[2008] ATP 15

Catchwords:

Section 602 - efficient, competitive and informed market - competitive disadvantage - declaration of unacceptable circumstances

Association - failure to disclose association in substantial holding notices - insufficient evidence - declined to commence proceedings

Midwest Corporation Limited - Sinosteel Ocean Capital Pty Limited - Murchison Metals Limited - Harbinger Capital Partners

Corporations Act 2001 (Cth) sections 12(2), 602, 657A, 657C, 657D, 657E, 671B

Foreign Acquisitions and Takeovers Act 1975 (Cth) sections 5, 6, 9, 18, 26

Introduction

- The Panel, Graham Bradley (sitting President), Brett Heading and Alastair Lucas, made a declaration of unacceptable circumstances on the basis that the Harbinger entities failed to comply with s26 of FATA in acquiring Midwest shares over the limit requiring compulsory notification to the Treasurer. This put Sinosteel at an unfair competitive disadvantage in the contest for control of Midwest.

- In these reasons the following definitions apply:

- Term

- Meaning

- Excess Midwest shares

- 9,108,804 shares in Midwest (approximately 4.27%) acquired by the Harbinger entities on 28, 29 and 30 May 2008

- FATA

- Foreign Acquisitions and Takeovers Act 1975

- FIRB

- Foreign Investment Review Board

- Harbinger entities

- Harbinger Capital Partners Master Fund I, Ltd, Harbinger Capital Partners Special Situations Fund, L.P, Harbet Management Corporation, including their controlled bodies corporate

- Sinosteel

- Sinosteel Ocean Capital Pty Limited

- Midwest

- Midwest Corporation Limited

- Murchison

- Murchison Metals Limited

- In these proceedings the Panel:

- adopted the published procedural rules and

- consented to parties being represented by their commercial lawyers.

Facts

Background

-

Midwest is a public company listed on ASX (ASX code: MIS). It has 213,040,818 ordinary shares on issue.

-

Midwest is currently the subject of an off-market takeover bid by Sinosteel, a wholly owned subsidiary of Sinosteel Corporation. At 12 June 2008, Sinosteel had a 43.62% relevant interest in Midwest.

-

Midwest is also the subject of a proposed merger with Murchison by way of scheme of arrangement.

-

Murchison is a public company listed on ASX (ASX code: MMX). Murchison currently has a 9.98% relevant interest in Midwest.

-

The Harbinger entities are the largest shareholder of Murchison, with a relevant interest of 19.98%. The Harbinger entities also have a relevant interest in Midwest of 9.29%.

- The various relationships are described in the following diagram:

Facts

- On 20 February 2008, Sinosteel made an off-market takeover bid for Midwest. The offer price was $5.60 per Midwest share, subsequently increased to $6.38.

- On 24 May 2008, Murchison increased its relevant interest in Midwest from 4.78% to 9.98%. A substantial holding notice to this effect was filed with ASX on 26 May 2008. There have been no further acquisitions of Midwest shares by Murchison.

- On 26 May 2008, Murchison announced its proposed merger with Midwest. The Murchison scheme as announced was subject to approval by Murchison shareholders and conditional on Midwest shareholders approving the implementation of the merger and the issue of options to certain Midwest managers and employees.1

- On 26 May 2008, the Harbinger entities acquired approximately a 1.44% relevant interest in Midwest.

- On 27 May 2008, the Harbinger entities increased their relevant interest in Midwest to approximately 3.48%. Between 18 February 2008 and 27 May 2008, the Harbinger entities also increased their relevant interest in Murchison from 18.98% to 19.98%. A substantial holding notice to this effect was filed with ASX on 29 May 2008.

- On 28 May 2008, the Harbinger entities increased their relevant interest in Midwest to 8.10%. An initial substantial holding notice to this effect was filed with ASX on 29 May 2008.

- On 29 May 2008, the Harbinger entities increased their relevant interest in Midwest from 8.10% to 9.11%. A substantial holding notice to this effect was filed with ASX on 30 May 2008.

- On 30 May 2008, Sinosteel informed Murchison and the Harbinger entities that in its view they were deemed to be associates for the purposes of FATA. Murchison and the Harbinger entities were requested to confirm that they had obtained FIRB clearance for their respective acquisitions of Midwest shares. If not, they were asked immediately to cease acquiring further Midwest shares and divest themselves of the excess Midwest shares within 24 hours. Sinosteel also raised concerns that Murchison and the Harbinger entities were acting in concert in relation to their acquisitions of Midwest shares and were, therefore, associates for the purposes of the Corporations Act. In subsequent correspondence, Murchison and the Harbinger entities separately rejected the allegation of an association under the Corporations Act.

