[2025] ATP 2

Catchwords:

Decline to conduct proceedings – association – timely application – extend time for making application – board spill – collective action

Corporations Act 2001 (Cth), sections 249D, 657A, 657C(3)(a), 657C(3)(b), 657D

Foreign Acquisitions and Takeovers Act 1975 (Cth), section 130

Takeovers Panel Procedural Rules 2020, rule 11(1)

Takeovers Panel Procedural Guidelines 2020, 4.6, 10.8(d)

ASIC Regulatory Guide 128: Collective action by investors

Global Lithium Resources Limited v Sincerity Development Pty Ltd [No 2] [2024] WASC 443, Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68

Tissue Repair Ltd [2024] ATP 20, Webcentral Group Limited 03 [2021] ATP 4, Aguia Resources Limited [2019] ATP 13, Caravel Minerals Limited [2018] ATP 8, Innate Immunotherapeutics Limited [2017] ATP 2, Sovereign Gold Company Limited [2016] ATP 12, Midwest Corporation Limited 02 [2008] ATP 15, Mount Gibson Iron Limited [2008] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Alberto Colla, Louise Higgins and Christian Johnston (sitting President), declined to conduct proceedings in relation to the affairs of Global Lithium Resources Limited. The application concerned an alleged undisclosed association, from at least February 2024, between certain Global Lithium shareholders holding approximately 30–40% in the context of an annual general meeting to be held on 13 February 2025. At the meeting, resolutions concerning the composition of the board are to be considered. The Panel considered that the application was not timely. Further, the Panel considered that an extension of time was needed in order to make the application and there was no reasonable prospect that it would exercise its discretion to extend time. Accordingly, it considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- AGM

- has the meaning given in paragraph 31

- Alleged Associates

- Canmax, Dr Dianmin Chen, Drock, Chen DM, Sincerity, Mr Liaoliang (Leon) Zhu, Ms Yongfang Guo, Ms Chi Fan Siu, United and Seah

- Canmax

- Canmax Technology Co Ltd (Stock Code 300390 CN)

- Chen DM

- Chen DM Pty Ltd

- Chen Group

- Dr Dianmin Chen, Chen DM, Drock

- Confidential Annexures

- has the meaning given in paragraph 112

- Drock

- Drock International Pty Ltd

- FATA

- Foreign Acquisitions and Takeovers Act 1975 (Cth)

- GL1

- has the meaning given in paragraph 3

- Manna Project

- has the meaning given in paragraph 15

- Seah

- CL Seah Holding Pty Ltd

- Sincerity

- Sincerity Development Pty Ltd

- United

- United Funds Pty Ltd

Facts

- Global Lithium Resources Limited (ASX code: GL1) (GL1) is an ASX-listed lithium exploration company. It has 261,732,123 voting shares on issue. Its current directors are:

- Mr Ronald Mitchell (executive chairman)

- Dr Dianmin Chen (non-executive director) and

- Mr Matthew Allen (non-executive director).

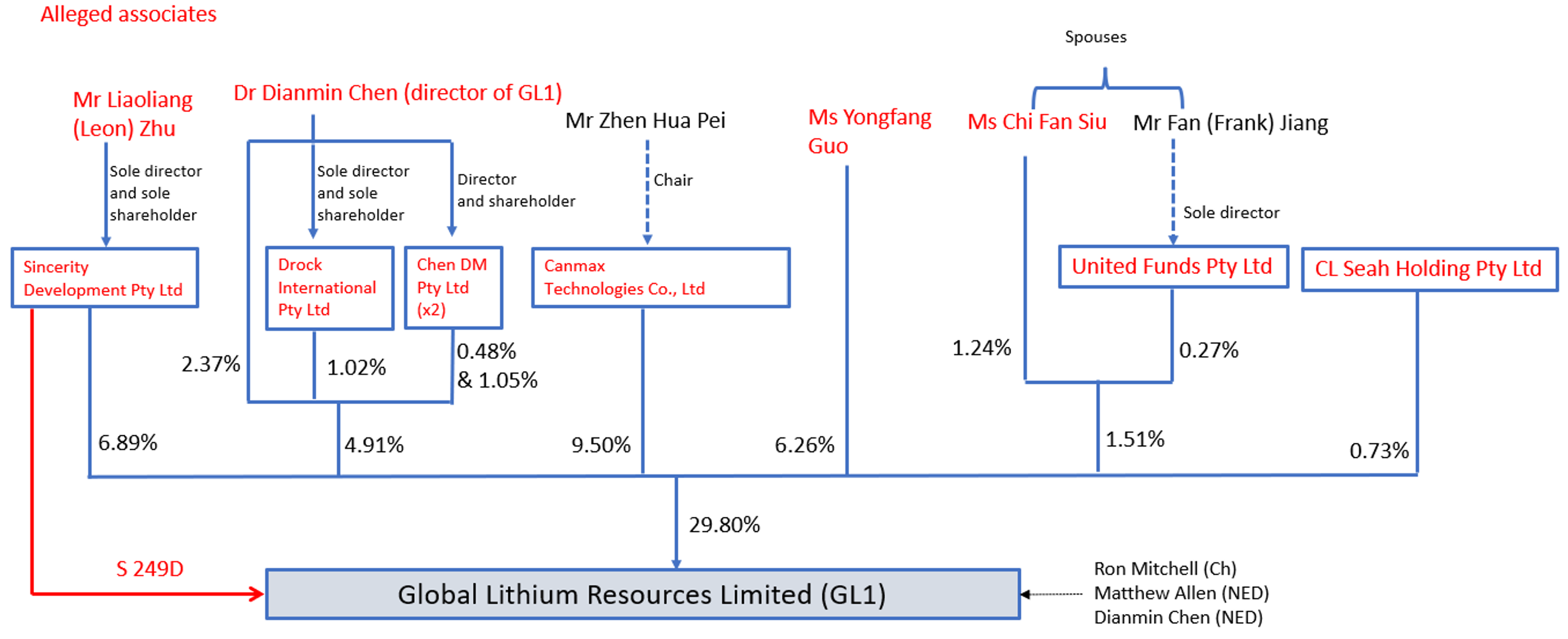

- Chen Group have a relevant interest in 12,853,297 GL1 shares (approximately 4.91% of the issued voting shares).

