TP04/094

The Panel announces today that it has made a declaration of unacceptable circumstances in relation to the affairs of Emperor Mines Limited (Emperor). The Panel has also made orders to remedy those unacceptable circumstances.

Summary

The Panel has made a declaration of unacceptable circumstances and orders in relation to the affairs of Emperor. The declaration and orders relate to a four for ten, pro-rata, non-renounceable rights issue (Rights Issue) proposed by Emperor, and associated underwriting arrangements (Underwriting). The Rights Issue was effectively underwritten by Durban Roodeport Deep, Limited (DRD) through its wholly owned subsidiary, DRD (Isle of Man) Limited (DRD IoM). The Applicants alleged that the Rights Issue and Underwriting were structured in such a way that it was likely that DRD would increase its control over Emperor at a discount to market and without the other shareholders in Emperor having a reasonable and equal opportunity to benefit.

The Panel was concerned to address the unacceptable circumstances but it was also concerned not to adversely affect the financial position of Emperor. Therefore, it was necessary for the Panel to make a number of orders.

The Panel considers that its orders strike an appropriate balance between a number of competing considerations:

- not causing undue prejudice to Emperor and its shareholders, in light of Emperor’s financial position and stated need to complete the Rights Issue in a timely fashion; and

- reducing, in a non-punitive manner, the increase in DRD's voting power in Emperor which the Rights Issue and the Underwriting were likely to cause, in circumstances where the Panel considered that the other Emperor shareholders did not have a reasonable and equal opportunity to participate in the benefits accruing through the Rights Issue and the Underwriting.

The Panel has ordered:

- a modification to the Shortfall Facility so that DRD IoM will not participate in any shortfall until all other shareholders’ applications to do so are satisfied in full;

- an extension in the Rights Issue timetable to allow information to be sent to Emperor shareholders and to allow Emperor shareholders to consider that information. The Rights Issue will now close no earlier than 5.00pm (Sydney time) on 26 October 2004;

- a 2-year freeze until 31 October 2006 on any increased voting power arising from the Rights Issue which DRD IoM would otherwise be able to exercise at a shareholders’ meeting of Emperor (subject to increases in voting power arising under future acquisitions of Emperor shares permitted by the Corporations Act);

- a 1 month period for DRD to dispose of any 'Unacceptable Shares'1, at any price which DRD is able to achieve, with half of any profits going to Emperor;

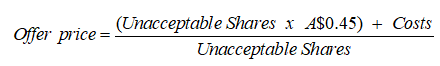

- a requirement that from 1 month after completion of the Rights Issue until 1month after the release of Emperor’s half-yearly report for the six months ending 31 December 2004, DRD IoM must instruct its broker to accept any order to purchase any remaining ‘Unacceptable Shares’ which is priced at $0.45 (plus an allowance for costs approved by the Panel) or above; and

- a requirement that DRD IoM not terminate the Participation Deed as a result of the effect of these orders.

Background

The Application

The proceedings arose from the application made by Power Treasure Limited, Phoenix Gold Fund Limited and Floreat Fund Limited (collectively, the Applicants) on 29September 2004 in relation to the affairs of Emperor.

The application related to the Rights Issue and DRD's underwriting of the Rights Issue.

Takeover bid by DRD

On 8 March 2004, DRD announced an off market takeover bid for all of the ordinary shares in Emperor.

DRD's bid closed on 30 July 2004 with DRD being the largest shareholder in Emperor, having relevant interests in 45.33% of the shares in Emperor. DRD had commenced with a voting power of 19.78%. Following the bid, two directors were removed and one additional nominee of DRD was appointed to the board of Emperor and the chairman of DRD was appointed to be the managing director of Emperor.

Rights Issue and Shortfall Facility

During the takeover bid, Emperor disclosed that it was investigating a rights issue to raise $12.5 million. It was not disputed in the proceedings that Emperor needed some degree of funding, at some various points of time. However, the amount, timing and nature of raising those funds were at the centre of the proceedings.

