[2019] ATP 12

Catchwords:

Decline to conduct proceedings – board spill – collective action – association – requisition notice – late application

Corporations Act 2001 (Cth), sections 249D, 602, 606, 671B

ASIC Regulatory Guide 128: Collective action by investors

Auris Minerals Limited [2018] ATP 7, Dragon Mining Limited [2014] ATP 5, Mount Gibson Iron Limited [2008] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Bill Koeck, Rory Moriarty and Karen Phin (sitting President), declined to conduct proceedings on an application by Australian Whisky Holdings Limited in relation to its affairs. The application concerned whether an association and voting agreement existed between certain shareholders of Australian Whisky Holdings in relation to a requisition under s249D1 to remove four directors and appoint two directors. The Panel considered that there was no reasonable prospect that it would declare the circumstances unacceptable based on the probative material provided and given the delay in making the application in the light of the timing of the requisition meeting.

- In these reasons, the following definitions apply.

- AWY

- Australian Whisky Holdings Limited

- Bainbridge Super

- GJ Bainbridge Super Pty Ltd, controlled by Mr Geoff Bainbridge

- Boman Asset

- Boman Asset Pty Ltd, controlled by Mr Rohan Boman, a director of AWY until 27 November 2018

- Buttonwood

- Buttonwood Nominees Pty Ltd, controlled by Mr Tim Hannon

- Lark Shareholders

- The persons referred to in paragraph 22

- Malcolm Property

- Malcolm Property Pty Ltd, controlled by Mr Christopher Malcolm, the CEO of AWY until 11 February

- Malcolm Super

- C H Malcolm Super Pty Ltd, controlled by Mr Christopher Malcolm

- Newgate

- Newgate Capital Partners Pty Ltd, controlled by Mr Tim Hannon

- Peppermint Bay

- Peppermint Bay Pty Ltd, controlled by Mr Bruce Neill

- Peppermint Bay Nominee

- Peppermint Bay Nominee Pty Ltd, controlled by Mr Bruce Neill

- Quality Life

- Quality Life Pty Ltd, controlled by Mr Bruce Neill

- ShadSuper

- ShadSuper Pty Ltd, controlled by Mr Anthony Shadforth

- Suetone

- Suetone Pty Ltd, controlled by Mr Anthony Shadforth

Facts

- AWY is an ASX listed company (ASX code: AWY).

- On 14 March 2019, the directors of AWY comprised Messrs Cuthbertson, Herd, Mares, Grant and Lark.

- On that day AWY received a s249D notice from Quality Life requesting that the directors call a general meeting to propose resolutions to remove the directors other than Mr Lark, and resolutions to appoint Messrs Bainbridge and David Dearie to the Board. By notices dated 12 March 2019, Quality Life nominated Mr Bainbridge for election to the board of AWY and Peppermint Bay nominated Mr Dearie for election to the board of AWY.

- Quality Life is a company controlled by Mr Neill, who indirectly held approximately 11.38% of AWY.

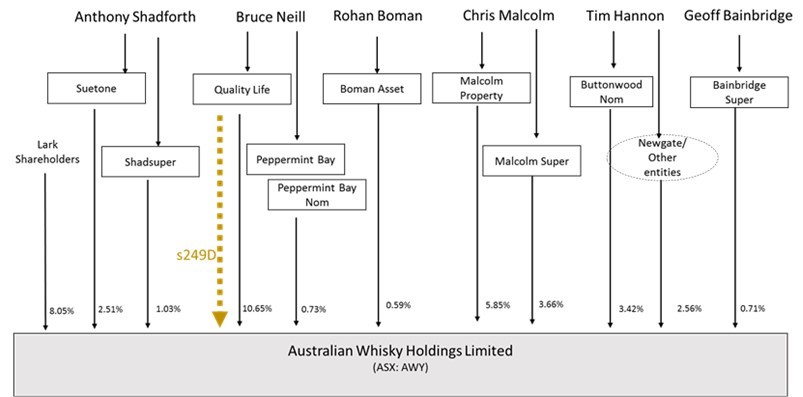

- Shareholdings in AWY and relevant relationships between the parties as disclosed in the application are set out in the diagram below.

Application

Declaration sought

- AWY submitted that all the persons in the diagram in paragraph 7, including the respective controllers, were associated (Alleged Associates).

