[2022] ATP 1

Catchwords:

Review – declaration – variation of orders – scheme of arrangement – association – relevant interest – voting power – break fee – listed investment companies – common directors – common management

Corporations Act 2001 (Cth), sections 12, 16(1), 411(4)(a)(ii), 602, 606, item 9 s611, 657A, 657C(1), 657D, 657EA, 671B

In the matter of PM Capital Asian Opportunities Fund Limited [2021] FCA 1380; Eastern Field Developments Limited v Takeovers Panel [2019] FCA 311; Meridian Global Funds Management Asia Ltd v Securities Commission [1995] 2 AC 500

Guidance Note 7: Lock-up devices

PM Capital Asian Opportunities Fund Limited 01 [2021] ATP 17; Breakfree Limited 04(R) [2003] ATP 42| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| YES | NO | YES | YES | YES | NO |

Introduction

- The Panel, Alex Cartel (sitting President), Rebecca Maslen-Stannage and John Sheahan QC affirmed the declaration and varied the orders made by the initial Panel in relation to the affairs of PM Capital Asian Opportunities Fund Limited.1 The review Panel agreed with the initial Panel’s conclusions, for substantially the same reasons, but varied the orders to deal with the change of circumstances, including the desire by parties associated with Mr Paul Moore to accept the bid by WAM Capital Limited.

- In these reasons, the following definitions apply.

- Term

- Meaning

- Break Fee

- The break fee in Clause 11 of the SID

- Direction

- The instruction given by PGF to PMC pursuant to Clause 5.17 of the PGF IMA on 14 September 2021 described in paragraph 17

- Excess Shares

- Has the meaning given in paragraph 26(e)

- Governance Protocols

- The PAF Governance Protocol and the PGF Governance Protocol

- IMA

- Investment Management Agreement

- IMA Extract

- The extract from the PGF IMA attached to the notice of change of interests of substantial holder given by PGF to PAF on 1 October 2021

- LIC

- Listed Investment Company

- Moore Group

- Paul Moore and all entities, other than PMC and PGF, named as substantial holders in the notice given to PAF by Paul Moore on 7 June 2021

- Moore Parties

- Paul Moore, Roaring Lion Pty Ltd as trustee for the Roaring Lion Super Fund and Horizon Investments Australia Pty Ltd as trustee for Hawkins Trust

- PAF

- PM Capital Asian Opportunities Fund Limited

- PAF Governance Protocol

- The governance protocol adopted by the PAF Board on 6 September 2021

- PGF

- PM Capital Global Opportunities Fund Limited

- PGF Governance Protocol

- The governance protocol adopted by the PGF Board on 6 September 2021

- PMC

- PM Capital Limited

- Proposed Transaction

- The proposed merger between PGF and PAF considered by the PGF Board on 6 September 2021 and announced on 15 September 2021

- Scheme

- The scheme of arrangement between PAF and PAF shareholders in the form attached to the SID, as amended or altered

- SID

- The Scheme Implementation Deed between PGF and PAF dated 15 September 2021

- WAM

- WAM Capital Limited

- WAM bid

- WAM’s takeover bid for PAF made under its bidder’s statement dated 14 October 2021

Facts

- The facts are set out in detail in PM Capital Asian Opportunities Fund Limited 01. Below is a summary.2

- PAF (ASX code: PAF) and PGF (ASX code: PGF) are both LICs listed on ASX. PMC is the investment manager of both PAF and PGF.

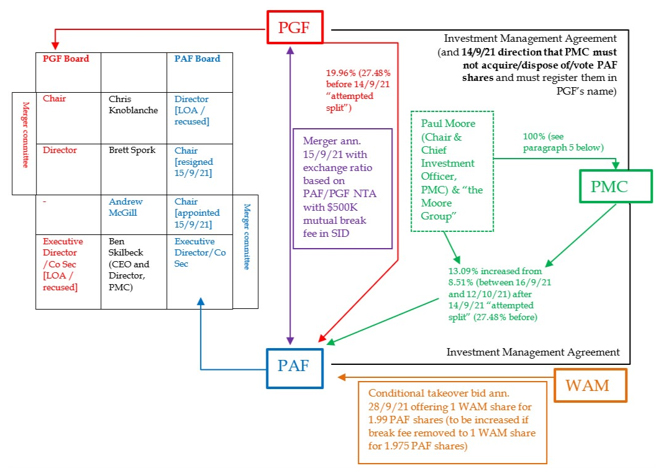

- A diagram of the relevant parties is below:

- All shares in PMC are held by an entity wholly-owned by Mr Moore. Approximately 88% are held on trust for Mr Moore and his family and the remainder on trust for PMC employees.

- On 6 September 2021, Mr Ben Skilbeck (in his capacity as the executive director of PGF) provided a final discussion paper on the Proposed Transaction, a merger between PGF and PAF, to a meeting of the PGF Board. Mr Skilbeck is also the executive director of PAF and Chief Executive Officer of PMC. The PGF Board had previously asked Mr Skilbeck to apprise the PGF Board of M&A opportunities as and when they were identified. Mr Skilbeck had considered various commercial aspects of a merger of PGF with PAF and presented on the matter to an earlier meeting of the PGF Board, which also discussed legal advice and a draft Governance Protocol.

- The PGF Board meeting considering the Proposed Transaction on 6 September 2021 was attended by Mr Skilbeck, Mr Brett Spork, Mr Chris Knoblanche (Chairman), and Mr Richard Matthews (as PGF Company Secretary – Mr Matthews was then also Company Secretary of PAF and Chief Operation Officer of PMC). The Minutes indicated that the meeting commenced at 4.03pm and closed at 4.20pm, and recorded no disclosures under the heading “Disclosure of Interests / Conflicts”.3 The Minutes stated:

-

noted that the Governance Protocol had been initially drafted by JWS, and then a second opinion (review and confirmation) had been undertaken by Bakers.

…

It was RESOLVED unanimously that:

…-

The company adopt Governance Protocol – whilst noting the amendment that B.Skilbeck be appointed as a co-Company Secretary for PGF (and then go on immediate leave of absence);

-

- The PGF Governance Protocol stated:

1 Overview

1.1 Background

The board of [PGF] is in the early stages of exploring the possibility of a potential merger of PGF and [PAF] by a scheme of arrangement …in which PGF will acquire all of the shares in PAF (Proposed Transaction).

PGF currently intends to provide a proposal to PAF concerning the Proposed Transaction. …

Due to the overlapping governance and management arrangements applying to PGF and PAF … the implementation of the Proposed Transaction has the potential to give rise to conflicts of interest for the directors of PGF and PAF as well as other difficulties.

In order to manage these potential conflicts and difficulties, the board of PGF …has adopted this Governance Protocol …

…

- The PGF Governance Protocol also noted, among other things, that as at the date of the protocol:

- Each of PGF and PAF had a “common board representation”, comprising Mr Skilbeck (Executive Director), Mr Knoblanche (Chairman of PGF and Chairman of the Audit Committee of PAF), and Mr Spork (Chairman of PAF and Chairman of the Audit Committee of PGF), and Mr Matthews was the Company Secretary of both PGF and PAF and the Alternate Director for Mr Skilbeck for each of PGF and PAF.