On 13 September 2004, Emperor lodged a prospectus in relation to the Rights Issue to raise $20.4 million. Each Emperor shareholder (other than certain excluded foreign shareholders) would have an entitlement (an Entitlement) to subscribe for 4 new shares for every 10 existing shares held, at a price of $0.45 per new Emperor share. On the day prior to the announcement of the Rights Issue, the Emperor share price closed at $0.67.

The Rights Issue would also involve a shortfall facility (the Shortfall Facility) under which Emperor shareholders could subscribe for any new Emperor shares not applied for by way of Emperor shareholders taking up their Entitlements. Emperor shareholders would be able to apply to participate in the Shortfall Facility to the full extent possible or up to a maximum limit specified by them. Shares would be allocated to Emperor shareholders who applied for shares under the Shortfall Facility in proportion to their Entitlements under the Rights Issue.

With some exceptions, shareholders with registered addresses outside Australia were not entitled to take up Entitlements or participate in the Shortfall Facility. This, however, affected shareholders holding less than 2% of Emperor's shares. Emperor did not appoint a nominee to participate in the Rights Issue on behalf of those shareholders (and to remit any cash benefits accruing from such participation to the underlying foreign shareholders).

Underwriting

DRD IoM entered into a Participation Deed with Emperor under which DRD IoM undertook to take up its Entitlement and to apply to participate in the Shortfall Facility. DRD IoM agreed to apply for as many shares as it could be issued under the Shortfall Facility without its voting power in Emperor increasing beyond 60% (to comply with Foreign Acquisitions and Takeovers Act requirements).

Therefore, as set out in the prospectus for the Rights Issue (the Prospectus), if DRD IoM were to be the only Emperor shareholder to take up its Entitlements and/or participate in the Shortfall Facility, DRD IoM would hold 60% of the issued capital in Emperor after the completion of the Rights Issue. The maximum percentage voting power in Emperor which DRD might have attained, if no other shareholders had taken up their rights under the Rights Issue, was 60.9%.

Purpose of the Rights Issue

The prospectus disclosed that the purpose of the Rights Issue was to raise $20.4million in order to fund:

- the completion of a previously announced expansion of Emperor’s gold mine at Vatukoula in Fiji;

- the repayment of money drawn for working capital requirements under an overdraft facility (due on the earlier of the completion of the Rights Issue and 15November 2004);

- the acquisition of heavy vehicles; and

- the costs of the Rights Issue.

The prospectus disclosed that Emperor had previously intended to fund the first three matters outlined above out of cash flow generated by operations, but that adverse developments meant that this would no longer be possible.

Financial position of Emperor

In Emperor’s financial report for the year ended 30 June 2004, its auditors stated that ‘there is significant uncertainty whether the Group will be able to continue as a going concern and therefore whether it will realise its assets and extinguish its liabilities in the normal course of business and at the amount stated in the financial report’.

Emperor has publicly indicated that the timely completion of the Rights Issue was critical for it to be in a position to meet its obligations.

Emperor strongly indicated to the Panel that if the Rights Issue should not proceed for any reason (or if the Participation Deed does not proceed and there is a substantial shortfall under the Rights Issue) Emperor would not have sufficient funds to meet its ongoing cash requirements and complete the expansion of Emperor’s gold mine referred to above. The Panel accepted Emperor's submissions (which were also made by DRD) as to its financial status and the effect on Emperor's solvency of the Rights Issue not proceeding very close to the original timetable. In accepting Emperor's submissions as to its financial status, the Panel did not investigate Emperor's financial circumstances, and in particular, did not seek evidence from Emperor's bankers or financial advisers.

The Panel's decision

Interim orders

The Panel issued a brief to parties on 1 October 2004 seeking further details regarding the Rights Issue, the Underwriting and other relevant matters (including the matters outlined in this section). The parties provided submissions in response to the brief on 5 October 2004.

