[2019] ATP 11

Catchwords:

Money lending and financial accommodation – security interest – excluded relevant interest – options over shares – notifiable interest of director – substantial holding disclosure – share acquisitions – potential control – effect on control – efficient, competitive and informed market – association – declaration – orders – divestment of shares

Corporations Act 2001 (Cth), sections 205G, 606, 609(1), 611 item 6, 657A(2), 657C(3), 657D, 671B

Corporations Regulations 2001 (Cth), regulation 1.0.04

Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 6, Bank of Western Australia Ltd v Ocean Trawlers Pty Ltd (1995) 16 ACSR 501

ASIC Regulatory Guide 5: Relevant interests and substantial holding notices, ASIC Regulatory Guide 193: Notification of directors' interests in securities – listed companies

Corporations and Markets Advisory Committee, Report on Aspects of Market Integrity, June 2009

Companies and Securities Advisory Committee, Anomalies in the Takeovers Provisions of the Corporations Law, Discussion Paper (January 1993)

Gondwana Resources Limited 02R [2014] ATP 18, Australian Pipeline Trust 01R [2006] ATP 29| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | YES | YES | YES | YES | NO |

Introduction

- The Panel, Shirley In't Veld, Robert McKenzie and John O'Sullivan (sitting President), made a declaration of unacceptable circumstances in relation to the affairs of Donaco International Limited. The application concerned an acquisition of almost 10% of Donaco shares by a lender in circumstances where the lender's right to enforce a security interest over 27.25% of Donaco had been triggered. The Panel declared the circumstances unacceptable as the almost 10% acquisition did not take place in an efficient, competitive and informed market and ordered the acquired shares to be vested in ASIC for sale.

- In these reasons, the following definitions apply.

- Alpha

- Total Alpha Investments Limited, a BVI company owned and controlled by Mr Joey Lim

- Applicants

- Mr Gerald Tan, Total Alpha Investments Limited, Slim Twinkle Limited, Convent Fine Limited, Max Union Corporate Development Limited and Mr Lim Keong Yew (Mr Joey Lim)

- Bond Instrument

- has the meaning given in paragraph 5(a)

- Bonds

- has the meaning given in paragraph 5(a)

- Debt Documents

- has the meaning given in paragraph 5

- December Acquisitions

- on-market acquisitions by OCP between 7 and 31 December 2018 (inclusive) of 80,000,000 Donaco shares

- December Acquisition Shares

- 80,000,000 Donaco shares representing 9.71% of Donaco acquired by OCP pursuant to the December Acquisitions

- Donaco

- Donaco International Limited

- Grantors

- Mr Joey Lim, Alpha and Slim Twinkle Limited, Convent Fine Limited and Max Union Corporate Development Limited, each a BVI company owned and controlled by Mr Joey Lim

- money lending exemptions

- section 609(1) and item 6 of section 6111

- OCP

- OL Master (Singapore Fund 1) Pte. Limited, a Singapore company

- OCP Group

- OCP Asia (Singapore) Pte. Limited as investment manager of OL Master Limited and OCP and all its related bodies corporate and associates

- Option Deed

- has the meaning given in paragraph 5(b)

- Options

- has the meaning given in paragraph 5(b)

- Potential Placee

- an entity proposing to take a placement of shares in Donaco

- Receivers

- Mr Vincent Pirina and Mr Mitchell Mansfield, acting as joint and several receivers

- Secured Lending Arrangement

- has the meaning given in paragraph 5

- Secured Shares

- 224,462,025 Donaco shares representing 27.25% of Donaco held by the Grantors and granted as security to the Security Trustee

- Security Trustee

- Madison Pacific Trust Limited, a Hong Kong company, acting as security trustee for and on behalf of OCP

- Specific Security Deed

- has the meaning given in paragraph 5(c)

- Thai Vendors

- has the meaning given in paragraph 93

Facts

- Donaco is an ASX listed company (ASX code: DNA). It owns and operates leisure and entertainment businesses across Asia Pacific, including casino and hotel complexes in Cambodia and Vietnam.

- Mr Joey Lim is a director and the former managing director and CEO of Donaco. His brother, Mr Ben Lim, is also a director of Donaco.

- On 5 May 2017, OCP entered into a secured lending arrangement with companies controlled by Mr Joey Lim (the Secured Lending Arrangement). The Secured Lending Arrangement documents (the Debt Documents)2 included:

- a Bond Instrument (the Bond Instrument) between Alpha, the Security Trustee and OCP pursuant to which Alpha issued senior secured bonds in an aggregate principal amount of US$34,285,000 (the Bonds) to OCP

- an Option Deed (the Option Deed) between Alpha and OCP pursuant to which Alpha granted options over US$6,071,250 of shares in Donaco3 (the Options) to OCP in consideration of the subscription for the Bonds by OCP and

- a Specific Security Deed (the Specific Security Deed) between the Grantors and the Security Trustee pursuant to which the Grantors granted security in shares of Donaco held by the Grantors to the Security Trustee for the purpose of securing the liabilities and obligations of the Grantors to OCP under the Bonds, the Option Deed and other Debt Documents.4

- On 5 November 2018, Alpha failed to make an interest payment on the Bonds which constituted an event of default under the Bond Instrument.

- On 3 December 2018, the Security Trustee requested that Alpha provide top-up shares to maintain the required share collateral value under the Specific Security Deed. Alpha did not do so within the time specified in the Specific Security Deed.

- On 6 December 2018, Donaco announced that Mr Joey Lim was taking a leave of absence as managing director and CEO for approximately 3 months and that Mr Ben Lim had been appointed interim managing director and CEO.5

- On 7 December 2018, OCP acquired 4,000,000 shares in Donaco on-market (representing less than 0.5% of Donaco).

- On 12 December 2018, OCP transferred the Option Deed and Options to an entity6 for US$1.00. Immediately prior to the transfer, the Options gave OCP a relevant interest in 4.4% of Donaco.

- On 13 December 2018, Donaco announced a strategic review to consider its funding options, noting the recent downward trading in its shares.

- Between 13 and 31 December 2018, OCP acquired a further 76,000,000 shares in Donaco on-market taking its holding in Donaco to 9.71%.7

- On 17 December 2018, a representative of OCP met with Mr Joey Lim to seek to find a solution that avoided enforcement of OCP's security interest as a matter of urgency.

- On 18 December 2018, a representative of OCP emailed Donaco directors Messrs Stuart McGregor, Ben Reichel and Ben Lim (copying others) stating: "I have copied Mathew Hunter. Mathew sits on the board of a number of companies we have invested in. We think he would be suitable as a board member of Donaco".

- On 27 December 2018, OCP sent a restructuring proposal to Alpha in an effort to deal with the subsisting defaults without needing to resort to enforcing its security interest.

- On 31 December 2018, Alpha was required, but failed, to redeem 10% of the aggregate initial principal amount of the Bonds and all amounts accrued and unpaid under the Bonds.

- On 7 January 2019, OCP's representative emailed Mr McGregor (copying the other recipients of his 18 December 2018 email) stating:

"As you will have seen from our most recent disclosure, the OCP funds now hold over 9% of DNA.

We would very much appreciate if you could arrange to meet Matthew as soon as is convenient as we are confident he would be a very positive addition to the DNA board."

- On 16 January 2019, OCP notified Alpha that certain events of default had occurred in relation to the Bond Instrument and Specific Security Deed, citing specifically the events described in paragraphs 6, 7 and 16.

- On 18 January 2019, on the instruction of OCP, the Security Trustee issued a letter of demand to Alpha.

- On 24 January 2019, Messrs McGregor, Reichel and Ben Lim met with a representative of the Potential Placee to discuss its interest in investing in Donaco. The Potential Placee, an industry participant, was introduced to Donaco by OCP.

