[2011] ATP 1

Catchwords:

association - related parties - substantial holding disclosure - beneficial tracing disclosure - efficient, competitive and informed market

Corporations Act 2001 (Cth), sections 602, 606, 608(2), 671B, 672B, 1041A, 1041C

Regis Resources Ltd [2009] ATP 7, International All Sports Limited 01R [2009] ATP 5, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Mount Gibson Iron Limited [2008] ATP 4, Rusina Mining NL [2006] ATP 13

Introduction

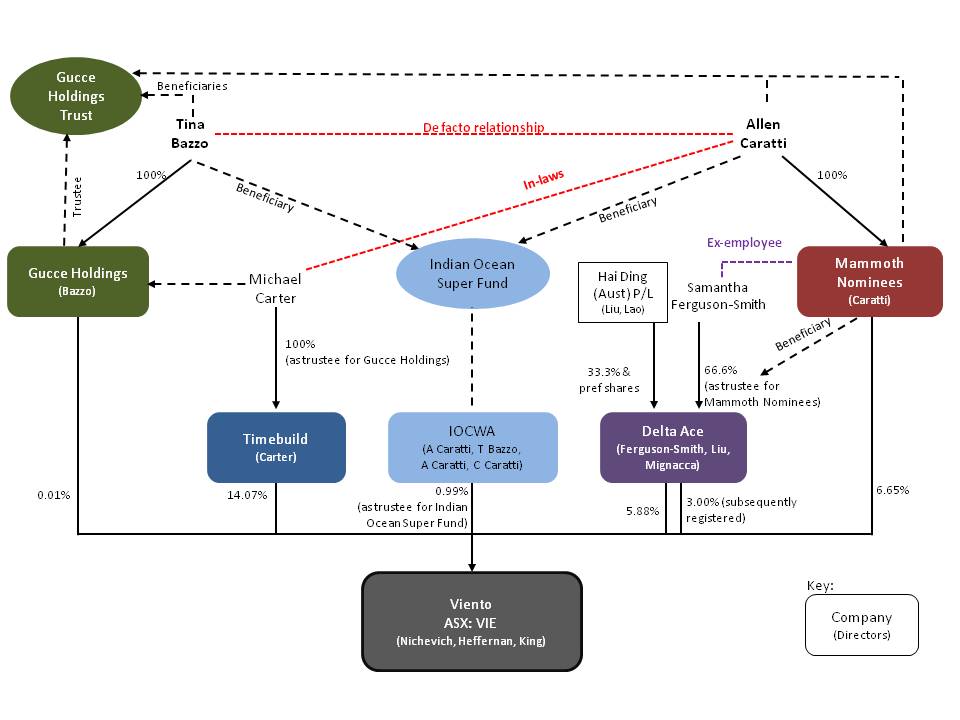

- The Panel, Martin Alciaturi, John Fast and Byron Koster (sitting President), made a declaration of unacceptable circumstances on an application by Viento Group Limited in relation to its affairs. The application concerned whether parties were associated in relation to Viento. The association resulted in the voting power of Ms Tina Bazzo, Mr Allen Caratti and other associated parties increasing above 20% in Viento otherwise than in accordance with section 611. Substantial holding notices and tracing notices were not filed, were late or were deficient, and no substantial holding notices were given reflecting the association and subsequent acquisitions. The Panel ordered vesting of shares above an aggregated holding of 20% and filing of substantial holding notices.

- In these reasons the following definitions apply.

- Bydand

- Bydand Capital Pty Ltd

- Delta Ace

- Delta Ace Pty Ltd

- Gucce Holdings

- Gucce Holdings Pty Ltd1

- IOCWA

- Indian Ocean Capital (WA) Pty Ltd

- Mammoth Nominees

- Mammoth Nominees Pty Ltd

- parties

- Ms Tina Bazzo, Mr Allen Caratti, Mr Michael Carter, Ms Samantha Ferguson-Smith, Timebuild, Delta Ace, Mammoth Nominees, Gucce Holdings and IOCWA

- Timebuild

- Timebuild Pty Ltd

- Viento

- Viento Group Ltd

Facts

- Viento, a funds management company, is an ASX listed company (ASX code: VIE). It has on issue 47,324,572 ordinary shares.

- Bydand was a shareholder in Viento, with approximately 23% of the shares.

- In or around November 2008, the 'Bydand shareholding' of approximately 23% of Viento was for sale. The shares were held in part by Bydand and in part by the MR and SJ Gordon Superannuation Fund. Mr Gordon (CEO of Bydand) informed Mr Nichevich (a director of Viento) of the potential sale. He also informed Mr Nichevich that Mr Allen Caratti had expressed interest in the shares.

- On 12 May 2009, Bydand lodged a notice of change of substantial holder, reflecting the sale of 6,658,880 shares in Viento. This reduced the holding from 22.9% to 8.9%.

- Also on 12 May 2009, Bydand and Delta Ace executed an agreement for the sale of the remaining shares in two tranches:

- 2,781,120 shares (5.88%) to be completed on 3 August 2009 and

- 1,420,000 shares (3%) to be completed on 8 November 2009.

- On 28 May 2009, Timebuild lodged a substantial holding notice (dated 22 May 2009), showing the acquisition of 6,658,880 shares in Viento (14.07%). No associates were listed in the notice.

- On 5 August 2009, Bydand lodged a notice of ceasing to be a substantial holder, reflecting the sale of 2,781,120 shares in Viento.

- On 27 January 2010, Delta Ace lodged a substantial holding notice dated 20 January 2010. It showed the acquisition of 2,781,120 shares in Viento (5.88%). The acquisition was said to have taken place on 20 August 2009. No associates were listed in the notice.

- According to the then most recent Appendix 3B, Viento had on issue 47,324,572 ordinary shares. A remaining tranche of 3% held by Bydand had been purchased by Delta Ace (although sold as part of the contract for sale dated 12 May 2009, it was only registered in Delta Ace's name during these proceedings). No change in substantial holding notice has been lodged.

- On 12 February 2010, Viento served tracing notices under section 672A2 on:

- Mr Michael Carter at Timebuild

- Ms Samantha Ferguson-Smith at Delta Ace

- Ms Tina Bazzo at IOCWA and

- Mr Allen Caratti at Mammoth Nominees.

- Responses were received during February and March 2010 as follows:

- Mr Carter gave his name and address as the only person who had a relevant interest in 6,658,880 shares. For details of the nature and extent of the interest, he said "sole shareholder/director"

- Ms Ferguson-Smith said "Delta Ace P/L owns the shares purchased in Viento. I … am the sole director/shareholder of Delta Ace P/L." For each other person who had a relevant interest, she said "N/A". For details of the nature and extent of the interest, she said "N/A"

- Ms Bazzo said "Am Director of Company that has many shareholdings in ASX listed companies, and acts as super fund". For each other person who had a relevant interest, she said "N/A". For details of the nature and extent of the interest, she said "N/A"

- Mr Caratti gave Mammoth Nominees as the only person who had a relevant interest. For the name and address of each person who has given instructions about the acquisition or disposal of shares or exercise of voting rights, he said "Allen Caratti.…"

- Shareholdings in Viento at 13 January 2011 include the following:

Delta Ace 2,781,120 shares

1,420,000 shares5.88% and

3.00% subsequently registeredGucce Holdings 3,000 shares 0.01% IOCWA 468,180 shares 0.99% Mammoth Nominees 3,148,349 shares 6.65% Timebuild 6,658,880 shares 14.07% - On 1 October 2010, Samantha Ferguson-Smith (a director of Delta Ace) requested a copy of the register of members of Viento under s173(3). The request directed that the copy of the register be sent by email to Ms Tina Bazzo at Gucce Holdings and by mail care of Delta Ace.