- PGF and PAF had no employees and they had separately entered into an IMA with PMC. PMC was responsible for the implementation of the investment strategy of each of PGF and PAF, and for the day-to-day administration of each company’s affairs. Also:

- the board of PMC comprised Mr Moore, Mr Skilbeck and one other director

- Mr Moore (through entities that he controlled) controlled 89% of the shares in PMC

- Mr Moore was also the portfolio manager for PGF (appointed by PMC)

- PGF held approximately 19% of the shares in PAF

- Mr Moore (through entities that he controlled) controlled approximately 8% of the shares in PAF

- PGF and Mr Moore jointly controlled approximately 27% of the shares in PAF as a consequence of the IMA (which was the subject of a substantial shareholding joint disclosed interest) and

- Mr Moore (through entities that he controlled) controlled approximately 19% of the shares in PGF.

- The PGF Governance Protocol indicated that its purpose included ensuring that:

(a) the PGF Board is able to make all decisions concerning the Proposed Transaction independently of

(i) [PMC]

(ii) Paul Moore; and

(iii) PAF;

…

(d) to the extent practicable, the entities controlled by Paul Moore that hold shares in PAF are not associates of PGF in relation to PAF in the context of the Proposed Transaction.

- In order to achieve that purpose the PGF Governance Protocol provided, among other things, for the following (subject to the relevant Board Committee making sensible adjustments as circumstances may require):

- Mr Spork and Mr Knoblanche to be the PGF Board Committee for the purposes of the Proposed Transaction, and

- Mr Spork to take leave of absence from the PAF Board on PGF providing a proposal to PAF, and resign on announcement of the Proposed Transaction provided PAF had appointed another director.

- Mr Knoblanche not to be involved as a director of PAF in decision making concerning the Proposed Transaction on PGF providing a proposal to PAF or as soon as reasonably practicable thereafter, and to take leave of absence from the PAF Board.

- Mr Skilbeck to:

- remain as Executive Director of PAF for the duration of the Proposed Transaction and, on PGF providing a proposal to PAF or as soon as reasonably practicable thereafter having regard to the need for PAF to put in place steps to adopt the proposal, not be involved as a director of PGF in decision making concerning the Proposed Transaction, and take leave of absence from the PGF Board

- “continue in his executive PGF role without exercising director powers” and

- be appointed as an additional PAF Company Secretary on announcement of the Proposed Transaction or as soon as reasonably practicable thereafter.

- Mr Andrew McGill to be appointed as a consultant to PAF and, subject to recommendations of the PAF nominations committee and resolution of the PAF Board, be “appointed a director of PAF shortly prior to entering into the Proposed Transaction”, and Mr McGill and Mr Skilbeck to be the PAF Board Committee for the purposes of the Proposed Transaction.

- Mr Matthews to continue to act as PGF Company Secretary and, on announcement of the Proposed Transaction or as soon as reasonably practicable thereafter having regard to the need for PAF to put in place steps to adopt the proposal, not be involved as a PAF Company Secretary for the duration of the Proposed Transaction in matters concerning the Proposed Transaction.

- At entry into a Scheme Implementation Agreement and the announcement of the Proposed Transaction, PGF to:

remove the PAF shares held in its portfolio from the [IMA] by giving notice to [PMC]. The effect of this will be that neither [PMC] nor Mr Moore will control the buy/sell or voting decisions relating to PGF’s shareholding in PAF. A change of substantial shareholding in relation to Mr Moore and PGF in relation to PAF.

- Mr Spork and Mr Knoblanche to be the PGF Board Committee for the purposes of the Proposed Transaction, and

- Also on 6 September 2021, PAF received a letter by email from Mr Knoblanche, as Chairman of PGF, to Mr Spork, PAF Chairman, proposing the Proposed Transaction and attaching governance protocols “likely to be appropriate should discussions advance” for both PGF (as above) and PAF for consideration, and stating that “PGF’s intent is that any scheme implementation agreement would contain customary and usual lock-up arrangements”. This proposal was considered at a PAF Board meeting attended by Mr Skilbeck, Mr Spork (Chairman), Mr Knoblanche, and Mr Matthews (as Company Secretary). The Minutes indicated that the meeting commenced at 5.07pm (47 minutes after the close of PGF’s Board meeting) and closed at 5.21pm, and recorded no disclosures under the heading “Disclosure of Interests / Conflicts”.4 The Minutes stated, among other things, that:

B.Skilbeck provided an outline of the proposed transaction. He concluded that it would appear that a transaction could be in the interests of shareholders and deserves appropriate consideration.

…

Members considered that on face value, the proposal could be in the interests of the shareholders and of the Company, and as such the Company should enter into discussions with PGF.

After noting discussion, the Minutes stated:

It was RESOLVED that:

- The Confidentiality Agreement with PGF be approved, and that Company officers be authorised to sign and return to PGF;

- Company officers be authorised to appoint Baker McKenzie as Counsel subject to Baker McKenzie not having conflict which would preclude them from acting for the Company;

- The Governance Protocol (as provided by PGF) be adopted, subject to counsel confirming its appropriateness;

- The Board considered that Mr McGill has the requisite skills, qualifications and character to be appointed as a consultant to, and/or director of, the Company;

- McGill be appointed as consultant, with intention to appoint him as a director should it become appropriate;

- Any director be authorised to formalise the appointment of Mr McGill as a director (as appropriate).

- Company officers be authorised to sign the consulting agreement with Mr McGill;

- Company officers be authorised to approach independent experts.

- Subject to B.Skilbeck consenting to the appointment, B.Skilbeck be appointed as co-Company Secretary.

- On 7 September 2021, Mr McGill accepted appointment by PAF as a consultant to the Board. He was not appointed to the PAF Board until 15 September 2021 shortly before the SID was entered into.

- On 9 September 2021, PAF’s legal advisers sent a draft of the SID to PAF which included a break fee of $600,000.

- On 10 September 2021, after discussion with its legal advisers, PAF reduced the break fee in the SID from $600,000 to $500,000 and sent the updated SID to PGF. The SID was agreed after minor subsequent changes unrelated to the Break Fee.

- On 14 September 2021, PGF, in a letter signed by Mr Matthews as Company Secretary, instructed PMC pursuant to Clause 5.17 of the PGF IMA:

- that it must not acquire or dispose of any securities held by PGF in PAF

- that it must not hold or exercise any rights of voting the shares on any resolutions put to a meeting of shareholders by PAF and

- to do all things necessary to facilitate moving PGF’s shares in PAF out of custody to be registered in the name of PGF (issuer sponsored) (Direction).

