[2011] ATP 3

Catchwords:

Association – association hurdle – acting in concert – related parties – scrip bid – substantial shareholders – substantial holding notice – tracing notices – 'guanxi' – decline to make a declaration – efficient, competitive and informed market – golf – Beach Road Singapore – British Virgin Island companies – further questions – timing of application

Corporations Act 2001 (Cth), sections 53, 606, 651A, 671B, 1043A

Corporations Regulation 1.0.18

ASIC Regulations 23 and 24

ASX Listing Rule 7.9

Guidance Note 4 (Remedies General)

Re North Broken Hill Holdings Ltd (1986) 10 ACLR 270

Mesa Minerals Ltd [2010] ATP 4, Gloucester Coal Limited 01R [2009] ATP 9, Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Mount Gibson Iron Limited [2008] ATP 4, Azumah Resources Limited [2006] ATP 34, Rusina Mining NL [2006] ATP 13, Bridgewater Lake Estate Ltd [2006] ATP 3, Coopers Brewery Limited 04R [2005] ATP 24, Coopers Brewery Limited 03R [2005] ATP 23, Austral Coal Limited 02(RR) [2005] ATP 20, Pacific Magnesium Corporation Ltd [2005] ATP 12, LV Living Limited [2005] ATP 5, Rivkin Financial Services Limited 01 [2004] ATP 14, Village Roadshow Limited [2004] ATP 4, Prudential Investment Company of Australia Limited [2003] ATP 36, Anaconda Nickel Limited 15 [2003] ATP 17, Winepros Limited [2002] ATP 18, Taipan Resources NL 03 [2000] ATP 17, Re Email Limited (No. 2) [2000] ATP 4

Introduction

- The Panel, Alastair Lucas (sitting President), Nora Scheinkestel and Robert Sultan, declined to make a declaration of unacceptable circumstances in relation to the affairs of Brockman. The application concerned whether parties were associates in relation to Brockman and alleged breaches of s606 and s671B.1 While remaining concerned, the Panel was not satisfied on the material available to it that it could draw the necessary inferences and find the alleged associations. Accordingly, the Panel was not satisfied that the circumstances were unacceptable.

- In these reasons, the following definitions apply.

- Beach Road shareholders

-

- Mr Cho Hong Cheen and Star Ray (owned by Mr Cho)

- Stockholm (owned by Ms Floreen Toh)

- Ms Chen Bernadette Pauline and Tradewin (owned by Ms Chen)

- Platinum (owned 90% by Mr Wong Sio Kuan and 10% by his son Mr Wong Hio Ip)

- Yencon (owned by Mr Wong's sister, Ms Wong Chon Nei)

- Mr Mo Yang

- Mr Wu Wei

- Mr Liang Wen-Chong and

- Mr Ng Kok Kuang (Michael)

- Brockman

- Brockman Resources Limited

- Ironwood

- Ironwood Group Limited

- Leading Pride

- Leading Pride Limited (owned by Ms Olivia Yu)

- Platinum

- Platinum Investment Holding Pte Ltd

- Star Ray

- Star Ray International Limited

- Stockholm

- Stockholm (SWD) Limited

- Tradewin

- Tradewin International Limited

- Wah Nam

- Wah Nam International Holdings Ltd

- Yencon

- Yencon Enterprises Limited

Facts

- Brockman is an ASX listed company (ASX code: BRM).

- Wah Nam is listed on the Stock Exchange of Hong Kong Limited (Code: 159) and ASX (ASX Code: WNI).

- On 1 March 2010, Wah Nam lodged a substantial holding notice indicating it had voting power of 19.90% in Brockman (following acquisitions on 25 and 26 February 2010).

- In June 2010, a director of Brockman put 3.25 million Brockman shares up for sale. Mr Peter Luk, the executive Chairman of Wah Nam, facilitated an introduction to a buyer for some of those shares. On 15 June 2010 Platinum, a company registered in Singapore, bought 3.25 million Brockman shares. Platinum submitted that most likely it purchased the shares in Brockman from the director.

- On 8 October 2010, Wah Nam lodged a substantial holding notice indicating it had increased its voting power in Brockman to 21.11%.2 On 25 October 2010, Wah Nam lodged a further substantial holding notice indicating it had increased its voting power to 22.83%.

- On 10 November 2010, Wah Nam announced that it, through a wholly owned subsidiary, intended to make a takeover offer for Brockman. The offer opened on 15 December 2010. It was a conditional scrip offer of 30 Wah Nam shares for every Brockman share. One condition was 50% minimum acceptance. The offer was scheduled to close on 16 February 2011.

- On 16 December 2010, Wah Nam lodged a substantial holding notice indicating it held 32,347,405 shares in Brockman (approximately 22.63%).

- At 10 January 2011, Wah Nam's offer remained conditional and Wah Nam had not announced any acceptances under its offer.

- At 10 January 2011, the date of the application, Leading Pride had a beneficial interest in approximately 2.71% of Brockman. Leading Pride is owned by Ms Yu Oi Kee (Olivia).

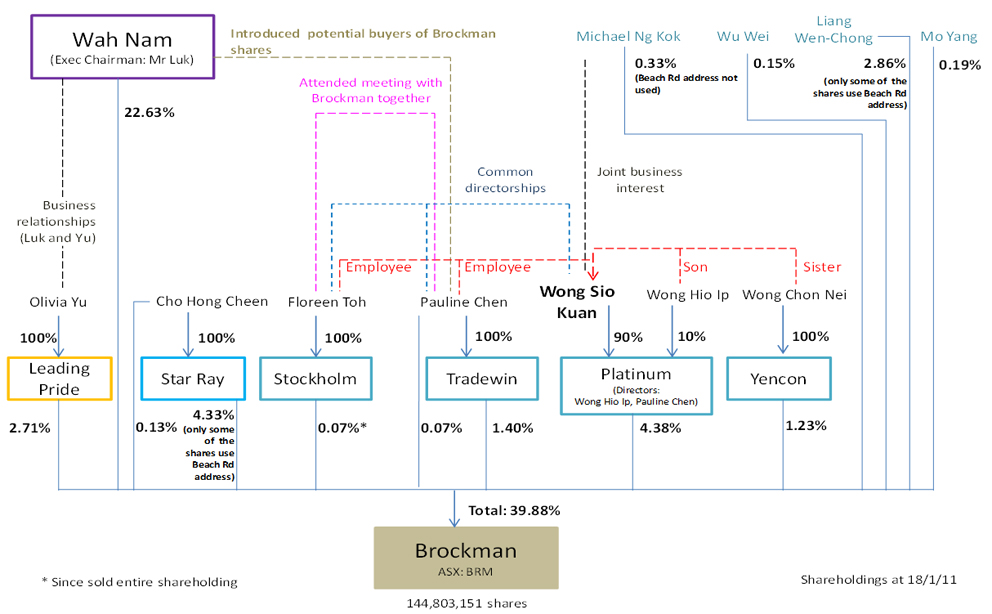

- On 18 January 2011, shareholdings in Brockman included the following:

Shareholder Number of shares % Leading Pride 3,922,000 2.71 Star Ray 6,262,990 4.33 Stockholm 100,0003 0.07 Yencon 1,780,496 1.23 Platinum 6,341,475 4.38 Tradewin 2,034,125 1.40 Mo Yang 275,000 0.19 Wu Wei 215,000 0.15 Liang Wenchong 4,146,402 2.86 Ng Kok Kuang 477,000 0.33 Wah Nam 32,347,405 22.63 - The application submitted that Ironwood held 57,000 shares in Brockman. Ironwood sold them on 24 November 2010 and bought and sold further shares in December 2010. On 18 January 2011, it held no shares in Brockman.

- Various structural relationships between the parties identified in the application are described below.

- The Beach Road shareholders are shown in blue.

- The application included Mr Mo and Mr Wu although there was little, if any, evidence available regarding their involvement beyond allegedly having used the Beach Road address.

Application

- By application dated 10 January 2011, Brockman sought a declaration of unacceptable circumstances. It submitted that, in addition to the 22.63% of Brockman held directly by Wah Nam, a further 7.1% and as much as 17.57% "may be held" by associates of Wah Nam.

- Essentially, 3 associations were alleged:

- between Wah Nam and Leading Pride, on the basis of commercial relationships between Mr Luk (executive Chairman and major shareholder of Wah Nam) and Ms Olivia Yu (the sole shareholder of Leading Pride). This, it submitted, resulted in a breach of s606

- between Wah Nam and Star Ray, on the basis that Wah Nam facilitated Star Ray's purchases.4 This, it submitted, resulted in a breach of s606 and

- between the Beach Road shareholders themselves, on the bases that:

- shareholders of 21,270,516 shares (approximately 14.8%) had addresses at, or had connections with parties having addresses at, 7500A Beach Road, Singapore

- there were family and employment relationships between several of the Beach Road shareholders and Mr Wong

- Ms Chen and Ms Toh, employees of Mr Wong, met with a Brockman representative in Singapore

- some of the parties had the same brokers, which only held Brockman shares on behalf of a small number of other entities and

- an association between Wah Nam and Star Ray (itself a Beach Road shareholder) may suggest an association involving the other Beach Road shareholders.

This, it submitted, resulted in a breach of s671B.

- Three further concerns were raised in the application:

- the association between Wah Nam and Star Ray and between the Beach Road shareholders gave rise to concern that "there may also be impermissible associations between Wah Nam and the other Beach Road shareholders"

- s1043A had been breached because Leading Pride and Star Ray traded in Brockman shares when in possession of "inside information", namely the likelihood of the bid and

- on the basis that Wah Nam was associated with Star Ray and Star Ray purchased Brockman shares for cash during the bid period, it was unacceptable not to have offered all Brockman shareholders a cash alternative as required by s651A(4).

- Brockman submitted that the effect of the circumstances was that:

- the acquisition of control of Brockman was not taking place in an efficient, competitive and informed market (s602(a))

- the market was not fully informed (s602(b)) and

- not all holders of Brockman shares had an equal opportunity to participate in the benefits accruing through a proposal under which Leading Pride, Star Ray and Wah Nam and its associates acquired a substantial interest in Brockman (s602(c)).

Interim orders sought

- Brockman sought interim orders, until the application was determined, preventing:

- Leading Pride and the Beach Road shareholders transferring or disposing of Brockman shares (including by acceptance into Wah Nam's offer) and

- Wah Nam declaring its offer unconditional or processing any acceptances.

- The Acting President of the Panel made interim orders in respect of Leading Pride and the Beach Road shareholders on 13 January 2011 (Annexure A). He did not think there was any need to make interim orders in respect of the bid.

- We varied the interim orders at the request of some of the parties. After considering submissions, we allowed disposal of shares in Brockman by way of sale on the Australian Securities Exchange in the ordinary course of trading if certain conditions were satisfied (Annexure B).

- In Re Email Limited (No. 2), the Panel said:

In making an interim order, the Panel needs to consider whether unacceptable circumstances exist or would develop if the order was not made, and weigh the burden of the interim order against the mischief which would occur if the order was not made....5

- We looked at a range of factors including strength of the preliminary evidence, the timeliness of the application, the number of parties alleged to be associates, the possible prejudice to the alleged associates, and the impact on the status quo of lifting the interim order to allow sales on market.6 We also took into account that a key allegation of association related to "warehousing" of shares for Wah Nam's bid. We also took into account that, as a result of the bid, there was reasonable volume being traded in the market and the likelihood of the alleged associates being able to move shares to other associates (a key reason usually not to allow any trading) was sufficiently remote in this case.

Final orders sought

- Brockman sought final orders to the following effect:

- divesting all the Brockman shares:

- acquired by Wah Nam and Leading Pride in excess of the number permitted under the Act

- acquired by Wah Nam and Star Ray (and any other associates of Wah Nam) in excess of the number permitted under the Act and

- acquired by the Beach Road shareholders while they were in breach of the substantial holding notice provisions

- the Beach Road shareholders cannot accept the Wah Nam offer

- following divestment, the Beach Road shareholders submit a substantial shareholder notice disclosing full details of their substantial holding and

- all acceptances of Wah Nam's offer prior to conclusion of the proceedings are invalid, or an order allowing withdrawal.

- divesting all the Brockman shares:

Undertaking from Brockman

- Wah Nam submitted that Brockman should be required to give undertakings to the Panel:

- so that Brockman could not "benefit from the mere fact that it has made the Application to the Panel". It submitted that the application increased the likelihood that the bid would not succeed within the 3 month period referred to in ASX Listing Rule 7.9.7 Without the undertaking, it submitted, Brockman would be able to issue shares without shareholder approval (under ASX Listing Rule 7.1) during the bid period and

- to prevent shareholders named in the application "from being disenfranchised by not being able to vote, in the event a shareholders' meeting is convened, whilst the interim orders are in place".

