6 January 2025, Keybridge released a notice of meeting scheduled for 3 February 20257 (Capital Raising Meeting), which included a resolution (Resolution 7) to issue:

- approximately 21 million new shares (approximately 10% of Keybridge’s issued capital) to Mr Nicholas Bolton (and/or his nominees)8

- approximately 3.4 million new shares (approximately 1.6% of Keybridge’s issued capital) to Mr Antony Catalano (and/or his nominees)9 and

- approximately 4 million new shares (approximately 1.9% of Keybridge’s issued capital) to WAM Active (and its associated entities).

- The notice of meeting stated that “[i]n accordance with the Listing Rules, no votes may be cast on this resolution by persons and/or parties who will participate in the issue of equity securities under Resolution 7.”

- On 20 January 2025, WAM Active filed an interlocutory process in the Injunctive Relief Proceedings seeking urgent relief in relation to, among other things, its ability to vote on Resolution 7 at the Capital Raising Meeting in circumstances where it does not participate in the capital raising.

Applications

Declaration sought

- Keybridge submitted a single application dated 21 January 2025 seeking a declaration of unacceptable circumstances in relation to its own affairs and the affairs of Benjamin Hornigold. This effectively constituted two separate applications. Keybridge undertook to pay a separate application fee for each, and we decided to deal with the applications together under regulation 16(1)(a) of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- In its applications, Keybridge submitted (among other things) that:

- WAM, Ravell, Mr Wilson and Mr Michael Glennon (together with Glennon Small, the Alleged Associates) have been “acting in concert over a long period of time in an organised and obsessive fashion to get control of pivotal assets in Keybridge such as Metgasco, BHD and Glennon Small (at various times)”.

- The Alleged Associates hold collectively voting power in 51% of Benjamin Hornigold10 (including through WAM’s interest in Keybridge).11

- The Alleged Associates “have obtained that interest in contravention of s606 of the Act and have orchestrated a s249F meeting to further their agenda on BHD”.

- The acquisition of interests in Benjamin Hornigold by Ravell, Mr Wilson and Mr Glennon “result in a material change in interests in BHD and are inconsistent with s602 of the Act and do not meet the requirements for a s611 item 14 exemption”.

- “WAM provided a copy of a Keybridge register (that it had formerly obtained under s173 of the Act) to Ravell in contravention of s177(1)(b) of the Act to Ravell” and in contravention of section 177(1)(a), Mr Ravell then “utilised [the Keybridge register] – without the knowledge or consent of Keybridge – to write to Keybridge shareholders”.

- Various breaches of section 671B flow as a consequence of the relevant circumstances.

Interim orders sought

- Keybridge sought interim orders that:

- Ravell Group and Mr Glennon be restrained from acquiring more shares in Benjamin Hornigold and

- WAM be restrained from voting more than 43,083,930 shares (20%) in Keybridge until resolution of the proceedings.

Final orders sought

- Keybridge sought final orders that:

- WAM “divest its relevant interest in Keybridge above 20%... in ASIC for sale” or

- alternatively, Ravell and Mr Glennon divest sufficient shares in Benjamin Hornigold with ASIC for sale such that they and Keybridge collectively hold no more than 20% of Benjamin Hornigold.

Preliminary submissions

- We received submissions from WAM Active, Mr Glennon and Glennon Small, and Benjamin Hornigold.

- WAM Active submitted that (among other things):

- Keybridge’s applications failed to disclose properly the existence of the Injunctive Relief Proceedings. Those proceedings substantially overlap matters in Keybridge’s applications and we should decline to conduct proceedings on that basis alone.

- Keybridge’s allegations of association are unsubstantiated and represent an attempt by the Keybridge directors to entrench their incumbency at the S249F Meeting.

- WAM Active proposes to replace Keybridge’s board of directors for proper governance reasons, including the “total failure of governance culminating in Keybridge transferring ~$5 million in July 2024 on an unsecured basis to an Italian entity controlled by Mr Nicholas Bolton to acquire a residence in Lake Como, Italy… This is subject of proceedings against Keybridge’s directors to restore those funds to Keybridge [the WAM Proceedings] … and in connection with which the Court issued asset freezing orders against Mr Bolton on 20 September 2024. Those asset freezing orders remain in place”.

