[2021] ATP 15

Catchwords:

Decline to make a declaration – association – warehousing – evidence

Corporations Act 2001 (Cth), sections 12, 606, 611 (item 9)

Aurora Funds Management Limited v Australian Government Takeovers Panel (Judicial Review) [2020] FCA 496, Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68, Australian Competition and Consumer Commission v CC (NSW) Pty Ltd (No 8) (1999) 92 FCR 375

Webcentral Group Limited 03 [2021] ATP 4, Cromwell Property Group [2020] ATP 1, Innate Immunotherapeutics Limited [2017] ATP 2, Avalon Minerals Limited [2013] ATP 11, Bentley Capital Limited 01R [2011] ATP 13, Viento Group Limited [2011] ATP 1, Mount Gibson Iron Limited [2008] ATP 4, Orion Telecommunications Ltd [2006] ATP 23

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | YES | NO | NO | NO |

Introduction

- The Panel, Robert McKenzie, Sarah Rennie and Nicola Wakefield Evans (sitting President), declined to make a declaration of unacceptable circumstances in relation to the affairs of AIMS Property Securities Fund. One application concerned an alleged association between a director of AIMS Property Securities Fund and his brother and sister. The other application concerned whether the same director was associated with three persons who (together with that director) collectively acquired approximately 22.84% of the AIMS Property Securities Fund units on issue in December 2020. The Panel was not satisfied on the material available to it that it could draw the necessary inferences and find the alleged associations. Accordingly, the Panel was not satisfied that the circumstances were unacceptable.

- In these reasons, the following definitions apply.

- Applicants

- Mr Benjamin Graham atf the Graham Family Trust and Mr Warwick Sauer in his personal capacity and as a director of Baauer Pty Ltd atf the Baauer Family Trust

- APP Securities

- APP Securities Pty Ltd

- APW

- AIMS Property Securities Fund

- APW RE

- AIMS Fund Management Limited (being the responsible entity of APW)

- ASIC

- Australian Securities and Investments Commission

- ATRF

- AIMS Total Return Fund

- Brief

- The Panel’s brief dated 24 August 2021

- Consolidated AIMS Group

- Mr George Wang and each of the entities referred to in Annexure A to the substantial holder notice of the Consolidated AIMS Group (signed by Mr George Wang as director) addressed to APW dated 24 December 2020

- December Transaction

- The acquisition of units in APW (for $1.785 per unit) and ATRF (for $0.5393 per unit) by AIMS Investment Group Holdings Pty Ltd and the Hong Kong buyers from STAM and Sandon pursuant to the Sale and Purchase Agreements

- Hong Kong buyers

- Ms Li Li, Mr Chi San Liu and Ms Hiu Ping Lau

- Mr Jason Wang

- Mr Jason Wang, including (where the context requires) Wasset Group Pty Ltd

- Sale and Purchase Agreements

- The sale and purchase agreements dated 24 December 2020 in respect of the December Transaction

- Sandon

- Sandon Capital Investments Limited and/or Fundhost Limited as trustee of Sandon Capital Activist Fund (as the context requires)

- STAM

- Samuel Terry Asset Management Pty Ltd as trustee of Samuel Terry Absolute Return Fund and/or Fred Woollard & Therese Cochrane as trustees of Woollard Superannuation Fund (as the context requires)

- Statutory Declaration

- The statutory declaration given by Mr George Wang dated 29 September 2021

- Supplementary Brief

- The Panel’s supplementary brief dated 8 September 2021

Facts

- APW is a listed managed investment scheme (ASX code: APW; SGX code: BVP). It has 44,519,083 units on issue.1 The units are thinly traded.

- On 24 December 2020, AIMS Investment Group Holdings Pty Ltd (a member of the Consolidated AIMS Group) and the Hong Kong buyers acquired approximately 22.84% of the APW units on issue pursuant to the December Transaction. The purchase price was $1.785 per unit, an approximate 33% premium to the prevailing price of APW units.

- As part of the December Transaction, Mr George Wang substantially exhausted his ‘creep’ allowance under item 9 of section 611,2 having acquired approximately 2.99% of the APW units on issue.3 Mr George Wang’s and the Consolidated AIMS Group’s substantial holder notice dated 24 December 2020 disclosed that they increased their interest in APW from 39.79% to 42.78%.

- During the period between 8 January 2021 and 24 June 2021, Mr Jason Wang and Ms Jenny Wang acquired a combined total of 1.48% of the APW units on issue.

- During the period from 26 July 2021 to 16 August 2021, AIMS Investment Group Holdings Limited acquired a further 0.39% of the APW units on issue. Accordingly, Mr George Wang and the Consolidated AIMS Group’s interest in APW increased to approximately 43.17%.

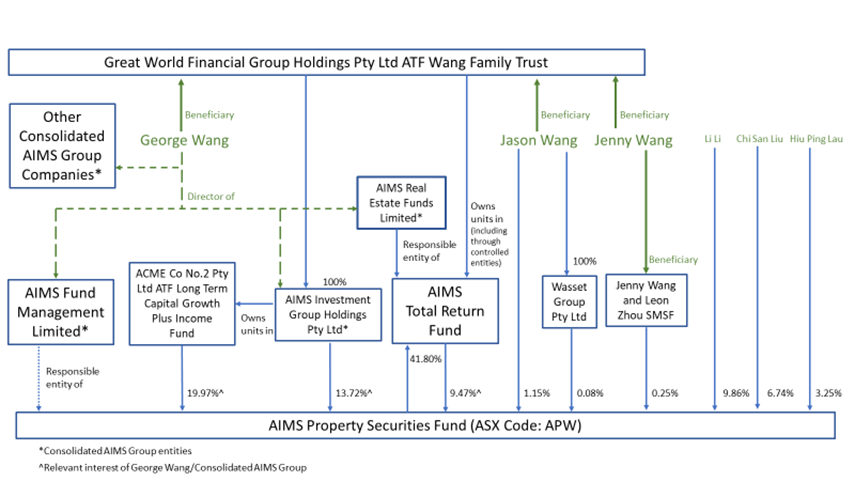

- Unitholdings in APW and various relationships between the parties are set out in the diagram below:

Application

Declaration sought: AIMS Property Securities Fund 01

- On 13 August 2021, the Applicants made an application to the Panel seeking a declaration of unacceptable circumstances in respect of the affairs of APW.

- The Applicants submitted (among other things) that:

- Mr Jason Wang and Ms Jenny Wang are associates of the Consolidated AIMS Group and Mr George Wang in relation to the affairs of APW

- Mr Jason Wang and Ms Jenny Wang are ‘warehousing’ the APW units they purchased for the benefit of the Consolidated AIMS Group and Mr George Wang and

- the acquisition of APW units by Mr Jason Wang and Ms Jenny Wang between 24 December 2020 and 24 June 2021 have resulted in contraventions of section 606 by reason of having been undertaken while the Consolidated AIMS Group was not able to utilise the ‘creep exception’ in item 9 of section 611.

Final orders sought: AIMS Property Securities Fund 01

- The Applicants sought final orders to the effect that all the APW units acquired by Mr Jason Wang and Ms Jenny Wang be vested in ASIC for sale to any non‑associated party, with ASIC to retain any sale proceeds in excess of the net acquisition costs paid by Mr Jason Wang and Ms Jenny Wang for those units.

Declaration sought: AIMS Property Securities Fund 02

- On 31 August 2021, the Applicants made a further application to the Panel seeking a declaration of unacceptable circumstances in relation to the affairs of APW, submitting (among other things) that the Hong Kong buyers were ‘warehousing’ the units they purchased, for the benefit of the Consolidated AIMS Group.

Final orders sought: AIMS Property Securities Fund 02

- The Applicants sought final orders to the effect that all the APW units acquired by the Hong Kong buyers be vested in ASIC for sale to any non‑associated party, with ASIC to retain any sale proceeds in excess of the net acquisition costs paid the Hong Kong buyers for those units.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Conducting proceedings

- In Mount Gibson Iron Limited,4 the Panel said at [15]:

“The Panel’s starting point was that it was for Mount Gibson - the applicant - to demonstrate a sufficient body of evidence of association and to convince the Panel as to that association, albeit with proper inferences being drawn.”

- We considered that the hurdle had been met in relation to whether Mr Jason Wang and Ms Jenny Wang are associates of the Consolidated AIMS Group and whether the acquisitions between 8 January 2021 and 24 June 2021 had resulted in contraventions of section 606 and the substantial holder provisions resulting in unacceptable circumstances.