- Bydand responded (dated 24 November 2010) to a s672A notice stating that it had sold its remaining shareholding in Viento on 6 November 20093 to Delta Ace and that the instructions for the sale were from "Alan (sic) Caratti, Delta Ace Pty Ltd". The response stated that the "shares were subject to a contract of sale & there appears to have been issues between the purchaser (Delta) and the sponsoring broker in getting the transfer processed".

- Various relationships between the parties are described below.

Application

- By application dated 14 December 2010, Viento sought a declaration of unacceptable circumstances.

- It submitted that, in relation to Viento:

- Mr Caratti orchestrated the transactions under which Delta Ace and Timebuild acquired shares in Viento from Bydand

- Mr Caratti and Mr Carter approached Viento jointly about Mr Carter obtaining a Viento board seat

- there were structural links between Timebuild, Delta Ace, Mammoth Nominees, Gucce Holdings, IOCWA, Mr Carter, Mr Caratti, Ms Bazzo and Ms Ferguson-Smith and

- the conduct of these parties (including recent acquisitions of shares in Viento), and structural links and relationships between them, evidenced an association between them in relation to Viento and that they had voting power of 30.16%4 in Viento (being the shares in which they or their associates have a relevant interest).

- It also submitted that there were:

- breaches of s606, because Delta Ace, Timebuild, Mammoth Nominees, Gucce Holdings and IOCWA collectively held 30.16% of Viento

- breaches of s671B, because the substantial holding notices had not shown the association of the parties, Delta Ace had not disclosed the acquisition of 3% of Viento and Mammoth Nominees had not disclosed a 6.22%5 shareholding in Viento and

- breaches of s672B, because Timebuild, Delta Ace, Mammoth Nominees and IOCWA had not disclosed any associated parties or any person who gave instructions in relation to Viento shares, and Timebuild, Delta Ace and IOCWA had responded out of time.

- Viento submitted that the effect of the circumstances was that the acquisition of the shares in breach of s606:

- was likely to inhibit the acquisition of control over Viento taking place in an efficient, competitive and informed market and

- resulted in the market not being fully informed regarding the identity, shareholdings and associations, resulting in an inefficient or false market.

- Viento also submitted that its shareholders were prejudiced as there was an existing and continuing unacceptable effect on control of Viento.

Interim orders sought

- Viento sought interim orders, until the application was determined, that the parties be prevented from acquiring further shares or increasing their voting power, be prevented from disposing of or transferring any shares, and be prevented from exercising any voting rights attaching to shares.

- We made interim orders to the effect that the parties not acquire or dispose of shares or exercise voting rights until further order (annexure A). We did so to maintain the status quo pending determination of the application. Various parties had offered undertakings, but there were significant differences between them, and each was different to the draft interim orders we had indicated we were considering. The position that would have resulted from accepting the undertakings was too difficult to keep track of and manage. Accordingly, we decided not to accept undertakings but to make interim orders.

Final orders sought

- Viento sought final orders that:

- shares acquired by on behalf of the parties in excess of 20% vest in ASIC and be sold by private tender to non-associated parties, with the net proceeds paid to the parties as appropriate. It requested that Viento be permitted to tender for the shares by way of selective buyback

- ASIC retain an independent investment bank or stockbroker to conduct the tender

- the parties disclose their voting power and associations and

- the parties be prohibited from acquiring any further shares or increasing their voting power other than as permitted by s611.

Discussion

Association hurdle

- Before the Panel will conduct proceedings on the issue of association, there must be a sufficient body of material demonstrated by the applicant, together with inferences (for example from partial evidence, patterns of behaviour and a lack of a commercially viable explanation) that might be drawn, to support the Panel conducting proceedings.6 This was established.

Timing

- Section 657B says:

The Panel can only make a declaration under section 657A within:

- 3 months after the circumstances occur; or

- 1 month after the application under section 657C for the declaration was made;

whichever ends last. The Court may extend the period on application by the Panel.

- Section 657C(3) says:

An application for a declaration under section 657A can be made only within:

- two months after the circumstances have occurred; or

- a longer period determined by the Panel.

- The Panel may extend time for receipt of an application.7 If it does, it has one month within which to make a declaration, unless that time is extended by the court on the application of the Panel.8

- In our view, the recent purchases bring the circumstances within the time in section 657C; alternatively there are alleged in the application contraventions of the Corporations Act which are ongoing; alternatively should it be necessary we extended the time for making the application to the date on which it was made (14 December 2010).

- On the basis of the second alternative, we had one month within which to make a declaration, if one was to be made.9

- We decided to conduct proceedings.

Acquisitions

- There have been further acquisitions. According to the application, and noting rounding errors, all the known acquisitions were as follows:

Number Date % holding accumulated % IOCWA 8,123 27/11/08 0.02 0.02 IOCWA 59,501 10/12/08 0.13 0.14 IOCWA 7,000 10/01/09 0.01 0.16 Merrill Lynch (for Timebuild) 6,658,880 21/05/09 14.07 14.23 IOCWA 275, 376 16/06/09 0.58 14.81 Delta Ace 2,781,120 20/08/09 5.88 20.69 Delta Ace 1,420,000 Nov 09 (3.00) 23.69 IOCWA 118,180 14/12/09 0.25 23.94 Mammoth 501,155 13/01/10 1.06 25.00 Mammoth 45,000 11/08/10 0.1 25.09 Mammoth 84,600 16/08/10 0.18 25.27 Mammoth 13,400 14/09/10 0.03 25.30 Mammoth 4,400 16/09/10 0.01 25.31 Gucce 3,000 24/09/10 0.01 25.31 Mammoth 41,000 7/10/10 0.09 25.40 Mammoth 263,000 13/10/10 0.56 25.96 Mammoth 199,600 18/10/10 0.42 26.38 Mammoth 150,000 20/10/10 0.32 26.70 Mammoth 85,000 27/10/10 0.18 26.87 Mammoth 71,700 17/11/10 0.15 27.03 Mammoth 416 22/11/10 0.00 27.03 Mammoth 10,000 24/11/10 0.02 27.05 Mammoth 392,856 30/11/10 0.83 27.88 Mammoth 42,144 2/12/10 0.09 27.97 Mammoth 29,210 6/12/10 0.06 28.03 Mammoth 192,300 7/12/10 0.41 28.44 Mammoth 256,436 9/12/10 0.54 28.98 Mammoth 436,936 10/12/10 0.92 29.90 Mammoth 124,328 13/12/10 0.26 30.16 - Subsequent acquisitions by Mammoth Nominees of 0.49%, and sales of 0.06%, resulted in a net increase of 0.43%, taking the total to approximately 30.6%.

- Of the Bydand 23% shareholding, approximately 19.9% was registered to Timebuild and Delta Ace. The additional 3% was subsequently registered to Delta Ace. The associated parties exceeded 20% on or about 12 May 2009 when the Bydand transaction was agreed, or at least on 20 August 2009 when Delta Ace's 5.88% was registered. Together with IOCWA and Timebuild, the accumulated registered holding on 20 August 2009 was 20.69%.

Preliminary findings

- Having considered the application, submissions and rebuttals, we made preliminary findings and invited comments on them. Our conclusions follow consideration of responses.

Outcome

- We considered the cumulative effect of the material and drew the necessary inferences.

- There appear to be two 'blocks' of shareholdings: Mr Caratti's and Ms Bazzo's. We turn first to Mr Caratti's, then Ms Bazzo's, and then look at whether there is an association between them.

Mr Caratti

Mammoth Nominees

- Mr Caratti is the sole director and shareholder of Mammoth Nominees. Mammoth Nominees is the registered owner of 6.65% of Viento fully paid ordinary shares.

- Mr Caratti has a relevant interest in those shares.