- The applications were not timely. Despite WAM Active giving its ‘Notice of intention to nominate for election’ on 27 November 2024 and its notice for the S249F Meeting on 19 December 2024, Keybridge submitted the applications on 21 January 2025 – one day after WAM Active filed an interlocutory process in the Injunctive Relief Proceedings seeking relief in relation to, among other things, its ability to vote on Resolution 7 at the Capital Raising Meeting.

- WAM never shared a copy of the Keybridge register with Mr Ravell.

- Mr Glennon and Glennon Small submitted that Keybridge relied on tenuous allegations of association and provided no evidence in relation to Mr Glennon or Glennon Small’s conduct that should persuade the Panel to conduct proceedings.

- They also submitted that Keybridge provided no evidence to suggest that any association – if found in relation to Keybridge’s affairs (which was denied) – should also extend to Benjamin Hornigold.

- Further, they disputed Keybridge’s submission that, since Mr Glennon holds no shares in Keybridge, his actions “can only be explained by the downstream benefits in BHD he hopes to achieve by also acting in concert with WAM”. They submitted that Keybridge failed to identify any discernible downstream benefits and that any such assertions are “at best, an imaginative overreach by the Applicant to support its Application”.

- Benjamin Hornigold submitted that Keybridge had not demonstrated any association, and that the applications appear to be “directed in substance towards seeking to affect or suppress the voting rights of some of the registered holders of Keybridge shares, at its upcoming shareholder meetings on the 3rd (now 4th) February and 10 February 2025 to consider a s 249F resolution to replace the Keybridge Board”.

- It also submitted that “disclosures made by WAM and Mr Ravell in relation to their interests in Keybridge and BHD have promoted the purposes of s 602 by informing the market of their respective interests on a timely basis”.

- Further, it submitted that Mr Ravell inspected the Keybridge register himself (rather than obtaining it from WAM), and in any event, the “accusations in the Application regarding alleged uses by Mr Ravell of the Keybridge share register ignore the existence of s 177(1A)”.12

Out of process submission from Keybridge

- We decided to accept an out of process submission from Keybridge rebutting WAM Active’s preliminary submissions.13 Among other things, Keybridge submitted that:

- “WAM seek to conflate, without explanation, the issues raised in Keybridge’s Applications with their own totally independent and spurious issues raised in [the] NSW Supreme Court”

- “It is not correct for WAM to assert, in an unqualified manner, that Keybridge transferred ~$5 million unsecured to an entity connected to Mr Bolton” and

- “WAM wrongly assert that ‘Keybridge has adduced no evidence’ to persuade the Panel to conduct proceedings. At least as between WAM and Ravell there is an uncontested and unwithdrawn declaration of association made under s671B of the Act (a strict liability obligation) before the Panel and on public record. Keybridge and the Panel are entitled to take this s671B notice as evidentiary fact and clear acceptance of an association between the parties, that, as the Keybridge Applications advance, is in contravention of the Act.”

Discussion

- We have considered all the material presented to us in coming to our decision, but only specifically address those things that we consider necessary to explain our reasoning.

Alleged association

- The Panel’s starting point for an association matter is that it is for the applicant to demonstrate a sufficient body of evidence of association and to convince the Panel as to that association, albeit with proper inferences being drawn (see Mount Gibson Iron Limited).14

- This test was discussed in Dragon Mining Limited:15

“We are conscious of the risk that some people may read this decision as signalling a raising of the ‘association hurdle’. This is not our intention. Our decision in this matter was based purely on the evidence that was submitted to us.

Dromana Estate Limited 01R acknowledges the difficulties that an applicant faces in gathering evidence in association matters. In deciding whether to conduct proceedings on an association case, this must be kept in mind. However, the Panel has limited investigatory powers which means, before we decide to conduct proceedings, an applicant must do more than make allegations of association and rely on us to substantiate them. An applicant must persuade us by the evidence it adduces that we should conduct proceedings.”

- Keybridge provided a substantial volume of text messages and emails exchanged between various of the Alleged Associates regarding Keybridge’s affairs, apparently obtained during the course of the WAM Proceedings. It submitted these materials were evidence of an association between the Alleged Associates in relation to the affairs of Keybridge. It also identified various indicia of association among the Alleged Associates, including structural links and common investments and directorships.16

- Apart from the potential association between WAM and Ravell Group which was disclosed “[f]or an abundance of caution”,17 we were not convinced that the association hurdle in Mount Gibson Iron Limited had been met between any or all of the other Alleged Associates in relation to the affairs of Keybridge. No evidence of a voting agreement was produced and no proper inference seems to be available since there is an obvious alternative motive for shareholder action, namely shareholders acting in their own interests given the WAM Proceedings.

