[2016] ATP 12

Catchwords:

Association – association hurdle – agreement, arrangement or understanding – acting in concert – common directors - rights issue – shortfall allocation – substantial holder notices – family relationships – vesting in Commonwealth – disclosure of association

Corporations Act 2001 (Cth), sections 12, 602, 606, 608(2), 657A, 657D, 671B

Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68, Queensland North Australia Pty Ltd v Takeovers Panel [2014] FCA 591, Re BCD Resources (Operations) NL (ACN 000 679 023) (subject to a deed of company arrangement) and Others (2014) 100 ACSR 450, Tinkerbell Enterprises Pty Limited as Trustee for The Leanne Catelan Trust v Takeovers Panel [2012] FCA 1272, Weaver and Others (in their capacity as joint and several deed administrators of Midwest Vanadium Pty Ltd) v Noble Resources Ltd (2010) 79 ACSR 237, Attorney-General (Cth) v Alinta Limited [2008] HCA 2, Gjergja v Cooper [1987] VR 167, Re Rossfield Group Operations Pty Ltd [1981] Qd R 372

Guidance Note 4: Remedies General

Ford, Austin and Ramsay’s Principles of Corporations Law, Lexis Nexis, Vol 3 para [23.050]

Ainsworth Game Technology Limited 01 and 02 [2016] ATP 9, Affinity Education Group Limited [2015] ATP 9, Richfield International Limited [2015] ATP 4, Dragon Mining Limited [2014] ATP 5, Avalon Minerals Limited [2013] ATP 11, World Oil Resources Limited [2013] ATP 1, CMI Limited 01R [2011] ATP 5, CMI Limited [2011] ATP 4, Viento Group Limited [2011] ATP 1, Powerlan Limited [2010] ATP 2, DataDot Technology Limited [2009] ATP 13, Mount Gibson Iron Limited [2008] ATP 4, Orion Telecommunications Ltd [2006] ATP 23, Dromana Estate Limited 01R [2006] ATP 8, Austral Coal Limited 03 [2005] ATP 14, LV Living Limited [2005] ATP 5

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| Yes | No | Yes | Yes | Yes | No |

Introduction

- The Panel, Karen Evans-Cullen (sitting President), Karen Phin and Sharon Warburton, made a declaration of unacceptable circumstances in relation to the affairs of Sovereign Gold Company Limited. The application concerned possible associations between persons connected with the current directors of Sovereign Gold. The Panel considered that the current directors of Sovereign Gold are associated with each other and another company (in which they are the sole directors) and contravened s606 and the substantial holder notice provisions. The Panel made a declaration of unacceptable circumstances and made orders including divestment of Sovereign Gold shares and disclosure.

- In these reasons, the following definitions apply.

- Alissa Bella

- Alissa Bella Pty Ltd

- Applabs

- Applabs Technologies Limited (ASX:ALA)

- Applicant

- Mr Brennan Westworth

- Glovac

- Mr Patrick Glovac

- GTT

- GTT Ventures Pty Ltd

- Hudson Corporate

- Hudson Corporate Ltd

- Hudson Resources

- Hudson Resources Ltd

- Mounts Bay

- Mounts Bay Investments Pty Ltd

- Murdoch Capital

- Murdoch Capital Pty Ltd

- Syracuse Capital

- Syracuse Capital Pty Ltd

- Sovereign Gold

- Sovereign Gold Company Limited

- Tassone

- Mr Rocco Tassone

- Thomas

- Mr Charles Thomas

Facts

- Sovereign Gold is an ASX listed company (ASX code: SOC).

- On 18 May 2015, Sovereign Gold announced a non-renounceable 1 for 1 rights issue at $0.002 per share to raise approximately $790,000 (approximately 397 million shares). The rights issue was originally not underwritten.

- On 29 June 2015, Sovereign Gold announced that GTT had agreed to partly underwrite the rights issue (with the right for GTT to nominate 2 directors). Glovac, Tassone and Thomas are the directors and founding partners of GTT. On 8 July 2015, Sovereign Gold announced that there had been a placement of further shares to GTT. On 15 July 2015, Sovereign Gold announced that Tassone and Thomas had been appointed to its board as nominee directors of GTT.

- On or about 9 December 2015, Hudson Resources sold 100 million Sovereign Gold shares to clients of GTT and lodged a notice of ceasing to be a substantial holder.

- On 14 December 2015, Sovereign Gold announced that Glovac had been appointed to its board.

- On 1 April 2016, Sovereign Gold announced that it would undertake a 2 for 5 non-renounceable rights issue.

- On 8 April 2016, Hudson Resources nominated a person to be appointed to the board of Sovereign Gold to be put to shareholders at the company's annual general meeting. On 11 April 2016, RafflesCo Limited also nominated a person to be appointed to the board of Sovereign Gold. Both nominations were later withdrawn.

- On 12 April 2016, Chia Park Alpacas Pty Ltd (a Sovereign Gold shareholder) nominated the Applicant to the board of Sovereign Gold to be put to shareholders at the company's annual general meeting.

- On 31 May 2016, Sovereign Gold held its annual general meeting. Glovac, Tassone and Thomas were re-elected to the board. The Applicant was not elected.

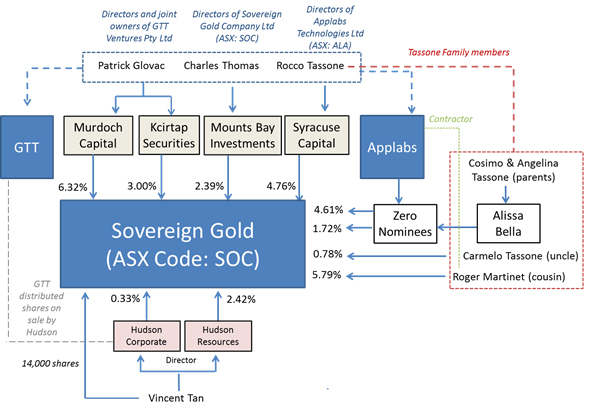

- Shareholdings in Sovereign Gold and various relationships between the parties are set out in the diagram below.

Application

Declaration sought

- On 9 June 2016, the Applicant made an application to the Panel. The Applicant submitted (among other things) that:

- Vincent Tan is the controller of the Hudson group of companies.

- Vincent Tan is associated with the former directors of Sovereign Gold because (among other things) the former board entered into a number of transactions with the Hudson group of companies1 which were uncommercial.

- Vincent Tan is associated with GTT because of (among other things) the circumstances surrounding of the sale of Sovereign Gold shares to clients of GTT and Vincent Tan deciding to withdraw nominations to the Sovereign Gold board following the sale.

- Glovac, Tassone and Thomas (directors of GTT and Sovereign Gold) currently holding in aggregate 16.47%2 of Sovereign Gold, are associated.

- Applabs (currently holding 4.61% of Sovereign Gold) is associated with Tassone, Thomas and Glovac. Tassone, Thomas and Glovac are currently the sole directors of Applabs.

- Glovac, Tassone and Thomas are also associated with Tassone's:

- parents, Cosimo Tassone and Angelina Tassone, (Alissa Bella Pty Ltd - currently holding 1.72%)

- relative, Carmelo Tassone3 (currently holding 0.78%)

- Glovac, Tassone and Thomas are also associated with Roger Martinet (currently holding 5.79%) because of business connections. Roger Martinet was also given approximately 5 times his entitlement to shortfall under the 2016 rights issue and

- Glovac, Tassone and Thomas are also associated with Byron Schammer (holding 1.37%), Chris Ntoumenopoulos (holding 4.65%) and Duncan Relf (holding 1.87%) because of business connections and, in the case of Ntoumenopoulos and Relf, a school connection with Thomas.

- The Applicant submitted that the above alleged associations have resulted in contraventions of s606 and the substantial holder notice provisions. The Applicant also submitted that the acquisition of approximately 300 million shares by GTT and/or its alleged associates following the 2015 rights issue is contrary to the principles in s602.