- On 15 September 2021, PGF gave a notice of change of interests of substantial holder to PAF stating its voting power as 19.96% and making no reference to PMC, the Moore Group, or the Direction PGF gave to PMC on 14 September 2021 (which was not attached). No associates or changes in association were disclosed.

- On 15 September 2021, PMC and the Moore Group gave a notice of change of interests of substantial holder to PAF stating its voting power had decreased from 27.48% to 8.51% and indicating in an annexure that PGF’s relevant interest had changed and the nature of the change was “Revocation of control of shares”. No associates or changes in association were disclosed. The Direction PGF gave to PMC on 14 September 2021 was not otherwise mentioned or attached.

- Also on 15 September 2021, PGF and PAF entered into the SID to merge the entities and announced this to ASX.

- On 28 September 2021, WAM announced its intention to make the WAM bid, subject to a number of conditions, including a condition that the Scheme not progress. The WAM bid offered 1 WAM share for every 1.99 PAF shares and WAM stated an intention to increase this to 1 WAM share for every 1.975 PAF shares if the Break Fee was removed.

- On 29 September 2021, PMC and the Moore Group gave a notice of change of interests of substantial holder to PAF stating its voting power had increased from 8.51% to 9.90%. No associates or changes in association were disclosed.

- On 1 October 2021, PGF gave a revised notice of change of interests of substantial holder to PAF which referred to and attached the Direction it had given to PMC on 14 September 2021. The Notice also attached the IMA Extract (which included Clause 5.17) and a summary of the PGF IMA taken from PGF’s prospectus. No associates or changes in association were disclosed. The IMA Extract did not include all provisions that may be relevant in determining whether the Direction was effective to achieve its intended purpose (as described in the PGF Governance Protocol).

- On 13 October 2021, PMC and the Moore Group gave a notice of change of interests of substantial holder to PAF stating its voting power had increased from 9.90% to 13.09%.

- On 15 October 2021, WAM made an application to the Panel, submitting (among other things) that:

- PGF and PMC had failed to properly disclose the full PGF IMA, resulting in an absence of proper disclosure to explain the operation of the Direction, and consequently the WAM bid could not take place in an efficient, competitive and informed market

- the Direction did not remove either the relevant interest or the association between PGF and PMC and accordingly recent acquisitions by PGF and PMC of PAF shares represented a 6.19% increase in their combined voting power of 26.86% (disclosed in combined substantial holding notices given by PGF, PMC “and their associates”) held six months previously and constituted a breach of s606(1) and

- the Break Fee created an unreasonable and unequal opportunity for PGF to participate in benefits under the WAM bid as, due to the Break Fee, PGF would receive $1.201 per PAF share (compared to $1.157 per PAF share for other PAF shareholders) if the WAM bid succeeded. WAM also submitted that “PAF did not undertake a public, transparent process designed to elicit proposals to achieve the best possible outcome for its shareholders. With a common investment manager, the cost, effort or risk involved for PAF and PGF in proposing the Scheme was minimal”.

- On 3 December 2021, the initial Panel made a declaration of unacceptable circumstances and orders. The initial Panel considered (among other things) that:

- although PGF had properly recognised the need for Governance Protocols, it had not implemented them soon enough

- the unusually extensive overlap in the boards and management of PGF, PAF and PMC and delayed implementation of Governance Protocols was unacceptable and had given rise to association

- the Direction was not effective to divide the voting power of PGF and PMC/Moore Group or end the association between them

- while the initial Panel stated that it made no comment on the merits of the Proposed Transaction, which are a matter for PAF’s shareholders, the inadequate disclosure of association and relationships, and the manner in which the Proposed Transaction was proposed, negotiated and agreed by PGF and PAF, given the circumstances, were inconsistent with s602(a) and (b) and

- the acquisition of approximately 3.19% of PAF shares by the Moore Group between 28 September 2021 and 12 October 2021 (Excess Shares), being the percentage shareholding acquired in excess of the amount permitted by the 3% creep rule, resulted in contraventions of s606(1) and substantial holding notices given by PGF, PMC and the Moore Group contravened s671B.

- The initial Panel considered that the Break Fee, of itself, did not give rise to unacceptable circumstances.

- The initial Panel made orders that in effect:

- required PGF, PMC and Moore Group to give a corrected substantial holder notice, accompanied by a copy of the IMA (redacted to no greater extent than that provided to the Panel)

- prevented Moore Group and their associates voting, acquiring or disposing of the Excess Shares and

- if the Proposed Transaction did not become effective (by 21 January 2022 or such later date as the Court or the Panel approves), vested the Excess Shares in ASIC for sale.

Applications

- On 7 December 2021, the Panel received two review applications:

- PMC sought a review of the initial Panel’s declaration and orders (PM Capital Asian Opportunities Fund Limited 03R), submitting in effect that the initial Panel should not have made those decisions.

- The Moore Parties sought a review of the initial Panel’s declaration and orders (PM Capital Asian Opportunities Fund Limited 04R), submitting (among other things) that:

- The initial Panel’s declaration and orders were “an incursion on the rightful jurisdiction of the Court vis-à-vis the PAF/PGF scheme”.

- As a matter of law, “the Panel has no jurisdiction to extend the scope of its enquiries to matters that go beyond that which even the Application sought to prosecute – this is plain from the wording of s657C”, because in effect WAM’s application referred to acquisitions only by PMC contravening s606 and did not refer to any of the acquisitions by the Moore Parties.

- The inference of association between each of the Moore Parties and PGF was “implausible and inconsistent with the facts”.

- The initial Panel had failed to take into account whether the Moore Parties were culpable, in making the declaration and orders.

Interim orders sought

- Prior to making their review applications, the Moore Parties and PMC sought urgent interim orders.5 The Moore Parties sought a stay of all the Panel’s orders, noting that a stay of the initial Panel’s order 1, requiring corrective substantial holder disclosure, was urgent because this disclosure was required by close of business on 7 December 2021. PMC sought an urgent stay of Order 1, but also supported the Moore Parties’ application seeking a stay of all the initial Panel’s orders. The President made an interim order staying order 1 (Annexure A), noting that the review Panel may consider it appropriate to review the interim orders.

- In support of its application seeking a stay of all the initial Panel’s orders, the Moore Parties submitted (among other things) that the meeting to approve the scheme was scheduled to be held on 13 December 2021 and given the order restricting the Moore Group and their associates from voting the Excess Shares and:

WAM's existing voting power in PAF of 12.55% as at 30 December 2021 and noting that WAM has expressly stated that it will vote all shares it acquires under its takeover bid against the Scheme, the impacts of the interim orders not being granted gives rise to a real prospect that the Scheme is not approved by the majorities of shareholders as required by section 411(4)(a)(ii) of the Corporations Act. In practical terms, this outcome would be irreversible and could not be properly remedied in the event the review Panel subsequently decided to vary, set aside or set aside and replace the Orders in response to this Review Application in accordance with section 657EA. (footnote omitted)

- WAM made a preliminary submission that, among other things, the Moore Parties’ request for further interim orders was inappropriate and was in effect seeking our “imprimatur for voting illegally acquired shares at the Scheme meeting”. PAF made a preliminary submission that, among other things, supported the Moore Parties’ request for further interim orders.