- In view of our assessment of the strength of the application (see paragraph 34 and following), we had a concern that there may be unfair prejudice caused to Wah Nam's bid. We accepted an undertaking from Brockman to extend the period during which it would not issue or agree to issue securities under ASX Listing Rule 7.9 (Annexure C). As no vote was contemplated, we did not think it was necessary to address this aspect.

Discussion

Timing

- The Panel can make a declaration within 3 months after the circumstances occur or 1 month after the application is made, and an application must be made within 2 months after the circumstances have occurred or a longer period determined by the Panel.8

- In this case the primary circumstances the subject of the application concern parties acting in concert to "warehouse Brockman shares in order to seek to effect a change of control through the Wah Nam Offer." The offer opened on 15 December 2010. Even though some of the purchases occurred in 2008 and 2009, there have been recent purchases. Moreover contraventions of the Corporations Act were alleged which are ongoing.

- In our view the application was made in time.

Association hurdle

- Before the Panel will conduct proceedings on the issue of association, there must be a sufficient body of material demonstrated by the applicant, together with inferences (for example from partial evidence, patterns of behaviour and a lack of a commercially viable explanation) that might be drawn, to support the Panel conducting proceedings.9

- As the Panel said in Winepros Limited:

Allegations of association will, by their very nature, usually be very difficult to prove and it is very difficult to provide direct evidence of the existence of association or agreements. On that basis, the Panel will frequently be required to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association. However, until there is a body of such material, the onus will normally remain on the person alleging the association....10

- The application made linkages, but also made significant extrapolations to seek to make its case.

- Tradewin, Yencon and Ms Chen made a preliminary submission that the Panel should not conduct proceedings as Brockman had failed to produce substantive allegations, reasons or evidence. The submission quoted from Boulder Steel Ltd:

It is not the role of the Panel to undertake investigations without first being provided with substantive allegations and reasons for, or evidence supporting, those allegations. Issues of association are notoriously difficult for outsiders to prove, but the Panel has repeatedly stated that its starting point is that it is for an applicant to demonstrate a sufficient body of material to satisfy the Panel that association can be established (albeit perhaps with inferences being drawn).11

- Platinum and Mr Liang made similar submissions. Wah Nam submitted that the application appeared to have started with conclusions and worked backwards.

- Before making a decision on whether to conduct proceedings, we asked the parties to provide additional information, including in relation to the operation of businesses from 7500A Beach Road, Singapore and about the method by which the various parties financed the purchase of their shares in Brockman.12 We noted business, family and social connections between certain Brockman shareholders and related parties. These things gave rise to enough of a concern that we considered we should ask some questions to clarify aspects of the application before deciding whether to conduct proceedings.

- In response to questions, we noted loans between some of the parties which funded the acquisition of Brockman shares.

- At least some of the additional information we received was consistent with possible unacceptable circumstances, particularly as the commercial logic of it was not readily evident. Accordingly, on balance, we considered that there was enough to justify us conducting proceedings.

Additional information volunteered

- Brockman filed "supplementary" submissions containing information which "has only become known to Brockman since the date of the application". The information concerned further alleged connections between some of the parties.

- Given that some of the purchases under investigation occurred in 2009, we found it a little surprising that such connections were not included in the initial application. In any event, an applicant must not make preliminary submissions.13 The reasons for the prohibition are to ensure a complete application is lodged (which other parties can respond to in preliminary submissions), and to reduce the procedural complexity of going backwards and forwards many times amongst the parties.

- Nevertheless, we agreed to receive the supplementary submissions and allowed the other parties to make a further preliminary submission in response to the supplementary submissions.

- Following receipt of preliminary submissions from the other parties, Brockman made "second supplementary submissions in response to the information provided by the Parties in response to the Panel's request for further information of 18 January 2011 (Information Request) and in respect of information that has only become known to Brockman since its last supplementary submissions".

- We had not asked Brockman for further information other than in respect of the undertaking it might be prepared to give. With annexures, Brockman's second supplementary submissions ran to about 50 pages.

- Brockman submitted that it was aware that a party must not make rebuttal submissions in response to preliminary submissions. However, it was of the view that the procedural rules did not apply to a response to the Panel's request for information. It submitted that the second supplementary submissions were not in the nature of rebuttals but addressed the matters raised in response to our request for further information and provided new information.

- We decided not to receive Brockman's second supplementary submissions. Had we decided to conduct proceedings (which we did) the brief invites parties to include any relevant additional information. The information in the second supplementary submissions could be re-lodged in that way if still relevant.

Additional party

- Wah Nam also bid for FerrAus Ltd (ASX Code: FRS) on 15 December 2010, offering 6 Wah Nam shares for every FerrAus share. FerrAus filed a notice of appearance seeking to become a party in the Brockman proceeding. It submitted that some of the shareholders in Brockman were also shareholders in FerrAus. It submitted that it may have information relevant to the affairs of Brockman, but would need access to the application and submissions to know what information may be relevant. It submitted that that there were close connections between the 2 bids and noted that the market had drawn connections between them.

- We did not accept the notice of appearance. We did not think that FerrAus would be likely to be able to assist us such that it should become a party. We also did not think that its interests were likely to be materially affected by Brockman's application.14 Of concern also was the risk of a 'fishing expedition', FerrAus having submitted "If FerrAus was a party to any Brockman proceedings it would be in a better position to move more quickly to make a separate application to the Panel in relation to its own affairs than if it had to wait until the outcome of any Brockman proceedings were announced and perhaps even until the Panel's reasons were published."

- Notwithstanding that we did not admit it as a party, we invited FerrAus to submit any information it considered relevant.15 FerrAus said it had proxy appointments in relation to the extraordinary general meeting of its shareholders held on 24 January 2011, information obtained from public searches and information included in its register of members, and provided answers to tracing notices. We passed this on to the parties.

Associations

- In Coopers Brewery Limited 03R and 04R,the Panel said:

Association, of itself, is neither a breach of the Corporations Act nor unacceptable. Association is simply the basis for aggregating relevant interests held by different people to determine voting power. However, an acquisition of a relevant interest may be a breach, and the formation of an association may be unacceptable if such an acquisition, or formation of association, causes a person's voting power, or control of a company, to increase either in breach of section 606, or gives rise to unacceptable circumstances.16

- However, even without a breach of s606, the aggregation of voting power in the context of a bid or potential bid, if not disclosed, is of serious concern to the legislature. Austral Coal Limited 02(RR) quoted Fullager J to make this point:

If an intending raider amasses a large parcel of shares secretly, then he does so in a manner ipso facto at odds with the strong policy of the legislation, because a large number of shares are transferred in a market which is not sufficiently informed. It is, for instance, part of the policy of the legislature, albeit incidentally, to oppose the secret buying and hoarding of shares for the purpose either of "spring-boarding a take-over" or of selling out at a large profit to some other raider provoked by the first secret buyer....17

- This proceeding relates to different circumstances, but the same policy concerns apply.