On 6 October 2004, following receipt of parties’ submissions, the Panel made interim orders delaying the acceptance date under the Rights Issue from 8 October 2004 until 22October 2004. The Panel made this order to ensure that Emperor shareholders were not required to make a decision in relation to whether or not to participate in the Rights Issue in circumstances where there was uncertainty as to whether the Rights Issue would proceed or the circumstances in which it would proceed.

The exceptions to section 606

The Panel noted that, because certain foreign shareholders were not able to participate in the Rights Issue and because a nominee facility had not been established in respect of those shareholders, the exception in item 10 of section 611 (the ‘rights issue exception’) did not apply to the Rights Issue. Therefore, any acquisitions of shares under the Rights Issue which would cause an increase in any Emperor shareholder's percentage voting power over 20%, could be in breach of the 20% threshold in section 606.

The exclusion of foreign shareholders meant that there would be a small increase in DRD and DRD IoM’s voting power as a result of DRD IoM taking up its Entitlement. This would not be exempt from section 606.

The Panel considered, however, that the technical requirements of the exception in item 13 of section 611 (the ‘underwriting exception’) were satisfied such that any increase in DRD or DRD IoM’s voting power as a result of the acquisition of shares under the Shortfall Facility would be exempt from the prohibition in section 606.

Panel considered that any such increase would not in itself justify a declaration of unacceptable circumstances, although it considered that such non-compliance in relation to a rights issue of a listed company is worrying.

Unacceptable circumstances

Although the technical requirements of item 13 of section 611 were satisfied, the Panel was concerned that application of the exception must meet the policy requirements of the takeovers chapters, as set out in section 602. Item 13 is an exception that the legislature has put into the takeovers chapter as a means to ensure that a company’s legitimate fundraising needs are not unnecessarily restricted by the policy objectives of the takeovers provisions. However, where such fundraisings may increase a major shareholder’s control, without other shareholders having a reasonable and equal opportunity to benefit from the increase in that shareholder’s control, or in the absence of being able to benefit, consenting to the increase, they may constitute unacceptable circumstances, even if the technical requirements of the exception appear to have been met.

The Panel concluded that the combination of the following circumstances in the Emperor Rights Issue meant that unacceptable circumstances existed in relation to the Rights Issue and Shortfall Facility.

- The Rights Issue is non-renounceable.

This increased materially the likelihood that rights would not be exercised (since there was no prospect of those rights being traded to a third party), thus increasing the likely size of the shortfall. It also prevented shareholders from renouncing their rights to mitigate the reduction in value of their ordinary shares caused by the issue of shares under the Rights Issue at a significant discount.

- The rights issue is priced at a deep discount meaning that, to raise the amount of money in question, the issue ratio was 4-for-10.

This meant that the Rights Issue would have a significant dilutionary impact on any shareholder which did not exercise their rights.

- Emperor’s underwriting arrangements in relation to the Rights Issue do not comprise normal commercial underwriting arrangements with an unrelated third party, but rather an arrangement with Emperor’s major shareholder.

This means that the Rights Issue could have (and in the Panel’s view is likely to have) a significant effect on the degree to which DRD IoM controlled Emperor, with any increase in that degree taking place at a significant discount to the market price of Emperor shares.

- That DRD IoM currently (before completion of the Rights Issue) has voting power of approximately 45.33% in Emperor.

This means that the Rights Issue had the potential to significantly increase DRD's control of Emperor (in that DRD IoM’s voting power could potentially move from 45.33% to slightly over 60%, although it is subject to a 60% limit without consent from the Foreign Investment Review Board).

In the Panel’s view, the combination of the above circumstances had the potential to affect the degree to which DRD has control over Emperor in a manner which was inconsistent with the policy of Chapter 6 of the Corporations Act. Accordingly, the Panel made the declaration of unacceptable circumstances set out in Annexure A.

Final Orders

Having decided that unacceptable circumstances existed in relation to the Rights Issue, the Panel considered what was required to remedy them. The Panel proposed a number of orders which it considered would remedy the unacceptable circumstances and invited parties to make submissions on the practicalities and commercial issues of the Panel's proposed orders. The Panel also asked parties to make alternative suggestions for possible orders or undertakings to remedy the Panel's concerns. The Panel received submissions from all of the parties in relation to its proposed orders.