- Accordingly, we conducted proceedings in relation to the AIMS Property Securities Fund 01 application and made a range of enquiries of the parties. To get a better understanding of the circumstances, we asked some questions about the December Transaction.

- After we received submissions and rebuttals to our brief, the Applicants made the AIMS Property Securities Fund 02 application. We decided to conduct proceedings on that application because we were concerned that the premium paid for the units by the Hong Kong buyers (an approximate 33% premium to the prevailing price of APW units) may have been uncommercial in circumstances where the size of the acquisition (collectively 22.84% of the APW units on issue) was significant.

- Given there was some overlap in the subject matter, we made a direction that the applications be heard together.5 However at that stage we were reasonably advanced in our enquiries in relation to the AIMS Property Securities Fund 01 application. Having considered the issues raised in that application and submissions and rebuttals, we made preliminary findings in relation to the issue of association and invited comments on them on 8 September 2021.

- Mr George Wang did not initially make comments in relation to the preliminary findings and raised instead a number of procedural matters (including a submission that we should consider whether to extend time for the making of each of the applications as a preliminary matter, which is discussed further below in paragraphs 24 to 28).

- We sought submissions from the parties, in relation to a revised preliminary findings and other matters on 23 September 2021. At this point, Mr George Wang supplied the Statutory Declaration, which is discussed further below in paragraphs 60, 102 to 108 and 150.

- We also sought submissions (twice) in relation to matters relating to the AIMS Property Securities Fund 02 application.

- For the reasons discussed below:

- We have decided (on balance) not to make a declaration of unacceptable circumstances in relation to the matters raised in the AIMS Property Securities Fund 01 application. We have extended time for the making of the application in AIMS Property Securities Fund 01 under s657C(3).

- We have also decided not to make a declaration of unacceptable circumstances in relation to the matters raised in the AIMS Property Securities Fund 02 application. We have extended time for the making of the application in AIMS Property Securities Fund 02 under s657C(3).

Timing for determination of extension of time

- On 14 September 2021, we received an email from Mr George Wang’s solicitors asserting (among other things) that the question whether either application had been brought within time must be determined by us as a “threshold issue”, and that the proceedings should be suspended pending this determination.

- In Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68, at [75], the Full Court of the Federal Court of Australia stated that:

“As the appellants correctly submit, this submission overlooks the reality that limitation periods often cannot be determined prior to findings on the facts underlying an asserted cause of action, so that limitation questions rarely justify summary determination of proceedings: see Wardley Australia Limited v State of Western Australia [1992] HCA 55; (1992) 175 CLR 514 at 533. The asserted facts in this case are that certain circumstances were said to exist and were such that the Panel should declare them to be unacceptable circumstances. Before the discretion to extend time may be exercised under s 657C(3) those circumstances require to be proved. There may be a factual contest. There is no difficulty, in that situation, for the Panel first resolving the factual questions and thereafter determining whether or not to extend time under s 657C(3). The legislative scheme here does not suggest a different approach.”

- We sought submissions from the parties, including in relation to whether the request for the suspension of the proceedings was consistent with the Queensland North Australia Pty Ltd v Takeovers Panel decision.

- ASIC submitted (among other things) that:

“The statement by the Full Federal Court makes expressly clear that, under the legislative scheme, there is “no difficulty” in the Panel resolving the Extension Question after resolving factual questions. It is therefore open to the Panel to determine the Extension Question before, after or simultaneously as it makes findings of facts. These questions are necessarily interrelated, and nothing fetters the order in which the Panel determines the Extension Question.”

- We agreed with ASIC’s submissions on this issue and accordingly refused Mr George Wang’s request to suspend the proceedings pending a determination of whether to extend time.

AIMS Property Securities Fund 01

- In Viento Group Limited,6 relying on Mount Gibson Iron Limited,7 the Panel said the circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- We have considered whether some or all of these elements exist in the current case. We turn to these now.

Structural links/common investments and dealings

Corporate structure

- The parties used different terminology to discuss entities that were related in some way to Mr George Wang. For example, Mr George Wang, Mr Jason Wang and Ms Jenny Wang in their submissions referred to “Consolidated AIMS Group”, “AIMS Consolidated Group”, “AIMS colleagues”, “AIMS’ products”, “AIMS staff”, “AIMS Group”, “AIMS accounting” and just “AIMS”.

- On 24 December 2020, a notice of change of interests of substantial holder notice was lodged in relation to APW. The name of the substantial holder was stated to be “Consolidated AIMS Group (see annexure A)”. Annexure A to the notice stated the Consolidated AIMS Group comprises:

1 AIMS Capital Management Pty Ltd 2 AIMS Capital Pty Limited 3 AIMS Financial Group Pty Ltd 4 AIMS Financial Service Group Pty Ltd 5 AIMS Fund Management Limited 6 AIMS Home Loans Pty Ltd 7 AIMS Investment Group Holdings Pty Ltd 8 AIMS Investment Managers Limited 9 AIMS Real Estate Funds Limited 10 AIMS Real Estate Group Pty Ltd 11 AIMS Securitisation Pty Limited 12 APP Securities Pty Ltd 13 Asia Pacific Exchange Pty Ltd (name changed to SSX Private Markets Pty Ltd on 20 May 2020) 14 Asia Pacific Prudential Capital Pty Ltd 15 Cinon Group Pty Ltd 16 Cinon Property Group Pty Ltd 17 Great World Financial Group Holdings Pty Ltd 18 Great World Financial Group Pty Ltd 19 George Wang 20 Sydney Blockchain Exchange Pty Ltd (name changed to SSX Digital Markets Pty Ltd on 27 April 2020) 21 Sydney Stock Exchange Limited - ASIC submitted that on 21 July 2021, “a Form 484 was lodged with ASIC indicating a change to member share holdings of Cinon Property Group Pty Ltd such that Cinon Property Group Pty Ltd has been, since 21 July 2021, wholly owned by Ms Jenny Wang”.8

- Perhaps reflecting the above change, on 12 August 2021 Mr George Wang lodged a change of director’s interest notice disclosing the Consolidated AIMS Group as the companies set out in paragraph 32 above except for Cinon Property Group Pty Ltd.

- Mr George Wang submitted that he “is the Chairman of the Consolidated AIMS Group”. He listed the entities of the Consolidated AIMS Group in his submission as companies that he is a director of. The difference between this list and the one set out in paragraph 32 above was that it not only excluded Cinon Property Group Pty Ltd, but also AIMS Home Loans Pty Ltd and AIMS Financial Group Pty Ltd.

- Mr George Wang submitted that he “is also a Director and shareholder of AIMS Home Loans PTY LTD (ACN 050 792 375) and AIMS Financial Group Pty Ltd (ACN 106 100 181) which is outside the Consolidated AIMS Group”. He did not explain why these two companies are now outside the Consolidated AIMS Group when they were included in the substantial holder notice dated 24 December 2020 and his change of director’s interest notice dated 12 August 2021.

- Some of the above entities are sometimes described collectively with other entities as the “AIMS Financial Group”. There is a website for the AIMS Financial Group9 that states (among other things):

“Established in 1991, AIMS Financial Group (AIMS) is a diversified financial services and investment group, active in the areas of mortgage lending, securitisation, investment banking, funds management, property investment, biomedicine investment, high‑tech investment and AIMS also owns the Sydney Stock Exchange (SSX).”

- The website states that Mr George Wang is the “founding Executive Chairman of AIMS Financial Group”.

- The operations of APW and APW RE are described as part of the group as well as:

- AIMS Home Loans (Australian Credit Licence Number 389027)

- AIMS Securitisation (AFS Licence Number 287846)

- Investment banking / AIMS Capital and

- AIMS Property.

- From Mr Jason Wang’s submission (see paragraph 51 below) we infer that the references on the AIMS Financial Group website to AIMS Home Loans and AIMS Securitisation are references to the following companies in the Consolidated AIMS Group – AIMS Home Loans Pty Ltd and AIMS Securitisation Pty Ltd. It is otherwise unclear as to which entities comprise the AIMS Financial Group.

Family relationship

- Mr George Wang, Mr Jason Wang and Ms Jenny Wang are siblings.

- Each of Mr George Wang, Mr Jason Wang and Ms Jenny Wang submitted that the fact that they are related does not make them associates within the meaning of section 12 and denied any association between themselves.