- On 30 May 2008, the Harbinger entities increased their relevant interest in Midwest from 9.11% to 9.29%. The Harbinger entities have made no further acquisitions of Midwest shares.

- On 30 May 2008, Sinosteel waived all remaining conditions to its offer and increased the offer consideration to $6.38 per Midwest share.

- On 30 May 2008, the Harbinger entities notified FIRB under s26 of FATA regarding their holding in Midwest (including any direct but deemed interest in Midwest shares held by Murchison) and of their intention to make further acquisitions of Midwest shares.

- On 30 May 2008, Sinosteel informed FIRB of its concerns regarding recent trading in Midwest shares by Murchison and the Harbinger entities without FIRB clearance.

- On 4 June 2008, Sinosteel filed a substantial holding notice with ASX, indicating that it had a relevant interest in Midwest of 28.37%. By 12 June 2008, Sinosteel's relevant interest in Midwest increased to 43.62%.2

- On 6 June 2008, Sinosteel extended its takeover offer until 5:00pm (WST) on 18 July 2008.

Application

- By application dated 4 June 2008, Sinosteel sought a declaration of unacceptable circumstances on the following grounds:

- the acquisition of the excess Midwest shares by the Harbinger entities, in breach of FATA, was inconsistent with the principle that the acquisition of control of Midwest shares takes place in an efficient, competitive and informed market (s602(a) of the Corporations Act3)

- the Harbinger entities and Murchison were associates for the purposes of Chapter 6 and their respective substantial holding notices had not disclosed this association. The Panel declined to conduct proceedings in respect of this claim for the reasons set out in paragraphs 36 to 41 and

- the Harbinger entities may also have breached FATA in respect of their acquisition of Murchison shares. The Harbinger entities provided a letter evidencing that clearance had been obtained for its acquisition of Murchison shares and the issue was not advanced further by Sinosteel.

Interim Orders

- Sinosteel sought interim orders prohibiting the Harbinger entities and Murchison from acquiring any further Midwest shares until permitted to do so in compliance with FATA.

- The Panel declined to make an interim order. In the Panel's view, it was unlikely that either Murchison or the Harbinger entities would acquire further Midwest share until clearance had been obtained. Relevantly, the Harbinger entities had also, in a letter to Sinosteel's lawyers dated 2 June 2008, agreed not to acquire any further shares in Midwest until clearance was obtained.

Final Orders

- Sinosteel sought final orders including that:

- the Harbinger entities and Murchison not acquire any further Midwest shares in breach of FATA

- the Midwest shares (and any Murchison shares) acquired by the Harbinger entities in breach of FATA be vested in ASIC for sale, with the Harbinger entities being restrained from dealing with those shares, including exercising any voting rights

- Midwest not register any transfer or transmission of the excess Midwest shares, except to give effect to the vesting, or pay any dividend

- if clearance is given to the Harbinger entities and Murchison to acquire Midwest shares in excess of 15%, they be restrained from acquiring such shares for a period determined appropriate by the Panel (which should be no less than the period during which the Harbinger entities and Murchison held the excess Midwest shares) and

- substantial holding disclosure is made on the basis of the alleged association between the Harbinger entities and Murchison for the purposes of the Corporations Act.

Discussion

Jurisdiction

- The Harbinger entities submitted that the application did not demonstrate any basis upon which the Panel could properly exercise its jurisdiction pending the Treasurer's determination of the application to FIRB.

- Murchison submitted that "the Panel is charged with overseeing the proper functioning of the market and may make a declaration of unacceptable circumstances having regard to the purposes of Chapter 6 set out in s602 and the other provisions of Chapter 6". It submitted that there was no association under the Corporations Act so no breach of that Act, and no principles in s602 were infringed because an alleged breach of FATA does not, in and of itself, impinge on those principles.

- The Panel accepts that there was no evidence of Murchison and the Harbinger acting in association in breach of the Corporations Act. However it does not agree that there is no jurisdiction.

- The Panel has jurisdiction in four situations under s657A(2):

- unacceptable circumstances having regard to the effect the circumstances have had, are having, will have or are likely to have on control or potential control of a company

- unacceptable circumstances having regard to the effect the circumstances have had, are having, will have or are likely to have on the acquisition or proposed acquisition of a substantial interest in a company

- unacceptable circumstances (whether effect in relation to a company or securities) having regard to s602 and

- unacceptable circumstances because of a contravention of Chapters 6, 6A, 6B or 6C.

