[2016] ATP 6

Catchwords:

Investa – DEXUS – managed investment schemes – trust scheme merger – responsible entity – manager – proxy form – voting – conflicts – interest other than as a member – disclosure of relationships and interest – efficient, competitive and informed market – not enough information to assess merits – substantial holder notice – redaction of attachment– failure to disclose – declaration – orders

Corporations Act 2001 (Cth), sections 12, 15, 253A, 253E, 601GC, 602, 611 item 7, 611 item 17, 657A, 657D

Trustee Act 1925 (NSW), s63

ASIC Regulation 24, Acquisitions approved by members

Procedural Rule 6.1.1 note 1

lnvesta Listed Funds Management Limited (as responsible entity of Armstrong Jones Office Fund & Anor) [2016] NSWSC 369 , In the matter of Investa Listed Funds Management Limited (as responsible entity of Armstrong Jones Office Fund: ARSN 090242229) [2016] NSWSC 344, In the matter of Investa Listed Funds Management Limited (as responsible entity of Armstrong Jones Office Fund: ARSN 090242229) [2016] NSWSC 341, Macedonian Orthodox Community Church St Petka Incorporated v His Eminence Petar The Diocesan Bishop of The Macedonian Orthodox Diocese of Australia and New Zealand [2008] HCA 42, Lionsgate Australia v Macquarie Private Portfolio [2007] NSWSC 318, Tower Software Engineering Pty Limited, Pendant Software Pty Limited v Harwood [2006] FCA 717, New Ashwick & Anor v Wesfarmers (2000) 18 ACLC 742

GN 15, Trust Scheme Mergers

GN 19, Insider Participation in Control Transactions

GN 22, Recommendations and Undervalue Statements

Bowen Energy Limited [2007] ATP 22, Austral Coal Limited 03 [2005] ATP 14, National Foods Limited [2005] ATP 8, Austar Communications Limited [2003] ATP 16, Colonial First State Property Trust Group 01 [2002] ATP 15, Normandy Mining Limited 02 [2001] ATP 28, St Barbara Mines Limited and Taipan Resources NL [2000] ATP 10

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | No | Yes | Yes | Yes | No |

Introduction

- The Panel, Peter Day, Lee Dewhirst and Andrew Lumsden (sitting President), on an application on behalf of DEXUS Property Group made a declaration of unacceptable circumstances in relation to the affairs of Investa Office Fund. The application concerned issues of conflict management by the manager of IOF, voting by Morgan Stanley of units held in IOF, disclosure deficiencies in a document (the IOMH Document) issued by the holding company of IOF's responsible entity and manager, and incomplete substantial holder disclosure. The Panel declared the circumstances unacceptable and ordered further disclosure.

- In these reasons, for ease of understanding, references are made to the head entity (for example, IOF includes IOF RE and the IBC) unless differentiation is needed, and the following definitions apply.

- DEXUS

- DEXUS Property Group, comprising DEXUS Diversified Trust, DEXUS Industrial Trust, DEXUS Office Trust, DEXUS Operations Trust

- DEXUS proposal

- Proposal by DEXUS to acquire the interests in IOF, as described in the explanatory memorandum issued by IBC dated 9 March 2016

- DEXUS RE

- DEXUS Funds Management Limited, the responsible entity of DEXUS

- IBC

- The independent board committee of IOF RE

- ICPF

- Investa Commercial Property Fund, which is stapled to ICPF Holdings Limited

- ICPF RE

- Investa Wholesale Funds Management Limited, the responsible entity of ICPF

- IOF

- Investa Office Fund, comprising Armstrong Jones Office Fund & Prime Credit Property Trust

- IOF RE

- Investa Listed Funds Management Limited, the responsible entity of IOF

- IOMH

- Investa Office Management Holdings Pty Ltd, the holding company of Investa Office Management Pty Ltd (IOM) which is the manager of IOF1

- Morgan Stanley

- Morgan Stanley Real Estate Investing and its subsidiary companies, including Post Sale Portfolio Issuer Pty Ltd (PSP) and Sundown Holdings BV (Sundown)2

- Share Sale Agreement

- Agreement for the sale of the IOF "platform" by Sundown to ICPF3 which was attached in redacted form to the substantial holder notice dated 23 March 2016 lodged by IOMH

Facts

- IOF is an ASX listed managed investment scheme (ASX code: IOF), comprising two trusts – the Armstrong Jones Office Fund & Prime Credit Property Trust.4 It owns office buildings in Australian CBD locations.

- DEXUS is an ASX listed managed investment scheme (ASX Code: DXS). It invests in Australian office and industrial properties and manages office, industrial and retail properties in Australia.

- Morgan Stanley has a relevant interest in approximately 11.8% of IOF, and owned the responsible entity and the manager (there was a separate management contract) of IOF (together, the "platform"). Morgan Stanley started a sale process to divest its interest in the IOF platform.

- On 15 December 2014, IOF established an independent board committee of IOF RE (the responsible entity for IOF) because it was undertaking a strategic review to consider internalisation of its management.

- On 18 December 2015, an implementation agreement was executed between IOF and DEXUS in respect of the acquisition by DEXUS of all the units in IOF. The standard consideration was $0.8229 cash and 0.4240 new DEXUS securities for each IOF unit. (On 30 March 2016, IOF announced that it would, with the consent of DEXUS, pay IOF unit holders a 7 cent special distribution, should the DEXUS proposal become effective. This would be in addition to the consideration being offered by DEXUS under the DEXUS proposal.)

- On 1 March 2016:

- Sundown and ICPF executed the Share Sale Agreement and

- IOMH, which had been part of Morgan Stanley, transferred 8.9% of IOF to PSP. This was, at the time, an internal transfer of the units within the Morgan Stanley Group. IOMH was part of the "platform" that was being sold to ICPF under the Share Sale Agreement.

- On 4 March 2016, the Share Sale Agreement was completed, and the shares in IOMH (and thus its subsidiary, IOM, which is the manager of IOF and owns the responsible entities for both IOF and ICPF) were transferred to an entity in the ICPF Group.

- On 9 March 2016, IOF issued a notice of meeting and explanatory memorandum for a meeting of IOF unit holders to be held on 8 April 2016 (subsequently moved to 15 April 2016). The meeting was to consider two resolutions to give effect to the DEXUS proposal:

- under item 7 of s611,5 as an ordinary resolution, to approve the acquisition of a relevant interest in all the units in IOF by DEXUS. This resolution was necessary to allow DEXUS to exceed 20% of IOF and

- under s601GC(1), as a special resolution, to amend IOF's constitution such that the DEXUS proposal be approved. This resolution was necessary to give effect to the trust scheme merger.

- The IBC recommended that unit holders vote in favour of the DEXUS proposal. An independent expert report attached to the explanatory memorandum stated that the DEXUS proposal was "fair and reasonable to, and in the best interests of, the IOF Unitholders in the absence of a superior proposal."