Interim order sought

- The Applicant sought an interim order to the effect that the persons he submitted were associates be restrained from selling their shares or converting options pending determination of his application. The Panel President urgently considered the request for an interim order.4 She considered the strength of the evidence (on the material provided in the application) and the number of potential persons affected by the interim order and decided not to make an interim order.

- After considering the application and ASIC's preliminary submission, we decided to make an interim order that persons within the scope of our proceedings must not dispose of, transfer, charge or otherwise deal with their shares in Sovereign Gold (Annexure A). We considered the other parties not to be within the scope of our proceedings for the reasons discussed below.

Final orders sought

- The Applicant sought final orders to the effect that:

- Disclosure be required by the persons referred to in the application "of the extent of their associations" in relation to Sovereign Gold.

- Shares accumulated above the 20% takeovers threshold by GTT and its alleged associates be vested in ASIC.

- The results of the 2016 annual general meeting be set aside and the convening of a new general meeting.

- Costs, "in the order of $100,000".

Discussion

- We have considered all the submissions and rebuttals and other material, but address specifically only those we consider necessary to explain our reasoning.

Association test

- Section 12 sets out the tests for association as they apply to Chapter 6. There are two relevant tests here:

- s12(2)(b) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company's board or conduct of its affairs and

- s12(2)(c) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company's affairs.

- As stated by the Panel in CMI Limited 01R,5 the cases make it clear that there is significant overlap between the concepts of "acting in concert" and "relevant agreement" in s12.

- In Mount Gibson Iron Limited,6 the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

Preliminary submissions

- Sovereign Gold submitted (among other things) that some of the alleged circumstances were out of time and the acquisition of shares by directors from 11 to 15 April 2016 were disclosed as required under the ASX listing rules. Sovereign Gold also submitted that the shortfall under the 2016 rights issue was oversubscribed and the directors gave preference to larger shareholders in distributing the shortfall in accordance with a formula.

- ASIC made a preliminary submission referencing material it had received in the course of its own enquiries. ASIC submitted that Glovac, Tassone and Thomas may be associated with each other, Applabs and various family members of these three individuals and their related entities. ASIC submitted that the Panel should consider (among other things):

- the unusual arrangements surrounding the underwriting and placement of shares by GTT under the rights issue and subsequent sell-down by Hudson Resources, which suggests a broader purpose and intent, including the apparent objective of appointing GTT principals to the board of Sovereign Gold

- that at the time Hudson Resources sold 100 million shares through GTT, there was an agreement between GTT and Hudson Resources that GTT and or its nominees would have first right of refusal to purchase the balance of any Sovereign Gold shares held by Hudson Resources, resulting in GTT (and any associates of GTT that the Panel may find) having voting power in the shares of Sovereign Gold held by Hudson Resources under s608(1)

- GTT had a pattern of allotting shares to the same persons as a result of underwriting arrangements in a number of other ASX listed entities under similar circumstances

- the structural links between Glovac, Tassone, Thomas, Applabs and various other parties who were allotted shares under the 2015 rights issue and subsequent sell-down by Hudson Resources and

- common investments and dealings between Glovac, Tassone and Thomas.

Conducting proceedings

- Mount Gibson Iron Limited7 [2008] ATP 4 the Panel said at [15]:

The Panel's starting point was that it was for Mount Gibson – the applicant - to demonstrate a sufficient body of evidence of association and to convince the Panel as to that association, albeit with proper inferences being drawn.

- The above statement has been referred to in subsequent Panel decisions as the 'association hurdle'.8 The Panel in Dromana Estate Limited 01R acknowledged that "issues of association are notoriously difficult for outsiders to prove since access to the type of evidence needed is rarely available".9 The Panel in Dragon Mining Limited referred to this difficulty and stated:10

In deciding whether to conduct proceedings on an association case, this must be kept in mind. However, the Panel has limited investigatory powers which means, before we decide to conduct proceedings, an applicant must do more than make allegations of association and rely on us to substantiate them. An applicant must persuade us by the evidence it adduces that we should conduct proceedings.

- We also acknowledge the difficulty that outside parties have in providing the material to meet the 'association hurdle'. In association cases, material provided by ASIC can be of great assistance.11 ASIC's preliminary submission in this matter assisted us in considering whether to conduct proceedings and the possible scope of those proceedings, although this application may be a matter in which an ASIC investigation would have been preferable to a Panel inquisitorial hearing.

- We consider there is sufficient material to conduct proceedings in relation to whether any acquisition of shares in Sovereign Gold constituted, or gave rise to, contraventions of s606, the substantial holding provisions or are otherwise unacceptable, as a result of associations among any of Glovac, Tassone, Thomas, GTT, Applabs, Cosimo Tassone, Angelina Tassone, Carmelo Tassone, Roger Martinet, Hudson Resources, Hudson Corporate and any companies controlled by them. This material included, in relation to:

- Glovac, Tassone, Thomas, GTT, Applabs – common directorships, prior collaborative conduct, shared goal and common investments and dealings

- Tassone, Cosimo Tassone, Angelina Tassone, Carmelo Tassone - family relationships and common investments and dealings

- Roger Martinet (with Glovac, Tassone, Thomas and GTT) – possible uncommercial actions and

- Hudson Resources and Hudson Corporate (with Glovac, Tassone, Thomas and GTT) – the circumstances surrounding the sale of Hudson Resources' shares in Sovereign Gold through GTT in December 2015.

- Other possible associations submitted by the Applicant in our view were too tenuous. There was little material to suggest there were associations between Glovac, Tassone and Thomas on the one hand and any of Schammer, Ntoumenopoulos and Relf on the other. The business and school connections were too remote without further evidence. The Applicant's submission that they "are all members of the Perth financial services community and it is reasonable to expect they would have regular contact at events such as conferences" did not sufficiently advance his case. Nor did the other material.

- Also, in our view, the same paucity of material existed in relation to Vincent Tan's (and Sovereign Gold's former directors') possible association with Glovac, Tassone and Thomas.12

- During the course of the proceedings, the Applicant submitted that there were other clients and relatives of Glovac, Tassone and Thomas who were associated with them. There are difficulties in extending our enquiries to consider these potential other possible associates, including providing procedural fairness to these additional parties. In any event insufficient material was provided to justify extending our enquiries to these people.

Preliminary findings

- Having considered the issues raised in the application and submissions and rebuttals, we made preliminary findings in relation to the issue of association and invited comments on them. Our conclusion on the issue of association follows our consideration of the comments made on the preliminary findings as well as the other material supplied to us.

- We considered the cumulative effect of all the material and have drawn inferences that, in our experience, seem appropriate. In doing so we had in mind that we must be satisfied by logical and probative material and the potential seriousness of a finding of association.

- Further, when making an assessment of all the material in this matter we have relied on our skills, knowledge and experience as practitioners (which has been made known to the parties) and as members of the sitting Panel.13

- We have procedural requirements to meet and statutory time constraints in which to make a decision.14 In our view, we have met these.

Glovac, Tassone and Thomas

Shared goal or purpose

- For the reasons discussed below, we consider that Glovac, Tassone and Thomas had a shared goal of achieving control of the board of Sovereign Gold.

- We do not need to decide why they wanted board control. Some of the material suggests that they facilitate the buying and selling of Sovereign Gold shares for themselves and their clients or family. Perhaps board control may be the goal so that they are able to undertake further corporate transactions. This latter reason has some support in the evidence. Soon after Glovac, Tassone and Thomas obtained control of the board, Sovereign Gold undertook a strategic review. On 12 May 2016, Sovereign Gold announced the completion of its strategic review and a potential change of direction for the company involving investment in Lithium projects, seen by the market as a 'hot sector'.

- Tassone submitted that our suggestion "displays a fundamental misunderstanding of how a micro-cap company builds value for shareholders and diversifies risk (project and community)".15 Tassone does not further elaborate and we do not find his submission persuasive.