- We agree that a familial relationship does not automatically make persons associates. However, such relationships may nevertheless be relevant in assessing whether the broader factual matrix establishes association10 and we consider that they are relevant here.

- As to the sibling relationship specifically, in Innate Immunotherapeutics Limited [2017] ATP 2, the Panel noted at [15] (emphasis added, footnotes omitted):

Family relationships are a possible indicator of association, depending on the context. The Panel has acknowledged that the spousal relationship is a strong indicator of association; relationships between siblings less so. The relationship between parent and child may also be a strong indicator of association depending on the age of the child and other circumstances.

- Context is always important though. At the very least, as the Panel said in Bentley Capital 01R11 at [56], "the family links make one part of the factual matrix”.

- ASIC noted in its submissions that the Panel “may be able to draw inferences from… the relationship between Mr George Wang and each of Mr Jason Wang and Ms Jenny Wang”. We now discuss the various working and business relationships between Mr George Wang, Mr Jason Wang and Ms Jenny Wang.

Working and business relationships

- As noted in paragraph 35 above, Mr George Wang submitted that he was the Chairman of the Consolidated AIMS Group and a director of each of the companies in the Consolidated AIMS Group. We infer that he is the controller of the Consolidated AIMS Group.

- In their application, the Applicants submitted that:

- Mr Jason Wang had been employed by the Consolidated AIMS Group “for nearly 20 years” and that in this role he is “subservient to, and answers to” Mr George Wang

- Ms Jenny Wang also appeared to have worked at the Consolidated AIMS Group and had previously acted as a director of one of its member companies and

- public websites identify various businesses that involve both Mr George Wang and Ms Jenny Wang, referring to Australia Baoze Qianhai Financial City (Shenzhen) Co., Ltd. and Baoze Investment Consulting (Shanghai) Co., Ltd. as examples.

- We asked each of Mr George Wang, Mr Jason Wang and Ms Jenny Wang to provide details of any past or present employment, business or other professional connections or relationships between each other.

- In his submission in response to this question, Mr George Wang stated12 as follows:

“Jason Wang

Currently, he works in AIMS Home Loans as an operations manager. He is also the responsible manager for AIMS Home Loans Pty Ltd (Credit Licence # 389027) and AIMS Securitisation Pty Ltd (Credit Licence # 287846).

Before, he received a retainer from AIMS Home Loans, based on loans originated and was a lending manager for AIMS Home Loans. He was also before the responsible manager of AIMS Fund Management Limited.

Jenny Wang

Currently, Jenny Wang is a financial controller for AIMS accounting. She owns a small share in AIMS Home Loans Pty Ltd.

Before, she was a director and consultant for AIMS Home Loans Pty Ltd.

She was also a director/licensee for Cinon Property Group Pty Ltd (no longer part of AIMS Consolidated Group).”

- In his submission in response to this question, Mr Jason Wang stated as follows:

“I’m an employee of AIMS Group.

Present

Currently, I am an employee of AIMS as the operations manager for AIMS Home Loans.

I’m also the responsible manager for Credit Licence 389027 of AIMS Home Loans Pty Ltd and Credit Licence 287846 of AIMS Securitisation Pty Ltd.

I’m a licensed agent in Cinon Property Group Pty Ltd and I receive a commission based on the number of properties I sell.

Jenny Wang is a director of Cinon Property Group Pty Ltd.

I also operate my own consulting business Wasset Group Pty Ltd.

Past

In the past, I was the responsible manager for AFSL 258052 of AIMS Fund Management Limited and lending manager for AIMS Home Loans.

I received a retainer and was entitled to a commission from AIMS Home Loans, depending on how many loans I originated for AIMS.”

- In her submission in response to this question, Ms Jenny Wang stated as follows:

“George Wang

I work for AIMS Group as a financial controller in the accounting department. I’m a director and licensee of Cinon Property Group Pty Ltd, which is no longer a member of the Consolidated AIMS Group (as at 21 July 2021).

I own 0.0001% of the shares outstanding in AIMS Home Loans Pty Ltd.

My husband and I also run our own consulting business, AOBO Group Pty Ltd.

Previously, I worked as a director and consultant for AIMS Home Loans Pty Ltd.

Jason Wang

I have no business/professional relationship with Jason, aside from being his colleague at AIMS.”

- ASIC submitted that in addition to the information provided by Mr George Wang, Mr Jason Wang and Ms Jenny Wang, searches of ASIC’s database revealed further details in relation to Mr Jason Wang’s and Ms Jenny Wang’s involvement in the Consolidated AIMS Group.

- In relation to Mr Jason Wang, the further details included the following positions held:

- Director of AIMS Capital Pty Ltd from 17 August 2007 to 23 September 2010

- Director of AIMS Capital Management Pty Ltd from 12 January 2010 to 23 September 2010 and

- Credit Registered Person of AIMS Capital Management Pty Ltd from 4 May 2010 to 7 December 2010.

- In relation to Ms Jenny Wang, the further details included the following positions held:

- Credit Representative of AIMS Home Loans Pty Ltd since 1 July 2010

- Director of AIMS Real Estate Group Pty Ltd from 27 June 2010 to 11 December 2019

- Secretary of AIMS Real Estate Group Pty Ltd from 27 June 2010 to 11 December 2019

- Director of AIMS Capital Management Pty Ltd from 5 September 2007 to 17 October 2010

- Secretary of Cinon Property Group Pty Ltd from 18 February 2001 to 21 January 2002 and since 7 May 2007

- Director of AIMS Capital Pty Ltd from 12 March 2004 to 13 March 2015

- Director of Cinon Group Pty Ltd from 15 January 2001 to 19 March 2003

- Secretary of Cinon Group Pty Ltd from 15 January 2001 to 29 January 2015 and

- Secretary of AIMS Home Loans Pty Ltd from 27 May 1996 to 27 July 2005.

- Mr Jason Wang’s LinkedIn profile lists his title as “Manager at AIMS” and the experience section refers to “AIMS”, “Manager” and “20 years”.

- Ms Jenny Wang’s husband works as a sales consultant for AIMS Home Loans and Cinon Property Group Pty Ltd.13

- In their rebuttal submissions in relation to this question, the Applicants submitted (among other things) that:

- “Information available on the internet suggests that George Wang’s response here is in various regards inaccurate and incomplete, and that the current and historical interrelationships between the three Wangs are much more substantial than they would have the Panel believe.”

- “Cinon’s website lists ‘Jason (Ye. J) Wang’… as being the ‘Senior Development Manager’ for ‘Cinon Property Group’.”

- “George Wang’s answer in relation to Jenny Wang makes no mention of Baoze Investment Consulting (Shanghai) Co., Ltd.” or “Australia Baoze Qianhai Financial City (Shenzhen) Co., Ltd.”

- From the material above, we infer that Mr George Wang, Mr Jason Wang and Ms Jenny Wang have a close family relationship.

- We had initially also been prepared to infer that Mr George Wang, Mr Jason Wang and Ms Jenny Wang work closely together in relation to entities ultimately controlled by Mr George Wang. However, Mr George Wang made various statements in relation to his professional relationship with Mr Jason Wang and Ms Jenny Wang in the Statutory Declaration, including:

- “I do not work closely with either my brother or my sister. While it is true that they are each employed as part of the AIMS Group, neither of them have any role at APW” and

- “[b]oth Jason and Jenny historically have held a number of other roles within the AIMS Group which are a matter of public record. As with their current roles, I have limited, if any, dealings with them – the dealings I have had have been confined to resolving queries or approving expenditure or payroll.”

Shared goal or purpose

Coincidences in timing

- On 27 May 2020, Mr George Wang and the Consolidated AIMS Group acquired 1,291,000 units (being approximately 2.90% of the APW units on issue) in an off‑market transfer.14

- In the following six‑month period, Mr George Wang and the Consolidated AIMS Group again substantially exhausted its ‘creep’ allowance under item 9 of section 611, having acquired approximately 2.99% of the APW units on issue in connection with the December Transaction. Mr George Wang submitted that prior to 27 May 2020, the Consolidated AIMS Group had “not utilised the full creep limit capacity and there have been many six‑month periods where no units were acquired”.

- Following the acquisition of units in connection with the December Transaction, the Consolidated AIMS Group was not able to rely on its ‘creep’ allowance under item 9 of section 611 to acquire further units in APW until 24 June 2021.