- Sincerity is an Australian property development company. It has a relevant interest in 18,023,984 GL1 shares (approximately 6.89% of the issued voting shares). Its sole director and shareholder is Mr Liaoliang (Leon) Zhu.

- Canmax is a Chinese entity involved in downstream battery materials production in China. It has a relevant interest in 24,858,189 GL1 shares (approximately 9.50% of the issued voting shares).1 Its chairman is Mr Zhen Hua Pei.

- Ms Yongfang Guo has a relevant interest in 16,378,000 GL1 shares (approximately 6.26% of the issued voting shares) which she holds directly.

- Ms Chi Fan Siu has a relevant interest in 3,238,875 GL1 shares (approximately 1.24% of the issued voting shares) which she holds directly.

- United has a relevant interest in 701,011 GL1 shares (approximately 0.268% of the issued voting shares). Its sole director is Mr Fan (Frank) Jiang, who is the husband of Ms Chi Fan Siu.

- Seah has a relevant interest in 1,907,163 GL1 shares (approximately 0.73% of the issued voting shares) which it holds directly.

- Relevant current shareholdings in GL1, in diagrammatic form, are as follows:

- GL1 was incorporated on 11 May 2018. Shortly thereafter Dr Chen was appointed a director. On 6 May 2021, GL1 listed on the ASX2. Upon listing, GL1’s top 20 shareholders included:

Shareholder Number of shares Percentage3 Ms Guo 16,000,000 12.14% Goldenstar Energy Pty Ltd 14,475,002 10.98% Chen Group 9,116,667 6.92% Bright Element Pty Ltd 5,333,334 4.05% Seah 2,666,667 2.02% United 1,692,500 1.28% - On 23 December 2021, Canmax, having participated in a placement, became a shareholder in GL1 with an initial shareholding of 16,699,794 GL1 shares (approximately 9.90%4).

- On 3 March 2022, GL1 and Canmax entered into a 10-year Spodumene Concentrate Offtake Agreement under which Canmax would initially take delivery of no less than 30% of available product from GL1’s operations.

- By 15 November 2022, GL1 had acquired the Manna Lithium Project (Manna Project) and at around that time Canmax subscribed for additional shares to maintain its interest in GL1. Since then, the lithium spodumene prices have fallen significantly.

- In around August 2023, Mr Ron Mitchell discussed with Dr Chen making a business trip to China to meet with representatives of Canmax, and in particular Mr Pei (Canmax Chairman), to discuss the status of the Manna Project, the Offtake Agreement, the potential provision of project funding by Canmax and potential fast-tracking of production of spodumene ore concentrate.

- At 5 October 2023, GL1 had 259,860,699 voting shares on issue and its board comprised:

- Mr Geoffrey Jones (chairman)

- Mr Mitchell

- Dr Chen

- Mr Gregory Lilleyman and

- Ms Hayley Lawrance.

- Between 9 and 14 October 2023, representatives of GL1 met with representatives of Canmax in Sichuan Province in China. The attendees at the meetings included Mr Mitchell, Dr Chen and Mr Pei along with a number of GL1 shareholder representatives invited by Dr Chen including Mr Zhu, Ms Guo and Dr Xiaoxuan (David) Sun. During one of the meetings, Mr Mitchell presented a project update to Canmax regarding the Manna Project. After the update, Mr Zhu said words to the effect that the Manna Project must meet Mr Pei’s requirements regarding operating costs and schedule targets.

- Between 12 and 15 January 2024, Goldenstar Energy Pty Ltd sold down its interest in GL1 shares via off-market transactions including as follows:

Shareholder acquiring Number of shares acquired Sincerity 5,040,000 Ms Siu 1,200,000 Seah 250,000 Chen DM 250,000 - On 16 January 2024, Mr Zhu sent an email to Mr Mitchell stating (among other things) “[a]s shareholders, we already try our best to purchase the shares from Golden star to reduce the impact to the market [price]”.

- On 25 January 2024, Mr Zhu sent an email to Mr Mitchell and Mr Allen referring to a meeting the three of them had had that morning and setting out various views relating to GL1’s priorities including how to improve its share price, which he described as “[j]ust my personal and also combine with some other shareholder’s view”, and stating (among other things):

- “I spoke to our other big shareholders – they are all very confident about GL1 – same as me – we will continue to support GL1 for all the future potential”.

- “And also I will try to tell more shareholders from my side – to calm them down – have more patient and support to GL1”.

- On or about 5 February 2024, Canmax approached GL1 expressing an intention to increase its shareholding to 14.7%.

- Between February and July 2024, Mr Zhu sent a considerable number of emails to GL1’s board members and others detailing discussions he had had with various shareholders, including Mr Pei, holding up to 40% of GL1, concerning the future affairs of GL1.

- On 10 May 2024, Bright Element Pty Ltd sold its interest in GL1 including as follows:

Shareholder acquiring Number of shares acquired Dr Chen 1,900,000 Sincerity 2,000,000 - On 18 June 2024, Sincerity acquired a further 2,783,984 GL1 shares.

- On 9 July 2024, Mr Jones resigned as Chairman of GL1. Mr Mitchell was appointed as Executive Chairman and Dr Chen was appointed as Executive Director.

- In July and August 2024, Mr Zhu sent further messages and held meetings regarding the affairs of GL1.

- On 20 August 2024, GL1 received a section 203D5 notice by Sincerity giving notice of its intention to move a resolution that Ms Lawrence and Mr Lilleyman be removed as directors of GL1.

- On 21 August 2024, GL1 received a section 249D notice6 by Sincerity proposing that:

- Ms Lawrence [sic] be removed as a director of GL1

- Mr Lilleyman be removed as a director of GL1

- Mr Zhu be appointed as a director of GL1 and

- the number of directors of GL1 be a maximum of 3.