- We decided not to make any further interim orders. We were not satisfied that the interim orders requested would appropriately preserve the status quo, considering the balance of convenience and PAF’s ability to adjourn or seek postponement of the meeting of PAF shareholders to consider the Scheme. We also considered the President’s interim orders staying Order 1 and decided not to vary them.

Discussion

- The powers of a review Panel are set out in section 657EA. Our role is to conduct a de novo review.6 Subsection (4) provides that a review Panel has the same powers to make a declaration or orders as the initial Panel and may vary or set aside the decision reviewed or substitute a new decision. It may also affirm the decision reviewed after conducting proceedings or decline to conduct proceedings and allow the initial Panel’s decision to stand. We received all the material before the initial Panel.

- On 13 December 2021, PAF announced that the resolution to approve the Scheme was not passed “by the requisite majorities of PAF shareholders”.

- On 17 December 2021, we were provided with a copy of the initial Panel’s reasons. In relation to the Panel’s role vis-à-vis the role of the Court the initial Panel stated (at [99]7):

We note also that the Court’s reasons began by outlining the well-known principles governing the limited role of the Court at the first stage of a scheme of arrangement procedure. We understand that the Court “considered the effect of the Direction” in accordance with those principles and its relevance to the proposed Scheme. As the Court makes clear in several places in its reasons, the issues we have been asked to consider are quite distinct.

- We agreed with the initial Panel’s approach and did not accept the Moore Parties’ submission that the initial Panel’s declaration and orders were “an incursion on the rightful jurisdiction of the Court vis-à-vis the PAF/PGF scheme”. In any event, in considering the matter de novo, we considered it was appropriate to consider the impact of the Scheme not proceeding.

- We decided to conduct proceedings, asking parties to what extent (if any) the matters raised in the review applications continued to be relevant given the outcome of the Scheme meeting and whether they had any further submissions to make in the light of the initial Panel’s reasons.

- We have considered all the material referred to above but address only specifically that part of the material we consider necessary to explain our reasoning. Given that, as discussed below, we agree with the conclusions and reasons of the initial Panel for making its declaration, we adopt, and will not repeat, those reasons. Instead, we focus on the concerns raised by the review applications.

Jurisdiction

- The Moore Parties in their review application submitted in effect that WAM’s initial application had referred only to contraventions of s606 by PMC. They submitted that:

Even though the Panel made no findings in relation to the Direction being used as an artifice to transfer control to Paul Moore and his associates, the Panel made Orders directly targeting the acquisitions of PAF shares made by Roaring Lion and Hawkins and requiring the divestment of certain of those shares (described as the Excess Shares in the Orders). The Panel reached these conclusions despite these issues not being the subject of the Application.

As a matter of law, the Panel has no jurisdiction to extend the scope of its enquiries to matters that go beyond that which even the Application sought to prosecute – this is plain from the wording of s657C.

- The initial Panel in its reasons stated the following on the scope of WAM’s application (at [39] and [40], footnote omitted):

- The Application identifies as circumstances (among other things):

- substantial holder notices given by PMC and PGF on 15 September 2021 and by PGF on 1 October 2021, in which WAM submitted “defective disclosure” had “compromised the efficient, informed and competitive market in the shares of PAF”

- that “[l]odged on 29 September and 13 October 2021, [PMC’s] Substantial Holding Notices disclosed acquisitions”, which WAM submitted resulted in a breach of s606(1).

- In our view, paragraph 39(b) sufficiently identifies the acquisitions of PAF shares by members of the Moore Group to give us jurisdiction to make a declaration and orders concerning them, despite the Application assuming that the shares (or, at least, relevant interests in the shares) were acquired by PMC.

- The Application identifies as circumstances (among other things):

- PGF submitted that the initial Panel had initially incorrectly understood that WAM’s application submitted that the Moore Group was an associate of PGF or PMC and that paragraphs 39 and 40 of the initial Panel’s reasons “assert a quite different basis on which the Original Panel claims it asserted jurisdiction, that is, that it was about the content of substantial holder notices”.

- We consider that this mischaracterises the initial Panel’s reasons, which refer to WAM’s application having identified acquisitions by reference to PMC’s substantial holder notices that, in WAM’s view, contravened s606. We consider that WAM’s misunderstanding as to which entity made the relevant acquisitions did not limit the initial Panel’s jurisdiction to consider whether those acquisitions contravened s606. In other words, the acquisitions were sufficiently identified, and whether those acquisitions by the Moore Group contravened s606 was clearly logically connected to WAM’s application.8

Association

Introduction

- PGF submitted that its “primary concern now is with the Original Panel’s gratuitous and unfounded criticisms of the steps taken by the PGF directors to address perceptions of conflicts of interest. The Original Panel had no basis for any such criticism”.

- We do not consider that the initial Panel made any gratuitous criticisms. It recognised that Governance Protocols had been put in place and that “such decisions can properly be made quickly where parties know each other well”.9 The initial Panel made its finding on association based on a detailed consideration of the facts of this case including the decision to enter the SID, adopt the Governance Protocols and make the Direction. In short, we agree with the initial Panel’s analysis.

Association through understandings pre-empting any Governance Protocols

- The PGF Governance Protocols detailed the common directors and officers of PGF, PAF and PMC (see paragraphs 8 to 13). The initial Panel made the following inferences from the material before it (at [64] and [65]):

- We infer that, by 6 September 2021:

- there was an agreement, arrangement or understanding between PGF, PAF and PMC to progress one or more of:

- the adoption and implementation of the Governance Protocols by PAF and PGF, and PMC permitting Ben Skilbeck and Richard Matthews to act as the Governance Protocols required

- separation of the substantial holding of the Moore Group and PMC in PAF from that of PGF by means of the Direction

- the Proposed Transaction, or

- PGF, PAF and PMC were acting in concert with the common purpose of advancing one or more of paragraphs 64(a)(i), 64(a)(ii) or 64(a)(iii).

- there was an agreement, arrangement or understanding between PGF, PAF and PMC to progress one or more of:

- We infer a consensus and common purpose or relevant agreement to advance one or more of paragraphs 64(a)(i), 64(a)(ii) or 64(a)(iii) based on the matters discussed in paragraphs 53 to 63 above and:

- PMC having been manager of each of PGF and PAF for more than seven years

- the links and common knowledge resulting from the same four individuals comprising the boards and company secretary of each of PGF and PAF and including both the CEO and COO of PMC for some time

- the roles contemplated by the Governance Protocols for the CEO and COO of PMC, and especially the very significant role for PMC’s CEO

- the confirmation by PMC’s CEO on 26 August 2021 to the PGF Board, in the presence of PMC’s COO, that no one else at PMC was “over the wall” (from which we infer that PGF was entitled to assume Mr Skilbeck had authority to bind PMC in relation to matters involving PGF and PAF)

- the speed with which PAF decided, after receiving PGF’s proposal:

- that it should enter into discussions with PGF and

- adopt the PAF Governance Protocol (subject to counsel confirming its appropriateness).

