[2017] ATP 10

Catchwords:

Association – otherwise unacceptable – efficient, competitive and informed market – structural links - shareholder requisition – nominee directors - common directors – extension of time for making application - extension of time for making declaration – conference - undertakings - declaration – orders – divestment of shares – voting restrictions

Corporations Act 2001 (Cth), sections 9, 11, 12(2)(b), 12(2)(c), 53, 249D, 602, 606, 657A, 657B, 657C, 657D

Australian Securities and Investments Commission Act 2001 (Cth) section 194

Australian Securities and Investments Commission Regulations 2001 (Cth) Regulations 16, 35, 38

Australian Securities and Investments Commission Regulatory Guide 5: Relevant interests and substantial holding notices

Ford, Austin & Ramsay’s Principles of Corporations Law [23.250]

Takeovers Panel v Keybridge Capital Limited, in the matter of Molopo Energy Limited [2017] FCA 469, Palmer Leisure Coolum Pty Ltd v Takeovers Panel [2015] FCA 1498, Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68, Molopo Energy Limited v Keybridge Capital Limited [2014] NSWSC 1864, Attorney-General (Cth) v Alinta Limited [2008] HCA 2, Re Takeovers Panel [2002] FCA 1120, ACCC v CC (NSW) Pty Ltd (No 8) (1999) 92 FCR 375, Adsteam Building Industries Pty Ltd & Anor v The Queensland Cement and Lime Co Ltd & Ors (1984) 14 ACLR 456

Kasbah Resources Ltd [2016] ATP 19, Merlin Diamonds Limited [2016] ATP 18, Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9, World Oil Resources Limited [2013] ATP 1, Minemakers Limited [2012] ATP 8, Real Estate Capital Partners USA Property Trust [2012] ATP 6, CMI Limited 01R [2011] ATP 5, CMI Limited [2011] ATP 4, Viento Group Limited [2011] ATP 1, Blue Energy Limited [2009] ATP 15, Mount Gibson Iron Limited [2008] ATP 4, Golden Circle Ltd 02 [2007] ATP 24, Australian Pipeline Trust 01 [2006] ATP 27, Orion Telecommunications Limited [2006] ATP 23, Bridgewater Lake Estate Ltd [2006] ATP 3, Winepros Limited [2002] ATP 18

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | Yes | Yes | Yes | Yes | No |

Introduction

- The Panel, Shirley In’t Veld, Karen Phin and John Sheahan QC (sitting President), made a declaration of unacceptable circumstances in relation to the affairs of Molopo Energy Limited. The two applications (heard together) concerned whether Keybridge Capital Limited and Aurora Funds Management Limited,1 both substantial shareholders in Molopo Energy Limited, were associated with one another in relation to Molopo with a combined shareholding in Molopo of 37.87%, in contravention of s606.2 Molopo’s application extended to whether the relationship between a broader group including Keybridge and Aurora was such that they were associated or it was otherwise unacceptable to have aggregated control. The Panel declared the circumstances unacceptable as it considered that the involvement of Mr Nicholas Bolton, or Mr Bolton together with Mr John Patton, in Keybridge and Aurora gave rise to unacceptable circumstances in relation to the affairs of Molopo.

- In these reasons, the following definitions apply.

- AGIT

- Aurora Global Income Trust (ARSN 127 692 406)

- AFARF

- Aurora Fortitude Absolute Return Fund (ARSN 145 894 800)

- ASG

- Australian Style Group Pty Ltd (ACN 108 841 103)

- ASH

- Australian Style Holdings Pty Ltd (ACN 108 602 491)

- Aurora

- Aurora Funds Management Limited (ACN 092 626 885), including as responsible entity of AFARF and AGIT

- Aurora Trust

- Aurora Investment Unit Trust

- Bentley

- Bentley Capital Limited (ACN 008 108 218)

- Keybridge

- Keybridge Capital Limited (ACN 088 267 190)

- Molopo

- Molopo Energy Limited (ACN 003 152 154)

- Mr Bolton

- Mr Nicholas Bolton

- Relevant Persons

- Messrs Farooq Khan, Simon Cato, William Johnson, Nicholas Bolton, John Patton and Jim Hallam and Ms Betty Poon, and their controlled entities, including Bentley, Scarborough, ASG, Keybridge and Aurora

- Scarborough

- Scarborough Equities Pty Ltd (ACN 061 287 045)

- Seventh Orion

- Seventh Orion Pty Ltd (ACN 613 173 238)

Facts

- Molopo is an ASX listed company (ASX Code: MPO) with 249,040,648 shares on issue. Its main asset is cash in the order of $67 million. Its shares have for some time traded at a substantial discount to its net tangible assets (in the order of 12-16 cents as opposed to NTA of about 27 cents per share).

- Keybridge is an ASX-listed investment company (ASX Code: KBC). It has a relevant interest in 49,683,828 shares in Molopo (19.95%).

- Aurora has a relevant interest in 44,629,831 shares in Molopo (17.92%).

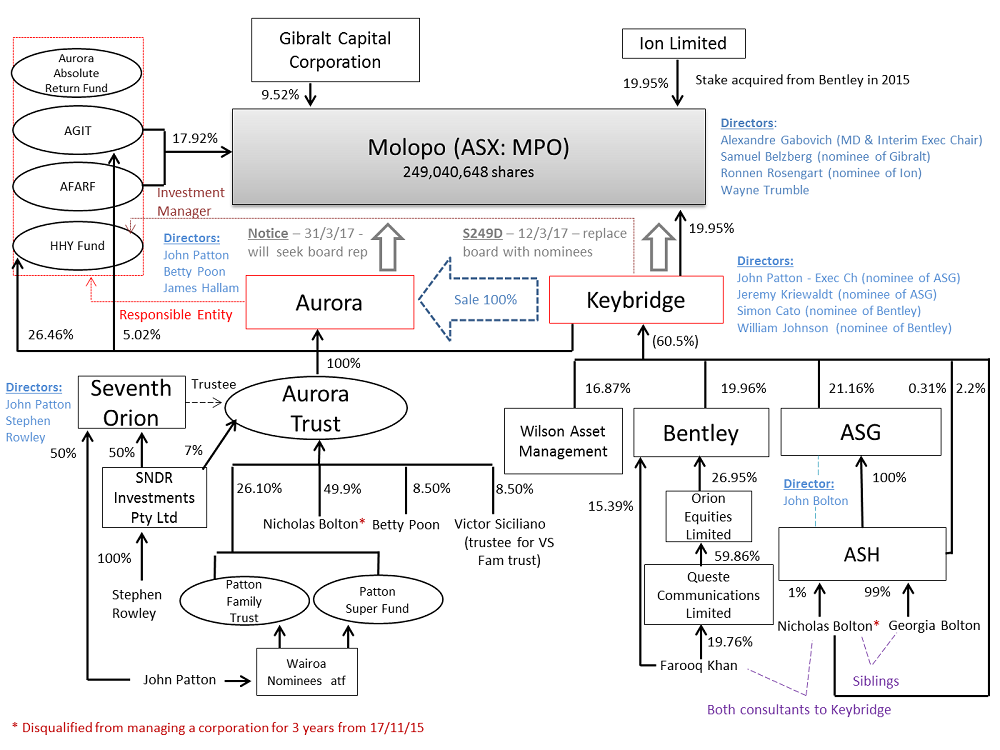

- Relevant relationships between the parties are shown in the following diagram.

- From about August 2014, Aurora (then owned by Aurora Fund Limited, a company unrelated to the parties to these applications) commenced acquiring shares in Molopo as responsible entity for various funds.

- In about January 2015, Scarborough (a subsidiary of Bentley) had a relevant interest in 19.98% of Molopo, which it transferred to Bentley3 and which was subsequently sold to Ion Limited.4 As part of the sale agreement, Bentley and Mr Khan agreed not to (and to procure their related parties and associates not to) acquire any Molopo shares for 12 months.

- On 16 February 2015, Keybridge announced the acquisition of Aurora. At the time, Aurora had a relevant interest in less than 5% of Molopo. Keybridge paid $4.3 million (part deferred, adjustable).5

- In about July 2015, the board of Keybridge comprised 3 non-executive directors –Andrew Moffatt (Chair), Craig Coleman and Bill Brown; and 2 executive directors – Mr Bolton and Antony Sormann.6 Mr Bolton was managing director of Keybridge.7 He resigned in December 2015 following an ASIC order disqualifying him from being a director of, or taking part in managing, a corporation for 3 years.8

- By 1 July 2015, Keybridge had a relevant interest of 19.68% in Molopo.9

- On 30 May 2016, Keybridge announced that it had received a notice from Bentley requisitioning a meeting of Keybridge shareholders.10 The Bentley requisition sought to remove Andrew Moffatt as a director of Keybridge, and appoint two Bentley nominees – William Johnson and Simon Cato. At the time the board of Keybridge comprised 2 non-executive directors – Andrew Moffatt (Chair) and Bill Brown; and 1 executive director – Antony Sormann.

