[2009] ATP 7

Catchwords:

Association - substantial holder notice - late lodgement - effect on share price - changes to board composition - appointment and removal of directors - requisition of meeting - remedies - other forums - continuing circumstances - decline to conduct proceedings

Corporations Act 2001 (Cth), sections 12(2), 249D, 602, 657A, 657C(3), 659B, 671B(4) and 671B(6)

Flinders Diamonds Limited v Tiger International Resources Inc (2004) 49 ACSR 199

Boulder Steel Limited [2008] ATP 24 - BigAir Group Limited [2008] ATP 12 - Mount Gibson Iron Limited [2008] ATP 4 - Bowen Energy Limited [2007] ATP 22 - Rinker Group Limited 02 [2007] ATP 17 - Rusina Mining NL [2006] ATP 13 - Dromana Estate Limited 01R [2006] ATP 8 - Citect Corporation Limited [2006] ATP 6 - Rivkin Financial Services Limited 01 [2004] ATP 14 - St Barbara Mines Limited 02 [2004] ATP 13 - Village Roadshow Limited [2004] ATP 4 - Grand Hotel Group [2003] ATP 34 - Online Advantage Limited [2002] ATP 14

Introduction

- The Panel, comprising Diana Chang, Norman O'Bryan SC (sitting President) and Mike Roche, declined to conduct proceedings on an application made by Regis Resources Limited alleging that a group of Regis shareholders became associates earlier than was described in a Form 603 (notice of initial substantial holder) lodged on behalf of those shareholders on 6 March 2009.

- In these reasons, the following definitions apply.

- Term

- Meaning

- New Directors

- The proposed directors of Regis nominated by the Requisitioning Shareholders, being Mark John Clark, Morgan Hart and Nicola Giorgetta

- Existing Directors

- The existing directors of Regis, being Jeffrey Lucy, David Walker and Paul Dowd

- Regis

- Regis Resources Limited

- Requisition Notice

- The notice dated 4 March 2009 requisitioning a general meeting of Regis under s249D1 for the purposes of considering the replacement of the Existing Directors with the New Directors

- Requisitioning Shareholders

- Mark John Clark, Morgan Cain Hart, Simone Jacquelyn Hart, Robertson McLennan Mitchell and Karen Joy Mitchell, Dawncrest Holdings Pty Ltd (and Glyn Evans), Glyn Evans as trustee for the Gvan Superannuation Plan Account, Piama Pty Ltd (and Francis Fergusson, Nicola Fergusson), Rollason Pty Ltd (and Nicola Enrico Giorgetta and Kay Doris Giorgetta)

Facts

- Regis is an ASX listed company (ASX code: RRL).

- On 4 March 2009, Regis received a letter from the Requisitioning Shareholders requesting that all Existing Directors resign within 48 hours. The letter stated that, if they did not resign, the Requisitioning Shareholders would requisition a general meeting of Regis under s249D to replace them with the New Directors.

- The Existing Directors did not resign, and on 6 March 2009 the Requisitioning Shareholders wrote to Regis requiring it to convene a general meeting as foreshadowed. Regis convened a general meeting to be held on 4 May 2009.

- On 6 March 2009, the Requisitioning Shareholders also lodged a Form 603 which disclosed that at 4 March 2009 their (aggregated) voting power in Regis was 10.73%.2

- On 5 March 2009 (the day before the Form 603 was lodged), the closing price of Regis shares was $0.175. On 6 March 2009, the closing price of Regis shares was $0.255. On each day between 6 March and 20 April 2009 (both inclusive), the Regis share price closed above $0.255. On 20 April 2009, the closing price of Regis shares was $0.39.

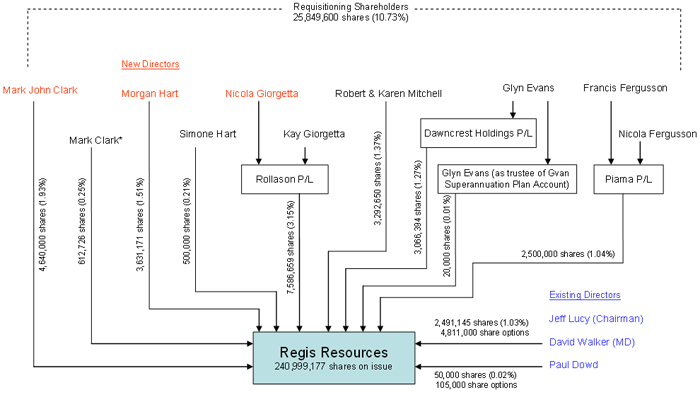

- The following diagram illustrates the relevant shareholdings in Regis.

Application

- By an application dated 14 April 2009, Regis sought a declaration of unacceptable circumstances. Regis submitted that the Requisitioning Shareholders:

- became associates on or about 13 October 2008

- reached aggregated voting power in Regis of 5% or more on 4 November 2008 and

- consequently contravened s671B by failing to lodge a Form 603 within 2 business days of acquiring that shareholding (i.e. by 6 November 2008).