- On the same day Dr Chen emailed the other GL1 board members (and its company secretary) stating (among other things) that, based on his “very good understanding of the share register and the sentiments of many of the unhappy shareholders”, he believed that ”it is highly likely, almost certain, that valid s249D notices with resolutions to remove the relevant directors will succeed.“ He sought “an amicable separation”.

- On 10 September 2024, GL1 released an ASX announcement titled ‘GL1 Corporate Update’ which stated (among other things) that Mr Lilleyman and Ms Lawrance had advised of their intention to resign at completion of GL1’s annual general meeting (AGM), that Dr Chen would return to a Non-Executive Director role and that Mr Allen had been appointed as Executive Director Finance.

- On 11 September 2024, GL1 applied to the Supreme Court of Western Australia for the section 249D resolutions to be held over to its AGM. The Court ordered the section 249D resolutions to be dealt with at the AGM on or before 20 November 2024.

- On 14 October 2024, GL1 made a confidential report to the Department of Treasury regarding potential contraventions of the FATA.

- On 18 October 2024, GL1 issued a Notice of AGM. The Notice of AGM stated (among other things) “The Directors, other than Dr Chen, recommend that you vote FOR Resolution 2 (Election of Director – Matthew Allen) and vote AGAINST Resolution 3 (Appointment of Director – Liaoliang Zhu). All Directors recommend that you vote AGAINST Resolution 5 (Approval to reduce the maximum number of Directors to 3).”

- On 4 November 2024, GL1 issued an Addendum to its Notice of AGM to include a resolution for Dr Xiaoxuan (‘David’) Sun to be a director7 stating “[t]he Directors make no recommendation to shareholders and will leave it to shareholders to determine the appointment or otherwise with respect to Resolution 9”.

- On 5 November 2024, Sincerity sent a letter to GL1 shareholders. Among other things it set out how Mr Zhu intended to vote in relation to the AGM resolutions:

-

“Resolution 2: Election of Director Matthew Allen

Vote: AGAINST. My vote AGAINST Matt Allen is related to my concern about costs. His role as Executive Director for Finance is completely unnecessary for an exploration and development company at this stage, causing unnecessary financial and staffing expenses.”

-

“Resolution 4: Appointment [sic] of Director – Dr Dianmin Chen

Vote: FOR. Dr Chen is a founding Director of GL1 and a mining engineer with more than 35 years’ experience in the mining and metals industry. He has been actively involved in the Manna DFS.”

-

“Resolution 5: Approval to reduce the maximum number of Directors to 3

Vote: OPEN. In relation to my resolution to reduce the maximum number of Directors to three, my intention was for this to support the lowering of overall personnel costs for an interim period only, not a permanent restriction.”

-

“Resolution 9: Appointment of Director – Dr Xiaoxuan (David) Sun

Vote: OPEN. While I am familiar with the other candidates up for election, I feel I am not qualified to advise shareholders on how to vote for Dr Sun, so leave this to your discretion.”

-

- On 13 November 2024, Mr Zhu sought to fill the casual vacancy on GL1’s board by the resignation of Ms Lawrance and Mr Lilleyman.

- On 19 November 2024, GL1 released an ASX announcement stating (among other things) that the Supreme Court of Western Australia had deferred GL1’s AGM to a date on or before 14 February 2025.

- On 13 January 2025, GL1 issued a Revised Notice of AGM and Proxy Form in relation to a rescheduled AGM to be held on 4.00pm (WST) on 13 February 2025. The notice included a revised statement regarding the directors’ recommendations as follows:

“The Directors, other than Dr Chen, recommend that you vote FOR Resolution 2 (Election of Director – Mr Allen) and vote AGAINST Resolution 3 (Appointment of Director – Mr Zhu) and vote AGAINST Resolution 4 (Re-election of Dr Chen). All Directors recommend that you vote AGAINST Resolution 5 (Approval to reduce the maximum number of Directors to 3). All Directors, other than Dr Chen, recommend that you vote AGAINST Resolution 9 (Election of Dr Sun).”

Application

- By application dated 9 January 2025, GL1 sought a declaration of unacceptable circumstances alleging in effect that there was a continuing association between the Alleged Associates since at least February 2024 to:

- attempt to obtain board control of GL1 (by securing a majority of board positions)

- obtain operational control for management of the affairs of GL1 and

- cause GL1 to act uncommercially to progress actions and expenditure to complete a definitive feasibility study on the Manna Project.

- GL1 also alleged that:

- the continuing alleged association was undisclosed

- by the formation of a relevant agreement, each of the Alleged Associates had contravened s 606(1) and

- each of the Alleged Associates had contravened s 671B by failing to give substantial holder notices.

- It submitted that the circumstances were unacceptable, including because:

- “of the likely effect on control of GL1, particularly in the absence of disclosure of the association between the [Alleged Associates]

- the intended change of control of GL1 will not be occurring in an efficient, competitive and informed market, and that no premium has been paid for taking control; and

- there have been contraventions of Chapters 6 and 6C.”

- It submitted that the effect of the unacceptable circumstances was that “[t]he potential re-election of Dianmin Chen and the election of Leon Zhu, as a director, would likely lead to the board being controlled:

- by a group of undisclosed associates without a transparent control transaction or an informed market voting on the proposed resolutions; and

- with plans or intentions for management of the affairs of [GL1], which do not appear to be in the best interests of [GL1] and its members as a whole.”

Interim orders sought

- GL1 did not seek interim orders.

Final orders sought

- GL1 sought final orders, including to the following effect:

- 30.03% of GL1 shares acquired by the Alleged Associates be vested for sale by ASIC within 18 months or

- alternatively,

- voting, acquisition, requisitioning and nominating restrictions be imposed for 3 years (alternatively for 18 months)

- substantial holder notices, reflecting their relevant interest in each of the shares, be provided

- failing the above, the shares of an Alleged Associate who does not comply be vested for sale

- GL1 appoint at least two independent directors to its board and

- the Alleged Associates pay the indemnity costs of the Applicant in the Panel proceedings.

Discussion

- We have considered all the materials but address specifically only those we consider necessary to explain our reasoning.