- Broadly, two or more persons are associates if:

- there is (or is proposed) an agreement, arrangement or understanding between them, whether formal or informal, written or oral, and whether or not legally binding, for controlling or influencing the composition of an entity's board or the conduct of an entity's affairs or

- they are acting, or proposing to act, in concert in relation to an entity's affairs.18

- The definition casts a wide net, given the broad definition of an entity's affairs,19 although we are principally concerned with the accumulation and exercise of voting power.20

- In Anaconda Nickel Limited 15, the Panel said:

... Most evidence in relation to association, or acting in concert, is likely to be circumstantial. Rarely in enquiries do parties to such agreements carefully document them and leave them on file for production ... Decisions in these cases are frequently made on an "on balance" basis and taking a view on the inferences which might properly be drawn from parties' commercial behaviour and from assertion evidence about conversations between parties who are not only interested in the proceedings, but in intense commercial competition. Eliciting such evidence will usually be time consuming, frustrating for parties, and involve iterations of evidence gathering.21

- We agree that nearly always there is a need to draw inferences and eliciting the evidence often involves iterations of evidence gathering.

- Similarly, in Bridgewater Lake Estate Ltd, the Panel said:

... Where conduct is assessed as evidence of association, it is often difficult to tell whether the conduct merely reveals that people are separately following interests which coincide, or whether they are carrying out an agreement to pool voting power in pursuit of an agreed common goal. One test the Panel applied in this matter to distinguish between these possibilities, particularly where evidence of acting in concert was lacking, was whether one of the possible associates had acted uncommercially (i.e. done something which was inconsistent with their merely following their own several interests and only explicable on the basis that they had subordinated their own interests to a common design).22

Wah Nam and Leading Pride

- Wah Nam increased its voting power in Brockman to 19.9% on 1 March 2010. Leading Pride started acquiring Brockman shares on 9 March 2009 and made acquisitions and disposals until 10 January 2011 (the date of the application).

- Brockman submitted that Leading Pride purchased 4,000,000 Brockman shares on 18 August 2010. It based this on a connection Leading Pride had to the broker which acted in the purchase of over 4,000,000 shares on that day. Leading Pride denied making this acquisition and a schedule of its buying and selling confirmed that it had not done so.

- Leading Pride is owned by Ms Olivia Yu, who is also a director of Cell Therapy Technologies Centre Ltd (CTTC). The directors of CTTC were Ms Yu, Ms Ho Pui Fan and Mr Peter Luk, executive Chairman of Wah Nam and a shareholder of Wah Nam. Mr Luk had been a director of CTTC since 28 September 2005.

- CTTC is now (ultimately) owned by Mr Luk. He acquired it on 1 December 2010 from Ms Ho Pui Fan. Ms Ho, through a company she controlled, was a shareholder of Wah Nam. Until 30 June 2009, she (through that company) had also been a convertible note holder of Wah Nam.

- Ms Yu borrowed the money to purchase the Brockman shares from 3 sources:

- a margin loan from Interactive Brokers

- CTTC when it was (ultimately) owned by Ms Ho Pui Fan and

- Ms Ho directly.

- The bulk of the loan came from CTTC, of which about half has been repaid.

- Ms Yu has shares in other entities but Brockman represents more than half the value of all her investments.

- Leading Pride submitted that Mr Luk had no involvement in the loan arrangement, which was made pursuant to a director loan scheme adopted on 1 December 2008, before Mr Luk joined Wah Nam. It submitted that the amount of the loan "is not considered unusual for a Hong Kong company". It also submitted that "Ms Yu negotiated the loan from CTTC with the shareholders of CTTC...." However, United Energy Investments Ltd (UIEL) owned all the shares in CTTC but one, which was owned by Ms Ho, and Ms Ho was the ultimate beneficial owner of UIEL. So it appears that there was only one 'shareholder' to negotiate with.

- Wah Nam's submission was more complete. It submitted that Mr Luk had no involvement in the loan from Ms Ho but, as a director of CTTC since 28 September 2005, he was involved with the other directors (Ms Ho and Ms Yu) in determining the terms and conditions of the loan scheme. Wah Nam submitted that Mr Luk had no involvement in the timing of the drawdown of funds or the purpose for which the funds were employed.

- Leading Pride also submitted that it had been actively trading Brockman shares, and had been a net seller since 1 March 2010, which was not consistent with it 'warehousing' shares for Wah Nam.

- Wah Nam made a preliminary submission that "Ms Yu and Mr Luk have a commercial relationship. They are not Associates, as that term is defined in the Corporations Act in relation to Brockman's affairs. Wah Nam has no knowledge of the actions of Ms Yu or that of Leading Pride in relation to Leading Pride's investment in Brockman". We doubt that Wah Nam has no knowledge given that Mr Luk is a director of Wah Nam, is a director of CTTC (and was a director at the time the loan was given) and is now the ultimate owner of CTTC.

- In response to the brief, Wah Nam identified Mr Luk's role as a director of CTTC in the loan scheme. Brockman submitted that it was only when directly asked by the Panel that Wah Nam clarified that CTTC had made a significant loan for the purchase of Brockman shares by Leading Pride. It is submitted that, for this and other reasons, "parties have not been fully candid with the Panel." We have some sympathy with that.

- Brockman pointed to a number of factors supporting a conclusion of association, including:

- the role Mr Luk played in the loan scheme

- Mr Luk's subsequent ownership of CTTC

- the loan to Ms Yu was around 3 times the usual working capital level of CTTC, itself suggesting that the loan in turn had been funded by a material loan from a shareholder and

- the coincidence of purchases by Wah Nam and Leading Pride.

- Brockman also submitted that there were attempts to conceal the nature of the ongoing relationship between Ms Ho and Mr Luk and queried whether Mr Luk had a role in Cryolife23 prior to his acquisition of CTTC.

- Certainly there are coincidences here which concern us. However, on balance we could not draw an inference of association with respect to the affairs of Brockman. A significant factor against an inference is that Leading Pride has been an active trader suggesting that its purpose was to make money rather than 'warehouse' shares.