Delta Ace

- Ms Ferguson-Smith now holds 66.6% of the shares in Delta Ace. She holds them on trust for Mammoth Nominees, pursuant to a declaration of trust dated 8 August 2007. She had been the sole shareholder. On or about 20 August 2010, Hai Ding (Australia) Pty Ltd subscribed for one ordinary share (33.3%) of Delta Ace and 1,000,000 redeemable preference shares. Hai Ding is owned by Gen Qiang Liu and Yang Cao. They have an address in WA. In respect of them, Mr Caratti said "I am informed that the directors of Hai Ding are involved in property development in China."

- Mr Caratti is the sole shareholder of Mammoth Nominees. Mr Caratti has a relevant interest in the shares held by Delta Ace.

- Delta Ace was the registered holder of 5.88% of Viento and is now the registered holder of 8.88%. Thus, Mr Caratti has a relevant interest in all the shares held by Mammoth Nominees and Delta Ace, which he defined as "Mammoth Group", namely 15.53%.

- The reason given for not registering the 3% shareholding at the time it was acquired was that the share transfer was "incorrectly executed by Ms Ferguson-Smith. Due to the termination of her employment, this took some time to rectify." We do not accept this. The purchase was by Delta Ace. Ms Ferguson-Smith was, and appears to remain, a director of Delta Ace. It was submitted on our preliminary findings that it became difficult to contact Ms Ferguson-Smith after the termination of her employment. We do not accept this. It is inconsistent with the earlier explanation and inconsistent with her remaining a director (indeed at the time the sole director) of Delta Ace. The termination of her employment (presumably with Mammoth Nominees) would not appear to be relevant to the registration of Delta Ace's holding, and its relevance remains unsatisfactorily explained. Another explanation might be that not registering this parcel was intended to keep the registered holding below 20%. If that was intended, it appears that it didn't work.10

- We infer that the registration of the 3% parcel was intentionally delayed, although we cannot be sure of the reason.

- Delta Ace used funds provided by Mammoth Nominees to acquire its holding. Mr Caratti said he "concluded the negotiations with Bydand on the basis that Gucce, via Timebuild, would acquire 6,658,880 and Mammoth, via Delta Ace would acquire the balance". It was submitted that Delta Ace was used because that would increase its asset base, improving its ability to procure finance for the property developments it was undertaking. The point remains, however, that Delta Ace was not acting independently.

- Mr Caratti also said "I have provided all instructions concerning the acquisition, disposal or exercise of voting or other rights concerning the Shares held by Mammoth and Delta Ace, including to Ms Ferguson Smith...."

Ms Bazzo

Timebuild

- Timebuild is the registered holder of 14.07% of Viento. Ms Bazzo incorporated Timebuild as a vehicle for Gucce Holdings to acquire the shares in Viento from the 'Bydand shareholding'.

- Mr Carter is the sole shareholder of Timebuild. He is a director and shareholder of Indian Ocean Capital Pty Ltd, a financial advisory and share broking firm used by Gucce Holdings, Mammoth Nominees and IOCWA.11 He holds the shares in Timebuild on trust for Gucce Holdings as trustee of the Gucce Holdings Trust, pursuant to a declaration of trust dated 21 April 2009.

- Mr Carter said the reason Ms Bazzo wished to use "a special purpose company and trust structure was to keep the investment separate from other investments and businesses of Gucce. In particular [Ms Bazzo] wished to keep the investment separate from the land holdings and land developments of Gucce in and around the Southern River subdivision of Viento, this including property immediately adjacent to that of Viento."

- Mr Caratti said that Ms Bazzo informed him that she did not wish to purchase the shares in Gucce Holding's name "due to Gucce's established reputation as a land developer", which she "was not willing to risk ... should there be any negative publicity concerning Viento or any of its developments." We did not regard this as an adequate explanation.

- Mr Nichevich said that Mr Carter never revealed to him that the shares were held on trust but that he (Mr Carter), together with Mr Caratti, "were major shareholders of Viento and it was on that basis he considered he should be appointed to the Viento Board." Mr Caratti submitted that he had no control over the Gucce Holdings Trust and neither he nor Mammoth Nominees had received any distribution. Be that as it may, the existence of the trust was not disclosed.

- The shares held by Mr Carter in Timebuild appear to be held on trust pursuant to a declaration of trust. They appear to be held for Gucce Holdings as trustee of the Gucce Holdings Trust pursuant to the Gucce Holdings Trust discretionary trust deed dated 1 July 2005. The general beneficiaries of the Gucce Holdings Trust include:12

- Ms Bazzo

- any spouse or de facto of Ms Bazzo (Mr Caratti is Ms Bazzo's de facto)

- the primary beneficiaries (being the children of Ms Bazzo and the children of any spouse or de facto of Ms Bazzo) and

- Mammoth Nominees (being an 'Eligible Entity' under the trust deed).

- An inference that can be drawn from the fact that the trust involving Mr Carter had not previously been revealed, is that it was intended by the parties that the existence of the trust could be used to hide the identity of persons who may have had a relevant interest in any of the shares held by Timebuild. Of course, it could have been established for another purpose, such as tax planning. Mr Carter commented on the non-disclosure of the trust referred to in our preliminary findings. He denied that he "intended or acted to conceal any matter or interest of any person in contravention of any law", and said that he disclosed the trust in response to our brief. However, the trust was not disclosed in any relevant discussion regarding a board seat in Viento, substantial holding notice or tracing notice. We therefore draw the inference that, even if the trust was established for some other purpose (eg, tax planning), the parties also decided to use it to hide the identity of persons who may have had a relevant interest in shares held by Timebuild.

- The share sale agreement under which Timebuild purchased its Viento shares was not provided when requested in the brief. Mr Carter said it was subject to a confidentiality clause and would be provided to the Panel on a strictly confidential basis upon request (although a request had been made in the brief).Yet the agreement allows for disclosure required by law and the agreement needed to be attached to a substantial holding notice. Subsequently the agreement was provided. This response to the brief was consistent with the general demeanour of concealment apparently being practised by parties to this transaction.

- We do not accept Mr Carter's submission that it was not apparent to him that he was required to provide a copy of the sale agreement to the Panel. He is a director of a financial advisory and share broking firm, who described himself in his statutory declarations as a "Share Broker".

- We do not accept a submission from other parties that the confidentiality clause did not expressly permit disclosure of the sale agreement to Viento, implying that that was the reason it was not given to the Panel. It was required to be attached to a substantial holding notice some months before.

- It was also submitted that "the inability of my clients to provide detailed responses or search for, locate and provide copies of documentation ... is a result of the extremely short time period afforded for such a response and my clients' office being closed effectively for all of this period." It was also submitted that the time of year and the fact that parties were overseas caused problems. We do not accept this submission. Short times were available for responses, and perhaps people were not readily available, but other documents were able to be produced by them within the time frame.

- In response to a brief question, Ms Bazzo said "I can only comment on the parcel that I requested be acquired, being the Timebuild, 6,658,880 shares, which was negotiated on my instruction in the Bydand transaction." Ms Bazzo has a relevant interest in Timebuild's shares by reason of the trust.13 In any event, we would separately be prepared to infer that Ms Bazzo has a relevant interest in Timebuild's shares.

Gucce Holdings

- Gucce Holdings is the registered holder of 0.01% of Viento. Gucce Holdings is the trustee of the Gucce Holdings Trust. Ms Bazzo said "I am the sole Director and Shareholder in Gucce Holdings Pty Ltd, which act both in it's (sic) own right and as trustee for the Gucce Holdings Trust, to which I am the appointer of the Discretionary Trust, and do own shares in Viento." It is unclear from this submission whether the 0.01% of shares in Viento held by Gucce Holdings are held on trust under this trust arrangement or not.

- Ms Bazzo is the sole director of Gucce Holdings.

- Ms Bazzo is the sole shareholder of Gucce Holdings.

- She has a relevant interest in shares held by Gucce Holdings.

- The funds for the purchase of shares in Viento by Timebuild were transferred from Gucce Holdings to the cash management account of Mammoth Nominees. Mammoth Nominees transferred the funds to the trust account of solicitors for Bydand.