- We infer that, by 6 September 2021:

- The initial Panel considered that, given the purposes of Chapters 6 and 6C and the circumstances discussed in its reasons, the state of mind of Mr Skilbeck in relation to PAF should be attributed to PMC, for the purposes of sections 12, 606 and 671B, in determining whether circumstances were unacceptable.10

- The initial Panel also considered that the actions of PMC, Mr Skilbeck and Mr Matthews “were not merely because of one or more of the matters in s16, and s16 does not prevent PMC being an associate of PGF or PAF”.11

- PMC submitted that the initial Panel’s “inference of a common purpose on the part of PMC, to progress or advance one or more of the matters identified in paragraph 64 of the Reasons, was incorrect and made in error. It was entirely unsupported by and contradicts the clear and unchallenged evidence before the initial Panel”. It also submitted that the “direct evidence of PMC (which was not challenged) was that it was not in any way involved in the Proposed Transaction, and was disinterested in the outcome. There was no evidence to the contrary (or any evidence of any conduct of PMC in relation to the Proposed Transaction), nor was there any evidence of any common purpose of PMC, PGF and PAF”12.

- We do not agree. The general involvement of PMC as investment manager of PAF and PGF and the role of Mr Skilbeck and Mr Matthews, were outlined by the initial Panel in paragraphs 64 and 65 of its reasons (reproduced above).

- This is supported by the initial Panel’s conclusion that the state of mind of Mr Skilbeck in relation to PAF should be attributed to PMC.13 PMC did not agree with this conclusion, and submitted that it was not supported by Meridian Global Funds Management Asia Ltd v Securities Commission14, one of the authorities cited by the initial Panel, as:

In Meridian, for the special rule of attribution to apply, it was key that the conduct attributed had been done with the company’s authority. Here, there was no interest of PMC which Mr Skilbeck was authorised to pursue … - We find that submission difficult to reconcile with Meridian15 but regardless, we consider the material before us supports a finding that Mr Skilbeck’s role at PAF indirectly benefitted PMC and was sufficiently authorised by PMC. Accordingly, we agree with the initial Panel that the state of mind of Mr Skilbeck in relation to PAF should be attributed to PMC to the extent required by the initial Panel’s decision.

- The initial Panel acknowledged the efforts PGF had taken in paragraph 61 of its reasons:

-

We acknowledge PGF’s recognition of the need to implement governance protocols and its efforts to do so appropriately. It is unusual for the boards of both acquirer and target to consist only of the same individuals. This, together with the fact that both LICs shared the same manager, made the task unusually difficult, although not impossible in our view. We accept that events may not have occurred as initially intended, and the problems we discuss below may have been inadvertent and unintended.

-

- PGF submitted that:

At [61] the Original Panel suggests that it was “not impossible” for PMC, PGF and PAF to have implemented the board changes before the decision to engage on the scheme proposal. But obviously, the board changes would have been prompted by a potential proposal, which is the very thing that the Original Panel says made PMC’s involvement improper and gave rise to conflicts between the PAF and PGF boards. It would also have required an ASX announcement which would have to have explained why the changes were made, potentially creating a false market if the Scheme proposal was not ultimately agreed.

- WAM submitted in response that:

Respectfully, it is an unusual governance position to suggest that any independent director appointment for PAF, or any unwinding of the PGF / PAF board overlap, would trigger a false market.

- The initial Panel recognised that there may be difficulties in undertaking a merger transaction between listed investment companies that share the same manager and have boards consisting of the same individuals. These difficulties derive from the basic principle that fiduciaries such as company directors may not place themselves in a position where their duties may conflict with duties owed to another beneficiary. A breach will occur as soon as there is a real and sensible possibility of conflict.

- We agree with the initial Panel’s observations and its conclusion regarding association.

Effect of Direction

- The initial Panel considered the terms of the IMA and the Direction in detail16 and concluded that it did not agree that “the Direction was effective to remove the relevant interest of PMC and/or the Moore Group, and reduce their voting power, in PGF’s shares in PAF”. 17 Their reasons included the “contractual interpretation of the IMA and the relationships between PGF, PAF and PMC over several years (which involve structural links, collaborative conduct, common management and directors and a shared goal) indicate that any association between them must be ongoing”.18

- PGF submitted that:

But with all due respect, the Original Panel’s reasoning reduces to farce with its tortuous reconstruction of the PGF IMA against the Direction to find that potentially, technically speaking on one view (i.e. the supposedly lay Panel members), it did not divest PMC of a relevant interest in PGF’s shares in PAF as a matter of law…

… a Panel comprised of a majority non-lawyers should not be basing its decisions on pure legal analysis (which the writers of these submissions, each with over 25 years of experience in commercial law and public company M&A, cannot follow).

- This submission suggests a lack of attention to the reasons of the initial Panel. Those reasons carefully laid out the competing submissions and addressed them in a reasoned and principled fashion. We agree with the Panel’s reasons and its conclusion. Nor were the reasons based on a “pure legal analysis”. That was made quite explicit (eg at [85], [90]).

- The submission also suggests a lack of understanding of the workings of the Panel. Sitting Panels are typically comprised of professionals and market participants from different backgrounds, but virtually always including an experienced lawyer. That was the case here. The initial Panel comprised a leading M&A lawyer, a leading investment banker and a highly experienced director of top 50 ASX entities. All of them contribute to the ultimate decision. The Panel’s executive are also, typically, lawyers.

- Finally, arguments and bare assertions of error are no substitute for reasoned engagement with the facts and law.

Contraventions of s671B and s606

- We agree with the initial Panel’s findings that notices given by PMC and the Moore Group to PAF of change of interests of substantial holder between 15 September 2021 and 15 October 2021 contravene s671B(1) as stated in paragraphs 91 and 92 of its reasons. We also agree with its finding in the alternative that “it was inconsistent with s602(a) and (b) for PGF, PMC, Mr Skilbeck, Mr Matthews and the Moore Group to treat the Direction as effective to divide the voting power PGF, PMC and the Moore Group had previously disclosed in their substantial holder notices” for the reasons given in paragraph 93 of the initial Panel’s reasons.

- The initial Panel stated (at paragraph 95 of its reasons) that:

The voting power of PGF, PMC and the Moore Group in PAF was approximately 26.8582% on 28 March 2021 and increased above 29.8582% (the level permitted by item 9 of s611) six months later on 28 September 2021. Accordingly, the shares acquired by members of the Moore Group between 28 September 2021 and 12 October 2021, amounting to approximately 3.1891%, were acquired in contravention of s606(1).

- PGF submitted, among other things, that:

It is not clear whether “the associations described above” include any association between Moore Group and PGF – the Original Panel has always been vague about who it thinks is associated with whom – but it would include an association between PMC and PGF.