- Brockman submitted that, some time before 1 December 2010, Mr Richards (Brockman's managing director) spoke to Mr Luk in Hong Kong and understood that Mr Luk "either controls, or has a material personal interest in Cryolife". The application stated that Cryolife was wholly owned by CTTC. We asked Wah Nam whether Mr Luk or any of his companies had any economic or beneficial interest in CTTC (whether through shares, trusts, loans, options to acquire shares or otherwise) prior to 1 December 2010. It submitted that Mr Luk did not have any legal or beneficial interest in CTTC under any kind of arrangement before 1 December 2010. Wah Nam's denial was unequivocal whereas Brockman's statement was less precise.

Wah Nam and Star Ray

- The application submitted that Wah Nam arranged for Star Ray (and potentially others) to purchase Brockman shares when Wah Nam was constrained by s606 (the 20% threshold).

- In June 2010, Mr Ross Norgard, a director and shareholder of Brockman, wanted to sell 3,250,000 Brockman shares. Brockman submitted that Star Ray bought 2,500,000 of them. Star Ray denied it was the buyer, and provided a schedule of acquisitions and disposals for Mr Cho and itself. The schedule confirmed no such acquisition.24

- In the submission, Mr Cho "confirmed that the decision to invest in Brockman shares was based on an ordinary investment decision-making process. He has confirmed he took into account the views and recommendations of trusted friends and advisers ...."

- This statement is supported in part by the preliminary submission of Platinum, an investment vehicle of Mr Wong's. Explaining the nature of Mr Wong's relationship with Mr Cho and Star Ray, the submission said, "Mr Wong recollects being asked in general social conversation by Mr Cho if Mr Wong had any stocks to recommend. Mr Wong believes he may have mentioned that, amongst others, Brockman, in his view, could be a potentially attractive investment opportunity".

- Platinum added that Mr Wong's friends and business acquaintances, including Mr Cho, used the Beach Road address and Ms Floreen Toh (an employee of Mr Wong who also held shares in Brockman) had run errands of an administrative nature for Mr Cho.

- Star Ray's only investment is in Brockman shares, which represents approximately 80% of Mr Cho's total share portfolio. In a statutory declaration Mr Cho confirmed that the purchase of Brockman shares by himself and Star Ray were financed wholly from his own funds.

- Brockman submitted that Mr Cho and Star Ray had connections to the Beach Road address and in particular to Mr Wong. Mr Wong has been Mr Cho's friend for over 20 years and they have played golf together.

- Mr Cho is involved in real estate and "his family has vast business interests in real estate in Singapore, China and Australia and in addition other business ventures in China and other parts of South East Asia."

- Brockman pointed to a number of factors supporting a conclusion of association, including:

- what it submitted was a false denial by Mr Cho that he did not know who conducted business at the Beach Road address when he is clearly Mr Wong's friend and used the address (even if he does not conduct business there)

- Mr Cho's long-standing friendship with Mr Wong, who recommended Brockman to Mr Cho as an investment

- Mr Cho knows Mr Luk and

- some coincidence of buying, suggesting coordinated purchases by Star Ray and Wah Nam.

- Perhaps a key aspect of Brockman's submission was that Star Ray was one of the Beach Road shareholders.

- There has plainly been a lot of communication and trading by persons sharing or using the Beach Road address. We take this up below. Insofar as Mr Cho and Star Ray are concerned, in our view there is little on which we can properly draw an inference of association with Wah Nam in relation to Brockman.

- Mr Cho submitted that he did not know who conducted business at the Beach Road address and used the address for minor administrative needs. It is therefore plausible (as was submitted) that Ms Toh attended to personal payments on his behalf. It is not clear why he would deny knowing who conducted business there, unless he held some other concern but this was not stated.

- Notwithstanding this, we do not think the coincidence of buying is strong enough for an inference of association with Wah Nam in this case. Nor do we think the fact that Mr Cho is Mr Wong's friend establishes a basis for an inference of association between Mr Cho or Star Ray and the Beach Road shareholders in this case.

Beach Road Shareholders themselves, and Wah Nam

- Multiple parties used the Beach Road address. It is Mr Wong's business address for the Kangqi Group, which is involved in oil trading and related business. Ms Pauline Chen and Ms Floreen Toh work for Mr Wong at that address. Ms Toh supports Ms Chen in Ms Chen's role as financial controller of the Kangqi Group. Mr Ng is Mr Wong's partner in that business. Ms Chen is also a director of several of Mr Wong's companies.

- Others using the address include Mr Michael Ng and Mr Liang Wen-Chong.

- Brockman submitted that Star Ray, Platinum, Yencon, and the other Beach Road shareholders had failed to lodge a substantial holding notice disclosing their association. It also submitted that this failure may have been deliberate to conceal an association with each other and Wah Nam.

- Brockman pointed to a number of factors supporting a conclusion of association between the Beach Road shareholders, including:

- the common address, which it submitted had been a basis for inferring that parties were associated in Mesa and PICA25

- Ms Chen worked for Mr Wong

- Ms Toh worked for Mr Wong (initially it was submitted that she worked at Star Ray)

- Yencon was controlled by Mr Wong's sister

- Ms Chen invited Ms Toh to attend a meeting with Mr Humphry (Brockman's CFO), suggesting various entities were communicating and

- some of the entities had used common brokers.

- The Beach Road address is a commercial building with offices, a hotel and serviced apartments.

Use of the address

- We think there are plausible reasons for many of the parties to have used this address. It is Mr Wong's and Mr Ng's business address. Ms Toh and Ms Chen work there. Mr Cho used it for some of his personal mail. Mr Liang used it as a convenient Singapore address for his Singapore broker to contact him.

- It is less clear why others use the Beach Road address, but Platinum submitted that offering the use of an address to friends and business acquaintances helped foster relationships ('guanxi'). This, it was submitted, was extremely important amongst Chinese business people. We have no reason to doubt this.

Why did Ms Chen and Ms Toh invest?

- The submission on behalf of Tradewin, Ms Chen and Yencon said that it was "both logical and reasonable for both Ms Toh and Ms Chen to invest in Brockman based on the research they both undertook for Mr Wong on the Australian resource sector and Brockman in particular". Ms Toh submitted that, having assisted in research on potential investments in the mining industry, she agreed with the team's favourable assessment of Brockman and made a personal investment decision (through Stockholm SWD Ltd, a British Virgin Island incorporated company, of which she was sole shareholder and director). Mr Wong had purchased Brockman shares.

