TP18/076

The review Panel has varied the initial Panel's orders in Tribune Resources Limited (see TP18/73). In that matter, the Panel made orders including the vesting of 12,025,519 Tribune shares held by Rand Mining Limited in ASIC to sell, further disclosure and voting restrictions.

On 31 October 2018, Rand sought a review of the initial Panel's decision to make orders (see TP18/74).

The review Panel varied the initial Panel's orders to remove a requirement for the Appointed Seller to notify ASIC in certain circumstances and clarify the operation of the orders for the avoidance of doubt (Annexure A). The review Panel otherwise agreed with the orders made by the initial Panel.

The sitting Panel was Karen Evans-Cullen, Ron Malek (sitting President) and Denise McComish.

The Panel will publish its reasons for the decision in due course on its website.

Allan Bulman

Director, Takeovers Panel

Level 10, 63 Exhibition Street

Melbourne VIC 3000

Ph: +61 3 9655 3500

takeovers@takeovers.gov.au

Annexure A

Corporations Act

Section 657EA and 657D

Orders

Tribune Resources Limited

The Panel in Tribune Resources Limited made a declaration of unacceptable circumstances on 14 September 2018 and final orders on 26 October 2018.

The final orders made on 26 October 2018 are varied to read as follows.

The Panel Orders

Divestment Orders

- The Sale Shares are vested in the Commonwealth on trust for Rand.

- ASIC must:

- sell the Sale Shares in accordance with these orders and

- account to Rand for the proceeds of sale, net of the costs, fees and expenses of the sale and any costs, fees and expenses incurred by ASIC and the Commonwealth (if any).

- ASIC must:

- retain an Appointed Seller to conduct the sale and

- instruct the Appointed Seller:

- to use the most appropriate sale method to secure the best available sale price for the Sale Shares that is reasonably available at that time in the context of complying with these orders, including the stipulated timeframe for the sale and the requirement that none of the Relevant Parties or their respective associates may acquire, directly or indirectly, any of the Sale Shares

- to provide to ASIC a statutory declaration that, having made proper inquiries, the Appointed Seller is not aware of any interest, past, present, or prospective which could conflict with the proper performance of the Appointed Seller's functions in relation to the disposal of the Sale Shares

- unless the Appointed Seller sells Sale Shares on market, that it obtain from any prospective purchaser of Sale Shares a statutory declaration including:

- a statement that the prospective purchaser is not associated with any of the Relevant Parties

- details of all historical relationships or connections (if any) between the prospective purchaser and any Relevant Party and

- details of all communications, agreements, arrangements or understandings (if any) between the prospective purchaser and any Relevant Party in the 12 months prior to the date of the statutory declaration

- to provide ASIC with a copy of each statutory declaration obtained under paragraph 3(b)(iii) within 2 business days of receipt and not sell any Sale Shares to a prospective purchaser until 2 business days after providing ASIC with a copy of the statutory declaration from the prospective purchaser

- unless the Appointed Seller sells Sale Shares on market, not to sell any Sale Shares to a prospective purchaser:

- who is a Relevant Party

- who does not provide a statutory declaration containing the statement and information required by paragraph 3(b)(iii) or

- in circumstances where ASIC has informed the Appointed Seller that it has reason to believe or suspect, drawing inferences where necessary, that the prospective purchaser may be an associate of a Relevant Party, unless ASIC has subsequently advised the Appointed Seller that it has formed the view that, on the basis of the information available, it is not likely that the prospective purchaser is an associate of a Relevant Party and

- to dispose of all of the Sale Shares within 6 months from the date of its engagement or a longer period approved by the Panel.

- The Company and the Relevant Parties must do all things necessary to give effect to these orders, including:

- doing whatever is necessary to ensure that the Commonwealth is registered with title to the Sale Shares in the form approved by ASIC and

- until the Commonwealth is registered, complying with any request by ASIC in relation to the Sale Shares.

- None of the Relevant Parties or their respective associates may, directly or indirectly, acquire any of the Sale Shares (including, in the case of the Company, under a buy-back).

- The Relevant Parties must not otherwise dispose of, transfer, charge or vote any Sale Shares.

- Nothing in these orders obliges ASIC or the Commonwealth to:

- invest, or ensure interest accrues on, any money held in trust under these orders or

- exercise any rights (including voting rights) attaching to, or arising as a result of holding, the Sale Shares.

