[2011] ATP 7

Catchwords:

decline to conduct proceedings - association – board spill – proxy – substantial holding notice – efficient, competitive and informed market – reasonable and equal opportunity – Eggleston principles – association hurdle – heads of agreement

Corporations Act 2001 (Cth), sections 12, 249D, 249P, 602, 606, 611, 671B

ASIC Regulation 20

ASX Listing Rule 3.1

Viento Group Limited [2011] ATP 1, Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Mount Gibson Iron Limited [2008] ATP 4, Rusina Mining NL [2006] ATP 13

Introduction

- The Panel, Garry Besson, Sophie Mitchell and Karen Wood (sitting President), declined to conduct proceedings on an application by Moat Investments Pty Ltd in relation to the affairs of ComOps Limited. The application concerned whether parties were associates in relation to ComOps and alleged breaches of s606.

The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- ComOps

- ComOps Limited

- EO Acquisition

- The acquisition of Executives Online from Time Management announced to ASX on 5 April 2011

- Moat

- Moat Investments Pty Ltd

- Time Management

- Time Management Group Pty Ltd

Facts

- ComOps is an ASX listed company (ASX code: COM).

- In August 2010, ComOps was considering the acquisition of the Executives Online business. A Heads of Agreement for the proposed acquisition between Time Management (of which Mr Stephen Rattray is a director) and ComOps was executed on 3 September 2010.

- Under the Heads of Agreement, it was agreed that, subject to due diligence by ComOps and legal documentation being agreed, the Executives Online business would be transferred from Time Management to ComOps. Consideration was to be the issue of 15 million ordinary shares in ComOps, 12 million of which were subject to cancellation if performance hurdles were not achieved. The shares were to be held in escrow and voting rights were to be assigned to the Chairman of ComOps (Mr Geoffrey Wild) until the performance hurdles were achieved.

- On 22 March 2011, the ComOps Board resolved to execute the EO Acquisition agreement and proceed to settle the transaction via the issue of 15 million shares to Mr Rattray (or his nominee), without the conditions regarding proxies, escrow or cancellation.

- On 17 March 2011, Moat lodged a s249D1 notice seeking to change the composition of the ComOps board by removing each of Mr Wild, Mr Richard Bradley (the CEO and Managing Director of ComOps) and Mr Stuart Clark from the board and appointing Mr Marcus Cake and Dr Kenneth Carr. Mr Marcus Cake was previously a director of ComOps from 13 May 2010 until his resignation on 2 January 2011.

- Mr Andrew Roberts (a shareholder and former director of ComOps) lodged a further s249D notice on 5 April 2011 seeking to remove Mr Alex Ninis as a director and to appoint Mr Denis Tebbutt as a director of ComOps.

- On 5 April 2011, ComOps announced the EO Acquisition on ASX, stating the effective date of the acquisition was 1 January 2011 and that "The consideration paid for the acquisition is 15 million shares in ComOps Limited".

- On 7 April 2011, ComOps announced that the resolutions from the s249D notices would be considered at an AGM to be held on 17 May 2011. The notice of meeting was released to ASX on 14 April 2011.

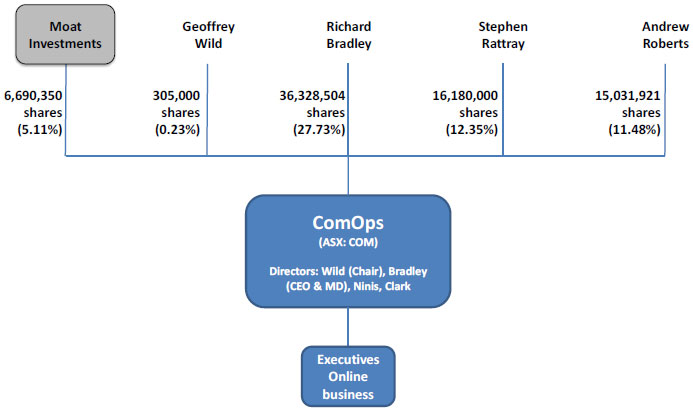

- Based on information in the application, ComOps shareholders include the following persons who currently have the following relevant interests:

- The most recent substantial holding disclosures made by persons described in paragraph 11 are summarised below: 2

Shareholder Date of notice Relevant interest at date of notice % voting power at date of notice Moat 16 February 2009 6,682,850 5.76% Mr Roberts 10 December 2007 15,000,000 13.91% Mr Bradley 2 July 2003 35,603,497 74.92% - Subsequent events have since reduced this voting power, mainly by dilution.

Application

Declaration sought

- By application dated 12 April 2011, Moat sought a declaration of unacceptable circumstances. Moat submitted that, by obtaining a proxy from Mr Rattray (in favour of Mr Wild), Mr Bradley and his associates had increased their relevant interest in ComOps by 12% otherwise than through one of the exceptions in s611 "which would have an unfair prejudice over the resolutions to change the board at the Annual General Meeting on 17th May 2011". It submitted that there were breaches of s606.

- Essentially, two associations were alleged:

- between Mr Bradley and Mr Rattray, because they had entered an agreement for the purposes of controlling or influencing the composition of the ComOps board and

- between Mr Bradley and Mr Wild, because of uncommercial actions or potential breaches of duty by Mr Wild which the Panel should use as a basis for inferring a relevant agreement regarding control.

- Regardless of any association, Moat also submitted that if a proxy was granted to Mr Wild, it gave Mr Wild a relevant interest in those shares.

- Moat also submitted that "no substantial shareholder notices have been lodged notifying a change in relevant interests" and that there was a breach of Listing Rule 3.1 because, given the materiality of the transaction, "the level of disclosure of the business acquired and relevant agreements is inadequate".

- Moat submitted that the effect of the circumstances was:

- the acquisition of voting shares in ComOps was not taking place in an efficient, competitive and informed market (s602(a))

- ComOps shareholders did not have a reasonable and equal opportunity to participate in benefits accruing to Mr Bradley (s602(c)) and

- there was a breach of the Eggleston principles because "it reduces efficiency, competitiveness and fairness with regard to changes in control by issuing 12m more shares than the implied value at the date of the transaction of 3m shares".

- Moat also submitted there were other matters "that may fall within the jurisdiction of the Panel", namely the Panel should, among other things:

- review the s249P members' statement and consider whether to order distribution under s249P and

- make an order stating that ComOps information and personal information of ComOps directors in the possession or control of various persons should not be destroyed (as separately requested by ComOps).

Interim orders sought

- Moat sought interim orders requiring disclosure of the commercial terms of the EO Acquisition and "resulting Associations", the issue of notices of meeting,3 the disclosure of proxies and orders preventing the parties from acquiring further shares, increasing voting power, disposing or transferring shares or exercising voting rights attached to shares.

Final orders sought

- Moat sought final orders to the effect that:

- 15 million ComOps shares held by Mr Rattray be vested in the Commonwealth for ASIC to sell and remit the net proceeds to Mr Rattray within 3 months

- disclosure of the associations between Mr Bradley, Mr Wild and Mr Rattray and lodgement of substantial holding notices and

- the parties be prohibited from acquiring any further shares or increasing voting power other than as permitted by s611.

Discussion

- As we understand it, Moat's case seems to be that Mr Rattray gave a proxy to Mr Wild, who was associated with Mr Bradley, as part of a defensive scheme.

- ComOps, in a preliminary submission, submitted that the application contained "no evidence to support any allegation made". We think there was some material.

Association hurdle

- Before the Panel will conduct proceedings on the issue of association, there must be a sufficient body of material demonstrated by the applicant, together with inferences (for example from partial evidence, patterns of behaviour and a lack of a commercially viable explanation) that might be drawn, to support the Panel conducting proceedings.4

- Relevantly, two or more persons are associates if:

- there is (or is proposed) an agreement, arrangement or understanding between them, whether formal or informal, written or oral, and whether or not legally binding, for controlling or influencing the composition of an entity's board or the conduct of an entity's affairs or

- they are acting, or proposing to act, in concert in relation to an entity's affairs.5

- No proxy was granted by Mr Rattray over the shares issued in connection with the EO Acquisition (even though one was originally contemplated). The final agreement, without more, was insufficient to get over the association hurdle in our view.

- We articulate our reasons for our conclusion below.

Association between Mr Bradley and Mr Rattray

- Moat submitted that Mr Bradley and Mr Rattray were associates because they had entered into an agreement for the purpose of controlling or influencing the composition of the ComOps board.

- It submitted that the structure of the EO Acquisition was contrary to accepted market practice because it included the issue of shares beyond the implied value of the company at the date of the transaction.6 Further, it submitted that the EO Acquisition was not on commercial terms because the Executives Online business "has relatively no revenue compared to…ComOps", but the value of the consideration was approximately 12% of the issued capital of ComOps. It also submitted that, among other things, the issue of the s249D notice on 17 March 2011 may have "inspired the execution of the agreements to acquire [Executives Online] business". We think this means the acquisition was a defence to Moat's s249D notice.

- It is unusual that an agreement negotiated with performance hurdles was concluded without them. In the end, however, that is a matter for the Board and in the absence of the proxy (which we discuss below) we think there is not enough material to warrant conducting proceedings.

Proxy

- We asked for additional information before deciding whether to conduct proceedings. In particular, we asked for a copy of the agreement relating to the EO Acquisition and copies of board minutes and board papers from the meeting(s) at which the terms of the acquisition were discussed or approved.

- We were given copies of the documents and informed by ComOps that:

"There is no other written or oral agreement, arrangement or understanding in connection with the acquisition of the Executives Online business.

There was no proxy granted, or any voting agreement entered into, as part of the acquisition although one was contemplated at an earlier stage …"

- There were Heads of Agreement in relation to the acquisition of the Executives Online business, executed on 3 September 2010, under which ComOps agreed to issue Mr Rattray 15 million ordinary shares in ComOps. The consideration was based "initially on an agreed value for delivering the business & IP and henceforth on meeting certain Net Profit after Taxation targets over the next five years". The shares were to remain in escrow. Voting rights on the shares were to be assigned to the chairman of the board of ComOps. Up to 12 million of the shares were to be subject to cancellation if performance hurdles were not met.

- Final documents in connection with the EO Acquisition were executed in a form different to the Heads of Agreement.

- Board minutes indicated that, before 22 March 2011, Mr Rattray had advised ComOps that he "[refused] to accept" the conditions regarding proxies, escrow and cancellation of shares. Legal advice was also obtained regarding the proposed cancellation of shares. According to the ComOps board minutes of 22 March 2011, the final contract therefore excluded reference to proxies, escrow and cancellation of shares. It was resolved at that 22 March meeting that the final contract be executed, subject to legal advice.

- The ComOps Board confirmed to the Panel that since 22 March 2011, no other matters have arisen that (a) bear on the proxy, escrow or cancellation of shares in relation to the Executives Online transaction or (b) otherwise bear on the Panel proceedings.

- Mr Rattray also confirmed that he:

- did not grant, or agree to grant, a proxy in favour of and

- did not enter into, or agree to enter into, an agreement, arrangement or understanding as to how ComOps shares should be voted with,

ComOps or any member of the ComOps board or any of their associates.

- He submitted that:

In initial discussions, it was put to me that some shares [issued on performance] would remain in escrow, however following subsequent discussions [early 2011] in which I indicated I was not prepared to deliver Executives Online on that basis, the agreement was finalised with an upfront issue of shares and no cash payment, with my commitment to become more involved in the overall sales and management of the company.

- Mr Rattray did, of course, enter into the Heads of Agreement on 3 September 2010 which contained an agreement to grant a proxy in favour the chairman of ComOps. However, the Heads of Agreement was superseded before the shares were issued and therefore nothing now turns on this point.

- It is unclear when precisely the sale and purchase became operative. The effective date of the contract ("Contract of Acquisition of Business Interest" between Time Management, a company connected with Mr Rattray, and ComOps) is 1 January 2011. The contract settlement date is 31 March 2011. The contract appears to be dated 4 April 2011.

- Nevertheless, the evidence of the final agreement and of the parties to it is that there is no proxy in relation to the 15 million shares and no ability to cancel up to 12 million shares depending on whether performance hurdles are met. There was an ASX announcement by ComOps under appendix 3B of the listing rules, dated 5 April 2011, disclosing the issue of 15 million shares in connection with the acquisition of the Executives Online business. The appendix 3B notice is consistent with the final contract, making no reference to a proxy, escrow or cancellation arrangement.

- The evidence of the parties also addresses the discrepancy between the final agreement and the material prior to the 22 March 2011 board meeting. The final agreement was never disclosed, for example as part of a substantial holding notice.

- Had the final agreement proceeded as the applicant believed it would, the number of shares involved would, in our view, potentially have had an effect on control of the company and (no substantial shareholding notices having been given) there would have been contraventions of section 671B (in relation to substantial holding notice disclosure) and perhaps also section 606 (if the "proxied shares" were to be aggregated with other holdings).

- We note also that the application referred to a conversation between Mr Cake and Mr Rattray on 31 March 2011. The applicant submitted that Mr Rattray had said:

- the acquisition contracts were signed earlier in the week (ie; Monday 28 or Tuesday 29)

- the transaction had the same deal structure outlined last August 2010 (involving initial issue of 15m shares and cancelation of 12m shares for non-performance)

- he did not know and did not care who was voting the 15m shares.

- Given the final form of the acquisition agreement, the parties' confirmations to the Panel and the ASX announcements, we do not think we can take this any further.

- The information available to us indicates that no proxy was granted in connection with the EO Acquisition, weakening the case that the terms are evidence of an association. Given the above, there is no evidence that is likely to lead to a finding of association between Messrs Rattray and Bradley.

- Further, without the proxy there is no evidence that Mr Wild has a relevant interest in the shares issued to Mr Rattray.

Association between Mr Bradley and Mr Wild

- This is enough to dispose of the application, however as the applicant addressed an alleged association between Mr Bradley and Mr Wild, and the prior conduct of those directors, we have considered this also.

- In relation to the alleged association between Mr Bradley and Mr Wild, Moat submitted that there were uncommercial actions by Mr Wild and Mr Bradley, and potential breaches of duty by Mr Wild, that the Panel should rely on as a basis for inferring a relevant agreement regarding control. It also submitted Mr Bradley and Mr Wild "may have engaged in prior collaborative conduct to influence control of the company by requiring proxies in favour of the Chairman as part of other commercial agreements". In particular, it submitted that Mr Roberts had granted a proxy in 2010 in favour of the Chairman and that Mr Roberts would confirm whether "[Mr] Wild or [Mr] Bradley was the holder of the proxy".

- We asked Mr Roberts whether he had ever granted a proxy in favour of any member of the ComOps board. Mr Roberts confirmed that he granted Mr Wild or the chairman from time to time a proxy over 15 million shares. The proxy was dated 31 August 2010 and was effective from 15 September 2010 until 15 March 2011.

- The existence of the proxy indicates that Mr Wild had a relevant interest in the shares the subject of the proxy, 7 although that proxy has now expired.

- Moat also submitted that minutes of a Board meeting of ComOps held in August 2010 confirmed that the managing director of ComOps (Mr Bradley) was to negotiate the terms of the EO Acquisition on behalf of ComOps, which "suggests a relevant agreement regarding control of ComOps between [Mr Rattray, Mr Wild and Mr Bradley]". We do not agree.

- We do not consider that this material meets the association hurdle.

Substantial holding notices

- On 31 August 2010, Mr Roberts granted a proxy over 15 million shares to Mr Wild. It is not apparent whether Mr Roberts received consideration for the proxy, but it expressly related to more than one meeting. Unless one of the exceptions in section 609 applied, Mr Wild had a relevant interest in those shares from 31 August 2010 until 15 March 2011, at the time representing 13% voting power in ComOps. No substantial holding notice has been given to ASX in respect of this.

- On 5 April 2011, ComOps applied for quotation of 15 million shares issued to Mr Rattray (or his nominee) as consideration for the EO Acquisition, stating that the company then had 130,995,085 ordinary shares on issue. Unless one of the exceptions in section 609 applied, Mr Rattray appears to have acquired a relevant interest in those shares, representing 11.4% voting power in ComOps. No substantial holding notice had been given to ASX in respect of this at the date of this decision.8

- Although each of these parcels is substantial, given that the Roberts proxy has expired and the Rattray allotment was mentioned in ComOps' announcement of the EO Acquisition, we think it unlikely that the lack of substantial holding notices would now give rise to unacceptable circumstances, but the relevant notices should be lodged.

Other matters submitted to be within the Panel's jurisdiction

- Moat submitted there were other matters "that may fall within the jurisdiction of the Panel", including review of a s249P members' statement and a request by ComOps to various persons for destruction of material.

- On the available material, it does not appear that these matters fall within the Panel's jurisdiction and we do not consider them further.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we have decided not to conduct proceedings, we make no orders, including as to costs.

Karen Wood

President of the sitting Panel

Decision dated 21 April 2011

Reasons published 28 April 2011

Advisers

| Party | Advisers |

|---|---|

| ComOps Limited | Chang, Pistilli & Simmons |

| Moat Investments Pty Ltd | n/a |

1 References are to the Corporations Act 2001 (Cth) unless otherwise indicated

2 A substantial holding notice was subsequently lodged by Mr Rattray on 21 April 2011

3 The notice of meeting was subsequently released to ASX on 14 April 2011

4 Mount Gibson Iron Limited [2008] ATP 4 at [15]. See also Viento Group Limited [2011] ATP 1, Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Rusina Mining NL [2006] ATP 13

5 Section 12(2)

6 At the time of the application, Moat did not have a copy of the minutes of the Board meeting on 22 March 2011 or the final agreement for the EO Acquisition

7 Section 609(5) does not seem to apply

8 A substantial holding notice was subsequently lodged by Mr Rattray on 21 April 2011