Emperor's Financial Position

In making final orders, the Panel was particularly mindful of the submissions made to it concerning Emperor’s financial position and Emperor’s stated need to complete the Rights Issue in a timely manner. As stated above, the Panel accepted Emperor's submissions on its funding requirements and solvency at face value without making enquiries of Emperor's bankers or financial advisers.

The Panel considered making, and in other circumstances it may have made, final orders requiring that the parties not proceed with the Rights Issue. It would then have been open to the parties to pursue a rights issue with a different structure or different underwriting arrangements. However, the Panel received submissions (and, after making independent inquiries and on the basis of its own experience, accepted) that it would not have been possible to complete such a restructured rights issue within the timeframe which Emperor indicated was necessary to meet its financial needs.

Renounceability

For instance, the Panel’s preference would have been for the Rights Issue to have been pursued on a renounceable basis. This would have increased the possibility of other investors taking up the new shares and reducing the concentrating effect of the Rights Issue on DRD's control of Emperor. In addition, the sale of renounceable rights may have compensated Emperor shareholders who did not take up their rights to some extent for the dilution of their interests. The Panel was not in any position to determine whether there would have been a ready market for Emperor rights if the Rights Issue had been made renounceable, but noted the discount to the market price at which the Rights Issue is being conducted.

In the circumstances of these proceedings, the Panel was satisfied that seeking to make the Rights Issue renounceable would have introduced delays which, in the circumstances, would have prejudiced Emperor’s ability to complete a rights issue within Emperor’s required timetable.

Underwriting Arrangements

The Panel was also satisfied that Emperor would not, at this late stage, be able to replace the Participation Deed with normal commercial underwriting arrangements with an unrelated third party without introducing a significant delay.

Sell Down Arrangements

The Panel considered making final orders requiring DRD IoM to sell-down, within a set timeframe, any shares obtained by it in connection with the Rights Issue which increased DRD’s voting power. The Panel considered the possible downward pressure on Emperor’s share price which such an order might cause, particularly given the potentially large shortfall to the Rights Issue and the historically thin trading in Emperor shares. The Panel was also conscious of the potential prejudice which such an order might cause DRD IoM in that DRD IoM might be required to sell shares acquired by it at a loss.

However, the Panel decided that simply allowing DRD to retain all shares it acquired under the Underwriting would not be acceptable. The Panel considers that the orders that it has made are a reasonable balance between the reasonable interests of DRD (especially acknowledging that DRD has agreed to provide needed finance for Emperor) and the interests of other Emperor shareholders.

In the circumstances, the Panel has made the orders set out in Annexure B.

Alternative Proposals

Although the Panel considered alternatives to the orders it has made, and it specifically asked the parties for alternative proposals, none of the parties raised alternatives which would have appropriately addressed the unacceptable circumstances (including, for example, an undertaking to pursue a renounceable rights issue or to pursue a sell down structured in a different way but which still met the Panel’s objectives). DRD proposed a modification to the Shortfall Facility which meant that other Emperor shareholders who applied under the shortfall facility would have their shortfall applications filled before any shares passed through to DRD. The Panel accepted this proposal and included it in the proposed orders. However, DRD did not propose any alternative resolutions or undertakings by which any increased percentage voting power it may have acquired under the Rights Issue and Underwriting would be reduced.

The Panel proposed its final orders to parties and invited DRD and Emperor to give undertakings to the same effect, as an alternative to the need for the Panel to make a declaration and orders. Emperor did provide an undertaking in the form invited, but DRD advised that it could not, in the interests of its shareholders give the undertaking. The Panel then offered Emperor the opportunity to continue with its undertaking, in which case the Panel would make orders relating only to DRD. Emperor declined.