- On 26 February 2019, the board of Donaco approved a transaction with the Potential Placee that would include a placement of 15% of Donaco shares to the Potential Placee at a price that represented a significant premium to the market price. The transaction also included a proposed management rights agreement in respect of one of Donaco's properties. Messrs Joey and Ben Lim voted against the transaction and Messrs McGregor and Reichel voted in favour of the transaction with Mr McGregor (as chairman) casting the deciding vote in favour. Ultimately, after the date of the application, the transaction did not eventuate.

- On 26 February 2019, on the instruction of OCP, the Security Trustee appointed Mr Vincent Pirina as receiver and manager of the secured property (which included the Secured Shares) under the Specific Security Deed.

- On 27 February 2019, Mr Pirina notified the Grantors of his appointment and the enforcement of the security interest.

- On 1 March 2019, the Security Trustee appointed Mr Mitchell Mansfield as a joint and several receiver with Mr Pirina and notified the Grantors of the same.

- On 1 March 2019:

- the OCP Group lodged a Notice of change of interests of substantial holder disclosing a relevant interest in the Secured Shares by virtue of the exercise of its security interest, taking its total relevant interest in Donaco to 37% and

- the Receivers and the Security Trustee lodged a Notice of initial substantial holder disclosing a relevant interest in the Secured Shares (equal to 27.25% of Donaco) by virtue of the Specific Security Deed and the deed of appointment of the Receivers.

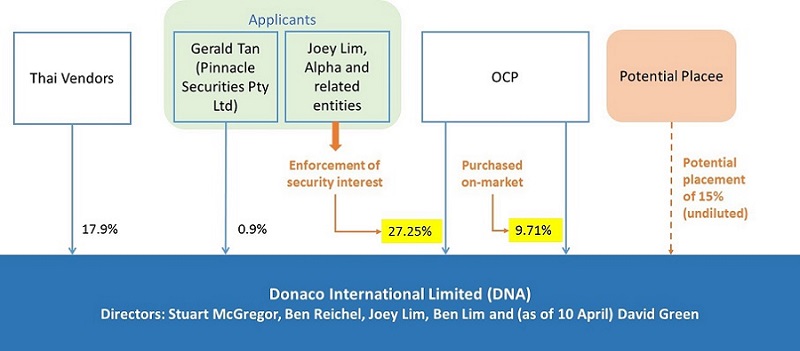

- Relevant shareholdings in Donaco as at 1 March 2019 are set out in the diagram below.

Application

Declaration sought

- By application dated 8 April 2019, the Applicants sought a declaration of unacceptable circumstances. The Applicants submitted (among other things) that:

- OCP had acquired a relevant interest and voting power in 37% of Donaco by virtue of the on-market acquisition of shares by OCP of 9.71%8 of Donaco and the subsequent enforcement by OCP of its security interest over shares representing 27.25% of Donaco

- the acquisition of control over 37% of Donaco shares did not take place in an efficient, competitive and informed market and resulted in circumstances which were unacceptable including because:

- the on-market acquisitions occurred after Alpha had defaulted under the Bond Instrument as a consequence of which OCP was entitled to procure the enforcement of its security interest over the 27.25% and

- by deferring the enforcement of the security, OCP was "able to orchestrate a position under which it was able to acquire DNA shares" representing relevant interests and voting power of 9.71% "in a way which was designed to avoid a breach of s 606"

- the fact that OCP may not have acquired a relevant interest in the 27.25% parcel as a consequence of the security held over those shares pursuant to section 609(1) (and that the subsequent appointment of the Receivers to enforce the security was an acquisition which was exempt pursuant to item 6 of section 611), did not preclude a finding that OCP had "acted in a way which has been designed to manipulate the provisions of the Act so as to enable it to acquire relevant interests and voting power well in excess of the 20% threshold in s 606"

- the Panel can infer from the circumstances that OCP's objective was to maximise its relevant interests and voting power in Donaco to enable it to control or substantially influence Donaco, as evidenced for example by OCP's proposal that Mr Hunter be appointed as a director of Donaco and

- the circumstances demonstrate that OCP and the Potential Placee are associated in relation to the acquisition of shares in Donaco and the potential placement of Donaco shares to the Potential Placee, which upon issue would result in OCP and its associate having voting power of over 50% in Donaco.9

Interim orders sought

- The Applicants sought interim orders including to restrain Donaco from issuing shares to the Potential Placee and to restrain OCP voting or dealing with any of the December Acquisition Shares pending the determination of their application.

- After receiving submissions from parties, the substantive President (Alex Cartel) considered the interim orders request on an urgent basis.

- The Potential Placee offered, and the substantive President accepted, an undertaking to the Panel that, without the Panel's consent, it would not participate in any placement of shares in Donaco until the conclusion of the Panel proceedings.

- The substantive President considered there was no need to restrain OCP from voting the December Acquisition Shares (or to accept an offer from OCP to provide an undertaking to this effect) because at the time there were no upcoming general meetings. Further, he did not consider it urgent to prevent OCP from disposing of the December Acquisition Shares, noting that OCP had held those shares since December, and indicated that this was something for the sitting Panel to consider.

- After we decided to conduct proceedings, we considered the interim orders in relation to OCP and accepted an undertaking from OCP (in lieu of an interim order) that it refrain from dealing with the December Acquisition Shares until the determination of the proceedings. This restriction preserved the status quo while we considered the application.

Final orders sought

- The Applicants sought final orders including to restrain the issue of Donaco shares to the Potential Placee or if issued, to vest any shares issued to the Potential Placee for sale by ASIC and to vest the December Acquisition Shares for sale by ASIC.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

Decision to conduct proceedings

- We received preliminary submissions from OCP and Donaco.

- Donaco submitted that around the same time it was negotiating a transaction with the Potential Placee, it was considering an alternate proposal from a consortium. It submitted that Messrs Joey and Ben Lim had material personal interests in the alternate proposal. It further submitted that it was concerned that the application was opportunistic, vexatious and frivolous, and had been made for a collateral purpose, namely, to delay or frustrate a potential transaction between Donaco and the Potential Placee in order to pave the way for the alternate proposal.

- OCP noted the same concerns and also made detailed submissions in response to the allegations in the application.

- In our view, the application raised concerns that warranted consideration so we decided to conduct proceedings on all matters.

Money lending exemptions

- Section 609(1), as modified by ASIC CO 13/520, provides that: "A person does not have a relevant interest in securities merely because of a security interest taken or acquired by the person if:

- the security interest is taken or acquired:

- in the ordinary course of the person's business of the provision of financial accommodation by any means; or

- for the benefit of one or more other persons in relation to financial accommodation provided by the other persons in the ordinary course of the other persons' business of the provision of financial accommodation by any means; and

on ordinary commercial terms; and

- the person whose property is subject to the security interest is not an associate of any other person mentioned in this subsection…"

- the security interest is taken or acquired:

- Item 6 of section 611, as modified by ASIC CO 13/520, provides an exception from the prohibition in section 606 that corresponds with section 609(1). It provides an exception from section 606 for: "An acquisition that results from the exercise by a person of a power, or the appointment of a receiver, or receiver and manager, under an instrument or agreement creating or giving rise to a security interest if:

- the ordinary business of:

- the person; or

- a person or persons for the benefit of whom the person took or acquired the security interest;

- the person took or acquired the security interest:

- in the ordinary course of their business of the provision of financial accommodation by any means; or

- for the benefit of one or more other persons in relation to financial accommodation provided by the other persons in the ordinary course of the other persons' business of the provision of financial accommodation by any means; and

- the ordinary business of:

- OCP submitted that its core business was the provision of tailored secured lending arrangements including, as in this case, secured direct lending to a major shareholder to fund the acquisition of shares in a listed company. It further submitted that the Debt Documents reflected terms customary for secured lending arrangements between a credit fund and an arm's length borrower, where the borrower did not have access to traditional bank lending.