- The submissions of the Moore Group and PMC to the initial Panel all assumed, consistently with all their substantial holding notices, that they shared the same voting power in PAF (albeit on their submission only until 14 September 2021).

- Regardless of the exact relevant interests and/or associate relationships of each of them (which the orders require to be clarified), the acquisition of the Excess Shares by the Moore Group entities contravened s606(1). That follows from the initial Panel’s finding, with which we agree, of association between PMC and PGF resulting in PMC having voting power in all PAF shares in which PMC, PGF and the Moore Group had a relevant interest. Even if Moore Group entities were not themselves associates of PGF, their acquisitions of PAF shares increased the voting power of ‘someone else’s voting power’ (namely PMC) in PAF above 20% beyond the increase permitted by item 9 of s611 and in contravention of s606(1).

Break fee

- The initial Panel considered that (in effect), while the process by which the Break Fee was negotiated and agreed gave rise to serious concerns, “given that the Break Fee is less than 1% of the equity value of the target, and was reduced by PAF after discussion with its legal advisers, we are not satisfied that the Break Fee, of itself, gave rise to unacceptable circumstances”.19

- WAM submitted that:

- “The purpose of a break fee is to compensate a party for costs to be expended and risk taken in the control transaction proposed” (citing paragraph 6 of Guidance Note 7: Lock-up devices).

- “Neither PGF’s proposal nor PAF’s suggestion as to Break Fee quantum related to reimbursing costs that might be incurred in proposing the Scheme. The contemporary documents available instead indicate that the purpose of the Break Fee was, instead, to protect the Scheme from competitive offers”.

- “In these circumstances, the initial Panel’s reasons for decision suggest removal of the additional considerations set out in Guidance Note 7 paragraph 10, or adjustment to the commentary as to their relevance to the Panel’s deliberations, would be helpful to the market in understanding the Panel’s position”.

- We consider that the initial Panel appropriately balanced the Panel’s 1% break fee guidance with other factors in Guidance Note 7 to determine that the break fee, of itself, did not give rise to unacceptable circumstances and that its conclusions are not inconsistent with paragraph 10 of Guidance Note 7.

The initial Panel’s declaration

- PGF submitted that the initial Panel “failed to articulate how its findings constituted unacceptable circumstances. All we get is a repetition of the words of [s657A] (at [102]). A Panel should articulate how it is that circumstances offend the s602 principles in the circumstances of the particular case. Since the Original Panel could not do that, it is reasonable to infer that it has not in fact found the circumstances to be unacceptable, and so has not properly exercised its discretion in accordance with s657A”.

- The initial Panel referred to the principles in s602 in paragraphs 56 and 93 of its reasons. In addition, it has been recognised by the High Court that:

In every case it remains for the Panel to conclude whether or not the circumstances are "unacceptable". For that conclusion to be reached, more is required than proof of a contravention of the Act, although in particular cases such proof may, in practice, be sufficient to result, without much more, in a conclusion of unacceptability.20

- PGF submitted that unacceptable circumstances could have been found on policy grounds rather than on contraventions of s606 and s671B:

The Original Panel could have found that, where PMC (accepting arguendo that Ben Skilbeck was PMC) had participated in the formulation of a scheme proposal by PGF to acquire PAF, Moore Group would indirectly benefit through its majority owned manager PMC successfully executing a transaction beneficial to PAF shareholders, so enhancing PMC’s reputation. Further, the closeness of the relationship of Moore Group with PMC, and the closeness in turn of the relationship of PMC with PGF (whilst not being an association as defined), was such that Moore Group when would obviously support the PGF Scheme against the WAM bid. (See by analogy Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9). Accordingly, PMC should be considered to be unacceptably close to PGF (despite there being no agreement as such between Moore Group and PGF) and so should not be buying more shares when PAF is subject to a competing takeover bid by WAM, because of the potential impact on control: it could be said that from the point the WAM competing bid was announced, the decision of PAF shareholders independent of the parties whether to vote for the PGF scheme or accept the competing WAM bid, or to sell on market or to do nothing, should be left to them in a market which is not effectively skewed towards PGF by Moore Group buying up more shares. That would not require a finding that anyone has broken the law, or needs to be criticised for lack of proper attention to governance issues or subservience. It would be an exercise of administrative discretion which is demonstrably permitted by s657A and would be unassailable on administrative law grounds.

PGF does not consider this to be a fair or accurate characterisation in the circumstances of this case. Simply though, we accept that the Review Panel will not overturn the Original Panel’s decision, not now anyway when the damage to PAF shareholders has been done. Our point is that the Original Panel (and the Review Panel) would have a basis to find unacceptable circumstances without criticising the PGF directors (or PMC or Moore Group).

- As noted above, we do not consider that the initial Panel unfairly criticised the PGF directors (or PMC or Moore Group) and we agree with the initial Panel’s findings in relation to contraventions of s606 and s671B. However, we consider that PGF’s attempt at describing the unacceptable circumstances above (noting that it is not its view) is helpful and supports the initial Panel’s declaration.

Orders

- The initial Panel made orders that (among other things):

- required PGF, PMC and the Moore Group to give a corrected substantial holder notice, accompanied by a copy of the IMA (redacted to no greater extent than that provided to the Panel)

- prevented the Moore Group and their associates voting, acquiring or disposing of the Excess Shares and

- if the Proposed Transaction does not become effective (by 21 January or such later date as the Court or the Panel approves), vested the Excess Shares in ASIC for sale.

- As the resolution to approve the Scheme was not passed by the requisite majorities of PAF shareholders, the orders vesting the Excess Shares in ASIC for sale came into effect.

- The Moore Parties submitted to the initial Panel that they had no culpability in relation to the asserted contraventions of s606 and s671B and the initial Panel must take that into account in determining whether orders that adversely affect members of the Moore Group are reasonable and appropriate.

- The initial Panel stated (at paragraph 119, footnotes omitted) that:

- We accept that Orders 2 to 4 restricting voting, acquisition and disposal of the Excess Shares, and Orders 5 to 9 vesting the Excess Shares in ASIC for sale, may be prejudicial, especially to members of the Moore Group. However, we are not satisfied that those orders unfairly prejudice members of the Moore Group or any person. We agree that our decision does not establish that members of the Moore Group are necessarily “culpable” for the contraventions we have found of s671B and s606. We have not found it necessary, or desirable given the urgency of the matter, to reach a view on that. However, we find that they participated and were sufficiently involved in the circumstances. That is enough to satisfy us that the prejudice to them, when weighed against the objective of protecting rights and interests as described above, is not unfair. The Moore Group’s involvement in the circumstances included the fact that they were aware of the Direction, had previously given combined substantial holder notices with PGF for over 7 years, and should have been aware that any acquisitions would need to fall within an exception to s606(1) if the Direction was not effective to separate their voting power from that of PGF. We note that Mr Moore (as Chairman of PMC) responded on 4 October 2021 to a letter from WAM dated 30 September 2021 raising queries regarding the Direction and PMC’s Form 604 dated 15 September 2021. Mr Moore indicated in his submissions that it was “his decision as the ultimate controller of the [Moore Group] to acquire further shares in PAF following the termination of the discretionary mandate” by means of the Direction.

