[2017] ATP 23

Catchwords

Association – relevant interest – tracing relevant interests – efficient, competitive and informed market – decline to make a declaration

Corporations Act 2001 (Cth) sections 249CA, 602, 606, 608, 609

ASIC Regulatory Guide 128: Collective action by investors

Resource Generation Limited [2015] ATP 12

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | YES | NO | NO | NO |

Introduction

- The Panel, Rod Halstead (sitting President), Christian Johnston and Tara Page, declined to make a declaration of unacceptable circumstances in relation to the affairs of Tap Oil Limited. The application concerned whether the two major shareholders of Tap were associates and whether the identity of those who may have a relevant interest in the Tap shares held by one of those shareholders was properly disclosed. The Panel was not satisfied that the circumstances were unacceptable.

- In these reasons, the following definitions apply.

- Manora Oil Field

- The G1/48 concession in the Gulf of Thailand containing the producing Manora Oil Field

- MP

- MP G1 (Thailand) Limited, a subsidiary of Mubadala

- Mubadala

- Mubadala Development Company PJSC

- NGPL

- Northern Gulf Petroleum Pte Limited, a wholly owned subsidiary of NGP

- NGP

- Northern Gulf Petroleum Holdings Limited

- Risco

- Risco Energy Investments (SEA) Limited

- Tap

- Tap Oil Limited

- Suncastle

- Suncastle Equities Inc

Facts

- Tap is an ASX listed company (ASX code: TAP). Its two major shareholders are:

- Mr Chatchai Yenbamroong, who has a relevant interest in 22.67% of the shares in Tap, holding his interest both directly and indirectly through NGP and

- Risco, and indirectly Suncastle, which have a relevant interest in 22.14% of the shares in Tap.

- Tap's main undertaking is its 30% interest in the Manora Oil Field. The remaining interests in the Manora Oil Field are held by MP (60%) and NGPL (10%).

- Tap has disclosed that:

- NGPL is in dispute with MP regarding NGPL's failure to pay cash calls relating to the Manora Oil Field. As a result, Tap risked being called upon by MP to carry its share of the amount sought by NGPL and

- it has entered into a settlement arrangement with MP, which involved MP releasing Tap from its obligation to contribute its share of the amount owing from NGPL in exchange for Tap agreeing to release MP from any potential claims that Tap may have against them.1

- On 12 September 2017, Mr Yenbamroong and two investors in Suncastle, Mr Dany Subrata and Mr Kindarto Kohar, met in Bali at a social function organised by Mr Kohar. At the function, Mr Yenbamroong, Mr Subrata and Mr Kohar discussed various matters, including their investments in Tap and the Manora Oil Field.

- On 25 September 2017, Mr James Menzies (the Executive Chair of Tap) met with Mr Yenbamroong and Mr Subrata (as a representative of Suncastle). On 27 September 2017, Mr Yenbamroong sent Mr Menzies a WhatsApp message stating, "I'm back in Bangkok. I hope you do understand the rationale of our decision together with Kindarto. For us it's a do or die thing. We need for this to work. Let me know if you want to talk. I'll be in Singapore early next week if you're around".

- On 28 September 2017, Mr Menzies emailed Mr Yenbamroong and Mr Subrata stating his understanding of what was said at the 25 September 2017 meeting. He also stated that he was informed that Mr Yenbamroong and Mr Subrata had met with Mr Kohar (apparently representing Risco's interest in Tap) in Bali earlier in September "at which various options were discussed as to how to recover the cost of your respective equity investments in" Tap and it was decided in effect that Tap's strategy needed to be changed and therefore:

- Tap should put commercial pressure on MP to buy out Tap's interest in the Manora Oil Field by joining forces with NGP/NGPL in its ongoing disputes with MP and

- the board of Tap should be replaced with three directors consisting of "a representative from each of Risco/Kindato & NGP and one new independent director (who has not been identified at this stage)".

- On 3 October 2017, Mr Yenbamroong emailed Mr Menzies,2 responding to Mr Menzies' email above stating, "I believe you have misunderstood what was discussed at the meeting. Further, your email is seeking to convey that NGP and Risco are acting together. This is not the case, NGP has always acted, and will continue to act, independently of Risco".3

- On 4 October 2017, Mr Subrata emailed Mr Menzies (copying Mr Yenbamroong), in response to Mr Menzies' email referred to above, stating, "Risco rejects both your description of its position with respect to its investment in Tap and any suggestion that Risco and NGP are acting together in relation to Tap". He also stated (among other things) that "Risco sees the immediate need to substantially reduce corporate costs and disagrees with Tap engaging in a poorly defined growth strategy" and "Risco is of the view that a Board comprising 3 directors instead of 5 would be more commensurate with a company of its size". Mr Subrata requested that Risco would like the views expressed in his email "shared with the Board and hopes the Board will support them".