- OCP submitted that OCP and the Security Trustee were entitled to rely on section 609(1) until the enforcement of the security over the Secured Shares on 27 February 2019. Thereafter, OCP submitted that the relevant interest in the Secured Shares of OCP and the Security Trustee was exempt under item 6 of section 611 from the prohibition in section 606(1) because it arose solely and directly from the exercise of OCP's security interest under the Debt Documents. In the case of the Receivers, the relevant interest in the Secured Shares arose solely and directly from their appointment. Accordingly, OCP submitted that only at the point in time that the security interest was enforced did an obligation to disclose the security interest arise.10

Were the December Acquisitions made in an informed market?

- We found no material showing that the existence of the Secured Lending Arrangement was known by the market at the time of the December Acquisitions.11

- We asked parties whether OCP's on-market acquisitions of the December Acquisition Shares were acceptable in light of circumstances where, at the time of making those acquisitions, OCP held a security interest in 27.25% of Donaco's shares, there were defaults by Alpha under the terms of the Debt Documents and OCP had the right to enforce the security interest.

- The Applicants submitted that the market was not aware of the potential enforcement of the security at the time of the December Acquisitions, and accordingly, the acquisitions of the December Acquisition Shares did not take place in an efficient, competitive and informed market.

- OCP submitted that the money lending exemptions are in place to protect the legitimate commercial interests of secured financiers and do not fall away as soon as a right to enforce crystallises. It submitted that "[p]remature disclosure of defaults would have an unfairly prejudicial impact on the companies whose shares are the subject of the relevant security interest"12 and possibly be "highly prejudicial to debtors in default in the period the parties are seeking to find a consensual solution which avoids enforcement". OCP submitted that this was pertinent here as there was a real prospect that the defaults would be cured, given OCP had found a solution in the past with Alpha when it defaulted13 and had Alpha responded to OCP's efforts to restructure the debt.14

- It appears to us reasonable, and generally desirable, for lenders and borrowers to have time to remedy defaults before being required to disclose the defaults.

- ASIC submitted that, even if disclosure of the Secured Lending Arrangement was not required because of the money lending exemptions,15 the fact that OCP acquired a significant interest in Donaco at a time when the market was not aware it had a right to demand immediate payment in full of a loan that was in default and was secured by 27.25% of the issued capital of Donaco, in ASIC's view, was sufficient to give rise to unacceptable circumstances.

- OCP submitted that by looking at the December Acquisitions in the manner suggested above, the Panel would be "reading into the legislation a moratorium on purchasing shares as principal…had legislators intended for this, the relevant exemptions would fall away once the right to enforce crystallises, rather than when it is acted upon". OCP submitted it would be unfairly prejudicial to a lender, who is economically exposed under a debt, to compromise the lender from taking other actions in its own commercial interests.

- OCP submitted that the December Acquisitions were undertaken as a commercial matter separate from the exercise of its security interest. Following a dramatic fall in the Donaco share price in late November 2018, OCP submitted that it formed the view that Donaco shares were undervalued and decided to acquire up to 10% of the shares in Donaco.

- We do not need to decide whether OCP's acquisitions were commercially reasonable or conclude that no acquisitions of shares by a lender can take place when a lender has a crystallised right to enforce security over shares of the same company. We only need to consider if the December Acquisitions in the circumstances of this matter were unacceptable. OCP's enforcement right over a sizeable stake in Donaco was clearly material information in itself affecting control of Donaco. We consider OCP's purchase of Donaco shares in these circumstances to be troubling.

Effect of the transfer of the Option Deed

- In considering whether the circumstances were sufficient to give rise to unacceptable circumstances, ASIC submitted that it was notable that OCP appeared to have turned its mind to what was known to the market about the Secured Lending Arrangement at the time of the December Acquisitions and the potential impact of disclosure.

- ASIC was referring to an internal email among representatives of OCP dated 6 December 2018 that stated (in part): "Just looking through the [Donaco] option deed poll, the opening page shows the amount of bonds that were issued as part of the overall deal that created the options. Once we cross over 5% threshold, do we need to disclose the full details of the option deed poll? It would show to the market that Joey has a share backed financing and is that something we want to disclose?" The next day OCP purchased a small number of Donaco shares which, when combined with OCP's relevant interest in the Options (representing 4.4% of Donaco), stayed just under the 5% threshold to require disclosure under section 671B. Shortly thereafter, on 12 December 2018, OCP transferred the Option Deed and Options to an entity for US$1.00. Thereafter, OCP purchased the rest of the December Acquisition Shares.

- Given that the Option Deed refers to the Bond Instrument and other Debt Documents and therefore disclosure of the Option Deed would have disclosed to the market the Secured Lending Arrangement generally, we queried whether we should infer that OCP's disclosure concerns were the reason why the Option Deed was transferred. OCP submitted that there was no evidence that OCP transferred the Options to avoid disclosure. It submitted that we should not draw this inference for the following reasons:

- the Options were "grossly" out of the money and therefore had no economic value16

- under the Foreign Acquisitions and Takeovers Act 1975 (Cth), OCP could not acquire any interest in Donaco above 10% without seeking approval from the Foreign Investment Review Board

- because the Options limited the number of Donaco shares OCP could acquire, it sought to contact Mr Joey Lim to seek his consent to either cancel the Options or amend them to be cash settled only and

- Mr Joey Lim was unresponsive so OCP transferred the Options.

- In our view, we did not need to infer that OCP's reason or one of OCP's reasons for the transfer was to avoid disclosure of the Secured Lending Arrangement. The transfer had the effect of avoiding disclosure and is therefore relevant to our consideration of whether the market was properly informed.

Did OCP have a control purpose that affected the application of the money lending exemptions?

- The Applicants submitted in effect that, notwithstanding the circumstances which might have existed when the Debt Documents were entered into, the "consequent conduct" of OCP materially departed from that which would typically be taken by a financier in its ordinary course of business. In addition to the making of the December Acquisitions, they submitted that actions inconsistent with those typically taken by a financier included proposing to nominate a director for the Donaco board (ie. Mr Hunter) and proposing other strategies such as the investment by the Potential Placee.

- We do not accept the proposition that "consequent conduct" as submitted by the Applicants can affect the application of section 609(1) which on a reading of the provision is measured at the time the security interest "is taken or acquired".17

- ASIC Regulatory Guide 5: Relevant interests and substantial holding notices is consistent with this view. It provides that ASIC may take regulatory action, including applying to the Panel, if a person seeks to rely on one of the financial accommodation exceptions where it appears that either (a) the security interest does not fall within the exception or (b) the person has taken or acquired the security for purposes that are otherwise inconsistent with the policy underlying the exceptions (e.g., the person has taken or acquired the security interest in connection with a proposal by the financier or its associates to acquire control, or a substantial interest in, the issuer of the securities).18

- There was nothing before us to suggest that at the time OCP took or acquired the security interest it did so for any other purpose than to secure the funds it had lent to Alpha.19

- OCP also denied that it had used the exercise of its security to accumulate a greater holding in Donaco shares or obtain control of Donaco. In support, OCP submitted that:

- its actions as lender reflected a sustained effort to avoid enforcement of the security including by:

- allowing additional time for defaults to be remedied

- meeting with Mr Joey Lim on several occasions in an attempt to find a solution to Alpha's defaults, including after the demand letter was issued and

- putting a restructuring proposal in writing to Mr Joey Lim

- while OCP was entitled to instruct the Receivers to transfer the Secured Shares to OCP, it had not done so and

- OCP was primarily concerned with recouping as much as possible of its cash exposure under the Bonds and to this end:

- the Receivers were mandated to sell the Secured Shares to third parties and

- in parallel, OCP was negotiating a proposal to sell the Bonds to a third party.