- On 8 January 2021, Mr Jason Wang submitted orders with his broker to acquire a total of 339,681 units in APW on‑market.15 Between 13 January 2021 and 19 July 2021, Mr Jason Wang acquired a further 209,689 units, representing a total of approximately 1.23% of the APW units on issue.16 Mr Jason Wang paid a total amount of $709,658.7717 for his APW unitholding. As at 27 August 2021, Mr Jason Wang is the 14th largest holder of APW units.18

- On 18 January 2021, Ms Jenny Wang submitted orders with her broker to acquire a total of 30,417 units in APW on‑market.19 Between 21 January 2021 and 26 February 2021, Ms Jenny Wang acquired a further 79,814 units, representing a total of approximately 0.25% of the APW units on issue.20 Ms Jenny Wang paid a total amount of $140,173.6821 for her APW unitholding.

- Despite both having a long and extensive history of working within the Consolidated AIMS Group, neither Mr Jason Wang nor Ms Jenny Wang had previously acquired units in APW before 8 January 2021.22 Accordingly, the first time that Mr Jason Wang and Ms Jenny Wang acquired units was:

- within two weeks of each‑other’s first acquisition of APW units and

- in a period when Mr George Wang and the Consolidated AIMS Group was not able to acquire APW units because their capacity to utilise their ‘creep’ allowance under item 9 of section 611 had been substantially exhausted.

- On or about 24 June 2021, Mr George Wang and the Consolidated AIMS Group regained full capacity to utilise their ‘creep’ allowance. As noted in paragraph 7 above, since 24 June 2021 Mr George Wang and the Consolidated AIMS Group (via AIMS Investment Group Holdings Limited) has acquired a further 0.39% of the APW units on issue utilising their ‘creep’ allowance. Save for Mr Jason Wang’s purchase of 4,300 APW units on 7 July 2021, neither Mr Jason Wang nor Ms Jenny Wang have purchased any APW units since Mr George Wang and the Consolidated AIMS Group regained full capacity to utilise ‘creep’ allowance.

- ASIC submitted that “the timing of the acquisitions on 8 and 18 January respectively demonstrates contemporaneous conduct.” In Orion Telecommunications Ltd,23 the Panel said that:

“While sequential buying of shares by two entities is not of itself evidence of an association, in the circumstances before the Panel, where there was other probative material indicating an association … what appeared to be concerted buying activity may be taken to support an inference of an “understanding” constituting a relevant agreement within section 12(2)(b) or a common purpose amounting to acting in concert within section 12(2)(c)…”

- We are minded to conclude that there is more than just coincidences in buying here.

Reasons provided by Mr Jason Wang and Ms Jenny Wang for their acquisitions of APW units

- Mr Jason Wang submitted that he did not “ask anyone” for advice or communicate with anyone in relation to his acquisition of units in APW. He submitted that:

“…I understand APW. I feel APW is good value and the interest rate is lowest in record, so I decide to buy APW…

No communication with anyone.

I did my own research. I understand APW.

I am monitor the financial market frequently, especially in current share markets.

Base my personal experience and understanding of investment opportunity, I decided to purchase the units in APW.”

- Mr Jason Wang submitted that he frequently monitors financial markets and submitted in rebuttals that he had “close to 20 years of financial market experience in Australia and I know APW well” and has several professional qualifications.

- Mr Jason Wang submitted that APW comprises approximately 80% of his “total security portfolio” and that he had “not made a single security purchase of this size in the past”.

- In response to a request from the Panel executive to explain how he funded his acquisition of units in APW, Mr Jason Wang submitted “[f]rom my own personal money”. We accept this submission.

- In response to a request from the Panel executive to explain the source of a credit of approximately $261,244 labelled “COMMSEC” on 9 December 2020 appearing on a bank statement24 supplied by Mr Jason Wang in relation to his Commonwealth Bank Direct Investment Account (being the account used to purchase the APW units held in his name), Mr Jason Wang submitted “I sold my shares on 9 Dec 2020, because I predicted the share market may going down during Christmas effected by Covid 19and global economic”. He also supplied a list of the shares in 7 ASX listed entities he sold on that date.

- Mr Jason Wang provided further explanation as to why he sold existing securities he held prior to investing in APW in his submissions on the Supplementary Brief: “[t]he unprecedented economic uncertainty caused by the COVID‑19 pandemic and reduced retail sales around Christmas time as a result, are fair and legitimate commercial reasons for divestment of my stock portfolio”. In their rebuttal submissions on the Supplementary Brief, the Applicants (in summary) queried how Mr Jason Wang could have expected “reduced retail sales around Christmas time” to affect the prospects or share price of certain mining companies within Mr Jason Wang’s securities portfolio, and submitted that he could not reasonably have held those concerns.

- Drawing on our commercial experience, we consider that it is unusual for Mr Jason Wang, a person who submits that he has experience in financial markets, to sell a securities portfolio of 7 listed companies worth around $260,000 for the reasons that he said he did and use those proceeds plus another approximately $450,000 of his own money to invest in one illiquid stock. This is particularly so in circumstances where his investment in APW comprises approximately 80% of his total security portfolio (being potentially a substantially higher percentage of his total security portfolio than the percentage which the securities portfolio he sold had represented of his total security portfolio when he sold it) and he has not made a single security purchase of that size in the past.

- Ms Jenny Wang submitted that she decided to invest in APW because:

“I work for AIMS. I like the people. They manage the fund and do a good job.

The fund value of the properties grows every year and this is a good investment. I discussed it with my husband Leon and he agreed that this was a good investment.

So we invested in the fund from our self‑managed super fund…

I only spoke to my husband Leon and we discussed whether APW’s value of property would grow every year.

We both believed it would and bought APW units”.

- In relation to what proportion her investment in APW units represents of her total security portfolio, Ms Jenny Wang submitted that:

“70% of our super was used to purchase an investment property. The other 30% was used to purchase shares, of which APW makes up 78% of our securities portfolio.

During 2019‑2020, at one point, ~75% of our securities portfolio was in AMP. At another point, 100% was in BOQ [Bank of Queensland Limited].”

- In her submissions in response to the Supplementary Brief, Ms Jenny Wang stated “[f]urthermore, despite the size of my APW holdings being 78% of my share portfolio, it only amounts to 18% of my total SMSF’s value (this does not include my family’s entire wealth, just my SMSF portfolio…of my entire family’s wealth, APW would be a very, very, small portion)”.

- In relation to how she funded her acquisition of units in APW, Ms Jenny Wang submitted “I used my family’s SMSF money to make these transactions…”. We accept this submission.

- In response to a request from the Panel executive to explain why she had supplied copies of bank statements25 that relate to periods before and after the period between 18 January 2021 to 26 February 2021 during which she acquired units in APW, Ms Jenny Wang submitted “[o]ver the past 2 years, from May 2019 to present, we have made 20 deposits into our Direct Investment Account… from our self‑managed super fund account… for investing in shares, with one withdrawal, totalling a deposit of $173,100. These deposits ultimately funded our purchase of units in APW, among our other holdings”.

- Additionally, in response to a request from the Panel executive to explain the source of a series of credits totalling approximately $117,782 labelled “COMMSEC” during the period from 3 November 2020 to 12 January 2021 (inclusive) appearing on a bank statement26 supplied by Ms Jenny Wang in relation to her Commonwealth Bank Direct Investment Account (being the account used to purchase the APW units held by her and her husband’s self managed super fund), Ms Jenny Wang submitted “[t]he various credits labelled COMMSEC were due to the sale of our other shares (A2M, AMP, SUN, S32, BOQ, TLS, WBC) bought before that period”.

- Drawing on our commercial experience, we consider that it is unusual for Ms Jenny Wang to sell a securities portfolio of a number of listed companies and use the proceeds to invest in one illiquid stock, particularly in circumstances where she submitted that her investment in APW comprises 78% of her self‑managed super fund’s securities portfolio.

- Mr Jason Wang and Ms Jenny Wang provided some further explanation as to why they invested in APW in their rebuttals in relation to the Brief. They did not explain why they did not provide this explanation in their submissions to the Brief and there is some commonality between their answers.

- Mr Jason Wang in his rebuttal submission stated that:

“I noticed that APW had some announcements in December 2020, where some overseas buyers and AIMS purchased units at $1.785, which was a premium to the price, however, still a significant discount to the NTA. I understand APW, it has low risk, with zero gearing and think it has great future potential upside. The interest rates are low and the underlying funds that are invested in great real estate continue to increase in value year‑on‑year. So I decided to invest my money to purchase units in APW and began purchasing units on market from 8 Jan 21. There is no inference to be drawn from the timing.”