- GL1 puts its case in this way. The Alleged Associates hold in total approximately 30.03% as follows: 8

- Canmax with 9.54%

- Sincerity with 6.93%

- Chen Group with 4.93%

- Ms Guo with 6.29%

- Ms Siu and United with 1.605% and

- Seah with 0.73%.

- GL1 noted two other relevant proceedings or processes:

- the Supreme Court of Western Australia had made orders to allow the section 249D resolutions to be put at the AGM and extended the time for holding that meeting to a date no later than 14 February 2025 and

- the directors of GL1 (other than Dr Chen) had made a report to the Department of Treasury raising concerns as to potential breaches of the FATA.

- GL1 relied on 4 “distinct unacceptable circumstances” in support of its application:

- “First, the [Alleged Associates] acting to obtain control of GL1 by securing a majority of positions on the board so as to obtain operational control of the affairs of GL1 and to use such control to engage in uncommercial behaviours.

- Secondly, the failure of the [Alleged Associates] to disclose their association for the purpose of securing control of the board and to cause GL1 to act uncommercially.

- Thirdly, each of the [Alleged Associates] having interests in the voting power in each other Associate’s shares in contravention of s 606(1).

- Fourthly, each of the [Alleged Associates] failing to give substantial holder notices as to their voting power in each other Associate’s shares in contravention of s 671B.”

- The applicant submitted that the association had existed since at least February 2024. This was said to be because the Alleged Associates had agreed to act, or otherwise have acted, in concert for the purpose of controlling or influencing the composition of GL1’s board and affairs.

- The evidence of this, it was submitted, included emails and text messages that Mr Zhu had an understanding with, or was acting in concert with, Mr Pei (Canmax), Dr Chen and the other Alleged Associates in seeking to obtain control of the board of GL1 and implementing a plan for the management of the affairs of GL1.

- It appears that the evidence also included that various of the Alleged Associates were increasing their holdings from October 2023.

- Moreover, GL1 submitted that proxies indicated “a strong pattern of voting for election of Mr Zhu as a director, against Mr Allen as a director, for the re-election of Dr Chen as a director and against other resolutions concerning Mr Mitchell’s remuneration.”

- Also, GL1 submitted that two of the Alleged Associates seemed to have lodged proxies utilising the same Internet Protocol (IP) address.

- Lastly, GL1 submitted that there was “comprehensive documentary evidence as across the [Alleged Associates], and numerous other shareholders with structural links and common investments and dealings, for which association can be inferred with confidence.”

Preliminary submission

- We received a preliminary submission from Mr Zhu and Sincerity. They submitted that:

- The evidence supporting the application does not disclose an association, understanding or persons acting in common and

- The Panel does not have evidence of a cogent nature sufficient to draw inferences of association.

- They also submitted that the sequence of events demonstrated transparent and consistent actions taken by Mr Zhu, on behalf of Sincerity, as a prudent shareholder concerned with board performance and share price.

- In particular they submitted:

- on 5 July 2024, Mr Mitchell asked Mr Zhu to speak to other shareholders to see if they shared his view that Mr Jones should resign and

- on 8 July 2024, at a dinner, Mr Mitchell told Mr Zhu, that Mr Lilleyman and Ms Lawrence would resign from the board if Dr Chen became the chairperson.

- These meetings were not mentioned in the application.

Preliminary questions

- At the outset, we had concerns in relation to the timing of the application, noting that key events in the chronology such as the provision of Sincerity’s section 249D notice on 21 August 2024 had occurred quite some time ago (see further below). GL1 did not include in the application an explanation for why it had waited until 9 January 2025, a little over a month before the scheduled AGM, to bring the application. GL1 also did not include in its application a request for an extension of time for the purposes of section 657C(3)(b), stating that “[a]s the circumstances which are unacceptable involve a continuing association for the intended change of control of the board of GL1 through the AGM set for no later than 14 February 2025 and future implementation for a plan in the management of its affairs, upon the obtaining of board control, the unacceptable circumstances are continuing, and the application is within time.”

- Moreover, there were potentially two other forums that had been, or were, involved in the matter:

- the Supreme Court of Western Australia, which was significantly more advanced in understanding the material than the Panel at that stage and

- the Department of Treasury to whom a complaint had been made in October 2024.

- In view principally of the timing of the application, we decided to ask some preliminary questions of the parties.

- In short, we asked:

- Whether the Supreme Court of Western Australia was better placed to investigate the applicant’s allegations as GL1 had already referred to concerns regarding a potential association as part of its application to align the section 249D with the AGM?

- Whether the Foreign Investment Division of the Department of Treasury was equally or better placed than the Panel to investigate issues relating to the alleged association as it had been apprised of the matter since 14 October 2024?

- Whether we should grant an extension of time for making the application under section 657C(3) to include any of the circumstances in the application for which that is, or may be, required?9

- Related to (c), why GL1 had waited until 9 January 2025 to lodge its application.

- Lastly, having received a preliminary submission from Mr Zhu, we asked him for documentary details of his preliminary submission and GL1 to comment on the accuracy of the submission. While this is not usually undertaken at this stage, we were concerned that there may have been discussions that were omitted from the application which cast a different light on matters.

- We received responses from Dr Chen, Mr Zhu and Sincerity and GL1.10

- Dr Chen responded, among other things, that the Supreme Court was unlikely to be able to deal with the matter in time for the AGM, the Foreign Investment Division of Treasury was better placed than the Panel to investigate the issues, GL1 had “delayed unjustifiably in making the application” and the Panel should not extend time.

- He also said “[t]he delay in bringing the application has compressed the time available to the parties to the application to consider and respond to the applicant’s allegations, which are supported by voluminous material and have potentially very serious consequences.”

- Mr Zhu and Sincerity responded, among other things, that GL1’s “conduct in not only reporting matters to the Treasury, but now also to the Takeovers Panel whilst proceedings remain on foot in the Supreme Court of WA with liberty to apply is akin to jurisdiction shopping…”. They said the Panel ought not proceed in light of the referral already made to Treasury. They also, in response to our preliminary question, provided some evidence in support of their preliminary submission and further submitted that Mr Mitchell “orchestrated circumstances where he was elected to be the Chairperson and it appears that he then blamed Mr Zhu.”