- In Alinta,4 it was made clear that the Panel does not deal only with contraventions of the Corporations Act. Hayne J observed:

"First, section 657A(2) permits the Panel to make a declaration only if it appears to the Panel 'that the circumstances ... are unacceptable'. Contravention of a provision of one of the specified Chapters of the Corporations Act may provide the footing for that conclusion but it must appear to the Panel the circumstances merit the description 'unacceptable'."5 (our emphasis)

- Clearly then, jurisdiction is not limited to matters involving only potential or actual contraventions of the Corporations Act. Nor is jurisdiction limited to the policies of Chapters 6, 6A, 6B or 6C. For example, Guidance Note 1 says:

"Although circumstances concerning takeover bids account for the majority of matters before the Panel, section 657A applies to unacceptable circumstances and situations that do not involve bids. Examples are rights issues, buybacks and resolutions to approve acquisitions of shares and reductions of capital which involve effects on control or potential control...."6

- Nor is jurisdiction necessarily limited to actions that arise under the Corporations Act.

- The Panel's jurisdiction is, of course, not at large. While its limits are not susceptible to a bright line test, in this case there is a takeover on foot and the applicant submits that circumstances have arisen which have an effect of the type in section 657A(2). The circumstances relate to a substantial interest and to control or potential control of the target. Accordingly, without seeking to become the enforcer of FATA, the Panel considers that it has jurisdiction in this proceeding.

Association under the Corporations Act

- The Panel declined to conduct proceedings in respect of the issue of association under the Corporations Act.

- Sinosteel submitted that the actions of Murchison and the Harbinger entities evidenced that they were acting in concert in relation to the affairs of Midwest and, therefore, were associates for the purposes of the Corporations Act. In particular, Sinosteel relied on:

- the fact that both parties had discussions regarding the proposed merger and

- the "immediate and sustained" purchasing of Midwest shares by the Harbinger entities between 26 May and 29 May 2008.

- It is not the role of the Panel to undertake investigations without first being provided with substantive allegations and reasons for, or evidence supporting, those allegations.7 The Panel did not consider that Sinosteel had demonstrated a sufficient body of evidence of association to warrant the Panel conducting proceedings on this aspect of the application. The discussions referred to by Sinosteel, in the Panel's view, merely demonstrated communications between Murchison, the proponent of a large corporate transaction, and its largest shareholder, the Harbinger entities, which at that time had an 18.98% relevant interest in Murchison. Given that the transaction was a scheme of arrangement involving Murchison, the Panel considered it was not unusual that it was discussed with the Harbinger entities prior to an announcement being made.

- The Panel noted the signed statement of Mr Philip Falcone, the chairman of Harbinger Capital Partners, dated June 2008, which provided a detailed account of the discussions between the parties. In particular, Mr Falcone made the following statement regarding the telephone conference that occurred between himself, Mr Michael Ashforth of Gresham Advisory and Mr Paul Kopejtka, a director of Murchison, on 23 May 2008:

"4. ...During this teleconference, Mr Ashforth outlined the indicative terms of a proposed merger between Murchison and Midwest Corporation Limited (Midwest) which were set out in a confidential briefing pack provided to me (Proposed Merger).

5. During this teleconference I was asked whether I would be prepared to have a statement attributed to me in an ASX announcement in relation to the Proposed Merger. I informed Mr Ashforth and Mr Kopejtka that I would be prepared to do so only after approving the wording of the statement.

...

9. At no time during any conversation, email exchange or communication did I give Mr Ashforth or Mr Kopejtka, nor did Mr Ashforth or Mr Kopejtka seek to obtain, any agreement (formal or otherwise), commitment, understanding or expectation of any kind of Harbinger Group in relation to the Proposed Merger."

- In the absence of any evidence to the contrary, the Panel did not find that Murchison's conduct in the circumstances was necessarily inconsistent with ordinary commercial practices.

- Insofar as the argument of "immediate and sustained" purchasing was concerned, the Panel considered that the acquisition of Midwest shares alone was insufficient to establish an association between Murchison and the Harbinger entities in relation to the affairs of Midwest. In the Panel's view, no evidence was provided that these purchases were other than independently made by the Harbinger entities.

Acquisition of Midwest shares by the Harbinger entities

Section 602

- Based on the number of Midwest shares in which Murchison had disclosed a relevant interest,8 the excess Midwest shares were those that, when aggregated with shares the Harbinger entities already held, exceeded the number that could be acquired without notice under s26 of FATA.

- The crux of Sinosteel's application was that the Harbinger entities had acquired the excess Midwest shares at a critical time during Sinosteel's takeover bid and their acquisition offended the principles in s602 and had a detrimental effect on the competition for control of Midwest.