- its actions as lender reflected a sustained effort to avoid enforcement of the security including by:

- ASIC submitted that whether OCP had demonstrated an intention to exercise or influence the control of Donaco did not affect whether the circumstances were unacceptable. It noted that Chapter 6 regulates "the acquisition of substantial interests and a capacity to affect control (rather than the implementation of a subjective control intent)". We agree that 'effect' is the relevant touchstone and consider that the December Acquisitions in the circumstances had the capacity to affect control of Donaco. Further, we note that from 5 November 2018 when the first event of default occurred, the Grantors' right to exercise all voting powers in the Secured Shares ceased and the Security Trustee was entitled to exercise all voting powers to the exclusion of the Grantors.

- OCP also sought to rebut the allegations that nominating Mr Hunter and introducing the Potential Placee supported a finding that OCP was not acting in the ordinary course of a financier.

- In relation to Mr Hunter, OCP submitted that merely suggesting a suitably qualified director in response to a request from Donaco20 cannot be said to be seeking to consolidate control. Donaco also disagreed with the Applicants' submission that Mr Hunter had been put forward as a director nominee of OCP, noting that the appointment process was at that point being handled by a recruitment firm without any involvement by OCP. It did not appear to us that in this case the recommendation of a director was part of a broader control plan. We also note that the recruitment process ultimately resulted in the appointment of another individual as an independent non-executive director.

- In relation to the Potential Placee, OCP submitted that following Mr Joey Lim's absence as Donaco's CEO and Donaco's share price performance, among other things, it saw an opportunity for the Potential Placee to provide operational experience to Donaco, noting that "positive change to [Donaco] equates to positive change to OCP under the Bonds". Before introducing the Potential Placee to Donaco, OCP submitted it had sought to arrange a meeting between Mr Joey Lim and the Potential Placee in early January 2019 to see if the Potential Placee could assist Mr Joey Lim, but Mr Joey Lim did not attend the arranged meeting. Given our conclusion on association (see paragraphs 98-102), without more, we do not consider the introduction of the Potential Placee by OCP as supporting a broader control plan.

Could OCP's reliance on the money lending exemptions in relation to the Secured Shares be unacceptable?

- While ASIC agreed that the application of section 609(1) (where it applied from the outset of the security arrangements) generally should not fall away, it submitted it is not the case that "broader arrangements cannot give rise to an interest that should be taken into account or that reliance on section 609(1) cannot give rise to unacceptable circumstances in particular cases". It submitted that:

- the magnitude of the stake in Donaco over which OCP had a security interest

- the apparent disclosure failure in connection with the Secured Lending Arrangement (see paragraphs 74 and 78 below)

- the fact that as a result of an event of default the Grantors no longer had voting rights in the Secured Shares and there was a significant risk that OCP would acquire an interest in the securities and

- the size of the acquisitions that were being made under the December Acquisitions

- On balance, we do not consider that the factors above support a finding that OCP could not rely on the section 609(1) exemption in relation to the Secured Shares. We recognise that section 609(1) (and item 6 of section 611) allow a security interest over 20% and therefore the magnitude of the stake alone is not unacceptable. We understand that enforcing a security interest is often a last resort for a lender and having done so, a lender's objective in the ordinary course is to recoup the outstanding debt from the proceeds of sale of the security and not, in the case of secured shares, to exercise control of the underlying issuer. As noted above, OCP's actions do not support the existence of a broader control plan. To now deprive or qualify OCP's ability as lender to enforce its security interest over the Secured Shares based on the factors above is not in our view appropriate on the material before us.

Are the December Acquisitions unacceptable?

- We agree with the view generally accepted by the parties and ASIC that there is no obligation, as a result of the operation of the money lending exemptions, for a lender to disclose its security interest at the point in time that a right to enforce the security interest is crystallised, but yet unexercised. Nevertheless, in our view, while OCP may not have been obligated to disclose its security interest prior to the December Acquisitions, this does not eliminate the possibility that the December Acquisitions in the circumstances in which they were made were unacceptable.

- The current circumstances are analogous to those in Australian Pipeline Trust 01R21 where Alinta Limited (Alinta) acquired 10.25% of the units in Australian Pipeline Trust (APT) in circumstances where Alinta in a merger implementation agreement (MIA) with The Australian Gas Light Company (AGL) had a deemed relevant interest in 30% of APT units held by AGL. One of the issues was whether an ASIC declaration applied to disregard the relevant interest obtained by Alinta under the MIA. The Panel found that it did not and concluded that the circumstances were unacceptable (under predecessor section 657A(2)(b)) because they gave rise to a breach of section 606. The Panel, however, also considered if the ASIC declaration was effective, whether the 10.25% acquisition still constituted unacceptable circumstances. It concluded (referring to predecessor section 657A(2)(a)):

"62. The Panel considered that even if the ASIC Declaration was effective to relieve Alinta of the relevant interest it acquired under the MIA, and the Acquisitions did not give rise to a contravention of section 606, that only has the consequence that section 657A(2)(b) does not apply to the Acquisitions. However, it does not prevent section 657A(2)(a) from applying. Accordingly, the Panel also considered whether the Acquisitions (in the context in which they occurred) constituted unacceptable circumstances under section 657A(2)(a). The Panel decided that they did because (in broad summary) the Acquisitions, when considered in the context of the AGL Parcel, the Schemes, and the relevant interest in the AGL Parcel that Alinta would obtain following implementation of the Schemes, had, or were likely to have:

- increased the degree of control Alinta will have over APT if the Schemes were approved; and

- increased the likelihood of Alinta controlling APT i.e. affected the potential control of APT; and

- further deterred any rival bidders who may have considered bidding for control of APT prior to the Schemes.

The Acquisitions (in the context in which they occurred) were unacceptable having regard to the effect of the circumstances on control, or potential control, of APT. The manner in which the Acquisitions occurred was not conducive to an efficient, competitive and informed market for the control of securities of APT and all APT unitholders did not have a reasonable and equal opportunity to share in the benefits which may flow from the Acquisitions."

- Here, the December Acquisitions occurred in circumstances where:

- the market was not aware that OCP had a security interest in 27.25% of Donaco shares held by the Grantors

- the market was not aware that the Grantors were in default and the Security Trustee had the right to declare all sums owing under the Bond Instrument and the Bonds immediately due and payable

- while the events of default were continuing, the Security Trustee had the right to exercise voting powers of the Secured Shares and

- the transfer of the Option Deed and the Options by OCP before it acquired a substantial interest in Donaco had the effect of avoiding disclosure of the Option Deed and in turn the Secured Lending Arrangement (see paragraphs 52-55).

- Without doubt, OCP's acquisition of an almost 10% stake in Donaco increased the degree of control OCP would have if it enforced its security rights over more than another 27% of Donaco. OCP knew or ought to have known when it decided to acquire a substantial interest in Donaco that there was a very real possibility that it could end up with a relevant interest of 37% because its right to enforce the security interest had crystallised.22 Moreover, the Security Trustee already had the right to vote the Secured Shares. OCP knew, but selling shareholders and the rest of the market did not know, these circumstances when it went on-market to make its acquisitions. As a result, we conclude that the December Acquisitions, in the circumstances in which they occurred, had or were likely to have an effect on control or potential control of Donaco and did not take place in an efficient, competitive and informed market.