- GL1 responded, among other things, that the Panel as a specialist statutory body had all the proper parties before it in properly constituted proceedings and the Supreme Court was not better placed to consider the application,11 and Treasury was not equally or better placed as it operated under a different statute with different legal tests and a different statutory objective. GL1 further said that it could not provide the correspondence with Treasury by reason of the statutory prohibition in section 130 of FATA12 although it had no objection to the Panel making a request.

- GL1 also said that the unacceptable circumstances “are continuing and still occurring such that the time limit in s657C(3)(a) has not been reached. Only upon the cessation of those circumstances does the 2 month time limit in s657C(3)(a) start to run and apply, such that there is a window within which an application under s657A must be made, unless a longer period is determined by the Panel under s657C(3)(b).”

- Further, GL1 said that it did not ‘wait’ to lodge its application, in the sense that it “was lodged at the earliest opportunity.” It had, it said, “neither rushed … nor dithered…”.

- As to applying for an extension of time, GL1 made detailed arguments why the circumstances were continuing, then said “[i]f, contrary to GL1’s primary submission, the Panel was to form the view that an extension of time was required then such an extension should be granted, noting that it is the usual course in association matters, and for good reasons, for the question of extension to be determined as part of the final determination of the matter.”

- GL1 accepted that Mr Mitchell spoke to Mr Zhu on 5 July 2024 regarding Mr Jones but denied asking Mr Zhu to speak to other shareholders. GL1 denied that Mr Mitchell attended a dinner with Mr Zhu on 8 July 2024, but said they met for a drink.

Decision not to conduct proceedings

- The matters the Panel generally considers in deciding whether to conduct proceedings are set out in the Panel’s Procedural Guidelines.13 Relevantly they include:

- whether the claims would give rise to unacceptable circumstances if established, or in other words a consideration of the apparent strength of the evidence

- whether the circumstances are the subject of court proceedings. If so, the question becomes whether the Panel should defer to it.14 In this case, there is also another forum – the Foreign Investment Review Board – that has been involved and

- whether the application is out of time and, if not, whether it is timely.

- We address each of these issues below, in no order of importance.

Strength of the evidence

- Despite the volume of material supplied, we had some concerns as to whether the application met the hurdle test15 for conducting proceedings in an association matter. While we did not ultimately need to reach a concluded view on this having regard to the bases for our decision to decline to conduct proceedings, we considered the hurdle test to be relevant to our assessment of whether the application made credible allegations of clear and serious unacceptable circumstances, being one of the factors relevant to whether the Panel’s discretion to extend time under section 657C(3)(b) should be exercised (discussed below).

- The application itself, in the details section, was about 20 pages long. Given the application sought to address a complicated association of 10 persons, we did not consider that this exceeded reasonable bounds. However, the annexures to the application ran to over 2,300 pages. Many seemed at best only inferentially relevant.

- Moreover, Schedules 1 and 2 in the application itself identified a significant number of other persons whose roles were not clearly explained. The existence of those Schedules raised concerns that the allegations of association may extend the number of alleged associates far beyond the original 10. This concern was raised because the applicant named Schedule 1 “Key persons and entities list” - although why they were “key” was not addressed. And in Schedule 2 the applicant tabulated the numerous shareholders listed there (exceeding the original 10) against indicia of association such as structural links and common voting patterns.

- Certainly, there are indicia of association identified in the application. These included various structural links between the Alleged Associates (or some of them), acquisition of shares in GL1 and certain behaviour, particularly on the part of Mr Zhu, that warranted explanation, pointing to a picture of coordination, such as the statement “I have relationships with local and foreign investors and will use these contacts to grow the company” in the Sincerity letter to shareholders dated 11 September 2024 in support of the section 249D requisition.

- However, the more we examined the material the less certain we became that the hurdle test for association cases had been met. We also considered whether the Alleged Associates’ activities were explicable as examples of shareholder activism that fell short of association. In our view, much appeared possibly explained as shareholder activism.

- In Aguia Resources16 the Panel stated principles in relation to applications involving shareholder activism, building on ASIC’s RG 128.17 It said (footnotes omitted):

“24 ….the Panel will consider whether it is in the public interest (see s657A) to intervene in the context of a board spill. We consider the following factors are important to the approach the Panel takes to a board spill:

- The ‘fact that an application involves a proposal to reconstitute a board of directors does not take it outside the purview of the Panel. If, in the context of issues regarding the composition of a company’s board, there is an accumulation or exercise of voting power possibly in contravention of s606, without proper disclosure under Chapter 6C or in otherwise unacceptable circumstances, those issues may be treated as control issues for the purposes of s657A.’

- In considering whether to conduct proceedings on the question of whether shareholders are associated in the context of a board spill, the Panel will apply its well-established principle that the applicant must demonstrate a sufficient body of evidence of association to convince the Panel as to that association, albeit with proper inferences being drawn. As a practical matter, it may be more difficult for an applicant to demonstrate a sufficient body of probative material where it is alleged that a large number of parties have recently commenced acting in concert.

- There may be more reason to be concerned if any alleged associates have acquired shares around the time of a s249D requisition.

- Even if the aggregate voting power of alleged associates is more than 20%, there is no contravention of s606 unless a person has acquired a relevant interest in shares through a transaction in relation to securities entered into by or on behalf of that person. In the context of a board spill, in the absence of any acquisitions of shares by alleged associates, the Panel will need to find that the alleged associates have acquired a relevant interest in each other’s shares by entering into a relevant agreement to each vote their shares in favour of the resolutions at the requisitioned meeting.

- There may be less reason to be concerned if a requisition seeks to appoint directors who are independent from, or not aligned with, the alleged associates and there is no material to suggest that any alleged association is likely to continue after the board spill.

- There may be more reason to be concerned if there is material to suggest that any of the alleged associates had joint plans for the management of the company after the requisition meeting.