- Sinosteel submitted that there was not an efficient, competitive and informed market for Midwest shares because:

- the acquisition of the excess Midwest shares facilitated sales of Midwest shares at prices and volumes that would not otherwise have been possible. Sinosteel relied on the increase in the volume and prices of Midwest shares traded during the period from 26 May to 2 June 2008 as support for this proposition and

- in bypassing FATA, the Harbinger entities were "locking-up" in excess of 4% of Midwest shares which would not otherwise have been available to them. This:

- provided Murchison and the Harbinger entities with a competitive advantage in the competition for control of Midwest shares

- inflated the Midwest share price to the extent that it was unlikely that Midwest shareholders who purchased shares during this period would accept into the Sinosteel bid and

- enabled Murchison and Midwest to use the inflated Midwest share price as evidence that the market supported the proposed merger.

- That the Harbinger entities and Murchison are associates in relation to Midwest for the purposes of FATA was not disputed. The Harbinger entities' notification to FIRB by letter dated 30 May 2008, acknowledged as much. Section 6 of FATA relevantly provides that any corporation in which an entity has a "substantial interest" is an associate of that corporation. Under s9 of FATA, a person holds a substantial interest in a corporation if the person, alone or together with any associates, is in a position to control not less than 15% of the voting power in the corporation or holds interests in not less than 15% of the issued shares in the corporation.

- That the Harbinger entities are also subject to s26 of FATA was also not disputed. This is supported by the fact that on 30 May 2008 the Harbinger entities notified FIRB under s26 of FATA.

- Under s 26 of FATA, if a person acquires a substantial shareholding in an Australian corporation but does not comply with the section (ie, provide prior notice of an intention to make the acquisition and wait for clearance or until the requisite time has passed), that person is guilty of an offence.9

- The Harbinger entities submitted that a breach of s26 of FATA is a criminal offence, importing the physical and fault elements outlined in the Criminal Code Act 1995 (Cth). The Harbinger entities submitted that as there was no evidence to conclude that either of the fault elements (intention and recklessness) were satisfied, the Harbinger entities had not breached s26 of FATA.

- In the Panel's view, s26 of FATA should be construed according to its plain language; that is, that a contravention occurs if a person to whom the provision applies enters an agreement to acquire a substantial shareholding and did not beforehand give the Treasurer notice. The term contravention is used to connote non-compliance that may not necessarily constitute a criminal breach. Many additional proofs may be needed to establish a breach, and to succeed at prosecution, such as a 'fault element', with which the Panel determined it did not need to concern itself.

- Whether an acquisition of shares is in breach of FATA, opening the acquirer to possible successful prosecution, is not material to the proceedings. The question for the Panel here is whether an acquisition amounts to unacceptable circumstances having regard to its effect on control, or its effect on the acquisition of a substantial interest, or is otherwise unacceptable having regard to the purposes of Chapter 6 set out in s602. Contravention of another Act, in this case FATA, is relevant, regardless of whether it gives rise to a breach that could be successfully prosecuted.

- Section 26 of FATA, in effect, prohibits a person acquiring10 15% or more of an Australian corporation until the Act has been complied with. Importantly, in the context of a takeover, there is a time gap between notification and clearance. On the information provided, it is clear that the Harbinger entities failed to comply with s26 of FATA by failing to give notice before they acquired the excess Midwest shares.

- One of the purposes of Chapter 6 in s602 is to ensure that the acquisition of control over the voting shares in a listed company takes place in an efficient, competitive and informed market.

- In the Panel's view, a necessary aspect of an efficient, competitive and informed market is a level playing field for all market participants. That includes market participants complying with Australian laws of general application, particularly those relating to the acquisition of securities, so that all participants can assume that all are complying with those laws.

- In the present case, the Harbinger entities have failed to comply with Australian law, specifically s26 of FATA, by purchasing the excess Midwest shares without first notifying the Treasurer and having satisfied the requirements of that section.

- A subsequent "no objection" notification by the Treasurer would not change the situation with which the Panel is concerned. The effect that the acquisition of the excess Midwest shares had on the market and on the competition for control of Midwest shares remains.

- Similarly, the fact that market participants may not in any event be aware of notification to, or clearance by, the Treasurer under FATA would not change the situation. It is not the withholding of information that is of concern to the Panel (substantial holding disclosures by Murchison and the Harbinger entities clearly showed their respective holdings) but the effect of the Harbinger entities acquiring shares they were not entitled to acquire.

Effect of acquisition

- In the Panel's view, the acquisition of the excess Midwest shares had the following effects.