- Ms Jenny Wang in her rebuttal submission stated that:

“Over the past 28 years, our SMSF’s superannuation has accumulated enough for us to purchase an investment property. Following this investment, from May 2019, we decided to invest the remaining in short term stocks. However, throughout the pandemic in 2020, many stocks had been very volatile, fluctuating more than what we were comfortable with.

My husband and I felt that the real estate industry was the one that we were most familiar with and had the most experience in. Furthermore, in the past, our investments in real estate had been the ones that had brought us the highest return. However, although real estate has that evident potential, our available superannuation funds were far from enough to purchase more property ourselves.

At this point in January of 2021, we saw other people buy APW units in December 2020 at a price higher than the market price. Following discussion with my husband, around 18th January 2021, we decided it was a good time to buy APW shares. We bought APW shares through and up until around 24th February 2021.

There are no conclusions to made from the timing.”

- Mr Jason Wang and Ms Jenny Wang provided some further explanation as to why they invested in APW in their submissions on the Supplementary Brief. They did not explain why they did not provide this explanation in their submissions or rebuttals in relation to the Brief.

- In his submissions on the Supplementary Brief, Mr Jason Wang stated “[APW] is not a risky investment in my view. It is based on real estate, which has been rising considerably and this is much more stable than other securities. Furthermore, the fund has no debt and the NTA has been steadily rising year‑on‑year”.

- In her submissions on the Supplementary Brief, Ms Jenny Wang stated: “[t]he reason I bought APW is because real estate is safe. During COVID‑19 times, you never know what’s going to happen. This is why I invested in APW, I want something consistent”.

- We were initially concerned that the explanations given by Mr Jason Wang and Ms Jenny Wang in their submissions on the Supplementary Brief for why they decided to invest in APW were not included in their original submissions or rebuttal submissions on the Brief and we noted in our amended preliminary findings that we were prepared to attribute less weight to these submissions. Mr Jason Wang and Ms Jenny Wang responded to this as follows in their joint submissions in response to the amended preliminary findings:

“…English is not the first language of either Mr Jason Wang and Ms Jenny Wang. Neither had engaged legal representation at the time. Neither have been involved in proceedings before the Takeovers Panel before. The parties were given two days to respond to a 17 page Brief containing 44 questions, a number of which contained sub‑questions.

Each of Mr Jason Wang and Ms Jenny Wang responded to the question in the Brief in a succinct, honest and plain manner. The answers in the rebuttals were entirely consistent wit [sic] the answers in the initial Brief, but contained further detail.”

Ultimately, we have decided not to infer anything from this.

- The timeline for Mr Jason Wang’s and Ms Jenny Wang’s liquidation of their securities portfolios in December 2020 and November 2020 respectively coincided with the finalisation of the negotiation of the December Transaction. This caused us to consider whether it may have been initially contemplated that Mr Jason Wang and Ms Jenny Wang would be involved in the December Transaction. However, as noted in paragraph 160 below, each of Mr Jason Wang and Ms Jenny Wang submitted that they did not have communications with any person or entity in relation to the potential purchase of any APW unit (or ATRF units)27 during the period 1 July 2020 to 31 December 2020.

Collaborative conduct

- As discussed in paragraph 33, Cinon Property Group Pty Ltd (originally part of the Consolidated AIMS Group) was acquired by Ms Jenny Wang around 21 July 2021. Ms Jenny Wang submitted the following in relation to her acquisition:

“Before I took over the company [Cinon Property Group Pty Ltd], George spoke to me and said that he’s not involved in this business and he’s no longer interested in this company. He asked me if I’d like to take over and even though it was making loss and had no fixed assets, I thought this may be a good opportunity to turn the business around and as I am the licensee in charge, I accepted.”

- Mr George Wang submitted that:

“Before the acquisition of the share capital in Cinon Property Group Pty Ltd, I spoke to Jenny Wang and suggested that I’m not involved in the real estate agency business of Cinon Property Group Pty Ltd and I’m not interested in this area. I said if it’s possible, she should take over the company. She agreed with my suggestion and we finalised the transfer.”

- While we consider that the sale of Cinon Property Group Pty Ltd implies some collaborative conduct between Mr George Wang and Ms Jenny Wang, for the reasons set out in paragraph 109 below we do not think this is significant.

Conclusion – shared goal and purpose

- We now return to the question of whether Mr George Wang had a common shared goal and purpose with his siblings that could give rise to an inference of association.

- Mr George Wang submitted that:

“The Applicants’ claim that there should be an inference drawn from the timing of Jason and Jenny’s acquisitions in APW is entirely unfounded. If I were truly wanting to consolidate further holdings in APW, I would simply wait the 6 months until my creep limit of 3.0% reset and then purchase the units through the AIMS Consolidated Group.

…I still have 2.611% available in my creep limit and this is higher than Jason and Jenny’s entire holdings combined. Why would I bother to have them purchase the units? There is no urgency to buy them in January. I could’ve just waited until June 2021 and bought them myself.

I’ve never had the intention to warehouse any of my units. I’ve never done this in the past and I have absolutely no intention of doing this in the future. There is no benefit to me to warehouse these units with my siblings”.

- We consider that the following material is inconsistent with Mr George Wang's submission above regarding his lack of interest in consolidating control in APW:

- The applications included a chronology that showed a history of Mr George Wang seeking to consolidate control in APW, including by taking steps to ensure that resolutions proposed in January 2017 and December 2018 to consider whether to wind up APW were defeated.

- Having a relevant interest in APW of 42.78% as at December 2020, an additional 1.48% interest in the hands of his siblings (although a small percentage relative to the size of his existing unitholding):

- provided Mr George Wang with additional comfort in relation to voting on future ordinary resolutions of APW. For example, it would be less likely for unitholders to be able to replace APW RE as the responsible entity for APW under s601FM(1), should this be put to a vote in the future.28 We consider this to be of elevated significance having regard to previous closely contested resolutions in relation to the winding up of APW29 and

- shortened the period of time required for Mr George Wang to utilise his ‘creep’ allowance to exceed 50% voting power and obtain absolute control of voting on future ordinary resolutions of APW. We consider this to be of elevated significance having regard to Mr George Wang’s previous use of his ‘creep’ allowance (see paragraph (c) below) and the illiquid market for trading in APW units (see paragraph (d) below).

- Mr George Wang and the Consolidated AIMS Group has utilised its ‘creep’ allowance under item 9 of section 611 in the last two six month periods. On 27 May 2020, it acquired 2.90% of the total APW units on issue.30 On 24 December 2020, it acquired 2.99% of the APW units on issue (under the December Transaction).31 Since regaining its creep capacity on or about 24 June 2021, it has acquired a further 0.39% of the APW units on issue during the period from 26 July 2021 to 16 August 2021. The Applicants submitted in their application that Consolidated AIMS Group’s acquisitions of APW units during the period from 22 July 2021 to 11 August 2021 accounted for 95.5% of all APW trades on ASX over that period.

- From our analysis of the trading in APW units, there are periods in which there is very little trading.32 Given that there were sellers on the market when Mr Jason Wang and Ms Jenny Wang started acquiring units,33 and Mr George Wang could not buy units, we consider it is reasonable to assume (for the reasons expressed in (a) and (b) above) that Mr George Wang would prefer those units kept in the family.

- We have considered whether there is sufficient material for us to infer that there is an understanding between Mr George Wang, Mr Jason Wang and Ms Jenny Wang to constitute a relevant agreement between each of them for the purpose of controlling or influencing:

- whether APW RE remains the responsible entity of APW34 or

- the conduct of APW’s affairs.

“Thus it is not a legally indispensable step in the process of seeking to prove the existence of an understanding to demonstrate that the parties communicated with each other. The existence of an understanding will very often be demonstrated by means of circumstantial evidence. No doubt, in that exercise the presence of communications is perhaps a very relevant circumstantial matter just as its absence may be. However, neither is legally essential for a conclusion that an understanding was reached (or not reached).”

- Mr George Wang submitted, in response to a question about what communications he had with Mr Jason Wang and Ms Jenny Wang in relation to their acquisitions, that:

“As Chairman and Director of the responsible entity of AIMS Property Securities Fund, I have great knowledge of APW and confidence in its potential and in my ordinary course of business, I have always promoted the fund to AIMS colleagues (including Jason and Jenny) and existing/potential investors.