- A contravention of the substantial holding provisions alone can give rise to unacceptable circumstances. However, it may be less likely to be in the public interest to intervene in a board dispute and make a declaration of unacceptable circumstances on a contravention of the substantial holding provisions alone if it is not material or where the market is not misinformed.

- A delay in making an application in the context of a requisitioned meeting may increase the Panel’s reluctance to interfere with the legitimate right of shareholders to exercise voting rights.”

- In that case the Panel made a declaration of unacceptable circumstances in relation to the affairs of Aguia Resources Limited having formed the view that shareholders had formulated a joint proposal in relation to the requisitions, including the co-signing of requisition notices, provision of strategic advice, and giving of drafting assistance.

- In our view the evidence here is not as strong and we are not satisfied that we would find sufficient evidence to support an inference of association. There is conflict about the meaning to be attributed to various meetings and messages; and little time left to dig deeply before the AGM. Moreover, we are unsure what to make of the fact that two seemingly important interactions between Mr Zhu and Mr Mitchell were not referenced or explained in the application.

- Thus, we are inclined to the preliminary view that the evidence points to shareholder pressure rather than combining for taking of control.

- We also considered whether, if the Alleged Associates’ activities gave rise to an association, there was an acquisition of shares through a transaction leading to a contravention of section 606.18

- While we acknowledge that the concept of ‘entering into a transaction’ is broad, we were nevertheless of the preliminary view that we were unlikely to find a contravention of section 606(1).

- GL1’s submissions and accompanying proxy reporting material concerning the common voting pattern of the Alleged Associates did not necessarily support the existence of an agreement, arrangement or understanding as to voting. We accept there were similarities in the proxies, but that may reflect like-minded actions rather than concerted actions. The applicant also pointed to the use of the same IP addresses for some of the proxies but our review of that did not, in our opinion, bear out the claim.

- We were also pointed to certain acquisitions of GL1 shares by Alleged Associates, including via the selldowns by Goldenstar Energy Pty Ltd and Bright Element Pty Ltd in January 2024 and May 2024 respectively, as well as an acquisition of GL1 shares by Sincerity in June 2024; however, each of these acquisitions occurred some time ago.

- In addition, while not strictly a ‘strength of evidence’ consideration, we were concerned that, should we conduct proceedings, we would need to consider the issue of procedural fairness to the extent that the applicant sought to extend the application to formally name individuals or entities which have not been provided with an opportunity to make submissions. The same issue could also arise should these persons be affected by any orders.19

Another forum

- We are not sure what detailed case was made to Treasury on 14 October 2024, and do not know the detail of the indications that have been given back to GL1, only that correspondence from Treasury has been received by GL1. We have not seen any of the material.

- As Justice Hill stated in her judgement on deferring the AGM:

“Shortly prior to the dispatch of the notice of meeting, on 14 October 2024, Peloton Legal, the commercial solicitors for the plaintiff, sent a letter to the Department of Treasury (Treasury) on behalf of the directors of the plaintiff (apart from Dr Chen) raising concerns as to whether there have been potential breaches of the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FIRB Act) by certain shareholders. Since lodging this complaint, representatives of the plaintiff have had a video call with representatives of Treasury, and correspondence has been exchanged between Treasury and the plaintiff’s commercial solicitors. Neither the court nor the defendant’s counsel or solicitors have been provided with copies of this correspondence consistent with the plaintiff’s obligations under the FIRB Act, although a copy of the complaint is annexed to Mr Mitchell’s confidential affidavit and has been provided to both the court as well as counsel and a named solicitor of the defendant.”20

- Mr Mitchell’s supporting affidavit to the Supreme Court of Western Australia originating process relating to these proceedings dated 11 September 2024 referred to GL1’s concerns regarding a potential association between Mr Zhu and others, including Dr Chen. It is reasonable to assume the reference to Treasury was of a similar, or the same kind, or at least included the allegation of association as it was apparently a basis for seeking the deferral of the AGM.21

- As noted above, GL1 submitted that the Foreign Investment Division of the Department of Treasury is not equally or better placed than the Panel to investigate issues relating to alleged association as they are different statutory bodies operating under different statutes with different legal tests and for different statutory objectives. GL1 also submitted that there is no legal prescription as to how a matter is dealt with that raises the separate issues under each of FATA and Chapter 6 and referred to Midwest Corporation Limited 02 [2008] ATP 15, where the Panel made a declaration of unacceptable circumstances on the basis that certain entities failed to comply with the FATA in acquiring Midwest Corporation Limited shares over the limit requiring compulsory notification to the Treasurer.

- Our preliminary view is that Treasury is better placed than the Panel to investigate issues relating to alleged association in this instance since it has been apprised of the matter since October 2024 and appears to have been actively investigating it and noting the presence of foreign persons among the group of Alleged Associates.

- Had we been minded to conduct proceedings, it would have been useful to invite Treasury to disclose the extent of the complaint by GL1 and their inquiries to date, which GL1 and the other parties did not oppose us doing, and so get a better understanding of whether the Panel would add value to any investigation of the association issue.

Timeliness

- Under section 657C(3), an application for a declaration under section 657A must be made within two months after the circumstances have occurred or a longer period determined by the Panel.

- GL1 submitted that the application addressed continuing unacceptable circumstances on these bases, in short:

- requisitioning the meeting is a current and live demand. The requisitioned call for the re-election of Dr Chen as an associate-aligned director is “current, live and continuing”. The unacceptable circumstances are the taking of board control at that future set meeting – the AGM

- agreed common voting by the Alleged Associates occurred by the record date of 18 November 2024, which is within the 2 months prior to the making of the application on 9 January 2025

- the current intentions of the Alleged Associates for intended future majority board control, having GL1 act uncommercially to progress actions and expenditure for the definitive feasibility study on the Manna Project, are not past events but current circumstances

- failure to disclose the continuing association between the Alleged Associates is a continuing circumstance, namely the absence of an informed market with the shareholders of GL1 not being sufficiently informed for the purpose of section 602(b)

- the contravention of section 606(1) by the attaining of interests in voting power by the formation of a relevant agreement are “current, live and continuing” as the voting power is the circumstance and is for the purpose of the AGM set for 13 February 2025 and

- quoting Innate Immunotherapeutics,22 the contravention of section 671B, by the Alleged Associates not providing substantial holder notices, is continuing as no updating notices have been given.