- On 15 March 2016, IOMH (now part of the ICPF Group) published the IOMH Document and sent a copy of it to each IOF unit holder. This document was not released to ASX. In it, IOMH recommended that IOF unit holders vote against the DEXUS proposal. The IOMH Document included a proxy form with the following features:

- the "Investa" logo appears in the top left hand corner, as in the proxy form attached to the explanatory memorandum

- it made provision for Jonathon Callaghan, the CEO and managing director of IOMH, as the proxy and

- it recommends that IOF unit holders mark the proxy form "Against" the resolutions.

- On 18 March 2016, IOF published a review of the IOMH Document. This document was released to ASX.

- On 30 March 2016, IOF announced that it would pay a 7 cent per unit special distribution if the DEXUS proposal became effective, which distribution DEXUS had consented to.

- On 31 March 2016, IOF issued a supplementary explanatory memorandum and adjourned the meeting until 15 April 2016. The supplementary explanatory memorandum stated that the independent expert continued to consider the proposal fair and reasonable to, and in the best interests of, IOF unit holders in the absence of a superior proposal.

- DEXUS understands that Morgan Stanley intends to vote the 8.9% parcel held by PSP against the DEXUS proposal.

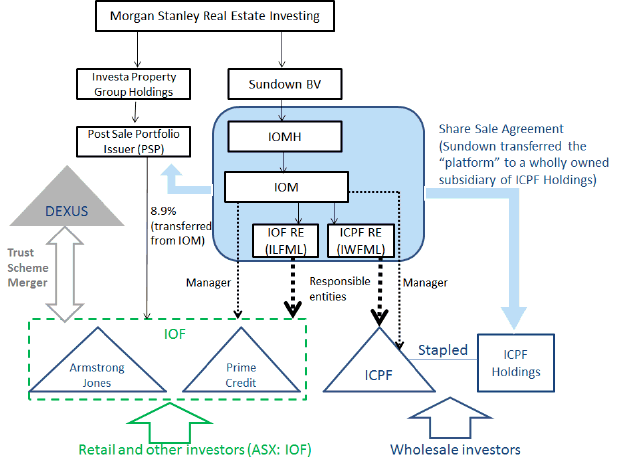

- A diagram of the relationships, in simplified form, follows.

Application

Declaration sought

- By application dated 21 March 2016, DEXUS sought a declaration of unacceptable circumstances. It put forward three main contentions.

Conflict

- DEXUS submitted that unacceptable circumstances arose from IOMH's conduct, recommendation and lack of cooperation with the IBC. This was because such conduct was inconsistent with the Management Deed under which IOM managed IOF and its duty to act in the best interests of IOF unit holders, IOMH had a conflict of interest with its duties owed to ICPF, and lastly because IOMH's recommendation was influenced by the fees and scale that it stood to lose, which had not been disclosed.

Disclosure

- DEXUS submitted that there were information deficiencies in the IOMH Document and that the "pre–filled" proxy form was misleading.

- DEXUS also submitted that various parties had not complied with s671B. It submitted that ICPF obtained a relevant interest in IOF units (then held by IOMH) when it signed the Share Sale Agreement but did not lodge a substantial holder notice. It also submitted that IOMH had not accompanied its notice of ceasing to be a substantial holder with a copy of relevant documents (primarily the Share Sale Agreement).

Voting

- DEXUS submitted that Morgan Stanley should not be entitled to vote the 8.9% of IOF transferred to PSP on the DEXUS proposal. This was because, had it still controlled IOMH, it would have been an associate of the responsible entity and under s253E could not vote. By analogy with s253E it should not now vote as the Share Sale Agreement had been designed to allow it to vote. DEXUS further submitted that, in any event, the Share Sale Agreement may make Morgan Stanley and companies in the ICPF Group associates such that Morgan Stanley could not vote. It further submitted that the Share Sale Agreement gave Morgan Stanley an interest different to other IOF unit holders and the principle in Panel GN 156 and ASIC RG 747 made it clear that only holders who would not gain other than as ordinary members (and who were not acting in concert with such persons) should vote.

- From these contentions DEXUS submitted:

- the market for control of IOF units was adversely affected

- the DEXUS proposal was taking place in an uninformed market and

- IOF unit holders did not have a reasonable and equal opportunity to participate in any benefits of the DEXUS proposal.

Interim orders sought

- DEXUS sought interim orders as the Panel considered necessary. We did not make any interim orders.

Final orders sought

- DEXUS sought final orders to the following effect:

- complying substantial holder notices be filed

- the IOMH Document and proxy form be withdrawn and IOMH cease advocating rejection of the DEXUS proposal

- Morgan Stanley not be entitled to vote at the IOF unit holder meeting and

- any votes cast by Mr Callaghan (CEO of IOMH) at the IOF unit holder meeting be disregarded.

Discussion

- We have considered all the submissions and rebuttals from parties, but address specifically only those we consider necessary to explain our reasoning.

Trust Schemes

- As the Panel noted in Colonial First State:

Prior to March 2000, the takeovers provisions of the Corporations Act and its predecessors did not regulate the acquisition of interests in Listed Managed Investment Schemes. However, the CLERP Act expanded the scope of the takeovers regime to include Listed Managed Investment Schemes….8

- Unfortunately, the expansion left some issues unresolved.

- Like schemes of arrangement, the acquisition of interests in a managed investment scheme does not need to take place by way of a takeover under Chapter 6. However, unlike schemes of arrangement, the procedure for the acquisition of units by way of a trust scheme is largely unregulated.

- ASIC does play a role in trust scheme mergers since the exception in s611 item 17 is limited to schemes of arrangement. Therefore with a trust scheme merger, as it is not a scheme of arrangement, an item 7 vote is required to effect it. Without ASIC relief no holders of the interests to be acquired could vote. This allows ASIC a role in regulating trust scheme mergers, including consideration of whether the principles in Chapter 6 have been undermined. ASIC has given relief for the unit holders in IOF to vote on the DEXUS proposal.

- Courts have the power to give judicial advice to a trustee under various State Trustee Acts.9 A number of features of this power were identified in the High Court, including the following, which we have paraphrased:

- there are no implied limitations on the power to give advice, provided the applicant can point to the existence of a question respecting the management or administration of the trust property or a question respecting the interpretation of the trust instrument

- there are no express words [in s63 of the NSW Act], and no implications from the words used, making some discretionary factors always more significant or controlling than others and

- the function is to give advice to the trustee (and protection to the trustee and the trust). Even if notice of the application is given to others (eg, under rules of court or by direction), they are not parties to proceedings even if they are able to participate to some extent.10

- It is observed in Jacobs Law of Trusts in Australia that interested persons will be bound by the opinion, advice or direction of the court if the procedures in the statute are followed.11

- IOF has sought judicial advice in relation to the DEXUS proposal on three occasions – before issuing the explanatory memorandum, before issuing a statement in response to the IOMH Document, and before issuing a supplementary explanatory memorandum and moving the date of the unit holders' meeting from 8 April to 15 April 2016.