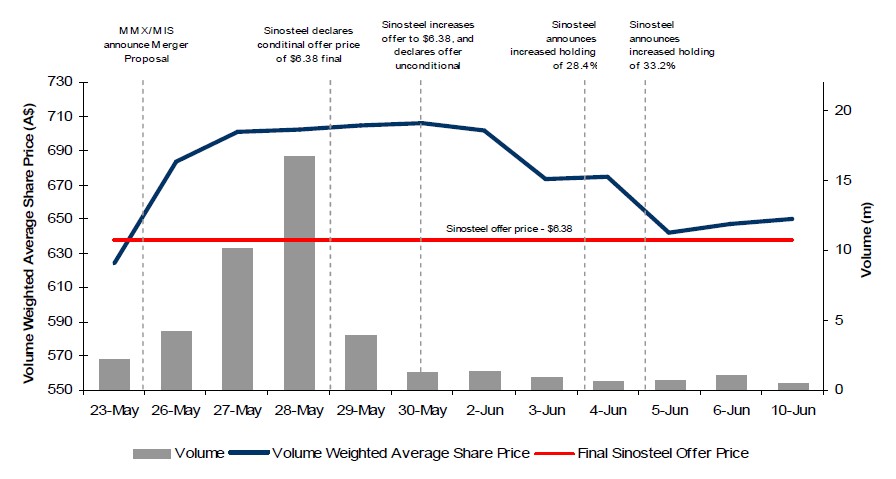

Maintenance of the Midwest share price

- The purchase of the excess Midwest shares was a factor in maintaining the Midwest share price. Perhaps many factors caused the price to increase from 23 May 2008, including purchases of Midwest shares by the Harbinger entities that were not in contravention of FATA, the announcement of the merger proposal and the announcement of variations to Sinosteel's bid. But while the acquisition of the excess Midwest shares does not appear to have increased the Midwest share price it was, in the Panel's view, a factor in maintaining the price. There may have been other factors as well.

- According to Sinosteel, the acquisitions of the excess Midwest shares affected market trading as follows:

To 28/5/08 28-29/5/08 (increase) 30/5-6/6/08 Trade value $76,970 $140,338 (82.3%) $23,772

Trade size 12,158 19,963 (64%) 3,508

Daily trades 230 481 (109%) 275

Daily value $16,471,816 $72,234,981 (339%) $6,595,174

Daily volume 2,552,397 10,276,717 (303%) 971,923

Daily VWAP $6.32 $7.04 (11.4%) $6.74

- The Harbinger entities disputed Sinosteel's market statistics. They submitted that, if the two days of 26 and 27 May were compared to the two days of 28 and 29 May, there would be a reduction in the number of trades, the increase in daily trading volume would be only 44% and the increase in daily VWAP only 1%. They also pointed out that, in any event, 33% of their acquisitions on 28 May were not excess Midwest shares (ie, not above FATA's limit).

- While different periods will give different results, the price information and therefore the Panel's conclusion remains. If the Harbinger entities had not bought the excess Midwest shares, the Panel considers that it is reasonable to assume that the price would be likely to have fallen earlier.

- This effect on the share price is demonstrated by the following Midwest VWAP graph of the relevant period, which formed part of Murchison's rebuttal submissions:

- Sinosteel submitted that an aspect of an efficient market was the existence of relatively stable share prices and volumes. In response, the Harbinger entities submitted that stable prices and volumes are not a feature of current market conditions compared with other periods. Murchison also submitted that there was no basis to suggest that efficiency required price stability, nor that volatility in price suggested that a market was functioning inefficiently. In any event, the Panel is not concerned with volatility here, but price. The Panel's view is that the maintenance of the share price meant that, on those days, a sale on-market was relatively more attractive than accepting the bid.

Merger proposal

- By reason of its effect on the Midwest share price, the Panel considered that the purchase of the excess Midwest shares influenced the view that market participants would be likely to take regarding the relative merits of the bid and the proposed merger. This affected the Sinosteel takeover bid during the period.

- Sinosteel submitted that 4.09% of Midwest's shares were removed from the pool of shares that could have been accepted into its bid because the share price and trading volumes distorted the market's view of the value of Murchison's proposed scheme. There was no evidence either that the shares the Harbinger entities bought would have been sold into the bid or that the Harbinger entities will not accept the bid.

- Sinosteel linked the acquisition of the excess Midwest shares with the price in the market, which the Panel accepts. It submitted that the price in the market made Murchison's proposed scheme appear more attractive, which the Panel accepts. Sinosteel submitted that Midwest shareholders who may have accepted Sinosteel's bid instead sold on-market and the buyers, having acquired the shares at a higher price, are unlikely now to accept the bid. The Panel accepts that they are less likely to accept.

- The Panel also considered that the Harbinger entities have increased their voting stake in Midwest which could have a positive effect on the prospects of the proposed merger. Sinosteel has an interest in the merger proposal as the single largest shareholder in Midwest.