Concerns in relation to the Option Deed

- In documents provided to us in response to our brief, we first learnt about the Option Deed. We asked the Applicants and OCP why the Option Deed had not been disclosed to us earlier and raised concerns as to whether we had received all relevant material. The Applicants submitted that they did not disclose the Option Deed because they were not aware of its significance until the questions raised by us. OCP submitted it did not provide the Option Deed because it no longer owned the Options and, in any event, they were so far out of the money that they had no relevance. OCP also submitted that given the Applicants had not considered the Option Deed relevant when they made their application, it should not be relevant to our consideration.

- We were troubled by the Option Deed for two reasons, notwithstanding that these issues were not raised by the Applicants. First, we queried whether Mr Joey Lim should have disclosed the Option Deed under section 205G as a notifiable interest (which in turn would have disclosed the Secured Lending Arrangement). Secondly, we considered the Option Deed was relevant to a consideration of section 609(1) because the security interest when entered into secured both the Bonds and the Options.

Section 205G

- Section 205G requires a director of a publicly listed company to disclose contracts to which the director is a party or under which the director is entitled to a benefit (section 205G(1)(b)(i)) and that confer a right to call for or deliver shares in the company (section 205G(1)(b)(ii)).

- ASIC submitted that, on one view, Mr Joey Lim was entitled to a benefit under the contracts comprising the Option Deed and the other Debt Documents, given he was the beneficial owner and controller of Alpha, and the contracts conferred a right to call for, or deliver, shares in Donaco.

- Both the Applicants and Donaco submitted that Mr Joey Lim was neither a party to, nor was he entitled to a benefit under, the Option Deed and accordingly, section 205G(1)(b)(i) was not satisfied. We consider the better view is that Mr Joey Lim, as the owner and controller of Alpha, was entitled to a benefit under the Debt Documents (which included the Option Deed) taken as one interconnected transaction.23

- The Applicants also submitted that the section did not apply because the Options were call options in favour of OCP which did not confer a right on the person in section 205G(1)(b)(i) (ie. the director) to call for or deliver shares in Donaco. It is not clear to us whether the provision is limited to a right the director has or extends to a right that the director has given to another party. Assuming a broad policy objective of disclosure in relation to directors' dealings in securities,24 then the view could be taken that section 205G(1)(b)(ii) extends to a call option given by a director. However, there is commentary to suggest that the provision may not be read that broadly.25

- While we are generally in favour of broader disclosure of directors' dealings in securities, given our conclusion above at paragraph 66, we did not find it necessary to reach a conclusion on whether Mr Joey Lim should, under section 205G, have disclosed the Option Deed to the market within 14 days of entering into the deed. It follows we therefore did not need to consider whether OCP was a party to any failure by Mr Joey Lim to comply with section 205G.

Substantial holding disclosure

- ASIC separately submitted that the Option Deed and Specific Security Deed should have been disclosed by the Grantors, Mr Ben Lim and their associates under the requirements of the substantial holding provisions no later than 27 September 2017 when their voting power changed as a result of the sale of 37.5 million shares held by Slim Twinkle Limited. ASIC submitted that this was because in disclosing details of their relevant interests they were each required to include details of "any qualification of the power of a person to exercise, control the exercise of, or influence the exercise of, the voting power or disposal of the securities to which the relevant interest relates (indicating clearly the particular securities to which the qualification applies)".26 It submitted that the substantial holder notices given were deficient because they did not disclose the significant qualification on the ability to dispose of, or control disposal of, the shares under the Secured Lending Arrangement.27

- The Applicants submitted that, in respect of the Option Deed, the Option Deed provided Alpha with the right to settle any exercise of the Options by the payment of cash consideration and therefore, there was no qualification on its ability to dispose of the shares. The Applicants did not address the disposal restriction in the Specific Security Deed. Further, the Applicants submitted that any requirement to disclose any qualification over the Secured Shares does not arise under section 671B rather, if it does arise, it was only because of the application of the Corporations Regulations and the terms of Form 604. Noting that the shares that were sold on 27 September 2017 were not Secured Shares, the Applicants submitted that linking the additional disclosure to the filing of a notice required as a consequence of the sale of shares which were not the subject of the security seemed "an unusual outcome and of a highly technical nature".

- While we consider that the Secured Lending Arrangement resulted in a qualification on the Grantors' ability to dispose of the Secured Shares, we have some concern with how the disclosure of this qualification sits with the money lending exemptions which effectively exempt a lender from disclosure until the security interest is enforced. We assume that a qualification on the disposal of shares pledged as security would be a common feature of most (if not all) lending arrangements with security over shares. Again, given our conclusion above at paragraph 66, we did not need to reach a conclusion on this issue and so did not consider this matter further.

Did the Option Deed affect whether OCP could rely on section 609(1)?

- We asked parties whether entry into the Option Deed as part of the Secured Lending Arrangement affected whether OCP's security interest was taken or acquired in the "ordinary course" of OCP's business of "the provision of financial accommodation by any means" and "on ordinary commercial terms".

- ASIC submitted that the concepts of 'ordinary course' and 'ordinary commercial terms' place "important limits around the otherwise facilitative role of the exception" and given their anti-avoidance function, should be strictly interpreted.

- ASIC submitted that, because OCP was acquiring an economic exposure as well as a security interest in the same securities, the Secured Lending Arrangement "tends to a conclusion" that the security interest formed part of a broader transaction that had, at least in part, an objective of making a financial investment in Donaco shares.28 Accordingly, ASIC submitted the security interest strayed from the 'ordinary course' of any business of financial accommodation OCP may have.

- OCP submitted that taking equity positions alongside its debt positions was in the ordinary course of its business of providing financial accommodation. It submitted that (at the time): (a) of its outstanding positions globally, 80% comprised a debt position with some form of equity participation and (b) approximately 50% of its positions were in respect of Australian borrowers, of which 75% comprised a debt position with some form of equity participation (either through direct holdings, options or warrants).

- ASIC submitted that when looking at whether the security interest falls within the exception it should not be defined solely by reference to what OCP does or has done. Rather, ASIC submitted, what OCP did in this case "must objectively constitute the taking of security as part of the business of financial accommodation on ordinary commercial terms". ASIC submitted that to do otherwise would allow persons to "self-define" the scope of the exemption. ASIC submitted that a security interest taken for the purpose of purchasing or obtaining the right to purchase underlying equities is contrary to the ordinary provision of financial accommodation where a lender is assumed to have no interest in the affairs of the issuer of the secured shares beyond those that impact its ability to liquidate the securities to obtain repayment of its debt.

- OCP submitted that section 609(1) was drafted to capture a broad range of credit arrangements. It noted that the section was specifically broadened by comparison to its predecessor provision, referring to Rennard & Santamaria, Takeovers and Reconstructions in Australia at [420]:

- OCP submitted that the broadening of the provision ensured that the legitimate commercial interests of a secured lender are protected regardless of the type of lending. Referring to the taking of equity positions by a lender, OCP submitted that these arrangements are commonplace in the non-bank lending market. It submitted that depending on the risk profile and circumstances of the borrower and the assets being secured, lenders will require a higher rate of return for the risk and a higher interest rate may not be serviceable by the borrower. Accordingly, OCP submitted, that required returns are structured as a combination of interest and arrangements allowing the lender access to additional returns in the form of rights to acquire equity or equity-linked returns in the relevant company.

- ASIC submitted that its concern with what is the ordinary provision of financial accommodation is not inconsistent with the extension of the exemption to include the provision of 'financial accommodation by any means'. In this regard, ASIC noted that the example given in the relevant CASAC discussion paper was that "a transaction … in connection with lending money" may be "too narrow to accommodate all financing techniques such as the granting of bill facilities".29

- ASIC also queried whether it is an 'ordinary commercial term' for purposes of section 609(1) to include an option over the shares that are being secured. Given that exercising the option would reduce the security backing the debt, ASIC submitted that the Options appeared to run counter to the commercial objectives ordinarily expected of taking a security. In rebuttal, OCP submitted that this was not correct. Under the Option Deed, OCP was permitted to set off the consideration payable for exercise of the Options against the amount outstanding under the Bonds, thereby reducing its debt exposure. It also submitted that the Options had a relatively high strike price which meant that at the time of exercise the value of the security would have appreciated significantly.