- By application dated 14 May 2019, AWY sought a declaration of unacceptable circumstances in respect of three circumstances:

- There was an undisclosed association that was formed between some or all of the Alleged Associates in and around February to March 2019. AWY submitted that a relevant agreement was entered into to control the composition of AWY's board, which became a voting agreement on 14 March 2019, when Quality Life issued its requisition.

- The Alleged Associates acquired a relevant interest in the voting shares of each other, increasing each Alleged Associate's voting power in AWY to more than 20% in contravention of s606(1).

- On 3 March 2019, Mr Hannon stated in an email to the Chairman of AWY that Newgate represented approximately 6% of AWY, which holding was undisclosed.

- AWY submitted that the effect of the first two circumstances (paragraphs 9(a) and (b)) was that the Alleged Associates would acquire control of AWY (through board control) without paying any consideration, let alone a control premium, and the acquisitions had not:

- taken place in an efficient, competitive and informed market

- been adequately disclosed to other AWY members, such that prior to the interest being acquired AWY members knew the identity of, and the proposal to acquire, the controlling interest or

- afforded AWY members, as far as practicable, an equal opportunity to participate in the benefits accruing through the proposal.

- AWY submitted that the effect of the third circumstance (paragraph 9(c)) was that the failure to disclose a substantial holding in AWY has meant that either the acquisition of control over voting shares in AWY has not taken place in an efficient, competitive and informed market or there was "an intentionally misleading and deceptive statement by Hannon in relation to a financial product for the purpose of exercising illegitimate control in relation to the affairs of AWY."

Interim orders sought

- AWY sought interim orders to the following effect:

- disclosure of the details of the association

- each of the Alleged Associates be restrained from –

- voting at the requisitioned meeting or any adjournment or

- disposing, transferring, charging or otherwise dealing with AWY shares

- Mr Shadforth and his associated entities disclose all AWY shareholders or associates that –

- he acts for in a professional or informal capacity

- he has a controlling influence in or

- are clients of his or his associated entites

- Mr Hannon disclose all AWY shareholders or associates that –

- he or Newgate act for in a professional or informal capacity

- he or Newgate have a controlling influence in or

- are clients of his or Newgate.

Final orders sought

- AWY sought final orders to the following effect:

- disclosure of the details of the association to the extent not already disclosed to the market

- the Alleged Associates not vote at the requisitioned meeting or any adjournment

- the Alleged Associates' voting shares in excess of 20% be vested in ASIC for sale, and until divestiture they be restrained from exercising any rights attaching to shares collectively held in excess of 20%

- disclosure of any substantial holding by Newgate or Mr Hannon and

- costs.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

- We have considered whether there is a sufficient body of evidence of association to convince us as to that association, albeit with proper inferences being drawn.2

- In Dragon Mining Limited,3 the Panel discussed the difficulty an applicant faces in an association case:

Dromana Estate Limited 01R acknowledges the difficulties that an applicant faces in gathering evidence in association matters. In deciding whether to conduct proceedings on an association case, this must be kept in mind. However, the Panel has limited investigatory powers which means, before we decide to conduct proceedings, an applicant must do more than make allegations of association and rely on us to substantiate them. An applicant must persuade us by the evidence it adduces that we should conduct proceedings.

- In our view, while there were various connections between the parties that the applicant identified, there was no real evidence of a voting agreement. Discussing concerns about the governance of a company, as at least some of the Alleged Associates appear to have done, is not necessarily a common goal of seeking control of the company and does not necessarily amount to the establishment of a relevant agreement. We acknowledge that this is a fine line to walk,4 but the material we have been given does not show that the Alleged Associates crossed that line.

- Preliminary submissions by each of Messrs Malcolm, Neill, Shadforth, Bainbridge and Hannon (and their respective related companies) deny association. This may not be surprising, but the submissions also particularise (in various ways) the paucity of the evidence pointing to association. We agree that there is little or no real evidence.

