[2019] ATP 17

Catchwords:

Decline to conduct proceedings – association – shareholder statements – misleading or deceptive statements

Corporations Act 2001 (Cth), sections 606, item 7 s611, 671B

The Australian Government the Treasury, Increasing Transparency of the Beneficial Ownership of Companies - Consultation Paper, February 2017

Innate Immunotherapeutics Limited [2017] ATP 2, Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, Mount Gibson Iron Limited [2008] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Yasmin Allen, Robert McKenzie (sitting President) and Bruce McLennan declined to conduct proceedings on an application by Havilah Resources Limited in relation to its affairs. The application concerned whether (i) Dr Keith Robert Johnson, a co-founder and former director of Havilah, was associated with other shareholders (in contravention of s6061 and the substantial holder provisions) and (ii) material sent by Dr Johnson to Havilah shareholders in relation to a general meeting under item 7 s611 contained misleading or deceptive statements. The Panel considered that Havilah had not provided a sufficient body of material to justify the Panel making further enquiries on the question of association and considered that Havilah was able to publish corrective disclosure to clarify any statements by Dr Johnson. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Control Transaction

- The transaction referred to in paragraph 4

- Dr Johnson

- Dr Keith Robert Johnson

- Havilah

- Havilah Resources Limited

- HNC

- HNC Holdings Pty Ltd

- I-Site

- I-Site Pty Ltd

- Item 7 Meeting

- The meeting referred to in paragraph 4

- IQ EQ (Jersey)

- IQ EQ (Jersey) Limited

- JP Morgan

- JP Morgan Nominees Pty Ltd

- Statsmin

- Statsmin Nominees Pty Ltd

- Statsmin Super

- Statsmin Super Fund

- SIMEC

- OneSteel Manufacturing Pty Ltd

- Trindal

- Trindal Pty Ltd

Facts

- Havilah is an ASX listed resources exploration and development company based in South Australia (ASX code: HAV).

- On 1 May 2019, Havilah entered into a share subscription agreement with SIMEC and Liberty Onesteel (MDR) UK Ltd, which provides for SIMEC to invest up to $100 million in Havilah in exchange for a series of share issues in Havilah, which once completed would result in SIMEC having voting power of up to 60.99% in Havilah (Control Transaction). Havilah convened a general meeting for 12 September 2019 to approve the issue of shares to SIMEC under item 7, s611 (Item 7 Meeting).2

- Dr Johnson is a co-founder of Havilah and is a former director. Dr Chris Giles is a current director of Havilah. On 2 August 2019, Dr Johnson sent an email to certain Havilah shareholders in relation to the Item 7 Meeting, stating (among other things) that (emphasis in the original):

- "It was with great relief that I noted Dr Chris Giles DOES NOT SUPPORT the transaction. It is only supported by the so-called Independent Directors who only have nominal shareholdings".

- "I and my associates will vote NO to the resolution".

Application

Declaration sought

- By application dated 21 August 2019, Havilah sought a declaration of unacceptable circumstances. Havilah submitted that:

- Dr Johnson had a relevant interest in Havilah shares held by Statsmin (in its own capacity and its capacity as trustee of Statsmin Super), I-Site, Talagar and Maptek.

- Dr Johnson had a relevant interest in Havilah shares held by his wife, Ms Gaynor Johnson.

- Havilah shares held by the Asycough Trust (held in the name of its trustee IQ EQ (Jersey)) and Woolsthorpe were subject to the same court order3 as shares held by Dr Johnson, Maptek and Statsmin (in its own capacity and its capacity as trustee of Statsmin Super). Correspondence in relation to this court order implied that Dr Johnson had a relevant interest in the Havilah shares held by these companies.

- Members of Dr Johnson's family hold Havilah shares, namely Mr Peter Johnson and Ms Melissa Johnson4 as trustees for the P & M SF, Mr Peter Johnson through HNC, Ms Melissa Johnson (in her own name) and Ms Claire Johnson5.

- Some of JP Morgan's shares were held on behalf of, or for the benefit of, Dr Johnson.

- Dr Johnson had some dealings with Mr Paul Clark who holds Havilah shares. Mr Clark's partner, Ms ████████ ███████████, also holds Havilah shares.

- On 17 December 2018, Dr Johnson, Statsmin (in its own capacity and its capacity as trustee of Statsmin Super), Talager, Mr Peter Johnson and Ms Melissa Johnson as trustees for the P & M SF, Ms Melissa Johnson, HNC and Mr Paul Clark lodged a notice of initial substantial holder. The notice disclosed that they had become associates by virtue of s12(2)(b), because they had issued "a notice of intention to move a resolution to remove the directors of" Havilah. They lodged a notice ceasing to be a substantial holder on 14 May 2019.

- Dr Johnson had become associated with Dr Giles because, among other things, Dr Johnson had been negotiating with Dr Giles in relation to the acquisition of shares held by Dr Giles through Trindal, equating to 6.6% of the total number of Havilah shares.

- Havilah submitted that because of the above, Dr Johnson has contravened the substantial holder provisions and s606 (including because of his acquisition of shares from Trindal).