- OCP submitted that no evidence was presented to support a contention that the arrangements between OCP and the Grantors were not on ordinary commercial terms in the context of non-traditional lending arrangements. This view was supported by Mr James Spenceley who submitted that, in his experience, it was common in this section of the market for a lender to take equity warrants or options as part of providing debt funding.30

- We indicated to parties that we were considering extending our declaration in relation to the Secured Shares on the basis that OCP could not rely on section 609(1) because of the Option Deed and Options and/or the circumstances noted in ASIC's submissions at paragraph 65 above.

- OCP submitted (among other things) that extending the declaration to the Secured Shares would: (a) introduce significant and fundamental dilution of the legal rights of OCP and other existing and future secured lenders, (b) likely result in the Donaco share price materially deteriorating if both the December Acquisition Shares and the Secured Shares are put to market to the detriment of OCP, the Applicants and other Donaco shareholders and (c) risk significantly the market for non-traditional credit in Australia including the willingness to extend credit. OCP submitted that the alternative lending market plays an important role for borrowers unable to qualify for major bank lending. It submitted that alternative lenders must be afforded the protections made available by lawmakers and taking steps to alter that framework would be "a serious matter".

- Donaco submitted that if the Panel's declaration extended to the Secured Shares, and therefore by extension, to the Panel's orders, any orders restricting the voting of the Secured Shares would result in unfair prejudice to Donaco and its minority shareholders. Donaco advised that it is involved in significant disputes with the vendors of its Star Vegas casino business in Cambodia (the Thai Vendors) who own approximately 17.9% of Donaco. It submitted that if we make orders preventing the exercise of voting rights attached to both the December Acquisition Shares and Secured Shares, the effective voting power of the Thai Vendors would substantially increase. With no other major shareholders on the register, Donaco submitted that the increased control or influence of the Thai Vendors over the affairs of Donaco may not be in the best interests of the minority shareholders in light of Donaco's disputes with the Thai Vendors.

- While the effect of our potential orders was not in this case a consideration in our decision to make a declaration, we are required to consider the public interest when making a declaration, which we did.31 We consider the potential transfer of control relevant to our consideration of the public interest.

- On balance, we decided not to extend the declaration to the Secured Shares on the basis that OCP could not rely on section 609(1). In addition to the legal questions around the scope of the money lending exemptions, on which we draw no conclusions, two other factors influenced our decision. First, the impact of such a finding on the non-traditional credit market in Australia and the uncertainty that our decision may cause in relation to the existing rights of non-bank lenders. Secondly, we were troubled by the control concern asserted by Donaco in relation to the Thai Vendors (although with further consideration we may have been able to address this concern with our orders).

- We have concerns remaining about the use of section 609(1) in respect to non-traditional credit arrangements that involve an equity component secured by a controlling stake in an ASX listed company.

- Given the strong submissions made by ASIC in relation to the Option Deed, in our view, ASIC should consider reviewing CO 13/520 in light of the issues raised in this matter.

"Section 609(1) is wider than its predecessor section under the former Ch 6, namely former s 38. Under the former s 38, the person's ordinary business had to include the lending of money, as opposed to the provision of financial accommodation, and the security interest had to be taken for the purposes of a transaction entered into in the ordinary course of business in connection with lending money. This concept was not sufficiently broad to accommodate other financing arrangements not involving the lending of money. Now, the exclusion requires that the security is taken or acquired in the ordinary course of the person's business of providing financial accommodation by any means…"

Alleged association between OCP and the Potential Placee

- The Applicants submitted that the circumstances relevant to finding an association between OCP and the Potential Placee included:

- a partner of OCP and an executive director of the Potential Placee were co‑workers at an investment bank during 2005 to 2009

- OCP introduced the Potential Placee to Donaco for purposes of arranging a placement of 15% of Donaco shares and

- one day after the introduction, the Potential Placee lodged a considered formal proposal with Donaco from which it could be inferred that OCP had provided assistance to the Potential Placee well in advance of the introduction.

- The Applicants submitted that OCP sought to pursue a course of conduct the consequence of which would be the Potential Placee taking a placement in Donaco, OCP invited the Potential Placee to seek to participate in the placement and the Potential Placee responded to OCP's invitation to do so. It submitted this demonstrated acting in concert because it involved at least an understanding (which may be proved by inference) between the parties as to a common purpose or objective.32

- OCP and the Potential Placee both denied the association. They both submitted (among other things) that:

- the application failed to provide any evidence of a shared goal or prior collaborative conduct between the alleged associates in relation to Donaco

- there were no structural links or common investments or dealings between the alleged associates

- the long-standing friendship and business relationship between the two representatives of the alleged associates did not go so far as to establish that they had a relevant agreement or were acting in concert33 and

- following the introduction of the Potential Placee to Donaco, OCP had no involvement in the negotiations between the Potential Placee and Donaco.

- Donaco confirmed that negotiations with the Potential Placee continued throughout February and March 2019 with no participation from OCP. It also clarified that the formal proposal from the Potential Placee was lodged 4 days after, not the day after (as submitted by the Applicants), the Potential Placee was introduced to Donaco. Donaco also submitted that it had received independent advice that the Potential Placee's proposal was the best alternative of the various proposals it reviewed for several reasons, including that the proposed placement was to be at a price that represented a significant premium to the market price.

- Based on the material before us and relying on our experience, we consider that there is insufficient material to support a finding of association between OCP and the Potential Placee in relation to Donaco.

Extension of time to make application

- Section 657C(3) says:

An application for a declaration under section 657A can be made only within:

- two months after the circumstances have occurred; or

- a longer period determined by the Panel.

- We sought submissions from parties on whether we should extend time based on the circumstances on which the application was based and on the circumstances raised by our further enquiries in relation to OCP's reliance on section 609(1).

- At the point in time we indicated to parties that we were considering a declaration in relation to the Secured Shares,34 in addition to the December Acquisition Shares, we determined that the 'circumstance' that was relevant for purposes of section 657C(3)(a) was the entry into the Secured Lending Arrangement being when the security interest was taken or acquired.35

- We decided to extend time to make the application to the date it was made.

- Given the security interest was created approximately two years ago, we considered carefully the principle that the discretion to extend time should not be exercised lightly. However, the security interest was well over 20% and had only been disclosed within the two month period. We also considered, in light of the potential control effect of the stake and the potential consequences of our decision on the non-traditional secured credit market, that it was appropriate for us to consider whether the entry into the security interest gave rise to unacceptable circumstances.

- Ultimately, our declaration did not extend to the Secured Shares. Our extension of time clearly covered the December Acquisitions. If however we had not extended time for the creation of the security interest, we would have extended time for purposes of the December Acquisitions. Again, the control effect of the December Acquisitions in the circumstances was serious and an essential matter supporting the Applicants' case, being the enforcement of the security interest, only arose during the two months preceding the application.

Decision

Declaration

- It appears to us that the circumstances in relation to the December Acquisitions are unacceptable:

- having regard to the effect that we are satisfied they have had, are having, will have or are likely to have on:

- the control, or potential control, of Donaco or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Donaco

- in the alternative, having regard to the purposes of Chapter 6 set out in section 602.

- having regard to the effect that we are satisfied they have had, are having, will have or are likely to have on:

- Accordingly, we made the declaration set out in Annexure A and consider that it is not against the public interest to do so. We had regard to the matters in section 657A(3).