- The money came directly from Gucce Holdings, and not through Timebuild, because, it was submitted, Timebuild did not have a bank account at the time "and accordingly Ms Bazzo wished to transfer the funds to the account of Mammoth Nominees so that payment to Bydand and the solicitors would not have any reference to Ms Bazzo or Gucce Holdings". There is no explanation how Timebuild accounts for the asset in its books given the money trail, or why it was important not to have any reference to Ms Bazzo or Gucce Holdings known.

- It was submitted that this account was a commercial and viable explanation. We do not agree that it is, and certainly not in the absence of documents establishing how the position was later regularised. We agree with Viento, which submitted, "the Panel should draw inferences from this money transfer given the clear lack of a commercially viable explanation".

- We infer that Ms Bazzo controlled Gucce Holdings and Timebuild and treated them as one and the same for this purpose. We infer that Ms Bazzo wanted to conceal her involvement.

- We also infer that Mr Caratti and Ms Bazzo did not distinguish between their respective interests in relation to Viento. While they may run their own businesses, Mr Caratti negotiated the acquisition of the Bydand parcel, handled the money for it, decided how many shares he wished to take into Delta Ace and how many would remain for Ms Bazzo. Moreover, Mr Caratti is a general beneficiary of the Gucce Holdings Trust.

IOCWA

- IOCWA is the registered holder of 0.99% of Viento. It is the trustee of the Indian Ocean Superannuation Fund.

- The directors and members of IOCWA are Mr Caratti, Ms Bazzo, Ms Alisha Beth Caratti and Ms Christina Marcia Caratti (relatives of Mr Caratti).

- The beneficiaries of the Indian Ocean Superannuation Fund are Mr Caratti, Ms Bazzo, Ms C Caratti and Ms A Caratti.

- We consider that Mr Caratti and Ms Bazzo each have relevant interest in the shares in Viento held by IOCWA.

- Further, they are both beneficiaries in the superannuation fund. This evidences a further common link between their interests.

- Ms Bazzo has a relevant interest in 14.08% of Viento, or 15.07% if IOCWA's shareholding is included.

- Ms Bazzo said in submissions: "I have voted on behalf of my shareholding by proxy". It is not clear which shares she refers to, but we infer that the reference to "my shareholding" is to either the 14.08% of Viento held by Timebuild and Gucce Holdings or the 15.07% of Viento if IOCWA's holding is included.

Association?

Bydand transaction

- Mr Caratti orchestrated the purchase of Bydand's interest in Viento. Ms Bazzo stated that the decision to invest in Viento was her own, and said that she had given instructions to both Mr Carter and Mr Caratti at different times since 2008 to negotiate or acquire shares in Viento on behalf of Gucce Holdings and IOCWA. Mr Caratti submitted that he facilitated a discussion between Ms Bazzo and Mr Nichevich, having established from Ms Bazzo that she would be interested in acquiring shares in Viento. While the discussions covered various commercial opportunities, Mr Caratti wanted Mammoth Nominees to secure any civil subdivision works that came out of any joint project between Viento and Ms Bazzo. We regard this as an example of the closeness with which Mr Caratti and Ms Bazzo act in each other's interests.

- We accept that Mr Caratti negotiated the purchase on behalf of the purchasers (and/or their beneficiaries). Whatever was understood by the vendors, Viento understood only that Mr Carter and Mr Caratti were the purchasers.

- Mr Caratti said he participated in discussions with an executive of Viento, Mr Nichevich, in relation to the purchase of shares in Viento from Bydand "on behalf of Mammoth ... knowing that Gucce had indicated that it was willing to purchase [s]hares". Mr Nichevich said "Mr Carter and Mr Caratti assured me that they had purchased Bydand's entire shareholding and that the transfer would be registered shortly". We infer that Ms Bazzo was not mentioned.

- Mr Caratti also said he "viewed Gucce as a likely suitor given that Gucce is involved in a number of similar activities to that of Viento". He was clearly familiar with the business of Ms Bazzo and had her business in mind. However, she was not mentioned in the discussion with Mr Nichevich.

- Ms Bazzo said: "Gucce Holdings Pty Ltd paid for the shares via transfer of funds to Mammoth Nominees Pty Ltd." Mr Caratti said Mammoth Nominees provided the funds for Delta Ace's purchase. However, we requested copies of relevant accounts evidencing payment and they were not provided.

- We infer that Mr Caratti directed which shares would be transferred to the various entities. He may have acted on Ms Bazzo's directions as to which entity she wished to use.

- Viento submits that the transactions were structured "to deliberately conceal the exact number of shares ultimately purchased" by the parties. There are late and deficient substantial holding notices. There are deficient tracing notices. We infer that there was deliberate concealment of the holdings from the market by reason of the initial non-registration of the 3% parcel and the deficiencies with respect to the substantial holding notices and tracing notices.

- We also infer, from the money trail and the fact that the Bydand purchase transactions were linked through Mr Caratti, that Mr Caratti and Ms Bazzo did not distinguish between their respective interests in relation to Viento. It may be that Ms Bazzo and Gucce Holdings gave Mr Caratti an authority to act for them. Even if, as Ms Bazzo submitted, the decision to make the purchase was hers alone, this does not refute an association. In our experience, the dynamics of the transaction suggest that Mr Caratti and Ms Bazzo were acting together in respect of the purchase. She may have made her own decision to participate, but we infer she did so at his initiation and he took the lead on all aspects. We infer that she was prepared to accept this because they were acting together.

Board seat on Viento

- Mr Caratti and Mr Carter approached members of the Viento board at various times, including in or around June 2009, seeking a seat on the board for Mr Carter. Ms Bazzo also had discussions with Mr Carter about seeking a board seat on behalf of Gucce Holdings.

- Mr Nichevich emailed Mr Carter on 21 July 2009 acknowledging Mr Carter's request for representation on the Viento Board and saying "Your holding is about 14% and a further 8% is to be purchased by interests that would support your appointment".

- Mr Carter said "I have had various communications with Mr Caratti concerning his support and desire for me to seek appointment to the board of directors of Viento...". Mr Caratti submitted that Mr Carter was experienced in the equities industry, there had been previous discussions between Mr Carter and Mr Nichevich, and Mr Carter's skill set would benefit Viento. That may be, but it is also significant, in our view, that there is a family relationship. Mr Carter has been Mr Caratti's son-in-law for approximately 15 years. That Mr Caratti should 'desire' a board seat for Mr Carter, whose interest in Viento was held on trust, rather than for himself or Ms Bazzo, suggests that Mr Carter would be likely to act as a nominee director for Mr Caratti and Ms Bazzo. It was submitted that there was "no intention, on Mr Caratti's part, to install Mr Carter as a director for the benefit of Mr Caratti or Ms Bazzo". However, it is clear that Mr Carter and Mr Caratti were working together to secure a board seat for Mr Carter. It is also clear, in our view, that such a board seat would have been held for the benefit of either or both of Mr Caratti and Ms Bazzo, who ultimately owned the shares supporting the request.

- In response to our preliminary findings, Mr Carter submitted that, following his discussion with Mr Nichevich, he did not press for a board seat. This is not consistent with Mr Nichevich's version of events. Mr Nichevich said "I told him that I would not be appointing him as a director to which he became very angry. He insisted that he be given the opportunity to meet with the other Viento board members and I agreed to arrange a meeting. During this meeting, I asked him if he was aware of who Delta Ace were. Mr Carter told me that the sole director and shareholder of Delta Ace, Ms Ferguson-Smith, was a person who worked for Mr Caratti as an accounts clerk. Mr Carter said that Mr Caratti had purchased the shares from Bydand and put them in the name of Delta Ace. Mr Carter asked me if I had met Ms Ferguson-Smith."

- We infer a common purpose of controlling or influencing the composition of Viento's board by Mr Caratti and Mr Carter.