- In the last matter, Black J in the Federal Court commented:

- on trust schemes generally –

So far as the questions of principle are concerned, s 63(1) of the Trustee Act provides that a trustee may apply to the Court for an opinion, advice or direction on any question regarding the management or administration of the trust property or regarding the interpretation of the trust instrument. The effect of such advice or direction, under s 63(2) of the Trustee Act, is that the trustee is deemed, so far as the trustee's own responsibility, to have discharged its duty as trustee in the subject matter of the application, provided it has not been guilty of any fraud or wilful concealment or misrepresentation in obtaining the opinion, advice or direction. The section is facilitative of the performance of a trustee's duties12

- and on this scheme in particular –

It seems to me that the Court must have regard to the fact that s 63 of the Trustee Act is here operating in the commercial context of an arrangement which is analogous to a company scheme, although it is not in fact a company scheme and it is not governed by the provisions of the Corporations Act 2001 (Cth) which apply in respect of such a scheme.13

- on trust schemes generally –

- Courts have on a number of occasions observed that the judicial advice process can function in a way that is analogous in a trust scheme merger to the scheme of arrangement process. However the analogy is incomplete in that there is no requirement to obtain judicial advice,14 or to follow the advice, and no necessary further court hearing at which the court approves the merger, as with a scheme of arrangement.

- Moreover, as observed by CAMAC:

A reorganization or change of control of a company may be achieved through a scheme of arrangement under Part 5.1 of the Corporations Act. These provisions do not apply to schemes. Instead, changes of control or other reorganizations of schemes have tended to proceed through ‘trust scheme' arrangements. There is no equivalent in these arrangements of the judicial and other procedural protections applicable to corporate schemes of arrangement under Part 5.1, though the proponents of a trust scheme may choose to seek judicial direction or advice on its implementation.15

- Following Colonial First State, the Panel issued Guidance Note 1516 detailing that a properly conducted trust scheme is not unacceptable as an alternative to a takeover. The guidance note sets out factors affecting the likely unacceptability of a trust scheme, by analogy with schemes of arrangement. The factors address disclosure and voting among other things.

Judicial advice sought by IOF

- IOF sought judicial advice under s63 Trustee Act 1925 (NSW) on 3 occasions.

- The first advice sought was that IOF would be justified in convening meetings of IOF unit holders17 to consider the DEXUS proposal, distributing the explanatory memorandum, and proceeding on the basis that the proposed amendments to the IOF constitutions would be within the powers of alteration conferred by them or by s601GC (or both).

- On 8 March 2016, Brereton J considered aspects of the DEXUS proposal, was "satisfied that the memorandum fairly and sufficiently represents and explains the scheme, and its advantages and disadvantages to unitholders"18 and made orders to the effect that IOF would be justified in convening the meetings, distributing the explanatory memorandum and in proceeding on the above basis. His Honour adjourned the proceedings to 12 April 2016 for a second court hearing at which any security holder wishing to oppose the constitutional amendments giving effect to the DEXUS proposal could appear.19

- On 18 March 2016, Brereton J made further orders to the effect that, subject to certain amendments, IOF would be justified in publishing on ASX and distributing to unit holders IOF's review of the IOMH Document.20

- The third judicial advice sought was for the issue of a supplementary explanatory memorandum. This followed IOF determining that it would pay a special distribution of 7 cents per unit if the DEXUS proposal became effective (which was additional to the consideration under the proposal), DEXUS having consented to that payment. In consequence of the special distribution to be provided to IOF unit holders, the meeting date was to be adjourned from 8 April to 15 April 2016.

- On 31 March 2016, Black J gave advice to the effect that IOF would be justified in adjourning the meeting to 15 April and issuing the supplementary explanatory memorandum (with some amendments). In the proceedings, IOM had sought to appear and be heard, leading his Honour to consider questions of principle and practice in judicial advice proceedings. He granted limited leave to IOM to address one issue and commented:

To the extent that other issues exist, as Mr Thomas has pointed out, there are ample means for Investa Office Management to address them, by advancing its view in the marketplace, and also by bringing any appropriate application in this Court or in the Takeovers Panel, or raising matters of concern with the regulator, or opposing the trust scheme at the second Court hearing (assuming that it has standing to be heard as an interested party)….21

- To the extent that it was relevant, the Court was aware that aspects of the DEXUS proposal for IOF may be brought before the Panel.

Morgan Stanley court proceedings

- On 23 March 2016, following the issue of the Panel proceedings, PSP, a subsidiary of Morgan Stanley, brought proceedings in the NSW Supreme Court claiming against IOF RE (and another) that it and IOF RE were not associates for the purposes of s253E and that it was entitled to vote on any resolution at the IOF unit holders' meetings on the DEXUS proposal and its vote must be counted.

- Orders were made by consent. They were (relevantly) that the Court declares, on the facts before it:

- that PSP and IOF RE are not associated for the purposes of s253E and

- that PSP is not precluded from voting by reason of s253E on any resolution put to IOF unit holders on the DEXUS proposal.

Conflict issue

- DEXUS submitted that "The conduct of IOF's manager in relation to the Platform Sale, the advocacy of the "vote no" case and the lack of co–operation with the Independent Board Committee of IOF RE which DEXUS RE has observed, in DEXUS RE's view amounts to unacceptable circumstances.

- It also submitted that it "does not understand how IOM as manager can manage the conflicted position it has placed itself in [In relation to its contractual duties under the Management Deed]"

- IOF, in a preliminary submission supporting DEXUS's application, fleshed out its concerns, submitting that the conflicting interests if the DEXUS proposal was approved and implemented included:

- loss of fees

- loss of some of the benefits that ICPF had hoped to receive from the "platform" purchase

- loss of scale benefits from continued management of both ICPF and IOF and

- loss of financial benefits to certain senior executives through a shadow equity scheme.

- Panel GN 19,22 although not directly on point, makes it clear that disclosure is an important consideration for the Panel when considering unacceptable circumstances in this area, and that the Panel is not directly concerned with whether there has been a breach of duty. We note that the application did not request any specific orders in connection with the conflict issue. IOF's supporting preliminary submission suggested that protocols seeking to preclude influence by participating insiders be implemented and disclosure be made. We note also that DEXUS said, in response to our brief, that it agreed that the function of the Panel was not to resolve the conflict per se.

- However, DEXUS submitted that "given [IOM's] position, it needs to express its opinion in a way which ensures that it is properly and fairly representing its views given its conflicted position. It cannot be allowed to promote its own views without adequately disclosing the personal benefits that will accrue to it if the DEXUS Proposal fails. It also cannot be allowed to put forward as an "alternative" a partial internalisation scenario which has not been documented and which, as is apparent from the Platform Sale Agreement, requires the consent of Morgan Stanley."

- IOF also agreed that resolution of the conflict (if any) was not a Panel function, but that "corrective disclosure which describes the relevant conflicts and special interests" should be made. It further submitted that, consistent with GN 19, members of the ICPF Group should not be able to advance the "No" case while purporting to be acting in the best interests of IOF unit holders. For us to address the latter point seems to us to be asking that we resolve the conflict, which it was submitted was not our function.

