[2018] ATP 15

Catchwords:

Association – board spill – substantial holding disclosure – effect on control – efficient, competitive and informed market – decline to conduct proceedings

Corporations Act 2001 (Cth), sections, 249D and 671B

ASIC Regulatory Guide 5: Relevant interests and substantial holding notices

Regis Resources Limited [2009] ATP 7, Auris Minerals Limited [2018] ATP 7, Dragon Mining Limited [2014] ATP 5

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | No | No | No | No | No |

Introduction

- The Panel, Bruce Cowley, Sarah Rennie and Nicola Wakefield Evans (sitting President), declined to conduct proceedings on an application by GTT Global Opportunities Pty Ltd in relation to the affairs of Baraka Energy and Resources Limited. The application was made in the context of a requisitioned general meeting and concerned alleged association between shareholders of Baraka and contravention of section 671B of the Corporations Act 2001 (Cth).1 The Panel considered that it was not provided with a sufficient body of material to justify making further enquiries as to the alleged association and accordingly, there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Alleged Associates

- The Vost Directors, Mrs Dalma Vost, Cervantes, JV Global, Nuzeno and Mr Patrick O'Neill

- Baraka

- Baraka Energy and Resources Limited

- Cervantes

- Cervantes Corporation Ltd

- EGM

- The general meeting of Baraka on 10 August 2018 to consider the resolutions the subject of the Requisition Notice

- GTT

- GTT Global Opportunities Pty Ltd

- JV Global

- JV Global Limited

- Nuzeno

- Nuzeno Holdings Pty Ltd

- Nuzeno Placement

- The placement of Baraka shares to Nuzeno described in paragraph 5

- Requisition Notice

- The notice referred to in paragraph 4

- Vost Directors

- Collin Vost and Justin Vost

Facts

- Baraka is an ASX listed company (ASX code: BKP). Its principal activity is oil and gas exploration and development in the Southern Georgina Basin in the Northern Territory.

- On 14 June 2018, Baraka announced that it had received a notice under section 249D from GTT and other shareholders to requisition a meeting of shareholders to consider resolutions for:

- the removal of all current directors, being the Vost Directors and Ray Chang, as directors of Baraka and

- the election of Messrs Jason Brewer, Christopher Zielinski and Patrick Glovac as directors of Baraka,

- On 28 June 2018, Baraka made a placement of 50,000,000 shares to Nuzeno at $0.002 per share (Nuzeno Placement).

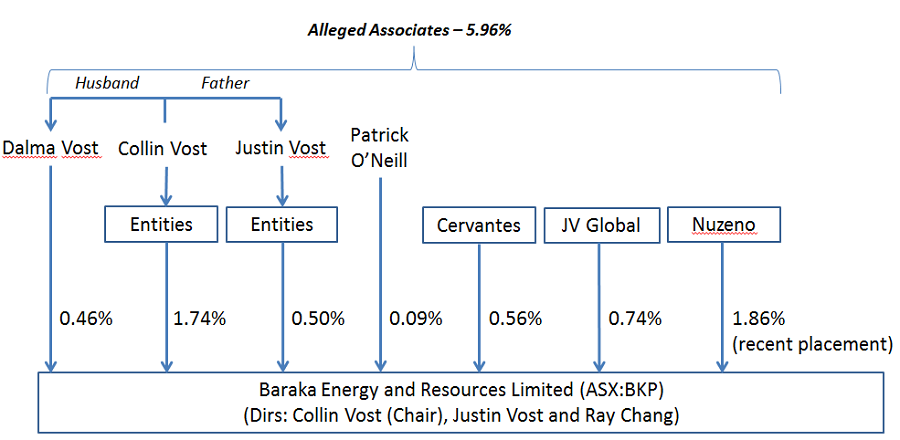

- The holdings of the Alleged Associates (based on information provided in the application) in Baraka are shown in the following diagram:

- The Vost Directors are also both directors of Cervantes and JV Global and have a beneficial interest in shares in those entities. Mr Collin Vost is Mr Justin Vost's father. Mrs Dalma Vost is Mr Collin Vost's wife and also holds shares in Cervantes and JV Global.

- Mr Patrick O'Neill is the company secretary of Baraka, Cervantes and JV Global.