Structural links

- Glovac, Tassone and Thomas were previously employees at Bell Potter. They are the founding partners and executive directors of GTT. In an email dated 30 April 2015 from Glovac to Simon Bird (then a director of Sovereign Gold), Glovac refers to a number of previous transactions undertaken by GTT and described GTT in the following terms:

GTT has been very active in the space for the past 15 months raising over $20m. Rocco, Charles and myself all spent 10 years at Bell Potter and setup GTT 15 months ago. Our whole model is about providing capital for companies with a goal of working with current Directors and Shareholders to drive value either with the current assets or obviously through a new acquisition…

- We consider that Glovac, Tassone and Thomas work closely together as founding partners and directors of GTT and in the absence of specific disagreement we consider that the acts and wishes of GTT are the acts and wishes of all three of them together. The material discussed below is consistent with this and no material has been provided to indicate, in relation to Sovereign Gold, any disagreement or different position being adopted. GTT does not own any Sovereign Gold shares, but should it have mattered, we would likely have found that GTT is associated with each of Glovac, Tassone and Thomas.

- The following table shows the other common directorships between them:

Company Director Start/end dates Sovereign Gold Tassone

Thomas

Glovac14 Jul 2015

14 Jul 2015

14 Dec 2015Applabs Tassone

Thomas

Glovac15 Oct 2013

9 Dec 2013

9 Dec 2013Mount Adrah Gold Limited

ACN 147 329 833

(wholly owned subsidiary of Sovereign Gold)Tassone

Thomas

Glovac14 Dec 2015

14 Dec 2015

14 Dec 2015XTV Networks Ltd Tassone

Thomas2 Feb 2015

2 Feb 2015D-Inkd Pty Ltd

ACN 157 949 178

(subject to a deregistration application)Tassone

Thomas23 Apr 2012

23 Apr 2012Cirrus Networks Holdings Ltd Thomas

Glovac19 Jun 2014 – 2 Jul 2015

20 Aug 2014RAP Property Developments Pty Ltd

ACN 149 890 942Tassone

Glovac16 Mar 2011

16 Mar 2011Home Open Pty Ltd

ACN 601 031 083

(wholly owned subsidiary of Applabs)Tassone

Glovac1 Aug 2014

1 Aug 2014 - While we recognise that two of the companies are subsidiaries of Sovereign Gold and Applabs respectively (and one is subject to deregistration), we consider that the other common directorships support our view that Glovac, Tassone and Thomas work closely together. We also consider the common directorships between GTT and Applabs are relevant to the question of whether there is an association between Applabs and Glovac, Tassone and Thomas (see below).

Prior collaborative conduct

GTT and Sovereign Gold's 2015 Rights Issue

- The directors of Sovereign Gold as at 30 April 2015 were John Dawkins AO, Simon Bird (managing director), Michael Leu, Bruce Dennis and Jacob Rebek.

- On 30 April 2015, Glovac submitted a proposal by email to Simon Bird for GTT or its nominees to underwrite a placement of Sovereign Gold shares to raise $1 million subject to shareholder approval. Tassone and Thomas were copied on the email and the email refers to a previous meeting. The email states that following the placement Sovereign Gold's market capitalisation would be $1.8 million. It would appear from these figures that the placement would be for an interest in more than 50% of Sovereign Gold and that may be why shareholder approval was necessary.

- The proposal included the right of GTT to nominate one director to the board and for "GTT to be mandated on a corporate services agreement immediately after settlement of placement at $2k per month to undertake investor and media relations". Glovac also states in the email:

As mentioned in the meeting we are not interested in getting involved in any director or shareholder disputes. We are happy to work with existing directors and shareholders. If Hudson and Co want to exit we would certainly look to buy them out above current market prices. Also if they want to participate in the placement or the RBS guys want to get further involved we have no issues. We just prefer everyone is upfront and on the same page with the plan going forward otherwise we won't get involved.

- It unclear from this proposal whether GTT proposed it would obtain a substantial interest in Sovereign Gold. If it was GTT's plan to disperse its underwriting commitment, it seems unusual that Glovac would be seeking board representation. Thomas submitted that it was clear from the email that "GTT was not seeking to control or influence the composition of the Board of Sovereign Gold as GTT was seeking to work cooperatively with the existing directors of the company". We consider that while Glovac may have wanted to demonstrate a willingness to work with the existing board, he also shows, at this early stage, interest in wanting influence on the board. This is supported by his willingness for GTT to buy out the Hudson companies' substantial holding in Sovereign Gold.

- GTT's placement proposal does not seem to have been progressed and on 18 May 2015, Sovereign Gold announced its then non-underwritten non-renounceable 1 for 1 rights issue.

- On 14 June 2015 Tassone put another proposal to Simon Bird (by email, copied to Thomas) to underwrite Sovereign Gold's rights issue "to the value of $500k @ 0.02c" and an option for GTT and/or its nominees for "the option and first right of refusal to undertake a further placement to $1m post the completion of the rights issue". Tassone stated that "GTT Ventures is keen to be the group to inject fresh blood into" Sovereign Gold and suggested the following terms in relation to Sovereign Gold's board:

- GTT "to nominate two directors to the board of SOC immediately after settlement of the rights issue"

- "Simon Bird to remain a Director of SOC for at least 3 months" and

- "All other directors will resign from the SOC board immediately after settlement of the rights issue".

- Tassone's proposal here was for the board to be changed so that the majority of the board (2 out of 3) are nominated by Glovac, Tassone and Thomas. We consider it unusual that Tassone would expect such a level of board control when GTT is proposing to underwrite a rights issue and potentially undertake a placement. Tassone submitted that he was of the view that an appropriately sized board for a micro-cap company would comprise three directors. This may be so but it does not in our view explain why he wanted 2 of the 3 directors to be nominated by GTT. This email supports our inference that Glovac, Tassone and Thomas had a shared goal of achieving control of the board of Sovereign Gold.

- Tassone's proposal in relation to board changes was not initially accepted by Sovereign Gold and there were negotiations between GTT and Sovereign Gold on this issue. On 15 June 2015, Simon Bird responds to Tassone's email (copied to Thomas and Benjamin Amzalak, who we assume provided corporate services to Sovereign Gold) suggesting instead that GTT nominees replace two existing directors on Sovereign Gold's board and that all "other board changes to be reviewed after the placement".

- Tassone responds to Simon Bird on 15 June 2015 (copied to Thomas and Benjamin Amzalak) stating that he is working on an underwriting agreement and he "just got off the phone with Patrick and Charles and they would like the following changes", which involved GTT nominees replacing 2 current Sovereign Gold directors, John Dawkins resigning following the rights issue, Michael Leu resigning as a director but staying with Sovereign Gold as a geologist and Simon Bird remaining as a director for at least three months. Tassone states in the email "The point on John Dawkins pre or post the placement we would like to have a clean board and direction immediately following the rights issue". We consider that the statements in this email, in particular the reference by Tassone to his discussions with Glovac and Thomas and the use of the word "we", supports our inference that Glovac, Tassone and Thomas had a shared goal of achieving control of the board of Sovereign Gold.

- In the course of their negotiations Sovereign Gold and GTT agree to change the Sovereign Gold board so that initially 2 out 5 directors would be nominated by GTT. For example, on 16 June 2015, Tassone sent an email to Simon Bird, reflecting Simon's position on board positions, in other words GTT would nominate two persons to replace two directors to the board immediately after settlement of the rights issue, Simon to remain a director for at least 3 months and other board changes to be reviewed after the placement. While the concessions made by GTT at this stage regarding board composition may have been a setback, we consider that subsequent events show that they retained their goal of achieving control of the board of Sovereign Gold.

- On 23 June 2015 at 8.15am, Thomas stated in an email to Tassone in relation to a draft underwriting agreement:

A few points there is no mention of board appointments and resignations. There is also no mention of the shortfall placement if we do not receive our full entitlement so we will need a separate letter outlining this.

Also there is no mention of being sole underwriter in this document so they could appoint someone else to co underwrite which we obviously don't want.

- Later that morning Tassone emailed Sovereign Gold's then lawyers, stating that the draft underwriting agreement was missing the following points:

- GTT "is the sole underwriter to the rights issue shortfall"

- The Underwriter may participate in a placement at the same price of the rights issue ($0.002 per share) should the rights issue shortfall be less than $600,000"

- "The combined Underwriting and placement will not exceed $600,000 unless agreed otherwise by the Board of Directors" and

- "The Underwriter will immediately [upon] receipt of funds replace and appoint 2 nominees to the Board of Directors".