- In our view, the sale of the "platform" was a form of internalisation of the management of IOF within the "Investa Group", although it may be more accurate to consider the "Investa Group" as two distinctly owned funds (‘wholesale' investors in ICPF and both ‘retail' and ‘wholesale' investors in IOF) with a common management structure. In any event, it appears to us that the conflict, if any, is internal to the "Investa Group" and is either resolvable internally (if a conflict) or it is not a conflict at all because the IBC is acting independently (as it should) and IOMH (as the owner of the manager) is simply exercising its right to hold a different view. Disclosure, though, is a different question.

- For us, therefore, the issue of conflict will be dealt with by a consideration of the disclosure issues that the application raised. We turn to this.

Disclosure issues

Background

- Pursuant to judicial advice that it was justified in issuing the explanatory memorandum, IOF put out a notice of meeting and explanatory memorandum on 9 March 2016.

- Subsequently, on 15 March 2016, IOMH issued a media release, together with the IOMH Document. The IOMH Document was sent to unit holders but not put on ASX (IOF considering that this was not appropriate).

- On 18 March 2016, pursuant to further judicial advice that IOF would be justified in publishing a ‘response' to the IOMH Document, IOF released on ASX its "review of the [IOMH Document]". The review document identified 3 key concerns:

- conflict of interest between the "platform" (and its ultimate owners, ICPF investors) and IOF unit holders

- that statements about the financial benefits of the DEXUS proposal were inconsistent with the analysis of the independent expert, which continued to hold the opinion that the DEXUS proposal was fair and reasonable to, and in the best interests of, the IOF unit holders in the absence of a superior proposal and

- statements about the opportunity for IOF to jointly own the "platform".

- IOF did not release on ASX the IOMH Document to which it was responding by the issue of the review document.

- On 21 March 2016, DEXUS released an announcement reiterating many of the points IOF had made in the announcement containing the review.

IOMH Document

- DEXUS submitted that the IOMH Document took comments from the explanatory memorandum out of context (eg, the size of the premium) and presented information in an unbalanced way (eg, disproportionate scale of graphs and statistics not compared like–for–like). Further it submitted that the IOMH Document was likely to confuse unit holders "as to the basis upon which IOM/IOMH has issued the IOMH Document."

- ICPF made a preliminary submission that the Panel should decline to conduct proceedings stating that the complaints did not relate to matters of substance and "To the extent DEXUS RE and IOF RE believe there is any misleading information that requires clarification, they may do this through further ASX announcements and unitholder communications (which we note they have already done)."

- We did not pursue arguments about the context or unbalanced nature of various comments in the explanatory memorandum. These do not appear to be matters of substance in this case and can be the subject of comment by the protagonists. More importantly, in our view, the IOMH Document did not disclose readily and reasonably the interest of IOMH in advocating the position that IOF unit holders vote against the resolutions.

- Corrective disclosure was offered by IOMH although we did not think that this was sufficient. In particular we considered that identification of the role of the manager, the fees payable to it under the current arrangements, and the relevant effect of the Share Sale Agreement if the DEXUS proposal should succeed or fail should be disclosed in a way that an ordinary, unsophisticated unit holder can readily understand.

- We do not think that the manager should be restrained from providing unit holders with its views. But given its duty and position, if it does so, it must make its relationship, role and interest clear to unit holders.

- ICPF submitted that "the authorship of the IOMH Document, as well as the capacity in which the IOMH Document is issued, is clear and it is repeated in numerous places in the [IOMH] document." We accept that some of the information that we have sought can be gleaned from existing disclosures. Even so, we have concerns about the likely level of understanding of this information at least in some quarters. IOF has retail investors. It is a managed investment scheme comprising two funds and has a responsible entity and a separate manager each using an "Investa" name. If this was not complicated enough, the transactions which investors are asked to consider are, presumably for reasons of accuracy, described by reference to the many intermediate entities in the corporate structures, and then often by acronyms that are disarmingly similar. At least some, perhaps many, of IOF's investors are likely not to have the level of investment sophistication or experience to extract from this mass of detail the important disclosure points raised in this matter.

- The law synthesises the takeover provisions to managed investment schemes in a rather incomplete fashion, heightening the obligation on parties to make very clear their position and motivation when informing unit holders.

- ICPF also submitted that "media coverage together with IOF releases to the ASX distinguishing the actions of the IBC and the IOF RE from those of the IOMH Group ensure that the IOMH Document is unlikely to be taken out of context." While helpful, we do not think this absolves an issuing party from being required to make its disclosure clear. While market commentators and intermediaries perform a valuable function in keeping the market properly informed they are only part of a broader scheme of helping investors stay informed. Apart from the risk of the media omitting important details, investors should be able to (and are more likely to) rely on originating sources of information.

- Accordingly, we think that additional disclosure is required and needs to be clearer and more prominent than is currently the case.

Proxy form

- DEXUS submitted that the "proxy form completed to vote no and directing IOF unitholders to return proxies to IOMH" attached to the IOMH Document was "particularly problematic" as its likeness to IOF's may confuse unit holders. (In fact the proxy form recommended that unit holders vote "No" but left blank the actual instruction box.)

- IOF, in a preliminary submission supporting DEXUS's application, submitted that the proxy form: "risks that IOF unitholders will mistake the proxy form accompanying the IOMH Document for the IOF proxy form" resulting in votes unintentionally being cast against the DEXUS proposal.

- ICPF disagreed. It submitted that the proxy form was clear, given that it was attached to the IOMH Document advocating the unit holders vote "No". It further submitted:

We fail to see how a reasonable IOF unitholder, who reads a document before signing it, could be misled by thinking that a proxy form enclosed with a document which is clearly not issued by the IOF RE (as explained above) and recommends that IOF unitholders vote "no" in respect of the DEXUS proposal, would if left undirected, be a vote in favour of the DEXUS proposal.

- However, in our view except on a close reading23 the similarity of the IOMH Document and the proxy form to those of IOF might mislead a unit holder who reads the proxy.

- ICPF acknowledged the similarity of the form to IOF's, submitting that this was to ensure that there was no scope to maintain that the form was invalid.

- It also submitted that it had been open to IOF to ask the Court to order that any votes cast on the proxy form be disregarded, but it did not do so.

- The proxy form does not clearly show that it is an alternative proxy form to the one issued on behalf of IOF and does the following:

- it uses the "Investa" logo in the same way as the proxy form issued on behalf of IOF

- it names a director of IOMH as the person to be appointed the proxy (IOMH proposing that unit holders vote against the resolutions) and

- it recommends that IOF unit holders mark the proxy form "Against" the resolutions.

- Even if the proxy form was prepared in this way because of a concern about validity, it has the appearance of the original but is altered in a nuanced way, which places a heightened obligation on its issuer to be clear that it is an alternative.

- Thus, in our view, the proxy form attached to the IOMH Document was likely to mislead or confuse IOF unit holders.