The Panel considers that its orders strike an appropriate balance between a number of competing considerations:

- not causing undue prejudice to Emperor and its shareholders, in light of Emperor’s financial position and stated need to complete the Rights Issue in a timely fashion;

- ensuring that all Emperor shareholders have a reasonable and equal opportunity to participate in the benefits accruing through any proposal under which DRD IoM significantly increases its control in Emperor; and

- not punishing DRD IoM for its involvement in the proposed Rights Issue.

The key features of the orders are:

- a modification to the Shortfall Facility so that DRD IoM will not participate in any shortfall until all other shareholders’ applications to do so are satisfied in full;

- an extension in the Rights Issue timetable to allow information to be sent to Emperor shareholders and to allow Emperor shareholders to consider that information. The Rights Issue will now close no earlier than 5.00pm (Sydney time) on 26 October 2004;

- a 2-year freeze on any increased voting power arising from the Rights Issue which DRD IoM would otherwise be able to exercise at a shareholders’ meeting of Emperor (subject to increases in voting power arising under future acquisitions of Emperor shares permitted by the Corporations Act);

- a 1 month period for DRD to dispose of any 'Unacceptable Shares', at any price which DRD is able to achieve, with half of any profits going to Emperor;

- a requirement that from 1 month after completion of the Rights Issue until 1month after the release of Emperor’s half-yearly report for the six months ending 31 December 2004, DRD IoM instruct its broker to accept any order to purchase any remaining ‘Unacceptable Shares’ which is priced at $0.45 (plus an allowance for costs) or above; and

- a requirement that DRD IoM not terminate the Participation Deed as a result of the effect of these orders.

Takeover bid by DRD

The above orders will generally terminate in the event of a successful2 takeover bid by DRD, or one of its associates, for the outstanding shares in Emperor. In those circumstances, Emperor shareholders would have had a reasonable opportunity to benefit from an increase in DRD's control.

One month initial period to sell ‘Unacceptable Shares’

The Panel has allowed a 1 month period between completion of the Rights Issue and the commencement of the instruction to accept ‘buy’ orders. This will allow DRD IoM a chance to find an alternative means of disposing of the ‘Unacceptable Shares’ and, so far as practicable, reduce the prospect of downward pressure on Emperor’s share price. For instance, DRD IoM might conduct a bookbuild to dispose of the shares. DRD and its associates must not buy any of these shares.

The initial month sell down period will allow DRD to seek an orderly disposal of any Unacceptable Shares if it wishes, with some recompense to DRD for accepting the risk of underwriting the Rights Issue. This should reduce any impact on the market price for Emperor shares, while giving some recompense to Emperor shareholders whose percentage voting power and economic interest in Emperor may be diluted. The offering, on market, of any remaining Unacceptable Shares after the one month initial period will allow other investors to acquire shares in Emperor, which may reduce any concentrating effect on DRD's power that the Rights Issue and Underwriting may have had.

If, at the end of the initial one month period, and the on-market sell down period, buyers have not come forward for all of the Unacceptable Shares, DRD should be entitled to retain any remaining shares.

However, DRD is not required, under the Panel's orders, to sell any DRD shares at a loss.

Half profits to Emperor

The Panel was concerned, however, that if there was to be any profit from sale of the Unacceptable Shares it should go back to those Emperor shareholders who might have profited from sale of their rights in a renounceable rights issue. The Panel was also concerned that DRD should not gain all of any profit which arose from the Panel's resolution of unacceptable circumstances. In this regard, the Panel considered requiring DRD to remit all profits from the sale of Unacceptable Shares during the 1 month period to Emperor. However, the Panel was concerned that this would remove any incentive for DRD IoM to dispose of the Unacceptable Shares during the 1 month period. Accordingly, the Panel settled on a 50-50 split of the net proceeds from the sale of the Unacceptable Shares between DRD IoM and Emperor during this 1 month initial period.