- In addition, there was a submission that the Requisitioning Shareholders had failed to properly disclose the association in the corrected Form 603 dated 12 March 2009 or comply with s671B(4).

- Regis submitted that the effect of the circumstances was to:

- inhibit the potential acquisition of control over Regis shares in an efficient, competitive and informed market

- allow the Requisitioning Shareholders to increase their voting power in Regis from 5% to 10.73% while the market for Regis shares was uninformed (which enabled them to acquire a substantial interest in Regis shares for a lower price than they would otherwise have had to pay)

- allow the Requisitioning Shareholders to vote the additional 5.73% interest to execute the common purpose of replacing the Existing Directors which was concealed by the Requisitioning Shareholders while they acquired that additional 5.73% interest and

- deprive shareholders who sold their Regis shares between 7 November 2008 and 6 March 2009 of a reasonable and equal opportunity to participate in the benefit of an (assumed) increased price for those shares.

- Regis sought an interim order that the Requisitioning Shareholders be restrained from exercising any voting power attaching to shares acquired between 7 November 2008 and 6 March 2009 at general meetings of Regis until determination of its application.

- Regis sought final orders that:

- the shares acquired by Requisitioning Shareholders while in breach of s671B be divested or not voted at the EGM or any subsequent general meeting regarding the removal of the Regis board

- the Requisitioning Shareholders compensate those shareholders who sold their Regis shares between 7 November 2008 and 6 March 2009 and

- any further orders the Panel considered appropriate.

Discussion

Association

- It is common ground that the Requisitioning Shareholders became associates of each other in relation to the affairs of Regis no later than 4 March 2009, the date on which the Requisition Notice was provided to Regis. Regis submitted that it was not credible for the Requisitioning Shareholders to suggest that an understanding3, or proposal to act in concert4, in relation to the replacement of the Existing Directors did not arise before then.

- Regis pointed to events which occurred in October 2008, when the Requisitioning Shareholders commenced acquiring shares in Regis, in some cases through the same nominees or at similar times. Regis further submitted that the Requisitioning Shareholders knew one another through prior business connections with Equigold NL. Also, Regis submitted that the Requisitioning Shareholders had admitted an intention to act together in relation to another company.

- We considered that, on balance, the body of evidence in relation to the association allegation provided by Regis was not sufficient to support its application. The Panel is not well-equipped to undertake investigations of the sort required unless it is first provided with such evidence.5

- Notwithstanding that we can draw inferences from partial evidence, patterns of behaviour and a lack of a commercially viable explanation6, we thought it was highly unlikely that we would be in a position to do so in this case. This is particularly the case when, in a preliminary submission, the Requisitioning Shareholders submitted that prior to 4 March 2009 there was no mutual expectation or understanding between them, and that they had not agreed to act or co-operate in any concerted manner, with respect to their shareholdings in Regis and in relation to the affairs of Regis, and that they were prepared to provide sworn statements in this regard if requested. This was a matter likely to boil down to one word against another. Such matters are usually inappropriate for resolution by the Panel with limited resources for an essentially forensic contest of this sort. In this case, judicial resolution is open to the applicant.

Control question

- However, even if we had found that the Requisitioning Shareholders became associates prior to 4 March 2009, there was no reasonable prospect that we would make a declaration of unacceptable circumstances in this case.

- We accept that compliance with substantial holder and tracing disclosure provisions is important to ensure an efficient, competitive and informed market.7 However, this application has more to do with a possible change in the composition of the Regis board, and does not otherwise involve a control transaction for the purposes of s657A8 or a contravention of s606.

- While we have an allegation of a contravention of Chapter 6C, it is in our opinion historical and would not, by itself, constitute unacceptable circumstances if established.

Market price of shares

- Regis submitted that shareholders who sold their Regis shares in the period of non-disclosure were deprived of an opportunity to benefit from an increased price for those shares. This assumes that, if the market had been fully informed, the market price for Regis shares would have been higher.

- Regis submitted that the significant increase in the Regis share price immediately after the release of the Form 603 on 6 March 2009 compared to immediately before was evidence of the effect that an earlier release would have had on the Regis share price.9 In their preliminary submissions, the Requisitioning Shareholders identified other factors which may have affected the Regis share price around that time, including the price of gold and expectations of an announcement (recently made) regarding the completion of the definitive (bankable) feasibility study for the Duketon Gold Project, a major gold mining project for Regis.

- Given the many other factors which may have affected the Regis share price, it was unlikely that we would be able to determine the extent to which (if any) the release of the Form 603 caused the increase in the share price.

Finding a suitable remedy

- We also consider that the orders sought by Regis would not be appropriate to remedy any unacceptable circumstances that might be established. The alleged contravention of s671B(6) is not ongoing, or if any loss or foregone profit to Regis' former shareholders is continuing, it is not connected to any control-related issue. Moreover, it is unclear whether it had any effect on the market for Regis shares at any time. Further, Regis shareholders have become aware of the association and the intentions of the Requisitioning Shareholders with respect to the Regis board before the EGM was announced and well before it is to take place.