- While the applications focused on associations in relation to Keybridge and the downstream effect on Benjamin Hornigold, a footnote in the applications stated that it “is reasonable for the Panel to infer that Glennon and Ravell are associates in the affairs of Keybridge and likely in the affairs of BHD”. As noted, we disagree as to a reasonable inference in relation to Keybridge. We agree with Mr Glennon and Glennon Small’s submission that “the operation of the association provisions in the Corporations Act do not have the effect that individuals acting collectively in relation to one entity (eg [Keybridge]) will mean that they are associates in relation to another entity (eg BHD)… the Application has provided no evidence to indicate that if any association as found in relation to [Keybridge’s] affairs, such association should be extended to operate in relation to BHD as well.”

- Accordingly, we also do not consider that the association hurdle in Mount Gibson Iron Limited has been met in relation to Benjamin Hornigold. It is not sufficient to simply assert that the association in relation to Benjamin Hornigold is “likely”. Probative direct evidence, or evidence on which proper inferences might be drawn, is needed. It has not been produced.

- We also considered whether correspondence involving WAM, Mr Wilson and Ravell Group (being the Alleged Associates owning shares in Keybridge) was explicable as examples of shareholder activism in relation to Keybridge that fell short of an association.

- In Aguia Resources Limited18 the Panel stated principles in relation to applications involving shareholder activism, building on ASIC Regulatory Guide 128. It said:

24 …the Panel will consider whether it is in the public interest (see s657A) to intervene in the context of a board spill. We consider the following factors are important to the approach the Panel takes to a board spill:

(a) The “fact that an application involves a proposal to reconstitute a board of directors does not take it outside the purview of the Panel. If, in the context of issues regarding the composition of a company's board, there is an accumulation or exercise of voting power possibly in contravention of s606, without proper disclosure under Chapter 6C or in otherwise unacceptable circumstances, those issues may be treated as control issues for the purposes of s657A.”

(b) In considering whether to conduct proceedings on the question of whether shareholders are associated in the context of a board spill, the Panel will apply its well-established principle that the applicant must demonstrate a sufficient body of evidence of association to convince the Panel as to that association, albeit with proper inferences being drawn. As a practical matter, it may be more difficult for an applicant to demonstrate a sufficient body of probative material where it is alleged that a large number of parties have recently commenced acting in concert.

(c) There may be more reason to be concerned if any alleged associates have acquired shares around the time of a s249D requisition.

(d) Even if the aggregate voting power of alleged associates is more than 20%, there is no contravention of s606 unless a person has acquired a relevant interest in shares through a transaction in relation to securities entered into by or on behalf of that person. In the context of a board spill, in the absence of any acquisitions of shares by alleged associates, the Panel will need to find that the alleged associates have acquired a relevant interest in each other's shares by entering into a relevant agreement to each vote their shares in favour of the resolutions at the requisitioned meeting.

(e) There may be less reason to be concerned if a requisition seeks to appoint directors who are independent from, or not aligned with, the alleged associates and there is no material to suggest that any alleged association is likely to continue after the board spill.

(f) There may be more reason to be concerned if there is material to suggest that any of the alleged associates had joint plans for the management of the company after the requisition meeting.

(g) A contravention of the substantial holding provisions alone can give rise to unacceptable circumstances. However, it may be less likely to be in the public interest to intervene in a board dispute and make a declaration of unacceptable circumstances on a contravention of the substantial holding provisions alone if it is not material or where the market is not misinformed.

(h) A delay in making an application in the context of a requisitioned meeting may increase the Panel’s reluctance to interfere with the legitimate right of shareholders to exercise voting rights.

- In those proceedings, the Panel made a declaration of unacceptable circumstances in relation to the affairs of Aguia Resources Limited, determining that shareholders had collaborated on a joint proposal concerning two requisitioned meetings. This included co-drafting and co-signing requisition notices and sharing strategic advice.