DRD not to Exercise Withdrawal Rights from the Underwriting solely due to the Panel's Decision and Orders

The Panel has ordered DRD not to exercise the withdrawal rights which it has under the terms of the Participation Deed where those rights would be enlivened as a result of these proceedings, the Panel's declaration or the Panel's orders. DRD is free to exercise any withdrawal rights which arise independently, and not due to, the Panel's proceedings. The Panel wishes to interfere with DRD's commercial decision making to the least possible extent. However, it would not be acceptable for a Panel's decision, which was intended to remedy unacceptable circumstances (in these circumstances, to get the proposed Rights Issue "back on track" consistent with the policy principles of the takeovers chapters), to be negated by a person relying on the existence of that very remedy. The Panel has carefully considered the prejudice that the order might be considered to cause DRD, but it considers that the terms of the orders make that prejudice actually fairly small, and commercially not materially different from the risk which DRD accepted when it entered into the Participation Deed.

Sitting Panel

The sitting Panel originally comprised Alison Lansley (sitting President), Michael Ashforth and Louise McBride. Early in the Proceeding, Michael Ashforth ceased to be available and was replaced by Simon Withers.

The Panel will post its reasons for this decision on its website when they have been settled.

DRD has advised the Panel that it is considering seeking a review of the Panel's decision.

Nigel Morris

Director, Takeovers Panel

Level 47, 80 Collins Street

Melbourne, VIC 3000

Ph: +61 3 9655 3501

nigel.morris@takeovers.gov.au

Annexure A

Emperor Mines - Panel Declaration of Unacceptable Circumstances

In the matter of Emperor Mines Limited

WHEREAS

- Emperor Mines Limited (Emperor) has proposed a 4-for-10 rights issue (the Rights Issue) to be made pursuant to a prospectus dated 13 September 2004.

- Emperor has proposed that eligible shareholders will be able to take up their entitlements under the Rights Issue and also to apply to participate in any shortfall under the Rights Issue (in proportion to their respective entitlements under the Rights Issue).

- The Rights Issue is non-renounceable.

- The subscription price under the Rights Issue is at a deep discount to the market price of Emperor shares prior to the announcement of the Rights Issue, such that the Rights Issue will have a significant dilutionary impact on those existing shareholders of Emperor who do not participate in the Rights Issue.

- DRD (Isle of Man) Limited (DRD IoM) currently (before completion of the Rights Issue) has voting power of approximately 45.33% in Emperor.

- Emperor’s underwriting arrangements in relation to the Rights Issue do not comprise normal commercial underwriting arrangements with an unrelated third party, but rather an assurance from Emperor’s major shareholder that it will take up its rights under the Rights Issue and apply to participate in any shortfall under the Rights Issue (to the extent that such participation does not result in DRD IoM having voting power in Emperor of greater than 60%).

Under section 657A of the Corporations Act, the Takeovers Panel declares that the combination of the circumstances set out in recitals A to F constitute unacceptable circumstances in relation to the affairs of Emperor.

Alison Lansley

President of the Sitting Panel

Dated 17 October 2004

Annexure B

Emperor Mines – Panel Final Orders

In the matter of Emperor Mines Limited

Pursuant to:

- section 657D of the Corporations Act 2001 (Cth); and

- a declaration of unacceptable circumstances in relation to the affairs of Emperor Mines Limited (Emperor) made by the President of the Sitting Panel on 17 October 2004,

the Takeovers Panel HEREBY ORDERS:

Emperor

- That the shortfall facility (Shortfall Facility) described in section 1.4 of the prospectus dated 13 September 2004 issued by Emperor in relation to the 4-for-10 non-renounceable rights issue (the Rights Issue) to be made by Emperor is modified so that Durban Roodepoort Deep, Limited (DRD), DRD (Isle of Man) Limited (DRD IoM) and their associates do not participate in any stage of the shortfall allocation under the Shortfall Facility until all Emperor shareholders eligible to participate in the Rights Issue (other than DRD, DRD IoM and their associates) have had their applications to participate in any shortfall to the Rights Issue satisfied in full.