- Given the timing and similarity of subject matter, we infer from Thomas and Tassone's emails on 23 June that they were of one mind on the question of board composition of Sovereign Gold.

- In addition, Thomas and Tassone's concern to guarantee a minimum amount of shortfall is not in our experience typical of a commercial underwriter. We infer that this shows a desire to place more shares in friendly hands. Glovac submitted that instead GTT's desire was explained by its confidence in Sovereign Gold shares and it is not uncommon or unusual for an underwriter to want access to shares it is underwriting. We disagree; a commercial underwriter's interest is usually to lay off the risk of holding shares.16 In addition, Tassone continued to show an interest in ensuring GTT received a guaranteed shortfall (see below).

- In response to a question in the Panel brief about what discussions Glovac, Tassone and Thomas had with each other in relation to the composition of the board of Sovereign Gold, Thomas submitted that in his capacity as a director of GTT he discussed with Tassone and Glovac GTT's right "in connection with the underwriting agreement with Sovereign Gold to appoint two directors to the Board of Sovereign Gold" and it was verbally decided that GTT would nominate Tassone and Thomas "to the board of Sovereign Gold, being a minority of two of the five directors of Sovereign Gold at the time". Tassone submitted in response to the same question that he "participated in verbal discussions with Glovac and Thomas (in their capacities as directors of GTT) regarding the changes to the board of Sovereign Gold in connection with the underwriting of the 2015 Rights Issue. Tassone is not in possession of any written documentation to evidence such discussions". While we would have expected more specificity and detail in Tassone and Thomas' description of their discussions, we consider that the fact that they had such discussions nevertheless supports our inference that Glovac, Thomas and Tassone had a shared goal of achieving control of the board of Sovereign Gold.

- In response to the same question in the brief in relation to the appointment of Tassone and Thomas to the Sovereign Gold board, Glovac only referred to an email he sent to them on 19 June 2015 where he in effect congratulated Tassone and Thomas on their appointments and stated, "no doubt we will find some new interesting skeletons". Tassone and Thomas' submissions suggest that there were other discussions between them. Accordingly, we are prepared to infer Glovac was involved in more discussions with Tassone and Thomas given his initial approach to Sovereign Gold on 30 April 2015 and Tassone's reference to a discussion with Glovac and Thomas in his 15 June email to Simon Bird. Also, the use of the word "we" is consistent with our inference that Glovac, Tassone and Thomas together had a shared goal of achieving control of the board of Sovereign Gold.

- On 6 July 2015 there is a series of email communications regarding allocation of the rights issue shortfall. Tassone emailed Simon Bird and Benjamin Amzalak (copying in Thomas), seeking confirmation that Sovereign Gold would not accept the $58,630.75 of applications for shortfall under the rights issue. There is also email correspondence between Tassone and Thomas on the question. On 6 July 2015, Benjamin Amzalek proposes a compromise that the applications for shortfall shares be accepted and GTT receives a $60,000 placement in addition to its existing $600,000 shortfall entitlement. This is accepted by Tassone.

- On 8 July 2015, Sovereign Gold announces the allocation of shares under the rights issue and placement. Through the underwriting and placement GTT allocated 330 million Sovereign Gold shares (to raise $660,000) to a number of its clients.

- Again, we consider that Tassone's initial insistence that shortfall applications not be processed and the subsequent negotiations are not consistent with the typical actions of a commercial underwriter. We infer that this shows a desire to place more shares in friendly hands.

- On 15 July 2015, Sovereign Gold announced that Tassone and Thomas had been appointed to the Sovereign Gold board and Bruce Dennis and Jacob Rebek had resigned. The board of Sovereign Gold therefore comprised Thomas, Tassone, John Dawkins, Simon Bird and Michael Leu.

December 2015 - GTT's involvement in the sale of 100 million Sovereign Gold shares held by Hudson Resources

- On or about 3 December 2015, Tassone and Benjamin Amzalak corresponded by email in relation to GTT acquiring some of Hudson Resources' shares in Sovereign Gold. The proposed terms included:

- GTT to purchase 100 million Sovereign Gold shares held by Hudson Resources at $0.003 for $300,000

- GTT to receive a fee of 6% plus GST

- Hudson Corporate to provide corporate services until 30 June 2016 at $10,000 per month

- resignation of John Dawkins from the Sovereign Gold board "to be announced on the 9th and take effect on 15th Dec"

- "Charles to be appointed Chairman"

- Simon Bird "to step down and will be paid out his contract to Feb 2016"

- "Michael Leu to become Chief Geologist and step down from his role as Director" and

- "GTT Ventures and or its nominees will have first right of refusal to purchase the balance of any SOC shares held by Hudson prior to any disposal".

- Those terms in relation to the Sovereign Gold board are similar to Tassone's proposed terms in his earlier email dated 14 June 2015. In subsequent email correspondence, Tassone and Vincent Tan agree to these terms, at least as those terms relate to board appointments.

- During this time there appeared to be some consideration of appointing a new managing director for Sovereign Gold. On 4 December 2015, Tassone emailed Amzalak asking "Also, Andrew Haythorpe cannot start until next year, will that be an issue if we put Patrick Glovac in as NE, Charles Thomas NE and myself as caretaker MD?". Amzalak replies stating "Unless u want to keep Simon on until Andrew is ready. I thought you wanted Charles as Chairman? Your call your company you decide!!!!! Pressure !!!!!". Tassone replied specifying the following board composition:

Rocco Tassone – MD

Charles Thomas – Chairman and NED

Patrick Glovac – NED. - We read this email correspondence as confirmation of roles on the board for Tassone and Thomas given they are already on the board of Sovereign Gold. We also consider that Amzalak's comment "your company you decide" is recognition from him that this transaction involved the passing of board control to GTT interests.

- On 7 December 2015, 100 million Sovereign Gold shares held by Hudson Resources were sold through GTT to its clients.

- On 14 December 2015, Sovereign Gold announced the appointment of Glovac to Sovereign Gold's board and the retirement of John Dawkins and Michael Leu. On 1 March 2016, Sovereign Gold announced that Simon Bird had retired from the Sovereign Gold board. He was not replaced nor was a new managing director appointed. Sovereign Gold's board since 14 December 2015 comprises Glovac, Tassone and Thomas.

- This position is effectively what Tassone originally wanted in his proposal put to Simon Bird on 14 June 2015. We infer that Glovac, Tassone and Thomas' continuing intention to achieve board control of Sovereign Gold came to fruition with this deal.

- Glovac submitted that the only communication he had on the subject of his board appointment was an email he sent to Tassone and Sovereign Gold's company secretary "attaching his consent to act, CV and biography". Thomas submitted in effect that the only discussion he had in relation to the composition of the board at this time was during board meetings at Sovereign Gold. Tassone submitted that he was likely to have had conversations with Glovac (in his capacity as an incoming director of Sovereign Gold) and Thomas (in his capacity as an existing director of Sovereign Gold) regarding Glovac's appointment but he was not in possession of any written documentation "to evidence such discussions". We were not provided the board minutes referred to.

- We infer that, while they may have had plans to appoint a managing director, the appointment of Glovac was part of a common intention between them to have control of the board of Sovereign Gold. In our view, given Glovac's appointment was part of a well understood plan to replace the board of Sovereign Gold, there was little need for Glovac, Tassone and Thomas to have extensive discussions in relation to Glovac's appointment.

Common investments and dealings

- There is a pattern in GTT allocating Sovereign Gold shares to Glovac, Tassone and Thomas, including:

- issue and sale of shares to Glovac's company (Murdoch Capital) through (i) GTT's dispersal of underwriting shortfall and placement in the 2015 rights issue and (ii) sale of shares held by Hudson Resources

- sale of shares to Thomas' company (Mounts Bay) through the sale of shares held by Hudson Resources and

- sale of shares to Tassone's company (Syracuse Capital) through the sale of shares held by Hudson Resources.

- We consider that the issue of Sovereign Gold shares to Glovac, Tassone and Thomas assisted them, at least to some extent, in negotiating or voting for board positions.