Application

Declaration sought

- By application dated 1 August 2018, GTT sought a declaration of unacceptable circumstances. GTT submitted that:

- there had been a contravention of section 671B as a result of undisclosed associations between shareholders with a combined holding of 5.96% of Baraka's issued share capital and

- there are unacceptable circumstances arising from "favourable" heavily discounted placements to friendly shareholders and uncommercial and undisclosed related party transactions, commencing in late 2011 and continuing to date.

- GTT submitted that the effect of the circumstances was that trading in Baraka shares had not taken place in an efficient, competitive and informed market.

Orders sought

- GTT sought interim orders restraining the Alleged Associates from voting or selling shares or converting options, and restraining Baraka's board from taking certain actions, including issuing new shares and disposing of assets.

- GTT sought final orders requiring disclosure of the alleged associations, and either reversing the Nuzeno Placement or vesting the shares issued to Nuzeno in ASIC for sale.

Discussion

- We have considered all the material, but address specifically only those things that we consider necessary to explain our reasoning.

- GTT raised concerns regarding placements, alleged related party transactions and alleged uncommercial transactions, that would normally only be matters for the Panel to address to the extent they could (at a minimum) affect potential control or involve contravention of the substantial holding disclosure requirements. In our view, that could only be likely if there was an association between Nuzeno (1.86% relevant interest) and the other Alleged Associates (given the Alleged Associates excluding Nuzeno hold an aggregate relevant interest in Baraka shares of 4.12%).

- In relation to allegations of association, the Panel's starting point is that it is for the applicant to demonstrate a sufficient body of probative material to support the Panel conducting proceedings.2 As the Panel has limited investigatory powers, before we decide to conduct proceedings, "an applicant must do more than make allegations of association and rely on us to substantiate them".3

- GTT submitted that circumstances surrounding the Nuzeno Placement demonstrated prior collaborative conduct and uncommercial dealings between Nuzeno and the other Alleged Associates. GTT pointed to the shares being placed to Nuzeno at a "highly discounted" price of $0.002,4 and that the placement was made shortly before the EGM and 6 weeks after Baraka announced that it was "well-funded". GTT submitted that this demonstrates that Nuzeno is a "friendly" shareholder of the Vost Directors and that the shares were placed to Nuzeno "in order to buy votes".

- Baraka made preliminary submissions rejecting GTT's claim that an association between the Alleged Associates had arisen by virtue of the Nuzeno Placement. Baraka noted that the Nuzeno Placement was done on the same terms as a recent placement of Baraka shares which was coordinated by GTT.

- We did not think that the discounted price of the Nuzeno Placement alone justified further inquiry given that Baraka had recently completed a placement on similar terms and it would be reasonable for an incoming placee to negotiate terms based on a previous placement.

- We were also not persuaded that the timing of the Nuzeno Placement, being shortly before the EGM, was sufficient given its limited impact on voting power.

- GTT also submitted that past transactions and certain structural links between the Alleged Associates indicated association.

- Even if we were to have concluded that there was some prospect of us finding that an association existed, we were not satisfied further enquiries were justified given the limited potential for any control effect.5

Timeliness of application

- Baraka submitted that the application had not been made in a timely manner. Baraka noted that the Nuzeno Placement was completed 5 weeks before the Panel application, and that GTT had waited until 1 week before the EGM to make an application to the Panel.

- Baraka submitted that "GTT is seeking to gain a tactical advantage in connection with the General Meeting, by supressing the votes which the [Alleged Associates] may wish to cast at the General Meeting and thereby enhancing the prospects of the success of the Requisitioning Shareholders at that meeting".

- We did not need to form a view on whether GTT made its application to gain a tactical advantage at the EGM, but we did consider that GTT could have made its application earlier to allow more time for a decision to be made before the EGM.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Nicola Wakefield Evans

President of the sitting Panel

Decision dated 8 August 2018

Reasons given to parties 20 August 2018

Reasons published 24 August 2018

Advisers

| Party | Advisers |

|---|---|

| GTT | - |

| Baraka | Steinepreis Paganin |

1 - Unless otherwise indicated, all section references are to theCorporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 - Dragon Mining Limited [2014] ATP 5 at [27]

3 - Dragon Mining Limited [2014] ATP 5 at [58]-[60]

4 - The Baraka share price closed at $0.006 on 27 June 2018

5 - Regis Resources Limited [2009] ATP 7 at [19], Auris Minerals Limited [2018] ATP 7 at [23]