- That, by 5 pm (Sydney time) on 19 October 2004, Emperor must send by post (and, in the case of an Emperor shareholder with a registered address outside Australia, airmail and, to the extent Emperor is aware of a fax or email contact address for any such shareholder, by fax or email) a notice to:

- each Emperor shareholder who is entitled to participate in the Rights Issue notifying them of the arrangements contemplated by Orders (vi) and (ix), the change to the operation of the Shortfall Facility, the possible consequences to them of the change to the operation of the Shortfall Facility and inviting them to participate in the Rights Issue (as amended); and

- each Emperor shareholder who has accepted the Rights Issue and not specified a maximum limit for their participation in the Shortfall Facility notifying them of the arrangements contemplated by Orders (vi) and (ix), the change to the operation of the Shortfall Facility, the additional consequences of the change for them as such a shareholder and inviting them to specify a maximum limit for their participation in the Shortfall Facility.

- That Emperor must extend the closing date for acceptances under the Rights Issue to no earlier than 5pm (Sydney time) on 26 October 2004.

- That, until the earlier of:

- 11.59 pm (Sydney time) on 31 October 2006; and

- DRD, DRD IoM or any of their associates acquiring pursuant to a takeover bid 50% of the shares in Emperor in which DRD, DRD IoM or any of their associates did not have a relevant interest immediately prior to the bid,

Emperor must:

- in its announcement to the Australian Stock Exchange after the conclusion of each meeting of Emperor (other than a meeting of directors), specify the number of votes exercised by DRD, DRD IoM and (to the best of Emperor’s knowledge) their associates at that meeting;

- send a copy of the notice referred to in paragraph (C) above to the Panel Executive within 24 hours after the conclusion of each such meeting; and

- disregard any votes cast by DRD, DRD IoM and (to the best of Emperor’s knowledge) their associates in contravention of Order (v).

DRD IoM

- That, until the earlier of:

- 11.59 pm (Sydney time) on 31 October 2006; and

- DRD, DRD IoM or any of their associates acquiring pursuant to a takeover bid 50% of the shares in Emperor in which DRD, DRD IoM or any of their associates did not have a relevant interest immediately prior to the bid,

DRD, DRD IoM and their associates must not exercise in aggregate more than the following number of votes at a meeting of Emperor (other than a meeting of directors):

- the total votes attached to any shares in Emperor which DRD, DRD IoM or any of their associates acquires after the issue of the Unacceptable Shares, other than pursuant to item 9 of section 611 of the Corporations Act 2001 (Cth) (the Act),

plus

- the votes which constitute A% of the maximum number of votes which could be cast at the meeting (where votes which DRD, DRD IoM or any of their associates does not exercise pursuant to these Orders are counted as votes which could not be cast at the meeting),

provided that if Emperor’s share capital is proposed to be reconstructed, DRD IoM must seek a variation of these orders in order to determine the appropriate number of votes which DRD, DRD IoM and their associates might exercise.

The number of votes referred to in paragraph (D) will be calculated as follows:

A

x (Issued Votes – DRD Votes)

100 – A

For the purposes of these Orders:

A = (51,305,307/113,186,911) x 100 + (Creep Votes/Issued Votes) x 100

Creep Votes are the aggregate votes attaching to shares in Emperor acquired by DRD, DRD IoM or any of their associates after 31 July 2004 pursuant to the exception in item 9 of section 611 of the Act;

DRD Votes are the aggregate votes attaching to shares in Emperor held by DRD, DRD IoM and their associates at the date of the relevant meeting minus such of those votes as are attached to the shares in Emperor referred to in paragraph (C).

Issued Votes are the aggregate votes attaching to the shares in Emperor on issue at the date of the relevant meeting; and

Unacceptable Shares are any shares acquired by DRD IoM under the Rights Issue or Shortfall Facility which result in DRD IoM increasing its voting power above the voting power it had immediately prior to the Rights Issue.