- Mr Wong submitted that he was not aware that Ms Chen or Tradewin had invested in Brockman.

- Mr Wong provided loan funds to Ms Chen, which she used to purchase Brockman shares. The loans were not documented or secured and were "loosely understood to be repayable in five years". Platinum submitted that this type of arrangement for talented and valued senior management staff was not uncommon in certain sections of the Chinese business community.

- Questions we asked Mr Wong about such loans went unanswered. It was submitted that he had made loans to several highly valued members of his senior management team but no further details were provided. He expressed concern about speculation, resentment and loss of morale amongst the team should he disclose details.

- Ms Chen also refused to answer some questions about loans she received.26 She submitted that "the amount and exact terms of all the loans provided to Ms Chen from Mr Wong is private and confidential (such details are not even known by Ms Chen's colleagues at Kangqi Group) and we submit not directly related to these proceedings". We disagree.

- The loan to Ms Chen seemed, to us, a very significant one. We have not been able to establish how commonly Mr Wong made such loans to Ms Chen or others, or how often Ms Chen took them, and we are left thinking that there may be more to their reluctance to disclose than the submissions suggest.

- However, it was also submitted that "there is no commercially logical reason why Mr Wong, an independent, decisive decision maker, would tie himself to acting together in relation to his small shareholding with anyone, (be it Ms Chen or any other), in relation to an even smaller shareholding, in a company where aggregating such small shareholdings could not deliver any meaningful commercial advantage to him on any analysis."

- We think this is plausible. We also think it is not unheard of for research staff (or other staff) to follow their employers into investments, although it is somewhat unusual that the employer knows nothing of it.

- Brockman submitted that Mr Humphry (Brockman's CFO) met Ms Chen at the Beach Road address to discuss concerns in relation to association and the Wah Nam Offer. Subsequently, on 4 January 2011, Ms Chen and Ms Toh met with Mr Humphry. Mr Humphry had expected only to meet Ms Chen, but she had arranged for Ms Toh to attend. Brockman submitted that Ms Chen represented herself, Tradewin and Mr Wong's companies at the meeting and that Ms Toh represented Mr Cho, Star Ray and Stockholm. This, it submitted, was evidence that parties were communicating.

- Ms Chen submitted that Brockman's description of the circumstances surrounding the meeting was inaccurate. She submitted that Mr Humphry had made an unsolicited visit to the Beach Road offices seeking a meeting with her and Ms Toh, but they had been on leave and Ms Chen arranged a meeting for 4 January 2011 on her return. The meeting was the first time she met Mr Humphry.

- Ms Chen holds a senior role with Mr Wong and it is not surprising that she would be involved in meetings with Mr Humphry and others.

- The loan arrangement, in particular, troubles us, and we are troubled by the submission that Ms Chen invested in Brockman without her employer's knowledge. But on balance, we think it is unlikely that Ms Chen has any control over Mr Wong's investments in the relevant sense and note her submission that her role is limited to execution of his investment decisions. The converse may not be so obvious. However, the only reason we could see why Mr Wong would use Ms Chen's company would be to avoid disclosure of a holding slightly above 5%, which seems unlikely.

- Ms Toh did not become a party to the proceedings. Stockholm, her company, has sold its shareholding in Brockman. In a preliminary submission Ms Toh denied any association with Mr Cho or Star Ray. She said that, at Mr Cho's request, she assisted him to open a trading account and used the Beach Road address for convenience. She submitted that she regularly ran errands for Mr Wong's friends and business associates. Mr Cho and Star Ray denied that Ms Toh represented them at the meeting on 4 January 2011, and submitted that Mr Cho had no knowledge the meeting was taking place. Mr Cho confirmed that Ms Toh assisted him with minor administrative matters.

- Ms Chen submitted that Mr Humphry had asked Ms Chen to pass on a message to Ms Toh about a mutual acquaintance, and so Ms Chen invited Ms Toh to attend a second meeting with Mr Humphry. The circumstances of Ms Toh's attendance at the meeting appears to have been explained.

Why did Mr Ng invest?

- Platinum submitted that Mr Wong may have mentioned Brockman as a company of interest to Mr Ng, his business partner in the Kangqi Group. Mr Ng recalled such a discussion, and submitted that he used his own money to make his investment, which represented approximately half of its current total share portfolio.

- It is not surprising that business partners might discuss investments, and make similar investments.

- Brockman submitted that Mr Ng and another Beach Road shareholder used the same broker. This also is not surprising in itself.

- No additional evidence has been provided to warrant an inference of association with the Beach Road shareholders in relation to Brockman.

Why did Mr Liang invest?

- Mr Liang is a professional golfer, "currently the number 1 ranked golfer in China".

- Mr Liang started buying Brockman shares in February 2009. With some disposals, he has acquired 4,146,402 shares, representing approximately 2.86% of Brockman. He financed the shares through his own funds and borrowings, including by way of mortgage of family property. The investment represents virtually all of his total share portfolio.

- Mr Liang has occasionally played golf with Mr Cho and Mr Wong. In preliminary submissions Mr Liang said "it is possible one of them could have suggested that Mr Liang consider Brockman as an investment." He also submitted that he cannot recall, but may have played golf with Mr Luk. Given his investment and the magnitude and importance of the investment for him, we think it is unlikely that he would have the vague recollection of the discussions he claims.

- Mr Liang submitted that he decided to invest in Brockman "purely for investment purposes. He considered Brockman to be an attractive investment as he understands there is expected to be very strong demand for resources generally from China (one of which is iron ore)". We regard this as unlikely. The size of his investment is very significant and was made with borrowed funds (in part) and without professional advice. He took a significant risk, including with a mortgage of property, and the investment represents almost all of his share portfolio. Mr Liang submitted that he was motivated to make money and pointed to his active trading in the shares to support this. This may be, but we think there may be additional explanations for how he identified Brockman. However, we are not satisfied of an association with the other Beach Road shareholders in relation to Brockman.

Why did Mr Wong invest?

- Mr Wong initially purchased Brockman shares in late 2008 through Yencon (refer below). He also bought Brockman shares in his own name. In mid-2009, Mr Wong sold all his Brockman shares. He has since repurchased, through Platinum. His interest in Brockman pre-dated Wah Nam's.

- Mr Wong has not been completely open with the Panel. Brockman submitted that the reason Mr Wong did not wish to disclose details of loans to other employees was that they were unequal. It submitted also that it was not credible that Mr Wong was not aware what Ms Chen was considering investing in. We have some concerns about these matters but no direct evidence.