- ASIC also submitted that there was a pattern of conduct of GTT placing shares to companies controlled by Glovac, Tassone and Thomas or members of their families in the following companies:

- Falcon Minerals Limited (ASX: FCN)

- Platypus Minerals Ltd (ASX: PLP) and

- AVZ Minerals Ltd (ASX: AVZ).

- The pattern of issuing shares to themselves and family in Sovereign Gold (and as ASIC submits, other companies) is further evidence that they work closely together.

- There is also a period between 11 April 2016 and 15 April 2016 when Glovac, Tassone and Thomas all acquired shares in Sovereign Gold. We asked Glovac, Tassone and Thomas what discussions they had between them in relation to acquisitions, disposals or transfers of shares in Sovereign Gold by them or their controlled entities. Glovac referred to an email he sent to Sovereign Gold's company secretary (copied to Tassone and Thomas) on 11 April 2016 about whether any directors' trading restriction applied. Thomas also refers to an email sent by Glovac relating to Glovac's acquisition of shares in Sovereign Gold (which could be the same email) and the circulation of directors' interest notices. Tassone submitted that the purpose of his acquisitions "was to increase Syracuse's shareholding in Sovereign Gold at a time when no trading restrictions applied to directors. Tassone does not recall if he discussed with Glovac and Thomas his intention to undertake these Acquisitions".

- ASIC submitted that Glovac, Tassone and Thomas' acquisitions in this period totalled 68,563,801 Sovereign Gold shares and comprised the majority (78.6%) of the total shares traded for Sovereign Gold from 11 to 15 April 2016. We infer that Glovac, Tassone and Thomas' acquisition of shares during this period assisted them in:

- for Glovac and Thomas, increasing their participation in Sovereign Gold's 2016 rights issue, announced on 1 April 2016, noting that they could not participate in any shortfall and

- rebuffing nominations of outsiders to the board of Sovereign Gold, noting that they were aware of nominations received from Hudson Resources on 8 April 2016, RafflesCo Limited on 11 April 2016 and the Applicant on 12 April 2016. We do not know why Hudson sought to have a nominee director rejoin the board but note that it and RafflesCo withdrew their nominations.

- Glovac submitted that it was not uncommon or unusual for investors to buy additional shares prior to a rights issue record date to access a greater entitlement and his acquisitions were consistent with his investment strategy and his confidence in the company. Thomas submitted that "there is nothing unusual or uncommon in directors of a company acquiring or disposing of shares in the company on or around the same time period. This often occurs in accordance with a company's securities trading policy where directors are only permitted to acquire or dispose of securities in the company in certain trading windows permitted by the company". He also submitted that similar acquisitions do not establish that any coordination has taken place, rather it "simply demonstrates that Mr Thomas may have a similar investment strategy to that of Mr Tassone and Mr Glovac".

- We accept that directors are often restricted to trading within a trading window and that shareholders may want to acquire shares to increase their participation in a rights issue. However, given the pattern and extent of buying during this period, in particular at a time coinciding with other parties seeking board representation, we infer that some level of co-ordination did take place to support Glovac, Tassone and Thomas's retaining board control of Sovereign Gold.

Applabs and Glovac, Tassone and Thomas

Shared goal or purpose

- For the reasons below we consider that Applabs was used to further the shared goal of Glovac, Tassone and Thomas – and Applabs had an agreement, arrangement or understanding with Glovac, Tassone and Thomas for the purpose of controlling or influencing the composition of Sovereign Gold's board.

Structural links and common investments and dealings

- The GTT and Applabs' boards have during the relevant period been identical, being Glovac, Tassone and Thomas.

- Thomas submitted that "the fact that Applabs and Sovereign Gold have common directors does not mean those directors are associates of each other", citing Orion Telecommunications Ltd.17 While we accept that common directorships do not necessarily constitute evidence of an association, we agree with the Panel in Orion that "common directorships may, in appropriate circumstances, be a factor which, in combination with other probative material, supports an inference of association".18 The Panel in Orion also cited the principle in Re Rossfield Group Operations Pty Ltd19 - that in the case of two companies with identical boards, the knowledge of one can be assumed to be within the knowledge of the other.20 The Panel noted that common knowledge did not make two companies associates but "common knowledge or intentions may, in some cases, go some way toward establishing an "understanding" constituting a relevant agreement within section 12(2)(b) or a common purpose amounting to acting in concert within section 12(2)(c)".21

- Applabs' initial investment in Sovereign Gold was through GTT's dispersion of Sovereign Gold shares following the 2015 rights issue.22 We consider that submissions from Applabs in relation to this investment (such as "The Applabs Board, being aware of the 2015 Rights Issue, resolved to pursue the investment opportunity.." and "The Board of Applabs verbally informed the Board of GTT of its desire to subscribe under the 2015 Rights Issue") were attempts to create artificial distinctions between Applabs and GTT which did not exist given that the boards are identical. Particularly in relation to the second-quoted submission, while it may be prudent for two companies with identical boards to communicate formally in writing on certain matters, the attempts to distinguish verbal conversations between two identical boards are not credible.

- We consider that Glovac, Tassone and Thomas were aware of the possibility of conflicts between GTT and Applabs because the boards of both companies were identical. For example, the circular resolution by Applabs' directors approving the investment dated 9 July 2015 noted that each director "confirmed their respective interest in GTT is a material personal interest" but that:

- they do not consider the benefits to which GTT will become entitled as a result of the Company's participation in the underwriting of the Rights Issue, including the underwriting fees, to be a material personal interest

- the benefits to which GTT will become entitled under the Rights Issue were negotiated on arms length commercial terms with SOC, and the Company's participation in the Rights Issue is on the same terms as those offered to SOC shareholders

- the benefits to which GTT will become entitled as a result of the underwriting of the Rights Issue are not contingent on the Company's participation in the underwriting of the Rights Issue and

- irrespective of GTT's role in the Rights Issue, the Company's participation in the Rights Issue is a valuable opportunity for the Company.

- Following Applabs' initial investment and prior to Glovac's appointment to the Sovereign Gold board, the Applabs' board verbally appointed Glovac as sole investment decision maker in respect of Applabs' dealings in Sovereign Gold shares because Tassone and Thomas were now on the board of Sovereign Gold. The appointment was subsequently formally ratified by the Applabs' board. All disposals of Sovereign Gold shares by Applabs between 3 August and 30 November 2015 were made by, or at the direction of, Glovac.

- Following the appointment of Glovac to the board of Sovereign Gold, Glovac, Tassone and Thomas noted at an Applabs' board meeting on 18 January 2016 the common directorships between Applabs and Sovereign Gold and, while confirming that they were each "acting independently", resolved to appoint an asset manager to oversee Applabs' Sovereign Gold investments to "create even further independence". Applabs submitted in response to our preliminary findings that the appointment of the asset manager "was implemented and intended to be binding immediately, with a formal agreement to follow the verbal agreement".

- Pursuant to an off-market transfer form dated 1 February 2016, Applabs transferred its shares in Sovereign Gold to Zero Nominees Pty Ltd (a wholly owned subsidiary of Euroz Securities Limited) as bare trustee. In response to an inquiry from ASIC dated 29 April 2016, Steinepreis Paganin on behalf of Tassone submitted that the transfer of Applabs' shares in Sovereign Gold to Zero Nominees Pty Ltd was undertaken "to create a level of independence as between the Applabs shareholding in the Company and our client and his fellow directors in Applabs".

- According to minutes of a board meeting on 6 May 2016, the asset management agreement (AMA) was executed but "on further legal review the current AMA was deemed to not provide any relevance as the SOC Investment was now held by Zero Nominees Pty Ltd through a bare trust and not directly by [Applabs]…It was agreed to not proceed with AMA and terminate the agreement". No acquisitions or disposals of Sovereign Gold shares were made by Applabs when the asset management agreement was said to be in place. While the bare trustee arrangement creates the appearance of independence, the arrangement does not affect control, or whether Glovac, Tassone, Thomas, GTT and Applabs have an understanding or were acting in concert in relation to Sovereign Gold's affairs. We consider that Applabs' actions create a level of apparent independence more than real independence and supports our inference that Applabs was used to further Glovac, Tassone and Thomas' shared goal in relation to control of the board of Sovereign Gold.