Substantial holder notice disclosure

- On 7 March 2016, Morgan Stanley lodged a notice of change of interest of a substantial holder in IOF. It identified that there had been no change in its voting power but there had been an internal transfer 54,878,455 units from IOMH to PSP. The covering letter noted that IOMH had ceased to be a related body corporate on 4 March 2016. The units represent approximately 8.9% of Morgan Stanley's total of approximately 11.8% of IOF.

- On 8 March 2016, IOMH lodged a notice of ceasing to be a substantial holder in IOF. The covering letter noted the sale of the 54,878,455 units to PSP and that on 4 March it and its subsidiaries had ceased to be related bodies corporate of Morgan Stanley and so no longer had any voting power in respect of those units. The notice referred to "Attachment B" being intra–group transfers but the transfers were not attached to the notice released on ASX.

- On 23 March 2016, IOMH lodged an amended notice adding, according to the covering letter, "an annexure that describes the circumstances in which IOMH and its subsidiaries have ceased to be associates" of Morgan Stanley. The transfer forms were annexed as Annexure B and an Annexure C was included, being a redacted copy of the Share Sale Agreement.

- DEXUS submitted that the notice was not lodged within the required time frame. It further submitted in the application that:

The information vacuum created as a consequence of the Platform Sale Agreement not being available to IOF unitholders could have been avoided if, among other things, [the ICPF RE] had complied with its obligations under law to provide a substantial holder notice in respect of its acquisition of a relevant interest in IOF at the time it signed the agreement to buy IOMH (on 22 February 2016) and if ICPF Holdco did the same when its obligations arose on its incorporation (on 26 February 2016).

- IOMH submitted that no further policy objective would be achieved by requiring the lodgement of any further notices. It further submitted that "there may actually be no legal requirement for such notices to be lodged in any event." This appeared to turn on the times on 1 March when various transfers actually took place.

- We have not pursued the timing question or whether other entities were required to lodge notices. We leave those issues to ASIC if it wishes to pursue them. We have focussed on the disclosure required with the IOMH notice. If that disclosure is complete, unit holders and the market will have sufficient information.

- Subsequent to the application, DEXUS submitted that the redaction concealed important relevant information.

- IOF submitted that all documents should have been provided including "emails and powerpoint presentations in connection with the Platform Sale." Again, we have not pursued this aspect. IOF also submitted that s671B does not permit redaction, quoting New Ashwick & Anor v Wesfarmers:

While the agreement may deal with the topic of the shares as merely one of a number of topics, a copy of the whole agreement must nevertheless be attached to the Notice.24

- IOF further submitted that, while it would not press for disclosure of wholly irrelevant material, the redacted material looked to be relevant.

- IOMH submitted that s671B does not expressly permit redaction, but might be interpreted so that "disclosure of documents (or parts of documents) whose disclosure does not assist in satisfying the policy objectives behind the substantial holder provisions" is not required. It identified Panel decisions in which disclosure had been required, it submitted, only because the relevant contribution to the circumstances giving rise to the need for a notice was material.25 It submitted that redaction here does not give rise to unacceptable circumstances.

- We do not draw a lot from the Panel cases on which IOMH relied. In Austar and Bowen disclosure was made, in Normandy and National Foods the material information had already been released, and in Austral Coal the application was out of time and other considerations seemed to be at play.

- ASIC also quoted New Ashwick Pty Ltd v Wesfarmers Ltd and submitted that:

- The substantial holding provisions do not permit any redaction of documents that are required to accompany a substantial holder notice. In addition, in the absence of obtaining appropriate relief, there is no statutory carve–out allowing for non–disclosure of documents or information that is subject to confidentiality or to protect privacy and

- Strict compliance with the substantial holding provisions is an important part of ensuring there is both an efficient and competitive market for control and the confident and informed participation of investors in financial markets generally.

- ASIC pointed out that redaction enabled persons with disclosure obligations to "selectively choose which terms of their agreements are disclosed to the market" and to redact without seeking relief was inappropriate.

- We agree with ASIC. Even if unit holders would not have an interest in, or understanding of, the details redacted, market commentators and intermediaries such as brokers might; and they perform a valuable function in keeping the market properly informed.

- However, the redaction was done. Therefore, the question before us is not whether it is material that a name has been redacted, or an amount such as a salary has been redacted, from a particular clause. The Share Sale Agreement removed whole clauses. All this does is create mystery where it would have been useful to have the full story. In the language of Austar, we think the full Share Sale Agreement is a document "where the contribution is material and the information disclosed would reasonably and materially assist the market."26

- Accordingly, in our view, IOMH's notice of ceasing to be a substantial holder of 8 March 2016 omitted documents required by s671B. Its amended notice of 23 March 2016 was accompanied by a redacted agreement, but there is no entitlement under s671B for a party to redact a document required to accompany a notice. While minimal redaction to prevent sensitive information that is not material to an understanding of a document may not give rise to unacceptable circumstances, the redaction provided in the amended notice went further.

Undervalue statements

- The application by DEXUS submitted that the IOMH Document ignored some of the key financial benefits of the DEXUS proposal and contained statements about the value of the DEXUS proposal that were inconsistent with the analysis and approach undertaken by the independent expert. DEXUS itemised what it submitted were misleading statements in its rebuttals. These included very detailed references to value statements.

- IOF, in its supporting preliminary submission, said that the IOMH Document contained statements of opinion and statements as to value about the DEXUS proposal but the identity and experience of the persons taking responsibility for them was not clear and an appropriate basis for many of them had not been provided. It reiterated that position in its submission on our brief.

- ICPF submitted that the IOMH Document clearly set out why it regarded the DEXUS proposal as undervaluing IOF units, that IOM (as manager of IOF and an experienced manager of over $8.5 billion in office assets) had the capability and expertise to conduct the necessary analysis, and that the Panel's Guidance Note 2227 did not impose any specific qualifications or expertise on a person who could make a statement regarding the value of a proposal, save that there must be clearly disclosed, soundly–based and reasonable reasons, which standards the IOMH Document met. It submitted that "IOMH does have a different view of the value of the DEXUS Scheme, which it has clearly explained in the IOMH Document."

- We are not satisfied that the undervalue statements properly formed part of the initial application, notwithstanding that they were referred to in some of the submissions and set out with some particularity in DEXUS's rebuttal. In our view, if this issue is to be pursued, it could be the subject of a fresh application. We note the timing issue that this may give rise to. Alternatively, clarifying disclosure could be issued by a party if it wished.

Voting issue

- A peculiarity of trust scheme mergers is that a takeover does not necessarily equate to control, because there is a separate responsible entity and there may be a separate manager under a management contract (as here). The peculiarity is at least partly addressed by s253E. Voting in managed investment schemes is covered by s253E, which provides:

The responsible entity of a registered scheme and its associates are not entitled to vote their interest on a resolution at a meeting of the scheme's members if they have an interest in the resolution or matter other than as a member. However, if the scheme is listed, the responsible entity and its associates are entitled to vote their interest on resolutions to remove the responsible entity and choose a new responsible entity.28

- Parliament has allowed the responsible entity for a listed scheme to vote on its replacement, which is clearly allowing a vote on an interest other than as a member, albeit one that other unit holders should immediately recognise.