To my knowledge, a number of people have acquired units in APW, due to my promotion. It’s not unusual for me to promote AIMS’ products, given my position and experience in this field.

I’ve had no communication with any person that relates to Jason and Jenny’s acquisition of units in APW.”

- Mr George Wang did not provide any details of when he promoted APW to Mr Jason Wang or Ms Jenny Wang (or any of his other AIMS colleagues) and how this can be reconciled with his concluding sentence “I’ve had no communication with any person that relates to Jason and Jenny’s acquisition of units in APW”. We were initially of the preliminary view that Mr George Wang’s submission above supported an inference of an understanding between him and his siblings, even if there was no material to show explicit communication with them directly in relation to their acquisition of APW units.

- Mr Jason Wang submitted that he did not discuss his acquisitions of APW units with anyone36 and Ms Jenny Wang submitted that she only discussed her acquisitions of APW units with her husband.37

- As noted in paragraph 21 above, following the release to the parties of an amended statement of our preliminary findings in relation to AIMS Property Securities Fund 01 proceeding, Mr George Wang supplied the Statutory Declaration together with his submissions.

- The Statutory Declaration contained statements about various matters in relation to both the AIMS Property Securities Fund 01 and 02 applications.

- In relation to the AIMS Property Securities Fund 01 application, the Statutory Declaration included (in summary) that Mr George Wang:

- does not work closely with either Mr Jason Wang or Ms Jenny Wang

- is not involved in either of Mr Jason Wang or Ms Jenny Wang’s private businesses or investments, or in any decisions that they make in relation to either

- denies that:

- he had “any advance knowledge of, or discussions in advance with, Jason or Jenny ahead of their respective decisions to acquire units in APW”

- Mr Jason Wang’s and Ms Jenny Wang’s acquisitions have the effect of increasing his voting rights in APW

- he entered into “any relevant agreement, arrangements or understanding with either Jason or Jenny for any purpose” and

- “Jenny or Jason are warehousing any APW units for myself or the associated AIMS Group entities”

- has “not sought at any time to acquire personally or through the AIMS Group entities, majority control of APW”

- denies that he or the AIMS Group entities have breached section 606 or section 671B of the Corporations Act 2001 (Cth)

- The Statutory Declaration was provided at a late stage of the proceeding and some of its content directly related to some of the inferences we had considered drawing.

- In reviewing the Statutory Declaration, we were mindful that there may be gaps. For example, while Mr George Wang has denied in the Statutory Declaration that he had discussions with Mr Jason Wang or Ms Jenny Wang ahead of their respective decisions to acquire units in APW, the chosen wording leaves open the possibility that he may have communicated with Mr Jason Wang or Ms Jenny Wang indirectly, including via an intermediary or through his promotion of the fund to his AIMS colleagues.

- Additionally, a significant proportion of the Statutory Declaration was not in the typical form for a statutory declaration, being statements of fact. The statutory declaration contained a number of statements which we considered were more akin to submissions, legal conclusions or opinions, including statements in relation to “the Applicants’ claims” in the proceeding. It also contained a number of statements in the form of questions, which we considered to be unusual for a statutory declaration.

- However, overall, we consider that the Statutory Declaration gives additional force to Mr George Wang’s submissions in the proceedings. We reach this view having regard to the criminal consequences of making a false statement in a statutory declaration.

- While we consider that there may be sufficient material to establish that Mr Jason Wang and Ms Jenny Wang communicated with each other in relation to their APW investment, in view of the factual matrix set out in the Statutory Declaration we do not consider that there is sufficient material to establish that Mr George Wang was involved in communications with either Mr Jason Wang or Ms Jenny Wang in relation to their APW investment. Accordingly, we are not prepared to infer that there is an understanding between Mr George Wang, Mr Jason Wang and Ms Jenny Wang for the purpose of controlling or influencing whether APW RE remains the responsible entity of APW or the conduct of APW’s affairs.

Conclusion on association between Mr George Wang, Mr Jason Wang and Ms Jenny Wang

- We accept that even reaching the level of an understanding (potentially the lowest bar for finding an association) requires “a consensus as to what is to be done, rather than a mere hope that something will be done”. It requires that “at least one party ‘assume an obligation’ or give an ‘assurance’ or ‘undertaking’ that it will act in a certain way. A mere expectation that as a matter of fact a party will act in a certain way is not enough, even if it has been engendered by that party.”38

- For the reasons outlined above, we consider that, on balance, there is not sufficient material to establish an association between Mr George Wang / Consolidated AIMS Group and either of Mr Jason Wang or Ms Jenny Wang in relation to Mr Jason Wang or Ms Jenny Wang’s APW investment.

AIMS Property Securities Fund 02

Initial enquiries

- We made enquiries of the parties concerning a range of matters in relation to the December Transaction, as summarised below. We also made enquiries of Mr Steven Larkins (director of APP Securities) and Sandon as non‑parties in relation to certain matters.

- Ms Hiu Ping Lau’s submissions in response to our enquiries were generally very similar to Mr Chi San Liu’s submissions. To avoid repetition, we generally refer to Mr Chi San Liu’s submissions below.

- We made enquiries as to each of the Hong Kong buyers’ occupation and whether any of them had any past or present personal or professional relationships with each other or Mr George Wang.

- Mr Chi San Liu and Ms Hiu Ping Lau are siblings and members of the “Lau family”. Mr Chi San Liu is aged in his early 20s. Ms Hiu Ping Lau is aged in her late 30s. Mr Chi San Liu and Ms Hiu Ping Lau each stated in their submissions that they work in their family business, which has owned hotels in China and has undertaken housing development projects in China.

- Ms Li Li stated in her submissions that she is a housewife and that her husband owns a factory in China that produces decoration materials and furniture. Ms Li Li is aged in her late 30s.

- Mr Chi San Liu submitted that Ms Li Li was his family friend, whose family previously had business connections with the Lau family in Hong Kong and China, including in relation to operating a hotel. Ms Li Li made a submission to the same effect.

- Mr Chi San Liu, Ms Hiu Ping Lau and Ms Li Li each submitted that they did not have any direct or indirect past or present personal connections or relationships (including familial) with Mr George Wang. Mr George Wang made a submission to the same effect.

- Mr Chi San Liu, Ms Hiu Ping Lau and Ms Li Li also each submitted that they did not have any direct or indirect, past or present employment, business or other professional connections or relationships with Mr George Wang. Mr George Wang made a submission to the same effect.

- We made enquiries as to why the Hong Kong buyers and AIMS Investment Group Holdings Pty Ltd agreed to pay a 33% premium to the market price of APW units under the December Transaction and whether they received any advice in relation to this price. Mr Chi San Liu submitted as follows:

“Having formed the view that I wished to acquire a significant stake in APW, I approached Steven Larkins of APP Securities to secure a significant stake in APW on market. Steven Larkins advised that it was not possible to buy such a stake on market given the highly illiquid nature of the stock. I did not wish to begin accumulating stock and find that I was unable to secure a significant stake. Accordingly, I was prepared to take a stake either by way of a placement or by way of a trade.”

- Mr Chi San Liu also submitted “[i]t is clear that the trading price of APW does not reflect its intrinsic value. It is trading at almost a 50% discount to NTA” and that “the opportunity to acquire units in APW at a 25% discount to NTA was very attractive to us given our desire to hold the investment for the long term”.

- Ms Li Li submitted that her family “feels comfortable with Chi San Liu and given his family has previously has [sic] successful property investments in Australia we were comfortable with the price of the APW units.” She also submitted that her family considered that buying APW units at a 25% discount to its net asset value was an attractive entry price.

- Mr George Wang submitted that he considered the APW units offered under the December Transaction were a good investment because they were at a deep discount to the net tangible value of APW.

- We also made enquiries as to how the Hong Kong buyers first heard about APW, why they decided to invest in APW and what due diligence or research they conducted in relation to the investment.

- Mr Chi San Liu submitted that in or around March 2020 he was introduced to APW through Mr Adam Chen, an immigration advisor who had been providing assistance to Mr Chi San Liu in relation to obtaining a 188C significant investor visa for the purposes of immigrating to Australia.

- Mr Chi San Liu submitted that Mr Adam Chen referred him to “AIMS” on the basis that some of AIMS’s managed investment products met that visa’s qualifying investment criteria and that APW owned a property on St Kilda Road, Melbourne, where Mr Chi San Liu’s family had previously invested. Mr Chi San Liu also submitted that APW appeared to be an attractive commercial property investment which fit his family’s investment strategy to “achieve wealth through real estate investments” and that APW’s St Kilda Rd property “gave us confidence given our familiarity with that area and our belief that that area will deliver long term capital growth.”