- Here, while there was some material potentially supportive of an inference of association – most notably WAM Active’s nomination of Mr Ravell as a director of Keybridge and their subsequent “abundance of caution” substantial holding notices – the material did not suggest an association of a similar nature to that in Aguia Resources Limited between any or all of the Alleged Associates in relation to either Keybridge or Benjamin Hornigold. The significance to be attributed to several text messages and emails exchanged between various of the Alleged Associates was not clearly explained by Keybridge. To the extent that explanations were provided, WAM Active, Mr Glennon, Glennon Small and Benjamin Hornigold denied those interpretations and offered credible alternative explanations.

- In addition, much of the correspondence involving the Alleged Associates, while relating to the affairs of Keybridge, appeared possibly explained as shareholder activism limited to an exchange of views or information regarding Keybridge and its governance – a plausible explanation in light of the WAM Proceedings.19 The correspondence did not point towards any joint plans for management of the company or identify any ‘downstream benefits’ sought in relation to Benjamin Hornigold. Furthermore, none of the Alleged Associates acquired any shares in Keybridge around the time of WAM Active’s section 249F notice.20

Alleged contravention of section 606

- Keybridge submitted that:

- WAM and Ravell had disclosed their association in Keybridge and that, as a result, “each of WAM and Ravell’s relevant interest in BHD has increased from below 20% to 29.43%” and

- “WAM and Ravell do not have a permissible exception under s611 of the Act to increase their relevant interest by this amount and by acting in concert have both contravened s606 of the Act”.21

- For a breach of section 606 to be established, there needs to be an acquisition of a relevant interest through a transaction in relation to securities. While we recognise that ‘entering into a transaction’ is broadly defined and can include entering into a relevant agreement in relation to securities, we considered it unlikely that we would find a breach of section 606. Keybridge did not provide any evidence to demonstrate the existence of an agreement, arrangement or understanding as to voting in either Keybridge or Benjamin Hornigold between any of the Alleged Associates, including between WAM and Ravell Group.22

- Keybridge submitted that the “acquisition of interests in BHD by Ravell, Wilson, Glennon, Glennon Small and WAM result in a material change in interests in BHD and are inconsistent with s602 of the Act and do not meet the requirements for a s611 item 14 exemption”. Keybridge did not explain why item 14 of section 611 would not apply, simply stating (as noted) that WAM and Ravell Group did “not have a permissible exception”. Even if the increase in voting power of these parties was the result of an acquisition, which is itself an open question, item 14 of section 611 would seem to apply on its terms.23

- Further, even if there was an increase in voting power as a result of an acquisition, we do not consider it likely that we would find any such acquisition to be contrary to section 602 principles, as we do not consider that it would have a material effect on control of Benjamin Hornigold.

- Finally, we note that Keybridge’s applications referred to an acquisition by Ravell Group of 567,100 shares in Benjamin Hornigold (approximately 2.35%) on 20 November 2024. However, Keybridge did not submit that this acquisition contravened of section 606. In any event, for the reasons outlined in paragraphs 33 to 43, we were not convinced that the association hurdle in Mount Gibson Iron Limited had been met between Ravell Group and any of the other Alleged Associates in relation to the affairs of Keybridge or Benjamin Hornigold, either before or after this acquisition.24

Court proceedings

- Paragraph 4.6(b) of the Panel’s Procedural Guidelines sets out the factors the Panel considers in deciding whether to conduct proceedings, which include “whether the circumstances are the subject of court proceedings”. The Panel will generally not commence proceedings on an issue on which the Court has jurisdiction and a party has already commenced proceedings.25 Consistent with the public interest (see discussion below), the Panel seeks to avoid duplicative proceedings.26

- In this instance, the circumstances outlined in Keybridge’s applications substantially overlap with matters in current Injunctive Relief Proceedings before the Supreme Court of New South Wales (including various issues relating to Chapter 6) and form part of a broader dispute between Keybridge and WAM Active. In our view, the Panel should apply a cautious approach to making orders which may have consequences in relation to litigation on foot. In any event, the Supreme Court of New South Wales is better placed to deal with the circumstances outlined in the applications as part of the Injunctive Relief proceedings. As we discuss in more detail below, the Panel was established to stop tactical litigation, and it appears that it is being used as part of a broader dispute between the parties. Accordingly, it would not be in the public interest to pick up one small aspect of this broader dispute and make a declaration and orders.