- Regis sought an order that the shares acquired by Requisitioning Shareholders while in breach of s671B be divested. We consider that a divestment order in this instance would be disproportionate and would not help remedy any remaining unacceptable circumstances.10

- We had the same concern with the proposed order which sought to restrain voting of those shares. We did not think that this order would help remedy any remaining unacceptable circumstances. The Requisitioning Shareholders have voting power in Regis well below 20% and are free to acquire additional Regis shares. The Panel assumes that appropriate disclosure of any such acquisition (or disposal) will be made.

- Regis also sought a separate order that the Requisitioning Shareholders compensate shareholders who sold their Regis shares in the non-disclosure period. Apart from all the other problems of proof referred to above, unlike the few other cases in which the Panel has ordered compensation11, there is no reference price from which the effect of the alleged delay in disclosure can be measured. We are concerned that this would require us to speculate as to such matters. We think it is unlikely that we will be in a position to determine a compensation outcome in this case and, in any event, there are other forums available in which this question might be better addressed.

Disclosure of particulars of association

- Regis also submitted that the Requisitioning Shareholders had failed to properly disclose the particulars of the association in the corrected Form 603 dated 12 March 2009 or all relevant documents in accordance with s671B(4). The Requisitioning Shareholders deny that allegation. Once again, this allegation raises a question of fact which might be better resolved by a Court.

- In any event, the association of the Requisitioning Shareholders and their intentions with respect to the composition of the Regis board is known to the market and has been known since 6 March 2009. Any contravention of s671B(4) as alleged by Regis is not likely to result in the exercise by the Panel of any of its remedial powers.

Other available forums

- It is open to Regis to raise its concerns in other forums, namely ASIC and the Court. We understand that the matter has been referred to ASIC by Regis. Also, the Court is not precluded from considering the matter under s659B, as there is no takeover offer announced or on foot in relation to Regis.

Timing and continuation of circumstances

- Pursuant to s657C(3), an application for a declaration under s657A can be made only within 2 months after the circumstances have occurred or a longer period determined by the Panel. Regis submitted that the circumstances in this matter are continuing. On one view, the circumstances occurred on 7 November 2008 when the alleged contravention of s671B(6) occurred. On another view, the circumstances continued until 6 March 2009.

- The application was made on 14 April 2009. On the first view, the application is out of time, unless we determine a longer period. On the second view, the application is in time but the circumstances ceased on 6 March 2009. We did not need to resolve this issue finally, as we decided on other grounds not to conduct proceedings.

Decision

- Given the above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the ASIC Regulations.

Orders

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make an interim order.

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Norman O'Bryan SC

President of the Sitting Panel

Decision dated 21 April 2009

Reasons published 23 April 2009

1 All references to sections are to sections of the Corporations Act 2001 (Cth) unless otherwise indicated

2 On 12 March 2009, a corrected Form 603 was lodged which did not alter the voting power disclosed earlier but which added that Nicola and Kay Giorgetta each held a relevant interest in Regis (as principal shareholders of Rollason Pty Ltd), Francis and Nicola Fergusson each held a relevant interest in Regis (as principal shareholders of Piama Pty Ltd), and Glyn Evans held a relevant interest in Regis in her own capacity (as principal shareholder of Dawncrest Holdings Pty Ltd). The amended notice also expressly acknowledged that the association arose by virtue of the Requisition Notice.

3 See s12(2)(b)

4 See s12(2)(c)

5 See, for example, Boulder Steel Limited [2008] ATP 24 at [22], BigAir Group Limited [2008] ATP 12 at [17], Mount Gibson Iron Limited [2008] ATP 4 at [15] and Rusina Mining NL [2006] ATP 13 at [41]

6 See, for example, Dromana Estate Limited 01R [2006] ATP 8 at [25] which was applied in Mount Gibson Iron Limited [2008] ATP 4 at [13]

7 See, for example, BigAir Group Limited [2008] ATP 12 at [24], Rusina Mining NL [2006] ATP 13 at [20], Village Roadshow Limited [2004] ATP 4 at [50-53] and Rivkin Financial Services Limited 01 [2004] ATP 14 at [19]

8 The Panel has confirmed previously that it will not treat issues about the composition of a company's board as a control issue for the purposes of s657A unless an accumulation or exercise of voting power occurs in contravention of Chapters 6-6C or in otherwise unacceptable circumstances. See, for example, Bowen Energy Limited [2007] ATP 22 at [29-32], Rivkin Financial Services Limited 01 [2004] ATP 14 at [26], St Barbara Mines Limited 02 [2004] ATP 13 at [9-10] and Grand Hotel Group [2003] ATP 34 at [7 and 51-53], which are consistent with Online Advantage Limited [2002] ATP 14 at [53-56]

9 See paragraph 7 for share price details

10 See Full Court's decision on orders in Flinders Diamonds Limited v Tiger International Resources Inc (2004) 49 ACSR 199 at 217-218

11 See, for example, Rinker Group Limited 02 [2007] ATP 17 and Citect Corporation Limited [2006] ATP 6