- The Company Law Review Act 1998 (Cth) introduced s253E without the second sentence, which was added by s323 of the Corporate Law Economic Reform Program Act 1999 (Cth). The CLERP explanatory memorandum says of the addition that it is to make clear that the responsible entity of a listed managed investment scheme:

… can be replaced by a simple majority of unit holders who vote at a duly convened meeting (whether in person or by proxy), without any restrictions on who can vote (proposed Schedule 3 Part 9 item 341 subsection 601FM(1) and items 322 — 325, sections 252L, 252M(1) and 253E). This is consistent with the voting requirements for the removal of company directors.29

- Here, the shares in IOMH (the holding company of the manager, which holds the management rights) and IOF RE were held within the Morgan Stanley group. They were sold into the "Investa group" (specifically to ICPF)30 as part of the "platform" sale. This gave rise to two issues in the application:

- whether Morgan Stanley was an associate of IOF RE, the responsible entity for IOF and

- whether, on the basis of a policy underpinning s253E, even if Morgan Stanley was no longer an associate of IOF RE, Morgan Stanley should not vote.

- The application noted that, but for the "platform" sale through the Share Sale Agreement, Morgan Stanley would have been restricted from voting as it was then an associate of IOF RE. DEXUS submitted that:

- Morgan Stanley was associated with ICPF (and in turn IOM and IOMH) by reason of the Share Sale Agreement. In other words, it submitted that there may be a provision in the Share Sale Agreement (which at that stage had not been made public) that made ICPF and Morgan Stanley associates under s12 and

- s253E was introduced to prevent conflicted voting arrangements, and here voting would not meet the policy objectives of the section because "the structuring of the Platform Sale and accompanying Sale of Units may have been designed to ensure that the Morgan Stanley Stake can be voted."

Association

- As noted, PSP commenced an action in the NSW Supreme Court. IOF RE consented to orders declaring that the parties were not associated for the purposes of s253E and that PSP was not precluded from voting at the meetings by reason of s253E.

- It is unclear, given this action and the judicial advice proceedings, what is left for us here.

- In St Barbara Mines the Panel noted in relation to schemes that "The Court does not simply apply black letter law: it exercises a wide discretion over process and substance."31 The same might be said of the court here seized of the trust scheme, and indeed Black J indicated something similar. We do not agree with a submission of DEXUS that "The Court can only make a determination as to whether a party can vote under the black–letter prohibition in section 253E." Section 253E is expressed in broad language and looks at "an interest…other than as a member." But even if the submission is correct, the Court has declared that Morgan Stanley is not an associate of IOF RE. It is unclear why a party would not be an associate for the purpose of s253E but would be an associate for the purpose of these Panel proceedings, as the same definition of association applies.32 We note ASIC's submission (agreeing with Morgan Stanley's submission) that "the court when interpreting section 253E of the Act would be expected to have appropriate regard to the purpose and object of the provision."

- The Court, in separate proceedings for judicial advice brought by IOF, has considered the explanatory memorandum and advised that IOF is justified in issuing it to unit holders. The explanatory memorandum did not exclude PSP voting. IOF, which supported DEXUS's application to the Panel, did not say why it could not have raised this issue before the Court.

- The initial concern DEXUS raised over the possible terms of the Share Sale Agreement appears not to have been borne out – at least no submissions were made after disclosure of the agreement that the agreement gave rise to an association.

- Thus, we think that this issue is not appropriate for us to consider further and therefore, on the issue of association, there is nothing before us to preclude Morgan Stanley from voting.

Policy

- DEXUS submitted that:

If Morgan Stanley's payment is at risk, it would have a direct financial interest in the DEXUS Proposal failing. This taken with the potential for asymmetry of information available to PSP which may not be available to other IOF unitholders, and possible "in concert" arrangements as described above, raises questions as to whether it is appropriate that the Morgan Stanley Stake be voted.

- The regulation of control transactions starts with the proposition that proponents of a proposal are not disinterested participants in the vote. Thus, item 7 of s611 (for example) prevents voting in favour of a resolution by the parties to the transaction and their associates. Similarly, GN 15, in seeking to apply Chapter 6 principles to trust scheme mergers, limits voting in favour.33

- That is not to say that voting against a proposal can never be prevented pursuant to the policy underpinning a provision in Chapter 6 that restricts voting in favour. There may be, admittedly rare, situations in which, on policy grounds, voting against a proposal under Chapter 6 should be prevented. Arguably, such a policy found a voice in s253E. Although not in Chapter 6, s253E does not allow a vote (of any kind) by the responsible entity if it has an interest in the resolution or matter other than as a member. However, even this has limits. As ASIC submitted:

… ASIC does not believe that s253E is authority for the proposition that any person who is not the responsible entity or an associate of the responsible entity should be precluded from voting on the trust scheme on the basis that they may have an interest in the resolution or matter other than as a member. The policy behind s253E is specifically directed at the behaviour of the responsible entity and its associates.

- The essence of the policy argument is, in our view, captured in this submission by DEXUS:

the fact that an association was found by the Court not to exist under section 253E on 24 March 2016 is not a reason to decline to find unacceptable circumstances exist. To the contrary DEXUS submits it is the very fact that section 253E has been avoided in circumstances where there are underlying conflicts, which have not been disclosed and continue to exist, which calls for the Panel to investigate and declare that there are unacceptable circumstances.

- A similar submission was made by IOF which referred to the Share Sale Agreement as creating an "artificial community of interest."

- Had there been an artifice created (for example by an option under which Morgan Stanley could recall the "platform" after the vote – and assuming this did not create an association), we would be inclined to accept that Morgan Stanley should not vote. (There might still be a question about whether there has been a duplication of proceedings in different jurisdictions that would warrant the Panel not proceeding, but that would be a different question.) However, there is no evidence that the agreement is in any sense artificial. In fact the "platform" sale was the subject of a previous process. We were asked to require the production of other information which has not been disclosed,34 but there is no basis for suspecting that other information will establish or tend to establish that the agreement is artificial and in that sense doing so amounts to a fishing expedition.

- Morgan Stanley submitted it was not the case that the "platform" sale was deliberately structured to 'sidestep' the operation of section 253E, but was the culmination of a well–publicised competitive sale process conducted over an extended time. It also submitted that, even if the "platform" sale had been structured to enable it to vote, it was not clear why this should prevent it from voting where there has not been a contravention of any law or policy. Provided there is no artifice, we agree.

- IOF also submitted that Morgan Stanley has a material financial interest, retained in the "platform" sale, and it is proposing to use its stake to deny IOF unit holders the opportunity to participate in the DEXUS proposal. In our view, this is an aspect of self–interest, which members may bring to their decision–making, and little different to any member whose vote in a particular way will benefit it.

- DEXUS also submitted that "The market is entitled to understand the precise interest IOM and/or IOMH has in advocating a "no" vote and, to date, IOM has not disclosed this interest." We agree with this.

Conclusion on voting

- We are not satisfied that a sufficient basis had been established for us to interfere with the voting rights attaching to units in which Morgan Stanley has a relevant interest.