Acquisition of potential blocking stake

- Sinosteel can proceed to compulsory acquisition if it acquires more than 90% of the bid class securities.11 The acquisition of the excess Midwest shares took the Harbinger entities to 9.29% of Midwest. While not enough to prevent compulsory acquisition, the Panel considered that the purchases of the excess Midwest shares materially affected Sinosteel's ability to compulsorily acquire Midwest, by allowing the Harbinger entities to acquire very close to a blocking stake in Midwest when they would not otherwise have been able to do so. Murchison also has a near blocking stake at 9.98%. While it is unlikely that Murchison will sell into the bid, it may do so. It is not for the Panel to speculate what Murchison will regard as in its best interests in future.

- Accordingly, although the Harbinger entities are not in a position to block the Sinosteel bid in their own right, they could be in a position to block the bid unless nearly all other Midwest shareholders accept.

Conclusion on effect

- The Panel is satisfied that the acquisition by the Harbinger entities of the excess Midwest shares had an effect, or is likely to have an effect, on the control or potential control of Midwest or on the proposed acquisition by Sinosteel of a substantial interest in Midwest. It was unacceptable having regard to the purposes of Chapter 6 set out in s602.

Public interest

- It is important that there is a level playing field for participants in the securities market. Non-compliance with relevant Australian law leads to a market that is not efficient, competitive and informed and this is not in the public interest.

- In this case, in the context of a takeover, there was non-compliance with an Australian law relevant to the acquisition of securities, even though it is a law that applies only to foreign participants in the market (which, incidentally, Sinosteel also was).

- The Harbinger entities acquired a substantial interest in Midwest when they should not have done so, because they were required to give notice under FATA and wait. They put Sinosteel at an unfair competitive disadvantage in the contest for control of Midwest, and had an effect on Sinosteel, contrary to the principle of an efficient, competitive and informed market in s602. In the Panel's view, it is not against the public interest to make a declaration of unacceptable circumstances.

Decision

Circumstances unacceptable

- It appears to the Panel that the circumstances of the Harbinger entities' purchase of Midwest shares in excess of the FATA threshold are:

- unacceptable having regard to the effect that the Panel is satisfied that the circumstances have had, are having, or are likely to have, on:

- the control or potential control of Midwest or

- the acquisition or proposed acquisition by Sinosteel of a substantial interest in Midwest or

- unacceptable having regard to the purposes of Chapter 6 set out in s602.

- unacceptable having regard to the effect that the Panel is satisfied that the circumstances have had, are having, or are likely to have, on:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances.

- The Panel has had regard to the matters in s657A(3).

- Accordingly, under s657A, the Panel declared that the circumstances constituted unacceptable circumstances in relation to the affairs of Midwest.

- A copy of the declaration is Annexure A.

Orders

- Under s657D, the Panel is empowered to make "any order"12 including a remedial order. Four tests must be met:

- the Panel has made a declaration under s657A. This it did on 20 June 2008

- the Panel must not make an order if it is satisfied that the order would unfairly prejudice any person. This is discussed below

- the Panel must give any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. The Panel sought and received submissions and

- the Panel must consider the orders appropriate either to:

- protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons or

- ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred.

Unfair prejudice

- As noted, whether the circumstances were unacceptable did not depend on whether clearance under FATA was subsequently given to the acquisitions. The Panel takes into account different considerations.

- It is also not relevant to the Panel's consideration of an appropriate remedial order whether the Treasurer, if clearance is not given, would take steps to remedy any non-compliance. However, the Panel did consider it relevant to look at the situation that resulted from clearance or non-clearance.

- An order to immediately divest the excess Midwest shares would be likely to have an adverse effect on the Midwest share price. However, that price is currently close to the Sinosteel bid price, which may provide a floor.

- If the Harbinger entities get clearance, the Panel considered that an order to immediately divest the excess Midwest shares would unfairly prejudice the Harbinger entities. The shares ordered to be divested could be re-acquired and this would impose transaction costs, and probably price impact on the Harbinger entities. It would seem that such an order would have served only to punish, which it is not the Panel's role to do.

- If the Harbinger entities do not get clearance by 11 July 2008, the Panel considered that divestment of the excess Midwest shares was not unfairly prejudicial. This date is the date 7 days before Sinosteel's bid is due to close, and is consistent with the time period for clearance under s26 of FATA.13 The shares should not have been acquired. Divestment in this situation removes as best can be done, the disadvantage to Sinosteel because it puts the excess Midwest shares back into the market and makes them potentially available to Sinosteel under its bid. In addition, to the extent that the acquisition of the excess Midwest shares affected the value that the market placed on the Murchison's proposed scheme, and so was an advantage that Murchison and the Harbinger entities were not otherwise entitled to, it reverses that.