- The Moore Parties appeared to submit in effect that the orders would be unfairly prejudicial if it was not established that members of the Moore Group were necessarily ‘culpable’ for the contraventions of s671B and s606. We do not agree. While the culpability of parties who may be affected by orders is a relevant factor,21 it is not a necessary precondition for orders to be made. Depending on the circumstances even “where an “innocent person” is prejudiced by an order, such prejudice may not necessarily be unfair”.22 We are prepared to accept the Moore Parties’ submission that Mr Moore “was not aware of the essential fact, and it was not obvious to him, that the Direction was legally ineffective to divide the voting power of PMC and PGF in PAF at the time of the unacceptable circumstances as found by the Initial Panel”. Nevertheless, in our view, the Moore Parties were culpable to the extent that they acquired shares in contravention of s606 and that this supports the position that any prejudice the orders impose on the Moore Parties is not unfair.

- On 11 January 2022, WAM and PAF made a joint announcement stating, among other things, that (emphasis in original):

WAM is pleased to advise that it is increasing the Offer Consideration from 1 WAM Share for every 1.99 PAF Shares, to 1 WAM Share for every 1.95 PAF Shares (Increased Offer). All PAF shareholders that have already accepted the WAM Offer will receive the increased Offer Consideration and will be issued additional new WAM Shares as a result…

On the basis of the improved Offer Consideration, PAF’s largest shareholder PM Capital Global Opportunities Fund Limited (ASX: PGF) intends to accept the Offer, as do PM Capital Limited, Paul Moore and their associated entities.

- In response to a submission from the Moore Parties, we varied the initial Panel’s orders to allow them to accept into the WAM bid (Annexure B). We consider that this variation is appropriate given the change in the circumstances above, and limits the prejudice suffered by the Moore Parties.

- PGF submitted that in light of its decision, and the decision of PMC and the Moore Parties, to accept the WAM bid, the initial Panel’s order for corrective disclosure was redundant. We agree, noting also that PGF disclosed to the market a copy of the redacted IMA in the form provided to the initial Panel on 8 December 2021. We accordingly varied the initial Panel’s orders to remove the requirement for further substantial holder notice disclosure (Annexure C).

Alex Cartel

President of the sitting Panel

Decision dated 7 January 2022

Reasons given to parties 11 March 2022

Reasons published 25 March 2022

Advisers

| Party | Advisers |

|---|---|

| Moore Parties | MinterEllison |

| PM Capital Asian Opportunities Fund Ltd | Baker McKenzie |

| PM Capital Global Opportunities Fund Ltd | Johnson Winter & Slattery |

| PM Capital Ltd | DLA Piper Australia |

| WAM Capital Limited | Mills Oakley |

Annexure A

Corporations Act

Section 657E

Interim Orders

PM CAPITAL ASIAN OPPORTUNITIES FUND LIMITED 03R & 04R

On 3 December 2021, the Panel made a declaration of unacceptable circumstances (Declaration) and final orders (Orders) in relation to an application dated 15 October 2021 by WAM Capital Limited in relation to the affairs of PM Capital Asian Opportunities Fund Limited.

The Panel has been informed that each of Paul Moore and PM Capital Limited intends to file an application for a review of the Declaration and Orders under section 657EA of the Corporations Act 2001 (Cth) by no later than 11.59pm on 7 December 2021.

The President ORDERS:

- Order 1 be stayed.

- These interim orders have effect until the earliest of:

- further order of the President or the review Panel

- the determination of the review proceedings and

- 2 months from the date of these interim orders.

Tania Mattei

General Counsel

with authority of Alex Cartel

President

Dated 7 December 2021

Annexure B

Corporations Act

Section 657EA and 657D

Orders

PM CAPITAL ASIAN OPPORTUNITIES FUND LIMITED 03R & 04R

The Panel in PM Capital Asian Opportunities Fund Limited 01 made a declaration of unacceptable circumstances and final orders on 3 December 2021.

THE PANEL ORDERS

The final orders made on 3 December 2021 are varied by:

- Staying Orders 6, 7, 8 and 9 until 22 February 2022 and reversing any previous vesting of Excess Shares.

- Amending orders 3 and 12 so that the varied orders read as follows:

Substantial holding notices

- Within 2 business days after the date of these orders, the Associated Parties must disclose, in the form of a substantial holder notice accompanied by a copy of the IMA (redacted to no greater extent than that provided to the Panel) and all documents required by s671B(4)1, as approved by the Panel:

- that the Associated Parties have continued to be associates in relation to PAF since 14 September 2021

- the name of each associate who has a relevant interest in voting shares in PAF

- the nature of their association

- details of any relevant agreement through which they have a relevant interest in shares in PAF and

- all transactions undertaken during the period covered by the disclosure.

Restriction on voting, acquisition and disposal of Excess Shares

- None of the Vendors or their associates may, directly or indirectly, acquire any of the Excess Shares.

- The Vendors and their associates may accept the WAM bid on or before 18 February 2022 in respect of Excess Shares, but must not otherwise dispose of, transfer, charge or vote any Excess Shares.

- None of the Vendors or their associates may:

- take into account any relevant interest or voting power that any of them had, or have had, in the Excess Shares when calculating the voting power referred to in Item 9(b) of s611 of a person six months before an acquisition exempted under Item 9 of s611 or

- rely on Item 9 of s611 earlier than six months after these orders come into effect.

Vesting of shares for sale if Scheme does not become effective

- Orders 6, 7, 8 and 9 take effect three business days after the first to occur of:

- the close of the Scheme Meeting, if the resolution to be considered is not passed in accordance with s411(4)(a)(ii)(B)

- 21 January 2022, or such later date as the Court or the Panel approves

- PAF announcing that the Scheme will not proceed or

- the Court declining to approve the Scheme under s411(4)(b) and (6).

All other orders take effect immediately.

- The Excess Shares are vested in the Commonwealth on trust for the Vendors.

- ASIC must:

- sell the Excess Shares in accordance with these orders

- account to the Vendors for their respective portions of the proceeds of sale, net of the costs, fees and expenses of the sale and any costs, fees and expenses incurred by ASIC and the Commonwealth (if any).