- Brockman also submitted that Mr Wong was "well acquainted" with Mr Luk. Certainly they are acquainted. It is unclear how well. Platinum submitted that "In light of Mr Luk's and Mr Wong's relative prominence in Chinese business circles Mr Wong and Mr Luk were casual, very infrequent acquaintances of one another." Ms Chen, on an oil-related business trip, was accompanied by Mr Luk as facilitator of an introduction. And in rebuttal submissions, Wah Nam said "The only relationship Mr Luk has with Mr Wong is that they have played golf together. Mr Luk recalls he played golf in a group with Mr Wong about 3 times in 2010, sometimes not even in the same tee-off group."

- It is evident that Mr Wong is a wealthy man and has been actively trading Brockman shares. He appears to be at the centre of an investment circle but it seems equally open to us that those circling him have taken a hint from his investment decisions, or from his recommendations.

- Given Mr Wong was interested in Brockman before Wah Nam was, and the connections to Mr Luk have not been firmly established, we regard the link between Wah Nam and Mr Wong to be insufficiently strong to establish an association.

Why did Ms Wong invest?

- Yencon was transferred to Ms Wong from her brother, Mr Wong, in March 2009. It was submitted that this was part of a family restructure of investment interests, the rationale being to allow Mr Wong to undertake his investment independently of his family.

- Yencon originally purchased its Brockman shares in October 2008, when Mr Wong controlled it.

- In 2010, under Ms Wong, Yencon actively bought and sold Brockman shares "in an attempt to make short-term trading profits".

- It was submitted that the inference that family members with common shareholdings were associated was without merit or substance. This may be too strong a statement. But the investment in Brockman held through Yencon passed from Mr Wong to Ms Wong and she had been actively selling shares throughout 2010. It seems plausible that there had been a division of family assets rather than a concerted effort to circumvent the substantial holder provisions of the Corporations Act. And we have little more to go on.

- We are unclear about the role Ms Chen plays in Yencon. She, Tradewin and Yencon were represented by the same advisers. It was submitted that "Consistent with Ms Chen's relationship with Mr Wong, Ms Chen has a purely professional role with respect to Yencon's affairs".

A substantial holding notice breach

- The combined holdings of Mr Wong and Yencon at 9 January 2009, when Mr Wong held the shares in Yencon, were approximately 5.59% of Brockman (subsequently increased), although Mr Wong did not have a 100% beneficial interest in Yencon at that date. In March 2009, a restructure of the family's business resulted in Mr Wong transferring his shareholding in Yencon to Ms Wong, his sister.

- The breach is not continuing, so we consider that it does not warrant a declaration of unacceptable circumstances.

- However, any contravention of the substantial holding (or tracing notice) provisions in Chapter 6C is contrary to the policy objectives of section 602.27 We leave this to ASIC, if it wishes to pursue the matter.

Conclusion on the Beach Road shareholders

- In all, we are not satisfied that we could draw the inferences and make findings of an association between the Beach Road shareholders in relation to Brockman.

- If there is an association, it results in a substantial holding notice contravention, not a contravention of s606 unless there is an association to Wah Nam. The connections there were too tenuous, in our view, for us to make such a finding. We could not be satisfied of an impermissible association to Wah Nam.

Other matters

Volume of material

- Association cases often involve drawing together many facts, and building a picture by drawing inferences from those facts. We understand that this is often difficult to do within the Panel's required page limit for applications.28 However every effort should be made to contain the length of an application and include only relevant material as attachments. It is usually the case that brevity serves parties better. It is always the case that repetition does not improve an argument.

- The application, as did a number of submissions subsequently, went well beyond this ideal. For example, if seeking to establish a common address it is not necessary to file a 16 page annual return when an extract of the relevant page would suffice. As well, some of the attachments to the application, which were provided as PDF documents, were barely legible. This was unhelpful.

- It would be of assistance in future association applications if the facts are drawn together by the relevant participants in statutory declarations, particularly where conversations are involved.

Procedural complexities

- As noted, Brockman made 2 supplementary submissions to the application before we decided to conduct proceedings. The first supplementary submission resulted in a round of rebuttals being invited. Brockman also made rebuttal submissions on the brief which, with annexures, ran to about 75 pages. The rebuttal submission came in after the Panel had granted Brockman an extension of time (Wah Nam had objected to an extension). They went further than rebuttals usually do, restating arguments and drawing new hypotheses.

- Brockman's rebuttal submission generated calls for a right of further response. Given the unusual nature of the rebuttal submission we allowed further responses.

- The Panel's processes are informal and flexible, but they are well-defined and designed to ensure procedural fairness and speedy resolution of the proceedings. This is not achieved if information is provided piecemeal or submissions go beyond what is necessary. Nor is the best case made out.

Submissions

- We found a number of the submissions unsatisfactory. We consider there was an attempt to "drip feed" information to the Panel, which Brockman noted in its rebuttal submission. While it was submitted (and we acknowledge) that some of the questions raised sensitivities, there was outright refusal to provide some information, which generally related to the financial affairs of the party involved. Such information was requested and is clearly relevant to the commerciality of making the investment in the first place. No doubt ASIC, a party to the application (as all applications), has noted this.

- Platinum submitted that "Brockman is now seriously abusing the relative flexibility and informality of the Panel forum and proceedings and should be curtailed by the Panel from doing so." We agree that Brockman pushed the limits.

- Brockman sought to draw inferences and conclusions that were clearly not sustainable on the material adduced and used language such as "it remains possible that Ms Ho was holding legal title for Mr Luk" and "Ms Chen would have known Mr Luk reasonably well" which did not provide us with the level of satisfaction we needed to draw inferences.

- An adviser must make the best case it can for its client, but has a responsibility not to overstate its case. Aspects of Brockman's case were overstated, which detracted from it. On the other hand, some clearly implausible explanations were provided by other parties.

Decision

- We are not satisfied on the material available to us that we could draw the necessary inferences and find the alleged associations. Nor are we satisfied that the circumstances are unacceptable in this case. However, there may be new circumstances if some or all of the shareholders identified in the application accept Wah Nam's bid such that it enables further inferences to be drawn and they support an association.

- For the reasons above, we decline to make a declaration of unacceptable circumstances. We consider that it is not against the public interest to decline to make a declaration and we had regard to the matters in s657A(3).