- We infer that Mr Caratti and Mr Carter are associates in relation to Viento. The discussions, and their proximity to the purchase of shares in Viento from Bydand, suggest that a purpose of the purchase was to seek representation on the Viento board. We do not consider the submission - that the purchase was made because value was seen in the shares - as necessarily precluding the inference we have drawn. Rather, in our experience, the acquisition of a substantial interest is usually accompanied by a request for representation on the board. There was a clear objective of undertaking land development with Viento and related engineering works, which board representation may assist.

- Mr Carter was used to acting on behalf of both Mr Caratti and Ms Bazzo, and stated that "Gucce, Mammoth and IOCWA are clients of [Indian Ocean Capital Pty Ltd]". As an example of this, the substantial holder notice for Delta Ace was faxed from the office of Indian Ocean Capital Pty Ltd. Mr Caratti submitted that he often used Indian Ocean Capital Pty Ltd to file notices on behalf of Mammoth Nominees or companies it owned such as Delta Ace. Mr Carter held the shares in Timebuild, on which he based a request for a board seat, on trust for Gucce Holdings (which is wholly owned by Ms Bazzo, and on whose instructions he was acting when he sought the board seat). Accordingly, we infer a common purpose of controlling or influencing the composition of Viento's board by Mr Caratti and Ms Bazzo.

- Further, Mr Nichevich's email suggests that Mr Carter's discussions regarding appointment to the Viento board were on behalf of the 14.07% held by Timebuild, supported by other "interests" that would acquire a further 8% (which we infer to be the Delta Ace purchases). Mr Carter does not dispute this account of their conversations.

- We infer that Mr Carter, Mr Caratti, Ms Bazzo and the entities they control were acting together in order to obtain a position on the board of Viento.

Personal relationships

- Mr Caratti and Ms Bazzo are in a de facto relationship.

- Mr Carter is Mr Caratti's son-in-law.

- We infer that these connections support an association between these parties.

Business links

- Mr Carter acts for both Ms Bazzo and Mr Caratti.

- Ms Ferguson-Smith was employed by Mammoth Nominees prior to the termination of her employment. It was submitted that she was under no impression that she worked for Gucce Holdings or Ms Bazzo. However, like Mr Carter, it appears that she was used to acting for both Mr Caratti and Ms Bazzo. For example, she lodged a request for a copy of the register of members of Viento on 1 October 2010. She asked for it to be forwarded to Ms Bazzo at Gucce Holdings and care of Delta Ace.

- According to Mr Caratti, Ms Ferguson-Smith was (and is) no longer employed by Mammoth Nominees at that time. Yet she remained (and remains) a director of Delta Ace. We note also that she is represented by the same law firm as Mammoth Nominees, Delta Ace and Mr Caratti.

- According to Ms Bazzo, Ms Ferguson-Smith was not employed by Gucce Holdings.

- It is unclear why Delta Ace would request share information for Ms Bazzo, given that Ms Ferguson-Smith "has never been employed by Gucce Holdings". Moreover, Ms Ferguson-Smith identifies herself as an employee of Gucce Holdings on her internet 'Linkedin' webpage. It is unclear why Ms Ferguson-Smith would so describe herself. She did not address this in submissions on the preliminary findings. Ms Bazzo refused to address it, saying "I refuse to be questioned over a Google search of which contents remain unauthorised and unverified."

- Ms Bazzo acknowledges that she requested the register, but was unsure who from her office requested it.

- We infer that either Ms Ferguson-Smith is an employee of Gucce Holdings or she is confused by reason of regularly taking instructions from Ms Bazzo.

- It is unclear what other interest in Viento Ms Ferguson-Smith would have, and the submission on preliminary findings confirmed that her sole interest was "as a director and as trustee owner of the shares in Delta Ace." We infer the interests were Mr Caratti's and Ms Bazzo's respectively.

- We infer that the request evidences a common purpose between Gucce Holdings (and therefore its ultimate controller, Ms Bazzo) and Delta Ace (and therefore its ultimate controller, Mr Caratti) as to their shareholdings in Viento.

- Moreover, Mr Nichevich said that in meetings between himself and Mr Caratti, Mr Caratti represented that he "holds an interest in the entire Bydand Shareholding". This would include the interests held by Ms Bazzo. Mr Caratti denied saying this. It was submitted on behalf of Mr Caratti and others that Mr Nichevich was aware of Timebuild's ownership of shares. However, that submission also said: "I can see no reason on the facts why Ms Bazzo would have at any time disclosed to Mr Nichevich her interest in Timebuild or by virtue of this Viento. To the contrary Ms Bazzo has informed Mr Caratti that she did not which (sic) for this to be common knowledge and be associated with Viento and its developments."

- Mr Nichevich also said "[i]n all my dealings with Ms Bazzo she has never declared an interest in any Viento shares". This is consistent with the submission above.

- We infer that Mr Caratti considered that he could speak for the Viento shares held by Timebuild. This supports an association between the parties.

Trusts

- There are a number of unexplained, or unsatisfactorily explained, trusts:

- Mr Carter's holding in Timebuild for Gucce Holdings. According to the submission on preliminary findings on behalf of Mr Caratti and others, Ms Bazzo "established the trust … for the purpose of not being associated with a substantial shareholding in Viento". This was not a legitimate purpose, as the law required its disclosure. We also think it supports our view of an association that Mr Caratti would know about, and feel able to comment on, Ms Bazzo's purpose.

- The existence of the Gucce Holdings Trust and its relationship to the parties. Mr Caratti and Mammoth Nominees fall within the broad class of general beneficiaries,14 although it was submitted they have not received a distribution and there is no relationship to Mr Caratti and others. But the inclusion of them in the class, in our view, supports an association.

- Ms Ferguson-Smith's holding in Delta Ace for Mammoth Nominees. It was submitted that the trust arrangement removed any reference to Mr Caratti or Mammoth Nominees being associated with Delta Ace on the public record with ASIC. It was submitted that if they were associated with Delta Ace this would have funding ramifications. This was not a legitimate purpose, as the law required disclosure.

- Clearly at least one advantage of these inadequately disclosed trusts would have been the ability to conceal the identity of some of the persons who may have had an interest in securities held. We infer this inadequate disclosure was effected for more than merely business convenience. It was to conceal an association.

- Moreover, it is clear that there was concern to keep the trusts themselves undisclosed. There was no mention of them in any substantial holding notices or tracing notices. There was reluctance to disclose them in these proceedings. We do not accept that the parties were mistaken as to the need for their disclosure.

- We infer that the foregoing arrangements support an association between the parties.

Structural links

- IOCWA holds its shares in Viento on trust for the Indian Ocean Superannuation Fund. Mr Caratti and Ms Bazzo are both directors and shareholders of IOCWA. They are both beneficiaries of the superannuation fund.

- Mr Caratti and Ms Bazzo are both general beneficiaries of the Gucce Holdings Trust.

- Mr Carter and Ms Ferguson-Smith act for them both.

- Money passed through Mr Caratti's company (Mammoth Nominees) on behalf of Ms Bazzo's company (Gucce Holdings).

- We do not accept submissions to the effect that the parties have acted separately in relation to Viento. We infer that these arrangements support an association between the parties.

Other matters

- The associated parties in these proceedings have displayed a pattern of recurring omissions and providing confusing or incomplete answers to questions. Further inquiries and requests for additional documents have flushed out salient facts, some of which continue to remain unexplained. We infer that these similarities in patterns of responses and behaviours by parties that claim not to be associated with one another were more than a coincidence. We infer that they support an association.

- It is notable that Timebuild and Delta Ace, who claim to have been acting independently and not to be associated with each other, had the same solicitors acting in relation to the purchase of shares in Viento from Bydand and that, even allowing for the fact that the share sale agreements had been prepared by Bydand's solicitors, the final share sale agreements for the acquisitions were virtually identical.