- We find it curious that Applabs continued to pursue the AMA for around 3 months after the bare trustee arrangement was in place and, having gone to the effort of finalising the AMA, did not set up a power of attorney with Euroz (or cancel the bare trustee arrangement) in order to effect the asset management arrangement. Applabs submitted in response to our preliminary findings that after "a subsequent preliminary legal review, the board was made aware that the terms of the bare trust could create practical issues for the asset manager and trustee". We were not told what these issues were, and do not understand why any practical issues, to the extent that they exist, could not be dealt with.

- Applabs has not provided a copy of the AMA. We typically would expect an asset manager to have a degree of discretionary capacity in respect of investments. It is telling that they chose not to proceed with this arrangement.

- Applabs submitted that the decision to terminate the AMA was made in light of the expected timetable for completing Applabs' off-market takeover of The Search Party Ltd, at which time Glovac and Tassone were required to and would resign as directors of Applabs. We are not minded to accept this explanation given that Applabs off-market takeover of The Search Party Ltd has not yet completed. We infer that the bare trustee arrangement was preferred over the asset manager arrangement, because Glovac, Tassone and Thomas preferred to retain control over the voting and disposal of Applabs' Sovereign Gold shares, in particular in relation to voting at the 31 May 2016 annual general meeting.

- When Applabs decided to subscribe under the 2016 rights issue, the 19 May 2016 board minutes record that "Each director confirms that they do not personally own over 20% of SOC and are acting independently".

- We also consider that the statements in the Applabs minutes and circular resolutions, in particular those dated 9 July 2015, 18 January 2016 and 19 May 2016, were attempts to provide some 'optics' to the conflict issues between GTT and Applabs but do not in fact address the control that Glovac, Tassone and Thomas have in relation to Applabs' Sovereign Gold shares. Nor do they address that Applabs was making decisions to support Glovac, Tassone and Thomas in their ambitions for Sovereign Gold.

Uncommercial conduct

- The circular resolution of the board of Applabs dated 9 July 2015 approving the company's subscription for 40 million shares in Sovereign Gold shares pursuant to the underwriting agreement between GTT and Sovereign Gold states:

Whilst SOC are currently a mining exploration company with expenditure commitments funded for the remainder of 2015, the Directors believe that in the event that the exploration fails, it is in the best interests of Shareholders if the Company has a stake in a relatively clean and inexpensive listed shell which could provide future opportunities to spin out assets of the Company. The Directors note the success of this strategy as implemented in respect of XTV and CNW.

- The statement in the circular resolution could be read two ways. One way is that Applabs was basing its investment decision solely on the prospect that the exploration fails and Sovereign Gold could be used as a listed shell. The other way is that using Sovereign Gold as a listed shell was a fall-back and that Applabs considered that Sovereign Gold's operations made it a suitable investment. However Applabs submissions to the Panel state that it made its investment decision on the first basis. In addition, whilst GTT had undertaken some due diligence, there is no evidence that Applabs independently considered Sovereign Gold as a prospective investment in a mining company or undertook any valuation or analysis. As a listed company this is surprising. In our view the basis for Applabs' investment is odd.

- Applabs' investment in Sovereign Gold following the 2015 rights issue represented approximately 4.2% of the issued capital of Sovereign Gold. With less than a 5% interest, we infer that Applab's reasons for investing in Sovereign Gold, being that Applabs could use Sovereign Gold as a listed shell, could only be brought to fruition if Applabs could work with others who had an ability to control Sovereign Gold. Otherwise given its strategy Applabs' investment was uncommercial. We therefore infer that the only way that Applabs could implement that strategy would be for it to work with Glovac, Tassone and Thomas given their interests in Sovereign Gold. In Applabs' submissions to our preliminary findings, while disagreeing with this inference, it made the following submission which we consider is consistent with our conclusion:

During the 2015 and 2016 period a significant number of junior ASX listed explorers changed their business from exploration to IT. Typically these transactions involved early investments prior to any change in direction. Accordingly, Applabs considers its investment in Sovereign Gold was, at the time, commercial.

- Moreover, given the reason for Applabs' investment, we would have expected Applabs to hold on to its stake rather than proceed to sell-down its stake between 3 August and 10 September 2015 (before reinvesting again at the end of November 2015). Applabs has not provided an explanation for the sell-down. Applabs submitted that its reinvestment in Sovereign Gold was made "as it remained in line with the original investment decision".

- We consider that the reasons given by Applabs for its investments in Sovereign Gold are more consistent with our inference that Applabs was used to further the shared goal of Glovac, Tassone and Thomas and had an agreement, arrangement or understanding with Glovac, Tassone and Thomas for the purpose of controlling or influencing the composition of Sovereign Gold's board than as a stand-alone investment.

Tassone and each of his relatives - Cosimo Tassone, Angelina Tassone, Carmelo Tassone and Roger Martinet

Introduction

- The application alleged that Glovac, Tassone and Thomas were associated with Tassone's parents and his other relatives. There is no evidence that suggests a possible association with Glovac and Thomas. We therefore focussed on Tassone's possible association with his relatives.

- We were initially concerned that Tassone was associated with each of his relatives - Cosimo Tassone and Angelina Tassone, Carmelo Tassone, and Roger Martinet - and that he had a shared goal with each of them to assist him (with Glovac and Thomas) in controlling the board of Sovereign Gold. However on the information provided to us after our preliminary findings were made known, we consider there is insufficient direct evidence to establish such associations between Tassone and his parents, Cosimo Tassone and Angelina Tassone. We also consider there is insufficient direct evidence to establish such associations between Tassone and each of Carmelo Tassone and Roger Martinet. Also we do not think there is sufficient other material before us that in our view allows us to draw the necessary inferences to establish the relevant associations in relation to Tassone's family members.

Cosimo Tassone and Angelina Tassone

- Cosimo Tassone and Angelina Tassone are Tassone's parents. While family relationships are a relevant factor in considering whether persons are associates, and maybe highly relevant depending on the strength of the family relationship,23 they are not determinative.

- Alissa Bella, Cosimo Tassone and Angelina Tassone's company, was issued 20 million Sovereign Gold shares as part of the dispersion of GTT's allocation under the 2015 rights issue and placement. Alissa Bella was also allocated shares by GTT in relation to an October 2015 rights issue by Platypus Minerals Ltd, which was underwritten by GTT.

- Cosimo Tassone and Angelina Tassone were also issued shares through GTT in their own names in relation to placements in February 2016 by Platypus Minerals Ltd and in March 2016 by AVZ Minerals Ltd.24

- Alissa Bella submitted that Sovereign Gold represents 68% of its share portfolio and "is 1 of 3 shares currently owned". Alissa Bella submitted that all of its Sovereign Gold shares "are held in my Superfund account". We do not know whether "my Superfund account" is a reference to Cosimo or Angelina Tassone's account or an account held by both of them. Given the size of the investment relative to the portfolio, and the risk profile of the micro-cap stock, the decision for the superannuation account of one or both of Tassone's parents to invest in Sovereign Gold is in our view unusual. However on balance, without more this does not lead us to conclude that Cosimo Tassone and Angelina Tassone are associated with their son.

- Alissa Bella submitted that it had purchased Sovereign Gold shares because of management and because it thought it was a good investment. Later its stockbroker recommended that it participate in the 2016 rights issue. We consider it likely, given Cosimo Tassone and Angelina Tassone did not receive any independent advice in making such a significant initial investment in a micro-cap company, that they relied on, at least to some extent, the advice of their son.

- In response to our preliminary findings regarding his parents, Tassone submitted that it was "not uncommon for a boutique corporate adviser to have a small pool of contacts whose names may appear as participants across numerous of its supported transactions." The implication must be that his parents are among those clients.