- We do not accept the submission by GL1 that the unacceptable circumstances are ’continuing’ at least in so far as the allegations of association are concerned.

- We think this was made clear by the Full Court of the Federal Court of Australia.23 We think, as in that case, that the dates on which the alleged associations arose (if they did) here would be an identifiable date or dates. The application states an identifiable date (albeit not with precision) as “since at least February 2024.” The application also alleges events giving rise to the association that are capable of being found to have identifiable dates, that is:

- causing previous independent directors to resign or be removed

- requisitioning or requiring meetings for board change and

- agreed common voting by the Alleged Associates for the postponed AGM.

- As the Full Court said:

- “In order for the time limitations under ss 657B and 657C to operate effectively the relevant circumstances must be capable of being identified as having arisen at a particular time”24 and

- “That the effects of the circumstances (the acquisition of the shares in breach of s 606) are continuing does not render the circumstances as continuing to ‘occur’ or as continuing to ‘have occurred’.”25

- We do not accept that Innate Immunotherapeutics stands for the proposition that not providing substantial holder notices amounts to continuing unacceptable circumstances. The Panel there declined to conduct proceedings on an application alleging association, and in a footnote said:

“If there was undisclosed association between Mr Collins and his children, it might be argued that there are continuing contraventions of the substantial holding notice requirements that would not require an extension under s657C(3)(b). However, for the reasons given above we do not consider that the applicant has provided a sufficient body of material to justify us making further enquiries as to this.”

- So, first association needs to be established and second, the Panel in that case made it clear only that it “might be argued”. We too leave open the question to another time. We do not need to consider the question of whether contravention of the substantial holder provisions can be continuing (because the legislation provides for an offence for each day or another as yet unargued reason) since we have determined not to conduct proceedings on the application.

- For the following reasons we think the application was not timely.

- GL1 received from Sincerity a purported section 249D notice on 15 August 2024 and a further section 249D notice on 21 August 2024. Almost 5 months passed before the Panel application was made.

- As noted above, Mr Mitchell referred to GL1’s concerns regarding a potential association between Mr Zhu and others, including Dr Chen, in his affidavit filed with the Supreme Court of Western Australia on 11 September 2024. Even accepting there was insufficient information that might meet the hurdle test for a Panel application at that time, a significant amount of time has passed since then, including the making of an application or complaint to the Department of Treasury on 14 October 2024 as to potential contraventions of the FATA. If the later date of the Treasury application is taken, almost 3 months passed before the Panel application was made.

- As a result of the timing of the Panel application dated 9 January 2025, and the court-allowed time for the AGM of 13 February 2025, we have been given much less time in which to obtain submissions from numerous parties on a voluminous application, and to make a decision and (potentially) orders. And as noted earlier, there could arise the need to add a significant number of potential parties.

- Further, we considered that an extension of time under section 657C(3)(b) was needed to make the application because it was not brought within two months of the date the allegedly unacceptable circumstances occurred (as required by section 657C(3)(a)) and we are inclined not to grant it.

- The relevant factors to consider in deciding whether to extend time have been set out in Webcentral Group Limited 03.26 They are:

- the discretion to extend time should not be exercised lightly27

- whether the application made credible allegations of clear and serious unacceptable circumstances, the effects of which are ongoing28

- whether it would be undesirable for a matter to go unheard, because it was lodged outside the two month time limit, if essential matters supporting it first came to light during the two months preceding the application29 and

- whether there is an adequate explanation for any delay, and whether parties to the application or third parties will be prejudiced by the delay.30

- GL1 referred to the Panel’s decision to grant an extension of time in Sovereign Gold.31 In that case the Panel made a declaration of unacceptable circumstances and, as part of its decision to extend time for making the application, said “features of [the matter] first came to light, and the contraventions of s606 occurred, during the 2 months preceding the application.”32 GL1 submitted that “not only did the matters first come to light during the two months preceding the Application, but the alleged association grew during that time to encompass other shareholders including more of the Associates”. We did not find this submission persuasive and we reiterate our comments above concerning the untimeliness of the application.33 Moreover, as noted above, it was not clear to us that contraventions of section 606 had occurred.34 Accordingly, we considered the present case could be distinguished from Sovereign Gold.

- Accordingly, our view is that there is no reasonable prospect that we would exercise our discretion to extend time, noting (among other things) that we should not exercise our discretion lightly35 and:

- The applicant alleged an association since at least February 2024, being around 11 months before it made the application.

- Having regard to the untimeliness in bringing the application,36 we were not persuaded there was an adequate explanation for why GL1 did not apply before 9 January 2025.

- We considered that there were arguments which weighed against granting an extension, including the untimeliness in bringing the application37 and our concerns in relation to the strength of the evidence.38

- We had some concerns, as set out above, regarding whether the application made credible allegations of clear and serious unacceptable circumstances; despite the volume of material provided by GL1 we did not consider it was strong enough to justify an extension of time of the length required to hear the matter in the form it was presented to us in the application.

- Of course, the Panel may first resolve the factual questions in an application before deciding whether to extend time under s 657C(3)(b).39 However, in this case we considered that it would not be appropriate in all the circumstances of the matter to seek to resolve factual questions and then determine whether to extend time. The factual questions involve a significant amount of work for many parties and we are inclined to the view on what we have seen that it is unlikely that there is a likelihood of finding unacceptable circumstances.

Request for confidentiality directions

- A number of the annexures to the application were marked ‘confidential’ (Confidential Annexures). The annexures referred to were board meeting minutes, which GL1 submitted contained sensitive and confidential information of GL1, and the GLI share register, which GL1 submitted contained private and confidential information of GL1’s shareholders. Fully redacted versions of each of the Confidential Annexures were provided to the parties but an unredacted version was included in the application provided to the Panel executive. GL1 requested that the Confidential Annexures be provided solely to legal representatives of the interested persons, subject to those recipients providing a confidentiality undertaking and submitted that doing so mitigates any procedural fairness or prejudice that may otherwise result from the requested disclosure restrictions.