- On 10 October 2017, Mr Menzies emailed Mr Subrata in response stating, "The position outlined in your email below [sent on 4 October 2017] has some consistency with my recollection of what you and Chatchai both outlined as what you wanted to see happen with both the composition of the Tap Board and Tap's strategy going forward, although it has been watered down from how it was put to me in Jakarta, I recall you both mentioning that the idea to use TAP, as a listed company, to join forces with NGP in its arbitration efforts came from [Mr Kohar] when [Mr Kohar] meet with Chatchai in Bali in September". Mr Subrata responded by email on the same day stating, "Clearly you and me have different recollections of our meeting in Jakarta".

- At a Tap board meeting on 18 October 2017, the independent directors of Tap requested that the members of the board who represent the interests of Risco and Mr Yenbamroong seek feedback from those shareholders on a proposal – which included the independent directors being replaced with three new independent directors approved by the outgoing independent directors acting reasonably.

- On 23 October 2017, Risco responded to a beneficial tracing notice issued by Tap, stating that Suncastle has a relevant interest in Risco's Tap shares by operation of s608(3) and has received instructions from Mr Subtrata in relation to those shares. On 26 October 2017, Mr Subrata and Suncastle responded to a beneficial tracing notice issued by Tap. Mr Subrata's and Suncastle's responses did not provide Tap with any further information.4

- On 2 November 2017, Mr Tom Soulsby (Risco's nominee on the Tap board) sent an email to his fellow Tap board members and Mr Chris Bath,5 responding to the independent board members' proposal. He stated, among other things, that Risco did not agree "to the stepping down and non-replacement of its nominee director" and proposed a board comprising 4 directors with one nominee from Risco, one nominee from NGP (if required by NGP), one independent director and Mr Bath (subject to his acceptance).

- On 20 November 2017, Mr Soulsby sent an email to the company secretary of Tap and Mr Bath attaching a proposed notice of extraordinary general meeting6 containing resolutions to remove himself, Mr Menzies and Mr Mansell and appoint Mr Chris Newton and Mr Govert van Ek as directors of Tap.

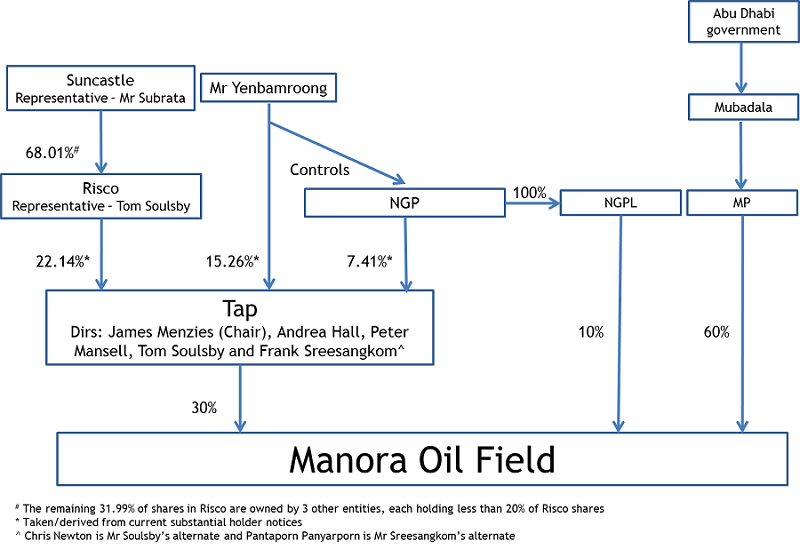

- Relevant relationships between the parties are shown in the following diagram.

Application

Declaration sought

- By application dated 24 November 2017, Tap sought a declaration of unacceptable circumstances. Tap submitted that:

- Mr Kohar and Mr Yenbamroong had entered into a relevant agreement or were otherwise acting in concert for the purposes of controlling or influencing the composition of Tap's board of directors and/or the conduct of Tap's affairs, giving rise to an association and an acquisition of a relevant interest in each other's shareholdings in Tap and

- each of Risco and Suncastle had failed to comply with the substantial holding provisions in failing to disclose the relevant interest and/or voting power that Tap submitted that Mr Kohar has in the Tap shares held by Risco.