- In support of an inference that Mr Hannon was associated with all or some of the other Alleged Associates, the applicant submitted that Mr Hannon in his 3 March 2019 email had stated (among other things) that he was "aware and highly supportive" of a proposal put to the AWY board by Mr Bainbridge. Mr Hannon and Newgate submitted that Mr Hannon is a fund manager and that they do not currently support Quality Life's requisition. Their submission also points out that the reference to 6% in Mr Hannon's 3 March 2019 email (see paragraph 9(c)) was an error, and the holding is approximately 4%. Irrespective of whether Mr Hannon subsequently changed his mind5, we consider that it is important for shareholders to be able to discuss the affairs of a company that are in the public domain, including proposals or resolutions regarding the composition of a company's board. Without more, these types of discussions do not support an inference of association.6

- Mr Neill acknowledges that discussions took place. The submission on his behalf states: "The proposed Board renewal is clearly a proposal put forward by the Quality Life Parties which they are endeavouring to seek support from various shareholders of AWY, including but not limited to some of the Alleged Associates. This is not denied by the Quality Life Parties. However, this does not make them 'associates' with the other Alleged Associates."

- The submission on behalf of Mr Shadforth points out that he is a stockbroker. We consider that this explains many of the structural links between Mr Neill, Mr Shadforth and some of the other Alleged Associates identified by the applicant.

- In 2018, AWY made a cash and scrip offer for all the shares it did not own in Lark Distillery Pty Ltd. The applicant submitted that Mr Shadforth liaised with the AWY board on behalf of shareholders in Lark Distillery Pty Ltd. The applicant submitted that these shareholders accepted the AWY offer at the same time as Mr Shadforth and voted the same way at AWY's 2018 annual general meeting. In the light of Mr Shadforth's role as a stockbroker, this material (without more) falls short of satisfying us that Mr Shadforth and these shareholders are associates.

- In short, we do not consider that there is sufficient probative material to satisfy us that proceedings should be conducted.

- The requisitioned meeting was scheduled to be held on Tuesday, 21 May 2019. The application was made late on Tuesday, 14 May 2019. We asked the applicant why it did not make the application sooner. It submitted that between 5 April 2019 and 14 May 2019, it took legal advice and conducted investigations to establish whether there was sufficient evidence and, at the same time, sought to negotiate an outcome "that served the interests of the shareholders of AWY and the purported objectives of the Associates."

- AWY further submitted that it was in the best interests of its shareholders that the expense and uncertainty of a Panel application (and a general meeting) be avoided if possible. That may be so, but as the Panel states in note 6 to Procedural Rule 3.1.1 "The Panel encourages parties to resolve issues by negotiation. However applicants should not delay unreasonably in making an application."

- In this case, the delay in making the application increased our reluctance to interfere with the legitimate right of shareholders to exercise voting rights.

- Lastly, we note from Auris Minerals Limited:7

As a practical matter it may be more difficult for an applicant to demonstrate a sufficient body of probative material where it is alleged that a large number of parties have recently commenced acting in concert. In such cases, if there is an association and it continues, it may well become easier over time to demonstrate patterns of conduct or other material to satisfy that requirement. Where that is the case, shareholders or ASIC may seek to apply to the Panel again.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Karen Phin

President of the sitting Panel

Decision dated 17 May 2019

Reasons given to parties 24 May 2019

Reasons published 28 May 2019

Advisers

| Party | Advisers |

|---|---|

| AWY | GrilloHiggins |

| Mr Bainbridge and Bainbridge Super | Gilbert + Tobin |

| Mr Hannon and Newgate | Arnold Bloch Leibler |

| Mr Malcolm, Malcolm Property and Malcolm Super | Corrs Chambers Westgarth |

| Mr Neill, Quality Life, Peppermint Bay and Peppermint Bay Nominee | MinterEllison |

| Mr Shadforth | Herbert Smith Freehills |

1 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapters 6 to 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 Mount Gibson Iron Limited [2008] ATP 4 at [15]

3 [2014] ATP 5 at [60]

4 We consider the interactions between the Alleged Associates is, prima facie, more of the nature of the matters referred to in Table 1 of ASIC Regulatory Guide 128: Collective Action by investors (Conduct unlikely to constitute acting as associates or entering into a relevant agreement giving rise to a relevant interest) than the matters referred to in Table 2 (Conduct more likely to constitute acting as associates or entering into a relevant agreement giving rise to a relevant interest)

5 or Quality Life's requisition is different to Mr Bainbridge's earlier proposal

6 The applicant also submitted that Mr Hannon's 3 March 2019 email expressed concern about a recent capital raising by AWY, which demonstrated that he had been in correspondence with some of the Alleged Associates who had similar concerns. Even if there had been such communication, sharing concerns about decisions made by a company is not of itself an indicator of any association

7 [2018] ATP 7 at [20]