- Rule 11(1)40 provides:

A person may request the Panel (or before the Panel is appointed, the President) to withhold information from a party (for confidentiality or other reasons). The person making the request should:

- make the request before the information is provided to the Panel or the President (as relevant)

- explain why the information needs to be withheld and

- include everything necessary for the Panel or the President (as relevant) to consider:

- any effect on procedural fairness and

- any adverse effect to the person of providing the information.

- The purpose of paragraph (a) is to avoid a difficulty of procedural fairness if the Panel relies on something the parties have not had an opportunity to address.

- The Procedural Guidelines41 expand on this obligation and say ”[g]iven the need for procedural fairness, a request under Rule 11(1) will only be accepted in exceptional cases.”

- As noted above, GL1 provided unredacted versions of the Confidential Annexures to the Panel executive. In order to ensure that rule 11(1)(a) was followed, we were not given access to unredacted versions of the Confidential Annexures.

- It is incumbent on an applicant that seeks to withhold information to explain why that information is relevant. GL1 did not explain how the Confidential Annexures were relevant to its application. In the case of the share register, it was difficult to see how the information in this document was relevant other than to confirm the shareholdings of the Alleged Associates (which could potentially have been extracted from the document). Moreover, we had some doubts as to whether GL1’s proposal for dealing with the Confidential Annexures effectively addressed any procedural fairness or prejudice that may otherwise result from the requested disclosure restrictions, noting that it appeared this would limit the other parties’ ability to make submissions. Given the bases on which we decided not to conduct proceedings, we did not consider it necessary to take this request any further.

Decision

- For the reasons above, there was no reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we declined to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we made no declaration of unacceptable circumstances, we do not (and do not need to) make final orders, including as to costs.

Christian Johnston

President of the sitting Panel

Decision dated 23 January 2025

Reasons given to parties 3 February 2025

Reasons published 6 February 2025

Advisers

| Party | Advisers |

|---|---|

| Global Lithium Resources Limited | Peloton Legal and Thomson Geer |

| Dr Dianmin Chen, Drock International Pty Ltd and Chen DM Pty Ltd | HFW Australia |

| Sincerity Development Pty Ltd and Mr Liaoliang Zhu | Cornerstone Legal |

| Canmax Technologies Co., Ltd | - |

| Ms Yongfang Guo | - |

| Ms Chi Fan Siu | - |

| United Funds Pty Ltd | - |

| CL Seah Holding Pty Ltd | Tan and Tan Lawyers |

1 HSBC Custody Nominees holds the shares on trust

2 Having converted from a proprietary company

3 Based on then existing share capital

4 Based on then existing share capital. At the time Canmax was known as Suzhou TA&A Ultra Clean Technology Co., Ltd

5 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth) and all terms used in Chapter 6, 6A or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

6 Sincerity had previously submitted a purported section 249D notice on 15 August 2024, which GL1 subsequently advised Sincerity was ineffective under the Corporations Act 2001 (Cth)

7 The Addendum included a Resolution 9 – Election of Director – Dr Xiaoxuan (‘David’) Sun

8 These figures appeared to be based on there being 260,587,886 voting shares on issue, which excludes 1,144,237 shares issued by GL1 on 30 December 2024 as part consideration for the acquisition of the Talga project from Octava Minerals Limited (see GL1’s Appendix 2A of 31 December 2024)

9 We also asked GL1 to explain the basis for its submission that the circumstances were continuing (noting Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68 at [65]-[73])

10 The executive informed us that additional responses from United and Sincerity were received after the deadline for responses had passed, which we decided not to receive

11 According to GL1, this would involve procedural complexity, a new proceeding to be commenced and likely an interlocutory application seeking leave to issue the proceeding (which could be contested)

12 Section 130, which relevantly provides that GL1 cannot be “required to disclose, or produce a document containing, protected information to: … (b) a tribunal, authority or person having power to require the production of documents or the answering of questions”

13 See Takeovers Panel Procedural Guidelines 2020 at [4.6]

14 We recognise that the Panel’s jurisdiction is not necessarily a completely overlapping one: Caravel Minerals Limited [2018] ATP 8 at [53]

15 See Mount Gibson Iron Limited [2008] ATP 4 at [15]

16 Aguia Resources Limited [2019] ATP 13 at [24] (footnotes omitted)

17 ASIC Regulatory Guide 128: Collective action by investors

18 As noted above, GL1 submitted that by the formation of a relevant agreement, each of the Alleged Associates had contravened section 606(1)

19 See section 657D

20 Global Lithium Resources Limited v Sincerity Development Pty Ltd [No 2] [2024] WASC 443 at [15]

21 Ibid at [40] “First, it [the plaintiff] relied on its complaint to Treasury, on the basis that this may have an impact on who should be entitled to vote at the AGM and EGM.”

22 Innate Immunotherapeutics Limited [2017] ATP 2, footnote 8

23 Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68 at [65]-[73]

24 Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68 at [64]

25 Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68 at [69]

26 Webcentral Group Limited 03 [2021] ATP 4

27 Austral Coal Limited 03 [2005] ATP 14 at [18]

28 Ibid at [19] and The President’s Club Limited 02 [2016] ATP 1 at [143]

29 Molopo Energy Limited 01 & 02 [2017] ATP 10 at [248]

30 Ibid at [249]

31 Sovereign Gold Company Limited [2016] ATP 12. On review (Sovereign Gold Company Limited 01R [2016] ATP 14) the review Panel declined to conduct proceedings on the basis that it was unlikely to reach a different conclusion to the initial Panel on the question of association

32 Ibid at [137]

33 See paragraphs 103 to 106

34 See paragraphs 85 to 88

35 See paragraph 108(a)

36 See paragraphs 103 to 106

37 See paragraphs 103 to 106

38 See paragraphs 76 to 89

39 Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68 at [75]

40 References to rules are to the Takeovers Panel Procedural Rules 2020

41 Takeovers Panel Procedural Guidelines 2020 at 10.8(d)