- ASIC must:

- retain an Appointed Seller to conduct the sale and

- instruct the Appointed Seller:

- to use the most appropriate sale method to secure the best available sale price or consideration for the Excess Shares that is reasonably available at that time in the context of complying with these orders, including the stipulated timeframe for the sale and the requirement that none of the Vendors or their associates may acquire, directly or indirectly, any of the Excess Shares

- to provide to ASIC a statutory declaration that, having made proper inquiries, the Appointed Seller is not aware of any interest, past, present, or prospective which could conflict with the proper performance of the Appointed Seller’s functions in relation to the disposal of the Excess Shares

- to obtain from any prospective purchaser of Excess Shares, a statutory declaration that the prospective purchaser is not associated with any of the Vendors or their associates, unless:

- the Appointed Seller sells Excess Shares on market or

- the Appointed Seller accepts the Excess Shares into a takeover bid for PAF or

- the Excess Shares are transferred under a scheme of arrangement or court order,

- to dispose of all of the Excess Shares within 6 months from the date of its engagement, and

- if the Excess Shares are accepted into a takeover bid for PAF, to inform the Vendors in writing and

- if the Excess Shares are accepted into a takeover bid for PAF and a Vendor requests ASIC in writing to sell any of its Consideration Securities, instruct the Appointed Seller to use the most appropriate sale method to secure the best available sale price for that Vendor’s Consideration Securities that is reasonably available at that time in the context of complying with these orders, including any stipulated timeframe for the sale.

- PAF, PMC and the Vendors must do all things necessary to give effect to these orders, including:

- doing whatever is necessary to ensure that the Commonwealth is registered with title to the Excess Shares in the form approved by ASIC and

- until the Commonwealth is registered, complying with any request by ASIC in relation to the Excess Shares.

- Nothing in these orders obliges ASIC or the Commonwealth to invest, or ensure interest accrues on, any money held in trust under these orders or exercise any rights (including voting rights) attaching to, or arising as a result of holding, the Excess Shares.

- The parties to these proceedings and ASIC have the liberty to apply for further orders in relation to these orders.

Interpretation

- In these orders the following terms apply.

- Appointed Seller

- an investment bank or stock broker

- Associated Parties

- PGF, PMC, Mr Paul Moore, Roaring Lion, Hawkins, Horizon Investments Australia Pty Ltd and Horizon Investments Australia Pty Ltd <George Hawkins Pty Ltd>

- ASIC

- Australian Securities and Investments Commission, as agent of the Commonwealth

- Consideration Securities

- securities received as consideration for Excess Shares

- Court

- has the meaning given in the Explanatory Memorandum

- Excess Shares

- 207,800 PAF shares held by Roaring Lion and 1,617,358 PAF shares held by or for Hawkins, in each case, less the number of PAF shares disposed of in accordance with Order 3

- Explanatory Memorandum

- PAF’s explanatory memorandum dated 4 November 2021

- Hawkins

- Horizon Investments Australia Pty Ltd <Hawkins Trust>

- IMA

- the Management Agreement made in 2013 between PGF and PMC

- on market

- in the ordinary course of trading on Australian Securities Exchange and not by crossing or special crossing

- PAF

- PM Capital Asian Opportunities Fund Limited

- PAF shares

- ordinary shares in the issued capital of PAF

- PGF

- PM Capital Global Opportunities Fund Limited

- PMC

- PM Capital Limited

- respective portions

- the respective percentage of Excess Shares held by each of Roaring Lion and Hawkins immediately prior to 22 February 2022

- Roaring Lion

- Roaring Lion Pty Ltd as trustee for the Roaring Lion Super Fund

- Scheme and Scheme Meeting

- have the meanings given in the Explanatory Memorandum

- the Vendors

- Roaring Lion and Hawkins

- WAM bid

- WAM's takeover bid for PAF made under its bidder's statement dated 14 October 2021

Tania Mattei

General Counsel

with authority of Alex Cartel

President of the sitting Panel

Dated 12 January 2022

Annexure C

Corporations Act

Section 657EA and 657D

Variation of Orders

PM CAPITAL ASIAN OPPORTUNITIES FUND LIMITED 03R & 04R

Pursuant to sections 657D(3) and 657EA of the Corporations Act 2001 (Cth).

THE PANEL ORDERS

The final orders made on 3 December 2021 and varied on 12 January 2022 are further varied by deleting Order 1.

Tania Mattei

General Counsel

with authority of Alex Cartel

President of the sitting Panel

Dated 13 January 2022

1 PM Capital Asian Opportunities Fund Limited 01 [2021] ATP 17. All references to the initial Panel are to the Panel in PM Capital Asian Opportunities Fund Limited 01

2 Taken mostly from the uncontested facts in the initial Panel’s declaration of unacceptable circumstances

3 PGF’s Board Minutes again also contained an entry:

“1.3 Confirmation of Quorum

Members confirmed their personal disclosures as per the Agenda.”

The Board Minutes of the earlier meeting on 26 August 2021 contained entries in the same terms and also recorded no disclosures

4 PAF’s Board Minutes again also contained an entry:

“1.3 Confirmation of Quorum

Members confirmed their personal disclosures as per the Agenda.”

5 The Moore Parties and PMC had each informed the Panel that they intended to file a review application by 11.59pm (Melbourne time) on 7 December 2021, being the time by which a review application could be made)

6 Eastern Field Developments Limited v Takeovers Panel [2019] FCA 311 at [181]

7 Referring to the Court’s decision In the matter of PM Capital Asian Opportunities Fund Limited [2021] FCA 1380 at [39] to [43], [54], [76]-[80] and [93]

8 See Breakfree Limited 04(R) [2003] ATP 42 at [47]

9 [2021] ATP 17 at [59]

10 [2021] ATP 17 at [66] to [70]

11 [2021] ATP 17 at [72], see also [53] to [57]

12 PMC referred to its submissions to the initial Panel that (among other things) “PMC’s involvement at all times with PGF and PAF has only been in its capacity as a service provider pursuant to separate management agreements with PGF and PAF. The services PMC has provided to PGF and PAF have been in the form of general administrative, marketing and investment support services. In this regard, all PMC staff have been involved either directly or indirectly in the provision of services to PGF and PAF. PMC has not been involved whatsoever in determining or otherwise influencing the strategic direction or operational decisions of PGF or PAF” and “Further, Mr Skilbeck and Mr Matthews are the only employees of PMC (or MAPP) who remain involved with PGF and PAF in any capacity since the direction given by PGF on 14 September 2021”

13 See [2021] ATP 17 at [66] to [77]

14 [1995] 2 AC 500. The initial Panel also cited other cases in its reasons

15 In Meridian (at [22]), the Privy Council said that the fact that the employee whose state of mind was attributed to Meridian had acted “for a corrupt purpose and did not give [the required notice] because he did not want his employers [Meridian] to find out cannot in their Lordships’s view affect attribution of knowledge and the consequent duty to notify”.

16 See [2021] ATP 17 at [73] to [90]

17 [2021] ATP 17 at [74]

18 Ibid

19 [2021] ATP 17 at [97]

20 Attorney-General (Cth) v Alinta Limited [2008] HCA 2 at [43], per Gleeson CJ

21 Eastern Field Developments Limited v Takeovers Panel [2019] FCA 311 at [152]

22 ASIC v Terra Industries Inc [1999] FCA 525 at [97]

1 All statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant chapter (as modified by ASIC)