Corrective Disclosure Orders

- Each Relevant Party must as soon as reasonably practicable and in any event within 2 months of the date of these orders:

- give the Company a substantial holder notice (Notice) detailing all acquisitions made, or disposals of, relevant interests in Company shares (to the extent known by the Relevant Party after making reasonable enquiries or to the extent that ASIC has otherwise indicated it is satisfied that disclosure will not be necessary having regard to the historical nature of the acquisitions and/or disposals) in a form acceptable to ASIC and containing any additional information reasonably required by ASIC within 14 days of receiving the draft required by Order 9 or

- satisfy ASIC that the market is adequately informed of the information that would otherwise be included in the Notice.

- Each Relevant Party must as soon as practicable, and in any event within 14 days of the date of these orders, provide ASIC with a draft Notice. One Notice may be provided for multiple Relevant Parties if acceptable to ASIC.

- The Company must publish a Notice on its ASX Announcements Platform within 2 business days of receiving the Notice.

- If a Relevant Party does not comply with Order 8 within 2 months of the date of these orders, the Company shares held by that Relevant Party are vested in the Commonwealth on trust for the Relevant Party. Orders 2 to 7 and 14 will then apply to those shares as if they are 'Sale Shares' and Order 2(b) will then apply as if the reference to 'Rand' is replaced with the name of the Relevant Party.

Voting Restrictions

- A Relevant Party must not exercise, and the Company must disregard, any voting rights in respect of the Company shares held by that Relevant Party and must not dispose of, transfer, charge or otherwise deal with any Company shares held by that Relevant Party until the date that is 1 month after the Relevant Party has complied with Order 8 (Initial Restriction Period).

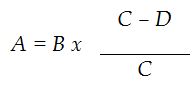

- After the Initial Restriction Period, a Relevant Party (not including Rand) may only exercise, and the Company may only take into account, voting rights in respect of such number of Company shares calculated in accordance with the following formula:

Where:

- is the number of Company shares in respect of which voting rights may be exercised and taken into account under this Order 13 by the Relevant Party

- is the number of Company shares held by the Relevant Party

- is the total number of Company shares on issue

- is the total number of Company shares that are vested in ASIC under Orders 1 and 11 and have not been sold by the Appointed Seller

Creep

- No Relevant Party may take into account any relevant interest or voting power that they or their associates had, or have had, in:

- the Sale Shares and

- until six months after the Relevant Party has complied with Order 8, any other Company shares,

Timing

- Orders 1 to 4 come into effect three business days after the date of these orders.

- All other orders took effect on 26 October 2018.

- For the avoidance of doubt, Orders 5, 6 and 13 have no application to Relevant Parties once all Relevant Parties have complied with Order 8 and the Appointed Seller has sold all of the Sale Shares.

Interpretation

- In these orders the following terms apply.

- Appointed Seller

- an investment bank or stock broker

- ASIC

- Australian Securities and Investments Commission, as agent of the Commonwealth

- Company or Tribune

- Tribune Resources Limited

- Company shares

- Ordinary shares in the issued capital of the Company

- date of the orders

- 26 October 2018 or in relation to a specific order, the business day after any stay of that order is lifted

- Notice

- the notice described in Order 8(a)

- on market

- in the ordinary course of trading on Australian Securities Exchange and not by crossing or special crossing

- Rand

- Rand Mining Limited

- Relevant Parties

- Company, Mr Anthony Billis, Ms Phanatchakorn Wichaikul, Ms Buasong Wichaikul, Sierra Gold Ltd, Sierra Gold Pty Ltd, Trans Global Capital Ltd, Rand, Nimby WA Pty Ltd, Lake Grace Exploration Pty Ltd and Northwest Capital Pty Ltd

- Sale Shares

- 12,025,519 Company shares held by Rand (comprising Rand's holding in Tribune less 1,135,000 Tribune shares acquired by Rand on or about 2 and 10 January 2014) and any Company shares vested in accordance with Order 11 (for the avoidance of doubt, Sale Shares cease to be Sale Shares once sold in accordance with Orders 1 to 7)

Allan Bulman

Director

with authority of Ron Malek

President of the sitting Panel

Dated 21 November 2018