Orders

- Following the declaration, we made the final orders set out in Annexure B. We were not asked to, and did not, make any costs orders. Under section 657D the Panel's power to make orders is very wide. The Panel is empowered to make 'any order'36 if 4 tests are met:

- it has made a declaration under section 657A. This was done on 6 May 2019.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. We are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 1 May 2019. The Applicants, Donaco, OCP and ASIC each made submissions and the Applicants, OCP and ASIC each made rebuttals.

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons. The orders do this by vesting the December Acquisition Shares with ASIC.

- Our proposed orders provided for the December Acquisition Shares to be sold within 3 months from the date of the appointed seller's engagement. ASIC submitted that a longer period may be appropriate given that at the same time that the sale is taking place, the Receivers may be seeking to sell the Secured Shares. No parties expressed a view on the period for sale so we extended the period to 6 months.

- The orders restrain OCP from exercising any voting rights attached to the December Acquisition Shares and ASIC (or the Commonwealth) has no obligation to vote those shares.

- Our orders also include a six month standstill on the ability for OCP or its associates to rely on the exemption in item 9 of section 611 which provides time for the market to digest the circumstances before OCP can make any further acquisitions.

- Given the potential sale of the Secured Shares by the Receivers at the same time as the divestment, we included a liberty to apply clause in our orders to make it clear that a party may seek a variation of orders from us if circumstances require.37

- Upon the making of our declaration and orders, the undertakings provided to us by the Potential Placee and OCP are no longer effective.

John O'Sullivan

President of the sitting Panel

Decision dated 6 May 2019

Reasons given to parties 6 June 2019

Reasons published 13 June 2019

Advisers

| Party | Advisers |

|---|---|

| Applicants | Clayton Utz |

| Donaco | Addisons |

| OCP | White & Case |

| Potential Placee | King & Wood Mallesons |

| Mr James Spenceley | Gilbert & Tobin |

1 All statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapters 6 to 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 References to any Debt Document means such document as amended

3 The number of Donaco shares was calculated by dividing the U.S. dollar amount by the option exercise price which was in Australian dollars

4 At the time of entry, the security interest was over approximately US$100m worth of Donaco shares

5 Mr Joey Lim's employment as an executive was terminated on 19 March 2019

6 The shareholders of the entity work for the same firm as one of the Receivers. No submissions were made about this apparent oddity and so we did not consider it further

7 On 17 December 2018, the OCP Group gave a Notice of initial substantial holder disclosing a relevant interest and voting power in 7.16% of Donaco. The OCP Group subsequently gave Notices of change of interests of substantial holder on 27 and 31 December 2018 disclosing a relevant interest and voting power in 8.26% and 9.35% of Donaco, respectively. A further acquisition of Donaco shares by OCP on 31 December 2018 (which took its interest to 9.71% on that date) was disclosed in the Notice of change of interests of substantial holder given on 1 March 2019

8 The application referred to the acquisition of Donaco shares in excess of 9.35% based on the OCP Group's substantial holding disclosures (see footnote 7). However, the aggregate on-market acquisitions represented 9.71% of Donaco

9 In fact, after the placement, the aggregate voting power of the alleged associates would be 45.2% on a fully diluted basis

10 See paragraph 25

11 Donaco submitted that its directors, Messrs McGregor and Reichel, were not aware of the debt until OCP's substantial holder notice was given on 1 March 2019. Messrs Joey and Ben Lim, Donaco's other directors at the time, were aware of the debt

12 Noting Donaco's announcement on 4 March 2019 discussing the potential impact of the appointment of the Receivers

13 Earlier defaults in 2018 were resolved by Alpha and OCP amending the Debt Documents

14 Alpha did not respond to a written restructuring proposal from OCP (see paragraph 15) and Mr Joey Lim engaged with OCP only on an intermittent basis

15 In ASIC's view, however, disclosure was required for other reasons – see paragraphs 74 and 78

16 At the time of transfer the minimum exercise price was $0.23 and the closing price of Donaco shares was $0.037

17 Item 6 of section 611 is also focused on when the lender "took or acquired the security interest"

18 See RG 5.75 and RG 5.76

19 As well as the liabilities and obligations of the Grantors under the Option Deed and other Debt Documents

20 Donaco released an ASX announcement on 21 December 2018 stating that it was seeking to appoint new non-executive directors and expressly noted that it was engaging with major shareholders as part of that process

21 [2006] ATP 29

22 There was no material suggesting it was more likely than not that OCP would reach an agreement with Mr Joey Lim

23 See also ASIC RG 193: Notification of directors' interests in securities – listed companies at RG 193.11

24 See RG 193.3

25 See, for example, the Corporations and Markets Advisory Committee (CAMAC) Report on Aspects of Market Integrity, June 2009 regarding whether section 205G captures directors entering into margin loans

26 Referring to ASIC Form 604, Note 6(b), the Corporations Regulations 2001 (Cth), regulation 1.0.04 and ASIC RG 5: Relevant interests and substantial holding notices at RG 5.323—RG 5.324 and Table 12 (under the heading 'Details of relevant interests')

27 The Specific Security Deed restricted the Grantors' dealings with the Secured Shares including on the right to dispose of any of the Secured Shares

28 Noting that the interests were not co-extensive

29 Companies and Securities Advisory Committee, Anomalies in the Takeovers Provisions of the Corporations Law, Discussion Paper (January 1993) page 5

30 Mr Spenceley is a shareholder of Donaco and sought leave from the Panel to become a party to the proceedings which we accepted. Mr Spenceley is also the chairman of Silver Heritage Group Limited (ASX code: SVH), which has a financing arrangement in place with OCP that includes options over SVH shares in favour of OCP

31 See section 657A(2)

32 Referring to Bank of Western Australia Ltd v Ocean Trawlers Pty Ltd (1995) 16 ACSR 501 at 524

33 Referring to Gondwana Resources Limited 02R [2014] ATP 18 at [21]

34 See paragraph 91

35 See Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68 at [75]

36 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

37 Section 657D(3) allows orders to be varied

Annexure A

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Donaco International Limited

Circumstances

- On 5 May 2017, OL Master (Singapore Fund 1) Pte. Limited, a Singapore company (OCP) entered into (among other related documents):

- a Bond Instrument (the Bond Instrument) with Total Alpha Investments Limited, a BVI company (Alpha) and Madison Pacific Trust Limited, a Hong Kong company (the Security Trustee) pursuant to which Alpha issued senior secured bonds in an aggregate principal amount of US$34,285,000 (the Bonds) to OCP and

- an Option Deed (the Option Deed) with Alpha pursuant to which Alpha granted options over a certain number1 of its shares in Donaco International Limited (Donaco) to OCP in consideration of the subscription for the Bonds by OCP.

- On the same day, the Security Trustee (acting as security trustee for and on behalf of OCP) entered into (among other related documents) a Specific Security Deed (the Specific Security Deed) with Alpha and others2 (the Grantors) pursuant to which the Grantors granted security in shares of Donaco held by the Grantors (the Secured Shares) to the Security Trustee for the purpose of securing the liabilities of the Grantors to OCP under the Bonds, the Option Deed and related documents.

- The principal shareholder and sole director of Alpha is Mr Joey Lim. Mr Joey Lim is a director and the former managing director and chief executive officer of Donaco.

- At the time of entry, OCP did not disclose its lending and security arrangements (including the Option Deed and options) with the Grantors.3 None of the Grantors, including Mr Joey Lim, disclosed the lending and security arrangements (including the Option Deed and options).

- On 5 November 2018, Alpha failed to make an interest payment on the Bonds which constituted an event of default under the Bond Instrument.

- Following a fall in the Donaco share price in late November 2018, OCP decided to acquire up to 10% of the shares in Donaco. Prior to purchasing, OCP considered its disclosure obligations including that, once its holding exceeded 5%, it would need to disclose the Option Deed and this would reveal the related lending and security arrangements with the Grantors.