Public interest

- Subsection 657A(2) states that: “The Panel may only make a declaration under this subsection, or only decline to make a declaration under this subsection, if it considers that doing so is not against the public interest after taking into account any policy considerations that the Panel considers relevant.” The Panel has previously declined to conduct proceedings on the basis that it was not satisfied that it would be in the public interest to make a declaration of unacceptable circumstances,27 including in association cases.

- For example, in Caravel Minerals Limited,28 the Panel considered that the following public interest considerations weighed against making a declaration of unacceptable circumstances on the basis of an association:

- any association was not likely to contravene section 606 and the names of the requisitioning shareholders were already in the public domain. The Panel said “we are concerned that prolonging proceedings to further investigate a potential association among the MRG related shareholders, in circumstances where we consider it unlikely that we would make an order for disclosure, would require Caravel and the other parties to incur further legal costs and diminish Caravel's limited cash reserves”

- there was a concurrent court action, with the Panel noting that “there is no reason why the matters raised (and especially the Chapter 6C matters) cannot be addressed by a court” and

- the section 249D notice and the Panel application were two out of a series of actions between Caravel and one or more of the requisitioning shareholders.

- The Panel in Caravel Minerals Limited concluded (at [56]):

“We do not consider it appropriate in these circumstances to unduly interfere (by prolonging these proceedings) with the proper functioning of a statutorily requisitioned meeting and shareholders’ opportunity to consider the replacement of the Caravel directors if they see fit.”

- The considerations discussed above in relation to Caravel Minerals Limited also apply here.

- In the circumstances of this matter, we consider that it is likely not to be in the public interest to make a declaration of unacceptable circumstances, assuming association and a contravention of section 606, also for the following reasons:

- As noted, the circumstances outlined in the applications substantially overlap with matters in the Injunctive Relief Proceedings and form part of a broader dispute between Keybridge and WAM. We do not think it is appropriate in this case to adjudicate on an isolated aspect of the broader conflict.29

- Parliament’s intention in introducing the Corporate Law Economic Reform Program Act 1999 (Cth) was to reduce the incidence of tactical litigation in takeovers.30 Having regard to paragraph (a), and the fact that Keybridge submitted its applications one day after WAM Active filed an interlocutory process in the Injunctive Relief Proceedings, conducting proceedings on Keybridge’s applications appears at odds with this intent. The Panel’s role is to resolve material disputes, not to accommodate procedural manoeuvring.31

- In our view, the applications had an element of artificiality, as Keybridge alleged an association in relation to its own affairs, purportedly resulting in an unspecified downstream effect and a breach of section 606 in relation to Benjamin Hornigold – without explaining why item 14 of section 611 would not apply – yet sought to remedy this through orders affecting Keybridge itself.

- Any potential contraventions of section 671B arising from the alleged circumstances are, in our view, unlikely to have a material effect on the outcome of the S249F Meeting.32 WAM and Ravell Group have already disclosed their potential combined voting power in relation to Keybridge, and neither Mr Glennon nor Glennon Small holds any shares in Keybridge. Therefore, any undisclosed association involving Mr Glennon or Glennon Small in relation to Keybridge would not increase the already disclosed combined voting power of Ravell Group and WAM. In addition, holders of the majority of Keybridge shares should already be aware of these issues as a result of the applications, if they were not before.

Alleged contraventions of section 177

- As noted above, Keybridge submitted that “WAM provided a copy of a Keybridge register (that it had formerly obtained under s173 of the Act) to Ravell in contravention of s177(1)(b) of the Act to Ravell” and in contravention of section 177(1)(a), Mr Ravell then “utilised [the Keybridge register] – without the knowledge or consent of Keybridge – to write to Keybridge shareholders.” In their preliminary submissions (also noted above), WAM submitted that it had never shared a copy of the Keybridge register with Mr Ravell and Benjamin Hornigold submitted that Mr Ravell inspected the Keybridge register himself (rather than obtaining it from WAM), and in any event, the “accusations in the Application regarding alleged uses by Mr Ravell of the Keybridge share register ignore the existence of s 177(1A)”.