- Mr Chi San Liu also submitted that “[t]he attraction of managed funds is that we have exposure to commercial properties without the obligation to manage them.”

- Ms Li Li submitted that she and her husband first came to know about APW through Mr Chi San Liu and that they had discussions with the Lau family in relation to potentially investing in and immigrating to Australia. She also submitted that they had done their own research on AIMS and APW by consulting with friends and connections in Australia and stated that “my family has made our investment decision purely based on our own judgement and investment needs.”

- Mr George Wang submitted that he was not initially intending to be involved in the December Transaction, but when he learned that Sandon was a seller he became interested in acquiring Sandon’s units up to the creep limit. He also submitted that the transaction initially contemplated was a placement of APW units to the Hong Kong buyers, which would have been dilutive of the Consolidated AIMS Group’s voting power because it would have involved the issue of additional APW units, but ultimately “because a placement was complex”, it was decided to explore an off‑market sale.

- We also made enquiries regarding who was involved in the discussions, negotiations, structuring and documentation of the December Transaction, including each party’s advisors. In response, we received submissions to the effect that:

- APP Securities, an entity wholly owned by Great World Financial Group Pty Ltd and a member of the Consolidated AIMS Group which operates as a licensed securities dealer, was engaged via mandate letters to act as the broker for the December Transaction, acting for both the Hong Kong buyers on the buy side and on behalf of STAM and Sandon on the sell side

- APP Securities engaged Clayton Utz as the legal advisor for the Hong Kong buyers in relation to the December Transaction and communicated with Clayton Utz on behalf of the Hong Kong buyers in relation to the December Transaction

- STAM and Sandon engaged Mont Lawyers as their legal advisor in relation to the December Transaction and

- neither Mr George Wang nor AIMS Investment Group Holdings Pty Ltd were legally represented in relation to the December Transaction.

- Mr Chi San Liu submitted that after expressing interest in investing in APW, he was referred to Mr Steven Larkins. He submitted that he relied on Mr Larkins to discuss with the lawyers the form of documentation in relation to the investment.

- Ms Li Li submitted that she understood that Mr Chi San Liu had discussed with Mr Larkins her family’s intention to invest in APW, transaction procedures, indicative pricing, and fees and charges.

- We also made enquiries regarding what communications certain of the parties and Mr Steven Larkins had with other persons or entities in relation to the December Transaction (or consideration of it) and requested copies of any documents evidencing such communications.

- Each of the Hong Kong buyers submitted that they had communications with each other in relation to the December Transaction. Ms Li Li submitted that she asked the Lau family to transfer the funds used to acquire the APW units for her as she did not have an Australian bank account.

- Each of the Hong Kong buyers also each submitted that they communicated with Mr Steven Larkins, including in relation to ID verification, and supplied copies of email correspondence in support.

- Mr Steven Larkins included with his submissions a timeline summarising various communications he had in relation to the December Transaction. The timeline referred to a number of meetings between himself and representatives of STAM regarding negotiation of the December Transaction commencing in late August 2020. The entry under 14 October 2020 in the timeline stated “Fred mentioned that if AIMS was happy to sell at $2.20 STAM would be prepared to make a takeover bid as STAM likes the assets in the APW portfolio”.

- STAM submitted that it “had little or no involvement with Mr [George] Wang in negotiating and completing the December Transaction” and that “[a]lmost all our dealings in negotiating and completing the December Transaction were with Mr Larkins”. STAM also submitted that in 2020 it considered making a takeover bid for APW, but decided not to proceed with it in September 2020.

- Mr Chi San Liu submitted that as part of his family's due diligence he and his father had a telephone discussion with Mr George Wang to make enquiries in relation to APW and AIMS. He submitted that “[n]o non‑public information in relation to AIMS' managed investment products, including APW, was provided” and that “[t]here was no discussion in relation to AIMS' unitholding in APW or its intentions regarding that unitholding”. Mr George Wang also submitted that such communication had occurred, although according to his submission there were two or three such phone calls.

- Ms Li Li and Ms Hiu Ping Lau each submitted that they had no communication with Mr George Wang in relation to the December Transaction.

- Clause 4.3 (‘Seller’s Covenant’) of the Sale and Purchase Agreements provided as follows:

Each Seller covenants with each Buyer that for 5 years from Completion, the Seller or its Affiliates (alone or with others) will not, without the prior written approval of each Buyer:

(a) subscribe for, buy, sell, transfer or otherwise deal in units or other securities of the each Fund; and

(b) procure, induce or encourage another person to subscribe for, buy, sell, transfer or otherwise deal in units or other securities of each Fund.

We asked for an explanation as to how this standstill came to be included and who sought to include it and requested any documents evidencing communications or negotiations concerning the provision.

- Mr Steven Larkins submitted that he had sought the standstill condition “on behalf of the buyers in negotiations with STAM and Sandon…”.

- Mr Chi San Liu and Ms Hiu Ping Lau submitted that they were not sure of the purpose of the standstill clause or who sought to introduce it and that they “remain entirely ambivalent as to its inclusion”. Ms Li Li submitted that she did not know who initially sought to include the standstill clause but that she did not object to its inclusion.

- We made enquiries as to how each of the Hong Kong buyers funded their purchases under the December Transaction.

- Mr Chi San Liu submitted that in order to fund the acquisition of APW units he and Hiu Ping Lau “combined [their] money in Australia and transferred some of our funds from Hong Kong and China into Australia to facilitate the APW acquisition.” He also submitted that he and Hiu Ping Lau’s investment comprises about 10% of their family’s total investment capital.

- Ms Li Li submitted that she funded her investment in APW out of family funds. She also submitted that her investment comprises approximately 15‑20% of her family’s total investment capital.

- Each of the Hong Kong buyers executed the Sale and Purchase Agreements under a power of attorney pursuant to which APP Securities was the appointed attorney. The power of attorney document gave APP Securities the power to “approve the terms and form of… any Transaction Document”.

- We made enquiries regarding the power of attorney document including the circumstances that led to APP Securities acting as attorney. In response, Mr Chi San Liu submitted “[t]his was suggested by APP Securities” and:

“…To facilitate a smooth transaction, I was comfortable to give the Power of Attorney. The key terms of our agreement namely the number of securities I was acquiring and the price were fixed.”

Ms Li Li made a submission to a similar effect.

- Under the December Transaction, in addition to its APW units STAM sold the 1,290,000 units it held in ATRF for $695,697 ($0.5393 per unit) to Ms Li Li.

- We made enquiries as to why Ms Li Li (as opposed to the other buyers) agreed to purchase STAM’s units in ATRF, and how she planned to mitigate the risk of investing a substantial amount of money in an illiquid unlisted managed investment scheme. Ms Li Li submitted that she was told STAM would only do the transaction if they could sell down the ATRF units at the same time. She also submitted that her investment in ATRF is only a very small portion of her and her husband’s investable funds.

- The Statutory Declaration contained certain statements in relation to the AIMS Property Securities Fund 02 application, including that Mr George Wang denies that the December Transaction was effected to increase his voting rights in APW and that he denies that the Hong Kong buyers were warehousing APW units for him.

Further enquiries

- Following the initial round of submissions, we made further enquiries in relation to a number of matters as summarised below.

- We asked the Hong Kong buyers which members of the Hong Kong buyers’ family were involved in their decision to invest in APW and who decided how many units would be acquired and/or how much money would be allocated to the investment.

- Mr Chi San Liu submitted that the members of his family involved in the decision to invest in APW were his father, Ms Hiu Ping Lau and himself. He also submitted that “[b]ased on the due diligence conducted of APW, including the understanding of the location and potential growth of the assets managed by APW, we decided that collectively we would be prepared to acquire up to 10% of the capital in APW.”

- Ms Li Li submitted that the members of her family involved in the decision to invest in APW were her husband and herself. She also submitted:

“As my husband and I had intended to apply for 188C visa to migrate to Australia, we had funds at hand that were readily available to invest, and we decided that an investment of approximately 10% of those readily available funds would be an appropriate starting point for this investment.”

- We asked further questions in relation to Mr Chi San Liu and Ms Hiu Ping Lau’s father including whether he had ever had any communications with Mr George Wang. Mr Chi San Liu submitted that his recollection is that there was only one telephone call between his father and Mr George Wang (being the discussion referred to in his initial submissions) and that his father has not had any other communications with Mr George Wang or any members of his family.