- Morgan Stanley submitted that "the appropriate forum for determination of the Voting Issue is the Court." We do not agree entirely. In forming our conclusion we have not abdicated our responsibility by merely deferring to the Court. The Panel jurisdiction to declare unacceptable circumstances is a broad, policy–based jurisdiction; Courts and the Panel may each exercise a different jurisdiction over the same subject matter.35 It is undesirable to place the jurisdictions in potential conflict, and we have therefore paid particular attention to the findings of the Court, but we have decided the issues before us for ourselves.

- It should be noted, as Morgan Stanley's preliminary submission stated, "The DEXUS Proposal is conditional on receiving judicial confirmation that the IOF RE would be justified in proceeding to implement the DEXUS Proposal." Any consideration the Court gives to the voting question at the second court hearing is of course a matter for it.

Decision

Declaration

- In our view, the IOMH Document is misleading or confusing for, or has the potential to mislead or confuse, IOF unit holders. IOMH's interest in the proposal not succeeding is not sufficiently clear in that document. The proxy form attached to that document is also not sufficiently clear as an alternative proxy form. By reason of the issue of the IOMH Document the acquisition of control over voting interests in IOF is not taking place in an efficient, competitive and informed market and IOF unit holders are not given enough information to enable them to assess the merits of the proposal. Lastly, the notice of ceasing to be a substantial holder in IOF dated 8 March 2016 and the one dated 23 March 2016 did not comply with section 671B.

- It appears to us that the circumstances are unacceptable:

- having regard to the control, or potential control, of IOF or the acquisition, or proposed acquisition, by a person of a substantial interest in IOF

- in the alternative, having regard to the purposes of Chapter 6 set out in section 602

- and, in relation to the notices of ceasing to be a substantial holder in IOF, because they constituted a contravention of a provision of Chapter 6C.

- Accordingly, we made the declaration set out in Annexure A and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

Orders

- Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make ‘any order'36 if 4 tests are met:

- it has made a declaration under s657A. This was done on 8 April 2016.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. Our orders are for additional disclosure, and we are satisfied that they do not unfairly prejudice any person. As part of this we considered the privacy aspects of disclosure of the complete Share Sale Agreement. IOMH submitted that publication "may unfairly prejudice the interests of those persons who are specifically named in clause 7 of the Platform Sale Agreement." We note ASIC's submission that there is no exception from the disclosure requirement in s671B for privacy.37

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 6 April 2016. Each party made submissions and rebuttals.

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. The orders do this by requiring clarifying information to be provided.

- The IOF meetings are to be held on 15 April 2016. It is essential that the supplementary information be provided to unit holders as soon as possible. Thus we think that it should be published on ASX, posted on IOMH's website and be sent by express post and email (where available) to all unit holders.

- Accordingly, we made the orders set out in Annexure B.

Shareholder emails

- Two unit holders wrote to the Panel executive to express views on whether Morgan Stanley should be allowed to vote. They consented to the parties being provided with their comments and the parties were asked to provide submissions on whether the comments should be received by the Panel.

- We accept that there was considerable market interest in this matter and on occasion the Panel will receive comments from interested persons who are not parties. It has discretion to do so, or not to receive them.38

- We considered the submissions on whether we should receive the emails from the unit holders and decided that we did not need to receive them.

Andrew Lumsden

President of the sitting Panel

Decision dated 8 April 2016

Reasons published 19 April 2016

Advisers

| Party | Advisers |

|---|---|

| DEXUS Funds Management Limited, the responsible entity for DEXUS Diversified Trust, DEXUS Industrial Trust, DEXUS Office Trust, DEXUS Operations Trust | King & Wood Mallesons |

| Investa Listed Funds Management Limited, the responsible entity of IOF | Herbert Smith Freehills Fort Street Advisers |

| Investa Wholesale Funds Management Limited, the responsible entity of ICPF, and others | Clayton Utz |

| Morgan Stanley Real Estate Investing, Post Sale Portfolio Issuer Pty Ltd, and Sundown Holdings B.V. | Allens Linklaters |

Annexure A

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Investa Office Fund

Circumstances

- Investa Office Fund (IOF) is an ASX listed stapled entity comprising managed investment scheme. It is subject to a proposal under which the responsible entity for DEXUS Property Group (DEXUS, which is also an ASX listed managed investment scheme) will, with another DEXUS entity, acquire all the units in IOF.

- After seeking judicial advice, the independent directors of the responsible entity for IOF issued a notice of meeting and explanatory memorandum for IOF unit holders to vote on a resolution under item 7 of section 61139 and a resolution under section 601GC to effect the proposal. The recommendation in the explanatory memorandum was for unit holders to vote in favour of the resolutions.

- Investa Office Management Holdings Pty Ltd (IOMH) is the holding company of the manager of IOF and the responsible entity for IOF.

- On or about 14 March 2016, in relation to the proposal, IOMH issued a document titled "Important Information for IOF Unitholders" (IOMH Document). The recommendation in the IOMH Document was for unit holders to vote against the resolutions.

- The IOMH Document is misleading or confusing for, or has the potential to mislead or confuse, IOF unit holders in that it is not sufficiently clear that IOMH has an interest in the proposal not succeeding, particularly by reason of the management arrangements currently in place potentially being lost if the proposal succeeds and by non–disclosure of the relevant effect of the Share Sale Agreement on IOMH's interests if the DEXUS proposal should succeed or fail.

- The proxy form attached to the IOMH Document is not sufficiently clear in that, whilst intended for use by an IOF unit holder who votes against the proposal, it is not sufficiently identified as an alternative proxy form.

- Morgan Stanley Real Estate Investing (MS) is a real estate investment platform for which an affiliate of Morgan Stanley acts as general partner. It has a relevant interest in units in IOF. IOMH was a related entity of MS. On 8 March 2016, IOMH lodged a notice of ceasing to be a substantial holder in IOF. The notice was not accompanied by a document that contributed to IOMH ceasing to be a substantial holder, namely a Share Sale Agreement. On 23 March 2016, IOMH amended the notice and included a copy of a Share Sale Agreement dated 1 March 2016. The Share Sale Agreement had various clauses in it redacted.

- Neither the notice of ceasing to be a substantial holder in IOF dated 8 March 2016 nor the one dated 23 March 2016 comply with section 671B.

Effect

- By reason of the issue of the IOMH Document the acquisition of control over voting interests in IOF is not taking place in an efficient, competitive and informed market and IOF unit holders are not given enough information to enable them to assess the merits of the proposal.

Conclusion

- It appears to the Panel that the circumstances are unacceptable circumstances:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- the control, or potential control, of IOF or

- the acquisition, or proposed acquisition, by a person of a substantial interest in IOF

- in the alternative, having regard to the purposes of Chapter 6 set out in section 602

- in relation to the notices of ceasing to be a substantial holder in IOF, because they constituted a contravention of a provision of Chapter 6C.

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Investa Office Fund.