- Similarly, if the Harbinger entities had complied with FATA they would not currently hold the excess Midwest shares. Accordingly, the Panel considered that it was not unfairly prejudicial to impose a voting restriction on the excess Midwest shares for the duration of the Sinosteel bid (including any extension). The Panel considered that such a restriction would remove the competitive advantage that Murchison and the Harbinger entities had obtained in the competition for control of Midwest.

- The Panel also considered the effect that divestment might have on Murchison and the proposed merger. It noted that Murchison had not contravened FATA. The Panel does not consider that the orders unfairly prejudice Murchison or parties interested in the merger. Third parties who acquire the shares may vote in the same way that the Harbinger entities may have voted. In any event, Murchison of course has no entitlement to an affirmative vote of those shares.

- The Panel also considered the effect that a voting restriction might have on Murchison and the proposed merger. The date for the merger has not been set and may be after Sinosteel's bid ends. Even if not, it is not unfair prejudice to Murchison or parties interested in the proposed merger that shares in the hands of a person who should not hold them cannot vote them.

- The Harbinger entities also submitted that divestment would not achieve an objective identified in s657D because, among other things, it could have acquired in the interests as swaps or under conditional contracts without contravening Chapter 6 or needing clearance under FATA. In the Panel's view this is not to the point as they were not acquired in that way.

Protect rights and interests

- The Panel considered the orders appropriate to protect the rights and interests of persons affected by the unacceptable circumstances, notably Sinosteel. The shares will be returned to the market if clearance is not obtained. Sinosteel then has an opportunity to acquire them under its bid. If not, it will be because clearance has been obtained in which case the Harbinger entities would be entitled to acquire those shares.

- The Panel also considered that the orders as far as possible ensure that takeover bid proceeds as it would have, by limiting the ability of those shares to be voted in the hands of the Harbinger entities while the bid remains on foot.

- Accordingly, the Panel made the final orders set out in Annexure B.

Costs

- The Panel did not make any costs orders.

Graham Bradley

President of the Sitting Panel

Decision dated 20 June 2008

Reasons published 9 July 2008

Annexure A

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

In the matter of Midwest Corporation Limited 02

Whereas

- Midwest Corporation Limited (Midwest) is the subject of:

- an off-market takeover bid by Sinosteel Ocean Capital Pty Limited (Sinosteel), which currently has a 43.62% interest in Midwest, and

- a proposed merger with Murchison Metals Limited (Murchison) by way of scheme of arrangement

- Midwest has 213,040,818 shares on issue

- On 24 May 2008, Murchison increased its relevant interest in Midwest from 4.78% to 9.98%, which it disclosed in a substantial holding notice on 26 May 2008. Murchison currently has a 9.98% interest in Midwest

- Harbinger Capital Partners Master Fund I, Harbinger Capital Partners Special Situations Fund LP, and other affiliated entities as identified in substantial holding notices dated 29 and 30 May 2008 (Harbinger entities) collectively have a 19.98% interest in Murchison

- Under the Foreign Acquisitions and Takeovers Act 1975(Cth) Murchison and the Harbinger entities are associates in relation to Midwest

- The Harbinger entities also currently have a 9.29% interest in Midwest, acquired as follows:

Date Shares % (approx) 26 May 08 2,047,991

1,023,9660.96

0.4827 May 08 1,158,345

1,751,430

579,172

875,7150.54

0.82

0.27

0.4128 May 08 6,542,577

3,271,2893.07

1.5429 May 08 782,063

649,285

391,032

324,6420.37

0.30

0.18

0.1530 May 08 266,958

133,4780.15

0.06Total 19,797,973 9.29 - In summary, under the Foreign Acquisitions and Takeovers Act 1975 (Cth) a person is not entitled to enter into an agreement to acquire shares in a corporation if their and their associates' voting power in the corporation is 15% or more unless the person has furnished the Treasurer with a notice stating the person's intention and either:

- 40 days has passed or

- advice is given that the Commonwealth Government does not object to that person entering into that agreement (with or without conditions)

- The Harbinger entities acquired some of the shares in Midwest referred to in paragraph 6 otherwise than in compliance with the requirements of the Foreign Acquisitions and Takeovers Act 1975 (Cth),

(the Circumstances).

- It appears to the Panel that the Circumstances are unacceptable having regard to:

- the effect that the Panel is satisfied that the Circumstances have had, are having, will have or are likely to have on:

- the control or potential control of Midwest; or

- the acquisition or proposed acquisition by Sinosteel of a substantial interest in Midwest; or

- the purposes of Chapter 6 set out in section 602 of the Act.