- Having already decided that there is no reasonable prospect that we would declare the circumstances unacceptable, we do not consider that it is necessary to consider this issue and come to a decision on it, including whether it is even a matter for the Panel, although at first blush the allegation does not seem to amount to much.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances in relation to the affairs of Keybridge or Benjamin Hornigold. Accordingly, we have decided not to conduct proceedings in relation to both applications under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Rebecca Maslen-Stannage

President of the sitting Panel

Decision dated 31 January 2025

Reasons given to parties 25 February 2025

Reasons published 4 March 2025

Advisers

| Party | Advisers |

|---|---|

| Keybridge Capital Limited | - |

| Benjamin Hornigold Ltd | W Advisers |

| WAM Active Limited | Mills Oakley |

| Mr Michael Glennon and Glennon Small Companies Limited | Corrs Chambers Westgarth |

1 On 9 February 2025, Keybridge Capital Limited voluntarily appointed an administrator

2 As submitted by the applicant. In its substantial holder notice dated 18 August 2021, WAM disclosed a voting power of 45.45%, though we note that BHD submits that “Keybridge’s holdings in BHD may be substantially lower than what Keybridge has publicly disclosed”

3 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth) and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

4 Though we note Ravell Group’s notice did not identify all the Ravell Group entities, only Mr Ravell and S4 Super Fund Pty Ltd as trustee for S4 Super Fund

5 Ibid

6 We note this reference to ‘4,733,06’ was an error and should have been ‘4,733,064’

7 On 4 February 2025 (after we had made and communicated our decision in this matter), the meeting was rescheduled to 18 February 2025

8 Mr Bolton is the Chief Executive Officer and Managing Director of Keybridge. According to Mr Bolton’s most recent Appendix 3Y – Change of Director’s Interest Notice, disclosed to ASX on 17 October 2022, he held a relevant interest in 10,693,898 Keybridge shares (approximately 5.15%)

9 Mr Catalano is a non-executive director of Keybridge. According to Mr Catalano’s most recent Appendix 3Y – Change of Director’s Interest Notice, disclosed to ASX on 30 September 2020, he held a relevant interest in 22,324,631 Keybridge shares (approximately 10.77%)

10 Keybridge did not explicitly allege an association in relation to the affairs of BHD, only Keybridge

11 Due to the operation of section 608(3)

12 Section 177(1A) relevantly provides that section 177(1) does not apply if the use or disclosure of the information is relevant to the holding of the interests recorded in the register or the exercise of the rights attaching to them

13 See Rule 20(1) of the Takeovers Panel Procedural Rules 2020

14 [2008] ATP 4 at [15]

15 [2014] ATP 5 at [59]-[60], footnotes omitted

16 See for example the common directorships and structural links in the diagram under paragraph 9

17 See paragraphs 11 and 12

18 [2019] ATP 13 at [24] (footnotes omitted)

19 See paragraph 24(c)

20 However, see paragraph 48 in relation to the acquisition of shares in Benjamin Hornigold by Ravell Group on 20 November 2024

21 Keybridge did not submit that there had been any breach of section 606 in relation to Keybridge shares

22 See also ASIC Regulatory Guide 128 at [29]: “It can sometimes be important when analysing the legal position to understand that a person does not automatically have a relevant interest in all the shares or interests in which an associate has a relevant interest”

23 If we had conducted proceedings, we would have explored this issue further

24 For completeness, we also note that this acquisition occurred 2 months and 1 day before the application was made. Therefore, we would have had to consider whether or not to extend time under section 657C(3)(b)

25 See Richfield Group Limited [2003] ATP 41 at [9]

26 Lantern Hotel Group [2014] ATP 6 at [16]

27 See for example Keybridge Capital Limited 02 [2019] ATP 19 at [16]

28 [2018] ATP 8 at [52] to [54]

29 See for example LV Living Limited [2005] ATP 5 at [55]-[56]

30 Corporate Law Economic Reform Program Bill 1999, Explanatory Memorandum, at [3.44]

31 Taipan Resources NL 07 [2000] ATP 18 at [54]-[55]

32 Noting that “A contravention of the substantial holding provisions alone can give rise to unacceptable circumstances. However, it may be less likely to be in the public interest to intervene in a board dispute and make a declaration of unacceptable circumstances on a contravention of the substantial holding provisions alone if it is not material or where the market is not misinformed” (per Aguia Resources Limited [2019] ATP 13 at [24(g)], citing Caravel Minerals Limited [2018] ATP 8 at [50] and Auris Minerals Limited [2018] ATP 7 at [23]‑[24]). See also Keybridge Capital Limited 02 [2019] ATP 19 at [16(b)]