- Tap submitted that the effect of the circumstances was that Tap shareholders were not:

- aware of any acquisition of control in Tap and have not been given any opportunity to participate in the benefits that would ordinarily be payable when control is acquired and

- informed that Mr Kohar was the person who controlled Risco's shareholding in Tap.

- Tap provided a statutory declaration from Mr Menzies with details of his interactions with Mr Yenbamroong and representatives of Risco and Suncastle, including his account of the meeting on 25 September 2017 in Jakarta (see paragraph 7).

Interim orders sought

- Tap sought interim orders to the effect that Risco disclose the interests of the ultimate controller of its Tap shares and that Tap's major shareholders disclose their association and be restrained from exercising their voting rights in Tap in respect of director change resolutions.

Final orders sought

- Tap sought final orders to the effect that:

- Mr Kohar and Mr Yenbamroong lodge corrective substantial holder notices disclosing their association

- shares in which Mr Kohar and Mr Yenbamroong have relevant interests in total exceeding 20% be vested in ASIC and

- Mr Kohar and Mr Yenbamroong and their associates be restrained from exercising any voting rights on any resolutions to remove or appoint directors at any general meeting of Tap shareholders until the ongoing disputes between NGP/NGPL and MP have been resolved.

Discussion

- We have considered all the submissions and rebuttals from parties, but address specifically only those we consider necessary to explain our reasoning.

Decision to conduct proceedings

- Risco made a preliminary submission stating (among other things) that:

- "the Panel should prefer the written correspondence provided on behalf of Risco over one person's recollection of what another person said at a face to face meeting, at which there can be differing interpretations or recollections of what was said, including linguistic or cultural differences between the parties who were present, that may contribute to misunderstanding" and

- Tap admitted in its application that its best evidence was the WhatsApp message from Mr Yenbamroong to Mr Menzies (described in paragraph 7). However it was only a message from one of the alleged associates and was "insufficient to establish any meeting of the minds that Risco (or persons with an alleged interest in Risco or its shareholding in Tap) is alleged to have had with" Mr Yenbamroong.

- Risco provided a statutory declaration from Mr Soulsby, submitting that:

- on no occasion had he said words to the effect attributed to him in Mr Menzies' statutory declaration that Mr Kohar was the major investor behind Risco's holding of Tap shares

- Mr Kohar "does not control Risco within the meaning of section 608(4)" and

- Mr Kohar "does not have a relevant interest in Risco's shares in Tap within the meaning of sections 608 and 609".

- We were concerned that interactions between Mr Yenbamroong, representatives of Risco and Mr Menzies, which were referred to in Mr Menzies' affidavit, may suggest that two shareholders with over 20% in Tap have become associated and potentially have acquired a relevant interest in each other's shares in contravention of s606. We recognise it is often important for shareholders of a company to meet with each other to discuss issues of common concern. ASIC also recognises the value of these activities in promoting good corporate governance.7 However shareholders holding collectively shares in a company over 40% could potentially take control of that company if they acted together, contrary to s602 principles. We consider it is important for the Panel to examine allegations of such behaviour, which appear on the material provided to be credible. In addition, Mr Soulsby's statutory declaration did not definitively say that Mr Kohar did not have voting power in Risco's Tap shares.

- Therefore, we decided to conduct proceedings.

Association

- In response to the brief we received a notarised declaration from Mr Yenbamroong and an affidavit from Mr Subrata both of which rebutted aspects of Mr Menzies' statutory declaration. Mr Yenbamroong's statement declared that Mr Subrata had put forward a proposal to Mr Menzies at the 25 September 2017 meeting, part of which was to the effect that "there may be merit in seeking a buy-out of Tap's interest" by MP. Mr Subrata's affidavit deposed that he said that while Mr Yenbamroong had alluded to a strategy of Tap and NGP/NGPL joining forces in relation to the latter's dispute with MP, he "did not provide explicit support other than mentioning words to the effect that Tap should keep an open mind in relation to its relationship with" MP.

- Mr Yenbamroong and Mr Subrata also gave separate accounts of the discussion involving themselves and Mr Kohar in Bali on 12 September 2017. Both stated that they met at a social function organised by Mr Kohar. Mr Yenbamroong stated that while he raised his dispute with MP, they did "not discuss any proposals in relation to the board of Tap or any potential revision of Tap's strategy". Mr Subrata also stated that Mr Yenbamroong had "briefly alluded" to his dispute with MP and he and Mr Yenbamroong had both expressed concern in relation to the "limited economic life" of the Manora Oil Field.