- Attached to Ms Li Li’s initial submission was a letter from APP Securities to Ms Li Li dated 30 September 2020 providing a confirmation that approximately $5.84 million in total had been received in APP Securities’ trust account. We made further enquiries as to why these funds were sent to APP Securities’ trust account on this date which appeared to be well in advance of the terms of the December Transaction being agreed. Mr Steven Larkins submitted that “[a]s at 28 September 2020 a placement by APW appeared the most likely option and we had requested that the funds be placed in the APP Securities trust account prior to the transaction being undertaken”. Ms Li Li also made a submission to this effect.

- We asked Mr Steven Larkins whether anyone asked him to seek the standstill clause in the Sale and Purchase Agreements or otherwise express a desire for it to be sought, noting that the Hong Kong buyers had each made submissions to the effect that they had not requested it. In response, Mr Steven Larkins submitted:

“No. I was of the view that a standstill condition was a prudent precaution in the scenario of two activist funds departing the register. Such a standstill condition would avoid the potential for the activist funds to return in the short to medium term.”

- We also asked further questions of STAM in relation to the takeover proposal by STAM for APW referred to in STAM’s and Mr Larkins’ submissions. STAM’s submissions in response to these questions included as follows:

“In paragraph 4 of STAM’s original submissions it stated that it had decided not to proceed with a takeover bid in September 2020. This statement is a reference to a hostile takeover bid. After that time, STAM remained open to considering an AIMS‑supported takeover bid, which would have required the support and participation of entities controlled by Mr Wang.

…

STAM remained willing to obtain control of APW at a price of $2.20 per unit during the period up to execution of the Sale & Purchase Agreement. STAM’s representatives cannot recall if October 14th was the last time a takeover was discussed. During discussions prior to execution of the Sale & Purchase Agreement Mr Larkins made it clear to STAM’s representatives that Mr Wang was not interested in selling APW units.”

- We received two versions of the mandate letter from APP Securities to Ms Li Li; one dated 30 November 2020 and another signed version dated 18 December 2020. The mandate letter dated 18 December 2020 stated that Ms Li Li would acquire 537,681 more APW units than the mandate letter dated 30 November 2020. We queried what communications Mr Larkins had with any person in relation to the possible acquisition of any or all of the additional 537,681 APW units ultimately acquired by Ms Li Li. In response, we were provided with a copy of any email from Mr Larkins to Ms Li Li dated 10 December 2020 which included the following statements:

“An additional stake of 538,682 units of APW (1.21%) needs to be acquired for the transaction to proceed.

…

Please transfer an additional A$900,000.00 to APP Securities’ Trust Account for the acquisition of these units and related costs.”

- The timeline for the finalisation of the negotiation of the December Transaction coincided with Mr Jason Wang’s and Ms Jenny Wang’s liquidation of their securities portfolios in November‑December 2020. Accordingly, we asked whether either of Mr Jason Wang or Ms Jenny Wang had communications with any person or entity in relation to the potential purchase of any APW units or ATRF units during the period 1 July 2020 to 31 December 2020. Each of them submitted in response that they had had no such communications.

Conclusion on association between the Hong Kong buyers and the Consolidated AIMS Group

- As noted at paragraph 31 above, the parties have used different terminology to discuss entities that are related in some way to Mr George Wang. In reviewing the submissions of the parties, we were mindful that terminology may have been used selectively and we were alert to the potential for gaps. For example, in Mr George Wang’s submission in response to a request to explain Mr Adam Chen’s relationship with the Consolidated AIMS Group and any other entity that Mr George Wang would describe as part of ‘AIMS’, including any past business or professional dealings, Mr George Wang stated “Mr Chen is not employed within the Consolidated AIMS Group”. It is conceivable that Mr Chen may have a relationship with an entity outside of the Consolidated AIMS Group that Mr George Wang would describe as part of ‘AIMS’.

- Based on our commercial experience, a number of aspects of the December Transaction are unusual, including:

- APP Securities’ and in particular Mr Steven Larkins’ broad role in acting as broker on both the buy side and sell side in circumstances where APP Securities is a related party of one of the buyers

- the inclusion of the standstill at the instance of Mr Steven Larkins in circumstances where this was not requested by any of the Hong Kong buyers

- Ms Li Li’s transfer of approximately $5.8 million to APP Securities’ trust account in advance of the transaction structure having been agreed and

- the form of Mr Steven Larkins’ email to Ms Li Li dated 10 December 2020 requesting an additional $900,000 for Ms Li Li to acquire a further 537,681 APW units.

- However, we also consider that it is open to infer that the December Transaction proceeded as it did and assumed the form it did due to the particular circumstances at hand, including:

- the inability of the Hong Kong buyers to purchase their desired volume of APW units on market and

- the Hong Kong buyers’ desire to satisfy the significant investor visa requirements in order to immigrate to Australia.

- In our view, there is not sufficient material to establish an association between Mr George Wang / Consolidated AIMS Group and any of the Hong Kong buyers in relation to the December Transaction.

Extension of time for the applications

AIMS Property Securities Fund 01

- The application in relation to AIMS Property Securities Fund 01 was made on 13 August 2021, which was more than 2 months after Mr Jason Wang and Ms Jenny Wang completed purchasing their APW units.

- Section 657C(3) provides that:

An application for a declaration under section 657A can be made only within:

(a) two months after the circumstances have occurred; or

(b) a longer period determined by the Panel.

- In Webcentral Group Limited 03 [2021] ATP 4, the Panel articulated the following factors as relevant in considering whether to extend time under section 657C(3)(b):

“(a) the discretion to extend time should not be exercised lightly”

(b) whether the application made credible allegations of clear and serious unacceptable circumstances, the effects of which are ongoing

(c) whether it would be undesirable for a matter to go unheard, because it was lodged outside the two month time limit, if essential matters supporting it first came to light during the two months preceding the application and

(d) whether there is an adequate explanation for any delay, and whether parties to the application or third parties will be prejudiced by the delay.” 39

- The Applicants requested an extension of time under section 657C(3)(b) in their application and made submissions in support of this request including:

- The relevant circumstances were concealed until 7 July 2021, when Mr Sauer inspected APW’s unitholders’ register, such register detailing the acquisition of units by Jenny Wang and Jason Wang starting on 8 January 2021.

- The relevant circumstances were not suspected by Mr Sauer until 27 July 2021, when Mr Sauer reviewed in detail the unitholders’ register that he had inspected on 7 July 2021, and noticed that two parties with the surname Wang had from 8 January 2021 commenced wholesale acquisition of APW units.

- Upon noticing that two parties with the surname Wang had from 8 January 2021 commenced wholesale acquisition of APW units, the Applicants began investigating whether the Wang Parties were connected and if so how and to what extent, and upon concluding that they were inexorably intertwined, began preparing this application.

- We provided the parties multiple opportunities to make submissions on whether we should extend time.

- As part of his submissions that we should not extend time, Mr George Wang stated that:

- “the initial acquisition of units by Mr Jason Wang is the relevant circumstances, and that the applicants had 2 months to make an application from this occurring”

- “The information regarding Jason and Jenny’s holdings in APW was not concealed to the entire world. On the contrary, it was readily available on the unit register of APW, which the Applicants could have inspected within the given timeframe, as is their right as unitholders. Another point is that the purchases were made in Jason and Jenny’s individual names or through their superannuation funds, which is very transparent.

…

I draw the Panel’s attention to the strange timing of the Applicants inspecting the register, shortly after I had a conversation with Warwick Sauer… There is no good reason provided by the Applicants as to why they did not inspect the register in January 2021, instead of many months later” and

- “the evidence before the Panel demonstrates that the Applicant is an activist minority unitholder. The Panel can reasonably infer from this that the applicant was closely monitoring APW's share price and trades (noting it is a very thinly traded fund) such that he either was on notice of the circumstances giving rise to the application at the time of Jason Wang's and Jenny Wang's acquisitions, or reasonably ought to have been aware at or about the time of the first acquisition.”

- The Applicants submitted that Mr Sauer initially requested access to the APW unitholder register on 22 June 2021. The Applicants also submitted that, in effect, Mr Sauer was delayed in obtaining access to the APW unitholder register by virtue of obstructive conduct on the part of APW RE. This submission was contested by APW RE. We were supplied with certain email correspondence in relation to the request to access the unitholder register.

- ASIC submitted (among other things) that: