[2024] ATP 18

Catchwords:

Decline to conduct proceedings – association – warehousing – evidence – not frivolous and vexatious

Corporations Act 2001 (Cth), sections 606, 657C(3), 658A

Takeovers Panel Procedural Rules 2020, Rule 10(6)

Minister for Immigration & Multicultural Affairs v Bhardwaj (Bhardwaj) (2002) 209 CLR 597, Tze Ching Leung & Chui Mei Wong v Minister for Immigration & Multicultural Affairs (1997) 79 FCR 400

AIMS Property Securities Fund 03 [2023] ATP 5, AIMS Property Securities Fund 01 & 02 {2021] ATP 15, Mount Gibson Iron Limited [2008] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Teresa Dyson, Jon Gidney and John Sheahan KC (sitting President), declined to conduct proceedings on an application by Benjamin Graham atf the Graham Family Trust and Warwick Sauer in his personal capacity and as a director of Baauer Pty Ltd atf the Baauer Family Trust in relation to the affairs of APW. The application concerned an alleged association between the controlling unitholder of APW and other shareholders. The Panel considered, among other things, that on balance the applicants did not provide a sufficient body of material to justify the Panel making further enquiries in relation to whether the persons and entities referred to in the application were associates in relation to APW. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Applicants

- Benjamin Graham atf the Graham Family Trust and Warwick Sauer in his personal capacity and as a director of Baauer Pty Ltd atf the Baauer Family Trust

- APW

- AIMS Property Securities Fund

- APW RE

- AIMS Fund Management Limited

- Consolidated AIMS Group

- Great World Financial Group Holdings Pty Ltd and subsidiaries referred to in Part 1 of Annexure A of the substantial holder notice lodged by Great World Financial Group Holdings Pty Ltd and Subsidiaries and Mr George Wang directly owned and controlled entities (and signed by Mr George Wang) dated 14 August 2024

- LH&F

- LH&F Pty Ltd, on its own behalf and as trustee of the LH&F Family Trust

Facts

- APW is an ASX listed1 managed investment scheme (ASX code: APW). It has 44,519,083 units on issue. The units are thinly traded.

- Mr George Wang has voting power of 59.72% in APW through the Consolidated AIMS Group.

- On 24 December 2020, AIMS Investment Group Holdings Pty Ltd (a member of the Consolidated AIMS Group), Ms Li Li, Mr Chi San Liu and Ms Hiu Ping Lau acquired approximately 22.84% (in aggregate) of the APW units on issue from two former shareholders of APW for $1.785 per unit.2 The market price for APW units on 24 December 2020 was $1.34 per unit. Following the acquisition:

- Mr George Wang had voting power of 42.78% in APW.

- Ms Li Li had voting power of 9.86% in APW.

- Mr Chi San Liu had voting power of 6.74% in APW.

- Ms Hiu Ping Lau had voting power of 3.25% in APW.

- Mr Chi San Liu and Ms Hiu Ping Lau are siblings.3 Mr Chi San Liu submitted in the AIMS Property Securities Fund 01 & 02 proceedings that Ms Li Li was a family friend.4

- On 9 August 2022, Mr Chi San Liu transferred his 6.74% interest in APW to LH&F for $1.785 per unit (the price at which he had acquired the units). The market price for APW units on 9 August 2022 was between $1.255 and $1.30 per unit. Mr Chi San Liu in a substantial holder notice disclosed that he continued to have a relevant interest in 6.74% of APW under section 608(3)5 as he had voting power of more than 20% in LH&F.

- On 14 June 2024, Ms Li Li transferred her 9.86% interest in APW to LH&F, also for $1.785 per unit. The market price for APW units on 14 June 2024 was $1.53 per unit.

- On 14 August 2024, AIMS Investment Group Holdings Pty Ltd (a member of the Consolidated AIMS Group) acquired 1,000,000 APW units (2.25%) from LH&F for $1.577 per unit. The market price for APW units on 14 August 2024 was $1.57 per unit.

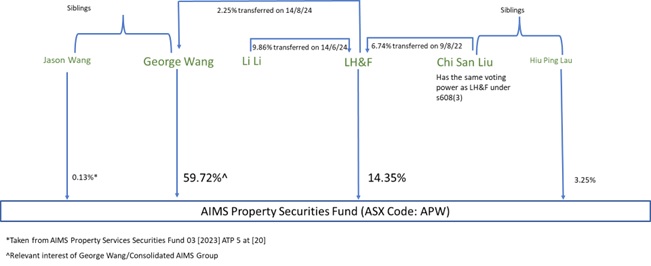

-

Unitholdings in APW and various relationships between the parties are set out in the diagram below:

Application

Declaration sought

- By application dated 20 August 2024, the Applicants sought a declaration of unacceptable circumstances. The Applicants submitted (among other things) that:

- The 14 August 2024 sale of 1,000,000 APW units from LH&F to the Consolidated AIMS Group at $1.577 per unit caused LH&F to incur a loss of $208,000 vis-à-vis LH&F’s purchase of APW units from Ms Li Li at $1.785 per unit 2 months earlier.

- LH&F acquired the APW units on 14 June 2024 from Ms Li Li for the purpose of warehousing those units for Mr George Wang and the Consolidated AIMS Group.

- The conduct would, if not remedied, result in the Consolidated AIMS Group and its associates, LH&F and Mr Chi San Liu, retaining 9.86% of APW acquired in contravention of the prohibition in section 606.6

- On 22 August 2024, the Applicants sought leave to amend their application to (in effect) include the transfer by Mr Chi San Liu to LH&F on 9 August 2022 as part of the alleged warehousing purpose. We decided to accept the amended application.

Interim order sought

- In their amended application, the Applicants sought an interim order that LH&F and Mr Chi San Liu not deal with the 6,390,053 APW units they had voting power in, and the Consolidated AIMS Group not deal with 1,000,000 of its APW units, pending determination of its application.

Final orders sought

- In their amended application, the Applicants sought final orders, including that:

- LH&F’s 6,390,053 APW units and the 1,000,000 units acquired by the Consolidated AIMS Group on 14 August 2024 be vested in ASIC for sale.7

- The Consolidated AIMS Group, Mr George Wang (his siblings – Mr Jason Wang and Ms Jenny Wang), LH&F, Mr Chi San Liu, Ms Li Li, Ms Hiu Ping Lau, and their associates, be prohibited from acquiring any of the vested units from ASIC.

Discussion

- Mr George Wang submitted (among other things) that:

- The application was frivolous and vexatious, warranting its dismissal pursuant to section 658A.

- “Although claiming to possess new evidence (which appears to be based purely on wild speculation), the Applicants are effectively seeking a re-hearing of matters already determined by the Panel in AIMS Property Securities Fund 01 [2001] ATP 15, AIMS Property Securities Fund 02 [2021] ATP 15, and AIMS Property Securities Fund 03 [2023] ATP 5 that is not being pursued in the appropriate form of a review application”.

- We do not consider that the Application was frivolous and vexatious as it referred to transactions that on first view did not appear entirely commercial. For example, the acquisition by LH&F of Ms Li Li’s APW units for $1.785 per unit was:

- at the same price which she acquired the units on 24 December 2020 (more than 3 and a half years’ ago) and

- at a significant premium to the current market price for the APW units.

- This acquisition raises the question as to whether Ms Li Li is associated with either Mr Chi San Liu or LH&F. However, while ASIC may wish to make further enquiries in relation to whether these persons have historically complied with their substantial holder notice obligations, in isolation we do not consider the acquisition to be probative in relation to the allegation of warehousing in relation to Mr George Wang or the Consolidated AIMS Group.

- We have considered the acquisition by LH&F of Mr Chi San Liu’s units to have no significance to a possible association of either of them with Mr George Wang or the Consolidated AIMS Group. That transaction could, by way of example, be a reorganisation of Mr Chi San Liu’s affairs, or perhaps the affairs of his family. It has no apparent significance to control of APW.

- The transfer of 1,000,000 APW units at $1.577 per unit from LH&F to the Consolidated AIMS Group of 14 August 2024 was potentially more probative, as the sale was at a loss to LH&F and in the light of Ms Li Li’s disposal to LH&F two months earlier. However, while the commerciality of this acquisition could be questioned, it was at or around the market price for APW units at the time, did not have a material control effect, did not involve all of LH&F’s holding and occurred more than 3½ years after the original purchases by Ms Li Li and Mr Chi San Liu. On balance by itself, this was not sufficient for us to consider conducting proceedings.

- We consider the facts in AIMS Property Securities Fund 01 & 02 and the material provided by the Applicants in their amended application. We do not agree with Mr George Wang’s submission that the Applicants are effectively seeking a rehearing of previous AIMS Property Securities Fund matters. The Applicants have provided further material, based on subsequent events, that is at least potentially relevant. It is the case, however, that the amended application is based on issues as to association which were the subject of the earlier applications to the Panel, and which were found not to justify a declaration of unacceptable circumstances.