- He also submitted that Alissa Bella was a seller of shares prior to the Annual General Meeting in May 2016, and that "it would be improbable that Alissa Bella would be disposing of a substantial portion of its shareholding so near to the Annual General Meeting thus reducing its voting capacity on which the association is based."25 We accept Tassone's submission that this is not consistent with his trading in Sovereign Gold shares and is not supportive of an inference of association between him and his parents.

- We think it more likely that Tassone's parents were happy to be involved, in order to make money, and were guided by their son's recommendations, but this is not enough for us to infer that they had an agreement, arrangement or understanding, or were acting in concert, with their son.

Carmelo Tassone

- Carmelo Tassone is Tassone's uncle. As noted above, in considering whether persons are associated family relationships are not determinative. The uncle – nephew relationship is a step further away than the parent – child relationship.

- In relation to the 2016 Sovereign Gold annual general meeting, Tassone provided a copy of text messages between him and Carmelo Tassone on 26 May 2016 which stated:

Tassone – Hi Zio [Italian for uncle], I'm just chasing some votes to be re-elected to the board of SOC. Do you have a voting form you would like to complete?

Carmelo Tassone – I do have one which i was going to send tonight how do you want me to vote

Tassone – thanks zio…. I have voted YES to everything except resolution 16, that's a BIG NO…. . The guy Brennan Westworth is a trouble maker and constantly harasses me……

- Tassone submitted in relation to the first text message from Tassone to Carmelo Tassone that it was "relatively typical for nominee directors to seek votes ahead of a potentially contested board election" and further submitted that "it would be contrary to the principles of association that those who are responsive to such canvassing would be considered associates of the canvasser". Tassone submitted in relation to his second text message that it would be "illogical that a recipient of a voting intention or recommendation, however they may subsequently elect to vote, would be considered an associate of the person who expressed that intention or recommendation". His uncle's response could imply an association or alternatively simply a willingness to consider and be guided by Tassone's advice. The latter alternative appears to us to be the more natural reading. Without more we consider there is insufficient evidence to suggest any agreement, arrangement or understanding between them or that they are acting in concert in relation to Sovereign Gold.

- In response to our preliminary findings, Tassone submitted that Carmelo Tassone:

- had been trading shares since 1998

- sold all 2,000,000 shares he then held on 20 May 2016 (11 days before the Annual General Meeting) and that he purchased 1,000,000 shares on 10 June 2016 (after the Annual General Meeting), which is "more consistent with a finding that Carmelo Tassone is an independent share trader"

- received shortfall shares in line with the allocation policy adopted by the directors of Sovereign Gold (see below), which would not be expected if the purpose was to exert influence for the composition of the Sovereign Gold board and

- "did not make [Tassone] aware of his trades in Sovereign Gold between 11 April 2016 and 20 May 2016, or that he was a shareholder of Sovereign Gold until he applied for shortfall shares under the 2016 Rights Issue. That evidence of an absence of knowledge indicates a reduced likelihood of any understanding between Carmelo Tassone and Rocco Tassone to influence the composition of the board"

- Carmelo Tassone's pattern of trading and his level of investment do not point to association. Nor is there any likely family imperative. We do not draw any inference in relation to the size of Carmelo's investment in Sovereign Gold, comprising 11.2% of his total share portfolio.

Roger Martinet

- Roger Martinet is Tassone's cousin. Roger Martinet had provided IT services for Applabs and other companies of which Tassone was a director. Roger Martinet's family relationship with Tassone and business connections with Applabs, Tassone and others were not strong enough to make us sufficiently comfortable to draw an inference of association without further evidence.

- Roger Martinet submitted that his investment in Sovereign Gold represented approximately 40% of his share portfolio. He submitted that he had sold some blue chip shares which were underperforming to fund his investment in Sovereign Gold shares under the 2016 rights issue. He submitted that he:

…decided to apply for as many additional shares in SOC under the offer as I could afford given the large premium the shares were now trading to the 0.3c offer price, anyone who didn't to me is not a smart investor. Also I had noticed that a large number of ASX listed companies share prices had seen big increases on the back of Lithium acquisitions recently so I saw this as a major opportunity to make money.

- While we consider that Roger Martinet's reasons for investing, and the size of his shareholding, in Sovereign Gold involved a very high risk investment strategy, this does not necessarily make it uncommercial for him.

- In relation to the 2016 rights issue, the Applicant submitted that Roger Martinet received 5 times his entitlement to shortfall.26

- Sovereign Gold submitted that the shortfall was allocated at the directors' discretion on the following basis:

- All shareholders who held more than 2,000,001 shares received 100% of their shortfall application.

- All shareholders who held more than 1,000,000 shares but less than 2,000,000 shares received 81.337% of their shortfall application.

- With two exceptions, all shareholders who held less than 1,000,000 shares did not receive any shortfall shares.27

- The directors' discretion was stated in an email from Tassone to Sovereign Gold's company secretary (copying Glovac and Thomas) dated 23 May 2016, which attached a spreadsheet of the shortfall applications. 11 shareholders with more than 2,000,001 shares applied for shortfall – Roger Martinet applied for 46 million and the next largest application from that group of shareholders applied for around 25 million. Over 45 shareholders holding less than 1,000,000 shares applied for shortfall – two of whom applied for over 16 million shares.

- Sovereign Gold submitted that the reason why most shareholders with less than 1 million shares were not given any shortfall shares was because it was considered unfair for shareholders with a small investment in the company to be allocated shortfall at the expense of other larger shareholders. However in our experience, a rights issue shortfall can easily be allocated fairly between shareholders, taking into account their shareholdings in the company by allocating the shortfall through rounds.28 It is unusual for small shareholders to be scaled back 100% while larger shareholders are not subject to any scale back. Given that Tassone's email stated that their rule was applied to applications already received, we infer that Glovac, Tassone and Thomas were aware of the applications for shortfall before deciding the methodology on how to allocate and that Tassone was aware that the methodology they applied significantly advantaged his cousin.

- We initially considered that this supported an inference that Roger Martinet was associated with Tassone. However on the information available to us after our preliminary findings were made known, it is more likely, and plausible, that the preferential treatment to Roger Martinet was a favour to a relative who was also a client of GTT. Roger Martinet submitted in response to our preliminary findings that the links were nothing more than "purely Business" and that he applied for as many shortfall shares as he could as a prospective investment. We accept this. We also accept Tassone's submission that it was improbable that Roger Martinet applied for $135,000 worth of shortfall shares in order to enable him to assist Tassone to be re-elected and to oppose the Applicant's attempt at election to the Sovereign Gold board. We note Roger Martinet's vehement denials.

Glovac, Tassone and Thomas and Hudson Resources Limited and Hudson Corporate Limited

- We considered whether the negotiations between GTT and Hudson Resources and/or Vincent Tan in relation to the sale of Hudson Resources shares in Sovereign Gold on 7 December 2015 constituted evidence of an association between Glovac, Tassone, Thomas, GTT, Hudson Resources Limited and Hudson Corporate Limited. ASIC submitted that as a result of an agreement to give a first right of refusal, it appeared that "GTT (and any associates of GTT that the Panel may find) may have voting power in the shares of SOC held by Hudson given GTT has a first right of refusal to purchase these shares", referring to s608(1).

- Hudson Resources and Hudson Corporate submitted that they had not agreed to a first right of refusal. They submitted that the email chain was confusing and ambiguous "and could never have founded a claim by GTT to have a right of first refusal over the shares held by" them in Sovereign Gold. They also submitted that the agreement by Vincent Tan in the email chain only related to an aspect of the board resignation of Michael Leu and not the right of first refusal.

- It is unclear whether the email chain led to GTT obtaining a contractual right of first refusal from Hudson Resources and/or Hudson Corporate. However, there appears to be in Vincent Tan's mind no ambiguity, because he sent an email to Tassone on 9 June 2016 (the day of the application) stating that "we agree to terminate with immediate effect GTT Ventures first right of refusal to purchase the balance of any SOC shares held by Hudson prior to any disposal". Perhaps this was done as a backstop. Given the possible ambiguity, we are prepared to adopt the interpretation more consistent with the submissions of Hudson Resources and Hudson Capital.