- the effect that the Panel is satisfied that the Circumstances have had, are having, will have or are likely to have on:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances in relation to the Circumstances and the affairs of Midwest.

- The Panel has had regard to the matters in section 657A(3).

Declaration

Under section 657A, the Panel declares that the Circumstances constitute unacceptable circumstances in relation to the affairs of Midwest.

Alan Shaw

Counsel

with authority of Graham Bradley

President of the Sitting Panel

Dated 20 June 2008

Annexure B

Corporations Act

Section 657D

Orders

In the matter of Midwest Corporation Limited 02

Pursuant To:

- A declaration of unacceptable circumstances in relation to the affairs of Midwest Corporation Limited (Midwest) on 20 June 2008.

- Section 657D of the Corporations Act 2001 (Cth).

The Panel Orders

- None of Harbinger Capital Partners Master Fund I, Ltd, Harbinger Capital Partners Special Situations Fund, L.P and the other affiliated entities identified in the substantial holding notices dated 29 and 30 May 2008 (Harbinger entities) may exercise, or allow the exercise of, any voting rights (directly or by proxy) attached to any excess Midwest shares.

- The order in paragraph 1 has effect for the duration of the off-market takeover bid by Sinosteel Ocean Capital Pty Limited (Sinosteel), including any extension thereof.

- If the Harbinger entities do not become entitled under the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA) to acquire the excess shares by 11 July 2008, the Harbinger entities must dispose of the excess shares before the close of the third trading day after that date.

- If the Harbinger entities become entitled under FATA to acquire or hold the excess shares, the order in paragraph 3 ceases to have effect in respect of any excess shares not finally disposed of.

- The parties may apply for a variation of these orders, or further orders, if the Sinosteel takeover bid is extended at any time prior to 11 July 2008.

- In these orders, 'excess Midwest shares' means 9,108,804 Midwest shares, being:

- shares acquired on 28, 29 and 30 May 2008 that, when aggregated with shares already held, exceeds the number that could be acquired without notice pursuant to section 26 of FATA, and

- based on the number of Midwest shares that Murchison Metals Limited (Murchison) has a relevant interest in as stated in Murchison's substantial holding notice of 26 May 2008.

Alan Shaw

Counsel

with authority of Brett Heading

Deputy President of the Sitting Panel

Dated 23 June 2008

1 The merger proposal was withdrawn by Murchison on 8 July 2008

2 During this period, Sinosteel made the following acquisitions of Midwest shares:

- 3 June 2008, from 19.89% to 28.37%

- 4 June 2008, from 28.37% to 33.82%

- 5 June 2008, from 33.82% to 40.09% and

- 12 June 2008, from 40.09% to 43.62%

3 Unless otherwise indicated, references are to the Corporations Act 2001 (Cth)

4 Attorney-General of the Commonwealth of Australia v Alinta Ltd and others [2008] HCA 2

5 Ibid at [81]

6 Guidance Note 1 "Unacceptable circumstances", paragraph [1.10]

7 Rusina Mining NL [2006] ATP 13; BigAir Group Limited [2008] ATP 12

8 Substantial holding notice of 26 May 2008

9 Headed "Compulsory notification of certain section 18 transactions", section 26 of FATA relevantly provides:

"(2) Where a person to whom this section applies:

-

enters into an agreement by virtue of which he acquires a substantial shareholding in an Australian corporation and did not, before entering into the agreement, furnish to the Treasurer a notice stating his intention to enter into that agreement; or

-

having furnished a notice to the Treasurer stating his intention to enter into an agreement by virtue of which he is to acquire a substantial shareholding in an Australian corporation, enters into that agreement before:

-

the expiration of 40 days after the date on which the notice was received by the Treasurer; or

-

the date on which advice is given that the Commonwealth Government does not object to the person entering into that agreement (whether or not the advice is subject to conditions imposed under subsection 25(1A));

whichever first occurs;

-

the person is guilty of an offence and is punishable, on conviction, by a fine not exceeding 500 penalty units or imprisonment for a period not exceeding 2 years, or both.

...

(6) In this section, a reference to an agreement by virtue of which a person acquires a substantial shareholding in a corporation is a reference to an agreement by virtue of which the person acquires any interests in any shares in the corporation where:

-

he already holds a substantial interest in the corporation; or

-

upon the acquisition by him of those interests, or of those interests and of any interests in other shares in the corporation, being interests that he has offered to acquire, he would hold a substantial interest in the corporation."

10 A conditional agreement can be entered, but this is not relevant here

11 Section 662A

12 Other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

13 Unless extended.