- Nevertheless, we are quite concerned about aspects of the matter, such as:

- the coincidence in timing of acquisitions and disposals of shares in Brockman by Leading Pride and Wah Nam. We note the business relationship between Mr Luk and Ms Yu and the fact that the funds for Leading Pride's acquisition were partly provided by a company subsequently acquired by Mr Luk. These make the coincidence worth further investigation, in our view and

- the business, family and social connections between some of the Beach Road shareholders and related parties. The funding of some acquisitions is unusual – for example, Ms Chen and Tradewin's use of loan funds from Ms Chen's employer and Mr Liang's decision to invest such a significant amount by way of mortgage and borrowing from a friend. There are also discussions between Beach Road shareholders about investing in Brockman and a pattern of acquisitions and disposals that are worth further investigation in our view.

- We will invite ASIC to consider the material.

Orders

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Alastair Lucas

President of the sitting Panel

Decision dated 31 January 2011

Reasons published 11 February 2011

|

Party: |

Brockman |

Advisers: |

Freehills |

|

Wah Nam |

Clayton Utz |

||

| Platinum | Thomsons Lawyers | ||

| Leading Pride | Cochrane Lishman Carson Luscombe | ||

| Pauline Chen, Tradewin, Yencon | Blake Dawson | ||

| Liang Wenchong | Baker & McKenzie | ||

| Michael Ng | Greenwich Legal Services | ||

| Cho Hong Cheen, Star Ray | Komesaroff Legal |

Annexure A

Corporations Act

Section 657E

Interim Orders

Brockman Resources Limited

Brockman Resources Limited (Brockman) made an application to the Panel dated 10 January 2011 in relation to its affairs.

The Acting President ORDERS:

- The shareholders in Brockman set out in Schedule A not:

- acquire any further shares or interests in shares or increase their voting power in Brockman

- dispose of, transfer or grant a security interest over any shares or interests in shares in Brockman or

- exercise any voting rights attaching to shares in Brockman.

- These interim orders have effect until the earliest of:

- further order of the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Schedule A

Leading Pride Limited

Star Ray International Limited

Yencon Enterprises Limited

Platinum Investment Holding Pte Ltd

Stockholm (SWD) Limited

Tradewin International Limited

Ironwood Group Limited

Cho Hong Cheen

Chen Bernadette Pauline

Mo Yang

Wu Wei

Liang Wenchong

Ng Kok Kuang

Alan Shaw

Counsel

with authority of Graham Bradley

Acting President of the Panel

Dated 13 January 2011

Annexure B

Corporations Act

Section 657E

Variation of Interim Orders

Brockman Resources Limited

Pursuant to

Section 657E of the Corporations Act 2001 (Cth)

The Panel Orders That

The interim orders made on 13 January 2011 are varied by adding the underlined words (below) at the end of paragraph 1(b):

"1. The shareholders in Brockman set out in Schedule A not:

- dispose of, transfer or grant a security interest over any shares or interests in shares in Brockman, except for a disposal by way of sale on the Australian Securities Exchange in the ordinary course of trading (other than a crossing or special crossing) where the following conditions are satisfied:

the seller has not provided any assistance, financial or otherwise, to the purchaser and

the seller notifies the Panel by 9.30am (Melbourne time) on the first business day after any trade of the number of shares disposed of on the previous business day."

Allan Bulman

Director

with authority of Alastair Lucas

President of the sitting Panel

Dated 20 January 2011

Annexure C

Australian Securities and

Investments Commission Act (Cth)

Section 201A

Undertaking

Brockman Resources Limited

Pursuant to section 201A of the Australian Securities and Investments Commission Act 2001 (Cth), Brockman Resources Limited undertakes to the Takeovers Panel that it will extend the period in which it will not issue or agree to issue securities under ASX Listing Rule 7.9 (which currently ends on 9 February 2011):

- to 2 March 2011; or

- by the number of days in the period from 13 January 2011 (when interim orders were made) to the date of the determination of the proceedings (including those two days),

whichever ends first.

Signed by Tara Robson as Company Secretary of Brockman Resources Limited

with the authority, and on behalf, of

Brockman Resources Limited

Dated 20 January 2011

1 References are to the Corporations Act 2001 (Cth) unless otherwise indicated. Sections 1043A and 651A were also raised

2 Re-lodged on 11 October 2010

3 Stockholm has sold its entire holding since the application was made

4 It appears that the shares went to Platinum

5 [2000] ATP 4 at [6], endorsed in Taipan Resources NL 03 [2000] ATP 17 at [26]

6 See GN 4 at [9]

7 LR 7.9 provides that, subject to exceptions, an entity must not issue securities for three months after being told in writing that a person is or is proposing to make a takeover for it

8 Sections 657B and 657C(3). The Court may extend the period for making a declaration on application by the Panel

9Mount Gibson Iron Limited [2008] ATP 4 at [15]. See also Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Rusina Mining NL [2006] ATP 13

10 [2002] ATP 18 at [27]

11 [2008] ATP 24 at [22], footnotes omitted

12 A similar course was adopted in Pacific Magnesium Corporation Ltd [2005] ATP 12

13 Procedural Rule 6.1.1

14 See Procedural rule 4.1.1 note 6

15 ASIC Regs 23 and 24

16 [2005] ATP 23 & ATP 24 at [62]; see also Bridgewater Lake Estate Ltd [2006] ATP 3 at [102]

17 [2005] ATP 20 at [264], quoting Re North Broken Hill Holdings Ltd (1986) 10 ACLR 270 at 284

18 Section 12

19 See section 53 and Corporations Regulation 1.0.18

20Gloucester Coal Limited 01R [2009] ATP 9 at [31], Azumah Resources Limited [2006] ATP 34 at [60], LV Living Limited [2005] ATP 5 at [77]

21 [2003] ATP 17 at [93]

22 [2006] ATP 3 at [100]

23 Cryolife is a brand name of CTTC and is in the business of the storage of cord blood

24 Platinum was most likely the buyer according to its schedule of acquisitions and disposals

25Mesa Minerals Ltd [2010] ATP 4 and Prudential Investment Company of Australia Limited [2003] ATP 36

26 Ms Chen offered to answer some of the Panel's questions in confidence. Procedurally this was unhelpful and such a course would only be able to be utilised by the Panel in very rare cases

27Rivkin Financial Services Limited 01 [2004] ATP 14 at [19], quoting Village Roadshow Limited [2004] ATP 4

28 Procedural rule 3.1.1(c) requires an application not to exceed 10 A4 pages in 12 point for the details of the application