- Moreover, any possible association between Hudson Resources and/or Hudson Corporate and one or more of Glovac, Tassone and Thomas is at best in our view historical. We have decided not to pursue this issue further.

Contraventions

- We consider that Glovac, Tassone and Thomas had a shared goal of achieving control of the board of Sovereign Gold, and an agreement, arrangement or understanding for the purpose of controlling or influencing the composition of Sovereign Gold's board and are associated under s12(2)(b). Alternatively, we consider that they are acting in concert in relation to Sovereign Gold's affairs and are associated under s12(2)(c).

- We also consider that Applabs was used to further the shared goal and had an agreement, arrangement or understanding with Glovac, Tassone and Thomas for the purpose of controlling or influencing the composition of Sovereign Gold's board and is associated with them under s12(2)(b). Alternatively, we consider that Applabs is acting in concert with Glovac, Tassone and Thomas in relation to Sovereign Gold's affairs and is associated with them under s12(2)(c).

- Immediately prior to 13 April 2016, Glovac, Tassone, Thomas and Applabs (as a result of their association) had voting power in approximately 18.27% of Sovereign Gold. On 13 April 2016, Kcirtap Securities (wholly owned by Glovac) and Mounts Bay (wholly owned by Thomas) each acquired 10,000,000 Sovereign Gold shares. By reason of whichever of these acquisitions occurred second,29 the voting power of each of Glovac, Tassone, Thomas and Applabs increased from below 20% to more than 20%. None of the exceptions of s611 applied and accordingly s606 was contravened.

- On 14 April 2016, Syracuse Capital acquired 11,406,509 shares in Sovereign Gold. By reason of this acquisition the voting power of each of Glovac, Tassone and Thomas and Applabs increased from a starting point that is above 20% and below 90%. None of the exceptions in s611 applied and accordingly s606 was contravened.

- On 15 April 2016 Syracuse Capital acquired a further 1,494,725 shares. By reason of this acquisition the voting power of each of Glovac, Tassone and Thomas and Applabs increased from a starting point that is above 20% and below 90%. None of the exceptions in s611 applied and accordingly s606 was contravened.

- The following contraventions of the s671B (the substantial holder provisions) also occurred:

- on 10 July 2015, Glovac, Tassone and Thomas and Applabs began to have a substantial holding in Sovereign Gold. No substantial holder notice was given

- on 8 September 2015, Glovac, Tassone and Thomas and Applabs ceased to have a substantial holding in Sovereign Gold. No notice of ceasing to be a substantial holder was given

- between 10 July 2015 and 8 September 2015, no substantial holder notices have been given to show changes in the substantial holding of more than 1%

- on 3 December 2015, Glovac, Tassone and Thomas and Applabs began again to have a substantial holding in Sovereign Gold. No substantial holder notice was given

- since 3 December 2015, no substantial holder notices have been given to show changes in the substantial holding of more than 1% and

- the acquisitions on 13 April 2016 and 14 April 2016 increased the voting power of each of Glovac, Tassone and Thomas and Applabs by more than 1%. No substantial holder notice has been given.

Decision

Extension of time

- Section 657C(3) says:

An application for a declaration under section 657A can be made only within:(a) two months after the circumstances have occurred; or

(b) a longer period determined by the Panel. - The Panel may therefore extend time under s657C to receive an application.

- As to how those time limits operate, the Full Federal Court has said:

… Before the discretion to extend time may be exercised under s 657C(3) those circumstances require to be proved. There may be a factual contest. There is no difficulty, in that situation, for the Panel first resolving the factual questions and thereafter determining whether or not to extend time under s 657C(3). The legislative scheme here does not suggest a different approach.30

- As to what matters the Panel should consider when deciding to extend time, the Panel has said in Austral Coal 03:

The Panel is given a discretion to extend the 2 month time limit set out in section 657C(3)(a) to make an application. The Panel considered that it should not lightly exercise that discretion. The time limit was set by the legislature to provide certainty to market participants in the context of takeovers that actions could not be challenged indefinitely.

Notwithstanding this, the Panel considered that it would be undesirable for Glencore's application be allowed (sic) to go unheard because it was lodged outside the 2 month time limit, if:

a. essential matters supporting Glencore's case first came to light during the 2 month period preceding the application; and

b. Glencore's application made credible allegations of clear, serious and ongoing unacceptable circumstances.

Unacceptable circumstances in relation to Austral Coal should not go unremedied merely because their existence has been able to be hidden for more than 2 months.31

- The existence of a breach is not the only consideration for a sitting Panel when determining whether unacceptable circumstances exist.32 The legislation set the time limit to ensure speedy resolution of matters before the Panel. However, the Applicant submitted that "The Company has frustrated the Applicants (sic) attempts to gain access to information it required to prepare this application."

- We invited submissions on whether we should extend time. Sovereign Gold submitted that was not appropriate for the Panel to extend time. Tassone submitted that "The principal events to which the Applicant refers as giving rise to his perception of association among the Potential Associates occurred in respect of the period between the 2015 Rights Issue (completed in July 2015) and the Hudson Share Transfer (completed in December 2015)", his allegations were not credible and the Panel should not extend time.

- We think there is a basis for extending time here. There have been contraventions established, which remained undisclosed. Having weighed the factors in Austral Coal, we are satisfied that there have been contraventions of Chapters 6 and 6C and the control implications and impact on other shareholders remain. It would be undesirable for this matter to go unheard. Further, features of it first came to light, and the contraventions of s606 occurred, during the 2 months preceding the application.

- We extend the time under s657C(3)(b) for the making of the application to the date it was made.

Declaration

- It appears to us that:

- the acquisition of control over voting shares in Sovereign Gold has not taken place in an efficient, competitive and informed market and

- the holders of shares in Sovereign Gold do not know the identity of persons who have acquired a substantial interest in Sovereign Gold.

- It appears to us that the circumstances are unacceptable:

- having regard to the effect that the Panel is satisfied they have had and are having on:

- the control, or potential control, of Sovereign Gold or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Sovereign Gold

- in the alternative, having regard to the purposes of Chapter 6 set out in section 602

- in the further alternative, because they constituted or constitute a contravention of a provision of Chapter 6 or Chapter 6C of the Act.

- having regard to the effect that the Panel is satisfied they have had and are having on:

- Accordingly, we made the declaration set out in Annexure B and consider that it is not against the public interest to make a declaration of unacceptable circumstances. We have had regard to the matters in section 657A(3).

Orders

- Following the declaration, we made the final orders set out in Annexure C. Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make 'any order'33 if 4 tests are met:

- it has made a declaration under s657A. This was done on 8 July 2016.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. We are satisfied, for the reasons below, that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 7 July 2016 and 14 July 2016. ASIC, Sovereign Gold, Glovac, Tassone, Thomas and Applabs made submissions.

- it considers the orders appropriate to either protect the rights or interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. The latter is not relevant here. We are satisfied that our orders are appropriate to meet the former test. The effect of the orders is to remedy the unacceptable circumstances by requiring that shares acquired in contravention of s606 be divested, disclosure be made of the previously undisclosed association and, since the date of disclosure, the associated parties not have the benefit of the 'creeping takeover' provision in item 9 for 6 months, consistent with the policy underpinning that provision.

- The divestment order remedies the transactions that occurred in contravention of s606, and therefore should not have taken place at all. The disclosure order is easily complied with and requires only what should have been provided to Sovereign Gold and the market in any event. The 'creep' order is to ensure that the market has time to appreciate the aggregation of voting power. The limitation imposed on creeping is consistent with the limitation in item 9 when coupled with adequate disclosure. In our view these orders are not unfairly prejudicial.

- Any prejudice that is suffered by these orders is not, in our view, unfair. As Ormiston J said in Gjergja v Cooper:

In the context of the present case the starting point must be that the parties had clearly contravened the provisions of the Code, and the obvious solution was the restoration of the status quo. It is difficult to see why the restoration of the position which applied before the contravention, and the consequences flowing from any order effecting that, should be considered unfair or as causing unfair prejudice, unless that restoration was likely to achieve nothing, or its benefits were so minimal or benefited so few shareholders, that the prejudice far outweighed the benefits likely to be attained.34