Conclusion on association

- The submissions of Mr Caratti and Ms Bazzo seek to establish that each acts independently of the other in their business affairs and that their business affairs are separate. In so far as the evidence in relation to Viento exists, we do not accept that.

- Circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.15

- Elements of each of these circumstances exist here.

- The Panel said in Dromana Estate Ltd 01R: 16

... Issues of association frequently need to be decided on the basis of inferences from partial evidence, patterns of behaviour and a lack of a commercially viable explanation for the impugned circumstances.

- In considering the whole of the material, and drawing appropriate inferences, we conclude that Mr Caratti and Ms Bazzo:

- intended to control or influence the composition of Viento's board or the conduct of Viento's affairs and

- are acting in concert in relation to Viento's affairs.

- Accordingly, Mr Caratti and Ms Bazzo are associates in relation to Viento.

- Therefore each has voting power of 30.60% in the shares in Viento.17

- It would follow, and we infer, that each of the entities which Mr Caratti or Ms Bazzo controls are associates in relation to Viento.

- The shares held in excess of the 20% limit in the Act were not acquired in accordance with the Act, and thus were acquired in contravention of s606.

Substantial holding notices

Timebuild

- Timebuild lodged a substantial holding notice on 28 May 2009, disclosing a 14.07% shareholding in Viento.

- The notice was late. The agreement for the purchase of the shares was undated but was executed at least on 12 May 2009, when Bydand lodged its notice of change in substantial holding.

- Mr Carter appears to hold the shares in Timebuild on trust for Gucce Holdings (according to a declaration of trust dated 21 April 2009) as trustee of the Gucce Holdings Trust (according to a trust deed dated 1 July 2005). He did so at the time of acquisition of shares in Viento. The notice was deficient because it did not include any information about the beneficial owner of the shares.

- The notice also does not detail the association between the parties.

- Therefore s671B has been contravened in relation to this holding.

Delta Ace

- Delta Ace lodged a substantial holding notice on 27 January 2010, disclosing that it had acquired a 5.88% shareholding in Viento.

- The notice was late. The agreement for the purchase of these shares by Delta Ace was executed on 12 May 2009.

- According to a declaration of trust dated 8 August 2007, Ms Ferguson-Smith holds her shares in Delta Ace on trust for Mammoth Holdings. The notice did not include any information about the beneficial owner of the shares.

- The notice also does not detail the association between the parties.

- Delta Ace has not disclosed its interest in the further 3.00% of Viento shares (purchased as part of the transaction with Bydand). The agreement for the purchase of these shares by Delta Ace was executed in May 2009. The shares have now been registered.

- Therefore s671B has been contravened in relation to these holdings.

Mammoth Nominees

- Mammoth Nominees, whether by mistake or intentionally, has not lodged a notice in respect of its 6.65% in Viento (regardless of any association between the parties).

- Therefore s671B has been contravened in relation to this holding.

Others

- Ms Bazzo and Mr Caratti, and entities they control, have not disclosed their interests in Viento based on their associations. Each of Ms Bazzo and Mr Caratti have voting power of 30.6% in Viento, being the relevant interests of each of them and their associates (including the shares held by Timebuild, IOCWA, Delta Ace, Mammoth Holdings and Gucce Holdings).

- Even if (contrary to our findings) Mr Caratti and Ms Bazzo are not associates of one another in relation to Viento, the notices by the companies they ultimately each control did not identify their respective interests.

- Therefore s671B has been contravened in relation to these holdings.

Beneficial tracing notices

- On 12 February 2010, Viento issued beneficial tracing notices under s672A(1) to:

- "Mr Michael Carter, Timebuild Pty Ltd", directing "Michael Carter" to disclose information

- "Samantha Claire Ferguson-Smith, Director, Delta Ace Pty Ltd" directing "Samantha Claire Ferguson-Smith" to disclose information

- "Tina Michelle Bazzo, Director, Indian Ocean Capital (WA) Pty Ltd" directing "Tina Bazzo" to disclose information and

- Allen Bruce Caratti, Director, Mammoth Nominees Pty Ltd" directing " Allen Bruce Caratti" to disclose information

with respect to shares held in Viento.

- The notices were poorly drafted. They were addressed to individuals whereas the members of Viento were companies. Nevertheless, the responses related to the holdings of the companies to whom the notices had been sent rather than the holdings of the individuals to whom they were directed.

- Viento submitted that the responses to the tracing notices were deficient in that none of the responses disclosed any associated parties or any person who gave instructions in relation to the Viento shares. Further, Viento submitted that the responses by IOCWA, Timebuild and Delta Ace were outside the time required for making disclosure under s672B(2).

- The responses indicated as follows:

- Mr Carter indicated in his response that he alone had a relevant interest in the shares held by Timebuild. He submitted that the reason the tracing notice did not include any relevant interest of Gucce Holdings or Ms Bazzo was that he thought the notice, being addressed to him, required him to give notice only of his personal relevant interest. However he also said that he had asked another person to complete the form for him, and he "did not provide him with information about Timebuild's association with Gucce Holdings because he did not ask me any questions as to whether my Timebuild shares were held on behalf of a third party and I did not appreciate the relevance of such information at the time."

- Ms Ferguson-Smith indicated in her response that she alone, as the sole director/shareholder of Delta Ace, had a relevant interest in the shares held by Delta Ace. In a submission on our preliminary findings it was said that "my clients believed that because [Delta Ace] owns shares (in Viento) beneficially and legally (not on trust for Mammoth Nominees) Mammoth Nominees and Mr Caratti had no relevant interest for the purpose of the notice." We do not accept that Ms Ferguson-Smith, as an employee of Mammoth Nominees, made the decisions in respect of Delta Ace's holdings.

- Ms Bazzo indicated in her response that she alone, as a "Director of a Company that has many share holdings in ASX listed companies and acts as super fund", had a relevant interest in the shares held by IOCWA.

- Mr Caratti indicated in his response that Mammoth Nominees had a relevant interest in the shares held by Mammoth Nominees. He identified himself as a person who had given instructions about the acquisition or disposal of shares or interests or the exercise of any voting or other rights, although not details of those instructions. This could be read as disclosing a relevant interest on his part. However, as he is a director of Mammoth Nominees, it need not necessarily be read that way. Indeed, in a submission on our preliminary findings it was said that "Mr Caratti did not believe that he had any relevant interest that needed disclosure as it is clear from the records of ASIC ... that he is the sole shareholder and officeholder of this company and this is well known to Viento." We accept that the deficiency in this notice is more technical than the others.

- Regardless of whether the responses to the notices were made in time, and regardless of whether there is any association between the parties, the responses were deficient in their disclosure for reasons including that:

- Mr Carter's response on behalf of Timebuild failed to disclose that Mr Carter holds the shares in Timebuild on trust for Gucce Holdings as trustee of the Gucce Holdings Trust

- Ms Ferguson-Smith's response on behalf of Delta Ace failed to disclose that she held the shares in Delta Ace on trust for Mammoth Holdings

- Ms Bazzo's response on behalf of IOCWA failed to disclose that there were other beneficiaries, including Mr Caratti

- Mr Caratti's response on behalf of Mammoth Nominees failed to disclose clearly that he had a relevant interest in the shares held by Mammoth Holdings.

- Therefore s672B has been contravened in relation to these holdings.

Failure to make adequate disclosure

- Further, we infer that the multiple failures to make adequate disclosure (both under s671B and in response to the tracing notices issued under s672A) evidence an intention on the part of Mr Caratti and Ms Bazzo to disguise their association and that of the various entities.

- Mr Carter submitted that he was not aware of his legal obligations in relation to substantial holding notices or tracing notices. Similar suggestions were made on behalf of Mr Caratti and others. We do not accept that. Mr Carter is an experienced stockbroker who was in receipt of a s672A notice under cover of a letter asking for "detailed information about the beneficial ownership of the recently acquired Viento shares". Mr Caratti referred to Mr Carter as "an experienced well-regarded person involved in the equities industry in Perth". Mr Caratti is also an experienced business person.