- We consider that Mr Yenbamroong's and Mr Subrata's accounts of the events on 12 September and 25 September 2017 may suggest some concurrence of views but not an association between Mr Yenbamroong/NGP and Mr Kohar (or Risco or Suncastle or any other representative of Risco and Suncastle). Mr Menzies' statutory declaration goes further and would support a conclusion that the above mentioned parties had formed an understanding between them as to a common purpose or object, namely a change of Tap's board and strategy.8 We have insufficient material to conclude that Mr Menzies' account should be preferred over the accounts of Mr Yenbamroong and Mr Subrata. We also do not consider that the WhatsApp message from Mr Yenbamroong (see paragraph 7) provides us with sufficient material to conclude there was an association between Mr Yenbamroong/NGP and Mr Kohar (or Risco or Suncastle or any other representative of Risco and Suncastle).

Controller of Risco's shareholding in Tap

- Tap submitted that Risco was ultimately controlled by Mr Kohar and that Mr Kohar therefore controlled Risco's shareholding in Tap.

- Mr Subrata, in our view, was best placed in these proceedings (due to his role as representative of Suncastle) to provide evidence regarding Suncastle's ownership and the impact of that ownership on substantial holdings in Tap. Mr Subrata deposed that the equity in Suncastle is owned by 7 individuals:

- Mr Subrata (██%)

- Mr Kohar (██%)

- ████ (0.5%) and

- 4 other unrelated individual investors,

- Mr Subrata deposed that Mr Kohar did not have voting power in Risco's shares in Tap because Mr Kohar was not an associate of Suncastle or any other investor in Suncastle and, as such, his voting power in Suncastle was less than 20%. Mr Subrata also deposed that Suncastle was not under the control of a single person.

- In response to our brief question in relation to his role, Mr Subrata deposed that he does not advise or represent Mr Kohar but does represent Suncastle "from time-to-time on material issues concerning the investors' interests in Suncastle". He deposed that he does so by canvassing the views of the other investors generally over the telephone, seeking to find a consensus view. If "a consensus view cannot be reached" he acts "on the directions of the majority of Suncastle's investors".

- We consider that it was unclear from the materials submitted whether there has been sufficient disclosure of the persons (including shareholders in Suncastle) who may have a relevant interest in Risco's shareholding in Tap. We have some concerns about Mr Subrata's statements, which in our view raises the question of whether he is acting in concert with each of the investors of Suncastle in relation to Risco's shareholding in Tap. Further there was material to suggest that both Mr Subrata and Mr Yenbamroong conferred with Mr Kohar in relation to Tap.

- However we consider that it is not desirable in the circumstances to continue making enquiries solely to determine this issue, ██████████████████████████████████. We note that ASIC has oversight in relation to compliance with Chapter 6C.

Decision

- For the reasons above, we declined to make a declaration of unacceptable circumstances. We consider that it is not against the public interest to decline to make a declaration and we had regard to the matters in s657A(3).

Orders

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Mr Rod Halstead

President of the sitting Panel

Decision dated 12 December 2017

Reasons given to parties 15 December 2017

Reasons published 20 December 2017

Advisers

| Party | Advisers |

|---|---|

|

Tap Oil Limited |

Corrs Chambers Westgarth |

|

Risco Energy Investments (SEA) Limited |

Jones Day |

|

Mr Chatchai Yenbamroong and Northern Gulf Petroleum Holdings Limited |

Steinepreis Paganin |

|

Suncastle Equities Inc and Dany Subrata |

Sundaraj & Co |

1 - Tap announcement to ASX dated 23 November 2017, attached letter from the non-aligned directors of Tap

2 - Copying someone who appears to be a representative of NGP

3 - Mr Yenbamroong sent a subsequent WhatsApp message to Mr Menzies on 7 October 2017 stating "The content of my reply to your email is very clear. NGP is not aware of the actions taken by Risco and the contents of Dany's email are his own personal views"

4 - Neither Mr Subtrata's nor Suncastle's responses disclosed information regarding any persons who have given them instructions in relation to the acquisition, disposal, exercise of voting or other rights, or any other matter relating to Risco's shares in Tap

5 - The General Manager and Chief Financial Officer of Tap

6 - Which he was calling as a director of Tap in accordance with s249CA. Unless otherwise specified, all statutory references are to the Corporations Act 2001 (Cth) (as modified by ASIC) and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter

7 - ASIC Regulatory Guide 128: Collective action by investors, at [128.41]; Resource Generation Limited [2015] ATP 12 at [103] and [106]

8 - See Resource Generation Limited [2015] ATP 12 at [97]