- In Minister for Immigration & Multicultural Affairs v Bhardwaj (Bhardwaj) (2002) 209 CLR 597 Gleeson CJ said (at [8]):

The requirements of good administration, and the need for people affected directly or indirectly by decisions to know where they stand, mean that finality is a powerful consideration. And the statutory scheme, including the conferring and limitation of rights of review on appeal, may evince an intention inconsistent with a capacity for self-correction. Even so, as the facts of the present case show, circumstances can arise where a rigid approach to the principle of functus officio is inconsistent with good administration and fairness. The question is whether the statute pursuant to which the decision-maker was acting manifests an intention to permit or prohibit reconsideration in the circumstances that have arisen.

- We have proceeded on the basis (favourable to the applicants) that the earlier Panel decisions are not binding on us as such, and do not render the Panel functus officio.8 However, consistently with “the requirements of good administration” we do not consider it appropriate to reconsider the questions dealt with in those decisons unless the new evidence indicates a reasonable prospect of a different outcome. We do not consider this is so. While the Applicants have provided additional material, we consider that this is not sufficient to justify us making further enquiries in relation to whether the persons and entities referred to in the application were associates in relation to APW.9 In addition, noting the difficulty of obtaining information by compulsion from persons resident outside Australia, 10 we consider that if we did make enquiriesthat it is unlikely that we would obtain sufficient material to make inferences that the limited transactions described above were for the purposes of warehousing.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- The Applicants requested that the Panel extend the time for the making of the application and amended application. Given we have decided not to conduct proceedings, we do not need to consider the request. However, we note that the most pertinent fact, being the acquisition of 1,000,000 APW units by AIMS Investment Group Holdings Pty Ltd, was within the time specified in section 657C(3).

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Postscript

- After these reasons were given to the parties, we were informed that two submissions from APW RE and Mr George Wang, both dated 23 August 2024, were not provided to the Applicants and ASIC.11 These submissions attached notices to become a party, objected to the Panel members who sat on previous matters relating to APW12 being appointed to consider this matter and made other preliminary submissions.13

- We understand that the review Panel in AIMS Property Securities Fund 05R have been provided with these submissions and it is now a matter for the review Panel to determine any procedural issues that may arise from them.

John Sheahan KC

President of the sitting Panel

Decision dated 28 August 2024

Reasons given to parties 9 September 2024

Reasons published 17 September 2024

Advisers

| Party | Advisers |

|---|---|

| Applicants | Deffenti & Queiroz Lawyers |

| APW RE | - |

| Consolidated AIMS Group | - |

1 On 14 December 2023, APW was delisted from the main board of the Singapore Exchange Securities Trading Limited at the request of APW RE

2 As part of the same transaction, Ms Li Li also acquired units in AIMS Total Return Fund. For more background see AIMS Property Securities Fund 01 & 02 [2021] ATP 15 at [4] and [112] to [164]

3 AIMS Property Securities Fund 01 & 02 [2021] ATP 15 at [115]

4 Ibid at [117]

5 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

6 The Applicants also sought as an order a declaration that each of LH&F, Mr Chi San Liu, Ms Li Li, Ms Hiu Ping Lau, Ms Jenny Wang, and Mr Jason Wang are associates of the Consolidated AIMS Group in relation to APW

7 The Applicants sought a further order that “insofar as the net proceeds of sale of the ASIC vested units exceeds the net acquisition cost of those units, that excess, after payment of ASIC’s reasonable costs of effecting those units’ sale, be distributed among those unitholders who suffered loss by reason of the respondents' wrongdoing set out in this application”

8 As to which, see the discussion by Finkelstein J (with whom Beaumont J agreed) in Tze Ching Leung & Chui Mei Wong v Minister for Immigration & Multicultural Affairs (1997) 79 FCR 400. In the case of the Panel, we note that the fact that its objects are the protection of public interests rather than private rights suggests it ought have a power of reconsideration if the circumstances warrant.

9 See Mount Gibson Iron Limited [2008] ATP 4 at [15]

10 Both Ms Li Li and Mr Chi San Liu reside outside Australia

11 Contrary to Rule 10(6) of the Takeovers Panel Procedural Rules 2020

12 AIMS Property Securities Fund 01 [2021] ATP 15, AIMS Property Securities Fund 02 [2021] ATP 15 and AIMS Property Securities Fund 03 [2023] ATP 5

13 Mr George Wang submitted that the application was frivolous and vexatious, as referred to in paragraph 15 above