Decision

Timing issues

- The application was made on 14 December 2010. On the basis that time was extended for making the application, we had one month within which to make a declaration, namely 13 January 2011.

- The timing of receipt of the application was unfortunate and we acknowledge the difficulty for any party seeking to respond to an application over the Christmas and New Year period. Mr Carter, Mr Caratti and Ms Bazzo raised concerns about timing. Within the constraints of the matter, we have tried to accommodate them.

- In drawing inferences from the non-production of documents, we took into account the timing difficulties. Nonetheless, some three weeks passed without requested documents being produced. We note also that some documents were produced in support of the submissions being made by some of the parties who said they were unable to produce other documents.

Conclusion

- It appears to us that the circumstances are unacceptable. We made a declaration of unacceptable circumstances (Annexure B), having considered that it is not against the public interest to do so and having had regard to the matters in s657A(3).

Orders

- Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make 'any order'18 if 4 tests are met:

- it has made a declaration under s657A. This was done on 13 January 2011

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. We are satisfied that our orders do not unfairly prejudice any person. Our orders involved 3 things –

- divestment of shares that were acquired in excess of the 20% limit. We calculated which acquisitions these were

- restriction on voting shares in excess of the 20% limit and

- disclosure of the associations

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 11 January 2011. Submissions and rebuttals were received and

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. There is no takeover in this case. The orders protect rights and interests by remedying the contravention of the 20% limit, and requiring disclosure of the associations to the market. The orders vest all the shares acquired since the associated parties reached the 20% limit (described in the orders as 'Sale Shares').

- Viento submitted that the divestment order should not prohibit it from participating in the divestment of the Sale Shares. Thus, it submitted, the orders should clarify that Viento may purchase Sale Shares by way of selective buy-back. It submitted that its participation in the divestment "can only result in achieving a higher sale price for the sale of shares." ASIC submitted that Viento's participation may breach Part 7.10 (particularly s1041A and s1041C).19 Gucce Holdings, Mr Caratti, Delta Ace, Ms Samantha Ferguson-Smith and Mammoth Nominees all opposed allowing a buy-back. One of the key reasons was that Mr Nichevich's significant stake would potentially be increased.

- We have not made any orders in relation to possible participation by Viento in the divestment by way of buy-back. Whether Viento can participate by way of a selective buy-back is a matter for it to decide in compliance with the law.

- Viento also submitted that the associated parties should be prevented from voting against any such buy-back resolution. Gucce Holdings, Mr Caratti, Delta Ace, Ms Samantha Ferguson-Smith and Mammoth Nominees submitted that they should not be precluded from voting if a selective buyback is proposed, because they remain shareholders with an interest in the company. We do not think we should interfere with the voting rights on the remaining shares held by the associated parties. If Viento seeks to undertake a selective buy-back, the law determines the rights of shareholders including their voting rights.

- Whether the Appointed Seller considers it appropriate to allow Viento to participate in the sell down is a matter for it to decide in compliance with our orders and any considerations under the Act.

- We also allow the associated parties to rely on item 9 of section 611. The effect of our orders is to return the associated parties to an aggregate holding of 20%. Thereafter, they will be in the same position as any other shareholder with that percentage of shares. The Act recognises that such a shareholder is entitled to rely on the 3% "creep" exception. Likewise, in our view, the associated parties may avail themselves of that exception. We set the date from which they may do so as the date on which the Sale Shares vest in the Commonwealth.

- We clarify in the orders that item 9 applies only in respect of the 20% of remaining shares. Item 9 of s611 provides an exception to the 20% limit in the following terms:

An acquisition by a person if:

- throughout the 6 months before the acquisition that person, or any other person, has had voting power in the company of at least 19%; and

- as a result of the acquisition, none of the persons referred to in paragraph (a) would have voting power in the company more than 3 percentage points higher than they had 6 months before the acquisition.

- It was suggested that this provision would allow the associated parties to return immediately to their previous holding (at least). If it were open to do this, it would clearly be untenable. For avoidance of doubt, we addressed it in our orders.

- Given that the associated parties may "creep" following the vesting of the Sale Shares in the Commonwealth, we see no reason to prohibit them seeking to participate in the divestment (up to the 3% limit) if the Appointed Seller sells those shares through the ordinary course on the market (that is, not through a crossing or special crossing).

- In our view, the orders remedy the unacceptable circumstances without seeking to punish the associated parties.

Byron Koster

President of the sitting Panel

Decision dated 13 January 2011

Reasons published 1 February 2011

| Party: | Advisers: |

|---|---|

| Viento | Arnold Bloch Leibler Gresham Advisory Partners Ltd |

| Tina Bazzo | NA |

| Allen Caratti | Summerslegal |

| Michael Carter | NA |

| Delta Ace | Summerslegal |

| Samantha Ferguson-Smith | Summerslegal |

| Gucce Holdings | Solomon Brothers then Clayton Utz |

| IOCWA | NA |

| Mammoth Nominees | Summerslegal |

| Timebuild | NA |

Annexure A

Corporations Act

Section 657E

Interim Orders

Viento Group Limited

Viento Group Limited made an application to the Panel dated 14 December 2010 in relation to its affairs.

The Panel Orders:

- Mr Allen Caratti, Mr Michael Carter, Timebuild Pty Ltd, Delta Ace Pty Ltd, Mammoth Nominees Pty Ltd, Gucce Holdings Pty Ltd, Indian Ocean Capital (WA) Pty Ltd, Ms Tina Bazzo and Ms Samantha Ferguson-Smith not:

- acquire any further shares or increase their voting power in Viento

- dispose of, transfer or grant a security interest over any shares in Viento or

- exercise any voting rights attaching to shares in Viento.

- These interim orders have effect until the earliest of:

- further order of the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Alan Shaw

Counsel

with authority of John Fast

Deputy President of the sitting Panel

Dated 21 December 2010

Annexure B

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Viento Group Limited

Circumstances

Shareholdings

- Viento Group Limited (Viento) is a listed company (ASX Code: VIE).

- Timebuild Pty Ltd (Timebuild) holds 6,658,880 Viento shares (approximately 14.07%).

- All the shares in Timebuild are held by Michael Carter on trust for Gucce Holdings Pty Ltd (Gucce Holdings) as trustee for the Gucce Holdings Trust. All the shares in Gucce Holdings are held by Tina Bazzo. Gucce Holdings is trustee for the Gucce Holdings Trust. Beneficiaries of the Gucce Holdings Trust include:

- Ms Bazzo

- Allen Caratti (as Ms Bazzo's de facto spouse)

- the children of Ms Bazzo and the children of Mr Caratti (as the primary beneficiaries) and

- Mammoth Nominees Pty Ltd (Mammoth Nominees) (as an 'eligible entity' under the trust deed).

- Mr Carter is Mr Caratti's son-in-law.

- Gucce Holdings holds 3,000 Viento shares (approximately 0.01%).

- Indian Ocean Capital (WA) Pty Ltd (IOCWA) holds 468,180 Viento shares (approximately 0.99%). IOCWA is trustee for Indian Ocean Superannuation Fund. The beneficiaries of the Fund include:

- Mr Caratti and

- Ms Bazzo.

- Delta Ace Pty Ltd (Delta Ace) holds 4,201,120 Viento shares (approximately 8.88%). Two-thirds of the shares in Delta Ace are held by Samantha Ferguson-Smith as trustee for Mammoth Nominees.

- Mammoth Nominees holds 3,148,349 Viento shares (approximately 6.65%). All the shares in Mammoth are held by Mr Caratti.

- The Panel considers that Ms Bazzo, Mr Caratti, Mr Carter, Ms Ferguson-Smith, Gucce Holdings, Timebuild, IOCWA, Delta Ace and Mammoth Nominees are associated:

- under section 12(2)(b)20 for the purpose of controlling or influencing the composition of Viento's board or the conduct of Viento's affairs, or

- under section 12(2)(c) in relation to the affairs of Viento.