- On 27 June 2016, Keybridge announced that it had agreed to sell Aurora to Seventh Orion, as trustee for the Aurora Trust, for up to $1.8 million. The sale completed on 30 June 2016. Keybridge had been seeking to sell Aurora and had held discussions with a number of parties, at least one of whom had signed a contract but it was not exchanged. One of the parties expressing an interest in acquiring Aurora was ASG.

- Ultimately, Seventh Orion bought Aurora, holding the shares on trust for the Aurora Trust. Mr Bolton holds 49.9% of the units in the Aurora Trust. John Patton holds 26.1% of the units. Mr Sormann dealt with Mr Patton about the Aurora sale agreement. Mr Bolton brought the Aurora investment opportunity to Mr Patton’s attention.

- On 30 June 2016, Mr Patton was appointed as managing director of Aurora.

- On 1 July 2016, Keybridge filed a substantial shareholder notice advising that its relevant interest in Molopo had reduced to 18.48% as a result of the sale of Aurora.11 Keybridge stated:

Pursuant to the Sale Agreement [Keybridge] disposed of 100% of its interest in [Aurora] on 30 June 2016. As such, Aurora is no longer an associate of Keybridge for the purposes of the Corporations Act 2001.

- Since the sale of Aurora to Seventh Orion, Aurora’s acquisitions in Molopo have been made as follows:

| Date | Number of Securities | % |

|---|---|---|

| At 30/06/2016 (already held) | 4,670,536 | 1.88% |

| 20/07/2016 (by settlement of an equity derivative) | 418,385 | 0.17% |

| 11/10/2016 - 31/10/2016 | 3,687,009 | 1.48% |

| 2/11/2016 - 1/12/201612 | 15,516,347 | 6.23% |

| 30/11/2016 - 07/02/2017 | 3,039,415 | 1.22% |

| 08/02/2017 - 16/02/2017 | 2,770,404 | 1.11% |

| 17/02/2017 - 03/03/2017 | 4,009,119 | 1.61% |

| 09/03/2017 - 20/03/2017 | 10,443,616 | 4.19% |

| 21/03/2017 | 75,000 | 0.03% |

| Total | 17.92% |

- On 29 July 2016, the Keybridge general meeting requisitioned by Bentley was held. Mr Andrew Moffatt (Chair) was removed as a director, and Messrs Johnson and Cato (directors of Bentley) were elected as directors.

- On 10 August 2016, Mr John Patton was appointed as a non-executive director of Keybridge,13 nominated by ASG. Mr John Bolton, the father of Mr Bolton, is the sole director of ASG and ASH. He became the sole director following Mr Bolton’s disqualification. Ms Georgia Bolton holds 99% of ASG’s holding company. Mr Bolton holds 1% of ASG’s holding company.

- Also on 10 August 2016, Mr Sormann agreed that he would resign from the board of Keybridge when its annual accounts had been completed.

- By 19 September 2016, Keybridge had increased its relevant interest to 19.15% of Molopo.14

- On 13 October 2016:

- The other two directors of Keybridge were nominated by Bentley.

- On 13 October 2016, Mr Khan entered a consultancy agreement with Keybridge.

- On 14 October 2016, Mr Bolton entered a consultancy agreement with Keybridge.

- On 2 December 2016, Mr Sormann resigned as a director of Molopo. On that day he emailed the other directors of Molopo stating:

I have thought long and hard over the last few days and had some wise counsel from a couple of Mentors in relation to the current situation I face having departed Keybridge and noting what they are now doing in combination to take control of Molopo.

- On 13 March 2017, Molopo announced that it had received a requisition under s249D from Keybridge for a general meeting to remove Molopo’s directors and appoint three directors nominated by Keybridge – Anthony Hartnell, William Johnson and David Sanders. This followed Molopo’s rejection of Keybridge’s request to appoint one director.

- The resolutions will be considered at the annual general meeting which was originally scheduled for 30 May 2017 but was postponed to 20 June 2017.

- On 31 March 2017, Aurora nominated Mr Ben Norman to the Molopo board. A resolution to appoint Mr Norman will be considered at this meeting.

Molopo board changes

- In May 2015, the board of Molopo comprised Samantha Tough (Chair) and David Sanders (representing Bentley) and Antony Sormann (representing Keybridge).17 Mr Sanders resigned on 27 August 2015 following the sale of Bentley’s Molopo shares to Ion Limited. Mr Sormann resigned on 2 December 2016. Mr Alexandre Gabovich and Mr Wayne Trumble were appointed directors on 27 February 2017. Mr Gabovich was appointed managing director on 8 March 2017 and interim executive chairman on 5 April 2017. Ms Tough resigned on 24 March 2017.

- The current board comprises Wayne Trumble, Ronnen Rosengart (representing Ion appointed 29 April 2016), Samuel Belzberg (representing Gibralt, appointed 31 July 2015) and Alexandre Gabovich.

Application

ASIC application

- By application dated 11 April 2017, the Australian Securities and Investment Commission sought a declaration of unacceptable circumstances. It submitted that “Aurora is acting, or is proposing to act, in concert with Keybridge in relation to the affairs of Molopo for the purposes of Chapter 6 of the Act, and accordingly, that Aurora and Keybridge are associates”.

- ASIC submitted that Keybridge and Aurora:

- share numerous structural links

- have maintained (and likely still maintain) common knowledge of relevant facts and strategies

- have multiple common investments

- engage in significant collaboration in relation to a number of listed entities (and presumably therefore also Molopo) and

- share a goal of unlocking value in Molopo.

- This indicated, ASIC submitted, that Keybridge and Aurora were acting in concert or have a relevant agreement in relation to the affairs of Molopo, and accordingly were associates for the purposes of Chapter 6.

- In summary, ASIC submitted that, if Aurora and Keybridge are associated, they would have collective voting power of approximately 37% and “together they have considerable control over Molopo”.

- It further submitted that there were contraventions of s606, as a result of Aurora's continued acquisitions of Molopo shares, and s671B by the continuing non-disclosure of the association. It submitted that “the parties' failure to acquire their interests in accordance with Chapter 6 of the Act and their failure to disclose their true collective voting power undermines the efficiency and competitiveness of the market for Molopo's shares”.

Molopo application

- By application also dated 11 April 2017, Molopo sought a declaration of unacceptable circumstances. Its application overlaps with ASIC’s but is broader.

- Molopo submitted that:

- there was “a calculated and systemic plan by several associated persons to take control of Molopo without payment of any premium to shareholders for doing so and without disclosing their association to the market in contravention of sections 606 and 671B of the Corporations Act.” and

- even if association was not made out, “the matters set out in [its] application, at the very least, evidence a relationship between the Relevant Persons that has an unacceptable effect on control or is otherwise unacceptable having regarding to the principles in s602.”

- Molopo submitted that:

- there were structural links and other collaborative conduct between the Relevant Persons, including common directorships and one being appointed to replace another who had resigned

- there were common investments and dealings

- the parties had common knowledge of relevant facts, particularly in light of Mr Patton’s involvement and

- there were actions which were uncommercial, including the sale of Aurora to Seventh Orion and Aurora’s acquisition of shares despite there being no announcement to ASX of any material matter that may affect the price or value of Molopo shares.

- It submitted that “the actions of the Relevant Persons evidence an agreed strategy to control Molopo at a shareholder and board level, without paying an appropriate premium for control”.

Interim orders sought

- ASIC sought interim orders restraining Keybridge and Aurora and their respective associated entities from exercising any voting rights over Molopo shares, acquiring any further relevant interests in Molopo and disposing of any Molopo shares.

- Molopo sought interim orders preventing any of Keybridge and Aurora and their respective associated entities acquiring further shares in Molopo or exercising voting rights attached to their shares in excess of 20% until further order of the Panel.

Undertakings

- Keybridge and Aurora provided undertakings (which we accepted) to the effect that they would not dispose of, or acquire, any shares in Molopo without giving 2 clear business days’ notice (Annexure A).

Final orders sought

- ASIC sought final orders that:

- any Molopo shares acquired by Keybridge and Aurora since 4 July 2016 be vested for sale

- Keybridge and Aurora and their respective associated entities lodge a substantial shareholder notice disclosing their voting power in Molopo and their association and

- Keybridge and Aurora and their respective associated entities be prohibited from making any further acquisitions of Molopo shares that would exceed in their combined shareholding exceeding 20%, unless permitted by s611.

- Molopo sought final orders:

- for disclosure of the association in accordance with s671B

- preventing the exercise of any voting rights attached to the shares of Keybridge and Aurora and their respective associated entities in excess of 20% and

- vesting for sale shares held in excess of 20% by Keybridge and Aurora and their respective associated entities (and that they not receive any profit on the sale of those shares).

Discussion

- We have considered all the relevant material, but address specifically only those things that we consider necessary to explain our reasoning.

Association and unacceptable circumstances

- Section 12 sets out the tests for association as applied to Chapter 6. There are two relevant tests here:

- s12(2)(b) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company’s board or conduct of its affairs and

- s12(2)(c) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company’s affairs.

- For ss12(2)(b) and (c) purposes, the affairs of a body include:

- the promotion, formation, membership, control, business, trading, transactions and dealings, property, liabilities, profits and other income, receipts, losses, outgoings and expenditure of the body

- the internal management and proceedings of the body

- the ownership of shares, debentures and interests in a management investment scheme made available by the body and

- the power of persons to exercise, or control the exercise of, voting rights.18

- A relevant agreement is an agreement, arrangement or understanding:

- whether formal or informal or partly formal and partly informal and

- whether written or oral or partly written and partly oral and

- whether or not having legal or equitable force and whether or not based on legal or equitable rights.19

- As stated by the Panel in CMI Limited 01R,20 the cases make it clear that there is significant overlap between the concepts of “acting in concert” and “relevant agreement” in s12.

- An understanding means an understanding – “plainly a word of wide import”21 - as to some common purpose or object in relation to the company in question.

- Often establishing an association requires the Panel “to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association.”22 In Mount Gibson Iron Limited,23the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- Keybridge submitted, and we accept, that the following propositions regarding association are established:

- There is no automatic association between corporations under section 11 merely because they have one or more common directors.24 The Panel has accepted that the mere fact of common directorships does not establish association.25

- Proving an associate relationship is difficult26 and may fail because of a lack of evidence.27

- Acting in concert connotes knowing conduct, the result of communication between the parties – not simultaneous actions which occur spontaneously (or coincidentally).28 It contemplates a consensus between the parties as to a common purpose or objective,29 but does not require any physical or overt act.30

- We also note that a common investment does not necessarily support the existence of association, depending on the circumstances.31

- There have been occasions when the Panel has found that parties were associated and, in the alternative, considered that those circumstances gave rise to unacceptable circumstances.32

Decision to conduct proceedings

- We decided to conduct proceedings. ASIC provided detailed information of, among other things, structural links and common investments and dealings between Aurora and Keybridge. Molopo provided correspondence from Mr Sormann expressing his concern that Keybridge and Aurora may be taking control of Molopo.

- Keybridge and Aurora made preliminary submissions that both applications were out of time. We sought submissions on whether we should extend time for ASIC and Molopo to make their applications.33

- Keybridge submitted, in effect, that it was open to us, if we were minded to conduct proceedings on ASIC’s application, to decline to conduct on Molopo’s application. It submitted that it would “have no objection to the Panel in that matter accepting the submissions contained in Molopo’s 02 Application as submissions in the Molopo 01 proceedings.” We considered that there was merit in conducting proceedings on Molopo’s application as well as ASIC’s. Molopo’s application was broader in scope than ASIC’s application. We directed that the applications be considered together.34

Conference

- The President convened a conference for 10 May 2017, and interviewed Mr Sormann. Mr Sormann had been invited to make a submission on the brief but declined to provide a response. We decided to conduct a conference, after issuing a brief and receiving submissions and rebuttals, to clarify matters arising from the submissions and rebuttals and otherwise to inform ourselves on matters relating to the proceedings.35 In particular, the conference was held:

- to explore the circumstances surrounding Mr Sormann’s resignations from Keybridge and Molopo

- to explore the circumstances surrounding certain emails from Mr Sormann (which suggested actions in combination by Keybridge and Aurora as regards Molopo) and

- to receive documents from Mr Sormann pursuant to a summons.

- We held the conference by telephone on 10 May 2017, although Mr Patton and a legal representative of Aurora attended in person. Mr Sormann and his lawyer also attended in person.

- We decided not to make a transcript.36 A recording of the conference was made available to the parties. We granted leave to the parties to be legally represented at the conference, on terms including that the lawyers would speak only if called upon.37 All the parties attended and abided by the terms.

- The President was in the room when Mr Sormann gave evidence. The other Panel members were on the teleconference. Our general impression however was shared.

- Mr Sormann became a director of Keybridge on 6 March 201438 “largely at the behest of [Mr Bolton] and therefore representing his interests”. It is clear that Mr Bolton regarded Mr Sormann as a representative of ASG.

- Mr Sormann resigned as a director of Keybridge on 13 October 2016, having made that decision after the Keybridge board changed in August.

- Mr Patton, as representative of ASG,39 joined the Keybridge board (and Mr Bill Brown resigned).

Preliminary findings

- Having considered the issues, submissions, rebuttals and the conference, we made preliminary findings and invited submissions on them. Our preliminary findings were, in summary, that:

- an association had been established between Keybridge and Aurora in relation to Molopo and

- even if association was not established, the relationship between Keybridge and Aurora gave rise to unacceptable circumstances because of the effect on control or potential control of Molopo.

- The purpose of preliminary findings in this case was to allow the parties an opportunity to respond to our thinking. After considering the submissions and rebuttals on our preliminary findings, we have, on balance, decided that we are not satisfied to the requisite level that Keybridge and Aurora are associated.

- Our decision was finely balanced and was made following consideration of (among other things) affidavits provided by Mr Patton, Mr Kriewaldt and by directors and officers of Aurora, late in the process, in response to our preliminary findings.

- Molopo submitted that our conclusion on association was a “significant reversal” from our preliminary findings. However, preliminary findings are not conclusions.

- In summary, the circumstances largely support a conclusion of association. However, we have, on balance, hesitated to come to that conclusion in the face of the direct evidence from individuals in Keybridge and Aurora regarding the absence of a consensus as to their dealings concerning Molopo. We were persuaded that the circumstances were nevertheless unacceptable even if they did not involve an association as such.

- These reasons are structured a little differently from other Panel reasons dealing with association matters. This is because of our findings. We think that the indicia usually supporting an association in this case support our conclusion on unacceptability.

- We therefore identify the role that Mr Bolton played and then look at the indicia of association, before detailing our conclusions on association and unacceptability.

Role of Nicholas Bolton

ASG

- ASG has a relevant interest in 21.16% of Keybridge. Bentley (with Scarborough) has a relevant interest in 19.96% of Keybridge.

- Mr Bolton holds 1% of ASG’s holding company (ASH). The remaining 99% is held by his sister, Georgia Bolton. He holds 2.2% of Keybridge directly.

- Mr Bolton’s father, John Bolton, is the sole director of:

- ASG (appointed on 10 October 2013) and

- ASH (appointed in December 2015 after Mr Bolton was disqualified from managing a corporation).

- Ordinarily one might expect that the principal actors in relation to decisions by ASH and ASG would be Mr John Bolton and Ms Georgia Bolton. This is not borne out by the evidence.

- Moreover, Mr Bolton made a submission that sought to reinforce what one might expect in the ordinary course. He submitted that “my 1% of shares gives me no control over Board composition or the conduct of the company.” That is literally true. He also submitted that “I have had no discussion whatsoever with the 99% shareholder Georgia Bolton about Keybridge, Molopo, Seventh Orion, Aurora or any of the affairs of ASH’s subsidiaries.”

- Mr Bolton also submitted, in response to our preliminary findings, that it was the role of a director to manage a company, not a major shareholder. As a general proposition, that is also true.

- However, in this case the evidence suggests that it was otherwise.

- Mr Sormann said that he had never had any dealings with Ms Georgia Bolton and never had a “personal dialogue” with Mr John Bolton about Keybridge.

- Ms Georgia Bolton submitted (through Mr Bolton) that “Since 21 June 2016, I have had no communication of any nature with any party about Seventh Orion, Keybridge, Molopo or Aurora.” Thus, as almost sole owner of ASG, which is itself a substantial shareholder in Keybridge, she has had no discussions at all with any party concerning Keybridge. Mr Bolton submitted that it was unremarkable that Ms Georgia Bolton did not play an active role in ASH or ASG because she was a shareholder not a director. We do not accept that. In our experience, a 99% shareholder would ordinarily have at least some contact. Her purely passive role supports a finding that Mr Bolton takes an active, likely dominant, role in the affairs of ASH, ASG, and their investments. Other evidence supports this.

- Similarly, but more narrowly, Mr John Bolton (through Mr Bolton) submitted that “Since 21 June 2016, I have had no communication of any nature with a director or officer of Molopo or an adviser” adding that, other than meeting Mr Patton socially at Keybridge’s AGM and at HHY’s annual meeting, he did not believe that he had communicated with any other director or officer of Keybridge during that period.

- Mr Bolton submitted that it was unremarkable that Mr John Bolton did not have any discussions with any director or officer of Molopo as ASG was a shareholder of Keybridge not Molopo. Perhaps it is unremarkable in the case of Molopo. However, Mr Bolton does not address Mr John Bolton’s comment regarding Mr Patton. This is surprising since ASG is the largest shareholder in Keybridge.

- Subsequently Mr Bolton produced emails between Mr John Bolton and the Keybridge directors to rebut our preliminary finding that Mr John Bolton did not take an active part in the running of ASG (except for formalities). ASIC also produced a number of emails where Mr John Bolton forwarded relevant materials relating to ASG's holding in Keybridge to Mr Bolton.

- ASIC also submitted that:

There also remains the simple fact that, Mr J Bolton is Mr N Bolton's father. Further, although Mr J Bolton has been a director of ASG since 10 October 2013, he was only appointed a director of ASH on 17 December 2015 (being the same date that Mr N Bolton was banned from managing corporations by ASIC). This timing cannot be mere coincidence. The more likely explanation is that Mr J Bolton stepped in as director of ASG and ASH following Mr N Bolton's banning, to help Mr N Bolton. It is not uncommon that a father will assist his children in times of need and indeed it is not uncommon that close family members will work together to achieve an aim.

- We accept that Mr John Bolton assisted his son by becoming the sole director of ASG, and the director of ASH, when Mr Bolton could no longer undertake those roles. However, the material does not satisfy us that Mr John Bolton acted in the roles independently of Mr Bolton.

- As for Mr John Bolton having had only “social” contact with Mr Patton, we note that Mr Patton was ASG’s nominee on the Keybridge board and he was a director of Seventh Orion (which bought Aurora from Keybridge, the deal having been introduced to him by Mr Bolton). Again, Mr John Bolton’s relatively passive role contrasts with the leading role of his son.

- Furthermore, other evidence clearly leaves an impression that communications involving Mr John Bolton are, for the most part, of a formal kind; that is, of a type made by or to the director of a shareholder rather than by or to the most influential person in the camp of the shareholder. Two things are striking:

- the limited number of such communications and

- more significantly, that Mr Bolton appears to be the principal actor in so far as ASG is concerned. For example, by email dated 8 August 2016, Mr John Bolton sent Keybridge Mr Patton’s consent to act as a director (as ASG’s nominee). He indicated that Mr Kriewaldt’s consent was to follow after “due diligence”. The evidence however indicates that Mr Bolton was entirely or substantially responsible for selecting and procuring Mr Patton and Mr Kriewaldt for these roles. In this vital matter for ASG, Mr John Bolton appears to have had little role to play. By further example, when Keybridge sends letters to Mr John Bolton regarding Mr Patton’s nomination, Mr John Bolton forwards them to Mr Bolton who then forwards them to Mr Patton. It is also noteworthy that the letter itself says that Keybridge received the nomination from Mr Nicholas Bolton.

- In summary, it appears to us that Mr Bolton did, and does, have an active and influential role in ASG’s affairs, in particular, so far as they concern Keybridge.

- In addition we would mention the following (without attempting to be exhaustive) as support for our finding on the role of Mr Bolton:

- in February 2016, Mr Bolton emailed a term sheet (signed by Mr John Bolton) to Mr Sormann proposing that ASG acquire Aurora. Mr Bolton and Mr Sormann subsequently emailed on numerous occasions in relation to ASG’s proposed acquisition of Aurora

- in February 2017, Keybridge’s company secretary sent an email to Mr Bolton with a query regarding ASG's substantial holder notice and he responded and

- Bentley dealt with Mr Bolton on behalf of ASG regarding Keybridge. For example, on 1 June 2016, Mr Khan emailed Mr Bolton stating that the priorities for their forthcoming meeting were:

- Meet with you (alone) to discuss ‘the way forward’

- Meet with Antony (with you and without bill [Brown]) to put forward a potential ‘way forward’ and get an update on the discussions with Moffatt.

Keybridge

- Mr Bolton was managing director of Keybridge until December 2015 when he resigned after he was disqualified from managing a corporation. He was privy to its transactional history and strategy. For example, he arranged the transaction in which Keybridge purchased Aurora in February 2015.41 And, as noted, he represented Keybridge’s major shareholder, ASG.

- Despite Mr Bolton lacking formal status as an officer of Keybridge after his resignation, we consider that his active involvement and substantial influence in Keybridge (at least since about mid-May 2016 when Bentley acquired a substantial holding in Keybridge) are easily inferred.

- Keybridge submitted that Mr Bolton “was not involved in any decision making by Keybridge in relation to its Molopo stake.” In our view, that can only be correct if understood in a direct or formal sense as opposed to an indirect or practical sense.

- As noted above, two directors of Keybridge were nominated by ASG and two were nominated by Bentley. Mr Sormann said at the conference that Mr Bolton had wanted equal representation on the Keybridge board between ASG and Bentley. This is consistent with a conversation between Mr Kriewaldt and Mr Bolton (see paragraph 230).

- Mr Bolton was appointed a consultant to Keybridge effective 13 October 2016. He has a broad remit. Mr Khan (a director of Bentley, which is a substantial shareholder in Keybridge) is also a consultant to Keybridge. Their appointments became effective on the same day (upon Mr Sormann’s resignation from the Keybridge board), were signed a day apart, were substantially in the same terms and were at the same fees.

- Mr Patton signed both consultancy agreements on behalf of Keybridge. The agreements state that Mr Patton was the Keybridge director to whom each was to report. Mr Patton deposed that they report to Mr Johnson in relation to Molopo. He said in his affidavit “In the case of Keybridge’s investment in Molopo, Nick Bolton and Farooq Khan do not report to me in relation to Molopo matters. Instead, they report to William Johnson”. This is cast in the present tense, saying nothing of the past. We believe it is relevant that:

- the creation of information barriers in Keybridge, separating him from consideration of matters concerning Molopo, came late and, we have found, were not fully effective

- the first contemporaneous evidence of Mr Patton withdrawing from formal board consideration of issues concerning Molopo appears in the minutes of Keybridge’s board meeting of 23 November 2016 and

- on 13 October 2016, when the consultancy agreement was signed, it included an unqualified reporting obligation. In our view, this has some significance.

- On 19 October 2016, Mr Patton and Mr Bolton were recipients of an email from Mr Khan in which he discussed a conversation with a potential purchaser of Keybridge’s Molopo stake. The price offered was obviously too low. Mr Khan concluded “My view is that we should get the cash position of Keybridge up and then creep to the maximum possible amount and then launch a scrip bid using Keybridge con notes. Let’s chat tomorrow on this.”

- Mr Bolton attended a Keybridge strategy meeting on 26 October 2016. Mr Khan was also present, along with Mr Patton and Mr Johnson. The object of the meeting was, according to Mr Johnson’s email of 14 October, to “map out a clear director (sic) for KBC – from both a strategic and operational perspective”. The agenda included the following:

- “Investments co-invested by [Keybridge] and [Aurora] – Manage association” Keybridge in response to our preliminary findings said that the intention of this item was to raise it for discussion

- a standing invitation for Mr Bolton and Mr Khan to attend Keybridge board meetings. Even though Mr Bolton is the former CEO of Keybridge, we regard this as most unusual, and note that on the prudent advice of Mr Kriewaldt the invitation was not in fact extended

- the appointment of Mr Bolton and Mr Khan to Keybridge’s investment committee (which we understand may have been an informal arrangement to advise Mr Sormann during August, September and October 2016). They were not appointed to this either and

- in relation to Molopo, two options being sale at 24c or launching a bid.

- The agenda, in our view, reflected that Keybridge viewed Mr Bolton’s role as significant.

- It was agreed at the meeting that Keybridge would increase its stake in Molopo. This appears from an email from Mr Johnson of 27 October 2016 (ie, the following day) copied to Mr Bolton and Mr Patton and others. Mr Patton did not raise the issue of a conflict on this course of correspondence.

- Mr Bolton and Mr Patton were also included in email communications on 9 November 2016 from Mr Johnson concerning Keybridge’s approach to Molopo about a new nominee director.

- Mr Patton first raised the issue of a conflict on 10 November 2016 in response to Mr Johnson’s email about Keybridge topping up its Molopo stake to 19.9%. Obviously Mr Johnson was unaware of any need to keep Mr Patton at arms’ length.

- On 2 December 2016, Mr Johnson sent his comments on Molopo’s response to Keybridge’s approach to Molopo about a new nominee director to Mr Bolton, Mr Patton and others. Both were included in a flurry of subsequent emails on the topic,42 despite the letter saying that Mr Patton had “recused himself” from discussions.

- On 11 January 2017, Mr Johnson emailed to suggest a board meeting to discuss a possible sale of Keybridge’s Molopo stake, with Mr Bolton to attend. The email was copied to Mr Patton, along with details of the proposal. This communication from Mr Johnson is quite telling as it comes three weeks after ASIC served notices on Keybridge seeking information in relation to its interests in Molopo. Understandably, Mr Bolton, “on advice of John Patton”, said that he would not attend. This followed Mr Bolton contacting Mr Kriewaldt to ask whether he should attend, to which Mr Kriewaldt replied that he know of no reason why not but Mr Bolton should ask Mr Patton. Mr Kriewaldt went on:

I subsequently understand from material provided in the Proceedings that Mr Bolton had been engaged as a consultant to Aurora in relation to the acquisition of shares in Molopo and I now understand why Mr Patton gave that advice.

- Nevertheless, on 17 February 2017, Mr Khan met Mr Bolton in Sydney. They discussed what further actions Keybridge might take in relation to Molopo. Mr Khan sent an email that they had agreed that they should send a share register request to Molopo and wait to see if Mr Johnson and Mr Sanders were appointed to the board of Molopo. If they were not appointed, it was proposed to serve a requisition calling for the removal of the Ion representatives. Mr Bolton in response to our preliminary findings denied that he offered an opinion. Mr Johnson responded to Mr Khan’s email by saying “Sounds like a plan!”

- Keybridge submitted in effect that Mr Bolton’s activities were to be explained by his status as a consultant. However, Mr Bolton was involved in at least one matter that, in our view, was properly the preserve of Keybridge’s directors. Mr Jeremy Kriewaldt had approached Mr Hartnell to join the Molopo board as Keybridge’s nominee. Mr Hartnell asked about fees and whether Keybridge would “stand behind payment”. Mr Khan emailed to say “I have just finished speaking to Nick and we would both support this.”

- All of this suggests a significant role for Mr Bolton in Keybridge, including in relation to its investment in Molopo.

- Keybridge denied in submissions that Mr Bolton was acting as a consultant in relation to the acquisition of Molopo shares, but accepted that he “as the former chief executive officer and a former director of Keybridge, was contacted by Keybridge from time to time so that he could provide background and details of various investments of Keybridge of which he had considerable knowledge.”

Aurora

- Seventh Orion bought Aurora. It holds the shares on trust for the Aurora Trust. Mr Bolton has a 49.9% interest in the Aurora Trust. Mr Patton holds 26.1% of the Aurora Trust, Betty Poon holds 8.5%, Victor Siciliano 8.5% and Stephen Rowley, indirectly, 7%.

- Mr Patton initially held all the shares in Seventh Orion. Mr Rowley now holds 50% and is a director. Mr Rowley deposed that Mr Patton had informed him that “he had received some legal advice suggesting that the introduction of another director may be beneficial, although not essential”. Mr Rowley has business dealings with Mr Bolton, including commencing a coffee business together and Mr Rowley has a “friendly relationship” with Mr Bolton.

- The directors of Aurora are Mr Patton, Ms Poon and Mr Hallam.

- Mr Bolton introduced Mr Patton to Keybridge as a potential purchaser of Aurora. Mr Bolton also introduced Mr Patton to legal advisers who may have been able to assist with the transaction.

- Mr Sormann said that he thought he was dealing with Mr Patton, but he did receive a confidentiality deed signed by Mr Bolton and a couple of calls from Mr Bolton during the negotiations to discuss Mr Bolton’s understanding of where the transaction was up to. Clearly, as Mr Sormann said in the conference, Mr Bolton displayed an active interest in how the transaction was progressing.

- Mr Sormann said that he learned of Mr Bolton’s interest in the Aurora Trust after the sale of Aurora and was “not particularly surprised”. There is evidence that it was important that Mr Bolton have no more than 49.9% of the Aurora Trust. This may have been as a result of Mr Sormann indicating to Mr Patton (according to Mr Patton’s file note):

Subject to some minor points, we are the preferred party…

(c) nominee entity that is controlled by me and/or Wilson Hanna (so not Aust Style)

If we can get these changes through then [Mr Sormann] has the authority to get this deal signed.

- Further, Mr Patton deposes that Mr Sormann said that he (ie, Mr Sormann) “had authority to do the deal with me if the purchasing entity was controlled by me (or my entity, Wilson Hanna) and not Australian Style Group Pty Ltd (ASG), an entity associated with Mr Bolton”.

- Notwithstanding the intention to keep Mr Bolton at arms’ length, Mr Patton involved Mr Bolton closely in relation to the acquisition of Aurora, inviting him to “feel free to make any changes to the heads of agreement”. Mr Patton in his affidavit stated that it made sense to enlist Mr Bolton’s assistance for a number of reasons including his knowledge of the business and “as the largest investor in the Aurora Investments Unit Trust, it was in his interests for Seventh Orion to acquire Aurora”. Aurora submitted in response to our preliminary findings that Mr Patton consulted Mr Bolton over the acquisition of Aurora because of “the tight sale timeframe, its complexity and Mr Bolton’s prior experience with it”.

- Mr Bolton in response to our preliminary findings denied hiding his involvement in Aurora, saying that he was actively involved in his personal capacity and his involvement was known to Keybridge. This may be accepted. He also submitted that his involvement was “not indicative of the governance of Aurora post-completion.” This also may be accepted so far as it goes, in that, post-completion, Aurora had a new board. However, it does not follow that Mr Bolton did not continue to have an active and influential role in Aurora’s affairs. We conclude that he did.

- One effect of these arrangements was that they concealed Mr Bolton’s involvement in Aurora from third parties. Aurora submitted in response to our preliminary findings that a unit trust was used because Mr Patton had not previously worked with Mr Bolton or any of the management team and he “wanted to ensure the structure enabled him to have effective (or negative) control despite not being a majority equity holder.” It is not obvious to us that this explains a trust structure as opposed to a corporate one.

- Perhaps there was a tax purpose to the structure, as submitted by Ms Poon and Mr Siciliano, but the structure obscures the involvement of Mr Bolton. We conclude that this was likely to have been seen as an advantage by Mr Bolton, even if it was not the only reason for the structure.

- It is clear that Mr Bolton remained involved in the affairs of Aurora. On 28 September 2016, Mr Bolton copied to Mr Patton an email exchange he had initiated with a potential vendor of Molopo shares. On 17 October 2016, he said to a different potential seller of Molopo shares that he was “consulting for a firm that is interested in acquiring a block of [Molopo] shares.” A feature of these emails is that, on their face, it is possible the inquiry was on behalf of either Keybridge or Aurora.

- Aurora has, however, submitted:

… despite describing himself as ‘consulting’, Mr Bolton was not engaged as a consultant by Aurora. Rather, because he knew Molopo shareholders who may consider selling, Mr Bolton offered to introduce Aurora to them (leaving Aurora to negotiate any acquisition).

- The absence of a formal consultancy does not mean that Mr Bolton was not in fact consulting. And we note that the second approach seems to have resulted in a transaction, finalised by Mr Bolton.

- Further, Mr Bolton and Mr Patton consulted together. Mr Patton outlined the involvement as:

- him canvassing Mr Bolton’s views from time to time

- Aurora requesting Mr Bolton to assist with discrete, largely administrative tasks. In this respect, Ms Poon’s and Mr Siciliano’s affidavits state in effect that Mr Bolton provided assistance to them on administrative matters and

- Aurora on a few occasions using Mr Bolton’s network to be introduced to potential counter-parties for transactions.

- However, Mr Patton also deposed that, during the month leading up to the acquisition of Aurora, he received 65 emails from Mr Bolton (an average of two a day) and in the six months to 31 December 2016, 45 emails (an average of one every four days). Aurora in response to preliminary submissions added that, in relation to Keybridge, Mr Patton received from Mr Bolton “circa 41 emails …between 13 October 2016 to 31 December 2016, averaging close to 1 every 2 days.”

- Moreover, Mr Patton consulted Mr Bolton in relation to workings of the various funds and Mr Bolton took advice from Mr Patton, such as whether he should attend a meeting of the Keybridge board.

- Mr Patton in his affidavit cited 9 examples where Mr Bolton made suggestions in relation to the affairs of Aurora that Aurora did not agree to or give effect to. ASIC submitted in response that:

…if Mr N Bolton is not involved in the affairs of Aurora other than for administrative tasks, it is unclear why Mr N Bolton would even attempt to suggest all of these corporate action proposals to Mr Patton. The more plausible explanation is that Mr N Bolton regularly provides ideas in relation to the affairs of Aurora to Mr Patton, some of which are implemented and some of which are not. The fact that Mr Patton does not implement all of Mr N Bolton's suggestions (if this is correct) does not mean that Mr N Bolton does not have significant influence in Aurora's affairs. On the contrary, Mr N Bolton would be more likely to regularly provide suggestions if they are often implemented.

- We agree with ASIC. We think that the examples display a close business relationship between Mr Bolton and Mr Patton.

- Ms Poon deposed that “Mr Bolton has not attended any Aurora board meetings, and I have not seen any evidence of his control or influence over the board of Aurora, or any of its directors. In particular, I have not seen any evidence of his contributing to any decision or strategy relating to Aurora’s investments in Molopo.” Whether or not this is so, it does not deny Mr Bolton’s significant role and influence, primarily via Mr Patton. In addition, it appears that Ms Poon was not involved in many of the informal but important communications that occurred.

- We consider Mr Bolton, either alone or together with Mr Patton, effectively controls or has substantial influence over the relevant affairs of Aurora, that is to say, the affairs of Aurora so far as they concern its stake in Molopo. Mr Bolton’s involvement in Seventh Orion’s acquisition of Aurora, his 49.9% interest in the Aurora Trust, the work undertaken by Mr Bolton for Aurora and the frequent communication between Mr Bolton and Mr Patton support our conclusion.

Mr Patton

- Mr Patton was appointed to the Keybridge board as a nominee of ASG. The Keybridge board understood as much. While Mr Bolton had previously put Mr Patton forward, on the day of his appointment he was put forward by Mr Cato and Mr Johnson. These directors of Keybridge were representatives of Bentley.

- Mr Patton’s appointment to Keybridge’s board resulted in many conflicts. This might have been thought a disqualifying factor, but it was not by Keybridge.

- Keybridge submitted that Mr Patton was appointed to represent the interests of ASG. Mr Patton has no interest in ASG, other than a connection to Mr Bolton. In substance, and taken with the evidence concerning Mr Bolton’s role in ASG, this suggests he represented Mr Bolton.

Structural links

- In our view significant structural links exist between Keybridge and Aurora.

- Mr Patton was Melbourne-based. On 16 December 2016, Keybridge moved its registered office to Melbourne (in the same office, or at least on the same floor, as Aurora, Seventh Orion and Wilson Hanna). However, it moved its administration to Perth.

- ASG is Keybridge’s largest shareholder, with 21.16%. Bentley is a substantial holder in Keybridge with 19.96%.

- The directors of Keybridge are Messrs Patton, Johnson, Cato and Kriewaldt. Two are Bentley representatives and two are ASG representatives. Messrs Khan and Bolton also consult for Keybridge.

- The directors of Bentley are Messrs Khan, Johnson and Cato.

- The directors of Aurora are Messrs Hallam and Patton and Ms Poon. Aurora’s shares are held on trust for the Aurora Trust, of which Mr Bolton holds 49.9% and Mr Patton holds 26.1%.

- Keybridge is the largest unit holder in HHY Fund, of which Aurora is responsible entity. Keybridge holds 26.4% of HHY Fund and is the investment manager of HHY Fund. It engages Mr Siciliano, a unit holder in the Aurora Trust and Aurora’s portfolio manager, as its adviser on the Fund.

- By reason of Mr Patton’s directorships on the boards of Aurora and Keybridge, there is a significant level of information “cross-over” (as we have found that information barriers were not fully effective in relation to Molopo). By reason of Mr Bolton’s ownership interest in each and level of influence (as we have found) there is a community of interest, as well as additional cross-over of information.

- At the time when Mr Sormann was the acting managing director of Keybridge, he appears to have been close to Mr Bolton. It was, of course, his job to secure a good price for Aurora. On 22 February 2016, he emailed Mr Bolton (presumably for ASG, as Seventh Orion had not been incorporated) noting that Keybridge had received an offer for Aurora, and inviting Mr Bolton to make an offer. In response to a query about whether the offer that had been received was capable of acceptance, Mr Sormann indicated that the offer was above “expected book value”.

- Mr Bolton subsequently emailed a Term Sheet to Keybridge signed by Mr John Bolton for ASG.

- On 26 May 2016, a draft contract was sent to ASG and Mr Bolton responded with questions, which were addressed.

- Ultimately the purchaser was Seventh Orion. It paid $750,000 plus deferred consideration.

- On 16 June 2016, heads of agreement with Wilson Hanna (of which Mr John Patton is a director) were signed. Mr Patton had asked Mr Bolton his thoughts on the draft heads of agreement and subsequently Mr Bolton remained involved in the transaction. It is clear that Mr Bolton had a significant level of involvement in the making of the offer by Wilson Hanna. He also signed a confidentiality agreement in relation to the acquisition.

- Mr Patton stated in his affidavit that he consulted with Mr Bolton because he wanted his perspective on how to secure the best price and terms for Aurora and Mr Bolton was well placed to provide useful information given his knowledge of Aurora and Keybridge. This reflects an additional level of information “cross-over”. It also supports our finding that Mr Bolton has a significant interest in, and influence over, Aurora since it appears that he assisted with Seventh Orion’s purchase even though ASG was itself interested in the purchase.

- Keybridge uses Mr Bolton as a consultant. It submitted that, while Mr Bolton was not acting as a consultant for it in relation to the acquisition of Molopo shares, he “as the former chief executive officer and a former director of Keybridge, was contacted by Keybridge from time to time so that he could provide background and details of various investments of Keybridge of which he had considerable knowledge.” We take this to mean he was contacted about Keybridge’s investment in Molopo.

- Keybridge submitted later, in rebuttals, that “Mr Khan and Mr Bolton were both acting as consultants providing advice and assistance to Keybridge” when discussing actions Keybridge might take in relation to its Molopo shareholding following the termination of earlier sale discussions and Molopo’s refusal to appoint a Keybridge nominee to its board when it then appointed two new directors.

- Mr Patton joined the Keybridge board on 10 August 2016; roughly one month after Keybridge had sold Aurora to Seventh Orion. Mr Patton is, and was then, subject to conflicts of interest. Mr Ho pointed out a list of current “issues” on 3 April 2017 that included Metgasco, HHY, NAC, Molopo and a number of others. Aurora submitted in response to our preliminary findings that the only conflict at the time of appointment was HHY Fund, the other conflicts having arisen since. We note the Metgasco and Molopo conflicts may have existed. They certainly became apparent by the Keybridge board meeting of 23 November 2016.

- Mr Patton first formally raised his conflicted position regarding Molopo with Keybridge on 10 November 2016. The board first recognised the position on 23 November 2016. Mr Patton’s position apparently did not arise for consideration when Aurora was starting to build its stake in Molopo or when Mr Patton attended a Keybridge strategy meeting on 26 October 2016 (that included a discussion of Keybridge’s investment in Molopo).

- In our view the structural links are extensive.

Shared goal or purpose

- ASIC submitted in relation to the relevant circumstance of a shared goal or purpose that it was reasonable to infer that Aurora and Keybridge wanted to control the Molopo board and ultimately Molopo’s significant cash assets. It submitted that:

- Aurora’s intentions were evident from an investment proposal that Mr Patton circulated to the other Aurora directors on 18 November 2016 (which was to “move to a 19.9% as a balance of power stake, seek Board representation”) and

- Keybridge’s intentions were evident from its letter to Molopo of 27 February 2017 (in which it sought board representation).

- ASIC submitted that it was reasonable to infer that collaboration between Keybridge and Aurora existed, “particularly given the fact that there are other very substantial Molopo shareholders and it is only through collaboration that Keybridge and Aurora can achieve their goals in relation to Molopo”.

- Molopo submitted that there was an agreed strategy amongst the Relevant Persons (a wider group than Keybridge and Aurora) “to control Molopo at a shareholder and board level.” The strategy involved the sale of Aurora to “a ‘friendly’ associated party” then Aurora acquiring a significant interest in Molopo so as to consolidate control.

- Molopo submitted that an email from Mr Sormann evidenced the shared goal. On 2 December 2016, Mr Sormann emailed other directors of Molopo stating:

I have thought long and hard over the last few days and had some wise counsel from a couple of Mentors in relation to the current situation I face having departed Keybridge and noting what they are now doing in combination to take control of Molopo.

- One of the mentors Mr Sormann spoke to was his father. We think this indicated a level of discomfort on Mr Sormann’s part about what was going on around him.

- Mr Sormann said he was referring to a board appointment by Keybridge and Aurora becoming a substantial holder in Molopo. He added that he “had a perception that Aurora was making its investment in support of Keybridge’s ambitions to appoint the directors.”

- Mr Sormann became a director of Molopo on 29 December 2014 as Keybridge’s representative (he was then executive director of Keybridge).

- On 23 September 2016, Mr Sormann emailed Ms Tough (chair of Molopo) saying:

As you also know, I am finding my position at Keybridge increasingly untenable, and do not see myself staying at the Company much longer…

- He said a similar thing to Keybridge some months later. Mr Sormann resigned as a director of Molopo on 2 December 2016, having been requested to do so by Keybridge (as he was no longer their representative). Keybridge “instructed” Mr Sormann to vote for Mr Sanders’ appointment in his place, but he was unable to get Mr Sanders appointed. By email dated 14 December 2016 to Mr Victor Ho (company secretary of Keybridge), copied to Mr Patton:

… I felt that my position had been made untenable by the Substantial Holder notice lodged by Aurora.

- Mr Sormann explained the references to “untenable”. He said that he had been excluded from discussions regarding the future direction of Keybridge, and raised this with Ms Tough because he did not want Molopo to think that he was taking information back to Keybridge.

- Keybridge submitted that there was no shared goal with Aurora, rather it tried to sell its Molopo stake and tried to maintain a representative on the Molopo board and only when frustrated in both those aims, sought to put to all shareholders the “decision on the composition of the board of Molopo”. Keybridge submitted that it had alternative goals - a representative on the Molopo board, Molopo to deploy some or all of its cash in profitable investments, Molopo to return cash to shareholders and voluntary liquidation.

- We note that, at Keybridge’s 26 October 2016 strategy meeting, the attendees considered that a potential sale of Keybridge’s Molopo stake had fallen through, in part because the potential buyer was not convinced that it could obtain a board seat.

- ASIC submitted that Keybridge was pursuing its goal to gain influence on, or control of, the Molopo board while also negotiating a sale of its Molopo shares. This is consistent with Keybridge’s submission. Mr Khan was, around the same time, recommending increasing Keybridge’s stake in Molopo.

- On 12 March 2017, Keybridge lodged a section 249D requisition with Molopo. This was not the first time. In November 2014, Keybridge requisitioned a shareholders’ meeting of Molopo shareholders to consider a return of capital and board changes.43 The NSW Supreme Court ruled that the requisition to return capital was invalid. However the Court held that Keybridge’s other requisition – to appoint directors – was valid.44 Subsequently, the Molopo board was reconstituted without the need for a meeting and included Mr Sormann and Mr David Sanders.45

- Aurora also sought board representation on the Molopo board. Aurora submitted that it had considered seeking representation since 16 February 2017. This is around the time when Keybridge considered requesting a meeting to consider composition of the Molopo board.

- On 22 March 2017, Mr Patton on behalf of Aurora wrote to Ms Tough seeking board representation. Aurora had sought representation on the Molopo board prior to this letter. This was 10 days after Keybridge’s s249D requisition. On 31 March 2017, Aurora gave notice to Molopo seeking to have Mr Ben Norman on the AGM agenda for election to the board.

- Aurora submitted that “it wished to influence the deployment of Molopo’s substantial cash resources, and to ensure that Molopo did not resile from its past repeated public representations that it would obtain shareholder approval before making any material acquisition or investment in any sector.”

- Keybridge and Aurora each had a significant investment in Molopo. It is not surprising that each wanted board representation. The question is whether they went further. We considered whether Aurora’s acquisitions furthered a plan.

- In early November 2016, Mr Siciliano prepared an investment proposal for Aurora to acquire up to 19.9% in Molopo as a ‘balance of power’ stake. He stated in his affidavit:

- “the Molopo shareholder base appeared to be dysfunctional”

- he “considered it unlikely that Keybridge and Ion would support each other’s strategy” and

- therefore “as a new entrant with a fresh motivation I believed that Aurora could drive its own strategy that all shareholders could live with (i.e. a strategy to support no major shareholder’s primary objective, but nonetheless a strategy those shareholders would consider to be satisfactory), such as providing an exit for all shareholders at or near Molopo’s underlying NTA”.

- The strategy was “as agreed by Mr Patton”.

- Mr Patton submitted Mr Siciliano’s investment proposal to Mr Hallam. Mr Hallam “had some concerns” and attached mark-up of the proposal in which he said:

- “Does [Aurora] funds and/or executives/shareholders have related party issues” and

- “[Keybridge] holds 19% - how do we manage conflicts and being viewed as a collective holding”.

- We initially considered that Mr Hallam was giving voice to concerns that the parties were associated. However, he deposed that his concerns “centred around the investment merits and the potential related party issues given Mr Patton was a director of Keybridge and Keybridge was also the investment manager of the HHY Fund”. Aurora submitted in response to our preliminary findings that Mr Hallam raised this issue as a matter of process.

- Keybridge and Aurora have harmonious goals in relation to Molopo. Each of them focused on influencing, or controlling, the use of Molopo’s cash by investment that lifted the share price closer to NTA, or return of cash, or in some other way. There were also coincidences in the timing of acquisitions and the seeking of board representation. However, on balance, we consider that goals which overlap and coincidences in timing have not in this case established that Keybridge and Aurora have an understanding in the strict sense.

- We initially considered that the role of Mr Bolton in Keybridge and Aurora justified a finding that there was a shared goal.

- ASIC submitted that Mr Bolton appeared instrumental in the operations of Aurora and had a significant degree of involvement with respect to Keybridge’s operations. It submitted that Mr Bolton:

- in relation to Aurora was -

… actively involved in negotiating the purchase of Aurora, finding counter-parties to share acquisitions and potential investment proposals, assisting in drafting various announcement and meeting materials for Aurora, and identifying flaws in voting documentation to benefit Aurora. Of note, Mr Bolton's involvement is not solely through Mr Patton, but he also has direct communications with Aurora's director/employees (i.e. Ms Betty Poon and Mr Victor Siciliano). Aurora's directors (other than Mr Hallam as evident from his s19 interview) and employees are aware of Mr Bolton's involvement and take instruction from Mr Bolton without questioning his role or authority with respect to Aurora's operations. (We note that Ms Poon’s affidavit somewhat contradicts this) and

- in relation to Keybridge operations had -

… input on various strategies, voting preferences and communications to externals. In particular, we note that Mr Bolton and Mr Khan agreed the strategy for obtaining Molopo Board representation on 17 February, provided significant input on how Keybridge should vote at the NAC AGM and agreed the salary to be paid to Mr Hartnell as one of Keybridge's nominees to the Molopo Board. Mr Bolton also has involvement in more administrative related tasks at Keybridge (such as the design of its website and commenting on Keybridge's proposed market announcements etc).

- in relation to Aurora was -

- We note that Mr Bolton was involved in the organisation of the settlement instructions for Aurora’s purchase of Molopo shares from Mr Skyler Wichers.

- Aurora submitted that “Mr Bolton is not instrumental in the operations of Aurora. He is not involved in the day-to-day management of Aurora and plays no role in deliberations or decisions by the board of directors of Aurora…”

- Aurora also submitted that:

- the examples ASIC provided were “limited instances of Mr Bolton interacting with Mr Patton.”

- “Mr Bolton is an investor in the AI Unit Trust and as such has a commercial interest to see Aurora succeed and to provide assistance to the Aurora management team when requested” and

- it was unreasonable to “conflate” ad hoc assistance, when Aurora’s resources were stretched, with Mr Bolton being “instrumental” in its operations.

- We think the interactions between Mr Patton and Mr Bolton were more than “limited.”

- However, we do not think the interactions get us to the point of a shared goal between Keybridge and Aurora having been established.

- Keybridge submitted:

…Mr Bolton did not attend any Keybridge Board meetings and was not involved in Board communications in relation to Keybridge. He was, however, a paid consultant to Keybridge and accordingly Keybridge’s Board and management consulted Mr Bolton from time to time on various matters, including to a very limited extent matters concerning Molopo. As outlined in previous submissions the whole of the Board and management of Keybridge was new and it was important for the new Board and management to receive information regarding the many, varied and complex assets of Keybridge and Mr Bolton was well placed to provide such information.

- While we conclude that Mr Bolton’s involvement in Keybridge and Keybridge's investment in Molopo was more than “to a very limited extent” the evidence does not allow us, in the end, to find that Keybridge and Aurora had reached a consensus in relation to Molopo. In particular, at the level of decision-making in relation to Molopo, we accept that Mr Patton was excluded by Keybridge from about mid-November 2016.

- However Mr Bolton’s role in relation to Keybridge’s and Aurora’s investments in Molopo, together with Mr Patton, is a key factor leading to our conclusion that unacceptable circumstances exist in relation to the affairs of Molopo.

- Confidential evidence was provided to us by Aurora relevant to its commercial objects concerning Molopo, about which we say little, for obvious reasons. It is sufficient to note that, having given it careful consideration, we do not find it assists Aurora’s submission that it had materially divergent objectives from Keybridge. If we had been minded to draw any inference from the material it would have been to the contrary.

Prior collaborative conduct

- ASIC submitted that Aurora and Keybridge had collaborated in relation to other listed entities, and it was reasonable to infer that collaboration extended to Molopo. ASIC identified:

- treating shareholdings in Naos Absolute Opportunities Company Limited (NAC) as a voting bloc and

- defending Aurora's position as responsible entity of HHY Fund, AGIT and AFARF.

NAC voting bloc

- In about November 2016, Keybridge and Aurora held, if aggregated, approximately 11.4% of NAC.

- The NAC annual general meeting for 2016 was to be held on 18 November 2016. Three resolutions were proposed – remuneration report, auditor remuneration and re-election of one director.

- By email dated 14 November 2016, Mr Ho (Keybridge) emailed Messrs Patton, Bolton, Johnson, Khan and Siciliano, noting that Keybridge held shares in NAC for itself and AFARF, and that HHY held shares. He asked:

I am not sure about voting on the HHY holding as the corro goes to [Aurora]

Can I please have the Investment Committee’s position on voting directions by COB Tuesday so that voting can be lodged Tuesday night (Perth time) and Wednesday morning…by [Aurora].

- The investment committee comprised Mr Patton and Mr Johnson, although Mr Patton did not participate in relation to Molopo.

- The exchanges were:

- Mr Patton supported all resolutions, saying “[Mr Johnson], I’m supportive of all the resolutions. Do you concur?”

- Mr Bolton suggested “Vote against REM report (as we can probably defeat it) and abstain on others (as we can’t defeat). Nuisance value. Best to give them a reason to get us out, or bring them to the table."

- Mr Khan opposed all resolutions, saying “My inclination is to vote against all resolutions. We owe them nothing and our intention should be made clear … It also sends a clear signal we are to be dealt with our (sic) we will be hostile”.

- Mr Johnson agreed with Mr Khan

- Mr Patton queried whether to vote against only the REM report and

- Mr Bolton agreed with Mr Patton, saying “however note that it's not necessary for Keybridge/HHY to vote the same way as Aurora."

- ASIC submitted that the need for Mr Bolton to “point out to experienced businessmen that it is not necessary for Keybridge and HHY to vote the same way as Aurora” suggested it was usual for them to do so.

- Mr Bolton submitted that he made the comment (paragraph 191(f)) to demonstrate that Keybridge (as manager of HHY) could ask Aurora (as responsible entity) to vote in a particular way but it was Aurora’s decision. He submitted that this “nuance of managed investment schemes” could easily be lost.

- It is not clear why Mr Bolton made the statement but we doubt it conveyed the message he submitted was its purpose.

- We consider that Mr Bolton’s participation in the exchange indicated his view of the Keybridge and HHY Fund shares as a ‘bloc’, and also that he had a role in Aurora.

Defending Aurora as responsible entity

- ASIC submitted that Keybridge and Aurora collaborated to protect Aurora's position as responsible entity.

- A major unit holder in Aurora funds, Wilson Asset Management, had requisitioned meetings to remove Aurora as the responsible entity of HHY, AGIT and the Aurora Property Buy-Write Income Trust (Buy-Write).

- On 12 September 2016, Mr Johnson emailed Messrs Sormann, Patton and Cato that “[Keybridge] should increase its holding in HHY if we wish to defend the position of Aurora as Responsible Entity.” The estimated cost was $270,000. Keybridge increased its holding in HHY from 21.08% to 24.03%. (It was also suggested that Keybridge increase its voting power in Molopo to above 19% for an estimated cost of $200,000.)

- Keybridge undertook its purchases at a time when it was in need of cash. According to Keybridge board minutes of 22 September 2016, under the heading “KBC Cash Position” it said “The Board noted the current positon and the need to sell an asset in the short to medium terms. The Board to consider various options.”

- ASIC submitted that investments in other funds were made to defend Aurora's position. In AGIT and Buy-Write, Aurora’s directors proposed that Aurora invest in AFARF (up to 19.9%), in Aurora Absolute Return Fund (up to 4.9%) and AFARF invest in Buy-Write (up to 4.9%).

- On or about 1 December 2016, days before the requisitioned meetings, Keybridge subscribed for units in AGIT and Buy-Write. Mr Ho noted in an email: “we need to invest and have the units allotted by Friday as the EGMs for [AGIT] and [Buy-Write] are on next Tuesday".

- On 2 December 2016, AGIT, issued units to Aurora (up to 19.9%),46 Keybridge (4.9%)47 and (ASIC submits) Bentley/Scarborough (4.9%). Ms Poon (Aurora) confirmed allocations 'per phone call by Nick'. Ms Poon deposed that the reference was in relation to Keybridge’s investment allocations in the Aurora funds. However, her email was in response to Mr Patton asking for Aurora’s investment to be increased. In our view, this is also evidence of a significant level of involvement by Mr Bolton in Aurora.

- The meetings were due to be held on 6 and 7 December 2016. On 7 December 2016, Mr Ho asked Keybridge’s accounts department to prepare redemption forms for the two funds. On 9 December 2016, the Buy-Write units were redeemed.

- The examples of Keybridge and Aurora acting together, in our view, while considerable do not get us to the point of drawing an inference that they have been acting together in relation to Molopo.

Common investments and dealings

- Aurora submitted in response to our brief that its initial acquisitions of Molopo shares in July 2016 were undertaken by its investment manager, Mr Ward, who was not required to seek the approval of the directors of Aurora, or otherwise notify them (and did not do so) before making the acquisitions. However, in response to our preliminary findings, Aurora submitted that the July 2016 purchase of Molopo shares was due to the closing out of a swap.

- Subsequently, from 7 to 30 October 2016, the current investment manager (Mr Siciliano) bought more Molopo shares. Aurora submitted:

These acquisitions were undertaken by Aurora’s investment manager, Victor Siciliano, acting within the scope of the investment mandate delegated to him by Aurora and consistently with Aurora’s investment strategy of acquiring Molopo shares while the trading price was at a deep discount to the assessed value of Molopo. Mr Siciliano was not required to seek the approval of the directors of Aurora, or otherwise notify them, before making these acquisitions (and did not do so).

- There are no denials of either investment manager telling Mr Bolton what he was doing. Mr Bolton has not denied knowing.

- On 10 November 2016, an investment proposal was prepared for the board and Aurora “continued to pursue [its] investment strategy of acquiring Molopo shares at a deep discount to assessed value.” The positioning was stated as “Move to a (sic) 19.99% as a balance of power stake, seek Board representation.” The proposal analysed the discount the Molopo share price trades at to its net tangible assets (effectively its net cash), and there did not appear to be any in-depth analysis of risk, particularly of the litigation liability.

- Keybridge submitted that the decisions by Aurora to acquire Molopo shares were co-incidences of which it had no knowledge. However, Mr Patton had that knowledge. We conclude that Mr Bolton, a consultant to Keybridge, also had that knowledge.

- Mr Bolton is invested in Aurora, through the Aurora Trust, and in Keybridge, through ASG and directly. Mr Khan is invested in Keybridge, through the Bentley group. Keybridge is invested in HHY Fund, for which Aurora is the responsible entity. Mr Patton sits on both Aurora and Keybridge boards.

- There are a considerable number of common investments and dealings.

Common knowledge of the relevant facts

- Keybridge made a preliminary submission that “an effective Chinese wall was in place with respect to Mr John Patton’s knowledge of Keybridge’s holding in Molopo and its actions and intentions with respect to the same.” The existence of information barriers was not formally documented until the board meeting of Keybridge on 23 November 2016. Keybridge submitted in response to our preliminary findings that “It was not until mid-November 2016 that it became necessary to put in place the information barrier for Mr Patton in relation to Molopo.”

- Molopo submitted, on the other hand, that “the ‘Chinese Wall’ was purely for appearance purposes.” ASIC submitted there was limited evidence that the information barrier (ie, the Chinese Wall) operated effectively. ASIC submitted that there was no effective information barrier separating Mr Patton from Keybridge's deliberations about Molopo at key points in time.

- Included in ASIC’s evidence in support:

- Keybridge's acquisition of Molopo shares in September 2016, which Mr Johnson asked Mr Patton to manage

- Keybridge's board minutes for 21 October 2016, which detail its proposals for investment in Molopo, and which are signed by Mr Patton. (We note also that they refer to dealing in HHY)

- an email from Mr Johnson on 27 October 2016 that Keybridge's meeting had agreed to “top back up in Molopo” “if John [Patton] agrees”. This was followed on 10 November 2016 by an email referring to a meeting between Messrs Johnson and Patton. Mr Johnson could not remember if he had “mentioned that we think it would be a good idea for [Keybridge] to top up its holding in Molopo to 19.9%.” It was not until 10 November 2016 that Mr Patton emailed to say that he was conflicted and would leave the decision to Mr Johnson and

- an email from Mr Sormann on 14 December 2016 regarding his departure from the board of Molopo, indicating that he had discussed his conduct as a director of Molopo with Mr Patton.

- Mr Patton explained in his affidavit that Mr Sormann called him to discuss issues regarding Mr Sormann’s share loan.

- As Molopo submitted: “ASG could have appointed another nominee that wouldn’t require an information barrier, but it did not.”

- Keybridge submitted that Mr Patton was excluded from all communications except a few instances of inadvertence, which were corrected. We are not prepared to accept that he was excluded from all communications. There may have been instances where he was not included, but by and large he appeared to be involved in many, if not most, of the relevant communications.

- ASIC submitted that “Aurora and Keybridge have maintained (and likely still maintain) common knowledge of relevant facts and strategies.” We agree. The appointment of Mr Patton to Keybridge’s board immediately created a conflict issue to be addressed in relation to HHY Fund. Subsequently, each of Keybridge and Aurora had a strategy for its investment in Molopo, which raised a further problem. As noted by Mr Ho, there are other problems as well.