- That, with effect from the date which is 1 month after the issue of the Unacceptable Shares and until the earliest of:

- 11.59 pm (Sydney time) on the date which is 1 month after the release of Emperor’s Half-Year Report for the six months ending 31 December 2004;

- the sale by DRD IoM of all of the Unacceptable Shares; and

- DRD, DRD IoM or any of their associates acquiring pursuant to a takeover bid 50% of the shares in Emperor in which DRD, DRD IoM or any of their associates did not have a relevant interest immediately prior to the bid;

(the time of such earliest occurrence being the Trigger Time), DRD IoM must:

- instruct its broker to accept any ‘buy’ orders on the Australian Stock Exchange for such of the Unacceptable Shares as it continues to hold from time to time by any person offering to buy such shares on the Australian Stock Exchange at a price of not less than the price determined by the following formula:

where Costs means:

- an amount approved by the Panel representing the direct transaction costs and funding costs incurred by DRD and DRD IoM in subscribing for Unacceptable Shares and underwriting the Rights Issue, and the expected brokerage costs in selling the Unacceptable Shares pursuant to this paragraph (D); or

- if the Panel does not receive within 3 weeks after the issue of the Unacceptable Shares a request to approve the amount referred to in paragraph (1) which itemises the relevant costs, an amount determined by the Panel by way of an estimate as to what would constitute reasonable costs in relation to the matters referred to in paragraph(1).

- DRD IoM must send a notice to the Australian Stock Exchange before 9.30 am on each trading day advising the market as to the number of Unacceptable Shares which it sold on the previous trading day and the total number of Unacceptable Shares which it has not yet sold,

except that if DRD, DRD IoM or any of their associates announces a takeover offer for Emperor shares, the operation of this Order (vi) will be suspended until the end of the offer period at which time (subject to paragraph (C) of this Order (vi)) this Order (vi) will recommence operation but on the basis that the date in paragraph (A) of this Order (vi) is 1month after the end of the offer period.

- That, until the Trigger Time, DRD and its associates must not buy any of the Unacceptable Shares.

- That, during the period ending 6 months and 1 week after the Trigger Time, DRD, DRD IoM and their associates must not acquire a relevant interest in any Emperor share which they would lawfully only be able to acquire because of item 9 of section611 of the Act unless, as a result of the relevant acquisition, none of them would have voting power in Emperor which is more than the higher of:

- 3 percentage points higher than such persons had immediately after the Trigger Time; and

- the percentage of Emperor shares that DRD, DRD IoM or any of their associates would lawfully have been able to acquire under item 9 of section 611 of the Act if the Rights Issue had not proceeded.

- That DRD IoM must remit to Emperor 50% of the Net Proceeds arising from the sale by DRD IoM or any of its associates of any Unacceptable Shares during the 1 month after the issue of the Unacceptable Shares (any shares sold during this period being Bookbuild Shares). For these purposes, Net Proceeds means:

(A) the gross amount received on the sale of the Bookbuild Shares,

less

(B) A$0.45 x Number of Bookbuild Shares,

less

(C)

Costs x Number of Bookbuild Shares

Number of Unacceptable Shares

- That DRD IoM must, between 1 month and 1 week after the issue of the Unacceptable Shares, notify the Panel Executive in writing of the identity of the purchaser of any Bookbuild Shares and (to the extent that DRD or DRD IoM is aware) of the identity of the beneficial owners of those shares immediately following their purchase from DRD IoM.

Participation Deed

- That the Participation Deed entered into by DRD IoM and Emperor on or about 10September 2004 be amended to the extent necessary to give effect to Order(i).

- That DRD IoM not terminate or seek to terminate the Participation Deed as a result of the effect of these Orders.

Alison Lansley

President of the Sitting Panel

Dated 17 October 2004

1 ‘Unacceptable Shares’: for these purposes, ‘Unacceptable Shares’ are shares issued to DRD IoM in connection with the Rights Issue which result in DRD IoM increasing its voting power in Emperor above the voting power it had immediately prior to the Rights Issue.

2 The Panel notes that the term "successful" in this context specifically means acquiring more than 50% of the shares bid for in any bid which DRD did make. The Panel also specifically notes it has not been notified of any intention of DRD to make any takeover.