Section 606

- The voting power in Viento of the associated parties has increased as a result of acquisitions beyond the 20% threshold in section 606 other than through one of the exceptions in section 611.

Substantial holding notices

- The Form 603 lodged by Timebuild on 28 May 2009 was late and is deficient.

- The Form 603 lodged by Delta Ace on 27 January 2010 was late and is deficient.

- No Form 603 has been lodged by Mammoth Nominees.

- No Form 603 has been lodged by Mammoth Nominees, Ms Bazzo, Mr Caratti or entities which they respectively control disclosing the association and no Form 604 has been lodged in respect of the increases in voting power.

Tracing notices

- On 12 February 2010 Viento served a direction under section 672A on:

- Mr Carter. His disclosure in response was deficient

- Ms Ferguson-Smith. Her disclosure in response was deficient

- Ms Bazzo. Her disclosure in response was deficient and

- Mr Caratti. His disclosure in response was deficient.

Unacceptable circumstances

- It appears to the Panel that the circumstances outlined above are unacceptable:

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on:

- the control, or potential control, of Viento or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Viento and

- having regard to the purposes of Chapter 6 set out in section 602 and

- because they constitute or give rise to a contravention of sections 606, 671B and 672B.

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Viento.

Alan Shaw

Counsel

with authority of Byron Koster

President of the sitting Panel

Dated 13 January 2011

Annexure C

Corporations Act

Section 657D

Orders

Viento Group Limited

The Panel made a declaration of unacceptable circumstances on 13 January 2011.

The Panel Orders

Divestment order

- The Sale Shares are vested in the Commonwealth on trust for Delta Ace, Gucce Holdings, Mammoth Nominees, IOCWA and Timebuild respectively.

- ASIC must:

- sell the Sale Shares in accordance with these orders and

- account to Delta Ace, Gucce Holdings IOCWA, Mammoth Nominees and Timebuild respectively for the proceeds of sale, net of the costs, fees and expenses of the sale and any costs, fees and expenses incurred by ASIC and the Commonwealth (if any).

- ASIC must:

- retain an Appointed Seller to conduct the sale and

- instruct the Appointed Seller -

- to use the most appropriate sale method to secure the best available sale price for the Sale Shares that is reasonably available at that time in the context of complying with these orders, including the stipulated timeframe for the sale

- to provide to ASIC a statutory declaration that, having made proper inquiries, the Appointed Seller is not aware of any interest, past, present, or prospective which could conflict with the proper performance of the Appointed Seller's functions in relation to the disposal of the Sale Shares

- unless the Appointed Seller sells Sale Shares on market, that it obtain from any prospective purchaser of Sale Shares a statutory declaration that the prospective purchaser is not associated with any of the Associated Parties

- that none of the Associated Parties may directly or indirectly purchase any of the Sale Shares, except to the extent that they are allowed to acquire additional shares under item 9(b) of s611 and the Appointed Seller sells those shares on market and

- to dispose all the Sale Shares within 3 months from the date of its engagement.

- Viento and the Associated Parties must do all things necessary to give effect to these orders, including:

- doing whatever is necessary to ensure that the Commonwealth is registered with title to the Sale Shares in the form approved by ASIC and

- until the Commonwealth is registered, complying with any request by ASIC in relation to the Sale Shares.

- The Associated Parties must not otherwise dispose of, transfer, charge or vote any Sale Shares (except those acquired on market under paragraph 3(b)(iv)).

- Until completion of orders 1 – 5:

- IOCWA can only exercise voting rights over 74,624 Viento shares

- Timebuild can only exercise voting rights over 5,757,654 Viento shares and

- Delta Ace can only exercise voting rights over 3,632,636 Viento shares.

- None of the Associated Parties may take into account any relevant interest or voting power that any of them or their respective associates had, or have had, in the Sale Shares, when calculating the voting power referred to in Item 9(b) of s611 of the Corporations Act 2001 (Cth), of a person six months before an acquisition exempted under Item 9 of s611. Any Sale Shares acquired on market under paragraph 3(b)(iv) must be taken into account in any subsequent calculation for item 9 purposes, taking the date of acquisition as the date they were acquired on market under paragraph 3(b)(iv).

Substantial holding disclosure order

- Each of the Associated Parties must as soon as practicable give notice of their combined substantial holding as required under Part 6C.1 in relation to their voting power in Viento and their association, including disclosing:

- the name of each associate who has a relevant interest in voting shares in Viento

- the nature of their association with each associate

- the relevant interest of each associate and

- details of any relevant agreement through which they have a relevant interest Viento shares.

Interpretation

In these orders:

| Term | Meaning |

|---|---|

| Appointed Seller | An investment bank or stock broker |

| ASIC | Australian Securities and Investments Commission, as agent of the Commonwealth |

| Associated Parties | Ms Tina Bazzo, Mr Allen Caratti, Mr Michael Carter, Ms Samantha Ferguson-Smith, Timebuild, Delta Ace, Mammoth Nominees, Gucce Holdings and IOCWA or any of their associates |

| Delta Ace | Delta Ace Pty Ltd |

| Gucce Holdings | Gucce Holdings Pty Ltd, itself and as trustee of the Gucce Holdings Trust |

| IOCWA | Indian Ocean Capital (WA) Pty Ltd, itself and as trustee of the Indian Ocean Superannuation Fund |

| Mammoth Nominees | Mammoth Nominees Pty Ltd |

| On market | in the ordinary course of trading on Australian Stock Exchange and not by crossing or special crossing |

| Sale Shares | The following shares in Viento: 568,484 shares held by Delta Ace 3,000 shares held by Gucce Holdings 393,556 shares held IOCWA 3,148,349 shares held by Mammoth Nominees 901,226 shares held by Timebuild |

| Timebuild | Timebuild Pty Ltd |

| Viento | Viento Group Ltd |

Alan Shaw

Counsel

with authority of Byron Koster

President of the sitting Panel

Dated 19 January 2011

1 Gucce Holdings acted in its own right and as trustee of the Gucce Holdings Trust

2 References are to the Corporations Act 2001 (Cth) unless otherwise indicated

3 Apparently an error as the agreement was dated 12 May 2009 and the 3% parcel was to be completed on 8 November 2009

4 Subsequent acquisitions have taken the total to 30.6%

5 Subsequent acquisitions have taken the total to 6.65%

6Mount Gibson Iron Limited [2008] ATP 4 at [15]. See also Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Rusina Mining NL [2006] ATP 13

7 This was done, for example, in International All Sports Limited 01R [2009] ATP 5

8 Section 657B

9 Section 657B. The last date for making a declaration was 13 January 2011, unless time was extended by the Court

10 Delta Ace's acquisition of 5.88% took the aggregated holdings of IOCWA, Timebuild and Delta Ace to 20.69%

11 There was confusion in some of the material between IOCWA and Indian Ocean Capital Pty Ltd. We did not need to take this any further. The latter company is not a party to the proceedings

13 Section 608(2)

14 The Gucce Holdings Trust includes any 'eligible entity' in its list of general beneficiaries. An 'eligible entity' is defined to include any corporation in which at least one share is beneficially owned by a general beneficiary or the trustee of an eligible trust. Mammoth Nominees is owned by Mr Caratti, who is a general beneficiary. Thus, Mammoth Holdings is an 'eligible entity' and so is a beneficiary of the Gucce Holdings Trust

15Mount Gibson Iron Limited [2008] ATP 4.

16 [2006] ATP 8 at [25]

17 Being the shares held by Gucce Holdings, Timebuild, IOCWA, Delta Ace and Mammoth Nominees

18 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

19 Market manipulation and false trading and market rigging

20 References are to the Corporations Act 2001 (Cth) unless otherwise indicated