- Havilah also submitted that Dr Johnson's correspondence relating to the Item 7 Meeting contained misleading or deceptive statements.

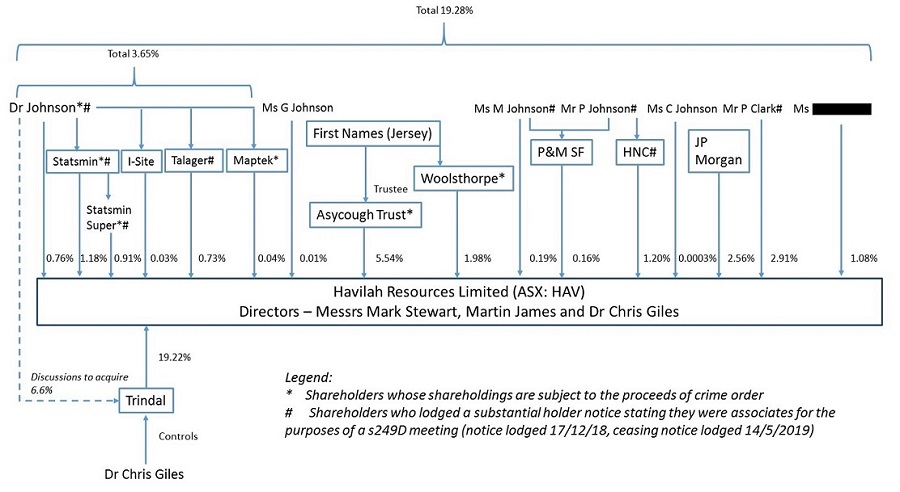

- The shareholders described above are also set out in the diagram below:

Final orders sought

- Havilah sought final orders including restraining Dr Johnson and certain other Havilah shareholders from voting at the Item 7 Meeting and requiring corrective substantial holder notice disclosure. Havilah also sought a final order that Dr Johnson make corrective disclosure in relation to his alleged misleading correspondence relating to the Item 7 Meeting, including withdrawing recommendations and undervalue statements.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

- We received preliminary submissions from each of Dr Johnson6, Mr Peter Johnson, Ms ███████████, Mr Clark and Dr Giles. We were concerned that Havilah should have made further enquires before making its application. We decided to seek information from Havilah prior to deciding whether to conduct proceedings.

Dr Johnson, Statsmin (in its own capacity and its capacity as trustee of Statsmin Super), I-Site, Talagar, Maptek and Ms Gaynor Johnson

- Dr Johnson submitted that he only had a relevant interest in Havilah shares held by himself, Statsmin (in its own capacity and its capacity as trustee of Statsmin Super),

I-Site, Talagar and Maptek. He submitted that this equated to 3.65% of Havilah's shares and accordingly there was no substantial holding for him to disclose under s671B. - Dr Johnson submitted that he is not an associate of Ms Johnson (his wife) and "is not involved in any investment decisions relating to, and does not control the exercise of the right to vote" any of her shares. Ms Johnson's interest is small. Even assuming Dr Johnson had voting power in Ms Johnson's Havilah shares, he would still not be required to lodge a substantial holder notice if his only other interests were as above.7

Dr Johnson, Asycough Trust (held in the name of its trustee IQ EQ (Jersey)) and Woolsthorpe

- Havilah submitted that the court order and correspondence in relation to the court order in effect suggested that Dr Johnson was a beneficiary of and controlled the shares held by Asycough Trust (held in the name of its trustee IQ EQ (Jersey)) and Woolsthorpe.

- We asked whether Havilah had ever issued beneficial tracing notices in relation to these shareholders in light of the following information:

- Havilah's 2002 initial public offering prospectus had the following statements, "Atlantique Trust Limited in its capacity as trustee of the Asycough Trust (a related party of K R Johnson)…" and "Atlantique Trust Ltd is not associated with Dr K R Johnson but it holds the Shares registered in its name as trustee of the Ayscough Trust, which is a trust principally for the benefit of the family of Dr K R Johnson".

- A substantial holder notice lodged by First Names (Jersey) Limited dated 20 March 2014 stated that Atlantique Trust Ltd was the former name of First Names (Jersey) Limited and that First Names (Jersey) Limited (with other related entities) controlled Woolsthorpe.

- First Names (Jersey) Limited was the former name for IQ EQ (Jersey).

- Havilah submitted in response (among other things) that:

- during the period that Dr Johnson was on the board (from at least the time of the 2002 initial public offering to 8 November 2013) he maintained that IQ EQ (Jersey) and Woolsthorpe "were managed independently of him"

- it decided "that its circumstances did not require or justify the expense of issuing beneficial tracing notices"

- IQ EQ (Jersey) and Woolsthorpe have not typically voted at general meetings of Havilah but recent voting by them has been "in the same pattern as Dr Johnson"

- any tracing notices were likely to be resisted and

- the Australian Department of Treasury has commented on the inherent difficulties with the beneficial tracing regime, particularly in relation to foreign shareholding structures.8

- We do not find Havilah's explanation as to why it did not issue beneficial tracing notices compelling. In the absence of Havilah issuing beneficial tracing notices, there is no reason for us to question Dr Johnson's submission that:

"…he is not, and never has been, a beneficiary or trustee of the Ayscough Trust, and the trustee of the Ayscough Trust [IQ EQ (Jersey)] alone has exercised and continues to exercise proper control over the trust's assets, and further Dr Johnson has no control over the trustee, for the avoidance of doubt, including but not limited to, the exercise of the rights to vote attaching to any Shares held by the trust."9

Dr Johnson, Mr Peter Johnson and Ms Melissa Johnson as trustees for the P & M SF, Ms Melissa Johnson, HNC, Ms Claire Johnson, Mr Clark and Ms ███████████

- Havilah submitted that the above persons were associated primarily because of family relationships and the admission of association between some of them in the substantial holding notice referred to in paragraph 6(g).

- A relationship between a parent and an adult child is less of an indicator of association compared to the spousal relationship.10 Each of Mr Clark and Ms ███████████ submitted that they did not have a familial relationship with Dr Johnson.

- Mr Peter Johnson submitted that the association between Dr Johnson, himself and others, disclosed in the substantial shareholder notice, had "ceased to exist" when resolutions to remove directors of Havilah failed, noting that a notice of ceasing to be a substantial holder was sent by him and accepted by Havilah on 14 May 2019.

- We asked Havilah whether it made any enquiries of those shareholders who had lodged the 14 May 2019 notice of ceasing to be a substantial holder, including determining whether they had ceased to be associated with each other. Havilah submitted in response that it did not make any enquiries because "the environment at the time was not conducive to Havilah making enquiries about any continuing association". It also submitted that it was making the application based on its investigations in relation to correspondence sent to shareholders in relation to the Item 7 Meeting on 2 August 2019. While that may not be unreasonable in the circumstances, we do not consider there is sufficient material to justify making enquiries as to whether the shareholders who previously lodged a substantial holder notice continued to be associated despite lodging a ceasing notice (particularly in circumstances where Havilah had not issued any beneficial tracing notices).

Dr Johnson and JP Morgan

- We asked Havilah to provide any additional material it had to support an inference that some of JP Morgan's Havilah shares were held for the benefit of Dr Johnson. Havilah submitted that part of JP Morgan's parcel voted in the same manner as Dr Johnson's Havilah shares on every resolution at its 2018 annual general meeting and the extraordinary general meeting held on 4 February 2019.

- We do not consider that this is sufficient in the circumstances to justify making further enquiries.

Dr Johnson and Dr Giles

- Havilah relied on statements made by Dr Giles in relation to the Control Transaction and the negotiations between Dr Johnson and Dr Giles in relation to the acquisition of some of Dr Giles's shares in its submission as to why Dr Johnson and Dr Giles are associates.

- Both Dr Johnson and Dr Giles submitted that the sale of Dr Giles's shares did not proceed. We asked Havilah whether it had any further material to support an association. Havilah in response said that its application included sufficient material to meet the "associations hurdle". We do not agree.

Conclusion on association

- In light of the above, we consider that Havilah has not provided a sufficient body of material to justify us making further enquiries as to whether there are any associations leading to a contravention of s606 or a material contravention of the substantial holder provisions.11

Statements made by Dr Johnson in relation to the Control Transaction

- We considered the statements by Dr Johnson in relation to the Control Transactions that Havilah submitted were misleading or deceptive. These statements related mostly to the value of Havilah's projects. We consider that Havilah could publish corrective disclosure to its shareholders in response.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Robert McKenzie

President of the sitting Panel

Decision dated 3 September 2019

Reasons given to parties 16 September 2019

Reasons published 18 September 2019

Advisers

| Party | Advisers |

|---|---|

| Mr Clark | |

| Havilah | Piper Alderman |

| IQ EQ (Jersey) and Woolsthorpe | Baker & McKenzie |

| Dr Johnson | Thomson Geer |

| Mr Peter Johnson | |

| Ms ███████████ | |

| Trindal |

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 Among other purposes

3 Stating that these shares subject to the order "not be disposed of or otherwise dealt with by any person except in the manner and circumstances specified in these orders or with the written consent of the Plaintiff".

4 His son and daughter in law respectively

5 Described in the application as "the daughter of Dr Johnson's wife"

6 With Statsmin (in its own capacity and its capacity as trustee of Statsmin Super), I-Site, Talager and Maptek

7 In other circumstances, we may have made further enquiries in relation to Dr Johnson's submission, see Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, at [53] to [57]

8 The Australian Government the Treasury, Increasing Transparency of the Beneficial Ownership of Companies - Consultation Paper, February 2017

9 We note for completeness that Ms Gaynor Johnson emailed Havilah's share registry on 13 December 2018, stating that she was "one of the beneficiaries of the Trust". We consider this is not inconsistent with the possibility that neither Dr Johnson nor Ms Gaynor Johnson have control over the shares held by IQ EQ (Jersey) on trust for the Ayscough Trust

10 Innate Immunotherapeutics Limited [2017] ATP 2 at [15] to [21]

11 See Mount Gibson Iron Limited [2008] ATP 4 at [15]