Alan Shaw

Counsel

with authority of Andrew Lumsden

President of the sitting Panel

Dated 8 April 2016

Annexure B

Corporations Act

Section 657D

Orders

Investa Office Fund

The Panel made a declaration of unacceptable circumstances on 8 April 2016.

The Panel Orders

- Investa Office Management Holdings Pty Ltd (IOMH) must make supplementary disclosure to the document titled "Important Information for IOF Unitholders" it issued on or about 14 March 2016 (IOMH document), in the form approved by the Panel, that provides the following disclosure in way that an ordinary, unsophisticated unit holder can readily understand:

- an explanation of IOMH's relationship with Investa Office Fund (IOF), the manager of IOF and the independent board committee of IOF's responsible entity (IBC)

- identification of the role of the manager, the fees payable to it under the current arrangements and the relevant effect of the Share Sale Agreement if the Dexus proposal succeeds or fails

- a description that the proxy form attached to the IOMH document came from IOMH (and not IOF or IBC) and recommended that unit holders vote against the proposals at the meeting to approve the Dexus proposal and

- information to assist unit holders, who have submitted a proxy form attached to the IOMH Document and may feel that they have been misled, on how to change their vote by either lodging another proxy form or voting at the unit holder meeting in person.

- The supplementary disclosure in order 1 must:

- as soon as practicable but no later than 5:00pm (EST) on 11 April 2016, be dispatched by IOMH to all unit holders by express post

- as soon as practicable but no later than 5:00pm (EST) on 11 April 2016, be emailed by IOMH to IOF unit holders where an email address is available to IOMH and

- as soon as practicable be placed by IOMH prominently on the website: www.investaforiof.com.au.

- IOMH must, as soon as practicable, ensure that the proxy form attached to the IOMH document is no longer made available to IOF unit holders, including by removing it from the website: www.investaforiof.com.au.

- IOMH lodge an amended notice of ceasing to be a substantial holder, amending the notice dated 23 March 2016 and attaching an unredacted copy of the Platform Sale Agreement, together with a covering letter explaining that it is an amended notice.

- IOF must, as soon as practicably after the media release of the Panel's decision is published on ASX, publish on ASX the supplementary disclosure in order 1 (a copy of which IOMH must provide to IOF).

Alan Shaw

Counsel

with authority of Andrew Lumsden

President of the sitting Panel

Dated 8 April 2016

1 For simplicity, no distinction is drawn between the companies unless necessary

2 As fn 1

3 Also referred to as the Platform Sale Agreement

4 On ASX the following notification appears: In December 1999, Armstrong Jones Office Fund became part of a stapled entity with Prime Credit Property Trust which was relisted on the Australian Stock Exchange as the Armstrong Jones Office Group (ASX: AJP). This fund was later renamed the ING Office Fund (ASX: IOF) in line with the change in name for the management company. In 2011 Investa Property Group took over the management of the fund and renamed it Investa Office Fund (ASX: IOF)….

5 References are to the Corporations Act 2001 (Cth) unless otherwise indicated

6 Guidance Note 15, Trust Scheme Mergers, Second Issue, 6 May 2011

7 Regulatory Guide 74, Acquisitions approved by members, Issued 21 December 2011

8Colonial First State Property Trust Group 01 [2002] ATP 15 at [42]

9 For example, as was used in this matter, Trustee Act 1925 (NSW), s63

10Macedonian Orthodox Community Church St Petka Incorporated v His Eminence Petar The Diocesan Bishop of The Macedonian Orthodox Diocese of Australia and New Zealand [2008] HCA 42 at [54]–[76], which involved how one of the defendants to litigation in the NSW Supreme Court should conduct those proceedings

11 Jacobs Law of Trusts in Australia, LexisNexis Butterworths, 7th ed, 2006, p589

12 lnvesta Listed Funds Management Limited (as responsible entity of Armstrong Jones Office Fund & Anor) [2016] NSWSC 369 at [2]

13 lnvesta Listed Funds Management Limited (as responsible entity of Armstrong Jones Office Fund & Anor) [2016] NSWSC 369 at [4]

14 For examples of mergers effected without judicial advice see Takeovers and Reconstructions In Australia LexisNexis Butterworths, at [1618]

15 Corporations and Markets Advisory Committee Discussion Paper – Managed Investment Schemes dated June 2011 at pp18–19

16 GN 15, Trust Scheme Mergers, First issue, 7 April 2004. The current issue is 6 May 2011

17 Concurrent meeting in each of the Armstrong Jones Office Fund & Prime Credit Property Trust

18In the matter of Investa Listed Funds Management Limited (as responsible entity of Armstrong Jones Office Fund: ARSN 090242229) [2016] NSWSC 341 at [10]

19 [2016] NSWSC 341 at [14]

20In the matter of Investa Listed Funds Management Limited (as responsible entity of Armstrong Jones Office Fund: ARSN 090242229) [2016] NSWSC 344

21 Investa Listed Funds Management Limited (as responsible entity of Armstrong Jones Office Fund & Anor) [2016] NSWSC 369 at [11]

22 GN 19, Insider Participation in Control Transactions, Second Issue, 18 December 2007

23 A statement is made on the front page in small print that the document was not issued by IOF

24New Ashwick & Anor v Wesfarmers (2000) 18 ACLC 742 at 750 at para 36

25Austar Communications Limited [2003] ATP 16 at [29] in footnote 5, Normandy Mining Limited 02 [2001] ATP 28, Bowen Energy Limited [2007] ATP 22, Austral Coal Limited 03 [2005] ATP 14 and National Foods Limited [2005] ATP 8

26Austar Communications Limited [2003] ATP 16 at [29] in footnote 5

27 Guidance Note 22 , Recommendations and Undervalue Statements, First Issue, 21 September 2010

28 Marked proxies are excluded: s253A(2)

29 Corporate Law Economic Reform Program Bill, Explanatory Memorandum, 1998, at para 7.11

30 It has been put to us that ICPF and IOF are independently owned but managed through the same structure

31St Barbara Mines Limited and Taipan Resources NL [2000] ATP 10 at [28]

32 Section 12 applies for Chapter 6 purposes. The Court noted that the declarations it made were based on the facts in the affidavit in support of the application, which expressed a view on association in terms of s12(2). Section 15 applies generally and, if anything, is broader

33 see GN 15 at [26]

34 DEXUS submitted that the Panel should order Morgan Stanley and ICPF to provide all documents, emails and power point presentations in connection with the Platform Sale, and the voting, or ability to vote, of the Morgan Stanley Stake, as well as details, and where applicable unredacted copies of, any agreements, understandings or arrangements in connection with the Morgan Stanley Stake

35 see, for example, Tower Software Engineering Pty Limited; Pendant Software Pty Limited v Harwood [2006] FCA 717, Lionsgate Australia v Macquarie Private Portfolio [2007] NSWSC 318

36 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

37 Morgan Stanley offered to release the unredacted document

38 ASIC regulation 24. See also Procedural Rule 6.1.1 note 1

39 References are to the Corporations Act 2001 (Cth) unless otherwise indicated