- On 3 December 2018, the Security Trustee requested that Alpha provide top-up shares to maintain the required share collateral value under the Specific Security Deed. Alpha did not do so within the time specified in the Specific Security Deed.

- On 7 December 2018, OCP acquired 4,000,000 shares in Donaco on-market (representing less than 0.5% of Donaco).

- On 12 December 2018, OCP transferred the Option Deed and all options under the Option Deed to an entity4 for US$1.00. Immediately prior to the transfer, the options gave OCP a relevant interest in 4.4% of Donaco.

- Between 13 and 31 December 2018, OCP acquired a further 76,000,000 shares in Donaco on-market taking its relevant interest in Donaco to 9.71%.

- On 31 December 2018, Alpha was required, but failed, to redeem 10% of the aggregate initial principal amount of the Bonds and all amounts accrued and unpaid under the Bonds.

- On 16 January 2019, OCP notified Alpha that certain events of default had occurred in relation to the Bond Instrument and Specific Security Deed, citing specifically the events described in paragraphs 5, 7 and 11.

- While an event of default is continuing, the rights of the Grantors to exercise voting powers in respect of the Secured Shares cease and the Security Trustee is entitled to exercise voting powers in respect of the Secured Shares.

- On 18 January 2019, on the instruction of OCP, the Security Trustee issued a letter of demand on Alpha.

- On 26 February 2019, on the instruction of OCP, the Security Trustee appointed Mr Vincent Pirina as receiver and manager of the secured property. On 27 February 2019, Mr Pirina notified the Grantors of his appointment and the enforcement of the security interest. On 1 March 2019, the Security Trustee appointed Mr Mitchell Mansfield as a joint and several receiver with Mr Pirina (the Receivers) and notified the Grantors of the same.

- As a result of the enforcement of the security, OCP, the Security Trustee and the Receivers obtained a relevant interest in the Secured Shares which represented 27.25% of Donaco.

- On 1 March 2019, OCP5 lodged a Form 604 (Notice of change of interests of substantial holder) disclosing for the first time its security interest and an increase in its relevant interest in Donaco to 37%.

- The Receivers have a broad range of powers under the Specific Security Deed, other related documents and their deed of appointment with respect to the Secured Shares. The Receivers have been mandated to sell the Secured Shares, however, OCP considers that it remains entitled to instruct the Receivers to transfer the Secured Shares to it.

Effect

- At no time between 5 May 2017 and 1 March 2019, was Donaco or any of its directors (other than Mr Joey Lim and his brother), or the market generally, aware of the security or lending arrangements (including the Option Deed and options).

- OCP's acquisitions between 7 and 31 December 2018 of 9.71% in Donaco occurred in circumstances where:

- the market was not aware that OCP had a security interest in 27.25% of Donaco shares held by the Grantors

- the market was not aware that the Grantors were in default under the Bond Instrument and the Specific Security Deed and the Security Trustee had the right to declare all sums owing under the Bond Instrument and the Bonds immediately due and payable

- while the events of default were continuing, the Security Trustee had the right to exercise voting powers of the Secured Shares and

- the transfer of the Option Deed and the options by OCP before it acquired a substantial interest in Donaco had the effect of avoiding disclosure of the Option Deed and in turn the related lending and security arrangements.

- The security and lending arrangements (including the Options Deed and options) and the acquisitions, in the circumstances in which they occurred and in light of the size of the stake in Donaco over which OCP has a security interest, had or were likely to have, an effect on control or potential control of Donaco and the acquisitions did not take place in an efficient, competitive and informed market.

Conclusion

- It appears to the Panel that the circumstances are unacceptable circumstances:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- the control, or potential control, of Donaco or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Donaco

- in the alternative, having regard to the purposes of Chapter 6 set out in section 602.

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Donaco.

Tania Mattei

Counsel

with authority of John O'Sullivan

President of the sitting Panel

Dated 6 May 2019

1 Calculated by dividing a fixed U.S. dollar amount by the option exercise price which was in Australian dollars

2 Slim Twinkle Limited, Convent Fine Limited and Max Union Corporate Development Limited, each a BVI company, and Mr Joey Lim (Keong Yew Lim)

3 Relying on section 609(1). All statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapters 6 to 6C have the meaning given in the relevant Chapter (as modified by ASIC)

4 The shareholders of the entity work for the same firm as one of the Receivers

5 In this paragraph, OCP refers to OCP Asia (Singapore) Pte. Limited and all its related bodies corporate and associates as investment manager of OL Master Limited and OL Master (Singapore Fund 1) Pte. Limited

Annexure B

Corporations Act

Section 657D

Orders

Donaco International Limited

The Panel made a declaration of unacceptable circumstances on 6 May 2019.

The Panel Orders

- The Sale Shares are vested in the Commonwealth on trust for OCP.

- ASIC must:

- sell the Sale Shares in accordance with these orders

- account to OCP for the proceeds of sale, net of the costs, fees and expenses of the sale and any costs, fees and expenses incurred by ASIC and the Commonwealth (if any).

- ASIC must:

- retain an Appointed Seller to conduct the sale and

- instruct the Appointed Seller:

- to use the most appropriate sale method to secure the best available sale price for the Sale Shares that is reasonably available at that time in the context of complying with these orders, including the stipulated timeframe for the sale and the requirement that none of OCP or its associates may acquire, directly or indirectly, any of the Sale Shares and

- to provide to ASIC a statutory declaration that, having made proper inquiries, the Appointed Seller is not aware of any interest, past, present, or prospective which could conflict with the proper performance of the Appointed Seller's functions in relation to the disposal of the Sale Shares

- unless the Appointed Seller sells Sale Shares on market, that it obtain from any prospective purchaser of Sale Shares, a statutory declaration that the prospective purchaser is not associated with OCP or its associates and

- to dispose of all of the Sale Shares within 6 months from the date of its engagement.

- Donaco and OCP must do all things necessary to give effect to these orders, including:

- doing whatever is necessary to ensure that the Commonwealth is registered with title to the Sale Shares in the form approved by ASIC and

- until the Commonwealth is registered, complying with any request by ASIC in relation to the Sale Shares.

- None of OCP or its associates may, directly or indirectly, acquire any of the Sale Shares.

- OCP and its associates must not otherwise dispose of, transfer, charge or vote any Sale Shares.

- None of OCP or its associates may:

- take into account any relevant interest or voting power that any of them had, or have had, in the Sale Shares when calculating the voting power referred to in Item 9(b) of s611 of the Corporations Act 2001 (Cth), of a person six months before an acquisition exempted under Item 9 of s611 or

- rely on Item 9 of s611 earlier than six months after these orders come into effect.

- Nothing in these orders obliges ASIC or the Commonwealth to invest, or ensure interest accrues on, any money held in trust under these orders or exercise any rights (including voting rights) attaching to, or arising as a result of holding, the Sale Shares.

- Orders 1, 2, 3 and 4 come into effect three business days after the date of these orders. All other orders come into effect immediately.

- The parties to these proceedings and ASIC have the liberty to apply for further orders in relation to these orders.

Interpretation

- In these orders the following terms apply.

- Appointed Seller

- an investment bank or stock broker

- ASIC

- Australian Securities and Investments Commission, as agent of the Commonwealth

- Donaco

- Donaco International Limited

- OCP

- OL Master (Singapore Fund 1) Pte. Limited

- on market

- in the ordinary course of trading on Australian Securities Exchange and not by crossing or special crossing

- Sale Shares

- 80,000,000 ordinary shares in the issued capital of Donaco held by OCP

Tania Mattei

Counsel

with authority of John O'Sullivan

President of the sitting Panel

Dated 6 May 2019